Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - BAB, INC. | ex21-1.htm |

| EX-31.1 - EXHIBIT 31.1 - BAB, INC. | ex31-1.htm |

| EX-10.1 - EXHIBIT 10.1 - BAB, INC. | ex10-1.htm |

| EX-32.2 - EXHIBIT 32.2 - BAB, INC. | ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - BAB, INC. | ex31-2.htm |

| 10-K/A - FORM 10-K/A - BAB, INC. | babs20150811_10ka.htm |

| EX-32.1 - EXHIBIT 32.1 - BAB, INC. | ex32-1.htm |

Exhibit 10.2

THIS STOCK REDEMPTION AGREEMENT (the "Agreement") is made as of the 30th day of June, 2002, by and between BAB, Inc., a Delaware company ("Company"), and Bruno Guazzoni, an individual ("Guazzoni").

WHEREAS, Guazzoni owns 345,010 shares of common stock of the Company; and

WHEREAS, Guazzoni wishes to sell shares and Company wishes to purchase Guazzoni's shares of the Company.

THE COMPANY AND GUAZZONI HEREBY AGREE AS FOLLOWS:

1. Purchase and Sale; Purchase Price and Closing. The Company agrees to purchase and Guazzoni agrees to sell 345,010 shares of common stock of the Company (the "Shares") free and clear of any liens and encumbrances, for the aggregate purchase price in the amount equal to Five Hundred Twenty-Five Thousand and 00/100 Dollars ($525,000.00), payable in fifteen annual equal installments of Thirty-Five Thousand and 00/100 Dollars ($35,000.00), commencing on the first day of October, 2002, and the anniversary date thereafter until paid in full.

In lieu of its obligation to pay the amounts due under this Agreement, the Company may deliver to Guazzoni an annuity in the amount of the payments issued by a bank, financial institution or insurance company having its senior long term debt rated at least A by Moody's or equivalent rating service.

2. Closing. The closing for redemption and the purchase and sale of the Shares (the

"Closing") shall be held at the offices of Wolin & Rosen, Ltd., 55 West Monroe Street, Suite

3600, Chicago, Illinois 60603, on July 1, 2002, at such time as the parties agree, or as the parties may otherwise agree.

3. Representations and Warranties of Guazzoni. Guazzoni hereby represents and warrants to the Company as follows:

(a) Access to Information. Guazzoni or Guazzoni's professional advisor has been granted the opportunity to ask questions of and receive answers from representatives of the Company, its officers, directors, employees and agents concerning the terms and conditions of the Company, and its business and prospects, and to obtain any additional information which Guazzoni or Guazzoni's professional advisor deems necessary to verify the accuracy and completeness of the information received.

(b) Reliance on Own Advisors. Guazzoni has relied completely on the advice of, or has consulted with, Guazzoni's own personal tax, investment, legal or other advisors and has not relied on the Company or any of its affiliates, officers, directors, attorneys, accountants or any affiliates of any thereof. The foregoing, however, does not limit or modify Guazzoni's right to rely upon representations and warranties of the Company in Section 5 of this Agreement.

(c) Capability to Evaluate. Guazzoni has such knowledge and experience in financial and business matters so as to enable Guazzoni to utilize the information made

available to him in connection with this Agreement in order to evaluate the merits and risks of selling shares of common stock of the Company, which are substantial.

(d) Due Diligence. Guazzoni, in making Guazzoni's investment decision to sell the Company common stock hereunder, represents that Guazzoni has received and had an opportunity to review the Company's books and records, including financial statements and such other information as deemed necessary. Guazzoni has had full access to all the information he considers necessary or appropriate to make an informed decision to sell.

(e) Investment Experience; Fend for Self. Guazzoni has substantial experience in investing in securities and has made investments in securities other than those of the Company. Guazzoni acknowledges that Guazzoni is able to fend for Guazzoni's self in the transactions contemplated by this Agreement.

(f) Company Financial Status. Guazzoni acknowledges that the Company expects to report a profit for the second quarter recently ended and expects to remain profitable for the remaining quarters of the fiscal year 2002.

(g) Title to Shares. Guazzoni owns beneficially and of record the Shares and has good and valid title to the Shares, free and clear of any and all liens and that 345,010 shares is the total amount of shares of common stock beneficially and of record owned by Guazzoni in the Company. After the redemption, Guazzoni will not own or beneficially own any shares of common stock in the Company. Upon delivery to Company of the stock certificates representing the Company's Shares and payment therefore, the Company shall acquire good and valid title to such Shares, free and clear of all liens.

4. Representations and Warranties of the Company. The Company hereby represents and warrants to Guazzoni that:

(a) Organization, Good Standing, and Qualification. The Company is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware and has all requisite power and authority to carry on its business as now conducted and as proposed to be conducted. The Company is not the subject of any pending, threatened or, to its knowledge, contemplated investigation or administrative or legal proceeding by the Internal Revenue Service, the taxing authorities of any state or local jurisdiction, or the Securities and Exchange Commission ("SEC"), or any state securities commission, or any other governmental entity, which have not been disclosed to Guazzoni.

(b) Corporate Condition. The financial and statistical information of the Company and data are, in all material respects, accurately presented and prepared on a basis consistent with such financial statements and the books and records of the Company. Without limiting the foregoing, there are no material liabilities, contingent or actual, that are not disclosed (other than liabilities incurred by the Company in the ordinary course of its business, consistent with its past practice). The Company has paid all material taxes which are due, except for taxes which it reasonably disputes and which have been disclosed to Guazzoni. There is no material claim, litigation, or administrative proceeding pending, or, to the best of the Company's knowledge, threatened against the Company. This agreement does not contain any untrue statement of a material fact and does not omit to state any material fact required to be stated therein or herein necessary to make the statements contained therein or herein not misleading in the light of the circumstances under which they were made.

(c) Authorization. All action on the part of the Company by its officers and board of directors, necessary for the authorization, execution and delivery of this Agreement, the performance of all obligations of the Company hereunder has been taken, and this Agreement, constitutes the valid and legally binding obligations of the Company, enforceable in accordance with its terms, except insofar as the enforceability may be limited by applicable bankruptcy, insolvency, reorganization, or other similar laws affecting creditors' rights generally or by principles governing the availability of equitable remedies. The Company has obtained all consents and approvals required for it to execute, deliver and perform its obligations under this Agreement.

(d) Compliance with Other Instruments. The Company is not in violation or default of any provisions of its Articles of Incorporation or by-laws each as it may be amended and in effect on and as of the date of the Agreement or of any provision of any instrument or contract to which it is a party or by which it is bound or, to its knowledge, of any provision of any federal or state judgment, writ, decree, order, statute, rule or governmental regulation applicable to the Company, which would have a material adverse effect on the Company's business or prospects. There exists no condition that, with notice, the passage of time or otherwise, would constitute a default under any such instrument or contract, except where such a default would not have a material adverse effect. The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby will not result in any such violation or be in conflict with or constitute, with or without the passage of time and giving of notice, either a default under any such provision, instrument or contract or an event which results in the creation of any lien, charge or encumbrance upon any assets of the Company.

(e) No Proceedings. There are no legal or governmental proceedings pending or, to the knowledge of the Company, threatened to which the Company is a party or to which any of their respective property is subject that could reasonably be expected to result, singly or in the aggregate, in a material adverse effect.

5. Miscellaneous.

5.1 Indemnification. Each party ("Indemnifying Party") to this Agreement agrees to indemnify, defend and hold harmless the other party ("Indemnified Party") to the fullest extent permitted by law from and against any and all losses, claims, or written threats thereof (including, without limitation, any claim by a third party), damages, expenses (including reasonable fees, disbursements and other charges of counsel incurred by the Indemnified Party in any action between the Indemnifying Party and the Indemnified Party or between the Indemnified Party and any third party or otherwise) (collectively, "Losses") resulting from or arising out of any breach of any representation or warranty, covenant or agreement by the Indemnifying Party in this Agreement.

5.2 Severability. In the event that any provision of this agreement becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue in full force and effect without said provision; provided that no such severability shall be effective if it materially changes the economic benefit of this Agreement to any party.

5.3 Successors and Assigns. The terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their respective successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

5.4 Governing Law. This Agreement shall be governed by and construed under the laws of the State of Illinois without regard to its conflict of laws rules or principles.

5.5 Execution in Counterparts Permitted. This Agreement may be executed in any number of counterparts, each of which shall be enforceable against the parties actually executing such counterparts, and all of which together shall constitute one (1) instrument.

5.6 Titles and Subtitles; Gender. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement. The use in this Agreement of a masculine, feminine or neither pronoun shall be deemed to include a reference to the others.

5.7 Written Notices, Etc. Any notice, demand or request required or permitted to be given by the Company or Guazzoni pursuant to the terms of this Agreement sh3ll be in writing and shall be deemed given when delivered personally, or by facsimile (with a hard copy to follow by two (2) day courier), addressed to the parties at the addresses and/or facsimile telephone number of the parties or such other address as a party may request by notifying the other in writing as follows:

|

If to Guazzoni: |

Bruno Guazzoni |

|

135 East 57th Street | |

|

15th Floor | |

|

New York, NY 10022 | |

|

Facsimile No.: 212/343-2121 | |

|

If to Company: |

BAB, Inc. |

|

8501 W. Higgins Road Suite 320 | |

|

Chicago, IL 60631 | |

|

Facsimile No.: 773/380-6183 | |

|

Attention: Michael Murtaugh | |

|

with a copy to: |

Wolin & Rosen, Ltd. |

|

55 West Monroe Street Suite 3600 | |

|

Chicago, IL 60603 | |

|

Facsimile No.: 312/424-0660 | |

|

Attention: Charles J Mack |

5.8 Expenses. Each of the Company and Guazzoni shall pay all costs and expenses that it respectively incurs, with respect to the negotiation, execution, delivery and performance of this Agreement.

5.9 Entire Agreement; Written Amendments Required. This Agreement, including the Exhibits and Schedules attached hereto and the other documents delivered pursuant hereto constitute the full and entire understanding and agreement between the parties with regard to the subjects hereof and thereof, and no party shall be liable or bound to any other party in any manner by any warranties, representations or covenants except as specifically set forth herein or therein. Except as expressly as provided herein, neither this Agreement nor any term hereof may be amended, waived, discharged or terminated other than by a written instrument signed by the party against whom enforcement of any such amendment, waiver, discharge or termination is sought.

5.10 Further Assurances. Each party shall do all such acts, and shall execute and deliver to the other all such certificates, instruments, assignments and other documents and shall do and perform or cause to be done all matters and such other things necessary or expedient to be done as either party may reasonable request from time to time in order to give full effect to this Agreement.

Interest Rate Stipulation

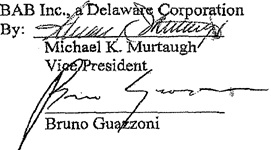

BAB, Inc., a Delaware Corporation. ("BAB") and Bruno Guazzoni ("Guazzoni") hereby enter into the following Interest Rate Stipulation ("Stipulation").

Whereas, BAB and Guazzoni have entered into a Stock Redemption Agreement dated June 30, 2002 whereby BAB acquired 345,010 shares of BAB, Inc. Stock formerly owned by Guazzoni; and

Whereas, due to the fact that the payment arrangements for the stock require a stipulation from the parties as to the interest rate applicable to the payments which are to be made;

It is hereby stipulated that the interest rate applicable to the purchase of the Stock under the Stock Purchase Agreement shall be 4.75% and the amortization schedule for the Stock Redemption Agreement shall be as set forth on Exhibit A to this stipulation.

Agreed to:

|

|

|

BAB Inc.

Note Payable Schedule for Bruno Guazzoni

9/1/02 through 10/01/16

|

annual |

|||

|

interest rate |

4.75% |

||

|

$35,000 |

15 payments |

||

|

$525,000 |

Total |

|

Interest Paid |

Principal Paid |

Balance |

shares purchased |

price per share |

||||||||||||||||||

| 385,531.17 | 345,010 | 1.1174 | ||||||||||||||||||||

|

|

0.00 | 0.00 | 385,531.17 | |||||||||||||||||||

|

1 |

10/1/02 |

1,526.06 | 33,473.94 | 352,057.23 | ||||||||||||||||||

|

2 |

10/1/03 |

16,722.72 | 18,277.28 | 333,779.95 | ||||||||||||||||||

|

3 |

10/1/04 |

15,854.55 | 19,145.45 | 314,634.50 | ||||||||||||||||||

|

4 |

10/1/05 |

14,945.14 | 20,054.86 | 294,579.64 | ||||||||||||||||||

|

5 |

10/1/06 |

13,992.53 | 21,007.47 | 273,572.17 | ||||||||||||||||||

|

6 |

10/1/07 |

12,994.68 | 22,005.32 | 251,566.85 | ||||||||||||||||||

|

7 |

10/1/08 |

11,949.43 | 23,050.57 | 228,516.27 | ||||||||||||||||||

|

8 |

10/1/09 |

10,854.52 | 24,145.48 | 204,370.79 | ||||||||||||||||||

|

9 |

10/1/10 |

9,707.61 | 25,292.39 | 179,078.41 | ||||||||||||||||||

|

10 |

10/1/11 |

8,506.22 | 26,493.78 | 152,584.63 | ||||||||||||||||||

|

11 |

10/1/12 |

7,247.77 | 27,752.23 | 124,832.40 | ||||||||||||||||||

|

12 |

10/1/13 |

5,929.54 | 29,070.46 | 95,761.94 | ||||||||||||||||||

|

13 |

10/1/14 |

4,548.69 | 30,451.31 | 65,310.63 | ||||||||||||||||||

|

14 |

10/1/15 |

3,102.26 | 31,897.74 | 33,412.89 | ||||||||||||||||||

|

15 |

10/1/16 |

1,587.11 | 33,412.89 | (0.00 | ) | |||||||||||||||||

| Total | 139,469 | 385,531 | 525,000 | |||||||||||||||||||