Attached files

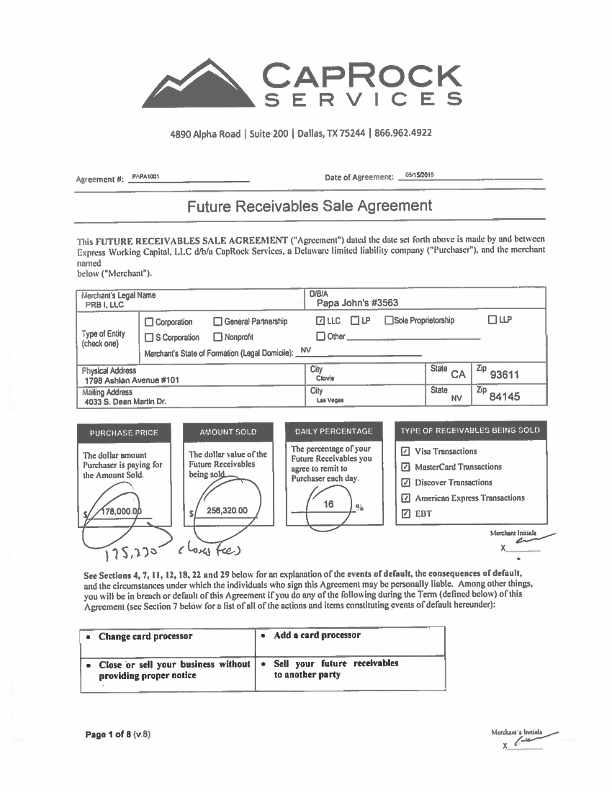

Exhibit 4.32

TERMS AND CONDITIONS

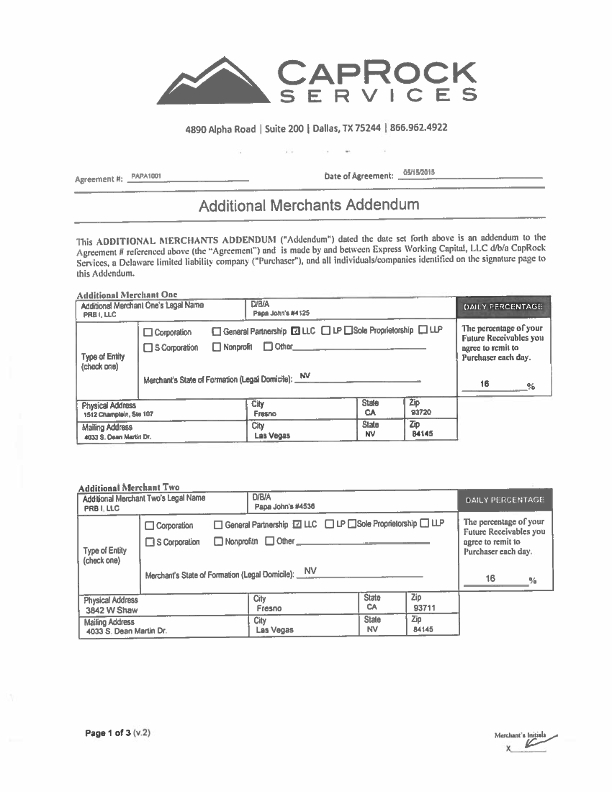

1. Sale. In consideration of the payment of the Purchase Price specified above, Purchaser purchases from merchant, and Merchant sell to Purchaser, the Amount Sold. In connection with such sale, Merchant agrees to remit to Purchaser the Daily Percentage of each of merchant's future accounts and contract rights arising from and relating to the payment of monies from the use by Merchant's customers of VISA, MasterCard, American Express, EBT and /or Discover credit cards, charge cards, debit cards and/or prepaid cards ("Future Receivables") to purchase Merchant's products and/or services in accordance with the terms of this agreement until the Amount Sold has been received by Purchaser, Purchaser purchases the Future Receivables free and clear of all claims, liens or encumbrances of any kind whatsoever. Merchant agrees that this Agreement applies to Merchant's entire right, title and interest in the Future Receivables up to the Amount Sold. The terms and conditions of this Agreement shall remain in full force and effect until the Amount Sold has been delivered to Purchaser subject to the terms of this Agreement. Merchant acknowledges Purchaser and Merchant may have entered into previous Future Receivables Sale Agreement ("Prior Agreements"). Furthermore, the Prior Agreements may have outstanding balances of the Amount Sold ("Prior Amount Sold") and an associated Purchase Price that purchased the Prior Amount Sold ("Prior Purchase Price") (If applicable, included in Exhibit A, attached hereto). Merchant acknowledges that any prior Purchase Price is included in the Purchase Price and any Prior Amount Sold is included in the Amount Sold. Merchant agrees that Merchant is only eligible to receive the Purchase Price less the Prior Purchase Price. Merchant and Purchaser agree that this sale and purchase is final and Merchant has no right to repurchase or resell the Future Receivables or any portion thereof, except as set forth in Section 6 below. Without limiting the generality of the preceding sentence, Purchaser shall have no obligation to refund or return the Amount Sold or any portion thereof to Merchant in the event a card issuer, card association, Merchant or other entity initiates a refund, credit, reversal or chargeback of a transaction subject to this Agreement. Merchant and Purchaser agree that the Purchase Price paid to Merchant is a purchase of the Future Receivables and is not intended to be, nor shall it be construed as, a loan from Purchaser to Merchant. Merchant understands, agrees and represents that this transaction is made for business or commercial purposes and that any account from which the Daily Percentage is forwarded to Purchaser is not maintained for personal, family or household purposes. Merchant shall permit purchaser to access all financial records of Merchant, including, but not limited to, all bank statements and credit card statements, that reflect the first 120 calendar days after the date of this Agreement ("120 Days"), for the purpose of comparing the Daily Percentage received to the total revenues received during the 120 days.

2. Term; Timing; Method of Payment; Processing Trial. The term of this Agreement is from the date Purchaser pays the Purchase Price or a portion thereof to Merchant until the date that the entire Amount Sold has been remitted to and received by Purchaser ("Term"). Merchant and Purchaser agree that Purchaser shall pay the Purchase Price or any portion thereof to Merchant only at a time, and through a method, acceptable to Purchaser and at Purchaser's sole discretion. Merchant and Purchaser also agree that Purchaser, in its sole discretion, may refuse to pay the Purchase Price, or any portion thereof, to merchant and cancel this Agreement at any time prior or the entire Purchase Price being paid by Purchaser to Merchant. After this Agreement has been signed by Merchant, Purchaser has the option, in its sole and absolute discretion, to instruct a card processor approved by Purchaser and utilized by Merchant("Processor") to conduct a process trial (the "Processing Trial") to determine whether the Daily Percentage will be correctly processed and/or reported by Processor to Purchaser. In the event Purchaser determines to conduct a Processing Trial, merchant acknowledges and agrees that Purchaser will make its final decision, in its sole and absolute discretion, whether to purchase the Future Receivables after completion of the Processing Trial. If Purchaser refuses to purchase the Future Receivables, Purchaser will return any receivables collected during the Processing Trial.

3. Waiver. Failure on the part of Purchaser to exercise, or delay in exercising, any right under this Agreement shall not constitute a waiver of such right, nor shall any single or partial exercise by Purchaser of any right under this Agreement preclude any other future exercise of any right. The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity.

4. Granting of Security Interest: Authorization to File Financing Statement.

A. Effective upon an event of default by Merchant under this Agreement, Merchant grants Purchaser a security interest in all of Merchant's present and future accounts, chattel paper, cash, deposit accounts, personal property, assets and fixtures, all licenses and permits, general intangibles, intellectual property, instruments, equipment, and inventory wherever located, and all proceeds and revenue now or hereafter owned or acquired by Merchant from any and all of the foregoing. Merchant hereby authorizes Purchaser to file a financing statement under the Uniform Commercial Code ("UCC") to evidence (i) the sale of the Future Receivables under this Agreement, and (ii) the security interest granted by Merchant under this Agreement. If Merchant files a bankruptcy petition, then Merchant agrees that the date of the event of default, as related to granting a security interest to Purchaser, shall occur on the date that Purchaser filed the financing statement as authorized herein.

B. The UCC filing shall state that the sale of the Future Receivables is intended to be a sale and not an assignment for security.

C. Merchant and Purchaser agree that the UCC filed by Purchaser shall be effective and apply to all subsequent future receivables sale agreements and the amounts advanced thereunder. Merchant further agrees that Purchaser shall not be required to file an amendment to or extension of the UCC initially filed, or a new UCC, relating to any subsequent future receivables sale agreements and amounts advanced thereunder to obtain the same rights granted under this provision.

D. It is the intent of the Merchant, Guarantor, and Purchaser for this Agreement to apply to subsequent advances , as it relates to the determination of the UCC filing date for the subsequent advances to the Merchant. The UCC filing date relating to the initial advance shall apply to any and all subsequent advances to merchant.

E. Purchaser reserves the right to obtain reimbursement from Merchant for all costs associated with the filing of any UCC financing statements, including a $95 charge for each UCC financing statement filed upon completion of paying the Amount Sold.

5. Non-Loan Advance. Because this is not a loan, Purchaser does not charge any interest, finance, points, late fees or similar fees (except as permitted by applicable law in connection with civil judgements). Purchaser is purchasing the Future Receivables at a discount. Because the transaction evidenced by this Agreement is not a loan, there are no scheduled payments and no fixed repayment term.

6. Right to Cancel. Merchant may cancel this transaction at any time prior to midnight on the fifth business day after Purchaser forwards the Purchase Price to Merchant. In order for such cancellation to be effective, Merchant must return the entire Purchase Price, including any prepaid Purchase Price, to Purchaser by midnight on the fifth business day after receipt of the Purchase price.

7. Merchant's Representations and Convenants; Events of Default. Events of Default. Merchant's breach of any of the following representations or covenants contained in this Section 7 shall constitute a "default" or an "event of default" under this Agreement:

A. As of the date of this Agreement, Merchant represents the following: (i) the Future Receivables are not subject to any claims, charges, liens, restrictions, encumbrances or security interests of any nature whatsoever, (ii) Merchant has not sold the Future Receivables to another party; (iii) Merchant is not currently a party to any other future receivables sales agreements or factoring agreements; (iv) Merchant has not declared bankruptcy or had an involuntary petition for bankruptcy brought against it; (v) Merchant is not contemplating the filing of a bankruptcy petition or closing Merchant's business (Merchant's filing for bankruptcy or closing its business within 90 days of the date of this Agreement shall constitute prima facie evidence that Merchant breached this provision), and Merchant does not anticipate that an involuntary petition for bankruptcy will be brought against it (an involuntary petition for bankruptcy being brought against Merchant within 90 days of the date of this Agreement shall constitute prima facie evidence that Merchant breached this provision); (vi) Merchant is not contemplating engaging in any transaction involving the sale of Merchant, either by an issuance, sale, or transfer of ownership interests in Merchant, that results in a change in ownership or voting control of Merchant, or the sale or transfer of substantially all of the assets of Merchant (Merchant selling its business or substantially all of the assets of the business within 90 days of the date of this Agreement shall constitute prima facie evidence that Merchant breached this provision), (vii) all information provided by Merchant to Purchaser in this Agreement, in Merchant's application, or otherwise in connection with this Agreement, and all of Merchant's financial statements, credit card processing statements, bank statements and other financial documents provided to Purchaser are true and correct and accurately reflect Merchant's financial condition and results of operations; (viii) Merchant possesses and is in compliance with all permits, licenses, approvals, consents and authorizations necessary to conduct its business; (ix) Merchant is in compliance with all of its material contracts, including, but not limited to, lease agreements, agreements for supply of alcoholic beverages, and/or agreements for supply of utilities; (x) Merchant owns all of the assets, inventory, and property located at the physical address listed on page 1 of this Agreement; (xi) Merchant and the person(s) signing this Agreement on behalf of Merchant have full power and authority to enter into and perform the obligations contained in this Agreement and this Agreement does not violate the terms of any other agreement to which Merchant is a party; and (xii) Merchant is not delinquent with any taxing authority as it relates to all business and sales taxes, including, but not limited to, income tax, sales tax, liquor/alcohol tax, franchise tax and employee related taxes, unless specifically disclosed in writing to Purchase prior to delivery of the Purchase Price. Any breach of the foregoing representations may constitute a separate cause of action for fraud or intentional misrepresentation by Merchant and/or Owner and/or Guarantor.

B. During the Term of this Agreement, Merchant agrees to the following covenants;(i) Merchant will not enter into any arrangement, agreement,or commitment that relates to or involves the Future Receivables, whether in the form of a sale or purchase of, a loan against, or the sale or purchase of credits against, the Future Receivables or future credit card sales with any person or entity other than Purchaser; (ii) Merchant will not conduct business under any name other than as disclosed herein; (iii) Merchant will not change its business location, business name, entity type, or state of formation without the prior written consent of Purchaser; (iv) Merchant will not suspend, dissolve, or close its business without providing Purchaser thirty (30) days' notice; (v) Merchant will not file for bankruptcy under any Title of the United States Bankruptcy Code without providing Purchaser one (1) days' notice; (vi) Merchant will not consent to an involuntary petition for bankruptcy being brought against it; (vii) Merchant will not change Processor or add any credit card processor(s) without the prior written consent of Purchaser; (viii) Merchant will not take any action or offer any incentive - economic or otherwise - to discourage the use of credit cards, debit cards or other payment cards for the purchase of Merchant's products and/or services; (ix) Merchant will not permit any event to occur that may have an adverse effect on the use, acceptance or authorization of credit cards, debit cards, or other payment cards for the purchase of Merchant's products and/or services; (x) Merchant will not permit any event to occur that could cause a diversion of any of Merchant's Future Receivables from Processor to any other entity; (xi) Merchant will not change its arrangements with Processor or amend its processing agreement with Processor in any way that is adverse to Purchaser, (xii) Merchant will not change its financial institution or bank account(s) (including the Lockbox Account (defined below), if applicable) without the prior written consent of Purchaser; (xiii) Merchant will batch out receipts with Processor a minimum of fifteen (15) days each month; (xiv) Merchant will not permit another person or company other than Purchaser, including, without limitation, a franchisor company (if Merchant is a franchisee), to assume or take over the operation and/or control of the Merchant's business or any of Merchant's business locations; (xv) Merchant will possess and maintain insurance in such amounts and against such risks as are necessary to protect its business and assets and shall show proof of such insurance upon demand by Purchaser; (xvi) Merchant will comply with all permits, licenses, approvals, consents and authorizations necessary to conduct its business (xvii)Merchant will pay its debts as they come due, including, but not limited to, rent, sales tax, employment tax, and liquor/alcohol tax; (xviii) Merchant will not breach or be in default under any of its material contracts, including, but not limited to, lease agreements, agreements for supply of alcoholic beverages, and agreements for supply of utilities; (xix) Merchant will not allow the lapse, suspension or forfeiture of any of Merchant's permits or licenses; (xx) Merchant will sign any and all documents that Purchaser, in its sole discretion, deems necessary to effectuate Merchant's obligations under this Agreement, including, but not limited to, a statement that this Agreement is unmodified and in full force and effect (or, if there have been modifications, that the same is in full force and effect as modified and stating the modifications; (xxi) Merchant will provide Purchaser with copies of all documents related to Merchant's card processing activity and financial and banking affairs (including bank statements, credit card processing statements and income statement) within two (2) business days of a request by Purchaser; (xxii) Merchant, Owner and Guarantor authorize Purchaser to obtain and receive information regarding the commercial lease for the physical location of Merchant's business from any applicable leasing company and/or agent, and will sign any and all documents that leasing company and/or agent deem necessary to provide information regarding the lease to Purchaser; (xxiii) Merchant will permit Purchaser and its agent to conduct a site inspection of Merchant's business, including an inspection of Merchant's credit card terminals, at any time without notice to Merchant; (xxiv) Merchant will not change any information associated with the Processing Portal (defined below), including, but not limited to, the user name and password, without Purchaser's prior written consent. In the event any information associate with the Processing Portal is changed, Merchant will provide Purchaser with the new information within two (2) business days. Purchaser and Merchant acknowledge and agree that Merchant going bankruptcy or out of business, in and of itself, does not constitute a breach of this Agreement.

8. Attorney in Fact. Merchant hereby makes, constitutes and appoints Purchaser (with full power of substitution) its true and lawful attorney in fact: (i) to execute and/or authenticate on Merchant's behalf and file financing statements under the UCC consistent with Section 7 and any other documents necessary or desirable to perfect or otherwise further the security interest granted herein; and (ii) to execute any third party agreements or assignments to grant Purchaser control over the collateral (to the extent control is necessary to perfect Purchaser's security interest in such collateral), including third party agreements between Merchant, Purchaser, and depository institutions, securities intermediaries, or other supporing obligations which third party agreements direct the third party to accept direction from Purchaser regarding the maintenance and disposition of the collateral and the products and proceeds thereof. It is understood and agreed that the foregoing power of attorney shall be deemed to be a power coupled with an interest which cannot be revoked until the termination of thisAgreement in accordance with the terms hereof.

9. Franchises. If Merchant is a Franchise, the Franchiseee must secure from Franchisor the acknowledgement of this sale of Future Receivables. Prior to Purchase rdelivering the Purchase Price to Merchant, Merchant must provide such acknowledgement in writing to Purchaser. Additionally, Merchant shall obtain a written agreeement from Franchisor to allow the outstanding balance of any Amount Sold to transfer to any successor of Merchant, including Franchisor, as it relates to Merchant's current franchise location(s).

10. Notice and Prior Consent. Merchant will not undertake any transaction involving the sale of Merchant, either by an issuance, sale, or transfer of ownership interests in Merchant, that results in a change in ownership or voting control of Merchant, or the sale or transfer of substantially all of the assets of Merchant without (i) providing notice to Purchaser as required by Section 19 of this Agreement, (ii) obtaining prior written consent of Purchaser, and (iii) including in any written agreement between merchant and any purchaser or transferee of Merchant's business and/or assets, that all of Merchant's obligations under this Agreement Are assumed by the purchaser or transferee of the Merchant. Merchant further agree to enter into a written agreement, as mentioned in (iii) above, satisfactory to Purchaser.

11. Authorization to Contact Financial Institutions. Merchant hereby authorizes Purchaser to contact any financial institution, bank, or credit card processor at which Merchant maintains an account or conducts business to verify any information provided by Merchant to Purchaser. If Merchant fails to remit payment of the Daily Percentage to Purchaser for more than five (5) consecutive calendar days, then Merchant is considered in default under this Agreement. In the event of such a default, Merchant grants Purchaser the right to notify such financial institutions, banks and credit card processors of such default.

12. Liquidated Damages for Breach of Covenants. In the event that Merchant breaches any of the covenants set forth in Section 7.B. of this Agreement, Merchant agrees that purchaser shall suffer $10,000.00 in liquidated damages and Merchant shall pay to Purchaser $10,000.00 for any such breach. Such liquidated damages; (i) shall be due and payable to Purchaser on demand; (ii) are in addition to all other damages Purchaser may seek under this Agreement, at law and/or in equity, including, but not limited to, recovery of the outstanding Amount Sold; and (iii) shall not be construed as a waiver of any breach or event of default under this Agreement, or otherwise reduce or limit Purchaser's rights and/or remedies provided under this Agreement, at law and/or in equity.

13. Daily Percentage.

A. Purchaser agrees to accept the remittance of the Daily Percentage in one of the following ways; (i) directly from Merchant's credit card processor; (ii) by debiting the Merchant's card processing deposit account; or (iii) by debiting a deposit account established by Merchant that is approved by Purchaser. Purchaser may decide from time to time, in its sole discretion, which one or more of the three methods it will accept for the remittance of the Daily Percentage.

B. If Purchaser agrees to accept the remittance of the Daily Percentage directly from the Merchant's card Processor, Merchant agrees to enter into an agreement with the Processor acceptable to Purchaser that authorizes Processor to pay the Daily Percentage directly to Purchaser rather than to Merchant until an Amount Sold has been forwarded by Processor to Purchaser. This authorization is irrevocable, absolute and unconditional. Merchant further acknowledges and agrees that Processor will be acting on behalf of Purchaser to collect the Daily Percentage. Merchant hereby irrevocably grants Processor the right to hold the Daily Percentage and to pay Purchaser directly ( at, before, or after the time Processor credits or remits to merchant the balance of the Future Receivable not sold by Merchant to Purchaser) until the entire Amount Sold has been forwarded to Purchaser, Merchant acknowledges and agrees that Processor may provide Purchaser with Merchant's credit card, debit card, and other payment card and instruments processing history, including, without limitation, Merchant's chargeback experience and any communications about Merchant received by Processor from a card processing system, as well as any other information Purchaser deems pertinent. Merchant understands that Purchaser does not have any power or authority to control Processor's actions with respect to the authorization, clearing, settlement and other processing of transactions, and that Purchaser is not responsible for Processor's actions. Merchant agrees to hold Purchaser harmless for Processor's actions and omissions.

C. If Purchaser agrees to accept remittance of the Daily Percentage by debiting Merchant's card processing deposit account, Merchant irrevocably authorizes Purchaser or its designated successor or assigned to withdraw a daily amount ("ACH Amount") by initiating a debit via the Automatic Clearing House ("ACH") system to Merchant's card processing deposit account (as listed in Merchant's application) or such other deposit account that merchant may instruct Purchaser to debit from time to time ("Bank Account"). Merchant will provide Purchaser with the user name, password, web site address, and any other necessary information required to electronically access Merchant's card processing portal ("Processing Portal"). By the twentieth (20th) of every month, provided Purchaser has access to Merchant's Processing Portal or Merchant has timely provided Merchant's prior month's processing statement. Merchant shall allow Purchaser to reconcile the prior monthly total of ACH Amounts withdraws ("Monthly Withdraws") with the prior month's Daily Percentage ("Actual Receivable Amount") ("True Up"). For clarification, if the Monthly withdraws are greater than the Actual Receivable Amount, Purchaser will owe Merchant the difference. Accordingly, if the Monthly Withdraws are less than the Actual Receivable Amount, Merchant will owe Purchaser the difference. Purchaser will provide Merchant with notice of every True Up. Purchaser may, at its sole discretion, pro-rate the True Up over a period of time not to exceed thirty one days by raising or lowering the ACH Amount accordingly. Merchant convenants to provide the prior month's credit card processing statement by the fifteenth (15th) of every month if a Processing Portal does not exist or Purchaser does not have access for any reason. Failure to timely provide the prior month's credit card processing statement permanently relieves Purchaser of its obligation to True Up that associated month. If Purchaser does not have access to the Processing Portal and Merchant does not timely provide the prior month's credit card processing statement, ten percent (10%) will be added to the Daily Percentage for the current month. Merchant covenants to not allow three (3) ACH Amounts to return unpaid or be rejected for any reason within thirty (30) days of each other. Merchant represents that the Bank Account is established for business or commercial purposes only and is not used for personal, family or household purposes. The attached, titled "ACH Addendum", further supplements this Agreement. Therefore, the ACH Addendum and all terms, obligations, representations, and covenants contained therein are incorporated into this Agreement.

D. If Purchaser agrees to accept the remittance of the Daily Percentage by debiting a deposit account established by Merchant that is approved by Purchaser ("Lockbox Account"), Merchant agrees to complete all necessary forms to establish the Lockbox Account, Merchant acknowledges and agrees that any funds deposited into the Lockbox Account by Merchant's processor will remain in the Lockbox Account until the Daily Percentage is withdrawn by Purchaser and then the remaining funds, minus any amount required to maintain the minimum balance for the Lockbox Account, will be forwarded to Merchant's Bank Account. If the Lockbox Account requires a minimum account balance, Purchaser may, in its sole discretion, fund the required minimum balance for the Lockbox Account out of the Purchase Price. All fees incurred in opening and maintaining the Lockbox Account shall be paid by Merchant. Upon Merchant's breach of or default under this Agreement, Merchant shall cause Processor and all other card processors utilized by Merchant to forward all proceeds from all credit and debit card transactions to the Lockbox Account and Merchant shall appoint Purchaser "Acting Agent" over the Lockbox Account. In connection with same, Merchant shall not be entitled to any of the funds in the Lockbox Account until a written request for a specified amount of the funds is provided to Purchaser and Purchaser, in its sole discretion, approves such written request. As Acting Agent, Purchaser has the full power and authority to direct the funds located in the Lockbox Account to be paid to Purchaser until the outstanding Amount Sold is remitted to and received by Purchaser.

14. Miscellaneous Service Fees. Merchant shall pay all fees for services relating to the origination and maintenance of all accounts under this Agreement. Merchant agrees to pay $495.00 out of the Purchase Price to cover the underwriting and origination costsassociated with the parties entering into this Agreement. If Merchant utilizes a Lockbox Account described in Section 13 of this Agreement, Merchant shall incur a one-time charge of $375 to be paid from the Purchase Price, which is in addition to the charge for the underwriting and origination fees. If applicable, fund transfers from the Lockbox Account to Merchant's operating bank account will be charged at $5.00 per month via ACH. Additional copies of any monthly statements provided to Merchant by Purchaser in connection with this Agreement will be available at a cose of $5.00 per page. Purchaser may increase any of the charges under this provision as it deems necessary in its sole discretion.

15. Telephone Monitoring, Recording and Contacts. To ensure that all merchants receive quality service, Purchaser may choose to monitor and/or record telephone calls with merchants and their employees or agents. These calls are monitored and/or recorded solely for evaluation by supervisors, training, monitoring for compliance purposes, and quality control. Merchant agrees that all calls between Purchaser and Merchant or a representative of merchant may be monitored and/or recorded for these purposes. Merchantfurther agrees that: (i) it has an established business relationship with Purchaser and may be contacted from time to time regarding transactions with Purchaser; (ii) such contacts are not considered unsolicited or inconvenient; and (iii) any such contact may be made by using any cellular or other phone number Merchant or its representative(s) provided to Purchase, any e-mail address(es) Merchant or its representative(s) provided to Purchaser, or an automated dialing and announcing or similar device, unless prohibited by law.

16. Miscellaneous. Merchant shall have no right to assign its interest hereunder without the p rior written consent of Purchaser. This Agreement shall be binding upon Merchant and its successors and permitted assigns and shall inure to the benefit of Purchaser and its successors and assigns. This Agreement shall not constitute a contract until fully executed by all parties hereto. This Agreement constitutes the entire agreement between the parties, and no representations, agreements, or understandings of any kind (other than the information contained in Merchant's application as referenced below), either written or oral, shall be binding upon the parties unless expressly contained herein. This Agreement is a complete and exhaustive statement of the terms of the parties' agreement, which may no be explained or supplemented by evidence of xonsistent additional terms or contradicted by evidence of any prior or contemporaneous agreement. This Agreement supersedes all prior agreements and understandings, whether oral or in writing, relating to the subject matter hereof unless otherwise specifically reaffirmed or restated herein. No modification of this Agreement shall be effective unless it is in writing and signed by each of the parties. If any provisions of this Agreement are found to be invalid, illegal or unenforceable in any respect, the remaining provisions shall not be affected in any manner. The parties agree to execute such further and additional documents, instruments, and writings as may be necessary, proper, required, desirable, or convenient for the purpose of fully effectuating the terms and provisions of this Agreement. The information submitted by Merchant as part of its application for this transaction is hereby incorporated into and made a part of this Agreement. The signatures to this Agreement may be evidenced by facsimile or PDF copies or other electronic means reflecting the parties' signature hereto, and any such copy or signature shall be enforceable as if it were an original signature.

17. Governing Law. Purchaser and Merchant agree that this Agreement is accepted and performed in Texas. This Agreement and all claims shall be governed by; and construed in accordance with, the laws of the State of Texas without regard to principles of conflicts of laws. All litigation, suits, court proceedings and other actions relating to , arising out of, or in connection with the Agreement, whether founded in contract, tort or otherwise, shall be submitted to the in personam jurisdiction of the state courts of Texas, and the exclusive venue for all such suits, proceedings and other actions shall be in Dallas County, Texas. No action may be brought in any other state or jurisdiction. Merchant and Purchaser hereby waive any claim against or objection to the in personam jurisdiction and venue of the state courts of Dalls County, Texas. Purchaser and Merchant hereby irrevocably waive any objection and any right of immunity on the ground of venue or the convenience of the forum, to the jurisdiction of such courts, and from the execution of judgements resulting therefrom. ALL PARTIES TO THIS AGREEMENT HEREBY WAIVE TRIAL BY JURY IN ANY ACTION, PROCEEDING, SUIT, COUNTERCLAIM, CROSS-CLAIM, OR THIRD-PARTY CLAIM BROUGHT BY ANY OF THE PARTIES HERETO ON ANY MATTERS WHATSOEVER ARISING OUT OF OR IN ANY WAY RELATED TO OR CONNECTED WITH THIS AGREEMENT. This Section shall survive any termination or transfer of this Agreement.

18. Remedies; Self-Help. In the event Merchant breaches, or defaults under, any of the provisions of this Agreement, including, but not limited to, the representations and covenants made in Section 7, the entire outstanding Amount Sold plus any liquidated damages shall become immediately due and payable by Merchant to Purchaser, and Purchaser shall be entitled to all remedies available under law and in equity. In the event of a breach or default by Merchant, Merchant further agrees that Purchaser may automatically debit from any of Merchant's bank accounts, via the ACII or otherwise, all or any portion of the outstanding Amount Sold plus any liquidated damages or may instruct Processor to forward to Purchaser, without any prior notice to merchant, all or any portion of the outstanding Amount Sold plus any liquidated damages. In addition to the foregoing, in the event Merchant breaches any of the provisions of this Agreement or is in default under this Agreement, Purchaser shall have the right, without notice to Merchant, to enter upon the premises of any or all of Merchant's business locations and take over the operation and/or control of Merchant's business, take all actions necessary to ensure that Processor is the only credit card and debit card processor utilized by Merchant's business, and direct all of the proceeds from the operations of Merchant's business to Purchaser until the outstanding Amount Sold plus any liquidated damages are remitted to and received by Purchaser, with any and all out of pocket expenses incurred by Purchaser in connection with such operation being charged back to merchant. By entering into this Agreement, Merchant hereby consents to such take over and/or control by Purchaser upon a breach of or default by merchant, and appoints Purchaser as its agent and attorney-in-fact with full authority to take any action and execute any instrument or document Purchaser deems necessary until the outstanding Amount Sold plus any liquidated damages is remitted to and received by Purchaser. Upon notice by Purchaser of Merchant's breach or default under this Agreement, Merchant agrees to enter into an assignment of lease acceptable to Purchaser and Merchant's landlord, and all other necessary documentation, in order to transfer Merchant's rights under its lease to Purchaser. Merchant further agrees that Purchaser may enter into an agreement with Merchant's landlord giving Purchaser the right to assign Merchant's lease to another merchant capable of operating a business comparable to Merchant's at such premises. If Merchant breaches covenant Section 7 (B)(i), Purchaser, at its sole discretion, may increase the Daily Percentage by a maximum of ten percent (10%) above the agreed upon Daily Percentage.

19. Required Notifications. Merchant, Owner and Guarantor are required to give Purchaser 24 hours' written notice prior to Merchant, Owner or Guarantor filing for bankruptcy relief under any Title of the United States Bankruptcy Code. Merchant is required to give Purchaser written notice thirty days prior to Merchant suspending, dissolving or closing its business. Merchant is required to give Purchaser written notice thirty days prior to Merchant completing a transaction involving the sale of Merchant, either by an issuance, sale, or transfer of ownership interests in Merchant that results in a change in ownership or voting control of Merchant, or the sale or transfer of substantially all of the assets of Merchant.

20. Reliance on Information. Merchant acknowledges and agrees that all information (financial and other) provided by or on behalf of Merchant has been relied upon by Purchaser in connection with its decision to purchase the Amount Sold of Future Receivables from Merchant.

21. Terminated Merchant File and Match File. Merchant expressly acknowledges that a Terminated Merchant File ("TMF"), or any successor thereto, is maintained by MasterCard and/or VISA containing the business name and names and identification of principals of merchants that have been terminated for one or more of the reasons specified in the MasterCard and/or VISA operating regulations. Such reasons include, but are not limited to, fraud, counterfeit drafts, unauthorized transactions, excessive charge-backs and retrieval requests, money laundering, or where a high security risk exists. MERCHANT ACKNOWLEDGES THAT PROCESSOR AND PURCHASER ARE REQUIRED TO REPORT THE BUSINESS NAME OF THE MERCHANT AND THE NAMES AND IDENTIFICATION OF ITS PRINCIPALS TO THE TMF WHEN A MERCHANT IS TERMINATED FOR ONE OR MORE OF THE REASONS SPECIFIED IN THE MASTERCARD AND/OR VISA OPERATING REGULATIONS, MERCHANT EXPRESSLY AGREES AND CONSENTS TO SUCH REPORTING BY PROCESSOR AND PURCHASER, AND RELEASES EACH FROM ANY LIABILITY AND DAMAGES FOR DOING SO IN GOOD FAITH.

22. Attorney's Fees and Costs. In the event of a default by Merchant, Purchaser shall be entitled to recover from Merchant all costs of collection. For the purpose of this Section "costs of collection" shall include the costs, including attorney's fees and court costs, associated with defending, protecting or enforcing Purchaser's rights under this Agreement, including the exercise of Purchaser's rights pursuant to Section 18 of this Agreement and in any bankruptcy proceeding. If Merchant files an action against Purchaser and the matter is dismissed or Purchaser prevails in the matter, Merchant agrees to pay all of Purchaser's attorney's fees and costs incurred in the matter, whether in court or arbitration. Any payments under an indemnity claim pursuant to Section 26 of this Agreement shall include all the foregoing costs and expenses, as well as interest on thereon at the rate of 1.5% per month from the date the obligation is due to the Purchaser.

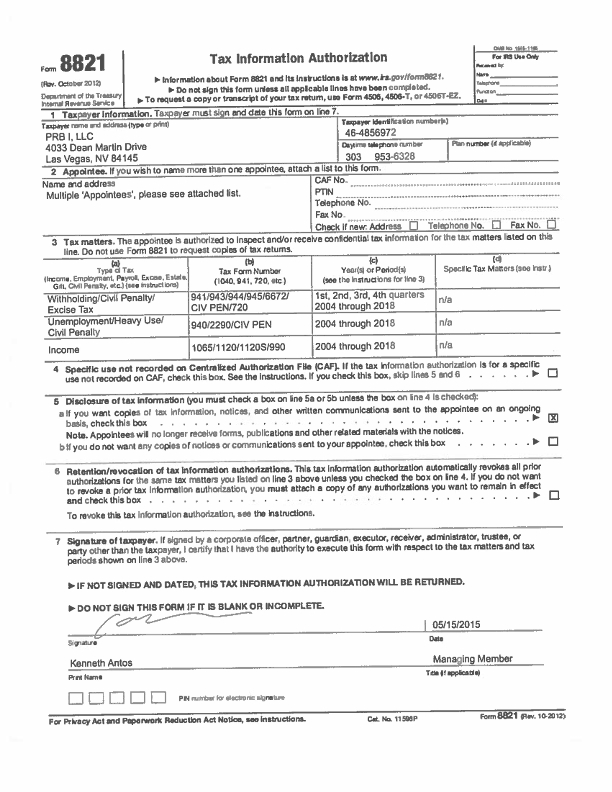

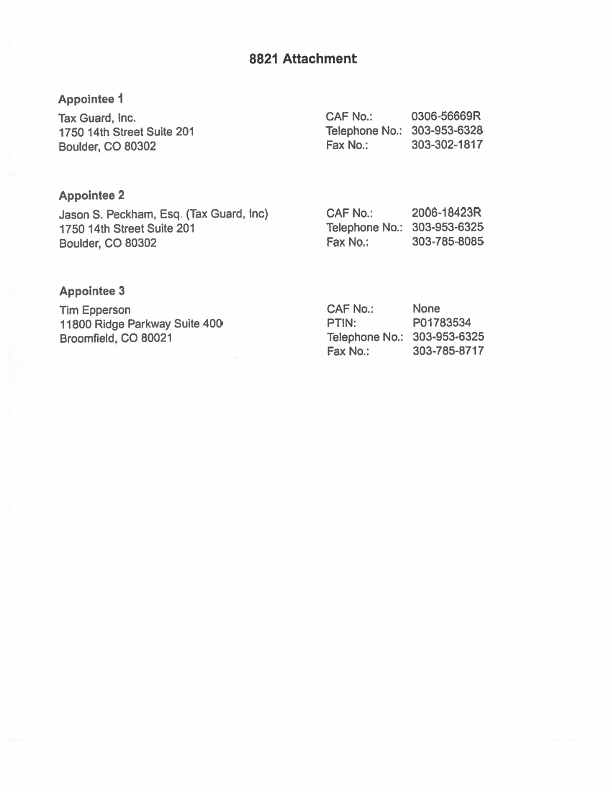

23. Reporting. Merchant and Guarantors (defined below) understand that Purchaser will obtain a credit report on Merchant, Guarantors and any individual who signs this Agreement. The report Purchaser obtains may include, but is not limited to, the Merchant's Guarantors' and individuals' credit history or similar characteristics, employment and education verifications, social security verification, criminal and civil case history, Department of Motor Vehicle records, any other public records, and any other information bearing on credit standing or credit capacity.

24. Publicity. Merchant, Guarantors and any individual who signs this Agreement authorizes Purchaser to use its, his or her name in a listing of clients and in advertising and marketing materials.

25. Facsimile and PDF Acceptance. Facsimile and PDF signatures shall be deemed acceptable for all purposes.

26. Indemnification. Merchant and Guarantor hereby agree to indemnify and hold Purchaser and its assigns, directors, managers, officers, members, employees, agents, affiliates, successors, direct and indirect subsidiaries, and direct and indirect parent entities harmless against any claimed demand, right, damage, liability, debt, account, action, cause of action, cost, or expense (including attorney's fees and costs actually incurred) arising out of or in any way connected with the defense of any breach of this Agreement by Merchant and/or Guarantor.

27. Consent to Participation. Merchant agrees and consents to Purchaser's sale or transfer, whether now or later, of one or more participation interests in the Amount Sold to one or more purchasers, whether related or unrelated to Purchaser. Purchaser may provide, without any limitation whatsoever, to one or more purchasers, or potential purchasers, any information or knowledge Purchaser may have about Merchant or about any other matter relating to the Amount Sold, and Merchant hereby consents to such disclosure. Merchant waives any and all notices of sale of participation interests, as well as all notices of any repurchase of such participation interests. Merchant agrees that the purchasers of any such participation interests will be considered third party beneficiaries and the absolute owners of such interests in the Amount Sold and will have all the rights granted under the participation agreement or agreements governing the sale of such participation interests. Merchant unconditionally agrees that either Purchaser or such purchaser may enforce Merchant's obligation under this Agreement irrespective of the failure or insolvency of any holder of any interest in the Amount Sold. Merchant further agrees that the purchaser of any such participation interests may enforce its interests irrespective of any personal claims or defenses that Merchant may have against Purchaser.

Free Will; Opportunity to Consult with Counsel. Each party hereto represents and warrants that he/she/it is executing this Agreement on his/her/its own free will and that he/she/it is not doing so as the result of any duress or coercion. Each party represents and warrants that the party (i) has read this Agreement, (ii) understands and agrees to be fully bound by its terms, (iii) has had the opportunity to consult with counsel, and (iv) executes this Agreement voluntarily with full knowledge of its legal significance.

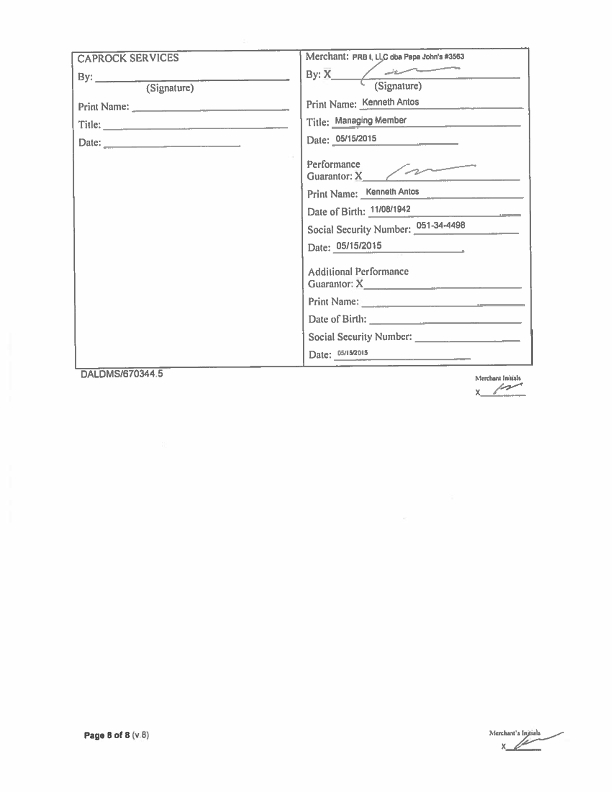

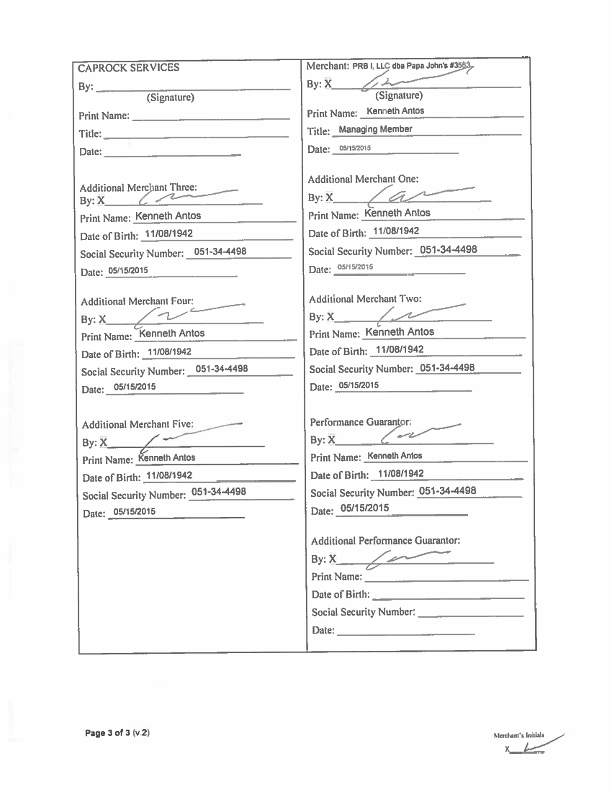

29. Performance Guarantor(s). In the Event Merchant breaches this Agreement in any manner, each Guarantor listed on the signature page of this Agreement is fully liable to Purchaser for the entire Amount Sold plus any liquidated damages and permitted fees and costs under this Agreement less the amount received by Purchaser from the Daily Percentage. Each Guarantor hereby assumes and, jointly and severally, guarantees the obligations of Merchant arising under this Agreement. This guarantee is binding upon each Guarantor and the Guarantor's heirs, legal representatives, successors and assigns. Each Guarantor hereby authorizes inquiry into the Guarantor's personal financial information, including, but not limited to, banking relationships, references given, consumer reports and credit bureaus, and criminal and civil matters. Without limiting the generality of the preceding sentence, each Guarantor hereby authorizes Purchaser to obtain consumer and/or investigative reports from one or more consumer reporting agencies about Guarantor. The Guarantors to this Agreement are hereby notified that a negative credit report reflecting on his/her credit record may be submitted to a credit reporting agency if the terms of this Agreement are breached. Each Guarantor acknowledges receiving a copy of this Agreement and having read the terms of this Agreement, including, without limitation, the guarantee set forth in this Section, and the Guarantor's signature below shall serve as confirmation that the Guarantor has read, understands and agrees to be bound by all terms and conditions contained in this Agreement.

(Signature page follows)