Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - EVIO, INC. | sgby_ex311.htm |

| EX-31.2 - CERTIFICATION - EVIO, INC. | sgby_ex312.htm |

| EX-32.1 - CERTIFICATION - EVIO, INC. | sgby_ex321.htm |

| EX-32.2 - CERTIFICATION - EVIO, INC. | sgby_ex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-Q

______________________________

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended JUNE 30, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________________ to ___________________ .

Commission File Number: 000-12350

| SIGNAL BAY, INC. |

| (Exact name of registrant as specified in its charter) |

| Colorado | 47-1890509 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |

| 9484 S. Eastern Ave, Suite 141, Las Vegas, NV | 89123 | |

| (Address of principal executive offices) | (Zip Code) |

(702) 748-9944

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Non-accelerated filer | ¨ |

| Accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Title of Each Class | Outstanding as of August 8, 2015 | |

| Common stock, par value $0.0001 per share | 356,254,845 | |

| Class A Preferred Stock, par value $0.0001 per share | 1,840,000 | |

| Class B Preferred Stock, par value $0.0001 per share | 5,000,000 |

SIGNAL BAY, INC.

FORM 10-Q

June 30, 2015

TABLE OF CONTENTS

| PART I -- FINANCIAL INFORMATION | |||||

| Item 1. | Financial Statements | 3 | |||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 10 | |||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 16 | |||

| Item 4. | Control and Procedures | 16 | |||

| PART II -- OTHER INFORMATION | |||||

| Item 1. | Legal Proceedings | 19 | |||

| Item 1A. | Risk Factors | 19 | |||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 19 | |||

| Item 3. | Defaults Upon Senior Securities | 19 | |||

| Item 4. | Mine Safety Disclosures | 19 | |||

| Item 5. | Other Information | 19 | |||

| Item 6. | Exhibits | 20 | |||

| 2 |

PART I -- FINANCIAL INFORMATION

ITEM 1 –FINANCIAL STATEMENTS

Signal Bay, Inc.

Balance Sheets

(Unaudited)

|

| June 30, 2015 |

|

| September 30, 2014 |

| |||

|

|

|

|

|

|

| |||

| ASSETS | ||||||||

|

|

|

|

|

|

|

| ||

| Current assets: |

|

|

|

|

|

| ||

| Cash or cash equivalents |

| $ | 4,345 |

|

| $ | - |

|

| Accounts receivable |

|

| 4,900 |

|

|

| - |

|

| Total current assets |

|

| 9,245 |

|

|

| - |

|

|

|

|

|

|

|

|

|

| |

| Fixed assets: |

|

|

|

|

|

|

|

|

| Property and Equipment |

| $ | 2,194 |

|

| $ | - |

|

| Software |

|

| 58,333 |

|

|

| - |

|

| Furniture and Fixtures |

|

| 10,413 |

|

|

| - |

|

| Intangible Assets |

|

| 34,750 |

|

|

| - |

|

| Accumulated Depreciation |

|

| (10,680 | ) |

|

| - |

|

| Total Fixed Assets |

|

| 95,010 |

|

|

| - |

|

|

|

|

|

|

|

|

|

| |

| Other assets: |

|

|

|

|

|

|

|

|

| Libra Wellness Center, LLC (4% ownership) |

| $ | 40,000 |

|

| $ | - |

|

| Total Other Assets |

|

| 40,000 |

|

|

| - |

|

| Total assets |

| $ | 144,255 |

|

| $ | - |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ DEFICIT | ||||||||

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

| $ | 11,375 |

|

| $ | 46,289 |

|

| Loans payable- related party |

|

| 62,500 |

|

|

| 10,000 |

|

| Short Term Notes - related party |

|

| 40,000 |

|

|

|

|

|

| Total liabilities |

|

| 113,875 |

|

|

| 56,289 |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

| Class A Preferred Stock, Par Value $.0001, 1,850,000 authorized, 1,840,000 issued and outstanding, respectively |

|

| 184 |

|

|

| 184 |

|

| Class B Preferred Stock, Par Value $.0001, 5,000,000 authorized, 5,000,000 issued and outstanding, respectively |

|

| 500 |

|

|

| 500 |

|

| Common stock, par value $0.0001, 750,000,000 authorized, 351,967,345 and 290,144,844 issued and outstanding, respectively |

|

| 35,197 |

|

|

| 29,014 |

|

| Additional paid in capital |

|

| 1,168,416 |

|

|

| (32,364 | ) |

| Accumulated deficit |

|

| (1,173,917 | ) |

|

| (53,623 | ) |

| Total shareholders' deficit |

|

| 30,380 |

|

|

| (56,289 | ) |

| Total liabilities and shareholders' deficit |

| $ | 144,255 |

|

| $ | - |

|

The accompanying notes are an integral part of these unaudited financial statements.

3

Signal Bay, Inc.

Statements of Operations

(Unaudited)

|

| Three months ended |

|

| Nine months ended |

| |||

|

| June 30, 2015 |

|

| June 30, 2015 |

| |||

|

|

|

|

|

|

|

|

|

|

| Revenues, net |

| $ | 6,399 |

|

| $ | 16,812 |

|

| Gross Profit |

|

| 6,399 |

|

|

| 16,812 |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

| SG&A |

|

| 320,939 |

|

|

| 1,126,426 |

|

| Depreciation and Amortization |

|

| 5,612 |

|

|

| 10,680 |

|

| Total operating expenses |

|

| 326,551 |

|

|

| 1,137,106 |

|

|

|

|

|

|

|

|

|

| |

| Net Loss |

| $ | (320,152 | ) |

| $ | (1,120,294 | ) |

| Net loss per share, basic and diluted |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

|

| |

| Weighted average shares outstanding |

|

| 353,102,137 |

|

|

| 323,902,484 |

|

The accompanying notes are an integral part of these unaudited financial statements.

4

Signal Bay, Inc.

Statements of Cash Flows

(Unaudited)

|

| Nine months ended |

| ||

|

| June 30, 2015 |

| ||

| Cash flows from operating activities |

|

|

| |

| Net loss |

| $ | (1,120,294 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

| Loss on Conversion of Debt |

|

| 90,000 |

|

| Stock based compensation |

|

| 907,880 |

|

| Depreciation |

|

| 10,680 |

|

| Change in operating assets and liabilities: |

|

|

|

|

| Accounts payable |

|

| 5,086 | |

| Accounts receivable |

|

| (4,900 | ) |

| Net cash used in operating activities |

|

| (111,549 | ) |

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

| Hardware and equipment purchased |

|

| (2,194 | ) |

| Domain, website, and social media accounts purchase |

|

| (3,500 | ) |

| Furniture and Fixtures |

|

| (10,413 | ) |

| Net cash used in investing activities |

|

| (16,107 | ) |

|

|

|

|

| |

| Cash flows from financing activities |

|

|

|

|

| Proceeds from issuance of common stock |

|

| 79,500 |

|

| Proceeds from related party advances |

|

| 52,500 |

|

| Net cash provided by financing activities |

|

| 132,000 |

|

|

|

|

|

| |

| Net change in cash |

|

| 4,345 |

|

| Cash balance, beginning of period |

|

| 0 |

|

| Cash balance, end of period |

| $ | 4,345 |

|

|

|

|

|

| |

| Supplemental disclosures: |

|

|

|

|

| Cash paid for interest |

| $ | - |

|

| Cash paid for income taxes |

|

| - |

|

|

|

|

|

| |

| Noncash investing and financing activities: |

|

|

|

|

| Software purchased with common stock |

|

| 58,333 |

|

| Domain, websites, and social media accounts purchased with common stock |

|

| 31,250 |

|

| 4% Interest in Libra Wellness Center, LLC for Installment Note to related party |

|

| 40,000 |

|

| Converted $40K liability to non-affiliated consultant for 12,000,000 shares |

|

| 40,000 |

|

The accompanying notes are an integral part of these unaudited financial statements.

| 5 |

SIGNAL BAY, INC.

NOTES TO UNAUDITED FINANCIAL STATEMENTS

Note 1 – Basis of Presentation

The accompanying unaudited financial statements of Signal Bay, Inc. (the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission ("SEC"), and should be read in conjunction with the audited financial statements and notes thereto contained in the Company's registration statement filed with the SEC on Form 10. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosure contained in the audited financial statements for the most recent fiscal year 2014 as reported in Form 10, have been omitted.

In regards to investments the company has chosen to use a Cost Method Investment accounting policy. The company accounts for these investments in accordance with ASC320 using historical cost method.

Note 2 – Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has negative working capital, recurring losses, and does not have an established source of revenues sufficient to cover its operating costs. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse effect upon it and its shareholders.

Note 3 – Related Party Transaction

During the nine months ended June 30, 2015, the Company borrowed $52,500 from Lori Glauser, our COO, for working capital. The total amount owed is $62,500 as of June 30, 2015. The loan is at 0% interest and is to be repaid by September 30, 2015.

During the quarter, June 30, 2015, $14,000 was paid Newport Commercials Advisors (NCA) for management consulting services, a company which is owned 100% by William Waldrop, our CEO. Under terms of the agreement, NCA will be paid $5,000 per month during the duration of the agreement.

During the quarter, June 30, 2015, the Company continued to provide consulting with Libra Wellness Center, LLC, of which Lori J. Glauser, our COO, is a minority (4%) owner. During the quarter the Company provided management consulting services and invoiced Libra Wellness for the amount of $4,500.

On June 22, 2015, the Company purchased a 4% ownership of Libra Wellness Center, LLC from Lori J Glauser, our COO for $40,000. The $40,000 is to be paid in one installment due no later than April 1, 2016.

6

Note 4 – Equity

On October 2, 2014, we issued 250,000 common shares in exchange for $2,500 cash.

On October 3, 2014, we issued 416,667 common shares in exchange for $5,000 cash.

On October 4, 2014, we issued 833,334 common shares in exchange for $10,000 cash.

On December 31, 2014, we issued 5,000,000 common shares for the purchase of the software database platform to be used by Signal Bay Research. The company recorded an asset acquisition of $58,333 related to this transaction.

On January 1, 2015, the company approved the 2015 Equity Incentive Plan.

On January 1, 2015, we issued 12,000,000 shares to our CEO under the Company’s Equity Incentive Plan. The company expensed $276,000 related to this transaction.

On January 1, 2015, we issued 12,000,000 shares to our COO under the Company’s Equity Incentive Plan. The company expensed $276,000 related to this transaction.

On January 1, 2015, we issued 1,000,000 shares to Joshua Copeland under the Company’s Equity Incentive Plan for software management services. There are 3,000,000 shares remaining to be vested over the next 3 months. The company expensed $23,000 related to this transaction.

On January 1, 2015, we issued 750,000 shares to our VP Business Development under the Company’s Equity Incentive Plan. There are 2,250,000 shares remaining to be vested over the next 3 months. The company expensed $17,250 related to this transaction.

On January 27, 2015, we issued 1,000,000 shares to Electrum Partners under the Company’s Equity Incentive Plan for advisory services. There are 3,000,000 shares remaining to be vested over the next 24 months. The company expensed $22,500 related to this transaction.

On February 1, 2015, we issued 1,000,000 shares to Joshua Copeland under the Company’s Equity Incentive Plan for software management services. There are 2,000,000 shares remaining to be vested over the next 2 months. The company expensed $22,500 related to this transaction.

On February 1, 2015, we issued 750,000 shares to our VP Business Development under the Company’s Equity Incentive Plan. There are 1,500,000 shares remaining to be vested over the next 2 months. The company expensed $16,875 related to this transaction.

On February 5, 2015, we issued 1,200,000 common shares in exchange for $15,000 cash.

7

On February 25, 2015, we issued 1,000,000 shares to a consultant for the purpose of writing the Medical Marijuana Desk Reference under the Company’s Equity Incentive Plan. The company expensed $22,500 related to this transaction.

On February 26, 2015, we issued 400,000 common shares in exchange for $5,000 cash.

On February 27, 2015, we issued 160,000 common shares in exchange for $2,000 cash.

On March 1, 2015, we issued 1,000,000 shares to Joshua Copeland under the Company’s Equity Incentive Plan for software management services. There are 1,000,000 shares remaining to be vested over the next 1 month. The company expensed $22,500 related to this transaction.

On March 1, 2015, we issued 750,000 shares to our VP Business Development under the Company’s Equity Incentive Plan. There are 750,000 shares remaining to be vested over the next 1 months. The company expensed $16,875 related to this transaction.

On March 1, 2015, we issued 125,000 shares to members of our advisory committee under the Company’s Equity Incentive Plan. The company expensed $2,813 related to this transaction.

On March 1, 2015, we issued 450,000 shares to a consultant for the purpose of social media and marketing efforts under the Company’s Equity Incentive Plan. The company expensed $10,125 related to this transaction.

On March 1, 2015, we issued 500,000 shares to our sales consultant under the Company’s Equity Incentive Plan. This was fully vested as of May 1, 2015 and the expense was calculated as part of a true-up as of June 30, 2015.

On March 5, 2015, we issued 2,500,000 common shares valued at $31,250 and $3,500 cash for the purchase of the domain Marijuanamath.com, website, all social media accounts. The company recorded an asset acquisition of $34,750 related to this transaction.

On March 24, 2015, we issued 1,600,000 common shares in exchange for $20,000 cash.

On April 1, 2015, we issued 1,000,000 shares to Joshua Copeland under the Company’s Equity Incentive Plan for software management services. This agreement is fully vested. The company expensed $22,500 related to this transaction.

On April 1, 2015, we issued 750,000 shares to our VP Business Development under the Company’s Equity Incentive Plan. This agreement is fully vested. The company expensed $16,875 related to this transaction.

On April 1, 2015, we issued 500,000 shares to our sales consultant our under the Company’s Equity Incentive Plan. This was fully vested as of May 1, 2015 and the expense was calculated as part of a true-up as of June 30, 2015.

8

On April 1, 2015, we issued 375,000 shares to members of our advisory committee under the Company’s Equity Incentive Plan. The company performed a true-up of the expense as of June 30, 2015.

On April 18, 2015, we issued 21,000,000 shares to a non-affiliate consultant in accordance with the August 28, 2014 management consulting agreement. The consultant exercised the option to convert the $40,000 owed to common stock.

On May 1, 2015, we rescinded 18,000,000 shares and reissued 9,000,000 shares to a non-affiliate consultant in accordance with the August 28, 2014 management consulting agreement. Valuation was erroneously calculated 50% discount of $40,000 liability. It was amended to reflect solely a 60% discount to the stock price on August 28, 2014. The company has expensed $90,000 in loss on conversion of debt associated with this transaction

On May 1, 2015, we issued 250,000 shares to our sales consultant our under the Company’s Equity Incentive Plan. This agreement is fully vested. This was fully vested as of May 1, 2015 and there has been a true-up of all the shares issued for the sales consultant. The true-up of the expenses totaling $123,635.

On May 1, 2015, we issued 156,250 shares to members of our advisory committee under the Company’s Equity Incentive Plan. The company performed a true-up of the expense as of June 30, 2015.

On May 26, 2015, we issued 1,600,000 common shares in exchange for $20,000 cash.

On June 1, 2015, we issued 300,000 shares to a consultant for social media and marketing services under the Company’s Equity Incentive Plan. The company expensed $4,500 related to this transaction.

On June 1, 2015, we issued 156,250 shares to members of our advisory committee under the Company’s Equity Incentive Plan. The company performed a true-up of the shares issued as of June 30, 2015 which resulted in a quarterly expense of $10,656.

On June 17, 2015, we issued 50,000 shares to Casey Houlihan under the Company’s Equity Incentive Plan for advisory services. There are 450,000 shares remaining to be vested over the next 12 months. The company performed a true-up of the shares issued to Casey Houlihan as of June 30, 2015, The true-up of the shares resulted in a quarterly expense of $776.

Note 5 – Subsequent Events

On July 1, 2015, the company engaged Jim Fitzpatrick as an independent consultant for management consulting services. Under the terms of the agreement, the company will compensate Mr. Fitzpatrick 1,000,000 common shares for management consulting services commencing July 1, 2015 for a period of 5 consecutive months.

On July 23, 2015, the company executed a promissory note in the amount of $105,000 with St. George Investments, LLC. The maturity date for the note is January 22, 2016. If in the event of default, St. George has the right to convert the outstanding balance to common stock at a 70% discount to market, calculated on the 3 lowest Closing Bid Prices in the 20 days immediately preceding the applicable conversion. The note contains in Original Issue Discount, in the amount of $22,500. The company will receive a $11,250 discount if paid within 90 days of Purchase Price Date and $5,000 if paid within 135 days of Purchase Price Date.

On July 31, 2015, we issued 3,500,000 shares to Kodiak Capital Group, LLC as a commitment fee for a One Million Dollar Equity Financing Agreement. The company expensed $60,900 related to this transaction. The company is subject to a Registration Rights Agreement which requires the Company to file a S1 Registration Statement with the SEC within 30 days and must receive a notice of effectiveness from the SEC prior to executing a Put Notice. The Purchase Price of the security is based on 75% of the Market Price based on the Put Date. Market price is calculated on the lowest daily volume weight average price for any trading day during the valuation period, which is the five days from the Put Notice to the Put Date.

9

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained herein involve risks and uncertainties, including statements as to:

| · | our future operating results; | |

| · | our business prospects; | |

| · | our contractual arrangements and relationships with third parties; | |

| · | the dependence of our future success on the general economy; | |

| · | our possible financings; and | |

| · | the adequacy of our cash resources and working capital. |

These forward-looking statements can generally be identified as such because the context of the statement will include words such as we “believe,” “anticipate,” “expect,” “estimate” or words of similar meaning. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which are described in close proximity to such statements and which could cause actual results to differ materially from those anticipated as of the date of this report. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this report, and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto, included elsewhere in this report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to those differences include those discussed below and elsewhere in this report, particularly in the “Risk Factors” section.

Critical Accounting Policies and Estimates.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

10

Business of the Registrant

Signal Bay, Inc. is an industry research, advisory, and services firm that currently focuses on the emerging cannabis industry. Signal Bay provides information, data, and advice to industry professionals via a subscription-based data service, publications, and advisory services both directly and via referrals to third party consultants through the Cannabis Consultant Marketplace.

The company also offers startup and management services to cultivators, producers, retailers, and test facilities.

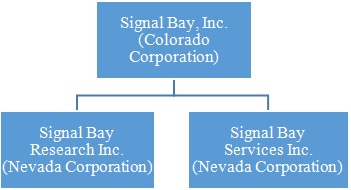

Corporate Structure

Description of Services

Signal Bay Research

The company, through its wholly owned subsidiary Signal Bay Research, provides industry research and advisory services for the legal cannabis industry.

Signal Bay Research is developing and initially expects to offer the following products and services.

· · · · · ·

Publications Industry news and information portal Downloadable datasets Custom analyses Advisory services Consultant marketplace

Signal Bay will work in partnership with industry experts to produce reports. Reports currently in development include: a medical marijuana desk reference, which provides information regarding the medical conditions that have been demonstrated to be treated by cannabis; reports describing the business, regulatory, and market environment of the legal cannabis industry; and a report discussing the energy implications and environmental impact of indoor cultivation. Datasets includes lists of companies, people, events, and regulations related to the cannabis industry.

Signal Bay Research developed CANNAiQ, a website that serves as the industry web portal to facilitate management and awareness of the services offered by Signal Bay Research.

Signal Bay also offers the Cannabis Consultant Marketplace. The Cannabis Consultant Marketplace an online platform to support a network of consultants who provide services to the cannabis industry, and introduce them to companies that are seeking expertise. Companies submit projects to Signal Bay and the company matches projects to consultants. Signal Bay facilitates referrals for a fee and/or manages resulting projects by retaining consultants and deploying them to clients who request work.

11

Signal Bay Services

The company, through its wholly owned subsidiary Signal Bay Services initially plans to offer the following services to state licensed medical marijuana establishments:

· Advice surrounding the processing and production of cannabis products including:

o Advice and services related to the acquisition, configuration, operation, and optimization of extraction and processing equipment and its use.

o Assistance in the extraction and purification of cannabis flower and its products.

o Refining and reformulation of cannabis products

· Development of standard operating procedures for cannabis processing facilities.

· Compliance and regulatory support

· Product development services, including development of infusions, concentrates, and infused edibles.

Partnership Model

Signal Bay, Inc. intends to develop strategic partnerships with licensed medical marijuana establishments, their agents, and industry experts to acquire the data and expertise necessary to fulfill our strategic plan. For example, we have engaged in a Services Agreement with Libra Wellness Center, LLC. (“Libra”) to provide services to the production facility, which will process cannabis from its hydroponic cultivation center to produce cannabis oil extractions, including CBD. Libra received a provisional medical marijuana establishment license from the State of Nevada and the local permits from the City of North Las Vegas to build and operate a cultivation and production facility.

Signal Bay is also collaborating with a number of experts in the areas of cultivation, building energy management, wholesale and retail product price reporting, medical research, nutraceutical development and sales, regulation and compliance, land use and planning, and cannabis market research. Signal Bay intends to pursue compelling acquisitions and form strategic partnerships to facilitate company growth.

MarijuanaMath.com

On March 5, 2015, Signal Bay, Inc. acquired the domain marijuananath.com, the website and social media accounts. At the time of acquisition, the marijuanamath.com social media accounts collectively had 950 active and verified followers. As of May 9, 2015 the marijuanamath.com social media accounts have 1205 followers.

RESULTS OF OPERATIONS

Operating Expenses

Revenue

The Company generated $6,399 in net revenue for the three months ending June 30, 2015.

The Company generated $16,812 in net revenue for the nine months ending June 30, 2015.

12

Operating Expenses

For the three months ending June 30, 2015, the Company had $326,551 in operating expenses, consisted of selling general and administrative expenses of $320,939 and depreciation expense of $5,612. The Company’s total expense for the period ending June 30, 2015 was $326,551.

For the nine months ending June 30, 2015, the Company had $1,137,106 in operating expenses consisted of selling general and administrative expenses of $1,126,427 and depreciation expense of $10,680. The Company’s total expense for the period ending June 30, 2015 was $1,137,106.

Net Profit (Loss)

For the three months ending June 30, 2015, the Company had Net Loss of $320,152. This was derived as follows:

| Sales: |

| $ | 6,867 |

|

| COGS: |

| $ | 468 |

|

| Gross Profit |

| $ | 6,399 |

|

| Expenses: |

| $ | 326,551 |

|

| Accrued Taxes: |

| $ | - |

|

| Net loss: |

| $ | (320,152 | ) |

For the nine months ending June 30, 2015, the Company had Net Loss of $1,120,294. This was derived as follows:

| Sales: |

| $ | 17,280 |

|

| COGS: |

| $ | 468 |

|

| Gross Profit |

| $ | 16,812 |

|

| Expenses: |

| $ | 1,137,106 |

|

| Accrued Taxes: |

| $ | - |

|

| Net loss: |

| $ | (1,120,294 | ) |

Dividends

During quarter ended June 30, 2015, the Company declared $0 in dividends.

During nine months ended June 30, 2015, the Company declared $0 in dividends.

| 13 |

Liquidity and Capital Resources

As of June 30, 2015 the Company had $4,345 in cash and $4,900 receivables for a total of $9,245 in current assets. In management’s opinion, the Company’s cash position is insufficient to maintain its operations at the current level for the next 12 months. Any expansion may cause the Company to require additional capital until such expansion began generating revenue. It is anticipated that the raise of additional funds will principally be through the sales of our securities. As of the date of this report, additional funding has not been secured and no assurance may be given that we will be able to raise additional funds.

As of June 30, 2015, our total liabilities were $113,875, which consists of $11,375 in accounts payable, $62,500 in loans from our shareholder and short term note of $40,000.

Critical Accounting Policies

Our critical accounting policies, including the assumptions and judgments underlying them, are disclosed in the notes to our audited financial statements included in this registration statement. We have consistently applied these policies in all material respects. Below are some of the critical accounting policies:

The company pursues opportunities to realize revenues from the sale of its products. It is the company’s policy that revenues and gains will be recognized in accordance with ASC Topic 605-10-25, “Revenue Recognition.” Net sales are recognized upon transfer of ownership, including passage of title to the customer and transfer of risk of loss related to those goods. Transfer of title and risk of loss are based upon shipment under free on board shipping point for most goods or upon receipt by the customer depending on the country of the sale and the agreement with the customer. We may also ship product directly from our supplier to the customer and recognize revenue when the product is delivered to and accepted by the customer. License and other revenues, if any, are primarily recognized based upon shipment of licensed products sold by our licensees. Sales taxes imposed, if any, on our revenues from product sales are presented on a net basis on the consolidated statements of income and therefore do not impact net revenues or costs of goods sold. Any amounts collected from a customer prior to transfer of title and transfer of risk of loss shall be presented as a liability under Deferred Revenue and only presented as revenue once the passage of title to the customer and transfer of risk of loss related to those goods occurs.

14

Emerging Growth Company Status

We are an “emerging growth company” as defined under the Jumpstart Our Business Startups Act, commonly referred to as the JOBS Act. We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

As an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to:

· · ·

not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act (we also will not be subject to the auditor attestation requirements of Section 404(b) as long as we are a “smaller reporting company,” which includes issuers that had a public float of less than $ 75 million as of the last business day of their most recently completed second fiscal quarter); reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Under this provision, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. In other words, an “emerging growth company” can delay the adoption of such accounting standards until those standards would otherwise apply to private companies until the first to occur of the date the subject company (i) is no longer an “emerging growth company” or (ii) affirmatively and irrevocably opts out of the extended transition period provided in Securities Act Section 7(a) (2) (B). The Company has elected to take advantage of this extended transition period and, as a result, our financial statements may not be comparable to the financial statements of other public companies. Accordingly, until the date that we are no longer an “emerging growth company” or affirmatively and irrevocably opt out of the exemption provided by Securities Act Section 7(a) (2) (B), upon the issuance of a new or revised accounting standard that applies to your financial statements and has a different effective date for public and private companies, clarify that we will disclose the date on which adoption is required for non-emerging growth companies and the date on which we will adopt the recently issued accounting standard.

Accounting and Audit Plan

In the next twelve months, we anticipate spending approximately $15,000 - $20,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

15

Our Website.

Our website can be found at www.signalbayinc.com.

ITEM 3 – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company, as a smaller reporting company, as defined by Rule 229.10(f)(1), is not required to provide the information required by this Item.

ITEM 4 – CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

Our principal executive and principal financial officers have evaluated the effectiveness of our disclosure controls and procedures, as defined in Rules 13a – 15(e) and 15d – 15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the SEC’s rules and forms and that the information is gathered and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow for timely decisions regarding required disclosure.

Our principal executive officer and principal financial officer evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this report. Based on this evaluation, our principal executive officer and principal financial officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report.

The reason we believe our disclosure controls and procedures are not effective is because:

| 1. | No independent directors; | |

| 2. | No segregation of duties; | |

| 3. | No audit committee; and | |

| 4. | Ineffective controls over financial reporting. |

As of June 30, 2015, the Company has not taken any remediation actions to address these weaknesses in our controls even though they were identified in September 2014. The Company’s management expects, once it is in the financial position to do so, to hire additional staff in its accounting department to be able to segregate the duties. The Company expects that the expense will be approximately $60,000 per year which would allow the Company to hire 2 new staff members.

This 10-Q does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to Rule 308(b) of Regulation S-K.

16

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

| 1. | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; |

| 2. | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. GAAP, and that our receipts and expenditures are being made only in accordance with the authorization of our management and directors; and |

| 3. | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of June 30, 2015. Based on this assessment, management concluded that the Company did not maintain effective internal controls over financial reporting as a result of the identified material weakness in our internal control over financial reporting described below. In making this assessment, management used the framework set forth in the report entitled Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, or COSO. The COSO framework summarizes each of the components of a company's internal control system, including (i) the control environment, (ii) risk assessment, (iii) control activities, (iv) information and communication, and (v) monitoring.

Identified Material Weakness

A material weakness in our internal control over financial reporting is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

Management identified the following material weakness during its assessment of internal controls over financial reporting as of June 30, 2015:

Independent Directors: The Company intends to obtain at least 2 independent directors at its 2015 annual shareholder meeting. The cost associated to the addition is minimal and not deemed material.

17

No Segregation of Duties: Ineffective controls over financial reporting: The company intends to hire additional staff members, either as employees or consultants, prior to June 30, 2015. These additional staff members will be responsible for making sure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required and will the staff members will have segregated responsibilities with regard to these responsibilities. The costs associated with the hiring the additional staff members will increase the Company's Sales, General and Administration (SG&A) Expense. It is anticipated the cost of the new staff members will be approximately $60,000 per year.

No audit committee: After the election of the independent directors at the 2015 annual shareholder meeting, the Company expects that an Audit Committee will be established. The cost associated to the addition an audit committee are minimal and not deemed material.

Resources: As of June 30, 2015, we have no full-time employees with the requisite expertise in the key functional areas of finance and accounting. As a result, there is a lack of proper segregation of duties necessary to insure that all transactions are accounted for accurately and in a timely manner.

Written Policies & Procedures: We need to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity transactions, and prepare, review and submit SEC filings in a timely manner.

Management’s Remediation Initiatives

As our resources allow, we will add financial personnel to our management team. We plan to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity transactions. We will also create an audit committee made up of our independent directors.

As of June 30, 2015, the Company has not taken any remediation actions to address these weaknesses in our controls even though they were identified during the year ending September 30, 2014. The Company’s management expects, once it is in the financial position to do so, to hire additional staff in its accounting department to be able to segregate the duties. The Company expects that the expense will be approximately $60,000 per year which would allow the Company to hire 2 new staff members.

(b) Changes in Internal Control Over Financial Reporting

We need to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity transactions, and prepare, review and submit SEC filings in a timely manner

18

PART II -- OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

The above statement notwithstanding, shareholders and prospective investors should be aware that certain risks exist with respect to the Company and its business, including those risk factors contained in our most recent Registration Statements on Form S-1 and Form 10, as amended. These risks include, among others: limited assets, lack of significant revenues and only losses since inception, industry risks, dependence on third party manufacturers/suppliers and the need for additional capital. The Company’s management is aware of these risks and has established the minimum controls and procedures to insure adequate risk assessment and execution to reduce loss exposure.

ITEM 2. UNREGISTERED SALE OF EQUITY SECURITIES AND USE OF PROCEEDS

On February 5, 2015, we issued 1,200,000 common shares in exchange for $15,000 cash.

On February 26, 2015, we issued 400,000 common shares in exchange for $5,000 cash.

On February 27, 2015, we issued 160,000 common shares in exchange for $2,000 cash.

On March 5, 2015, we issued 2,500,000 common shares for the purchase of the domain marijuanamath.com, website, social media accounts and customer list. The company recorded an asset acquisition of $34,750 related to this transaction.

On March 24, 2015, we issued 1,600,000 common shares in exchange for $20,000 cash.

On May 26, 2015, we issued 1,600,000 common shares in exchange for $20,000 cash.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. Mine Safety Disclosures.

Not Applicable.

ITEM 5. OTHER INFORMATION

There was no other information during the quarter ended June 30, 2015, which was not previously disclosed in our filings during that period.

19

ITEM 6. EXHIBITS

| 31.1 | Certifications pursuant to Section 302 of Sarbanes Oxley Act of 2002 | |

| 31.2 | Certifications pursuant to Section 302 of Sarbanes Oxley Act of 2002 | |

| 32.1 | Certifications pursuant to Section 906 of Sarbanes Oxley Act of 2002 | |

| 32.2 | Certifications pursuant to Section 906 of Sarbanes Oxley Act of 2002 | |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

| 20 |

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

| SIGNAL BAY, INC. | |||

| Date: August 14, 2015 | By: | /s/ William Waldrop | |

| William Waldrop | |||

| Chief Executive and Financial Officer | |||

| Date: August 14, 2015 | By: | /s/ Lori Glauser | |

| Lori Glauser | |||

| Director, Chief Operating Officer |

21