Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra201509248k-pressrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Kraton Corp | kra201509248k-exhibit991.htm |

Kraton Performance Polymer’s Acquisition of Arizona Chemical Kevin M. Fogarty, President and Chief Executive Officer Stephen E. Tremblay, Executive Vice President and Chief Financial Officer September 28, 2015

Forward- Looking Statement Disclaimer This presentation includes forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often characterized by the use of words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions. All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in forward-looking statements. The statements in this presentation that are not historical statements, including statements regarding the benefits, synergies and cost rationalizations of the proposed transaction, the expected method of financing the transaction, the expected timing of reaching Kraton’s target net leverage range after the closing of the acquisition, future opportunities for the combined company and products, beliefs regarding strengthening relationships with customers, the expected timetable for completing the proposed acquisition, future financial performance and any other statements regarding Kraton’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. Our expectations and assumptions regarding cost rationalizations, variable cost optimizations and reductions in overhead may not materialize, or our costs to achieve synergies may exceed our estimates, any of which would adversely affect our ability to achieve projected synergies. Our expectations and assumptions regarding the financial performance of the combined company may not materialize, which would adversely affect our ability to achieve expected accretion. Regulatory approvals that are conditions to the closing may not be obtained as anticipated, which could delay or prevent closing of the transaction. Our performance or that of Arizona Chemical Holdings Corporation could be adversely affected by other risks and uncertainties, which would adversely affect the ability of the combined company to achieve expected advantages. Additional information concerning factors that could cause actual results to differ materially from those expressed in forward-looking statements is contained in Kraton’s SEC filings, including but not limited to Kraton’s annual report on Form 10-K for the fiscal year ended December 31, 2014, and include, but are not limited to, risks related to: conditions in the global economy and capital markets; declines in raw material costs; limitations in the availability of raw materials we need to produce our products in the amounts or at the prices necessary for us to effectively and profitably operate our business; competition in our end-use markets, from other producers of SBCs and from producers of products that can be substituted for our products; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update such information in light of new information or future events. Kraton Performance Polymers’ Acquisition of Arizona Chemical 2

GAAP Disclaimer This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are EBITDA, Adjusted EBITDA, and Financing Adjusted EBITDA. We consider these non-GAAP financial measures important supplemental measures of financial performance and believe they are frequently used by investors, securities analysts and other interested parties in the evaluation of our performance and/or that of other companies in our industry, including period-to-period comparisons. Further, management uses these measures to evaluate operating performance. These non-GAAP financial measures have limitations as analytical tools and in some cases can vary substantially from other measures of financial performance. You should not consider them in isolation, or as a substitute for analysis of results under GAAP in the United States. In the case of EBITDA, these limitations include: EBITDA does not reflect cash expenditures, or future requirements for capital expenditures or contractual commitments; EBITDA does not reflect changes in, or cash requirements for, working capital needs; EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on debt; although depreciation and amortization are non- cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; EBITDA calculations under the terms of debt agreements may vary from EBITDA presented herein, and our presentation of EBITDA herein is not for purposes of assessing compliance or non-compliance with financial covenants under debt agreements; and other companies in our industry may calculate EBITDA differently from how we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. In addition, we prepare Adjusted EBITDA by adjusting EBITDA to eliminate the impact of a number of items we do not consider indicative of ongoing performance, but you should be aware that in the future, expenses similar to the adjustments in this presentation may be incurred. Our presentation of Adjusted EBITDA should not be construed as an inference that future results will be unaffected by unusual or non-recurring items. Kraton Performance Polymers’ Acquisition of Arizona Chemical 3

Kraton Performance Polymers’ Acquisition of Arizona Chemical 4 Acquisition of Arizona Chemical Industry leading supplier of specialty chemicals and high-value products derived primarily from non-hydrocarbon, renewable resources Extremely complementary to Kraton’s existing business with greater than 50% of Arizona’s sales into common end markets Similar business philosophy with focus on product differentiation and portfolio shift Attractive margin profile with Adjusted EBITDA margins above 20% Strong free cash flow profile Significant value creation with synergies of $65 million

Kraton Performance Polymers’ Acquisition of Arizona Chemical 5 Transaction highlights $1.37 billion in cash funded with committed debt facilities 7.4x June 2015 TTM Adjusted EBITDA, 5.5x with synergies a) Based on preliminary purchase price allocation Purchase price and transaction value Financial impact Expected EPS accretion of $1.40(a) in first full year Pre-tax synergies of $65 million expected to be realized by 2018 Expected closing leverage of 4.6x June 2015 TTM Adjusted EBITDA Regulatory and other customary approvals and conditions Closing anticipated late 2015 or early 2016 Closing conditions / Timing

Headquartered in Jacksonville, FL and Almere, Netherlands Leading converter of Crude Tall Oil (“CTO”) to value added specialty chemicals CTO is a renewable resource and a by-product of the kraft papermaking process 9 manufacturing plants in Europe and North America, 3 science & technology centers Operates in 4 business units Adhesives Roads and Construction Tires Chemical Intermediates which include Fuel Additives / Lubricants Oilfield Chemicals Coatings Track record of 20%+ Adjusted EBITDA margins Kraton Performance Polymers’ Acquisition of Arizona Chemical 6 A global leader in specialty chemicals… Revenue by Geography Revenue $863 million Adjusted EBITDA $184 million Adj. EBITDA margin 21% a) EMEA is Europe, Middle East and Africa TTM June 30, 2015 TTM June 30, 2015 (a)

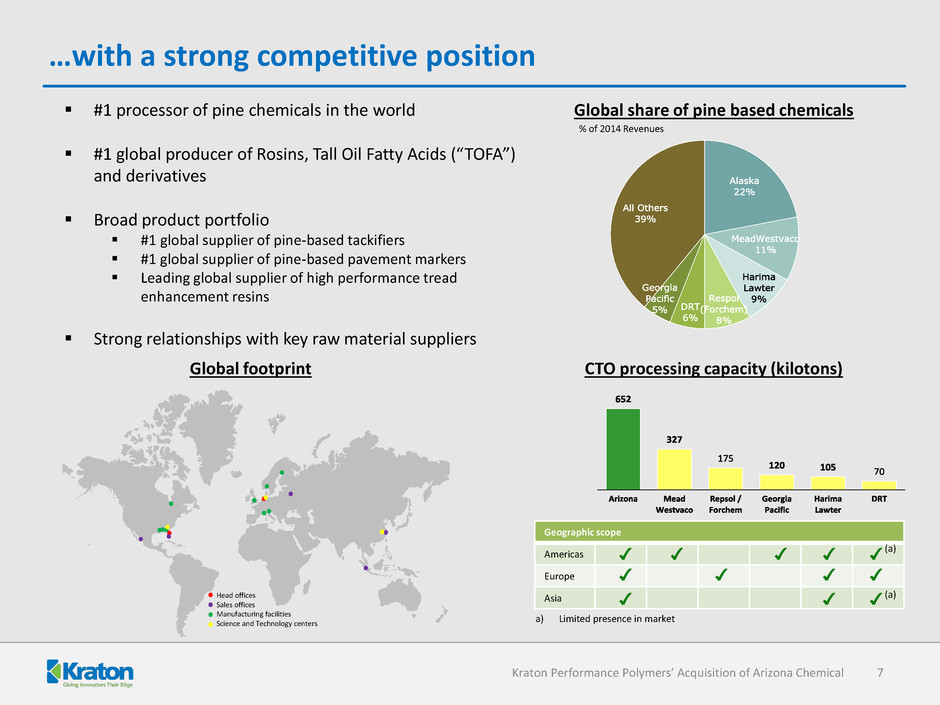

Kraton Performance Polymers’ Acquisition of Arizona Chemical 7 …with a strong competitive position #1 processor of pine chemicals in the world #1 global producer of Rosins, Tall Oil Fatty Acids (“TOFA”) and derivatives Broad product portfolio #1 global supplier of pine-based tackifiers #1 global supplier of pine-based pavement markers Leading global supplier of high performance tread enhancement resins Strong relationships with key raw material suppliers CTO processing capacity (kilotons) Geographic scope Americas Europe Asia (a) (a) Global share of pine based chemicals % of 2014 Revenues a) Limited presence in market Head offices Sales offices Manufacturing facilities Science and Technology centers Global footprint

The acquisition of Arizona is consistent with Kraton’s strategic objectives Kraton Performance Polymers’ Acquisition of Arizona Chemical 8 Kraton’s M&A focus: Technology or product adjacency “Develop strategic platforms complementing current business” Expands organic growth platform by moving into adjacent markets Adds related technology / product lines Leading market positions with growth potential Similar business culture

Kraton Performance Polymers’ Acquisition of Arizona Chemical 9 Arizona’s business is highly complementary to Kraton’s Adhesives Common customers, markets and applications Kraton: Diapers, tapes and labels Arizona: Rigid packaging, tapes and labels Roads & Construction Common customers, markets and applications Kraton: Asphalt modification, road marking Arizona: Road marking and asphalt modification Fuel Additives / Lubricants Common customers and adjacent markets and applications Kraton: Viscosity modifiers for oils and lubricants Arizona: Lubricants and corrosion inhibitors for fuels and oils Oilfield Chemicals Common customers and adjacent markets and applications Kraton: Viscosity modifiers in oil based fluids Arizona: Corrosion inhibitors, emulsifiers, and thickening agents More than 50% of sales to common markets and customers Revenue by Submarket % of 2014 Revenues

Kraton Performance Polymers’ Acquisition of Arizona Chemical 10 Arizona historical financial summary $ millions 2012 2013 2014 TTM 06/30/15 Volume (kT) 657 676 620 612 Revenues 1,042 992 938 863 Adjusted EBITDA 241 205 192 184 % margin 23% 21% 20% 21% Capex 34 47 35 38 Adjusted EBITDA less Capex 207 158 157 146 Quarterly Adjusted EBITDA ($ millions) Consistent 20%+ Adjusted EBITDA margins Strong cash flow generation Stable quarterly Adjusted EBITDA performance Quarterly EBITDA may not total annual EBITDA due to rounding

Kraton Performance Polymers’ Acquisition of Arizona Chemical 11 Well defined cost and operational improvement opportunities Leverage expertise within Arizona and Kraton to: Reduce energy consumption Lower maintenance spending Improve productivity and yields Optimize supply chain network to lower overall logistics costs Corporate and G&A overhead Improvements expected to be realized by end 2018 $20-25 million by year 1; $50-60 million by year 2 $50 million estimated cost to achieve

Kraton Performance Polymers’ Acquisition of Arizona Chemical 12 Capital structure Expected closing leverage of 4.6x June 2015 TTM Adjusted EBITDA reducing to 3.0x by end 2017 Post-closing, total Kraton pro-forma indebtedness of $1.78 billion $1.35 billion covenant-lite term loan $425 million senior unsecured notes $250 million ABL facility provides for liquidity needs (expected to be undrawn at closing) NOL’s provide tax shield in the first two years post-combination Kraton pro-forma expected to generate more than $450 million of free cash flow over first three years

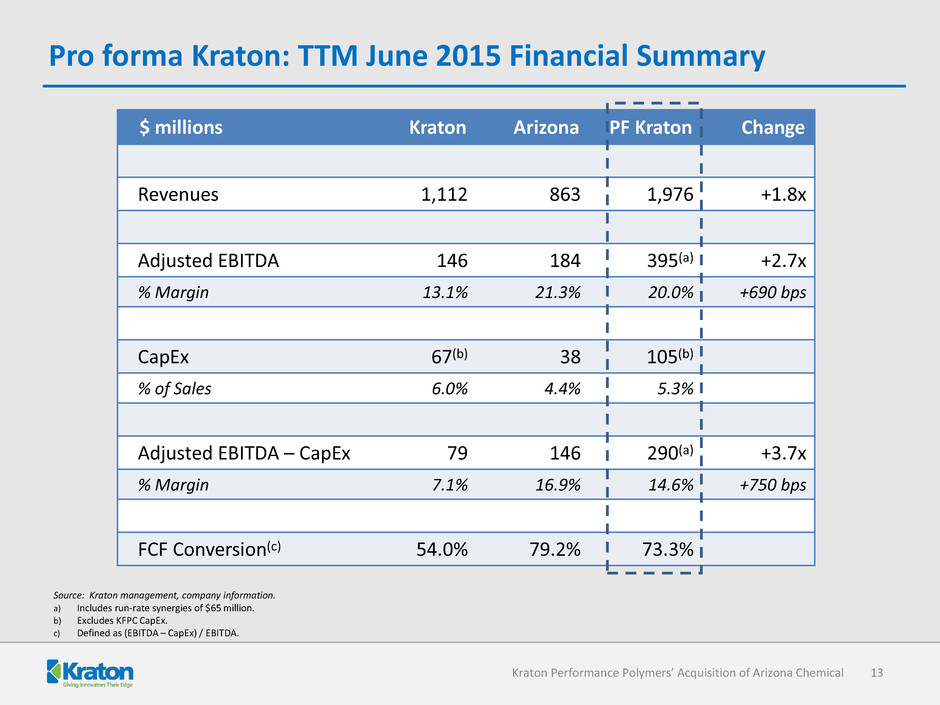

Kraton Performance Polymers’ Acquisition of Arizona Chemical 13 Pro forma Kraton: TTM June 2015 Financial Summary $ millions Kraton Arizona PF Kraton Change Revenues 1,112 863 1,976 +1.8x Adjusted EBITDA 146 184 395(a) +2.7x % Margin 13.1% 21.3% 20.0% +690 bps CapEx 67(b) 38 105(b) % of Sales 6.0% 4.4% 5.3% Adjusted EBITDA – CapEx 79 146 290(a) +3.7x % Margin 7.1% 16.9% 14.6% +750 bps FCF Conversion(c) 54.0% 79.2% 73.3% Source: Kraton management, company information. a) Includes run-rate synergies of $65 million. b) Excludes KFPC CapEx. c) Defined as (EBITDA – CapEx) / EBITDA.

Kraton Performance Polymers’ Acquisition of Arizona Chemical 14 Arizona is a compelling and transformative acquisition Complementary with Kraton’s business in multiple end use markets Attractive margin and cash flow profile Increases Kraton’s scope and scale, with significant combined free cash flow available for debt reduction or return to stockholders Anticipated synergies of $65 million provide opportunity for value creation Expected to be accretive to EPS by $1.40 in the first full year of operation

Kraton Performance Polymers’ Acquisition of Arizona Chemical 15 Appendix

Kraton Performance Polymers’ Acquisition of Arizona Chemical 16 Arizona’s broad product portfolio serves growth markets $ millions ADHESIVES ROADS & CONSTRUCTION TIRES CHEMICAL INTERMEDIATES Revenue(a) % Total 265 31% 55 6% 42 5% 501 58% Key Products Rosin esters & dispersions Terpenes & derivatives Rosin esters TOFA & derivatives AMS resins Terpenes & derivatives Rosins & derivatives TOFA &derivatives Terpenes & derivatives Submarkets Rigid packaging Tapes Labels Assembly Pavement marking Paving Roofing High performance tires Winter tires All-Season tires Coatings Fuel additives / Lubricants / Fluids Oilfield chemicals Mining Inks Flavors & fragrances Applications EVA based hot melts for rigid packaging Rosin ester dispersions for PSA’s Tackifier for tapes and labels Pavement marking binders Additives for Reclaimed Asphalt Pavement (RAP) Asphalt emulsifiers Enhances wet grip properties Improved fuel economy Emulsifiers and adhesion promoters Key performance additive Emulsifiers Surface treatment Lubricity a) TTM June 30, 2015 Market Growth (’15-’20) 3% 2% 8% (high performance tires) 1%-5% (depending on submarket)

Kraton Performance Polymers’ Acquisition of Arizona Chemical 17 Kraton – Historical Financial Summary $ millions 2012 2013 2014 TTM 6/30/15 Volume (kT) 313 314 306 303 Sales 1,423 1,292 1,230 1,112 Adjusted EBITDA 144 141 147 146 % margin 10.1% 10.9% 12.0% 13.1% Capex 70 77 70 67 Adjusted EBITDA less Capex 74 64 77 79 Note: Capex in 2013, 2014 and for the TTM period ended June 30, 2015 excludes capex of KFPC joint venture.

Kraton - Reconciliation of Consolidated Net Income (Loss) to EBITDA and Adjusted EBITDA Note: Table may not foot due to rounding. a) Receipt from LyondellBasell in settlement of disputed charges, which is recorded in cost of goods sold. b) Charge associated with resolution of a property tax dispute in France, of which $5.6 million is recorded in cost of goods sold and $0.6 million is recorded in selling, general and administrative expenses. c) In 2014, charges associated with the termination of the defined benefit restoration pension plan, which are primarily recorded in selling, general and administrative expenses. In 2012, retirement plan settlement charge associated with a disbursement from a benefit plan upon the retirement of an employee, which is recorded in selling, general and administrative expenses. d) Restructuring and other charges which are primarily recorded in selling, general and administrative expenses in 2014 and 2013 and primarily in cost of goods sold in 2012. e) Primarily professional fees related to the terminated Combination Agreement with LCY, which are recorded in selling, general and administrative expenses. f) In 2014, $2.4 million related to engineering and design assets for projects we determined were no longer economically viable; $1.4 million related to information technology and office assets associated with fourth quarter restructuring activities; and $0.9 million related to other long-lived assets. In 2012, $3.4 million related to the Asia HSBC facility and $2.0 million related to other long-lived assets. g) Impairment of spare parts inventory associated with the coal-burning boilers which started decommissioning in 2015 which is recorded in cost of goods sold. h) For the trailing twelve months ended June 30, 2015, the reduction in costs is due to additional insurance recoveries related to the first quarter 2014 Belpre production downtime, which are primarily recorded in cost of goods sold. In 2014, weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility, of which $9.9 million is recorded in cost of goods sold and $0.4 million is recorded in selling general and administrative expenses. In 2013, production downtime at our Belpre, Ohio facility, in preparation for the installation of natural gas boilers to replace the coal-burning boilers required by the MACT legislation, which is recorded in cost of goods sold. In 2012, storm related charges at our Belpre, Ohio, facility, which are recorded in cost of goods sold. i) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses. j) We had historically recorded these costs in selling, general and administrative expenses; however, beginning in the second quarter of 2013, a portion of these costs were recorded in cost of goods sold and research and development expenses. In the trailing twelve months ended June 30, 2015, $7.6 million, $0.7 million, and $0.6 million, and in 2014, $9.0 million, $0.9 million, and $0.6 million and in 2013, $7.1 million, $0.5 million and $0.3 million is recorded in selling, general and administrative, research and development expenses and cost of goods sold, respectively. ($ in Millions) Twelve months ended Twelve months ended Twelve months ended Trailing twelve months ended 12/31/2012 12/31/2013 12/31/2014 6/30/2015 Consolidated net income (loss) (16.2) (1.0) 1.2 (17.2) Add: Interest expense, net 29.3 30.5 24.6 23.9 Income tax expense (benefit) 19.3 (3.9) 5.1 3.9 Depreciation and amortization expenses 64.6 63.2 66.2 63.9 EBITDA 97.0 88.8 97.2 74.4 Add (deduct): Settlement gain (a) (6.8) - - - Property tax dispute (b) 6.2 - - - Retirement plan charges (c) 1.1 - 0.4 0.4 Restructuring and other charges (d) 1.4 0.8 3.0 3.3 Transaction and acquisition related costs (e) - 9.2 9.6 (2.6) Impairment of long-lived assets (f) 5.4 - 4.7 4.7 Impairment of spare parts inventory (g) - - 0.4 0.4 Production downtime (h) 2.5 3.5 10.3 (2.9) KFPC startup costs (i) - - 1.9 2.2 Non-cash compensation expense (j) 6.6 7.9 10.5 8.9 Spread between FIFO and ECRC 30.5 30.7 9.3 56.8 Adjusted EBITDA $ 143.8 $ 140.9 $ 147.2 $ 145.5 18 Kraton Performance Polymers’ Acquisition of Arizona Chemical

Arizona - Reconciliation of Consolidated Net Income (Loss) to EBITDA and Adjusted EBITDA Note: Table may not foot due to rounding. a) Charges associated with the termination of an employee defined benefit pension plan including curtailment costs and cash costs related to the termination of the plan. b) Restructuring and other charges primarily related to severance expenses for employees in eliminated positions which were not replaced. The trailing twelve months ended June 30, 2015 also includes costs associated with the closure of the UK manufacturing facility including severance costs, pension entitlements and other exit costs. c) Professional fees and other costs associated with the evaluation of acquisition transactions. For the trailing twelve months ended June 30, 2015, primarily professional fees and other related costs associated with the sale of the company. d) Represents expense recognized for non-cash share-based compensation. e) Represents other share-based compensation expense in the form of common profit interests granted to certain employees. These interests are recognized as compensation expense at fair market value when probable of monetization. f) In 2013 and 2014, the net gains relate to the sale of Arizona's personal care business consisting of intellectual property, customer relationships and inventories, for $12.0 million in cash on May 23, 2013 of which $11.4 million was received in May 2013 and $0.6 million was received in June 2014. The gain of $9.1 million in 2013 is net of restructuring expenses and the gain of $0.4 million in 2014 is net of an expense for a claim from a distributor. In 2012, this amount represents a net gain on the sale of Arizona's 10% investment in Arboris and the related land for $15 million in cash and $5 million receivable over the following two year period. g) Professional fees and other costs incurred related to the refinancing of Arizona's indebtedness. h) Management fees and out of pocket expenses paid to Arizona's owners in accordance with the management agreement. i) In 2013, this represents litigation expenses and damages associated with a claim filed by a former customer for an alleged breach of warranty and breach of contract regarding delivery of resin products during the period 2005 through 2009. In 2014, the credit represents an accrued insurance recovery for the related litigation expenses and damages. j) In December 2011, a leak was discovered in CTO tanks owned by Arizona Chemical in Söderhamn, Sweden. The net reduction in costs in 2012 represents insurance recoveries related to environmental remediation costs and the amount in 2014 represents additional storage costs incurred as a result of the loss of the CTO tanks. k) Represents the expected operational expense savings related to the closure of Arizona’s UK manufacturing facility in advance of realizing the actual benefit. ($ in Millions) Twelve months ended Twelve months ended Twelve months ended Trailing twelve months ended 12/31/2012 12/31/2013 12/31/2014 6/30/2015 Consolidated net income (loss) 92.8 35.3 98.4 93.0 Add: Interest expense, net 48.5 36.6 54.3 55.2 Income tax expense (benefit) 49.7 17.1 50.0 52.4 Depreciation and amortization expenses 42.0 34.8 33.7 33.6 EBITDA 232.9 123.9 236.2 234.1 Add (deduct): Retirement plan charges (a) - - 1.0 1.0 Restructuring and other charges (b) 1.2 2.1 4.1 6.4 Transaction and acquisition related costs (c) 0.8 0.1 0.8 1.4 Non-cash compensation expense (d) 16.1 5.8 2.0 1.2 Other share-based compensation expense (e) - 0.3 10.6 - (Gain) / loss on sale of assets (f) (10.0) (9.1) (0.4) 0.5 Debt refinancing costs (g) 3.5 1.3 4.3 0.7 Management fees (h) 2.2 2.2 2.1 2.2 Litigation expense (i) - 70.1 (70.1) (70.1) CTO spill related costs (j) (4.9) - 1.2 1.2 UK manufacturing plant closure (k) - - - 4.8 Unrealized foreign currency losses / (gains) (1.3) 8.2 (0.2) 0.7 Adjusted EBITDA $ 240.6 $ 204.9 $ 191.7 $ 184.1 19 Kraton Performance Polymers’ Acquisition of Arizona Chemical

Kraton + Arizona - Pro-Forma Combined Calculation of Net Leverage at Transaction Close Note: Table may not foot due to rounding. a) Adjustment to normalize turnaround costs subject to a cap of $7.5 million. b) Adjustment to attain the run-rate cost savings for implemented actions. c) Represents the expected run-rate SAR synergies to be realized associated with the acquisition of Arizona Chemical. ($ in Millions) Kraton Arizona Pro-Forma Combined TTM 6/30/2015 TTM 6/30/2015 TTM 6/30/2015 Adjusted EBITDA 145.5 184.1 329.6 Turnaround costs (capped at $7.5 million) (a) 7.5 - 7.5 Kraton run-rate cost reset initiatives (b) 17.5 - 17.5 Run-rate selling, administrative, and research cost synergies (c) - 26.5 26.5 Financing Adjusted EBITDA 170.5 210.6 381.1 Balance sheet debt estimated at transaction close 1,775.0 Kraton capital lease liability at transaction close 1.6 KFPC joint venture debt at June 30, 2015 (50% of total) 21.5 Kraton cash at June 30, 2015 (excluding KFPC cash) (47.3) Kraton cash used at closing 6.0 Net debt 1,756.8 Net leverage 4.61 20 Kraton Performance Polymers’ Acquisition of Arizona Chemical