Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FARMERS NATIONAL BANC CORP /OH/ | d27442d8k.htm |

Investor Presentation June 30, 2015 Exhibit 99.1 |

2 Disclosure Statements Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements

about the financial condition, results of operations, asset quality trends and profitability of Farmers National Banc Corp. (“Farmers”). Forward-looking statements are not historical facts but instead express

management’s current expectations, forecasts of future events or long-term-goals, many of which, by their nature, are inherently uncertain and outside of

Farmers control. Forward-looking

statements

are

preceded

by

terms

such

as

“expects,”

“believes,”

“anticipates,”

“intends”

and

similar

expressions,

as

well

as

any

statements

related to future expectations of performance or

conditional verbs, such as “will,” “would,” “should,” “could” or “may.” Farmers’ actual results and financial condition could differ, possibly materially, from those indicated in these

forward-looking statements. Factors that

could cause Farmers’ actual results to differ

materially from those described in the forward-looking statements can be found in Farmers’ periodic reports and registration statements filed with the Securities and Exchange Commission, including its

Annual Report on Form 10- K for the

year ended December 31, 2014, as amended, and Quarterly Report on Form 10-Q for the period ended June 30, 2015, which have been filed with the Securities and Exchange Commission and are available on Farmers’ website

(www.farmersbankgroup.com) and on the

Securities

and

Exchange

Commission’s

website

(www.sec.gov).

Factors

that

may

cause

or

contribute

to

these

differences

may

also

include,

without limitation, Farmers’ failure to integrate

Tri-State and its subsidiary in accordance with expectations, and deviations from performance expectations related to Tri-State and its subsidiary. Forward-looking statements are not guarantees of future performance and should not be relied upon as representing management’s views as of any subsequent date. Farmers

undertakes no obligation to update

forward-looking statements, whether as a result of

new information, future events or otherwise, except as may be required by law. Use of Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with

accounting principles generally accepted

in the United States (“GAAP”). These non-GAAP financial measures include “Core Deposits” and “Pre-tax, Pre- provision Earnings”. Farmers believes that these non-GAAP financial measures provide both

management and investors a more complete

understanding of the Company’s deposit profile and

profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Because not all companies use the same

calculation of “Core Deposits”

and

“Pre-tax,

Pre-provision

Earnings”,

this

presentation

may

not

be

comparable

to

other

similarly

titled

measures

as

calculated

by

other

companies. |

3 Disclosure Statement Important Additional Information About the Merger. In connection with the proposed merger with Tri-State 1 st Banc, Inc. (Tri-State), Farmers has filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that includes a proxy statement and a

prospectus, as well as other relevant

documents concerning the proposed

transaction. SHAREHOLDERS OF TRI-STATE

AND OTHER INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS TO BE INCLUDED IN THE REGISTRATION STATEMENT ON FORM S-4, BECAUSE IT WILL

CONTAIN IMPORTANT INFORMATION ABOUT FARMERS,

TRI-STATE, THE PROPOSED MERGER, THE PERSONS SOLICITING PROXIES WITH RESPECT TO THE PROPOSED MERGER AND THEIR INTERESTS IN THE PROPOSED MERGER AND RELATED MATTERS. The respective directors and executive officers of Farmers and Tri-State and other persons may be deemed to be

participants in the

solicitation

of

proxies

from

shareholders

of

Tri-State

with

respect

to

the

proposed

merger.

Information

regarding

the

directors

and

executive officers of Farmers is available in its proxy

statement filed with the SEC on March 13, 2015. Information regarding directors and executive officers of Tri-State is available on its website at http://www.1stncb.com/. Other information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will

be contained in the proxy

statement/prospectus to be included in the Registration

Statement on Form S-4 and other relevant materials filed with the SEC when they become available. Investors and security holders will be able to obtain free copies of the registration statement and other

documents filed with the SEC by

Farmers

through

the

website

maintained

by

the

SEC

at

http://www.sec.gov. Copies of the documents filed with the SEC by Farmers will be available free of charge on Farmers’ website at https://www.farmersbankgroup.com. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor

shall there be any sale of securities in

any jurisdiction in which the offer, solicitation or sale is unlawful before registration or qualification of the securities under the securities laws of the jurisdiction. No offer of securities shall be made except by means of a prospectus satisfying the requirements of Section 10 of the Securities Act. |

4 FMNB - Legacy Financial Highlights at March 31, 2015 • Banking Locations: 19 • Assets: $1.13 billion • Loans: $673.78 million • Deposits: $909.41 million • Loan/Deposit Ratio: 74.09% • Tangible Common Equity: 10.50% • Market Capitalization: $150.77 million Strategic Objectives • Strong Capital Position • Strong Asset Quality • Loan Growth • Diversifying Revenue Stream • Controlling Non-interest Expenses (PIC) |

5 FMNB-NBOH Merger Financial Highlights at June 30, 2015 • Banking Locations: 33 • Assets: $1.67 billion • Loans: $1.13 billion • Deposits: $1.32 billion • Loan/Deposit Ratio: 85.94% • Tangible Common Equity: 8.76% • Market Capitalization: $211.8 million Strategic Objectives • Creates the third largest community bank 1 by asset size headquartered in NE Ohio • Complementary business lines & compelling cultural fit • Enhanced board of directors and management team bringing strengths and best practices from both sides • Catalyst for additional growth opportunities (1) Community Banks defined as those with assets less than $20.0 billion. Northeast Ohio includes area codes

216, 330 and 440 |

6 FMNB-NBOH Combined with TSOH Acquisition Pro Forma Financial Highlights • Banking Locations: 38 • Assets: $1.8 billion • Loans: $1.2 billion • Deposits: $1.5 billion • Loan/Deposit Ratio: 78.16% • Tangible Common Equity: 8.75% • Market Capitalization: $223 million 1 Strategic Objectives • Pro-forma, Farmers will rank 2 nd in market share with ~20% of the county’s deposits • TSOH provides an attractive deposit base with $54.3 million of demand deposits and an overall cost of deposits of 0.19% • Entrance into the Pennsylvania market (1) Based on FMNB’s stock price of $8.25 on June 30, 2015

Source: SNL Financial

|

7 Who We Are Today • Operating in eight counties in Ohio – Founded over 128 years ago • Sound franchise with commitment to independence and positioned

for growth

• Profitable throughout cycle and growth in current year core

earnings

• Diversified and growing revenue streams • Compelling valuation: – 1.48x of tangible book value – 13.30x LTM pre-tax pre-provision earnings (excludes security gains)

– 1.45% dividend yield |

8 About Farmers National Banc Corp. • Stock Price: $8.25 • Dividend (yield): $0.03 (1.45%) • Cash Dividends: $552 thousand • Tangible Book Value: $5.57 Stock Data – NASDAQ: FMNB as of 6/30/15 • Revenue: $15.13 million • Net Income: $812 thousand • Net Income-Diluted Share: $0.04

•

ROAA: 0.27%

•

ROAE:

2.74% Operating Results for 3 Months Ended 6/30/15 • Revenue: $15.13 million • Net Income: $2.4 million • Net Income-Diluted Share: $0.12

•

ROAA: 0.82%

•

ROAE:

8.33% Operating Results for 3 Months Ended 6/30/15 excluding One-time Acquisition Expenses |

• Established and experienced management team with over 300 years of combined experience,

130 of which has been with Farmers.

Experienced Management Team

9 Years of Experience FMNB Industry President & Chief Executive Officer Kevin J. Helmick (43) 21+ 21+ Senior EVP, Chief Banking Officer Mark Witmer (51) <1 25+ EVP, Chief Financial Officer Carl D. Culp (52) 26+ 30+ EVP, Chief Credit Officer Mark L. Graham (60) 37+ 37+ SVP, Chief Retail & Marketing Officer Amber Wallace (49) 7+ 7+ SVP, Chief Information Officer Brian Jackson (46) 6+ 22+ SVP, Chief Risk Officer Jay VanSickle (45) <1 20+ SVP, Chief Lending Officer and Regional President Joseph Gerzina (59) 4+ 33+ SVP, Regional President Tim Shaffer (53) 3+ 29+ SVP, Director of Human Resources Mark A. Nicastro (44) 6+ 17+ President, Farmers Trust Company Joseph J. DePascale (50) 4+ 21+ President, National Associates Inc. Aubrey Christ (41) <1 20+ VP, Farmers National Investments/Farmers National Insurance Dan Cvercko (43) 14+ 17+ |

10 Seven Key Focuses • Lending/Credit • Wealth Management • Retail/Marketing • Finance • Information Technology • Enterprise Risk Management • Human Resources |

11 New Locations - Alliance |

12 New Locations - Fairlawn |

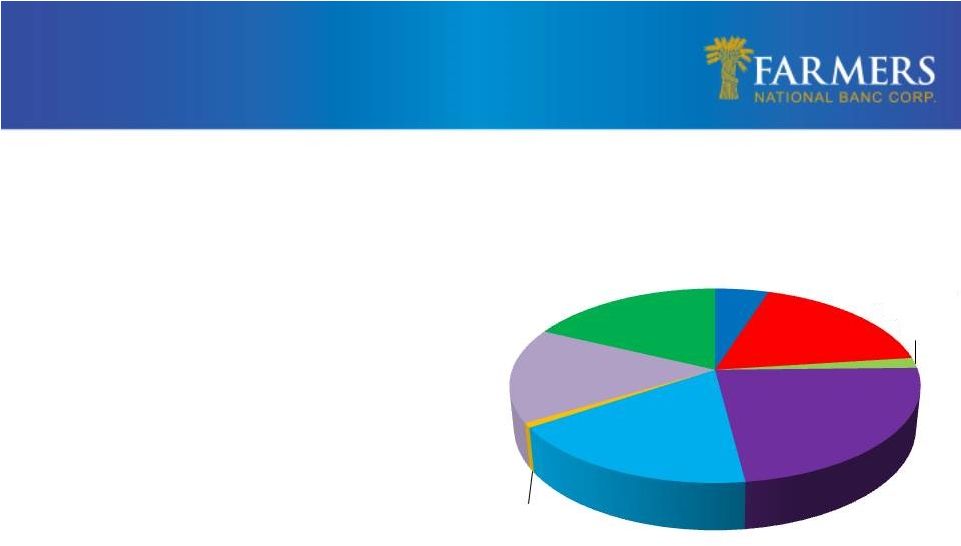

13 Commitment to Stakeholders • Four Pillars – Shareholders o 2015 Strategic Initiative o Increased Communication Plan – Customers o Small Business Support o 45% of small business

lending

comes from community banks* – Associates o 429 associates o Top 100 employer in the region – Community o 2015 Community Giving as of June 30, 2015: $169,595

*Source:

FDIC

Quarterly

Banking

Profile

-

Second

Quarter

2014

Arts

5%

Civic

18%

Community

Athletics

2%

Education

/

Higher

Education

23%

Health &

Wellness

17%

Religious

1%

Social

Services

16%

CRA

18%

2015 Community Giving

YTD 06/30/15 |

14 Increasing Shareholder Value Stable Dividend Policy • Consistently paid a quarterly cash dividend • Current yield 1.45% • Dividend payout range policy of 25% - 35% • Dividend payout 2015 YTD* is 36.55% of net income *As of June 30, 2015 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10 11 12 13 14 15* 3.62 4.95 6.20 6.55 8.35 8.25 Stock Price |

15 Source: Debrosse Memorial Report, 2014 Ohio and Gas Activity in Ohio, Ohio Oil and Gas Association

• Completions – Top 10 Counties in Ohio – Columbiana #3 – Stark # 6 • Top 12 Most Active Counties in Ohio – By Well – Columbiana #3 – Stark #5 • Top 12 Most Active Counties in Ohio – By Footage – Columbiana #3 – Stark #7 – Trumbull #8 – Mahoning #9 Utica Shale Impact |

16 Source: Debrosse Memorial Report, 2014 Ohio and Gas Activity in Ohio, Ohio Oil and Gas Association

Utica Shale Impact |

17 Source: Debrosse Memorial Report, 2014 Ohio and Gas Activity in Ohio, Ohio Oil and Gas Association

Utica Shale Impact |

Virtual Bank 18 |

Mobile Banking Analytics Transactions • Account to Account Transfers • Bill Payments • Mobile Captures • Picture Payments Growth: 285% * Farmers’ Active Users: 85% Active User Target: 75% 19 1170 4500 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 Mobile Banking Users 2013 2014 2015 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 1,608 8,760 Mobile Transactions |

Online Banking Analytics 20 Transactions - Fiserv • Bill Pay • PopMoney • Account to Account Transactions • Same Day EBT • All Other Electronic Payments • Overnight Checks • All Other Paper Payments 2012 2013 2014 2015 21447 15258 Online Banking Users 10,000 12,000 14,000 16,000 18,000 20,000 22,000 24,000 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 Online Banking Transactions 16,296 17,323 |

21 • Focus for Growth – Continued organic growth in current markets – Growth opportunities in new markets with Private Banking, Trust

and Investments

– Targeted acquisitions include fee-based business and banks

• Target Metrics for Acquisition – Accretive to earnings near term (excluding one-time charges)

– Manageable initial tangible book value dilution – Growth of fee revenue to 30+% of total revenue – Must enhance shareholder value – Must sustain our culture – Not materially change our investment merits – Sustain our TCE and regulatory ratios Growth Focus and Target Metrics |

The Health of Our Wealth • Wealth Management Creates Fee-based Income – Fee Income 2009: 14.5% of total gross income o Noninterest income excluding security gains – Fee Income 2015*: 28.8% of total gross income o Noninterest income excluding security gains • Wealth Management Build-out Timeline – 2000 Farmers National Investments – 2009 Farmers Trust Company – 2010 Farmers National Insurance – 2012 Private Client Services – 2013 National Associates, Inc. *For the six months ended June 30, 2015 22 |

23 • 130 consecutive quarters of profitability • Completed merger with National Bancshares on June 19, 2015

• Announced proposed merger with Tri-State 1 st Banc, Inc. on June 24, 2015 • Net income for quarter ended June 30, 2015 was $812 thousand

compared to $2.2 million for most recent

quarter •

On-time costs related to acquisitions were $1.9

million pre-tax for the second

quarter •

Noninterest income increased 16.1% compared to same

quarter in 2014

• Non-performing assets to total assets remain at low levels, 0.54%

at June 30, 2015

Continued Strong Results –

Overview of 2Q 2015 |

24 Net Interest Income and Margin Dollars in thousands $8,952 $9,285 $9,243 $8,992 $9,749 3.54% 3.58% 3.63% 3.64% 3.66% 3.50% 3.55% 3.60% 3.65% 3.70% 3.75% 3.80% 3.85% 3.90% $8,400 $8,600 $8,800 $9,000 $9,200 $9,400 $9,600 $9,800 $10,000 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015 Net Interest Income Net Interest Margin |

25 Growing and Diverse Revenue Stream • Continued Focus on Growing Noninterest Income • Non-interest Revenue: 28.7% of Total Revenue *For the six months ended June 30, 2015 71.2% 10.8% 10.8% 2.8% 4.4% Total Revenue 2015*: $29.2 million Net Interest Income Other Non -interest Income Trust Income Insurance & Investment Income Retirement Planning Income |

26 Loan Growth $- $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 6/30/2012 6/30/2013 6/30/2014 6/30/2015 $572,453 $596,838 $637,774 $704,838 $430,000 Farmers Total Loans NBOH Acquisition YOY Growth: 4.26% YOY Growth: 77.94% Organic Growth:10.52% YOY Growth: 6.86% $1,134,838 |

27 • Diverse loan mix • No national lending • No sub-prime lending • Farmers’ practice is to lend primarily within its market area • Less than 2% of loan portfolio is participations purchased • Less than 4.5% of loan portfolio is construction loans Loan Portfolio Mix – June 30, 2015 Overview of Loan Portfolio Note: Dollars in thousands Commercial Real Estate $392,103 34.6% Residential Real Estate $305,134 26.9% Consumer $187,579 16.5% Commercial & Industrial $202,004 17.8% Commercial Construction $34,214 3.0% Residential Construction $13,804 1.2% |

28 Excellent Asset Quality Note: Dollars in millions; Asset quality ratios exclude troubled debt restructuring

6/30/2015

Nonaccrual loans

$7.0

Accruing loans past due 90 days or more

1.0

OREO

1.1

Total nonperforming assets (NPAs)

$9.1

Troubled Debt Restructuring (TDR)

$8.5

Loans 30-89 days delinquent

7.1

Gross portfolio loans

1,134.8

Loans held for sale (HFS)

0.4

Allowance for loan losses (ALL)

7.3

Total Assets

$1,672.4

NPLs & 90 days past due/Gross loans (excl.

HFS) 0.70%

NPAs/Total Assets

0.54%

TDR/Gross loans (excl. HFS)

0.75%

30-89 days delinquent/Gross loans (excl.

HFS) 0.63%

ALL/NPLs & 90 days past due

91.26%

ALL/Gross loans (excl. HFS)

0.64%

Texas

Ratio

6.06%

Nonaccrual Loans by Type

Nonaccrual

$7.0mm

77.1%

Accruing

loans past

due 90 days

or more

$1.0mm

10.6%

OREO

$1.1mm

12.4%

Commercial

Real Estate

43.5%

Residential

Real Estate

42.4%

Commercial

11.9%

Consumer

2.2% |

29 Supplemental Information |

30 GAAP to Non-GAAP Reconciliation Reconciliation of Common Stockholders' Equity to Tangible Common Equity

June 30,

March 31,

Dec. 31,

Sept. 30,

June 30,

2015

2015

2014

2014

2014

Stockholders' Equity

$182,575

$126,771

$123,560

$121,401

$121,020

Less Goodwill and other intangibles

39,569

8,646

8,813

9,768

9,960

Tangible Common Equity

$143,006

$118,125

$114,747

$111,633

$111,060

Reconciliation of Income Before Taxes to Pre-Tax,

Pre-Provision Income For the Three

Months Ended For the Six Months

Ended

June 30,

March 31,

Dec. 31,

Sept. 30,

June 30,

June 30,

June 30,

2015

2015

2014

2014

2014

2015

2014

Income before income taxes

$1,221

$2,828

$2,744

$2,964

$3,071

$4,049

$5,889

Provision for loan losses

850

450

825

425

300

1,300

630

Pre-tax, pre-provision income

$2,071

$3,278

$3,569

$3,389

$3,371

$5,349

$6,519

Reconciliation of Total Assets to Tangible

Assets June 30,

March 31,

Dec. 31,

Sept. 30,

June 30,

2015

2015

2014

2014

2014

Total Assets

$1,672,403

$1,133,651

$1,136,967

$1,139,739

$1,133,286

Less Goodwill and other intangibles

39,569

8,646

8,813

9,768

9,960

Tangible Assets

$1,632,834

$1,125,005

$1,128,154

$1,129,971

$1,123,326 |

31 Consolidated Statements of Income Consolidated Statements of Income For the Three Months Ended For the Six Months Ended June 30, March 31, Dec. 31, Sept. 30, June 30, June 30, June 30, Percent 2015 2015 2014 2014 2014 2015 2014 Change Total interest income $10,753 $9,999 $10,321 $10,413 $10,118 $20,752 $20,181 2.8% Total interest expense 1,004 1,007 1,078 1,128 1,166 2,011 2,373 -15.3% Net interest income 9,749 8,992 9,243 9,285 8,952 18,741 17,808 5.2% Provision for loan losses 850 450 825 425 300 1,300 630 106.3% Other income 4,409 4,037 4,193 3,880 3,797 8,446 7,230 16.8% Other expense 12,087 9,751 9,867 9,776 9,378 21,838 18,519 17.9% Income before income taxes 1,221 2,828 2,744 2,964 3,071 4,049 5,889 -31.2% Income taxes 409 617 597 688 720 1,026 1,347 -23.8% Net income $812 $2,211 $2,147 $2,276 $2,351 $3,023 $4,542 -33.4% |

32 Consolidated Statements of Financial Condition Consolidated Statements of Financial Condition June 30, March 31, Dec. 31, Sept. 30, June 30, 2015 2015 2014 2014 2014 Assets Cash and cash equivalents $37,028 $26,929 $27,428 $28,294 $28,070 Securities available for sale 386,319 369,919 389,829 404,895 409,285 Loans held for sale 399 146 511 895 275 Loans 1,134,838 673,784 663,852 646,981 637,774 Less allowance for loan losses 7,286 7,723 7,632 7,333 7,356 Net Loans 1,127,552 666,061 656,220 639,648 630,418 Other assets 121,105 70,596 62,979 66,007 65,238 Total Assets $1,672,403 $1,133,651 $1,136,967 $1,139,739 $1,133,286 Liabilities and Stockholders' Equity Deposits $1,320,569 $909,408 $915,703 $913,000 $907,443 Other interest-bearing liabilities 155,591 80,338 87,517 90,649 93,807 Other liabilities 13,668 17,134 10,187 14,689 11,016 Total liabilities 1,489,828 1,006,880 1,013,407 1,018,338 1,012,266 Stockholders' Equity 182,575 126,771 123,560 121,401 121,020 Total Liabilities and Stockholders' Equity $1,672,403 $1,133,651 $1,136,967 $1,139,739 $1,133,286 |

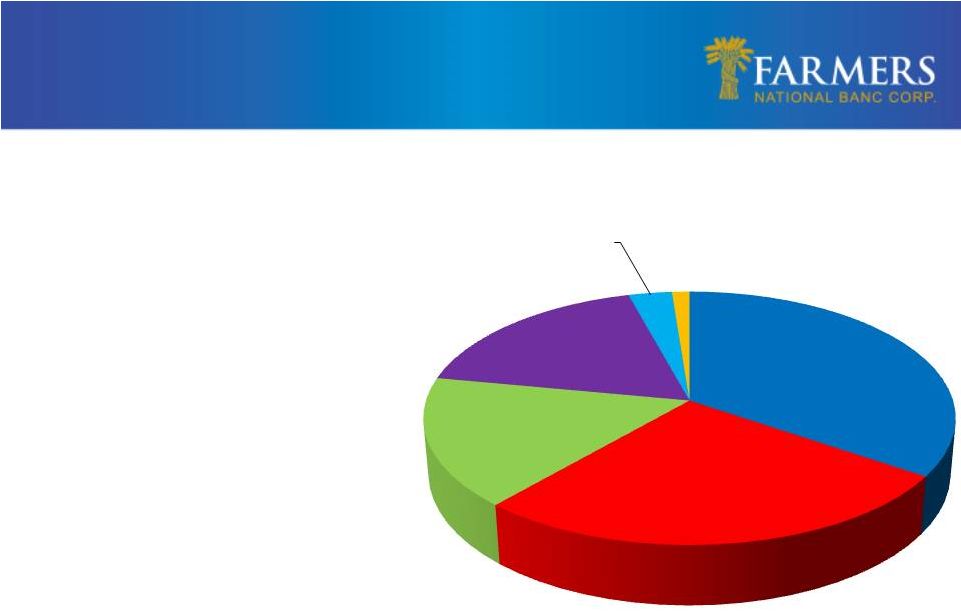

• Opportunity for growth with approximately 10.50% deposit market share in the Mahoning Valley

–

Large regional competitors lack

focus – Community competitors inwardly focused Deposit Market Share by County 33 Note: Market share data as of June 30, 2014 Source:

SNL |

Note: Market share data as of June 30, 2014 Source:

SNL Deposit Market Share by

County 34 |