Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - POWERSECURE INTERNATIONAL, INC. | d42505d8k.htm |

| EX-99.1 - PRESS RELEASE - POWERSECURE INTERNATIONAL, INC. | d42505dex991.htm |

1 1 August 2015 Exhibit 99.2 |

Forward-Looking Statements

Safe Harbor– All forward-looking statements made or referred to in this presentation are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are all statements other than statements of historical facts and include beliefs, opinions, estimates, expectations and projections about future business developments, opportunities, financial guidance, prospects, and outlook, are not guarantees of future performance or events but are based upon current assumptions and subject to risks, uncertainties and other factors that could cause actual results to differ materially from those expressed, projected or implied, including risks and uncertainties set forth in the Company's SEC filings, including but not limited to the Company’s most recent Form 10-K and subsequent SEC filings including reports on Form 8-K and Form 10-Q. Any forward-looking statements in this presentation speak only as of the date hereof and are subject to change, and the Company assumes no duty or obligation to update or revise any forward-looking statements. 2 |

3 3 POWR Q2 year-over- year revenue growth >800 employees Focused on Operational Excellence Strong balance sheet $333 million Trailing 12 month revenues Headquarters: Wake Forest, NC $468 million Record backlog Record 2 nd Quarter revenues of $107.2 million Who We Are 88% |

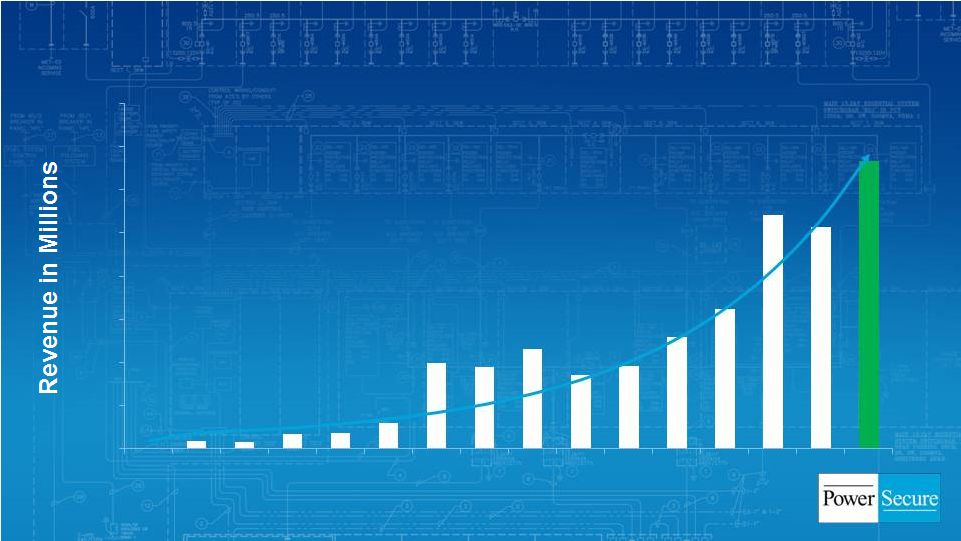

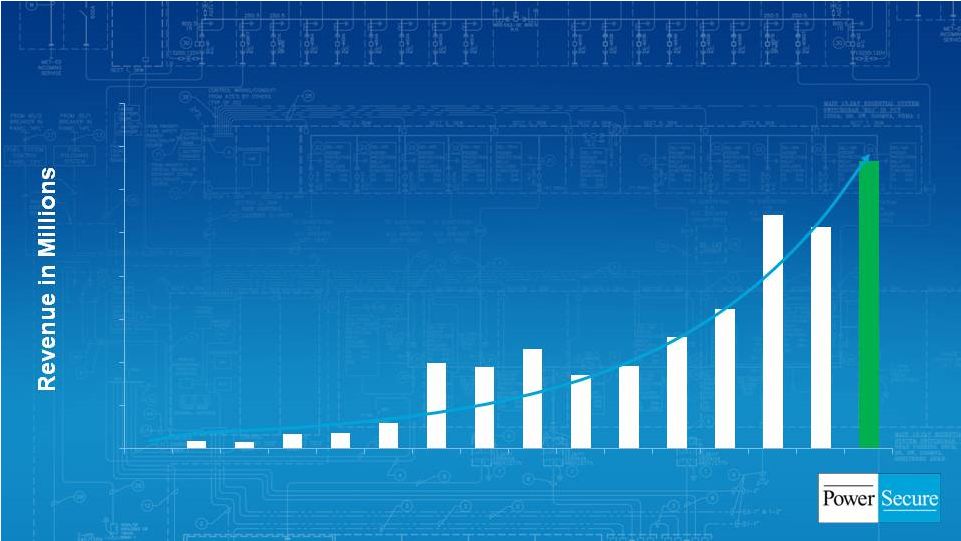

4 4 Where We Have Been: Building and Growing our Business 0 50 100 150 200 250 300 350 400 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 TTM Historical CAGR: 29.4% |

5 Where We Are Now: Solid Q2 Execution • Revenues of $107.2 million (+87.8% y-o-y) • Gross margin of 22.5% (DG: 34.2%, EE: 33.7%) • GAAP EPS of $0.04 • Record backlog grows to $468 million (vs. $349 million at August 2014) • $20.5 million in cash, $20.2 million in term debt and capital leases, nothing drawn on

$20 million revolving credit facility

• Operating margin continues to expand y-o-y 5 |

6 PowerSecure Solutions Across the Grid Generation Step-Up Substation Step-Down Substation Transmission Distribution Solar EPC Utility Infrastructure Distributed Generation Energy Efficiency Distributed Generation Consumption Energy Efficiency Products/Services Utility Infrastructure Solutions Distributed Generation Systems |

7 7 • Focused hospital and data center sales teams • Proprietary PowerBlock solution drivers higher ROI for customers • Manage >1 GW nationwide • 70% bi-fuel capability delivers environmental & economic benefits • 18-24 month sales cycle • Acquisition expands data center capabilities DG: Hospital & Data Center Growth Drivers |

8 • Full turnkey electrical infrastructure, design, implementation and commissioning to data center owners • Established market leader • Speeds access to key data center

decision makers • Nearly $9M in Q1 2015 revenues Acquisitions Add Value: Data Center Purchased for $13M in October 2014 |

9 Utility Infrastructure: Direct Service to our Customers • Full turnkey electrical infrastructure, design, implementation & commissioning to data center owners • T&D maintenance and construction • Substation products and services • Advanced metering and lighting installation • Storm repair and restoration • Utility engineering and design • Regulatory consulting and rate design • Cyber security & NERC-CIP compliance consulting services 9 |

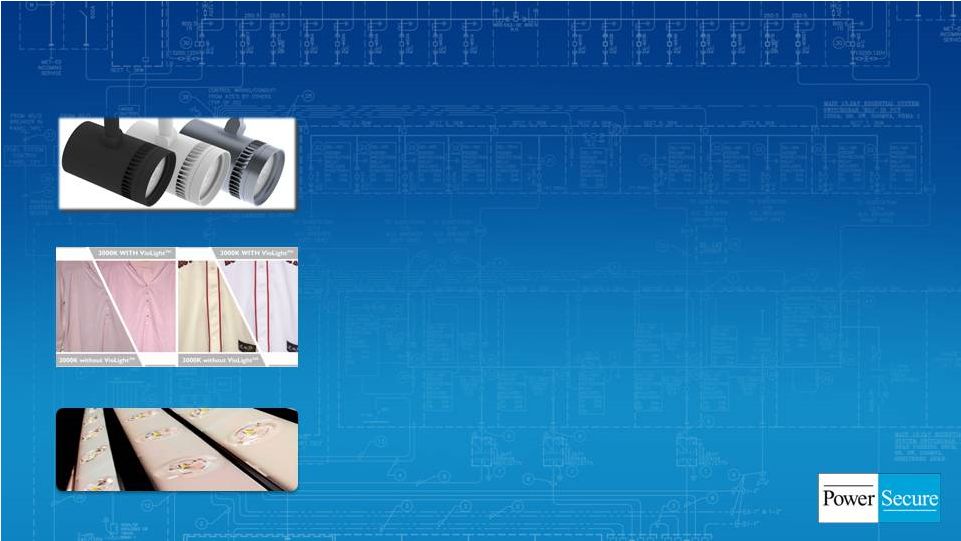

10 Energy Efficiency: LED Solutions • Department store/high-end retail lighting – Solais product line adds new customers • Utility lighting – Utilities and municipalities – Energy and maintenance savings drive payback – Opportunity: millions of lights across U.S. • Grocery, drug, and convenience stores – Best-in-class lights for freezer/refrigerated cases 10 |

11 11 Acquisitions Add Value: Solais • Significant sourcing and manufacturing expertise • Adding substantial efficiencies to manufacturing of PowerSecure’s existing LED solutions • Gross margins have expanded >10pp • Outstanding proprietary portfolio of LED lamps and fixtures for C&I applications • Superior light output, thermal management, optics, light quality and aesthetics Purchased Solais lighting business for $15 M April 2013 |

12 12 Acquisitions Add Value: Energy Efficiency Services • Serve super-ESCOs with lighting, mechanical, water and building envelope solutions to deliver savings • Added retail capability in 2014 • Opens new customer channels for DG and LED lighting solutions Paid ~$6M for EES capabilities in 2013/14 |

13 13 Acquisitions Add Value: Solar • + $240 M to backlog since mid-2014 - Includes >$200M w/large IOUs • Accretive to net income & EPS • In-house turnkey EPC capability • Strategic offering integrated into microgrid solutions Purchased solar business for $4M in June 2012 |

14 Where We Are Going: 2015 Focus Areas 1. Relentless pursuit of operational excellence in everything we do 2. Expand our operating margins to drive EPS in 2015 and beyond 3. Grow pipeline of opportunities for 2016 and convert them to backlog |

15 15 Where We Are Going: Building and Growing our Business 0 50 100 150 200 250 300 350 400 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 TTM Historical CAGR: 29.4% |

16 16 |