Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Great Western Bancorp, Inc. | gwb-8xkx3qfy15investorpres.htm |

Quarterly Investor Relations Presentation At and for the three and nine months ended June 30, 2015

Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the sections titled “Item 1A. Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2014. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP measures should be considered in context with our GAAP results. A reconciliation of these non-GAAP measures appears in our earnings release dated July 27, 2015 and in the appendix to this presentation. Our earnings release and this presentation are available in the Investor Relations section of our website at www.greatwesternbank.com. This presentation is also available as part of our Current Report on Form 8-K filed with the SEC on August 17, 2015. Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp, Inc. combined with those of its predecessor, Great Western Bancorporation, Inc. Disclosures 2

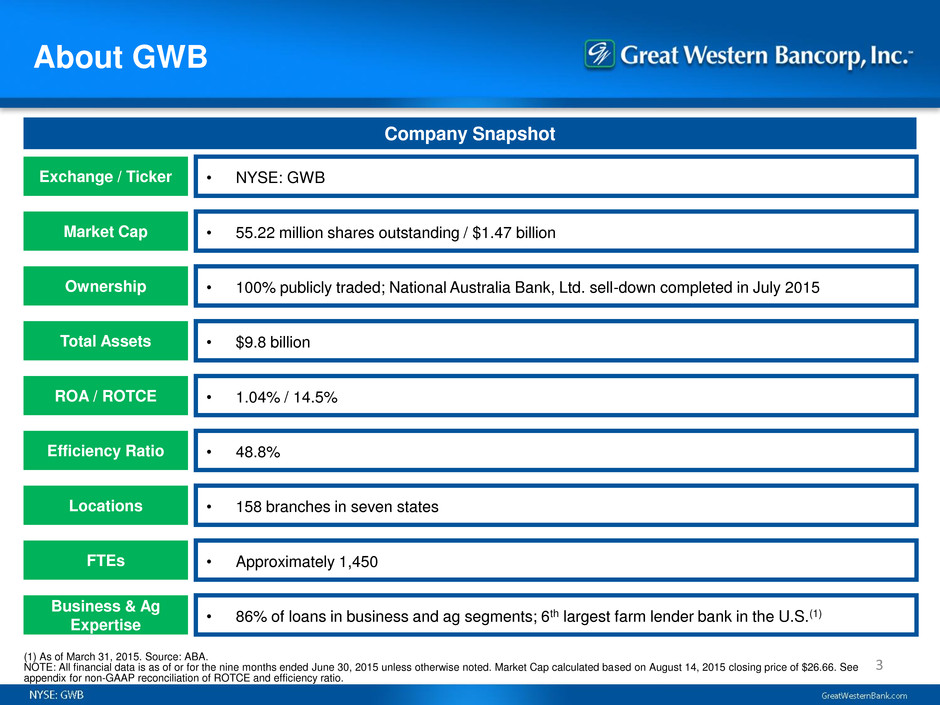

About GWB 3 Company Snapshot Exchange / Ticker • NYSE: GWB Market Cap • 55.22 million shares outstanding / $1.47 billion Ownership • 100% publicly traded; National Australia Bank, Ltd. sell-down completed in July 2015 Total Assets • $9.8 billion ROA / ROTCE • 1.04% / 14.5% Efficiency Ratio • 48.8% FTEs • Approximately 1,450 Locations • 158 branches in seven states Business & Ag Expertise • 86% of loans in business and ag segments; 6th largest farm lender bank in the U.S.(1) (1) As of March 31, 2015. Source: ABA. NOTE: All financial data is as of or for the nine months ended June 30, 2015 unless otherwise noted. Market Cap calculated based on August 14, 2015 closing price of $26.66. See appendix for non-GAAP reconciliation of ROTCE and efficiency ratio.

Footprint 4 • 158 banking branches across seven Midwestern and Western states • Vibrant, diverse economies largely rooted in agriculture with growing commercial hub cities • Opportunities for expansion into new markets within and adjacent to footprint Attractive Markets

• Asset quality performance improved after elevated credit-related charges in the previous quarter: • Nonaccrual loans 0.94% of total loans • Net charge-offs / total loans improved to 0.17% annualized FYTD • OREO balance declined $21.6 million or 50% during the quarter to $22.0 million • “Watch” loans declined $62.2 million or 16% during the quarter to $322.3 million Executing on Strategy Focused Business Banking Franchise with Agribusiness Expertise • Continued business and agribusiness lending growth driving 6.7% FYTD loan growth and aligned to strategy; contributing to balance sheet and earnings growth • Net interest margin and adjusted net interest margin(1) stabilized compared to the previous quarter driven by front line staff balancing growth and overall profitability Strong Profitability and Growth Driven by a Highly Efficient Operating Model • Increased profitability compared to 2QFY15 led to improvements in FYTD return metrics: 1.04% ROAA and 14.5% ROTCE(1) • Expense management supplemented by favorable non-recurring items drove an efficiency ratio(1) of 48.8% FYTD Risk Management Driving Strong Credit Quality Strong Capital Generation and Attractive Dividend • Capital ratios remained stable with Tier 1 Capital Ratio of 11.5%, Total Capital Ratio of 12.5% and Tier 1 Leverage Ratio of 9.4% • Quarterly dividend of $0.12 per share announced July 27, 2015 (1) This is a non-GAAP measure. See appendix for reconciliation. 5

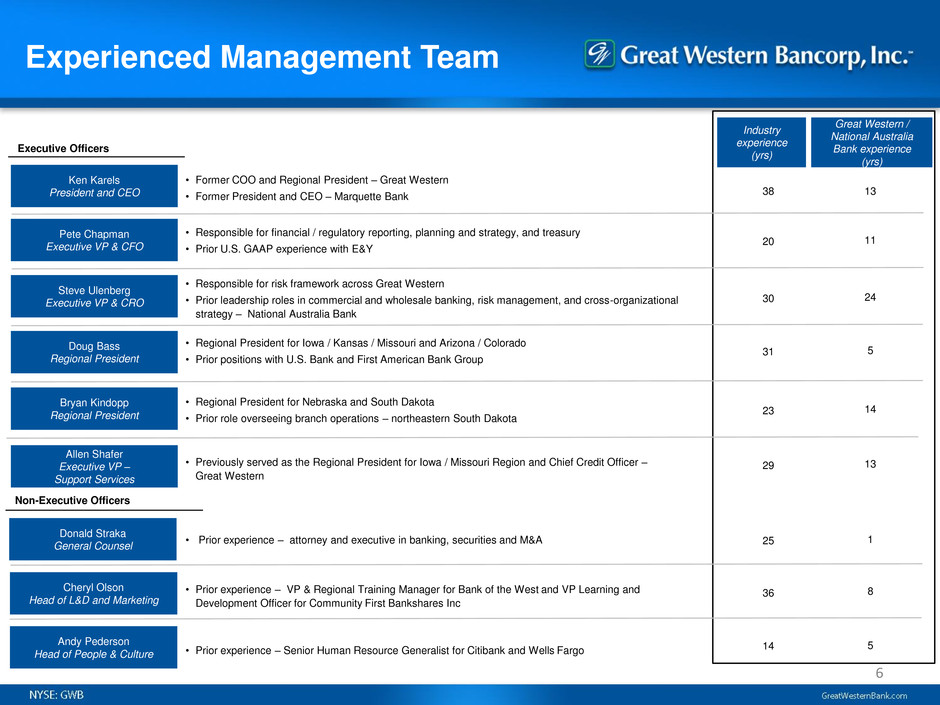

Experienced Management Team • Prior experience – Senior Human Resource Generalist for Citibank and Wells Fargo 36 38 31 23 20 14 29 30 25 5 13 8 5 14 11 13 24 1 Ken Karels President and CEO Doug Bass Regional President • Regional President for Iowa / Kansas / Missouri and Arizona / Colorado • Prior positions with U.S. Bank and First American Bank Group Bryan Kindopp Regional President • Regional President for Nebraska and South Dakota • Prior role overseeing branch operations – northeastern South Dakota Pete Chapman Executive VP & CFO • Responsible for financial / regulatory reporting, planning and strategy, and treasury • Prior U.S. GAAP experience with E&Y • Previously served as the Regional President for Iowa / Missouri Region and Chief Credit Officer – Great Western Allen Shafer Executive VP – Support Services Steve Ulenberg Executive VP & CRO • Responsible for risk framework across Great Western • Prior leadership roles in commercial and wholesale banking, risk management, and cross-organizational strategy – National Australia Bank Executive Officers • Former COO and Regional President – Great Western • Former President and CEO – Marquette Bank • Prior experience – VP & Regional Training Manager for Bank of the West and VP Learning and Development Officer for Community First Bankshares Inc Cheryl Olson Head of L&D and Marketing Industry experience (yrs) Great Western / National Australia Bank experience (yrs) Andy Pederson Head of People & Culture Donald Straka General Counsel • Prior experience – attorney and executive in banking, securities and M&A Non-Executive Officers 6

Acquisition History $3.1 $3.4 $4.3 $5.2 $8.3 $8.2 $9.0 $9.1 $9.4 $9.8 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 '06 '07 '08 '09 '10 '11 '12 '13 '14 3Q'15 Pre-Acquisition Assets Acquired Assets Acquired Security Bank ($0.1 billion) Acquired Sunstate Bank and three branches from HF Financial Corp. ($0.2 billion total) Acquired First Community Bank’s Colorado franchise and a branch from Wachovia ($0.6 billion total) Acquired F&M Bank-Iowa and TierOne Bank ($3.0 billion total) Acquired North Central Bancshares Inc. ($0.4 billion) Asset CAGR ‘09 – 3Q‘15: 12% Note: Total assets are as of September 30 of each fiscal year and June 30, 2015. Acquired assets are the total of the fair value of total assets acquired and the net cash and cash equivalents received, at the time of acquisition of each indicated year. 7

Loan Portfolio Composition Portfolio Segmentation by Type Loan Portfolio ($MM) Geographic Diversification At September 30 of each fiscal year unless otherwise noted (UPB). Focused business and ag lending growth; partially offset by runoff of acquired CRE 8

Ag Lending 101 Highlights • Underwriting fundamentals are identical to comparable C&I and CRE businesses • Cash flow is the primary source of repayment • Collateral is the secondary source of repayment • Advance rates on lines and amount of term debt subject to LTV limits and collateral values based on “normalized” valuations • Liquid markets typically exist for ag-related collateral (e.g. harvested grain or grain inventory, cattle, farm equipment and land sale/lease) in foreclosure scenarios • Federally-subsidized crop insurance and FSA guarantees are two examples of risk mitigants unique to ag lending • A number of market and economic conditions can be leading indicators for individual borrowers and are monitored by GWB; none are broadly indicative for GWB’s ag portfolio as a whole: • Interest rates, economic growth and policy • Farm leverage ratios • Weather and drought conditions • Disease • Commodity prices – corn, soybeans, cattle, hogs, milk, cheese, etc. • Yields Protein farmers tend to do better when grain prices (feed) are low and demand for protein outputs are high; global demand will influence herd populations and impact downstream economics. Grain farmers have come under some revenue pressure (commodity prices); depressed revenue will drive costs down and/or marginal producers out of business. Customers are generally well positioned to sustain lean years with low debt and strong crop conditions. Grain vs Protein – A Natural “Hedge” Deal Structure Short Term Operating (Typically 1-2 Years) •Operational / working capital subject to borrowing base requirements •$729 million at June 30, 2015 Medium Term (Typically 3- 5 Years) •Machinery / equipment and livestock subject to LTV guidelines of 50-75% depending on asset class •$270 million at June 30, 2015 Real Estate Loans (Typically 5-15 Years with Amortization) •Valuation based on 3rd Party appraisals; 70% max LTV guideline •$814 million at June 30, 2015 9

Ag Loan Portfolio Highlights Ag Portfolio Composition by Industry (UPB) Ag Portfolio Exposure Sizes (UPB) Ag Net Charge-offs / Average Loans (1) • Portfolio balanced across protein, grain and specialty crop operations and across geographies • 6th largest farm lender bank in the U.S. as of March 31, 2015 • 10 largest Ag exposures represent 10% of total Ag and average $18.8 million • Approximately 3,300 customers with an average exposure size of $550,000 NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. (1) Net charge-offs / average loans represent charge-offs, net of recoveries, as a percent of average loans for each period. Average loans are calculated as the two point average of each period. 3Q’15 FYTD net charge-offs / average loans annualized. Grains 37% Proteins 49% Other 14% 10

Diverse C&I Exposure Highlights C&I Portfolio Composition by Industry (UPB) C&I Portfolio Exposure Sizes (UPB) C&I Net Charge-offs / Average Loans (1) • Diverse range of industry exposure across C&I lending portfolio, including healthcare, tourism & hospitality, freight & transport and agribusiness-related services • No significant energy-related exposure • 10 largest C&I exposures represent 20% of total C&I and average $33.3 million • Approximately 4,000 customers with an average exposure size of $422,000 NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. (1) Net charge-offs / average loans represent charge-offs, net of recoveries, as a percent of average loans for each period. Average loans are calculated as the two point average of each period. 3Q’15 FYTD net charge-offs / average loans annualized. 11

Focused CRE Lending Highlights CRE Portfolio Composition by Type (UPB $MM) CRE Portfolio Exposure Sizes (UPB) CRE Net Charge-offs / Average Loans (1) • Focus on owner-occupied properties, commercial property investors and multi-family property investors; de- emphasizing Land Development lending but supportive of quality construction projects in desired industry segments • Strong growth in non-owner occupied CRE stemming from the healthcare and hospitality industries • Significant run-off of undesirable CRE relationships from TierOne acquisition partially masks underlying growth • 10 largest CRE exposures represent 9% of total CRE and average $25.0 million NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. (1) Net charge-offs / average loans represent charge-offs, net of recoveries, as a percent of average loans for each period. Average loans are calculated as the two point average of each period. 3Q’15 FYTD net charge-offs / average loans annualized. 12

Investment Portfolio • Investment portfolio has historically been heavily skewed toward GNMA Mortgage-backed securities because of the favorable capital treatment afforded by the Australian regulator • Recent reinvestments have been in other segments: • Will transition to a portfolio composition more similar to U.S. peers over time • Opportunities to increase overall portfolio yield over time without substantially altering the interest rate or credit risk profile • Portfolio weighted average life of 3.3 years as of June 30, 2015 and yield of 1.76% for the nine months ended June 30, 2015 13

Deposits Portfolio Segmentation by Type Portfolio Over Time ($MM) Geographic Diversification At September 30 of each fiscal year unless otherwise noted. Successful portfolio transformation away from time deposits toward transaction accounts NOTE: South Dakota and Other deposits include a small amount of deposits managed by our Corporate staff. 14

Capital Summary Capital Ratios Tier 1 Capital Composition Total Capital Composition • Attractive dividend of $0.12 quarterly (approx. yield of 1.8% based on August 14, 2015 closing price) • Strong overall capital position with potential for generation of incremental capital to deploy for M&A, share buybacks and/or capital return to shareholders via dividends • Strong relationships with regulators at holding company and bank level Ratio Well Capitalized Minimum Excess to Well Capitalized Tier 1 capital 11.5% 6.0% 5.5% Total capital 12.5% 10.0% 2.5% Tier 1 leverage 9.4% 5.0% 4.4% Common equity tier 1 10.8% 6.5% 4.3% Risk-weighted assets ($MM) 7,435$ Ratio Well Capitalized Minimum Excess to Well Capitalized Tier 1 capital 11.6% 6.0% 5.6% Total capital 12.4% 10.0% 2.4% Tier 1 leverage 9.5% 5.0% 4.5% Common equity tier 1 11.6% 6.5% 5.1% Risk-weighted assets ($MM) 7,433$ Great Western Bancorp, Inc. Great Western Bank 15

Interest Rate Sensitivity • Management believes the balance sheet is well-prepared for a range of interest rate actions, but is modestly asset sensitive • Internal planning assumes a flat rate environment with any lift from a rate increase viewed as potential upside • Investment portfolio weighted average life of 3.3 years • Relatively short average tenor of the loan portfolio (1.4 years at March 31, 2015) due to: • Higher proportion of 12-month revolving lines of credit in line with business and agriculture lending focus • All fixed-rate loans with original terms greater than 5 years are swapped to floating 16

Asset Quality 17 Highlights Net Charge-offs Reserves / NALs Strong Credit Quality • Net charge-offs were $0.9 million for the quarter, bringing FYTD net charge-offs / average loans to 0.17% • Loans on “watch” status decreased to $322.3 million, a decrease of $62.2 million compared to March 31, 2015 • Majority of the decrease concentrated in commercial non-real estate segment with smaller decreases in commercial real estate and agriculture • Ratio of ALLL / total loans increased to 0.77%

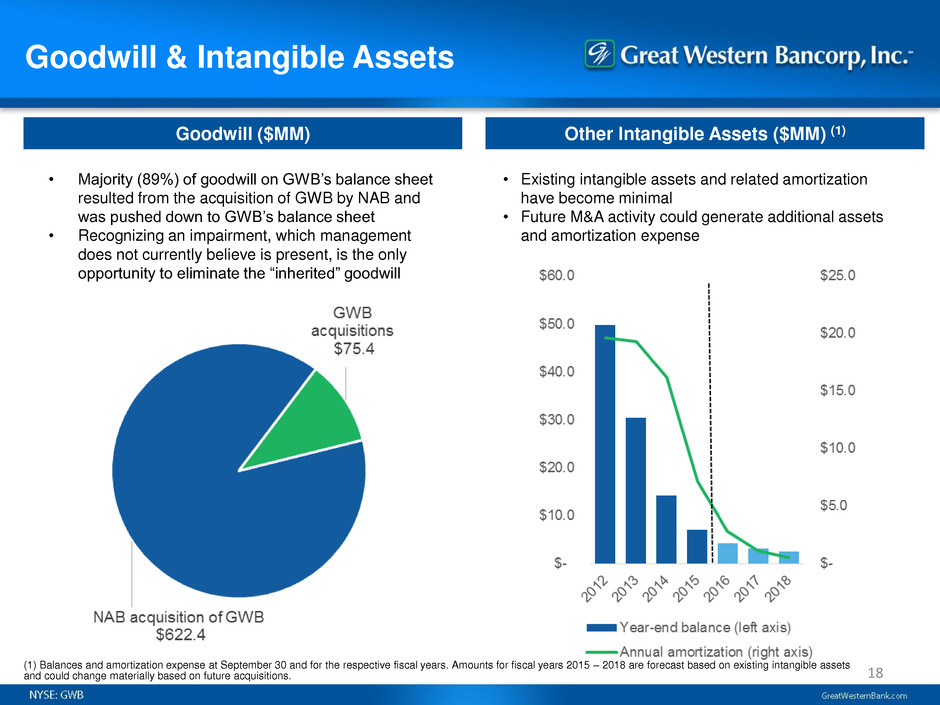

Goodwill & Intangible Assets Goodwill ($MM) Other Intangible Assets ($MM) (1) • Majority (89%) of goodwill on GWB’s balance sheet resulted from the acquisition of GWB by NAB and was pushed down to GWB’s balance sheet • Recognizing an impairment, which management does not currently believe is present, is the only opportunity to eliminate the “inherited” goodwill • Existing intangible assets and related amortization have become minimal • Future M&A activity could generate additional assets and amortization expense 18 (1) Balances and amortization expense at September 30 and for the respective fiscal years. Amounts for fiscal years 2015 – 2018 are forecast based on existing intangible assets and could change materially based on future acquisitions.

Income Statement Summary

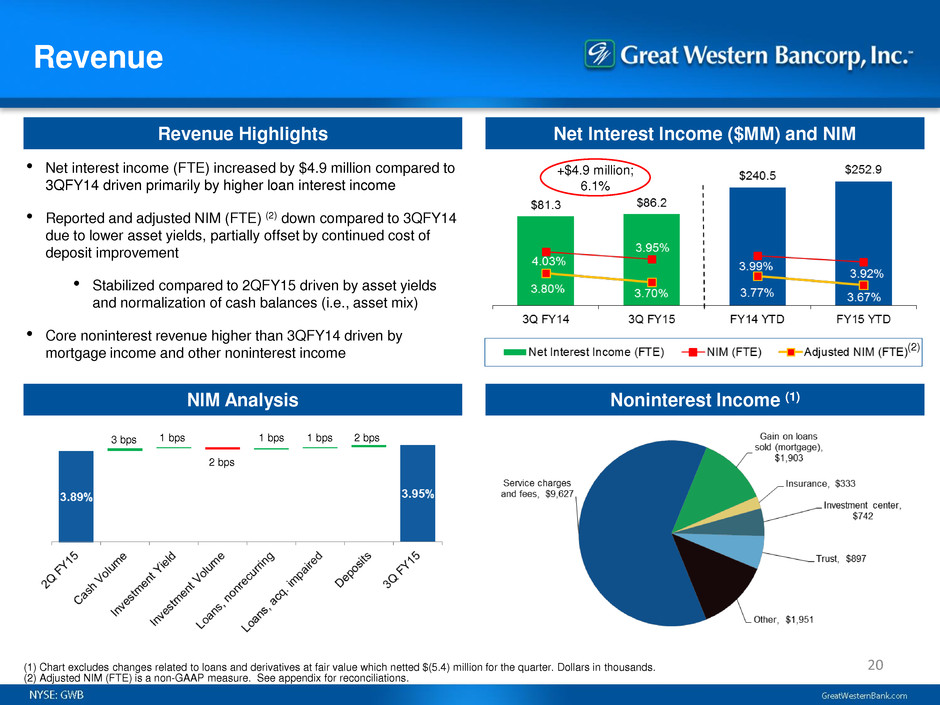

(1) Chart excludes changes related to loans and derivatives at fair value which netted $(5.4) million for the quarter. Dollars in thousands. (2) Adjusted NIM (FTE) is a non-GAAP measure. See appendix for reconciliations. Revenue 20 Revenue Highlights Net Interest Income ($MM) and NIM NIM Analysis Noninterest Income (1) • Net interest income (FTE) increased by $4.9 million compared to 3QFY14 driven primarily by higher loan interest income • Reported and adjusted NIM (FTE) (2) down compared to 3QFY14 due to lower asset yields, partially offset by continued cost of deposit improvement • Stabilized compared to 2QFY15 driven by asset yields and normalization of cash balances (i.e., asset mix) • Core noninterest revenue higher than 3QFY14 driven by mortgage income and other noninterest income (2) +$4.9 million; 6.1% 3 bps 1 bps 2 bps 1 bps 1 bps 2 bps

Expenses, Provision & Earnings 21 Highlights Provision for Loan Losses ($MM) Noninterest Expense ($MM) Net Income ($MM) • Commitment to expense control and favorable nonrecurring items (closed branch sale) drove an efficiency ratio (1) of 46.4% for the quarter and 48.8% FYTD • Quarterly efficiency ratio would have been approximately 48% without nonrecurring items • Provision for loan losses $2.9 million higher than 3QFY14 but substantially lower than 2QFY15 • Total credit-related costs down $8.6 million compared to 2QFY15 Stable Expense Base Aided by Lower Intangible Amortization Abnormally Low in Comparable Periods (1) Efficiency ratio is a non-GAAP measure. See appendix for reconciliation. (1) Elevated OREO Charges

Proven Business Strategy 22 Focused Business Banking Franchise with Agribusiness Expertise Risk Management Driving Strong Credit Quality Attract and Retain High-Quality Relationship Bankers Prioritize Organic Growth While Optimizing Footprint Deepen Customer Relationships Strong Profitability and Growth Driven by a Highly Efficient Operating Model Strong Capital Generation and Attractive Dividend

Appendix: Non-GAAP Reconciliations

Non-GAAP Measures 24 For the 9 Months Ended June 30, At or for the 3 Months Ended 2014 2015 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Tangible common equity and tangible common equity to assets: Total Stockholders' Equity $1,430,964 $1,487,851 $1,430,964 $1,421,090 $1,451,370 $1,469,552 $1,487,851 Less: Goodwill and other intangible assets 714,803 705,634 714,803 712,036 709,723 707,410 705,634 Tangible Common Equity $716,161 $782,217 $716,161 $709,054 $741,647 $762,142 $782,217 Total Assets $9,292,283 $9,764,159 $9,292,283 $9,371,429 $9,641,261 $9,781,645 $9,764,159 Less: Goodwill and other intangible assets 714,803 705,634 714,803 712,036 709,723 707,410 705,634 Tangible Assets $8,577,480 $9,058,525 $8,577,480 $8,659,393 $8,931,538 $9,074,235 $9,058,525 Tangible Common Equity to Tangible Assets 8.3% 8.6% 8.3% 8.2% 8.3% 8.4% 8.6% For the 9 Months Ended June 30, At or for the 3 Months Ended 2014 2015 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Efficiency Ratio: Total Revenue $268,477 $272,913 $90,414 $91,727 $90,809 $87,561 $94,543 Add: Tax equivalent adjustment 3,339 4,798 1,200 1,324 1,504 1,590 1,704 Total Revenue (FTE) $271,816 $277,711 $91,614 $93,051 $92,313 $89,151 $96,247 Noninterest Expense $151,904 $141,959 $54,278 $48,318 $47,091 $48,438 $46,430 Less: Amortization of intangible assets 13,448 6,402 4,069 2,767 2,313 2,313 1,776 Tangible Noninterest Expense $138,456 $135,557 $50,209 $45,551 $44,778 $46,125 $44,654 Efficiency Ratio 50.9% 48.8% 54.8% 49.0% 48.5% 51.7% 46.4%

Non-GAAP Measures 25 For the 9 Months Ended June 30, At or for the 3 Months Ended 2014 2015 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Adjusted net interest income and adjusted net interest margin (fully-tax equivalent basis): Net Interest Income $237,198 $248,072 $80,100 $83,226 $82,909 $80,625 $84,538 Add: Tax equivalent adjustment 3,339 4,798 1,200 1,324 1,504 1,590 1,704 Net Interest Income (FTE) $240,537 $252,870 $81,300 $84,550 $84,413 $82,215 $86,242 Add: Current realized derivative gain (loss) (13,277) (16,005) (4,600) (4,978) (5,282) (5,307) (5,416) Adjusted Net Interest Income (FTE) $227,260 $236,865 $76,700 $79,572 $79,131 $76,908 $80,826 Average Interest-Earning Assets $8,067,544 $8,624,469 $8,098,052 $8,181,194 $8,556,688 $8,560,477 $8,756,244 Net Interest Margin (FTE) 3.99% 3.92% 4.03% 4.10% 3.91% 3.89% 3.95% Adjusted Net Interest Margin (FTE) 3.77% 3.67% 3.80% 3.86% 3.67% 3.64% 3.70%

Non-GAAP Measures 26 For the 9 Months Ended June 30, At or for the 3 Months Ended 2014 2015 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Adjusted net interest income and adjusted yield (fully-tax equivalent basis), on loans other than loans acquired with deteriorated credit quality: Interest Income $235,807 $244,783 $79,245 $82,968 $81,372 $80,317 $83,094 Add: Tax equivalent adjustment 3,339 4,798 1,200 1,324 1,504 1,590 1,704 Interest Income (FTE) $239,146 $249,581 $80,445 $84,292 $82,876 $81,907 $84,798 Add: Current realized derivative gain (loss) (13,277) (16,005) (4,600) (4,978) (5,282) (5,307) (5,416) Adjusted Interest Income (FTE) $225,869 $233,576 $75,845 $79,314 $77,594 $76,600 $79,382 Average loans other than loans acquired with deteriorated credit quality $6,239,191 $6,816,785 $6,362,850 $6,527,721 $6,626,507 $6,828,510 $6,995,340 Yield (FTE) 5.12% 4.90% 5.07% 5.12% 4.96% 4.86% 4.86% Adjusted Yield (FTE) 4.84% 4.58% 4.78% 4.82% 4.65% 4.55% 4.55%

Non-GAAP Measures 27 For the 9 Months Ended June 30, At or for the 3 Months Ended 2014 2015 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Cash net income and return on average tangible common equity: Net Income $77,077 $75,253 $22,502 $27,875 $26,697 $19,724 $28,832 Add: Amortization of intangible assets 13,448 6,402 4,069 2,767 2,313 2,313 1,776 Add: Tax on amortization of intangible assets (2,433) (660) (811) (811) (220) (220) (220) Cash Net Income $88,092 $80,995 $25,760 $29,831 $28,790 $21,817 $30,388 Average Common Equity $1,411,137 $1,456,174 $1,445,813 $1,439,117 $1,433,837 $1,458,131 $1,476,556 Less: Average goodwill and other intangible assets 721,630 708,799 717,104 713,462 711,088 708,782 706,526 Average Tangible Common Equity $689,507 $747,375 $728,709 $725,655 $722,749 $749,349 $770,030 Return on Average Common Equity 7.30% 6.91% 6.24% 7.68% 7.39% 5.49% 7.83% Return on Average Tangible Common Equity 17.1% 14.5% 14.2% 16.3% 15.8% 11.8% 15.8%