Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNEDISON, INC. | form8k_080615xcall.htm |

| EX-99.3 - EXHIBIT 99.3 - SUNEDISON, INC. | exhibit993ped.htm |

| EX-99.1 - EXHIBIT 99.1 - SUNEDISON, INC. | exhibit991final.htm |

August 6, 2015 Second Quarter 2015 Results Exhibit 99.2 Filed by SunEdison, Inc. (Commission File No. 001-13828) pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Vivint Solar, Inc. Commission File No.: 001-36642

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Safe Harbor 2 With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in SunEdison’s and TerraForm Power’s filings with the Securities and Exchange Commission (SEC), including Forms 10-K and Forms 10-Q, as well as other filings with the SEC, in addition to the risks and uncertainties described on page 3 of this presentation. These forward-looking statements represent the SunEdison’s and TerraForm Power’s judgment as of the date of this presentation. SunEdison and TerraForm Power disclaims, however, any intent or obligation to update these forward- looking statements, except as required by law. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of these securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state. You can find SunEdison’s and TerraForm Power’s press releases filed today on Forms 8-K with the SEC or on their respective websites.

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Forward-Looking Statements 3 This communication may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variation of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that SunEdison expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected cash available for distribution (CAFD), earnings, revenues, capital expenditures, liquidity, capital structure, future growth, and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide SunEdison’s or TerraForm Power’s current expectations or predictions of future conditions, events or results and speak only as of the date they are made. Although SunEdison and TerraForm Power believes their expectations and assumptions are reasonable, they can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, delays or unexpected costs during the completion of projects under construction; regulatory requirements and incentives for production of renewable and solar power; operating and financial restrictions under agreements governing indebtedness; the condition of capital markets and our ability to borrow additional funds and access capital markets; the ability to compete against traditional and renewable energy companies; challenges inherent in constructing and maintaining renewable energy projects; the success of ongoing research and development efforts; the ability to successfully integrate the businesses of acquired companies and realize the benefits of such acquisitions; and hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages. Furthermore, any dividends are subject to available capital, market conditions and compliance with associated laws and regulations. Many of these factors are beyond SunEdison’s and TerraForm Power’s control. SunEdison and TerraForm Power disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in SunEdison’s and TerraForm Power’s Forms 10-K for the fiscal year ended December 31, 2014, as well as additional factors they may describe from time to time in other filings with the Securities and Exchange Commission. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Executive Summary 4 Group and Platform Review Ahmad Chatila, SunEdison CEO TerraForm 2Q Results, Guidance, and Capital Alex Hernandez, TerraForm Power CFO SunEdison Group Business Model Value Creation Brian Wuebbels, SunEdison CFO SunEdison Execution, Vivint Solar Economics & Guidance Brian Wuebbels, SunEdison CFO TerraForm Power Review Carlos Domenech, TerraForm Power CEO

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Ahmad Chatila, CEO of SunEdison Group and Platform Review

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Group Executive Summary 6 SunEdison DevCo: Unmatched Organic Execution – Record 404 MW delivered 2Q vs. guidance of 300-340 MW; up 186 MW Y/Y – 1.9 GW of projects under construction, up 1.1 GW Q/Q – 8.1 GW Pipeline and 5.6 GW Backlog, gross pipeline additions of 1.0 GW – 4.2 - 4.5 GW 2016 guidance initiated, up 50% vs. prior outlook TerraForm Power: Delivering World Class Execution & Growth – 2Q: $65M CAFD, DPS $0.335/share; strong operating fleet performance ‒ $1.35 2015 DPS guidance on track, up 50% vs. IPO Platform Transformation: Largely Complete – #1 Global Renewable Utility Scale Developer – DG leadership with Vivint Solar acquisition – GLBL IPO delivers widest geographic coverage of peers – SunEdison Semiconductor: remaining shares sold down during the quarter Emerging Sustainable Competitive Advantages Through Scale and Scope

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Congruent Growth Platform 7 General Partner SUNE: Shareholders Common Dividends + IDRs Utility Solar and Wind Third-Party Partners (e.g. Renova, etc.) DG: RSC/C&I Solar + + + Warehouse Vehicles + TERP GLBL Public Shareholders And Private Investors Future Dividends Long Term Dividend Growth + Predictable Returns Contracted Cash flows 1 2 3 2

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 $3 $27 $38 $279 $537 $0 $200 $400 $600 YieldCo Equity MLP Equity Global Unlisted InfraFunds Global Project Finance Global Private Equity Relative Financial Market Size 8 2014 Issuances Across Products Source: Preqin, InfraDeals, Bloomberg, S&P LCD News, SEC filings and Barclays internal databases. 1. Totals represent 2014 inflows into infrastructure funds. 2. In 2014, renewables represented $68.6 billion of total project finance. 3. Totals represent 2014 inflows into all of private equity (including infrastructure funds). (2) (3) (1) $B

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 $0 $500 $1,000 $1,500 Global YieldCo MLPs Global REITs 9 Total Industry Market Capitalizations Source: Bloomberg, Morgan Stanley, and Global X YieldCo ETF YieldCo Market Size vs. Mature Markets $B

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Brian Wuebbels, CFO of SunEdison SunEdison Results, & Platform Transformation and Guidance

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 SunEdison Second Quarter 2015 Results Overview 11 Key Metrics 2Q’15 Guidance 2Q’15 Actual CAFD for Retained MW ($M) $35 - $40 $63 Total MW 300 – 340 404 Retained MW 245 – 270 359 3rd Party Sales MW 55 – 70 45 Consistently Executing Exceptional Operational Execution with Record Second Quarter Results − 404 MW delivered; up 186 MW year-on-year − 801 MW of gross backlog additions; 1,002 MW of gross pipeline additions − 1.9 GW under construction at quarter end Completing Platform Transformation − $1.5 billion First Reserve Warehouse closed − $500 million TerraForm Private Warehouse closed − SunEdison Semiconductor: remaining shares sold July 1 − TerraForm Global IPO priced on July 31 1. Conversions based on SunEdison’s historical conversion rates from each category Note: Represents MW for completed projects and percentage of completion for projects under construction See Definitions in Appendix

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2009 2010 2011 2012 2013 2014 2015E 2016E MW Range Targeting Rapid, Global Scale 12 100x Growth from 2009 to 2016 MW 283 430 537 1,048 2,100 – 2,300 4,200 – 4,500 38 110 1. CAGR calculated utilizing midpoint in 2016 2. Represents MW for completed projects and percentage of completion for projects under construction

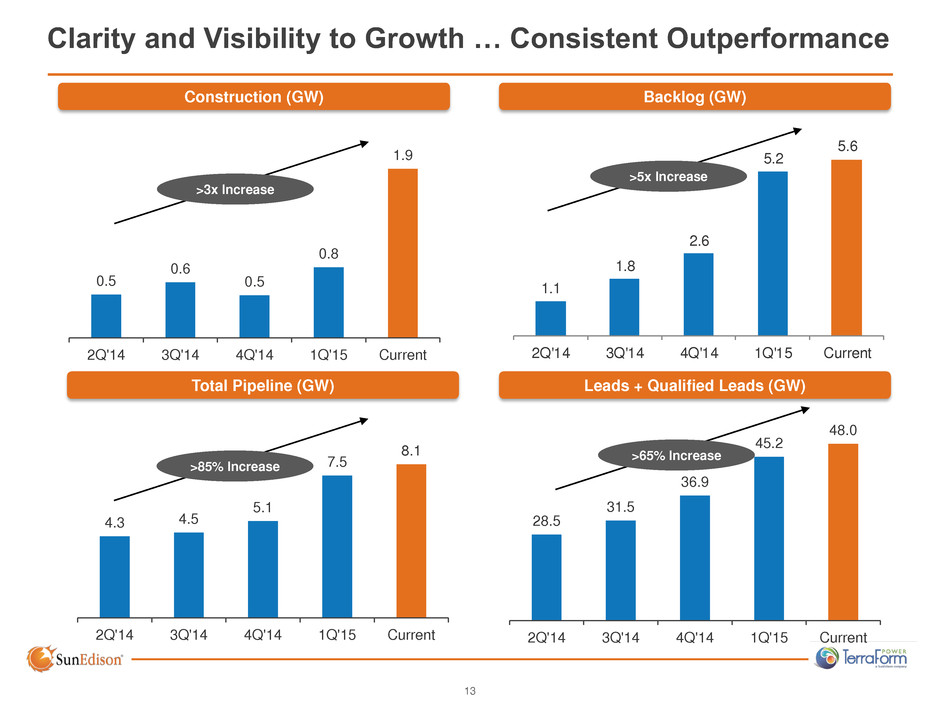

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 4.3 4.5 5.1 7.5 8.1 2Q'14 3Q'14 4Q'14 1Q'15 Current Clarity and Visibility to Growth … Consistent Outperformance 13 Backlog (GW) Total Pipeline (GW) Leads + Qualified Leads (GW) Construction (GW) 1.1 1.8 2.6 5.2 5.6 2Q'14 3Q'14 4Q'14 1Q'15 Current >85% Increase >65% Increase >5x Increase 28.5 31.5 36.9 45.2 48.0 2Q'14 3Q'14 4Q'14 1Q'15 Current 0.5 0.6 0.5 0.8 1.9 2Q'14 3Q'14 4Q'14 1Q'15 Current >3x Increase

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 ~5.0 GW Conversion %1 ~3.3 GW ~1.5 GW ~5.8 GW Leading Development Engine 14 Conversion Weighted 1. Conversions based on SunEdison’s historical conversion rates from each category 2. Total Pipeline equals 8.1 GW and excludes Qualified Leads and Leads 3. Gross Annualized Unlevered CAFD – See Appendix for Definition Visibility into 56 GW of Opportunity Excludes residential and most future C&I Excludes India and China MOUs 15.7 GW $2.5B CAFD3 33.4 14.6 2.5 5.6 Leads 1 % Qualified Leads 40% Pipeline Exc. Backlog 60% Backlog 90% Distinct Capabilities and Alignment Lead to High Conversion

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Project Activity Pipeline by Vehicle Leads + QL by Vehicle 49 169 74 91 45 51 75 206 76 54 46 88 71 45 5 41 12 - 25 127 74 164 251 295 202 359 147 104 117 73 135 200 558 504 463 475 610 467 774 1,853 - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2012 2013 2014 2015 Retained 3rd Party Under Construction Project Pipeline & Installations MW * MW Sold, MW’s Retained on Balance Sheet and MW under construction include percentage of completion (POC) 8.1 GW Pipeline 1 GW gross additions in 2Q’15 5.6 GW Backlog 0.8 GW gross additions in 2Q’15 1.9 GW Under Construction Up 239% from 774 MW in Q1’15 50 ≤ MW <100 23% MW≥100 43% 10 ≤ MW <50 22% EMEA & LA 17% US 57% Canada 3% APAC & Africa 23% Note: Unaudited 15 TERP 54% GLBL 46% TERP 72% GLBL 28%

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 2Q ’15 Cash Walk $M 16 Cash above includes cash and cash equivalents and cash committed for construction projects. Note: Unaudited Greater than $1 Billion of Cash at DevCo … Sufficient Liquidity to Grow Platform $919 $1,948 $1,998 $237 $677 ($455) $487 ($590) $673 $50 1Q Ending Cash TerraForm Net Cash Increase Converts, Net Acquisitions, Net GLBL Private Placements Project Construction / Capex Warehouses, Net Other 2Q Ending Cash

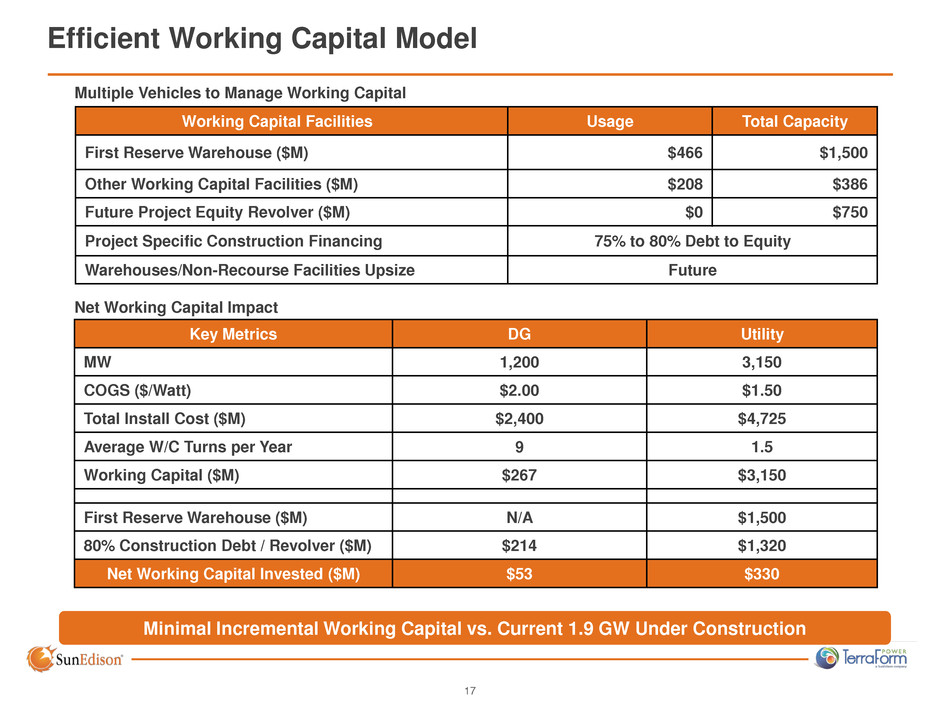

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Efficient Working Capital Model 17 Key Metrics DG Utility MW 1,200 3,150 COGS ($/Watt) $2.00 $1.50 Total Install Cost ($M) $2,400 $4,725 Average W/C Turns per Year 9 1.5 Working Capital ($M) $267 $3,150 First Reserve Warehouse ($M) N/A $1,500 80% Construction Debt / Revolver ($M) $214 $1,320 Net Working Capital Invested ($M) $53 $330 Minimal Incremental Working Capital vs. Current 1.9 GW Under Construction Working Capital Facilities Usage Total Capacity First Reserve Warehouse ($M) $466 $1,500 Other Working Capital Facilities ($M) $208 $386 Future Project Equity Revolver ($M) $0 $750 Project Specific Construction Financing 75% to 80% Debt to Equity Warehouses/Non-Recourse Facilities Upsize Future Multiple Vehicles to Manage Working Capital Net Working Capital Impact

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Vivint Solar Acquisition: Significant Value Accretion 18 Breakeven Scale Economics 2016 SUNE RSC 2016 SUNE + VSLR IRR (Levered) Renewal % No Repowering Repowering Fixed OPEX ($M) $87 $179 10% 5.8% 7.9% Variable OPEX ($/W) $0.34 $0.40 25% 6.8% 9.4% Cash Margin ($/W) $0.54 $0.81 50% 8.1% 10.9% Breakeven MW 428 4341 75% 9.0% 11.9% Volume MW ~400 800+ 90% 9.4% 12.6% 1. A portion of sales will be cash sales that are not dropped down to TerraForm Power. Cash generation • Economies of scale, cash positive > 434 MW/year • Splitting DevCo and YieldCo = immediate cash generation RSC drop down margins are predictable cash engine for SUNE and TERP Excellent off-taker quality with industry leading FICO > 750 Residential Project IRR 9.5+%, net of default rates • VSLR pricing 20% lower than retail utility rates

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 2Q ’15 Opex Walk $M 19 Note: Unaudited $276 $155 ($71) ($50) Q2 Total Opex Acquisition & IPO Costs Non-Cash, Stock Comp & Other Expenses Q2 Run Rate Cash Opex

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Q3 2015 FY 2015 2016 Guidance Guidance Guidance Total MW 540 – 600 2,100 – 2,300 4,200 – 4,500 Retained 490 – 530 1,840 – 2,000 3rd Party 50 – 70 260 – 300 Unlevered CAFD from Retained MW $75M – $85M $275M – $325M Guidance 20 Executing on 2015 Plan: Increased 2016 Guidance by 50%

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Carlos Domenech, CEO of TerraForm Power TerraForm 2Q Overview: Strong Execution

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Continued Execution Above Plan 22 Strong Execution Supports DPS Guidance Note: Represents MW-ac for wind assets, MW-dc for solar assets 2Q Performance Delivers CAFD of $65M (vs. 1Q CAFD of $39M) – Diversified portfolio performing above underwriting case – High-quality contracted portfolio with creditworthy offtakers, no fuel or commodity exposure – 146 MW of drop downs from SUNE with $21M of run rate CAFD – Dedicated management team focused on growth and enhancing shareholder value Sufficient Capital on Hand to Support 2016 DPS Guidance of $1.75 – $1.3B of current liquidity – Closed $1.0B of capital in June and July ($599M equity and $450M debt) – Plan to fund Invenergy and Vivint without equity Drop Down Visibility Supports DPS Growth – Clear visibility to 7.6 GW high-quality asset portfolio – Closed $525M TerraForm Private warehouse to hold 521 MW of Atlantic Power assets Declaring 2Q Dividend of $0.335/share; Up 48% vs. IPO Dividend 1 Year Ago – Reaffirming 2015 CAFD guidance of $225M and DPS guidance of $1.35 – Reaffirming 2016 DPS guidance of $1.75

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Diversified, High-Quality Operating Portfolio of 1,883 MW U.S. 71% U.K. 20% Canada 4% Chile 5% Location Asset Age Assets located in attractive power markets Remaining Contract Length Average remaining PPA life of 16 years Wind 21% Solar 73% Most projects are <2 years old, with average 30-year expected asset life S&P Counterparty Rating AA+ <1% AA 1% AA- 2% A+ 13% A 19% A- 30% BBB+ 10% BBB 7% BBB- 12% NR 6% Average high quality credit rating of A- Generation Type Diversified fleet 20+ years 19% 16-20 years 32% 11-15 years 25% 6-10 years 4% 0-5 years 20% < 2 years 56% 2-5 years 23% >5 years 21% Note: All information as of June 30, 2015. Weighted by MW. Excludes July 2015 Invenergy Wind and Vivint Solar acquisitions Wind 27% Solar 73% 23

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 1,883 788 1,186 3,716 7,573 Current Portfolio 2015 Announced Acquisitions Operating Assets in Warehouse Call Right Projects Pro Forma Portfolio Visibility to Growth Beyond 2016 with Contracted Assets Note: All information as of June 30, 2015 1. Invenergy assets of 665 MW anticipated to be placed into TerraForm Private warehouse facility by 4Q 2015 24 265 MW Invenergy 523 MW Vivint Solar 665 MW Invenergy (1) 521 MW Atlantic Power Construction Assets Operating Assets MW

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 $0.90 $1.35 $1.75 $2.05 At IPO 2015 2016 2017 Strong Visibility to DPS Growth 25 Execution CAFD Growth DPS Growth Reaffirming DPS guidance – 2015: $1.35; up 50% YOY – 2016: $1.75; up 30% YOY Significant visibility to CAFD and DPS growth on the basis of current fleet and drop down visibility 30% DPS Increase

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Alex Hernandez, CFO of TerraForm Power TerraForm Power 2Q Results: Strong Execution

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 2Q 2015 Results Overview 27 Strong Operational Performance Underpinned by Diversity and Scale of Generation Fleet − Geographically diverse wind fleet (Northeast, Hawaii) performed above expectations during the quarter − Solar fleet performed in line and maintained balanced generation mix − Achieved fleet capacity factor of 24%, up from 22% in 1Q Increased fleet size by 228 MW to 1,883 MW − 146 MW of 2Q drop downs completed − Closed acquisitions (Integrys / Duke, Invenergy Solar, and Moose Power) Includes only partial period 2Q M&A − Pro forma Revenue and Adj. EBITDA for full quarter of economic ownership is $139M and $114M, respectively 1. Revenue adjusted for PPA amortization and changes in fair value of commodity hedges Metric Result MW Owned (Quarter End) 1,883 MWh 944k Capacity Factor 24% Revenue / MWh $140 Revenue(1) $132M Adjusted EBITDA $108M CAFD $65M DPS $0.335 Highlights

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 CAFD By Project TerraForm Has a Highly Diversified Portfolio 28 1. Represents 36 projects / portfolios with less than 3% CAFD contribution 2. Portfolio consists of 39 projects in 4 distinct funds TerraForm Asset Map Other (sub 3%) 57% Mt. Signal 7% Project C 7% Project D 5% Project E 4% Project F 4% Project G 4% Project H 4% Project I 3% Project J 3% Project K 2% (1) (2) CO AZ CA OR NY CT NC NJ GA OH NV PR FL MD NM MA TX NE IL Canada Ontario Copiapo (Atacama Desert) Chile UK Bristol Ampney CrucisWiltshire HampsDevon Pembrokeshire Cornwall Crundale Fairwinds ME Kent VT HI PA

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Strong Organic Execution: 146 MW of Drop Downs from SUNE 29 Drop Down Execution Overview 2Q Drop Downs Size 146 MW 10-Year Average Unlevered CAFD $21M Equity $177M Aggregate Purchase Price(1) $245M Cash-on-Cash Yield (Unlevered) 8.5% Cash-on-Cash Yield (Levered)(2) 9.5% 1. Excludes tax equity minority interest of $75M (for total enterprise value of $320M) 2. Unlevered yield calculated as 10-year average unlevered CAFD divided by HoldCo capital. Levered yield calculated assuming 3.25x HoldCo leverage and 6.0% cost of debt 2Q Drop Downs Drop Downs By Geography US 57% UK 43% Project Name Generation Country MW Hill Houses Farm Solar UK 28.3 Distributed Generation Solar US 26.6 AP North Lake I Solar US 24.4 Castle Combe Solar UK 15.3 Wrockwardine Solar UK 10.5 Duke Energy Solar US 10.0 Horam Solar UK 8.1 Beryl Solar US 3.3 Cedar Valley Solar US 3.3 Granite Peak Solar US 3.3 Laho Solar US 3.4 Milford Flat Solar US 3.3 Buckhorn Solar US 3.3 Greenville Solar US 2.5 Total 2Q Drop Downs 145.8 Weighted average contract rating of A- Weighted average contract life of 18.5 years

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 5.767% 7.342% 5.446% 6.802% 4.000% 5.000% 6.000% 7.000% Jan-15 Feb-15 Mar-15 Apr-15 May-15 May-15 Jun-15 Jul-15 Aug-15 TerraForm 5.875% due 2023 Abengoa Yield 7.000% due 2019 NRG Yield 5.375% due 2024 Citi HY Index (Domestic) Strong Liquidity Position and Bond Yields 30 Commitment to increase revolver to $725 million, and passed amendment to grow revolver to $1 billion Warehouse vehicles with Sponsor and infrastructure partners provide incremental liquidity to stage drop downs 1. Excludes $82M of restricted cash Comparable Bond Yields Balance Sheet Liquidity as of August 5, 2015 Yield to Worst ABY HY Index TERP 2023 NYLD Debt funding costs for TerraForm remain attractive given disciplined leverage and compliance with financial policy: – HoldCo Leverage: 3.0-3.5x – Consolidated Leverage 5.0-5.5x $665 $725 $0 $54 $1,336 Cash on Hand Revolver Size Revolver Draw LC Total Liquidity $(54) $M

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Warehouses Provide Alternate Source of Capital to Public Market 31 1. Market capitalization as of August 5, 2015 First Reserve Warehouse has current availability of $1 billion to fund and stage drop downs (NYSE: SUNE) Market Cap: $7.2B (1) First Reserve Warehouse TerraForm Private Warehouse: U.S. Invenergy Assets + (NASDAQ: TERP) Market Cap: $4.1B (1) TerraForm Private Warehouse Tranche I: Atlantic Power $1.5B AUM: $30B Equity & Debt Investors $0.5B AUM: $130B AUM: $364B Closed 1Q Closed 2Q Projects Acquired After COD Project Acquisition Timing Decided by TerraForm Target 4Q Close ~$1.5B

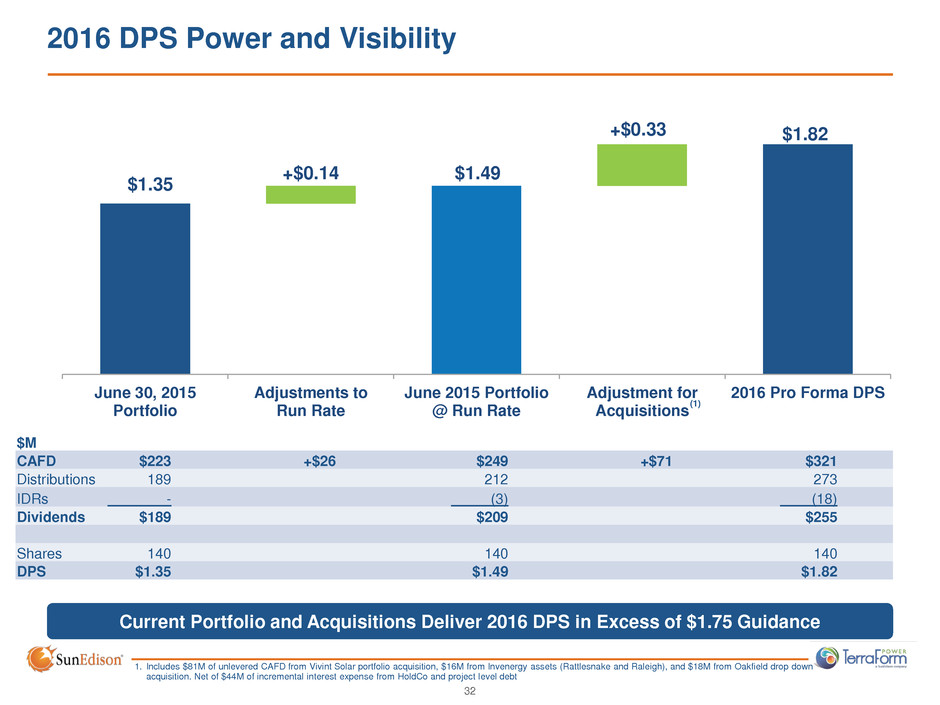

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 $1.35 +$0.14 $1.49 +$0.33 $1.82 June 30, 2015 Portfolio Adjustments to Run Rate June 2015 Portfolio @ Run Rate Adjustment for Acquisitions 2016 Pro Forma DPS 2016 DPS Power and Visibility Current Portfolio and Acquisitions Deliver 2016 DPS in Excess of $1.75 Guidance 1. Includes $81M of unlevered CAFD from Vivint Solar portfolio acquisition, $16M from Invenergy assets (Rattlesnake and Raleigh), and $18M from Oakfield drop down acquisition. Net of $44M of incremental interest expense from HoldCo and project level debt 32 $M CAFD $223 +$26 $249 +$71 $321 Distributions 189 212 273 IDRs - (3) (18) Dividends $189 $209 $255 Shares 140 140 140 DPS $1.35 $1.49 $1.82 (1)

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 TERP Enjoys a Low Cost of Equity and WACC Low (<1.0) Beta reflects limited systemic risk: ‒ Commodity exposure mitigated by 17 year average contracted cash flows ‒ Counterparty risk mitigated by high quality single-A average weighted off-takers group ‒ Limited leverage due to conservative financial policy Cost of Equity Risk-Free Rate + (Beta * Equity Risk Premium ) = Cost of Equity 2.59% + (0.72 * 6.55% ) = 7.28% 1 Implied Growth Rate CoE = Dividend Yield + DPS Growth CoE – Dividend Yield = Implied DPS Growth 7.28% – 4.50% = 2.78% 2 Note: Risk Free Rate is 20 year treasury yield., beta is mean of yieldco and infrastructure peers, and risk premium is average of Ibbotson and Damodaran, all as of 8/5/2015 Dividend Yield ≠ cost of equity Cost of equity reflects both dividend yield and expected long-term growth in DPS At current 4.50% dividend yield, only 2.78% of implied growth Discussed with Barclays, finalizing calc of 3.5% growth from 15% CAFD Retention 33

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 W eig ht ed C os t DPS Debt Equity IDR 0% 20% 40% 60% 80% 100% $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 S h a re o f C A F D DPS IDR HoldCo Retained Common TERP Enjoys a Low Cost of Equity and WACC Weighted Average Cost of Capital ������ ∗ ������������ �������������� + ������ ∗ �������� �������������� = �������� 7.28% * (50%) + 6.00% * (50%) = 6.64% 4 IDR Share of CAFD 3 TERP underwrites unlevered project IRRs at a significant premium to its WACC Use of debt reduces the impact of IDRs Cost of capital is affected by aggregate share of cash flows received by GP (as opposed to marginal rate) At 2016 DPS guidance of $1.75, IDR share of CAFD is 4% Even at $2.71 DPS (long-term target), IDRs share of CAFD is 23% Weighted Avg. Cost of Capital 7.31% @ $2.71 6.74% @ $1.75 Share of CAFD 23% of CAFD to IDR @ $2.71 4% CAFD to IDR @ $1.75 Confirm project debt interest rate Confirm weightings Redraw WACC graph 34 Note: Risk Free Rate is 20 year treasury yield., beta is mean of yieldco and infrastructure peers, and risk premium is average of Ibbotson and Damodaran, all as of 8/5/2015

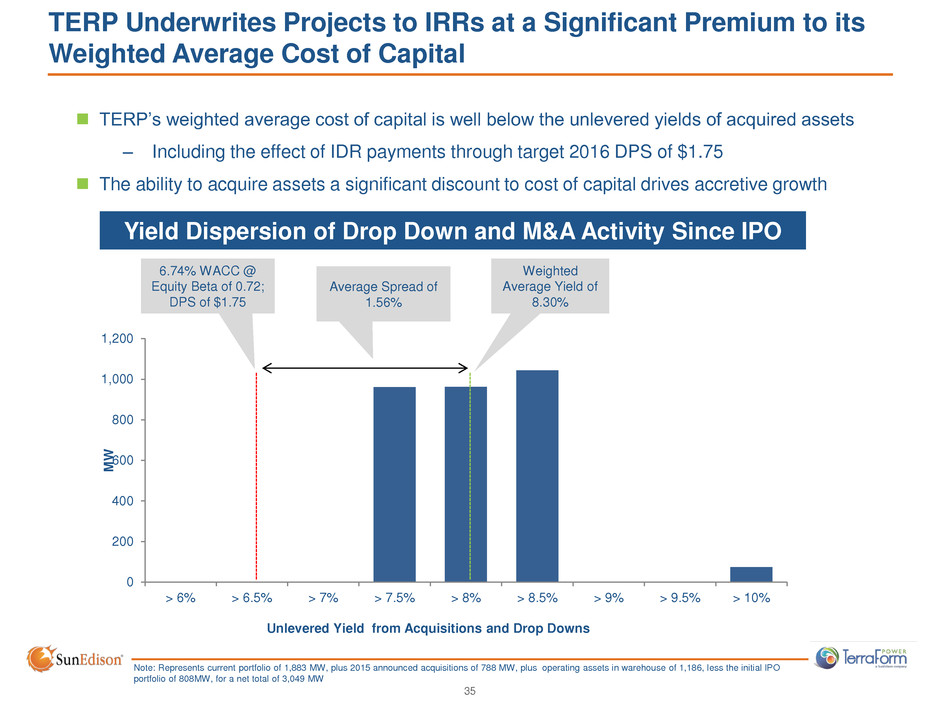

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 0 200 400 600 800 1,000 1,200 > 6% > 6.5% > 7% > 7.5% > 8% > 8.5% > 9% > 9.5% > 10% MW Unlevered Yield from Acquisitions and Drop Downs TERP Underwrites Projects to IRRs at a Significant Premium to its Weighted Average Cost of Capital TERP’s weighted average cost of capital is well below the unlevered yields of acquired assets ‒ Including the effect of IDR payments through target 2016 DPS of $1.75 The ability to acquire assets a significant discount to cost of capital drives accretive growth 35 6.74% WACC @ Equity Beta of 0.72; DPS of $1.75 Note: Represents current portfolio of 1,883 MW, plus 2015 announced acquisitions of 788 MW, plus operating assets in warehouse of 1,186, less the initial IPO portfolio of 808MW, for a net total of 3,049 MW Yield Dispersion of Drop Down and M&A Activity Since IPO Weighted Average Yield of 8.30% Average Spread of 1.56%

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Brian Wuebbels, CFO of SunEdison SunEdison Business Model Value Creation

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Congruent Growth Platform 37 General Partner SUNE: Shareholders Common Dividends + IDRs Utility Solar and Wind Third-Party Partners (e.g. Renova, etc.) DG: RSC/C&I Solar + + + Warehouse Vehicles + TERP GLBL Public Shareholders And Private Investors Future Dividends Long Term Dividend Growth + Predictable Returns Contracted Cash flows 1 2 3 2

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 x 5 = Platform Creates Value at DevCo and GP Level (North America Utility Example) 38 ($ / Watt Unless Otherwise Noted) 2016 2017 TERP Levered Yield 8.0% 9.5% 11.0% 8.0% 9.5% 11.0% TERP Unlevered Yield 7.3% 8.1% 8.8% 7.3% 8.1% 8.8% TERP Purchase Price (1) $1.73 $1.56 $1.43 $1.86 $1.67 $1.54 Tax Equity Contribution (2) $0.52 $0.52 $0.52 $0.24 $0.24 $0.24 Total DevCo ASP $2.25 $2.07 $1.95 $2.10 $1.91 $1.78 All-in Costs (Including Opex) $1.80 $1.80 $1.80 $1.46 $1.46 $1.46 DevCo Operating Margin $0.45 $0.27 $0.15 $0.64 $0.45 $0.31 TERP Equity $1.10 $0.93 $0.80 $1.18 $1.00 $0.86 TERP Debt (3) $0.63 $0.63 $0.63 $0.68 $0.68 $0.68 Unlevered CAFD (4) $0.13 $0.13 $0.13 $0.14 $0.14 $0.14 Levered CAFD $0.09 $0.09 $0.09 $0.09 $0.09 $0.09 Spread vs. Cost of Equity (5) 0.03% 1.53% 3.03% 0.72% 2.22% 3.72% Incremental SUNE Dividend / Yr (6) $0.007 $0.010 $0.012 $0.008 $0.011 $0.013 Incremental SUNE IDR / Yr $0.008 $0.010 $0.011 $0.008 $0.010 $0.011 GP Multiple 40x 40x 40x 40x 40x 40x GP Value Created $0.63 $0.80 $0.92 $0.66 $0.84 $0.97 DevCo + GP Value Created $1.07 $1.07 $1.07 $1.30 $1.29 $1.29 Change YoY $0.22 $0.22 $0.22 C E A B D B E A B D C ÷ ÷ C + = 1. Total cash consideration (including HoldCo Debt) and assumed project debt 2. Tax equity equal to 25% of 9.5% case ASP (e.g. fixed with respect to varying TERP ASPs) 3. Total debt, including project-level and HoldCo, sized equal to 5.0x unlevered CAFD. Cost of debt 6.00% 4. Unlevered CAFD before debt service, after payments to tax equity investors 5. Cost of equity equal to 7.28% 6. Incremental DPS calculated based upon ASP less project and HoldCo debt divided by shares being issued at a price equal to a 4.5% yield on the post- announcement DPS. Incremental SUNE Dividend / Yr is the incremental dividend from its total 60M shares owned

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 39 Q&A

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 40 Appendix

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 SunEdison’s Consolidated Debt Overview 41 Non- Recourse Obligations • $466mm First Reserve Warehouse Term Loan • $280mm TERP Private Warehouse Term Loan • $410mm 2017 Margin Loan • $328mm 2020 Exchangeable Notes • $460mm Acquisition Facility • $370mm SMP Ltd. Credit Facility • $2,334mm Pre-, Construction, and Term-debt • $1,461mm Financing Leaseback • $236mm Other Credit Facilities Total = $6,345mm Non- Recourse Obligations • $1,320mm System Financing Recourse Obligations • $947mm 2023 Senior Notes2 1. LC Indebtedness is not a balance sheet item 2. Non-recourse to SunEdison Recourse Obligations • $690mm Letter of Credit Facility1 • $249mm 2018 Convertible Senior Notes • $445mm 2020 Convertible Senior Notes • $220mm 2021 Convertible Senior Notes • $338mm 2022 Convertible Senior Notes • $303mm 2023 Convertible Senior Notes • $281mm 2025 Convertible Senior Notes • $8mm Pre-, Construction, and Term-debt • $266mm Other Credit Facilities Total = $2,800mm

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 SUNE - 2Q'15 Summary Results 42 (in millions) Renewable Energy Development TerraForm Power Consolidating Adjustments Consolidated Net sa les $ 329 $ 130 $ (4) $ 455 Cost of goods sold 286 70 (4) 352 Gross profi t 43 60 - 103 Operating expenses : Marketing and adminis tration 239 20 - 259 Long-l ived asset impairment charges 17 - - 17 Operating (loss ) income (213) 40 - (173) Non-operating expense (income): Interest expense 110 36 - 146 Interest income (12) - - (12) Loss (ga in) on early extinguishment of debt 75 (11) - 64 Other, net (3) (15) - (18) Total non-operating expense 170 10 - 180 Gain (Loss ) from continuing operations before income tax (benefi t) expense and equity in (loss ) earnings of equity method investments (383) 30 - (353) Income tax (benefi t) expense (106) 1 - (105) Gain (Loss ) from continuing operations before equity in loss of equity method investments (277) 29 - (248) Equity in loss of equity method investments , net of tax (8) - - (8) Income (Loss ) from continuing operations (285) 29 - (256) (Loss ) income from discontinued operations , net of tax - - - - Net loss (income) (285) 29 - (256) Net loss (income) attributable to noncontrol l ing interests and redeemable noncontrol l ing interests 4 (11) - (7) Net income (loss ) attributable to SunEdison s tockholders $ (281) $ 18 $ - $ (263)

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 SUNE – 2Q’15 YTD Segment Cash Flow 43 (in millions) Renewable Energy Development TerraForm Power Disc Ops + Consol Adj Consolidated SunEdison Net (Loss) Income $ (506) $ (55) $ (119) $ (680) Depreciation, Amortization 109 87 10 206 Stock Compensation 29 7 1 37 Deferred Tax (Expense) Benefit (220) 1 - (219) Deferred Revenue (38) (1) - (39) Restructuring & Impairment Charges 70 - - 70 Loss on Sale of Equity Interest in SSL - - 123 123 Loss on Extinguishment of Debt 75 9 - 84 Other non-Cash 19 2 - 21 Other Operating (501) (15) (16) (532) Operating Cash Flow $ (963) $ 35 $ (1) $ (929) Construction of renewable energy systems & Capex (974) (351) 329 (996) Contribution of renewable energy systems 343 - (343) - Proceeds from sale of equity interest in SSL 188 - - 188 Cash paid for acquisitions, net of cash acquired (1,176) (1,005) - (2,181) Change in intercompany note balances 15 (15) - - Other (666) (6) (9) (681) Investing Cash Flow $ (2,270) $ (1,377) $ (23) $ (3,670) Proceeds from short-term and long-term debt 3,803 1,457 - 5,260 Principal payments on short-term and long-term debt (595) (942) - (1,537) Proceeds from TerraForm equity offerings 136 922 - 1,058 Net parent investment and other intercompany financing activity 53 (53) - - Contributions from noncontrolling interests 641 28 - 669 Dividends paid by TerraForm Power 17 (51) - (34) Other (304) (97) - (401) Financing Cash Flow $ 3,751 $ 1,264 $ - $ 5,015 Effect of Fx on cash & cash equivalents (2) - (1) (3) Cash Used by Discontinued Operations - - (25) (25) Total Cash Flow - Continued Operations $ 516 $ (78) $ - $ 438

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 a. Reflects all costs of doing business associated with the forecast operating portfolio, including expenses paid by SunEdison in excess of the payments received under the Management Services Agreement, and stock compensation expense. Excludes expenses associated with acquisition and financing activities b. Includes non-recurring and other non-cash expenses including loss on extinguishment of debt, acquisition and other non-operating expenses, and loss on foreign exchange associated with the revaluation of intercompany loans c. Adjusted EBITDA and cash available for distribution are non-GAAP measures. You should not consider these measures as alternatives to net income (loss), determined in accordance with GAAP, or net cash provided by operating activities, determined in accordance with GAAP (in thousands) Year Ended December 31, 2015 Operating revenues $ 493,000 Operating costs and expenses: Costs of operations 109,700 Depreciation, amortization and accretion 170,400 General and administration (a) 25,700 Other non-recurring or non-cash expenses (b) 55,300 Total operating costs and expenses 361,100 Operating income 131,900 Interest expense, net 123,200 Other income (1,400 ) Income before income tax expense 10,100 Income tax expense 2,100 Net income $ 8,000 Add: Depreciation, amortization and accretion $ 170,400 Interest expense, net 123,200 Income tax expense 2,100 Other non-recurring or non-cash expenses 55,300 Stock-based compensation 15,700 Other 7,400 Adjusted EBITDA (c) $ 382,100 TERP Reg. G: 2015 Reconciliation of Net Income to Adjusted EBITDA 44 Note: Unaudited

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 a. Primarily represents contributions received from SunEdison pursuant to the Interest Payment Agreement, which we expect will be satisfied upon the scheduled interest payment on the Senior Notes in August, 2017 (in thousands) Year Ended December 31, 2015 Adjustments to reconcile net income to net cash provided by operating activities: Net income $ 8,000 Depreciation, amortization and accretion 170,400 Non-cash items 23,700 Changes in assets and liabilities 8,500 Other non-recurring or non-cash expenses 55,300 Net cash provided by operating activities $ 265,900 Adjustments to reconcile net cash provided by operating activities to cash available for distribution: Net cash provided by operating activities $ 265,900 Changes in assets and liabilities (8,500 ) Deposits into/withdrawals from restricted cash accounts 15,200 Cash distributions to non-controlling interests (23,300 ) Scheduled project-level and other debt service and repayments (35,800 ) Non-expansionary capital expenditures (13,000 ) Contributions received pursuant to agreements with SunEdison (a) 16,500 Other 8,000 Estimated cash available for distribution $ 225,000 TERP Reg. G: 2015 Reconciliation of Net Income to CAFD 45 Note: Unaudited

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 46 TERP Reg. G: Full Year 2016 Pro Forma Reconciliation of Run-Rate Net Income to Adjusted EBITDA a. Reflects all costs of doing business associated with the forecast operating portfolio, including expenses paid by SunEdison in excess of the payments received under the Management Services Agreement, and stock compensation expense. Excludes expenses associated with acquisition and financing activities b. Includes non-recurring and other non-cash expenses including loss on extinguishment of debt, acquisition and other non-operating expenses, and loss on foreign exchange associated with the revaluation of intercompany loans c. Adjusted EBITDA and cash available for distribution are non-GAAP measures. You should not consider these measures as alternatives to net income (loss), determined in accordance with GAAP, or net cash provided by operating activities, determined in accordance with GAAP (in thousands) Full Year Run-Rate Operating revenues $ 716,500 Operating costs and expenses: Costs of operations 147,300 Depreciation, amortization and accretion 280,400 General and administration (a) 27,700 Other non-recurring or non-cash expenses (b) 55,200 Total operating costs and expenses 510,600 Operating income 205,900 Interest expense, net 178,800 Other income (1,300) Income before income tax expense 28,400 Income tax expense 5,800 Net income $ 22,600 Add: Depreciation, amortization and accretion $ 280,400 Interest expense, net 178,800 Income tax expense 5,800 Other non-recurring or non-cash expenses 55,200 Stock-based compensation 15,800 Other 8,000 Adjusted EBITDA (c) $ 566,600 Note: Unaudited

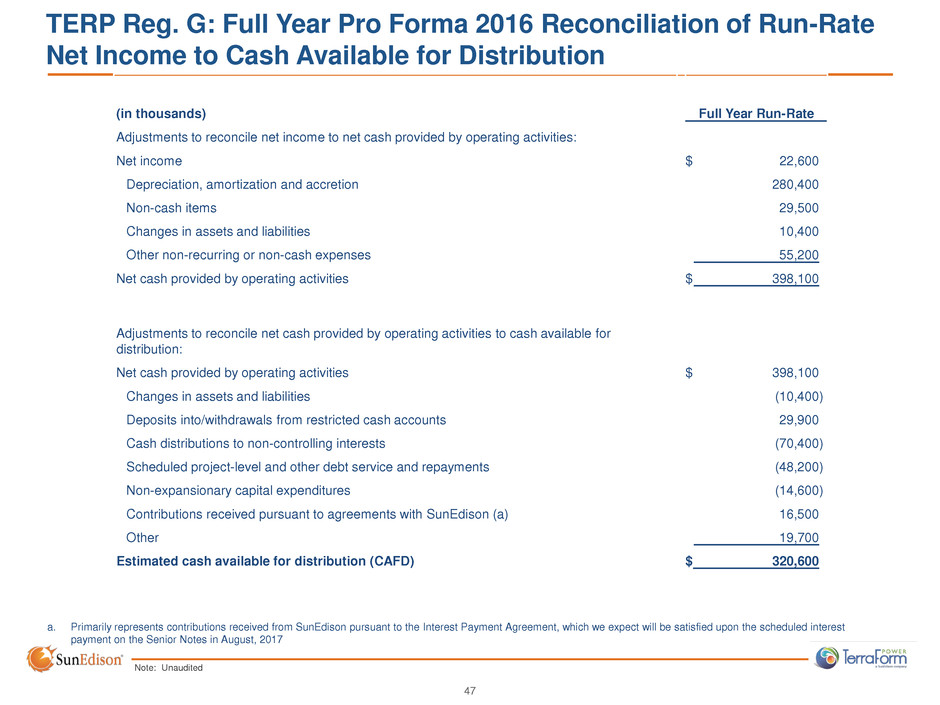

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 (in thousands) Full Year Run-Rate Adjustments to reconcile net income to net cash provided by operating activities: Net income $ 22,600 Depreciation, amortization and accretion 280,400 Non-cash items 29,500 Changes in assets and liabilities 10,400 Other non-recurring or non-cash expenses 55,200 Net cash provided by operating activities $ 398,100 Adjustments to reconcile net cash provided by operating activities to cash available for distribution: Net cash provided by operating activities $ 398,100 Changes in assets and liabilities (10,400 ) Deposits into/withdrawals from restricted cash accounts 29,900 Cash distributions to non-controlling interests (70,400 ) Scheduled project-level and other debt service and repayments (48,200 ) Non-expansionary capital expenditures (14,600 ) Contributions received pursuant to agreements with SunEdison (a) 16,500 Other 19,700 Estimated cash available for distribution (CAFD) $ 320,600 47 TERP Reg. G: Full Year Pro Forma 2016 Reconciliation of Run-Rate Net Income to Cash Available for Distribution a. Primarily represents contributions received from SunEdison pursuant to the Interest Payment Agreement, which we expect will be satisfied upon the scheduled interest payment on the Senior Notes in August, 2017 Note: Unaudited

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Adjusted EBITDA: A supplemental non-GAAP financial measure which eliminates the impact on net income of certain unusual or non-recurring items and other factors that we do not consider indicative of future operating performance. This measurement, which is used by TerraForm Power, Inc., is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance, including net income. The presentation of Adjusted EBITDA should not be construed as an inference that future results will be unaffected by unusual or non-recurring items. We believe Adjusted EBITDA is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance and debt service capabilities. In addition, Adjusted EBITDA is used by our management for internal planning purposes and for analysis of performance. See the reconciliation and detailed definition of this TerraForm Power non-GAAP measure in the press release issued by TerraForm Power today and furnished by TerraForm Power in a Form 8-K. Gross Annualized Unlevered CAFD: 12 months of post-completion project operating cash flow, calculated as project revenue, inclusive of cash received directly or indirectly due to governmental incentive programs (including but not limited to feed-in-tariffs, and sale or allocation of solar renewable energy credits, production tax credits, etc.), less project operating expenses but prior to interest payments for project level debt and payments to tax equity investors. Gross Annualized Unlevered CAFD is an operational measure that is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance, including net income, net cash provided by (used in) operating activities or any other liquidity measure determined in accordance with GAAP, nor is it indicative of funds available to fund our cash needs. We believe Gross Annualized Unlevered CAFD is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance. In addition, Gross Annualized Unlevered CAFD is used by our management team for internal planning purposes and for analysis of performance. Backlog: A project that qualifies for pipeline that has an associated executed PPA, other executed off-take agreement, such as a feed-in-tariff, or an un-executed, alternative energy off-take agreement (i.e. hedge) in advanced stages of negotiation and in a liquid market where the off-take agreement is readily available. Definitions 48 3%

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Cash Available for Distribution (CAFD): net cash provided by operating activities as adjusted for certain other cash flow items that we associate with our operations. CAFD is a supplemental non-GAAP measure used by TerraForm Power, Inc. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance, including net income, net cash provided by (used in) operating activities or any other liquidity measure determined in accordance with GAAP, nor is it indicative of funds available to fund our cash needs. We believe cash available for distribution is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance. In addition, cash available for distribution is used by our management team for internal planning purposes and for analysis of performance. See the detailed definition and reconciliation of this TerraForm Power non-GAAP measure in the press release issued by TerraForm Power today and furnished by TerraForm Power in a Form 8-K. Delivered MW: The aggregate of Retained MW and 3rd Party Sales MW for the period. Lead: An early stage project for which a potential customer or offtake has been identified. MW: All references to watts (e.g., Megawatts, Gigawatts, MW, GW, etc.) refer to measurements of direct current, or “DC,” with respect to solar generation assets, and measurements of alternating current, or “AC,” with respect to wind generation assets. Represents the nameplate production capacity. Nameplate capacity for solar projects represents the maximum generating capacity at standard test conditions of a facility. Nameplate capacity for wind facilities represents the manufacturer’s maximum nameplate generating capacity of each turbine multiplied by the number of turbines at a facility. Pipeline: A project with either a signed or awarded PPA or other energy offtake agreement or that has achieved each of the following three items: a) site control, b) an identified interconnection point with an estimate of the interconnection costs, and c) a determination that there is a reasonable likelihood that an energy offtake agreement will be signed. Definitions 49 3%

15-118-187 147-201-73 228-112-30 127-127-127 32-85-138 64-64-64 89-89-89 244-168-30 Font is Arial; Main Color is 64-64-64 Qualified Lead: A project with an identified customer or offtake and more clearly identified characteristics including but not limited to governmental program qualification and interconnection point. Retained MW: Represents the number of MW for completed projects and percentage of completion for projects under construction during that period that are associated with the expected receipt of ongoing cash flow due to control or contract with SunEdison, a subsidiary, or affiliate. Retained Annualized Unlevered CAFD: Gross Annualized Unlevered CAFD associated with Retained MW. Retained Annualized Unlevered CAFD is an operational measure that is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance, including net income, net cash provided by (used in) operating activities or any other liquidity measure determined in accordance with GAAP, nor is it indicative of funds available to fund our cash needs. We believe Retained Annualized Unlevered CAFD is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance. In addition, Retained Annualized Unlevered CAFD is used by our management team for internal planning purposes and for analysis of performance. TERP Drops: Represents the number of MW for completed and operational projects that were dropped down to TerraForm during the period. 3rd Party Sales MW: Represents the number of MW for completed projects and percentage of completion for projects under construction during the period that will be sold to third parties. Also included are cash sales through channel partners including installations, kits, modules, solar water pumps, and other residential and small commercial equipment and system sales. Under Construction: A project within pipeline and backlog, in various stages of completion, which is not yet operational. Definitions 50 3%