Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Thompson Creek Metals Co Inc. | a8-kq22015.htm |

| EX-99.1 - PRESS RELEASE - Thompson Creek Metals Co Inc. | pressrelease2015q21.htm |

NYSE:TC TSX:TCM Second Quarter 2015 Investor Conference Call August 7, 2015 NYSE:TC TSX:TCM

2 Webcast Information Webcast: This Webcast can be accessed on the Thompson Creek Metals Company website under the Events Section: www.thompsoncreekmetals.com Q&A Instructions: If you would like to ask a question, please press star 1 on your telephone keypad. If you’re using a speakerphone, please make sure your mute function is turned off to allow your signal to reach the operator.

3 Cautionary Statement This document contains ''forward-looking statements'' within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and applicable Canadian securities legislation. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "future," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Our forward-looking statements include, without limitation, statements with respect to: future financial or operating performance of the Company or its subsidiaries and its projects; access to existing or future financing arrangements and ability to refinance or reduce debt on favorable terms or at all; future inventory, production, sales, payments from customers, cash costs, capital expenditures and exploration expenditures; future earnings and operating results; expected concentrate and recovery grades; estimates of mineral reserves and resources, including estimated mine life and annual production; statements as to the projected ramp-up at Mount Milligan Mine, including expected achievement of design capacities, decisions regarding whether to proceed with the construction of a permanent secondary crusher, and the effects of secondary crushing; future operating plans and goals, including statements regarding Langeloth’s business model; and future molybdenum, copper, gold and silver prices. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking statements can be found in the section entitled "Risk Factors" in Thompson Creek's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed on EDGAR at www.sec.gov and on SEDAR at www.sedar.com. Although we have attempted to identify those material factors that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors, currently unknown to us or deemed immaterial at the present time that could cause results or events to differ from those anticipated, estimated or intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, the reader is cautioned not to place undue reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

4 Management in Attendance Jacques Perron President, Chief Executive Officer and Director Pam Saxton Executive Vice President and Chief Financial Officer Mark Wilson Executive Vice President and Chief Commercial Officer

5 Jacques Perron President, Chief Executive Officer and Director Overview

6 Improving Safety Performance Company All Incident Recordable Rate (AIRR)1 5.94 5.03 2.60 2.25 1.40 2.48 2.46 0.46 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 2008 2009 2010 2011 2012 2013 2014 2015 YTD 1 Includes Lost Time and Reportable Incidents. Mining Association British Columbia AIRR Average Surfaces Metals Mining U.S. AIRR Average Compared to Q214 AIRR of 3.43

7 Q215 Highlights Significantly improved operational performance at Mount Milligan Mine Consistent utilization of temporary secondary crusher Achieved highest quarterly average daily mill throughput to date of 44,940 tonnes, and for May and June averaged 49,913 tonnes From July 26 through August 4, daily mill throughput averaged 52,290 tonnes Exceeded design recoveries; copper – 85.5% and gold – 72.7% Copper sales – $49 million Gold sales – $56 million Completed three copper and gold concentrate shipments and recorded four sales, including one sale from Q1 shipment Achieved quarterly unit cash cost on a by-product basis of $0.48 per pound of copper produced

8 Q215 Highlights (continued) Generated positive cash flow of $10 million, prior to bond repurchases Repurchased and retired $34 million of 9.75% senior secured notes due December 1, 2017 Future interest savings of $0.8 million to call date of December 2015 and $8.2 million to maturity date of December 2017 Since December 2014, we have repurchased and retired $67 million of our outstanding notes Future interest savings of $22 million to maturity dates Ended Q2 with $211 million of cash Molybdenum business generated cash flow of approximately $4 million, excluding capital expenditures or $0.5 million Molybdenum sales – $21 million Tolling, calcining and other – $8 million

9 Focused on Continuous Improvements at Mount Milligan Mine Continue to optimize the mill to sustain design recoveries and achieve design mill throughput, while containing costs Installation of second SAG discharge screen deck expected to occur at the beginning of Q4 Temporary secondary crushing circuit Consistent utilization during Q2 has demonstrated positive impact of secondary crushing on throughput Contractor proved ability to provide steady supply of secondary crushed material Continuing to look for opportunities to increase pre-crushed material Temporary secondary crushing, together with the installation of the second SAG discharge screen deck, is expected to help us to achieve daily mill throughput of 60,000 tonnes by year-end

10 Mount Milligan Permanent Secondary Crushing Circuit Detailed engineering substantially complete Current capex estimate is $65 – $70 million, assuming an exchange rate of US$1.00 = C$1.25, including $15 million of estimated capital expenditures for 2015, of which $2.3 million has been incurred through June 30, 2015 Earthwork and concrete work commenced in Q3 Decision expected in Q4 whether to purchase long-lead items and proceed with construction With proven success in Q2, continued utilization of temporary secondary crushing circuit is a viable short-term option should the Company decide to delay moving forward with construction of a permanent secondary crusher If a decision to move forward with construction of permanent secondary crushing circuit is made in Q415, we expect construction to be completed and commissioning to occur in Q416 Once installed and commissioned, average daily mill throughput expected to increase to 62,500 tonnes

11 Committed to Strengthening the Balance Sheet and Reducing Debt Actively evaluating opportunities to reduce and refinance debt Goal to have solution in place well in advance of debt maturity dates 9.75% Senior Secured Notes due December 1, 2017 7.375% Senior Unsecured Notes due June 1, 2018 12.5% Senior Unsecured Notes due May 1, 2019 Target debt level three times EBITDA for a twelve month period

12 Reduced Debt by $121 Million over 8 Quarters Since completion of Mount Milligan Mine, reduced debt by $121 million, or ≈12%1 Since December 2014, repurchased $67 million of our senior secured and unsecured notes, with total future interest savings to maturity from these notes repurchased of approximately $22 million $1,019 $1,013 $1,004 $984 $977 $945 $939 $898 $820 $840 $860 $880 $900 $920 $940 $960 $980 $1,000 $1,020 $1,040 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Q215 [US$ in millions] 1 Includes net repayments of the Company’s capital leases.

13 Maintaining Optionality of Molybdenum Business Shifting Langeloth from integrated service facility for Thompson Creek and Endako mines to a cash generating business Strategic goal to transform Langeloth into one of the largest independent molybdenum conversion plants in the world Molybdenum business expected to contribute $20 to $21 million of cash flow in 2015, excluding capital expenditures, including our 75% share of Endako one-time severance costs of approximately $7 million For the first half of 2015, molybdenum business generated $24 million of cash flow, excluding the impact of capital expenditures at Langeloth of $0.9 million. Our share of Endako one-time severance costs of approximately $7 million was paid in July 2015

14 Pam Saxton Executive Vice President and Chief Financial Officer Financial Review

15 Financial Summary | Q215 vs Q214 134 248 12 57 41 91 0 62 (14) 22 24 51 [millions of US$] Revenue Operating Income Net Income (Loss) Adjusted Net Income Operating Cash Flow 1 Please refer to Appendix for non-GAAP reconciliation. Q215 Q214 1 Non-GAAP EBITDA 1

16 Financial Summary | First Half 2015 vs First Half 2014 257 409 17 70 68 131 (87) 23 (28) 26 19 67 [millions of US$] Revenue Operating Income Net Income (Loss) Adjusted Net Income Operating Cash Flow 1 Please refer to Appendix for non-GAAP reconciliation. H1 2015 H1 2014 1 Non-GAAP EBITDA 1

17 Three Months Ended 6/30/15 6/30/14 Six Months Ended 6/30/15 6/30/14 Cash Flow from Operations 23.9 50.7 18.6 66.9 Cash (Used) in Investing Activities (9.9) (27.9) (16.7) (65.4) Cash (Used) in Financing Activities (41.1) (10.6) (55.4) (19.6) Effect of Exchange Rate Changes on Cash - 1.2 (1.0) 0.3 Increase (Decrease) in Cash and Cash Equivalents (27.1) 13.4 (54.5) (17.8) Cash and Cash Equivalents, beginning of period 238.2 202.7 265.6 233.9 Cash and Cash Equivalents, end of period 211.1 216.1 211.1 216.1 Summary of Statement of Cash Flows [US$ in millions]

18 Updated 2015 Production and Unit Cost Guidance Year-Ended 12/31/15 (Estimate) (Updated) Year-Ended 12/31/15 (Estimate) (Previous) Mount Milligan Copper and Gold Concentrate production (000’s dry tonnes) 140 – 160 140 – 160 Copper payable production (millions lb) 70 – 90 70 – 90 Gold payable production (000’s oz) 200 – 220 200 – 220 Unit cash cost – By-product (US$/payable lb copper production) 1,2 $0.70 – $0.90 $0.70 – $0.90 Molybdenum Business – Cash Inflow (outflow) (US$ in millions) 2,3 Ongoing molybdenum operations – Langeloth $6 – $10 $10 – $15 Suspended molybdenum operations: Thompson Creek Mine Care and maintenance ($7 – $10) ($6 – $8) Phase 8 stripping ($4 – $5) ($8 – $10) Sale of inventory $32 – $34 $25 – $28 Endako Mine (75% share) Temporary suspension, care and maintenance and estimated severance costs ($17 – $19) ($5 – $8) Sale of inventory $10 – $11 $9 – $10 Total Cash Flow from Molybdenum Operations $20 – $21 $25 – $27 1 Copper by-product unit cash cost is calculated using copper payable production and deducts a gold by-product credit, which is determined based on expected revenue from payable gold production assuming a gold price of $801 per ounce for the first half of 2015 and approximately $730 per ounce for the second half of 2015, which takes into account the contractual price of $435 per ounce un the Bold Stream Arrangement. 2 Estimates for cash costs and molybdenum cash inflow (outflow) assume an average foreign exchange rate of US$1.00 = C$1.24 for the first half of 2015 and US$1.00 = $1.25 for the second half of 2015. 3 Cash flow (outflow) excludes capital expenditures.

19 Updated 2015 Capital Expenditure Guidance Year-Ended December 31, 2015 (Updated Estimate) Year-Ended December 31, 2015 (Previous Estimate) Capital Expenditures (US$ in millions) 1,2 Mount Milligan operations $22 +/- 10% $22 +/- 10% Mount Milligan tailings dam $24 +/- 10% $24 +/- 10% Mount Milligan secondary crusher engineering and site preparation $15 +/- 10% $15 +/- 10% Mount Milligan vendor claim settlements 3 $13 nil Langeloth and other $7 +/- 10% $7 +/- 10% Total Cash Capital Expenditures $81 +/- 10% $68 +/- 10% 1 Estimates for cash capital expenditures assume an average foreign exchange rate of US$1.00 = C$1.24 for the first half of 2015 and US$1.00 = $1.25 for the second half of 2015.. 2 Includes 2015 cash capital expenditures, but excludes cash capital expenditures related to 2014 accruals paid in 2015. 3 In July 2015, Terrane Metals Corp., a wholly-owned subsidiary of the Company, settled outstanding claims from two contractors that provided construction and installation services for the construction of Mount Milligan. The settlement amount, which represents a one-time payment, will be made in the third quarter of 2015.

20 2015 EBITDA Estimates at Various Copper Prices Average Estimated EBITDA1, 2 (US$ in millions) ($1,050/oz Gold and $6/lb Molybdenum Oxide for the second half of 2015) $0 $20 $40 $60 $80 $100 $120 $140 Cu $2.25/lb Cu $2.50/lb Cu $2.80/lb 1 EBITDA estimates were assumed to be at the mid-point of guidance, utilizing foreign exchange rate of US$1.00 = C$1.25 for the second half of 2015, and assumes all production for 2015 is sold, using the 2015 first half actual realizations and the second half at the various copper prices. EBITDA equals operating income excluding the deferred revenue from the Gold Stream Arrangement, depreciation, depletion and amortization, accretion expense and any asset impairments. Does not include any additional severance costs for Endako Mine. 2 EBITDA estimates were updated for the Endako Mine being placed on care and maintenance and related severance costs. $93 $104 $117 Exchange Rate US$1.00 = C$1.25 for the second half of 2015

21 Hedging1 Quantity Sell Price Buy Price Maturities Through Forward Gold Sales (oz) 4,900 $1,222 TBD Jul 2015 – Aug 2015 Forward Copper Sales (lb) 5,511,550 $2.86 TBD Jul 2015 – Aug 2015 Quantity Put Price Call Price Maturities Through Gold Collars (oz) 12,000 $1,175- $1,200 $1,267 - $1,360 Jul 2015 – Dec 2015 Copper Collars (lb) 13,227,720 $2.00 $2.99 Jul 2015 – Dec 2015 1 Information is as of June 30, 2015.

22 Significant Positive Impact from US$/C$ Foreign Exchange Rate Current US$/C$ exchange rate continues to have positive impact on Mount Milligan operating margins Approximately 90% of costs are in C$ The US$ to C$ average exchange rate for the first half of 2015 was US$1.00 = C$1.24. This exchange rate had a positive impact on Mount Milligan operating costs for the first half of 2015 of approximately $9 million, or a positive unit cost impact of $0.25 per pound of copper, compared to applying the average fourth quarter exchange rate of December 31, 2014 of US$1.00 = C$1.14 The weakening Canadian dollar supports margins and somewhat mitigates the effects of copper and gold pricing volatility

23 Copper Margins Supported by Weakening Canadian Dollar Source: FactSet $2.00 $2.50 $3.00 $3.50 $4.00 31-Dec-13 31-Mar-14 30-Jun-14 30-Sep-14 31-Dec-14 31-Mar-15 30-Jun-15 Co pp er P ric e ($/ lb ) Copper Price in US$ Copper Price in C$

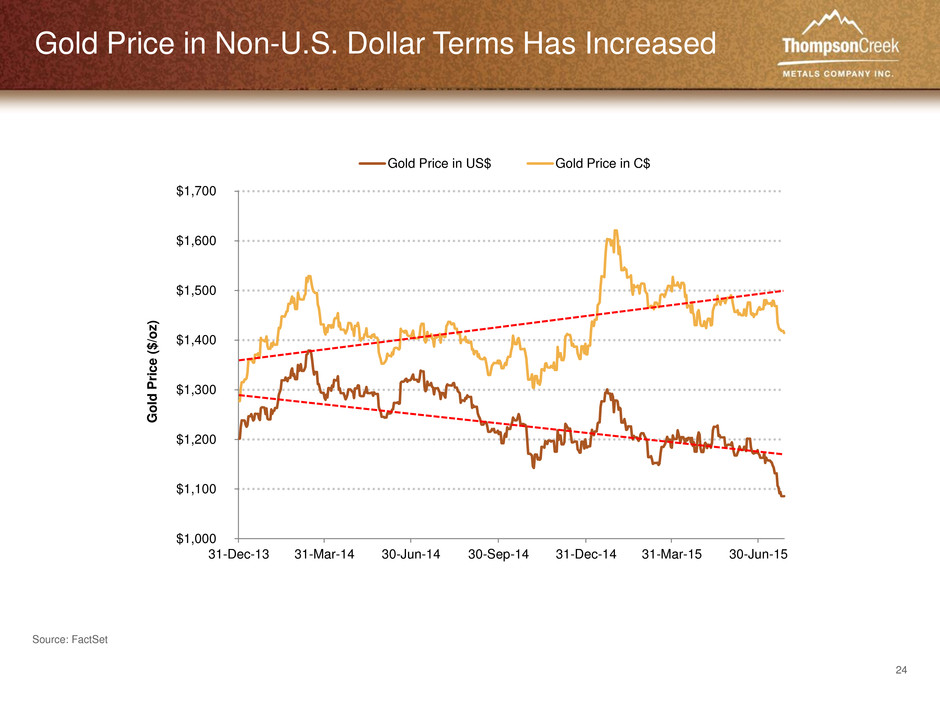

24 Gold Price in Non-U.S. Dollar Terms Has Increased Source: FactSet $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 31-Dec-13 31-Mar-14 30-Jun-14 30-Sep-14 31-Dec-14 31-Mar-15 30-Jun-15 G old P ric e ($/o z) Gold Price in US$ Gold Price in C$

25 Mark Wilson Executive Vice President and Chief Commercial Officer Sales Summary and Market Commentary

26 36.0 32.7 H115 H114 Copper (Cu) Sales 1 Please refer to Appendix for non-GAAP reconciliation. 21.2 21.9 Q215 Q214 Cu Sales (millions lbs) Average Realized Sales Price1 (US$/lb) Cu Sales (millions lbs) Average Realized Sales Price1 (US$/lb) 49.3 64.8 Q215 Q214 81.5 94.6 H115 H114 $2.56 $3.14 H115 H114 Cu Revenue (millions US$) Cu Revenue (millions US$) $2.63 $3.20 Q215 Q214 Three Months Ended June 30 Six Months Ended June 30

27 92.3 78.5 H115 H114 Gold (Au) Sales 1 Please refer to Appendix for non-GAAP reconciliation. 57.9 52.0 Q215 Q214 Au Sales (000’s oz) Average Realized Sales Price1 (US$/oz) Au Sales (000’s oz) Average Realized Sales Price1 (US$/oz) 56.3 54.1 Q215 Q214 $979 $1,040 H115 H114 Au Revenue (millions US$) Au Revenue (millions US$) 975 1,047 Q215 Q214 Three Months Ended June 30 Six Months Ended June 30 94.7 75.9 H115 H114

28 Molybdenum Sales Total Sales Tolling, Calcining and Other 21 126 64 229 8 3 20 7 Q215 Q214 H115 H114 2.3 9.7 6.5 19.5 Q215 Q214 H115 H114 Avg Realized Mo Price/Lb. $9.73 $11.73 Mo Sales Volumes [US$ in millions] [millions of pounds] $9.23 $13.03

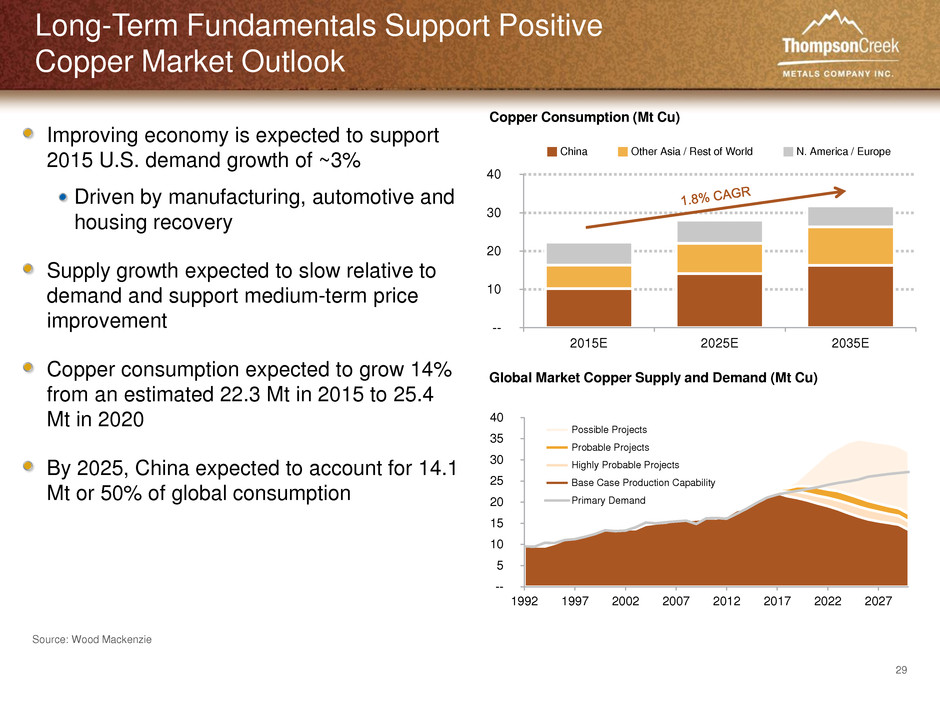

29 Long-Term Fundamentals Support Positive Copper Market Outlook Improving economy is expected to support 2015 U.S. demand growth of ~3% Driven by manufacturing, automotive and housing recovery Supply growth expected to slow relative to demand and support medium-term price improvement Copper consumption expected to grow 14% from an estimated 22.3 Mt in 2015 to 25.4 Mt in 2020 By 2025, China expected to account for 14.1 Mt or 50% of global consumption Copper Consumption (Mt Cu) Global Market Copper Supply and Demand (Mt Cu) -- 10 20 30 40 2015E 2025E 2035E China Other Asia / Rest of World N. America / Europe Source: Wood Mackenzie -- 5 10 15 20 25 30 35 40 1992 1997 2002 2007 2012 2017 2022 2027 Possible Projects Probable Projects Highly Probable Projects Base Case Production Capability Primary Demand

30 Operations Review and Closing Remarks Jacques Perron President, Chief Executive Officer and Director

31 Operating Statistics Copper (Cu) 1 Please refer to Appendix for non-GAAP reconciliation. 20.2 16.0 35.6 30.3 21.2 21.9 35.9 32.7 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 Q215 Q214 H115 H114 Cu-Payable Production (millions lbs) Cu-Sales (millions lbs) $0.48 $0.33 $0.75 $1.34 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 Q215 Q214 H115 H114 Cu-Cash cost ($/payable lb produced) By-Product 1 Q215 Q214 H115 H114 Cu Ore Grade 0.28% 0.27% 0.27% 0.28% Cu Recovery 85.5% 80.4% 82.7% 79.8%

32 Operating Statistics Gold (Au) 1 Please refer to Appendix for non-GAAP reconciliation. 59,917 37,030 106,036 76,273 57,920 51,983 94,670 75,857 0 20,000 40,000 60,000 80,000 100,000 Q215 Q214 H115 H114 Au-Payable Production (oz) Au-Sales (oz) $434 $538 $462 $573 $0 $100 $200 $300 $400 $500 $600 Q215 Q214 H115 H114 Au-Cash cost ($/payable oz produced) Co-Product 1 Q215 Q214 H115 H114 Au Ore Grade (g/tonne) 0.65 0.52 0.64 0.61 Au Recovery 72.7% 65.1% 70.0% 61.8%

33 Mount Milligan Ramp-up 38,970 40,445 43,781 39,569 44,940 0 10,000 20,000 30,000 40,000 50,000 60,000 Q214 Q314 Q414 Q115 Q215 Mill Throughput Design 60,000 tpd 1,959 1,958 2,002 1,890 2,054 0 500 1,000 1,500 2,000 2,500 Q214 Q314 Q414 Q115 Q215 89.4% 88.7% 91.1% 87.3% 91.2% 85% 86% 87% 88% 89% 90% 91% 92% Q214 Q314 Q414 Q115 Q215 Hourly Throughput Design 2,715 tpoh Mill Availability Design 92% 80.4% 83.1% 79.0% 79.3% 85.5% 55% 60% 65% 70% 75% 80% 85% 90% Q214 Q314 Q414 Q115 Q215 65.1% 66.6% 60.8% 66.7% 72.7% 55% 57% 59% 61% 63% 65% 67% 69% 71% 73% 75% Q214 Q314 Q414 Q115 Q215 Copper Recovery Design 84% Gold Recovery Design 71%

34 Key Messages We believe we are favorably positioned to withstand current volatility in commodity markets Cash of $211 million as of June 30, 2015 Significant positive impact of US$/C$ exchange rate on Mount Milligan operating costs, which somewhat mitigates effects of copper and gold pricing volatility With installation of second SAG discharge screen deck, together with continued utilization of temporary secondary crusher, daily mill throughput is expected to reach 60,000 tonnes by year end Remain focused on Company’s current business strategy to: Complete the ramp-up of Mount Milligan by year-end 2015 Reduce and refinance debt Maintain optionality of molybdenum business, while generating positive cash flow Contain costs throughout the Company

35 NYSE:TC TSX:TCM Thompson Creek Metals Company www.thompsoncreekmetals.com Pamela Solly Director, Investor Relations and Corporate Responsibility Phone (303) 762-3526 Email psolly@tcrk.com

36 Appendix

37 Non-GAAP EBITDA Reconciliation (1) Certain prior year reclassifications were made to DD&A to conform with current year presentation. (US$ in millions) Q215 Q214 First Half 2015 First Half 2014 Net income (loss) 0.3 61.6 22.5 (86.9) (Interest income)/expense, net 25.4 23.7 47.2 47.6 Tax expense (benefit) 5.1 14.5 (0.5) (11.6) DD&A 1 26.8 33.0 55.6 46.8 Accretion 0.6 0.9 1.8 1.2 Asset impairments - - - - (Gain) loss on foreign exchange (16.9) (42.3) 4.2 71.3 Non-GAAP EBITDA 41.4 91.4 130.8 68.4

38 Non-GAAP Reconciliation Adjusted Net Income (Loss) (US$ in millions, except per share amounts) (1) Included a foreign exchange gain of $0.3 million and a foreign exchange loss of $1.3 million presented in income and mining tax expense (benefit) on the Condensed Consolidated Statements of Operations for the three and six months ended June 30, 2015, respectively. Included $0.4 million and nil of foreign exchange loss presented in income and mining tax expense (benefit) on the Condensed Consolidated Statements of Operations for the three and six months ended June 30, 2014, respectively. Three Months Ended Six Months Ended Jun 30 2015 Jun 30 2014 Jun 30 2015 Jun 30 2014 $ 0.3 $ 61.6 $ (86.9 ) $ 22.5 Add (Deduct): (Gain) loss on foreign exchange (1) (17.2 ) (41.9 ) 72.6 4.2 Tax expense (benefit) on foreign exchange (gain) loss 3.4 2.3 (13.4 ) (0.4 ) Non-GAAP adjusted net income (loss) $ (13.5 ) $ 22.0 $ (27.7 ) $ 26.3 Net income (loss) per share Basic $ 0.00 $ 0.35 $ (0.40 ) $ 0.13 Diluted $ 0.00 $ 0.28 $ (0.40 ) $ 0.10 Adjusted net income (loss) per share Basic $ (0.06 ) $ 0.13 $ (0.13 ) $ 0.15 Diluted $ (0.06 ) $ 0.10 $ (0.13 ) $ 0.12 Weighted-average shares Basic 218.0 174.5 216.2 173.1 Diluted 218.0 220.3 216.2 217.3

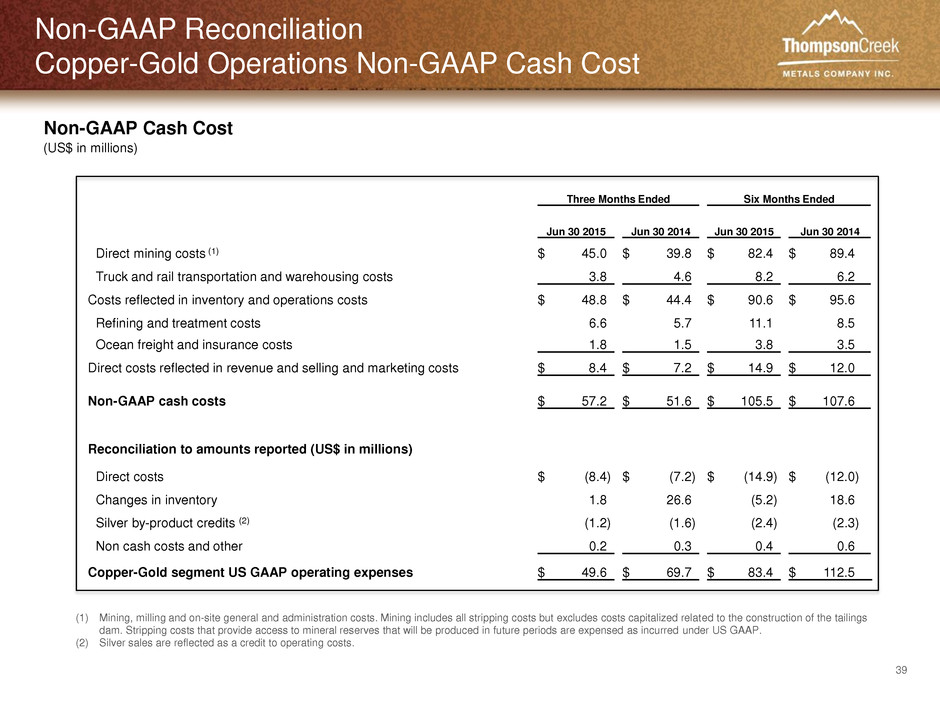

39 Non-GAAP Reconciliation Copper-Gold Operations Non-GAAP Cash Cost (US$ in millions) Non-GAAP Cash Cost (1) Mining, milling and on-site general and administration costs. Mining includes all stripping costs but excludes costs capitalized related to the construction of the tailings dam. Stripping costs that provide access to mineral reserves that will be produced in future periods are expensed as incurred under US GAAP. (2) Silver sales are reflected as a credit to operating costs. Three Months Ended Six Months Ended Jun 30 2015 Jun 30 2014 Jun 30 2015 Jun 30 2014 Direct mining costs (1) $ 45.0 $ 39.8 $ 82.4 $ 89.4 Truck and rail transportation and warehousing costs 3.8 4.6 8.2 6.2 Costs reflected in inventory and operations costs $ 48.8 $ 44.4 $ 90.6 $ 95.6 Refining and treatment costs 6.6 5.7 11.1 8.5 Ocean freight and insurance costs 1.8 1.5 3.8 3.5 Direct costs reflected in revenue and selling and marketing costs $ 8.4 $ 7.2 $ 14.9 $ 12.0 Non-GAAP cash costs $ 57.2 $ 51.6 $ 105.5 $ 107.6 Reconciliation to amounts reported (US$ in millions) Direct costs $ (8.4 ) $ (7.2 ) $ (14.9 ) $ (12.0 ) Changes in inventory 1.8 26.6 (5.2 ) 18.6 Silver by-product credits (2) (1.2 ) (1.6 ) (2.4 ) (2.3 ) Non cash costs and other 0.2 0.3 0.4 0.6 Copper-Gold segment US GAAP operating expenses $ 49.6 $ 69.7 $ 83.4 $ 112.5

40 By-Product (US$ in millions, except pounds and per pound amounts) Non-GAAP Reconciliation Copper-Gold Operations By-Product Unit Cost Per Pound Produced (1) Excluded refining and treatment charges. (2) Silver sales are reflected as a credit to operating costs. Three Months Ended Six Months Ended Jun 30 2015 Jun 30 2014 Jun 30 2015 Jun 30 2014 Copper payable production (000's lbs) 20,159 16,035 35,564 30,278 Non-GAAP cash cost $ 57.2 $ 51.6 $ 105.5 $ 107.6 Less by-product credits Gold sales (1) $ 56.5 $ 54.4 $ 92.7 $ 78.9 Gold sales related to deferred portion of Gold Stream Arrangement (10.0 ) (9.7 ) (16.4 ) (14.1 ) Net gold by-product credits $ 46.5 $ 44.7 $ 76.3 $ 64.8 Silver by-product credits (2) 1.3 1.6 2.5 2.3 Total by-product credits $ 47.8 $ 46.3 $ 78.8 $ 67.1 Non-GAAP cash cost net of by-product credits $ 9.4 $ 5.3 $ 26.7 $ 40.5 Non-GAAP unit cash cost on a by-product basis, per pound $ 0.48 $ 0.33 $ 0.75 $ 1.34

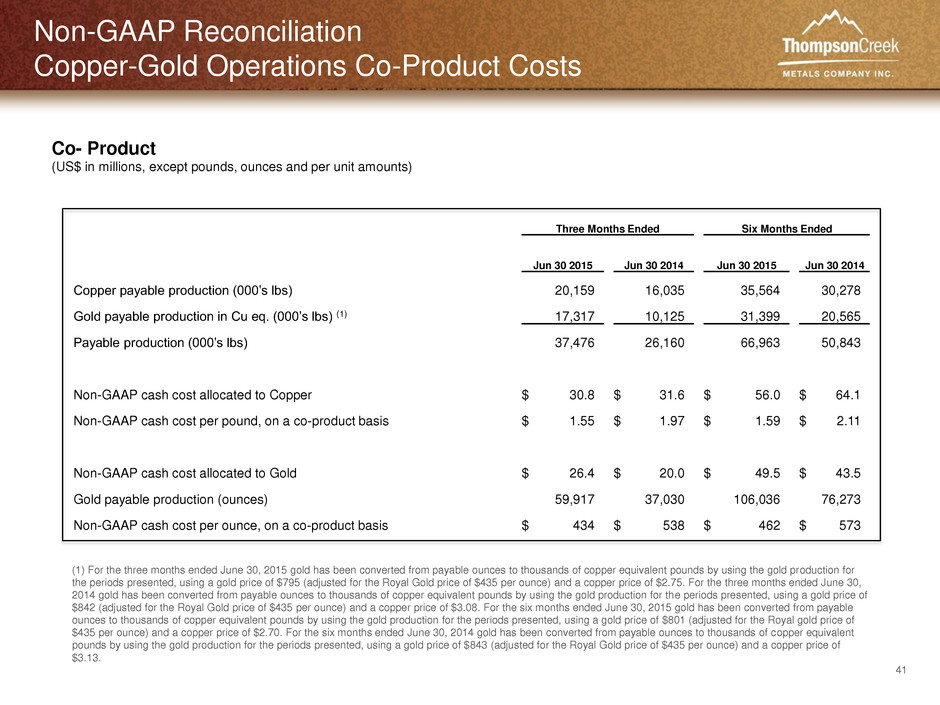

41 Co- Product (US$ in millions, except pounds, ounces and per unit amounts) Non-GAAP Reconciliation Copper-Gold Operations Co-Product Costs Three Months Ended Six Months Ended Jun 30 2015 Jun 30 2014 Jun 30 2015 Jun 30 2014 Copper payable production (000’s lbs) 20,159 16,035 35,564 30,278 Gold payable production in Cu eq. (000’s lbs) (1) 17,317 10,125 31,399 20,565 Payable production (000’s lbs) 37,476 26,160 66,963 50,843 Non-GAAP cash cost allocated to Copper $ 30.8 $ 31.6 $ 56.0 $ 64.1 Non-GAAP cash cost per pound, on a co-product basis $ 1.55 $ 1.97 $ 1.59 $ 2.11 Non-GAAP cash cost allocated to Gold $ 26.4 $ 20.0 $ 49.5 $ 43.5 Gold payable production (ounces) 59,917 37,030 106,036 76,273 Non-GAAP cash cost per ounce, on a co-product basis $ 434 $ 538 $ 462 $ 573 (1) For the three months ended June 30, 2015 gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented, using a gold price of $795 (adjusted for the Royal Gold price of $435 per ounce) and a copper price of $2.75. For the three months ended June 30, 2014 gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented, using a gold price of $842 (adjusted for the Royal Gold price of $435 per ounce) and a copper price of $3.08. For the six months ended June 30, 2015 gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented, using a gold price of $801 (adjusted for the Royal gold price of $435 per ounce) and a copper price of $2.70. For the six months ended June 30, 2014 gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented, using a gold price of $843 (adjusted for the Royal Gold price of $435 per ounce) and a copper price of $3.13.

42 Non-GAAP Reconciliation Copper-Gold Operations Average Realized Sales Prices (1) The average realized sales price per payable pound of copper sold and payable ounces of gold sold is impacted by any final volume and pricing adjustments and mark-to-market adjustments for shipments made in prior periods. (US$ in millions, except pounds, ounces and per unit amounts) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Copper sales reconciliation ($) Copper sales, excluding adjustments $ 58.4 $ 68.6 $ 96.7 $ 102.6 Final pricing adjustments 1.6 (1.9 ) (5.7 ) (2.0 ) Mark-to-market adjustments (4.3 ) 3.5 1.2 2.1 Copper sales, net of adjustments 55.7 70.2 92.2 102.7 Less Refining and treatment costs 6.4 5.4 10.7 8.1 Copper sales $ 49.3 $ 64.8 $ 81.5 $ 94.6 Pounds of Copper sold (000's lb) 21,195 21,939 35,986 32,732 Average realized sales price for Copper on a per pound basis Copper sales excluding adjustments $ 2.76 $ 3.13 $ 2.69 $ 3.13 Final pricing adjustments 0.08 (0.09 ) $ (0.16 ) (0.06 ) Mark-to-market adjustments (0.21 ) 0.16 $ 0.03 0.07 Average realized Copper sales price per pound sold $ 2.63 $ 3.20 $ 2.56 $ 3.14 Continued Average Realized Sales Prices for Copper

43 Non-GAAP Reconciliation (continued) Copper-Gold Operations Average Realized Sales Prices (1) The average realized sales price per payable pound of copper sold and payable ounces of gold sold is impacted by any final volume and pricing adjustments and mark-to-market adjustments for shipments made in prior periods. (US$ in millions, except pounds, ounces and per unit amounts) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Gold sales related to cash portion of Gold Stream Arrangement $ 13.1 $ 11.7 $ 21.4 $ 17.2 Gold sales related to deferred portion of Gold Stream Arrangement 10.0 9.7 16.4 14.1 Gold sales under Gold Stream Arrangement 23.1 21.4 37.8 31.3 TCM share of gold sales to MTM Customers 34.0 32.2 55.2 47.2 Final pricing adjustments (1.1 ) (0.2 ) (0.4 ) (0.3 ) Mark-to-market adjustments 0.4 1.0 — 0.7 Gold sales TCM Share 33.3 33.0 54.8 47.6 Gold sales, net of adjustments 56.4 54.4 92.6 78.9 Less Refining and treatment costs 0.1 0.3 0.3 0.4 Gold sales 56.3 54.1 92.3 78.5 Ounces of gold sold to Royal Gold 30,070 26,990 49,224 39,364 TCM share of ounces of gold sold to MTM customers 27,850 24,993 45,446 36,493 Total ounces of Gold sold 57,920 51,983 94,670 75,857 Average realized sales price for Gold on a per ounce basis Gold sales related to cash portion of Gold Stream Arrangement $ 435 $ 435 $ 435 $ 435 Gold sales related to deferred portion of Gold Stream Arrangement 334 359 334 $ 359 Average realized sales price per ounce sold to Royal Gold $ 769 $ 794 $ 769 $ 794 TCM share of gold sales to MTM Customers $ 1,221 $ 1,288 1,215 $ 1,293 Final pricing adjustments (39 ) (8 ) (10 ) (7) Mark-to-market adjustments 15 40 - 19 Average realized sales price per payable ounce sold for TCM share $ 1,197 $ 1,320 $ 1,205 $ 1,305 Average realized sales price per ounce sold $ 975 $ 1,047 $ 979 $ 1,040 Average Realized Sales Prices for Gold