Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - Southcorp Capital, Inc. | sthc_ex312.htm |

| EX-31.1 - CERTIFICATION - Southcorp Capital, Inc. | sthc_ex311.htm |

| EX-32.1 - CERTIFICATION - Southcorp Capital, Inc. | sthc_ex321.htm |

| EX-32.2 - CERTIFICATION - Southcorp Capital, Inc. | sthc_ex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2015

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________ .

Commission File Number: 000-55044

|

|

| (Exact name of registrant as specified in its charter) |

| Delaware | 46-5429720 | |

| (State of Incorporation) |

| (I.R.S. Employer Identification No.) |

| 520 Broadway, Suite 350, Santa Monica, California | 90401 | |

| (Address of principal executive offices) |

| (Zip Code) |

(949) 461-1471

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, $.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer | ¨ | Non-accelerated filer | ¨ |

| Accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter (September 1, 2015): $125,463

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Title of Each Class | Outstanding as of June 30, 2015 | |

| Common stock, par value $0.0001 per share Class C Preferred Stock, par value $0.001 per share | 114,057,315(1) 23,000,000 |

The Company’s shareholder WB Partners agreed to cancel 150,000,000 shares of Common Stock which reduced the outstanding to 114,057,315.

(1)

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

|

|

| Page |

| ||

| PART I |

|

|

| ||

|

|

|

|

| ||

| Item 1. | Business |

|

| 4 |

|

| Item 1A. | Risk Factors |

|

| 5 |

|

| Item 1B. | Unresolved Staff Comments |

|

| 5 |

|

| Item 2. | Properties |

|

| 5 |

|

| Item 3. | Legal Proceedings |

|

| 5 |

|

| Item 4. | Mine Safety Disclosure |

|

| 5 |

|

|

|

|

|

|

| |

| PART II |

|

|

|

| |

|

|

|

|

|

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

| 6 |

|

| Item 6. | Selected Financial Data |

|

| 7 |

|

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| 7 |

|

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

|

| 10 |

|

| Item 8. | Financial Statements and Supplementary Data |

|

| 11 |

|

| Balance Sheets |

| F-2 |

| ||

| Statements of Operations |

| F-3 |

| ||

| Statements of Cash Flows |

| F-4 |

| ||

| Statements of Stockholders’ Equity (Deficit) |

| F-5 |

| ||

| Notes to the Financial Statements |

| F-6 |

| ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

| 12 |

|

| Item 9A. | Controls and Procedures |

|

| 12 |

|

| Item 9B. | Other Information |

|

| 13 |

|

|

|

|

|

|

| |

| PART III |

|

|

|

| |

|

|

|

|

|

| |

| Item 10. | Directors, Executive Officers and Corporate Governance |

|

| 14 |

|

| Item 11. | Executive Compensation |

|

| 15 |

|

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| 15 |

|

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

| 16 |

|

| Item 14. | Principal Accountant Fees and Services |

|

| 16 |

|

|

|

|

|

|

| |

| PART IV |

|

|

|

| |

|

|

|

|

|

| |

| Item 15. | Exhibits and Financial Statement Schedules |

|

| 17 |

|

|

|

|

|

|

| |

| SIGNATURES |

|

| 18 | ||

| 2 |

PART I

Forward-Looking Statements

Certain statements contained in this report (including information incorporated by reference) are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions provided for under these sections. Our forward-looking statements include, without limitation:

|

| · | Statements regarding future earnings; |

|

| · | Estimates of future mineral production and sales, for specific operations and on a consolidated or equity basis; |

|

| · | Estimates of future costs applicable to sales, other expenses and taxes for specific operations and on a consolidated basis; |

|

| · | Estimates of future cash flows; |

|

| · | Estimates of future capital expenditures and other cash needs, for specific operations and on a consolidated basis, and expectations as to the funding thereof; |

|

| · | Estimates regarding timing of future capital expenditures, construction, production or closure activities; |

|

| · | Statements as to the projected development of certain ore deposits, including estimates of development and other capital costs and financing plans for these deposits; |

|

| · | Statements regarding the availability and costs related to future borrowing, debt repayment and financing; |

|

| · | Statements regarding modifications to hedge and derivative positions; |

|

| · | Statements regarding future transactions; |

|

| · | Statements regarding the impacts of changes in the legal and regulatory environment in which we operate; and |

|

| · | Estimates of future costs and other liabilities for certain environmental matters. |

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. More detailed information regarding these factors is included in Item 1, Business, Item 1A, Risk Factors, and elsewhere throughout this report. Given these uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

The Company maintains an internet website at www.southcorpcapital.com. The Company makes available, free of charge, through the Investor Information section of the web site, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Section 16 filings and all amendments to those reports, as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission. Any of the foregoing information is available in print to any stockholder who requests it by contacting our Investor Relations Department.

| 3 |

ITEM 1. BUSINESS

Corporate Background and Our Business

Business Of The Registrant

Southcorp Capital, Inc. is a Delaware corporation. The Company focus is on the acquisition of residential, commercial and industrial properties.

Our Portfolio

The following table provides an overview of our properties:

| Property |

| City, State |

| Acquisition Date |

| Type |

| Purchase Price |

| |

| 808 N. Franklin Street |

| Portland, Indiana |

| April-14 |

| Single Family |

| $ | 1,500 |

|

| 465 Fulton |

| Berne, Indiana |

| April-14 |

| Vacant Land |

| $ | 1,500 |

|

| Jefferson Street |

| Berne, Indiana |

| April-14 |

| Vacant Industrial |

| $ | 2,500 |

|

| 356 Franklin Street |

| Berne, Indiana |

| April-14 |

| Single Family |

| $ | 16,000 |

|

| 163 Behring Street |

| Berne, Indiana |

| April-14 |

| Commercial |

| $ | 35,000 |

|

| 7003 Balsam Lane |

| Fort Wayne, Indiana |

| May-14 |

| Single Family |

| $ | 6,000 |

|

| 1063 Winchester |

| Decatur, Indiana |

| August-14 |

| Single Family |

| $ | 1,890 |

|

| 448 E Line |

| Geneva, Indiana |

| November-14 |

| Commercial |

| $ | 1,919 |

|

| 664 Seminary |

| Roanoke, Indiana |

| November-14 |

| Single Family |

| $ | 10,727 |

|

| 3217 Raymond |

| Fort Wayne, Indiana |

| November-14 |

| Single Family |

| $ | 10,727 |

|

In the opinion of management, available funds will not satisfy our growth requirements for the next twelve months. The Company previously expected to expand outside of Indiana. The Company’s corporate plan was to initially acquire houses to renovate and flip. However, the Company is currently focusing on developing its current properties for industrial use and residential use.

Industrial properties: The Company has begun to acquire industrial property with the intention of building factories. The Company has agreements to manufacture products that food products and weight loss.

| 4 |

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

The above statement notwithstanding, shareholders and prospective investors should be aware that certain risks exist with respect to the Company and its business, including those risk factors contained in our most recent Registration Statements on Form 10, as amended. These risks include, among others: limited assets, lack of significant revenues and only losses since inception, industry risks, dependence on third party manufacturers/suppliers and the need for additional capital. The Company’s management is aware of these risks and has established the minimum controls and procedures to insure adequate risk assessment and execution to reduce loss exposure.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 2. PROPERTIES

Our principal executive office is located in the Los Angeles Metropolitan area of California. Our office space is provided to us by the officers of the company. The Company does not incur fees for the space.

ITEM 3. LEGAL PROCEEDINGS

The Company is not a party to any litigation.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable to the company. Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K (17 CFR 229.104) requires operators of coal or other mines to include in their periodic and current reports disclosures regarding certain safety violations, orders and regulatory actions.

| 5 |

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASE OF EQUITY SECURITIES

Market Information

Our common stock trades over-the-counter and is quoted on the OTC Bulletin Board under the symbol “STHC.” The table below sets forth the high and low bid prices for our common stock as reflected on the OTC Bulletin Board for the last two fiscal years. Quotations represent prices between dealers, do not include retail markups, markdowns or commissions, and do not necessarily represent prices at which actual transactions were affected.

| Common Stock |

| |||||||

| Fiscal Year 2014 |

| High |

|

| Low |

| ||

| First Quarter |

| $ | 126.000 |

|

| $ | 5.640 |

|

| Second Quarter |

| $ | 5.560 |

|

| $ | 0.004 |

|

| Third Quarter |

| $ | 0.029 |

|

| $ | 0.002 |

|

| Fourth Quarter |

| $ | 0.009 |

|

| $ | 0.003 |

|

| Common Stock |

| |||||||

| Fiscal Year 2015 |

| High |

|

| Low |

| ||

| First Quarter |

| $ | 0.051 |

|

| $ | 0.010 |

|

| Second Quarter |

| $ | 0.028 |

|

| $ | 0.003 |

|

| Third Quarter |

| $ | 0.045 |

|

| $ | 0.001 |

|

| Fourth Quarter |

| $ | 0.019 |

|

| $ | 0.001 |

|

Holders of Common Equity

As of June 30, 2015 there were 114,057,315 common shares outstanding. During the fiscal year 2015, the high and low sales prices of our common stock on the OTCQB were $0.051 and $0.001, respectively, and we had 481 holders of record of our common stock.

Penny Stock Rules

Due to the price of our common stock, as well as the fact that we are not listed on Nasdaq or a national securities exchange, our stock is characterized as a “penny stock” under applicable securities regulations. Our stock therefore is subject to rules adopted by the SEC regulating broker-dealer practices in connection with transactions in penny stocks. The broker or dealer proposing to effect a transaction in a penny stock must furnish his customer a document containing information prescribed by the SEC and obtain from the customer an executed acknowledgment of receipt of that document. The broker or dealer must also provide the customer with pricing information regarding the security prior to the transaction and with the written confirmation of the transaction. The broker or dealer must also disclose the aggregate amount of any compensation received or receivable by him in connection with such transaction prior to consummating the transaction and with the written confirmation of the trade. The broker or dealer must also send an account statement to each customer for which he has executed a transaction in a penny stock each month in which such security is held for the customer’s account. The existence of these rules may have an effect on the price of our stock, and the willingness of certain brokers to effect transactions in our stock.

Transfer Agent

Pacific Stock Transfer is the transfer agent for our common stock. Their principal office of is located at 4045 Spencer St # 403, Las Vegas, NV 89119 and its telephone number is (702) 361-3033.

Dividend Policy

During the fiscal year ended April 30, 2015, the Company declared $19,925 in dividends. As of April 30, 2015, the Company paid $13,405 and has accrued $6,520 in dividends. Payment of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including the terms of any credit arrangements, our financial condition, operating results, current and anticipated cash needs and plans for expansion.

| 6 |

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained herein involve risks and uncertainties, including statements as to:

|

| · | our future operating results; |

|

| · | our business prospects; |

|

| · | our contractual arrangements and relationships with third parties; |

|

| · | the dependence of our future success on the general economy; |

|

| · | our possible financings; and |

|

| · | the adequacy of our cash resources and working capital. |

These forward-looking statements can generally be identified as such because the context of the statement will include words such as we “believe,” “anticipate,” “expect,” “estimate” or words of similar meaning. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which are described in close proximity to such statements and which could cause actual results to differ materially from those anticipated as of the date of this report. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this report, and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto, included elsewhere in this report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to those differences include those discussed below and elsewhere in this report, particularly in the “Risk Factors” section.

Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has negative working capital, recurring losses, and does not have an established source of revenues sufficient to cover its operating costs. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse effect upon it and its shareholders.

| 7 |

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

Business Of The Registrant

Southcorp Capital, Inc. is a Delaware corporation. The Company focus is on the acquisition of residential, commercial and industrial properties.

Our Portfolio

The following table provides an overview of our properties:

| Property |

| City, State |

| Acquisition Date |

| Type |

| Purchase Price |

| |

| 808 N. Franklin Street |

| Portland, Indiana |

| April-14 |

| Single Family |

| $ | 1,500 |

|

| 465 Fulton |

| Berne, Indiana |

| April-14 |

| Vacant Land |

| $ | 1,500 |

|

| Jefferson Street |

| Berne, Indiana |

| April-14 |

| Vacant Industrial |

| $ | 2,500 |

|

| 356 Franklin Street |

| Berne, Indiana |

| April-14 |

| Single Family |

| $ | 16,000 |

|

| 163 Behring Street |

| Berne, Indiana |

| April-14 |

| Commercial |

| $ | 35,000 |

|

| 7003 Balsam Lane |

| Fort Wayne, Indiana |

| May-14 |

| Single Family |

| $ | 6,000 |

|

| 1063 Winchester |

| Decatur, Indiana |

| August-14 |

| Single Family |

| $ | 1,890 |

|

| 448 E Line |

| Geneva, Indiana |

| November-14 |

| Commercial |

| $ | 1,919 |

|

| 664 Seminary |

| Roanoke, Indiana |

| November-14 |

| Single Family |

| $ | 10,727 |

|

| 3217 Raymond |

| Fort Wayne, Indiana |

| November-14 |

| Single Family |

| $ | 10,727 |

|

In the opinion of management, available funds will not satisfy our growth requirements for the next twelve months. The Company previously expected to expand outside of Indiana. The Company’s corporate plan was to initially acquire houses to renovate and flip. However, the Company is currently focusing on developing its current properties for industrial use and residential use.

Industrial properties: The Company has begun to acquire industrial property with the intention of building factories. The Company has agreements to manufacture products that food products and weight loss.

RESULTS OF OPERATIONS

The Company generates revenue from the sale of houses it renovates.

Revenue

During the Fiscal Year ended April 30, 2015, the Company generated revenue of $17,773 compared to $0 for the fiscal year ended April 30, 2014.

Cost of properties sold

The Company had $5,500 in costs of goods sold from the properties that were sold during the fiscal year ended April 30, 2015 this compared to $0 for the fiscal year ended April 30, 2014.

| 8 |

Operating Expenses

For the Fiscal Year ended April 30, 2015, the Company had $490,245 in operating expenses, $2,549 in derivative gain, $19,618 in interest expense and booked a one-time $400,000 in expense related stock issuance to its officers and consultant. The Company’s net loss for the period ended April 30, 2015 was $495,041.

Net Profit (Loss)

For year ended April 30, 2015, the Company had Net Loss of ($495,041). This was derived as follows:

| Revenue: |

| $ | 17,773 |

|

| Discounts: |

| $ | - |

|

| COS: |

| $ | (5,500 | ) |

| Expenses: |

| $ | (490,245 | ) |

| Gain on derivatives |

| $ | 2,549 |

|

| Interest expense: |

| $ | (19,618 | ) |

| Net loss: |

| $ | (495,041 | ) |

Dividends

The Company issued a cash dividend of $.0001 to shareholders of record as of August 15, 2014 with a payment date of August 23, 2014.

Liquidity and Capital Resources

As of April 30, 2015, the Company had $1,979 in cash, $31,554 in loan receivables from related party, $3,000 in loan receivables, $30,000 of prepaid expense, $177,712 in equipment, and $125,932 in real estate for a total of $370,177 in assets. In management’s opinion, the Company’s cash position is insufficient to maintain its operations at the current level for the next 12 months. Any expansion may cause the Company to require additional capital until such expansion began generating revenue. It is anticipated that the raise of additional funds will principally be through the sales of our securities. As of the date of this report, additional funding has not been secured and no assurance may be given that we will be able to raise additional funds.

As of April 30, 2015, our total liabilities were $485,573, which consists of $974 in accounts payable, $17,366 in third party loans, $2,252 in accrued interest, $407,618 in loans from our shareholder, $6,520 in accrued dividend $10,892 in a mortgage payable related to the purchase of one of the properties and $39,951 in derivative liabilities.

Critical Accounting Policies

Our critical accounting policies, including the assumptions and judgments underlying them, are disclosed in the notes to our audited financial statements included in this Form 10-K. We have consistently applied these policies in all material respects. Below are some of the critical accounting policies:

Revenue Recognition

The company pursues opportunities to realize revenues from two principal activities: sale of houses it renovates It is the company’s policy that revenues and gains will be recognized in accordance with ASC Topic 605-10-25, “Revenue Recognition.” Under ASC Topic 605-10-25, revenue earning activities are recognized upon claiming the purse winnings and the company has substantially accomplished all it must do to be entitled to the benefits represented by the revenue. Gains or losses from the sale of the houses are recognized when the house is sold or otherwise disposed of, the cost and associated accumulated depreciation are removed from the accounts and the resulting gain or loss is recognized in the statement of operations.

Depreciation schedule

The Company depreciates houses that it acquires at 50% or greater position in. The Company depreciates the house via straight-line depreciation over its useful life of 27.5 years.

The Company has not depreciated any houses since the houses it has acquired as of the Year Ended April 30, 2015 did not exceed the land value or whose renovations have not been completed.

| 9 |

Emerging Growth Company Status

We are an “emerging growth company” as defined under the Jumpstart Our Business Startups Act, commonly referred to as the JOBS Act. We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

As an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to:

|

| · | not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act (we also will not be subject to the auditor attestation requirements of Section 404(b) as long as we are a “smaller reporting company,” which includes issuers that had a public float of less than $ 75 million as of the last business day of their most recently completed second fiscal quarter); |

|

| · | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

|

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Under this provision, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. In other words, an “emerging growth company” can delay the adoption of such accounting standards until those standards would otherwise apply to private companies until the first to occur of the date the subject company (i) is no longer an “emerging growth company” or (ii) affirmatively and irrevocably opts out of the extended transition period provided in Securities Act Section 7(a) (2) (B). The Company has elected to take advantage of this extended transition period and, as a result, our financial statements may not be comparable to the financial statements of other public companies. Accordingly, until the date that we are no longer an “emerging growth company” or affirmatively and irrevocably opt out of the exemption provided by Securities Act Section 7(a) (2) (B), upon the issuance of a new or revised accounting standard that applies to your financial statements and has a different effective date for public and private companies, clarify that we will disclose the date on which adoption is required for non-emerging growth companies and the date on which we will adopt the recently issued accounting standard.

Accounting and Audit Plan

In the next twelve months, we anticipate spending approximately $15,000 - $20,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Our Website.

Our website can be found at www.southcorpcapital.com.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company, as a smaller reporting company, as defined byRule 229.10(f)(1), is not required to provide the information required by this Item.

| 10 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

SOUTHCORP CAPITAL, INC.

FORM 10-K

April 30, 2015

TABLE OF CONTENTS

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

| F-1 |

|

| FINANCIAL STATEMENTS: |

|

|

|

|

| Consolidated Balance Sheet |

|

| F-2 |

|

| Consolidated Statements of Operations |

| F-3 |

| |

| Consolidated Statement of Stockholders' (Deficit) Equity |

|

| F-4 |

|

| Consolidated Statements of Cash Flows |

|

| F-5 |

|

| Notes to the Consolidated Financial Statements |

| F-6 |

|

| 11 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of

Southcorp Capital, Inc.

Berne, Indiana

We have audited the accompanying consolidated balance sheets of Southcorp Capital, Inc. and its subsidiary (collectively, the “Company”) as of April 30, 2015 and 2014, and the related statements of operations, stockholders’ equity, and cash flows for the year ended April 30, 2015 and for the period from the date of inception on March 26, 2014 to April 30, 2014. Southcorp Capital, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Southcorp Capital, Inc. and its subsidiary as of April 30, 2015 and 2014, and the results of their operations and their cash flows for the year ended April 30, 2015 and for the period from the date of inception on March 26, 2014 to April 30, 2014, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered losses from operations and negative operating cash flows which raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

September 4, 2015

| F-1 |

SOUTHCORP CAPITAL, INC.

CONSOLDATED BALANCE SHEETS

|

| April 30, |

|

| April 30, |

| |||

|

|

|

|

|

|

| |||

| ASSETS | ||||||||

| Current assets: |

|

|

|

|

|

| ||

| Cash or cash equivalents |

| $ | 1,979 |

|

| $ | 200 |

|

| Loan receivable – Related Party |

|

| 31,554 |

|

|

| - |

|

| Loan receivable |

|

| 3,000 |

|

|

| - |

|

| Prepaid expenses – Related Party |

|

| 30,000 |

|

|

| - |

|

| Total current assets |

|

| 66,533 |

|

|

| 200 |

|

| Fixed assets: |

|

|

|

|

|

|

|

|

| Equipment, not placed in service |

|

| 177,712 |

|

|

| 68,000 |

|

| Real estate, commercial properties |

|

| 36,919 |

|

|

|

|

|

| Real estate, rental properties |

|

| 46,844 |

|

|

|

|

|

| Real estate, vacant |

|

| 4,000 |

|

|

| - |

|

| Renovation, rental properties |

|

| 38,169 |

|

|

| - |

|

| Total assets |

| $ | 370,177 |

|

| $ | 68,200 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Short term liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

| 974 |

|

|

| - |

|

| Convertible notes payable, net of discounts |

|

| 17,366 |

|

|

| - |

|

| Loans payable- mortgage |

|

| 10,892 |

|

|

| 13,692 |

|

| Accrued interest |

|

| 2,252 |

|

|

| - |

|

| Derivative liability |

|

| 39,951 |

|

|

| - |

|

| Accrued dividend |

|

| 6,520 |

|

|

| - |

|

| Total current liabilities |

|

| 77,955 |

|

|

| 13,692 |

|

| Long term liabilities |

|

| 407,618 |

|

|

| 54,938 |

|

| Loans payable- related party |

|

| - |

|

|

| - |

|

| Total liabilities |

|

| 485,573 |

|

|

| 68,630 |

|

| Shareholders’ deficit: |

|

|

|

|

|

|

|

|

| Class C Preferred Stock, Par Value $.0001, 50,000,000 authorized, 23,000,000 issued and outstanding |

|

| 2,300 |

|

|

| 2,300 |

|

| Common stock, par value $0.0001, 750,000,000 authorized, 254,057,315 and 224,057,315 issued and outstanding, respectfully |

|

| 25,406 |

|

|

| 22,406 |

|

| Additional paid in capital |

|

| 374,294 |

|

|

| (22,706 | ) |

| Accumulated deficit |

|

| (517,396 | ) |

|

| (2,430 | ) |

| Total shareholders' deficit |

|

| (115,396 | ) |

|

| (430 | ) |

| Total liabilities and shareholders' deficit |

| $ | 370,177 |

|

| $ | 68,200 |

|

See accompanying notes to consolidated financial statements

| F-2 |

SOUTHCORP CAPITAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

| For the Year |

| From Inception on | |||||

|

|

| April 30, 2015 |

|

| April 30, 2014 | |||

|

|

|

|

|

|

|

| ||

| Revenue |

| $ | 17,773 |

|

| $ | - |

|

| Cost of properties sold |

|

| 5,500 |

|

|

| - |

|

| Gross Profit |

|

| 12,273 |

|

|

| - |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

| SG&A |

|

| 490,245 |

|

|

| 2,430 |

|

| Total operating expenses |

|

| 490,245 |

|

|

| 2,430 |

|

| Loss from operations |

|

| 477,972 |

|

|

| 2,430 |

|

| (Other income) expense |

|

|

|

|

|

|

|

|

| Gain on derivative |

|

| (2,549 | ) |

|

| - |

|

| Interest expense |

|

| 19,618 |

|

|

| - |

|

| Net Loss |

| $ | (495,041 | ) |

| $ | (2,430 | ) |

|

|

|

|

|

|

|

|

| |

| Net loss per share, basic and diluted |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

|

| |

| Weighted average shares outstanding |

|

| 244,591,562 |

|

|

| 164,380,521 |

|

See accompanying notes to consolidated financial statements

| F-3 |

SOUTHCORP CAPITAL, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' (DEFICIT) EQUITY

|

| Common Stock |

|

| Series C Preferred Stock |

|

| Additional Paid |

|

|

|

|

| Total |

| ||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| In Capital |

|

| Net Loss |

|

| Equity |

| ||||||||

| Balances, March 26, 2014 (Inception) |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Issuance on March 26, 2014 for cash |

|

| 200,000,000 |

|

|

| 20,000 |

|

|

| - |

|

|

| - |

|

|

| (18,000 | ) |

|

| - |

|

|

| 2,000 |

|

| Reverse merger adjustment |

|

| 24,057,315 |

|

|

| 2,406 |

|

|

| 23,000,000 |

|

|

| 2,300 |

|

|

| (4,706 | ) |

|

| - |

|

|

| - |

|

| Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (2,430 | ) |

|

| (2,430 | ) |

| Balances April 30, 2014 |

|

| 224,057,315 |

|

|

| 22,406 |

|

|

| 23,000,000 |

|

|

| 2,300 |

|

|

| (22,706 | ) |

|

| (2,430 | ) |

|

| (430 | ) |

| Stock issued for compensation |

|

| 30,000,000 |

|

|

| 3,000 |

|

|

| - |

|

|

| - |

|

|

| 397,000 |

|

|

| - |

|

|

| 400,000 |

|

| Dividend |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (19,925 | ) |

|

| (19,925 | ) |

| Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (495,041 | ) |

|

| (495,041 | ) |

| Balances April 30, 2015 |

|

| 254,057,315 |

|

|

| 25,406 |

|

|

| 23,000,000 |

|

|

| 2,300 |

|

|

| 374,294 |

|

|

| (517,396 | ) |

|

| (115,396 | ) |

See accompanying notes to consolidated financial statements

| F-4 |

SOUTHCORP CAPITAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

| For the Year |

|

| From Inception on |

| |||

|

| April 30, 2015 |

|

| April 30, 2014 |

| |||

| Cash flows from operating activities |

|

|

|

|

|

| ||

| Net loss |

| $ | (495,041 | ) |

|

| (2,430 | ) |

| Adjustments to reconcile net loss to net cash: |

|

|

|

|

|

| - |

|

| Amortization of debt discount |

|

| 17,366 |

|

|

| - |

|

| Stock issued as compensation |

|

| 400,000 |

|

|

| - |

|

| Gain on derivative |

|

| (2,549 | ) |

|

| - |

|

| Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

| 974 |

|

|

| - |

|

| Accrued interest |

|

| 2,252 |

|

|

| - |

|

| Prepaid expenses |

|

| (30,000 | ) |

|

| - |

|

| Net cash used in operating activities |

|

| (106,998 | ) |

|

| (2,430 | ) |

|

|

|

|

|

|

|

|

| |

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Loans to Related Party |

|

| (32,549 | ) |

|

| - |

|

| Repayments from Related Party loans |

|

| 995 |

|

|

| - |

|

| Loan to 3rd party |

|

| (3,000 | ) |

|

| - |

|

| Equipment purchased |

|

| (177,712 | ) |

|

| - |

|

| Real estate purchased |

|

| (19,763 | ) |

|

| - |

|

| Renovations to properties |

|

| (26,419 | ) |

|

| - |

|

| Net cash used in investing activities |

|

| (258,448 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Proceeds from Convertible note payable |

|

| 42,500 |

|

|

| - |

|

| Proceeds from sale of common stock |

|

| - |

|

|

| 2,000 |

|

| Repayment of mortgage |

|

| (2,800 | ) |

|

| - |

|

| Dividend payment |

|

| (13,405 | ) |

|

| - |

|

| Proceeds from related party advances |

|

| 410,704 |

|

|

| 630 |

|

| Repayment of proceeds from related party advances |

|

| (69,774 | ) |

|

| - |

|

| Net cash provided by financing activities |

|

| 367,225 |

|

|

| 2,630 |

|

| Net change in cash |

|

| 1,779 |

|

|

| - |

|

| Cash balance, beginning of period |

|

| 200 |

|

|

| 200 |

|

| Cash balance, end of period |

| $ | 1,979 |

|

|

| 200 |

|

|

|

|

|

|

|

|

|

| |

| Noncash investing and financing activities: |

|

|

|

|

|

|

|

|

| Payments for real estate renovations by related party |

| $ | 11,750 |

|

|

| - |

|

| Accrued dividend |

|

| 6,520 |

|

|

| - |

|

| Discount on debt due to derivative |

|

| 42,500 |

|

|

| - |

|

| Reverse merger transaction |

|

| - |

|

|

| 4,706 |

|

| Purchase of real estate by related party |

|

| - |

|

|

| 54,308 |

|

| Liability assumed through purchase of real estate |

|

| - |

|

|

| 13,692 |

|

See accompanying notes to consolidated financial statements

| F-5 |

SOUTHCORP CAPITAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – Basis of Presentation

A summary of significant accounting policies of Southcorp Capital, Inc. (the “Company”) is presented to assist in understanding the Company’s financial statements. The accounting policies presented in these footnotes conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the accompanying financial statements. These financial statements and notes are representations of the Company’s management who are responsible for their integrity and objectivity.

Organization, Nature of Business and Trade Name

Southcorp Capital, Inc. (“Southcorp”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of Delaware on June 12, 2006. On April 7, 2014, the Company executed a reverse merger with Skyline Holdings, Inc. On April 7, 2014, the Company entered into an Agreement whereby the Company acquired 100% of Skyline Holdings, Inc, incorporated in the State of Indiana on March 26, 2014. Skyline was the surviving Company and became a wholly owned subsidiary of SouthCorp Capital. SouthCorp Capital previously had no operations, assets or liabilities. On April 8, 2014, the acquisition closed and under the terms of the agreement Skyline Holdings was the surviving entity. The Company selected April 30 as its fiscal year end.

The Company focus is on the acquisition and renovation of single-family and mutli-family properties in the U.S with the intent of reselling the property after renovations have occurred. Our real estate investments are expected to focus properties undervalued and/or in need of some repairs.

We intend to seek potential property acquisitions meeting the above criteria and which are located throughout the United States. We believe the most important criteria for evaluating the markets in which we intend to purchase properties include:

|

| · | historic and projected population growth; |

|

| · | historically high levels of tenant demand and lower historic investment volatility for the type of property being acquired; |

|

| · | markets with historic and growing numbers of a qualified and affordable workforce; |

|

| · | high historic and projected employment growth; |

|

| · | markets with high levels of insured populations; |

|

| · | stable household income and general economic stability; and |

|

| · | sound real estate fundamentals, such as high occupancy rates and strong rent rate potential. |

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of three months or less to be cash equivalents.

Revenue Recognition

The company pursues opportunities to realize revenues from two principal activities: sale of houses it renovates. It is the company’s policy that revenues and gains will be recognized in accordance with ASC Topic 605-10-25, “Revenue Recognition.” Under ASC Topic 605-10-25, revenue earning activities are recognized upon sale of its properties and the company has substantially accomplished all it must do to be entitled to the benefits represented by the revenue. Gains or losses from the sale of the houses are recognized when the house is sold or otherwise disposed of, the cost and associated accumulated depreciation are removed from the accounts and the resulting gain or loss is recognized in the statement of operations.

| F-6 |

Sale of the Company’s real estate property will occur through the use of a sales contract where revenues from renovated real estate property sales will be recognized upon closing of the sale. In accordance with FASB ASC 360-20, the Company will use the accrual method and recognize revenue on the sale of its properties when the earnings process is complete and the collectability of the sales price and additional proceeds is reasonably assured, which is typically when the sale of the property closes. At the time of sale the Company will determine it the transaction will be recognized under the full accrual method, installment method, cost recovery method, deposit method or reduced profit method. Rental Income is recognized at the time the Company deposits the monies.

Property and Equipment

Property and equipment are carried at cost. Expenditures for maintenance and repairs are charged against operations. Renewals and betterments that materially extend the life of the assets are capitalized. When assets are retired or otherwise disposed of, the cost and related accumulated depreciation are removed from the accounts, and any resulting gain or loss is reflected in income for the period.

Depreciation is computed for financial statement purposes on a straight-line basis over estimated useful lives of the related assets. The estimated useful lives of depreciable assets are:

|

| Estimated |

| ||

|

| Useful Lives |

| ||

| Equipment |

|

| 5-10 years |

|

| Residential Real Estate |

|

| 27.5 years |

|

| Non-residential Real Estate |

|

| 30 years |

|

For federal income tax purposes, depreciation is computed under the modified accelerated cost recovery system. For financial statements purposes, depreciation is computed under the straight-line method.

During the Fiscal Year ended April 30, 2015, the Company acquired food-processing equipment for $177,712. The equipment has a useful life of 10 years. The equipment was installed and began being used in May 2015. As such, the Company will begin to deprecate it starting May 2015.

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and other intangible assets are tested for impairment annually and more frequently if facts and circumstances indicate goodwill carrying values exceed estimated reporting unit fair values and if indefinite useful lives are no longer appropriate for the Company’s trademarks. Based on the impairment tests performed, there was no impairment of goodwill or other intangible assets in fiscal 2015. Definite-lived intangibles are amortized over their estimated useful lives.

Impairment of long-lived assets

The Company reviews long-lived assets to be held and used for impairment annually or whenever events or changes in circumstances indicate that the historical-cost carrying value of an asset may no longer be appropriate. The Company assesses recoverability of the asset by comparing the undiscounted future net cash flows expected to result from the asset to its carrying value. If the carrying value exceeds the undiscounted future net cash flows of the assets, an impairment loss is measured and recognized. An impairment loss is measured as the difference between the net book value and the fair value of the long-lived asset. Fair value is estimated based upon either discounted cash flow analysis or estimated salvage value. There was no impairment recorded in the year April 30, 2015.

Use of Estimates

The preparation of financial statements in accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. A change in managements’ estimates or assumptions could have a material impact on Southcorp Capital Inc.’s financial condition and results of operations during the period in which such changes occurred. Actual results could differ from those estimates. Southcorp Capital Inc.’s financial statements reflect all adjustments that management believes are necessary for the fair presentation of their financial condition and results of operations for the periods presented.

| F-7 |

Income Taxes

The Company uses the asset and liability method of accounting for income taxes in accordance with ASC 740-10, “Accounting for Income Taxes.” Under this method, income tax expense is recognized for the amount of: (i) taxes payable or refundable for the current year; and, (ii) deferred tax consequences of temporary differences resulting from matters that have been recognized in an entity’s financial statements or tax returns. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that includes the enactment date. A valuation allowance is provided to reduce the deferred tax assets reported if, based on the weight of available positive and negative evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

ASC 740-10 prescribes a recognition threshold and measurement attribute for the financial statement recognition of a tax position taken or expected to be taken on a tax return. Under ASC 740-10, a tax benefit from an uncertain tax position taken or expected to be taken may be recognized only if it is “more likely than not” that the position is sustainable upon examination, based on its technical merits. The tax benefit of a qualifying position under ASC 740-10 would equal the largest amount of tax benefit that is greater than 50% likely of being realized upon ultimate settlement with a taxing authority having full knowledge of all the relevant information. A liability (including interest and penalties, if applicable) is established to the extent a current benefit has been recognized on a tax return for matters that are considered contingent upon the outcome of an uncertain tax position. Related interest and penalties, if any, are included as components of income tax expense and income taxes payable.

Basic Earning (Loss) Per Share

The Company computes net income (loss) per share in accordance with Accounting Standards Codification (“ASC”) 260, "Earnings per Share". ASC 260 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. As at April 30, 2015 and 2014, there are no dilutive potential common shares.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary and have been prepared in accordance with United States generally accepted accounting principles ("U.S. GAAP"). All intercompany accounts and transactions have been eliminated in consolidation.

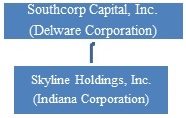

This is the current corporate organization:

Fair Value Measurements

As defined in ASC 820 “Fair Value Measurements”, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). The Company utilizes market data or assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated, or generally unobservable. The Company classifies fair value balances based on the observability of those inputs. ASC 820 establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to unobservable inputs (level 3 measurement).

| F-8 |

The three levels of the fair value hierarchy defined by ASC 820 are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis. Level 1 primarily consists of financial instruments such as exchange-traded derivatives, marketable securities and listed equities.

Level 2 – Pricing inputs are other than quoted prices in active markets included in level 1, which are either directly or indirectly observable as of the reported date. Level 2 includes those financial instruments that are valued using models or other valuation methodologies. These models are primarily industry standard models that consider various assumptions, including quoted forward prices for commodities, time value, volatility factors, and current market and contractual prices for the underlying instruments, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace throughout the full term of the instrument, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace. Instruments in this category generally include non-exchange-traded derivatives such as commodity swaps, interest rate swaps, options and collars.

Level 3 – Pricing inputs include significant inputs that are generally less observable from objective sources. These inputs may be used with internally developed methodologies that result in management’s best estimate of fair value.

The following table sets forth by level with the fair value hierarchy the Company’s financial assets and liabilities measured at fair value on April 30, 2015:

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| |||||

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Derivative financial instruments |

| $ | - |

|

| $ | - |

|

| $ | 39,951 |

|

| $ | 39,951 |

|

Recently Issued Accounting Pronouncements

Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The adoption of this ASU allows the company to remove the inception to date information and all references to development stage.

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

Note 2 – Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has negative working capital, recurring losses, and does not have an established source of revenues sufficient to cover its operating costs. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse effect upon it and its shareholders.

| F-9 |

Note 3 – Related Party Transaction

On April 4, 2014, we issued 189,500,000 shares of common stock to our officers, directors and principal shareholders for $1,895 in cash from our officers, directors and principal shareholders.

On April 4, 2014, we issued 10,500,000 shares of common stock to SC Capital for $105.

During the period ended April 30, 2014, the Company borrowed $54,938 from our officer for the purchase of the Company’s properties. The monies borrowed are payable December 31, 2016.

During the Fiscal Year ended April 30, 2015, the Company borrowed $67,466 from Joseph Wade, related to the purchase and/or renovation of the Company’s properties and working capital. Of this amount, $11,750 was paid directly to vendors for the renovation of real estate property. The Company has repaid $10,559. The total amount owed is $111,845 as of April 30, 2015. The loan is at 0% interest and is to be repaid by December 31, 2016.

During the Fiscal Year ended April 30, 2015, the Company borrowed $18,676 from Matt Billington related to the purchase and/or renovation of the Company’s properties and working capital. The Company has repaid $7,500. The total amount owed is $11,176 as of April 30, 2015. The loan is at 0% interest and is to be repaid by December 31, 2016.

During the Fiscal Year ended April 30, 2015, the Company borrowed $336,312 from WB Partners, our majority shareholder, related to the purchase and/or renovation of the Company’s properties and working capital. The Company has repaid $51,715. The total amount owed is $284,597 as of April 30, 2015. The loan is at 0% interest and is to be repaid by December 31, 2016.

During the Fiscal Year ended April 30, 2015, the Company lent $7,013 to 1PM Industries, Inc in which repayments of $995 were made back to the Company. The total amount due from related party is $6,018 as of April 30, 2015. The loan is at 0% interest and is to be repaid by December 31, 2015.

During the Fiscal Year ended April 30, 2015, the Company lent $25,536 to Nate’s Food Company. The loan is at 0% interest and is to be repaid by December 31, 2015.

During the Fiscal Year ended April 30, 2015, the Company purchased product from Nate’s Food Company. The Company booked a prepaid expense of $30,000 related to this purchase.

At April 30, 2015, the property located at 163 Behring Street, Berne, IN is being held under the entity named MLB Ventures. MLB Ventures is owned by Matt Billington.

Note 4 – Equity

On March 26, 2014 we issued 200,000,000 shares to the shareholder of Skyline Holdings in exchange for shares owned of Skyline that were acquired for $2,000. Additionally, the Company accounted for 24,057,315 as an adjustment for the previous outstanding shares of SouthCorp immediately prior to the reverse merger.

On July 21, 2014, we issued 12,500,000 shares to our CEO under the Company’s S-8 and stock compensation plan. The company expensed $125,000 related to this transaction.

On July 21, 2014, we issued 12,500,000 shares to our COO under the Company’s S-8 and stock compensation plan. The company expensed $125,000 related to this transaction.

On March 26, 2014, we issued 5,000,000 shares to for consulting services. The company expensed $150,000 related to this transaction.

During the period ended January 31, 2015, the Company declared $19,925 in dividends. As of January 31, 2015, the Company paid $13,405 and has accrued $6,520 in dividends.

Note 5 – Mortgage Notes Payable

In conjunction with the purchase of one of the properties, the Company entered into a noninterest bearing installment promissory note for a mortgage on the property of $13,692. The amount is repayable in monthly installments of $350 and the remaining balance due on maturity date of April 1, 2015. As of April 30, 2015, $10,892 was due. The Company has extended the pay-off period by paying $2,500 in May 2015 and $500 in August and September against the outstanding. The Company expects to pay the balance in October 2015.

| F-10 |

Note 6 – Note receivable from sale of property

In August 2014, the Company agreed to sell 3 of its properties for $105,000. The closing occurred on September 15, 2014 and the Company provided financing to the buyer. The Company will receive $291.66 per month with a balloon payment on March 15, 2017 of $99,750. The Company has accounted for the sale of the properties under the cost recovery method in accordance with ASC 360-20 and as such no profit is recognized until cash payments by the buyer, including principal and interest on debt due to the seller and on existing debt assumed by the buyer, exceed the seller's cost of the property sold. As of April 30, 2015, the payments exceeded the cost and therefore there is recognized gross profit.

The below table summarizes the activity for the year ended April 30, 2015:

| Sales – Properties |

| $ | 105,000 |

|

| Cost of the sales of properties |

|

| 5,500 |

|

| Gross Profit |

|

| 99,500 |

|

| Payments |

|

| 15,528 |

|

| Unrecognized Gross profit |

|

| 83,972 |

|

| Total note receivable |

| $ | - |

|

Note 7 – Real Estate

The following table provides an overview of our properties:

| Property |

| City, State |

| Acquisition Date |

| Type |

| Purchase Price |

| Commercial |

| Rental |

| Vacant |

| ||

| 808 N. Franklin Street |

| Portland, Indiana |

| April-14 |

| Single Family - Rental |

| $ | 1,500 |

|

|

|

| x |

|

|

|

| 465 Fulton |

| Berne, Indiana |

| April-14 |

| Vacant Land |

| $ | 1,500 |

|

|

|

|

|

| x |

|

| Jefferson Street |

| Berne, Indiana |

| April-14 |

| Vacant Land |

| $ | 2,500 |

|

|

|

|

|

| x |

|

| 356 Franklin Street |

| Berne, Indiana |

| April-14 |

| Single Family – Rental |

| $ | 16,000 |

|

|

|

| x |

|

|

|

| 163 Behring Street |

| Berne, Indiana |

| April-14 |

| Commercial |

| $ | 35,000 |

|

| x |

|

|

|

|

|

| 7003 Balsam Lane |

| Fort Wayne, Indiana |

| May-14 |

| Single Family - Rental |

| $ | 6,000 |

|

|

|

| x |

|

|

|

| 1063 Winchester |

| Decauter, Indiana |

| August-14 |

| Single Family - Rental |

| $ | 1,890 |

|

|

|

| x |

|

|

|

| 448 E Line |

| Geneva, Indiana |

| November-14 |

| Commercial |

| $ | 1,919 |

|

| x |

|

|

|

|

|

| 664 Seminary |

| Roanoke, Indiana |

| November-14 |

| Single Family - Rental |

| $ | 10,727 |

|

|

|

| x |

|

|

|

| 3217 Raymond |

| Fort Wayne, Indiana |

| November-14 |

| Single Family - Rental |

| $ | 10,727 |

|

|

|

| x |

|

|

|

|

|

|

|

|

|

|

|

| $ | 87,763.00 |

|

|

|

|

|

|

|

|

Renovations: During the Fiscal Year Ended April 30, 2015, the Company spent $38,169 in renovations related to its properties. Of this amount, $11,750 was paid directly to vendors for the renovation of real estate property.

Acquisitions: The Company acquired new properties for $19,763 and sold properties that the company had a cost basis of $5,500.

| F-11 |

Note 8 – Convertible Notes Payable

KBM Worldwide September 5, 2014 convertible note.

On September 22, 2014 the Company received a note in the amount of $42,500 from KBM Worldwide, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on June 24, 2015. The note cannot be converted until 180 days from the Issue date as such the Company concluded that there is no embedded derivative on issuance date but at 180th day it was a derivative. The note is convertible into shares of Common Stock, at 55% of the Market Price, which means the average of the lowest three trading price during the ten trading days prior to the conversion date.

The Company has determined that the conversion feature of the Note represents an embedded derivative since the Note is convertible into a variable number of shares upon conversion. Accordingly, the Note is not considered to be conventional debt and the embedded conversion feature must be bifurcated from the debt host and accounted for as a derivative liability. Accordingly, the fair value of this derivative instrument has been recorded as a liability on the balance sheet with the corresponding amount recorded as a discount to the Note. Such discount will be accreted from the issuance date to the maturity date of the Note. The change in the fair value of the derivative liability will be recorded in other income or expenses in the statement of operations at the end of each period, with the offset to the derivative liability on the balance sheet. The fair value of the embedded derivative liability was determined using the Black- Scholes valuation model on the 180th day and April 30, 2015 with the assumptions in the table below.

The Company recognized a total $2,549 as a gain on derivative related to this convertible note. The Company calculated the liability as on March 23, 2015 and April 30, 2015. On March 23, 2015 the company recognized debt discount of $42,500, derivative liability of $167,231 and day one loss of $124,731 related to this convertible note. At April 30, 2015, the Company revalued the embedded derivative liability. For the period from March 23, 2015 (commencement date) to April 30, 2015, the Company decreased the derivative liability by $127,280, resulting in a derivative liability of $39,951 and a total net gain of $2,549. The Company recognized amortization of debt discount of $17,366 for the period end April 30, 2015.

|

Reporting |

| Fair Value |

|

| Term |

|

| Assumed Conversion |

|

| Market Price |

|

| Volatility Percentage |

|

| Risk-free Rate |

| ||||||

| 3/23/2015 |

|

| 167,231 |

|

|

| 0.255 |

|

|

| 0.006 |

|

|

| 0.0264 |

|

|

| 349 | % |

|

| 0.03 |

|

| 4/30/2015 |

|

| 39,951 |

|

|

| 0.151 |

|

|

| 0.002 |

|

|

| 0.0004 |

|

|

| 214 | % |

|

| 0.00 |

|

Note 9 – Income Tax