Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Adaptive Medias, Inc. | v420476_8k.htm |

Exhibit 99.1

REVOLUTIONIZING THE DIGITAL VIDEO ECONOMY OTCQB: ADTM

FORWARD - LOOKING STATEMENTS SAFE HARBOR STATEMENT This presentation contains forward-looking statements made by or on behalf of Adaptive Medias, Inc . (OTCQB : ADTM) . All statements that address operating performance that the Company expects will occur in the future, including statements relating to operating results for fiscal 2013 and beyond, revenue growth, future profitability or statements expressing general optimism about future operating results, are forward-looking statements . These forward-looking statements are based on management's current views and we cannot assure that anticipated results will be achieved . These statements are subject to numerous risks and uncertainties, including, among other things, uncertainties relating to the Company's success in mobile, video and display online advertising, financing the Company's operations, entering into strategic partnerships, engaging additional key management, seasonal and period-to-period fluctuations in sales, failure to increase market share or sales, inability to service outstanding debt obligations, dependence on a limited number of customers, intense competition within the industry, changes in market conditions and other risks and uncertainties indicated from time to time in our filings with the U . S . Securities and Exchange Commission (SEC) available via the SEC's website at www . sec . gov . Readers are cautioned not to place undue reliance on forward-looking statements and are encouraged to consider the risk factors that could affect actual results . The Company disclaims any intent to update forward-looking statements . © 2015 Adaptive Media | www.adaptivem.com

ADAPTIVE MEDIAS INVESTOR SNAPSHOT © 2015 Adaptive Media | www.adaptivem.com MEDIA GRAPH IS ONE OF THE FIRST PLATFORMS TO OFFER ITS CLIENTS A DIGITAL VIDEO PLAYER BUILT SPECIFICALLY FOR THE MOBILE WORLD. SHARE STATISTICS OTCQB: ADTM Price $0.38 Market Capitalization $7M Shares Outstanding 21.68M 2 - Year CAGR Revenue Growth Rate 83.09% Cash $1.25M Long - Term Debt $0 Inside Ownership 30% **as of 9/16

© 2015 Adaptive Media | www.adaptivem.com WHAT IS MEDIA GRAPH?

© 2015 Adaptive Media | www.adaptivem.com “MOBILE - FIRST” UNIVERSAL VIDEO PLAYER By 2019, mobile video will represent 72% of global mobile data traffic, up from 55% in 2014.* Cisco © 2015 Adaptive Media | www.adaptivem.com

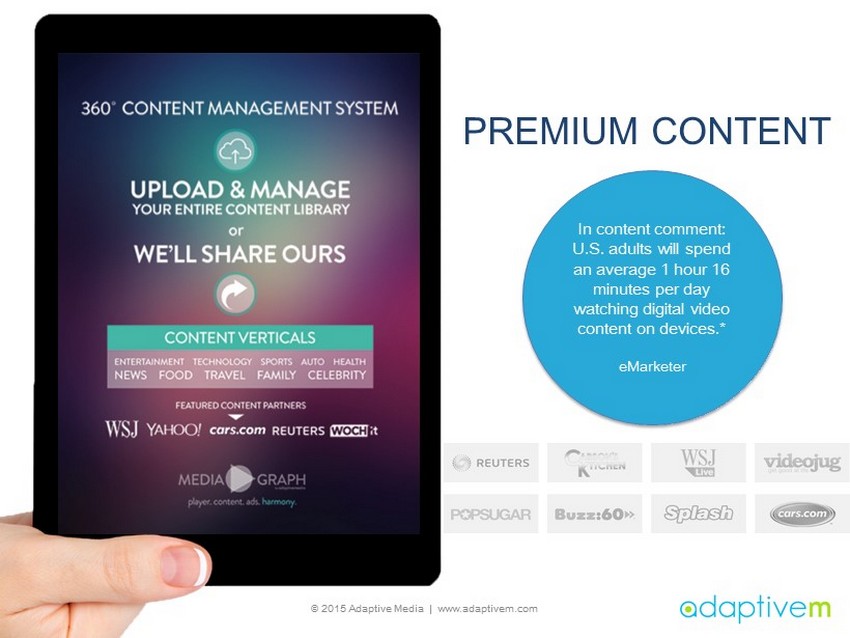

© 2015 Adaptive Media | www.adaptivem.com PREMIUM CONTENT In content comment: U.S. adults will spend an average 1 hour 16 minutes per day watching digital video content on devices .* eMarketer © 2015 Adaptive Media | www.adaptivem.com

© 2015 Adaptive Media | www.adaptivem.com DYNAMIC AD SERVER U.S. digital ad spending will overtake TV in 2016 and hit $ 103B in 2019 to represent 36 % of all ad spending .* Forrester © 2015 Adaptive Media | www.adaptivem.com

© 2015 Adaptive Media | www.adaptivem.com EMBED & MONETIZE SELECT YOUR CONTENT CHOOSE YOUR PLAYER SIZE VIDEO FOR MOBILE HAS NEVER BEEN THIS EASY RESPONSIVE Multiple player sizes, including full screen POWERFUL COMBINATION Mobile and desktop - friendly, HTML5 capable, responsive design ENGAGEMENT MAXIMIZATION Ad supportive for any advertiser MEDIA GRAPH 3 EASY STEPS TO MONETIZATION

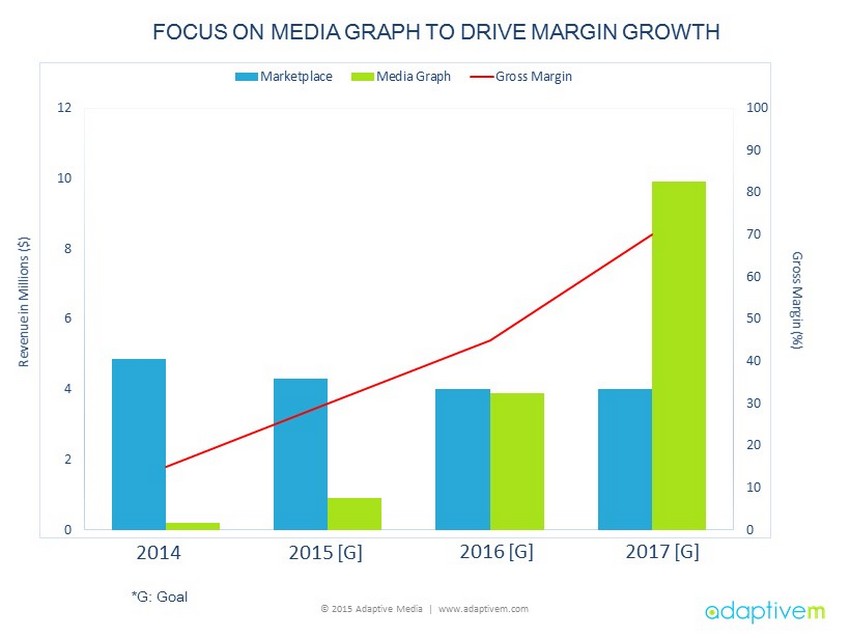

© 2015 Adaptive Media | www.adaptivem.com MARGIN MARGIN PLATFORM MARKETPLACE REVENUE OUR OLD MODEL: HIGH AD REVENUES, LOW MARGINS OUR NEW MODEL: MOVING TO HIGH - MARGIN MEDIA GRAPH PLATFORM SALES UNTIL NOW, ADAPTIVE MEDIAS HAS GENERATED MOST REVENUE FROM OUR MARKETPLACE SERVICE, ALLOWING US TO DESIGN AND REFINE OUR TECHNOLOGY PLATFORM MEDIA GRAPH AND BUILD OUR OPERATIONS TEAM.

MEDIA GRAPH REPLACES THE NEED FOR MULTIPLE VENDORS © 2015 Adaptive Media | www.adaptivem.com WE DEFRAGMENT THE MARKETPLACE Onscreen Video Player Content Management & Delivery Ad Server Demand Network & Ad Exchange Adaptive Medias, Inc. AVOID HAVING TO WORK WITH 4 - 7 DIFFERENT TYPES OF TECHNOLOGY VENDORS TO MANAGE YOUR DIGITAL VIDEO NEEDS FRAGMENTATION

© 2015 Adaptive Media | www.adaptivem.com REVENUE GROWTH COMPARED TO COMPETITORS

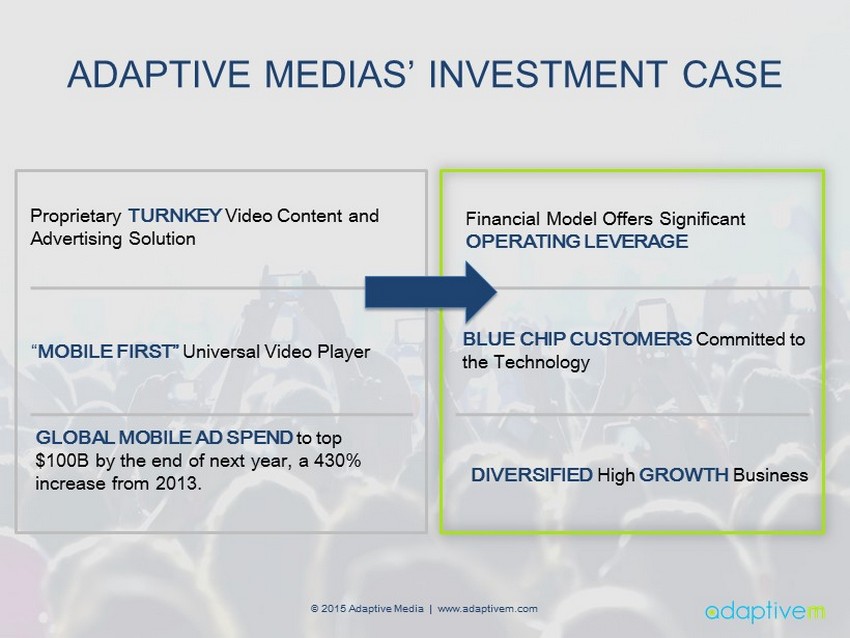

ADAPTIVE MEDIAS’ INVESTMENT CASE “ MOBILE FIRST” Universal Video Player Proprietary TURNKEY Video Content and Advertising Solution BLUE CHIP CUSTOMERS Committed to the Technology Financial Model Offers Significant OPERATING LEVERAGE DIVERSIFIED High GROWTH Business GLOBAL MOBILE AD SPEND to top $ 100B by the end of next year, a 430% increase from 2013. © 2015 Adaptive Media | www.adaptivem.com

FINANCIAL HIGHLIGHTS © 2015 Adaptive Media | www.adaptivem.com Strong Track Record of Sequential Revenue Growth Highly Scalable Technology - Driven Business Model Solid Balance Sheet with Zero L ong - Term D ebt, Decreasing Burn Rate Significant Potential Margin Leverage in Media Graph R evenues Poised for Profitability in Q1 2016

© 2015 Adaptive Media | www.adaptivem.com 0 1 2 3 4 5 6 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Revenue in Millions ($) ADAPTIVE MEDIAS QUARTERLY REVENUE GROWTH 2013 2014 2015 2016 2017 Q1 Q2 Q3[G] Q4[G ] Q1[G] Q2[G] Q3[G] Q4[G] Q1[G] Q2[G] Q3[G] Q4[G] *G: Goal

© 2015 Adaptive Media | www.adaptivem.com 0 2 4 6 8 10 12 14 Revenue in Millions ($) ADAPTIVE MEDIAS ANNUAL REVENUE GROWTH 2013 2014 2015 [G] 2016 [G] 2017 [G ] *G: Goal

© 2015 Adaptive Media | www.adaptivem.com 0 10 20 30 40 50 60 70 80 90 100 0 2 4 6 8 10 12 Marketplace Media Graph Gross Margin FOCUS ON MEDIA GRAPH TO DRIVE MARGIN GROWTH Revenue in Millions ($) Gross Margin (%) 2014 2015 [G] 2016 [G] 2017 [G] *G: Goal

© 2015 Adaptive Media | www.adaptivem.com -8 -6 -4 -2 0 2 4 6 8 ADJUSTED EBITDA ($) TARGETING PROFITABILITY & EARNINGS GROWTH BY Q1 2016 2013 2014 2015 [G] 2016 [G] 2017 [G] *G: Goal

© 2015 Adaptive Media | www.adaptivem.com LEADERSHIP JOHN B. STRONG Interim CEO OMAR AKRAM Co - Founder, Chairman, CFO EXPERIENCE FROM EXPERIENCE FROM / SEASONED TEAM BRYAN NGUYEN Chief Architect © 2015 Adaptive Media | www.adaptivem.com SAL AZIZ Co - Founder, GM, Platform

Q&A © 2015 Adaptive Media | www.adaptivem.com

© 2015 Adaptive Media | www.adaptivem.com APPENDIX

© 2015 Adaptive Media | www.adaptivem.com INDUSTRY TRENDS $2.9 $4.2 $5.9 $7.6 $9.3 $10.8 $1.5 $3.8 $6.0 $8.7 $11.6 $14.5 2012 2013 2014 2015 E 2016 E 2017 E Digital Video Mobile Display SOURCE: eMarketer CORD CUTTING REVENUE OPPORTUNITIES 4.5% 7.9% 12.7% 6.5% 12.4% 18.1% All Households Anyone aged 18-34 in household Household has Netflix or Hulu account 2010 2013 SOURCE: Wall Street Journal/ Statista Percent of U.S. households ending their cable subscriptions EQUALS Mobile 46% CAGR Digital Video 30% CAGR

© 2015 Adaptive Media | www.adaptivem.com AUDIENCES ARE CHANGING BEHAVIORS LONG - FORM CONTENT SHORT - FORM CONTENT 20+ minutes Includes linear TV shows, live streams , feature films , web series, and sporting events 0 - 5 minutes I ncludes video clips, music videos, interviews and user - generated content DIGITAL AUDIENCE (millions) 400 575 85 800 Dec-10 Dec-14 Deskto… Mobile… SOURCE: comScore Short - form video content will generate ~$5B from ad & subscription revenues in 2015.* Long - form video content will generate ~$400B from ad & subscription revenues in 2015 .* *Deloitte