Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARIZONA PUBLIC SERVICE CO | a8-k8x19x15august19x21inve.htm |

Powering Growth, Delivering Value Barclays Mid-West Utilities Conference August 19-21, 2015 POWERING GROWTH DELIVERING VALUE

Powering Growth, Delivering Value 2 FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation or regulation, including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, particularly in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental and other concerns surrounding coal-fired generation; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2014 which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

Powering Growth, Delivering Value 3 • Top quartile ratings in Customer Satisfaction, Reliability and Safety • Palo Verde Nuclear Generating station continues record levels of electricity production • Disciplined cost management Operational Excellence • Arizona’s long-term growth fundamentals remain largely intact, including population growth, job growth and economic development Leverage to Economic Recovery • Creating a sustainable energy future for Arizona • Working with Arizona Corporation Commission and key stakeholders to modernize rates Proactively Addressing Rate Design • Rate base growth of 6-7% through 2018 • Focus on core electric utility business • Investing in a portfolio that is flexible, responsive, reliable and cost-effective Executing on Long-Term Investment Plan • Consolidated earned ROE more than 9.5% through 2016, weather-normalized • Dividend growth target of 5% • Strong credit ratings and balance sheet Financial Strength Driving Competitive Returns VALUE PROPOSITION We are a vertically integrated, regulated electric utility in the growing southwest U.S.

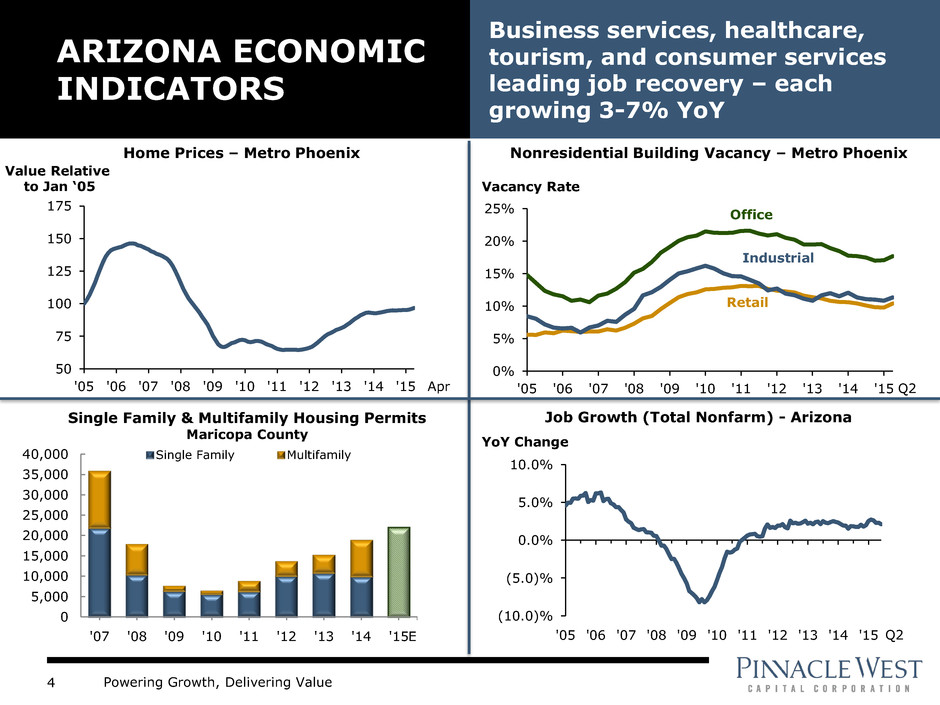

Powering Growth, Delivering Value 4 ARIZONA ECONOMIC INDICATORS Business services, healthcare, tourism, and consumer services leading job recovery – each growing 3-7% YoY 0% 5% 10% 15% 20% 25% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Industrial Nonresidential Building Vacancy – Metro Phoenix Single Family & Multifamily Housing Permits Maricopa County Home Prices – Metro Phoenix Value Relative to Jan ‘05 50 75 100 125 150 175 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Vacancy Rate Office Retail Job Growth (Total Nonfarm) - Arizona (10.0)% (5.0)% 0.0% 5.0% 10.0% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 YoY Change E Q2 Apr 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 '07 '08 '09 '10 '11 '12 '13 '14 '15 Single Family Multifamily Q2

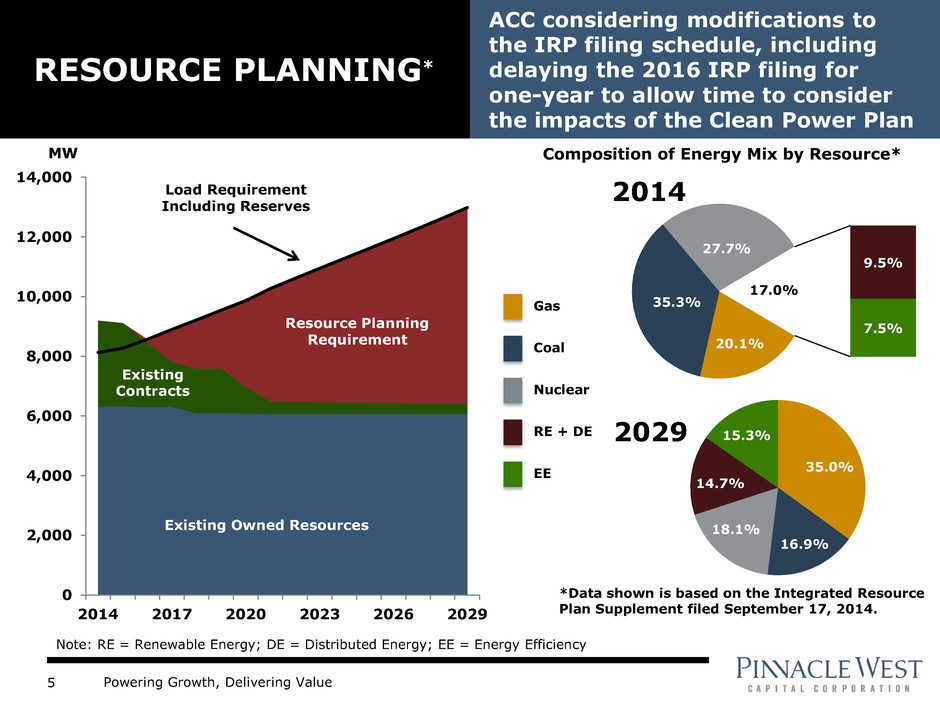

Powering Growth, Delivering Value 5 RESOURCE PLANNING* ACC considering modifications to the IRP filing schedule, including delaying the 2016 IRP filing for one-year to allow time to consider the impacts of the Clean Power Plan 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2014 2017 2020 2023 2026 2029 Existing Owned Resources Existing Contracts Resource Planning Requirement Load Requirement Including Reserves MW 20.1% 35.3% 27.7% 9.5% 7.5% 17.0% 2014 Gas Coal Nuclear RE + DE EE Composition of Energy Mix by Resource* Note: RE = Renewable Energy; DE = Distributed Energy; EE = Energy Efficiency 35.0% 16.9% 18.1% 14.7% 15.3% *Data shown is based on the Integrated Resource Plan Supplement filed September 17, 2014. 2029

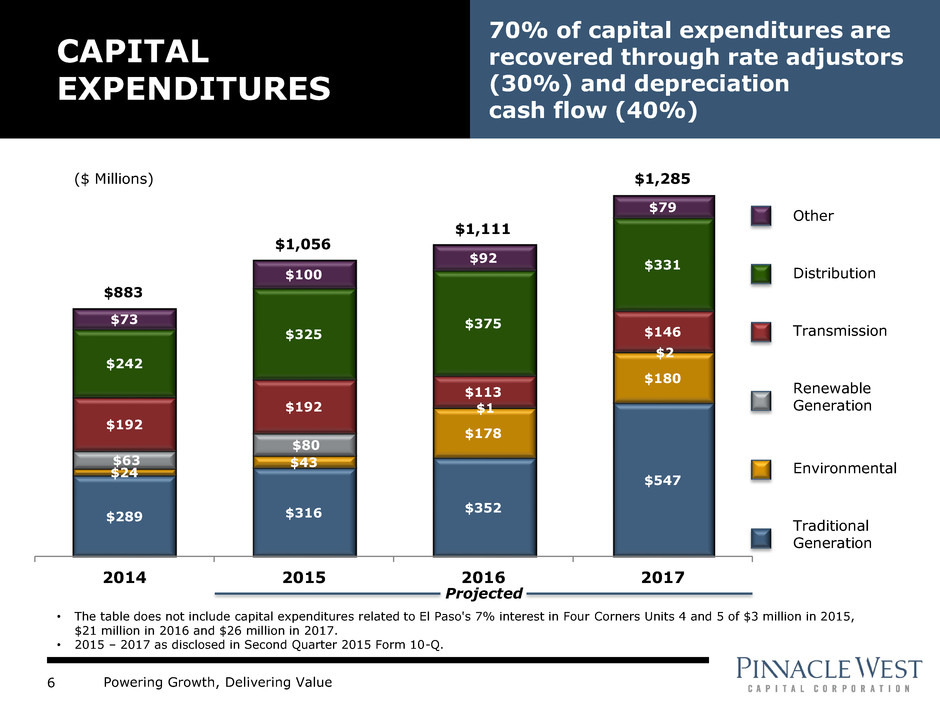

Powering Growth, Delivering Value 6 $289 $316 $352 $547 $24 $43 $178 $180 $63 $80 $1 $2 $192 $192 $113 $146 $242 $325 $375 $331 $73 $100 $92 $79 2014 2015 2016 2017 CAPITAL EXPENDITURES 70% of capital expenditures are recovered through rate adjustors (30%) and depreciation cash flow (40%) ($ Millions) $883 $1,056 $1,111 Other Distribution Transmission Renewable Generation Environmental Traditional Generation Projected $1,285 • The table does not include capital expenditures related to El Paso's 7% interest in Four Corners Units 4 and 5 of $3 million in 2015, $21 million in 2016 and $26 million in 2017. • 2015 – 2017 as disclosed in Second Quarter 2015 Form 10-Q.

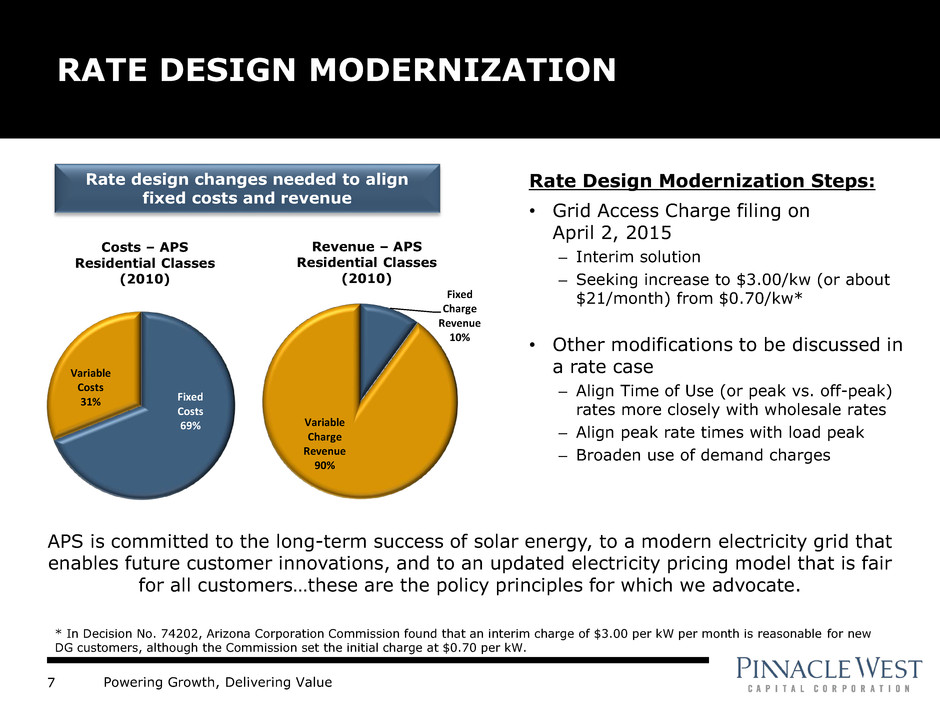

Powering Growth, Delivering Value 7 Rate Design Modernization Steps: • Grid Access Charge filing on April 2, 2015 – Interim solution – Seeking increase to $3.00/kw (or about $21/month) from $0.70/kw* • Other modifications to be discussed in a rate case – Align Time of Use (or peak vs. off-peak) rates more closely with wholesale rates – Align peak rate times with load peak – Broaden use of demand charges RATE DESIGN MODERNIZATION Fixed Costs 69% Variable Costs 31% Costs – APS Residential Classes (2010) Fixed Charge Revenue 10% Variable Charge Revenue 90% Revenue – APS Residential Classes (2010) Rate design changes needed to align fixed costs and revenue * In Decision No. 74202, Arizona Corporation Commission found that an interim charge of $3.00 per kW per month is reasonable for new DG customers, although the Commission set the initial charge at $0.70 per kW. APS is committed to the long-term success of solar energy, to a modern electricity grid that enables future customer innovations, and to an updated electricity pricing model that is fair for all customers…these are the policy principles for which we advocate.

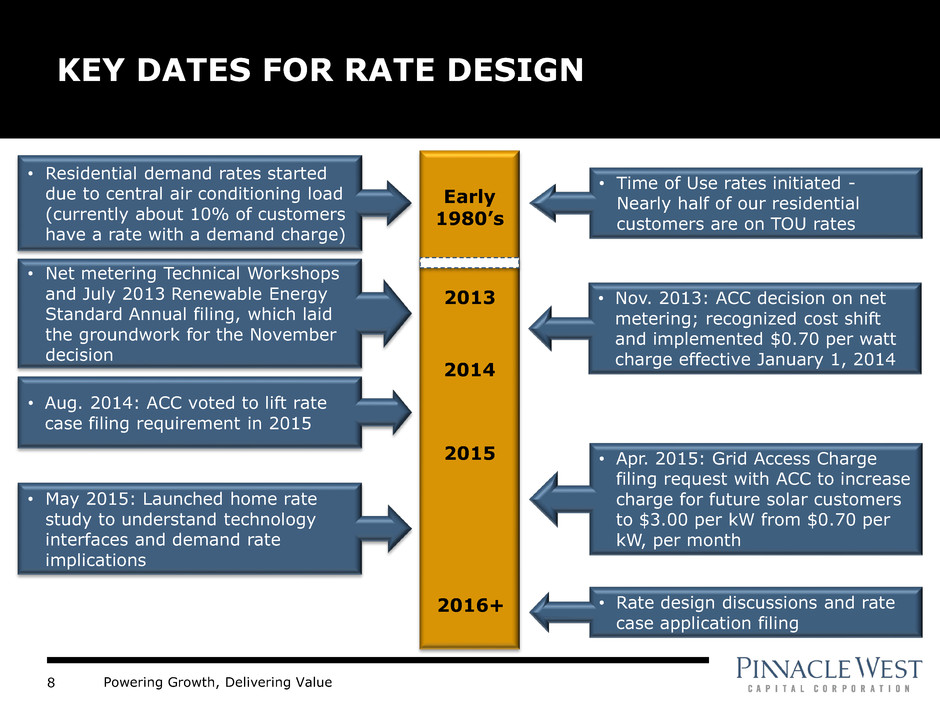

Powering Growth, Delivering Value 8 KEY DATES FOR RATE DESIGN 2013 2014 2015 • Net metering Technical Workshops and July 2013 Renewable Energy Standard Annual filing, which laid the groundwork for the November decision • Nov. 2013: ACC decision on net metering; recognized cost shift and implemented $0.70 per watt charge effective January 1, 2014 • Time of Use rates initiated - Nearly half of our residential customers are on TOU rates • Residential demand rates started due to central air conditioning load (currently about 10% of customers have a rate with a demand charge) Early 1980’s 2016+ • Aug. 2014: ACC voted to lift rate case filing requirement in 2015 • May 2015: Launched home rate study to understand technology interfaces and demand rate implications • Apr. 2015: Grid Access Charge filing request with ACC to increase charge for future solar customers to $3.00 per kW from $0.70 per kW, per month • Rate design discussions and rate case application filing

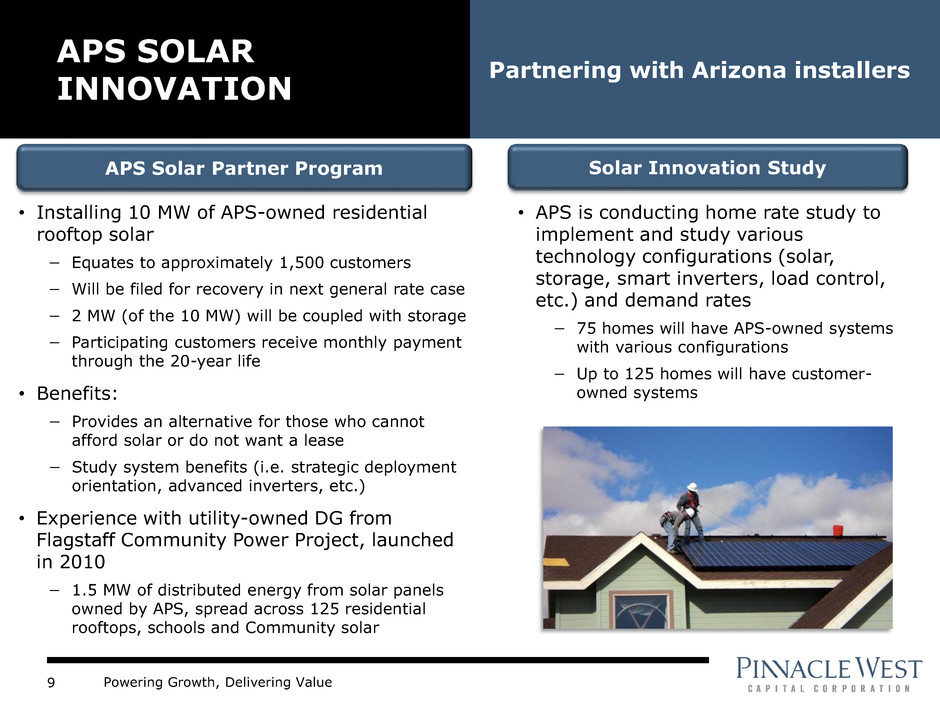

Powering Growth, Delivering Value 9 • Installing 10 MW of APS-owned residential rooftop solar − Equates to approximately 1,500 customers − Will be filed for recovery in next general rate case − 2 MW (of the 10 MW) will be coupled with storage − Participating customers receive monthly payment through the 20-year life • Benefits: − Provides an alternative for those who cannot afford solar or do not want a lease − Study system benefits (i.e. strategic deployment orientation, advanced inverters, etc.) • Experience with utility-owned DG from Flagstaff Community Power Project, launched in 2010 − 1.5 MW of distributed energy from solar panels owned by APS, spread across 125 residential rooftops, schools and Community solar APS SOLAR INNOVATION Partnering with Arizona installers APS Solar Partner Program • APS is conducting home rate study to implement and study various technology configurations (solar, storage, smart inverters, load control, etc.) and demand rates − 75 homes will have APS-owned systems with various configurations − Up to 125 homes will have customer- owned systems Solar Innovation Study

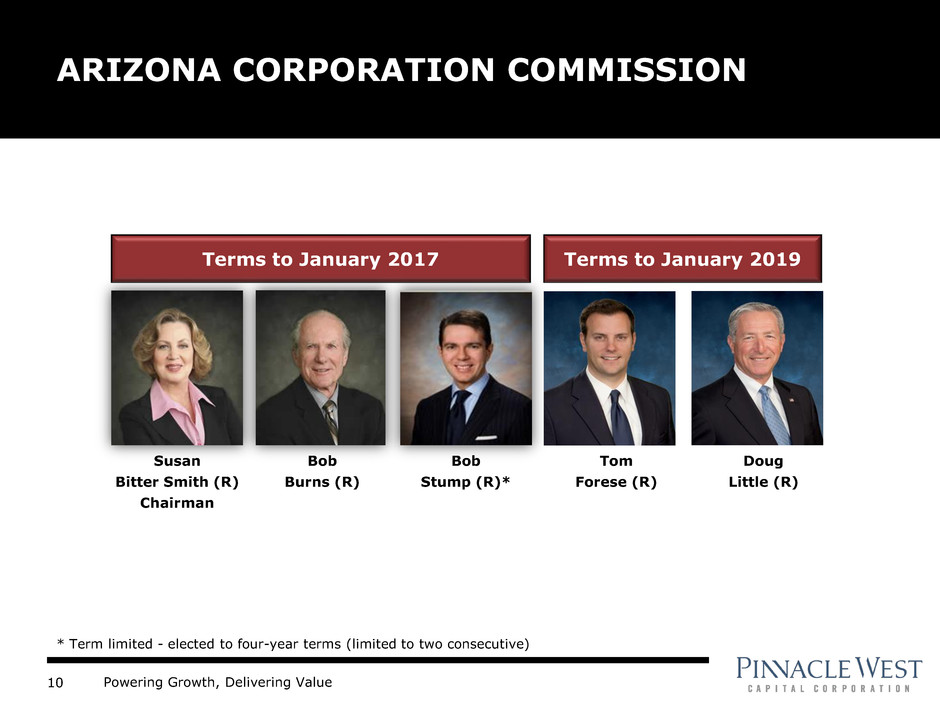

Powering Growth, Delivering Value 10 ARIZONA CORPORATION COMMISSION * Term limited - elected to four-year terms (limited to two consecutive) Bob Stump (R)* Tom Forese (R) Doug Little (R) Terms to January 2019 Terms to January 2017 Susan Bitter Smith (R) Chairman Bob Burns (R)

Powering Growth, Delivering Value 11 FINANCIAL STRENGTH • Goal of a consolidated earned ROE more than 9.5%, weather- normalized • Sustainable cost management ingrained in business planning framework • Strong balance sheet o A- rating or better at S&P, Moody’s and Fitch, all with stable outlook1 o Currently expect up to an additional $300 million of new long-term debt in 2015 o Equity not needed until 2017, at the earliest • Targeting annual dividend growth of 5%2 1 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. 2 Future dividends subject to declaration at Board of Directors’ discretion.