Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Premier, Inc. | d19436d8k.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d19436dex991.htm |

| EX-99.2 - EX-99.2 - Premier, Inc. | d19436dex992.htm |

August

24, 2015 Fourth-Quarter and Fiscal Year 2015

Financial Results and Update

Exhibit 99.3 |

2 © 2015 PREMIER, INC. Forward-looking statements—Certain statements included in this

presentation, including, but not limited to, those related to our

financial and business outlook, strategy and growth drivers, member

retention and renewal rates and revenue visibility, cross and upsell opportunities,

acquisition activities and pipeline, revenue available under contract,

and 2016 financial guidance and related assumptions, are

“forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the

actual results of Premier to be materially different from historical results or from

any future results or projections expressed or implied by such

forward-looking statements. Accordingly, readers should not place

undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,”

“estimates,” “intends,” “anticipates” or

“plans” to be uncertain and forward-looking.

Forward-looking statements

may include comments as to Premier’s beliefs and expectations as to future events

and trends affecting its business and are necessarily subject to

uncertainties, many of which are outside Premier’s

control. More information on potential risks and other factors that could

affect Premier’s financial results is included, and updated, from

time to time, in Premier’s periodic and current filings with the

SEC, including Premier’s most recent Form 10-K for the year ended June 30, 2015, to be filed shortly thereafter. Forward-looking statements speak only as of the date they are made. Premier

undertakes no obligation to publicly update or revise any forward-looking

statements. Non-GAAP financial

measures—This presentation includes certain “non-GAAP financial measures”

as defined in Regulation G under the Securities Exchange Act of

1934. Schedules are attached that reconcile the non-GAAP financial

measures included in this presentation to the most directly comparable

financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 10-K for the year ended June 30, 2015, to be

filed shortly hereafter, provides further explanation and disclosure regarding our use

of non-GAAP financial measures and should be read in conjunction with

this presentation. Forward-looking statements and Non-GAAP financial

measures |

Susan

DeVore, President & CEO Overview and Business Update

|

4 © 2015 PREMIER, INC. Fiscal 2015 financial highlights * *See non-GAAP Adjusted EBITDA, Segment Adjusted EBITDA, and Adjusted Fully Distributed Earnings Per Share reconciliations to GAAP equivalents

in Appendix. Strong

performance with total revenue exceeding $1 billion Net revenue increased 16% Supply chain services revenue increased 16%

Performance services revenue increased 16%

Adjusted EBITDA increased 12% to $393.2 million

Adjusted fully distributed earnings per share increased 10% to $1.43 |

5 © 2015 PREMIER, INC. Fiscal 2015 operating highlights Expanded our member base, finishing the year serving ~3,600 hospitals and ~120,000 other providers Achieved 99% GPO retention rate and 94% SaaS institutional renewal rate Supply chain spend through GPO increased 7% to $44 billion Expanded and enhanced PremierConnect ® platform Strong growth in Bundled Payment Collaborative Successfully integrated Theradoc and Aperek acquisitions |

6 © 2015 PREMIER, INC. CECity acquisition expands performance improvement capabilities across the healthcare continuum Closed on August 20, 2015 Leader in performance management and improvement, pay-for-value reporting and professional education for healthcare professionals in ambulatory settings Provides the ability to deliver unique end-to-end solutions that span the continuum of care » Supporting providers as they move towards value- based payment models Purchase price of $400 million |

7 © 2015 PREMIER, INC. Healthcare Insights acquisition enhances PremierConnect Supply Chain Closed on July 31, 2015 Integrated financial management software developer providing budgeting, forecasting, labor productivity and cost analytics capabilities Enabling a more comprehensive analytics solution to Premier’s existing cost and quality applications » Preparing for the growing movement to value-based payments to include bundling, shared savings and risk-based contracting Purchase price of $65 million |

8 © 2015 PREMIER, INC. Healthcare is accelerating towards alternative payment models – population health is here to stay CURRENT VBP & regulatory cuts HACs & readmissions Shared savings Bundled payments Full risk sharing FUTURE HHS announces plan to accelerate payment shift » Shifting fee-for-service, Medicare payments to alternative payment models. Congress passes Medicare Access & CHIP Reauthorization Act of 2015 (MACRA) » Bill permanently reforms the Medicare physician payment system (Sustainable Growth Rate formula). Medicare payment reform – a watershed transformation Premier is well positioned to lead health systems through this transformation CMS announces plan to introduce mandatory payment model for joint replacements » Hospitals will be held accountable for the quality and costs of care from time of surgery through 90 days after discharge. |

9 © 2015 PREMIER, INC. Positioned to lead in rapidly evolving healthcare environment Recent Medicare payment reform is a transformative trend that is accelerating healthcare to alternate payment models and away from fee-for-service. Member and Industry Needs » Total cost reduction » Quality improvement across the continuum » Evolving delivery and payment models » Actionable data and information Premier Strategic Differentiation » Scale » Co-innovation » Trusted to transform from the inside » Leadership in population health » Shared services and infrastructure |

10 © 2015 PREMIER, INC. Continuing our momentum into fiscal 2016 Expect year-over-year double-digit revenue and adjusted EBITDA increases » Provider-centric model focused on serving our members » Developing solutions in close collaboration with members » Positioned to deliver consistent long-term value to stockholders Provider-centric and co-innovative alignment drives consistent and increasing demand for our solutions |

Michael Alkire, Chief Operating Officer

Operations Update |

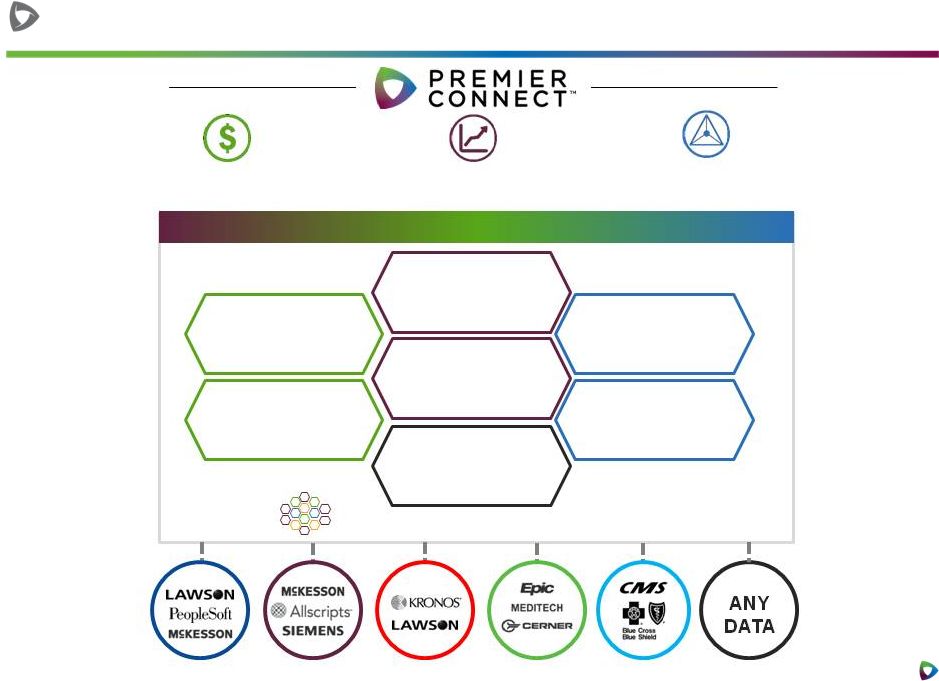

12 © 2015 PREMIER, INC. Addressing member needs for continuous improvement PREMIERCONNECT

SUPPLY CHAIN BILLING PURCHASING CLAIMS CLINICAL FINANCIAL Combines People, Process, and Technology Manage Populations Improve Quality and Safety Reduce Costs QUALITY & REGULATORY SAFETY PREMIERCONNECT

OPERATIONS PREMIERCONNECT

ENTERPRISE POPULATION HEALTH PREMIERCONNECT

RESEARCH PREMIERCONNECT

PREMIERCONNECT

PREMIERCONNECT

PREMIERCONNECT

DATA SERVICES |

13 © 2015 PREMIER, INC. PremierConnect Quality » Premier Quality Cycle Management » Helping predict the financial impact of federal payment programs to health systems based on clinical outcomes PremierConnect Population Health » Community Focus » Assisting health systems to acquire, integrate and manage community-level health data » Creating targeted interventions to improve population health management Strengthening our platform of solutions PremierConnect Supply Chain » Enabling health systems to manage the entire procurement process across their acute and ambulatory settings |

14 © 2015 PREMIER, INC. Rochester Regional Health » Extended GPO contract through 2020 » New PremierConnect Quality, Supply Chain and Safety relationships » Participation in QUEST and PACT performance improvement collaboratives 4Q’15 New and expanded relationships Peace Health » New PremierConnect Enterprise relationship Mercy Health » Extended PremierConnect Enterprise, Quality and Operations contracts » New specialty pharmacy member » 5-year GPO contract extension National Rural Health Association » New 5-year GPO contract University of Tennessee Medical Center » Extended agreement through 2020 to include GPO, PremierConnect Quality, Safety and Operations |

15 © 2015 PREMIER, INC. Platform provides path for successful integration Combines People, Process, and Technology PREMIERCONNECT

SUPPLY CHAIN QUALITY & REGULATORY SAFETY PREMIERCONNECT

OPERATIONS PREMIERCONNECT

ENTERPRISE PREMIERCONNECT

RESEARCH PREMIERCONNECT

POPULATION HEALTH PREMIERCONNECT DATA SERVICES PREMIERCONNECT

PREMIERCONNECT

|

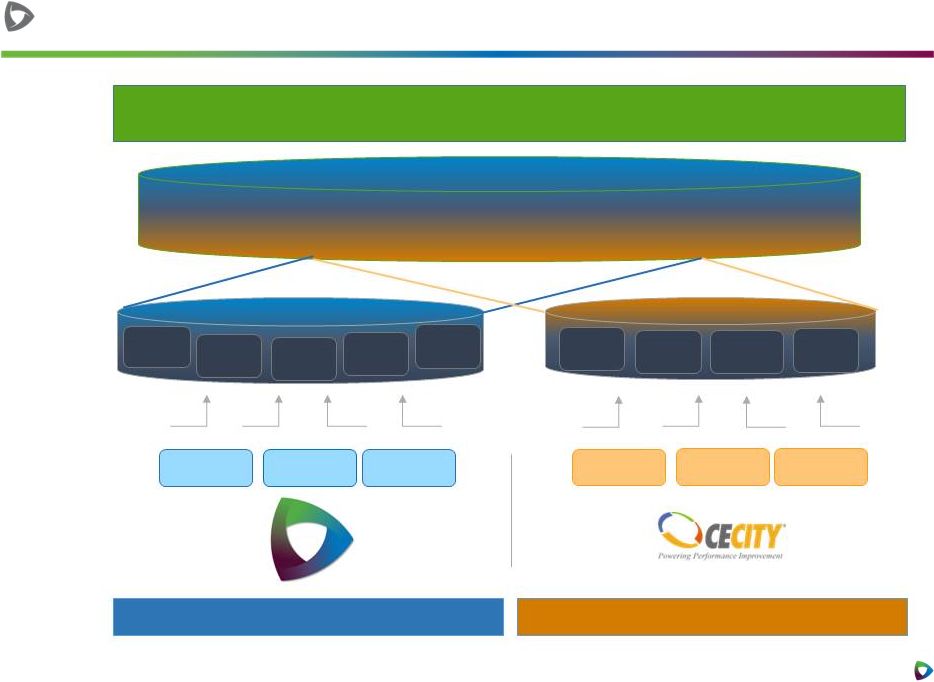

16 © 2015 PREMIER, INC. Unified Performance Management Seamless Acute to Ambulatory Platform Predictive Analytics Patient Safety Hospital Acquired Conditions Hospital eCQM HEDIS PQRS & Value Modifier ACO Ambulatory eCQM PCMH0 Acute Care Ambulatory Care Amb Clinical Amb Billing Additional Amb Systems Acute Clinical Acute Billing Additional Acute Systems PREMIER Data Sources Integrated performance management across continuum Premier CECity |

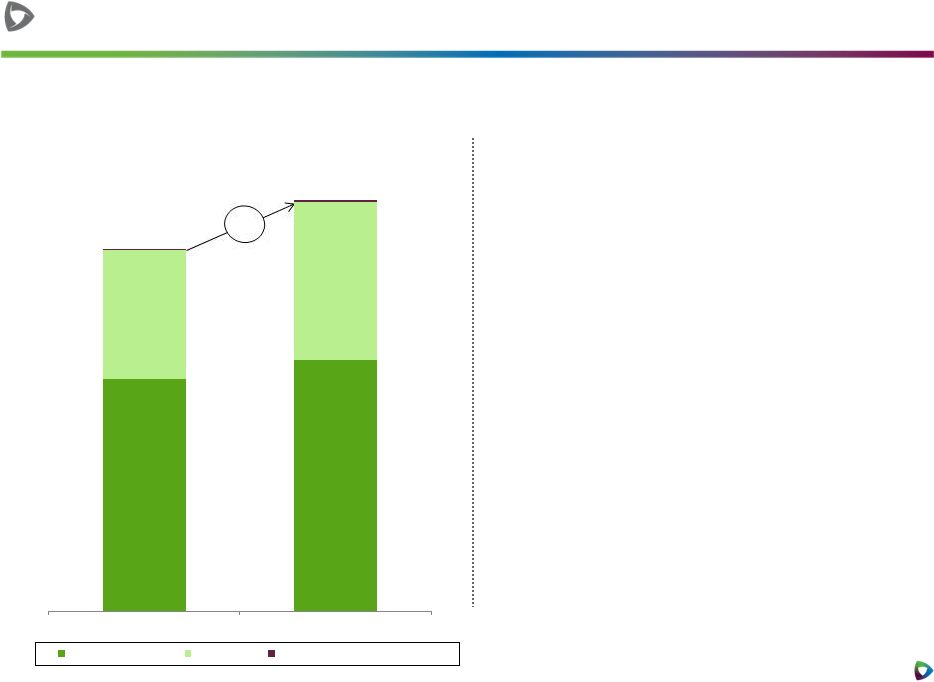

17 © 2015 PREMIER, INC. CECity acquisition expands performance improvement capabilities across the healthcare continuum Leader in performance improvement, pay-for- value reporting and professional education for healthcare professionals in ambulatory settings End-to-end solutions spanning care continuum » Support providers as they move towards advanced payment models 1.2 million healthcare professionals 5,000 practices 100 professional societies |

Craig

McKasson, Chief Financial Officer Financial Review

|

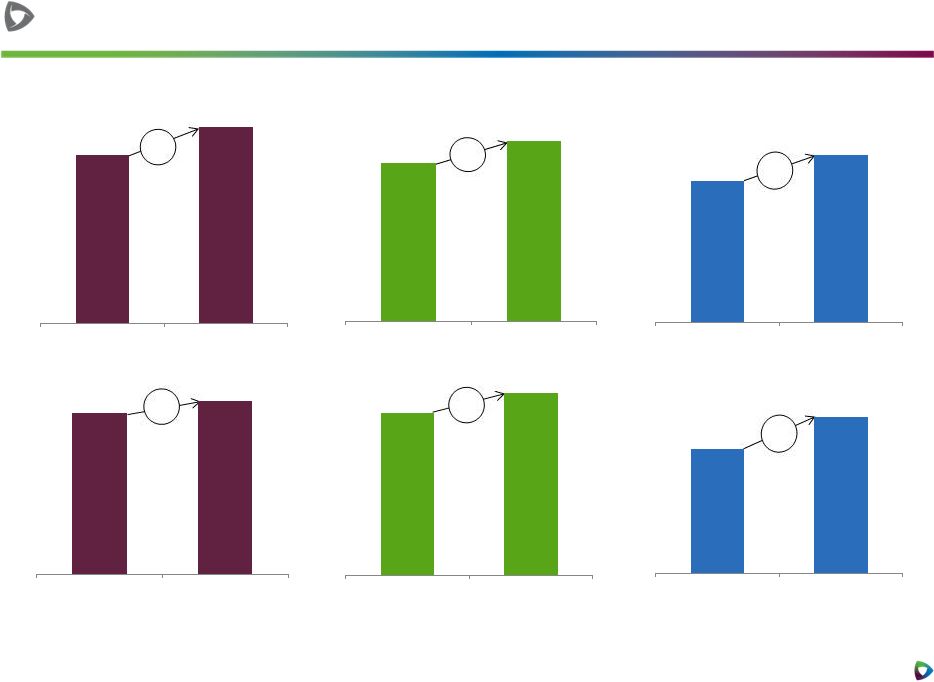

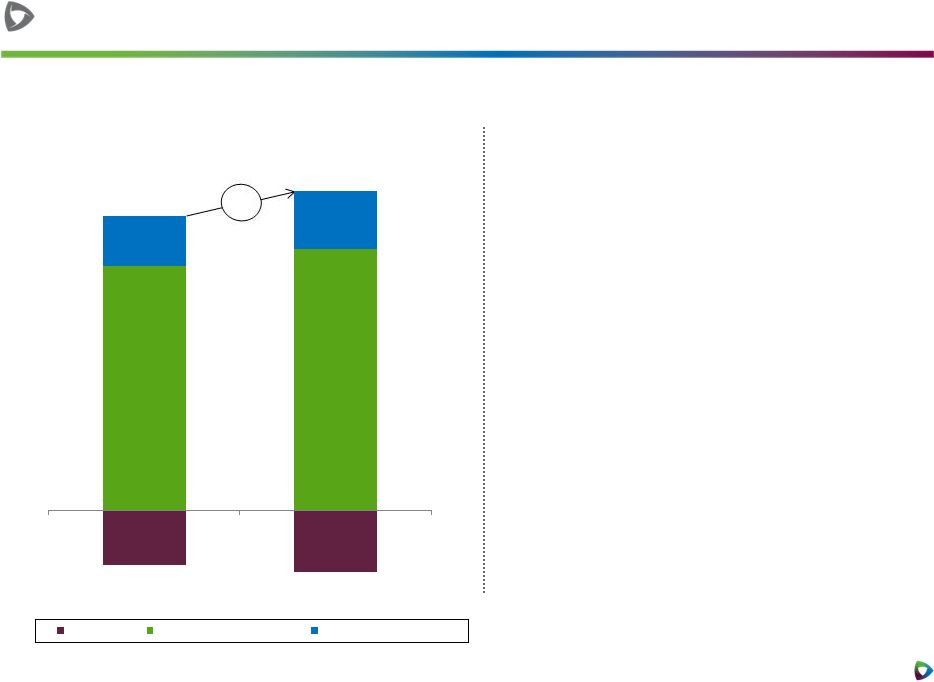

19 © 2015 PREMIER, INC. the 19.5 22.5 4Q'14 4Q'15 93.2 100.1 4Q'14 4Q'15 62.6 70.3 4Q'14 4Q'15 94.4 101.0 4Q'14 4Q'15 172.8 196.2 4Q'14 4Q'15 Fourth-quarter consolidated and segment highlights * Consolidated Net revenue ($millions) Supply Chain Services Net revenue ($millions) Performance Services Net revenue ($millions) Adjusted EBITDA ($millions) Adjusted EBITDA ($millions)

Adjusted EBITDA

($millions) *See

non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix. 235.5 266.6 4Q'14 4Q'15 13% 14% 12% 7% 7% 15% |

20 © 2015 PREMIER, INC. Fourth-quarter Supply Chain Services revenue 111.0 119.9 61.5 75.6 4Q'14 4Q'15 Net Admin Fees Products Other Services and Support 14% 172.8 196.2 Supply Chain Services Net revenue ($millions) Supply Chain Services revenue increased 14% » GPO net admin fees revenue increased 8% » Expanding contract penetration in both acute and alternate site » Continuing impact of the recruitment and conversion of new members » Improved utilization trends » Products revenue increased 23% » Ongoing member support for direct sourcing and specialty pharmacy businesses |

21 © 2015 PREMIER, INC. Fourth-quarter Performance Services revenue 62.6 70.3 4Q'14 4Q'15 12% Performance Services Net revenue ($millions) » Performance Services revenue increased 12% » Continued growth of PremierConnect SaaS-based subscriptions and renewals » Continued growth of Advisory Services led by engagements tied to: » Population health » Physician preference |

22 © 2015 PREMIER, INC. Fourth-quarter adjusted EBITDA* (20.7) (23.4) 94.4 101.0 19.5 22.5 4Q'14 4Q'15 Corporate Supply Chain Services Performance Services Adjusted EBITDA ($millions)

93.2 100.1 Consolidated adjusted EBITDA increased 7% » Supply Chain Services adjusted EBITDA increased 7% » Strong net admin fee revenue growth » Performance Services adjusted EBITDA increased 15% » New PremierConnect SaaS-based subscription sales » Contribution from Aperek and Theradoc acquisitions » Effective management of operating expenses * See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on

fully distributed net income reconciliations to GAAP equivalents in

Appendix 7% |

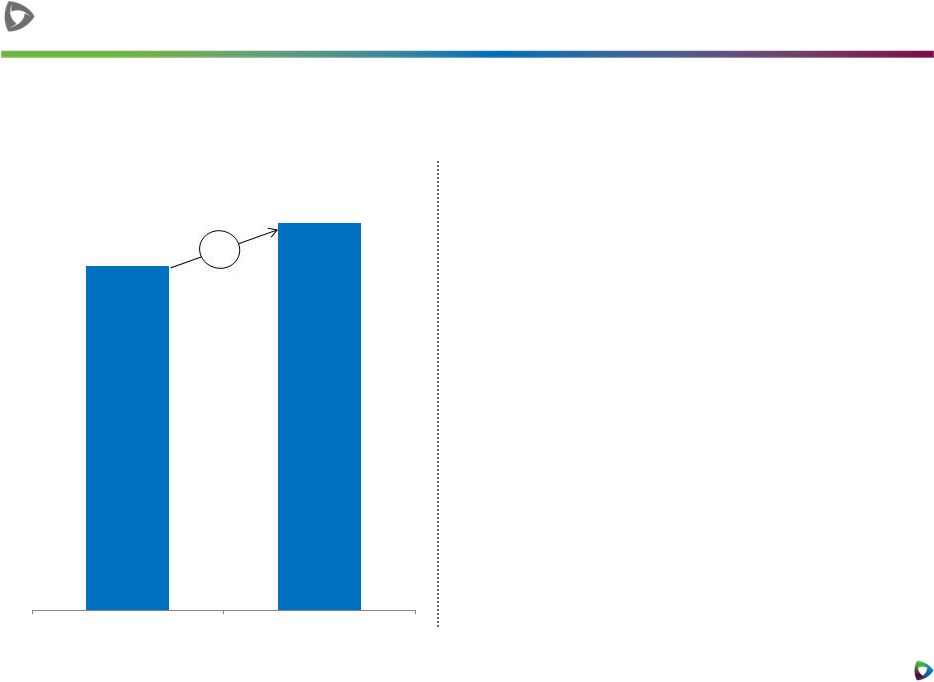

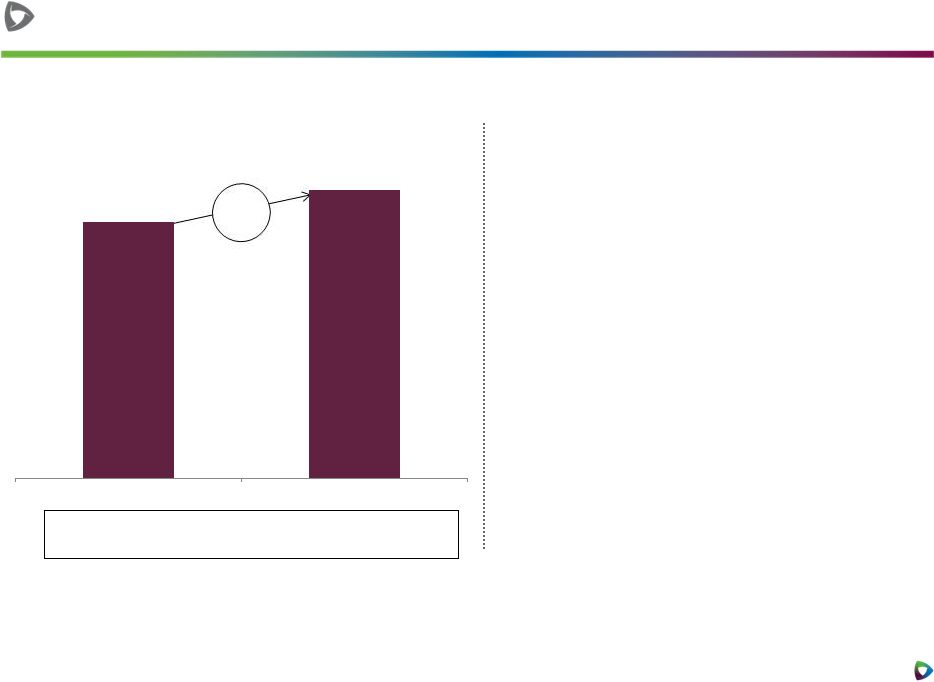

23 © 2015 PREMIER, INC. Fourth-quarter non-GAAP adjusted fully distributed net income * 49.9 53.0 4Q'14 4Q'15 (in millions, except per share data) $0.34 $0.36 Non-GAAP earnings per share on adjusted fully distributed net income – diluted * See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on

fully distributed net income reconciliations to GAAP equivalents in

Appendix »

Calculates income taxes at

40% on pre-tax income,

assuming taxable C corporate

structure » Calculates adjusted fully distributed earnings per share, assuming total Class A and B common shares held by public 6% |

24 © 2015 PREMIER, INC. Cash flow and capital flexibility at June 30, 2015 CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND BUSINESS GROWTH *Three months ended June 30, 2015. Company defines free cash flow as cash provided by operating activities less distributions to limited partners

and purchases of property and equipment. See non-GAAP free cash

flow reconciliation to GAAP equivalent in Appendix. Fiscal 2015 cash flow

from operations of $364.1 million

Fourth-quarter free cash flow increases 28% to

$53.9 million * Cash, cash equivalents & marketable securities of $561.9 million No outstanding borrowings on $750 million five- year unsecured revolving credit facility Subsequent to fiscal year end, Premier used approximately $315 million in cash and $150

million from its credit facility to fund the acquisitions of Healthcare Insights and

CECity |

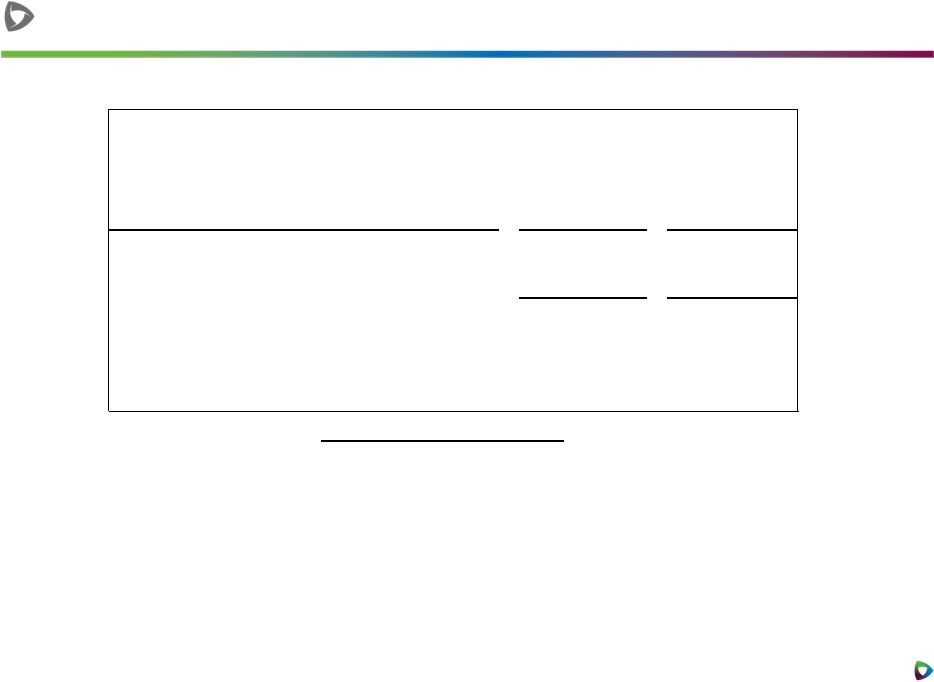

25 © 2015 PREMIER, INC. Fiscal 2016 annual guidance* * Guidance is based on comparisons with prior-year non-GAAP pro forma results, which have been adjusted to reflect the impact of the

company’s reorganization and IPO. The Company does not reconcile

guidance for adjusted EBITDA and non-GAAP adjusted fully distributed net income per-share to net income (loss) or GAAP earnings per share because the Company does not provide guidance for reconciling items between net income (loss) and adjusted EBITDA and non-GAAP adjusted fully

distributed earnings per share. The Company is unable to provide guidance

for these reconciling items since certain items that impact net income (loss) are outside of the Company’s control and cannot be reasonably predicted. Accordingly, a reconciliation to net income (loss) or GAAP earnings per share is not available without unreasonable

effort. Financial guidance for year ending June 30, 2016:

Supply Chain Services growth driven by:

» Mid-single-digit net administrative fee revenue growth » 16-19% product revenue growth » Continued high GPO retention rates Guidance Assumptions: Performance Services growth driven by: » Continued demand for integrated offerings of SaaS-based subscription and licensed products, advisory services and collaboratives » Continuation of high SaaS institutional renewal rates » $30-35 million revenue and $7-9 million adjusted EBITDA contributions from CECity and Healthcare Insights acquisitions (in millions, except per share data) FY 2016 % YoY Increase Net Revenue: Supply Chain Services segment $792.0 - $813.0 7% - 10% Performance Services segment $346.0 - $355.0 29% - 32% Total Net Revenue $1,138.0 - $1,168.0 13% - 16% Non-GAAP adjusted EBITDA $425.0 - $444.0 8% - 13% Non-GAAP adjusted fully distributed EPS $1.54 - $1.62 8% - 13% Fiscal 2016 Financial Guidance Premier, Inc. introduces full-year fiscal 2016 financial guidance, as follows:

|

26 © 2015 PREMIER, INC. Capital expenditures of ~$83M for the year

Adjusted EBITDA margin approximating

37-38% of net revenue

Effective tax rate of 40%

Additional fiscal 2016 guidance assumptions |

27 © 2015 PREMIER, INC. Exchange update On July 31 , 2015, approximately 91,000 Class B units were exchanged for Class A common shares on 1-for-1 basis; equal number of Class B common shares retired The upcoming October 31, 2015 exchange process is underway. » Maximum of 6.2 million shares indicated for exchange » Indicated shares remain subject to retraction and purchase by other member owners under right-of- first-refusal process |

Questions |

Appendix |

30 © 2015 PREMIER, INC. Fiscal 2015 and fiscal 2014 non-GAAP reconciliations 2015* 2014* 2015* 2014 Reconciliation of Pro Forma Net Revenue to Net Revenue:

Pro Forma Net Revenue

266,553

$

235,466

$

1,007,029

$

869,286

$

Pro forma adjustment for revenue share

post-IPO —

—

—

41,263

Net Revenue

266,553

$

235,466

$

1,007,029

$

910,549

$

Net income

32,061

$

66,632

$

234,785

$

332,617

$

Pro forma adjustment for revenue share

post-IPO —

—

—

(41,263)

Interest and investment income, net

(349)

(378)

(866)

(1,019)

Income tax expense

24,235

3,248

36,342

27,709

Depreciation and amortization

12,079

9,809

45,186

36,761

Amortization of purchased intangible assets

2,538

904

9,136

3,062

EBITDA

70,564

80,215

324,583

357,867

Stock-based compensation

7,369

6,358

28,498

19,476

Acquisition related expenses

2,629

711

9,037

2,014

Strategic and financial restructuring

expenses 92

146

1,373

3,760

(Gain) loss on investment

—

(522)

1,000

(38,372)

Adjustment to tax receivable agreement

liability —

6,215

—

6,215

Acquisition related adjustment -

deferred revenue

4,147

—

13,371

—

Loss on disposal of long-lived assets

15,243

15,243

Other expense (income), net

60

121

70

65

Adjusted EBITDA

100,104

$

93,244

$

393,175

$

351,025

$

Segment Adjusted EBITDA:

Supply Chain Services

100,970

$

94,394

$

391,180

$

396,470

$

Pro forma adjustment for revenue share

post-IPO —

—

—

(41,263)

Supply Chain Services

(including pro forma adjustment)

100,970

$

94,394

$

391,180

$

355,207

$

Performance Services

22,518

19,531

90,235

73,898

Corporate

(23,384)

(20,681)

(88,240)

(78,080)

Adjusted EBITDA

100,104

$

93,244

$

393,175

$

351,025

$

Depreciation and amortization

(12,079)

(9,809)

(45,186)

(36,761)

Amortization of purchased intangible assets

(2,538)

(904)

(9,136)

(3,062)

Stock-based compensation

(7,369)

(6,358)

(28,498)

(19,476)

Acquisition related expenses

(2,629)

(711)

(9,037)

(2,014)

Strategic and financial restructuring

expenses (92)

(146)

(1,373)

(3,760)

Adjustment to tax receivable agreement

liability —

(6,215)

—

(6,215)

Acquisition related adjustment -

deferred revenue

(4,147)

—

(13,371)

—

Equity in net income of unconsolidated

affiliates (6,473)

(4,805)

(21,285)

(16,976)

Deferred compensation plan expense (income)

544

(1,972)

753

(1,972)

65,321

62,324

266,042

260,789

Pro forma adjustment for revenue share

post-IPO —

—

—

41,263

Operating income

65,321

$

62,324

$

266,042

$

302,052

$

Equity in net income of unconsolidated

affiliates 6,473

4,805

21,285

16,976

Interest and investment income, net

349

378

866

1,019

(Loss) gain on investment

—

522

(1,000)

38,372

Loss on disposal of long-lived assets

(15,243)

—

(15,243)

—

Other (expense) income, net

(604)

1,851

(823)

1,907

Income before income taxes

56,296

$

69,880

$

271,127

$

360,326

$

* Note that no pro forma adjustments were made for the

three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.

Three Months Ended

June 30,

Year Ended

June 30,

Supplemental Financial Information -

Reporting of Pro Forma Adjusted EBITDA

(Unaudited)

(In thousands)

Reconciliation of Selected Non-GAAP Measures to GAAP

Measures and Non-GAAP Adjusted Fully

Distributed Net Income Reconciliation of Net

Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes: |

31 © 2015 PREMIER, INC. Fiscal 2015 and fiscal 2014 non-GAAP reconciliations 2015* 2014* 2015* 2014 Reconciliation of Non-GAAP Pro Forma Adjusted Fully Distributed Net Income:

Net income attributable to shareholders

7,990

$

8,879

$

38,743

$

28,332

$

Pro forma adjustment for revenue share

post-IPO —

—

—

(41,263)

Income tax expense

24,235

3,248

36,342

27,709

Stock-based compensation

7,369

6,358

28,498

19,476

Acquisition related expenses

2,629

711

9,037

2,014

Strategic and financial restructuring

expenses 92

146

1,373

3,760

(Gain) loss on investment

—

(522)

1,000

(38,372)

Adjustment to tax receivable agreement

liability —

6,215

—

6,215

Acquisition related adjustment -

deferred revenue

4,147

—

13,371

—

Loss on disposal of long-lived assets

15,243

—

15,243

—

Amortization of purchased intangible

assets 2,538

904

9,136

3,062

Net income attributable to noncontrolling interest in

Premier LP 24,071

57,281

194,206

303,336

Non-GAAP pro forma adjusted fully distributed

income before income taxes

88,314

83,220

346,949

314,269

Income tax expense on fully distributed income before

income taxes 35,326

33,288

138,780

125,708

Non-GAAP Pro Forma Adjusted Fully Distributed Net

Income 52,988

$

49,932

$

208,169

$

188,561

$

* Note that no pro forma adjustments were made for the

three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.

Three Months Ended

June 30,

Year Ended

June 30,

Supplemental

Financial

Information

-

Reporting

of

Pro

Forma

Adjusted

EBITDA

(Unaudited)

(In thousands)

Reconciliation of Selected Non-GAAP Measures to GAAP

Measures and Non-GAAP Adjusted Fully

Distributed Net Income |

32 © 2015 PREMIER, INC. Fiscal 2015 and fiscal 2014 non-GAAP reconciliations 2015 2014 Reconciliation of Non-GAAP Free Cash Flow to Net Cash Provided by Operating Activities:

Net cash provided by operating activities

108,483

$

79,431

$

Purchases of property and

equipment (19,670)

(15,898)

$

Distributions to limited partners

(23,412)

(21,299)

$

Payments to limited partners under tax receivable

agreements (11,499)

—

$

Non-GAAP

free cash flow 53,902

$

42,234

$

Supplemental Financial Information -

Reporting of Non-GAAP Free Cash Flow

Reconciliation of Selected Non-GAAP Measures to GAAP

Measures (Unaudited)

(In thousands)

Three Months Ended

June 30, |

33 © 2015 PREMIER, INC. Fiscal 2015 and fiscal 2014 non-GAAP reconciliations 2015* 2014* 2015* 2014 Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders

Net (loss) income attributable to stockholders after

adjustment of redeemable

(84,076)

$

491,389

$

(865,292)

$

(2,713,256)

$

Adjustment of redeemable limited partners' capital to

redemption amount 92,066

(482,510)

904,035

2,741,588

Net income attributable to stockholders

7,990

8,879

38,743

28,332 Reconciliation of

denominator for GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders Weighted Average: Common shares used for basic and diluted earnings per share

37,576

32,375

35,681

25,633 Potentially dilutive

shares

1,592

194

1,048

124

Weighted average fully distributed shares outstanding

- diluted

39,168

32,569

36,729

25,757 Reconciliation of GAAP EPS to

Non-GAAP EPS on Net Income Attributable to Stockholders GAAP earnings (loss) per share $ (2.24)

$

15.18

$ (24.25) $ (105.85)

Impact of adjustment of redeemable limited partners'

capital to redemption amount

$ 2.45 $ (14.90)

$ 25.34 $ 106.96

Impact of potentially dilutive shares

$ (0.01) $ (0.01)

$ (0.04) $ (0.01)

Non-GAAP earnings per share on net income attributable

to stockholders - diluted

$ 0.20 $ 0.27

$ 1.05 $ 1.10

Reconciliation of numerator for GAAP EPS to Non-GAAP

EPS on Adjusted Fully Distributed Net Income

Net (loss) income attributable to shareholders after

adjustment of redeemable limited partners'

capital to redemption amount

(84,076)

$

491,389

$

(865,292)

$

(2,713,256)

$

Adjustment of redeemable limited partners' capital to

redemption amount 92,066

(482,510)

904,035

2,741,588

Net income attributable to shareholders

7,990

8,879

38,743

28,332 Pro forma adjustment

for revenue share post-IPO

—

—

—

(41,263)

Income tax expense

24,235

3,248

36,342

27,709

Stock-based compensation

7,369

6,358

28,498

19,476

Acquisition related expenses

2,629

711

9,037

2,014

Strategic and financial restructuring

expenses 92

146

1,373

3,760

(Gain) loss on investment

—

(522)

1,000

(38,372)

Adjustment to tax receivable agreement

liability —

6,215

—

6,215

Acquisition related adjustment - deferred

revenue 4,147

—

13,371

—

Loss on disposal of long-lived assets

15,243

—

15,243

—

Amortization of purchased intangible assets

2,538

904

9,136

3,062

Net income attributable to noncontrolling interest in

Premier LP 24,071

57,281

194,206

303,336

Non-GAAP pro forma adjusted fully distributed income

before income taxes 88,314

83,220

346,949

314,269

Income tax expense on fully distributed income before

income taxes 35,326

33,288

138,780

125,708

Non-GAAP pro forma adjusted fully distributed net

income 52,988

$

49,932

$

208,169

$

188,561

$

Reconciliation of denominator for GAAP EPS to Non-GAAP

Adjusted Fully Distributed Net Income

Weighted Average:

Common shares used for basic and diluted earnings per

share

37,576

32,375

35,681

25,633 Potentially dilutive

shares

1,592

194

1,048

124 Class A common shares outstanding

-

-

-

6,742 Conversion

of Class B common units

106,471

112,511

108,518

112,584 Weighted average fully distributed

shares outstanding - diluted

145,639

145,080

145,247

145,083

Reconciliation of GAAP EPS to Adjusted Fully

Distributed EPS GAAP earnings (loss) per

share

$ (2.24) $ 15.18

$

(24.25)

$ (105.85) Impact of adjustment of redeemable limited partners' capital to redemption amount

$ 2.45 $ (14.90)

$ 25.34 $ 106.96

Impact of additions:

Pro forma adjustment for revenue share

post-IPO

$ - $ -

$ - $ (1.61)

Income tax expense

$ 0.64 $ 0.10

$ 1.02 $ 1.08

Stock-based compensation

$ 0.20 $ 0.20

$ 0.80 $ 0.76

Acquisition related expenses

$ 0.07 $ 0.02

$ 0.25 $ 0.08

Strategic and financial restructuring

expenses

$ 0.00 $ 0.00

$ 0.04 $ 0.15

(Gain) loss on investment

$ - $ (0.02)

$ 0.03 $ (1.50)

Adjustment to tax receivable agreement

liability

$ - $ 0.19

$ - $ 0.24

Acquisition related adjustment - deferred

revenue

$ 0.11 $ -

$ 0.37 $

- Loss on disposal of

long-lived assets

$ 0.41 $ -

$ 0.43 $

- Amortization of

purchased intangible assets

$ 0.07 $ 0.03

$ 0.26 $ 0.12

Net income attributable to noncontrolling interest in

Premier LP

$ 0.64 $ 1.77

$ 5.44 $ 11.83

Impact of corporation taxes

$ (0.94) $ (1.03)

$ (3.90) $ (4.90)

Impact of increased share count

$ (1.05) $ (1.20)

$ (4.40) $ (6.06)

Non-GAAP earnings per share on adjusted fully

distributed net income - diluted

$ 0.36 $ 0.34

$ 1.43 $ 1.30

* Note that no pro forma adjustments were made for the

three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.

Three Months Ended

June 30,

Year Ended

June 30,

Supplemental Financial Information - Reporting of Net

Income and Earnings Per Share

(Unaudited)

(In thousands, except per share data)

Reconciliation of Selected Non-GAAP Measures to GAAP

Measures |