Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - TRANS ENERGY INC | d85473dex312.htm |

| EX-32.2 - EX-32.2 - TRANS ENERGY INC | d85473dex322.htm |

| EX-31.1 - EX-31.1 - TRANS ENERGY INC | d85473dex311.htm |

| EX-32.1 - EX-32.1 - TRANS ENERGY INC | d85473dex321.htm |

| 10-Q - FORM 10-Q - TRANS ENERGY INC | d85473d10q.htm |

Exhibit 99.1

Execution Version

PURCHASE AND SALE AGREEMENT

BY AND AMONG

TRANS

ENERGY, INC., AMERICAN SHALE DEVELOPMENT, INC.,

PRIMA OIL COMPANY, INC., REPUBLIC ENERGY VENTURES, LLC,

REPUBLIC PARTNERS VIII, LLC, REPUBLIC PARTNERS VI, LP, REPUBLIC

PARTNERS VII, LLC, AND REPUBLIC ENERGY OPERATING, LLC,

AS SELLERS,

AND

TH EXPLORATION, LLC,

AS BUYER

April 3, 2015

TABLE OF CONTENTS

| ARTICLE I |

DEFINITIONS; CONSTRUCTION |

1 | ||||

| 1.1 |

Definitions |

1 | ||||

| 1.2 |

Construction |

21 | ||||

| ARTICLE II |

PURCHASE AND SALE |

22 | ||||

| 2.1 |

Purchase and Sale |

22 | ||||

| 2.2 |

Purchase Price |

22 | ||||

| 2.3 |

Deposit |

22 | ||||

| 2.4 |

Escrow |

23 | ||||

| 2.5 |

Adjustments to Base Purchase Price |

24 | ||||

| 2.6 |

Determination of Purchase Price |

26 | ||||

| 2.7 |

Allocation of Purchase Price |

27 | ||||

| 2.8 |

No Assumption of Retained Liabilities |

28 | ||||

| 2.9 |

Effective Time |

28 | ||||

| ARTICLE III |

REPRESENTATIONS AND WARRANTIES OF SELLER |

28 | ||||

| 3.1 |

Organization |

28 | ||||

| 3.2 |

Due Authorization |

30 | ||||

| 3.3 |

No Violation or Conflict; Consents; Preferential Rights |

30 | ||||

| 3.4 |

Title |

30 | ||||

| 3.5 |

Contracts |

31 | ||||

| 3.6 |

Lease Provisions |

32 | ||||

| 3.7 |

Compliance with Law |

33 | ||||

| 3.8 |

Litigation |

33 | ||||

| 3.9 |

Taxes |

34 | ||||

| 3.10 |

Environmental Matters |

34 | ||||

| 3.11 |

Liens |

36 | ||||

| 3.12 |

AFE’s |

36 | ||||

| 3.13 |

Brokers’ Fees |

36 | ||||

| 3.14 |

Imbalances |

36 | ||||

| 3.15 |

Payout Balances |

36 | ||||

| 3.16 |

No Material Adverse Change |

36 | ||||

| 3.17 |

Wells; Plugging and Abandonment |

36 | ||||

| 3.18 |

No Expenses Owed and Delinquent |

37 | ||||

| 3.19 |

Revenues |

37 | ||||

| 3.20 |

Current Bonds |

37 | ||||

| 3.21 |

Right of First Refusal |

37 | ||||

| 3.22 |

Well Pads |

37 | ||||

| 3.23 |

Insurance; Condemnation |

37 | ||||

| 3.24 |

Suspense Accounts |

37 | ||||

| 3.25 |

Offset Obligations |

37 | ||||

| 3.26 |

Property Costs |

37 | ||||

| 3.27 |

Title Insurance Policy |

37 | ||||

| 3.28 |

No Other Representations or Warranties; Disclosed Materials |

38 | ||||

i

TABLE OF CONTENTS

(continued)

| ARTICLE IV |

REPRESENTATIONS AND WARRANTIES OF BUYER |

38 | ||||

| 4.1 |

Organization |

38 | ||||

| 4.2 |

Due Authorization |

38 | ||||

| 4.3 |

Noncontravention |

38 | ||||

| 4.4 |

Purchase for Investment |

39 | ||||

| 4.5 |

Broker’s Fees |

39 | ||||

| 4.6 |

Financial Resources |

39 | ||||

| 4.7 |

Buyer’s Evaluation |

39 | ||||

| ARTICLE V |

COVENANTS |

39 | ||||

| 5.1 |

Conduct of Business |

39 | ||||

| 5.2 |

Seller as Non-Operator |

41 | ||||

| 5.3 |

Access to Information |

42 | ||||

| 5.4 |

Further Assurances; Consents; Preferential Rights |

42 | ||||

| 5.5 |

Filings |

44 | ||||

| 5.6 |

Publicity |

44 | ||||

| 5.7 |

Covenant to Satisfy Conditions |

44 | ||||

| 5.8 |

Liability |

44 | ||||

| 5.9 |

Additional Acreage Acquisitions |

44 | ||||

| ARTICLE VI |

CONDITIONS PRECEDENT TO CONSUMMATION OF THE CLOSING; CLOSING |

45 | ||||

| 6.1 |

Conditions Precedent to each Party’s Obligations to Close |

45 | ||||

| 6.2 |

Conditions Precedent to Obligations of Buyer |

46 | ||||

| 6.3 |

Conditions Precedent to Obligations of Sellers |

47 | ||||

| 6.4 |

The Closing |

47 | ||||

| ARTICLE VII |

ADDITIONAL COVENANTS |

49 | ||||

| 7.1 |

Access to Books, Records and Data |

49 | ||||

| 7.2 |

Tax Matters |

49 | ||||

| 7.3 |

Surety Bonds |

51 | ||||

| 7.4 |

Casualty |

51 | ||||

| 7.5 |

Confidentiality |

51 | ||||

| 7.6 |

Exclusivity |

51 | ||||

| 7.7 |

Post-Closing Payments |

51 | ||||

| 7.8 |

Operator Transition Services |

52 | ||||

| 7.9 |

Non-Competition |

52 | ||||

| 7.10 |

Title Insurance Policy |

52 | ||||

| 7.11 |

Certain Site Matters |

53 | ||||

| 7.12 |

Blackshere Lease |

56 | ||||

| 7.13 |

Robinson Lease |

57 | ||||

| 7.14 |

EQT Release Acres |

60 | ||||

| 7.15 |

Transfer of Permits |

60 | ||||

| 7.16 |

Partition Matter |

60 | ||||

ii

TABLE OF CONTENTS

(continued)

| ARTICLE VIII |

SURVIVAL; INDEMNIFICATION |

61 | ||||

| 8.1 |

Limitation on and Survival of Representations and Warranties |

61 | ||||

| 8.2 |

Indemnification by Sellers |

62 | ||||

| 8.3 |

Indemnification by Buyer |

64 | ||||

| 8.4 |

Consent to Settlement; Cooperation |

65 | ||||

| 8.5 |

Limitation of Liability |

66 | ||||

| 8.6 |

Exclusive Remedy |

66 | ||||

| 8.7 |

Title Defects and Environmental Defects |

67 | ||||

| 8.8 |

Disclaimer of Other Warranties |

67 | ||||

| 8.9 |

Materiality Qualifiers Disregarded |

68 | ||||

| ARTICLE IX |

TERMINATION |

68 | ||||

| 9.1 |

Termination |

68 | ||||

| 9.2 |

Effect of Termination |

69 | ||||

| 9.3 |

Remedies Upon Termination |

70 | ||||

| 9.4 |

Remedy |

70 | ||||

| 9.5 |

Extension; Waiver |

70 | ||||

| ARTICLE X |

MISCELLANEOUS |

70 | ||||

| 10.1 |

Entire Agreement |

70 | ||||

| 10.2 |

Expenses |

71 | ||||

| 10.3 |

Governing Law |

71 | ||||

| 10.4 |

Assignment |

71 | ||||

| 10.5 |

Notices |

71 | ||||

| 10.6 |

Counterparts |

72 | ||||

| 10.7 |

Specific Performance |

72 | ||||

| 10.8 |

Severability |

72 | ||||

| 10.9 |

No Third-Party Reliance |

72 | ||||

| 10.10 |

Amendments |

72 | ||||

| 10.11 |

No Partnership |

73 | ||||

| 10.12 |

Resolution of Disputes |

73 | ||||

| 10.13 |

Seller Representative |

76 | ||||

iii

TABLE OF CONTENTS

(continued)

EXHIBITS

| Exhibit A | Title Defects and Environmental Defect Provisions | |

| Exhibit B | Assignment and Bill of Sale | |

| Exhibit C | Leases and Wells | |

| Exhibit D | Capital Expenditures Paid by Sellers | |

| Exhibit E | Form of Escrow Agreement | |

| Exhibit F | Form of Title Insurance Policy | |

| Exhibit G | Form of Surface Use Agreement | |

| Exhibit H | Form of Access Agreement | |

| Exhibit I | Appendix E to Consent Decree | |

| Exhibit J | EPA Letter |

SCHEDULES

| Schedule 1.1(a) | Excluded Assets – Leases | |

| Schedule 1.1(b) | Dewhurst Site | |

| Schedule 1.1(c) | Hart Site | |

| Schedule 1.1(d) | Sellers’ Knowledge – Republic Parties | |

| Schedule 1.1(e) | Sellers’ Knowledge – TE Parties | |

| Schedule 2.5(b) | Accrued Suspense Funds by Well | |

| Schedule 3.3(a) | Violation of Laws | |

| Schedule 3.3(b) | Preferential Rights to Purchase | |

| Schedule 3.3(c) | Consents | |

| Schedule 3.4 | Title to Personal Property | |

| Schedule 3.4(b) | List of Wells | |

| Schedule 3.5(a) | Material Contracts | |

| Schedule 3.5(b) | Written demands to renegotiate; commissions due; take or pay | |

| Schedule 3.6 | Lease Rentals, continuous drilling requirements | |

| Schedule 3.7 | Compliance with Law | |

| Schedule 3.8 | Litigation | |

| Schedule 3.9 | Taxes | |

| Schedule 3.10 | Environmental Matters | |

| Schedule 3.10(c) | Environmental Permits | |

| Schedule 3.12 | AFE’s | |

| Schedule 3.14 | Imbalances | |

| Schedule 3.15 | Payout Balances | |

| Schedule 3.16 | Material Adverse Change | |

| Schedule 3.17 | Plugging and Abandonment | |

| Schedule 3.20 | Current Bonds (surety bonds, letter of credit) | |

| Schedule 3.21 | Leases with Right of First Refusal (below Marcellus) | |

| Schedule 3.22 | Well Pads | |

| Schedule 3.23 | Insurance; Condemnation | |

| Schedule 5.1 | Other Capital Expenditures (date of PSA to Closing) | |

| Schedule 5.2 | Third-Party Operator Assets |

iv

TABLE OF CONTENTS

(continued)

| Schedule 7.4(b) | Description of Casualty Well | |

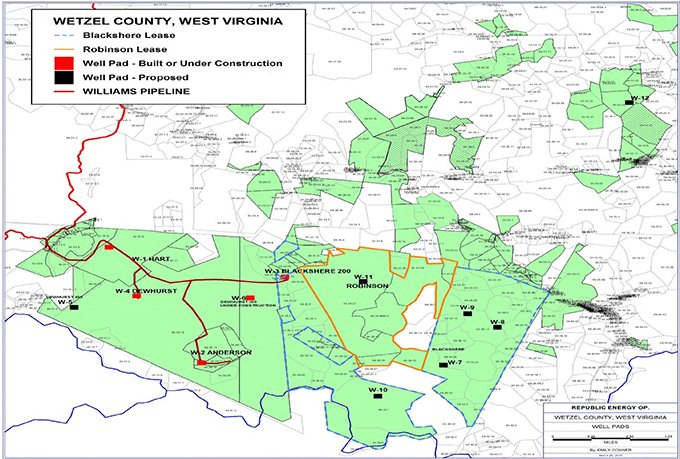

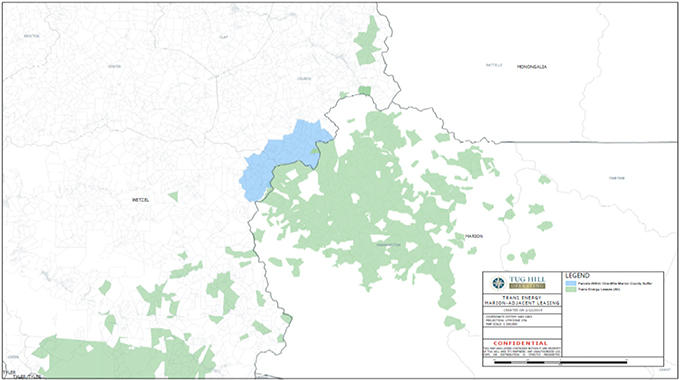

| Schedule 7.9 | Marion Border Area Map | |

| Schedule 7.13 | Form of Blackshere Release and Robinson Release | |

| Schedule 7.14 | EQT Release Acres |

v

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (“Agreement”) is made as of April 3, 2015 (the “Execution Date”), by and among Trans Energy, Inc., a Nevada corporation (“Trans Energy”), Prima Oil Company, Inc., a Delaware corporation (“Prima”), American Shale Development, Inc., a Delaware corporation (“ASD”) (Trans Energy, Prima, and ASD referred to collectively herein as the “TE Parties”), Republic Energy Ventures, LLC, a Delaware limited liability company (“REV”), Republic Partners VIII, LLC, a Texas limited liability company (“RP8”), Republic Partners VI, LP, a Texas limited partnership (“RP6”), Republic Partners VII, LLC, a Texas limited liability company (“RP7”) and Republic Energy Operating, LLC, a Texas limited liability company (“REO”) (REV, RP8, RP6, RP7 and REO referred to collectively herein as the “Republic Parties”), collectively called “Sellers” and each a “Seller,” and TH Exploration, LLC, a Texas limited liability company (the “Buyer”). Buyer and Sellers (either individually or as a group, as context requires) may each be referred to herein as a “Party” and together as the “Parties.”

RECITALS

A. Sellers own separate interests in certain oil and gas leases, mineral interests and wells located in Wetzel County, West Virginia (all as further defined below, the “Assets”).

B. Each Seller desires to sell and Buyer desires to acquire the Assets on the terms and under the conditions set forth in this Agreement.

AGREEMENT

The Parties, in consideration of the premises and of the mutual representations, warranties, covenants, conditions and agreements set forth herein and intending to be bound, agree as set forth below:

ARTICLE I

DEFINITIONS; CONSTRUCTION

1.1 Definitions. When used in this Agreement, the following terms shall have the meanings specified:

“Acceptable Modifications” is defined in Section 7.10.

“Access Agreements” is defined in Section 7.11(f).

“Action” means any action, claim, suit, litigation, arbitration or governmental investigation.

“Adverse Blackshere Filing” means any Action commenced by way of a filing with any court or Governmental Authority involving a direct or collateral attack on the final judgment entered into in respect of the Blackshere Litigation by EQT.

1

“Additional Escrow Payment” is defined in Section 2.4(a).

“Additional Interests” is defined in Section 5.9.

“Additional Mineral Acres” is defined in Section 7.16(d).

“Adverse Robinson Filing” means, in respect of the Robinson Lease, the entry of an order, judgment, decree, finding or judicial decision by the applicable district court or state court (A) granting EQT’s pending Motion to Dismiss for Lack of Subject Matter Jurisdiction and Failure to Join an Indispensable Party, docketed at no. 37, Case No. 5:13-cv-00093, or any continuation thereof; or (B) quieting title to the Robinson Lease not in favor of Buyer.

“AFE” is defined in Section 5.2.

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, through one or more intermediaries or otherwise. For purposes of this definition, “control” shall mean, when used with respect to any Person, the power to direct the management and policies of such Person, directly or indirectly, through the ownership of voting securities, by contract or otherwise.

“Agreement” is defined in the Preamble.

“Allocated Value” means the good faith monetary allocation amount prepared and determined by Buyer and agreed by Sellers, for each Subject Well or Lease, as set forth on Exhibit C attached hereto, for the purpose of (among others) determining Environmental Defect Amounts and Title Defect Amounts. As among the individual party Sellers, the contractual arrangements among them on sharing of the Purchase Price shall control over the Allocated Values set forth herein for the Sellers’ internal purposes of allocating value among such Sellers, but not for the purpose of the allocation of the Purchase Price for Tax purposes pursuant to Section 2.7 or for determining the Environmental Defect Date or for Title Defect Amounts between Buyer and Seller for which the allocation on Exhibit C shall control.

“Anderson 8H Well” means the Anderson 8H Well on the Anderson Lease in Wetzel County with API Number 4710302933.

“Anderson 9H Well” means the Anderson 9H Well on the Anderson Lease in Wetzel County with API Number 4710302934.

“Anderson Site” means the site encompassed by the surface rights conveyance, recorded at Volume 417, Page 512, in the Real Property Records of Wetzel County, West Virginia.

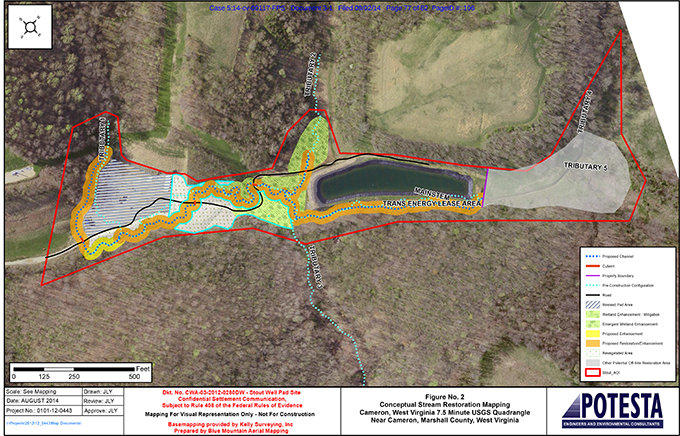

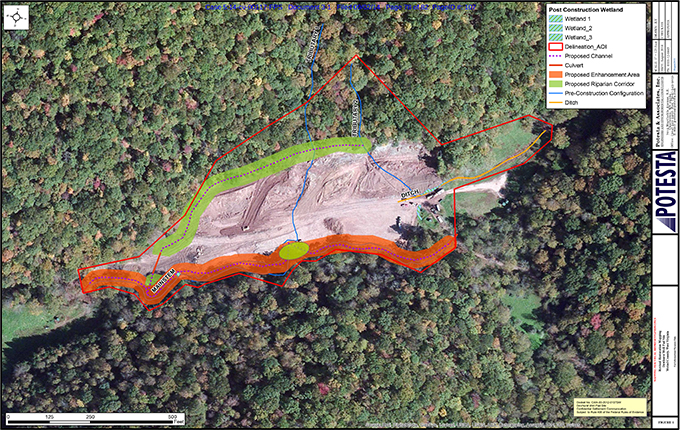

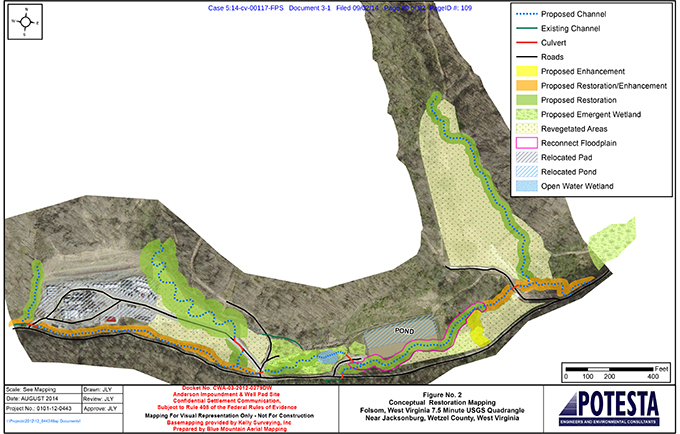

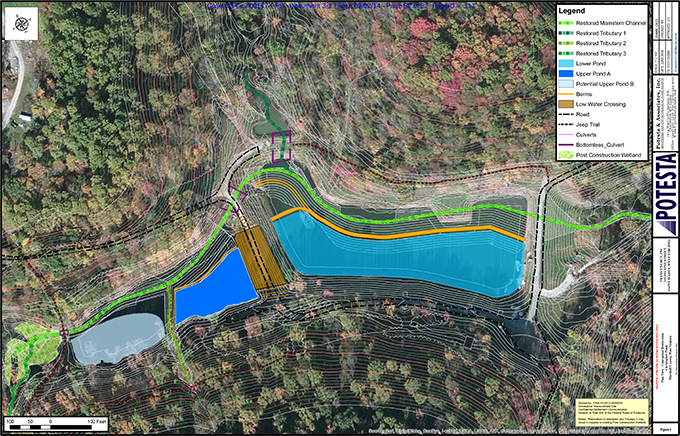

“Anderson Site Matter” means all matters referenced in the letter(s), citation(s), order(s) or other documentation received by Sellers from the Environmental Protection Agency or any other Governmental Authority about the Anderson Site (including the matters referenced in the 7th, 8th and 9th items delineated on Schedule 3.10 as well as the Consent Decree), and any additional matters, as may be expanded, regarding such investigation and/or action against Sellers.

“Anderson Site Resolution” is defined in Section 7.11(c)(i).

2

“ASD” is defined in the Preamble.

“Asset Taxes” means Property Taxes and Severance Taxes.

“Assets” means the following, less and except the Excluded Assets:

(a) oil and gas mineral interests which are owned by Sellers in fee simple on lands located in Wetzel County, West Virginia (the “Fee Properties”);

(b) the Leases and all other rights in and to the lands covered by the Leases (the “Lands”), including all rights, privileges, claims, causes of action and benefits of Sellers under such Leases (i) arising from and after the Effective Time and (ii) arising prior to the Effective Time to the extent any liability or obligation related thereto constitutes an Assumed Liability, and all rights of Sellers under such Leases to audit the records of any party thereto and to receive refunds of any nature thereunder (x) arising from and after the Effective Time and (y) arising prior to the Effective Time to the extent any liability or obligation related thereto constitutes an Assumed Liability;

(c) all of Sellers’ right, title and interest in any pools or units including all or a part of any Property (the “Units”);

(d) the Wells and all other Personal Property;

(e) all rights, privileges, benefits and powers of each Seller as the owner or holder of any Asset or interest in such Asset with respect to the use and occupation of the surface of, and the subsurface depths under, the Lands that may be necessary, convenient or incidental to the possession and enjoyment of any Property or interest, including all surface fee interests, easements, permits, servitudes, rights-of-way, surface leases and other surface rights;

(f) the Property Agreements, including all rights, privileges, claims, causes of action and benefits of Sellers under such Property Agreements (i) arising from and after the Effective Time and (ii) arising prior to the Effective Time to the extent any liability or obligation related thereto constitutes an Assumed Liability, and all rights of Sellers under such Property Agreements to audit the records of any party thereto and to receive refunds of any nature thereunder (x) arising from and after the Effective Time and (y) arising prior to the Effective Time to the extent any liability or obligation related thereto constitutes an Assumed Liability;

(g) the Production;

(h) the original Books, Records and Data;

(i) any rights, claims and causes of action of any nature arising under or with respect to any Asset and all proceeds, receivables and revenues arising from such rights, claims and causes of action, including any settlements thereof, to the extent such rights, claims, causes of action proceeds, receivables and revenues are attributable to the period after the Effective Time or relate to an Assumed Liability;

3

(j) all other right, title and interest of any Seller in and to the Properties, it being the intent of the Parties that Sellers convey all of their right, title and interest in all properties located within Wetzel County, West Virginia.

“Assignment” means the Assignment, Conveyance and Bill of Sale in the form of Exhibit B attached hereto.

“Assumed Liabilities” means, other than the Retained Liabilities:

(a) Property Costs accruing from and after the Effective Time; provided, however, that: (i) such Property Costs shall not include (x) capital expenditures for which Sellers are obligated as set forth on Schedule 5.1, including any costs and expenses incurred by Sellers relating thereto (including any such costs and expenses that are capitalized and in excess of such capital expenditure amounts on Schedule 5.1), (y) any costs or expenses incurred with respect to the ownership and operation of the Assets paid or payable to an Affiliate of Seller (other than per well/per month overhead charges, paid to REO in REO’s capacity as operator of the Assets, which shall be deemed to be Property Costs to the extent incurred in the ordinary course of business in accordance with an operating agreement in effect as of the date hereof and shall not exceed $500.00 per well in any calendar month) and (z) any amounts incurred in connection with the cure or remediation by Seller of any Title Defects or Environmental Defects in accordance with this Agreement, and (ii) the Sellers shall be responsible for Property Costs related to Excluded Assets and Retained Liabilities.

(b) any liability or obligation arising out of or resulting from performance due on or after the Effective Time arising from or related to any Property Agreement, including but not limited to the Leases, or any of the Assets;

(c) except to the extent already borne by Buyer as a result of (i) adjustments to the Purchase Price made pursuant to Sections 2.5 or 2.6, as applicable, or (ii) payments made from one Party to the other in respect of Asset Taxes pursuant to Section 7.2, any liability or obligation for Asset Taxes allocable to Buyer pursuant to Section 7.2;

(d) any liability or obligation for properly plugging and abandoning all of the Wells and restoring the surface areas associated with the Wells in accordance and compliance with the rules and regulations of Governmental Authorities having jurisdiction and the terms of the Leases arising on or after the Effective Time;

(e) any liability or obligation relating to the accrued suspense funds set forth on Schedule 2.5(b);

(f) any liability or losses attributable to a Title Defect, including, without limitation, any Title Defects for which the Base Purchase Price is decreased pursuant to Section 2.5(b)(v);

(g) any liability or obligation arising from, based upon, related to or associated with the Assets arising on or after the Effective Time; and

(h) except as it may arise from a breach of the representation set forth in Section 3.10, any matter relating to the environmental condition of the Assets on and after the Effective Time (except to the extent such matter is a Retained Liability), including, without limitation, any Environmental Defects for which the Base Purchase Price is adjusted at Closing.

4

“Base Purchase Price” is defined in Section 2.2.

“Basket” is defined in Section 8.5(a).

“Blackshere Lease” means, collectively, those certain oil and gas Leases in Wetzel County identified as Blackshere Leases on Exhibit C.

“Blackshere Litigation” means that certain civil action (Civil Action No. [1:11CV75]) initiated in 2011 by certain of the Sellers and their Affiliates against EQT Production Company seeking to quiet title on the Blackshere Lease and other relief, including all related Actions, claims, demands, answers, counterclaims, motions, hearings, judgments and other procedures related thereto.

“Blackshere Release” means a release executed by EQT of all rights with respect to the Blackshere Lease containing at a minimum the terms and conditions described in Schedule 7.13 hereto.

“Blackshere Site” means the site encompassed by the surface rights conveyance, recorded at Volume 126, Page 60, in the Real Property Records of Wetzel County, West Virginia.

“Blackshere Site Matter” means matters referenced in the letter(s), citation(s), order(s) or other documentation received by Sellers from the Environmental Protection Agency or any other Governmental Authority about the Blackshere Site (including the matters referenced in the Consent Decree), and any additional matters, as may be expanded, regarding such investigation and/or action against Sellers.

“Blackshere Site Resolution” is defined in 7.11(c)(ii).

“Books, Records and Data” means, in whatever form or media expressed, all books, records, files, data or copies thereof, in Sellers’ possession relating directly to the Assets, including, without limitation, geological, plats, surveys, maps, cross sections, production records, division order decks, electric logs, cuttings, cores, core data, pressure data, decline and production curves, well files and all related matters, division of interest records, division orders, lease files, title opinions and title information, abstracts, lease operating statements and all other accounting and Asset Taxes information, files, engineering reports and other technical data, databases, surveys, regulatory filings, magnetic tapes, electronic files and databases, interpretations and other analysis, marketing reports, statements, gas balancing information and all other marketing information, all geophysical and seismic records and data (including licenses, franchises and rights to such records and data), except to the extent that the transfer of such geophysical or seismic records and data would violate existing licensing or other contractual restrictions on such transfer or require the payment of a fee or penalty which Buyer is unwilling to pay, but excluding all income Tax Returns.

5

“Business Day” means any day other than (i) a Saturday or Sunday or (ii) a day on which commercial banks in Houston, Texas are closed.

“Buyer” is defined in the opening paragraph.

“Buyer Claim” is defined in Section 8.2(b).

“Buyer Indemnified Party” is defined in Section 8.2(a).

“Buyer’s Claim Notice” is defined in Section 8.2(b).

“Casualty Loss” is defined in Section 7.4(a).

“Casualty Well” means the Blackshere well pad located in Wetzel County, West Virginia, on which the Blackshere 200H Well (API Number 4710302615) and the Blackshere 201H Well (API Number 4710302944) are located.

“Cleanup Standard” is defined in Section 7.11(c)(i).

“Closing” means the conference held at 10:00 a.m., local time, on the Closing Date, at the offices of Vinson & Elkins L.L.P., Suite 3700, 2001 Ross Avenue, Dallas, Texas.

“Closing Date” means: (a) the fifth (5th) day after the end of the Examination Period (or if such day is not a Business Day, the next Business Day thereafter), or if all Closing conditions set forth in Sections 6.1, 6.2 and 6.3 have not been satisfied or waived as of such day (other than conditions with respect to actions the respective Parties will take at the Closing itself), the second Business Day following the satisfaction or waiver (as permitted by such Sections) of the conditions set forth in Sections 6.1, 6.2 and 6.3 or (b) such other date as the Parties may mutually agree in writing.

“Closing Payment” is defined in Section 2.2(a).

“Code” means the Internal Revenue Code of 1986, as amended.

“Company Net Acres” means the product of (x) the number of gross acres in the land covered by each Lease multiplied by (y) the Lessor’s mineral interest in the land covered by such Lease multiplied by (z) Sellers’ Working Interest in such Lease.

“Conceptual Restoration Plans” is defined in the definition of Site Matter Event.

“Confidentiality Agreement” means that certain Confidentiality Agreement between Sellers and Buyer dated August 15, 2014.

“Consent Decree” means the consent decree lodged on September 2, 2014 in the matter styled U.S. v. Trans Energy, Inc., No. 5:14-cv-117 (N.D.W. Va.), as may be amended or modified, and as entered by the court.

“Court Order” means any judgment, injunction, order or ruling of any court or other judicial authority that is binding on any Person or its property under applicable Laws.

6

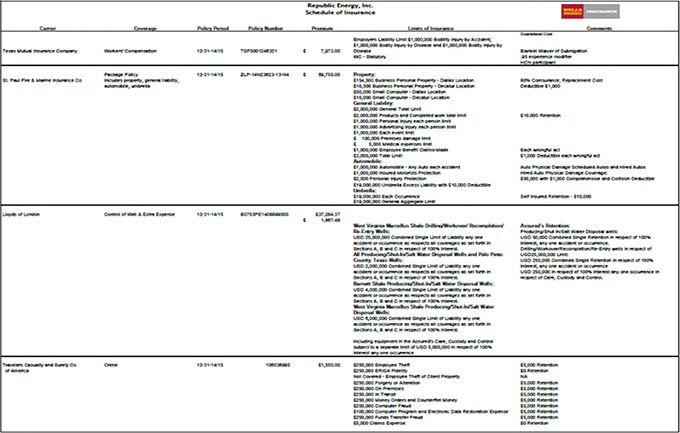

“Credit Facilities” means that certain Credit Agreement among American Shale Development, Inc., as borrower & Morgan Stanley Capital Group Inc. dated May 21, 2014, and that certain Credit Agreement dated August 15, 2011, as amended February 22, 2012, Resignation, Consent & Appointment Agreement and Amendment Agreement dated April 20, 2012, Amendment No. 2 dated May 30, 2013 & Amendment No. 3 dated June 9, 2014 between Republic Partners VIII, LLC, Borrower & Republic Energy Ventures, LLC, the Parent, and Wells Fargo Bank, N.A., Lender.

“CPR” is defined in Section 10.12(c).

“Current Tax Period” is defined in Section 7.2(a).

“Defect Basket” is defined in Exhibit A, Section 9.

“Defensible Title” is defined in Exhibit A, Section 5.

“Deposit” is defined in Section 2.3.

“Dewhurst Lease” means, collectively, those certain oil and gas Leases in Wetzel County identified as lease numbers 103-4-407A, 103-4-407B, 103-4-407C, 103-4-407D, 103-4-407E, 103-4-407F, 103-4-407G, 103-4-407H and 103-4-407I on Exhibit C.

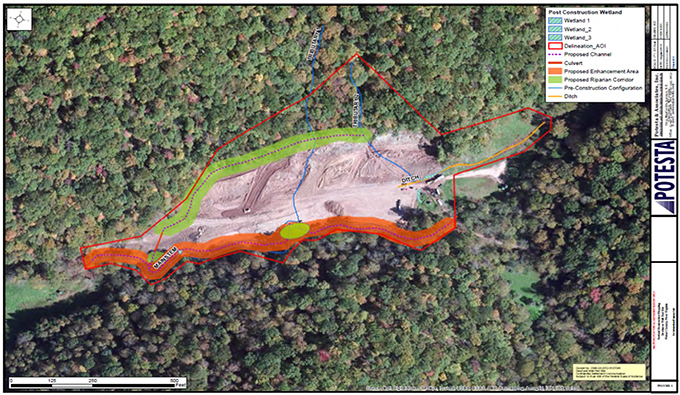

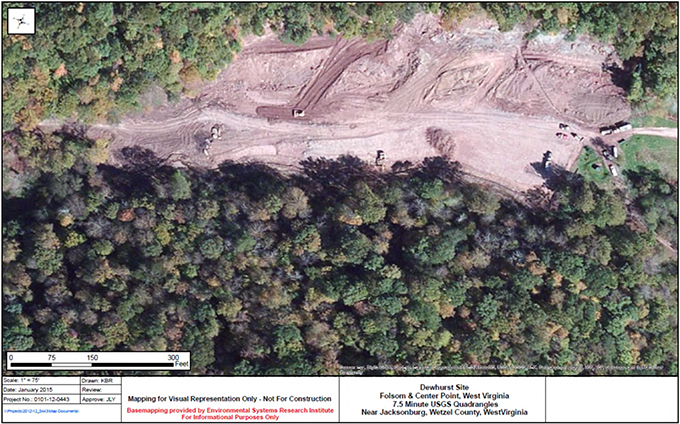

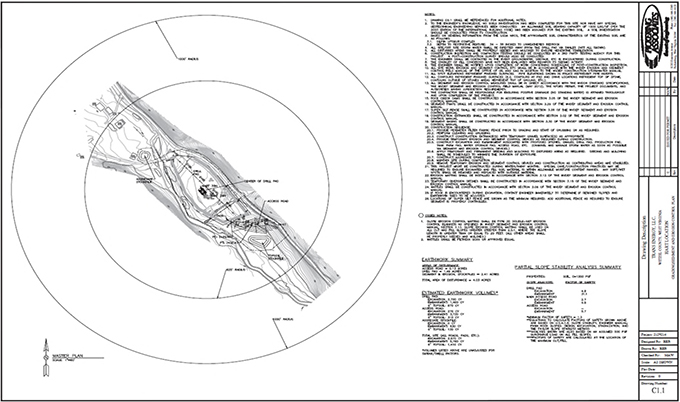

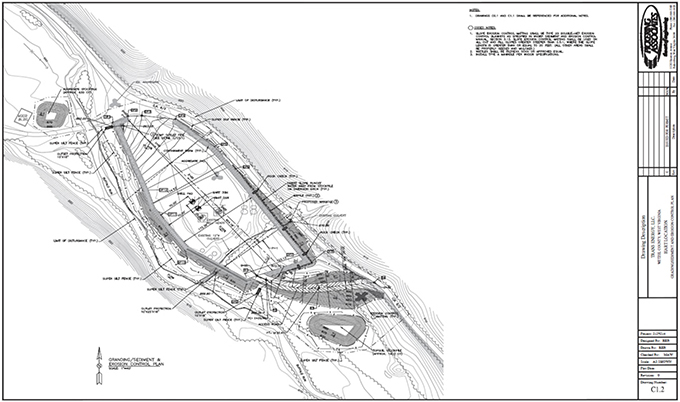

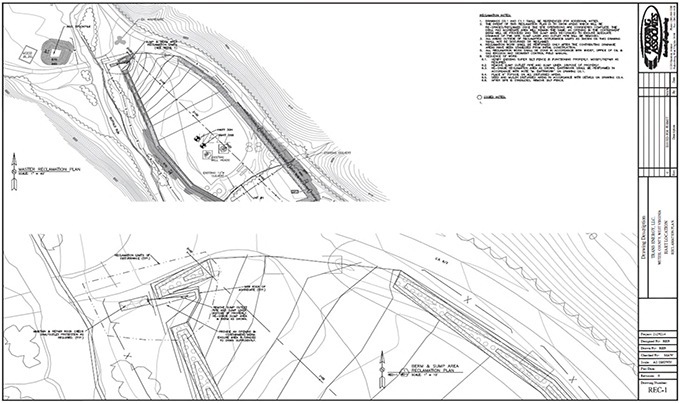

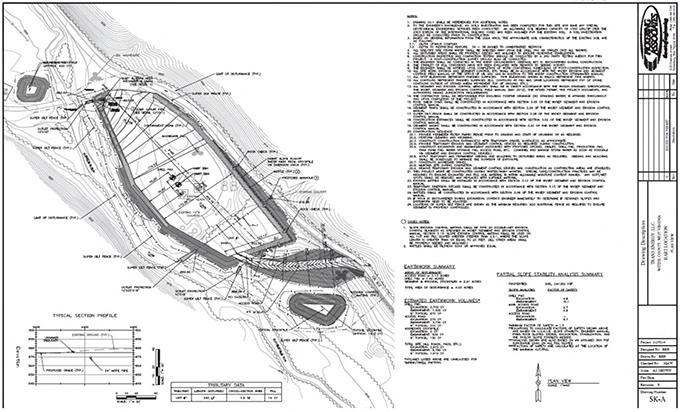

“Dewhurst Site” means the site located on the plat shown on Schedule 1.1(b).

“Dewhurst Site Matter” means all matters referenced in the letter(s), citation(s), order(s) or other documentation received by Sellers from the Environmental Protection Agency or any other Governmental Authority about the Dewhurst Site (including the matters referenced in the 1st, 2nd, 3rd, 4th, 5th and 6th items delineated on Schedule 3.10 as well as the Consent), and any additional matters, as may be expanded, regarding such investigation and/or action against Sellers.

“Dewhurst Site Resolution” is defined in Section 7.11(c)(i).

“Dispute” is defined in Section 10.12.

“Disputed Amounts” is defined in Section 2.6(c)(ii).

“Effective Time” is defined in Section 2.9.

“Encumbrances” is defined in Exhibit A, Section 5(d).

“Environmental Condition” is defined in the definition of Retained Liabilities.

“Environmental Defect” means:

(a) any violation of, or condition or circumstance, which could result in or give rise to Losses under, any Environmental Law as it exists (whether in effect or, in the case of the West Virginia Aboveground Storage Tank Act (Senate Bill No. 373) and any interpretative rule, proposed rule and any additional rules, regulations and guidance promulgated thereunder, proposed) on the Closing Date (i) on or relating to any of the Assets, or (ii) which arises from the ownership, record keeping, construction, maintenance, repair or operation of the Leases or the other Properties; or

7

(b) any condition or circumstance with respect to (i) any of the Assets, or (ii) the ownership, record keeping, construction, maintenance, repair or operation thereof, which (without regard to notice or the lapse of time or both, in each case) would be reasonably likely to result in or give rise to, any Losses under any Environmental Law, including any Remediation, property damage or personal injury from exposure to, handling or Release of Hazardous Substances.

“Environmental Defect Amount” is defined in Exhibit A, Section 6.

“Environmental Defect Arbitrator” is defined in Exhibit A, Section 8(b)(ii).

“Environmental Defect Notice” is defined in Exhibit A, Section 3.

“Environmental Defect Property” is defined in Exhibit A, Section 4.

“Environmental Laws” means any and all Laws, regulations, guidance, permits, orders, determinations, decrees or other requirements or provisions having the force or effect of law, including common law, relating to or concerning public health and safety, worker health and safety, pollution or protection of the environment (including, without limitation, ambient air, surface water, groundwater, land surface or subsurface strata), conservation of resources (including threatened or endangered species) or natural resource damages, including all those relating to the presence, use, production, generation, handling, transportation, treatment, storage, disposal, distribution, emission, labeling, testing, processing, discharge, release, remediation, threatened release, control or cleanup of any Hazardous Substances. The term “Environmental Laws” includes, without limitation, the Clean Air Act, the Comprehensive Environmental Response Compensation and Liability Act, the Resource Conservation and Recovery Act of 1976, the Toxic Substances Control Act, the Clean Water Act, the Safe Drinking Water Act, the Hazardous Materials Transportation Act, the Oil Pollution Act of 1990, the Occupational Safety and Health Act, as in effect or as proposed as of the Closing Date, and any state laws implementing or analogous to the foregoing federal laws and the rules, regulations and guidance promulgated thereunder (and including the West Virginia Aboveground Storage Tank Act (Senate Bill No. 373) and any interpretative rule, proposed rule and any additional rules, regulations and guidance promulgated thereunder) in the form proposed as of the Closing Date.

“Environmental Permits” is defined in Section 3.10(c).

“EQT” means EQT Production Company, its assigns, successors or Affiliates.

“EQT Release Acres” is defined in Section 7.14.

“Escrow Agent” is defined in Section 2.3.

“Escrow Agreement” is defined in Section 2.3.

8

“Escrow Amount” means an amount equal to the sum of: (a) 10% of the Purchase Price funded at Closing; plus (b) $1,000,000 associated with the Anderson Site Matter; plus (c) $1,000,000 associated with the Dewhurst Site Matter; plus (d) $250,000 associated with the Hart Site Matter; plus (e) $250,000 associated with the Blackshere Site Matter; plus (f) the Robinson Deposit pursuant to Section 7.13(b).

“Escrow Fund” has the meaning set forth in Section 2.4(a).

“Examination Period” is defined in Exhibit A, Section 1.

“Excess Acreage” is defined in Section 5.9.

“Excluded Assets” means:

(a) any Leases and other Properties that are excluded due to Environmental Defects pursuant to Exhibit A;

(b) a copy of the Books, Records and Data;

(c) any production hedges or other derivatives related to the Assets;

(d) all rights and causes of action arising, occurring or existing in favor of Sellers prior to the Effective Time or arising out of the operation of or production from the Assets prior to the Effective Time (including, but not limited to, any and all contract rights, claims, receivables, revenues, recoupment rights, recovery rights, accounting adjustments, mispayments, erroneous payments or other claims of any nature in favor of Sellers and relating and accruing to any time period prior to the Effective Time);

(e) except to the extent assumed by Buyer hereunder, any accounts receivable or accounts payable accruing before the Effective Time;

(f) all hydrocarbon production from or attributable to the Assets with respect to all periods prior to the Effective Time, and all proceeds attributable thereto;

(g) any refund of costs or expenses borne by Sellers attributable to the period prior to the Effective Time, including Property Taxes or Severance Taxes allocated to Sellers in accordance with Section 7.2;

(h) except to the extent constituting the suspended funds on royalty, all deposits, cash, checks, funds and accounts receivable attributable to Sellers’ interest in the Assets with respect to any period of time prior to the Effective Time;

(i) any software, vehicles, office equipment, office leases, and any master service agreements not expressly included on any Schedule hereunder;

(j) any other assets held by Sellers that are not expressly identified herein as the Assets;

9

(k) Leases described in Section 2.5(b)(v).

(l) any Excluded New Interests;

(m) all gas imbalances, including those set forth on Schedule 3.14, as of the Closing Date;

(n) the Leases described in the map attached as Schedule 1.1(a);

(o) except to the extent assumed by Buyer pursuant to Section 7.11, excluded surface areas constituting the Sites;

(p) unless and until acquired by Buyer pursuant to Section 7.13, the Robinson Lease;

(q) all insurance claims or proceeds arising out of the fire at the Casualty Well occurring on December 15, 2014;

(r) the EQT Release Acres;

(s) unless acquired by Buyer pursuant to Section 7.12(c), the Wells located on the Blackshere Lease;

(t) unless acquired by Buyer pursuant to Section 7.13(a), the Wells located on the Robinson Lease; and

(u) the Wellbore Capital Purchase Agreement.

“Excluded New Interests” is defined in Section 5.9.

“Execution Date” is defined in the Preamble.

“Favorable Robinson Judgment” is defined in Section 7.13(b).

“Fee Properties” is defined in the definition of Assets.

“Final Resolution” or “Finally Resolved” means the dismissal with prejudice, resolution by final judgment of a court of competent and proper jurisdiction or by final settlement without any further liability or obligation of any named party thereto.

“Final Settlement Date” is defined in Section 2.6(c)(i).

“Final Settlement Statement” is defined in Section 2.6(c)(i).

“Future Well” means a well to be drilled in the future upon a Lease, Leases or units as such well is identified on Exhibit C attached hereto (and as such well is generally located on the map labeled as “Map 1” attached to Exhibit C).

“Governmental Authority” means any federal, state, provincial, municipal, local or other governmental department, commission, board, bureau, agency or instrumentality, or any court, in each case whether of the United States, any of its possessions or territories, or of any foreign nation.

10

“Hard Consent Asset” is defined in Section 5.4(b).

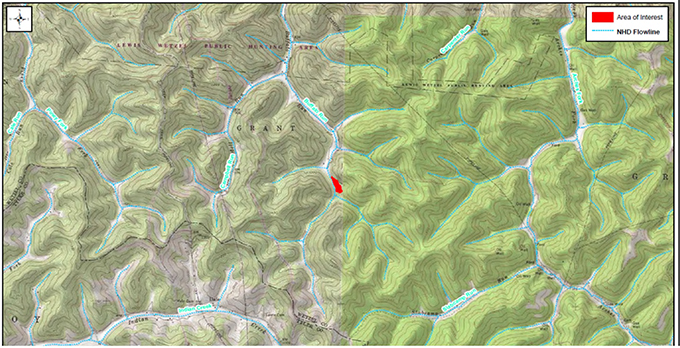

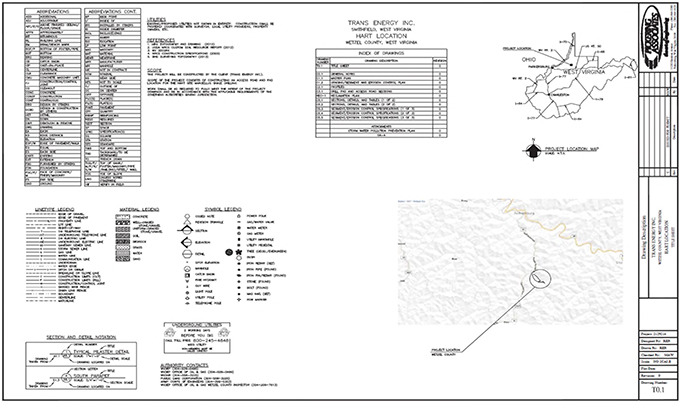

“Hart Site” means the site located on the plat shown on Schedule 1.1(c).

“Hart Site Matter” means all matters referenced in the letter(s), citation(s), order(s) or other documentation received by Sellers from the Environmental Protection Agency or any other Governmental Authority about the Hart Site (including the matters referenced the Consent Decree), and any additional matters, as may be expanded, regarding such investigation and/or action against Sellers.

“Hart Site Resolution” is defined in 7.11(c)(ii).

“Hazardous Substances” means any substances, wastes or materials regulated, defined, designated or classified under or that forms the basis for liability or Losses under any Environmental Law, now or in the future, including, without limitation, chemicals, pollutants, contaminants, solid wastes, hazardous wastes, hazardous substances, hazardous materials, toxic substances, asbestos or asbestos-containing material, polychlorinated biphenyls, petroleum and petroleum substance or by-product, natural gas or natural gas liquids, radioactive materials (including naturally occurring radioactive material ), drill cuttings, flowback water and produced water, urea formaldehyde insulation, hydrogen sulfide or polychlorinated biphenyls.

“Identified Title Matter” means the loss of title to the Leases identified on Schedule 3.6 on account of the failure to maintain such Leases with sufficient continuous production.

“Income Taxes” means (i) all Taxes based upon, measured by, or calculated with respect to gross or net income or gross or net receipts or profits (including, but not limited to, franchise Tax and any capital gains, alternative minimum Taxes and net worth Taxes, but excluding ad valorem, property, excise, severance, production, sales, use, real or personal property transfer or other similar Taxes), (ii) Taxes based upon, measured by, or calculated with respect to multiple bases (including, but not limited to, corporate franchise, doing business or occupation Taxes) if one or more of the bases upon which such Tax may be based upon, measured by, or calculated with respect to, is described in clause (i) above, and (iii) withholding Taxes measured with reference to or as a substitute for any Tax described in clauses (i) or (ii) above).

“Indemnifying Party” is defined in Section 8.4.

“Individual Title Defect Threshold” means: (a) $25,000 in the case of Leases covering three (3) or more Company Net Acres as shown on Exhibit C, (b) $5,000 in the case of Leases covering less than three (3) Company Net Acres as shown on Exhibit C, and (c) $25,000 in the case of any Wells or other Property (other than a Lease).

“Interim Period” is defined in Section 5.1.

“Joint Instructions” is defined in Section 2.4(b).

11

“Knowledge of such Seller” or “Sellers’ Knowledge” or “Known by Sellers” as to the Republic Parties means the actual knowledge of the individuals set forth on Schedule 1.1(d) after making due and appropriate inquiry with all personnel directly reporting to them; and as to the TE Parties means the actual knowledge of the individuals set forth on Schedule 1.1(e) after making due and appropriate inquiry with all personnel directly reporting to them.

“Lands” is defined in the definition of Assets.

“Laws” means any federal, state, local, tribal, foreign or other law, judicial decision or governmental requirement of any kind, and the rules, regulations, ordinances, determinations and orders promulgated thereunder, all of the foregoing as in effect on the date hereof.

“Lease” (individually) and “Leases” (collectively) means (a) all of Sellers’ right, title and interest in and to, the oil, gas, and/or mineral leases, subleases and other leaseholds, royalties, overriding royalties, net profits interests, carried interests and other interests in production of hydrocarbons in, under or that may be produced from or attributable to the lands located in Wetzel County, West Virginia, including the Leases set forth on Exhibit C, including, but not limited to leaseholds, record title and operating rights, royalty or overriding royalty interests in such leases, and (b) all of Sellers’ right, title and interest in and to the Blackshere Lease to the extent the lands covered thereby are located in Doddridge County, West Virginia, including, but not limited to leaseholds, record title and operating rights, royalty or overriding royalty interests in the Blackshere Lease. Exhibit C sets forth a description of Sellers’ Net Revenue Interest, Working Interest and Company Net Acres in each Lease set forth therein, and a list of the Wells associated with such Leases.

“Lease Burdens” means the royalties, overriding royalties, production payments, net profit interests, and all similar interests burdening the Leases or production therefrom.

“Liability” means any direct or indirect liability, indebtedness, obligation, commitment, expense, claim, deficiency or guaranty of or by any Person of any type, whether known or unknown.

“Losses” is defined in Section 8.2(a).

“Marion Border Area” is defined in Section 7.9.

“Material Adverse Effect” or “Material Adverse Change” means a material adverse effect on or material adverse change in (or any development that, insofar as reasonably can be foreseen, is reasonably likely to have a material adverse effect on or material adverse change in) the ownership, operation, use or value of the Assets, or the business, financial condition or results of operations of the businesses relating to the Assets as currently and historically conducted by the Sellers, taken as a whole, other than any change, circumstance or effect (a) relating to the economy or securities markets in general, (b) affecting the oil and gas or energy industry generally, such as fluctuations in the price of oil or gas, (c) natural declines in well performance, or (d) resulting from the execution or performance of this Agreement or the announcement thereof.

“Material Property Agreements” is defined in Section 3.5(a).

12

“Maximum Indemnity Amount” is defined in Section 8.5(c).

“Net Revenue Interest” means the decimal ownership of the lessee in production from a Subject Well or Lease, after deducting all applicable Lease Burdens.

“New Seller Representative” is defined in Section 10.13(b).

“Objection Report” is defined in Section 2.6(c)(i).

“Oil and Gas Interests” means (a) oil and gas fee mineral interests on lands located in Wetzel County, West Virginia, and, with respect to the Blackshere Lease, lands located in Doddridge County, West Virginia, (b) interests in oil, gas, and/or mineral leases, subleases and other leaseholds, royalties, overriding royalties, net profits interests, carried interests and other interests in production of hydrocarbons in, under or that may be produced from or attributable to the lands located in Wetzel County, West Virginia, and, with respect to the Blackshere Lease, lands located in Doddridge County, West Virginia, including, but not limited to leaseholds, record title and operating rights, royalty or overriding royalty interests in such leases, (c) interests in lands covered by the leases referred to in clause (b), (d) interests in oil or gas wells, condensate wells, water source wells or water and other types of injection wells located on the leases referred to in clause (b), and (e) interests in any pools or units on lands located in Wetzel County, West Virginia, and, with respect to the Blackshere Lease, lands located in Doddridge County, West Virginia.

“Partition Property” means 31.3 acres being part of Map 38, Parcel 11 on the waters of Archers Fork in Grant District, Wetzel County, West Virginia.

“Partition Property Adjusted Price” is defined in Section 7.16(c).

“Partition Property Closing” is defined in Section 7.16(e).

“Partition Property Diligence Period” is defined in Section 7.16(c).

“Partition Property Matter” means Civil Action No. 13-c-119 originally filed on or about April 4, 2013 in the Circuit Court of Wetzel County by American Shale Development, Inc., as Plaintiff, with a Motion for Leave to File Amended Complaint filed January 20, 2015, covering the Partition Property, requesting that any and all un-leased interests in the oil and gas interests in said 31.3 acre tract be sold at public (partition) sale to the highest bidder.

“Partition Property Resolution” is defined in Section 7.16(c).

“Party” and “Parties” is defined in the Preamble.

“Permits” means all permits, licenses and governmental authorizations, registrations and approvals, franchises, consents, certificates, waivers, clearances, credits (including, but not limited to, any emission reduction credits, emission offsets or similar credits, whether under voluntary or mandatory programs under Environmental Laws), immunities, privileges, grants and other rights or approvals required or issued, as of the date hereof, in connection with the ownership or operation of the Assets.

13

“Permitted Encumbrances” means: (A) liens, charges, encumbrances, contracts, agreements, instruments, obligations, defects and irregularities of title and restrictions of right or interest of any nature affecting any Asset that will be discharged and released in full as to the Assets at Closing; (B) lessors’ royalties, overriding royalties, and similar burdens that do not operate to reduce the Net Revenue Interest of Sellers below that Net Revenue Interest set forth on Exhibit C or increase the Working Interest of Sellers above that Working Interest set forth on Exhibit C (without a proportionate increase in the corresponding Net Revenue Interest) or reduce the Company Net Acres below that Company Net Acres set forth on Exhibit C; (C) contingent future obligations under any joint operating agreement, farm-out agreement, or any similar agreement whereby an operator or other party with an interest in such agreement may earn, or otherwise become entitled to, an interest in any Lease or Well that do not operate to reduce the Net Revenue Interest of Sellers below that Net Revenue Interest set forth on Exhibit C or increase the Working Interest of Sellers above that Working Interest set forth on Exhibit C (without a proportionate increase in the corresponding Net Revenue Interest), or reduce the Company Net Acres below that Company Net Acres set forth on Exhibit C; (D) sales, transportation and processing contracts terminable upon 60-days’ notice; (E) all rights to consent by, required notices to, and filings with or other actions by Governmental Authorities, if any, in connection with the change of ownership or control of an interest in any Asset; (F) materialmen’s, mechanics’, repairmen’s, employees’, contractors’, operators’ and other similar liens or charges arising pursuant to operations or in the ordinary course of business incidental to construction, maintenance, or operation of the Leases if they are not now due and payable and pursuant to which no Seller is in default; (G) all applicable Laws, rules and orders of any Governmental Authority; (H) inchoate liens for Taxes not due and payable before the Closing Date; (I) easements impacting the surface estates associated with the Assets not materially interfering with the operation, exploration, development, value or use of any Assets; (J) consents which if not obtained do not cause the affected Asset to be a Hard Consent Asset; (K) property rights associated with the right to mine for coal, but not including rights to produce oil or gas; (L) all other defects and irregularities that (i) do not operate to reduce the Net Revenue Interest of Sellers below that Net Revenue Interest on Exhibit C or increase the Working Interest of Seller above that Working Interest set forth on Exhibit C (without a proportionate increase in the corresponding Net Revenue Interest) or reduce the Company Net Acres below that Company Net Acres set forth on Exhibit C; (ii) do not materially interfere with the operation, exploration, development, value or use of any Asset, (iii) are not the subject of an adverse claim threatened or prosecuted by a Person other than a Party, and (iv) would customarily be waived by a prudent land manager in the ordinary conduct of exploration and drilling activities; and (M) any adverse claims of EQT to the extent such claims were included and Finally Resolved in the Blackshere Litigation or the Robinson Litigation.

“Person” means any natural person, corporation, limited partnership, general partnership, limited liability company, joint stock company, joint venture, association, company, estate, trust, bank trust company, land trust, business trust or other organization, whether or not a legal entity, custodian, trustee-executor, administrator, nominee or entity in a representative capacity and any Governmental Authority.

“Personal Property” means all of Sellers’ interest in all of the tangible personal property, fixtures and improvements now and as of the Effective Time on, appurtenant to, or used solely in connection with the Assets or with the production, treatment, storage, sale or disposal of

14

hydrocarbons, water or other minerals or substances produced from the Leases, including, without limitation, all Wells, wellhead equipment, fixtures, casing and tubing, all production, storage, treating, compression, dehydration, delivering, salt water disposal and pipeline fixtures and personalty, machinery, platforms, tanks, boilers, pumps, motors, inventory, rolling stock, separators, buildings, structures, roads, field processing plants, pipelines, flow lines, gathering lines, transportation lines (including long lines and laterals), power lines, improvements and other facilities of every kind, character and description, used or usable solely in connection with the production, treatment, storage, delivery, sale or disposal of hydrocarbons, water or other minerals or substances produced from the Assets, including but not limited to those identified on Schedule 3.4.

“Preferential Right” is defined in Section 5.4(c)(i).

“Preliminary Settlement Statement” is defined in Section 2.6(a).

“Prima” is defined in the Preamble.

“Prime Rate” means the prime rate of interest reported in The Wall Street Journal on the Final Settlement Date or, if not published on such date, as most recently published prior to the Final Settlement Date.

“Production” means all of Sellers’ right, title and interest in the oil, gas, casinghead gas, condensate, distillate and other liquid and gaseous hydrocarbons and other minerals produced from the Leases or lands pooled or unitized therewith, products refined and manufactured therefrom and the accounts and proceeds from the sale thereof to the extent that such production has been produced, or accrued, from the Leases or lands pooled or unitized therewith from and after the Effective Time.

“Properties” means, collectively, the Fee Properties, the Leases, the Units, the Wells and the Personal Property.

“Property Agreements” means all joint operating agreements, surface use agreements, pooling and unitization agreements, hydrocarbon purchase and sale contracts, leases, Permits, rights-of-way, easements, servitudes, licenses, farmin and farmout agreements, options, surface leases, surface fee interests, orders, royalty agreements, assignments, exploration agreements, bottom hole agreements, transportation and marketing agreements, acreage contribution agreements, unit agreements, treating, gathering and processing agreements, facilities or equipment leases and other contracts, rights or agreements and any and all amendments, ratifications or extensions of the foregoing, to the extent such instruments relate to any Well or to the other Assets or the production, storage, treatment, transportation, processing, sale or disposal of hydrocarbons, water or other minerals or substances produced therefrom or attributable thereto or are otherwise appurtenant to or affect the Properties, or are used or held for use in connection with the ownership or operation of the Properties, in each case including but not limited to the Property Agreements identified on Schedule 3.5(b).

“Property Costs” means all operating expenses (including obligations to pay working interests, burdens on production or other interest owners’ revenues or proceeds attributable to sales of hydrocarbons relating to the Properties) and capital expenditures (including leasing costs and

15

bonus payments) incurred in the ownership and operation of the Assets in the ordinary course of business and in accordance with the relevant operating or unit agreement, if any, and overhead costs charged to the Assets under the relevant operating agreement or unit agreement, if any; provided that the term “Property Costs” shall not include any Income Taxes or Asset Taxes.

“Property Taxes” means all ad valorem, real property, personal property, and similar Taxes assessed against the Assets or based upon or measured by the ownership of the Assets, but not including Income Taxes, Severance Taxes or Transfer Taxes.

“Purchase Price” means the amount specified in Section 2.2 hereof.

“Reduced NRI Lease” is defined in Exhibit A, Section 6(a)(i).

“Referral Firm” is defined in Section 2.6(c)(ii).

“Release” means any spilling, leaking, pumping, pouring, placing, emitting, discarding, abandoning, emptying emitting, discharging, depositing, migrating, injecting, escaping, leaching, dumping or disposing or other release into the indoor or outdoor environment (including the abandonment or disposal of any barrels, containers or other closed receptacles) or the movement through the air, soil, surface water or ground water, whether intentional or unintentional.

“Remediation” means all actions, including any expenditures, undertaken to (i) restore, clean up, remove, remediate, abate, treat or in any other way address any noncompliance of Environmental Laws, a Release or threatened Release, (ii) prevent any Release or threat of Release, or minimize the further Release so that it does not endanger or threaten to endanger public health or welfare or the indoor or outdoor environment, (iii) perform studies, assessments, and investigations of any Release or threat of Release or monitoring and care of any Release or threat of Release, or (iv) correct or prevent a condition of noncompliance with Environmental Laws (including the purchase of any mitigation credits or payments made with regard to compliance with Environmental Laws).

“REO” is defined in the Preamble.

“Republic Parties” is defined in the Preamble.

“Retained Liabilities” means all liabilities and obligations, known or unknown, arising from, based upon, related to or associated with (i) the ownership or operations of the Assets prior to the Effective Time (excluding liabilities for any title defects (other than with respect to the special warranty of title of Seller contained in the Assignment or any subsequent assignment and bill of sale) or any environmental liabilities, which are covered in (ix) below), (ii) the Excluded Assets, (iii) any liabilities to third parties for personal injury or death attributable to Sellers’ or their Affiliates’ operation of the Assets prior to the Closing Date, (iv) any liability or obligation including Taxes that is not an Assumed Liability, (v) any and all Seller Taxes, (vi) any liability arising out of or resulting from any breach of any representation, warranty, covenant or agreement contained in this Agreement by any Seller, (vii) any liability for any Seller’s failure to pay when due any royalties relating to the Assets to the extent such royalties are due and payable prior to the Effective Time, (viii) any liabilities for Sellers’ or Sellers’ Affiliates’ gross negligence or willful misconduct in respect of Sellers’ or Sellers’ Affiliates’ operation of the

16

Assets, (ix) environmental liabilities based (A) on conditions existing as of the Effective Time relating to requirements under Environmental Laws or existing as of the Closing Date and due to ownership or operations of Seller (“Environmental Conditions”), or (B) on the assertion by governmental entities or third parties of Claims against Buyer for Environmental Conditions to the extent specified in a written notice delivered to Sellers no later than eighteen (18) months after the Closing Date, (x) the violation of any Law, rule, regulation, order or injunction by any Seller or its Affiliates, (xi) any liability with respect to gas imbalances, including those set forth on Schedule 3.14, for any periods prior to the Closing Date, (xii) any liability associated with the fire damage to the Casualty Well resulting from the fire on December 15, 2014, including any costs and expenses incurred for repairs, fines, notices, violations or other penalties from Governmental Authorities or otherwise in relation to such fire damage, (xiii) capital expenditures incurred by Sellers between the Effective Time and Closing in respect of the Anderson 8H Well and the Anderson 9H Well, (xiv) the Anderson Site Matter, the Dewhurst Site Matter, the Hart Site Matter and the Blackshere Site Matter, including any and all liabilities and obligations related to any actions to be taken to resolve or remediate such Site Matters, including any obligations required pursuant to a Site Resolution to plug and abandon any of the wells located thereon and any loss of value in connection with the loss of production associated with such wells, and any restrictions on future drilling thereon and any loss of value in connection therewith, and including, without limitation, any Site Matter Event, (xv) the Partition Property Matter, (xvi) the Blackshere Litigation if and only if deemed to be a Retained Liability in accordance with Section 6.2(d), and (xvii) the Robinson Litigation if and only if deemed to be a Retained Liability in accordance with Section 7.13(g)(v).

“REV” is defined in the Preamble.

“Revised Per Acre Amount” means, with respect to any Reduced NRI Lease, the amount allocated to each Company Net Acre in the calculation of Allocated Value with respect to any Lease adjacent to or in the same geographical vicinity of such Reduced NRI Lease that has the same Net Revenue Interest as the actual Net Revenue Interest of such Reduced NRI Lease.

“Robinson Adjusted Price” is defined in Section 7.13(g)(iii).

“Robinson Closing” is defined in Section 7.13(g)(iv).

“Robinson Deposit” is defined in Section 7.14(b).

“Robinson Diligence Period” is defined in Section 7.13(g)(ii).

“Robinson Escrow Agreement” is defined in Section 7.13(g)(iv).

“Robinson Escrow Amount” means an amount equal to 10% of the Robinson Adjusted Price, payable to the Escrow Agent pursuant to Section 7.13(g)(iv) at the time of the Robinson Closing.

“Robinson Escrow Fund” is defined in Section 7.13(h).

“Robinson Final Resolution” is defined in Section 7.13(g).

17

“Robinson Lease” means, collectively, those certain oil and gas Leases in Wetzel County identified as Robinson Leases on Exhibit C.

“Robinson Litigation” collectively means the certain civil action (Civil Action 13-C-65, Circuit Court for Wetzel County, West Virginia) initiated in 2013 by EQT against certain of the Sellers and their affiliates and the companion civil action (Civil Action No. [No. 5:13-CV-93], United States District Court for the Northern District of West Virginia) initiated in 2013 by certain of the Sellers and their Affiliates against EQT respectively seeking to quiet title on the Robinson Lease and other relief, including all related claims, demands, answers, counterclaims, motions, hearings, judgments and other procedures related thereto.

“Robinson Notice” is defined in Section 7.13(g)(i).

“Robinson Release” is defined in Section 7.13(b).

“RP6” is defined in the Preamble.

“RP7” is defined in the Preamble.

“RP8” is defined in the Preamble.

“Schedule of Exceptions” is defined in Section 7.10.

“Seller” is defined in the Preamble.

“Seller Claim” is defined in Section 8.3(b).

“Seller Indemnified Party” is defined in Section 8.3(a).

“Seller Representative” is defined in Section 10.13(a).

“Seller Taxes” means (a) all Income Taxes imposed by any applicable laws on any Seller, any of its direct or indirect owners or Affiliates, or any combined, unitary, or consolidated group of which any of the foregoing is or was a member, (b) Asset Taxes allocable to the Sellers pursuant to Section 7.2 (taking into account, and without duplication of, (i) such Asset Taxes effectively borne by the Sellers as a result of the adjustments to the Purchase Price made pursuant to Sections 2.5 or 2.6, as applicable, and (ii) any payments made from one Party to the other in respect of Asset Taxes pursuant to Section 7.2), (c) any Taxes imposed on or with respect to the ownership or operation of the Excluded Assets or that are attributable to any asset or business of any Seller that is not part of the Assets and (d) any and all Taxes (other than the Taxes described in clauses (a), (b) or (c) of this definition) imposed on or with respect to the ownership or operation of the Assets for any Tax period (or portion thereof) ending before the Effective Time.

“Seller’s Claim Notice” is defined in Section 8.3(b).

“Sellers” is defined in the Preamble.

18

“Severance Taxes” means all extraction, production, excise, severance and all other similar Taxes with respect to the Assets that are based upon or measured by the production of Hydrocarbons or the receipt of proceeds therefrom, but not including Property Taxes, Income Taxes, or Transfer Taxes.

“Site Matter Escrow Amounts” means (a) $1,000,000 with respect to the Anderson Site, (b) $1,000,000 with respect to the Dewhurst Site, (c) $250,000 with respect to the Hart Site and (d) $250,000 with respect to the Blackshere Site.

“Site Matter Event” means the occurrence of any of the following events or occurrences in respect of any of the Sites: (a) with respect to any well pad on any Site, any change in configuration of such well pad or any reduction in the size of such well pad resulting in the inability of Buyer to drill additional wells on such well pad, which such change in configuration or reduction in size is caused by, arises out of or is related in any way to a Site Matter, or is caused by Sellers without the consent of Buyer, except for restoration in the location delineated in conceptual restoration plans contained in Appendix E to the draft Consent Decree, a copy of which is attached hereto as Exhibit I, (“Conceptual Restoration Plans”) and any modifications to such plans approved by the Environmental Protection Agency that have also been approved in writing by Buyer in its sole discretion; (b) an order, finding, judgment, ruling or decree by the Environmental Protection Agency, any other federal or state agency, or any other Governmental Authority requiring Buyer to be joined as a party to any settlement, settlement agreement, memorandum of understanding, plea, suit, hearing, investigation, consent decree or any related arrangement in respect of any Site Matter; (c) the entry into or establishment of any settlement, settlement agreement, decree, judgment or Remediation plan by the Environmental Protection Agency, any other federal or state agency, or any other Governmental Authority relating to any Site Matter such that such settlement, settlement agreement, decree, judgment or Remediation plan materially and adversely impacts Buyer’s ability to drill additional wells; it being understood and agreed that, for the purpose of clause (c), the occurrence of Buyer’s loss of the ability to obtain any Permits for any future wells located on any Site, or any change in configuration of, or any reduction in the size of, any well pad on any Site, except for such changes in configuration or reduction in size specified in the Conceptual Restoration Plans (and any modifications to such plans approved by the Environmental Protection Agency that have also been approved in writing by Buyer in its sole discretion), shall be deemed to materially and adversely impact Buyer’s ability to drill additional wells; provided, however, that notwithstanding anything to the contrary contained herein, including the restoration delineated in the Conceptual Restoration Plans, Sellers shall not, and shall not allow any other Party to, take any action with respect to any Site that would restrict Buyer from having access to an all-weather access road on such Site, and in the case of the Anderson Site, that would restrict Buyer from having access to all access roads shown on Exhbit I with respect to such Anderson Site, and failure to comply with this proviso shall be deemed to constitute a Site Matter Event.

“Site Matters” means the Anderson Site Matter, the Dewhurst Site Matter, the Hart Site Matter and the Blackshere Site Matter.

“Site Resolution” means either of the Anderson Site Resolution, the Dewhurst Site Resolution, the Blackshere Site Resolution or the Hart Site Resolution respectively.

19

“Sites” means the Anderson Site, the Dewhurst Site, the Hart Site and the Blackshere Site.

“Subject Well” means a Well or Future Well, as the context requires.

“Surface Use Agreements” is defined in Section 7.11(e).

“Taxes” means all federal, state, local and foreign income, profits, franchise, sales, use, ad valorem, property, severance, production, excise, stamp, documentary, gross receipts, goods and services, registration, capital, transfer or withholding taxes, fees, levies, duties, assessments, unclaimed property and escheat obligations or other charges imposed by any Governmental Authority, including any interest, penalties or additional amounts which may be imposed with respect thereto, and including any liability for any of the foregoing items that arises by reason of contract, assumption, transferee or successor liability, operation of Law (including by reason of participation in a consolidated, combined or unitary Tax Return) or otherwise.

“TE Parties” is defined in the Preamble.

“Title Company” means Old Republic Title Company of Houston, or another reputable and creditworthy insurer reasonably satisfactory to Buyer.

“Title Company Notice Date” is defined in Section 7.12(d).

“Title Defect” means any condition that causes Sellers not to have Defensible Title; provided, however, that the fact that any Lease (other than Leases constituting the Robinson Lease, the Blackshere Lease and the Dewhurst Lease) does not contain unitization and pooling provisions that permit lessee to pool with neighboring lands to form a suitable drilling unit that would be sufficient to allow for horizontal drilling activities to be conducted on such Lease shall not, by itself, constitute a Title Defect.

“Title Defect Amount” is defined in Exhibit A, Section 6.

“Title Defect Arbitrator” is defined in Exhibit A, Section 8(a).

“Title Defect Credit” is defined in Exhibit A, Section 6(b).

“Title Defect Notice” is defined in Exhibit A, Section 3.

“Title Defect Property” is defined in Exhibit A, Section 4.

“Title Policy Commitment Failure Date” means the earlier of (1) the Title Company Notice Date and (2) April 30, 2015.

“Trans Energy” is defined in the Preamble.

“Transaction Documents” means this Agreement, the Escrow Agreement, the Surface Use Agreement and the Assignment.

“Transfer Taxes” means any sales, use, excise, transfer, registration, documentary, stamp or similar Taxes incurred or imposed with respect to the transactions described in this Agreement.

20

“Units” is defined in the definition of Assets.

“Unresolved Indemnification Claims” is defined in Section 2.4(d).

“Wellbore Capital Purchase Agreement” means that certain Purchase and Sale Agreement dated December 24, 2014 by and between ASD, Trans Energy and Wellbore Capital, LLC.

“Wells” means any of the oil or gas wells located on the Leases, including, without limitation, those Wells specifically identified in Schedule 3.4(b), and all condensate wells, water source wells, or water and other types of injection wells located on the Leases or used or held for use in connection with any of the Properties, whether producing, operating, shut-in or temporarily abandoned.

“Working Interest” means that interest which bears a share of all costs and expenses proportionate to the interest owned, associated with the exploration, development and operation of a Subject Well or Lease that the owner thereof is required to bear and pay by reason of such ownership, expressed as a decimal.

1.2 Construction.

(a) All Article, Section, Subsection, Schedule and Exhibit references used in this Agreement are to Articles, Sections, Subsections, Schedules, and Exhibits to this Agreement unless otherwise specified. The Exhibits and Schedules attached to this Agreement constitute a part of this Agreement and are incorporated herein for all purposes. The Table of Contents and Article and Section headings in this Agreement are inserted for convenience of reference only and shall not constitute a part hereof.

(b) If a term is defined as one part of speech (such as a noun), it shall have a corresponding meaning when used as another part of speech (such as a verb). Unless the context requires otherwise, all words used in this Agreement in the singular number shall extend to and include the plural, all words in the plural number shall extend to and include the singular. Unless the context of this Agreement clearly requires otherwise, words importing the masculine gender shall include the feminine and neutral genders and vice versa. The words “includes” or “including” mean “including without limitation,” the words “hereof,” “hereby,” “herein,” “hereunder,” and similar terms in this Agreement shall refer to this Agreement as a whole and not any particular Section or Article in which such words appear and any reference to a law shall include any amendment thereof or any successor thereto and any rules and regulations promulgated thereunder. Currency amounts referenced in this Agreement are in U.S. Dollars.

(c) Whenever this Agreement refers to a number of days, such number shall refer to calendar days unless Business Days are specified. Whenever any action must be taken hereunder on or by a day that is not a Business Day, then such action may be validly taken on or by the next day that is a Business Day.

(d) Each Party acknowledges that it and its attorneys have been given an equal opportunity to negotiate the terms and conditions of this Agreement and that any rule of construction to the effect that ambiguities are to be resolved against the drafting party or any similar rule operating against the drafter of an agreement shall not be applicable to the construction or interpretation of this Agreement.

21

ARTICLE II

PURCHASE AND SALE

2.1 Purchase and Sale.

(a) At the Closing, Sellers shall sell, assign, convey, transfer and deliver to Buyer, and Buyer shall purchase and accept from Sellers, all of Sellers’ right, title and interest in and to the Assets; provided, however, the Excluded Assets will not be conveyed or purchased hereunder, but will be excluded from this transaction.

(b) At the Closing, Buyer shall assume and become obligated to pay, perform, or otherwise discharge the Assumed Liabilities.

2.2 Purchase Price. The purchase price for the Assets will be ONE HUNDRED EIGHTY EIGHT MILLION FOUR HUNDRED SEVENTY SIX THOUSAND NINE HUNDRED FIFTY NINE DOLLARS ($188,476,959) (the “Base Purchase Price”), adjusted as provided in this Article II (the Base Purchase Price as so adjusted, being herein called the “Purchase Price”). The Purchase Price will be payable as follows:

(a) At Closing, the Purchase Price less the Escrow Amount (but excluding the amount of the Robinson Deposit) (the “Closing Payment”) shall be paid by Buyer to Sellers (or to Seller Representative on behalf of Seller) in cash by wire transfer of immediately available funds. Sellers will deliver to Buyer no later than two (2) Business Days prior to Closing written instructions to Buyer indicating the allocation of the Closing Payments among the Sellers and applicable wire transfer information; and

(b) the Additional Escrow Payment will be paid by Buyer to the Escrow Agent by wire transfer of immediately available funds and in accordance with Section 2.4 and the Escrow Agreement.

2.3 Deposit. As soon as reasonably possible after the Execution Date, but not later than two (2) Business Days after the Execution Date, Buyer shall deposit with Wells Fargo Bank, National Association, as Escrow Agent (“Escrow Agent”) by wire transfer of immediately available funds, an amount equal to $8,854,891.00 (the “Deposit”). In connection with the Deposit, Buyer, Seller Representative and Escrow Agent shall enter into an agreement substantially in the form attached hereto as Exhibit E (the “Escrow Agreement”). The Deposit shall be held by the Escrow Agent pursuant to the terms of this Agreement and the Escrow Agreement. If Closing occurs, the Deposit shall be reclassified as a partial satisfaction of the Escrow Amount, and the release of the Deposit shall be handled in accordance with the terms and conditions of this Section 2.3, Section 2.4 and the Escrow Agreement. If no Closing occurs, the release of the Deposit shall be handled in accordance with the terms and conditions of the provisions of Section 2.4 and Section 9.2 and the Escrow Agreement.

22

2.4 Escrow.

(a) At Closing, a portion of the Purchase Price equal to the Escrow Amount less the Deposit (the “Additional Escrow Payment”) shall be deposited by Buyer in immediately available funds to the Escrow Agent. The Escrow Amount shall thereafter be held in escrow and invested by the Escrow Agent pending disbursement pursuant to this Section 2.4, Article VIII and the terms of the Escrow Agreement. “Escrow Fund” means the aggregate amount of funds held by the Escrow Agent pursuant to this Section 2.4 and the Escrow Agreement other than the Robinson Escrow Fund, including, as of Closing, the Escrow Amount, as such amount may be adjusted from time to time by interest earned thereon and by any disbursements made in accordance with this Section 2.4, Article VIII and the Escrow Agreement. After the Closing, the Escrow Fund shall be used to satisfy obligations to the Buyer Parties under Article VIII.

(b) When any party becomes entitled to any distribution of all or any portion of the Escrow Fund pursuant to this Agreement and the Escrow Agreement, each of Buyer and Seller Representative (acting on behalf of Sellers) shall promptly execute a joint written instruction (“Joint Instructions”) setting forth amounts to be paid to such party from the Escrow Fund.

(c) Within five (5) Business Days following a Final Resolution that any Buyer Indemnified Party is entitled to any distribution of all or any portion of the Escrow Fund pursuant to its indemnification rights under Article VIII of this Agreement, Buyer and Seller Representative shall execute Joint Instructions to the Escrow Agent instructing the Escrow Agent to distribute all or a portion of the Escrow Fund, as applicable, to the appropriate Buyer Indemnified Party, in accordance with such Final Resolution. If Buyer or Seller Representative fails to execute Joint Instructions in accordance with this Agreement, either Buyer or Seller Representative, as applicable, shall be entitled to receive distributions from the Escrow Fund from the Escrow Agent promptly upon delivery to the Escrow Agent of a final written non-appealable instruction or Court Order (setting forth the amounts to be paid to such party pursuant to this Section 2.4 or Article VIII) issued or entered into by a court of competent jurisdiction.

(d) On the nine (9) month anniversary of the Closing Date, subject to any properly asserted Buyer Claims for indemnification under Article VIII that are not yet resolved or paid (such claims, the “Unresolved Indemnification Claims”), Buyer and Seller Representative shall execute Joint Instructions instructing the Escrow Agent to distribute to Seller Representative an amount from the Escrow Fund equal to the difference between, if positive: (i) the aggregate amount of funds in the Escrow Fund as of the nine (9) month anniversary of the Closing Date (less the Site Matter Escrow Amount for the Site Matters that have not been resolved in accordance with Section 7.11 by such date), minus (ii) the greater of: (A) 5% of the Purchase Price funded at Closing; or (B) the aggregate amount attributable to Unresolved Indemnification Claims as of the nine (9) month anniversary of the Closing Date.

23

(e) On the eighteen (18) month anniversary of the Closing Date, Buyer and Seller Representative shall execute Joint Instructions instructing the Escrow Agent to distribute the balance of the Escrow Fund to Seller Representative less (i) any amounts attributable to Unresolved Indemnification Claims and (ii) the Site Matter Escrow Amount for the Site Matters that have not been resolved in accordance with Section 7.11 by such date. Upon the Final Resolution of all Unresolved Indemnification Claims (if any), and after all disbursements from the Escrow Fund have been made to pay any and all such Unresolved Indemnification Claims pursuant to Section 2.4(c), Buyer and Seller Representative shall promptly execute Joint Instructions instructing the Escrow Agent to distribute the balance of the Escrow Fund to Sellers (less the Site Matter Escrow Amount for the Site Matters that have not been resolved in accordance with Section 7.11 by such date).

(f) On the third anniversary of the Closing Date, Buyer and Seller Representative shall execute Joint Instructions instructing the Escrow Agent to distribute to Buyer the remaining Site Matter Escrow Amount for the Site Matters that have not been resolved in accordance with Section 7.11 by such date.

(g) Notwithstanding anything in this Agreement to contrary, if at any time there is a Final Resolution that any Buyer Indemnified Party is entitled to recovery of a monetary amount pursuant to its indemnification rights under Article VIII of this Agreement, and if such monetary amount to which any Buyer Indemnified Party is entitled to recover is greater than the balance of the Escrow Fund at such time of determination, such Buyer Indemnified Party may recover from the Robinson Escrow Fund, to the extent of the Robinson Escrow Fund and to the extent such monetary amount exceeds the balance of the Escrow Fund, pursuant to Section 7.13(h) and the Robinson Escrow Agreement.