Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Energy Transfer LP | ete-williamsmergerx8xkx09x.htm |

| EX-99.1 - EXHIBIT 99.1 - Energy Transfer LP | ex99-1xetexwilliamsmergerp.htm |

ENERGY TRANSFER EQUITY, L.P. TO ACQUIRE WILLIAMS Investor Presentation September 28, 2015

LEGAL DISCLAIMER 2 Additional Information and Where to Find It SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND THE REGISTRATION STATEMENT REGARDING THE TRANSACTION (THE "TRANSACTION”) INVOLVING THE BUSINESS COMBINATION OF ENERGY TRANSFER EQUITY, L.P. (“ETE”) AND THE WILLIAMS COMPANIES, INC. (“WMB" AND/OR “WILLIAMS”) CAREFULLY WHEN IT BECOMES AVAILABLE. These documents (when they become available), and any other documents filed by ETE, Energy Transfer Corp LP (“ETC”) or Williams with the U.S. Securities and Exchange Commission (“SEC”), may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus by phone, e-mail or written request by contacting the investor relations department of ETE or Williams at the following: Energy Transfer Equity, L.P. 3738 Oak Lawn Ave. Dallas, TX 75219 Attention: Investor Relations Phone: 214-981-0700 The Williams Companies, Inc. One Williams Center Tulsa, OK 74172 Attention: Investor Relations Phone: 800-600-3782 Participants in the Solicitation ETE, ETC, Williams and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information regarding the directors and executive officers of ETE is contained in ETE’s Form 10-K for the year ended December 31, 2014, which was filed with the SEC on March 2, 2015. Information regarding the directors and executive officers of Williams is contained in Williams’ Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 25, 2015. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed merger will be included in the proxy statement/prospectus. Cautionary Statement Regarding Forward-Looking Statements This communication may contain forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the merger of ETE and Williams, the expected future performance of the combined company (including expected results of operations and financial guidance), and the combined company's future financial condition, operating results, strategy and plans. Forward-looking statements may be identified by the use of the words "anticipates," "expects," "intends," "plans," "should," "could," "would," "may," "will," "believes," "estimates," "potential," "target," "opportunity," "designed," "create," "predict," "project," "seek," "ongoing," "increases" or "continue" and variations or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results to differ materially from those described in the forward-looking statements. These assumptions, risks and uncertainties include, but are not limited to, assumptions, risks and uncertainties discussed in the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for each of ETE, ETP, SXL, SUN, WMB and WPZ filed with the U.S. Securities and Exchange Commission (the "SEC") and assumptions, risks and uncertainties relating to the proposed transaction, as detailed from time to time in ETE’s, ETP’s, SXL’s, SUN’s, WMB’s and WPZ’s filings with the SEC, which factors are incorporated herein by reference. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this communication are set forth in other reports or documents that ETE, ETP, SXL, SUN, WMB and WPZ file from time to time with the SEC include, but are not limited to: (1) the ultimate outcome of any business combination transaction between ETE and ETC and Williams; (2) the ultimate outcome and results of integrating the operations of ETE and Williams, the ultimate outcome of ETE’s operating strategy applied to Williams and the ultimate ability to realize cost savings and synergies; (3) the effects of the business combination transaction of ETE, ETC and Williams, including the combined company's future financial condition, operating results, strategy and plans; (4) the ability to obtain required regulatory approvals and meet other closing conditions to the transaction, including approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and Williams stockholder approval, on a timely basis or at all; (5) the reaction of the companies’ stockholders, customers, employees and counterparties to the proposed transaction; (6) diversion of management time on transaction- related issues; (7) unpredictable economic conditions in the United States and other markets, including fluctuations in the market price of ETE common units and ETC common shares; (8) the ability to obtain the intended tax treatment in connection with the issuance of ETC common shares to Williams stockholders; and (9) the ability to maintain Williams’, WPZ’s, ETP’s, SXL’s and SUN’s current credit ratings. All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. Neither ETE nor WMB undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this communication or to reflect actual outcomes.

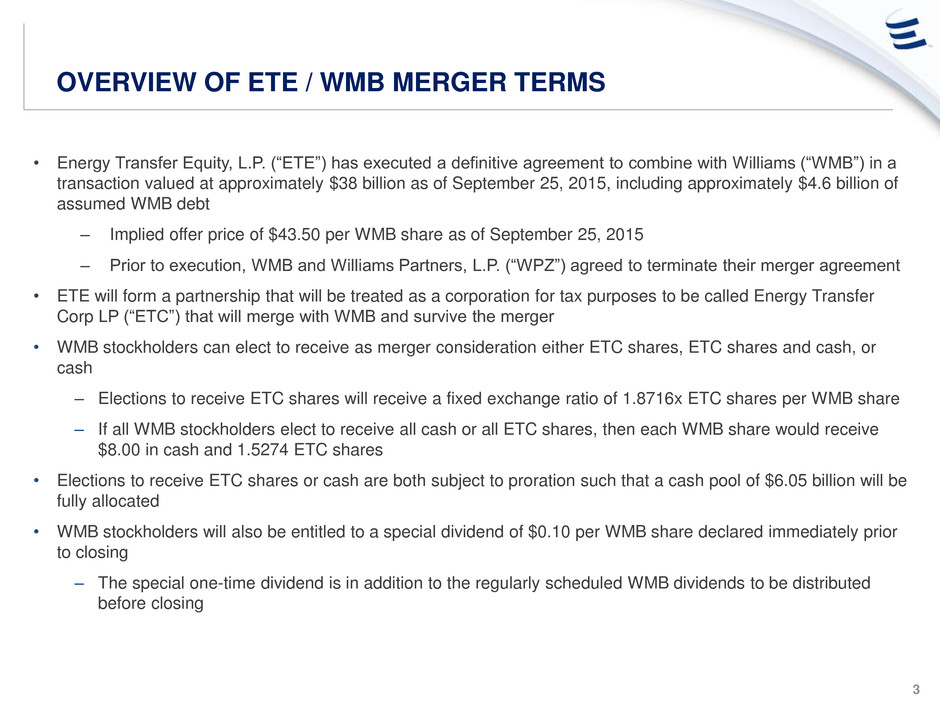

OVERVIEW OF ETE / WMB MERGER TERMS • Energy Transfer Equity, L.P. (“ETE”) has executed a definitive agreement to combine with Williams (“WMB”) in a transaction valued at approximately $38 billion as of September 25, 2015, including approximately $4.6 billion of assumed WMB debt – Implied offer price of $43.50 per WMB share as of September 25, 2015 – Prior to execution, WMB and Williams Partners, L.P. (“WPZ”) agreed to terminate their merger agreement • ETE will form a partnership that will be treated as a corporation for tax purposes to be called Energy Transfer Corp LP (“ETC”) that will merge with WMB and survive the merger • WMB stockholders can elect to receive as merger consideration either ETC shares, ETC shares and cash, or cash – Elections to receive ETC shares will receive a fixed exchange ratio of 1.8716x ETC shares per WMB share – If all WMB stockholders elect to receive all cash or all ETC shares, then each WMB share would receive $8.00 in cash and 1.5274 ETC shares • Elections to receive ETC shares or cash are both subject to proration such that a cash pool of $6.05 billion will be fully allocated • WMB stockholders will also be entitled to a special dividend of $0.10 per WMB share declared immediately prior to closing – The special one-time dividend is in addition to the regularly scheduled WMB dividends to be distributed before closing 3

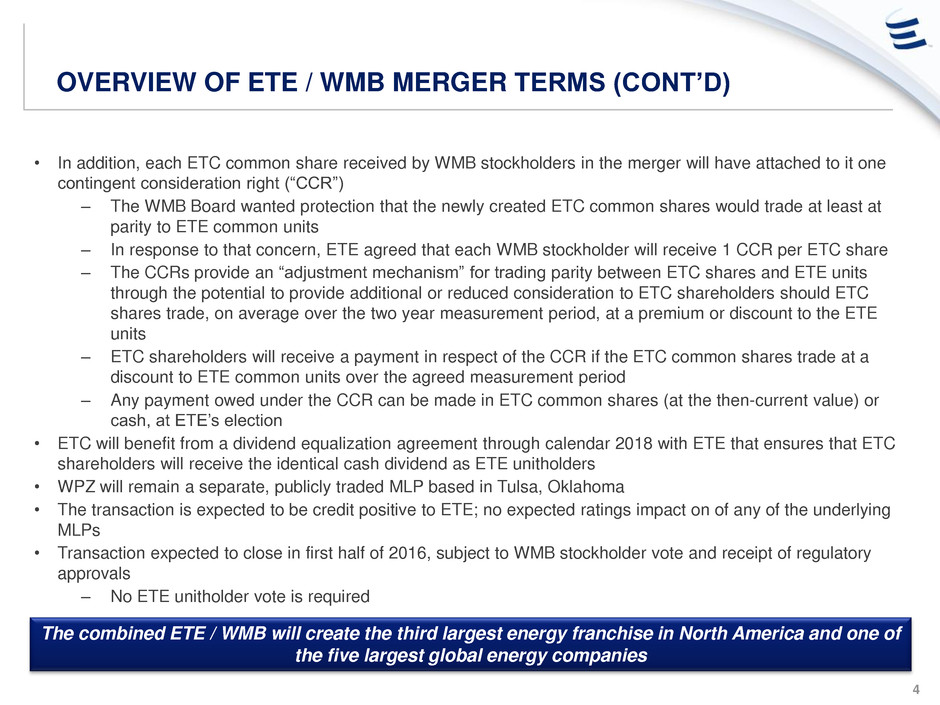

OVERVIEW OF ETE / WMB MERGER TERMS (CONT’D) • In addition, each ETC common share received by WMB stockholders in the merger will have attached to it one contingent consideration right (“CCR”) – The WMB Board wanted protection that the newly created ETC common shares would trade at least at parity to ETE common units – In response to that concern, ETE agreed that each WMB stockholder will receive 1 CCR per ETC share – The CCRs provide an “adjustment mechanism” for trading parity between ETC shares and ETE units through the potential to provide additional or reduced consideration to ETC shareholders should ETC shares trade, on average over the two year measurement period, at a premium or discount to the ETE units – ETC shareholders will receive a payment in respect of the CCR if the ETC common shares trade at a discount to ETE common units over the agreed measurement period – Any payment owed under the CCR can be made in ETC common shares (at the then-current value) or cash, at ETE’s election • ETC will benefit from a dividend equalization agreement through calendar 2018 with ETE that ensures that ETC shareholders will receive the identical cash dividend as ETE unitholders • WPZ will remain a separate, publicly traded MLP based in Tulsa, Oklahoma • The transaction is expected to be credit positive to ETE; no expected ratings impact on of any of the underlying MLPs • Transaction expected to close in first half of 2016, subject to WMB stockholder vote and receipt of regulatory approvals – No ETE unitholder vote is required The combined ETE / WMB will create the third largest energy franchise in North America and one of the five largest global energy companies 4

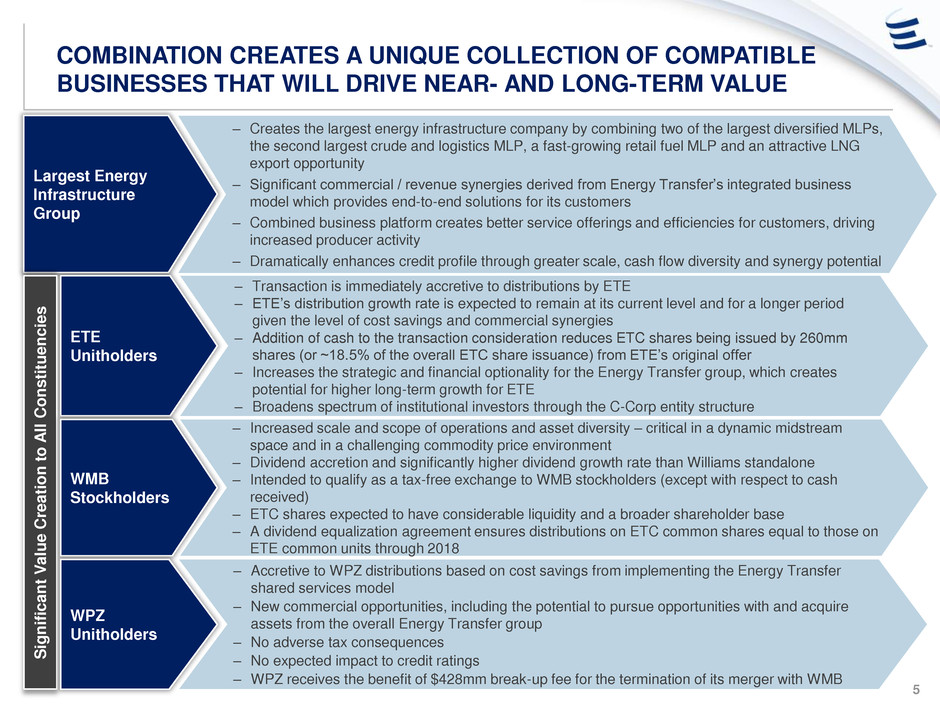

COMBINATION CREATES A UNIQUE COLLECTION OF COMPATIBLE BUSINESSES THAT WILL DRIVE NEAR- AND LONG-TERM VALUE Largest Energy Infrastructure Group ETE Unitholders – Creates the largest energy infrastructure company by combining two of the largest diversified MLPs, the second largest crude and logistics MLP, a fast-growing retail fuel MLP and an attractive LNG export opportunity – Significant commercial / revenue synergies derived from Energy Transfer’s integrated business model which provides end-to-end solutions for its customers – Combined business platform creates better service offerings and efficiencies for customers, driving increased producer activity – Dramatically enhances credit profile through greater scale, cash flow diversity and synergy potential S ig n ific a n t V a lue C re atio n t o A ll C o n stit u en c ie s WMB Stockholders WPZ Unitholders – Transaction is immediately accretive to distributions by ETE – ETE’s distribution growth rate is expected to remain at its current level and for a longer period given the level of cost savings and commercial synergies – Addition of cash to the transaction consideration reduces ETC shares being issued by 260mm shares (or ~18.5% of the overall ETC share issuance) from ETE’s original offer – Increases the strategic and financial optionality for the Energy Transfer group, which creates potential for higher long-term growth for ETE – Broadens spectrum of institutional investors through the C-Corp entity structure – Accretive to WPZ distributions based on cost savings from implementing the Energy Transfer shared services model – New commercial opportunities, including the potential to pursue opportunities with and acquire assets from the overall Energy Transfer group – No adverse tax consequences – No expected impact to credit ratings – WPZ receives the benefit of $428mm break-up fee for the termination of its merger with WMB 5 – Increased scale and scope of operations and asset diversity – critical in a dynamic midstream space and in a challenging commodity price environment – Dividend accretion and significantly higher dividend growth rate than Williams standalone – Intended to qualify as a tax-free exchange to WMB stockholders (except with respect to cash received) – ETC shares expected to have considerable liquidity and a broader shareholder base – A dividend equalization agreement ensures distributions on ETC common shares equal to those on ETE common units through 2018

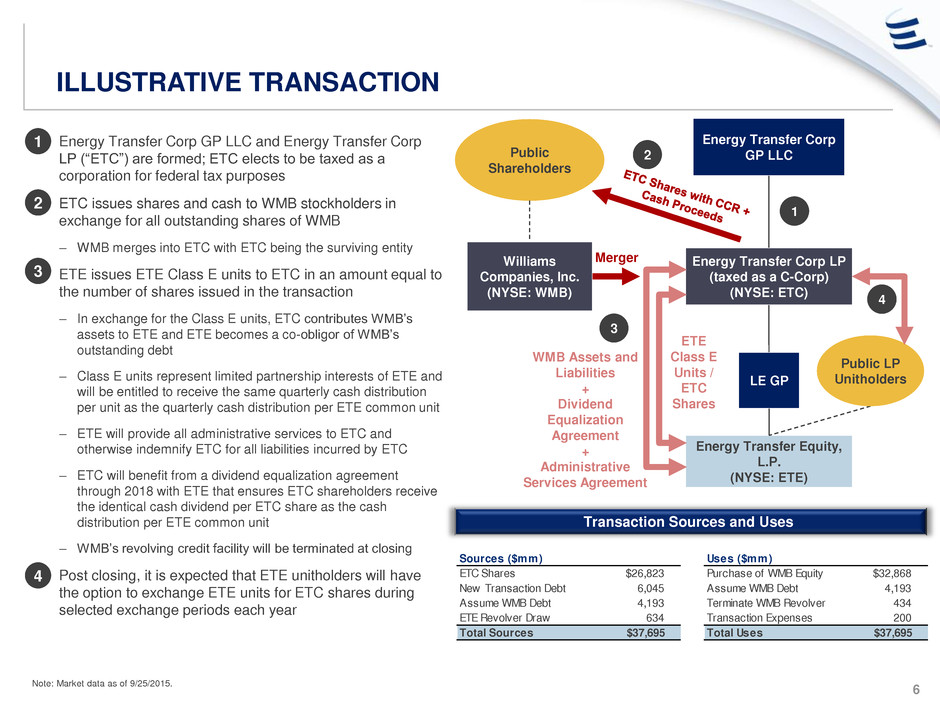

ILLUSTRATIVE TRANSACTION – Energy Transfer Corp GP LLC and Energy Transfer Corp LP (“ETC”) are formed; ETC elects to be taxed as a corporation for federal tax purposes – ETC issues shares and cash to WMB stockholders in exchange for all outstanding shares of WMB – WMB merges into ETC with ETC being the surviving entity – ETE issues ETE Class E units to ETC in an amount equal to the number of shares issued in the transaction – In exchange for the Class E units, ETC contributes WMB’s assets to ETE and ETE becomes a co-obligor of WMB’s outstanding debt – Class E units represent limited partnership interests of ETE and will be entitled to receive the same quarterly cash distribution per unit as the quarterly cash distribution per ETE common unit – ETE will provide all administrative services to ETC and otherwise indemnify ETC for all liabilities incurred by ETC – ETC will benefit from a dividend equalization agreement through 2018 with ETE that ensures ETC shareholders receive the identical cash dividend per ETC share as the cash distribution per ETE common unit – WMB’s revolving credit facility will be terminated at closing – Post closing, it is expected that ETE unitholders will have the option to exchange ETE units for ETC shares during selected exchange periods each year 1 2 3 Energy Transfer Corp LP (taxed as a C-Corp) (NYSE: ETC) Energy Transfer Equity, L.P. (NYSE: ETE) Merger WMB Assets and Liabilities + Dividend Equalization Agreement + Administrative Services Agreement Public LP Unitholders 2 Energy Transfer Corp GP LLC Public Shareholders 1 3 ETE Class E Units / ETC Shares LE GP Williams Companies, Inc. (NYSE: WMB) 6 Transaction Sources and Uses 4 4 Note: Market data as of 9/25/2015. Sources ($mm) ETC Shares $26,823 New Transaction Debt 6,045 Assume WMB Debt 4,193 ETE Revolver Draw 634 Total Sources $37,695 Uses ($mm) Purchase of WMB Equity $32,868 Assume WMB Debt 4,193 Terminate WMB Revolver 434 Transaction Expenses 200 Total Uses $37,695

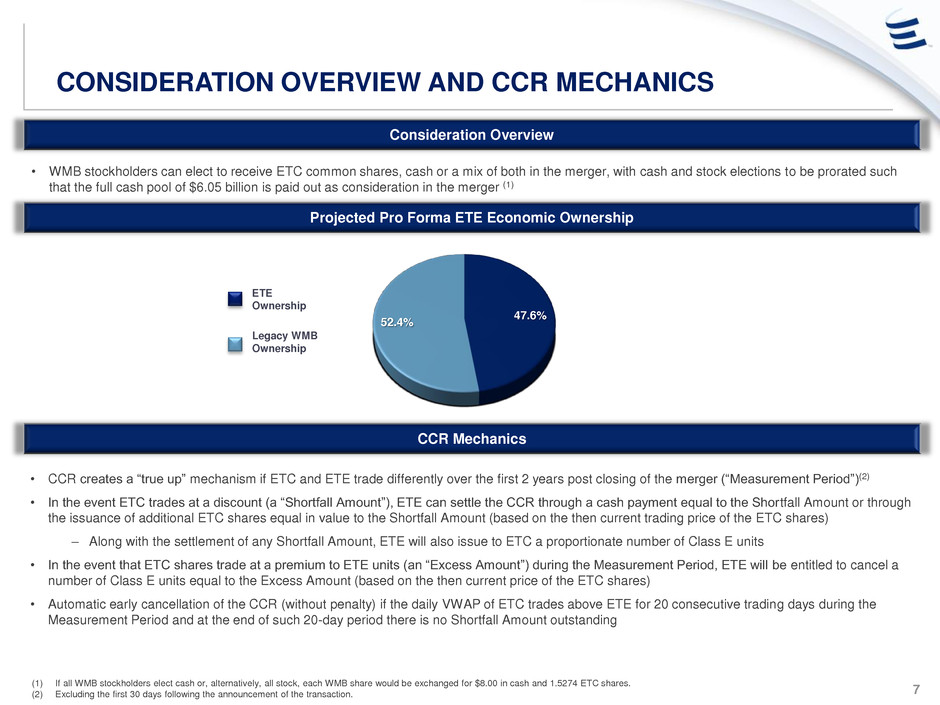

CONSIDERATION OVERVIEW AND CCR MECHANICS 7 CCR Mechanics ETE Ownership Legacy WMB Ownership (1) If all WMB stockholders elect cash or, alternatively, all stock, each WMB share would be exchanged for $8.00 in cash and 1.5274 ETC shares. (2) Excluding the first 30 days following the announcement of the transaction. Consideration Overview • WMB stockholders can elect to receive ETC common shares, cash or a mix of both in the merger, with cash and stock elections to be prorated such that the full cash pool of $6.05 billion is paid out as consideration in the merger (1) • CCR creates a “true up” mechanism if ETC and ETE trade differently over the first 2 years post closing of the merger (“Measurement Period”)(2) • In the event ETC trades at a discount (a “Shortfall Amount”), ETE can settle the CCR through a cash payment equal to the Shortfall Amount or through the issuance of additional ETC shares equal in value to the Shortfall Amount (based on the then current trading price of the ETC shares) – Along with the settlement of any Shortfall Amount, ETE will also issue to ETC a proportionate number of Class E units • In the event that ETC shares trade at a premium to ETE units (an “Excess Amount”) during the Measurement Period, ETE will be entitled to cancel a number of Class E units equal to the Excess Amount (based on the then current price of the ETC shares) • Automatic early cancellation of the CCR (without penalty) if the daily VWAP of ETC trades above ETE for 20 consecutive trading days during the Measurement Period and at the end of such 20-day period there is no Shortfall Amount outstanding Projected Pro Forma ETE Economic Ownership 47.6% 52.4%

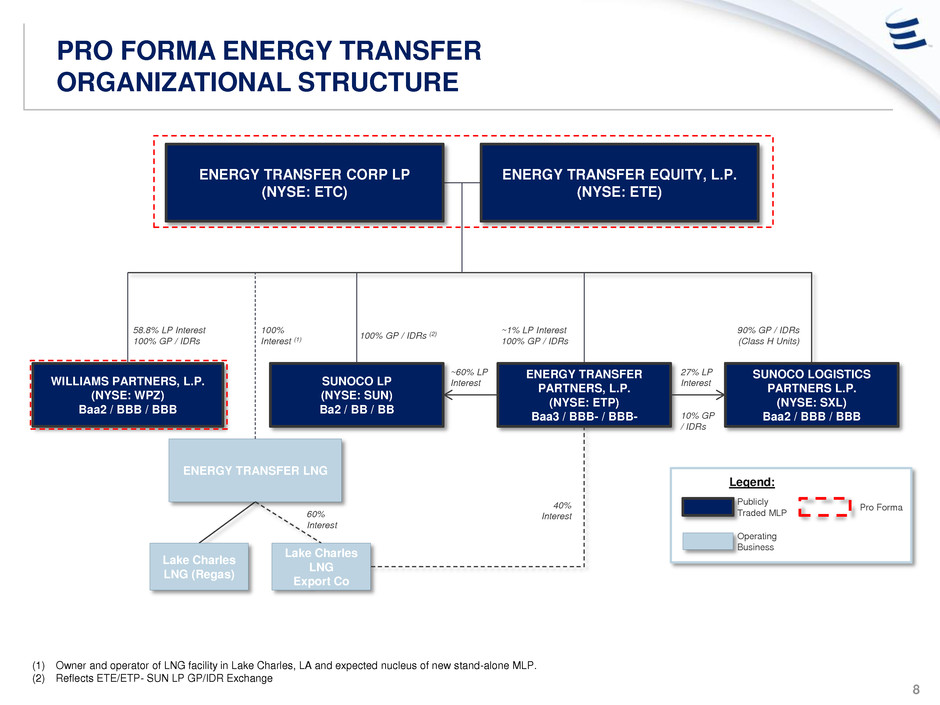

PRO FORMA ENERGY TRANSFER ORGANIZATIONAL STRUCTURE ENERGY TRANSFER LNG SUNOCO LOGISTICS PARTNERS L.P. (NYSE: SXL) Baa2 / BBB / BBB ~1% LP Interest 100% GP / IDRs 90% GP / IDRs (Class H Units) 27% LP Interest SUNOCO LP (NYSE: SUN) Ba2 / BB / BB ENERGY TRANSFER EQUITY, L.P. (NYSE: ETE) ENERGY TRANSFER PARTNERS, L.P. (NYSE: ETP) Baa3 / BBB- / BBB- 100% GP / IDRs (2) Legend: Publicly Traded MLP Operating Business Pro Forma 58.8% LP Interest 100% GP / IDRs 10% GP / IDRs ~60% LP Interest Lake Charles LNG (Regas) Lake Charles LNG Export Co 60% Interest WILLIAMS PARTNERS, L.P. (NYSE: WPZ) Baa2 / BBB / BBB ENERGY TRANSFER CORP LP (NYSE: ETC) 100% Interest (1) (1) Owner and operator of LNG facility in Lake Charles, LA and expected nucleus of new stand-alone MLP. (2) Reflects ETE/ETP- SUN LP GP/IDR Exchange 40% Interest 8

ETC PREMIUM VALUE OPPORTUNITY ETC Advantages 9 Vast C-Corp Market Compared to MLPs(1) US Equity Market Cap ~ $20T MLPs ~ $~500B • MLP C-Corp structure well received by the market • 60% of pro forma float at ETC • 1099 rather than K-1 for tax purposes • Provides access to broader range of high quality institutional investors including pension funds, endowments, and foreign investors • Liquidity of C-Corps allows investors to build meaningful positions • Eligible for broader index inclusion (S&P 500, S&P Energy) • Strategic currency for use in future acquisitions Source: Bloomberg, Alerian, S&P, Dealogic, FactSet. (1) US Equity Market Cap based on Wilshire 5000 Total Market Index as of 9/25/2015. Blue Chip Investors Likely to be Focused on ETC

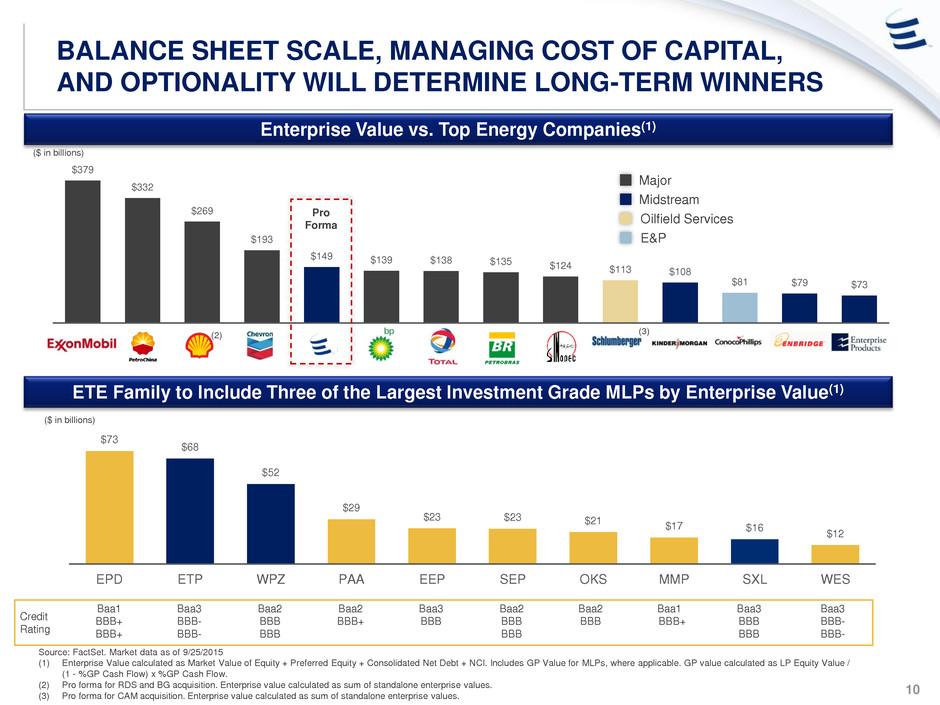

$379 $332 $269 $193 $149 $139 $138 $135 $124 $113 $108 $81 $79 $73 XOM PTR RDS CVX ETE PF BP TOT PBR SNP SLB KMI COP ENB EPD BALANCE SHEET SCALE, MANAGING COST OF CAPITAL, AND OPTIONALITY WILL DETERMINE LONG-TERM WINNERS Equity Value Enterprise Value Enterprise Value vs. Top Energy Companies(1) Midstream Major Oilfield Services E&P Pro Forma ETE Family to Include Three of the Largest Investment Grade MLPs by Enterprise Value(1) Credit Rating Baa1 BBB+ BBB+ Baa3 BBB- BBB- Baa2 BBB BBB Baa2 BBB+ Baa3 BBB Baa2 BBB BBB Baa2 BBB Baa1 BBB+ Baa3 BBB BBB Baa3 BBB- BBB- ($ in billions) ($ in billions) (2) $73 $68 $52 $29 $23 $23 $21 $17 $16 $12 EPD ETP WPZ PAA EEP SEP OKS MMP SXL WES Source: FactSet. Market data as of 9/25/2015 (1) Enterprise Value calculated as Market Value of Equity + Preferred Equity + Consolidated Net Debt + NCI. Includes GP Value for MLPs, where applicable. GP value calculated as LP Equity Value / (1 - %GP Cash Flow) x %GP Cash Flow. (2) Pro forma for RDS and BG acquisition. Enterprise value calculated as sum of standalone enterprise values. (3) Pro forma for CAM acquisition. Enterprise value calculated as sum of standalone enterprise values. 10 (3)

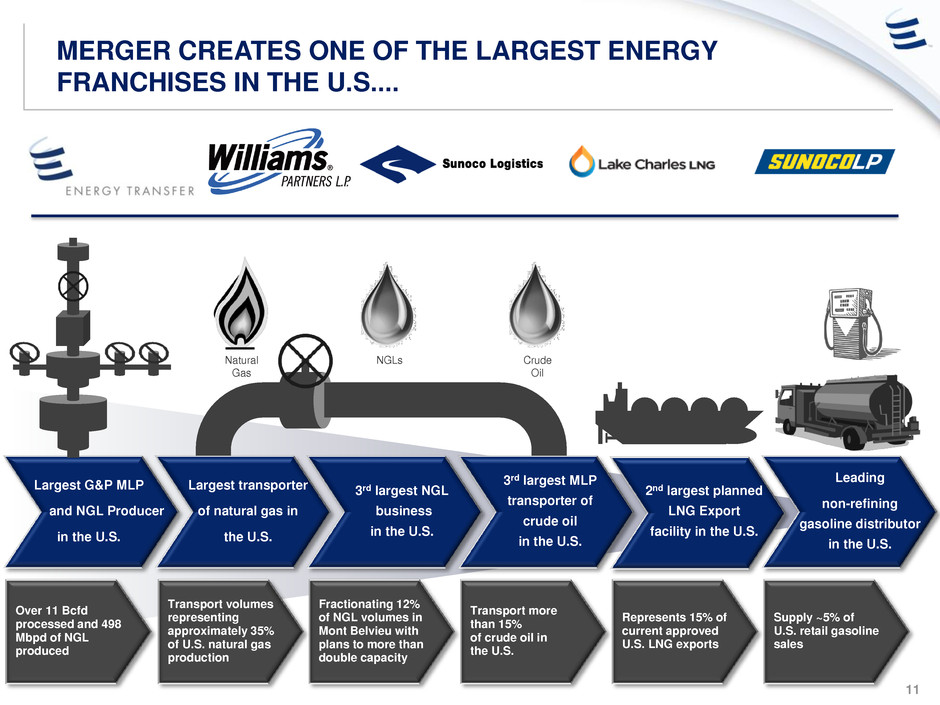

MERGER CREATES ONE OF THE LARGEST ENERGY FRANCHISES IN THE U.S.... Largest transporter of natural gas in the U.S. 3rd largest NGL business in the U.S. Largest G&P MLP and NGL Producer in the U.S. 3rd largest MLP transporter of crude oil in the U.S. Natural Gas NGLs Crude Oil 2nd largest planned LNG Export facility in the U.S. Leading non-refining gasoline distributor in the U.S. Transport volumes representing approximately 35% of U.S. natural gas production Over 11 Bcfd processed and 498 Mbpd of NGL produced Fractionating 12% of NGL volumes in Mont Belvieu with plans to more than double capacity Transport more than 15% of crude oil in the U.S. Represents 15% of current approved U.S. LNG exports Supply ~5% of U.S. retail gasoline sales 11

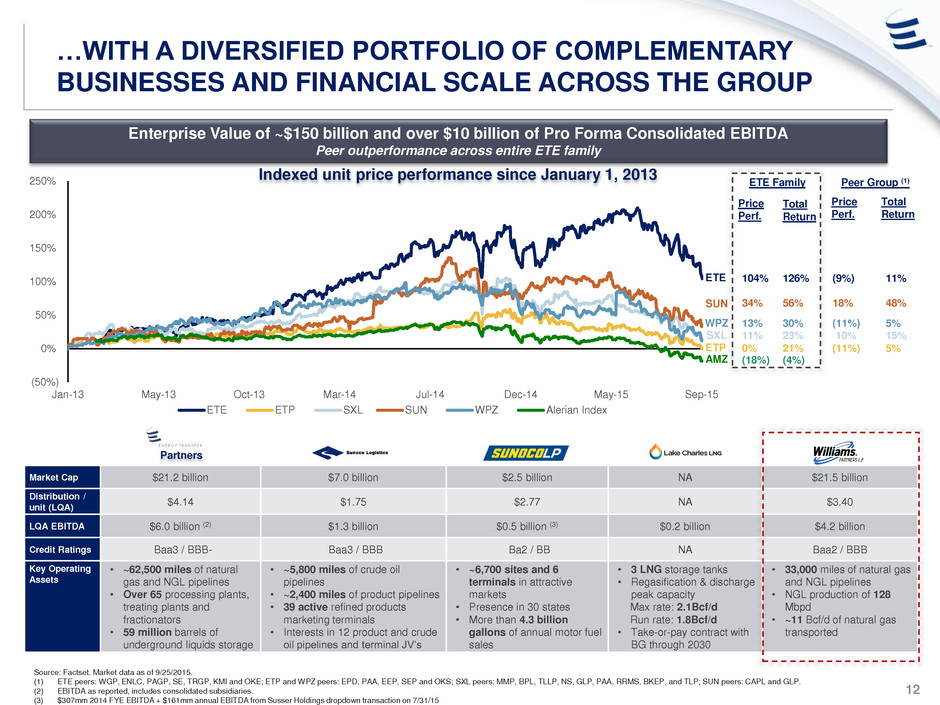

(50%) 0% 50% 100% 150% 200% 250% Jan-13 May-13 Oct-13 Mar-14 Jul-14 Dec-14 May-15 Sep-15 ETE ETP SXL SUN WPZ Alerian Index …WITH A DIVERSIFIED PORTFOLIO OF COMPLEMENTARY BUSINESSES AND FINANCIAL SCALE ACROSS THE GROUP Enterprise Value of ~$150 billion and over $10 billion of Pro Forma Consolidated EBITDA Peer outperformance across entire ETE family Source: Factset. Market data as of 9/25/2015. (1) ETE peers: WGP, ENLC, PAGP, SE, TRGP, KMI and OKE; ETP and WPZ peers: EPD, PAA, EEP, SEP and OKS; SXL peers: MMP, BPL, TLLP, NS, GLP, PAA, RRMS, BKEP, and TLP; SUN peers: CAPL and GLP. (2) EBITDA as reported, includes consolidated subsidiaries. (3) $307mm 2014 FYE EBITDA + $161mm annual EBITDA from Susser Holdings dropdown transaction on 7/31/15 Indexed unit price performance since January 1, 2013 12 Price Perf. Price Perf. Total Return Total Return (9%) 126% 11% 56% 18% 48% 10% 23% 15% (11%) 21% 5% ETE Family Peer Group (1) (4%) ETE SUN SXL ETP AMZ WPZ (11%) 30% 5% Market Cap $21.2 billion $7.0 billion $2.5 billion NA $21.5 billion Distribution / unit (LQA) $4.14 $1.75 $2.77 NA $3.40 LQA EBITDA $6.0 billion (2) $1.3 billion $0.5 billion (3) $0.2 billion $4.2 billion Credit Ratings Baa3 / BBB- Baa3 / BBB Ba2 / BB NA Baa2 / BBB Key Operating Assets • ~62,500 miles of natural gas and NGL pipelines • Over 65 processing plants, treating plants and fractionators • 59 million barrels of underground liquids storage • ~5,800 miles of crude oil pipelines • ~2,400 miles of product pipelines • 39 active refined products marketing terminals • Interests in 12 product and crude oil pipelines and terminal JV’s • ~6,700 sites and 6 terminals in attractive markets • Presence in 30 states • More than 4.3 billion gallons of annual motor fuel sales • 3 LNG storage tanks • Regasification & discharge peak capacity Max rate: 2.1Bcf/d Run rate: 1.8Bcf/d • Take-or-pay contract with BG through 2030 • 33,000 miles of natural gas and NGL pipelines • NGL production of 128 Mbpd • ~11 Bcf/d of natural gas transported Partners 104% 34% 11% 0% (18%) 13%

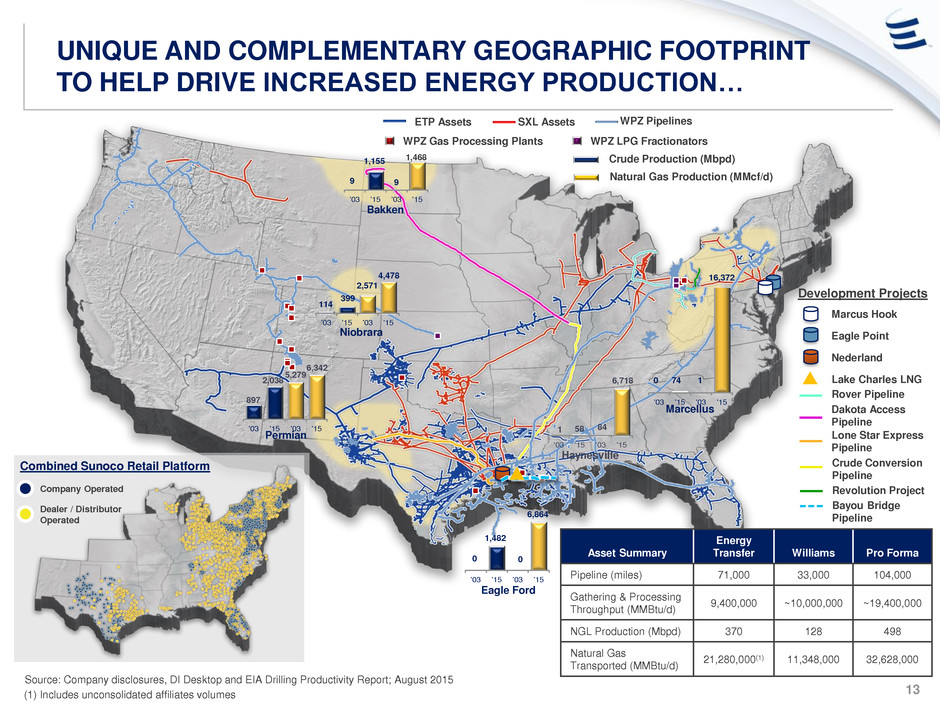

ETP Assets SXL Assets Lone Star Express Pipeline Development Projects Lake Charles LNG Rover Pipeline Dakota Access Pipeline ` Company Operated Dealer / Distributor Operated Combined Sunoco Retail Platform SUN Terminals Marcus Hook Nederland Eagle Point Crude Conversion Pipeline UNIQUE AND COMPLEMENTARY GEOGRAPHIC FOOTPRINT TO HELP DRIVE INCREASED ENERGY PRODUCTION… Source: Company disclosures, DI Desktop and EIA Drilling Productivity Report; August 2015 Crude Production (Mbpd) Natural Gas Production (MMcf/d) Bakken Niobrara Permian , , , , , , , , , , , , , , , '03 '15 '03 '15 '03 '15 '03 '15 , , , , , , , , '03 '15 '03 '15 Marcellus '03 '15 '03 '15 16,372 Eagle Ford Haynesville '03 '15 '03 '15 '03 '15 '03 '15 9 1,155 9 1,468 114 399 2,571 4,478 897 2,038 5,279 6,342 0 74 1 1 58 84 6,718 0 1,482 0 6,864 WPZ Pipelines WPZ Gas Processing Plants WPZ LPG Fractionators (1) Includes unconsolidated affiliates volumes Revolution Project 13 Bayou Bridge Pipeline Asset Summary Energy Transfer Williams Pro Forma Pipeline (miles) 71,000 33,000 104,000 Gathering & Processing Throughput (MMBtu/d) 9,400,000 ~10,000,000 ~19,400,000 NGL Production (Mbpd) 370 128 498 Natural Gas Transported (MMBtu/d) 21,280,000(1) 11,348,000 32,628,000

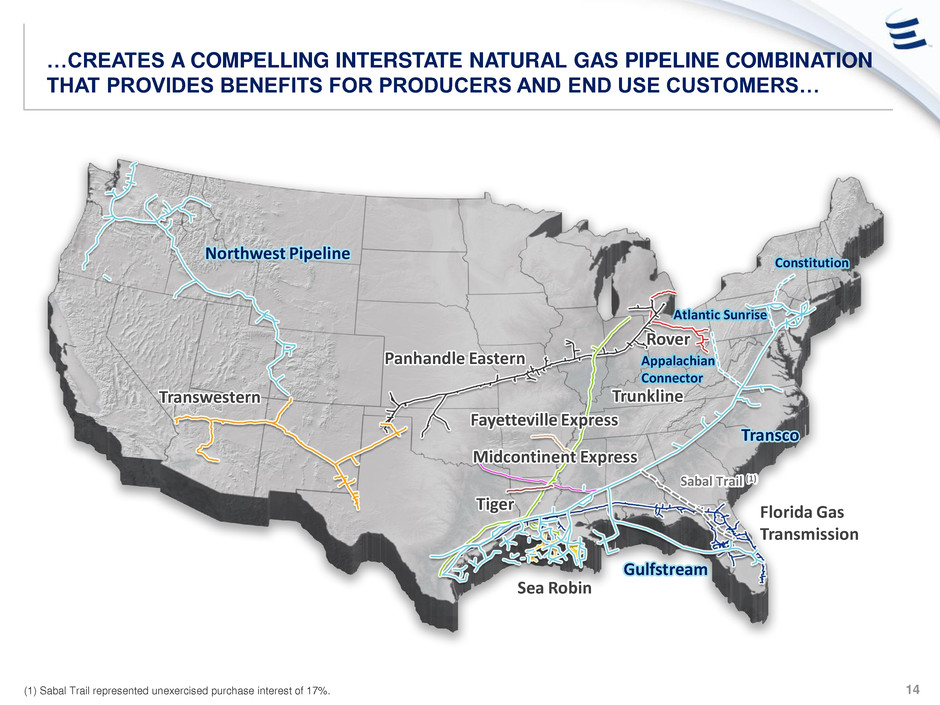

…CREATES A COMPELLING INTERSTATE NATURAL GAS PIPELINE COMBINATION THAT PROVIDES BENEFITS FOR PRODUCERS AND END USE CUSTOMERS… 14 Fayetteville Express Tiger Trunkline Florida Gas Transmission Sea Robin Transwestern Rover Panhandle Eastern Midcontinent Express Northwest Pipeline Transco Gulfstream Constitution Appalachian Connector Sabal Trail (1) Atlantic Sunrise (1) Sabal Trail represented unexercised purchase interest of 17%.

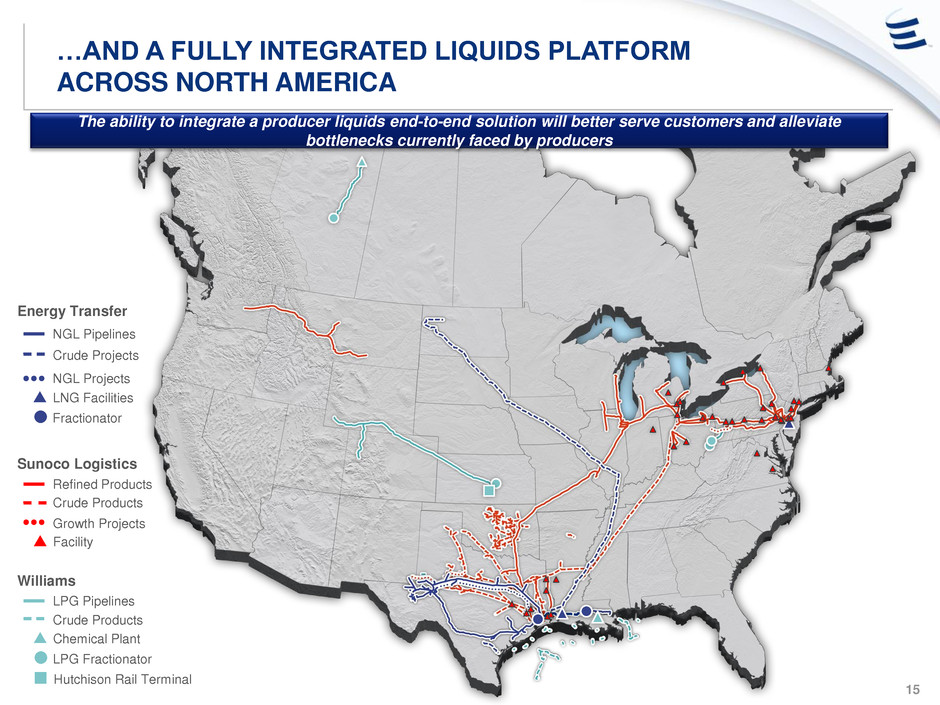

…AND A FULLY INTEGRATED LIQUIDS PLATFORM ACROSS NORTH AMERICA NGL Pipelines Crude Projects NGL Projects Refined Products Crude Products Growth Projects LPG Pipelines Crude Products Energy Transfer Sunoco Logistics Williams Chemical Plant LPG Fractionator Facility LNG Facilities Fractionator 15 Hutchison Rail Terminal The ability to integrate a producer liquids end-to-end solution will better serve customers and alleviate bottlenecks currently faced by producers

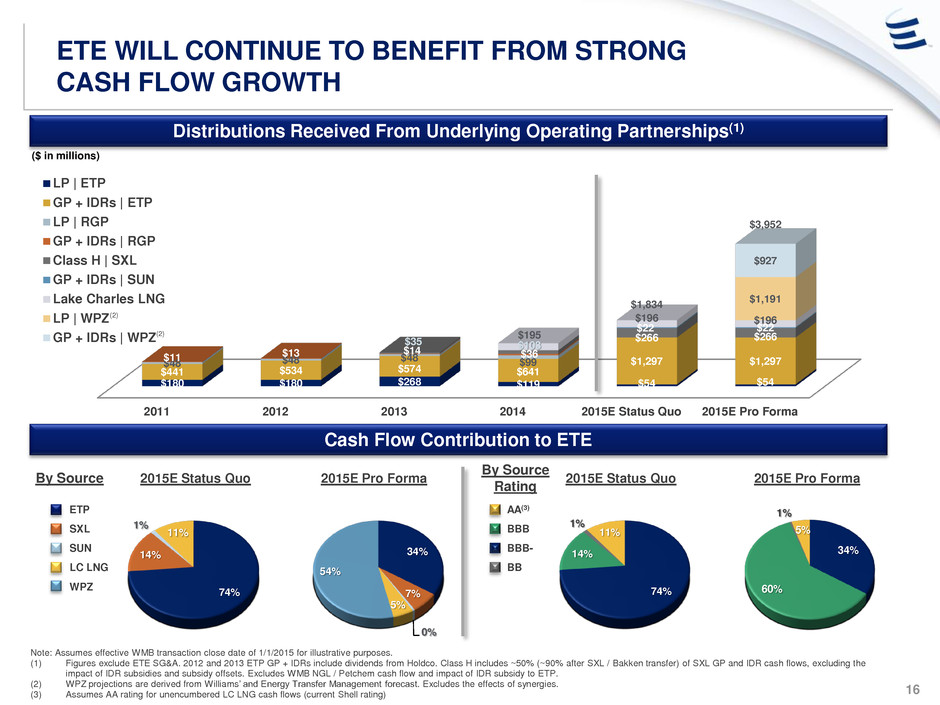

2011 2012 2013 2014 2015E Status Quo 2015E Pro Forma $180 $180 $268 $119 $54 $54 $441 $534 $574 $641 $1,297 $1,297$48 $48 $48 $9911 $13 $14 $36 $35 $103 $266 $266 $22 $22 $195 $196 $196 $1,191 $927 $1,834 $3,952 LP | ETP GP + IDRs | ETP LP | RGP GP + IDRs | RGP Class H | SXL GP + IDRs | SUN Lake Charles LNG LP | WPZ GP + IDRs | WPZ ETE WILL CONTINUE TO BENEFIT FROM STRONG CASH FLOW GROWTH ($ in millions) (2) AA(3) BBB BBB- BB 2015E Status Quo ETP SXL SUN LC LNG WPZ (2) 34% 7% 0% 5% 54% 74% 14% 1% 11% 2015E Status Quo Distributions Received From Underlying Operating Partnerships(1) Cash Flow Contribution to ETE 34% 60% 1% 5% 16 2015E Pro Forma 2015E Pro Forma 74% 14% 1% 11% Note: Assumes effective WMB transaction close date of 1/1/2015 for illustrative purposes. (1) Figures exclude ETE SG&A. 2012 and 2013 ETP GP + IDRs include dividends from Holdco. Class H includes ~50% (~90% after SXL / Bakken transfer) of SXL GP and IDR cash flows, excluding the impact of IDR subsidies and subsidy offsets. Excludes WMB NGL / Petchem cash flow and impact of IDR subsidy to ETP. (2) WPZ projections are derived from Williams’ and Energy Transfer Management forecast. Excludes the effects of synergies. (3) Assumes AA rating for unencumbered LC LNG cash flows (current Shell rating) By Source By Source Rating

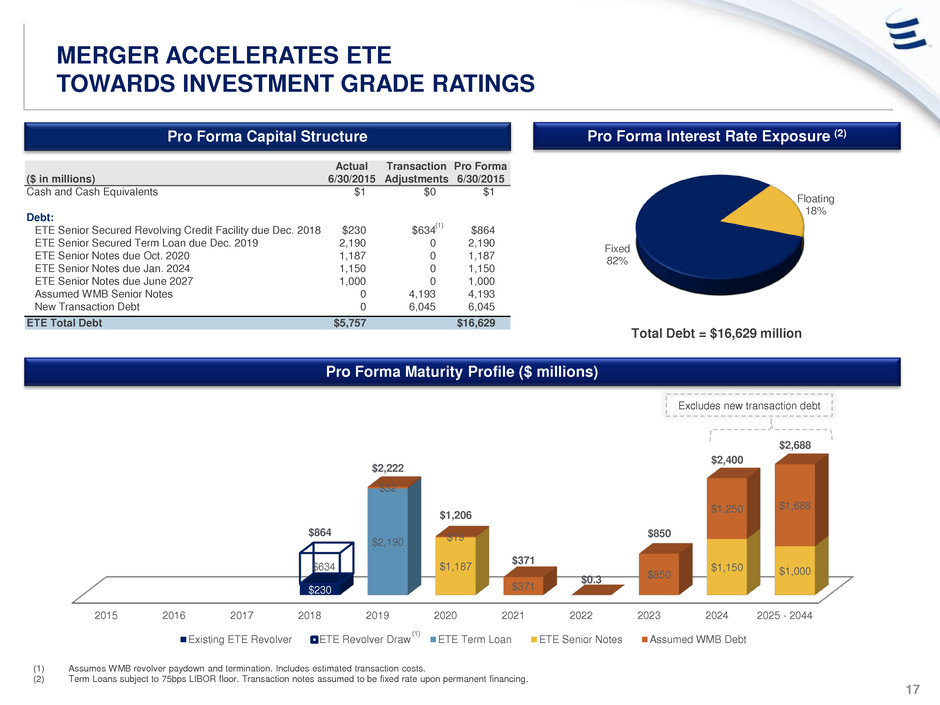

Fixed 82% Floating 18% MERGER ACCELERATES ETE TOWARDS INVESTMENT GRADE RATINGS Pro Forma Interest Rate Exposure (2) Pro Forma Maturity Profile ($ millions) Total Debt = $16,629 million Pro Forma Capital Structure (1) Assumes WMB revolver paydown and termination. Includes estimated transaction costs. (2) Term Loans subject to 75bps LIBOR floor. Transaction notes assumed to be fixed rate upon permanent financing. 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 - 2044 $230 $634 $2,190 $1,187 $1,150 $1,000 $32 $19 $371 $850 $1,250 $1,688 $864 $2,222 $1,206 $371 $0.3 $850 $2,400 $2,688 Existing ETE Revolver ETE Revolver Draw ETE Term Loan ETE Senior Notes Assumed WMB Debt Excludes new transaction debt (1) (1) 17 Actual Transaction Pro Forma ($ in millions) 6/30/2015 Adju tments 6/30/2015 Cash and Cash Equivalents $1 $0 $1 Debt: ETE Senior Secured Revolving Credit Facility due Dec. 2018 $230 $634 $864 T rm Loan due Dec. 2019 2,19 0 2,190 i r Notes due Oct. 2020 1 87 1 87 Jan 4 , 5 , 5 TE Senio t u e 2027 000 00 Assumed WMB Senior Not s 4,193 4,193 New Transaction Debt 6 045 6 45 ETE t l Debt $5,757 $1 ,629

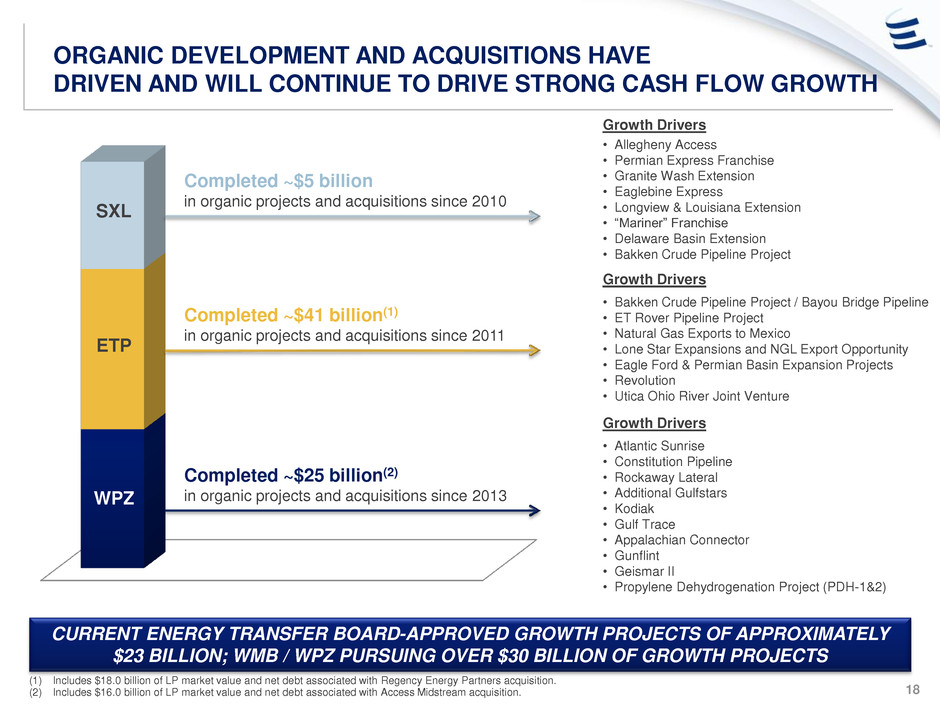

ORGANIC DEVELOPMENT AND ACQUISITIONS HAVE DRIVEN AND WILL CONTINUE TO DRIVE STRONG CASH FLOW GROWTH Growth Drivers • Bakken Crude Pipeline Project / Bayou Bridge Pipeline • ET Rover Pipeline Project • Natural Gas Exports to Mexico • Lone Star Expansions and NGL Export Opportunity • Eagle Ford & Permian Basin Expansion Projects • Revolution • Utica Ohio River Joint Venture Growth Drivers • Allegheny Access • Permian Express Franchise • Granite Wash Extension • Eaglebine Express • Longview & Louisiana Extension • “Mariner” Franchise • Delaware Basin Extension • Bakken Crude Pipeline Project CURRENT ENERGY TRANSFER BOARD-APPROVED GROWTH PROJECTS OF APPROXIMATELY $23 BILLION; WMB / WPZ PURSUING OVER $30 BILLION OF GROWTH PROJECTS Growth Drivers • Atlantic Sunrise • Constitution Pipeline • Rockaway Lateral • Additional Gulfstars • Kodiak • Gulf Trace • Appalachian Connector • Gunflint • Geismar II • Propylene Dehydrogenation Project (PDH-1&2) (1) Includes $18.0 billion of LP market value and net debt associated with Regency Energy Partners acquisition. (2) Includes $16.0 billion of LP market value and net debt associated with Access Midstream acquisition. $1.20 ETP SXL Completed ~$41 billion(1) in organic projects and acquisitions since 2011 Completed ~$5 billion in organic projects and acquisitions since 2010 WPZ Completed ~$25 billion(2) in organic projects and acquisitions since 2013 18

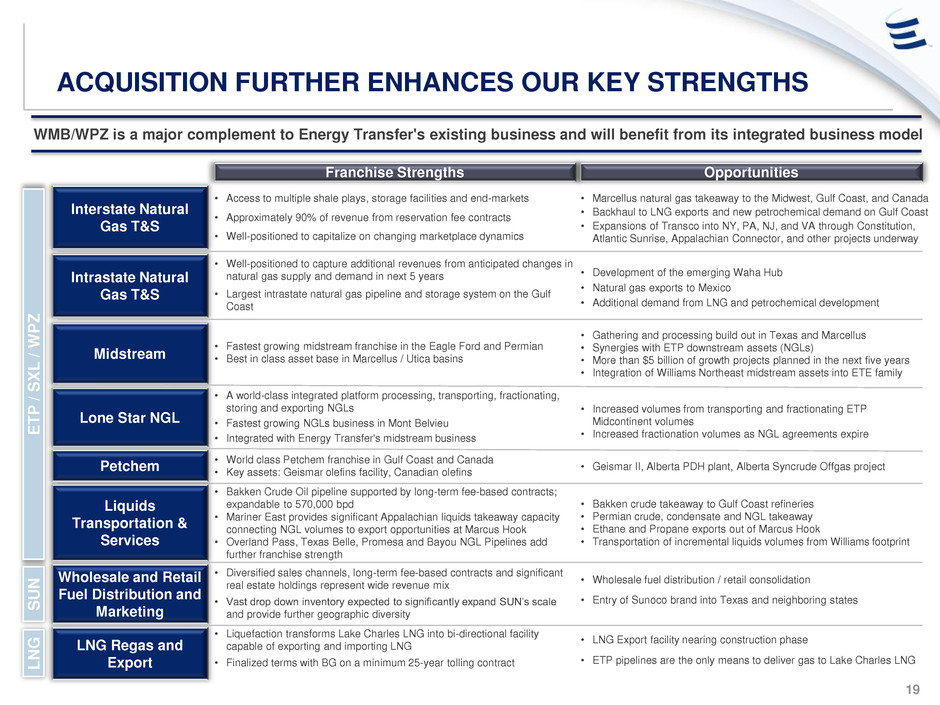

ACQUISITION FURTHER ENHANCES OUR KEY STRENGTHS WMB/WPZ is a major complement to Energy Transfer's existing business and will benefit from its integrated business model Interstate Natural Gas T&S Franchise Strengths Intrastate Natural Gas T&S Midstream Liquids Transportation & Services Lone Star NGL LNG Regas and Export Wholesale and Retail Fuel Distribution and Marketing • Access to multiple shale plays, storage facilities and end-markets • Approximately 90% of revenue from reservation fee contracts • Well-positioned to capitalize on changing marketplace dynamics • Marcellus natural gas takeaway to the Midwest, Gulf Coast, and Canada • Backhaul to LNG exports and new petrochemical demand on Gulf Coast • Expansions of Transco into NY, PA, NJ, and VA through Constitution, Atlantic Sunrise, Appalachian Connector, and other projects underway E T P / S X L / W P Z Opportunities • Development of the emerging Waha Hub • Natural gas exports to Mexico • Additional demand from LNG and petrochemical development • Gathering and processing build out in Texas and Marcellus • Synergies with ETP downstream assets (NGLs) • More than $5 billion of growth projects planned in the next five years • Integration of Williams Northeast midstream assets into ETE family • Increased volumes from transporting and fractionating ETP Midcontinent volumes • Increased fractionation volumes as NGL agreements expire • Bakken crude takeaway to Gulf Coast refineries • Permian crude, condensate and NGL takeaway • Ethane and Propane exports out of Marcus Hook • Transportation of incremental liquids volumes from Williams footprint • Wholesale fuel distribution / retail consolidation • Entry of Sunoco brand into Texas and neighboring states • LNG Export facility nearing construction phase • ETP pipelines are the only means to deliver gas to Lake Charles LNG S U N LN G • Well-positioned to capture additional revenues from anticipated changes in natural gas supply and demand in next 5 years • Largest intrastate natural gas pipeline and storage system on the Gulf Coast • Fastest growing midstream franchise in the Eagle Ford and Permian • Best in class asset base in Marcellus / Utica basins • Bakken Crude Oil pipeline supported by long-term fee-based contracts; expandable to 570,000 bpd • Mariner East provides significant Appalachian liquids takeaway capacity connecting NGL volumes to export opportunities at Marcus Hook • Overland Pass, Texas Belle, Promesa and Bayou NGL Pipelines add further franchise strength • Liquefaction transforms Lake Charles LNG into bi-directional facility capable of exporting and importing LNG • Finalized terms with BG on a minimum 25-year tolling contract • Diversified sales channels, long-term fee-based contracts and significant real estate holdings represent wide revenue mix • Vast drop down inventory expected to significantly expand SUN’s scale and provide further geographic diversity • A world-class integrated platform processing, transporting, fractionating, storing and exporting NGLs • Fastest growing NGLs business in Mont Belvieu • Integrated with Energy Transfer's midstream business Petchem • Geismar II, Alberta PDH plant, Alberta Syncrude Offgas project • World class Petchem franchise in Gulf Coast and Canada • Key assets: Geismar olefins facility, Canadian olefins 19

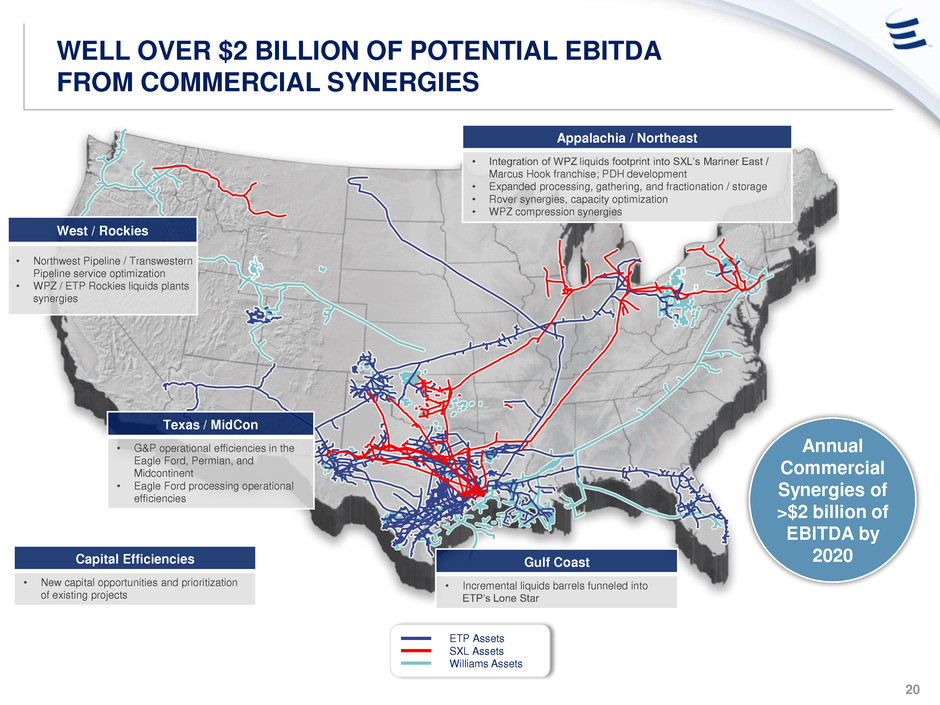

WELL OVER $2 BILLION OF POTENTIAL EBITDA FROM COMMERCIAL SYNERGIES West / Rockies • Northwest Pipeline / Transwestern Pipeline service optimization • WPZ / ETP Rockies liquids plants synergies Appalachia / Northeast • Integration of WPZ liquids footprint into SXL’s Mariner East / Marcus Hook franchise; PDH development • Expanded processing, gathering, and fractionation / storage • Rover synergies, capacity optimization • WPZ compression synergies Gulf Coast • Incremental liquids barrels funneled into ETP’s Lone Star Texas / MidCon • G&P operational efficiencies in the Eagle Ford, Permian, and Midcontinent • Eagle Ford processing operational efficiencies Annual Commercial Synergies of >$2 billion of EBITDA by 2020 Capital Efficiencies • New capital opportunities and prioritization of existing projects ETP Assets SXL Assets Williams Assets 20

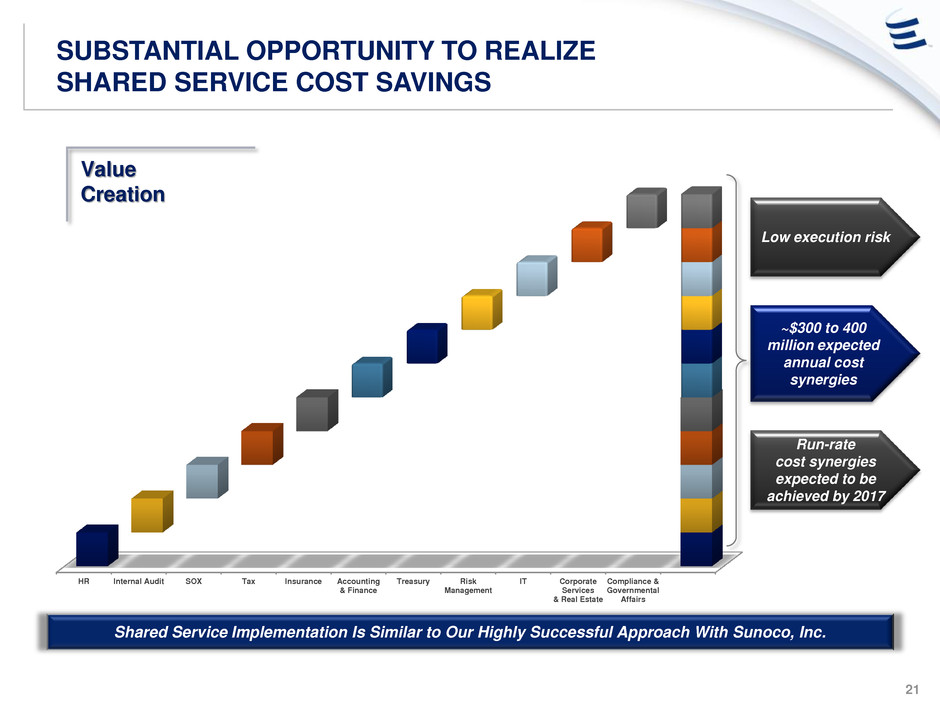

SUBSTANTIAL OPPORTUNITY TO REALIZE SHARED SERVICE COST SAVINGS Shared Service Implementation Is Similar to Our Highly Successful Approach With Sunoco, Inc. Compliance & Governmental Affairs Corporate Services & Real Estate ITRisk Management TreasuryAccounting & Finance InsuranceTaxSOXInternal AuditHR Value Creation Low execution risk Run-rate cost synergies expected to be achieved by 2017 ~$300 to 400 million expected annual cost synergies 21

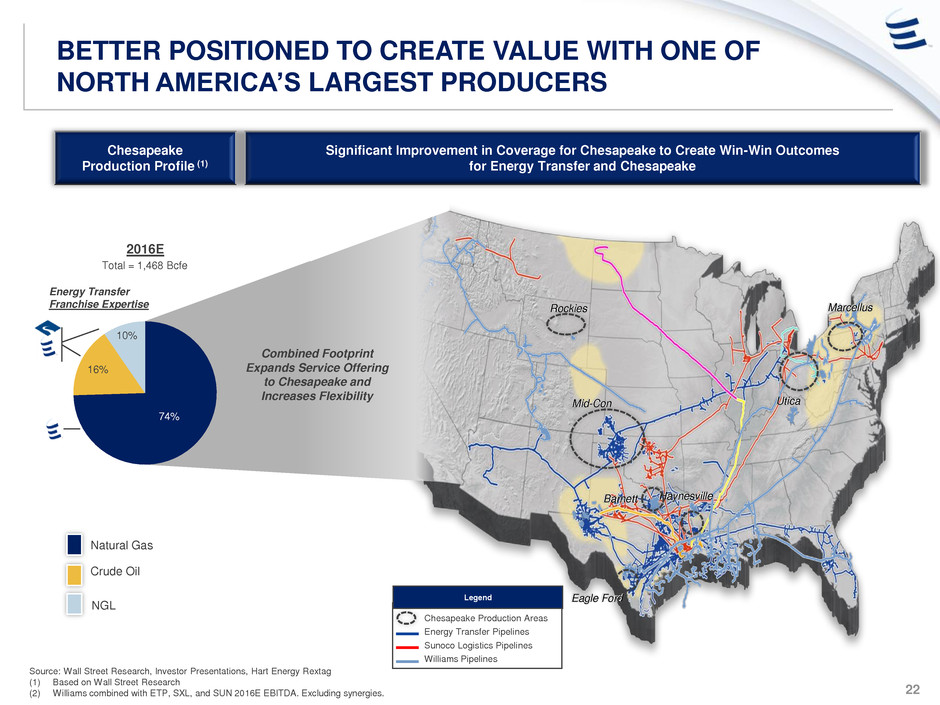

BETTER POSITIONED TO CREATE VALUE WITH ONE OF NORTH AMERICA’S LARGEST PRODUCERS 22 Source: Wall Street Research, Investor Presentations, Hart Energy Rextag (1) Based on Wall Street Research (2) Williams combined with ETP, SXL, and SUN 2016E EBITDA. Excluding synergies. Chesapeake Production Profile (1) Rockies Mid-Con Eagle Ford Haynesville Barnett Utica Marcellus Natural Gas Crude Oil 74% 16% 10% 2016E Total = 1,468 Bcfe Energy Transfer Franchise Expertise NGL Combined Footprint Expands Service Offering to Chesapeake and Increases Flexibility Chesapeake Production Areas Energy Transfer Pipelines Sunoco Logistics Pipelines Williams Pipelines Legend Significant Improvement in Coverage for Chesapeake to Create Win-Win Outcomes for Energy Transfer and Chesapeake

KEY TAKEAWAYS • The merger creates numerous benefits: – Enhances overall cash flow diversification by commodity exposure, geographic areas and customer base – Increases long-term cash flow growth – Improves pro forma credit profile – ETC is strategic currency for use in future acquisitions • ETE / ETC will derive its cash flow strength from: – Three of the largest investment grade diversified MLPs (ETP, SXL and WPZ) as well as a fast growing retail fuel MLP (SUN) – Increasing incentive distributions resulting from significant growth projects that have been announced by ETP, SXL and WPZ – Direct participation in a substantial LNG export opportunity with fixed fees for 25 years from high credit quality customer • WMB benefits from the size and strength of a broader, more diversified platform: – Tax deferred exchange using a C-Corp structure – Attractive premium with significant upside through ownership of ETC common shares – Higher dividends per share and dividend growth than WMB on a stand alone basis ETE / ETC will be stronger and better positioned with even greater strategic and financial optionality Consolidated group has better potential for growth in a volatile commodity price environment Largest energy infrastructure group 23

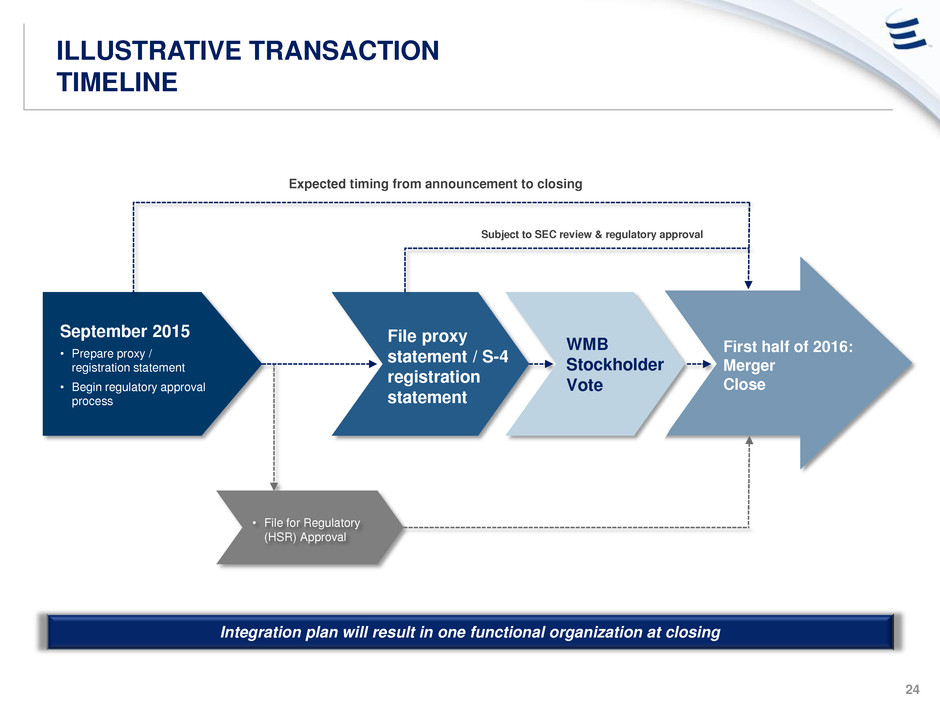

24 ILLUSTRATIVE TRANSACTION TIMELINE September 2015 • Prepare proxy / registration statement • Begin regulatory approval process File proxy statement / S-4 registration statement First half of 2016: Merger Close • File for Regulatory (HSR) Approval Expected timing from announcement to closing Subject to SEC review & regulatory approval Integration plan will result in one functional organization at closing WMB Stockholder Vote