Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | form8-kforseptember282015e.htm |

| EX-10.1 - HOMESTREET, INC. DEFINITIVE AGREEMENT AND PLAN OF MERGER WITH OCBB - HomeStreet, Inc. | mergeragreementocbb.htm |

| EX-99.1 - HOMESTREET, INC. PRESS RELEASE ANNOUNCING DEFINITIVE MERGER AGREEMENT WITH OCBB - HomeStreet, Inc. | hsb-obccpressrelease.htm |

1 Merger of HomeStreet, Inc. and Orange County Business Bank NASDAQ: HMST OTC: OCBB

2 Important Disclosures Forward-Looking Statements This presentation contains forward-looking statements concerning HomeStreet, Inc. and HomeStreet Bank, Orange County Business Bank and their operations, performance, financial conditions and likelihood of success. All statements other than statements of historical fact are forward-looking statements. In particular, statements about the timing and likelihood of the consummation of the acquisitions, shareholder approvals, regulatory approvals, the successful integration of their employees and customers and anticipated size and value of the combined entity, as well as statements that anticipate these events, are forward looking in nature. Forward-looking statements are based on many beliefs, assumptions, estimates and expectations of our future performance, taking into account information currently available to us, and include statements about the competitiveness of the banking industry. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond HomeStreet’s and Orange County Business Bank’s control. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. We caution readers that a number of factors could cause actual results to differ materially from those expressed in, implied or projected by, such forward-looking statements. Among other things, our ability to obtain federal and state regulatory approval, our ability of Orange County Business Bank to obtain required shareholder approvals, our ability to retain the assets and customers related to this merger, our ability to realize the revenue enhancements and other benefits expected from these transactions, and our ability to successfully integrate the two institutions, may be limited due to future risks and uncertainties including, but not limited to, changes in general economic conditions that impact our markets and our business, actions by the Federal Reserve affecting monetary and fiscal policy, regulatory and legislative actions that may constrain our ability to do business, and the competitive environment. A discussion of the factors that we recognize to pose risk to the achievement of our business goals and our operational and financial objectives more generally is contained in HomeStreet’s Quarterly Report on Form 10-Q for the period ended June 30, 2015. These factors are updated from time to time in our filings with the Securities and Exchange Commission, and readers of this release are cautioned to review those disclosures in conjunction with the discussions herein. Additional Information About the Merger and Where to Find it The merger will require the approval of Orange County Business Bank’s stockholders. This announcement is not a recommendation in favor of a vote on the transaction or on the issuance of shares in the transaction, nor is it a solicitation of proxies in connection with any such vote. Orange County Business Bank will prepare and mail a proxy statement and other relevant documents to it’s stockholders in connection with the merger. The parties also will apply for registration of the HomeStreet shares to be issued in the transaction following a fairness hearing to be convened by the Commissioner of the California Department of Business Oversight. Details about the fairness hearing, including a formal notice of the hearing, will be published and made available to Orange County Business Bank stockholders in accordance with Section 25142 of the California Corporations Code. STOCKHOLDERS OF ORANGE COUNTY BUSINESS BANK ARE ADVISED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, AS WELL AS THE FAIRNESS HEARING NOTICE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE CALIFORNIA DEPARTMENT OF BUSINESS OVERSIGHT, IN ADDITION TO ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement, fairness hearing notice, and other relevant materials (when they become available), may be obtained free of charge by contacting the Corporate Secretary of Orange County Business Bank at 949-221-0001. Orange County Business Bank and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Orange County Business Bank in connection with the proposed merger. Information concerning such participants’ ownership of Orange County Business Bank and HomeStreet common shares will be set forth in the proxy statement relating to the merger when it becomes available. This communication does not constitute an offer to sell, or a solicitation of an offer to buy, any securities. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending June 30, 2015. Non-GAAP Financial Measures Information on any non-GAAP financial measures referenced in today’s presentation, including a reconciliation of those measures to GAAP measures, may also be found in our SEC filings and in the earnings release available on our web site.

3 Key Highlights Source: SNL Financial and regulatory filings (1) As of 6/30/15 Transaction • HomeStreet to acquire Orange County Business Bank (OCBB) for $11.70 per share, or a total value of $55.3M with $5.5M paid in cash and the remainder in HomeStreet common stock • Transaction is expected to close in the first quarter of 2016, subject to, among other things, OCBB shareholder and state and federal regulatory approvals OCBB Profile (1) • OCBB is a $200M asset commercial bank with one office in Irvine, California. OCBB offers complete relationship banking services for locally owned and operated businesses, professional practices, and commercial / industrial companies of Orange County and adjacent markets • Total loans of $130M • Total deposits of $127M • 23.3% Tier 1 Leverage Ratio • .4% Classified Assets and zero NPAs Strategic • Transaction compliments other recent HomeStreet expansion in Southern California, including the Q1 2015 merger with Covina based Simplicity Bank, the addition of 2 specialty lending teams in the Los Angeles Metro area, and the continued growth of the HomeStreet Home Lending Center network throughout the region • Excess capital to support accelerated in market growth

4 HomeStreet Pro Forma Branch Map Increased California Presence • Entered Northern & Southern California in mid 2013 with Mortgage Lending, which now accounts for over 28% of total 2Q 2015 HMST Mortgage production volume • Merged with Simplicity Bank in 1Q 2015, establishing a HMST retail presence in Southern California, including approx. $650M in retail deposits and $650M of consumer and CRE loans • Added specialized lending teams in first half of 2015, focusing on SBA and small balance CRE lending operating within and around the Southern California retail branch footprint • OCBB provides prominent Orange County location; including potential to serve as a regional HQ, with strong lending and deposit relationships

5 Strategic Regional Expansion • Orange County Business Bank: $200 million asset - $127 million deposit institution with one location in the demographically desirable Los Angeles / Orange County / San Diego metro market – largest population concentration in California and 2nd largest urban area in the nation • Accelerates earnings diversification and growth of Commercial & Consumer Banking businesses • Complements recent expansion of mortgage, retail banking, commercial lending, commercial real estate and residential construction lending in Southern California • Infrastructure in place to ramp up loan lending and deposit gathering Strategically Attractive • 1.15x P/TBV- attractive valuation • 13.1% discount to average paid for California banks since 2014 (1) • Strong asset quality profile, with no NPAs •Meaningful cost synergies: targeting 60% of OCBB’s noninterest expenses • Strong long term deposit relationships • HomeStreet executive management experienced in Los Angeles / Orange County marketplace Low-Cost Low-Risk Opportunity • 2015 net loan growth through 3/31/2015 in CA of 14.8% was driven by strong C&I and CRE activity, which is strongest in the nation and nearly double the national average • Los Angeles and Orange County population and jobs growing faster than U.S. • Orange County unemployment rate of 4.7% as of 7/31/15 • Orange County Population of ~3.2 million projected to increase by 2.25% from 2015- 2020 • Orange County CRE vacancy rates among the lowest in the U.S. • Office vacancy rates of 11.07% in 2Q 2015 • Industrial vacancy rates of 2.95% in 2Q 2015 • Apartment vacancy rates of 2.40% in 2Q 2015 Expansion in Attractive & High Growth Market (1) Includes deals with target between $100M - $500M, NPAs / Assets <2.5%, and ROAA and ROAE >0.

6 Key Transaction Metrics Purchase Price Consideration $55.3 million total ($5.5 million cash and remainder in HMST common stock)(1) Purchase Price per Share $11.70 (estimated, subject to the collar as provided for in the merger agreement) Implied TBV Multiple 1.15x OCBB 6/30/15 tangible book value EPS Accretion/Dilution 3.2% accretive in first full year of operations and 3.1% accretive in second year; highly accretive to commercial and consumer banking segment EPS in both years(2) TBV Accretion/Dilution 0.6% dilutive TBV Earnback Period 0.8 years using incremental earnings method IRR & ROIC >15% Internal Rate of Return and Return On Invested Capital Estimated Ownership 91% HMST, 9% OCBB(1) Exchange Ratio 0.468 (estimated, subject to the collar as provided for in the merger agreement) First Full Year Operating Cost Savings (pre-tax) $4.0 million (approximately 60% of OCBB’s estimated non-interest expense) Restructuring Charge (pre-tax) $6.8 million First Full Year Revenue Enhancements (pre-tax) Approximately $7.9 million (earnings from increased OCBB lending opportunities and HMST utilization of excess capital) Loan Fair Value Adjustment 0.7% reduction to OCBB’s gross loans (approximately $0.9 million) Core Deposit Intangible $1.7 million; estimated at 1.4% of OCBB’s core deposits Goodwill $7.8 million (1) Based on 22.07 million shares of HMST common stock and 4.72 million shares of OCBB common stock as of 6/30/15 (2) EPS accretion/dilution excludes one-time transaction and integration expenses, and based on 2016 consensus analysts’ estimates of $2.88 for HMST and 2017 estimate of $3.02 that represents 5% increase from 2016

7 Loan Portfolio Composition Orange County Business Bank Balances: $129M Yield: 4.59% Pro Forma Balances: $3.05B Yield: 4.28% Source: Regulatory filings Balances as of and for the quarter ended 6/30/15 HomeStreet Balances: $2.92B Yield: 4.27% 1-4 Family Construction Multifamily Consumer & Other Construction C&I CRE-Non Owner Occ CRE- Owner Occ 39.1% 12.5%5.1% 4.5% 4.5% 13.6% 3.7% 16.9% 0.0% 49.8% 0.9% 22.5% 11.9% 11.8% 3.0% 0.0% 37.4% 14.1% 4.9% 5.3% 4.8% 13.5% 3.7% 16.2%

8 Deposit Composition Balances: $127M Cost: 0.40% Balances: $3.45B Cost: 0.37% Source: Regulatory filings Balances as of and for the quarter ended 6/30/15 Balances: $3.32B Cost: 0.37% Other Interest Bearing Non-Interest Bearing Retail Time Jumbo Time Orange County Business Bank Pro Forma HomeStreet 57% 20% 2% 21% 64% 3%0% 33% 57% 20% 2% 21%

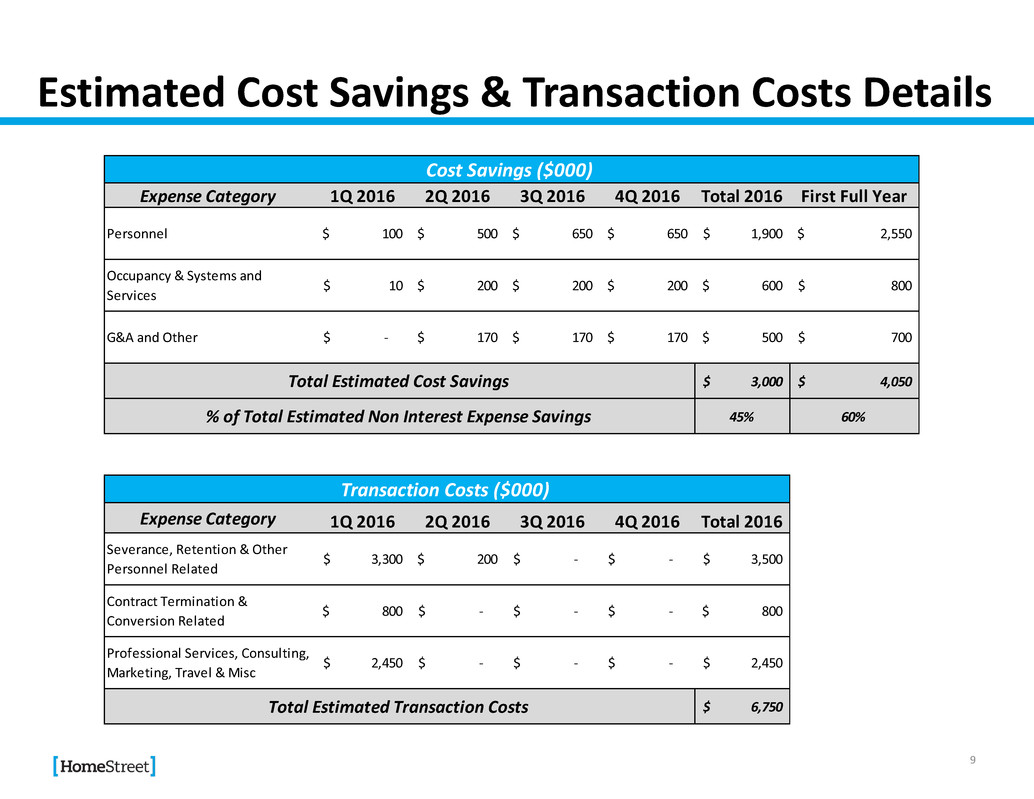

9 Estimated Cost Savings & Transaction Costs Details Expense Category 1Q 2016 2Q 2016 3Q 2016 4Q 2016 Total 2016 First Full Year Personnel 100$ 500$ 650$ 650$ 1,900$ 2,550$ Occupancy & Systems and Services 10$ 200$ 200$ 200$ 600$ 800$ G&A and Other -$ 170$ 170$ 170$ 500$ 700$ 3,000$ 4,050$ 45% 60% Total Estimated Cost Savings Cost Savings ($000) % of Total Estimated Non Interest Expense Savings Expense Category 1Q 2016 2Q 2016 3Q 2016 4Q 2016 Total 2016 Severance, Retention & Other Personnel Related 3,300$ 200$ -$ -$ 3,500$ Contract Termination & Conversion Related 800$ -$ -$ -$ 800$ Professional Services, Consulting, Marketing, Travel & Misc 2,450$ -$ -$ -$ 2,450$ 6,750$ Transaction Costs ($000) Total Estimated Transaction Costs

10 Pro Forma Balance Sheet (1) Source: 6/30/15 balances from regulatory filings ($ in thousands, except share data) HomeStreet Standalone 1 OCBB Standalone 1 Merger Adjustments Pro Forma Combined Cash and cash equivalents 46,197$ 30,864$ (30,864)$ 46,197$ Investment securities 509,545 30,903 (30,903) 509,545 Loans held for sale 972,183 - - 972,183 Loans held for investment (net of reserves) 2,900,675 127,153 849 3,028,677 Mortgage servicing rights 153,237 - - 153,237 Premises & equipment 58,111 121 - 58,232 Other real estate owned 11,428 - - 11,428 Accounts receivable and other assets 194,094 10,950 (1,400) 203,644 Goodwill 11,945 - 7,846 19,791 Core deposit intangible 8,833 - 1,735 10,568 Total assets 4,866,248$ 199,991$ (52,737)$ 5,013,502$ Deposits 3,322,653$ 126,631$ 157$ 3,449,441$ FHLB advances & other borrowings 922,832 24,000 (55,291) 891,541 Long term debt 61,857 - - 61,857 Accounts payable and other liabilities 111,180 1,386 621 113,187 Total liabilities 4,418,522 152,017 (54,513) 4,516,026 Shareholder's equity 447,726 47,974 1,776 497,476 Total liabilities and shareholder's equity 4,866,248$ 199,991$ (52,737)$ 5,013,502$ Shares outstanding 22,065,249 4,724,576 (2,512,491) 24,277,334 Tangible book value per share 19.35$ 10.15$ 19.24$ Tangible common equity / tangible assets 8.8% 24.0% 9.4% Basel III tier 1 leverage ratio (Bank) 9.5% 9.9%