Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CABOT CORP | d82382d8k.htm |

Exhibit 99.1

|

|

Cabot Corporation

Investor Presentation

August 2015

|

|

Forward Looking Statements & Use of Non—

GAAP Financial Measures

This presentation contains forward-looking statements based on management’s current expectations, estimates and

projections. All statements that address expectations or projections about the future, including statements about the

Company’s strategy for growth, product development, market position, expected financial results, and how we expect to

achieve our growth targets are forward-looking statements. Some of the forward-looking statements may be identified by

words like “expects,” “anticipates,” “plans,” “intends,” “projects,” “indicates,” and similar expressions. Forward-looking

statements are based on our current expectations, assumptions, estimates and projections about Cabot’s businesses and

strategies, market trends and conditions, economic conditions and other factors. These statements are not guarantees of

future performance and are subject to risks, uncertainties, potentially inaccurate assumptions, and other factors, some of

which are beyond our control and difficult to predict. If known or unknown risks materialize, or should underlying assumptio ns

prove inaccurate, our actual results could differ materially from past results and from those expressed in the forward -looking

statement. Important factors that could cause our results to differ materially from those expressed in the forward -looking

statements include, but are not limited to lower than expected demand for our products; the loss of one or more of our

important customers; our inability to complete capacity expansions or other development projects; the timing of

implementation of environmental regulations; our failure to develop new products or to keep pace with technological

developments; patent rights of others; the timely commercialization of products under development (which may be disrupted

or delayed by technical difficulties, market acceptance, competitors’ new products, as well as difficulties in moving from th e

experimental stage to the production stage); changes in raw material costs; demand for our customers’ products; competitors’

reactions to market conditions; delays in the successful integration of structural changes, including acquisitions or joint

ventures; the laws, regulations, policies and economic conditions, including inflation, interest and foreign currency exchange

rates, of countries where we do business; and severe weather events that cause business interruptions, including plant and

power outages or disruptions in supplier or customer operations. These factors are discussed more fully in the reports we file

with the Securities and Exchange Commission, particularly our latest annual report on Form 10-K.

This presentation includes references to the following non -GAAP financial measures: adjusted EPS (earnings per share),

adjusted EBITDA (earnings before interest, taxes, depreciation and amortization), and adjusted EBITDA margins. The definitions

of adjusted EPS, adjusted EBITDA, and EBITDA margins and a reconciliation of adjusted EPS and adjusted EBITDA to the most

comparable GAAP financial measures are provided at the end of this presentation or in our latest annual report on Form 10-K.

INVESTOR PRESENTATION 2

|

|

About Cabot

NYSE: CBT

Founded 1882

Global specialty chemicals and performance

materials company

45 manufacturing sites in 21 countries

Core technical competencies in fine particles

and surface modification

9 month FY2015 sales: $2.2 billion

INVESTOR PRESENTATION 3

|

|

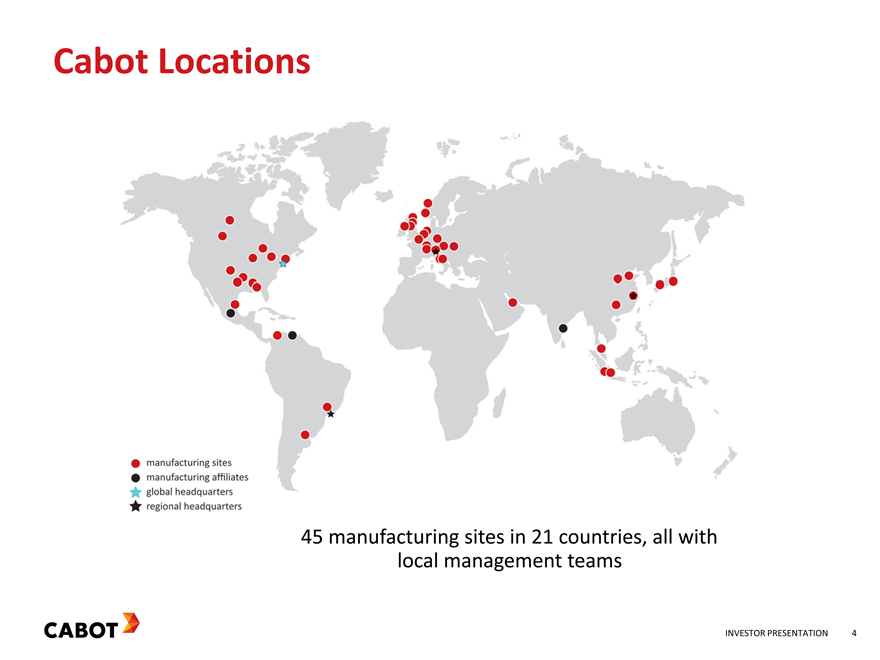

Cabot Locations

45 manufacturing sites in 21 countries, all with

local management teams

INVESTOR PRESENTATION 4

|

|

Key Segment Highlights

REINFORCEMENT MATERIALS

Rubber blacks and elastomer composites product lines

#1 Global position in carbon black Industry leading product and process technology EBITDA margins of 15%

PERFORMANCE CHEMICALS

Specialty carbons and formulations and metal oxides product lines Global Leadership positions Strong applications knowledge Customized solutions EBITDA margins of 24%

PURIFICATION SOLUTIONS

World’s largest producer of activated carbon

Strong macro trends for purification for air, water, food and beverage, and pharmaceuticals EBITDA margins of 17%

SPECIALTY FLUIDS

Cesium Formate oil and gas drilling fluids and fine cesium chemicals Unique and enabling solutions for the oil field Differentiated High-purity cesium chemicals Range of EBITDA margins 30 – 40%

INVESTOR PRESENTATION 5

|

|

Vision and Strategic Levers

“Deliver earnings growth through leadership

in performance materials.”

Capacity and Emerging

Margin Improvement

Market Expansion

Portfolio Management New Product and

New Business Development

Strategic levers

INVESTOR PRESENTATION 6

|

|

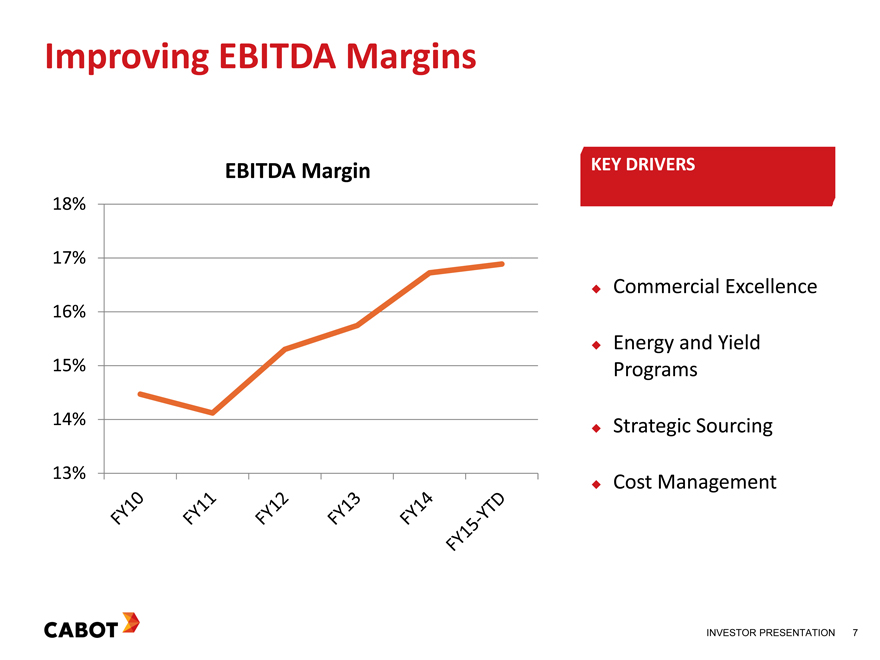

Improving EBITDA Margins

EBITDA Margin KEY DRIVERS

18%

17%

Commercial Excellence

16%

Energy and Yield

15% Programs

14% Strategic Sourcing

13%

Cost Management

INVESTOR PRESENTATION 7

|

|

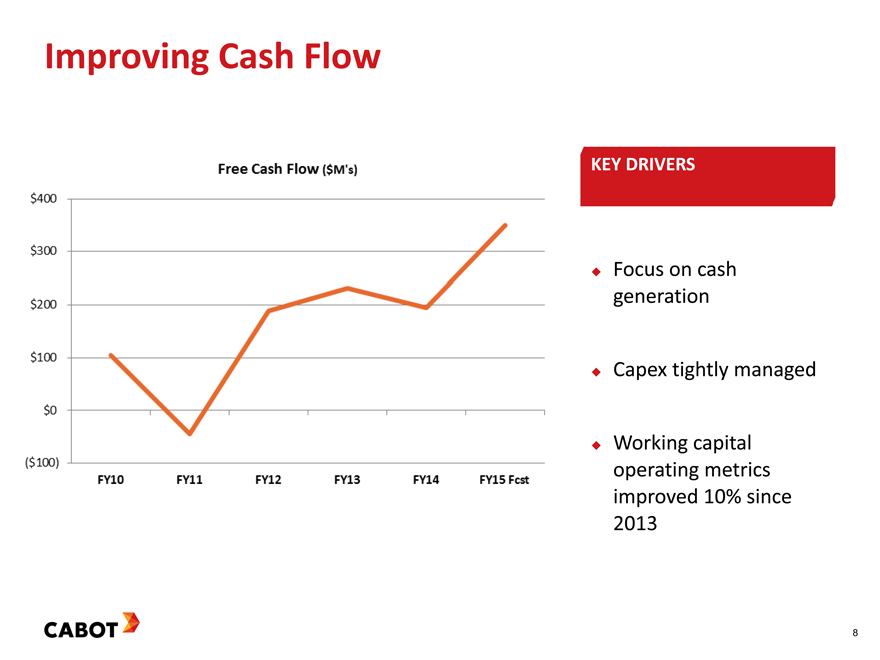

Improving Cash Flow

KEY DRIVERS

Focus on cash

generation

Capex tightly managed

Working capital

operating metrics

improved 10% since

2013

| 8 |

|

|

|

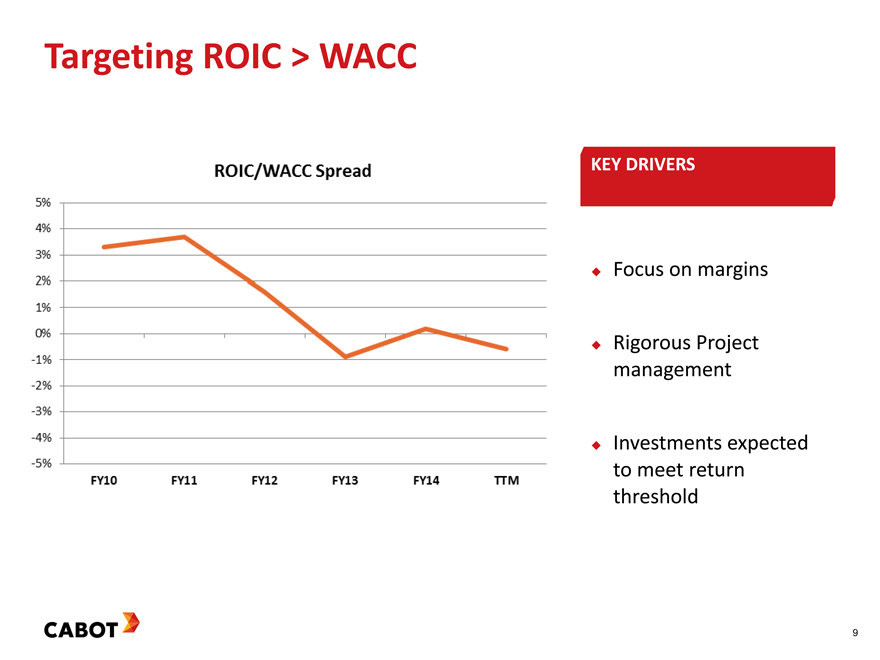

Targeting ROIC > WACC

KEY DRIVERS

Focus on margins

Rigorous Project

management

Investments expected

to meet return

threshold

9

|

|

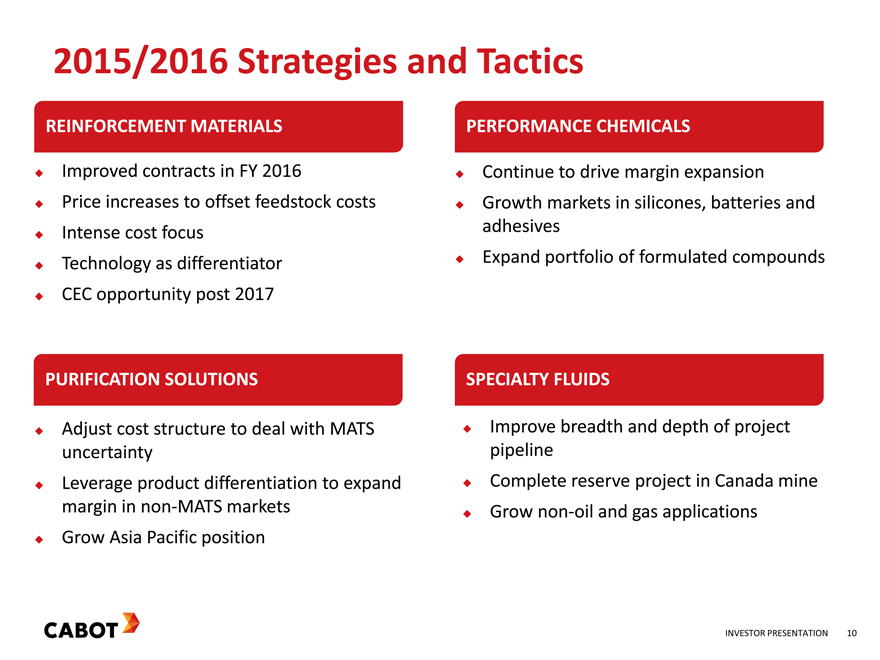

2015/2016 Strategies and Tactics

REINFORCEMENT MATERIALS PERFORMANCE CHEMICALS

Improved contracts in FY 2016 Continue to drive margin expansion

Price increases to offset feedstock costs Growth markets in silicones, batteries and

Intense cost focus adhesives

Technology as differentiator Expand portfolio of formulated compounds

CEC opportunity post 2017

PURIFICATION SOLUTIONS SPECIALTY FLUIDS

Adjust cost structure to deal with MATS Improve breadth and depth of project

uncertainty pipeline

Leverage product differentiation to expand Complete reserve project in Canada mine

margin in non-MATS markets Grow non-oil and gas applications

Grow Asia Pacific position

INVESTOR PRESENTATION 10

|

|

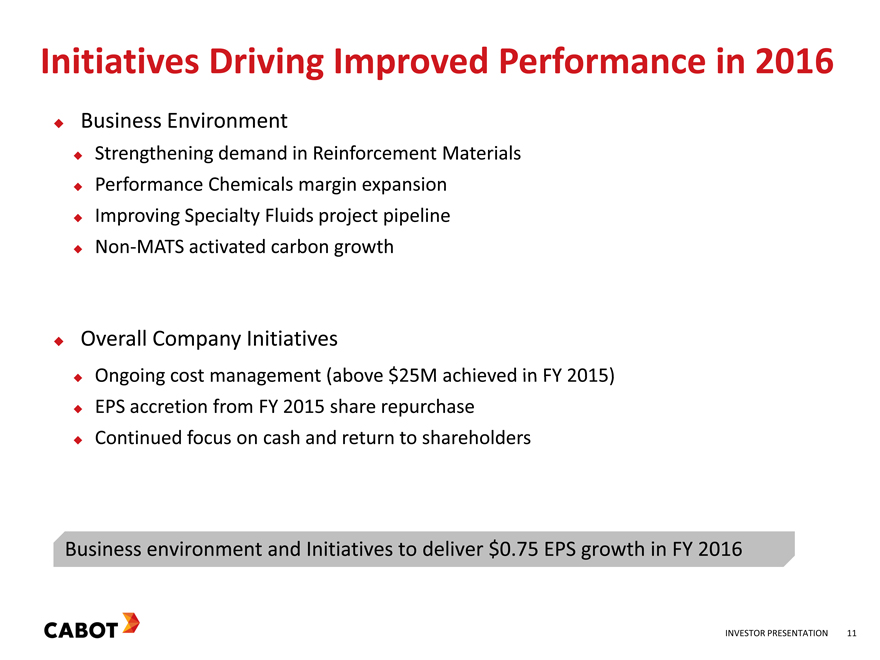

Initiatives Driving Improved Performance in 2016

Business Environment

Strengthening demand in Reinforcement Materials

Performance Chemicals margin expansion

Improving Specialty Fluids project pipeline

Non-MATS activated carbon growth

Overall Company Initiatives

Ongoing cost management (above $25M achieved in FY 2015)

EPS accretion from FY 2015 share repurchase

Continued focus on cash and return to shareholders

Business environment and Initiatives to deliver $0.75 EPS growth in FY 2016

INVESTOR PRESENTATION 11

|

|

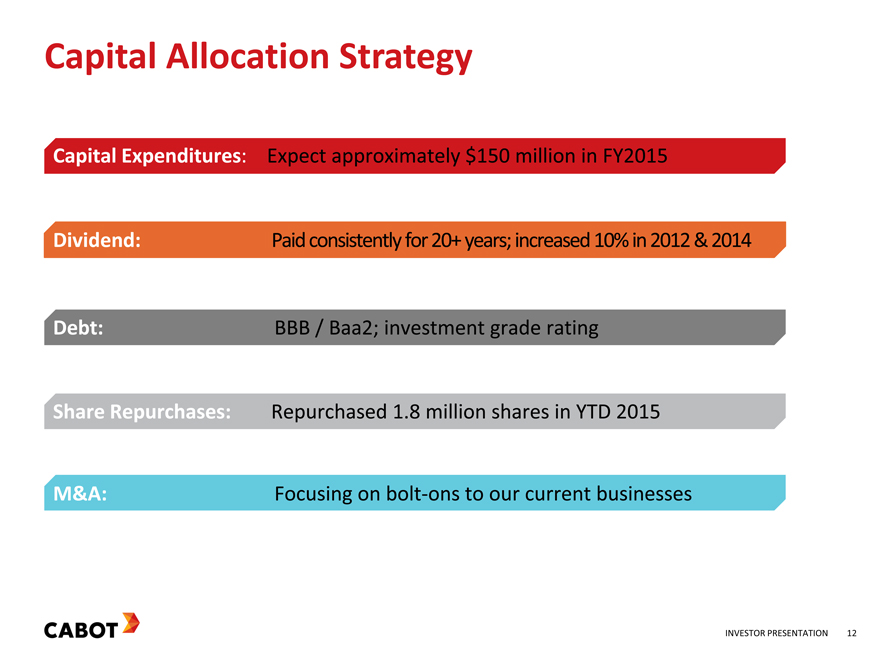

Capital Allocation Strategy

Capital Expenditures : Expect approximately $150 million in FY2015

Dividend: Paid consistently for 20+ years; increased 10% in 2012 & 2014

Debt: BBB / Baa2; investment grade rating

Share Repurchases: Repurchased 1.8 million shares in YTD 2015

M&A: Focusing on bolt-ons to our current businesses

INVESTOR PRESENTATION 12

|

|

Shareholder Focus and Financial Goals

Target 10% to 15% through -cycle earnings growth from:

Underlying industry demand

Efficiency improvements and leveraged capacity

Capital allocation actions

Maintain return on invested capital above weighted average cost of capital

Disciplined cash flow prioritization

Return cash to shareholders

INVESTOR PRESENTATION 13

|

|

Thank You NYSE: CBT

Investor Relations Contact: Jim Kelly Interim Vice President, Investor Relations (617) 342-6020 jim.kelly@cabotcorp.com

INVESTOR PRESENTATION 14

|

|

Appendix

15

|

|

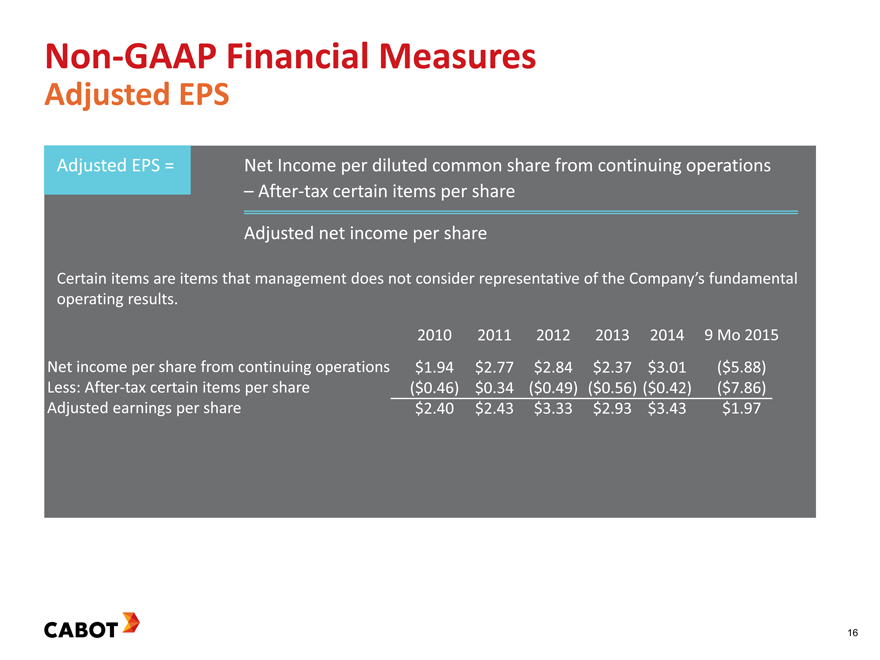

Non-GAAP Financial Measures

Adjusted EPS

Adjusted EPS = Net Income per diluted common share from continuing operations

– After-tax certain items per share

Adjusted net income per share

Certain items are items that management does not consider representative of the Company’s fundamental

operating results.

2010 2011 2012 2013 2014 9 Mo 2015

Net income per share from continuing operations $ 1.94 $ 2.77 $ 2.84 $ 2.37 $ 3.01 ($ 5.88)

Less: After-tax certain items per share ($ 0.46) $ 0.34 ($ 0.49) ($ 0.56) ($ 0.42) ($ 7.86)

Adjusted earnings per share $ 2.40 $ 2.43 $ 3.33 $ 2.93 $ 3.43 $ 1.97

16

|

|

Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted EBITDA Margin

Please visit the Investor Relations section of our website for 2014 and 2015 reconciliations of Adjusted EBITDA and Adjusted EBITDA Margins.

17

|

|

Cabot