Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DTE ENERGY CO | a8-kmacquariendrandgoldman.htm |

Business Update August 10-11, 2015 EXHIBIT 99.1

Safe Harbor Statement The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, FERC, MPSC, NRC and CFTC as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation, including legislative amendments and Retail Access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and increased thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increased costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; volatility in commodity markets; deviations in weather and related risks impacting the results of DTE Energy’s energy trading operations; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant construction projects; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission or generation facility; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; contract disputes; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2014 Forms 10-K and 2015 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

• Overview • Long-Term Growth Update • Summary 3

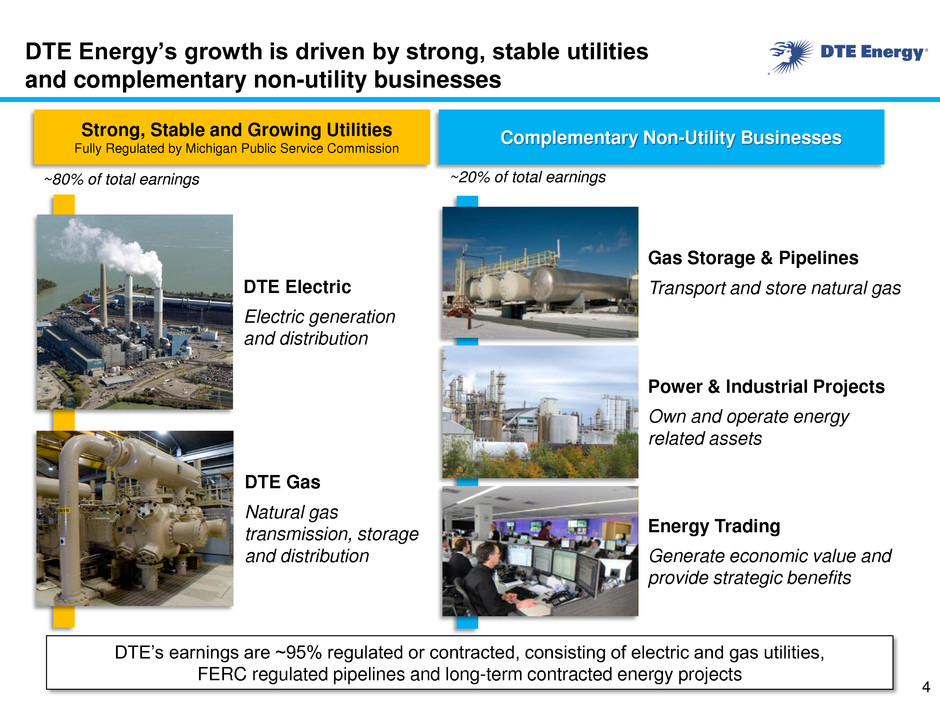

DTE Energy’s growth is driven by strong, stable utilities and complementary non-utility businesses DTE Electric Electric generation and distribution DTE Gas Natural gas transmission, storage and distribution Complementary Non-Utility Businesses Strong, Stable and Growing Utilities Fully Regulated by Michigan Public Service Commission Gas Storage & Pipelines Transport and store natural gas Power & Industrial Projects Own and operate energy related assets Energy Trading Generate economic value and provide strategic benefits DTE’s earnings are ~95% regulated or contracted, consisting of electric and gas utilities, FERC regulated pipelines and long-term contracted energy projects ~80% of total earnings ~20% of total earnings 4

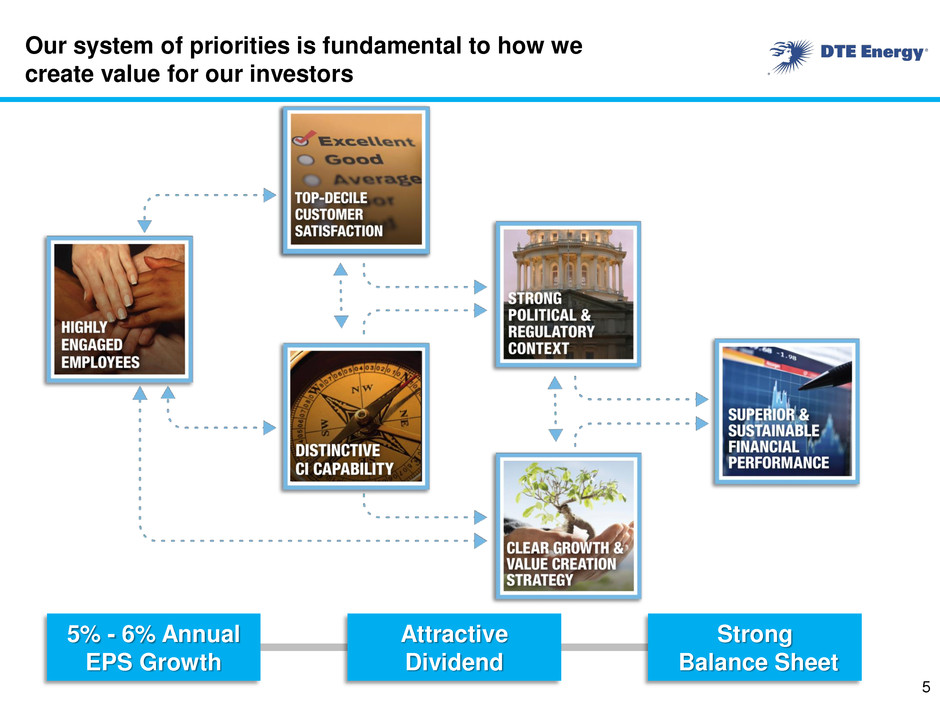

5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet Our system of priorities is fundamental to how we create value for our investors 5

DTE Energy has earned Gallup’s Great Workplace Award for the third year in a row 6 2013, 2014, 2015 • Winners recognized for extraordinary ability to create an engaged workforce culture • Annual award granted to a handful of companies worldwide • DTE Energy is the only utility company to ever receive the award

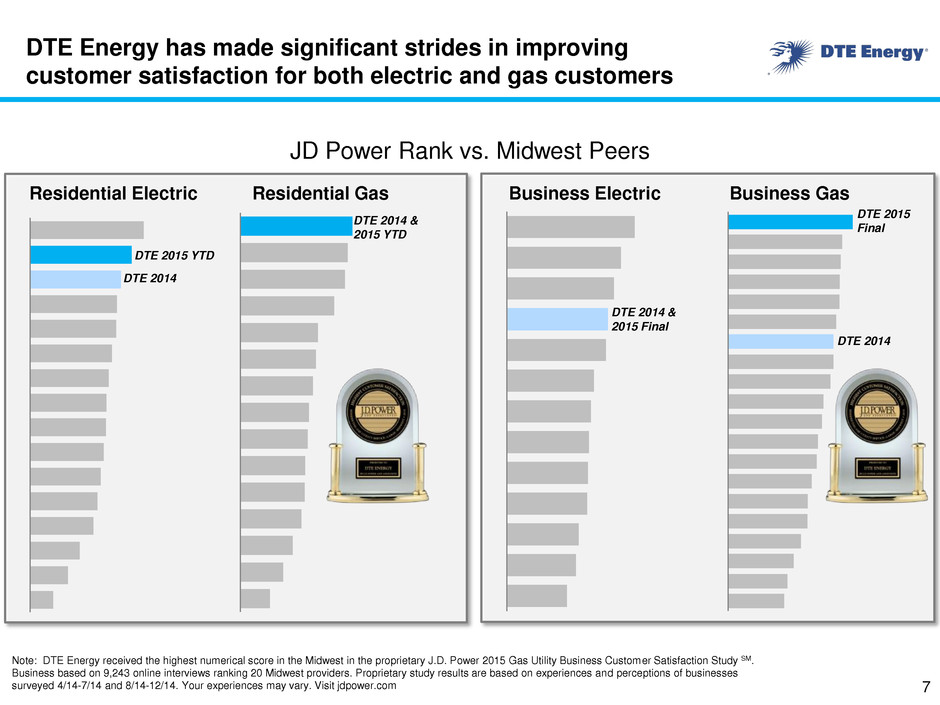

DTE Energy has made significant strides in improving customer satisfaction for both electric and gas customers 7 Residential Electric Residential Gas Business Electric Business Gas DTE 2015 YTD DTE 2014 DTE 2014 & 2015 YTD DTE 2014 & 2015 Final DTE 2015 Final DTE 2014 Rank #2 Rank #3 Rank #1 Rank #7 JD Power Rank vs. Midwest Peers Note: DTE Energy received the highest numerical score in the Midwest in the proprietary J.D. Power 2015 Gas Utility Business Customer Satisfaction Study SM. Business based on 9,243 online interviews ranking 20 Midwest providers. Proprietary study results are based on experiences and perceptions of businesses surveyed 4/14-7/14 and 8/14-12/14. Your experiences may vary. Visit jdpower.com

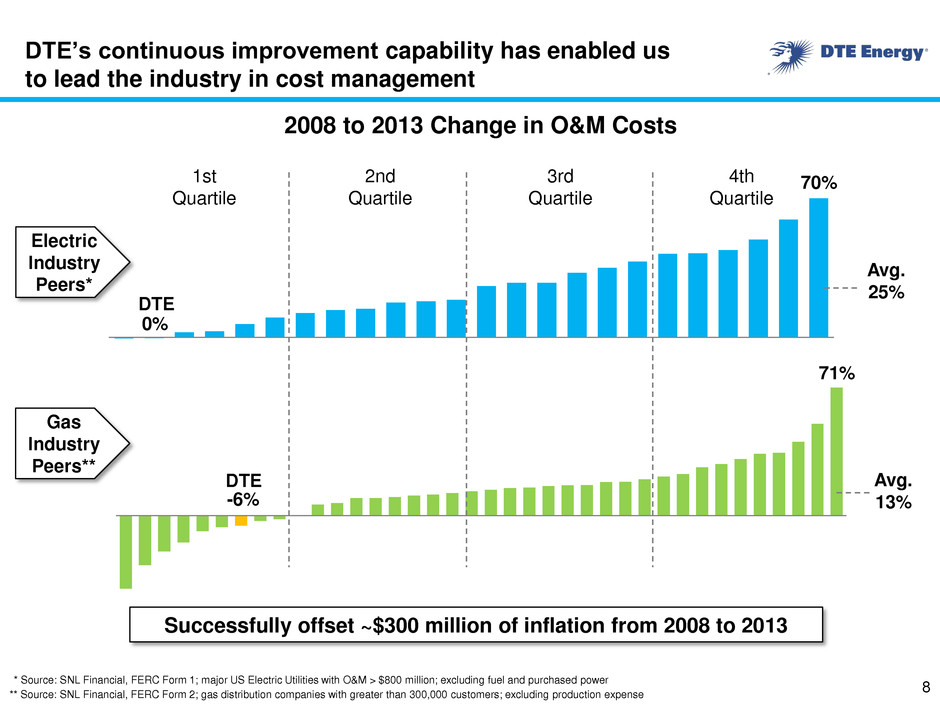

DTE’s continuous improvement capability has enabled us to lead the industry in cost management * Source: SNL Financial, FERC Form 1; major US Electric Utilities with O&M > $800 million; excluding fuel and purchased power ** Source: SNL Financial, FERC Form 2; gas distribution companies with greater than 300,000 customers; excluding production expense 70% DTE 0% Avg. 25% 71% DTE -6% Avg. 13% 2008 to 2013 Change in O&M Costs Electric Industry Peers* Gas Industry Peers** 1st Quartile 2nd Quartile 3rd Quartile 4th Quartile Successfully offset ~$300 million of inflation from 2008 to 2013 8

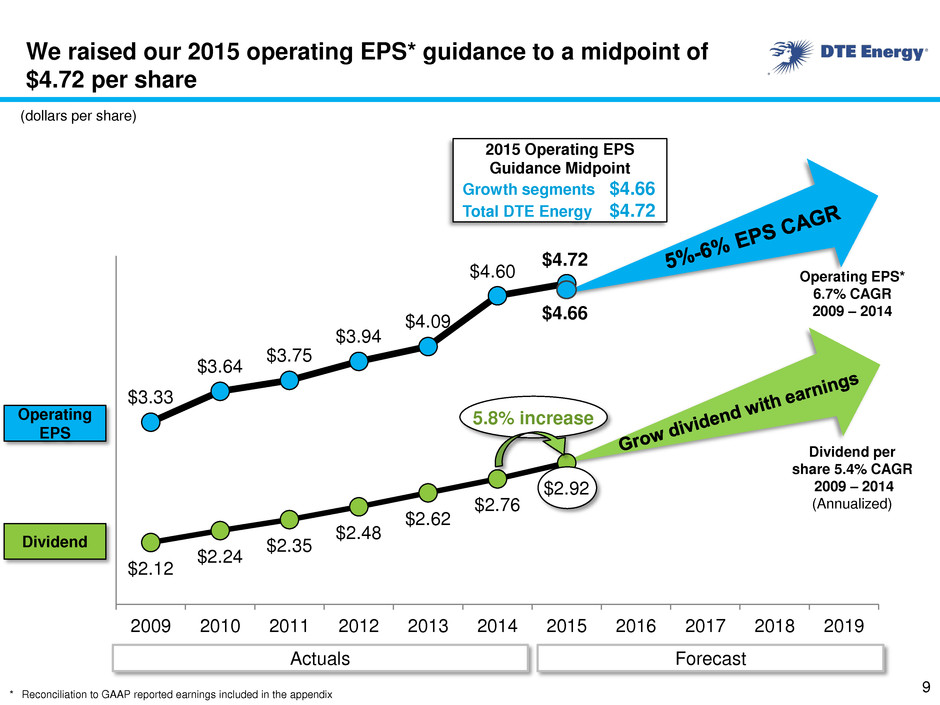

* Reconciliation to GAAP reported earnings included in the appendix (dollars per share) We raised our 2015 operating EPS* guidance to a midpoint of $4.72 per share $3.33 $3.64 $3.75 $3.94 $4.09 $4.60 $2.12 $2.24 $2.35 $2.48 $2.62 $2.76 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Operating EPS Dividend Actuals Forecast Operating EPS* 6.7% CAGR 2009 – 2014 Dividend per share 5.4% CAGR 2009 – 2014 (Annualized) 9 2015 Operating EPS Guidance Midpoint Growth segments $4.66 Total DTE Energy $4.72 $4.72 $4.66 5.8% increase $2.92

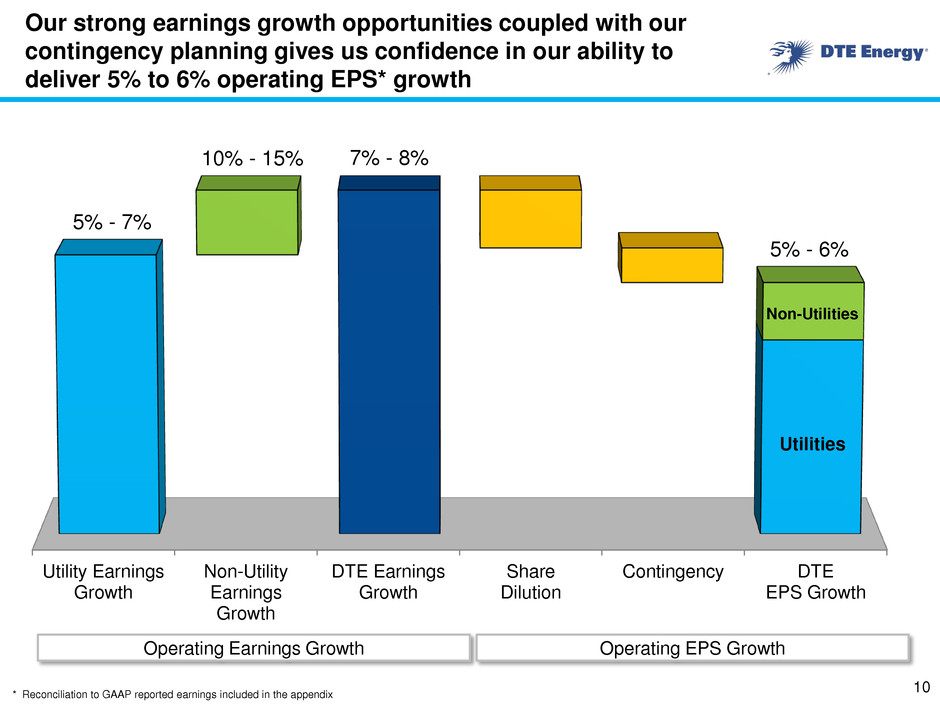

Our strong earnings growth opportunities coupled with our contingency planning gives us confidence in our ability to deliver 5% to 6% operating EPS* growth Utility Earnings Growth Non-Utility Earnings Growth DTE Earnings Growth Share Dilution Contingency DTE EPS Growth Non-Utilities 5% - 7% 5% - 6% Utilities * Reconciliation to GAAP reported earnings included in the appendix 10% - 15% 7% - 8% Operating Earnings Growth Operating EPS Growth 10

• Overview • Long-Term Growth Update • Summary 11

Economic indicators continue to improve in Michigan and the City of Detroit 12 Detroit Metro #8 in number of new or expansion projects* Lowest Michigan unemployment since 2001 #7 most competitive state for job creation* Michigan has most new manufacturing jobs since 2009** * Source: Site Selection magazine ** Source: State of Michigan website

Governor Snyder appoints new commissioner to Michigan Public Service Commission 13 Sally Talberg Commissioner Appointed: 7/3/13 Term Ends: 7/2/19 Norm Saari Commissioner Appointed: 8/2/15 Term Ends: 7/2/21 Source: State of Michigan website - www.michigan.gov/ • Norm Saari appointed to a six year term beginning August 2, 2015 • “Norm has had a distinguished career in the utility industry as well as in public service, and he brings decades of experience to the Michigan Public Service Commission,” Governor Snyder said John Quackenbush Chairman Appointed: 9/15/11 Term Ends: 7/2/17 TBD

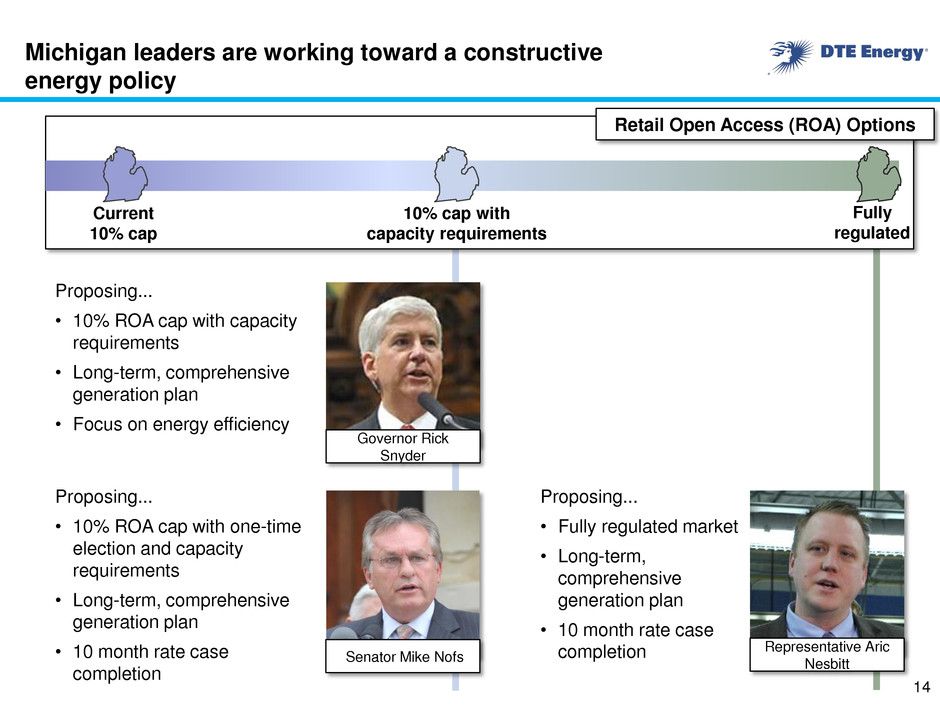

Michigan leaders are working toward a constructive energy policy 14 Governor Rick Snyder Representative Aric Nesbitt Proposing... • Fully regulated market • Long-term, comprehensive generation plan • 10 month rate case completion Proposing... • 10% ROA cap with one-time election and capacity requirements • Long-term, comprehensive generation plan • 10 month rate case completion Proposing... • 10% ROA cap with capacity requirements • Long-term, comprehensive generation plan • Focus on energy efficiency Senator Mike Nofs Current 10% cap 10% cap with capacity requirements Retail Open Access (ROA) Options Fully regulated

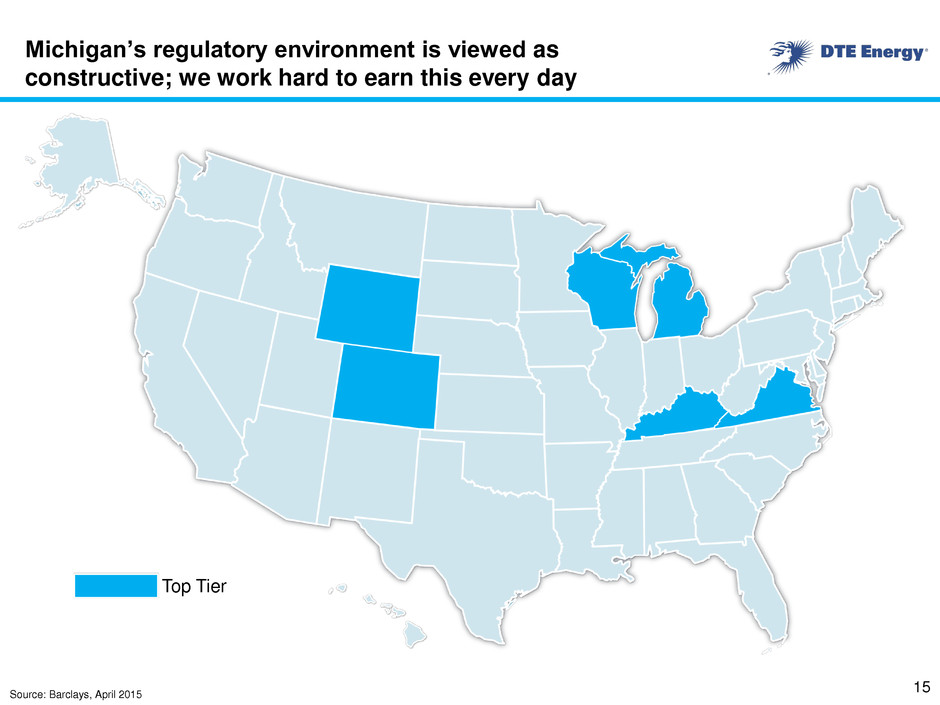

Michigan’s regulatory environment is viewed as constructive; we work hard to earn this every day 15 Source: Barclays, April 2015 Top Tier

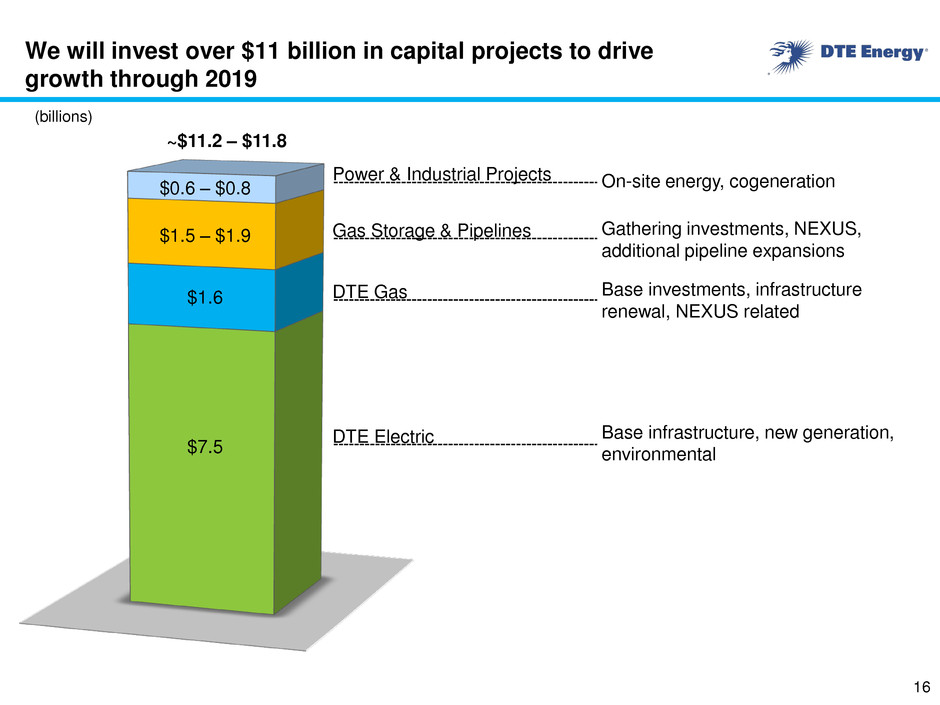

We will invest over $11 billion in capital projects to drive growth through 2019 (billions) 16 ~$11.2 – $11.8 $0.6 – $0.8 $1.5 – $1.9 $1.6 $7.5 Power & Industrial Projects Gas Storage & Pipelines DTE Gas DTE Electric On-site energy, cogeneration Gathering investments, NEXUS, additional pipeline expansions Base investments, infrastructure renewal, NEXUS related Base infrastructure, new generation, environmental

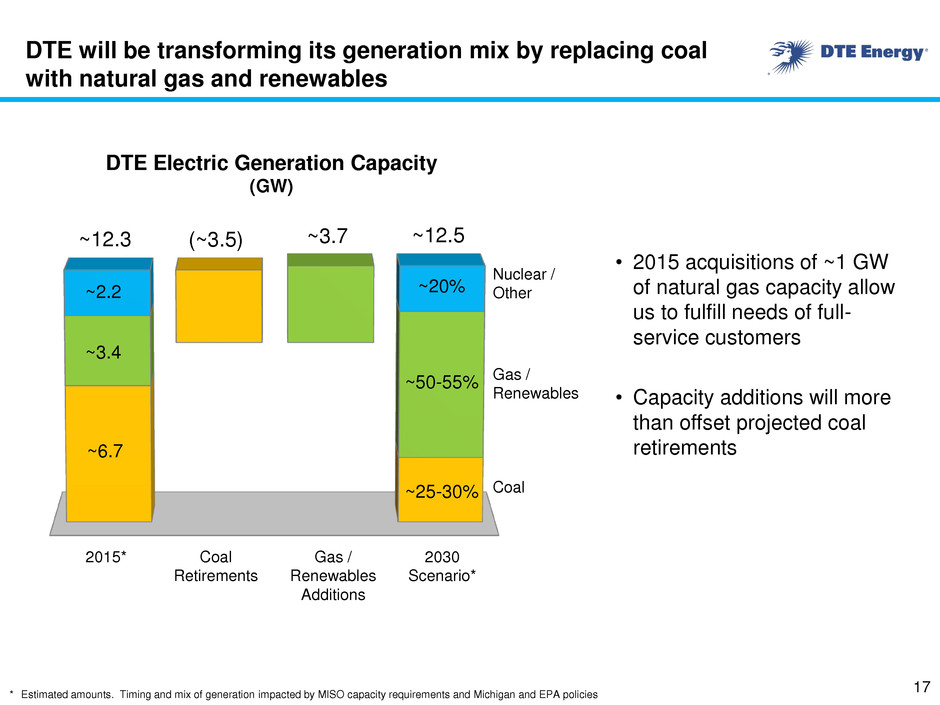

DTE will be transforming its generation mix by replacing coal with natural gas and renewables DTE Electric Generation Capacity (GW) Coal Retirements 2030 Scenario* ~6.7 2015* 17 Gas / Renewables Additions ~3.4 ~2.2 ~12.3 (~3.5) ~3.7 ~12.5 • 2015 acquisitions of ~1 GW of natural gas capacity allow us to fulfill needs of full- service customers • Capacity additions will more than offset projected coal retirements ~25-30% ~50-55% ~20% Gas / Renewables Nuclear / Other Coal * Estimated amounts. Timing and mix of generation impacted by MISO capacity requirements and Michigan and EPA policies

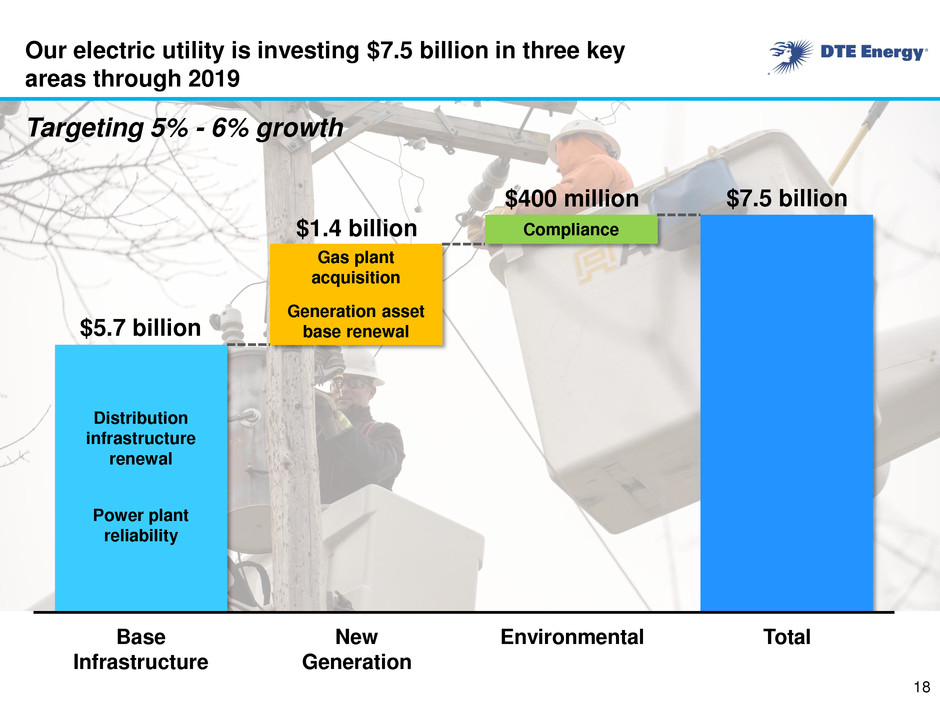

Our electric utility is investing $7.5 billion in three key areas through 2019 $5.7 billion Distribution infrastructure renewal Power plant reliability Compliance Gas plant acquisition Generation asset base renewal $1.4 billion $400 million $7.5 billion Targeting 5% - 6% growth Base Infrastructure New Generation Environmental Total 18

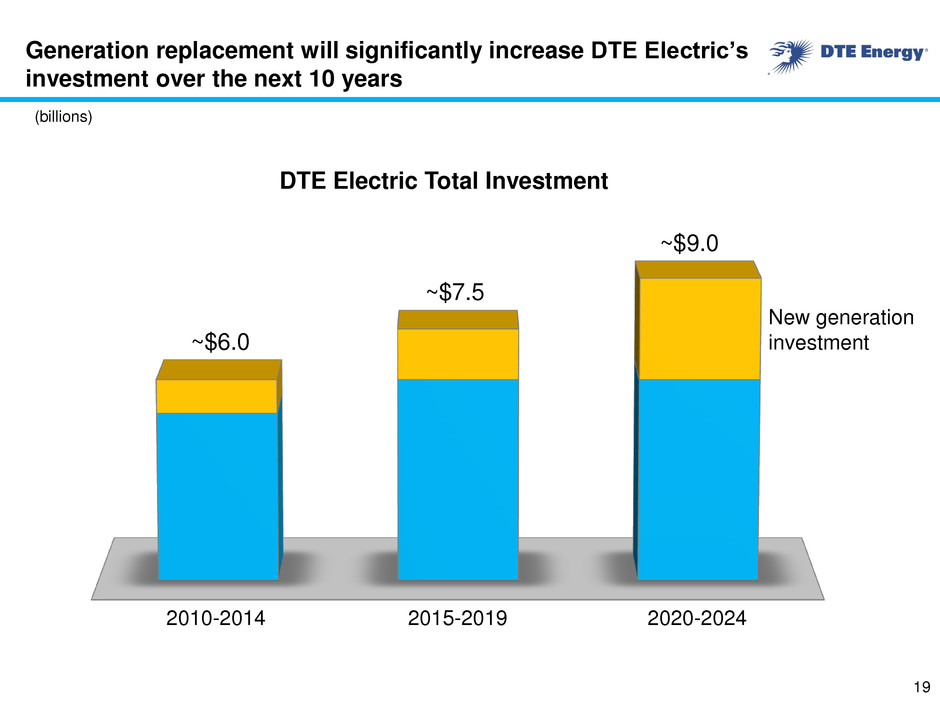

Generation replacement will significantly increase DTE Electric’s investment over the next 10 years DTE Electric Total Investment ~$7.5 ~$9.0 2015-2019 2020-2024 ~$6.0 2010-2014 New generation investment (billions) 19

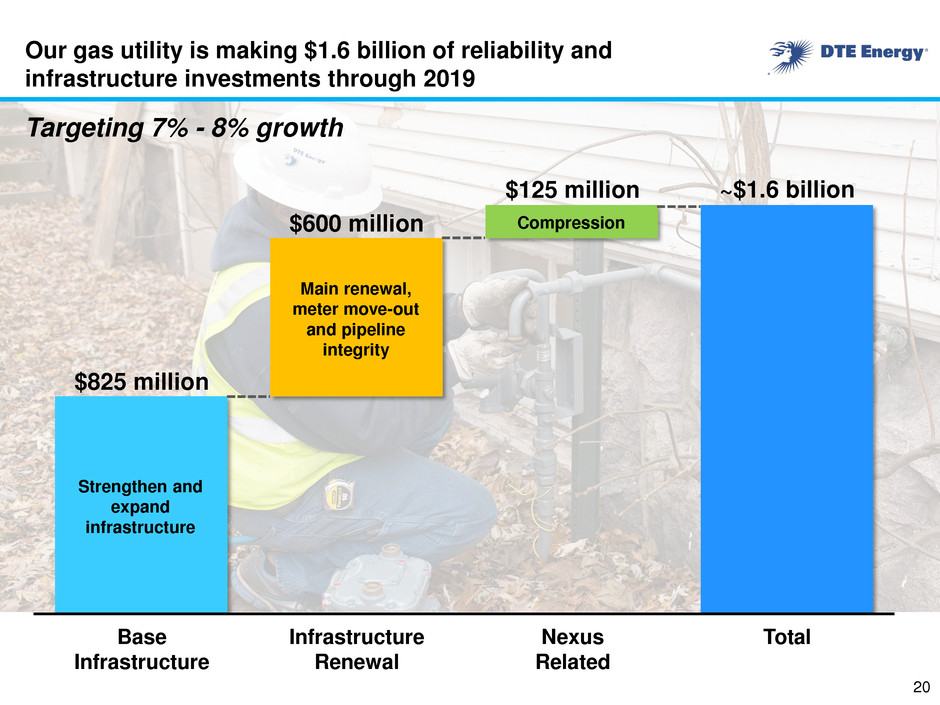

Our gas utility is making $1.6 billion of reliability and infrastructure investments through 2019 Strengthen and expand infrastructure Main renewal, meter move-out and pipeline integrity Compression Targeting 7% - 8% growth Base Infrastructure Infrastructure Renewal Nexus Related Total $825 million $600 million $125 million ~$1.6 billion 20

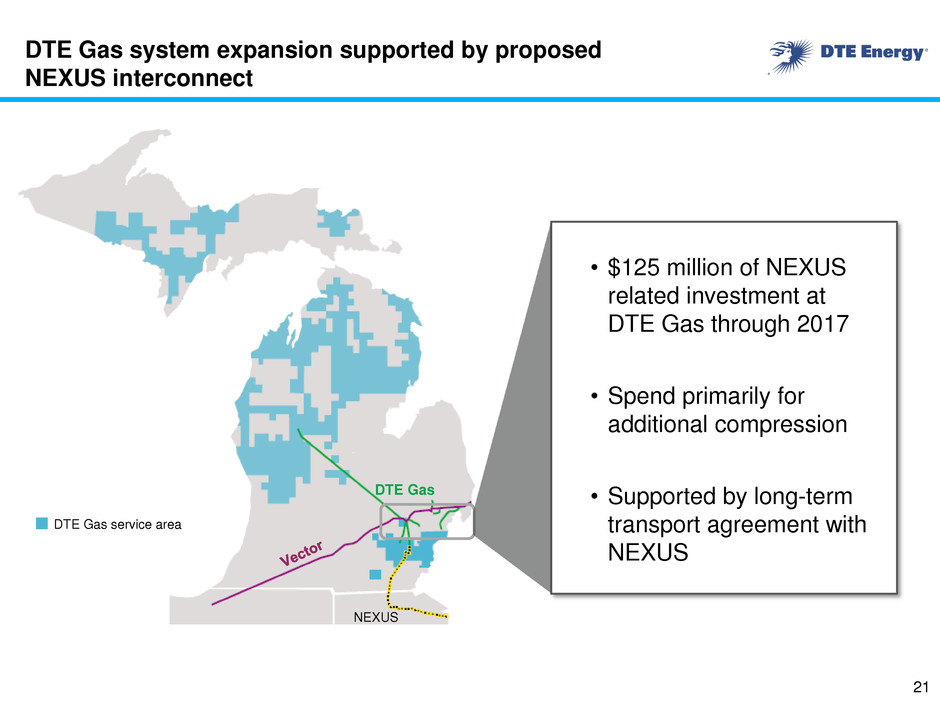

DTE Gas system expansion supported by proposed NEXUS interconnect 21 • $125 million of NEXUS related investment at DTE Gas through 2017 • Spend primarily for additional compression • Supported by long-term transport agreement with NEXUS DTE Gas service area NEXUS DTE Gas

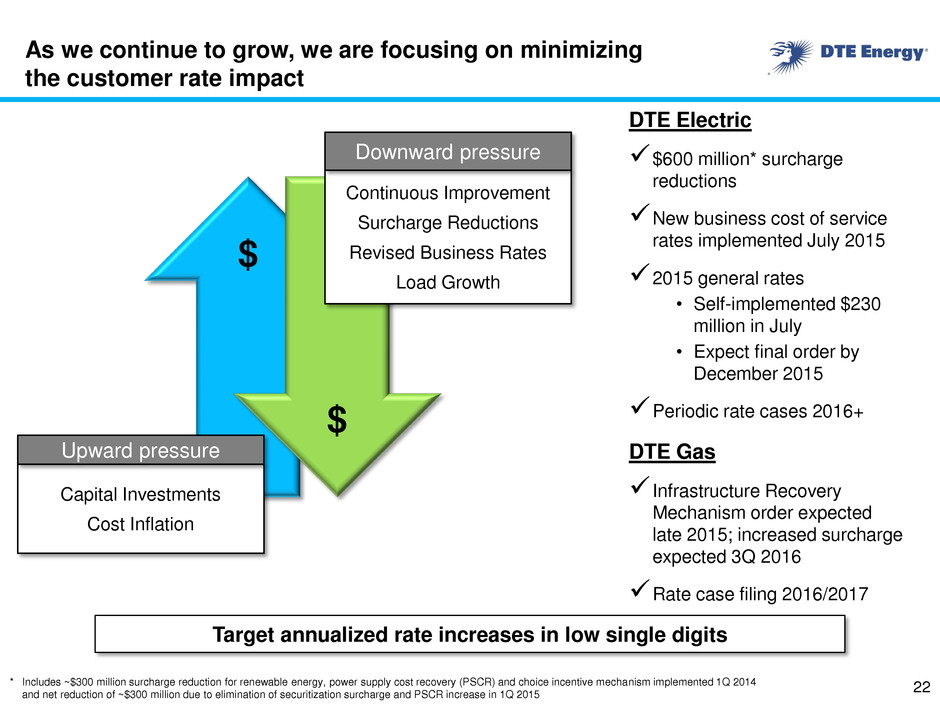

$ * Includes ~$300 million surcharge reduction for renewable energy, power supply cost recovery (PSCR) and choice incentive mechanism implemented 1Q 2014 and net reduction of ~$300 million due to elimination of securitization surcharge and PSCR increase in 1Q 2015 As we continue to grow, we are focusing on minimizing the customer rate impact Target annualized rate increases in low single digits 22 $ Capital Investments Cost Inflation Upward pressure Continuous Improvement Surcharge Reductions Revised Business Rates Load Growth Downward pressure DTE Electric $600 million* surcharge reductions New business cost of service rates implemented July 2015 2015 general rates • Self-implemented $230 million in July • Expect final order by December 2015 Periodic rate cases 2016+ DTE Gas Infrastructure Recovery Mechanism order expected late 2015; increased surcharge expected 3Q 2016 Rate case filing 2016/2017

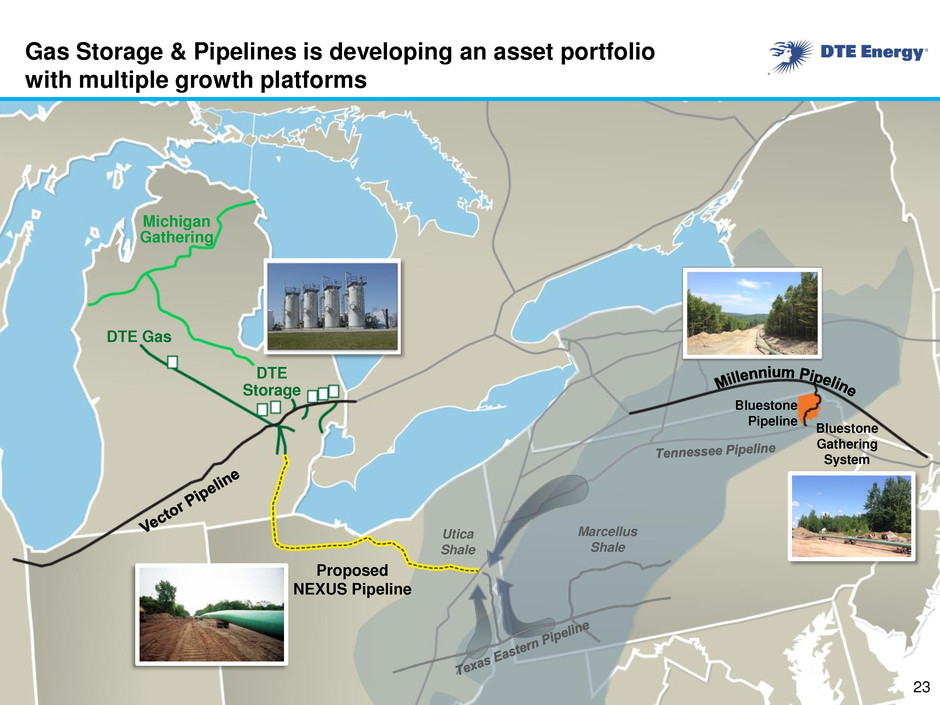

DTE Gas DTE Storage Proposed NEXUS Pipeline Marcellus Shale Bluestone Pipeline Utica Shale Michigan Gathering Bluestone Gathering System Gas Storage & Pipelines is developing an asset portfolio with multiple growth platforms 23

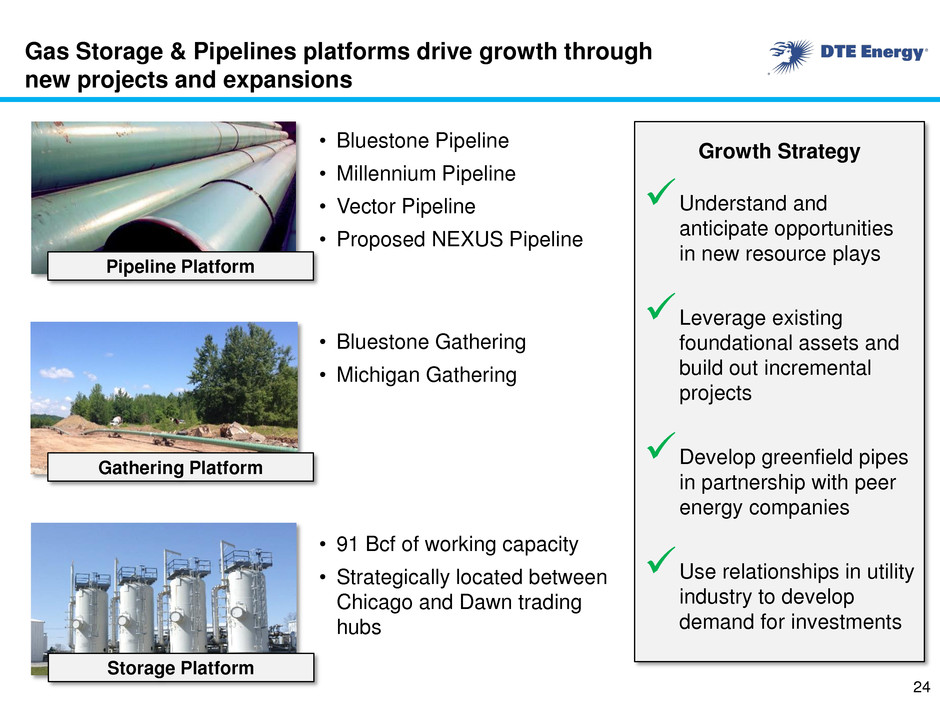

Gas Storage & Pipelines platforms drive growth through new projects and expansions Pipeline Platform Gathering Platform Storage Platform • Bluestone Pipeline • Millennium Pipeline • Vector Pipeline • Proposed NEXUS Pipeline • Bluestone Gathering • Michigan Gathering • 91 Bcf of working capacity • Strategically located between Chicago and Dawn trading hubs Understand and anticipate opportunities in new resource plays Leverage existing foundational assets and build out incremental projects Develop greenfield pipes in partnership with peer energy companies Use relationships in utility industry to develop demand for investments Growth Strategy 24

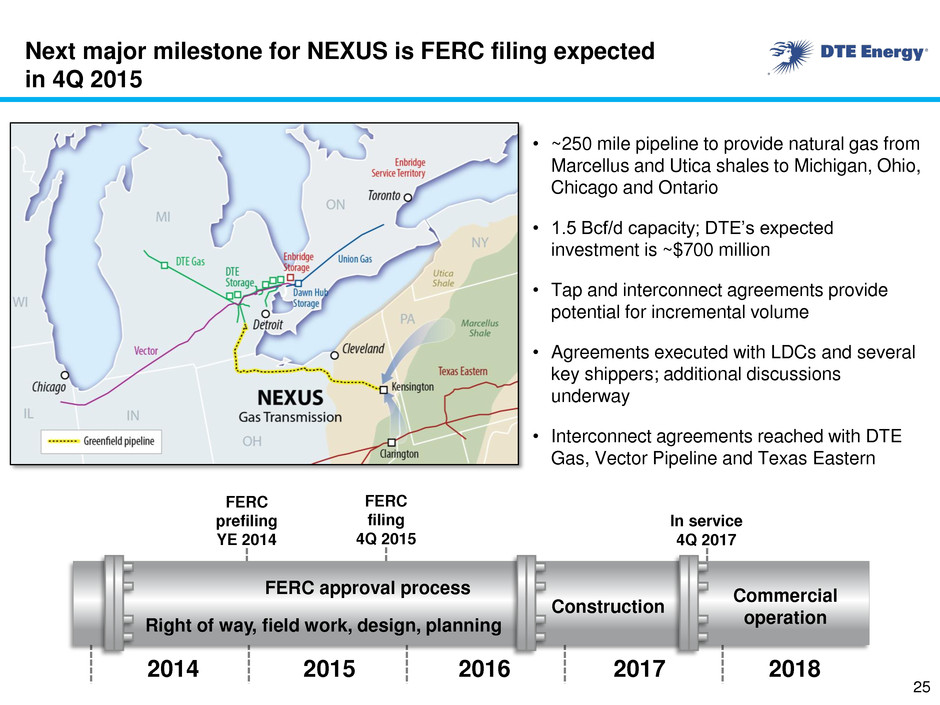

FERC filing 4Q 2015 Next major milestone for NEXUS is FERC filing expected in 4Q 2015 • ~250 mile pipeline to provide natural gas from Marcellus and Utica shales to Michigan, Ohio, Chicago and Ontario • 1.5 Bcf/d capacity; DTE’s expected investment is ~$700 million • Tap and interconnect agreements provide potential for incremental volume • Agreements executed with LDCs and several key shippers; additional discussions underway • Interconnect agreements reached with DTE Gas, Vector Pipeline and Texas Eastern 2014 2015 2016 2017 2018 FERC approval process Right of way, field work, design, planning Construction Commercial operation FERC prefiling YE 2014 In service 4Q 2017 25

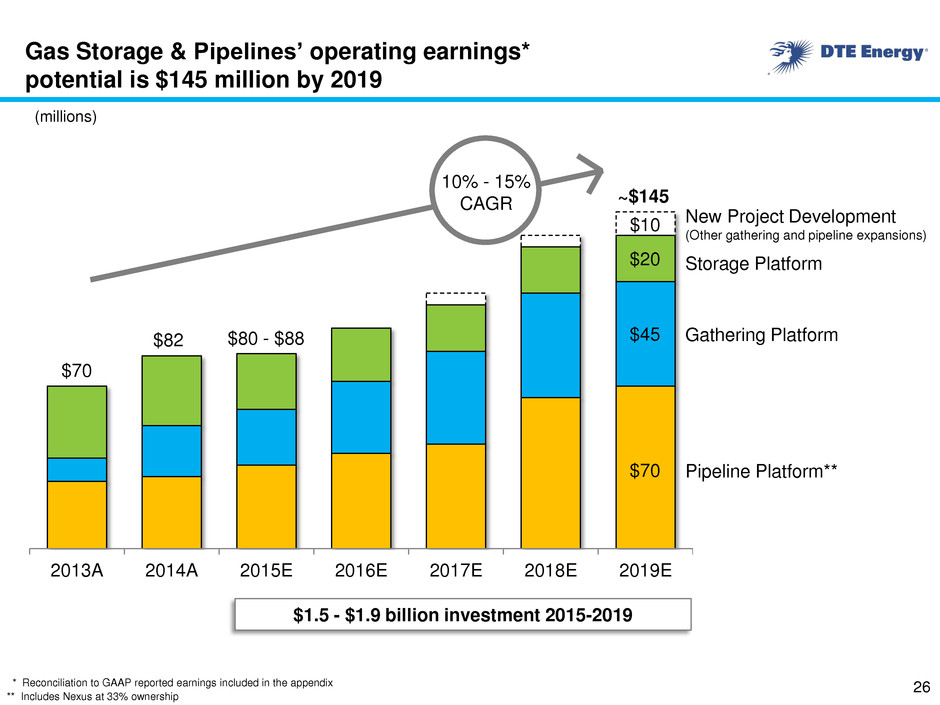

Gas Storage & Pipelines’ operating earnings* potential is $145 million by 2019 2013A 2014A 2015E 2016E 2017E 2018E 2019E * Reconciliation to GAAP reported earnings included in the appendix Pipeline Platform** Gathering Platform Storage Platform New Project Development (Other gathering and pipeline expansions) $1.0 - $1.3 billion investment ~$145 $70 $45 $20 $10 $1.5 - $1.9 billion investment 2015-2019 ** Includes Nexus at 33% ownership 10% - 15% CAGR $70 $82 $80 - $88 (millions) 26

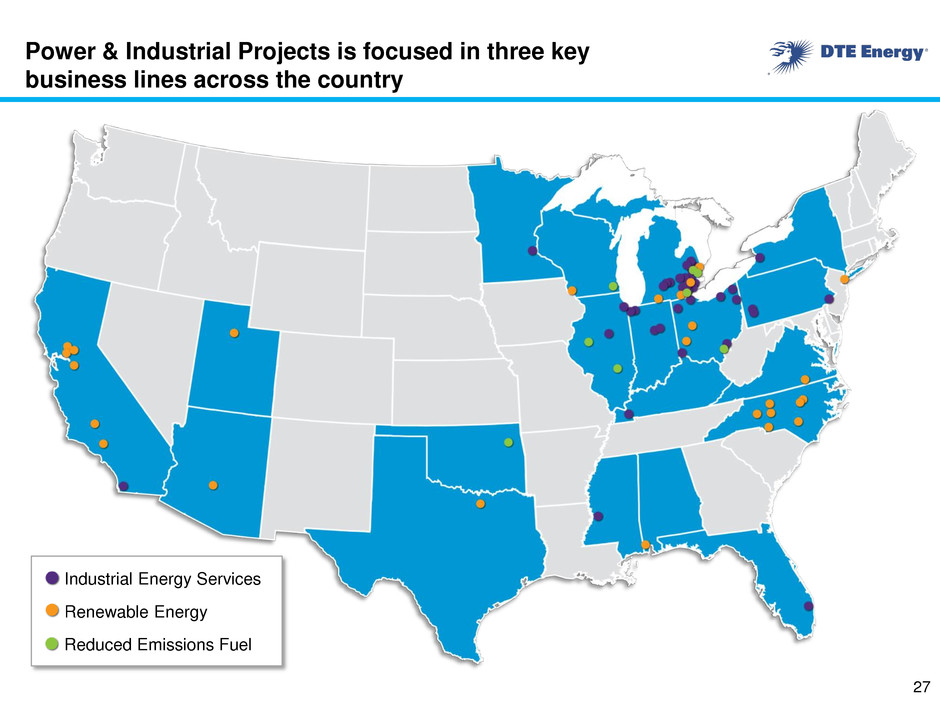

Power & Industrial Projects is focused in three key business lines across the country Industrial Energy Services Renewable Energy Reduced Emissions Fuel 27

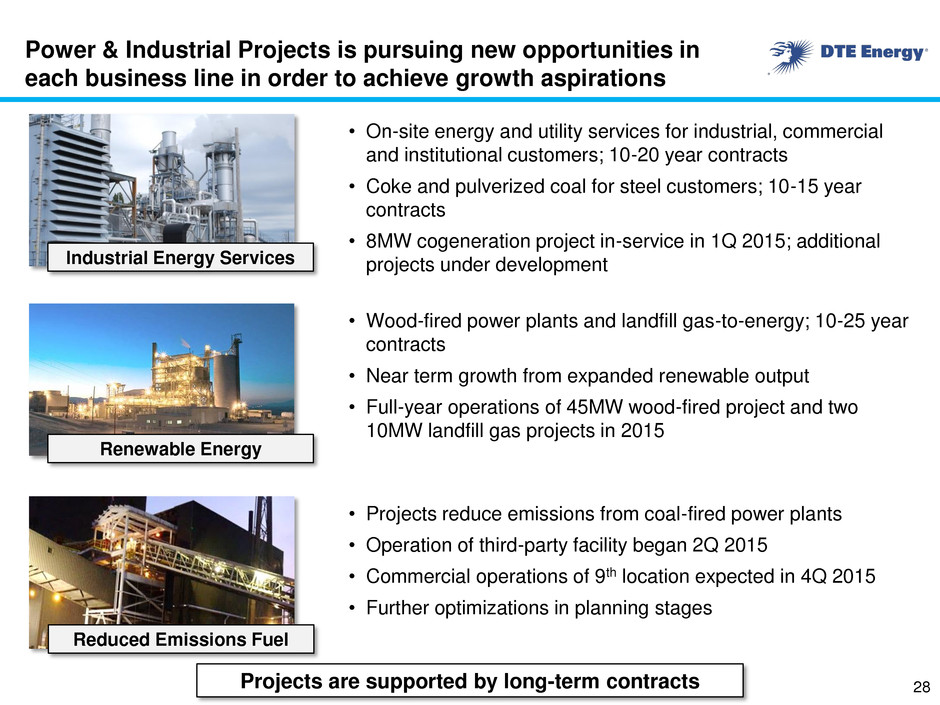

Power & Industrial Projects is pursuing new opportunities in each business line in order to achieve growth aspirations 28 • On-site energy and utility services for industrial, commercial and institutional customers; 10-20 year contracts • Coke and pulverized coal for steel customers; 10-15 year contracts • 8MW cogeneration project in-service in 1Q 2015; additional projects under development • Wood-fired power plants and landfill gas-to-energy; 10-25 year contracts • Near term growth from expanded renewable output • Full-year operations of 45MW wood-fired project and two 10MW landfill gas projects in 2015 • Projects reduce emissions from coal-fired power plants • Operation of third-party facility began 2Q 2015 • Commercial operations of 9th location expected in 4Q 2015 • Further optimizations in planning stages Industrial Energy Services Renewable Energy Reduced Emissions Fuel Projects are supported by long-term contracts

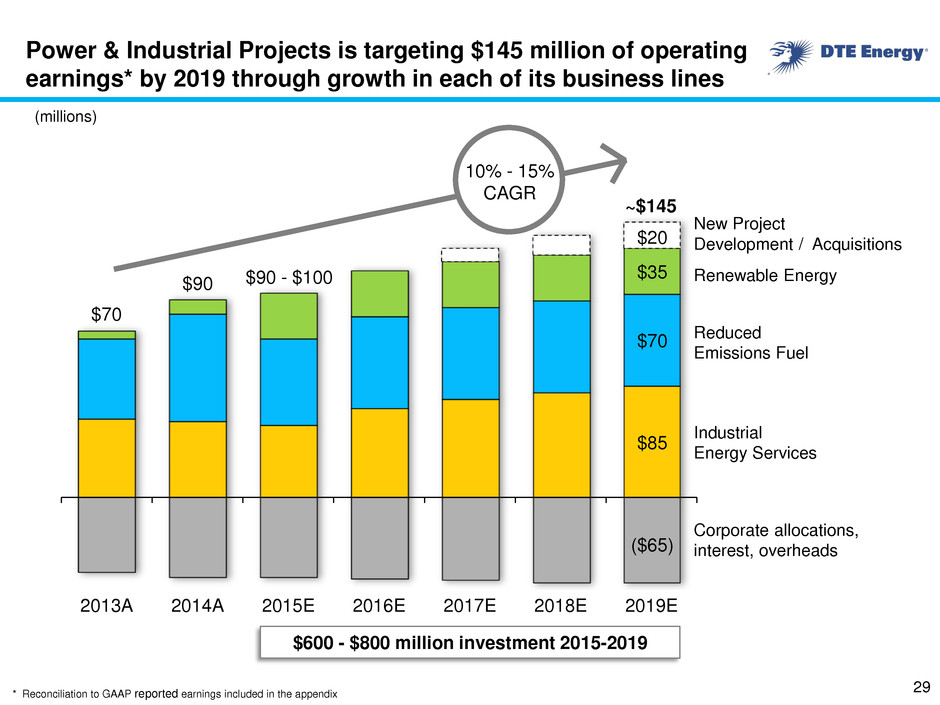

Power & Industrial Projects is targeting $145 million of operating earnings* by 2019 through growth in each of its business lines 2013A 2014A 2015E 2016E 2017E 2018E 2019E ~$145 $35 $70 $85 ($65) $20 $70 New Project Development / Acquisitions Renewable Energy Reduced Emissions Fuel Industrial Energy Services Corporate allocations, interest, overheads $90 $600 - $800 million investment 2015-2019 * Reconciliation to GAAP reported earnings included in the appendix $90 - $100 (millions) 10% - 15% CAGR 29

• Overview • Long-Term Growth Update • Summary 30

Summary * Reconciliation to GAAP reported earnings included in the appendix 31 • We are confident in this year’s performance as we increased our 2015 operating EPS* guidance midpoint to $4.66 for our growth segments and $4.72 for DTE Energy • We increased our annual dividend 16 cents to $2.92 per share, a 5.8% increase • On track to meet balance sheet and cash flow metrics • Constructive outcomes expected in both Michigan’s energy policy reform and DTE’s regulatory filings • Utility investments and strategic growth opportunities in our non-utility businesses expected to provide 5% - 6% annual EPS growth going forward DTE Energy Investor Meeting – September 28th in Detroit (Portions of event will be webcast live on DTE Energy’s investor website)

Contact Us DTE Energy Investor Relations www.dteenergy.com/investors (313) 235-8030 32

Appendix

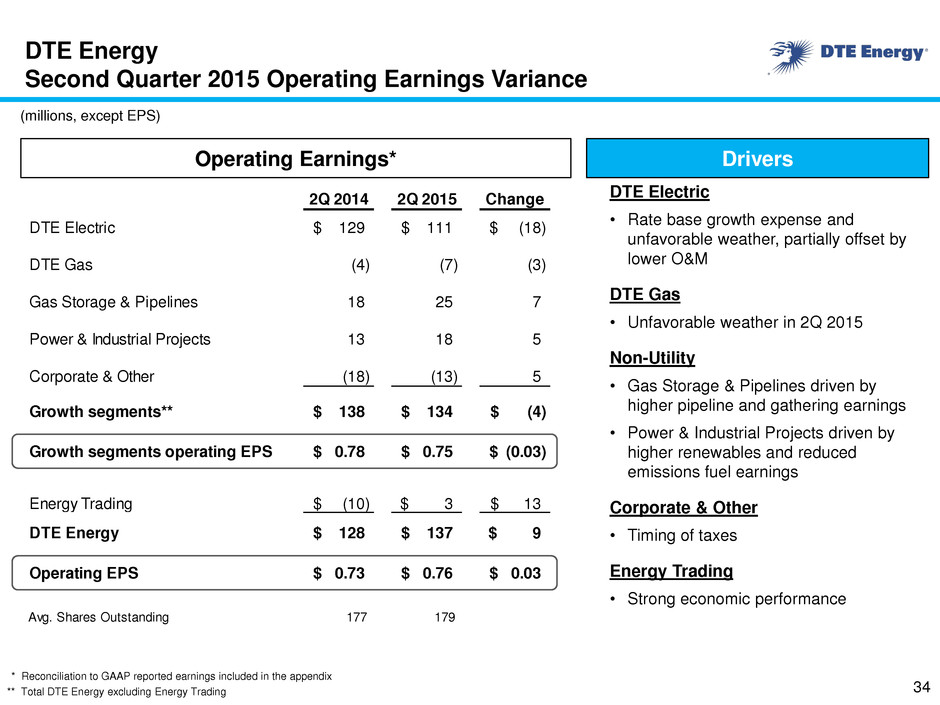

34 DTE Energy Second Quarter 2015 Operating Earnings Variance 2Q 2014 2Q 2015 Change DTE Electric 129$ 111$ (18)$ DTE Gas (4) (7) (3) Gas Storage & Pipelines 18 25 7 Power & Industrial Projects 13 18 5 Corporate & Other (18) (13) 5 Growth segments** 138$ 134$ (4)$ Growth segments operating EPS 0.78$ 0.75$ (0.03)$ Energy Trading (10)$ 3$ 13$ DTE Energy 128$ 137$ 9$ Operating EPS 0.73$ 0.76$ 0.03$ Avg. Shares Outstanding 177 179 Operating Earnings* * Reconciliation to GAAP reported earnings included in the appendix ** Total DTE Energy excluding Energy Trading Drivers DTE Electric • Rate base growth expense and unfavorable weather, partially offset by lower O&M DTE Gas • Unfavorable weather in 2Q 2015 Non-Utility • Gas Storage & Pipelines driven by higher pipeline and gathering earnings • Power & Industrial Projects driven by higher renewables and reduced emissions fuel earnings Corporate & Other • Timing of taxes Energy Trading • Strong economic performance (millions, except EPS)

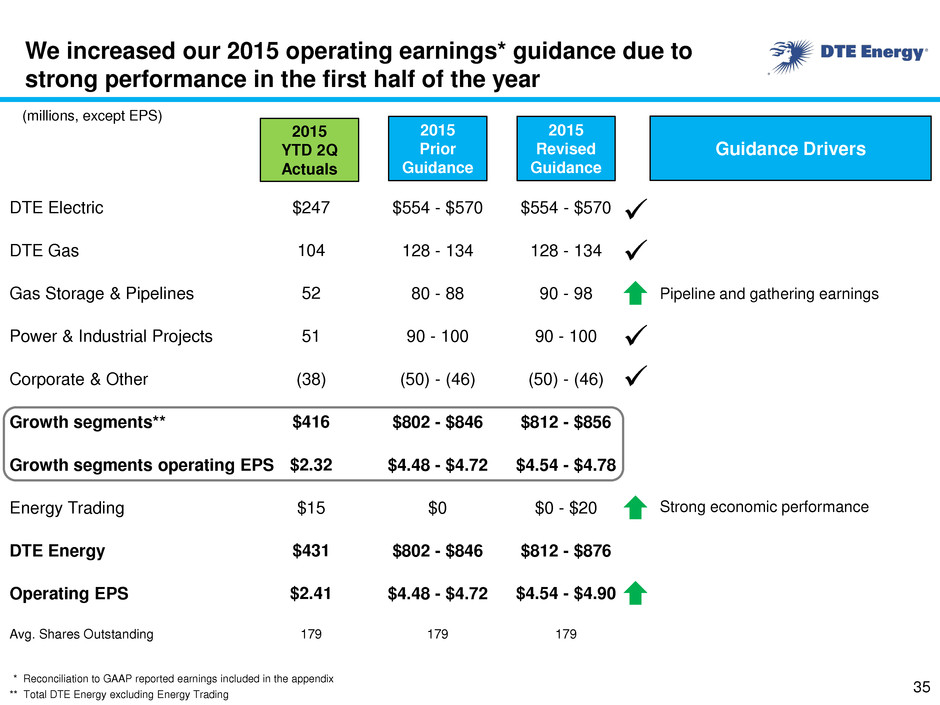

We increased our 2015 operating earnings* guidance due to strong performance in the first half of the year (millions, except EPS) 35 * Reconciliation to GAAP reported earnings included in the appendix ** Total DTE Energy excluding Energy Trading 2015 Prior Guidance 2015 Revised Guidance 2015 YTD 2Q Actuals Guidance Drivers DTE Electric DTE Gas Gas Storage & Pipelines Power & Industrial Projects Corporate & Other Growth segments** Growth segments operating EPS Energy Trading DTE Energy Operating EPS Avg. Shares Outstanding $554 - $570 128 - 134 80 - 88 90 - 100 (50) - (46) $802 - $846 $4.48 - $4.72 $0 $802 - $846 179 $4.48 - $4.72 $554 - $570 128 - 134 90 - 98 90 - 100 (50) - (46) $812 - $856 $4.54 - $4.78 $0 - $20 $812 - $876 179 $4.54 - $4.90 Pipeline and gathering earnings $247 104 52 51 (38) $416 $2.32 $15 $431 179 $2.41 Strong economic performance

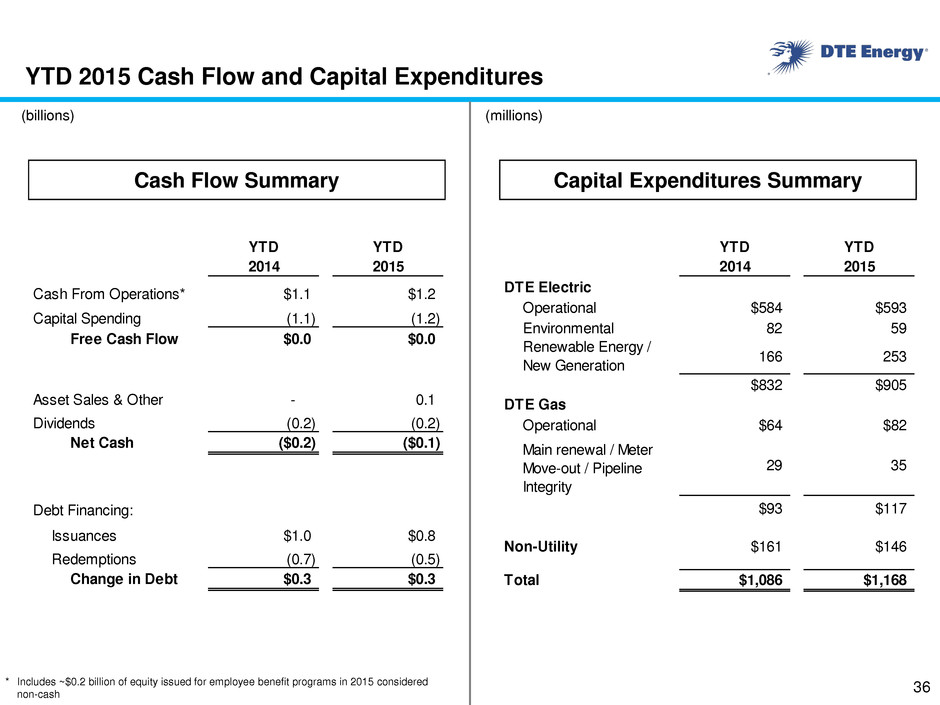

YTD 2015 Cash Flow and Capital Expenditures (billions) 36 Capital Expenditures Summary Cash Flow Summary (millions) YTD YTD 2014 2015 Cash From Operations* $1.1 $1.2 Capital Spending (1.1) (1.2) Free Cash Flow $0.0 $0.0 Asset Sales & Other - 0.1 Dividends (0.2) (0.2) Net Cash ($0.2) ($0.1) Debt Financing: Issuances $1.0 $0.8 Redemptions (0.7) (0.5) Change in Debt $0.3 $0.3 YTD YTD 2014 2015 DTE Electric Operational $584 $593 Environmental 82 59 166 253 $832 $905 DTE Gas Operational $64 $82 29 35 $93 $117 Non-Utility $161 $146 Total $1,086 $1,168 Main renewal / Meter Move-out / Pipeline Integrity Renewable Energy / New Generation * Includes ~$0.2 billion of equity issued for employee benefit programs in 2015 considered non-cash

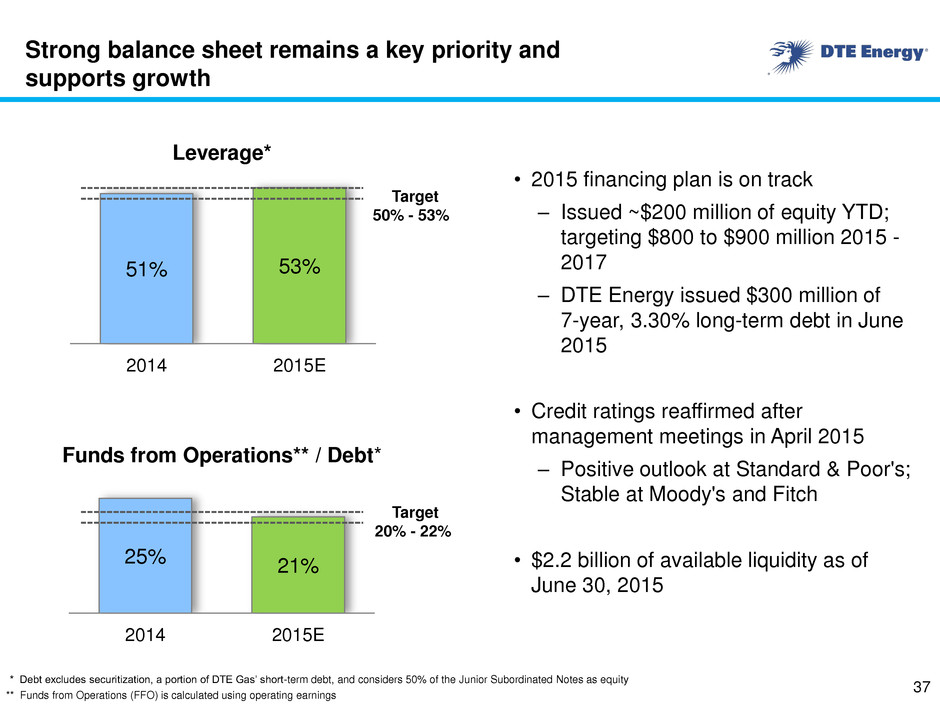

Leverage* 49% 51% 23% 25% Strong balance sheet remains a key priority and supports growth * Debt excludes securitization, a portion of DTE Gas’ short-term debt, and considers 50% of the Junior Subordinated Notes as equity Funds from Operations** / Debt* Target 50% - 53% Target 20% - 22% 5 ** Funds from Operations (FFO) is calculated using operating earnings 37 51% 53% 2014 2015E 25% 21% 2014 2015E • 2015 financing plan is on track ‒ Issued ~$200 million of equity YTD; targeting $800 to $900 million 2015 - 2017 ‒ DTE Energy issued $300 million of 7-year, 3.30% long-term debt in June 2015 • Credit ratings reaffirmed after management meetings in April 2015 ‒ Positive outlook at Standard & Poor's; Stable at Moody's and Fitch • $2.2 billion of available liquidity as of June 30, 2015

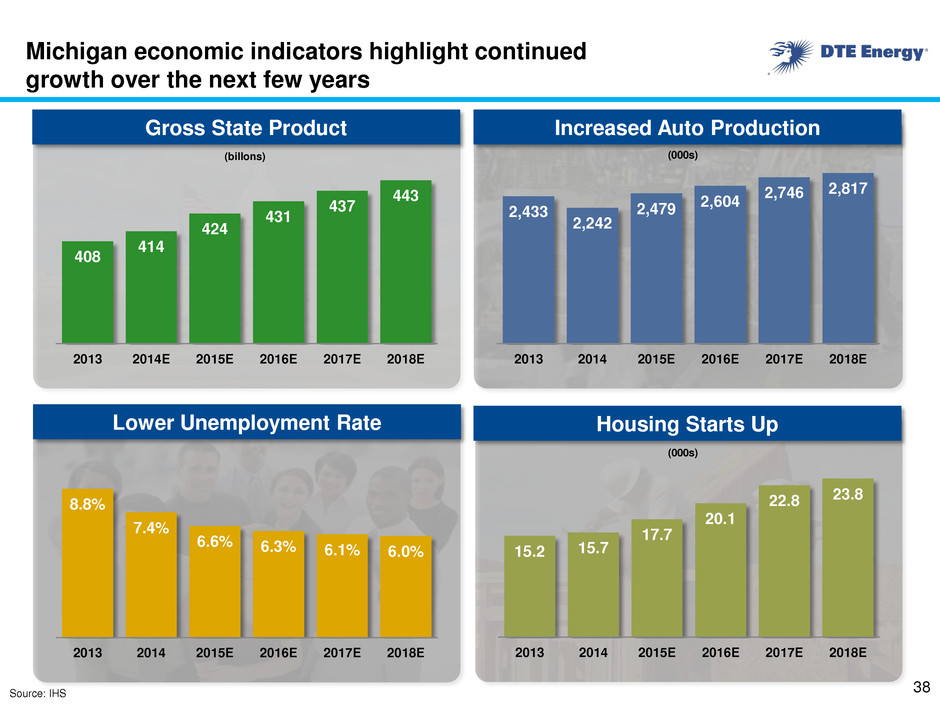

Michigan economic indicators highlight continued growth over the next few years 8.8% 7.4% 6.6% 6.3% 6.1% 6.0% 2013 2014 2015E 2016E 2017E 2018E 408 414 424 431 437 443 2013 2014E 2015E 2016E 2017E 2018E (billons) 2,433 2,242 2,479 2,604 2,746 2,817 2013 2014 2015E 2016E 2017E 2018E (000s) 15.2 15.7 17.7 20.1 22.8 23.8 2013 2014 2015E 2016E 2017E 2018E (000s) Gross State Product Increased Auto Production Lower Unemployment Rate Housing Starts Up Source: IHS 38

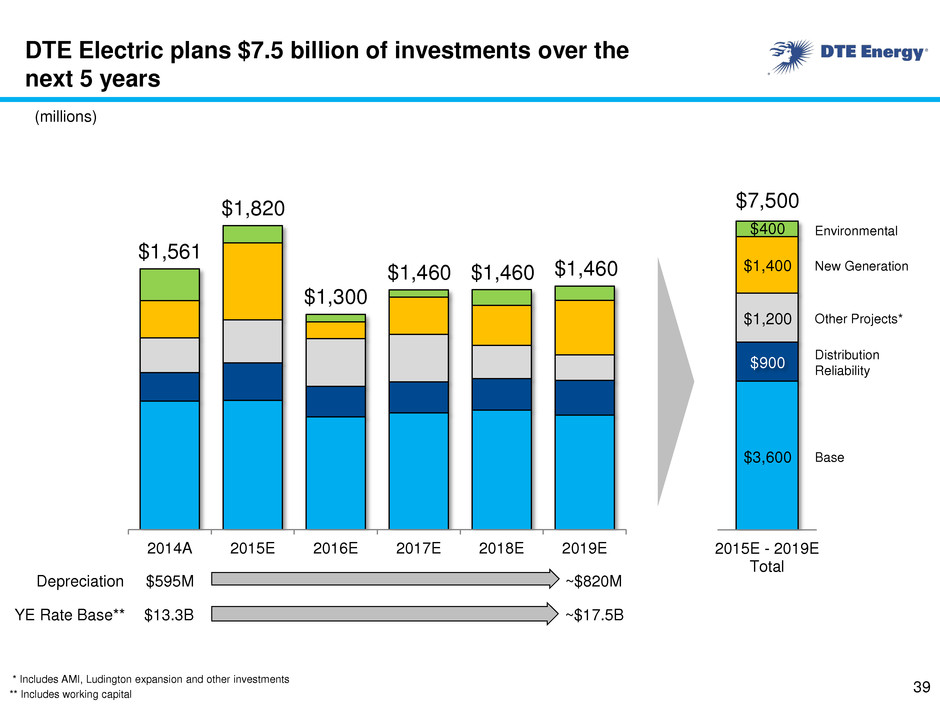

DTE Electric plans $7.5 billion of investments over the next 5 years 2014A 2015E 2016E 2017E 2018E 2019E Base New Generation Other Projects* Environmental Distribution Reliability 2015E - 2019E Total $13.3B ~$17.5B YE Rate Base** $595M ~$820M Depreciation * Includes AMI, Ludington expansion and other investments ** Includes working capital $1,561 $1,820 $1,300 $1,460 $1,460 $1,460 $400 $900 $1,400 $3,600 $7,500 $1,200 (millions) 39

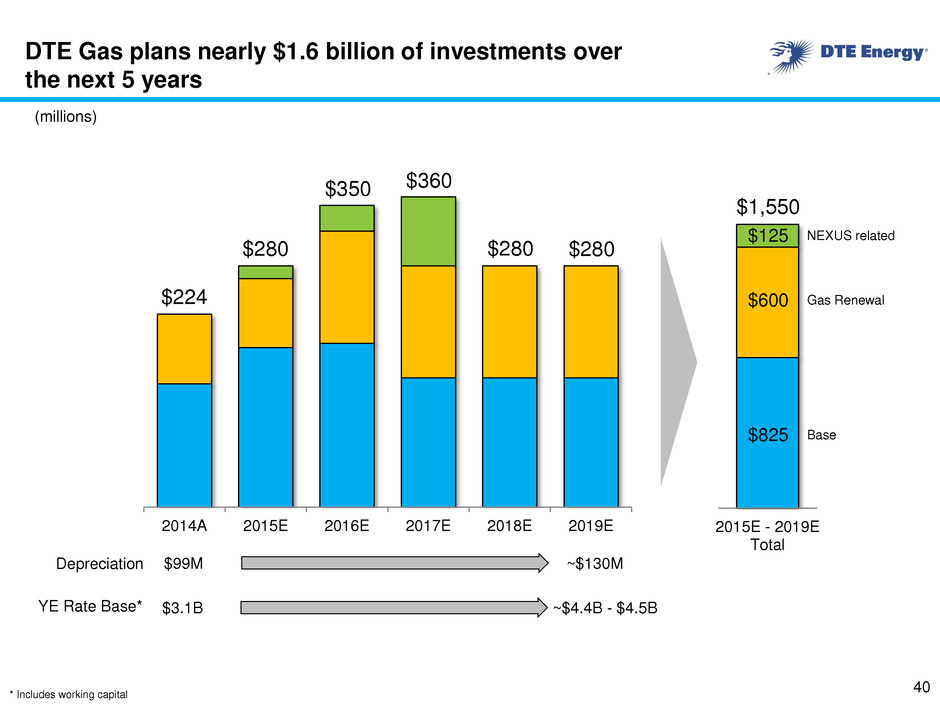

DTE Gas plans nearly $1.6 billion of investments over the next 5 years 2014A 2015E 2016E 2017E 2018E 2019E 2015E - 2019E Total Base Gas Renewal NEXUS related $224 $280 $350 $360 $280 $280 $1,550 $125 $600 $825 $3.1B ~$4.4B - $4.5B YE Rate Base* $99M ~$130M Depreciation * Includes working capital (millions) 40

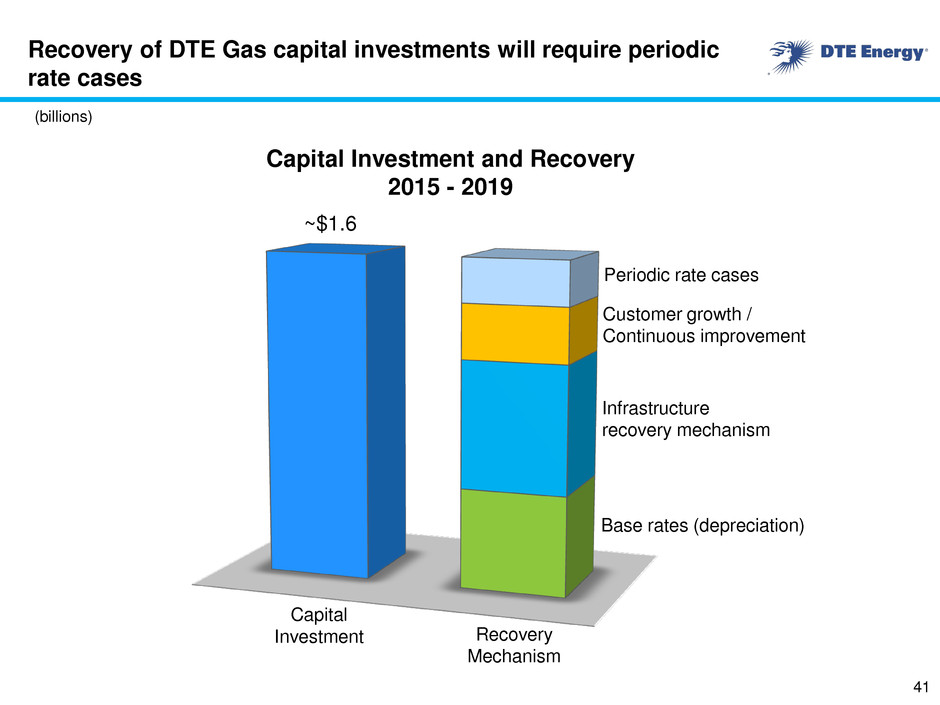

Recovery of DTE Gas capital investments will require periodic rate cases Capital Investment and Recovery 2015 - 2019 Infrastructure recovery mechanism Base rates (depreciation) Customer growth / Continuous improvement Periodic rate cases Capital Investment Recovery Mechanism (billions) ~$1.6 41

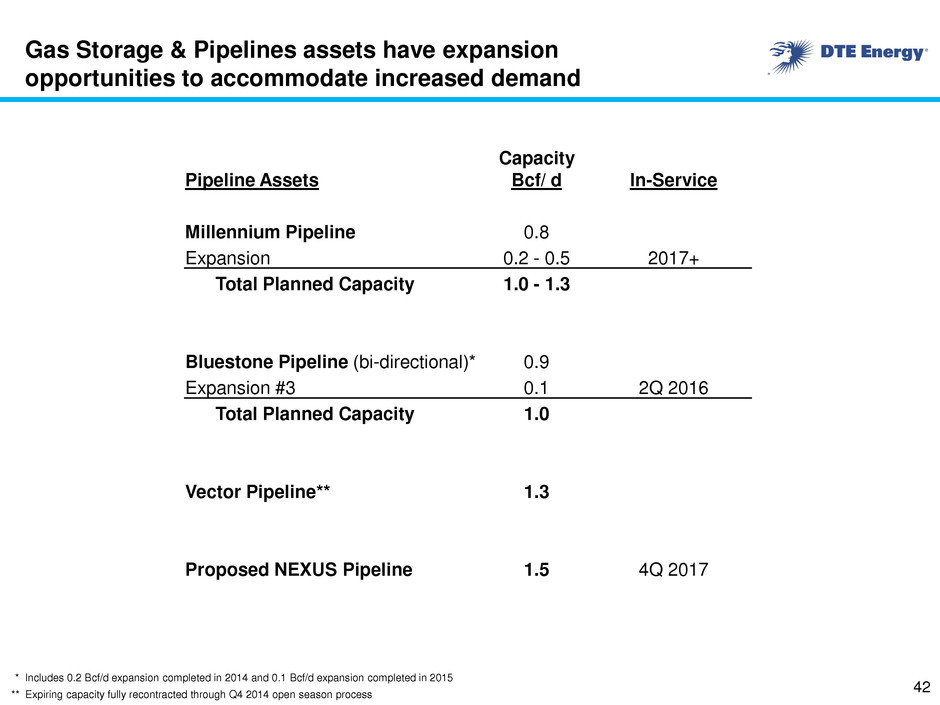

Gas Storage & Pipelines assets have expansion opportunities to accommodate increased demand Pipeline Assets Capacity Bcf/ d In-Service Millennium Pipeline 0.8 Expansion 0.2 - 0.5 2017+ Total Planned Capacity 1.0 - 1.3 Bluestone Pipeline (bi-directional)* 0.9 Expansion #3 0.1 2Q 2016 Total Planned Capacity 1.0 Vector Pipeline** 1.3 Proposed NEXUS Pipeline 1.5 4Q 2017 * Includes 0.2 Bcf/d expansion completed in 2014 and 0.1 Bcf/d expansion completed in 2015 42 ** Expiring capacity fully recontracted through Q4 2014 open season process

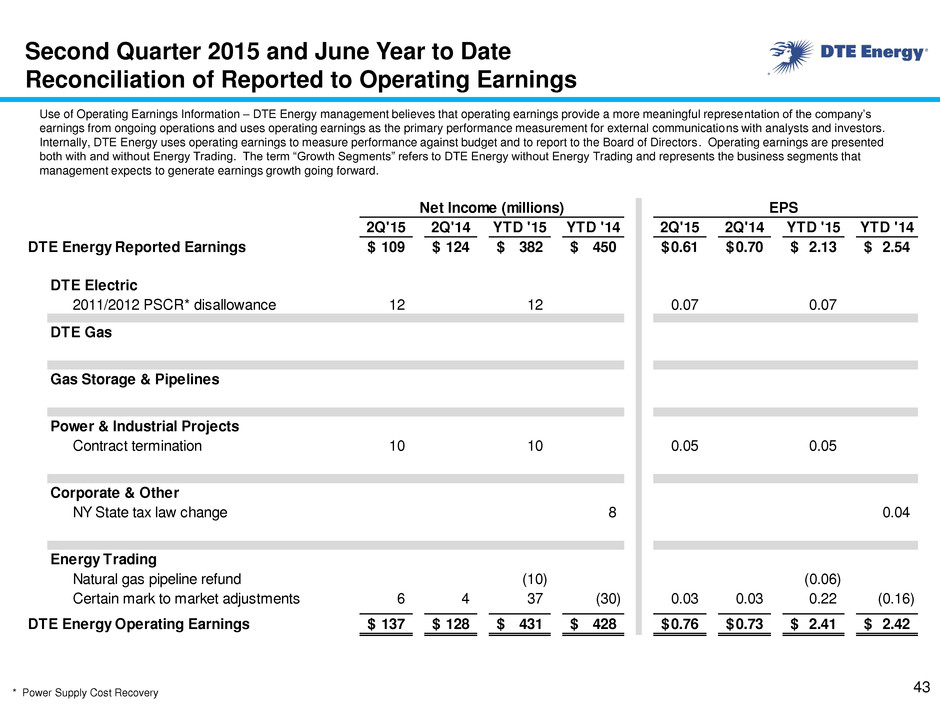

Second Quarter 2015 and June Year to Date Reconciliation of Reported to Operating Earnings 43 Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. 2Q'15 2Q'14 YTD '15 YTD '14 2Q'15 2Q'14 YTD '15 YTD '14 DTE Energy Reported Earnings 109$ 124$ 382$ 450$ 0.61$ 0.70$ 2.13$ 2.54$ DTE Electric 2011/2012 PSCR* disallowance 12 12 0.07 0.07 DTE Gas Gas Storage & Pipelines Power & Industrial Projects Contract termination 10 10 0.05 0.05 Corporate & Other NY State tax law change 8 0.04 Energy Trading Natural gas pipeline refund (10) (0.06) Certain mark to market adjustments 6 4 37 (30) 0.03 0.03 0.22 (0.16) DTE Energy Operating Earnings 137$ 128$ 431$ 428$ 0.76$ 0.73$ 2.41$ 2.42$ Net Income (millions) EPS * Power Supply Cost Recovery

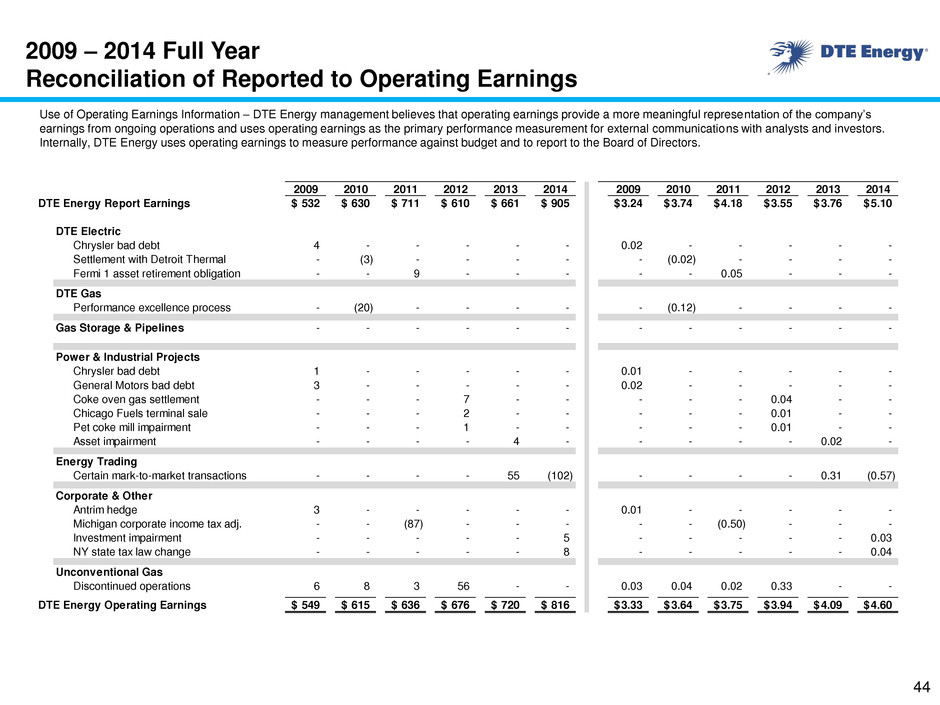

2009 – 2014 Full Year Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 DTE Energy Report Earnings 532$ 630$ 711$ 610$ 661$ 905$ 3.24$ 3.74$ 4.18$ 3.55$ 3.76$ 5.10$ DTE Electric Chrysler bad debt 4 - - - - - 0.02 - - - - - Settlement with Detroit Thermal - (3) - - - - - (0.02) - - - - Fermi 1 asset retirement obligation - - 9 - - - - - 0.05 - - - DTE Gas Performance excellence process - (20) - - - - - (0.12) - - - - Gas Storage & Pipelines - - - - - - - - - - - - Power & Industrial Projects Chrysler bad debt 1 - - - - - 0.01 - - - - - General Motors bad debt 3 - - - - - 0.02 - - - - - Coke oven gas settlement - - - 7 - - - - - 0.04 - - Chicago Fuels terminal sale - - - 2 - - - - - 0.01 - - Pet coke mill impairment - - - 1 - - - - - 0.01 - - Asset impairment - - - - 4 - - - - - 0.02 - Energy Trading Certain mark-to-market transactions - - - - 55 (102) - - - - 0.31 (0.57) Corporate & Other Antrim hedge 3 - - - - - 0.01 - - - - - Michigan corporate income tax adj. - - (87) - - - - - (0.50) - - - Investment impairment - - - - - 5 - - - - - 0.03 NY state tax law change - - - - - 8 - - - - - 0.04 Unconventional Gas Discontinued operations 6 8 3 56 - - 0.03 0.04 0.02 0.33 - - DTE Energy Operating Earnings 549$ 615$ 636$ 676$ 720$ 816$ 3.33$ 3.64$ 3.75$ 3.94$ 4.09$ 4.60$ 44

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. For comparative purposes, 2009 through 2012 operating earnings exclude the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. Reconciliation of Other Reported to Operating Earnings 45