Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ashford Inc. | aincremingtontransacationt.htm |

| EX-99.1 - EXHIBIT 99.1 - Ashford Inc. | ashfordinc-remingtonconfer.htm |

AINC / Remington Merger Discussion Materials Combination With Remington Holdings September 2015

Certain statements and assumptions in this presentation contain or are based upon "forward-looking" information and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such statements are subject to numerous assumptions and uncertainties, many of which are outside Ashford's control. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated, including, without limitation: the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction; the failure to satisfy conditions to completion of the transaction, including receipt of regulatory approvals, stockholder approval and a private letter ruling from the IRS; changes in the business or operating prospects of Remington; adverse litigation or regulatory developments; our success in implementing our business development plans of integrating Ashford's and Remington's business and realizing the expected benefits of the transaction; general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy; and the degree and nature of our competition. These and other risk factors are more fully discussed in Ashford's filings with the Securities and Exchange Commission (the "SEC"). The forward-looking statements included in this presentation are only made as of the date of this presentation. Investors should not place undue reliance on these forward-looking statements. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise. In connection with the transactions described herein, Ashford will file a proxy statement with the SEC. STOCKHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT WHEN IT IS AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain a free copy of the proxy statement when available and other relevant documents filed with the SEC from the SEC's website at www.sec.gov, or by directing a request by mail to Ashford Inc., 14185 Dallas Parkway, Suite 1100, Dallas, TX 75254 or from Ashford's website at www.ashfordinc.com. Ashford and certain of its directors and officers may, under the rules of the SEC, be deemed to be "participants" in the solicitation of proxies from its stockholders that will occur in connection with the transaction. Information concerning the interests of the persons who may be considered "participants" in the solicitation is set forth in Ashford's proxy statements and its Annual Report on Form 10-K previously filed with the SEC, and will be set forth in the proxy statement relating to the transaction when the proxy statement becomes available. Copies of these documents can be obtained, without charge, at the SEC's website at www.sec.gov, by directing a request to Ashford at the address above, or at www.ashfordinc.com. 2 Disclosures / Forward-Looking Statements

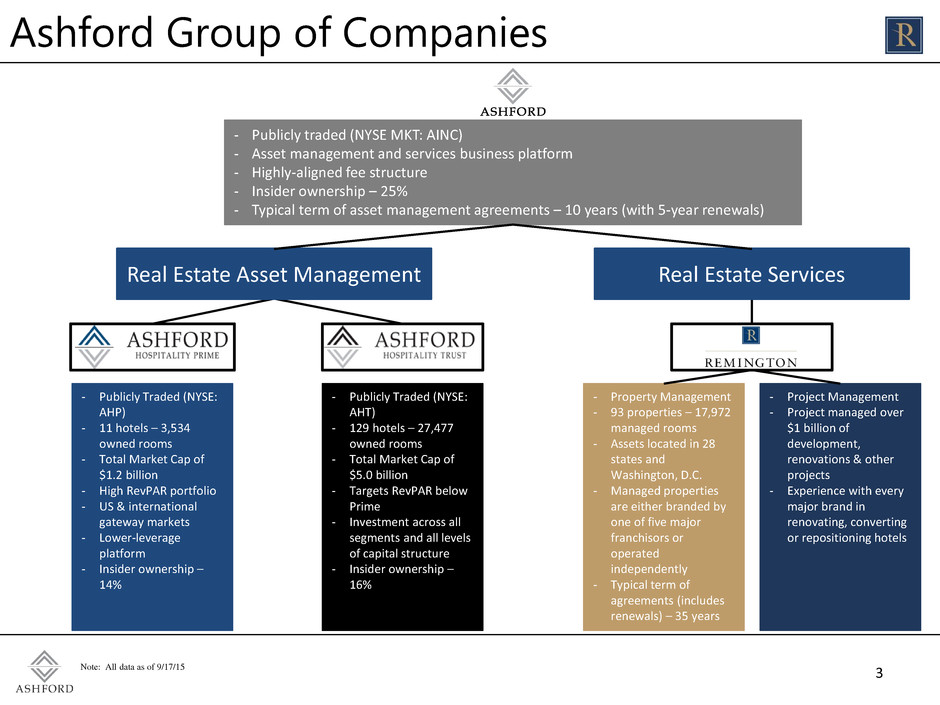

3 Ashford Group of Companies - Publicly traded (NYSE MKT: AINC) - Asset management and services business platform - Highly-aligned fee structure - Insider ownership – 25% - Typical term of asset management agreements – 10 years (with 5-year renewals) - Publicly Traded (NYSE: AHP) - 11 hotels – 3,534 owned rooms - Total Market Cap of $1.2 billion - High RevPAR portfolio - US & international gateway markets - Lower-leverage platform - Insider ownership – 14% - Publicly Traded (NYSE: AHT) - 129 hotels – 27,477 owned rooms - Total Market Cap of $5.0 billion - Targets RevPAR below Prime - Investment across all segments and all levels of capital structure - Insider ownership – 16% - Property Management - 93 properties – 17,972 managed rooms - Assets located in 28 states and Washington, D.C. - Managed properties are either branded by one of five major franchisors or operated independently - Typical term of agreements (includes renewals) – 35 years - Project Management - Project managed over $1 billion of development, renovations & other projects - Experience with every major brand in renovating, converting or repositioning hotels Real Estate Asset Management Real Estate Services Note: All data as of 9/17/15

AINC has entered into an agreement to combine with Remington(1) for total transaction value of $299.5 million 916,500 subsidiary nonvoting common shares issued at $100 per share (current market value of $59.5 million) $230 million in subsidiary convertible preferred stock 6.625% yield $120 conversion price (85% premium)(2) $10 million cash consideration(3) 4 _____________________ (1) Remington Holdings LP and its affiliates. A 20% interest in Remington Holdings will be retained by the current owners. (2) Based on closing stock price of AINC as of September 17, 2015. (3) Paid out quarterly over 4 years. Transaction Overview AINC to create new subsidiary (“NewCo”) & contribute all assets to NewCo Securities issued to sellers will be NewCo securities, but are intended to be economically equivalent to AINC securities NewCo stock will be issued to sellers at 54% premium to pre-announcement market price of AINC stock(2) Sellers only taking 3% of the consideration in cash signifying strong belief in future prospects for AINC & Remington

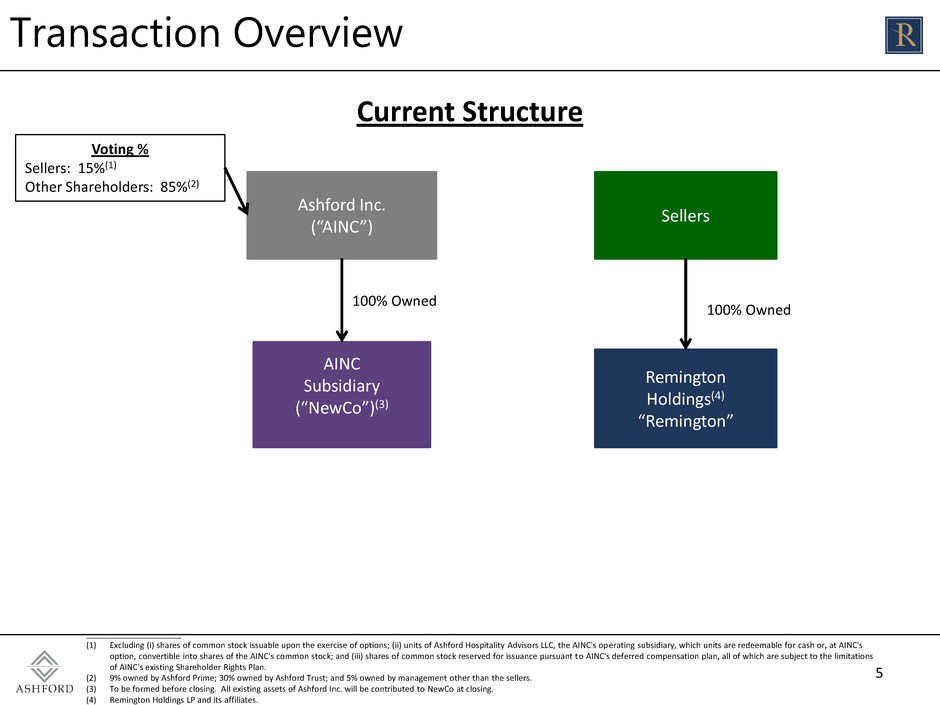

5 Ashford Inc. (“AINC”) Remington Holdings(4) “Remington” AINC Subsidiary (“NewCo”)(3) 100% Owned _____________________ (1) Excluding (i) shares of common stock issuable upon the exercise of options; (ii) units of Ashford Hospitality Advisors LLC, the AINC's operating subsidiary, which units are redeemable for cash or, at AINC's option, convertible into shares of the AINC's common stock; and (iii) shares of common stock reserved for issuance pursuant to AINC's deferred compensation plan, all of which are subject to the limitations of AINC's existing Shareholder Rights Plan. (2) 9% owned by Ashford Prime; 30% owned by Ashford Trust; and 5% owned by management other than the sellers. (3) To be formed before closing. All existing assets of Ashford Inc. will be contributed to NewCo at closing. (4) Remington Holdings LP and its affiliates. Transaction Overview Sellers 100% Owned Current Structure Voting % Sellers: 15%(1) Other Shareholders: 85%(2)

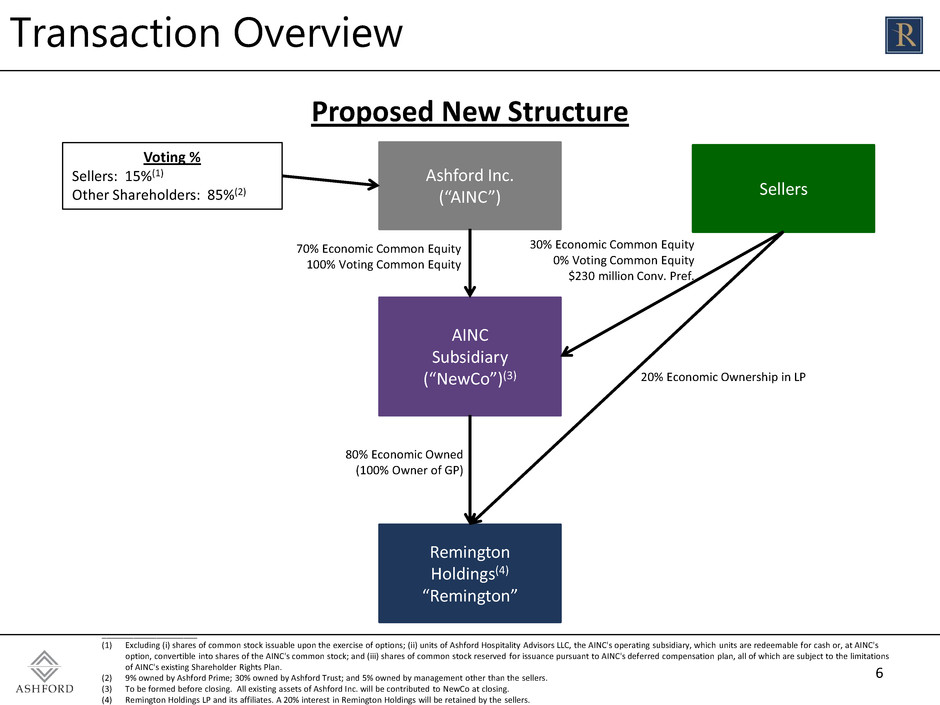

6 Ashford Inc. (“AINC”) Remington Holdings(4) “Remington” AINC Subsidiary (“NewCo”)(3) 70% Economic Common Equity 100% Voting Common Equity _____________________ (1) Excluding (i) shares of common stock issuable upon the exercise of options; (ii) units of Ashford Hospitality Advisors LLC, the AINC's operating subsidiary, which units are redeemable for cash or, at AINC's option, convertible into shares of the AINC's common stock; and (iii) shares of common stock reserved for issuance pursuant to AINC's deferred compensation plan, all of which are subject to the limitations of AINC's existing Shareholder Rights Plan. (2) 9% owned by Ashford Prime; 30% owned by Ashford Trust; and 5% owned by management other than the sellers. (3) To be formed before closing. All existing assets of Ashford Inc. will be contributed to NewCo at closing. (4) Remington Holdings LP and its affiliates. A 20% interest in Remington Holdings will be retained by the sellers. Transaction Overview Sellers 20% Economic Ownership in LP Proposed New Structure 30% Economic Common Equity 0% Voting Common Equity $230 million Conv. Pref. 80% Economic Owned (100% Owner of GP) Voting % Sellers: 15%(1) Other Shareholders: 85%(2)

7 Significant Benefits to AINC Financial Benefits Strategic Benefits Attractive valuation relative to the intrinsic value of the business and recent comparable transactions Expected to increase AINC’s normalized Adjusted EBITDA by approximately $32 million (approximately 250% increase) based on Remington 2016 EBITDA forecast, giving it significantly greater scale Expected to be immediately accretive to AINC's normalized Adjusted Net Income Per Share Subsidiary common shares issued at $100 per share, a 54% premium to current market price of AINC(1) Subsidiary as-converted shares issued at 85% premium to current market price of AINC(1) Very little cash consideration for large transformational combination signifying strong belief by the sellers in the future growth prospects for AINC and Remington Adds incremental incentive fees which are tied to property performance, not strictly shareholder returns, as is currently the case for AINC Adds talented executives to help lead AINC’s growing platform Enhances strong alignment of Sellers through issuance of non-voting common equity and convertible preferred equity Combination creates the only public, pure-play provider of asset and property management services to the lodging industry _____________________ (1) Based on closing stock price of AINC as of September 17, 2015.

8 Attractive Valuation / Structure Immediately accretive to AINC Normalized Adjusted Net Income Per Share: Common shares 2,273 Adjusted Net Income Per Share (Normalized) 3.73 Combined Companies: AINC Adjusted EBITDA (Normalized) (1) 13,042 80% Share of Remington's 2016E EBITDA 32,000 Combined Pro Forma Adjusted EBITDA 45,042 Less: Assumed taxes at full tax rate of 35% (15,765) Combined Pro Forma Adjusted Net Income Before Minority Interest 29,277 Less: Minority Interest(2) (19,366) Combined Pro Forma Adjusted Net Income 9,912 Common shares 2,273 Combined Pro Forma Adjusted Net Income Per Share 4.36 Accretion - $ per share 0.63 Accretion - % 16.9% Combined Companies ("As-Converted"): Combined Pro Forma Adjusted Net Income 9,912 Plus: Minority Interest(2) 19,366 Combined Pro Forma Adjusted Net Income Before Minority Interest 29,277 Common shares(3) 5,106 Combined Pro Forma Adjusted Net Income Per Share 5.73 Accretion - $ per share 2.00 Accretion - % 53.7% _____________________ (1) 2Q 2015 YTD Annualized. (2) Includes 30% interest in NewCo and 70% of convertible preferred dividend. (3) Assumes all NewCo common stock and NewCo convertible preferred stock is converted into AINC common stock, which can occur only in limited circumstances as provided in the Investor Rights Agreement.

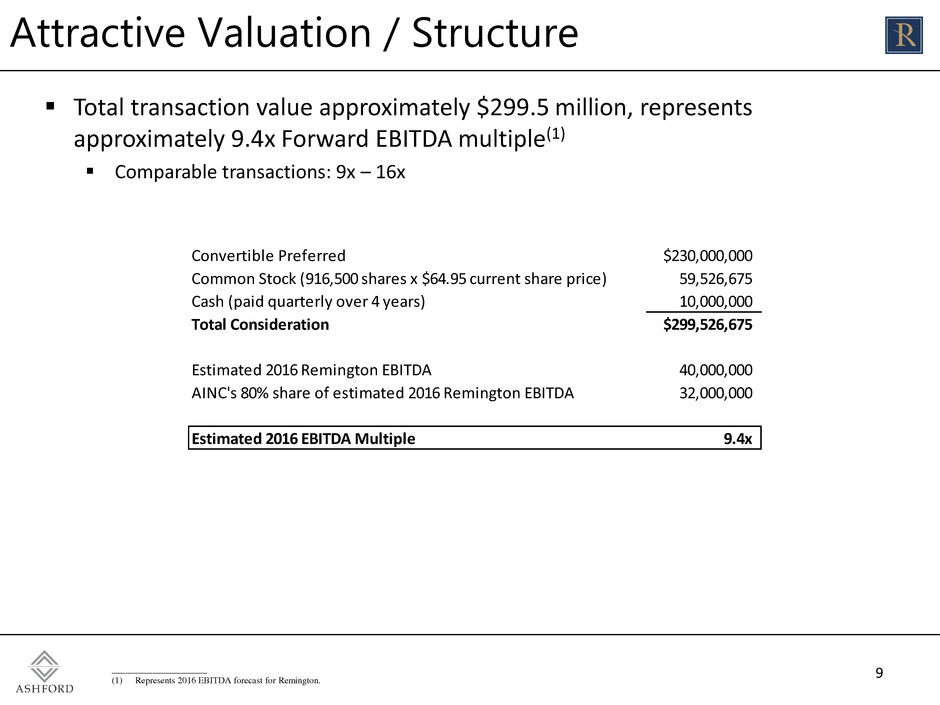

9 Attractive Valuation / Structure Total transaction value approximately $299.5 million, represents approximately 9.4x Forward EBITDA multiple(1) Comparable transactions: 9x – 16x _____________________ (1) Represents 2016 EBITDA forecast for Remington. Convertible Preferred $230,000,000 Common Stock (916,500 shares x $64.95 current share price) 59,526,675 Cash (paid quarterly over 4 years) 10,000,000 Total Consideration $299,526,675 Estimated 2016 Remington EBITDA 40,000,000 AINC's 80% share of estimated 2016 Remington EBITDA 32,000,000 Estimated 2016 EBITDA Multiple 9.4x

10 Illustrative Transactions Source: S&P Financial Capital IQ and company filings. (1) Represents 2015 expected EBITDA calculated using management’s expectation for 2017 EBITDA and straight-lining EBITDA growth from 2014 through 2017. (2) Forward EBITDA based on NSAM-reported Q1 2015 income from Island Hospitality Management, annualized. NSAM acquired a 45% interest in Island Hospitality Management. (3) Represents expected 2014 EBITDA. Total transaction value of 2.046 billion rand, which represents $193 million per Marriott’s Q2 2014 10Q. (4) Represents expected 2010 adjusted recurring EBITDA as provided in the definitive proxy statement for the transaction. Gross transaction value is increased by total cash and short term investments on Interstate’s balance sheet at time of transaction of $20.94M. Illustrative Comparables Buyer Target Announce Date Close Date Gross Transaction Value ($MM) Implied EV ($MM) Implied EV / EBITDA Intercontinental Hotels Group plc Kimpton Hotel & Restaurant Group, LLC 12/16/2014 1/16/2015 430.0 430.0 16.3x (1) Norths ar Asset Management Group Island Hospitality Management, Inc. 11/6/2014 1/9/2015 37.7 83.8 9.4x (2) Marriott International, Inc. Protea Hospitality Holdings (Pty) Ltd 11/7/2013 4/1/2014 193.0 193.0 10.0x (3) Thayer Lodging Group; Shanghai Jin Jiang International Hotels Co. Ltd. Interstate Hotels & Resorts Inc. 12/18/2009 3/17/2010 320.5 299.6 15.6x (4) Mean: 12.8x $430.0 $299.6 $193.0 $83.8 16.3x 15.6x 10.0x 9.4x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 Kimpton Interstate Protea Island Hospitality Im p li ed E V / E B IT D A E n te rp ri se V a lu e EV Implied EV / EBITDA The following are four transactions selected by management for illustrative purposes only. The illustrative transactions are not intended to represent all comparable transactions or all possible methods for evaluating the transaction.

11 Structure Terms Sellers will have no increase in voting shares of AINC Under limited circumstances pursuant to the Investor Rights Agreement, Sellers can put their NewCo stock to AINC for AINC common stock or cash Contractual rights for AINC to acquire remaining interests in Remington ROFR for life of ownership Right to “call” remaining ownership after 10 years at appraised value Sellers have the right to nominate one director to the board of each of AINC and NewCo of which Monty Bennett will serve as initial Director Board of NewCo will be same as the board of AINC Sellers have registration rights requiring NewCo to file a registration statement after two years providing for either or both of: An IPO of the NewCo voting common stock; and/or The registration and resale of all of the registrable securities of NewCo

AINC / Remington Merger Discussion Materials Remington Holdings Overview

Remington has a long history of success in the hospitality industry Over 40 years developing, owning and operating lodging assets Employs approximately 8,000 associates at its managed hotels and approximately 245 corporate professionals Diverse portfolio that spans full-service, select-service, condo/hotels, convention centers and luxury hotels under 16 hotel brands A well established, successful management company with a strong operating culture, with over $1.1 billion in annualized managed revenue(1) 93 managed hotels with 17,972 total rooms Responsible for Project Management of 140 hotels with approximately $200 million of capital projects annually Remington’s extensive operating experience includes many of the major franchise brands, such as Hilton, Marriott, Starwood, Hyatt, and IHG as well as a variety of upscale and luxury independent hotels 13 _____________________ (1) Most recent quarter, annualized. Company Overview Bardessono Hotel & Spa Yountville, CA Lakeway Resort Austin, TX Le Pavillon Hotel New Orleans, LA

14 Company History Mid 1970s 1968 1988- 1989 Early 1990s Late 1990s 2003 2011 2015 Archie Bennett opens his first hotel – Holiday Inn Galveston, Texas After oil bust, company moves to Dallas, Texas Pioneers new 150-room Embassy Suites to brand and company Adds Hilton, Marriott, Radisson and Sheraton brands to portfolio Remington takes over management of 19 new properties as part of the Highland Takeover Oil boom in Texas creates demand for new hotels Develops 600-room hotel in downtown Houston Forms joint venture with Marriott: develops and operates 10 Marriotts Becomes the largest Marriott franchisee Becomes largest buyer of RTCs non-performing hotel loans (150) and serves as property and asset manager for operating hotels Remington seeds 6 wholly owned hotels to help launch Ashford Hospitality Trust Remington manages 93 hotels in 28 states, 16 brands, independents, 17,972 rooms and approx. 8,000 associates One Ocean Resort Atlantic Beach, FL The Silversmith Chicago, IL Crowne Plaza Key West Key West, FL The Churchill Washington D.C.

Remington is a highly respected management company in the hospitality industry. Aside from being a preferred management company with the industry’s largest brands, including Marriott, Hilton, Starwood, IHG and Hyatt, Remington and the hotels managed by Remington are frequently noted in industry publications and granted awards. Some notable awards from 2011 through 2014 are listed below: 15 • Embassy Suites Palm Beach Gardens Wins Leapfrog/Most Improved TQS Make A Difference Award • Sheraton Anchorage Wins Best of Alaska from Anchorage Daily News for Best Hotel and Best Day Spa - Ice Spa • The Utah Committee of Employer Support of the Guard & Reserve Honors Columbus Courtyard with Seven Seals Award • Crowne Plaza La Concha’s Website Wins W3 Silver Award and Interactive Media’s Outstanding Achievement Award • Travel & Leisure announce One Ocean Resort as one of the Top 500 hotels in the world • Embassy Suites Dulles Highest Overall F&B Award within the Embassy Suites brand • Annapolis Maryland Hotel and Lodging Association Awards Lifetime Achievement Award to "Miss Peg" from Historic Inns of Annapolis • (2012) TripAdvisor Certificate of Excellence Award – 8 Hotels • One Ocean Resort named by Condé Nast Traveler as a Top 100 U.S. Resort/Spa • Pier House Resort named by Condé Nast Traveler No. 12 among the Top 100 U.S. Resort/Spa • Embassy Suites Philadelphia Wins Embassy Brand Leap Frog Award for Year Over Year Market Share Growth • WorldQuest Wins Trip Advisor Travelers' Choice Award as One of the Best Hotels for Families in the World • (2013) TripAdvisor Certificate of Excellence Award Winners – 47 Hotels • Hilton Boston Back Bay Wins the 2nd Quarter Make It Right Best Practice Award for Hilton Americas • One Ocean Resort named by Condé Nast Traveler No. 2 Florida Resort, Atlantic & Keys • Pier House Resort named by Condé Nast Traveler No. 1 Florida Resort, Atlantic & Keys • Silversmith Hotel TripAdvisor.com Certificate of Excellence • Sugarland Marriott #3 In Guest Service among all US Marriott, #5 in Marriott in Americas, #1 among Marriott in TX • (2014) TripAdvisor Certificate of Excellence Award Winners - 32 Hotels • Remington Hotels Earn Green Leaders Award from TripAdvisor - 17 Hotels • Hilton Boston Back Bay Wins Hilton Hotels & Resorts Best Practice Award - Team Member Relations Award in the Americas • Remington Design Department Nominated as one of the Top Three Design Firms in Dallas • Pier House Resort named one of the Best Resorts in the Continental Units States Notable Awards

• Remington focuses on five company drivers: 16 Asset Maintenance Effective Cost Controls Exceptional Guest Service Revenue Growth Associate Empowerment • RevPAR in excess of the competitive set • Quantitative metric: STR reports • Based on Flowthroughs • Quantitative metric: 50% Standard • Must be in top 25% of each franchisor’s Hotel Service/Quality Ranking • Quantitative metric: Franchise Scores/ Ranking • Requires hotel to be maintained in exceptional condition • Quantitative metric: Independent Audit Inspection • On-going training and empowerment • Quantitative metric: AOS – Associate Opinion Surveys FIVE DRIVERS Five Company Drivers Marriott Beverly Hills Beverly Hills, CA Marriott Beverly Hills Beverly Hills, CA Marriott Beverly Hills Beverly Hills, CA Marriott Beverly Hills Beverly Hills, CA

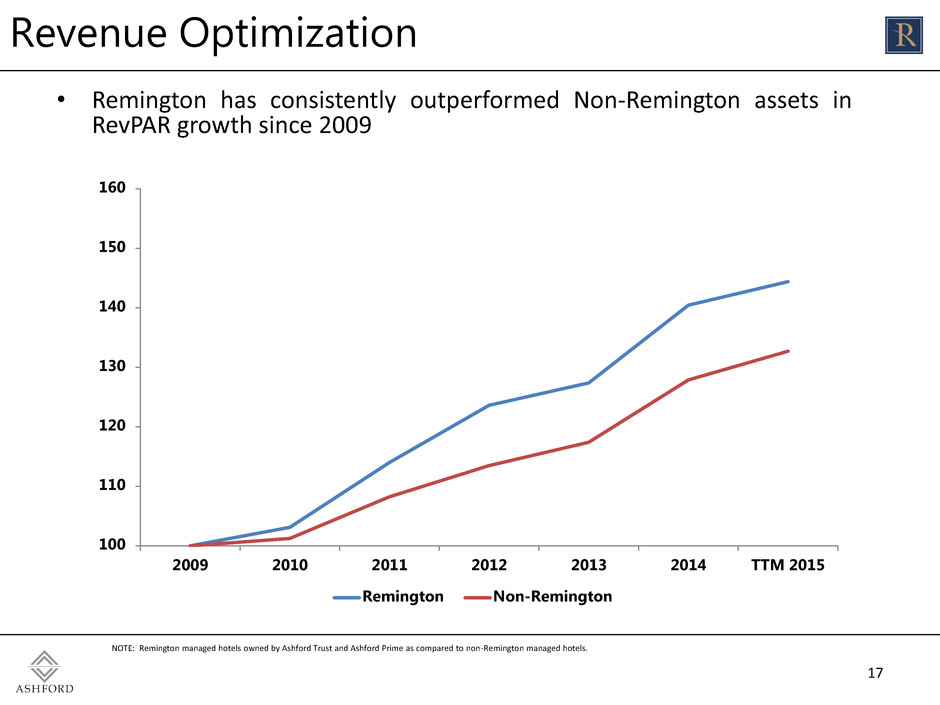

17 Revenue Optimization 100 110 120 130 140 150 160 2009 2010 2011 2012 2013 2014 TTM 2015 Remington Non-Remington • Remington has consistently outperformed Non-Remington assets in RevPAR growth since 2009 NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to non-Remington managed hotels.

18 Driving Profitability -62.0% 60.9% 61.9% 30.7% 53.3% 83.3% 47.5% 54.3% -514.6% 55.8% 154.4% 28.0% 59.8% 43.0% 41.6% 49.4% -90% -70% -50% -30% -10% 10% 30% 50% 70% 90% 2008 2009 2010 2011 2012 2013 2014 TTM 2015 Remington Non-Remington • Remington has outperformed in EBITDA flow-throughs 6 out of the last 8 years NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to non-Remington managed hotels.

19 Case Study – Acquisition & Conversion to Remington-Managed 12 Months Pre-Takeover 12 Months Post-Takeover Variance % (BPs) RevPAR $283.94 $ 323.66 +1,400 Total Revenue* $19,196 $21,284 +1,090 EBITDA* $6,031 $8,312 +3,780 EBITDA Flow 109.2% • Eliminated $1.5M in expenses through cost cutting initiatives: • Right-sized staffing level • Implemented improved housekeeping practices • Identified additional F&B efficiencies • Realized synergies with other Remington- managed Key West assets • Saved $385K in insurance expense by adding to Ashford program • Realized approximately $400K in annualized incremental parking revenue Pier House Resort $283.94 $323.66 $6,031 $8,312 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $260 $270 $280 $290 $300 $310 $320 $330 12 Months Pre-Acquisition 12 Months Post-Acquisition 12 Months Pre-Acquisition 12 Months Post-AcquisitionRevP A R E B IT D A in T h o u sa n d s *In Thousands Implemented Strategies: Pier House Resort – Key West, FL RevPAR EBITDA

20 Case Study – Acquisition & Conversion to Remington-Managed Aug-May 2014 Pre-Takeover Aug-May 2015 Post-Takeover Variance % (BPs) RevPAR $104.15 $126.02 +2,099 Total Revenue* $15,585 $18,112 +1,622 EBITDA* $3,177 $5,438 +7,116 EBITDA Flow 89.5% Marriott Fremont *In Thousands $15,585 $3,177 $18,112 $5,438 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 Aug-May 2014 Pre-Acquisition Aug-May 2015 Post-Acquisition Aug-May 2014 Pre-Acquisition Aug-May 2015 Post-Acquisition Marriott Fremont – Fremont, CA Total Revenue EBITDA

21 Case Study – Acquisition & Conversion to Remington-Managed • In November 2011, Ashford converted property to franchise • Ashford & Remington have driven 9.4% revenue growth with 71.4% flow-through to GOP since conversion • Replaced Hilton sales cluster with newly-hired staff, saving on expenses and driving revenue • Significantly reduced staffing expense by retaining only necessary personnel Conversion Summary: 37.0% 38.0% 39.0% 40.0% Nov-11 May-12 Nov-12 May-13 Nov-13 Hilton Boston Back Bay TTM Nov-11 TTM Nov-13 Variance % (BPs) Total Revenue* $ 30,083 $ 32,860 +923 GOP Margin 44.6% 47.7% +310 EBITDA Margin 37.1% 39.9% +280 Cumulative EBITDA Flow 71.0% EBITDA Margin Post-Conversion +320 BPs Hilton Back Bay – Boston, MA *In Thousands

22 Remington provides a cost effective, comprehensive grouping of in-house Project Management services that includes the oversight, coordination, planning and execution of any renovation or capital expenditure project Extensive experience in hotel renovation and construction projects and has project managed over $1 billion of development, renovations and other capital projects Provides expertise in several areas including project management, purchasing and design and also provides a turn-key solution for the hotel owner Experience as an operator and developer enables it to readily identify potential cost savings in design, purchasing and construction Extensive experience working with the following major brands in renovating, converting and repositioning hotels Project Management Hilton Boston Back Bay Boston, MA

Remington’s project management department offers a turn-key solution for property owners seeking a property renovation. 23 Remington Project Management Services Brand Negotiations and Approvals Architectural Oversight Interior Design Construction Management FF&E Purchasing FF&E Freight Management FF&E Warehousing FF&E Installation and Supervision Accounting Lender and Other Reporting Project Management Services Provided by Remington Project Management Sheraton Anchorage Anchorage, AK Marriott Fremont Fremont, CA

AINC / Remington Merger Discussion Materials Combination With Remington Holdings September 2015