Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GRAFTECH INTERNATIONAL LTD | d59164d8k.htm |

| EX-3.1 - EX-3.1 - GRAFTECH INTERNATIONAL LTD | d59164dex31.htm |

| EX-99.1 - EX-99.1 - GRAFTECH INTERNATIONAL LTD | d59164dex991.htm |

| EX-10.1 - EX-10.1 - GRAFTECH INTERNATIONAL LTD | d59164dex101.htm |

| EX-10.2 - EX-10.2 - GRAFTECH INTERNATIONAL LTD | d59164dex102.htm |

| EX-99.2 - EX-99.2 - GRAFTECH INTERNATIONAL LTD | d59164dex992.htm |

Exhibit 3.2

EXECUTION VERSION

CERTIFICATE OF DESIGNATIONS

OF THE

SERIES B CONVERTIBLE PREFERRED STOCK,

PAR VALUE $0.01 PER SHARE,

OF

GRAFTECH INTERNATIONAL LTD.

Pursuant to Section 151 of the

General Corporation Law of the State of Delaware

The undersigned DOES HEREBY CERTIFY that the following resolution was duly adopted by the Board of Directors (the “Board”) of GrafTech International Ltd., a Delaware corporation (hereinafter called the “Corporation”), with the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, having been fixed by the Board pursuant to authority granted to it under Article Sixth of the Corporation’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate”) and in accordance with the provisions of Section 151 of the General Corporation Law of the State of Delaware:

RESOLVED: That, pursuant to authority conferred upon the Board by the Certificate, the Board hereby authorizes the issuance of 13,384 shares of Series B Convertible Preferred Stock, par value $0.01 per share, of the Corporation and hereby fixes the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, of such shares, in addition to those set forth in the Certificate, as follows:

Section 1. Designation. The shares of such series shall be designated “Series B Convertible Preferred Stock,” and the number of shares constituting such series shall be 13,384 (the “Series B Preferred Stock”). The number of shares of Series B Preferred Stock may be increased or decreased by resolution of the Board and the approval by the holders of a majority of the outstanding shares of the Series B Preferred Stock, voting as a separate class; provided that no decrease shall reduce the number of shares of Series B Preferred Stock to a number less than the number of shares of such series then outstanding.

Section 2. Currency. All Series B Preferred Stock shall be denominated in United States currency, and all payments and distributions thereon or with respect thereto shall be made in United States currency. All references herein to “$” or “dollars” refer to United States currency.

Section 3. Ranking. The Series B Preferred Stock shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank senior to each other class or series of shares of the Corporation that the Corporation may issue in the future the terms of which do not expressly provide that such class or series ranks equally with, or senior to, the Series B Preferred Stock, with respect to dividend rights and/or rights upon liquidation, winding up or dissolution, including, without limitation, the common stock of the Corporation, par value $0.01 per share (the “Common Stock”) (such junior stock being referred to hereinafter collectively as “Junior Stock”).

The Series B Preferred Stock shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank equally with each other class or series of shares of the Corporation that the Corporation may issue in the future the terms of which expressly provide that such class or series shall rank equally with the Series B Preferred Stock with respect to dividend rights and rights upon liquidation, winding up or dissolution (“Parity Stock”).

The Series B Preferred Stock shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank junior to each other class or series of shares of the Corporation that the Corporation may issue in the future, the terms of which expressly provide that such class or series shall rank senior to the Series B Preferred Stock with respect to dividend rights and rights upon liquidation, winding up or dissolution. The Series B Preferred Stock shall also rank junior to the Corporation’s existing and future Indebtedness.

For the avoidance of doubt, the Series A Convertible Preferred Stock of the Corporation (the “Series A Preferred Stock”) shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank equally with the Series B Preferred Stock.

Section 4. Dividends.

(a) The holders of Series B Preferred Stock shall be entitled to receive, when, as and if declared by the Board, out of any funds legally available therefor, dividends per share of Series B Preferred Stock of an amount equal to (i) 7.0% per annum of the Stated Value (as herein defined) of each share of such Series B Preferred Stock then in effect, before any dividends shall be declared, set apart for or paid upon the Junior Stock (the “Regular Dividends”), and (ii) the aggregate amount of any dividends or other distributions, whether cash or other property (but excluding dividends in kind), paid on outstanding shares of Common Stock on a per share basis based on the number of shares of Common Stock into which such share of Series A Preferred Stock could be converted on the applicable Record Date for such dividends or other distributions, assuming such shares of Common Stock were outstanding on the applicable Record Date for such dividend or other distributions (the “Participating Dividends” and, together with the Regular Dividends, the “Dividends”). For purposes hereof, the term “Stated Value” shall mean $1,000.00 per share of Series B Preferred Stock, as adjusted as described in Section 4(c) below.

(b) Regular Dividends shall be payable quarterly in arrears on January 1, April 1, July 1 and October 1 of each year (unless any such day is not a Business Day, in which event such Regular Dividends shall be payable on the next succeeding Business Day, without accrual to the actual payment date), commencing on October 1, 2015 (each such payment date being a “Regular Dividend Payment Date”, and the period from the date of issuance of the Series B Preferred Stock to the first Regular Dividend Payment Date and each such quarterly period thereafter being a “Regular Dividend Period”). The amount of Regular Dividends payable on the Series B Preferred Stock for any period shall be computed on the basis of a 365-day year and the actual number of days elapsed. Participating Dividends shall be payable as and when paid to the holders of shares of Common Stock (each such date being a “Participating Dividend Payment Date,” and, together with each Regular Dividend Payment Date, a “Dividend Payment Date”).

2

(c) Regular Dividends shall begin to accrue from the Issue Date and, if not declared, shall be cumulative. Any Regular Dividend or portion thereof undeclared and accrued but unpaid on any Regular Dividend Payment Date shall be added to the Stated Value until, but only until, such Regular Dividend or portion thereof is paid in cash in full. If at any time the Corporation does not pay any Regular Dividend in full on any scheduled Regular Dividend Payment Date, such Regular Dividends will accrue at an annual rate of 8.0% of the Stated Value from such scheduled Regular Dividend Payment Date to the date that all accumulated Regular Dividends on the Series B Preferred Stock have been paid in cash in full, and thereafter will accrue at an annual rate of 7.0%. For the avoidance of doubt, Regular Dividends shall accumulate whether or not in any Regular Dividend Period there have been funds of the Corporation legally available for the payment of such dividends. Participating Dividends are payable on a cumulative basis once declared, whether or not there shall be funds legally available for the payment thereon.

(d) Except as otherwise provided herein, if at any time the Corporation pays less than the total amount of Dividends then accrued but unpaid with respect to the Series B Preferred Stock, such payment shall be distributed pro rata among the holders thereof based upon the Stated Value on all shares of Series B Preferred Stock held by each such holder as of the Record Date for such payment. When Dividends are not paid in full upon the shares of Series B Preferred Stock, all Dividends declared on Series B Preferred Stock and any other Parity Stock shall be paid pro rata so that the amount of Dividends so declared on the shares of Series B Preferred Stock and each such other class or series of Parity Stock shall in all cases bear to each other the same ratio as accrued but unpaid Dividends (for the full amount of dividends that would be payable for the most recently payable dividend period if dividends were declared in full on non-cumulative Parity Stock) on the shares of Series B Preferred Stock and such other class or series of Parity Stock bear to each other.

(e) When and if declared, the Regular Dividends shall be paid in cash.

(f) The Corporation shall not declare or pay any dividends on shares of Common Stock unless the holders of the Series B Preferred Stock then outstanding, other than in the case of a dividend payable on the Common Stock in shares of Common Stock, shall simultaneously receive Participating Dividends on a pro rata basis as if the shares of Series B Preferred Stock had been converted into shares of Series A Preferred Stock pursuant to Section 7 immediately prior to the Record Date for determining the stockholders eligible to receive such dividends.

(g) Each Dividend shall be payable to the holders of record of shares of Series A Preferred Stock as they appear on the stock records of the Corporation at the Close of Business on such Record Date, which (i) with respect to Regular Dividends, shall be not more than thirty (30) days nor less than ten (10) days preceding the applicable Regular Dividend Payment Date, and (ii) with respect to Participating Dividends, shall be the same day as the Record Date for the payment of dividends or distributions to the holders of shares of Common Stock.

(h) From and after the time, if any, that the Corporation shall have failed to pay all accrued but unpaid Regular Dividends for all prior Regular Dividend Periods and/or declared and unpaid Participating Dividends in accordance with this Section 4, no dividends shall be declared or paid or set apart for payment, or other distribution declared or made, upon any Junior Stock, nor shall any Junior Stock be redeemed, purchased or otherwise acquired for any

3

consideration (nor shall any moneys be paid to or made available for a sinking fund for the redemption of any shares of any such Junior Stock) by the Corporation, directly or indirectly until all such Regular Dividends and/or Participating Dividends have been paid in full, without the consent of the holders of a majority of the outstanding shares of Series B Preferred Stock; provided, however, that the foregoing limitation shall not apply to:

(1) purchases, redemptions or other acquisitions of shares of Junior Stock in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of any one or more employees, officers, directors, managers or consultants of or to the Corporation or any of its Subsidiaries;

(2) an exchange, redemption, reclassification or conversion of any class or series of Junior Stock for any class or series of Junior Stock; or

(3) any dividend in the form of stock, warrants, options or other rights where the dividended stock or the stock issuable upon exercise of such warrants, options or other rights is the same stock as that on which the dividend is being paid or ranks equal or junior to that stock.

Section 5. Liquidation, Dissolution or Winding Up.

(a) Upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation (each, a “Liquidation”), after satisfaction of all liabilities and obligations to creditors of the Corporation and before any distribution or payment shall be made to holders of any Junior Stock, each holder of Series B Preferred Stock shall be entitled to receive, out of the assets of the Corporation or proceeds thereof (whether capital or surplus) legally available therefor, an amount per share of Series B Preferred Stock equal to the greater of:

(1) the Stated Value per share, plus an amount equal to any Regular Dividends accrued but unpaid thereon (whether or not declared) plus declared but unpaid Participating Dividends, in each case, through the date of Liquidation; and

(2) the payment such holders would have received had their shares of Series B Preferred Stock been converted into Series A Preferred Stock (at the then-applicable conversion rate), pursuant to Section 7, immediately prior to such Liquidation, plus declared but unpaid Participating Dividends through the date of Liquidation.

(the greater of (1) and (2) is referred to herein as the “Liquidation Preference”). Holders of Series B Preferred Stock will not be entitled to any other amounts from the Corporation after they have received the full amounts provided for in this Section 5(a) and will have no right or claim to any of the Corporation’s remaining assets.

(b) If, in connection with any distribution described in Section 5(a) above, the assets of the Corporation or proceeds thereof are not sufficient to pay in full the Liquidation Preference payable on the Series B Preferred Stock and the corresponding amounts payable on the Parity Stock, then such assets, or the proceeds thereof, shall be paid pro rata in accordance with the full respective amounts which would be payable on such shares if all amounts payable thereon were paid in full.

4

(c) For purposes of this Section 5, the merger or consolidation of the Corporation with or into any other corporation or other entity, or the sale, conveyance, lease or other disposition of all or substantially all of the assets of the Corporation, shall not constitute a liquidation, dissolution or winding up of the Corporation.

Section 6. Voting Rights.

(a) The holders of shares of Series B Preferred Stock will not have any voting rights, including the right to elect any directors, except (i) the right to vote as a class on all matters adversely affecting the rights of holders of Series B Preferred Stock or (ii) any other voting rights required by law.

(b) For so long as the Outstanding Preferred Percentage is at least 50%, the Corporation shall not and shall not permit any direct or indirect Subsidiary of the Corporation to, without first obtaining the written consent or affirmative vote at a meeting called for that purpose of holders of a majority of outstanding shares of Series B Preferred Stock and Series A Preferred Stock, voting together as a single class, take any of the following actions:

(1) Any change, amendment, alteration or repeal (including as a result of a merger, consolidation, or other similar or extraordinary transaction) of any provisions of the Certificate or By-Laws that adversely amends, modifies or affects the rights, preferences, privileges or voting powers of the Series B Preferred Stock; or

(2) Any authorization, issuance or reclassification of stock that would rank equal or senior to the Series B Preferred Stock with respect to the redemption, liquidation, dissolution or winding up of the Corporation or with respect to dividend rights.

Section 7. Conversion.

(a) Mandatory Conversion. Effective as of the close of business on the Stockholder Approval Date, each share of Series B Preferred Stock shall automatically, without any action of the holder, convert into one share of Series A Preferred Stock, plus an amount in cash per share of Series B Preferred Stock equal to accrued but unpaid dividends on such share from and including the immediately preceding Dividend Payment Date to but excluding the date of such conversion, out of funds legally available therefor. No holder of Series B Preferred Stock may convert shares of Series B Preferred Stock other than pursuant to this Section 7(a).

(b) Conversion Procedures.

(1) In the event of conversion pursuant to Section 7(a), the Corporation shall deliver as promptly as practicable written notice to each holder specifying (A) the Stockholder Approval Date; and (B) the place or places where certificates or evidence of book-entry notation for such shares of Series B Preferred Stock are to be surrendered for issuance of certificates or evidence of book-entry notation representing shares of Series A Preferred Stock; and

Unless the shares of Series A Preferred Stock issuable upon conversion are to be issued in the same name as the name in which such shares of Series B Preferred Stock are registered, each share surrendered for mandatory conversion shall be accompanied by instruments of transfer, in form satisfactory to the Corporation, duly executed by the holder thereof or such holder’s duly authorized attorney and an amount sufficient to pay any transfer or similar tax in accordance with Section 7(f).

The “Conversion Date” shall be the Stockholder Approval Date.

5

(c) Effect of Conversion. Effective immediately prior to the Close of Business on the Conversion Date applicable to any shares of Series B Preferred Stock, dividends shall no longer accrue or be declared on any such shares of Series B Preferred Stock and such shares of Series B Preferred Stock shall cease to be outstanding.

(d) Record Holder of Underlying Securities as of Conversion Date. The Person or Persons entitled to receive the Series A Preferred Stock and, to the extent applicable, cash, issuable upon conversion of Series B Preferred Stock on a Conversion Date shall be treated for all purposes as the record holder(s) of such shares of Series A Preferred Stock and/or cash as of the Close of Business on such Conversion Date. As promptly as practicable on or after the Conversion Date (and in any event no later than three Trading Days thereafter), the Corporation shall issue the number of shares of Series A Preferred Stock issuable upon conversion. Such delivery of shares of Series A Preferred Stock and, if applicable, cash, shall be made in certificated form or by book-entry. Any such certificate or certificates shall be delivered by the Corporation to the appropriate holder on a book-entry basis or by mailing certificates evidencing the shares to the holders at their respective addresses as set forth in the conversion notice. In the event that a holder shall not by written notice designate the name in which shares of Series A Preferred Stock to be delivered upon conversion of shares of Series B Preferred Stock should be registered or paid, or the manner in which such shares and, if applicable, cash, should be delivered, the Corporation shall be entitled to register and deliver such shares and, if applicable, cash, in the name of the holder and in the manner shown on the records of the Corporation.

(e) Status of Converted or Acquired Shares. Shares of Series B Preferred Stock duly converted in accordance with this Certificate of Designations, or otherwise acquired by the Corporation in any manner whatsoever, shall be retired promptly after the acquisition thereof. All such shares shall upon their retirement and any filing required by the Delaware General Corporation Law become authorized but unissued shares of Preferred Stock, without designation as to series until such shares are once more designated as part of a particular series by the Board pursuant to the provisions of the Certificate of Incorporation.

(f) Taxes.

(1) The Corporation and its paying agent shall be entitled to withhold taxes on all payments on the Series B Preferred Stock or the Series A Preferred Stock or other securities issued upon conversion of the Series B Preferred Stock to the extent required by law. Prior to the date of any such payment, the Corporation shall request and, upon request, each holder of Series B Preferred Stock shall deliver to the Corporation or its paying agent a duly executed, valid, accurate and properly completed Internal Revenue Service Form W-9 or an appropriate Internal Revenue Service Form W-8, as applicable.

6

(2) Absent a change in law or Internal Revenue Service practice, or a contrary determination (as defined in Section 1313(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”)), each holder of Series B Preferred Stock and the Corporation agree not to treat the Series B Preferred Stock (based on their terms as set forth in this Certificate of Designations) as “preferred stock” within the meaning of Section 305 of the Code, and Treasury Regulation Section 1.305-5 for United States federal income tax and withholding tax purposes and shall not take any position inconsistent with such treatment.

(3) The Corporation shall pay any and all documentary, stamp and similar issuance or transfer tax due on (x) the issuance of the Series B Preferred Stock and (y) the issuance of shares of Series A Preferred Stock upon conversion of the Series B Preferred Stock. However, in the case of conversion of Series B Preferred Stock, the Corporation shall not be required to pay any tax or duty that may be payable in respect of any transfer involved in the issuance and delivery of shares of Series A Preferred Stock in a name other than that of the holder of the shares to be converted, and no such issuance or delivery shall be made unless and until the person requesting such issuance has paid to the Corporation the amount of any such tax or duty, or has established to the satisfaction of the Corporation that such tax or duty has been paid.

(4) Each holder of Series B Preferred Stock and the Corporation agree to cooperate with each other in connection with any redemption of part of the shares of Series B Preferred Stock and to use good faith efforts to structure such redemption so that such redemption may be treated as a sale or exchange pursuant to Section 302 of the Code; provided that nothing in this Section 7(f) shall require the Corporation to purchase any shares of Series B Preferred Stock, and provided further that the Corporation makes no representation or warranty in this Section 7(f) regarding the tax treatment of any redemption of Series B Preferred Stock.

Section 8. Redemption and Repurchase.

(a) Optional Redemption.

(1) The Series B Preferred Stock may be redeemed, in whole or in part, at any time on or after the seventh anniversary of the Issue Date, at the option of the Corporation, upon giving notice of redemption pursuant to Section 8(d), at a redemption price per share equal to the sum of the Stated Value per share of the Series B Preferred Stock to be redeemed plus an amount per share equal to accrued but unpaid dividends on such share of Series B Preferred Stock from and including the immediately preceding Dividend Payment Date to but excluding the date of redemption.

(2) The Series B Preferred Stock may be redeemed in whole or in part, if, at any time after the fourth anniversary of the Issue Date, the daily volume weighted average price of the Common Stock equals or exceeds 175.0% of the conversion price then in effect for at least 40 Trading Days during a period of 60 consecutive Trading Days, at the option of the Corporation, upon giving notice of redemption pursuant to Section 8(d), at a redemption price per share equal to the sum of the Stated Value per share of the Series B Preferred Stock to be redeemed plus an amount per share equal to accrued but unpaid dividends on such share of Series B Preferred Stock from and including the immediately preceding Dividend Payment Date to but excluding the date of redemption.

7

(3) For the avoidance of doubt, the Series B Preferred Stock shall convert into Series A Preferred Stock pursuant to Section 7(a) upon occurrence of the Stockholder Approval Date prior to any date fixed for redemption.

(b) Repurchase at the Option of the Holder Upon a Change of Control. Upon the occurrence of a Change of Control, each holder of shares of Series B Preferred Stock shall have the right to require the Corporation to repurchase, by irrevocable, written notice to the Corporation, all or any portion of such holder’s shares of Series B Preferred Stock at a purchase price per share equal to the value calculated in accordance with the applicable formula as set forth on Annex 1 (the “Fair Value”).

Within thirty (30) days of the occurrence of a Change of Control, the Corporation shall send notice by first class mail, postage prepaid, addressed to the holders of record of the shares of Series B Preferred Stock at their respective last addresses appearing on the books of the Corporation stating (1) that a Change of Control has occurred, (2) that all shares of Series B Preferred Stock tendered prior to a specified Business Day no earlier than thirty (30) days nor later than sixty (60) days from the date such notice is mailed shall be accepted for repurchase and (3) the procedures that holders of the Series B Preferred Stock must follow in order for their shares of Series B Preferred Stock to be repurchased, including the place or places where certificates for such shares are to be surrendered for payment of the repurchase price. Any notice mailed as provided in this subsection shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of Series B Preferred Stock designated for repurchase shall not affect the validity of the proceedings for the redemption of any other shares of Series B Preferred Stock.

(c) Mandatory Redemption. If the Stockholder Approval is not obtained by the date that is the later of (i) the date that is 180 days from the date of the Investment Agreement and (ii) the date that is 90 days from the Tender Offer Closing, a holder of shares of Series B Preferred Stock may thereafter irrevocably elect to require the Corporation to repurchase all or any portion of such holder’s shares of Series B Preferred Stock by giving irrevocable, written notice to the Corporation (a “Redemption Notice”) at a repurchase price per share, payable in cash, equal to the greater of (x) the Stated Value and (y) the average trading price of the Common Stock for the 20 Trading Days immediately preceding the date of the Redemption Notice multiplied by (ii) the number of shares of Common Stock into which a share of Series A Preferred Stock would have been convertible.

(d) Notice of Redemption at the Option of the Corporation. Notice of every redemption of shares of Series B Preferred Stock pursuant to Section 8(a) shall be given by first class mail, postage prepaid, addressed to the holders of record of the shares to be redeemed at their respective last addresses appearing on the books of the Corporation. Such mailing shall be at least thirty (30) days and not more than sixty (60) days before the date fixed for redemption. Any notice mailed as provided in this Section 8(d) shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of Series B Preferred Stock designated for redemption shall not affect the validity of the proceedings for the redemption of any other shares of Series B Preferred Stock. Each notice of redemption given to a

8

holder shall state: (1) the redemption date; (2) the number of shares of the Series B Preferred Stock to be redeemed and, if less than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder; (3) the redemption price; and (4) the place or places where certificates for such shares are to be surrendered for payment of the redemption price.

(e) Partial Redemption. In case of any redemption of part of the shares of Series B Preferred Stock at the time outstanding pursuant to Section 8(a), the shares to be redeemed shall be selected pro rata. Subject to the provisions hereof, the Corporation shall have full power and authority to prescribe the terms and conditions upon which shares of Series B Preferred Stock shall be redeemed from time to time. If fewer than all the shares represented by any certificate are redeemed, a new certificate shall be issued representing the unredeemed shares without charge to the holder thereof.

(f) Effectiveness of Redemption. If notice of redemption has been duly given under Section 8(d) and if on or before the redemption date specified in the notice all funds necessary for the redemption have been deposited by the Corporation, in trust for the pro rata benefit of the holders of the shares called for redemption, with a bank or trust company doing business in the Borough of Manhattan, The City of New York, and having a capital and surplus of at least $500 million and selected by the Board, so as to be and continue to be available solely therefor, then, notwithstanding that any certificate for any share so called for redemption has not been surrendered for cancellation, on and after the redemption date specified in the notice dividends shall cease to accrue on all shares so called for redemption, all shares so called for redemption shall no longer be deemed outstanding and all rights with respect to such shares (including voting and consent rights) shall forthwith on such redemption date specified in the notice cease and terminate, except that the right of the holders thereof to receive the amount payable on such redemption from such bank or trust company, without interest shall survive such cessation and termination. Any funds unclaimed at the end of three years from the redemption date specified in the notice shall, to the extent permitted by law, be released to the Corporation, after which time the holders of the shares so called for redemption shall look only to the Corporation for payment of the redemption price of such shares.

Section 9. Anti-Dilution Provisions.

(a) Reorganization Events. In the event of:

(1) any reclassification, statutory exchange, merger, consolidation or other similar business combination of the Corporation with or into another Person, in each case, pursuant to which the Series A Preferred Stock is changed or converted into, or exchanged for, cash, securities or other property of the Corporation or another person;

(2) any sale, transfer, lease or conveyance to another Person of all or substantially all the property and assets of the Corporation, in each case pursuant to which the Series A Preferred Stock is converted into cash, securities or other property; or

(3) any statutory exchange of securities of the Corporation with another Person (other than in connection with a merger or acquisition) or reclassification, recapitalization or reorganization of the Series A Preferred Stock into other securities, (each of which is referred to as a “Reorganization Event”), each share of Series B Preferred Stock outstanding

9

immediately prior to such Reorganization Event will, without the consent of the holders of Series B Preferred Stock and subject to Section 9(b), remain outstanding but shall become convertible into, out of funds legally available therefor, the number, kind and amount of securities, cash and other property (the “Exchange Property”) (without any interest on such Exchange Property and without any right to dividends or distribution on such Exchange Property which have a Record Date that is prior to the applicable Conversion Date) that the holder of such share of Series B Preferred Stock would have received in such Reorganization Event had such holder converted its share of Series B Preferred Stock into the applicable number of shares of Series A Preferred Stock immediately prior to the effective date of the Reorganization Event, assuming that such holder is not a Person with which the Corporation consolidated or into which the Corporation merged or which merged into the Corporation or to which such sale or transfer was made, as the case may be (any such Person, a “Constituent Person”), or an Affiliate of a Constituent Person to the extent such Reorganization Event provides for different treatment of Series A Preferred Stock held by Affiliates of the Corporation and non-Affiliates; provided that if the kind or amount of securities, cash and other property receivable upon such Reorganization Event is not the same for each share of Series A Preferred Stock held immediately prior to such Reorganization Event by a Person other than a Constituent Person or an Affiliate thereof, then for the purpose of this Section 9(a), the kind and amount of securities, cash and other property receivable upon such Reorganization Event will be deemed to be the weighted average, as determined by the Corporation in good faith, of the types and amounts of consideration received by the holders of Common Stock. Any notice mailed as provided in this subsection shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of Series B Preferred Stock designated for repurchase shall not affect the validity of the proceedings for the redemption of any other shares of Series B Preferred Stock.

(b) Exchange Property Election. In the event that the holders of the shares of Series A Preferred Stock have the opportunity to elect the form of consideration to be received in such transaction, the Exchange Property that the holders of Series B Preferred Stock shall be entitled to receive shall be determined by the holders of a majority of the outstanding shares of Series B Preferred Stock on or before the earlier of (i) the deadline for elections by holders of Series A Preferred Stock and (ii) two Business Days before the anticipated effective date of such Reorganization Event. The number of units of Exchange Property for each share of Series B Preferred Stock converted following the effective date of such Reorganization Event shall be determined from among the choices made available to the holders of the Series A Preferred Stock and based on the per share amount as of the effective date of the Reorganization Event, determined as if the references to “share of Series A Preferred Stock” in this Certificate of Designations were to “units of Exchange Property.”

(c) Successive Reorganization Events. The above provisions of Sections 9(a) and Section 9(b) shall similarly apply to successive Reorganization Events and the provisions of Section 9 shall apply to any shares of Capital Stock (or capital stock of any other issuer) received by the holders of the Series A Preferred Stock in any such Reorganization Event.

10

(d) Reorganization Event Notice. The Corporation (or any successor) shall, no less than twenty (20) Business Days prior to the occurrence of any Reorganization Event, provide written notice to the holders of Series B Preferred Stock of such occurrence of such event and of the kind and amount of the cash, securities or other property that constitutes the Exchange Property. Failure to deliver such notice shall not affect the operation of this Section 9.

(e) The Corporation shall not enter into any agreement for a transaction constituting a Reorganization Event unless (i) such agreement provides for or does not interfere with or prevent (as applicable) conversion of the Series B Preferred Stock into the Exchange Property in a manner that is consistent with and gives effect to this Section 9, and (ii) to the extent that the Corporation is not the surviving corporation in such Reorganization Event or will be dissolved in connection with such Reorganization Event, proper provision shall be made in the agreements governing such Reorganization Event for the conversion of the Series B Preferred Stock into stock of the Person surviving such Reorganization Event or such other continuing entity in such Reorganization Event, or in the case of a Reorganization Event described in Section 9(a)(2), an exchange of Series B Preferred Stock for the stock of the Person to whom the Corporation’s assets are conveyed or transferred, having voting powers, preferences, and relative, participating, optional or other special rights as nearly equal as possible to those provided in this Certificate of Designations.

Section 10. Reservation of Shares. The Corporation shall at all times when the Series B Preferred Stock shall be outstanding reserve and keep available, free from preemptive rights, for issuance upon the conversion of Series B Preferred Stock, such number of its authorized but unissued Series A Preferred Stock as will from time to time be sufficient to permit the conversion of all outstanding Series B Preferred Stock. Prior to the delivery of any securities which the Corporation shall be obligated to deliver upon conversion of the Series B Preferred Stock, the Corporation shall comply with all applicable laws and regulations which require action to be taken by the Corporation.

Section 11. Notices. Except as otherwise provided herein, any and all notices or other communications or deliveries hereunder shall be in writing and shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number specified in this Section 11 prior to or at the Close of Business on a Business Day and electronic confirmation of receipt is received by the sender, (ii) the next Business Day after the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number specified in this Section 11 on a day that is not a Business Day or later than the Close of Business on any Business Day, (iii) the Business Day following the date of mailing, if sent by nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given. The addresses for such communications shall be: (i) if to the Corporation, Suite 300, Park Center I, 6100 Oak Tree Boulevard, Independence, Ohio USA 44131, Attention: Chief Executive Officer and General Counsel, Facsimile: (216) 676-2526, or (ii) if to a holder of Series B Preferred Stock, to the address or facsimile number appearing on the Corporation’s stockholder records or such other address or facsimile number as such holder may provide to the Corporation in accordance with this Section 11.

11

Section 12. Certain Definitions. As used in this Certificate of Designations, the following terms shall have the following meanings, unless the context otherwise requires:

“Affiliate” with respect to any person, any person directly or indirectly controlling, controlled by or under common control with, such other person; provided, however, that (i) portfolio companies in which any person or any of its Affiliates has an investment shall not be deemed an Affiliate of such person, or (ii) the Corporation, any of its Subsidiaries, or any of the Corporation’s other controlled Affiliates, in each case, will not be deemed to be Affiliates of the Brookfield Group for purposes of this Certificate of Designations. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”) when used with respect to any person, means the possession, directly or indirectly, of the power to cause the direction of management or policies of such person, whether through the ownership of voting securities, by contract or otherwise.

“Beneficially Own” shall mean “beneficially own” as defined in Rule 13d-3 of the Exchange Act or any successor provision thereto.

“Brookfield Group” means Brookfield Capital Partners Ltd. and any of its Affiliates, any successor entity and any other investment fund, vehicle or similar entity of which such person or an Affiliate, advisor or manager of such person serves as the general partner, manager or advisor.

“Board” shall have the meaning ascribed to it in the recitals.

“Business Day” shall mean a day that is a Monday, Tuesday, Wednesday, Thursday or Friday and is not a day on which banking institutions in New York, New York, or Cleveland, Ohio, generally are authorized or obligated by law, regulation or executive order to close.

“By-Laws” shall mean the Amended and Restated By-laws of the Corporation.

“Capital Stock” shall mean any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) stock issued by the Corporation.

“Certificate” shall have the meaning ascribed to it in the recitals.

“Certificate of Designations” shall mean this Certificate of Designations relating to the Series B Preferred Stock, as it may be amended from time to time.

“Change of Control” shall mean the occurrence of any of the following on or after May 4, 2015:

(1) any Person (other than a member of the Brookfield Group) shall Beneficially Own, directly or indirectly, through a purchase, merger or other acquisition transaction or series of transactions, shares of the Corporation’s Capital Stock entitling such Person to exercise 35% or more of the total voting power of all classes of Voting Stock of the Corporation, other than an acquisition by the Corporation, any of the Corporation’s Subsidiaries or any of the Corporation’s employee benefit plans (for purposes of this clause (1), “Person” shall include any syndicate or group that would be deemed to be a “person” under Section 13(d)(3) of the Exchange Act);

12

(2) the Corporation (i) merges or consolidates with or into any other Person, another Person merges with or into the Corporation, or the Corporation conveys, sells, transfers or leases all or substantially all of the Corporation’s assets to another Person or (ii) engages in any recapitalization, reclassification or other transaction in which all or substantially all of the Common Stock is exchanged for or converted into cash, securities or other property, in each case other than a merger, consolidation or sale:

1. that does not result in a reclassification, conversion, exchange or cancellation of the Corporation’s outstanding Common Stock; or

2. which is effected solely to change the Corporation’s jurisdiction of incorporation and results in a reclassification, conversion or exchange of outstanding shares of the Common Stock solely into shares of common stock of the surviving entity; or

3. where the Voting Stock outstanding immediately prior to such transaction is converted into or exchanged for Voting Stock of the surviving or transferee Person constituting a majority of the outstanding shares of such Voting Stock of such surviving or transferee Person (immediately after giving effect to such issuance); or

(3) the Common Stock ceases to be listed or quoted on any of the New York Stock Exchange, the Nasdaq Global Select Market or the Nasdaq Global Market (or any of their respective successors),

provided, that (x) transfers by any holder of any shares of Series B Preferred Stock (or shares of Series A Preferred Stock converted therefrom) to any Person shall not be taken into account for purposes of determining whether or not a Change of Control has occurred and (y) notwithstanding the foregoing, a transaction or transactions will not constitute a Change of Control if at least 90% of the consideration received or to be received by holders of Common Stock (other than cash payments for fractional shares or pursuant to statutory appraisal rights) in connection with such transaction or transactions consists of common stock, ordinary shares, American depositary receipts or American depositary shares and any associated rights listed and traded on the New York Stock Exchange or another U.S. national securities exchange or automated inter-dealer quotation system (or which will be so listed and traded when issued or exchanged in connection with such consolidation or merger).

“Close of Business” shall mean 5:00 p.m., New York City time, on any Business Day.

“Code” shall have the meaning ascribed to it in Section 7(f)(ii).

“Common Stock” shall have the meaning ascribed to it in Section 3.

“Constituent Person” shall have the meaning ascribed to it in Section 9(a).

“Conversion Date” shall have the meaning ascribed to it in Section 7(b).

“Corporation” shall have the meaning ascribed to it in the recitals.

13

“Dividend” shall have the meaning ascribed to it in Section 4(a).

“Dividend Payment Date” shall have the meaning ascribed to it in Section 4(b).

“Exchange Act” shall mean the U.S. Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange Property” shall have the meaning ascribed to it in Section 9(a).

“Fair Value” shall have the meaning ascribed to it in Section 8(b).

“Indebtedness” shall mean any indebtedness (including principal and premium) in respect of borrowed money.

“Investment Agreement” shall mean that certain Investment Agreement, dated as of May 4, 2015, by and between GrafTech International Ltd. and BCP IV Graftech Holdings LP.

“Issue Date” shall mean August 11, 2015.

“Junior Stock” shall have the meaning ascribed to it in Section 3.

“Liquidation” shall have the meaning ascribed to it in Section 5(a).

“Liquidation Preference” shall have the meaning ascribed to it in Section 5(a).

“Outstanding Preferred Percentage” means, as of any date, the percentage equal to (i) the aggregate number of shares of Series B Preferred Stock then outstanding divided by (ii) the total number of shares of Series B Preferred Stock issued pursuant to the Investment Agreement.

“Parity Stock” shall have the meaning ascribed to it in Section 3.

“Participating Dividend” shall have the meaning ascribed to it in Section 4(a).

“Person” shall mean any individual, company, partnership, limited liability company, joint venture, association, joint stock company, trust, unincorporated organization, government or agency or political subdivision thereof or any other entity.

“Preferred Stock” shall mean any and all series of preferred stock of the Corporation, including the Series B Preferred Stock.

“Record Date” shall mean, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock have the right to receive any cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of shareholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board or by statute, contract, this Certificate of Designations or otherwise).

14

“Regular Dividend” shall have the meaning ascribed to it in Section 4(a).

“Regular Dividend Payment Date” shall have the meaning ascribed to it in Section 4(b).

“Regular Dividend Period” shall have the meaning ascribed to it in Section 4(b).

“Reorganization Event” shall have the meaning ascribed to it in Section 9(a).

“Series A Preferred Stock” shall have the meaning ascribed to it in Section 3.

“Series B Preferred Stock” shall have the meaning ascribed to it in Section 1.

“Stated Value” shall have the meaning ascribed to it in Section 4(a).

“Stockholder Approval” means the stockholder approval of the proposal to issue Series A Preferred Stock upon conversion of the Series B Preferred Stock pursuant to the terms of this Certificate of Designation in compliance with Rule 312 of the NYSE Listed Company Manual.

“Stockholder Approval Date” means the date on which the Stockholder Approval is obtained.

“Subsidiary” means any company or corporate entity for which the Corporation owns, directly or indirectly, an amount of the voting securities, other voting rights or voting partnership interests of which is sufficient to elect at least a majority of its board of directors or other governing body (or, if there are no such voting interests, more than 50% of the equity interests of such company or corporate entity).

“Tender Offer Closing” means the closing of the tender offer contemplated by that certain letter of intent, dated as of April 29, 2015, by and between the Corporation and Brookfield Capital Partners Ltd. regarding a proposed tender offer for the outstanding shares of the Common Stock.

“Trading Day” shall mean any Business Day on which the Common Stock is traded, or able to be traded, on the principal national securities exchange on which the Common Stock is listed or admitted to trading.

“Voting Stock” shall mean Capital Stock of the class or classes pursuant to which the holders thereof have the general voting power under ordinary circumstances (determined without regard to any classification of directors) to elect one or more members of the Board (without regard to whether or not, at the relevant time, Capital Stock of any other class or classes (other than Common Stock) shall have or might have voting power by reason of the happening of any contingency).

Section 13. Headings. The headings of the paragraphs of this Certificate of Designations are for convenience of reference only and shall not define, limit or affect any of the provisions hereof.

15

Section 14. Record Holders. To the fullest extent permitted by applicable law, the Corporation may deem and treat the record holder of any share of the Series B Preferred Stock as the true and lawful owner thereof for all purposes, and the Corporation shall not be affected by any notice to the contrary.

Section 15. Notices. All notices or communications in respect of the Series B Preferred Stock shall be sufficiently given if given in writing and delivered in person or by first class mail, postage prepaid, or if given in such other manner as may be permitted in this Certificate of Designations, in the Certificate or By-Laws or by applicable law or regulation. Notwithstanding the foregoing, if the Series B Preferred Stock is issued in book-entry form through The Depository Trust Corporation or any similar facility, such notices may be given to the holders of the Series B Preferred Stock in any manner permitted by such facility.

Section 16. Replacement Certificates. The Corporation shall replace any mutilated certificate at the holder’s expense upon surrender of that certificate to the Corporation. The Corporation shall replace certificates that become destroyed, stolen or lost at the holder’s expense upon delivery to the Corporation of reasonably satisfactory evidence that the certificate has been destroyed, stolen or lost, together with any indemnity that may be required by the Corporation.

Section 17. Transfer Agent, Conversion Agent, Registrar and Paying Agent. The duly appointed Transfer Agent, Conversion Agent, Registrar and Paying Agent for the Series B Preferred Stock shall be the Corporation. The Corporation may, in its sole discretion, resign from its position as Transfer Agent or remove a successor Transfer Agent in accordance with the agreement between the Corporation and such Transfer Agent; provided that the Corporation shall appoint a successor transfer agent who shall accept such appointment prior to the effectiveness of any such resignation or removal. Upon any such removal, resignation or appointment, the Corporation shall send notice thereof by first-class mail, postage prepaid, to the holders of the Series B Preferred Stock.

Section 18. Severability. If any term of the Series B Preferred Stock set forth herein is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, all other terms set forth herein which can be given effect without the invalid, unlawful or unenforceable term will, nevertheless, remain in full force and effect, and no term herein set forth will be deemed dependent upon any other such term unless so expressed herein.

Section 19. Other Rights. The shares of Series B Preferred Stock shall not have any rights, preferences, privileges or voting powers or relative, participating, optional or other special rights, or qualifications, limitations or restrictions thereof, other than as set forth herein or in the Certificate of Incorporation or as provided by applicable law and regulation.

Section 20. Transfer Rights. The shares of Series B Preferred Stock may not be sold or otherwise transferred.

16

IN WITNESS WHEREOF, GrafTech International Ltd. has caused this Certificate of Designations to be duly executed by its authorized corporate officer this 10th day of August, 2015.

| GRAFTECH INTERNATIONAL LTD. | ||

| By | /s/ Quinn J. Coburn | |

| Name: Quinn J. Coburn | ||

| Title: VP Finance, Treasurer and Interim CFO | ||

17

Annex 1

Fair Value Calculations

Annex 1

The basis for the Fair Value Top-Up Payment will be the Black Scholes Option Valuation methodology as described below:

Call Value (CV) = SN(d1) – Ke–rtN(d2)

where by,

S = The Change of Control price

K = The conversion price

t = The time to option expiration (put date)

r = ln(1+r’) where r’ = US Treasury with closest maturity to option expiration (put date)

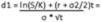

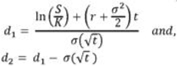

N = The Normal Distribution of d1 amd d2 where, as defined below,

¨ = Volatility of the underlying security

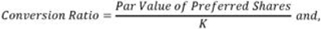

The Fair Value Top-Up Payment will then be calculated as follows:

Fair Value Top-Up Payment = Net Option Value * Conversion Ratio * Preferred Shares Outstanding

* (% of Fair Value Top – Up Applicable Percentage)

where by,

Net Option Value = Call Value – In the Money Value where,

In the Money Value = S – K

Fair Value Top – Up Applicable Percentage = one of the following scenarios:

(i) Change of Control on or after 2nd anniversary of the date of the Investment Agreement:

Fair Value Top – Up Applicable Percentage = 100%

(ii) Change of Control before 2nd anniversary of the date of the Investment Agreement not initiated by an Approved Holder (as defined in the Investment Agreement) or any of their respective Affiliates (as defined in the Investment Agreement):

Fair Value Top – Up Applicable Percentage = 100%

18

(iii) Change of Control before 2nd anniversary of the date of the Investment Agreement initiated by Approved Holder (as defined in the Investment Agreement) or any of their respective Affiliates (as defined in the Investment Agreement):

Fair Value Top – Up Applicable Percentage = 25%

(iv) Change of Control during Go-Shop Period (or Go-Shop Extension) (each as defined in that certain letter of intent, dated as of April 29, 2015, by and between the Corporation and Brookfield Capital Partners Ltd. regarding a proposed tender offer for the outstanding shares of the Common Stock)

Fair Value Top – Up Applicable Percentage = 0%

A holder of shares of Series A Preferred Stock would be entitled to the amount such holder would have received had they converted such shares into shares of Common Stock immediately prior to such transaction.

An illustrative example of the Fair Value is as follows:

Assumptions

| Source: | ||||||

| Market Assumptions |

||||||

| Issue Date |

30-Apr-15 | |||||

| US Treasury1 |

1.29 | % | Bloomberg | |||

| Change of Control Price |

$ | 5.50 | ||||

| Options Assumptions |

||||||

| Put Date |

30-Apr-22 | |||||

| Change of Control Date |

30-Apr-18 | |||||

| Strike Price |

$ | 5.00 | ||||

| Volatility |

35.00 | % | Fixed | |||

| 1. | Liquid US Treasury with closest maturity to Put Date from Bloomberg |

US$ Option Value Calculation

| Expiry Date (Put Date) |

30-Apr-22 | |||||||

| Change of Control Price |

S= | $ | 5.50 | |||||

| Strike Price |

K= | $ | 5.00 | |||||

| Time to Expiration (years) |

t= | 4 years | ||||||

| US Govt’ Risk Free Rate |

r’= | 1.29 | % | |||||

| Continuous Risk Free Rate = r = ln(1 + r’) = |

0.013 | |||||||

| Volatility |

¨= | 35 | % | |||||

| Normal Distribution of d1 |

0.712 | |||||||

| Normal Distribution of d2 |

0.444 |

19

| [A] Call Value = SN(d1) - Ke-rtN(d2) = |

$ | 1.81 | ||||||||

|

|

0.392 | = | 0.559 | |||||||

|

|

|

|||||||||

| 0.700 | ||||||||||

|

d2= d1 - ¨* ¨t = |

(0.141 | ) | ||||||||

| N(d1) = |

0.712 | |||||||||

| N(d2) = |

0.444 | |||||||||

Fair Value in Change of Control

US$

| Par Value per Share of Preferred Stock |

$ | 1,000.00 | ||

| Strike Price of Conversion Option |

$ | 5.00 | ||

|

|

|

|||

| Shares of Common Equity per share of Preferred Stock |

200 | |||

| [A] Call Value of Conversion Option per share of Common Stock |

$ | 1.81 | ||

| Less: In-the-money Value of Conversion Option |

($0.50 | ) | ||

|

|

|

|||

| Net Fair Value Payment per share of Common Stock (as-converted basis) |

$ | 1.31 | ||

| Shares of Common Stock per share of Preferred Stock |

200 | |||

|

|

|

|||

| Fair Value of Top-Up Payment per share of Preferred Stock |

$ | 261.37 | ||

| Shares of Preferred Stock Issued |

150,000 | |||

|

|

|

|||

| Fair Value Top-Up Payment in Change of Control |

$ | 39,204,791 | ||

| Fair Value Top-up Applicable Percentage |

100 | % | ||

|

|

|

|||

| Adjusted Fair Value Top-Up Payment in Change of Control |

$ | 39,204,791 | ||

| Adjusted Fair Value Top-Up Payment in Change of Control per Share of Preferred Stock |

$ | 261.37 | ||

| Shares of Common Stock per share of Preferred Stock |

200 | |||

| Change of Control Price |

$ | 5.50 | ||

|

|

|

|||

| As-Converted Value of a Share of Preferred Stock |

$ | 1,100.00 | ||

| Adjusted Fair Value Top-Up Payment in Change of Control per Share of Preferred Stock |

$ | 261.37 | ||

|

|

|

|||

| Fair Value per share of Preferred Stock |

$ | 1,361.37 |

20

In addition, an illustrative example of Fair Value Top-Up Payment under several Change of Control outcomes is provided below, noting that such outcomes do not intend to demonstrate an exhaustive set of potential outcomes. The values in the below tables are calculated using the US Treasury rate from the above example for simplicity (i.e. 4 year) and are not intended to govern the agreement.

(i) Change of Control on or after 2nd anniversary of the date of the Investment Agreement

Change of Control on or after 2nd anniversary of the date of the Investment Agreement

US$

| Time of | Time to | Change of Control Price | ||||||||||||||||||||||||||||||

| CoC |

Expiration | $5.00 | $5.25 | $5.50 | $5.75 | $6.00 | $6.25 | $6.50 | ||||||||||||||||||||||||

| 2.0 yrs |

5.0 yrs | $ | 49,044,551 | $ | 46,742,523 | $ | 44,598,312 | $ | 42,599,769 | $ | 40,735,714 | $ | 38,995,872 | $ | 37,370,804 | |||||||||||||||||

| 3.0 yrs |

4.0 yrs | $ | 43,875,023 | $ | 41,449,736 | $ | 39,204,791 | $ | 37,126,081 | $ | 35,200,522 | $ | 33,416,021 | $ | 31,761,423 | |||||||||||||||||

| 4.0 yrs |

3.0 yrs | $ | 37,952,855 | $ | 35,387,837 | $ | 33,035,583 | $ | 30,879,008 | $ | 28,902,078 | $ | 27,089,842 | $ | 25,428,428 | |||||||||||||||||

| 5.0 yrs |

2.0 yrs | $ | 30,885,686 | $ | 28,158,618 | $ | 25,697,547 | $ | 23,480,019 | $ | 21,484,511 | $ | 19,690,665 | $ | 18,079,438 | |||||||||||||||||

(ii) Change of Control before 2nd anniversary of the date of the Investment Agreement not initiated by an Approved Holder (as defined in the Investment Agreement) or any of their respective Affiliates (as defined in the Investment Agreement):

Change of Control before 2nd anniversary of the date of the Investment Agreement not Initiated by Investor or Holder

US$

| Time of | Time to | Change of Control Price | ||||||||||||||||||||||||||||||

| CoC |

Expiration | $5.00 | $5.25 | $5.50 | $5.75 | $6.00 | $6.25 | $6.50 | ||||||||||||||||||||||||

| 0.0 yrs |

7.0 yrs | $ | 57,860,533 | $ | 55,769,503 | $ | 53,806,092 | $ | 51,960,656 | $ | 50,224,403 | $ | 48,589,314 | $ | 47,048,063 | |||||||||||||||||

| 0.5 yrs |

6.5 yrs | $ | 55,810,421 | $ | 53,670,321 | $ | 51,664,133 | $ | 49,781,699 | $ | 48,013,746 | $ | 46,351,799 | $ | 44,788,108 | |||||||||||||||||

| 1.0 yrs |

6.0 yrs | $ | 53,665,431 | $ | 51,473,976 | $ | 49,423,449 | $ | 47,503,117 | $ | 45,703,159 | $ | 44,014,582 | $ | 42,429,157 | |||||||||||||||||

| 1.5 yrs |

5.5 yrs | $ | 51,414,613 | $ | 49,169,276 | $ | 47,072,767 | $ | 45,113,694 | $ | 43,281,609 | $ | 41,566,926 | $ | 39,960,859 | |||||||||||||||||

21

(iii) Change of Control before 2nd anniversary of the date of the Investment Agreement initiated by Approved Holder (as defined in the Investment Agreement) or any of their respective Affiliates (as defined in the Investment Agreement):

Change of Control before 2nd anniversary of the date of the Investment Agreement Initiated by Investor or Holder

US$

| Time of | Time to | Change of Control Price | ||||||||||||||||||||||||||||||

| CoC |

Expiration | $5.00 | $5.25 | $5.50 | $5.75 | $6.00 | $6.25 | $6.50 | ||||||||||||||||||||||||

| 0.0 yrs |

7.0 yrs | $ | 14,465,133 | $ | 13,942,376 | $ | 13,451,523 | $ | 12,990,164 | $ | 12,556,101 | $ | 12,147,329 | $ | 11,762,016 | |||||||||||||||||

| 0.5 yrs |

6.5 yrs | $ | 13,952,605 | $ | 13,417,580 | $ | 12,916,033 | $ | 12,445,425 | $ | 12,003,437 | $ | 11,587,950 | $ | 11,197,027 | |||||||||||||||||

| 1.0 yrs |

6.0 yrs | $ | 13,416,358 | $ | 12,868,494 | $ | 12,355,862 | $ | 11,875,779 | $ | 11,425,790 | $ | 11,003,646 | $ | 10,607,289 | |||||||||||||||||

| 1.5 yrs |

5.5 yrs | $ | 12,853,653 | $ | 12,292,319 | $ | 11,768,192 | $ | 11,278,424 | $ | 10,820,402 | $ | 10,391,731 | $ | 9,990,215 | |||||||||||||||||

22