Attached files

| file | filename |

|---|---|

| 10-Q/A - 10-Q/A - BG Medicine, Inc. | d941096d10qa.htm |

| EX-31.2 - EX-31.2 - BG Medicine, Inc. | d941096dex312.htm |

| EX-31.1 - EX-31.1 - BG Medicine, Inc. | d941096dex311.htm |

EXHIBIT 10.6

THIRD AMENDMENT TO

GALECTIN-3 LICENSE AND DISTRIBUTION AGREEMENT

THIS THIRD AMENDMENT TO GALECTIN-3 LICENSE AND DISTRIBUTION AGREEMENT (this “Third Amendment”) is entered into as of May 8, 2015, by and between Abbott Laboratories, a corporation of the state of Illinois, having its principal place of business at 100 Abbott Park Road, Abbott Park, Illinois 60064-3500 (“Abbott”) and BG Medicine, Inc., a corporation of the state of Delaware, having its principal place of business at 880 Winter Street, Suite 210, Waltham, Massachusetts 02451 (“BGM”).

RECITALS

A. Abbott and BGM are parties to that certain Galectin-3 License and Distribution Agreement, dated as of November 11, 2009, as amended, (the “Agreement”), pursuant to which BGM granted Abbott a license under BGM’s Patent Rights to commercialize Products in the Territory.

B. The Parties now desire to amend the Agreement to replace the Product Fee, Test Rebate, marketing service fee and certain exhibits among other things.

NOW, THEREFORE, in consideration of the mutual covenants and agreement contained herein, and upon the terms and subject to the conditions set forth below, Abbott and BGM hereby agree as follows:

AMENDMENT

1. Except as modified by this Amendment, capitalized terms used and not otherwise defined herein shall have the meanings given to them in the Agreement.

2. Section 1.2, “AUP”, is hereby deleted in its entirety and replaced with the following:

1.2 “AUP” is the total sales of Tests to unaffiliated Third Parties (as hereinafter defined), calculated in Dollars, in an arm’s length transaction, divided by the number of Tests sold to unaffiliated Third Parties in an arm’s length transaction by Abbott or its Affiliates.

3. A new Section 1.6A is hereby added to the Agreement to read as follows:

1.6A “Dollar”, “$” and “Dollars” means a United States Dollars or United States Dollars, as applicable.

4. Section 1.7 is hereby deleted in its entirety and is replaced with the following:

1.7 “First Commercial Sale” means April 01, 2013.

Page 1 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

5. Section 1.13 is hereby deleted in its entirety and is replaced with the following:

1.13 “Product” means individually and collectively, any Galectin-3 assay kits; any Galectin-3 control kit; and any Galectin-3 calibrator kit; in each case whether sold alone or as a part of another product; as well as any individual Galectin-3 assay test, control test or calibrator test.

6. Section 1.17 is hereby deleted in its entirety and is replaced with the following:

1.17 “Test” means an individual Galectin-3 assay test or Galectin-3 assay kit for a single determination of Galectin-3, sold by Abbott or its Affiliates, that would infringe one or more Valid Claims of a Patent Right in the country where such product is sold; provided, however, that a Test does not include Galectin-3 control kits or Galectin-3 calibrator kits.

7. The first sentence of Section 2.1 is hereby deleted in its entirety and is replaced with the following:

2.1 License Grant. BGM hereby grants to Abbott and its Affiliates a royalty-bearing license under Patent Rights to make, have made, use, offer for sale, sell, have sold, import, distribute and have distributed Products in the Territory.

8. Section 2.2 is hereby deleted in its entirety and is replaced with the following:

2.2 Additional Licensees; Most Favored Terms. BGM shall have the right to license Patent Rights to no more than four (4) Third Parties (“Other Licensees,” and together with Abbott, the “BGM Licensees”) for such Other Licensees to make, have made, use, offer for sale, sell, have sold, import, distribute, have distributed a Galectin-3 assay, whether on an automated system or not; provided, that such Other Licensees’ Galectin-3 assays may be commercialized only under the Other Licensees’ names and brands and only with respect to platforms or technology that are owned or controlled by such Other Licensees, unless Abbott otherwise consents after considering in good faith an alternative proposal by BGM; provided, further, that (a) beginning five (5) years after the date of First Commercial Sale, BGM may license Patent Rights to additional Third Parties (who shall then be considered Other Licensees) to offer for sale, sell, have sold, import, distribute or have distributed a Galectin-3 assay; and (b) no Other Licensee shall receive more favorable financial terms than those set forth in this Agreement for Abbott. If BGM enters into an arrangement with any Other Licensee for a Galectin-3 assay that contains more favorable financial terms than those set forth in this Agreement, BGM shall so inform Abbott within ten (10) days of entering such arrangement, and Abbott shall be entitled to elect to receive the benefit of the more favorable financial terms of such other arrangement from the date of the arrangement with the Other Licensee. In the event Abbott desires to elect such financial terms, Abbott will notify BGM within ten (10) days of learning of these terms, after which the Parties will develop and execute the necessary amendments to incorporate the more favorable financial terms into this Agreement. Other Licensees shall not have the right to grant sublicenses to any Third Party. For avoidance

Page 2 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

of doubt, BGM and the BGM Licensees shall be free to enter into agreements for development, manufacturing or distribution of their products, and such agreements shall not be considered licenses to Patent Rights for purposes of this Section 2.2.

9. Section 3.1 is hereby deleted in its entirety and is replaced with the following:

3.1 Product Fee.

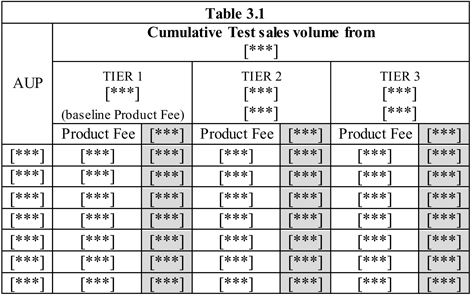

(a) [***], as consideration for the rights and licenses granted by BGM to Abbott and its Affiliates and BGM’s agreement to the other terms and conditions set forth in this Agreement, Abbott shall pay to BGM a fee as set forth in this Section 3.1, and as shown below in Table 3.1 (the “Product Fee”) for Tests sold to Third Parties in the Territory.

(b) The Product Fee [***], the following tiers shall apply:

| (i) | Cumulative Test sales by Abbott or its Affiliates to unaffiliated Third Parties from [***]; |

| (ii) | Cumulative Test sales by Abbott or its Affiliates to unaffiliated Third Parties from [***]; and |

| (iii) | Cumulative Test sales by Abbott or its Affiliates to unaffiliated Third Parties from [***]. |

[***], Abbott shall pay the Product Fee stipulated in this Section 3.1(b) subject to the provisions of Section 3.13 on completion of the renegotiation.

(c) Subject to the other terms and conditions of this Agreement, if there is any unlicensed competitor selling Galectin-3 products and, that unlicensed competitor’s product is covered by a Valid Claim, in any country in which a Test is then being sold, the Parties shall renegotiate the Product Fee to be paid, if any.

(d) [***]. Provided that, however, in no [***]that was being paid by Abbott immediately prior to the [***].

Page 3 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

10. Section 3.2 is hereby deleted in its entirety and replaced with the following:

3.2 [***].

(a) Abbott shall be entitled to [***] per Test by Abbott to BGM [***].

(b) [***], Abbott, in its sole discretion, shall have the right to terminate this Agreement under Section 11.2(j), and upon such termination, Abbott shall have no further rights and no further obligation to BGM, financial or otherwise hereunder, except as expressly set forth herein

11. Section 3.3, Test Rebate, is hereby deleted in its entirety.

12. Section 3.4 is hereby deleted in its entirety and replaced with the following:

3.4 [***]. The Product Fee set forth in Section 3.1 shall be payable hereunder only once with respect to a Test, regardless of the number of Valid Claims or patents set forth in Patent Rights pertaining thereto.

13. Section 3.7 is hereby deleted in its entirety and replaced with the following:

3.7 Product Fee Reports. With each payment hereunder, Abbott shall deliver to BGM a report describing on either a country-by-country basis the number of Tests sold by Abbott and its Affiliates, the gross invoice price for such sales and resultant Product Fees.

Table 3.1AUP Cumulative Test sales volume from [***] TIER 1 [***] TIER 2[***] TIER 3 [***] (baseline Product Fee) [***] [***] Product Fee [***] Product Fee [***] Product Fee [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***][***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***]

Page 4 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

14. Section 3.13 shall be added to the Agreement as follows:

3.13 True-Up. In the event that Abbott has paid an incorrect amount of Product Fee as a result of applying the wrong Tier, AUP or total sales; or that, pursuant to Section 3.1(b) above, [***]: (i) the amount of any such overpayment shall be applied either as an off-set against future Product Fees owed, or Abbott may request a refund, at its discretion; and (ii) Abbott will pay to BGM the amount of any such underpayment within sixty (60) days of the amount of any such underpayment being agreed upon by the Parties.

15. Section 6.2 is hereby deleted in its entirety and replaced with the following:

6.2 Abbott’s Galectin-3 Intellectual Property. If Abbott solely conceives and reduces to practice any new Product Inventions or Indication Inventions that result in new patents being sought to cover such new reagents or indications, Abbott shall own such Product Inventions and Indication Inventions, and shall make such Product Inventions and Indication Inventions available to BGM and the Other Licensees on a non-exclusive, royalty-free basis during the Term, so long as Abbott is compensated for the use of such Product Inventions and Indication Inventions. Abbott, in its sole discretion and for its own benefit, shall have the right to exploit such Abbott-owned Product Inventions and Indication Inventions in the Territory.

16. Section 11.2, Abbott Termination, is hereby amended as follows:

(a) 11.2(i) is hereby deleted in its entirety and replaced with the following:

11.2(i) A new marker shows superior clinical utility and is adopted by the physician community, or

17. Section 11.2(j) is hereby added to the Agreement as follows:

11.2(j) Abbott terminates this Agreement pursuant to Section 3.2(b).

18. Section 11.5 is hereby deleted in its entirety and replaced with the following:

11.5 Survival. The following Articles and Sections shall survive the expiration or termination of this Agreement: Articles 1, 8, 9, 10 and 11 and Sections 3.4, 3.10, 3.11, 3.12, 3.13, 6.1, 6.2, 6.5, 7.1.4 and 7.1.5. All provisions that survive termination, that are irrevocable or that arise due to termination shall survive in accordance with their terms. Any provisions of this Agreement contemplated by their terms to pertain to a period of time following termination or expiration of this Agreement shall survive only for the specified period of time.

Page 5 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

| 19. | A new Section 11.6, “Termination for Challenge of Patents” is hereby added to the Agreement as follows: |

11.6 Termination for Challenge of Patents. Subject to the exceptions set forth in 11.6(a), in the event that Abbott or any of its Affiliates initiates, or assists a Third Party in initiating, a patent re-examination, inter parties review, post grant or other patent office proceeding, opposition, litigation, or other court proceeding challenging the validity of any issued U.S. patent within the Patent Rights licensed under this Agreement (a “Patent Challenge”), BGM may terminate this Agreement upon sixty (60) days’ written notice to Abbott, unless such Patent Challenge is terminated or withdrawn by the end of such 60-day notice period.

(a) BGM shall have no right to terminate this Agreement under this Section 11.6 in the following circumstances:

(1) If there are no Other Licensees as defined in Section 2.2;

(2) If BGM is unable to obtain the same commitment set forth in Section 11.6 from any and all Other Licensees;

(3) If BGM asserts or threatens to assert the Patent Rights against an Abbott Indemnitee, a distributor or customer of an Abbott Indemnitee; or

(4) If BGM chooses not to enforce any and all claims of infringement of any BGM patents included in the Patent Rights, or any related proprietary rights, under the provisions of Section 7.1.2.

20. A new Section 11.7, “Bankruptcy,” is hereby added to the Agreement as follows:

11.7 Bankruptcy. All rights and licenses granted by BGM under this Agreement are and shall be deemed to be rights and licenses to “intellectual property”, as such term is used and interpreted under Section 365(n) of the United States Bankruptcy Code (the “Code”) (11 U.S.C. § 365(n)). Abbott shall have all rights, elections and protections under the Code and all other applicable bankruptcy, insolvency and similar laws with respect to the rights and licenses granted under this Agreement.

21. Section 12.7, “Notices”, shall be amended to replace the Parties contact information as follows:

| If to Abbott: | With a copy to: | |

| Abbott Laboratories | Abbott Laboratories | |

| 100 Abbott Park Road | 100 Abbott Park Road | |

| Abbott Park, IL 60064-6095 | Abbott Park, IL 60064-6049 | |

| Attn: [***] | Attn: [***] | |

| [***] | Dept. [***] | |

| Facsimile: [***] | Facsimile: [***] | |

Page 6 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

If to BGM:

BG Medicine, Inc.

Suite 210

880 Winter Street

Waltham, MA. 02451

Tel: 781-890-1199

Fax: 781-895-1119

Attn: President & CEO

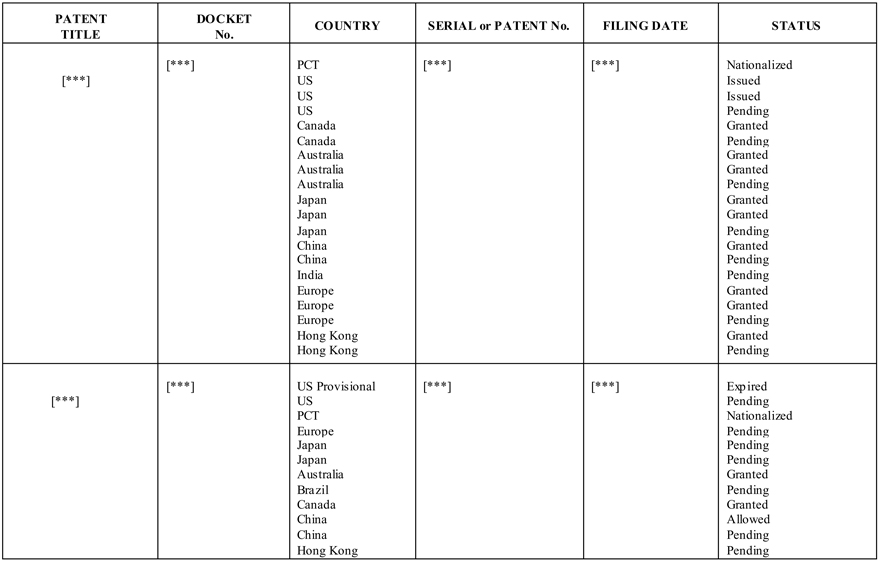

22. Exhibit 1.12, “Patent Rights” is hereby deleted in its entirety and is replaced with the Exhibit 1.12 attached to this Amendment as Schedule B.

23. Exhibit 4.4, “BGM Promotional Activities,” is hereby deleted in its entirety and is replaced with the Exhibit 4.4 attached to this Amendment as Schedule A.

24. Except as expressly amended by this Third Amendment, all of the terms and conditions of the Agreement remain in full force and effect.

25. This Third Amendment may be executed in two (2) original counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Parties have executed this Third Amendment as of the date first above written.

| ABBOTT LABORATORIES | BG MEDICINE, INC. | |||||||

| By: | /s/ Brian J. Blaser |

By: | /s/ Paul R. Sohmer, M.D. | |||||

| Name: | Brian J. Blaser | Name: | President & CEO | |||||

| Title: | Executive Vice President | Title: | Paul R. Sohmer, M.D. | |||||

| President Diagnostics | ||||||||

Page 7 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

Schedule A

Exhibit 4.4

BGM Promotional Activities

BGM agrees to use Commercially Reasonable Efforts, as set forth in Section 4.4, to accomplish the following activities in support of Galectin-3 marker development. These activities shall be reviewed at the quarterly Steering Committee meetings and adjusted by mutual written agreement of the Parties.

| 1) | Continue to develop and execute a [***] of Galectin-3 [***] and [***] in [***], the US, [***]. Activities shall include: |

| a. | Development and training of [***] to [***] of Galectin-3 products. |

| b. | Continue to work with [***] where Galectin-3 [***]. |

| c. | Continued [***] for Galectin-3 [***]. |

| 2) | Create and execute a [***] in [***] and US. Activities shall include: |

| a. | Develop, test and refine Galectin-3 [***] and [***]. |

| b. | Create, train and deploy a [***] for Galectin-3. |

| 3) | Develop and implement a [***] for Galectin-3 in [***] Galectin-3 [***]. Activities shall include: |

| a. | Conduct a [***] in the above countries [***] of Galectin-3 [***] and [***], the key [***] and [***]. Develop and execute a [***] in the above countries. |

Page 8 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

Schedule B - Exhibit 1.12

Patent Rights - BG MEDICINE PATENTS and PATENT APPLICATIONS RELATING TO GALECTIN-3

PATENT TITLE

DOCKETNo.

COUNTRY

SERIAL or PATENT No.

FILING DATE

STATUS [***] PCT [***] [***] Nationalized [***] US Issued US Issued US Pending

Canada Granted Canada Pending Australia Granted Australia Granted Australia Pending Japan Granted Japan Granted Japan Pending China Granted China Pending India Pending Europe Granted Europe Granted Europe Pending Hong Kong Granted Hong Kong Pending

[***] US Provisional [***] [***] Expired [***] US Pending PCT Nationalized Europe Pending Japan Pending Japan Pending Australia Granted Brazil Pending Canada Granted China Allowed China Pending Hong Kong Pending

Page 9 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

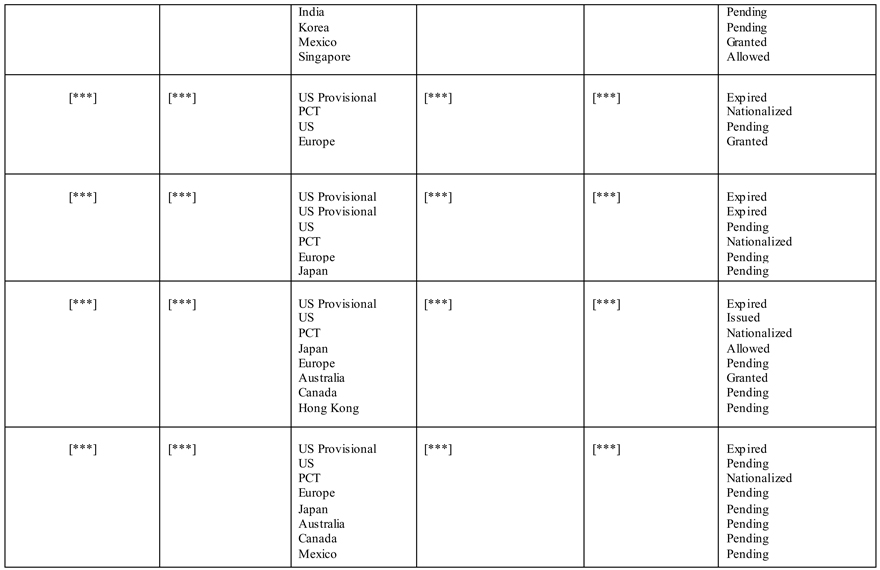

India Korea Mexico Singapore Pending Pending Granted Allowed [***] [***] US Provisional [***] [***] Expired PCT Nationalized US Pending Europe Granted [***] [***] US Provisional [***] [***] Expired US Provisional Expired US Pending PCT Nationalized Europe Pending Japan Pending [***] [***] US Provisional [***] [***] Expired US Issued PCT Nationalized Japan Allowed Europe Pending Australia Granted Canada Pending Hong Kong Pending [***] [***] US Provisional [***] [***] Expired US Pending PCT Nationalized Europe Pending Japan Pending Australia Pending Canada Pending Mexico Pending

Page 10 of 12

Portions of this Exhibit, indicated by the mark “[***],” were omitted and have been filed separately with the Securities and Exchange Commission pursuant to the Registrant’s application requesting confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended.