Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEELOS THERAPEUTICS, INC. | a8-kfor8x10x15.htm |

NASDAQ: APRI August 2015

2 Forward-Looking Statements This corporate presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act, as amended. Statements in this presentation that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things: references to royalty revenues from the sale of Vitaros® in various countries by Apricus’ commercial partners; the planned launch of Vitaros in Italy and other countries; the potential for the new European Decentralized Procedure approvals to enhance the value of Vitaros for Apricus’ partners and shareholders; the planned production of the required 12-month stability data and the expected timing of approval in Europe for the Vitaros room temperature device; the expected timing of top-line data for the Phase 2a clinical trial of RayVa™ and the Phase 2b clinical trial for fispemifene; the timing of an approved pathway for RayVa and fispemifene; the potential to receive priority review on RayVa and the potential timing of any NDA submission; the timing and success of current and planned clinical trials; the size of the commercial opportunity for Vitaros, RayVa and fispemifene and the potential for such products to achieve commercial success; the potential for a US development program for Vitaros; the opportunity of potential indications for fispemifene; the planned out-license of Vitaros and RayVa; the timing of patent expirations and potential for additional patent protection; and Apricus’ 2015 financial outlook, including cash projections. Actual results could differ from those projected in any forward-looking statements due to a variety of reasons that are outside the control of Apricus, including, but not limited to: the effect of the previously-reported out-of- stock situation for Vitaros in Germany and the potential that Apricus’ partner there, Sandoz, does not resume ordering product for Germany or other countries pending the results of an ongoing out-of-specification investigation by our contract manufacturer; Apricus’ ability to have its product Vitaros be approved by relevant regulatory authorities in Europe and in other countries, such as national phase approvals for Vitaros in the additional European Concerned Member State territories; Apricus’ ability to further develop its product Vitaros for the treatment of erectile dysfunction, such as the room temperature version of Vitaros, and its product candidates RayVa for the treatment of Raynaud’s phenomenon and fispemifene for the treatment of secondary hypogonadism, chronic prostatitis and lower urinary tract symptoms in men, as well as the timing of such events; Apricus’ ability to successfully carry out and complete clinical studies for RayVa and fispemifene, as well as the timing and success of the results of such studies; feedback received from regulatory agencies, such as the FDA on the development of Apricus’ product candidates; Apricus’ dependence on its commercial partners to carry out the commercial launch or grow sales of Vitaros in various territories and the potential for delays in the timing of commercial launches in additional countries, such as Italy; competition in the erectile dysfunction market and other markets in which Apricus and its partners operate; Apricus’ ability to obtain and maintain intellectual property protection for Vitaros, RayVa, fispemifene or any other product candidates; Apricus’ ability to raise additional funding that it may need to continue to pursue its commercial and business development plans; Apricus’ ability to remain in compliance with the terms and restrictions under the credit facility; Apricus’ ability to access additional capital under the equity facility; Apricus’ ability to obtain the requisite governmental approval for the room temperature version of Vitaros, RayVa and fispemifene; and market conditions. These forward-looking statements are made as of the date of this presentation, and Apricus assumes no obligation to update the forward- looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Readers are urged to read the risk factors set forth in Apricus’ most recent annual report on Form 10-K, subsequent quarterly reports filed on Form 10-Q, and other filings made with the SEC. Copies of these reports are available from the SEC’s website at www.sec.gov or without charge from Apricus.

3 Apricus Overview Advancing Innovations in Specialty Urology and Rheumatology Markets ― Headquarters: San Diego, CA ― NASDAQ: APRI

4 Richard W. Pascoe Chief Executive Officer Brian T. Dorsey SVP, Chief Development Officer Barbara Troupin, MD SVP, Chief Medical Officer Catherine Bovenizer VP, Finance & Chief Accounting Officer Neil Morton VP, Business Development Kleanthis G. Xanthopoulos, Ph.D. Chairman Rusty Ray Director Deirdre Y. Gillespie, M.D. Director Paul V. Maier Director Wendell Wierenga, Ph.D. Director Sandford Smith Director Management Team Board of Directors Experienced team leading life science companies Apricus Executive Management & Board of Directors

5 Additional Vitaros launches by our commercial partners in Europe Generation of Vitaros revenue via licensing, milestone and royalty payments RayVa Phase 2a trial data in 3Q 2015 Initiate 2nd Indication Fispemifene exploratory study in 4Q 2015 Vitaros room temperature device EU submission in 2016 Release Fispemifene Phase 2b trial data in early 2016 Creating Value

6 Apricus: Recent Highlights ― Successful Vitaros launches in France and Spain resulting in over 100% quarter over quarter retail unit growth in Europe ― Completed enrollment in RayVa Phase 2a clinical trial in June 2015 ― Enrolled first patient ahead of schedule in fispemifene Phase 2b clinical trial in June 2015 ― Closed on second $5 million tranche of venture debt with Oxford Finance/Silicon Valley Bank in July 2015 ― Vitaros approved in twelve additional countries in Europe under the Decentralized Procedure (DCP) in August 2015 ― Acheived 50% enrollment target in fispemifene Phase 2b clinical trial in August 2015 Continued Focus on Execution

7 2 0 Fispemifene Novel SERM for Urological Conditions in Men

8 Fispemifene: A Novel Development Stage Asset ― Novel new chemical entity (NCE) ― First tissue-specific selective estrogen receptor modulator (SERM) designed specifically for men ― Multi-indication potential to treat symptoms related to secondary hypogonadism (low testosterone/low T), chronic prostatitis and lower urinary tract symptoms ― Clinical proof-of-concept established in normalizing T levels in men with secondary hypogonadism ―Composition of matter patent (through 2025), expected patent term extension, additional issued and pending applications expected to extend to 2028 and beyond

9 Fispemifene acts by using the body’s own regulatory mechanisms, through the hypothalamus and pituitary, to normalize production of testosterone by the testes Fispemifene has shown in pre-clinical studies unique tissue effects that favor use in males1: ― Prostate: Reduces prostate inflammation ―Urinary Tract: Improves urodynamics Fispemifene has also shown other positive tissue effects found in other SERMS1: ―Bone-Sparing: Preserves bone density in vitro and in vivo ―Anti-Tumor: Anti-proliferative activity in prostate and breast cancer animal models ― Lipid-Lowering: Beneficial effects on lipids - liver Fispemifene: A Differentiated SERM

10 Fispemifene: Multi-Indication Opportunity Potential Value in Multiple Male Urological Conditions Strategic Development Considerations ―Non-clinical work supports broad safety package for compound ―Urology therapeutic focus helps to further strengthen FDA relationship ― Enhances risk profile of compound with “multiple shots on goal” Assessment of Unmet Clinical Need ― Scientific review – clinical indications based on MOA ― Regulatory review – establishing path to approval ―Commercial evaluation – understand market potential ― Clinical evaluation – announced initiation of a proof-of-concept clinical study in US in June 2015

11 LUTS4 Chronic Non-bacterial Prostatitis2 Secondary Hypogonadism3 5M 24M 65M Fispemifene: Large Addressable Market Opportunity Three major areas of unmet need US Men Ages 40 to 79 40+ 45+

12 Fispemifene: Secondary Hypogonadism Large and Dynamic Market Opportunity5 Primary Hypogonadism ~$200MM Fispemifene will target adult men with Symptomatic Secondary Hypogonadism Secondary Hypogonadism ~$1.5B 2013 Topical TRT Market in Primary and Secondary Hypogonadism: ~ $1.7B* * Tested and Treated with Topical TRT ~30% Others ~70% 40-60 Years Fispemifene Market Opportunity in Secondary Hypogonadism: ~ $1.0B

13 Fispemifene vs. Testosterone Replacement Therapies (TRT) Fispemifene Testosterone Replacement Dosing Oral, simple once daily Injectable or topical administration Bone Beneficial effects* Limited effects Prostate Expected to be neutral or positive anti-inflammatory (improved urodynamics) Enlargement risk Testes Maintains normal spermatogenesis Testicular atrophy: impaired spermatogenesis / infertility Cardiovascular Lack of supra-physiological T levels associated with increased risk Increases hematocrit and blood pressure. Concern with supra- physiological T levels Partner risks None Topical exposure risk to female and children; label warnings / precautions Abuse potential Low – endogenous stimulation preserves natural feedback mechanism Prone to abuse, over treatment and unpredictable peak / trough effects; controlled substance *in vitro or in vivo animal models

14 2 0 Fispemifene: Clinical Development Follow-up Visit Week 6 FIS 100 mg FIS 300 mg FIS 200 mg 4 wks R A N D O M I Z E D Screening Placebo ― 77 hypogonadal men at 23 centers in the US ― Primary endpoint – change in serum testosterone ― PSA, LH, FSH, lipids, prostate ultrasound and safety labs Phase 2a Clinical Study

15 2 0 Fispemifene: Clinical Development – Mean Morning Testosterone levels increased up to 78% (300 mg) – Other hormonal parameters (↑LH) confirm mechanism of action Phase 2a Clinical Study: Change in Total Testosterone3

16 Fispemifene: Robust Execution ― Asset acquired in October 2014 ― Received FDA regulatory guidance on the clinical development plan, indication and endpoints ― FDA input on non-clinical safety, tox and carc studies received ― Non-clinical program underway ― Formulation development work to optimize late stage and commercial product underway ― Phase 2b protocol written and aligned with FDA guidance ― US clinical sites actively enrolling ― First patient enrolled May 28 ― Over 50% enrolled as of August 10, 2015 Phase 2b Data Expected in 1Q 2016

17 Potential first-in-class topical cream treatment for Raynaud’s Phenomenon Secondary to Scleroderma (alprostadil cream)

18 RayVa™: Treatment for Raynaud’s Phenomenon Secondary to Scleroderma (SSc) RayVa – Alprostadil/DDAIP.HCl ―Topical, on-demand route of administration ― Increased blood flow observed in preclinical models of Raynaud’s Phenomenon with RayVa, using a comparable cold challenge Attractive Commercial Opportunity ―Currently no approved Raynaud’s treatments in the US ―Targeted call point – only 4,500 rheumatologist treating secondary Raynaud’s patients in US6 ― Broad IP position with potential exclusivity to 2032

19 RayVa™: Moving from Proof of Concept to Later Phase Completion of 2a Proof-of-Concept Study ― Enrollment completed in Phase 2a proof-of-concept trial at four sites ―Study activities finished, database lock in 3Q 2015 ―Top-line data available 3Q 2015 ―Company evaluation of blinded data show no indication of safety or tolerability concerns ―Data monitoring committee provided safety/tolerability oversight Clear and Defined Pathway to Approval ― Later-stage trials in US expected in 2016 ―Trial designs for at-home dosing to be vetted with FDA ―Formulation work for at-home dosing initiated ―Due to unmet need, RayVa may qualify for Priority Review following NDA submission, which could occur as early as 2017

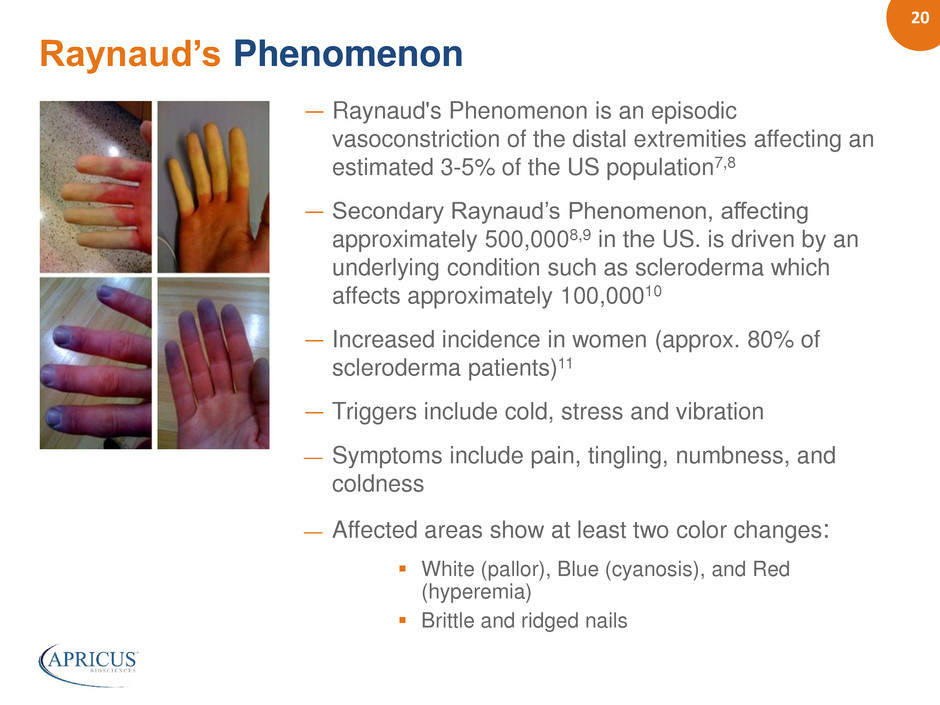

20 ― Raynaud's Phenomenon is an episodic vasoconstriction of the distal extremities affecting an estimated 3-5% of the US population7,8 ― Secondary Raynaud’s Phenomenon, affecting approximately 500,0008,9 in the US. is driven by an underlying condition such as scleroderma which affects approximately 100,00010 ― Increased incidence in women (approx. 80% of scleroderma patients)11 ― Triggers include cold, stress and vibration — Symptoms include pain, tingling, numbness, and coldness — Affected areas show at least two color changes: White (pallor), Blue (cyanosis), and Red (hyperemia) Brittle and ridged nails Raynaud’s Phenomenon

21 First-in-class topical cream treatment for erectile dysfunction

22 Vitaros – Alprostadil/DDAIP.HCl ― Only topically delivered cream approved for ED ― Approved in Canada and Europe ― Rapid onset (generally 5-15 minutes) ― Significant efficacy and safety profile – including difficult to treat populations and those with greatest need: • Diabetics • Hypertensives • Post-prostatectomy • Patients on nitrates/alpha blockers • PDE-5 (e.g. Viagra®) failures Vitaros®: Treatment for Erectile Dysfunction (ED)

23 Vitaros®: Targeting the Untreated Drop out after initial prescription (31%) or drop out after 3 years from start (48%)14 Non-responders 13 Contraindicated due to medications or concurrent diseases12 ED Market Segmentation Significant ED patient population with an unmet need

24 Vitaros®: Attractive Market Opportunity ― Large ED market – $5.5B worldwide with $1.3B in Europe15 ― Unique profile has potential to double the number of treatable patients12,13,14 ― Launched in the United Kingdom, Germany, Sweden, Belgium, Spain and France ― Launch in Italy expected later in 2015 ― Royalty and milestone revenues expected through 2032 ― Out-licensed in Canada, Europe, Africa, Asia-Pacific, Israel and the Middle East for up to approximately $178M in total value ― Exploring options to advance the US clinical development program ― Licensing opportunities in Latin America, Japan and China ― Room temperature device (RTD) in development ― No refrigeration required ― Key driver of Vitaros global market growth and expansion

25 Vitaros®: Launch Update 132 7,318 28,902 36,620 74,260 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 European Quarterly Retail Units Sold European R et ai l U n it s —Currently launched in the United Kingdom, Germany, Belgium, Sweden, Spain and France — Rx growth continues to exceed expectations: Q2 2015 retail sales data shows 103% growth over Q1 2015 —Additional EU launches expected throughout 2015, including key markets such as Italy —Approved in 22 countries in Europe under the DCP Source: IMS Midas Interim Data

26 2 0 Financial Overview

27 Financial Dashboard NASDAQ: APRI Cash on hand plus access to capital provides sufficient funding to support the current operating plan into 2016 50.4M† 67.0M† $65M† $7.4M‡ Shares outstanding Shares fully diluted Market Cap Cash position † As of August 10, 2015 ‡ As of June 30, 2015 ―Vitaros revenue expected to off-set operating expenses in 2015 and beyond ― Second $5MM tranche of Oxford/SVB venture debt drawn down in July 2015. Cash numbers do not include this $5MM.

28 Additional Vitaros launches by our commercial partners in Europe Generation of Vitaros revenue via licensing, milestone and royalty payments RayVa Phase 2a trial data in 3Q 2015 Initiate 2nd Indication Fispemifene exploratory study in 4Q 2015 Vitaros room temperature device EU submission in 2016 Release Fispemifene Phase 2b trial data in early 2016 Creating Value

NASDAQ: APRI August 2015

30 1 Data on file. 2 Estimates based on 2014 US Census data, Longitudinal Association between Prostatitis and Development of Benign Prostatic Hyperplasia, Urology. 2008 March ; 71(3): 475–479, and Epidemiology of prostatitis, Int J Antimicrob Agents. 2008 February ; 31(Suppl 1): S85–S90. 3 Estimates based on 2014 US Census data and Mulligan T et al. Prevalence of hypogonadism in males aged at least 45 years: the HIM study. Int J Clin Pract. 2006 Jul;60(7):762-9. 4 Benign Prostatic Hyperplasia and Male Lower Urinary Tract Symptoms Report, Decision Resources; December 2012. 5 According to data on file with the Company, certain published data and information presented at the September 17, 2014 Joint Meeting of the Bone, Reproductive and Urologic Drugs Advisory Committee and the Drug Safety and Risk Management Advisory Committee. 6 American Medical Association 2011. 7 N Engl J Med 2002; 347: 1001–1008. 8 Drugs 2007; 67: 517-525. 9 2012 U.S. Census Bureau: State and County QuickFacts (http://quickfacts.census.gov/qfd/states/00000.html). 10 Curr Opin Rheumatol 2012; 24: 165–170; American College of Rheumatology (http://www.rheumatology.org/Practice/Clinical/Patients/Diseases_And_Conditions/Scleroderma). 11 Medicine 2013; 92: 191-205. 12 D2 Market Research, June 2007. 13 J Sex Med 2012; 9: 2361–2369. 14 International Journal of Urology 2007; 14: 339-342. 15 IMS Health 2013. References