Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Xenia Hotels & Resorts, Inc. | a20158-kseptember14investo.htm |

1 Investor Presentation September 2015 Andaz Napa Grand Bohemian Hotel Orlando Marriott Woodlands Waterway Hotel & Convention Center

2 Forward-Looking Statements; Non-GAAP Financial Measures This presentation has been prepared by Xenia Hotels & Resorts, Inc. (the “Company” or “Xenia”) solely for informational purposes. This presentation contains, and our responses to various questions from investors may include, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about our plans, strategies and financial performance, the amount and timing of future cash distributions, our lodging portfolio, and our prospects and future events. Such statements involve known and unknown risks that are difficult to predict. As a result, our actual financial results, performance, achievements or prospects may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” “illustrative,” “forecasts,” “guidance,” “project” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward- looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management based on their knowledge and understanding of the business and industry, are inherently uncertain. These statements are not guarantees of future performance, and stockholders should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or forecasted in the forward-looking statements due to a variety of risks, uncertainties and other factors, including but not limited to the factors listed and described under “Risk Factors” in the Company’smost recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the U.S. Securities and Exchange Commission (“SEC”). These factors are not necessarily all of the important factors that could cause our actual financial results, performance, achievements or prospects to differ materially from those expressed in or implied by any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made, and we do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. On February 3, 2015, Xenia was spun off from InvenTrust Properties Corp. (“InvenTrust”). Prior to the separation, the Company effectuated certain reorganization transactions which were designed to consolidate the ownership of its hotels into its operating partnership, consolidate its TRS lessees in its TRS, facilitate its separation from InvenTrust, and enable the Company to qualify as a REIT for federal income tax purposes. Unless otherwise indicated or the context otherwise requires, all financial and operating data herein reflect the operations of the Company after giving effect to the reorganization transactions, the disposition of other hotels previously owned by the Company, and the spin-off. Xenia® and related trademarks, trade names and service marks of Xenia appearing in this presentation are the property of Xenia. Unless otherwise noted, all other trademarks, trade names or service marks appearing in this presentation are the property of their respective owners, including but not limited to Marriott International, Inc., Hilton Worldwide Holdings Inc., Hyatt Hotels Corporation and Starwood Hotels and Resorts Worldwide, Inc., or their respective parents, subsidiaries or affiliates. None of the owners of these trademarks, their respective parents, subsidiaries or affiliates or any of their respective officers, directors, members, managers, shareholders, owners, agents or employees, has any responsibility for the creation or contents of this presentation. This document is not an offer to buy or the solicitation of an offer to sell any securities of the Company.

3 Overview of Xenia (1) As defined by STR (2) As of 8/31/2015 (49 wholly owned, 1 majority owned) (3) 2015 Q2 year-to-date statistics National platform of high quality assets focused on the Top 25 Markets1 and key leisure destinations in the U.S. Invest primarily in premium full service, lifestyle and urban upscale assets Unique market and asset type investment strategy drives growth potential 50 Hotels, 13,104 Rooms2 1 Hotel under development (100 Rooms ) 1 Hotel under contract 77% of rooms comprised of Luxury and Upper Upscale2 $142.44 RevPAR, $185.45 ADR, 76.8% Occupancy 3 89% of Rooms Affiliated with Marriott, Hilton, Hyatt, Kimpton or Starwood2 Hotel Monaco Chicago Lorien Hotel & Spa Listed on NYSE February 4, 2015

4 Timeline of Xenia Formation and Portfolio Evolution Source: InvenTrust 10K (2007-2014); Xenia 10K thereafter. (1) Includes the sale of 52 select service assets to Northstar / Chatham which closed in November 2014. (2) InvenTrust acquired two hotel portfolios in 2007, which were placed under current management’s asset management platform. Divested 89 non-core primarily legacy select service hotels for $1.4bn1 (2009-2014) Xenia established its platform in 2007 as Inland American Lodging Group and began implementing a portfolio repositioning strategy since 2009, driving significant improvement in portfolio quality Acquired 55 primarily full service hotels for $3.2bn (2007-2014) 2007: Marcel Verbaas (CEO) and Philip Wade (CIO) establish IA Lodging 2H 2009: Process of portfolio repositioning strategy begins Aug. 2014: IA Lodging renamed Xenia Hotels & Resorts Announced spin-off from InvenTrust Jun. 2014: Andrew Welch joins as CFO Nov. 2014: Closes sale of 52 Select Service assets to Northstar / Chatham for $1.1bn Jul. 2013: Barry Bloom joins as COO 2007 2008 2009 2010 2011 2012 2013 2014 2015 Acquisitions: Dispositions: 20072 2008 2009 2010 2011 2012 2013 2014 + 2 Hotels - 0 Hotels + 23 Hotels - 0 Hotels + 0 Hotels - 0 Hotels + 5 Hotels - 7 Hotels + 3 Hotels - 7 Hotels + 7 Hotels - 15 Hotels + 14 Hotels - 5 Hotels + 1 Hotel - 55 Hotels Pre Listing

5 Timeline of Xenia Formation and Portfolio Evolution May 2015: Joseph Johnson joins as CAO March 2015: Completes Modified Dutch Tender Offer and purchases approximately $37mm of common stock Pays off the $26 mm Andaz San Diego loan Feb 2015: Completes separation from InvenTrust Lists on NYSE under ticker “XHR” Closes $400mm unsecured line of credit Feb Mar Apr May Jun Jul Aug Sept2015 Oct Since listing in February 2015, Xenia has strengthened its balance sheet and improved its portfolio through strategic acquisitions June 2015: Pays off the $55mm Hilton Garden Inn DC loan Hotel CommonwealthHotel PalomarRiverPlace HotelCanary Hotel Jan Nov Dec July 2015: Acquires the Canary Hotel, RiverPlace Hotel and the Hotel Palomar for $245mm August 2015: Announces agreement to acquire the Hotel Commonwealth in Boston, upon completion of expansion project, for $136mm (expected Jan 2016) Grand Bohemian Hotel Charleston opens. Post Listing

6 Portfolio Overview As of 9/9/2015 HI FL NM DE MD TX OK KS NE SD NDMT WY CO UT ID AZ NV WA CA OR KY ME NY PA VT NH RI CT WV INIL NC TN SC AL MS AR LA MO IA MN WI NJ GA DC VA OH MI MA Hotel Under DevelopmentOperating Hotels National footprint in 34 markets including 21 states and the District of Columbia Westin Houston Galleria & Oaks Marriott San Francisco Airport Hilton Garden Inn Washington DC Aston Waikiki Beach Hotel Fairmont Dallas Hyatt Regency Santa Clara Renaissance Atlanta Waverly Renaissance Austin Residence Inn Boston Cambridge Andaz Savannah

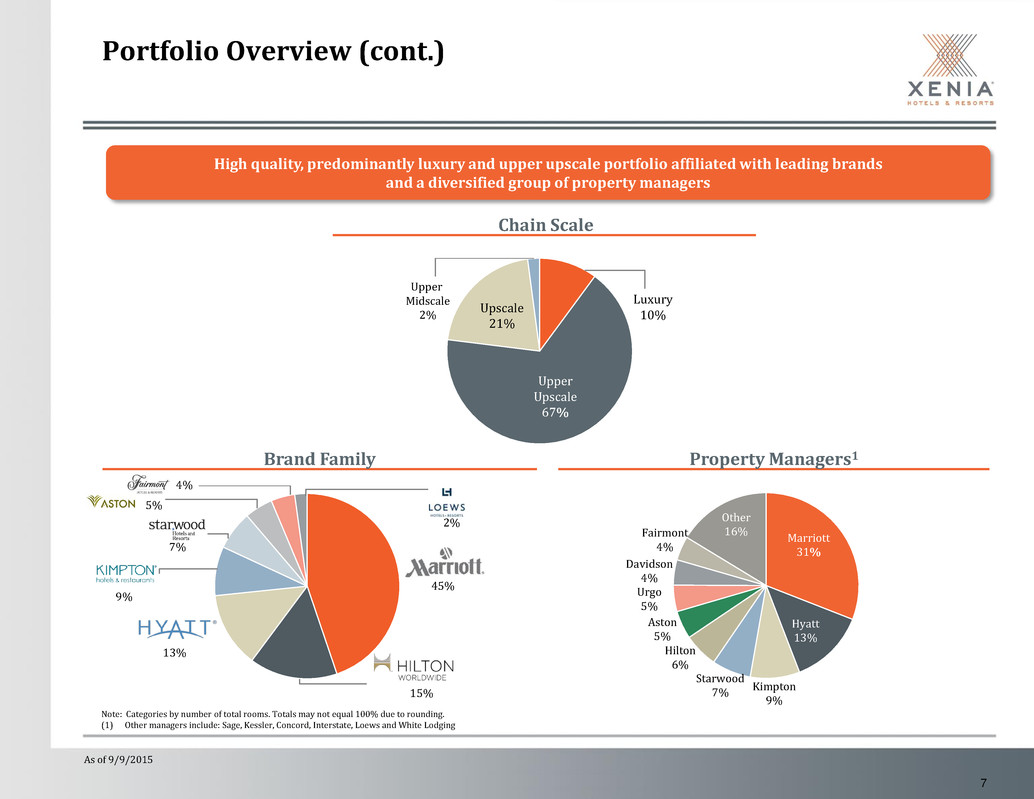

7 Chain Scale Brand Family Property Managers1 As of 9/9/2015 Portfolio Overview (cont.) Note: Categories by number of total rooms. Totals may not equal 100% due to rounding. (1) Other managers include: Sage, Kessler, Concord, Interstate, Loews and White Lodging Upper Upscale 67% Luxury 10% Upscale 21% Upper Midscale 2% High quality, predominantly luxury and upper upscale portfolio affiliated with leading brands and a diversified group of property managers 45% 15% 13% 9% 7% 5% Marriott 31% Hyatt 13% Fairmont 4% Kimpton 9% Hilton 6% Other 16% Starwood 7% Aston 5% Urgo 5% Davidson 4% 2% 4%

8 (1) Grand Bohemian Hotel Charleston was a development project in which the Company is a majority owner. (2) Kimpton Portfolio includes RiverPlace Hotel, Canary Hotel and Hotel Palomar in Portland, Santa Barbara and Philadelphia. (3) Hotel Monaco Portfolio includes hotels in Chicago, Denver and Salt Lake City. (4) Andaz Portfolio includes hotels in Napa and Savannah. (5) Westin Galleria Houston and Westin Oaks Houston at the Galleria were purchased in one transaction. (6) Bohemian Portfolio includes hotels in Celebration, Savannah and Orlando. (7) Marriott/Renaissance Portfolio includes hotels in Lexington, Atlanta and Austin. Recent Acquisitions In-Line with Investment Strategy Date Property State # Rooms Purchase Price ($mm) Top 25 / Key Leisure Dest. Aug 2015 Grand Bohemian Charleston1 SC 50 30.8 Jul 2015 Kimpton Portfolio2 PA, CA, OR 411 245.0 Feb 2014 Aston Waikiki Beach Hotel HI 645 183.0 Nov 2013 Hyatt Key West Resort & Spa FL 118 76.0 Nov 2013 Hotel Monaco Portfolio3 CO, IL, UT 605 189.0 Oct 2013 Lorien Hotel & Spa VA 107 45.3 Oct 2013 Loews New Orleans Hotel LA 285 74.5 Sep 2013 Hyatt Regency Santa Clara CA 501 99.0 Sep 2013 Andaz Portfolio4 CA, GA 292 115.0 Aug 2013 Westin Houston Galleria & Oaks5 TX 893 220.0 Apr 2013 Residence Inn Denver City Center CO 228 80.0 Mar 2013 Andaz San Diego CA 159 53.0 Aug 2012 – Feb 2013 Bohemian Portfolio6 FL, GA 437 154.0 Mar 2012 Marriott/Renaissance Portfolio7 GA, KY, TX 1,422 262.5 Mar 2012 Hilton St. Louis Downtown at the Arch MO 195 22.6 Mar 2012 Marriott San Francisco Airport CA 685 108.0 26 Assets Acquired Since 2012 7,033 $1,957.7 Nearly $2.0 billion of acquisitions since 2012, targeting the Top 25 Markets and key leisure destinations in the U.S. Residence Inn Denver City Center Hyatt Key West Resort & Spa Loews New Orleans Hotel

9 Kimpton Portfolio Acquisition Purchase Price $245 Million 2016 Est. EBITDA $18.5 - $20.5 Million 2016 EBITDA Multiple 12.0x – 13.2x 2015 TTM RevPAR 2015 YTD RevPAR Growth $224.59 10.1%

10 RiverPlace Hotel Year Built 1985 Number of Rooms 84 Total Meeting Space 2,760 square feet Management Kimpton Upside Opportunities Refine market mix and rate strategy. Reduce the size of the restaurant and create an upscale meeting space focused on social catering Portland, Oregon

11 Canary Hotel Year Built 2005 Number of Rooms 97 Total Meeting Space 7,374 square feet Management Kimpton Upside Opportunities Refine market mix and rate strategy. Upgrade rooftop pool and catering space. Santa Barbara, California

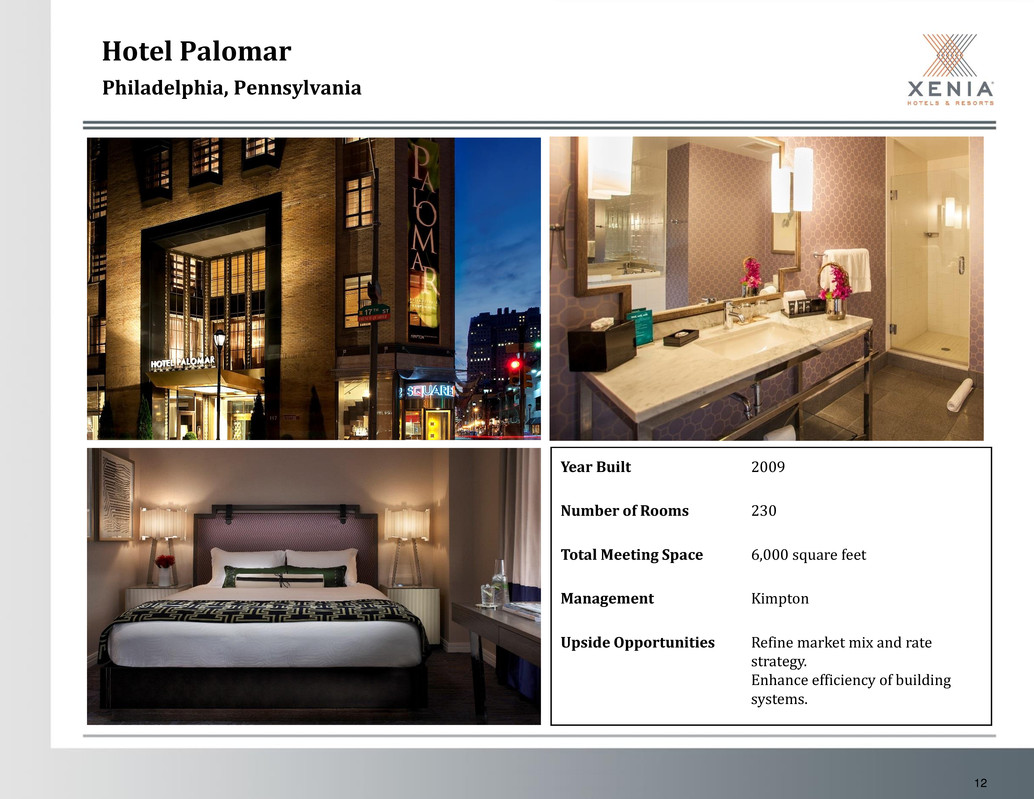

12 Hotel Palomar Year Built 2009 Number of Rooms 230 Total Meeting Space 6,000 square feet Management Kimpton Upside Opportunities Refine market mix and rate strategy. Enhance efficiency of building systems. Philadelphia, Pennsylvania

13 Grand Bohemian Hotel Charleston Date Completed August 2015 Number of Rooms 50 Total Meeting Space 3,000 square feet Management Kessler Ownership 75% Xenia / 25% Kessler Total Development Cost $30.8 million ($7.2 million equity contribution by Xenia) Charleston, South Carolina

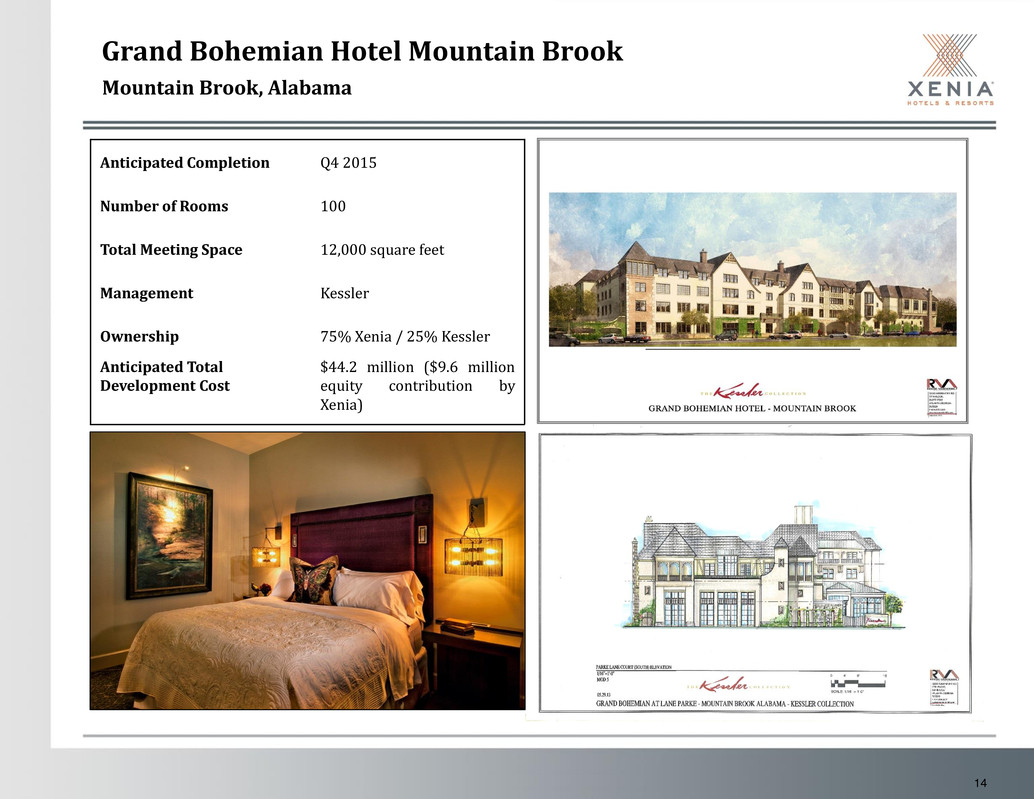

14 Grand Bohemian Hotel Mountain Brook Anticipated Completion Q4 2015 Number of Rooms 100 Total Meeting Space 12,000 square feet Management Kessler Ownership 75% Xenia / 25% Kessler Anticipated Total Development Cost $44.2 million ($9.6 million equity contribution by Xenia) Mountain Brook, Alabama

15 Asset Management Platform with Uniquely Integrated Capabilities Integrated Platform Revenue enhancement Cost containment Frequent interaction with management companies Integrated with asset management team to identify and execute new opportunities at attractive costs Development expertise Constantly review opportunities to accretively invest and recycle capital Maintain quality, increase long-term value, generate attractive returns Existing platform provides capacity to grow portfolio Same in-place asset and project management team that managed over 100 hotels for InvenTrust Integrated platform with multiple strategies for driving growth within existing portfolio and strong track record of reinvestment (over $270mm invested since 2008)

16 Driving Improvements – The Process Thorough review of all properties’ cost structures and revenue opportunities during due diligence and immediately following purchase. • At the Andaz San Diego, Xenia determined a need for restructuring of F&B and other operations. Overall profitability in both dollars and margin improved significantly as a result of restructuring of several outlets. • As with all acquisitions Xenia evaluated opportunities for enhanced/accelerated ADR growth at Hyatt Key West and Hyatt Regency Santa Clara. Both hotels were found to have significant upside for ADR growth, which was rapidly achieved. Post Acquisition Review Determine opportunities for maximum ROI enhancements. • CapEx improvements at the Hyatt Regency Santa Clara were designed to coincide with strong market demand and RevPAR opportunities. • Guestroom and public space improvements at the Renaissance Waverly Atlanta were key in the hotel being selected for multi-year large corporate bookings. Strategic CapEx Reinvestment The Property Optimization Process (“POP”) involves “deep-dives” into hotel revenues, expenses and key operating metrics. • In 2014, the POP identified $657k in annual incremental revenue and $1.0 million in net expense savings recommendations at three of Xenia’s largest hotels. • The corporate/hotel level implementation rate for recommended savings exceeds 75%. In cases where recommendations are not accepted, information often becomes the basis for future discussions. Property Optimization Process A rigorous asset management process is continuously in place at each Xenia hotel. This includes daily, weekly, and monthly points of interface for each hotel. • Xenia asset managers perform advanced weekly and monthly monitoring of revenue management, social media performance, utility consumption, departmental labor productivity and other key factors. • The Xenia analytics platform continues to be further refined. The data collection process has become more granular and will provide additional support going forward. Ongoing Asset Management

17 Driving Improvements – The Results Hotels Included: Andaz San Diego, Andaz Savannah, Bohemian Hotel Celebration, Bohemian Hotel Savannah Riverfront, Grand Bohemian Hotel Orlando, Hotel Monaco Chicago, Hotel Monaco Denver, Hotel Monaco Salt Lake City, Hyatt Key West Resort & Spa, Hyatt Regency Santa Clara, Loews New Orleans Hotel, Lorien Hotel & Spa, Residence Inn Denver City Center, Westin Galleria and Oaks Houston. $288 $308 $323 $101 $113 $126 35.0% 36.6% 39.1% 32.0% 33.0% 34.0% 35.0% 36.0% 37.0% 38.0% 39.0% 40.0% $0 $50 $100 $150 $200 $250 $300 $350 2012 2013 2014 Mi lli on s 2013 Acquisitions Revenue Gross Operating Profit (GOP) GOP Margin

18 Driving Improvements – Hotel Case Examples Hyatt Key West Resort & Spa • Hyatt Key West Resort & Spa was acquired in mid- November 2013 for $76 million, or $644,100 per key. • Immediately upon acquisition, Xenia implemented a more aggressive rate strategy combined with an expense maintenance plan. Since acquisition, the focus has been on ADR growth and ancillary revenues, including Resort Fee value/growth. • Revenue between 2012 and 2014 increased $3.8 million, or 25.0%. GOP for this same period increased $3.0 million, or 48.2%. • For 2014, the Hotel achieved an EBITDA margin of 41.8%. This was 690 basis points greater than the EBITDA margin achieved for the 12 months before acquisition. • Significant improvements are underway at the Hotel in order to improve revenues and efficiencies in the F&B outlets. Significant guestroom renovations and upgrades are either underway or planned for the near future.

19 Driving Improvements – Hotel Case Examples Hyatt Regency Santa Clara • Hyatt Regency Santa Clara was acquired in mid- September 2013 for $93 million, or $185,300 per key. • Upon acquisition, Xenia immediately implemented a more aggressive rate strategy combined with an expense control plan. Since acquisition, the focus has been on ADR growth with an optimal business mix. • Revenue between 2012 and 2014 increased $9.9 million, or 25.1%. GOP for this same period increased $6.2 million, or 50.2%. • For 2014, the Hotel achieved an EBITDA margin of 26.2%. This was 530 basis points greater than the EBITDA margin achieved for the 12 months before acquisition. • The Hotel’s public areas had been refreshed just prior to acquisition. A guestroom renovation ($7.5 million) was undertaken in late 2014 and early 2015, which will continue to drive ADR growth. • In close proximity to the Hotel, Levi’s Stadium, home to the San Francisco 49ers, opened in the summer of 2014. The stadium will host Super Bowl 50 in February 2016.

20 Driving Improvements – Hotel Case Examples Andaz San Diego • Andaz San Diego was acquired in early 2013 for $53 million, or $333,300 per key. • Close analysis of the Hotel’s operating structure and expense levels indicated significant opportunity for efficiencies. Several of the Hotel’s food and beverage venues have been reorganized, with the major restaurant tenant also departing in 2014. • As a result of these changes, including the closing of the nightclub, revenue between 2012 and 2014 decreased $2.2 million, or 11.7%. However, GOP for this same period increased $1.4 million, or 38.7%. • The Hotel achieved 940 basis points EBITDA margin growth in 2014 compared to the 12 months prior to acquisition. • A new restaurant tenant, STK Rebel, has been signed and will benefit the Hotel beginning in 2016. Additionally, incremental expense efficiencies (centralized accounting) have been put in place post- 2014 that will allow for continued margin growth.

21 Driving Improvements – Hotel Case Examples Hotel Monaco Portfolio Hotel Monaco Chicago Hotel Monaco Salt Lake City Hotel Monaco Denver • Hotel Monaco Denver, the Hotel Monaco Chicago, and the Hotel Monaco Salt Lake City were acquired as a portfolio in November 2013 for $189 million, or $312,400 per key. • Revenue between 2012 and 2014 increased $5.2 million, or 10.9%. GOP for this same period increased $3.1 million, or 17.9%. • For 2014, the three Monaco Hotels achieved a combined EBITDA margin of 30.0%. This was 150 basis points greater than the EBITDA margin achieved for the 12 months before acquisition.

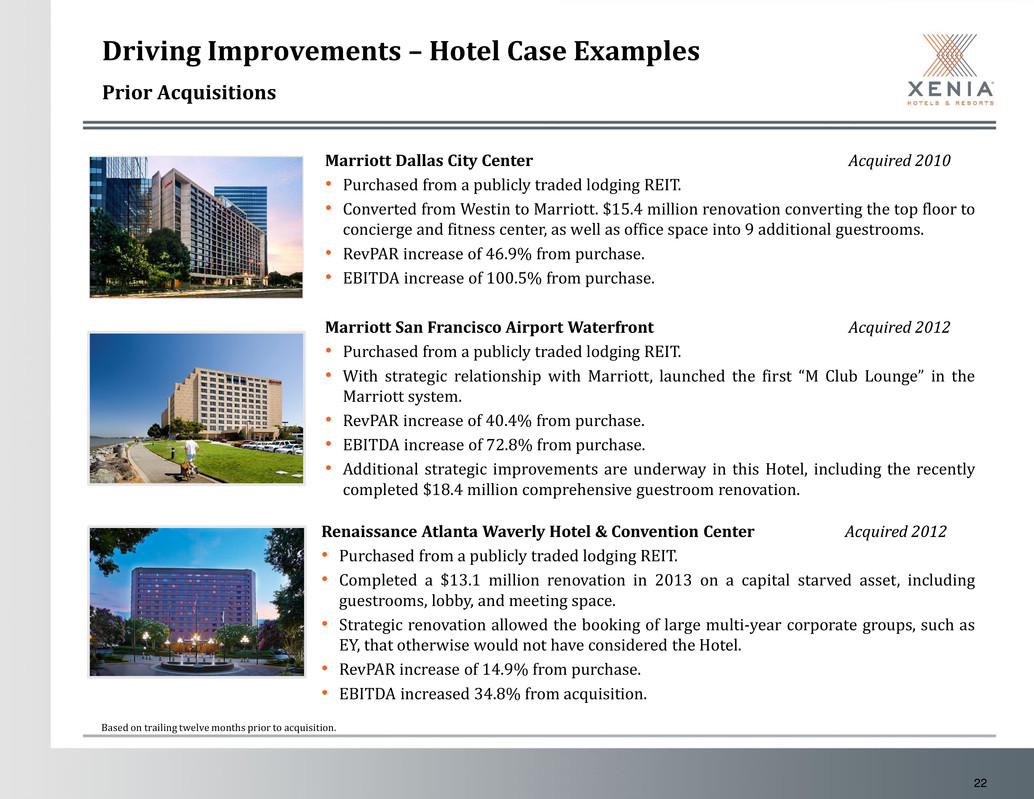

22 Driving Improvements – Hotel Case Examples Prior Acquisitions Based on trailing twelve months prior to acquisition. Marriott Dallas City Center Acquired 2010 • Purchased from a publicly traded lodging REIT. • Converted from Westin to Marriott. $15.4 million renovation converting the top floor to concierge and fitness center, as well as office space into 9 additional guestrooms. • RevPAR increase of 46.9% from purchase. • EBITDA increase of 100.5% from purchase. Marriott San Francisco Airport Waterfront Acquired 2012 • Purchased from a publicly traded lodging REIT. • With strategic relationship with Marriott, launched the first “M Club Lounge” in the Marriott system. • RevPAR increase of 40.4% from purchase. • EBITDA increase of 72.8% from purchase. • Additional strategic improvements are underway in this Hotel, including the recently completed $18.4 million comprehensive guestroom renovation. Renaissance Atlanta Waverly Hotel & Convention Center Acquired 2012 • Purchased from a publicly traded lodging REIT. • Completed a $13.1 million renovation in 2013 on a capital starved asset, including guestrooms, lobby, and meeting space. • Strategic renovation allowed the booking of large multi-year corporate groups, such as EY, that otherwise would not have considered the Hotel. • RevPAR increase of 14.9% from purchase. • EBITDA increased 34.8% from acquisition.

23 Driving Improvements – Property Optimization Process • The Property Optimization Process includes an intensive five to seven day site-visit by Xenia team members, followed by a period of analysis and additional research. Based upon this work, a comprehensive set of recommendations are provided to the property and corporate management teams for review and implementation. • 2014 Hotels included in the POP were the Hyatt Regency Orange County, the Hyatt Regency Santa Clara, and the Renaissance Atlanta Waverly Hotel. • For 2014, the Xenia POP Team recommended $657k in revenue enhancements and over $1.0 million in net expense reductions. • Revenue opportunities generally occur through mispricing of ancillary products or services. For example, the Room Service Delivery Fee at a hotel may be set at $2.00 per order, when the brand and market norm are $4.00. Expense savings are generally driven by scheduling-to-demand. • Overall buy-in rate on Xenia recommendations are roughly 75.0%. • In 2015, the Fairmont Dallas, Marriott Woodlands Waterway, Renaissance Atlanta Waverly Hotel, and Hotel Monaco Denver have gone through the process, and over $244k in revenue enhancements and $960k in net expense reductions have been recommended so far. Renaissance Atlanta Waverly Fairmont Dallas Marriott Woodlands Waterway

24 Second Quarter Results Same Property RevPAR Same-Property RevPAR increased 4.7% from the second quarter of 2014 to $150.19, driven by a 5.2% ADR increase slightly offset by a 0.5% decrease in occupancy Excluding Houston, the portfolio RevPAR increased 6.3%, indicating the strength of the portfolio Same-property hotel EBITDA margin Same-property hotel EBITDA margin was 34.1% 70 basis point increase from the same period in 2014 Adjusted EBITDA Adjusted EBITDA was $80.2 million Adjusted FFO Adjusted FFO available to common stockholders per diluted share was $0.57 Capital Investments Completed the $18.3 million renovation at the Marriott San Francisco Airport Waterfront, including guest room renovation, bathroom conversion, and the addition of three keys Added one additional key at the Hyatt Regency Santa Clara 2015 Revised Guidance RevPAR growth: 5.0% to 6.0% Adjusted EBITDA: $288 million to $297 million Adjusted FFO: $227 million to $236 million Capital Expenditures: $45 million to $55 million Houston Update Low oil prices continue to add pressure to the Houston lodging market, however successful cost containment strategies in the portfolio helped bottom line hotel performance Westin Galleria & Oaks RevPAR down nearly 9%, but hotel EBITDA remained flat year over year Marriott Woodlands RevPAR up 3.5% due to backfilling of group cancellations with higher rated transient and small group business

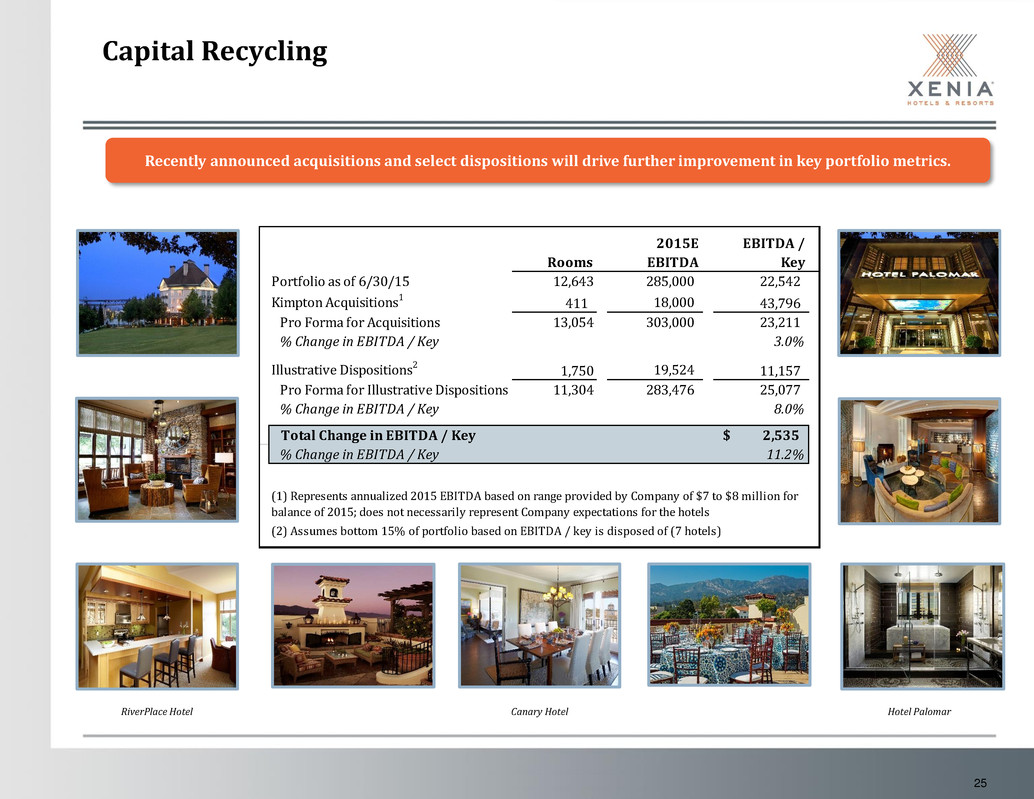

25 Capital Recycling Recently announced acquisitions and select dispositions will drive further improvement in key portfolio metrics. RiverPlace Hotel Canary Hotel Hotel Palomar 2015E EBITDA / Rooms EBITDA Key Portfolio as of 6/30/15 12,643 285,000 22,542 Kimpton Acquisitions1 411 18,000 43,796 Pro Forma for Acquisitions 13,054 303,000 23,211 % Change in EBITDA / Key 3.0% Illustrative Dispositions2 1,750 19,524 11,157 Pro Forma for Illustrative Dispositions 11,304 283,476 25,077 % Change in EBITDA / Key 8.0% Tota Cha ge in EBITDA / Key 2,535$ % Change in EBITDA / Key 11.2% (2) Assumes bottom 15% of portfolio based on EBITDA / key is disposed of (7 hotels) (1) Represents annualized 2015 EBITDA based on range provided by Company of $7 to $8 million for balance of 2015; does not necessarily represent Company expectations for the hotels

26 2016 Incremental EBITDA Hotel Commonwealth In addition to anticipated growth in its same-store portfolio, Xenia anticipates approximately $21.0 to $23.5 million of additional EBITDA from acquisitions in 2016 Low End High End Kimpton Acquisitions 18.5$ 20.5$ Kimpton Acquisitions- 2015 EBITDA (7.0)$ (8.0)$ Commonwealth Acquisition 9.5$ 11.0$ 2016 Total Incremental EBITDA 21.0$ 23.5$

27 AFFO Payout Ratio Overview of Dividend Policy Dividend Yield Sources: Company Financials, Bloomberg, SNL Financial Note: Peer data reflects a 09/09/2015 pricing date. (1) AFFO payout ratio calculated using most recent annualized dividend divided by SNL Financial median 2015E AFFO. (2) Xenia AFFO payout ratio reflects midpoint of 2015E Adjusted FFO guidance less 5% FF&E reserve. Dividend yield of 5.0% is on the high end of our lodging REIT peers, while maintaining a comfortable AFFO payout ratio 6.3% 5.8% 5.4% 5.0% 4.6% 4.6% 4.6% 4.3% 3.2% 2.6% 2.0% 1.4% AHT LHO CHSP XHR RLJ HT HST DRH PEB AHP FCH SHO Peer Median 4.6% 75.6% 64.6% 61.0% 60.4% 58.4% 55.4% 54.7% 53.2% 38.3% 25.2% 24.2% 15.3% LHO RLJ PEB CHSP DRH XHR HT HST AHT AHP FCH SHO Peer Median 54.7%

28 Staggered Debt Maturity Profile Note: Data as of 6/30/2015 and proforma information in connection with 3 Kimpton acquisitions and loan pay offs for Andaz San Diego and Hilton Garden Inn DC. Assumes all extension options exercised. (1) Unsecured Line of Credit of $400 million shown at fully extended maturity. Current balance of $127 million and capacity of $273 million after 3 Kimpton acquisitions. Manageable near-term debt maturities with significant embedded equity value and opportunity to reduce cost of capital Fixed Floating WA Fixed Rate Maturing Debt NA 5.35% 5.18% 6.46% NA 3.85% WA Floating Rate Maturing Debt NA NA 2.69% 2.47% 2.19% 2.43% # Mortgages Maturing 0 5 7 3 1 12 Line of Credit Capacity 1 Line of Credit Balance 1 Debt $1,255 mm Fixed / Floating 44.8%/ 55.2% Wtd. Avg. Interest Rate 3.72% Pro Forma Fixed Charge Coverage 4.7x Pro Forma # of Unencumbered Properties 23

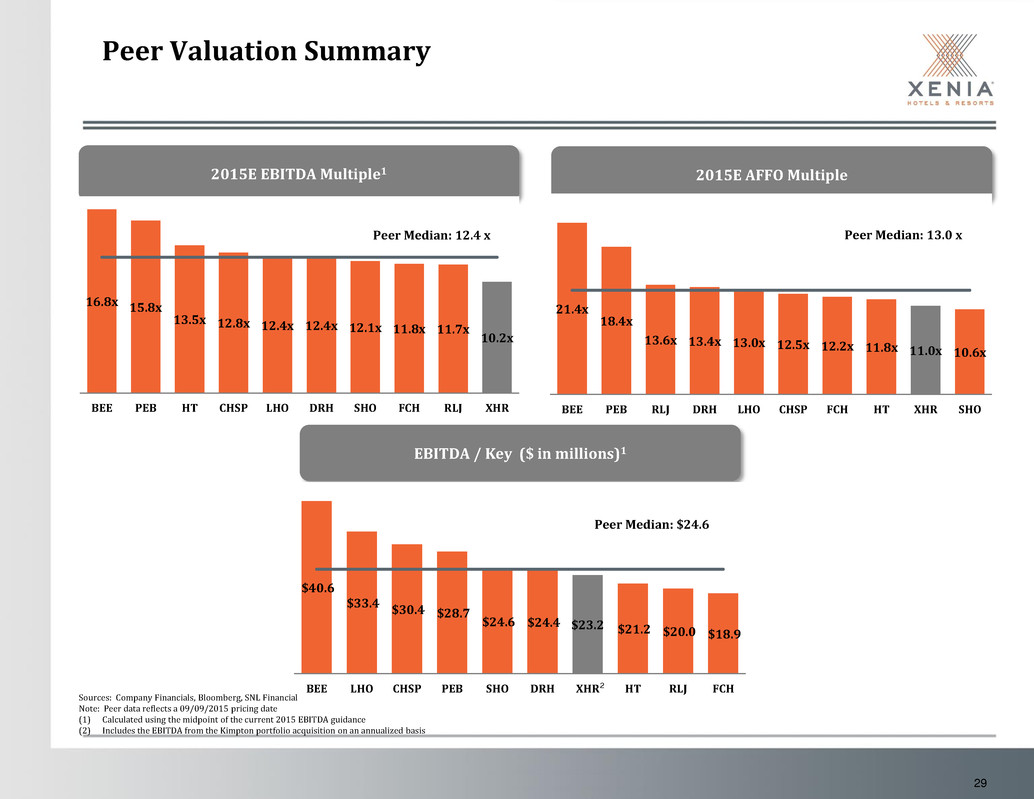

29 EBITDA / Key ($ in millions)1 Peer Valuation Summary 2015E AFFO Multiple 2015E EBITDA Multiple1 16.8x 15.8x 13.5x 12.8x 12.4x 12.4x 12.1x 11.8x 11.7x 10.2x BEE PEB HT CHSP LHO DRH SHO FCH RLJ XHR Peer Median: 12.4 x $40.6 $33.4 $30.4 $28.7 $24.6 $24.4 $23.2 $21.2 $20.0 $18.9 BEE LHO CHSP PEB SHO DRH XHR HT RLJ FCH Peer Median: $24.6 21.4x 18.4x 13.6x 13.4x 13.0x 12.5x 12.2x 11.8x 11.0x 10.6x BEE PEB RLJ DRH LHO CHSP FCH HT XHR SHO Peer Median: 13.0 x Sources: Company Financials, Bloomberg, SNL Financial Note: Peer data reflects a 09/09/2015 pricing date (1) Calculated using the midpoint of the current 2015 EBITDA guidance (2) Includes the EBITDA from the Kimpton portfolio acquisition on an annualized basis 2

30 Key Takeaways National platform of high quality assets located in Top 25 markets and key leisure destinations consisting premium full-service, lifestyle and urban upscale hotels Experienced management team with track record of executing on investment strategy Successful implementation of asset management capabilities to increase revenues, reduce expenses and improve margins Significant incremental EBITDA from strategic acquisitions anticipated in 2016 Continued focus on improvement of key portfolio operating statistics to further enhance high portfolio quality

31 Non-GAAP Financial Measures We consider the following non-GAAP financial measures useful to investors as key supplemental measures of our operating performance: EBITDA, Adjusted EBITDA, FFO and Adjusted FFO. These non- GAAP financial measures should be considered along with, but not as alternatives to, net income or loss, operating profit, cash from operations, or any other operating performance measure as prescribed per GAAP. Gross Operating Profit (GOP) and GOP Margin We calculate hotel GOP in accordance with the Uniform System Accounts for the Lodging Industry (USALI) Eleventh Revised Edition, which defines GOP as net income or loss (calculated in accordance with GAAP) after adding back base and incentive management fees, non-operating income and expenses, replacement reserve and excluding franchise fees. We believe GOP provides another financial measure in evaluating and facilitating comparison of operating performance between periods of our underlying hotel property entities. EBITDA and Adjusted EBITDA EBITDA is a commonly used measure of performance in many industries and is defined as net income or loss (calculated in accordance with GAAP) excluding interest expense, provision for income taxes (including income taxes applicable to sale of assets) and depreciation and amortization. We consider EBITDA useful to an investor regarding our results of operations, in evaluating and facilitating comparisons of our operating performance between periods and between REITs by removing the impact of our capital structure (primarily interest expense) and asset base (primarily depreciation and amortization) from our operating results, even though EBITDA does not represent an amount that accrues directly to common stockholders. In addition, EBITDA is used as one measure in determining the value of hotel acquisitions and dispositions and along with FFO and Adjusted FFO, it is used by management in the annual budget process for compensation programs. We further adjust EBITDA for certain additional items such as hotel property acquisitions and pursuit costs, amortization of share-based compensation, equity investment adjustments, the cumulative effect of changes in accounting principles, impairment of real estate assets, operating results from properties sold and other costs we believe do not represent recurring operations and are not indicative of the performance of our underlying hotel property entities. We believe Adjusted EBITDA provides investors with another financial measure in evaluating and facilitating comparison of operating performance between periods and between REITs that report similar measures. FFO and Adjusted FFO We calculate FFO in accordance with standards established by the National Association of Real Estate Investment Trusts (NAREIT), which defines FFO as net income or loss (calculated in accordance with GAAP), excluding real estate-related depreciation, amortization and impairments, gains (losses) from sales of real estate, the cumulative effect of changes in accounting principles, similar adjustments for unconsolidated partnerships and joint ventures, and items classified by GAAP as extraordinary. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most industry investors consider presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. We believe that the presentation of FFO provides useful supplemental information to investors regarding our operating performance by excluding the effect of real estate depreciation and amortization, gains (losses) from sales for real estate, impairments of real estate assets, extraordinary items and the portion of these items related to unconsolidated entities, all of which are based on historical cost accounting and which may be of lesser significance in evaluating current performance. We believe that the presentation of FFO can facilitate comparisons of operating performance between periods and between REITs, even though FFO does not represent an amount that accrues directly to common stockholders. Our calculation of FFO may not be comparable to measures calculated by other companies who do not use the NAREIT definition of FFO or do not calculate FFO per diluted share in accordance with NAREIT guidance. Additionally, FFO may not be helpful when comparing us to non-REITs. We further adjust FFO for certain additional items that are not in NAREIT’s definition of FFO such as hotel property acquisition and pursuit costs, amortization of debt origination costs and share-based compensation, operating results from properties that are sold and other expenses we believe do not represent recurring operations. We believe that Adjusted FFO provides investors with useful supplemental information that may facilitate comparisons of ongoing operating performance between periods and between REITs that make similar adjustments to FFO and is beneficial to investors’ complete understanding of our operating performance. FFO, Adjusted FFO, EBITDA and Adjusted EBITDA do not represent cash generated from operating activities under GAAP and should not be considered as alternatives to net income or loss, operating profit, cash flows from operations or any other operating performance measure prescribed by GAAP. Although we present and use FFO, Adjusted FFO, EBITDA and Adjusted EBITDA because we believe they are useful to investors in evaluating and facilitating comparisons of our operating performance between periods and between REITs that report similar measures, the use of these non-GAAP measures has certain limitations as analytical tools. These non-GAAP financial measures are not measures of liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to fund capital expenditures, contractual commitments, working capital, service debt or make cash distributions. These measures do not reflect cash expenditures for long-term assets and other items that we have incurred and will incur. These non-GAAP financial measures may include funds that may not be available for management’s discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, and other commitments and uncertainties. These non-GAAP financial measures as presented may not be comparable to non-GAAP financial measures as calculated by other real estate companies. Therefore, these measures should not be considered in isolation or as an alternative to GAAP measures. For a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for historical periods presented and our calculation of Hotel EBITDA, please refer to our website www.xeniareit.com