Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SOUTHERN Co GAS | form8k.htm |

| EX-99.1 - JOINT PRESS RELEASE OF THE SOUTHERN COMPANY AND AGL RESOURCES INC. - SOUTHERN Co GAS | ex99-1.htm |

Exhibit 99.2

Southern Company to acquire AGL Resources August 24, 2015 Doing Energy Better

Cautionary Statement Regarding Forward-Looking Information 2 This communication contains forward-looking statements which are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements, among other things, concerning the expected benefits of the proposed transaction, such as efficiencies, growth potential, market profile, financial strength, and enhanced revenues and earnings per share, the potential financing of the transaction and the expected timing of the completion of the transaction. These forward-looking statements are often characterized by the use of words such as "expect," "anticipate," "plan," "believe," "may," "should,” "will," "could," "continue" and the negative or plural of these words and other comparable terminology. Although Southern Company and AGL Resources believe that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, including, but not limited to, factors and assumptions regarding the items outlined above. Actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from these expectations include, among other things, the following: the failure to receive, on a timely basis or otherwise, the required approvals by AGL Resources shareholders and government or regulatory agencies (including the terms of such approvals); the possibility that long-term financing for the transaction may not be put in place prior to the closing; the risk that a condition to closing of the merger or the committed financing may not be satisfied; the possibility that the anticipated benefits from the proposed merger cannot be fully realized or may take longer to realize than expected; the possibility that costs related to the integration of Southern Company and AGL Resources will be greater than expected; the credit ratings of the combined company or its subsidiaries may be different from what the parties expect; the ability to retain and hire key personnel and maintain relationships with customers, suppliers or other business partners; the diversion of management time on merger-related issues; the impact of legislative, regulatory and competitive changes; and other risk factors relating to the energy industry, as detailed from time to time in each of Southern Company’s and AGL Resources’ reports filed with the Securities and Exchange Commission (the “SEC”). There can be no assurance that the proposed transaction will in fact be consummated.Additional information about these factors and about the material factors or assumptions underlying such forward-looking statements may be found in the body of this presentation, as well as under Item 1.A. in each of Southern Company’s and AGL Resources’ Annual Reports on Form 10-K for the fiscal year ended December 31, 2014 and Item 1.A in each of Southern Company’s and AGL Resources’ most recent Quarterly Reports on Form 10-Q for the quarter ended June 30, 2015. Southern Company and AGL Resources caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on forward-looking statements to make decisions with respect to Southern Company and AGL Resources, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Southern Company or AGL Resources or any other person acting on their behalf are expressly qualified in their entirety by the cautionary statements referenced above. The forward-looking statements contained herein speak only as of the date of this presentation.Neither Southern Company nor AGL Resources undertakes any obligation to update or revise any forward-looking statement, except as may be required by law.

Additional Information 3 Additional Information and Where to Find ItAGL Resources expects to announce a shareholder meeting soon to obtain shareholder approval in connection with the proposed merger between AGL Resources and Southern Company. In connection with the shareholder meeting, AGL Resources expects to file with the SEC a proxy statement and other relevant documents in connection with the proposed merger. INVESTORS OF AGL Resources ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AGL RESOURCES, SOUTHERN COMPANY AND THE PROPOSED MERGER. Investors may obtain a free copy of these materials (when they are available) and other documents filed by AGL Resources with the SEC at the SEC’s website at www.sec.gov, at AGL Resources’ website at ir.aglr.com or by sending a written request to AGL Resources Inc., Attention: Investor Relations, P.O. Box 4569, Location 1071, Atlanta, Georgia 30302-4569. Security holders may also read and copy any reports, statements and other information filed by Southern Company and AGL Resources with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.Participants in the Merger Solicitation Southern Company, AGL Resources and certain of their respective directors, executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding Southern Company’s directors and executive officers is available in Southern Company’s proxy statement filed with the SEC on April 10, 2015 in connection with its 2015 annual meeting of stockholders, and information regarding AGL Resources’ directors and executive officers is available in AGL Resources’ proxy statement filed with the SEC on March 17, 2015 in connection with its 2015 annual meeting of shareholders. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Agenda Transaction OverviewStrategic RationaleAGL Resources Overview Combined Company Profile Q&A 4

Transaction Overview 5 *Southern Company to acquire AGL Resources for$66 per share in cash *A premium of 36.3% to AGL Resources shareholders based on the August 21, 2015 20-day volume-weighted average price *AGL Resources to become the 3rd largest operating subsidiary of Southern Company *Expect to issue debt and equity as a result of the transaction, with equity issuances through 2019 *Anticipated closing second half of 2016, subject to approvals

Transaction Overview – Major Approvals 6 *AGL Resources shareholder approval required *Hart-Scott-Rodino *Key state approvals required *Georgia Public Service Commission *Illinois Commerce Commission *New Jersey Board of Public Utilities *Maryland Public Service Commission *Virginia State Corporation Commission

Strategic Rationale *Advances customer-focused business model *Strengthens our mostly-regulated earnings profile *A broader platform for long-term success as end-use energy consumption evolves *Combined natural gas consumption supports expanded infrastructure opportunities Doing Energy Better Make Energy Better Move Energy Better So That Customers Can Use Energy Better 7

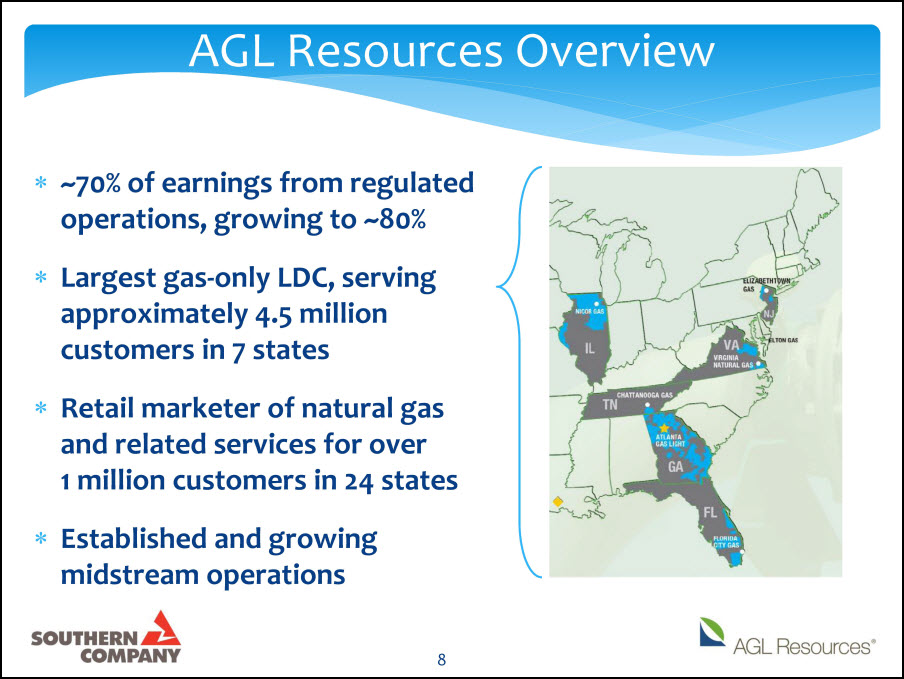

AGL Resources Overview *~70% of earnings from regulated operations, growing to ~80% *Largest gas-only LDC, serving approximately 4.5 million customers in 7 states *Retail marketer of natural gas and related services for over 1 million customers in 24 states *Established and growing midstream operations 8

AGL Resources Value Drivers 9 *95% of projected capital investments are for regulated utilities and pipelines *Minimal regulatory lag for LDC investments *Long-term contracts for pipeline investments *Constructive regulatory jurisdictions *Strong margin contribution from retail markets *Solid balance sheet

Combined Profile *Over 1,500 bcf per year of combined natural gas consumption and throughput volume *Over $50B of projected regulated rate base (largest in industry) *Approximately 9 million regulated utility customers in 9 states(2nd largest in industry) $50B $44B $43B SO SO DUK NEE + EXC + AEP+GAS HE POM D ETR NI SRE GAS ATO Retail Regulated Rate Base(2014 – company filings) Utility Customers 10 2.8 0.2 9.9 9.0 EXC + SO +POM GAS SRE DUK AEP NEE + SOHE GAS NI D ATO ETR $32B $28B $27B$22B $17B $7B $7B $5B $5B 1.3 4.5 8.2 7.8 (2014 in millions) 8.6 6.7 0.5 Electric Gas5.3 5.2 7.3 5.3 5.2 4.5 4.5 4.5 3.8 3.8 3.40.5 1.3 3.1 3.0 3.1 2.5 1.4

Combined Outlook 11 *Accretive to on-going EPS in the first full year *Expected long-term EPS growth of 4% to 5% *Supports a strong credit profile and preserves the ability to invest in additional value-accretive projects *Opportunity to raise dividend growth rate,subject to board approval *Priority: Deliver clean, safe, reliable and affordable energy

Summary 12 *Two leading corporate citizens combining to better serve customers, communities and shareholders *Creates an expanded platform that will allow us to succeed well into the future *Positions combined company to capture growth opportunities in natural gas infrastructure Doing Energy Better