Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLUMBIA PROPERTY TRUST, INC. | cxp8-k201508presentation.htm |

1 AUGUST 2015 COMPANY PRESENTATION

2 FORWARD-LOOKING STATEMENTS Certain statements contained in this presentation other than historical facts may be considered forward-looking statements. Such statements include, in particular, statements about our plans, strategies, and prospects, and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this presentation, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward-looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered. See Item 1A in the Company's most recently filed Annual Report on Form 10-K for the year ended December 31, 2014, for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those presented in our forward-looking statements. The risk factors described in our Annual Report are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also harm our business. For additional information, including reconciliations of any non-GAAP financial measures found herein, please reference the supplemental report furnished by the Company on a Current Report on Form 8-K filed on July 30, 2015. The names, logos and related product and service names, design marks, and slogans are the trademarks or service marks of their respective companies. Unless otherwise noted, all data herein is as of June 30, 2015, and pro forma for the 11-Property Sale, which closed on July 1, 2015, and the acquisition of 229 W. 43rd Street, which closed on August 4, 2015.

3 PRESENTATION OVERVIEW • High-Barrier Focus • Portfolio Transformation • Proactive Operator • Strong and Flexible Balance Sheet 221 Main Street

4 HIGH-BARRIER FOCUS View of 333 Market Street, San Francisco

5 EXECUTING GROWTH STRATEGY Company formed in 2003; raised/invested over $5B Rated investment-grade by S&P and Moody’s Acquired Market Square in Washington, D.C. 2011 and Prior Listed shares on NYSE Expanded in San Francisco by acquiring 221 Main Street and 650 California Street Sold 23 noncore assets, reducing markets from 25 to 15 2013 - 2014 2012 Acquired 333 Market Street in San Francisco Sold nine-property portfolio, reducing markets from 30 to 26 Created dedicated management team 333 Market Street Expanded in target markets with purchase of 315 Park Ave. S. and 229 W. 43rd Street in New York and 116 Huntington Ave. in Boston Sold 11 suburban, noncore assets 2015 315 Park Ave. S.

6 REGIONAL MANAGEMENT PLATFORM San Francisco Western Region Management Office Washington, D.C. Eastern Region Management Office Atlanta Corporate Headquarters LEADERSHIP TEAM • Nelson Mills, CEO • Jim Fleming, CFO • Drew Cunningham, SVP – Real Estate Operations • Dave Dowdney, SVP – Western Region • Wendy Gill, SVP – Corporate Operations and CAO • Kevin Hoover, SVP – Real Estate Transactions

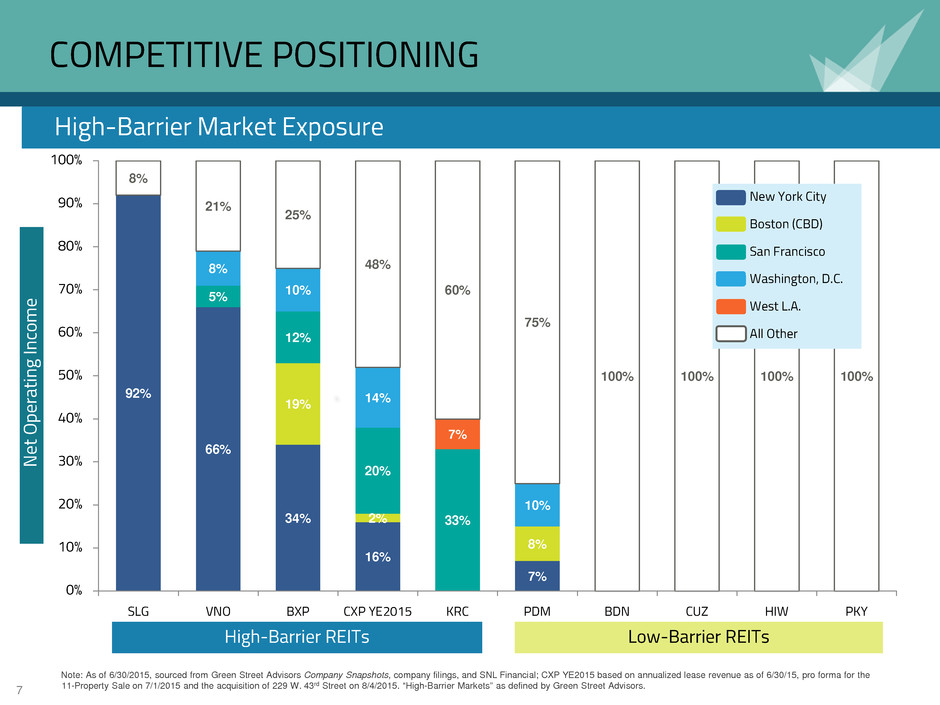

7 COMPETITIVE POSITIONING 92% 66% 34% 16% 7% 19% 2% 8% 5% 12% 20% 33% 8% 10% 14% 10% 7% 8% 21% 25% 48% 60% 75% 100% 100% 100% 100% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% SLG VNO BXP CXP YE2015 KRC PDM BDN CUZ HIW PKY New York City Boston (CBD) San Francisco Washington, D.C. West L.A. All Other Note: As of 6/30/2015, sourced from Green Street Advisors Company Snapshots, company filings, and SNL Financial; CXP YE2015 based on annualized lease revenue as of 6/30/15, pro forma for the 11-Property Sale on 7/1/2015 and the acquisition of 229 W. 43rd Street on 8/4/2015. “High-Barrier Markets” as defined by Green Street Advisors. High-Barrier Market Exposure High-Barrier REITs Low-Barrier REITs N et O pe ra tin g In co m e

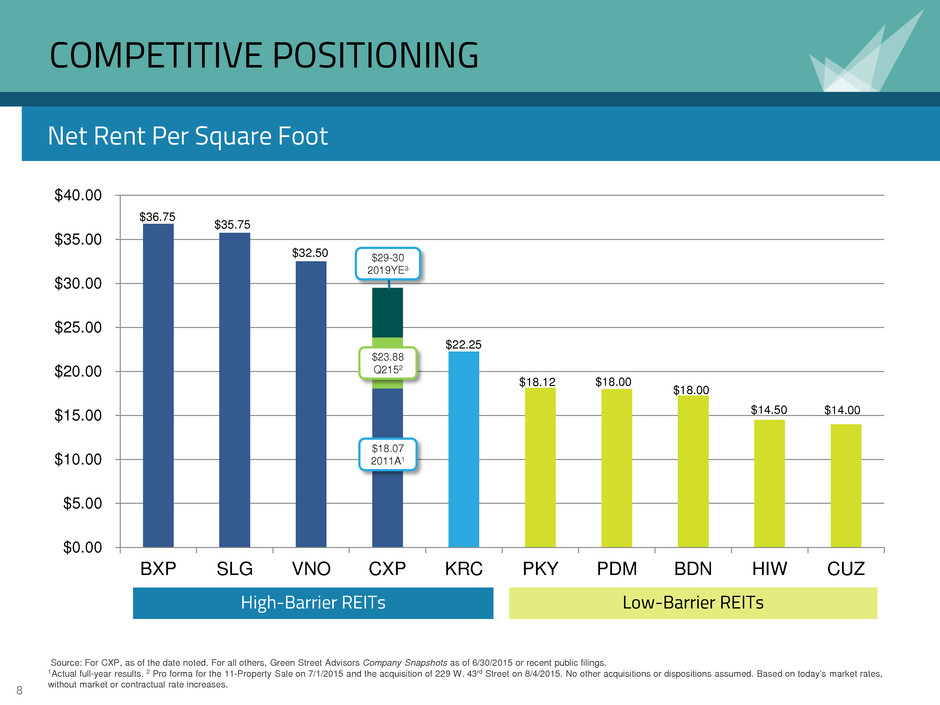

8 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 BXP SLG VNO CXP KRC PKY PDM BDN HIW CUZ COMPETITIVE POSITIONING High-Barrier REITs Low-Barrier REITs Net Rent Per Square Foot Source: For CXP, as of the date noted. For all others, Green Street Advisors Company Snapshots as of 6/30/2015 or recent public filings. 1Actual full-year results. 2 Pro forma for the 11-Property Sale on 7/1/2015 and the acquisition of 229 W. 43rd Street on 8/4/2015. No other acquisitions or dispositions assumed. Based on today’s market rates, without market or contractual rate increases. $36.75 $23.88 Q2152 $18.07 2011A1 $35.75 $32.50 $22.25 $18.12 $18.00 $18.00 $14.50 $14.00 $29-30 2019YE3

9 2015 OBJECTIVES • Dispositions − 14 assets identified; 11 completed and three remaining in process − Exclusively suburban and predominantly single-tenant • Leasing and Operations − Continue to proactively address upcoming expirations − Unlock value of recent acquisitions with higher rent spreads − Enhance assets’ competitive positioning through capital investment • Capital Markets − Extend maturities − Increase unsecured debt − Build flexibility • Investments − Opportunistic based on modest leverage and consistent with high-barrier market strategy 100 East Pratt

10 315 Park Avenue South, New York City PORTFOLIO TRANSFORMATION

11 PORTFOLIO TRANSFORMATION High-Barrier / CBD Markets • Concentration in markets with long-term demand growth and constrained supply • Capitalize on urbanization trends Highly Competitive Assets • Top-of-market physical and locational attributes • Primarily multi-tenanted, which positions us to benefit from improving leasing trends and tenant demand Embedded Growth • Value-add assets with near-term leasing and/or renovation opportunities • Stabilized assets that offer long-term appreciation Target Portfolio Profile 116 Huntington Avenue

12 PORTFOLIO TRANSFORMATION Dispositions 2015 Disposition Plan Accomplished 2015 YTD Sell 14 suburban and predominantly single- tenant properties 11 properties sold, remaining 3 in process Achieve $500M - $600M in proceeds $433M in proceeds Accomplished since Q4 2011 (total) 46 properties sold • Predominantly suburban and single- tenant assets • Exited 17 markets $1.8B in proceeds

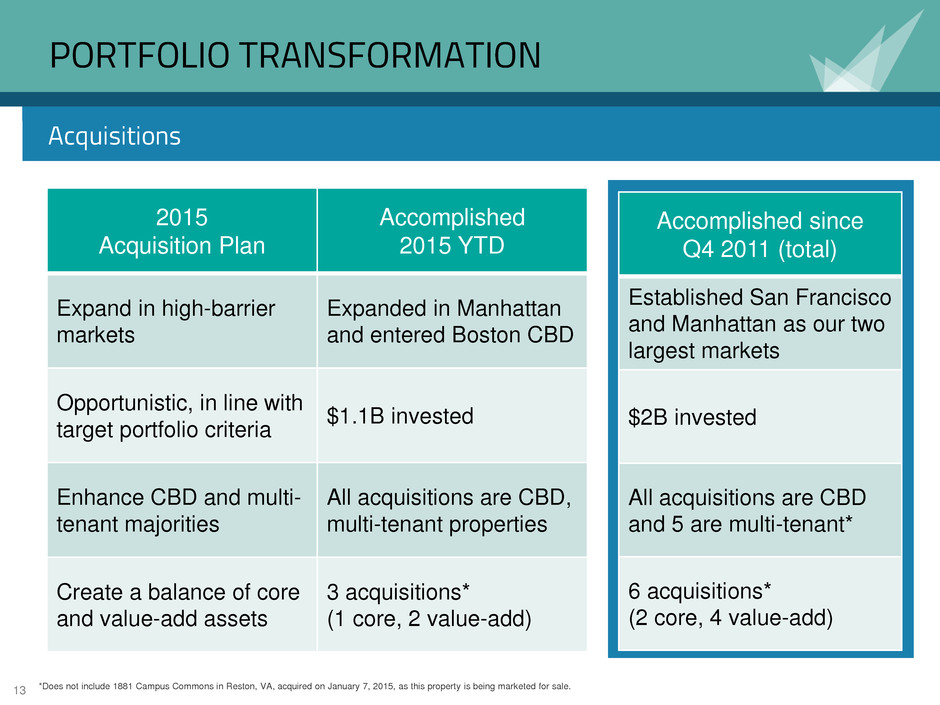

13 PORTFOLIO TRANSFORMATION Acquisitions 2015 Acquisition Plan Accomplished 2015 YTD Expand in high-barrier markets Expanded in Manhattan and entered Boston CBD Opportunistic, in line with target portfolio criteria $1.1B invested Enhance CBD and multi- tenant majorities All acquisitions are CBD, multi-tenant properties Create a balance of core and value-add assets 3 acquisitions* (1 core, 2 value-add) *Does not include 1881 Campus Commons in Reston, VA, acquired on January 7, 2015, as this property is being marketed for sale. Accomplished since Q4 2011 (total) Established San Francisco and Manhattan as our two largest markets $2B invested All acquisitions are CBD and 5 are multi-tenant* 6 acquisitions* (2 core, 4 value-add)

14 Acquired April 2014 RSF* 377,000 Year Built / Reno- vated 1974, 2011 Leased 97.3% ALR PSF $56.41 Major Tenants DocuSign, Prosper Marketplace 2014 ACQUISITIONS: San Francisco 221 MAIN STREET South Financial District 650 CALIFORNIA STREET North Financial District Acquired Sept. 2014 RSF 477,000 Year Built / Reno- vated 1964, 2007 and 2013 Leased 87.6% ALR PSF $51.76 Major Tenants Littler Mendelson, Credit Suisse *BOMA fully re-measured SF is 388,000.

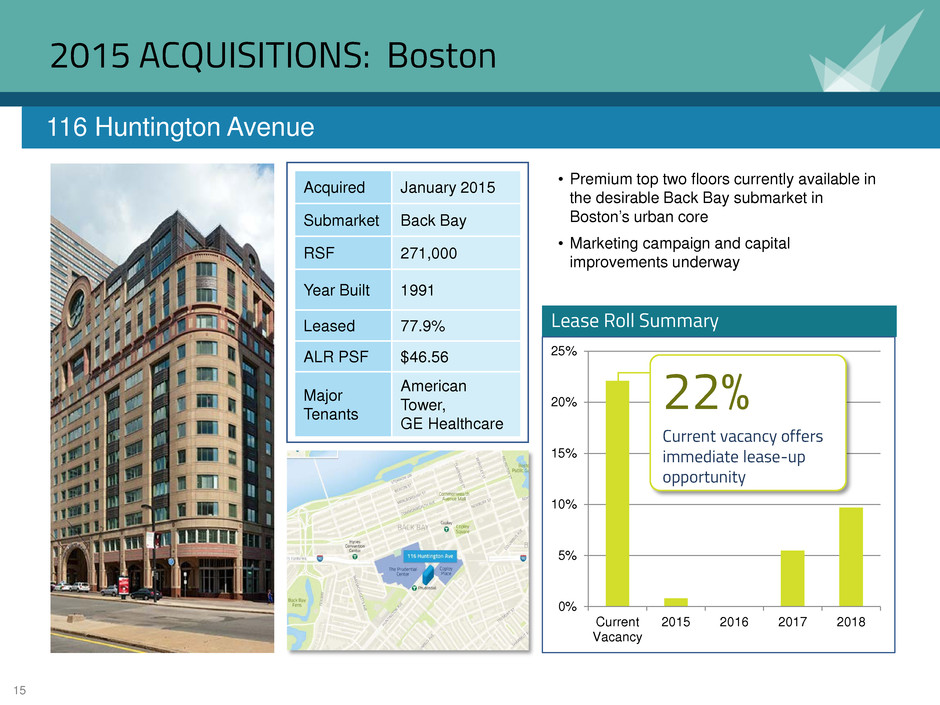

15 2015 ACQUISITIONS: Boston 116 Huntington Avenue Acquired January 2015 Submarket Back Bay RSF 271,000 Year Built 1991 Leased 77.9% ALR PSF $46.56 Major Tenants American Tower, GE Healthcare Lease Roll Summary 0% 5% 10% 15% 20% 25% Current Vacancy 2015 2016 2017 2018 22% Current vacancy offers immediate lease-up opportunity • Premium top two floors currently available in the desirable Back Bay submarket in Boston’s urban core • Marketing campaign and capital improvements underway

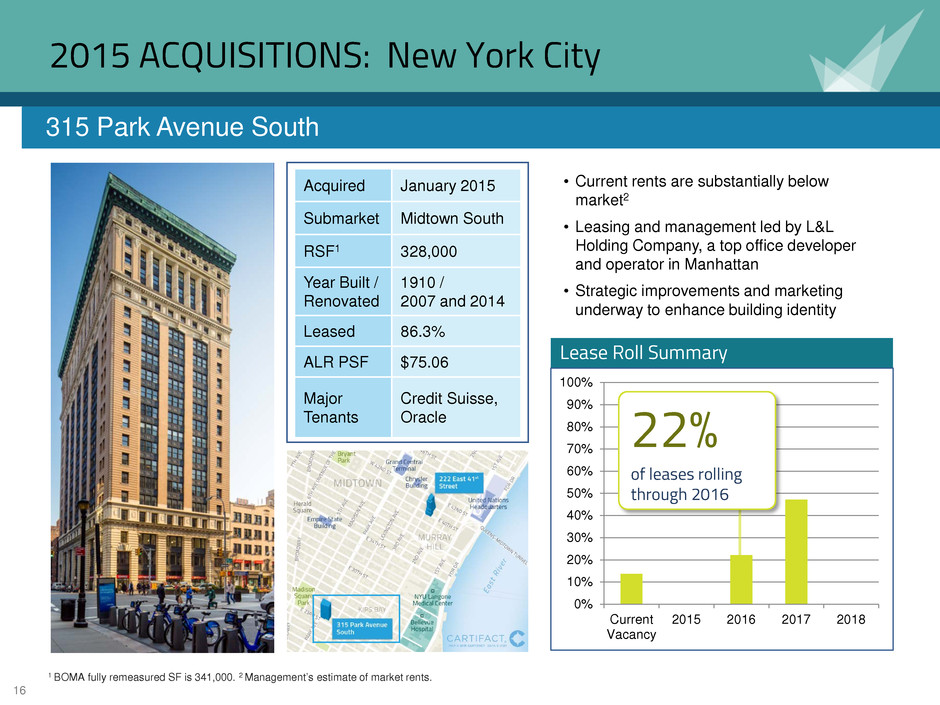

16 2015 ACQUISITIONS: New York City 315 Park Avenue South Acquired January 2015 Submarket Midtown South RSF1 328,000 Year Built / Renovated 1910 / 2007 and 2014 Leased 86.3% ALR PSF $75.06 Major Tenants Credit Suisse, Oracle • Current rents are substantially below market2 • Leasing and management led by L&L Holding Company, a top office developer and operator in Manhattan • Strategic improvements and marketing underway to enhance building identity Lease Roll Summary 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Current Vacancy 2015 2016 2017 2018 1 BOMA fully remeasured SF is 341,000. 2 Management’s estimate of market rents. 22% of leases rolling through 2016

17 Acquired August 2015 Submarket Times Square RSF 481,000 Year Built / Renovated 1912-1947 / 2011-2015 Leased 97.7% ALR PSF $68.09 Major Tenants Yahoo, Snapchat 2015 ACQUISITIONS: New York City 229 West 43rd Street (former New York Times Building)

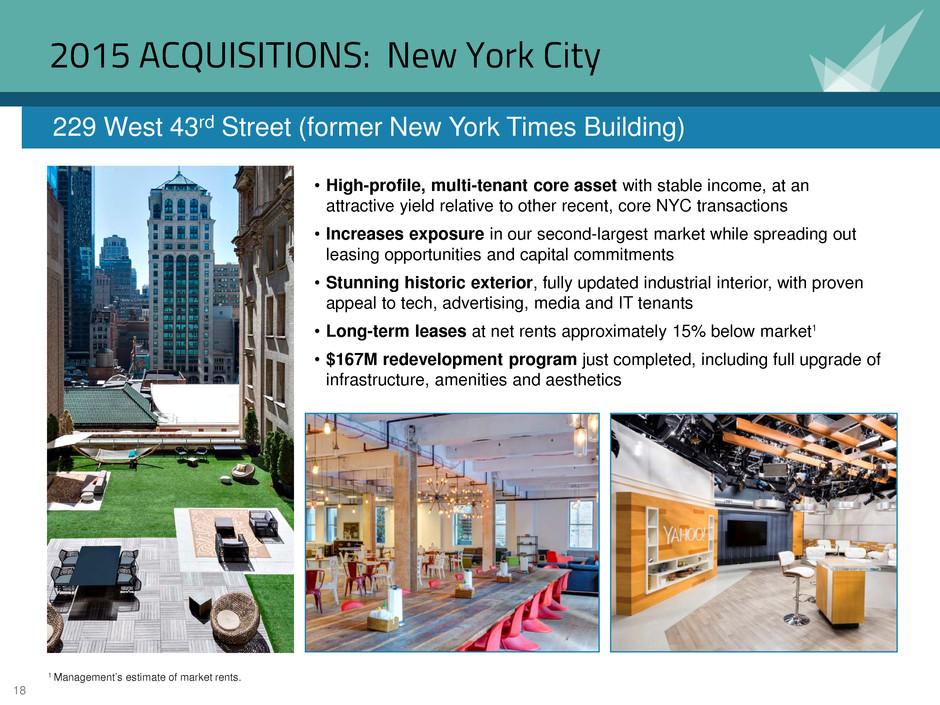

18 2015 ACQUISITIONS: New York City 229 West 43rd Street (former New York Times Building) 1 Management’s estimate of market rents. • High-profile, multi-tenant core asset with stable income, at an attractive yield relative to other recent, core NYC transactions • Increases exposure in our second-largest market while spreading out leasing opportunities and capital commitments • Stunning historic exterior, fully updated industrial interior, with proven appeal to tech, advertising, media and IT tenants • Long-term leases at net rents approximately 15% below market1 • $167M redevelopment program just completed, including full upgrade of infrastructure, amenities and aesthetics

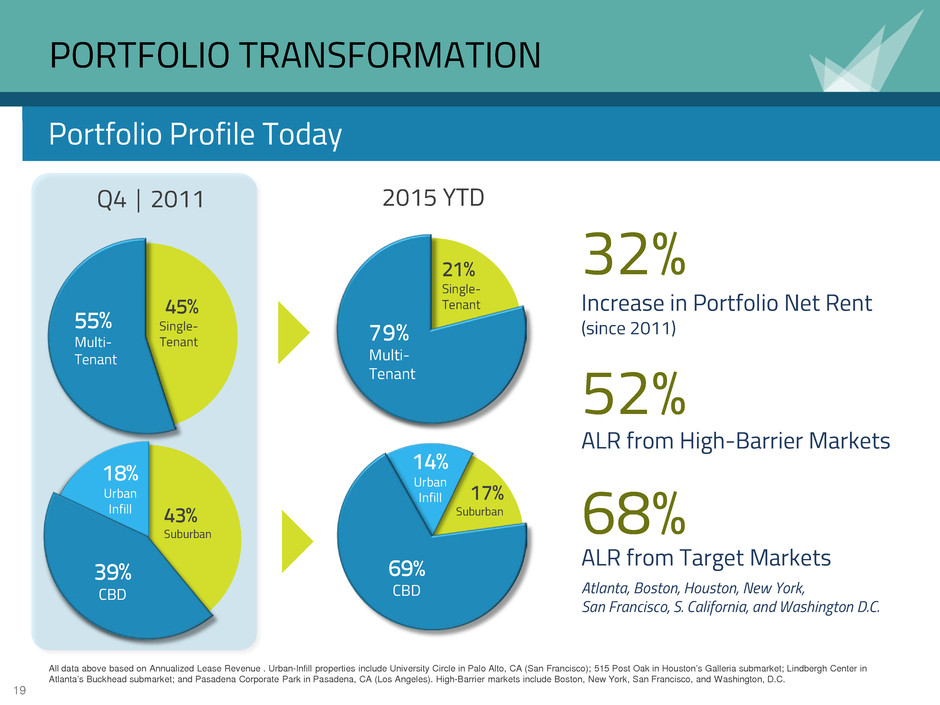

19 PORTFOLIO TRANSFORMATION Portfolio Profile Today All data above based on Annualized Lease Revenue . Urban-Infill properties include University Circle in Palo Alto, CA (San Francisco); 515 Post Oak in Houston’s Galleria submarket; Lindbergh Center in Atlanta’s Buckhead submarket; and Pasadena Corporate Park in Pasadena, CA (Los Angeles). High-Barrier markets include Boston, New York, San Francisco, and Washington, D.C. 45% Single- Tenant Q4 │ 2011 43% Suburban 21% Single- Tenant 2015 YTD 55% Multi- Tenant 39% CBD 18% Urban Infill 17% Suburban 79% Multi- Tenant 32% Increase in Portfolio Net Rent (since 2011) 52% ALR from High-Barrier Markets 68% ALR from Target Markets Atlanta, Boston, Houston, New York, San Francisco, S. California, and Washington D.C. 69% CBD 14% Urban Infill

20 PROACTIVE OPERATOR 221 Main Street, San Francisco

21 SUMMARY: KEY LEASING ACCOMPLISHMENTS 2011 to Present 8.5M+ SF of leasing since Q1 2011* Major Leases Signed Key Tower Cleveland KeyBank – 478K SF through 2030 BakerHostetler – 116K SF through 2031 80 Park Plaza Newark, NJ PSEG – 824K SF through 2030 Market Square D.C. Edison Electric – 79K SF through 2030 100 East Pratt Baltimore T. Rowe Price – 425K SF through 2027 Sterling Commerce Dallas CaremarkPCS – 208K SF through 2022 221 Main Street San Francisco DocuSign – 119K SF to 2024 68K SF with other tenants since acquisition University Circle Palo Alto, CA 264K+ SF since 2011 (includes Amazon Web Services – new 62K SF lease through 2021) 650 California Street San Francisco Textainer – 23K SF lease renewal through May 2027 315 Park Avenue South New York City Oracle – 17K SF through 2022 *Includes assets sold and/or positioned for sale.

22 KEY LEASING ACCOMPLISHMENTS ONE GLENLAKE Atlanta • Oracle New lease for 51K SF to 2023 • Comcast New lease for 26K SF to 2024 • McDonald’s New lease for 19K SF to 2022 Nearly half of the building is now leased out to 2022 and beyond 100 EAST PRATT Baltimore • T. Rowe Price Renewed in 425K SF (all of original space) and extended to 2027 Successfully competed with proposed build-to-suit to maintain anchor tenant, to keep property 98.8% leased 221 MAIN STREET San Francisco Brought occupancy to 97.3%, with leases averaging over 20% above underwriting • DocuSign Expanded from 35K to 119K SF and extended to 2024 • Prosper Marketplace New 48K SF lease through 2023 • Bright Horizons Renewed 14K SF through 2020

23 KEY LEASING ACCOMPLISHMENTS • KeyBank Retained 478K SF (71% of prior space) and extended to 2030 • Over half of give-back (116K SF) now leased to BakerHostetler, from 2016 to 2031 • PSEG Renewed 824K SF and extended to 2030 • Top five floors available for lease in Sept. 2015 KEY TOWER Cleveland Early renewal to retain anchor tenant through 2030 Rolled up rates on retained space, with lease-up opportunity on top five floors 80 PARK PLAZA Newark, NJ UNIVERSITY CIRCLE Palo Alto, CA (San Francisco) Returned to near 100% occupancy by capitalizing on tech demand • 273K SF total leasing since 2011 to replace departing tenants • Remodeled vacant spaces to reposition for more diverse tenancy • Rate roll-up on nearly all renewals/ extensions (avg. cash increase of 20%+ from prior rents)

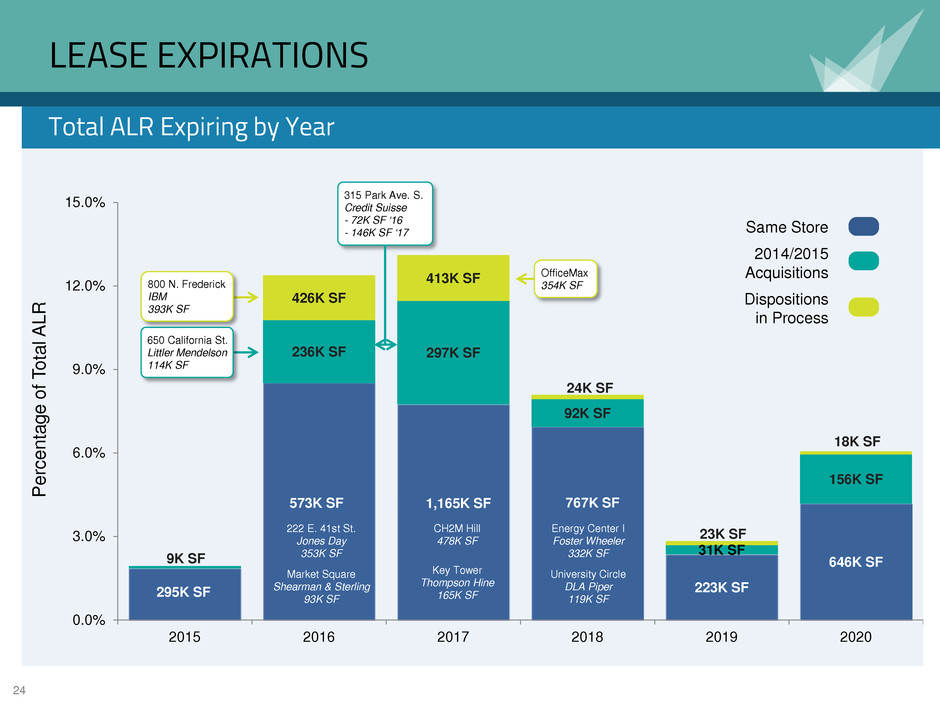

24 295K SF 573K SF 1,165K SF 767K SF 223K SF 646K SF 9K SF 236K SF 297K SF 92K SF 31K SF 156K SF 426K SF 413K SF 24K SF 23K SF 18K SF 0.0% 3.0% 6.0% 9.0% 12.0% 15.0% 2015 2016 2017 2018 2019 2020 CH2M Hill 478K SF Key Tower Thompson Hine 165K SF 222 E. 41st St. Jones Day 353K SF Market Square Shearman & Sterling 93K SF Energy Center I Foster Wheeler 332K SF University Circle DLA Piper 119K SF LEASE EXPIRATIONS OfficeMax 354K SF Total ALR Expiring by Year Same Store 2014/2015 Acquisitions Dispositions in Process 315 Park Ave. S. Credit Suisse - 72K SF ‘16 - 146K SF ‘17 650 California St. Littler Mendelson 114K SF P er ce nt ag e of T ot al A LR 800 N. Frederick IBM 393K SF

25 KEY LEASING OPPORTUNITIES Maximizing Rent Growth in a Strong Market 650 CALIFORNIA STREET San Francisco In-place leases at the 88%-leased building are approximately 40% below market.1 • Main lobby upgrades, new marketing center and spec suites in process, to position property as a top competitor in its class • Working to assemble a large block of space to meet market demand • Our first lease at the property—a 23K SF renewal with Textainer—was signed in April 2015, at a rate well above underwriting 33% rollover in first two years of ownership 1 Based on management’s estimate of market rents.

26 KEY LEASING OPPORTUNITIES 222 EAST 41ST STREET New York City MARKET SQUARE Washington, D.C. Early Positioning in Midtown / Grand Central • Jones Day’s 353K SF lease expires in October 2016 • Aggressively marketing this rare opportunity for the submarket – significant block of space in newer-construction building • New marketing suite completed and modest upgrades underway to entrance, lobby and amenities Proactively Leasing an Iconic Asset • Five leases executed to date, back-filling 25% of the 220K SF of law firm space expiring in 2015 and 2016 • Edison Electric renewed and extended through 2030 (79K SF) • Capital improvements in process, including upgrades to lobbies and other common areas 24th Floor Marketing Suite Columbia’s Eastern Region Office and Marketing Suite

27 SUMMARY: KEY LEASING OPPORTUNITIES Major Expirations 80 Park Plaza Newark, NJ PSEG – 136K SF in Sept. 2015 Market Square Washington, D.C. Fulbright – 127K SF in June 2015 (38% already leased) Shearman – 94K SF in March 2016 (7% already leased) 650 California Street San Francisco Littler Mendelson – 114K SF in March 2016 222 E. 41st Street New York City Jones Day – 353K SF in Oct. 2016 315 Park Avenue South New York City Credit Suisse – 40K SF in 2016, 146K SF in 2017 SanTan Corporate Center Phoenix Toyota – 133K SF in March 2017 CH2M (S. Jamaica Street) Denver CH2M – 478K SF in Sept. 2017 University Circle San Francisco DLA Piper – 119K SF in June 2018 Energy Center I Houston Foster Wheeler – 332K SF in Aug. 2018 2015 to 2018 One Glenlake Parkway

28 650 California Street, San Francisco STRONG AND FLEXIBLE BALANCE SHEET

29 CAPITAL PROFILE • Baa2 Stable / BBB Stable ratings • 39% Debt-to-Gross-Real-Estate- Assets • 29% Secured / 71% Unsecured • 5.99x Net Debt1 to Adjusted EBITDA2 (as of Q2 2015) • 4.03x Fixed-Charge Coverage Ratio (as of Q2 2015) • Large unencumbered asset pool of $4.4 billion (77% of total portfolio)3 Mortgage Debt Bonds Term Loans Line of Credit 38% 26% 35% 1% Conservative Leverage Diversified Debt Capital Sources Unless otherwise noted, data are as of June 30, 2015, and pro forma for the 11-Property Sale which closed on July 1, 2015; the payoff of $105M 100 E. Pratt mortgage note; paydown of revolving credit facility to $10M; recast of revolving credit facility and unsecured term loan on July 30, 2015; and acquisition of 229 W. 43rd Street on August 4, 2015. 1Net Debt is calculated as the total principal amount of debt outstanding, minus cash and cash equivalents and discounts on bonds payable. 2Q2 2015 adjusted EBITDA of $87.3M. 3Based on Gross Real Estate Assets. 4.87% 4.76% 2.00% L+100

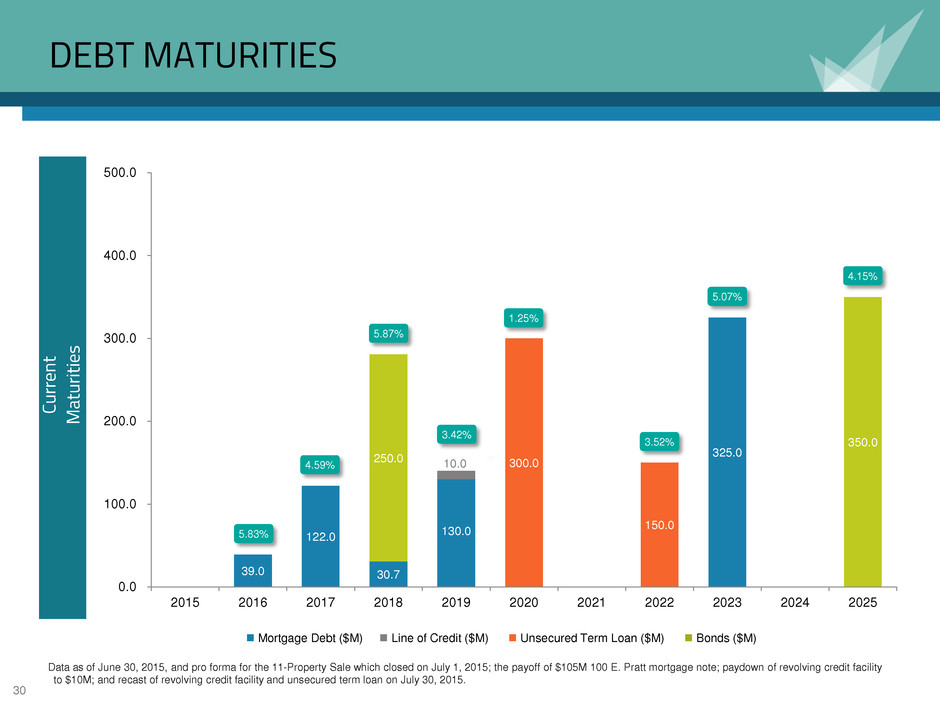

30 DEBT MATURITIES 39.0 122.0 30.7 130.0 325.0 10.0 300.0 150.0 250.0 350.0 0.0 100.0 200.0 300.0 400.0 500.0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Cu rr en t M at ur iti es Mortgage Debt ($M) Line of Credit ($M) Unsecured Term Loan ($M) Bonds ($M) Data as of June 30, 2015, and pro forma for the 11-Property Sale which closed on July 1, 2015; the payoff of $105M 100 E. Pratt mortgage note; paydown of revolving credit facility to $10M; and recast of revolving credit facility and unsecured term loan on July 30, 2015. 5.83% 4.59% 5.87% 3.42% 1.25% 3.52% 5.07% 4.15%

31 FOR MORE INFORMATION: Columbia Property Trust Investor Relations Tripp Sullivan, SCR Partners, LLC t 615-760-1104 e IR @ columbiapropertytrust.com 0050-CXPPRES1507 Market Square, Washington D.C.