Attached files

| file | filename |

|---|---|

| EX-3.2 - EXHIBIT 3.2 - FITBIT, INC. | exhibit32.htm |

| EX-3.1 - EXHIBIT 3.1 - FITBIT, INC. | exhibit31.htm |

| EX-32.1 - EXHIBIT 32.1 - FITBIT, INC. | exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - FITBIT, INC. | exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - FITBIT, INC. | exhibit311.htm |

| 10-Q - FORM 10-Q - FITBIT, INC. | fitbit06301510q.htm |

OFFICE LEASE

Property: 199 Fremont Street, San Francisco, CA

Landlord: GLL BIT Fremont Street Partners, L.P.,

a California limited partnership

Tenant: Fitbit Inc.,

A Delaware corporation

1 | SALIENT LEASE TERMS. | 1 | ||

1.1 | Rent Payment Address: | 1 | ||

1.2 | Parties and Notice Address: | 1 | ||

1.3 | Facility/Building/Premises: | 2 | ||

1.4 | Term: | 4 | ||

1.5 | Rent: | 5 | ||

1.6 | Deposit: | 7 | ||

1.7 | Permitted Uses: | 7 | ||

1.8 | Tenant’s Percentage Share: | 8 | ||

1.9 | Base Years: | 8 | ||

1.1 | Brokers: | 8 | ||

1.11 | Tenant’s Parking Privileges: | 8 | ||

1.12 | Guarantor: | 8 | ||

1.13 | Contents: | 8 | ||

2. | LEASE OF PREMISES | 9 | ||

2.1 | Demising Clause. | 9 | ||

2.2 | Description. | 10 | ||

2.3 | Delivery of Premises. | 10 | ||

3. | USES | 12 | ||

3.1 | Permitted Uses. | 12 | ||

3.2 | Restriction on Use. | 13 | ||

3.3 | Compliance with Laws. | 14 | ||

3.4 | Sustainable Building Operations. | 14 | ||

3.5 | Recycling and Waste Management. | 15 | ||

3.6 | Carbon Credits. | 15 | ||

4. | ENERGY MANAGEMENT | 15 | ||

5. | RENT | 16 | ||

5.1 | Minimum Monthly Rent. | 16 | ||

5.2 | Definition of Rent; Prorations. | 16 | ||

5.3 | Place and Manner of Payment. | 16 | ||

5.4 | Late Charges. | 16 | ||

5.5 | Time of Payment. | 17 | ||

i | ||

5.6 | Partial Payments. | 17 | ||

5.7 | Electricity to the Premises. | 17 | ||

6. | PAYMENT OF TAXES, ASSESSMENTS, AND OPERATING EXPENSES | 18 | ||

6.1 | Tenant’s Percentage Share. | 18 | ||

6.2 | Taxes and Assessments. | 18 | ||

6.3 | Operating Expense Increases. | 21 | ||

6.4 | Allocations of Certain Costs. | 26 | ||

6.5 | Estimated Payments. | 26 | ||

6.6 | Statement of Expenses. | 27 | ||

6.7 | Non-Waiver of Rights. | 27 | ||

6.8 | Right to Accounting Audit. | 27 | ||

7. | SECURITY DEPOSIT | 29 | ||

7.1 | Deposit. | 29 | ||

7.2 | Letter of Credit. | 29 | ||

7.3 | No Bar or Defense to Other Remedies. | 31 | ||

8. | HAZARDOUS SUBSTANCES | 31 | ||

8.1 | Definitions. | 31 | ||

8.2 | Consent Required for Hazardous Substances. | 32 | ||

8.3 | Notices. | 32 | ||

8.4 | Compliance with Environmental Requirements. | 33 | ||

9. | NO LIGHT, AIR OR VIEW EASEMENT | 34 | ||

10 | ALTERATIONS | 34 | ||

10.1 | Tenant’s Right to Make Alterations. | 34 | ||

10.2 | Installation of Alterations. | 34 | ||

10.3 | Tenant Improvements - Treatment at End of Lease. | 36 | ||

10.4 | Other Improvements in the Building. | 37 | ||

11. | REPAIR OBLIGATIONS | 37 | ||

11.1 | Tenant’s Obligations | 37 | ||

11.2 | Landlord’s Obligations. | 37 | ||

12. | LIENS | 38 | ||

13. | SIGNS; NAMES OF BUILDING AND FACILITY | 39 | ||

14. | ASSIGNMENT AND SUBLETTING | 39 | ||

ii | ||

14.1 | “Transfer” Defined. | 39 | ||

14.2 | No Transfer Without Consent. | 39 | ||

14.3 | Procedure for Assignment and Subletting/Landlord’s Recapture Rights. | 40 | ||

14.4 | Conditions to Approval. | 41 | ||

14.5 | Sublease Gross Receipts. | 42 | ||

14.6 | Assignment Gross Receipts. | 43 | ||

14.7 | Joint and Several Obligations. | 43 | ||

14.8 | Non-Competition. | 44 | ||

14.9 | No Merger. | 44 | ||

14.10 | Landlord’s Right to Assign. | 44 | ||

14.11 | ERISA/UBIT. | 44 | ||

14.12 | Reasonable Standard. | 44 | ||

15. | INDEMNIFICATION; INSURANCE; ALLOCATION OF RISK | 45 | ||

15.1 | Indemnification. | 45 | ||

15.2 | Tenant’s Insurance. | 45 | ||

15.3 | Landlord’s Insurance. | 47 | ||

15.4 | Exculpation. | 48 | ||

16. | SECURITY SERVICES | 49 | ||

16.1 | Landlord’s Obligation to Furnish Security Services. | 49 | ||

16.2 | Tenant’s Right to Install Security System. | 50 | ||

17. | BUILDING SERVICES | 50 | ||

17.1 | Standard Building Services. | 50 | ||

17.2 | Additional Services. | 50 | ||

17.3 | Conservation. | 50 | ||

17.4 | Landlord’s Right to Cease Providing Services. | 51 | ||

18. | FORCE MAJEURE | 52 | ||

19. | RULES AND REGULATIONS | 52 | ||

20. | HOLDING OVER | 52 | ||

20.1 | Surrender of Possession. | 52 | ||

20.2 | Holding Over Without Consent. | 53 | ||

21. | SUBORDINATION | 53 | ||

21.1 | Subordination and Non-Disturbance. | 53 | ||

iii | ||

21.2 | Attornment. | 54 | ||

22. | ENTRY BY LANDLORD | 54 | ||

22.1 | Reservation. | 54 | ||

22.2 | Designation. | 54 | ||

22.3 | Representative. | 55 | ||

22.4 | Limitation. | 55 | ||

22.5 | Mitigation. | 55 | ||

22.6 | Emergency. | 55 | ||

23. | DEFAULTS AND REMEDIES | 55 | ||

23.1 | Events of Default. | 55 | ||

23.2 | Remedies. | 56 | ||

23.3 | Right to Cure. | 56 | ||

23.4 | Waiver of Redemption. | 56 | ||

23.5 | Remedies Cumulative. | 57 | ||

23.6 | Default by Landlord. | 57 | ||

23.7 | Landlord’s Remedies. | 58 | ||

24. | DAMAGE OR DESTRUCTION | 60 | ||

24.1 | Exclusive Remedy. | 60 | ||

24.2 | Loss Covered by Insurance. | 60 | ||

24.3 | Landlord’s Rights. | 61 | ||

24.4 | Destruction During Final Twelve Months. | 61 | ||

24.5 | Effective Date of a Lease Termination. | 61 | ||

24.6 | Abatement of Rent. | 62 | ||

24.7 | Destruction of Tenant’s Personal Property, Tenant Improvements or Property of the Tenant Parties. | 62 | ||

25. | EMINENT DOMAIN | 62 | ||

25.1 | Definitions. | 62 | ||

25.2 | Permanent Taking. | 63 | ||

26. | SALE BY LANDLORD | 64 | ||

27. | ESTOPPEL CERTIFICATES | 64 | ||

28. | REQUIREMENTS OF LANDLORD’S LENDERS | 65 | ||

28.1 | Mortgagee Protection. | 65 | ||

iv | ||

29. | CONFIDENTIALITY | 65 | ||

30. | ATTORNEYS’ FEES | 66 | ||

31. | NON-WAIVER | 66 | ||

32. | NOTICES | 66 | ||

33. | JOINT AND SEVERAL LIABILITY | 66 | ||

34. | TIME | 67 | ||

35. | SUCCESSORS | 67 | ||

36. | ENTIRE AGREEMENT | 67 | ||

37. | RESTRICTIONS ON OPTIONS | 67 | ||

37.1 | Definition. | 67 | ||

37.2 | Options Personal. | 67 | ||

37.3 | Multiple Options. | 67 | ||

37.4 | Strict Enforcement of Conditions and Limitations Upon Options. | 68 | ||

37.5 | Events of Bankruptcy. | 68 | ||

38. | RIGHT OF FIRST OFFER | 69 | ||

38.1 | Scope of Right. | 69 | ||

38.2 | Exceptions. | 69 | ||

38.3 | Procedure. | 70 | ||

38.4 | Limitations. | 70 | ||

39. | RECORDING | 70 | ||

40. | AUTHORIZATION TO SIGN LEASE | 70 | ||

41. | BROKER PARTICIPATION | 71 | ||

42. | SURVIVAL OF CERTAIN RIGHTS AND OBLIGATIONS | 71 | ||

43. | PARKING | 71 | ||

43.1 | Entitlement. | 71 | ||

43.2 | Basis of Operation. | 71 | ||

43.3 | Rates. | 71 | ||

43.4 | Licenses. | 72 | ||

43.5 | Parking Facility Operator. | 72 | ||

43.6 | Bike Racks. | 72 | ||

44 | SEVERABILITY | 72 | ||

45 | CERTAIN RIGHTS RESERVED BY LANDLORD | 72 | ||

v | ||

45.1 | Repairs. | 73 | ||

45.2 | Security. | 73 | ||

46 | WAIVER OF JURY TRIAL | 73 | ||

47 | INTERPRETATION | 74 | ||

48 | COOPERATION WITH LANDLORD’S SUSTAINABLE PRACTICES AND GOVERNMENT SPONSORED PROGRAMS | 74 | ||

48.1 | In General. | 74 | ||

48.2 | Transportation. | 74 | ||

48.3 | Assistance. | 75 | ||

49. | OFFER | 75 | ||

50. | LANDLORD’S DISCLOSURE REGARDING HAZARDOUS SUBSTANCES | 75 | ||

50.1 | In General. | 75 | ||

50.2 | Disclosures. | 75 | ||

51. | SIGNAGE | 76 | ||

51.1 | Grant of Signage Rights. | 76 | ||

51.2 | Costs and Installation. | 76 | ||

51.3 | Multi-Tenant Directory. | 76 | ||

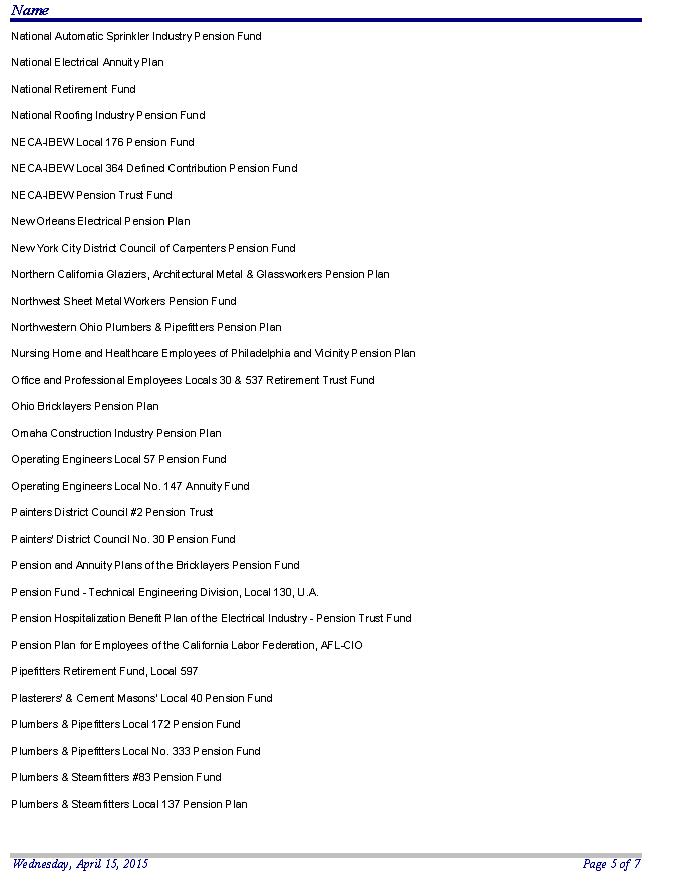

52 | LABOR COVENANT | 76 | ||

52.1 | Maintenance Covenant. | 76 | ||

52.2 | Construction Covenant. | 77 | ||

52.3 | Indemnity. | 77 | ||

52.4 | Default and Remedies. | 78 | ||

53. | ERISA AND THE CODE | 78 | ||

53.1 | ERISA Representation. | 78 | ||

53.2 | No Affiliation. | 79 | ||

53.3 | Conditions Precedent to Assignment or Sublease. | 79 | ||

54. | UBIT | 79 | ||

55. | COVENANT OF QUIET ENJOYMENT | 79 | ||

56. | EXERCISE ROOMS AND DAYCARE CENTER | 79 | ||

57. | ANTI-MONEY LAUNDERING/INTERNATIONAL TRADE LAW COMPLIANCE | 80 | ||

57.1 | Anti-Money Laundering/International Trade Law Compliance. | 80 | ||

58. | INCORPORATION | 81 | ||

vi | ||

59. | RENEWAL OPTION | 82 | ||

59.1 | Grant of Renewal Option. | 82 | ||

59.2 | Minimum Monthly Rent. | 82 | ||

60. | EXECUTION; COUNTERPARTS | 84 | ||

61. | FINANCIAL STATEMENTS | 84 | ||

62. | ROOFTOP EQUIPMENT | 84 | ||

63. | ACCESSIBILITY; AMERICANS WITH DISABILITIES ACT | 85 | ||

64. | ENERGY USE DISCLOSURE REQUIREMENTS | 86 | ||

65. | TENANT’S PROPERTY | 86 | ||

66. | GOVERNING LAW | 86 | ||

67. | AMENDMENTS | 86 | ||

68. | TIME PERIODS | 86 | ||

vii | ||

OFFICE LEASE

THIS OFFICE LEASE (this “Lease”), between the parties named below as Landlord and Tenant, is dated June __, 2015 (the “Effective Date”) for reference purposes only.

1. SALIENT LEASE TERMS.

1.1 Rent Payment Address: | GLL BIT Fremont Street Partners, L.P. Dept. 33453 P. O. Box 39000 San Francisco, CA 94139 |

1.2 Parties and Notice Address: | Landlord: GLL BIT Fremont Street Partners, L.P. 199 Fremont Street, Suite 1150 San Francisco, CA 94105 Attn: Asset Manager, 199 Fremont Street Building With a copy to: GLL BIT Fremont Street Partners, L.P. 199 Fremont Street, Suite 100 San Francisco, CA 94105 Attn: Property Manager |

Tenant: Fitbit Inc. a Delaware corporation Prior to and after the Commencement Date, Tenant’s Notice Address shall be: Fitbit, Inc. 405 Howard Street, Suite 550 San Francisco, CA 94105 Attention: Dawn Birkett | |

1 | ||

1.3 Facility/Building/Premises: | 1.3.1 Name and Location of Facility where the Building is located: 199 Fremont Street, including its underground parking garage and the adjoining sidewalks and plaza (specifically including the third floor of the “Marine Electric Building” as defined in Section 2.2.1 below, which third floor is Common Area but specifically excluding the first and second floors of such building). |

1.3.2 Street Address of Building: 199 Fremont Street, San Francisco, CA | |

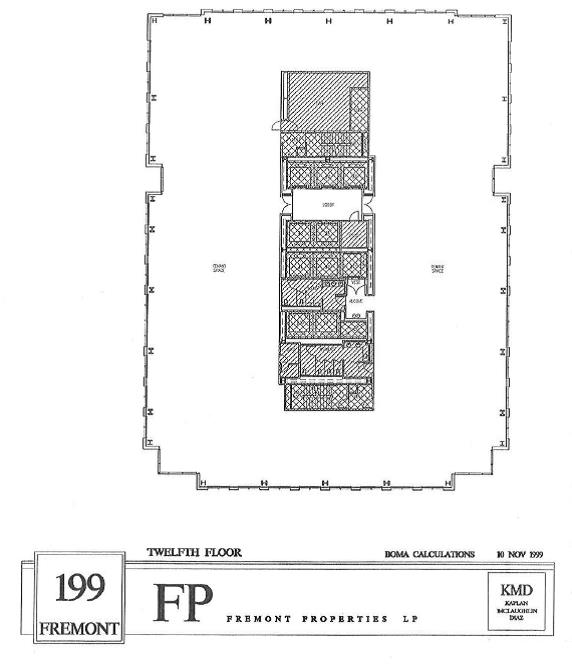

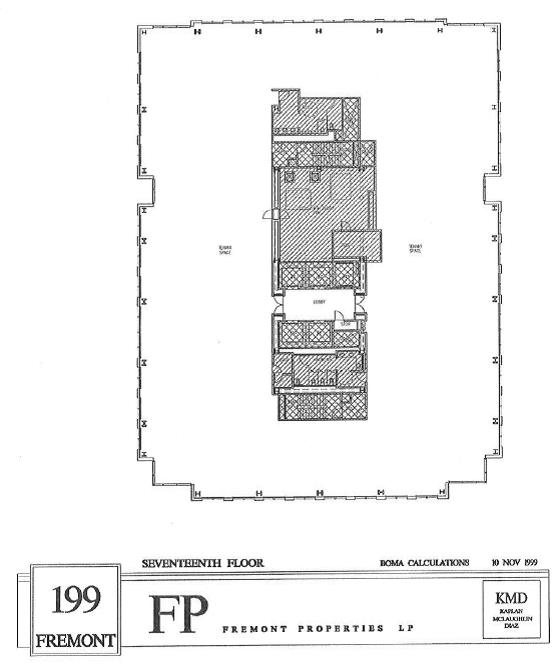

1.3.3 Premises: the entire eighth (8th) (the “Eighth Floor Premises”), ninth (9th) (the “Ninth Floor Premises”), eleventh (11th) (the “Eleventh Floor Premises”), twelfth (12th) (the “Twelfth Floor Premises”), fourteenth (14th) (the “Fourteenth Floor Premises”), fifteenth (15th) (the “Fifteenth Floor Premises”), sixteenth (16th) (the “Sixteenth Floor Premises”), seventeenth (17th) (the “Seventeenth Floor Premises”) and eighteenth (18th) (the “Eighteenth Floor Premises”) floors of the Building. The Eighth Floor Premises and the Ninth Floor Premises are sometimes hereinafter together referred to as the “Lower Premises”. The Eleventh Floor Premises, Twelfth Floor Premises, Fourteenth Floor Premises, Fifteenth Floor Premises, Sixteenth Floor Premises, Seventeenth Floor Premises and Eighteenth Floor Premises and sometimes hereinafter collectively referred to as the “Upper Premises”. | |

1.3.4 Approximate number of rentable square feet (“RSF”) of: (a) the Premises: 163,628 RSF comprised of: Eighth Floor Premises: 20,809 RSF | |

2 | ||

Ninth Floor Premises: 17,751 RSF Eleventh Floor Premises: 17,762 RSF Twelfth Floor Premises: 17,753 RSF Fourteenth Floor Premises: 17,677 RSF Fifteenth Floor Premises: 17,700 RSF Sixteenth Floor Premises: 18,221 RSF Seventeenth Floor Premises: 18,149 RSF Eighteenth Floor Premises: 17,806 RSF (b) entire Building: 393,887 RSF (c) office portion of Building: 387,876 RSF Landlord and Tenant stipulate that the number of RSF in the Premises and in the Building set forth above is conclusive and shall be binding upon them. Landlord represents that the Building has been measured in accordance with Standard Methods of Measurement - ANSI/BOMA Z65.1—1996. | |

3 | ||

1.4 Term: | Lower Premises: A period of approximately one hundred eight (108) full calendar months commencing on the later of the following dates (the “Lower Premises Commencement Date”): (i) two (2) months after the delivery of the Lower Premises to Tenant in the Required Delivery Condition (as defined in Section 2.3), or (ii) August 1, 2015. Upper Premises: A period of approximately one hundred (100) full calendar months commencing on the later of the following dates (the “Upper Premises Commencement Date”): (i) two (2) months after the delivery of the Upper Premises to Tenant in the Required Delivery Condition (as defined in Section 2.3), or (ii) April 1, 2016. The Lower Premises Commencement Date and the Upper Premises Commencement Date are sometimes hereinafter together referred to as the “Commencement Date”. Notwithstanding the foregoing, the Commencement Date for the Eleventh Floor Premises may be delayed until a date no later than June 1, 2016, as more particularly set forth in Section 2.3 herein, provided the Eleventh Floor Premises is delivered to Tenant in the Required Delivery Condition no later than April 1, 2016. The “Expiration Date” for the entire Premises shall be July 31, 2024. |

4 | ||

1.5 Rent: | 1.5.1 Minimum Monthly Rent: | |||||||||

Lower Premises: | ||||||||||

Period During Lease Term | Per Annum | Per Month | Annual Fixed Rent Per Rentable Square Foot | |||||||

Lease Year 1* | $ | 2,390,720.00 | $ | 199,226.67 | $62.00 | |||||

Lease Year 2 | $ | 2,462,441.60 | $ | 205,203.47 | $63.86 | |||||

Lease Year 3 | $ | 2,536,476.80 | $ | 211,373.07 | $65.78 | |||||

Lease Year 4 | $ | 2,612,440.00 | $ | 217,703.33 | $67.75 | |||||

Lease Year 5 | $ | 2,691,102.40 | $ | 224,258.53 | $69.79 | |||||

Lease Year 6 | $ | 2,771,307.20 | $ | 230,942.27 | $71.87 | |||||

Lease Year 7 | $ | 2,854,596.80 | $ | 237,883.07 | $74.03 | |||||

Lease Year 8 | $ | 2,940,200.00 | $ | 245,016.67 | $76.25 | |||||

Lease Year 9 | $ | 3,028,502.40 | $ | 252,375.20 | $75.54 | |||||

Upper Premises: | ||||||||||

Period During Lease Term | Per Annum | Per Month | Annual Fixed Rent Per Rentable Square Foot | |||||||

Lease Year 1* | $ | 8,004,352.00 | $ | 667,029.33 | $64.00 | |||||

Lease Year 2 | $ | 8,244,482.56 | $ | 687,040.21 | $65.92 | |||||

Lease Year 3 | $ | 8,492,117.20 | $ | 707,676.43 | $67.90 | |||||

Lease Year 4 | $ | 8,747,255.92 | $ | 728,937.99 | $69.94 | |||||

Lease Year 5 | $ | 9,009,898.72 | $ | 750,824.89 | $72.04 | |||||

Lease Year 6 | $ | 9,280,045.60 | $ | 773,337.13 | $74.20 | |||||

Lease Year 7 | $ | 9,558,947.24 | $ | 796,578.94 | $76.43 | |||||

Lease Year 8 | $ | 9,845,352.96 | $ | 820,446.08 | $78.72 | |||||

Lease Year 9 | $ | 10,140,513.44 | $ | 845,042.79 | $81.08 | |||||

*Tenant shall have no obligation to pay Minimum Monthly Rent for the first three (3) months of Lease | ||||||||||

5 | ||

Year 1 (i.e. Lower Premises Commencement Date through Month 3) for the Lower Premises and Tenant shall have no obligation to pay Minimum Monthly Rent for the first three (3) months of Lease Year 1 (i.e. Upper Premises Commencement Date through Month 3) for the Upper Premises. In the event the Commencement Date for the Eleventh Floor Premises is not the same Commencement Date as the Upper Premises Commencement Date, Tenant's obligation to pay Minimum Monthly Rent for the Eleventh Floor Premises shall not commence until the first day of the fourth (4th) month after the Commencement Date for the Eleventh Floor Premises occurs. | |

6 | ||

1.5.2 Prepaid Rent: N/A | |

1.5.3 As used in this Section 1.5, the term “Month” shall mean a full calendar month during the Term. If the Term shall commence on a day other than the first day of a calendar month, or if the Term shall expire on a day other than the last day of a calendar month, the monthly rent for such partial month shall be at the same rate as stated for such month, but prorated based upon the number of days in such calendar month. “Lease Year” shall mean each consecutive twelve (12) month period thereof during the Term, with the first (1st) Lease Year for the Lower Premises commencing on the Lower Premises Commencement Date and for the Upper Premises commencing on the Upper Premises Commencement Date, provided, however, that, if either the Lower Premises Commencement Date or the Upper Premises Commencement Date shall occur on a day other than the first (1st) day of a calendar month, then (a) the first (1st) Lease Year shall end on the last day of the twelfth (12th) full calendar month after the Lower Premises Commencement Date or the Upper Premises Commencement Date, as the case may be, and the second (2nd) and each succeeding Lease Year shall commence on the first (1st) day of the next calendar month, and (b) the last Lease Year shall end on the Expiration Date. | |

1.6 Deposit: | $13,253,868.00 (Article 7) |

1.7 Permitted Uses: | The Premises shall be used only for the uses permitted in Section 3.1. |

7 | ||

1.8 Tenant’s Percentage Share: | FULL BUILDING EXPENSE SHARE: Lower Premises: 9.79 percent Upper Premises: 31.75 percent Total: 41.54 percent OFFICE ONLY EXPENSE SHARE: Lower Premises: 9.94 percent Upper Premises: 32.25 percent Total: 42.19 percent (Section 6.1) |

1.9 Base Years: | The Base Expense Year for Operating Expenses shall be calendar year 2016, and the Base Tax Year shall be calendar year 2016. |

1.10 Brokers: Landlord’s Broker: | Avison Young – Northern California, Ltd. |

Tenant’s Broker: | Savills Studley |

1.11 Tenant’s Parking Privileges: | Parking in the garage of the Building for up to thirty-three (33) automobiles (based on 1 parking permit for each 5,000 RSF of Premises delivered). Tenant shall be assessed monthly parking charges. In Landlord’s sole discretion, the parking garage may be leased to a parking operator who shall be responsible for providing such services. (Article 43) |

1.12 Guarantor: | N/A |

1.13 Contents: | This Lease consists of: All Articles, plus the Exhibits listed on the Table of Contents page attached to this Lease. |

8 | ||

2. LEASE OF PREMISES

2.1 Demising Clause.

2.1.1 Landlord hereby leases to Tenant, and Tenant hires from Landlord, the Premises, together with the nonexclusive right to the use and enjoyment of the “Base Building Systems” and the “Common Area” for the entire Term. “Base Building Systems” shall mean the Building’s HVAC, life-safety, plumbing, electrical, and mechanical systems. “Common Area” shall mean and refer to the parking facilities, walkways, elevators, stairwells, multi-tenant floor corridors, multi-tenant floor bathrooms, multi-tenant floor corridor fountains, multi-tenant floor corridor elevator lobbies, lobbies, plazas, landscaped areas, loading docks and driveways serving the Building and located at the Facility and other common facilities designated by Landlord from time to time for the common use of all tenants of the Building, together with any day care facility at the Facility, and the “Exercise Room” described in Article 56 below. Said letting and hiring are upon and subject to the terms, covenants, and conditions set forth in this Lease, including the “Salient Lease Terms” in Article 1 and the attached exhibits. Tenant covenants as a material part of the consideration for this Lease to keep and perform each and all of said terms, covenants, and conditions applicable to Tenant hereunder. This Lease is made upon the condition of such performance.

2.1.2 Landlord reserves to Landlord the areas beneath and above the Premises and the use thereof together with the right to install, maintain, use, repair and replace pipes, ducts, conduits, wires, and structural elements leading through the Premises and serving other parts of the Facility, so long as such items are concealed by walls, flooring or ceilings. Landlord reserves the right to affect such other tenancies in the Building as Landlord may elect in its reasonable business judgment, which tenancies shall be consistent with the first class nature of the Building and similar to other tenancies located in Comparable Buildings. Notwithstanding the foregoing, Landlord shall not lease space in the Building or the Facility on a direct basis to Jawbone or Garmin.

2.1.3 For the avoidance of doubt, Tenant shall have the exclusive use of the roof deck located on the Ninth Floor Premises (the “Roof Deck”) and the same shall be deemed a part of the Premises for all purposes herein (except that Tenant shall not be required to pay any additional rental in connection therewith). Notwithstanding the foregoing, Landlord shall be permitted access to the Roof Deck from time to time for the purpose of performing periodic Building maintenance activities. In the event Tenant elects to construct improvements on or in connection with the Roof Deck (the “Deck Improvements”), (a) Tenant shall present plans for said construction to Landlord for its prior approval, which shall not be unreasonably withheld, conditioned or delayed, (b) Landlord shall provide a one-time allowance in the amount of up to $100,000.00 (the “Deck Allowance”) to be applied to the costs incurred in connection with the Deck Improvements, said Deck Allowance to be paid to Tenant upon presentation of final permits, paid invoices and other evidence and documentation reasonably satisfactory to Landlord including, but not limited to, lien waivers and contractor’s certificates and (c) the obtaining of all required permits and governmental approvals (which shall be obtained prior to the commencement of any construction) and all costs incurred in connection with the Deck Improvements (except for the Deck Allowance) shall be the sole responsibility of Tenant.

9 | ||

2.1.4 During the Term, as may be extended, Tenant shall have the option to lease the storage spaces B-313 and B-314 consisting of approximately 113 rentable square feet located in the basement of the Building (each, a “Storage Space”) upon written notice to Landlord. If Tenant elects to lease one or both of the Storage Spaces, Tenant shall pay Landlord rent for such Storage Space at the rate of Three and 00/100 Dollars ($3.00) per rentable square foot per month. The foregoing right to lease any Storage Space is explicitly subject to availability at the time of Tenant’s notice and Landlord makes no representation that the Storage Space will remain or be available at such time.

2.2 Description.

As used herein, the following capitalized terms shall have the indicated meanings:

2.2.1 The “Facility” shall mean that certain real property, including the high-rise office Building and the land on which such Building and plaza area are situated (specifically including any day care center that may be located on the third floor of that certain building located at 342 Howard Street and commonly known as the “Marine Electric Building,” as Common Area, the third floor of the Marine Electric Building, and an undivided one-third (1/3) interest in the land under the Marine Electric Building [but specifically excluding the first and second floors of the Marine Electric Building and an undivided two-thirds (2/3) interest in the land under the Marine Electric Building]; or, if a day care center is located elsewhere, the area used for the day care center and an equitable proportion of the land on which the day care center is located), the Building and Common Areas described in Exhibit A-1 attached hereto, said real property being described in Section 1.3.1 above.

2.2.2 The “Building” shall mean that certain building constituting a part of the Facility and located at the address described in Section 1.3.2 above.

2.2.3 The “Premises” shall mean that certain space located in the Building and described in Section 1.3.3 above and delineated on Exhibit A-2 attached hereto, which space will consist of the amount of rentable square footage specified in Section 1.3.4.

2.2.4 The “Term” shall mean, with respect to any portion of the Premises, the period commencing upon the Commencement Date and ending on the Expiration Date (both as defined in Sections 1.4 above).

2.3 Delivery of Premises.

Except as otherwise expressly stated in this Lease, Tenant shall accept the Premises in their “AS-IS” condition on the date of delivery. The Lower Premises shall be delivered to Tenant in the Required Delivery Condition on the date that is two (2) business days following the execution of this Lease by Landlord and Tenant. If Landlord has not delivered the Lower Premises to Tenant in the Required Delivery Condition on the date that is thirty (30) days following the execution of this Lease by Landlord and Tenant, subject to Force Majeure, Tenant shall be entitled to one (1) day of free Minimum Monthly Rent for each day of delay in delivering the Lower Premises to Tenant in the Required Delivery Condition beginning on the thirty-first (31st) day following the

10 | ||

execution of this Lease by Landlord and Tenant until the Lower Premises are delivered to Tenant in the Required Delivery Condition, which free rent period shall commence after the expiration of three (3) month abatement period set forth in Section 1.5 above. If Landlord has not delivered the Lower Premises to Tenant in the Required Delivery Condition by that date that is sixty (60) days after the execution of this Lease by Landlord and Tenant, Tenant shall have the right to terminate this Lease upon ten (10) days prior written notice to Landlord. Notwithstanding the foregoing, Tenant acknowledges and agrees that, as of the Effective Date of this Lease, the Upper Premises (the “Occupied Premises”) is occupied by another tenant (the “Existing Tenant”), and that Landlord shall have no obligation to seek to obtain possession of the Occupied Premises from the Existing Tenant until after December 31, 2015 (the “Anticipated Repossession Date”). In the event the Existing Tenant remains in possession of the Occupied Premises, or any portion thereof, after the Anticipated Repossession Date, Landlord agrees to use commercially reasonable efforts, including, if necessary, commencing and diligently pursuing any summary proceedings, to obtain possession of the Occupied Premises from the Existing Tenant. Landlord agrees to deliver possession of the Occupied Premises in the Required Delivery Condition to Tenant upon the earlier to occur of (a) January 1, 2016, or (b) within five (5) days after Landlord obtains possession thereof from the Existing Tenant. If, despite Landlord’s commercially reasonable efforts, Landlord is unable to deliver possession of the Occupied Premises in the Required Delivery Condition to Tenant within one hundred twenty (120) days after the Anticipated Repossession Date, Tenant shall be entitled to one (1) day of free Minimum Monthly Rent for each day of delay in delivering the Occupied Premises to Tenant in the Required Delivery Condition until the Occupied Premises are delivered to Tenant in the Required Delivery Condition, which free rent period shall commence after the expiration of three (3) month abatement period set forth in Section 1.5 above. If, despite Landlord’s commercially reasonable efforts, Landlord is unable to deliver possession of the Occupied Premises to Tenant in the Required Delivery Condition within two hundred forty (240) days after the Anticipated Repossession Date, then either Landlord or Tenant may terminate this Lease at any time thereafter upon ten (10) days’ advance written notice to the other party (provided that if Landlord obtains possession of the Premises within such ten (10) day period after Tenant provides notice, the termination notice shall be deemed null and void), without cost or penalty to either party.

In addition, and notwithstanding the foregoing, Landlord may delay delivery of the Eleventh Floor Premises, upon written notice to Tenant, to a date no later than April 1, 2016. In the event of a delay in delivery of the Eleventh Floor Premises, as aforesaid, the Commencement Date for the Eleventh Floor Premises shall likewise be delayed on a day-for-day basis to a date no later than June 1, 2016.

Notwithstanding anything in this Lease to the contrary, Landlord shall deliver the Premises to Tenant in the Required Delivery Condition. As used in this Lease, the term “Required Delivery Condition” means that each applicable floor or portion of a floor comprising the Premises has been delivered to Tenant (a) free of tenants or other occupants, (b) with the Base Building Systems in good condition and repair, and (c) in broom-clean condition, without any debris, personal property or trade fixtures of any prior occupant.

11 | ||

3. USES

3.1 Permitted Uses.

The Premises shall be used for general office use and hardware lab for the research, testing and prototyping of Tenant’s products in its business of developing mobile software applications and accessories for use in the health and wellness industry, commercial cafeteria (including a kitchen), all hands meeting space for assembly, and related uses incidental thereto and no other use. Tenant shall not use the Premises for any other use or purpose besides those permitted under this Section 3.1. Tenant’s use of the Premises shall be consistent with the character of those Class A high-rise office buildings in the San Francisco Financial District which are perceived in the marketplace to be similar to the Facility, taking into account the size, age, quality, tenant-mix, and location within the sub-areas of the Financial District, as such market perception may change over time, depending upon future development in downtown San Francisco (“Comparable Buildings”) and shall not unreasonably interfere with the use of the Building by other tenants or occupants thereof. Tenant shall not use or operate the Premises or permit the Premises to be used or operated in any manner that will cause the Building or any part thereof not to conform to Landlord’s sustainability practices or the LEED-EBOM certification of the Building described in Section 3.4 below.

Tenant’s permitted lab use shall be subject to the following conditions: (i) such hardware labs shall be located at not more than four (4) separate locations in the Premises unless otherwise approved by Landlord in its reasonable discretion, (ii) the use of such portions of the Premises as hardware labs shall be consistent with office occupancy and shall not include any manufacturing or production or life science or chemical laboratories; (iii) the use of such portions of the Premises as hardware labs shall not include the use of any Hazardous Substances other than those normally utilized in connection with typical office occupancy or as provided below; and (iv) Tenant shall not sublease any hardware lab to any sub-tenant separate and apart from a bona fide sublease of office space where the predominant use of the subleased premises is for office purposes and the subtenant’s use of the hardware lab is ancillary to its use of the balance of the subleased premises for office purposes. Landlord and Tenant recognize that Tenant’s use of the hardware labs may include Tenant’s use of reasonable amounts of the Hazardous Substances listed on Schedule 1 attached to this Lease (“Substances”) and Tenant shall not be considered to be in violation of the foregoing provision by virtue of the use of such Substances in quantities reasonably necessary for Tenant’s use of the hardware lab for the purposes herein described provided and so long as (1) Tenant’s use, storage, generation and disposition of such Substances shall be in accordance with and subject to the provisions of Sections 8 and 50 of this Lease, and (2) all flammable Substances will be stored in a fire-proof cabinet in the hardware lab. Landlord reserves the right to require Tenant, at its expense, to take remedial measures to address any deleterious effects of the use of the Premises, or applicable portion thereof, as hardware labs, including without limitation, to address the presence of such Substances in the Premises or Building, installing adequate venting and filtration of any smoke, fumes, vapors or odors generated by the use of the Premises or applicable portion thereof, as a hardware lab and installing one arm extraction system at each soldering station.

12 | ||

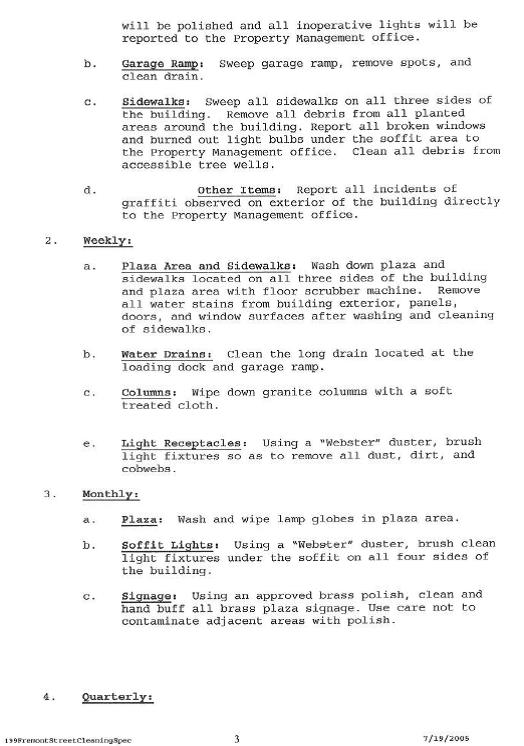

To the extent Tenant uses any portion of the Premises for a commercial cafeteria, the following provisions shall apply;

(a) Tenant shall, at Tenant’s sole cost and expense, cause the Premises to be exterminated from time to time, to the satisfaction of Landlord, as is necessary to prevent the presence of vermin, rodents or other pests therein, and shall employ exterminators which are approved by Landlord. In addition, Tenant shall be responsible, at its sole cost and expense, for the removal of its cafeteria-related trash and rubbish. In the event Landlord has established or should establish a common trash and rubbish removal or disposal program at the Building for such trash removal, Tenant shall participate in such program. All garbage and refuse shall be stored, handled and transported in such manner as will prevent odors and vermin. Any janitorial requirements not covered by Landlord’s Janitorial Specifications attached hereto as Exhibit H shall be the sole responsibility of Tenant. Under no circumstances may garbage be stored at or picked up from any service corridor. Tenant shall be responsible for any spillage or residue of garbage and refuse from the Premises outside of the Premises and shall immediately remove such spillage or residue upon its occurrence.

(b) Tenant shall install grease traps in the Premises in order to eliminate the problem of sewer back-up and health hazards, the type and manner of installation of such grease traps being subject to Landlord’s prior written approval. In addition, Tenant shall establish a bi-monthly servicing and cleaning program with respect to any grease traps installed in the Premises pursuant to this Section and provide Landlord with written confirmation of full compliance with such service and cleaning program. In the event that Tenant shall fail to provide such confirmation, Landlord may (but shall not be obligated to) initiate such program for Tenant, and Tenant shall pay the cost of such program, plus a fifteen percent (15%) administrative fee. In addition to the bi-monthly servicing and cleaning of any grease traps installed in the Premises, Tenant shall use “Cloroben PT,” or a similar type of chemical, in all drain lines, in accordance with the manufacturer’s recommendation, to help dissolve any grease build-up. Tenant shall provide Landlord with copies of its cleaning contract for its grease traps and its extermination contracts on a yearly basis or sooner if requested by Landlord.

(c) Tenant shall keep all grease traps and kitchen exhaust systems located within the Premises in a clean and orderly condition and replace all kitchen exhaust filters on a regular basis (and in no event less than once every three (3) calendar months), and shall provide Landlord with written documentation evidencing such regular maintenance and servicing.

3.2 Restriction on Use.

Without limitation to the generality of the foregoing use restriction, Tenant specifically covenants and agrees that it shall not (a) do, bring, or keep, or permit to be done, brought, or kept, anything in or about the Premises that will in any way (i) adversely interfere with the access or other rights of any other tenants or occupants of the Facility or injure or annoy them, (ii) cause a weight load or stress on the floor or any other portion of the Premises in excess of the weight load or stress that the floor or other portion of the Premises is designed to bear, or (iii) cause or threaten a cancellation of any fire or other insurance upon the Building or its contents, (b) use the Premises,

13 | ||

or allow them to be used, for any residential or disreputable purpose; (c) sublease any portion of the Premises, or otherwise transfer occupancy, to a governmental agency, or (d) commit or suffer to be committed any waste in or upon the Premises or the Facility.

3.3 Compliance with Laws.

Tenant shall construct the Tenant Improvements in accordance with Exhibit B and all applicable Laws (as defined below). If triggered by the construction of the Tenant Improvements, any Alterations made by Tenant, or Tenant’s use of the Premises, then Tenant shall be responsible for any additional work required to cause the Premises to comply with all applicable and future laws, statutes, rules, regulations, ordinances, codes, licenses, permits, certificates of occupancy, orders, decrees, directives, judgments, approvals, plans, authorizations, and similar items of any local, state, or federal governmental or quasi-governmental authority (collectively, “Laws,” or individually, a “Law”) that impose any duty upon Landlord or Tenant with respect to the condition, use, occupancy, or alteration of the Premises, including, but not limited to, any required changes to the structural elements of the Premises such as floor shoring, elevator lobbies, corridors, and drinking fountains. Without limiting the generality of the forgoing definition, the parties expressly acknowledge that the term “Laws” shall include all Environmental Requirements (as defined below) and all Laws relating to the rights of individuals with disabilities. Tenant shall immediately furnish to Landlord any notices received from any insurance company or governmental agency or inspection bureau regarding any unsafe or unlawful conditions within the Premises. Notwithstanding the foregoing but subject to Section 10.4, Tenant shall not be required to make any changes to the base, shell or core of the Building, Common Areas, Base Building Systems or structural elements of the Premises (collectively, “Base Building”), except to the extent the same are caused or triggered by Tenant’s unique and particular use of the Premises. With respect to any changes described in the preceding sentence, Tenant shall make such changes, subject to Landlord’s direction and supervision; provided, however, that at Landlord’s option, Landlord may make the same at Tenant’s cost. The cost of all such work performed by Landlord shall be paid by Tenant to Landlord within 30 days after Landlord has invoiced Tenant therefor. Notwithstanding the foregoing, Tenant shall not be required to perform or pay for (1) removal of any asbestos, asbestos-containing material, or other Hazardous Substances present at the Premises, the Building and/or the Facility prior to the Commencement Date, or (2) any work or other changes necessary to cure any failure of the Premises to comply with any Laws existing as of the Commencement Date for such Premises.

3.4 Sustainable Building Operations.

3.4.1 The Building has been awarded the gold certification under the United States Green Building Council’s (“USGBC”) Leadership in Energy and Environmental Design (“LEED”) for Existing Building: Operations and Maintenance (“LEED-EBOM”) rating system. Tenant acknowledges and agrees that (i) Landlord shall have the right, but not the obligation to maintain the Building’s certification under LEED-EBOM including, without limitation, having the Building recertified under LEED-EBOM every five (5) years, and (ii) Landlord shall not be in default under this Lease if Landlord fails to maintain the LEED-EBOM certification or the certification of any other green building rating system for the Building. Landlord’s sustainability practices address

14 | ||

whole-building operations and maintenance issues including chemical use; indoor air quality; energy efficiency; water efficiency; recycling programs; exterior maintenance programs; and systems upgrades to meet green building energy, water, Indoor Air Quality, and lighting performance standards.

3.4.2 Tenant shall use proven energy and carbon reduction measures, including energy efficient bulbs in task lighting; use of lighting controls; daylighting measures to avoid overlighting interior spaces; closing shades on the south side of the building to avoid over heating the space; turning off lights and equipment at the end of the work day; and purchasing ENERGY STAR® qualified equipment, including but not limited to lighting, office equipment, commercial quality kitchen equipment, vending and ice machines; and purchasing products certified by the U.S. EPA’s Water Sense® program.

3.5 Recycling and Waste Management.

Tenant covenants and agrees, at its sole cost and expense: (a) to comply with all present and future Laws of the Federal, State, county, municipal or other governing authorities, departments, commissions, agencies and boards regarding the collection, sorting, separation, and recycling of garbage, trash, rubbish and other refuse (collectively, “trash”); (b) to comply with Landlord’s recycling policy as part of Landlord’s sustainability practices where it may be more stringent than applicable Law; (c) to sort and separate its trash and recycling into such categories as are provided by Law or Landlord’s sustainability practices; (d) that each separately sorted category of trash and recycling shall be placed in separate receptacles as directed by Landlord; (e) that Landlord reserves the right to refuse to collect or accept from Tenant any waste that is not separated and sorted as required by Law or Landlord’s recycling policy, and to require Tenant to arrange for such collection at Tenant’s sole cost and expense, utilizing a contractor reasonably satisfactory to Landlord; and (f) that Tenant shall pay all costs, expenses, fines, penalties or damages that may be imposed on Landlord or Tenant by reason of Tenant’s failure to comply with the provisions of this Section.

3.6 Carbon Credits.

Landlord shall be entitled to all so-called “Carbon Credits” that may be created, credited or recoverable because of activities conducted within the Facility or the Premises, excluding Carbon Credits to which the Tenant is entitled in accordance with applicable Law. Landlord shall be entitled to allocate, acting reasonably, Carbon Credits created with the participation of the Tenant and/or other tenants in the Building.

4. ENERGY MANAGEMENT

Notwithstanding anything contained herein to the contrary, Landlord shall have the right, but not the obligation, to meet some or all of the Facility’s total energy use with on-site or off-site renewable energy systems. On-site systems may include, without limitation, photovoltaic, wind energy systems, solar thermal, biofuel-based, and geothermal energy systems. Off-site renewable energy sources may include, without limitation, solar, wind and other sources defined by the Center for Resource Solutions Green-e Energy program’s products certifications requirements, or similar

15 | ||

green power certification system. Landlord may procure off-site renewable energy from a Green-e Energy-certificated power marketer or a Green-e Energy accredited utility program, or through a Green-e Energy-certified tradable renewable energy certificates or similar program.

5. RENT

5.1 Minimum Monthly Rent.

Tenant shall pay to Landlord, as “Minimum Monthly Rent” for the Premises, the amount specified in Section 1.5.1 above. Payments of Minimum Monthly Rent shall be made in advance, on or before the first day of each calendar month during the entire Term. The first installment of Minimum Monthly Rent (for the applicable Premises) shall be payable on the first day of the fourth (4th) month of Term of such applicable Premises.

5.2 Definition of Rent; Prorations.

Any and all payments of: (i) Minimum Monthly Rent; (ii) costs of Tenant’s electricity in accordance with Section 5.7 (only if such amounts are owed to Landlord and not to a utility company); (iii) Tenant’s Percentage Share of all other electricity utilized in the Facility (specifically including, without limitation, the Common Area variable portion of the electricity which shall be grossed up to 95% occupancy) but not including space demised to third party tenants of the Building; and (iv) any and all taxes, assessments, fees, charges, costs, expenses, insurance obligations, late charges, Operating Expenses, and all other payments or reimbursements that are attributable to, payable by or the responsibility of Tenant under this Lease (including, without limitation, charges for any “above-building-standard services” requested by Tenant or Tenant’s authorized representatives from time to time), shall constitute “Rent” for all purposes of this Lease and any applicable unlawful detainer statute. Any Rent payable to Landlord by Tenant for any fractional month shall be prorated based upon the actual number of days in such calendar month.

5.3 Place and Manner of Payment.

All Rent shall be paid by Tenant to Landlord in lawful money of the United States of America at Landlord’s address set forth in Section 1.1 above, or to such other person or at such other place as Landlord may from time to time designate in writing. All payments of Minimum Monthly Rent shall be payable without prior notice or demand and all payments of Rent shall be paid, except as otherwise expressly provided herein, without deduction, setoff or counterclaim for any reason whatsoever. Payments made by check must be drawn either on a financial institution in the state where the Facility is located or on a financial institution that is a member of the Federal Reserve System. Any payment made to cure a default after receipt of a default notice must be by cashier’s check.

5.4.1 Late Charges. Tenant acknowledges that the late payment of Rent will cause Landlord to incur damages, the exact amount of which would be impractical and extremely difficult to ascertain. Such damages may include, without limitation, processing, accounting, and other administrative costs, loss of use of the overdue funds, and late charges that may be imposed on Landlord by the terms of any encumbrance and note secured by any encumbrance covering the

16 | ||

Premises. Landlord and Tenant agree that if Landlord does not receive a payment of Rent within seven (7) days after such payment becomes due, Tenant shall pay to Landlord a late charge in an amount equal to five percent (5%) of such overdue Rent. Notwithstanding the foregoing, such late charge shall not be assessed if all of the following conditions shall apply: (a) the late payment is made within five (5) days after Landlord’s written notice of delinquent payment and (b) Landlord shall not, during the 365-day period immediately preceding the due date of such late payment, have delivered to Tenant written notice of more than two (2) delinquent payments of Rent.

5.4.2 If Landlord does not receive a payment of Rent by the date such payment becomes due, Landlord shall be entitled to interest thereon computed at the interest rate of five percent (5%) per annum or, if lower, the maximum interest rate allowed by law (the “Interest Rate”).

5.4.3 The parties agree that such late charges and interest charges represent a fair and reasonable estimate of the cost that Landlord will incur by reason of late payment by Tenant. Acceptance of any late charge or interest charge by Landlord shall not cure or waive Tenant’s default nor prevent Landlord from exercising, before or after such acceptance, any of the rights and remedies for a default provided by this Lease or at law. Tenant shall be liable for late charges and interest charges regardless of whether Tenant’s failure to pay the Rent when due constitutes an Event of Default under this Lease.

5.5 Time of Payment.

Tenant agrees to pay all Rent required under this Lease within the applicable time limits set forth in this Lease. If no such time period is elsewhere specified herein for payment of a particular amount, then such amount shall be due and payable thirty (30) days after Landlord’s delivery of an invoice or demand therefor.

5.6 Partial Payments.

Payments by Tenant shall be applied against the then outstanding rental charges that first became due. No payment by Tenant or receipt by Landlord of a lesser amount than any installment or payment of Rent due shall be deemed to be other than on account of the amount due, and no endorsement or statement on any check or payment of Rent shall be deemed an accord and satisfaction. Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of such installment or payment of Rent, or pursue any other remedies available to Landlord.

5.7 Electricity to the Premises.

All electricity directly serving the Premises shall be metered, and Tenant shall pay to Landlord, as Rent at the same time and in the same manner as payment of Monthly Minimum Rent, Operating Expenses, Taxes and Assessments, an amount equal to Landlord’s estimate of the cost of all such directly metered electricity to Landlord as a reimbursement. Concurrently therewith, Tenant shall additionally pay Landlord Tenant’s Percentage Share of the estimated cost of all other electricity utilized in the Facility (specifically including, without limitation, the Common Area variable portion of the electricity which shall be grossed up to 95% occupancy) but not including

17 | ||

space demised to third party tenants of the Building. One time per calendar year, Landlord shall perform a reconciliation between such estimates and the actual costs, and notify Tenant of any deficiency or overage. Payments to Landlord of any deficiency shall be made within thirty (30) days of Landlord’s delivery of an invoice to Tenant therefor. Subject to all of the terms, conditions and limitations pertaining to Tenant’s audit right in Section 6.8 herein, Tenant shall have the right to review the books and records of the Landlord in connection with the electricity costs billed to Tenant, and audit the same at Tenant’s election. If any audit reveals that Landlord overstated the electricity costs by more than five percent (5%), Landlord shall pay the cost of such audit. Landlord shall refund to Tenant any overage in Tenant’s estimated payments to Landlord pursuant hereto. Notwithstanding the foregoing, at Landlord’s election, Tenant shall pay the electrical utility provider directly with respect to electricity directly serving the Premises.

6. PAYMENT OF TAXES, ASSESSMENTS, AND OPERATING EXPENSES

6.1 Tenant’s Percentage Share.

In addition to paying the Minimum Monthly Rent, Tenant shall pay to Landlord the percentage set forth in Section 1.8 (“Tenant’s Percentage Share”) of the amounts set forth below in Sections 6.2 and 6.3. Tenant’s Percentage Share has been calculated by dividing the RSF of the Premises by the RSF contained in the Building. Tenant’s Percentage Share shall not be subject to correction or recalculation, except as provided in connection with any expansion or contraction of the Premises (pursuant to the terms of an amendment to this Lease). In all other cases, Tenant’s Percentage Share shall be fixed during the initial Term of this Lease.

6.2 Taxes and Assessments.

6.2.1 Payment of Taxes. Tenant shall pay to Landlord an amount equal to Tenant’s Percentage Share of any increase in Taxes above the amount of Taxes accrued for the Base Tax Year set forth in Section 1.9, either by way of increase in the rate or in the assessed valuation of the Facility (or any portion thereof) or by imposition of any such charges by ordinance, statute or otherwise of any authority having jurisdiction.

(a) Definition. As used in this Article 6, the term “Taxes” shall mean all real property taxes, impositions, excises, penalties (unless due to Landlord’s negligence or willful misconduct or Landlord’s failure to pay Taxes in a timely manner), fees (including, without limitation, all license, permit and inspection fees), and other charges (but excluding Assessments, as defined in Section 6.2.2 below) assessed, levied, charged, confirmed, or imposed by and payable to any government, any political subdivision, public corporation, district, or other political or public entity or authority, including without limitation: (i) on the Facility (or any portion thereof), (ii) on Landlord with respect to the Facility (or any portion thereof), (iii) on the act of leasing or entering into leases of space in the Facility, (iv) on or measured by the Rent payable under leases of space in the Building, or (v) on personal property of Landlord used in the operation of the Facility (or any portion thereof). Such Taxes may be general or specific, ordinary or extraordinary, or of any kind or nature whatsoever, whether or not now customary or within the contemplation of the parties to this Lease. All references to Taxes herein shall be deemed to refer to taxes accrued during a particular

18 | ||

year, including supplemental tax bills, regardless of when they are actually assessed and without regard to when such taxes are payable. For the avoidance of doubt, the parties hereto acknowledge that Tenant shall only be responsible for Taxes applicable to the time period within the Term of this Lease, irrespective of the date such Taxes are actually assessed or billed. The term “Taxes” shall include, without limitation, all “Carbon Taxes” (as herein defined). The term “Carbon Tax” shall mean and refer to the aggregate of all taxes, rates, duties, levies, fees, charges and assessments whatsoever, imposed, assessed, levied, confirmed, rated or charged against or in respect of the energy consumption of the Facility or the emissions of Greenhouse Gases (as defined below) from the Facility or any part of it or levied in lieu thereof, levied against Landlord by any local, state or federal government or any agency thereof having jurisdiction. “Greenhouse Gases” shall mean any or all of carbon dioxide, methane, nitrous oxide, CFC-12, HCFC-22, Perflouroethane, Sulfur Hexaflouride and ozone.

(b) Exclusion. Notwithstanding the foregoing, federal, state, and local documentary transfer taxes, gift, franchise, inheritance and estate taxes, and income taxes shall not be included as Taxes or Assessments, nor shall the computation of increases in Taxes or Assessments for which Tenant shall pay Tenant’s Percentage Share include any amounts paid by Tenant under Sections 6.2.3 and 6.2.4 or any amounts separately billed to a particular tenant of the Facility with respect to similar matters (other than as its percentage share of increases in Taxes or Assessments). In addition, “Taxes” and “Assessments” shall not include any capital levy, transfer, or capital stock taxes, any amounts paid by Tenant directly to the applicable governmental authorities on account of the Tenant Improvements or Tenant’s personal property. “Taxes” and “Assessments” shall also not include (i) any item to the extent included in Operating Expenses; (ii) environmental assessments, charges or liens arising in connection with the remediation of Hazardous Substances from the Building and/or the Facility in particular (as opposed to any such assessments, charges or lien imposed upon the Building, the Facility and other buildings generally based on location or classification); or (iii) reserves for future Taxes or Assessments (provided, however, that the collection of Tax accruals for Taxes that will become due but are not yet payable shall not be excluded).

(c) Base Year Calculation. The amount of Taxes attributable to the Base Tax Year shall be reduced by the amount of any Tax refund arising out of an appeal and permanent reduction of the Building’s assessed valuation for the Base Tax Year. If the Facility’s actual assessed valuation for the Base Tax Year shall be lower than what the taxing authority would have determined the Facility’s assessed valuation to have been under conditions where the Building was at stabilized occupancy for the full tax year, and the Building Standard tenant improvements were complete throughout the Building and the construction of the Facility in accordance with the Final Plans were complete prior to commencement of the Base Tax Year, then the amount of Taxes for the Base Tax Year shall be set at an amount equal to what such Taxes would have been if the taxing authority had determined the Facility’s assessed valuation based upon all of said conditions being satisfied.

6.2.2 Payment of Assessments. Tenant shall also pay to Landlord an amount equal to Tenant’s Percentage Share of any increase in Assessments above the amount of Assessments levied or assessed against the Facility for the Base Tax Year.

19 | ||

(a) Definition. As used in this Article 6, the term “Assessments” shall mean all assessments, transit charges, housing charges, and levies assessed, charged, levied, confirmed, or imposed by any government, any political subdivision, public corporation, district, or other political or public entity or authority thereof on or with respect to any of the items described in clauses (i) through (v) of Section 6.2.1(a) or with respect to the use, occupancy, management, maintenance, alteration, repair, or operation of the Facility (or any portion thereof) or any services or utilities furnished or consumed in connection with the use, occupancy, management, alteration, repair or operation of the Facility (or any portion thereof).

(b) Base Year Calculation. Except to the extent otherwise expressly provided below, the amount of Assessments attributable to the Base Tax Year shall be reduced by the amount of any Assessment refund arising out of an appeal of an assessment levied or assessed against the Facility for the Base Tax Year. If an Assessment shall be lower than what the taxing authority would have determined it to be if the Building was at stabilized occupancy for the full tax year and the Building standard tenant improvements were complete throughout the Building and the construction of the Facility in accordance with the Final Plans were complete prior to the commencement of the Base Tax Year, then the amount of the assessments for the Base Tax Year shall be set at an amount equal to what such Assessments would have been if the taxing authority had determined the Facility’s assessed valuation based upon all of the said conditions being satisfied.

6.2.3 Full Responsibility. In addition to paying Tenant’s Percentage Share of increases in the Taxes and Assessments described in Sections 6.2.1 and 6.2.2, Tenant shall pay one hundred percent (100%) of the following, as reasonably determined by Landlord: any increase in Taxes or Assessments after the Base Tax Year resulting from any improvements or installations above Building-standard made to the Premises by or at the request of Tenant. The total amounts due under this Section 6.2.3 shall be paid to Landlord on or before the date full payment of such Taxes or Assessments shall become due, or if payable in installments, the date payment of the installment of such Taxes or Assessments shall become due. In the event such Taxes or Assessments are paid by Landlord, Tenant forthwith upon demand therefor shall reimburse Landlord for all amounts of such Taxes or Assessments chargeable against Tenant pursuant to this Section 6.2.3.

6.2.4 Personal Property. Tenant shall pay, before delinquency, any and all levied or assessed taxes that become payable during or with respect to the Term upon Tenant’s equipment, furnishings, fixtures, and other personal property of Tenant located in the Premises (collectively, “Tenant’s Personal Property”). In the event said taxes are paid by Landlord, Tenant forthwith upon receipt of written demand therefor shall reimburse Landlord for all such taxes paid by Landlord within thirty (30) days.

6.2.5 Apportionment. Any Taxes or Assessments that may be paid over more than a one-year period shall be apportioned evenly over the maximum period of time permitted by Law and only the portion thereof accruing during a given year shall be included in Taxes or Assessments for that year. In the event that Landlord contests the amount of any Taxes or Assessments and receives a refund or credit as a result thereof, then, after first deducting all of Landlord’s expenses in connection with such contest, Landlord shall pay Tenant its pro rata share of such refund to the extent that the refund relates to Taxes or Assessments that have been paid by Tenant.

20 | ||

6.3 Operating Expense Increases.

6.3.1 Definition. Tenant shall pay to Landlord an amount equal to Tenant’s Percentage Share of any increase in Operating Expenses above the Operating Expenses for the Base Expense Year. As used in this Article 6, the term “Operating Expenses” shall mean costs and expenses accrued by Landlord in connection with the ownership, operation, repair, replacement, management, or maintenance of the Facility (which costs shall be accounted for under sound accounting principles consistently applied), excluding, however, the items described in Section 6.3.3 below, which items shall not be included in Operating Expenses for purposes of this Lease. By way of illustration but not limitation, Operating Expenses shall include (subject to the specific exclusions described in Section 6.3.3 below) the following costs and expenses:

(a) costs for heating, cooling, ventilation, fuel, and utilities including, without limitation, the cost of building systems commissioning;

(b) costs and expenses for maintenance, ordinary and extraordinary repairs, testing, and operation of building systems and components including, without limitation, costs and expenses for maintenance and repair of the roof membrane;

(c) costs and expenses for security, landscaping, refuse disposal, janitorial services, labor, supplies, materials, equipment, tools, and leasing rotating art in the lobby, including any sales, use, or excise taxes thereon;

(d) market management fees and other costs of managing the Facility (not to exceed market rate management fees for Comparable Buildings, however in no event shall management fees exceed 3% of gross operating revenue for the Building), whether managed by Landlord or an independent contractor, which may or may not be affiliated with Landlord;

(e) wages, salaries, bonuses, employee benefits and payroll burden, pro-rated to account for the time actually spent with respect to the Facility, of all Landlord’s (or its agents’) on-site or off-site employees at or below the level of senior property manager engaged in the day-to-day operation, maintenance, management, or security of the Facility, including employers’ payroll, social security, workers’ compensation, unemployment, and similar taxes with respect to such employees;

(f) subject to the provisions of Section 6.3.2 below, insurance premiums paid or incurred by Landlord with respect to the Facility and all amounts paid in connection with claims or losses that are less than the amount of such deductibles or self-insured retentions as Landlord may have deemed reasonable for its insurance policies;

(g) all reasonable costs and expenses of contesting by appropriate proceeding the amount or validity of any Taxes or Assessments;

(h) the annual amortized costs (plus interest on the unamortized balance at a commercially reasonable interest rate (the “Reference Rate”) of any capital improvements, capital repairs, capital assets or other capital expenditures constructed, made, purchased or installed after the Base Year (i) to the Facility or any portion thereof that are required to comply with any

21 | ||

Law (as defined in Section 3.3), (ii) in order to conserve energy or reduce other Operating Expenses or increase the efficiency of any of the Base Building Systems, or (iii) which are reasonably determined by Landlord to be in the best interests of the Facility and consistent with capital expenditures at Comparable Buildings (as defined in Section 3.1 hereof), with any such capital costs above to be amortized over the useful life of such capital improvements or capital assets, as determined by GAAP;

(i) the fair market rental value of the building office and other space in the building occupied by Landlord or its manager in connection with the operation or management of the Facility;

(j) the cost of complying with Section 48.3 below;

(k) the cost of complying with the rules and regulations applicable to the Facility as mandated by governmental authorities with jurisdiction over the Facility, including employment brokerage services pursuant to San Francisco Planning Code Article 164;

(l) the cost of insurance endorsements in order to repair, replace and recommission the Building for recertification pursuant to LEED;

(m) all other costs and expenses that under sound accounting principles or practices of Comparable Buildings would be included in Operating Expenses; and

(n) costs of maintenance of any exercise rooms, food service facility, day care center or other similar specialty service facility, subject to a credit against such costs of maintenance for any revenue generated by or rent collected from such facility.

The above itemization of Operating Expenses is for illustrative purposes only and shall not be deemed to increase or modify Landlord’s obligations to provide services under this Lease. In addition to the above Operating Expenses, Operating Expenses shall also include any and all costs incurred by Landlord in operating, managing, repairing, and maintaining the Facility in accordance with Landlord’s sustainability practices or the LEED-EBOM certification of the Building described in Section 3.4 including, without limitation, (i) all costs of maintaining, managing, reporting, commissioning, and recommissioning the Building or any part thereof that was designed and/or built to be sustainable and conform with LEED, and (ii) all costs of applying, reporting and commissioning the Building or any part thereof to seek certification or re-certification under LEED.

6.3.2 Earthquake Insurance. From time to time, Landlord may carry and maintain a policy of earthquake insurance insuring the Building and related income against property damage and business interruption caused by certain seismic hazards. The parties acknowledge that the market for earthquake insurance policies is very volatile, and may include large fluctuations in the availability and cost of such insurance. As more fully provided below, it is the intent of the parties that, when determining what insurance premium costs should be included in the calculation of Operating Expenses for the Base Expense Year and any later year (hereinafter, a “Comparison Year”), appropriate adjustments should be made so that Tenant will only be charged its percentage share of increases allocable to what comparable insurance policies would have cost in the two years then in question and so that Tenant will not be charged for cost increases allocable to insurance

22 | ||

coverage exceeding what is then ordinary or customary. Accordingly, to the extent that Landlord at any time carries greater earthquake insurance coverage than is provided under any “Conventional Earthquake Policy” (as defined below), Landlord shall only include in Base Expense Year Operating Expenses and Comparison Year Operating Expenses the respective amounts reflecting what a then reasonable Conventional Earthquake Policy would have cost for the years in question. Also, to the extent that the coverage under the respective earthquake policies (or the deemed coverage, where the actual policy was greater than a then reasonable Conventional Earthquake Policy) are different from each other, Landlord shall recalculate the cost of the premiums for the Base Expense Year to reflect what an earthquake policy with coverage comparable to the Comparison Year’s coverage (not to exceed the reasonable Conventional Earthquake Policy) would have cost during the Base Expense Year. Notwithstanding any provision hereof to the contrary, if the earthquake coverage actually maintained during the Base Expense Year exceeds a then reasonable Conventional Earthquake Policy then available or exceeds the earthquake coverage actually maintained during the Comparison Year, then the amount attributed to the cost of such policy attributable to the Base Expense Year shall not be greater than the amount attributed to the cost of such Comparison Year’s earthquake insurance when calculating Tenant’s Percentage Share of increases in Operating Expenses for such Comparison Year.

(a) Conventional Policy. As used herein, the term “Conventional Earthquake Policy” shall mean, for any given year, a policy of earthquake insurance that was then either customary or usual for owners of Comparable Buildings. Landlord shall have the right, in its sole and absolute discretion, to carry no earthquake insurance at all.

(b) Determination. Whenever Section 6.3.2 above requires the determination of the cost of an earthquake policy different from that actually carried by Landlord for the year in question, a reputable independent insurance broker selected by Landlord with a minimum of five years of experience in the earthquake insurance market in the San Francisco Financial District shall reasonably determine what the premium would have been for such a policy in the year in question.

6.3.3 Exclusions. The following costs and expenses shall be excluded from the definition of “Operating Expenses” for purposes of this Lease:

(a) Any costs for which Landlord is reimbursed by insurance or warranty proceeds.

(b) Brokers/leasing commissions, attorneys’ fees, accountants’ fees, costs and disbursements and other expenses incurred in connection with negotiations with present or prospective tenants or other occupants.

(c) Costs (including permit, license and inspection fees) incurred in renovating or otherwise improving or decorating, painting, or redecorating space for new tenants or existing tenants in connection with extensions of the terms of their respective tenancies.

(d) Landlord’s costs of any services sold or provided to tenants or other occupants for which Landlord is entitled to be reimbursed by such tenants or other occupants as an additional charge or rental over and above the basic rental and escalations payable under the lease

23 | ||

with such tenant or other occupant, unless Landlord is likewise entitled to reimbursement for like services provided to Tenant or its subtenants and elects not to require reimbursement from Tenant or its subtenants.

(e) Interest on debt or amortization payments (except as expressly included as Operating Expenses under Section 6.3.1 above) on any mortgages or deeds of trust.

(f) Taxes and Assessments, as defined in Sections 6.2.1 and 6.2.2 above.

(g) Costs of electricity (such costs are specifically treated in Sections 5.2 and 5.7 above).

(h) Rental under any ground lease or other underlying lease of the Building or Facility.

(i) Costs due to Landlord’s breach of this Lease.

(j) All costs, including legal fees, relating to the activities for the solicitation and execution of leases of space in the Building or Facility or disputes with other tenants of the Building or Facility.

(k) Any legal fees or other costs incurred by Landlord in enforcing its rights under other leases for space in the Building or Facility.

(l) Fines, penalties or interest resulting from late payment of Taxes or Assessments or Operating Expenses.

(m) Fines or penalties resulting from any violations of Law, negligence or willful misconduct of Landlord or its employees, agents, contractors or subcontractors;

(n) Advertising expenses.

(o) Landlord charitable and political contributions.

(p) Costs of purchasing or leasing major sculptures, paintings or other artwork (except as permitted above).

(q) Costs of curing defects in design or original construction of the Building or Facility.

(r) Reserves.

(s) Costs of selling, financing or refinancing the Building and/or the Facility.

(t) The cost of operating any commercial concession which is operated by Landlord at the Building and/or the Facility.

24 | ||

(u) Replacement of the structural portions of the roof or to the exterior walls, the foundations, load bearing walls, or any other structural replacements to the Building and/or the Facility.

(v) Items that are or should be capitalized under GAAP, other than those referred to in Section 6.3.1(h) above.

(w) Landlord’s general overhead expenses not related to the Building or Facility.

(x) Costs of abatement or remediation of Hazardous Substances brought upon, stored, used or disposed of in or about the Building or the Facility by Landlord or by a particular tenant or occupant of the Building or the Facility other than Tenant.

(y) Earthquake insurance deductibles in excess of $16,000,000.00 (provided, however, that earthquake insurance deductibles of $16,000,000.00 or less shall be amortized over a ten [10] year period, and Tenant shall only be responsible for the amortized portion of such costs falling within the Term);

(z) Sums (other than management fees) paid to subsidiaries or other affiliates of Landlord for services on or to the Building and/or the Premises, but only to the extent that the costs of such services exceed competitive cost for such services rendered by unrelated persons or entities of similar skill, competence and experience.

(aa) Costs of compliance with all applicable building codes to the extent the Building or Facility does not comply with such building codes as of the Effective Date.

(bb) Costs of compliance with the ADA, to the extent the Building or Facility does not comply therewith as of the Effective Date.

(cc) Costs of installing or constructing telecommunications equipment or facilities unless such equipment or facilities are used by Tenant.

(dd) Costs of major Building or Facility signage which identifies a tenant other than Tenant.

(ee) Costs to the extent attributable to the garage in the Building and/or the Facility or any other concession or club operated by Landlord for which a separate charge or fee is required for the use thereof by Tenant or its employees, including, without limitation, payroll for clerks, attendants, book-keeping, parking, insurance premiums, parking charge taxes, parking management fees, parking tickets, janitorial services, striping and painting of surfaces.

(ff) Wages, salaries, benefits or other similar compensation paid to executive employees of Landlord or Landlord’s agents above the rank of general manager.

25 | ||

If, in any year following the Base Year, Landlord incurs any category of Operating Expense that was not incurred and included in Operating Expenses for any portion of the Base Year, Operating Expenses for the Base Year shall be deemed increased by the amount that would have been included in Operating Expenses for the Base Year with respect to such category of Operating Expense if Landlord had incurred such category of Operating Expense and included the same in Operating Expenses during the entire Base Year. Conversely, if, in any year following the Base Year, Landlord does not incur a category of Operating Expense that was included in Operating Expenses during the Base Year, Operating Expenses for the Base Year shall be deemed reduced by the amount Landlord incurred during the Base Year with respect to such category of Operating Expense.

6.3.4 Gross-Up. If at any time, including the Base Year, less than ninety-five percent (95%) of the rentable area of the Building is occupied by office tenants and/or if the Base Year is less than twelve (12) full calendar months, then Operating Expenses shall be reasonably adjusted by Landlord to approximate such operating and maintenance costs which vary with the occupancy level of the Building as would have been incurred if the Building had been at least ninety-five percent (95%) occupied by office tenants. If Landlord is not furnishing any work or service (the cost of which if performed by Landlord would be included in Operating Expenses) to a tenant who has undertaken to perform such work or service in lieu of performance by Landlord, Operating Expenses shall be deemed increased by an amount equal to the Operating Expenses that would have been incurred by Landlord if it had performed such work or service.

6.4 Allocations of Certain Costs.

If any Taxes, Assessments, or Operating Expenses paid in one year relate to more than one calendar year or to buildings, land or facilities other than the Facility, Landlord shall allocate such Taxes, Assessments, or Operating Expenses among the appropriate calendar years or buildings, land or facilities. If the Term ends other than on December 31, Tenant’s obligations to pay Tenant’s Percentage Share of estimated and actual amounts of increases in Taxes, Assessments, and Operating Expenses for such final calendar year shall be prorated to reflect the portion of such year included in the Term. Such proration shall be made by multiplying the total estimated or actual (as the case may be) Taxes, Assessments, and Operating Expenses for such calendar year by a fraction, the numerator of which shall be the number of days of the Term during such calendar year, and the denominator of which shall be 365. Landlord may, but shall not be required to, calculate prorations with regard to when during a calendar year particular items of Operating Expenses accrued.

6.5 Estimated Payments.

Landlord shall notify Tenant of its reasonable good faith estimate of the monthly amount of Tenant’s Percentage Share of increases in Taxes, Assessments, or Operating Expenses and Tenant shall pay Landlord such estimated monthly payment at the same time as, and together with, Tenant’s Minimum Monthly Rent. Landlord may from time to time, by notice to Tenant, change such estimated monthly amounts based upon Landlord’s actual or projected Taxes, Assessments, or Operating Expenses.

26 | ||

6.6 Statement of Expenses.