Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Pangaea Logistics Solutions Ltd. | form8-kinvestorpresentatio.htm |

Introductory Presentation August 2015

Safe Harbor This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

• Management owns ~50% outstanding equity • No competing interests or businesses • No related-party transactions • Deep transparency Aligned Interests & Transparency • Value-added backhaul specialization • Dominance in ice-class 1A dry bulk segment • Embedded, loyal customer base • “Asset-right” strategy • Operating income grew 26% to $16.9 million during the first half of 2015 • Net income increased 67% during the first half of 2015 to $13.1 million • Operating cash flow rose 31% for the first half of 2015 to $12.8 million • Continued demand-driven expansion: 7% CAGR for voyage days (‘11-’14) • Carriage of over 20.8m DWT of cargo to more than 200 ports (2014) • Meaningful new contracting activity throughout 2015 • Signed 3-5 year COA using ice-class vessels - $135mm in potential revenue • Global provider of comprehensive maritime logistics solutions • 19 years of continuous market leadership • JVs with world-class companies • Positioned for sustainable growth in a multitude of rate environments Investment Highlights: Pangaea Logistics Solutions Ltd. (“Pangaea”) Strong Performance vs. Industry Proven Industry Leader Robust Demand for Services Defensible Pillars of Profitability

A Global Leader in Maritime Logistics • A preferred partner: - Selected by customers to transport mission-critical cargos - Favored counterparty for banks & stressed owners - Adviser to the European Commission on Arctic maritime issues • An innovator: - Designer of value-creating solutions in ports & operations - Early implementer of engine efficiency & vessel maintenance enhancements - Pioneer of the Northern Sea Route and modern Northwest Passage • A recognized leader: - Leading backhaul operator in North America - Leading hard ice route operator globally - Carriage of over 20.8m DWT of cargo in 2014 to more than 200 ports - Joint venture owner & operator of Nordic Odyssey – 2013 “Ship of the Year” - Operates fleet of 45-60 handy, handymax, supramax, and panamax vessels

Diversified, Blue-Chip Client Base • Our clients are world-class, diversified, & loyal - Repeat clients (≥3 years in the past 4) are 54% of our shipping days - Our top 10 clients represent 41% of our revenue during 2014 - No cargo accounts for more than 16% of our traffic for 2014

Defensible Pillars of Profitability • Unique approach & execution specialization: - Material cost savings & enhanced profit through granular operating knowledge - Secured & defended by 200+ years of expertise & embedded relationships • Backhaul specialization: - Generating profit from a cost center - Secured & defended by reputation, long-term contracts & repeat customers - High level of owned fleet utilization – minimal days without revenue - Minimal ballast time • Ice-class specialization: - Capturing profit from limited supply of tonnage & lower costs - Secured & defended by technical expertise & ownership of specialized fleet - Own & operate a significant portion of the world’s 1A ice-class dry tonnage • Broader logistics solutions: - Design & implement loading & discharge efficiencies in critical ports - Expand markets & improve business terms for customers

Backhaul Specialization: A Source of Profitability & Stability • Deep client relationships & proven reputation drive our backhaul practice: - Majority of backhaul days are for repeat, longstanding customers and tied to Contracts of Affreigthment (“COAs”) - ~30% of backhaul days derived from new routes we developed with customers - Backhaul business is secured on expertise, not price • High-quality, long-term COAs provide visibility: - Over 20 COAs with a weighted average life of 2.5-3.0 years • 10-year CoA for bauxite from Caribbean to US • 6-year CoA for limestone from Canada to Brazil • 3-5 year CoA for iron ore from Canada to Europe • 3-5 year CoA for alumina from Brazil to Canada • 2-3 year CoA for cement clinker from China to Brazil • 1-2 year CoA for pig iron from Brazil to US • 1-year CoA for dolomite from Canada to Venezuela

Backhaul Specialization: Generating Profit from a Cost Center Europe Brazil Canada Fronthaul Trip Revenue ($17/t) Positioning Revenue 870,000 430,000 Bunkers & Port Costs Vessel Hire (35 days) (340,000) (350,000) Voyage Result 610,000 Typical Operator: Ballast Revenue 0 Bunkers Vessel Hire (13 days) (240,000) (130,000) Voyage Result (370,000) Typical Operator Voyage Result = $240,000 Pangaea Logistics Solutions: Ballast Revenue 0 Bunkers Vessel Hire (8 days) (150,000) (80,000) Voyage Result (230,000) Pangaea Logistics Solutions: Backhaul Trip Revenue ($18/t) 900,000 Bunkers & Port Costs Vessel Hire (28 days) (230,000) (280,000) Voyage Result 390,000 Difference = $530,000 PLS Voyage Result = $770,000 This schematic illustration simplifies and summarizes three example voyages. Although the illustration is based on assumptions consistent with recent markets, they do not include all costs, including material costs such as port disbursements, lubricants, or broker commissions. There is no guarantee that the company or its competitors has or will achieve results equal to those set out above. Actual results are subject to market rates for the carriage of cargos, bunker prices, hire costs, weather, port congestion and other factors affecting transoceanic shipping. The Profitability of Backhaul: Schematic Illustration

Backhaul Specialization: Generating Profit from a Cost Center China Brazil Fronthaul Trip Revenue ($28/t) Positioning Revenue 2,000,000 500,000 Bunkers & Port Costs Vessel Hire (55 days) (900,000) (550,000) Voyage Result 1,100,000 Typical Operator: Ballast Revenue 0 Bunkers Vessel Hire (30 days) (800,000) (300,000) Voyage Result (1,100,000) Typical Operator Voyage Result = $0 Pangaea Logistics Solutions: Backhaul Trip Revenue ($19/t) 1,350,000 Bunkers & Port Costs Vessel Hire (55 days) (900,000) (550,000) Voyage Result (100,000) Difference = $1,000,000 PLS Voyage Result = $1,000,000 This schematic illustration simplifies and summarizes three example voyages. Although the illustration is based on assumptions consistent with recent markets, they do not include all costs, including material costs such as port disbursements, lubricants, or broker commissions. There is no guarantee that the company or its competitors has or will achieve results equal to those set out above. Actual results are subject to market rates for the carriage of cargos, bunker prices, hire costs, weather, port congestion and other factors affecting transoceanic shipping. The Profitability of Backhaul: Schematic Illustration

Defensible Pillars of Profitability • Unique approach & execution specialization: - Material cost savings & enhanced profit through granular operating knowledge - Secured & defended by 200+ years of expertise & embedded relationships • Backhaul specialization: - Generating profit from a cost center - Secured & defended by reputation, long-term contracts & repeat customers - High level of owned fleet utilization – minimal days without revenue - Minimal ballast time • Ice-class specialization: - Capturing profit from limited supply of tonnage & lower costs - Secured & defended by technical expertise & ownership of specialized fleet - Own & operate a significant portion of the world’s 1A ice-class dry tonnage • Broader logistics solutions: - Design & implement loading & discharge efficiencies in critical ports - Expand markets & improve business terms for customers

Ice-Class Specialization: Premium Rates Generate Superior Profits

Ice-Class Specialization: Premium Rates Generate Superior Profits • A very attractive, low-competition, premium-rate trade - Northern routes in winter: minimal choices for service at ice-bound ports - Polar routes in summer: far more efficient routes improve profits significantly • Dramatically reduce time & fuel requirements • Significantly increase cargo capacity • All with notably lower CO2 emissions • We pioneered these routes: - First non-Russian dry bulk vessel to transit the Northern Sea Route - First dry bulk vessel to transit the Northwest Passage • We dominate the 1A ice-class dry bulk ocean-going trade: - Only 0.3% of all dry tonnage in the world is rated “1A ice-class” - We expect to own and control a majority of the world’s 1A Panamaxes for the foreseeable future

2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 Baltic Panamax Index BPI Average Pangaea Ice-Class Average Ice-Class Specialization: Premium Rates Generate Superior Profits Year-Round Demand Advantages plus Limited Supply Our ice-class fleet generated 57% higher revenues than conventional vessels Our Ice-Class Average TCE = $12,394 / day Baltic Panamax Index Average = $7,907 / day +57% Premium Source: Company data, Clarksons

Ice-Class Specialization: The View from the Bridge NSR to FE Via Suez to FE MurmanskKirkenes

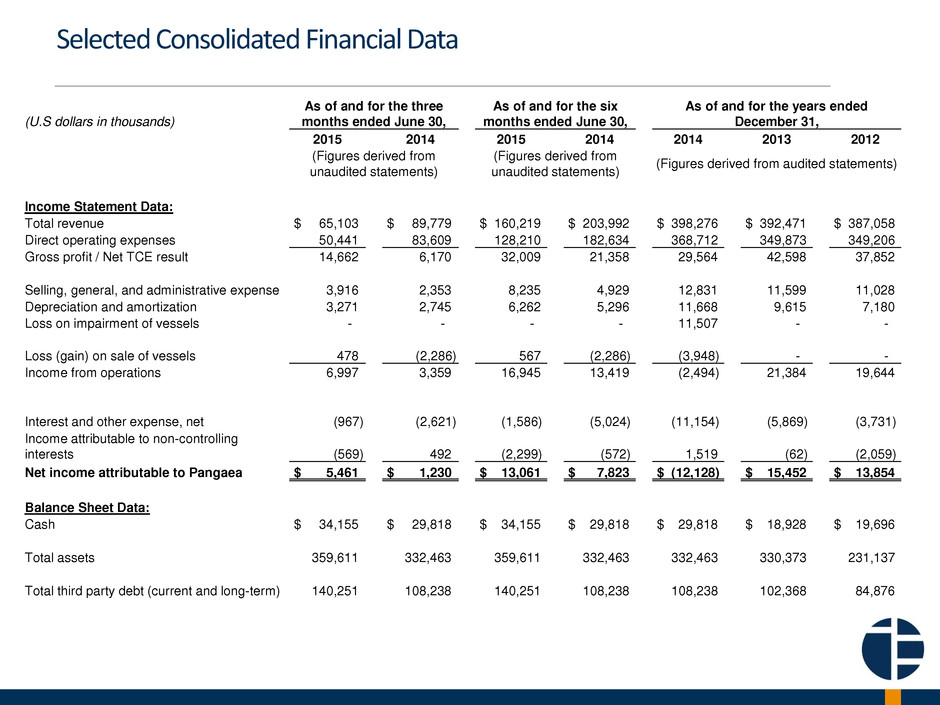

Selected Consolidated Financial Data (U.S dollars in thousands) As of and for the three months ended June 30, As of and for the six months ended June 30, As of and for the years ended December 31, 2015 2014 2015 2014 2014 2013 2012 (Figures derived from unaudited statements) (Figures derived from unaudited statements) (Figures derived from audited statements) Income Statement Data: Total revenue $ 65,103 $ 89,779 $ 160,219 $ 203,992 $ 398,276 $ 392,471 $ 387,058 Direct operating expenses 50,441 83,609 128,210 182,634 368,712 349,873 349,206 Gross profit / Net TCE result 14,662 6,170 32,009 21,358 29,564 42,598 37,852 Selling, general, and administrative expense 3,916 2,353 8,235 4,929 12,831 11,599 11,028 Depreciation and amortization 3,271 2,745 6,262 5,296 11,668 9,615 7,180 Loss on impairment of vessels - - - - 11,507 - - Loss (gain) on sale of vessels 478 (2,286) 567 (2,286) (3,948) - - Income from operations 6,997 3,359 16,945 13,419 (2,494) 21,384 19,644 Interest and other expense, net (967) (2,621) (1,586) (5,024) (11,154) (5,869) (3,731) Income attributable to non-controlling interests (569) 492 (2,299) (572) 1,519 (62) (2,059) Net income attributable to Pangaea $ 5,461 $ 1,230 $ 13,061 $ 7,823 $ (12,128) $ 15,452 $ 13,854 Balance Sheet Data: Cash $ 34,155 $ 29,818 $ 34,155 $ 29,818 $ 29,818 $ 18,928 $ 19,696 Total assets 359,611 332,463 359,611 332,463 332,463 330,373 231,137 Total third party debt (current and long-term) 140,251 108,238 140,251 108,238 108,238 102,368 84,876

Conclusion: Long-term Competitive Advantages and Strong Performance • Enhanced utilization & profitability through strategic backhaul & triangulation • Expertise in niche markets & less commoditized routes (particularly ice routes) • Continued demand-driven expansion: 8% CAGR for ship days (‘11-’14) • Deep relationships with major industrial customers • In-house commercial & technical management capability • Experienced management team • Alignment of interests & best-in-class corporate governance • Strong first half 2015 performance in a depressed rate environment • Positioned for sustainable growth in a multitude of business conditions