Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Lumentum Holdings Inc. | d32457d8k.htm |

| EX-2.3 - EX-2.3 - Lumentum Holdings Inc. | d32457dex23.htm |

| EX-2.1 - EX-2.1 - Lumentum Holdings Inc. | d32457dex21.htm |

| EX-2.2 - EX-2.2 - Lumentum Holdings Inc. | d32457dex22.htm |

| EX-3.2 - EX-3.2 - Lumentum Holdings Inc. | d32457dex32.htm |

| EX-3.1 - EX-3.1 - Lumentum Holdings Inc. | d32457dex31.htm |

| EX-4.1 - EX-4.1 - Lumentum Holdings Inc. | d32457dex41.htm |

| EX-10.4 - EX-10.4 - Lumentum Holdings Inc. | d32457dex104.htm |

| EX-10.2 - EX-10.2 - Lumentum Holdings Inc. | d32457dex102.htm |

| EX-10.5 - EX-10.5 - Lumentum Holdings Inc. | d32457dex105.htm |

| EX-10.1 - EX-10.1 - Lumentum Holdings Inc. | d32457dex101.htm |

| EX-10.3 - EX-10.3 - Lumentum Holdings Inc. | d32457dex103.htm |

| EX-99.2 - EX-99.2 - Lumentum Holdings Inc. | d32457dex992.htm |

Exhibit 99.1

INFORMATION STATEMENT

This information statement is being furnished to you in connection with the distribution by JDS Uniphase Corporation (“JDSU”) to its stockholders of 80.1% of the outstanding shares of common stock of our company, Lumentum Holdings Inc. (“Lumentum”), a wholly-owned subsidiary of JDSU that will indirectly hold the assets and liabilities associated with JDSU’s communications and commercial optical products (“CCOP”) business. To implement the separation, Viavi will retain 19.9% of the shares of our common stock and JDSU will distribute the remaining 80.1% of the shares of Lumentum common stock on a pro rata basis to JDSU stockholders in a manner that is intended to be tax-free for U.S. federal income tax purposes.

For every five shares of JDSU common stock held of record by you as of the close of business on July 27, 2015, the record date for the distribution, you will receive one share of Lumentum common stock. You will receive cash in lieu of any fractional shares of our common stock that you would have received after application of the above ratio. As discussed under “The Separation and Distribution-Trading between the Record Date and Ex-Dividend Date,” if you also sell your JDSU common stock after the record date and before the ex-dividend date, August 4, 2015, you will have the option to sell your right to receive shares of our common stock in connection with the separation. The first day you can sell your JDSU common stock after the record date without the option to sell your right to receive shares of our common stock is August 4, 2015 (at which time JDSU shall have been renamed Viavi). This date is commonly known as the “ex-dividend date.”

We expect the shares of our common stock to be dividended by JDSU on August 1, 2015. We refer to the date of the distribution of the shares of our common stock as the “distribution date.” Because August 1, 2015 is a Saturday and not a business day, the shares are expected to be credited to “street name” stockholders through the Depository Trust Corporation (DTC) on the first trading day thereafter, Monday, August 3, 2015. No vote of JDSU stockholders is required for the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send JDSU a proxy, in connection with the distribution. You do not need to pay any consideration, exchange or surrender your existing JDSU common stock or take any other action to receive your shares of our common stock.

There is no current trading market for our common stock, although we expect that a limited market, commonly known as a “when-issued” trading market, will be established on the NASDAQ stock market on Thursday, July 23, 2015. We expect “regular-way” trading of our common stock to begin on the ex-dividend date, Tuesday, August 4, 2015. We have applied to have our common stock authorized for listing on The Nasdaq Stock Market (“NASDAQ”) under the symbol “LITE.” In connection with the separation, JDSU will be renamed Viavi Solutions Inc. (“Viavi”) and Viavi will continue to trade on NASDAQ under the new symbol “VIAV.”

We are an “emerging growth company” as defined under federal securities laws. For implications of our status as an “emerging growth company,” please see “Summary-‘Emerging Growth Company’ Status” beginning on page 15 and “Risk Factors” beginning on page 17.

In reviewing this information statement, you should carefully consider the matters described in the section captioned “Risk Factors” beginning on page 17.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is July 16, 2015.

This information statement was first mailed to JDSU stockholders on or about July 28, 2015.

TABLE OF CONTENTS

| QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION |

2 | |||

| SUMMARY |

10 | |||

| SUMMARY HISTORICAL COMBINED FINANCIAL DATA |

16 | |||

| RISK FACTORS |

17 | |||

| CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS |

32 | |||

| THE SEPARATION AND DISTRIBUTION |

33 | |||

| DIVIDEND POLICY |

40 | |||

| CAPITALIZATION |

41 | |||

| UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS |

42 | |||

| SELECTED HISTORICAL COMBINED FINANCIAL DATA |

49 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

50 | |||

| BUSINESS |

74 | |||

| MANAGEMENT |

85 | |||

| EXECUTIVE COMPENSATION |

91 | |||

| DIRECTOR COMPENSATION |

101 | |||

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS |

102 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

110 | |||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES |

112 | |||

| DESCRIPTION OF MATERIAL INDEBTEDNESS |

116 | |||

| DESCRIPTION OF OUR CAPITAL STOCK |

117 | |||

| WHERE YOU CAN FIND MORE INFORMATION |

122 | |||

| INDEX TO FINANCIAL STATEMENTS |

F-1 | |||

i

PRESENTATION OF INFORMATION

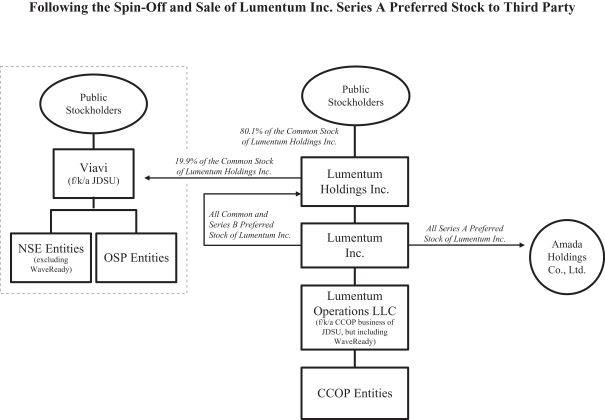

Except as otherwise indicated or unless the context otherwise requires, the information about us included in this information statement assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “Lumentum,” the “company,” “we,” “us” and “our” refer to the communications and commercial optical products (“CCOP”) business of JDSU prior to the spin-off, which will be held as follows under our anticipated corporate structure:

| • | Prior to the separation and distribution, JDSU will contribute the designated assets and liabilities of the Lumentum business to a wholly-owned Delaware limited liability company, Lumentum Operations LLC (“Lumentum Operations LLC”); |

| • | Following the contribution above and immediately prior to the separation and distribution, JDSU will contribute all of the membership interests in Lumentum Operations LLC to Lumentum Inc., a Delaware corporation (“Lumentum Inc.”); |

| • | Following the contribution above and immediately prior to the separation and distribution, JDSU will contribute all of the common stock and Series B Preferred Stock of Lumentum Inc. to Lumentum Holdings, Inc.; |

| • | Following the separation and distribution and certain related intercompany transactions, Lumentum Holdings Inc. will hold all common stock and Series B Preferred Stock of Lumentum Inc. and a third- party investor, Amada Holdings, Co. Ltd., has contractually agreed to purchase from JDSU all of the Series A Preferred Stock of Lumentum Inc., at an aggregate price intended to equal approximately 3% of Lumentum Holdings equity value, for a minimum of $30 million and up to a maximum of $40 million. |

JDSU’s WaveReady product lines (“WaveReady”) address system level optical communications needs of communications services providers. Prior to the separation and distribution, the WaveReady product lines were contained within the network enablement (“NE”) segment of JDSU. The JDSU board of directors has determined that the WaveReady product lines have attributes that would lend them to being included in either the NE or CCOP segments but, because of the anticipated future directions of both the CCOP and WaveReady businesses, the JDSU board of directors has concluded that the WaveReady business should be transferred to us along with the CCOP segment. Accordingly, we have reflected the assets, liabilities and results of operations of WaveReady in our combined financial statements. In the fiscal years ended June 28, 2014, June 29, 2013 and June 30, 2012, net revenue associated with WaveReady would have represented approximately 3% of our net revenue assuming we had been a stand-alone company as of those dates. References to the CCOP business and the Lumentum business in this information statement also include WaveReady.

Except as otherwise indicated or unless the context otherwise requires, references in this information statement to “JDSU” refer to JDS Uniphase Corporation, a Delaware corporation, and its consolidated subsidiaries. In connection with the separation and distribution, JDSU will be renamed Viavi Solutions Inc. Generally, references to “Viavi” are to the existing JDSU network enablement, service enablement and optical security and performance products businesses, which Viavi will continue to operate following the spin-off of the CCOP business.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

All our registered or common law trademarks, service marks, or trade names appearing in this information statement are the property of Lumentum Holdings Inc. or its subsidiaries. Other trademarks, service marks, or trade names appearing in this information statement are, to our knowledge, the property of their respective owners.

1

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is Lumentum and why is JDSU spinning off the CCOP business? |

We are currently a wholly-owned subsidiary of JDSU that will, indirectly through Lumentum Operations LLC, hold JDSU’s CCOP business after the separation. Our separation from JDSU and the distribution of our common stock are intended to provide you with equity investments in two separate, publicly traded companies focused on each of their respective businesses. We and JDSU expect that the separation will enhance the long-term performance of each business for the reasons discussed in “The Separation and Distribution-Background” and “The Separation and Distribution-Reasons for the Separation.” |

| Why am I receiving this document? |

JDSU is delivering this document to you because you are a holder of JDSU common stock. If you are a holder of JDSU common stock as of the close of business on July 27, 2015, the record date for the distribution, and do not subsequently sell your right to receive the dividend of Lumentum common stock, you will be entitled to receive one share of our common stock for every five shares of JDSU common stock that you held immediately prior to such date. This document will help you understand how the separation and distribution will affect your investment in JDSU and your investment in us after the separation. |

| How will our separation from JDSU work? |

To accomplish the separation, Viavi will retain 19.9% of the shares of our common stock and JDSU intends to distribute the remaining 80.1% of the outstanding shares of our common stock to JDSU stockholders on a pro rata basis. |

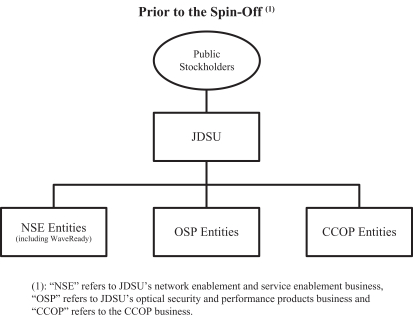

| What will the organizational structure look like before and after the spin-off? |

We were formed in Delaware on February 10, 2015, for the purpose of holding JDSU’s CCOP business. |

| Prior to the Spin-Off |

| As part of the plan to separate the CCOP business from the remainder of its businesses, JDSU: |

| • | intends to transfer the CCOP assets and liabilities to Lumentum Operations LLC; |

| • | intends to transfer all of the membership interests in Lumentum Operations LLC to Lumentum Inc. in exchange for all of the common stock, Series A Preferred Stock and Series B Preferred Stock of Lumentum Inc.; |

| • | has entered into a contract under which JDSU has agreed to sell all of the Series A Preferred Stock of Lumentum Inc. to a third-party investor, Amada Holdings Co., Ltd. (“Amada”), which contract precedes the sale of such stock (For a description of the sale and the terms of the Series A Preferred Stock, see “Certain Relationships and Related Party Transactions - Securities Purchase Agreement”); and |

| • | intends to transfer all of the common stock and Series B Preferred Stock of Lumentum Inc. to Lumentum Holdings Inc. |

2

| Following the Spin-Off |

| Following the separation: |

| • | the CCOP business will be held by Lumentum Operations LLC; |

| • | Lumentum Operations LLC will be a wholly-owned limited liability company of Lumentum Inc.; |

| • | all shares of Lumentum Inc., except for the shares of Series A Preferred Stock to be held by Amada, will be held by Lumentum Holdings Inc.; and |

| • | JDSU is contractually obligated to immediately sell all of the Series A Preferred Stock of Lumentum Inc. to Amada. |

| We refer to this series of transactions as the “Transaction Structure.” For diagrams depicting the basic organizational structure of JDSU before the spin-off and Viavi and us after the spin-off, see “The Separation and Distribution - Organizational Structure Before and After the Spin-Off.” |

| Why is our separation structured as a distribution? |

JDSU believes that a tax-free distribution for U.S. federal income tax purposes of shares of our common stock to the JDSU stockholders is an efficient way to separate its CCOP business in a manner that will create long-term value for JDSU, us and our respective stockholders. |

| What is the record date for the distribution? |

The record date for the distribution will be July 27, 2015. |

| When will the distribution occur? |

It is expected that JDSU will distribute 80.1% of the shares of our common stock to holders of record of JDSU common stock at the close of business on the record date for the distribution. |

| What do stockholders need to do to participate in the distribution? |

You do not have to take any action to receive shares of our common stock in the distribution, but you are urged to read this entire information statement carefully. No stockholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing JDSU common stock or take any other action to receive your shares of our common stock. Please do not send in your JDSU stock certificates. The distribution will not affect the number of outstanding JDSU shares or any rights of JDSU stockholders, although it will affect the market value of each outstanding share of JDSU common stock. |

| How will shares of our common stock be issued? |

You will receive shares of our common stock through the same channels that you currently use to hold or trade JDSU common stock, whether through a brokerage account or other channel. Receipt of shares of our common stock will be documented for you in the same manner that you typically receive stockholder updates, such as monthly broker statements. |

3

| The distribution agent will electronically distribute shares of our common stock to you or to your brokerage firm on your behalf in book-entry form. We will mail you a book-entry account statement that reflects your shares of our common stock, or your bank or brokerage firm will credit your account for the shares. |

| How many shares of our common stock will I receive in the distribution? |

JDSU will distribute to you one share of our common stock for every five shares of JDSU common stock held by you immediately prior to the ex-dividend date. Based on approximately 233.9 million shares of JDSU common stock outstanding as of March 28, 2015, a total of approximately 46.8 million shares of our common stock will be distributed and additionally, approximately 11.6 million shares will be retained by JDSU. For additional information on the distribution, see “The Separation and Distribution.” |

| Will we issue fractional shares of our common stock in the distribution? |

No. We will not issue fractional shares of our common stock in the distribution. Fractional shares that JDSU stockholders would otherwise have been entitled to receive will be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed pro rata (based on the fractional share such holder would otherwise be entitled to receive) to those stockholders who would otherwise have been entitled to receive fractional shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts paid in lieu of fractional shares. The receipt of cash in lieu of fractional shares generally will be taxable to the recipient stockholders for U.S. federal income tax purposes as described in “Material U.S. Federal Income Tax Consequences.” |

| What are the conditions to the distribution? |

The distribution is subject to final approval by the JDSU board of directors, as well as a number of conditions, including the following conditions (each of which may be waived by JDSU in its sole discretion): |

| • | completion of the steps contemplated by our Transaction Structure; |

| • | receipt by JDSU of the opinion of JDSU’s tax advisor, PricewaterhouseCoopers LLP (“PwC”), that the separation and distribution should qualify as tax-free for U.S. federal income tax purposes under Section 368(a)(1)(D) and 355 of the Internal Revenue Code (the “Code”); |

| • | declaration by the U.S. Securities and Exchange Commission (“SEC”) of the effectiveness of the registration statement of which this information statement forms a part, no stop order suspending the effectiveness of the registration statement will be in effect, no proceedings for such purpose will be pending before or threatened by the SEC and the mailing of this information statement to JDSU stockholders; |

| • | no order, injunction or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the |

4

| consummation of the separation, the distribution or any of the related transactions will be in effect; |

| • | acceptance for listing on NASDAQ of the shares of our common stock to be distributed, subject to official notice of distribution; and |

| • | no other event or development will have occurred or exist that, in the judgment of JDSU’s board of directors, in its sole discretion, makes it inadvisable to effect the separation, the distribution or the other related transactions. |

| We cannot assure you that any or all of these conditions will be met. In addition, JDSU can, in its sole and absolute discretion, decline at any time to go forward with the separation. For a complete discussion of all of the conditions to the distribution, see “The Separation and Distribution-Conditions to the Distribution.” |

| What is the expected date of completion of the separation? |

It is expected that the shares of our common stock will be distributed by JDSU to the holders of an entitlement to shares of our common stock immediately prior to the ex-dividend date. However, the completion and timing of the separation are dependent upon a number of conditions and no assurance can be provided as to the timing of the separation or that all conditions to the separation will be met. |

| Can JDSU decide to cancel the distribution of our common stock even if all the conditions have been met? |

Yes. Until the distribution has occurred, JDSU has the right to terminate the distribution, even if all of the conditions are met. See “The Separation and Distribution-Conditions to the Distribution.” |

| What if I want to sell my JDSU common stock or my Lumentum common stock? |

You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. |

| What is “regular-way” and “ex-distribution” trading of JDSU stock? |

Beginning on Thursday, July 23, 2015 and continuing up to Tuesday, August 4, 2015, the ex-dividend date, it is expected that there will be two markets in JDSU common stock: a “regular-way” market and an “ex-distribution” market. JDSU common stock that trades in the “regular-way” market will trade with an entitlement to shares of our common stock distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without an entitlement to shares of our common stock distributed pursuant to the distribution. |

| If you decide to sell any JDSU common stock between the record date and the ex-dividend date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your shares of JDSU common stock with or without your entitlement to receive shares of our common stock pursuant to the distribution. |

5

Set forth below is a summary of material dates involving the trading of JDSU (to be renamed Viavi) and Lumentum common stock as they relate to the separation and distribution:

| Key Dates |

Ticker Symbol |

Trading Implications | ||

| On or before July 22, 2015

|

JDSU

|

JDSU (including the Lumentum business) trades under ticker symbol “JDSU”.

| ||

| From Thursday, July 23, 2015 until close of NASDAQ on Monday, August 3, 2015 |

JDSU

|

Ticker symbol “JDSU” continues to represent “regular-way” trades of JDSU (including the right to receive Lumentum shares in connection with the distribution.)

| ||

| JDSUV

|

Ticker symbol “JDSUV” represents “ex-distribution” trades of JDSU, which will NOT carry the right to receive shares of Lumentum in connection with the distribution.

| |||

| LITEV

|

Ticker symbol “LITEV” represents “when-issued” trades of Lumentum, whereby shareholders trade the right to receive shares of Lumentum in connection with the distribution.

| |||

| From NASDAQ opening on Tuesday, August 4, 2015 (the ex-dividend date) | VIAV

|

JDSU will change its name to Viavi Solutions Inc. and will trade under ticker symbol “VIAV”, which shares will not carry the right to receive Lumentum shares.

| ||

| LITE | Lumentum shares will trade “regular-way” under ticker symbol “LITE”.

| |||

| Where will I be able to trade shares of our common stock? |

We have applied to list our common stock on NASDAQ under the symbol “LITE.” We anticipate that trading in shares of our common stock will begin on a “when-issued” basis on or shortly before the record date for the distribution and will continue up to the ex-dividend date and that “regular-way” trading in our common stock will begin on the ex-dividend date. If trading begins on a “when-issued” basis, you may purchase or sell our common stock up to the ex-dividend date, but your transaction will not settle until after the ex-dividend date. We cannot predict the trading prices for our common stock before, on or after the distribution date. |

| What will happen to the listing of JDSU common stock? |

In connection with the separation, JDSU will change its name to Viavi Solutions Inc. Viavi common stock will continue to trade on NASDAQ after the distribution under the symbol “VIAV.” JDSU’s name change to Viavi will not affect the validity or transferability of any currently outstanding stock certificates and JDSU stockholders will not be requested to surrender for exchange any certificates presently held by them. |

| Will the number of shares of JDSU common stock that I own change as a result of the distribution? |

No. The number of shares of JDSU common stock that you own will not change as a result of the distribution. |

6

| Will the distribution affect the market price of my JDSU shares? |

Yes. As a result of the distribution, we expect the trading price of Viavi common stock immediately following the ex-dividend date to be lower than the “regular-way” trading price of JDSU common stock immediately prior to the ex-dividend date, because the trading price will no longer reflect the value of the CCOP business. The aggregate market value of Viavi’s common stock and our common stock following the separation may be higher or lower than the market value of JDSU common stock would have been if the separation did not occur. This means, for example, that the sum of the trading prices of one share of Viavi common stock plus the number of shares of our common stock to be received for every five shares of JDSU common stock in the distribution may be equal to, greater than or less than the trading price of one JDSU common share before the ex-dividend date. |

| What are the material U.S. federal income tax consequences of the distribution? |

We have received a private letter ruling from the IRS (“IRS Ruling”) to the effect that the retention by Viavi of 19.9 percent of our common stock will not be deemed to be pursuant to a plan having as one of its principal purposes the avoidance of U.S. federal income tax within the meaning of Section 355(a)(1)(D)(ii) of the Code. The distribution is conditioned upon JDSU’s receipt of the opinion of PwC, its tax advisor, to the effect that the distribution, together with certain related transactions necessary to effectuate the distribution, should qualify as a tax-free distribution for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Code. Assuming the distribution so qualifies, for U.S. federal income tax purposes, (i) no gain or loss should be recognized by you, and no amount should be included in your income, upon receipt of the distribution of shares of our common stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares, (ii) the aggregate tax basis of your JDSU common stock should be allocated between the shares of our common stock that you receive in the distribution and your shares of Viavi common stock in proportion to their respective fair market values immediately after the distribution and (iii) your holding period for the shares of our stock that you receive in the distribution should generally include your holding period for your JDSU common stock with respect to which our common stock is distributed. |

| For more information regarding the potential U.S. federal income tax consequences to us, JDSU and you of the separation and distribution, see “Material U.S. Federal Income Tax Consequences.” |

| TAX MATTERS ARE COMPLICATED AND THE TAX CONSEQUENCES OF THE DISTRIBUTION TO ANY PARTICULAR JDSU STOCKHOLDER WILL DEPEND ON THAT STOCKHOLDER’S PARTICULAR SITUATION. YOU SHOULD CONSULT YOUR OWN TAX ADVISOR TO DETERMINE THE TAX CONSEQUENCES OF THE DISTRIBUTION TO YOU. |

7

| What are the material state, local and foreign income tax consequences of the separation and distribution? |

The opinion of PwC, JDSU’s tax advisor, will not address the state, local or foreign income tax consequences of the separation and the distribution. You should consult your personal tax advisor about the particular state, local and foreign tax consequences of the separation and distribution to you, which consequences may differ from those described in “Material U.S. Federal Income Tax Consequences.” |

| What will our relationship be with Viavi following the separation and distribution? |

Following the separation and distribution, we will be an independent, publicly-owned company and it is anticipated that Viavi will retain 19.9 percent of our common stock. In connection with the separation and the distribution, we will enter into a separation agreement with JDSU to effect the separation and provide a framework for our relationship with Viavi after the separation. We will also enter into certain other agreements, including a tax matters agreement, an employee matters agreement, an intellectual property matters agreement, a stockholder’s and registration rights agreement applying to our shares of common stock retained by Viavi, an escrow agreement and a supply agreement. These agreements provide for the allocation between JDSU and us of our assets, employees, liabilities and obligations (including our investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after our separation from JDSU, and will govern certain relationships between Viavi and us after the separation. For additional information regarding the separation agreement and other transaction agreements, see the sections entitled “Risk Factors-Risks Related to the Separation” and “Certain Relationships and Related Person Transactions.” |

| Who will manage Lumentum after the separation? |

We will benefit from an experienced management team after the separation, including Alan Lowe—President and Chief Executive Officer; Aaron Tachibana—Chief Financial Officer; Vincent Retort—Senior Vice President—Research and Development; Craig Cocchi—Senior Vice President—Operations; Jason Reinhardt—Senior Vice President—Sales and Judy Hamel—General Counsel and Secretary. For more information regarding our management, see “Management.” |

| Are there risks associated with owning Lumentum common stock? |

Yes. Ownership of our common stock is subject to both general and specific risks, including those relating to our business, the industry in which we operate, our ongoing contractual relationships with JDSU and our status as a separate, publicly traded company. Ownership of our common stock is also subject to risks relating to the separation. These risks are described in the “Risk Factors” section of this information statement. You are encouraged to read that section carefully. |

| Does Lumentum plan to pay dividends? |

We do not currently expect to pay dividends on our common stock. The declaration and payment of any dividends in the future by us will be subject to the sole discretion of our board of directors and will depend upon many factors. See “Dividend Policy.” |

8

| Will Lumentum incur any indebtedness prior to or at the time of the distribution? |

From and after the separation, Viavi and Lumentum will, in general, each be responsible for the debts, liabilities, rights and obligations related to the business or businesses that it owns and operates following consummation of the spin-off. See “Certain Relationships and Related Person Transactions—Agreements with JDSU.” See “Description of Material Indebtedness” and “Risk Factors-Risks Related to Our Business.” |

| Who will be the distribution agent, transfer agent, registrar and information agent for Lumentum’s common stock? |

The distribution agent, transfer agent and registrar for our common stock will be Computershare Trust Company, N.A. For questions relating to the transfer or mechanics of the stock distribution, you should contact: |

| Do I have appraisal rights in connection with the distribution? |

No. JDSU stockholders will not be entitled to any appraisal rights in connection with the distribution. |

| Where can I find more information about JDSU and Lumentum? |

Before the distribution, if you have any questions relating to JDSU’s business performance, you should contact: |

| JDS Uniphase Corporation |

Attn: Investor Relations

430 N. McCarthy Blvd.

Milpitas, CA 95035

408-404-4512

| After the distribution, our stockholders who have any questions relating to our business performance should contact: |

| Lumentum Holdings Inc. |

Attn: Investor Relations

400 N. McCarthy Blvd.

Milpitas, CA 95035

408-404-0606

9

SUMMARY

The following is a summary of material information discussed in this information statement. This summary may not contain all of the details concerning the separation or other information that may be important to you. To better understand the separation and our business and financial position, you should carefully review this entire information statement.

This information statement describes the CCOP business of JDSU to be transferred to us by JDSU in the separation as if the transferred business was our business for all historical periods described. References in this information statement to our historical assets, liabilities, products, businesses or activities are generally intended to refer to the historical assets, liabilities, products, businesses or activities of the CCOP business as part of JDSU and its subsidiaries prior to the separation.

Our Company

We are an industry leading provider of optical and photonic products addressing a range of end markets including data communications (“Datacom”) and telecommunications (“Telecom”) networking, and industrial and commercial lasers (“commercial lasers”) for manufacturing, inspection and life-sciences applications. We are using our core optical and photonic technology and our volume manufacturing capability to expand into attractive emerging markets that benefit from advantages that optical or photonics-based solutions provide, including 3-D sensing for consumer electronics and diode light sources for a variety of consumer and industrial applications. Our customers tend to be original equipment manufacturers (“OEMs”) that incorporate our products into their products which then address end-market applications. For example, we sell fiber optic components which our network equipment manufacturer (“NEM”) customers assemble into communications networking systems which they sell to network service providers or enterprises with their own networks. Similarly, many of our customers for our commercial laser products incorporate our products into tools they produce which are used for manufacturing processes by their customers.

We operate two reportable segments: Optical Communications (“OpComms”) and Commercial Lasers (“Lasers”). Our OpComms portfolio includes products used by Telecom and Datacom NEMs and cloud and data center service providers. The Lasers business develops commercial lasers employed in a variety of OEM applications.

We have a global marketing and sales footprint that enables us to address global market opportunities for our products. We have manufacturing capabilities and facilities in North America, Asia, and Europe, the Middle East and Africa (“EMEA”) with employees engaged in research and development (“R&D”), administration, manufacturing, support, and sales and marketing activities. We employ approximately 1,550 people around the world.

Industry Trends

Our business is driven by end-market applications which benefit from the performance advantages that optical solutions enable. The OpComms markets we serve are experiencing a continually increasing need for higher data transmission speeds, fiber optic network capacity and network agility. This is driven by significant growth in both the number of higher bandwidth broadband connections, notably those associated with mobile devices, such as high-definition video, and the number and scale of datacenters that require fiber optic links to allow the higher speeds and increased scale needed to deliver high bandwidth video and other services. Our technology, originally developed for communications applications, is also finding use in other emerging market opportunities including 3-D sensing applications which employ our laser technology to enable the use of natural body gestures to control electronic devices.

10

In our Lasers markets, the demand for laser-based optical solutions is driven by the need to enable faster, higher precision volume manufacturing techniques with lower power consumption, reduced manufacturing footprints and increased productivity. These capabilities are critical as industries develop products that are smaller and lighter, increasing productivity and yield, and lowering their energy consumption. Additionally, demand continues for electronic products which offer greater functionality while becoming smaller, lighter and less expensive.

Our optical and laser solutions, developed in close collaboration with OEM partners, are positioned to meet demand resulting from these trends.

Our Strengths

We believe the following strengths provide us with long-term competitive advantages:

| • | Depth and breadth of products, technology and intellectual property. Our product and technology portfolio stems from more than 30 years of innovation and our intellectual property portfolio currently consists of more than 1,000 issued patents. Our leadership in products, technology and intellectual property is the result of the strength and capability of our people and our close long-term relationships with our key customers. |

| • | Business model. We have a global operation and maintain internal manufacturing capabilities for key differentiated, high intellectual property content in addition to using experienced, high-volume contract manufacturing partners with operations in low-cost geographic regions. This manufacturing model is well adapted to variations in end-market demand and rapid high-volume product ramps as we introduce successful new products. |

| • | Customer relationships. We have developed strong relationships with our customers over a lengthy period of time. By placing our product development, marketing and sales people close to our customers, our goal is to anticipate network challenges well before they appear. |

| • | Experience. We benefit from more than 30 years of experience in the optical industry with important insights learned from our many years of developing and manufacturing optical and photonics products. We apply this know-how to develop and manufacture high-quality and reliable products that our customers can depend on with confidence. |

Our Strategy

To continue to be a leading provider in all the markets and industries we serve, our strategy includes:

| • | Enabling our customers through collaborative innovation. We plan to continue engaging with our customers at the early stages of development to give them the most innovative and timely products and to ensure that our focus remains aligned with their rapidly evolving requirements. |

| • | Maintaining a lean and scalable business. We intend to continue to streamline our manufacturing operations and reduce costs by using contract manufacturers where appropriate, and consolidating to reduce our footprint and total fixed costs. |

| • | Investing in profitable, market-based innovation. We expect to continue to invest aggressively in R&D and pursue acquisitions and partnerships to develop new technologies, products and services. |

| • | Expanding our addressable markets. We anticipate continuing to explore new market opportunities for our differentiated technologies and products. |

11

Risks Associated with Our Business and the Separation and Distribution

An investment in our common stock is subject to a number of risks, including risks relating to our business and the separation and distribution. The following list of risk factors is not exhaustive. Please read the information in the section captioned “Risk Factors” for a more thorough description of these and other risks.

Risks Related to Our Business

| • | Our operating results may be adversely affected by unfavorable economic and market conditions. |

| • | Changing technology and intense competition require us to continue to innovate. |

| • | The manufacture of our products may be affected if our contract manufacturers and suppliers fail to meet our needs or if we are unable to manufacture certain products in our manufacturing facilities. |

| • | We depend on a limited number of suppliers for raw materials, packages and components. |

| • | We rely on a limited number of customers for a significant portion of our sales; our business is subject to seasonality; and the majority of our customers do not have contractual purchase commitments. |

| • | The contemplated transaction structure may result in additional income tax liabilities which would negatively impact our operating results. |

| • | We are subject to continued changes in tax laws; the possible fluctuation of our effective tax rate over time could materially and adversely affect our operating results. |

| • | We may change our international corporate structure in the near future in order to minimize our effective rate; however, if we are unable to adopt this structure or if it is challenged by U.S. or foreign tax authorities, we may be unable to realize such tax savings which could materially and adversely affect our operating results. |

| • | Our future operating results may be subject to volatility due to fluctuations in foreign currency. |

| • | We face a number of risks related to our strategic transactions. |

| • | Our business and operations would be adversely impacted in the event of a failure of our information technology infrastructure. |

| • | If we have insufficient proprietary rights or if we fail to protect our rights, our business would be materially harmed. |

| • | Our products may be subject to claims that they infringe the intellectual property rights of others. |

| • | We face certain litigation risks that could harm our business. |

| • | We may be subject to environmental liabilities which could increase our expenses and harm our operating results. |

| • | We will be subject to provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act regarding “conflict” minerals that could subject us to additional costs and liabilities. |

| • | Certain provisions in our charter and Delaware corporate law could hinder a takeover attempt. |

Risks Related to the Separation

| • | We have no history of operating as an independent company, and our historical and pro forma financial information is not necessarily representative of the results that we would have achieved as a separate, publicly traded company and may not be a reliable indicator of our future results. |

| • | Certain contracts that will need to be transferred or assigned to us from JDSU or its affiliates in connection with the separation require the consent of the counterparty to such an assignment, and failure to obtain these consents could increase our expenses or otherwise reduce our profitability. |

12

| • | Potential indemnification liabilities to Viavi pursuant to the separation agreement could materially and adversely affect our business, financial condition, results of operations and cash flows. |

| • | In connection with the separation, JDSU will indemnify us for certain liabilities. However, there can be no assurance that the indemnity will be sufficient to insure us against the full amount of such liabilities, or that JDSU’s ability to satisfy its indemnification obligation will be impaired in the future. |

| • | The distribution could result in significant tax liability to JDSU and its stockholders. |

| • | We could have an indemnification obligation to JDSU if the distribution were determined not to qualify for non-recognition treatment, which could materially and adversely affect our financial condition. |

| • | We intend to agree to restrictions to preserve the non-recognition treatment of the distribution, which may reduce our strategic and operating flexibility. |

| • | The separation may not occur, we may not achieve any or all of the expected benefits of the separation, and the separation may adversely affect our business. |

| • | The separation may expose us to potential liabilities and business complications arising out of state and federal fraudulent conveyance laws and legal dividend requirements. |

| • | We are an “emerging growth company” and cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our common stock less attractive to investors. |

Risks Related to Our Common Stock

| • | We cannot be certain that an active trading market for our common stock will develop or be sustained after the separation, and following the separation, our stock price may fluctuate significantly. |

| • | A number of shares of our common stock are or will be eligible for future sale, including the sale by Viavi of the shares of our common stock that it retains after the distribution, which could materially increase the volatility of our stock price and may cause our stock price to decline. |

| • | We cannot guarantee the payment of dividends on our common stock, or the timing or amount of any such dividends. |

| • | The obligations of Lumentum Inc. to holders of its Series A Preferred Stock could have a negative impact on holders of our common stock. |

The Separation and Distribution

On September 10, 2014, JDSU announced that it intended to separate its CCOP business from its network enablement, service enablement and optical security and performance products businesses through a distribution of the common stock of a new entity. This new entity, Lumentum Holdings Inc., was formed to indirectly hold the assets and liabilities associated with the CCOP business through Lumentum Operations LLC. In connection with the separation, JDSU will change its name to Viavi Solutions Inc.

The JDSU board of directors has approved, after giving effect to Viavi’s retention of 19.9% of our common stock, the distribution of the remaining 80.1% of the issued and outstanding shares of our common stock on the basis of one share of our common stock for every five shares of JDSU common stock held as of the close of business on the record date of July 27, 2015.

Our Post-Separation Relationship with Viavi

We have entered into a separation agreement with JDSU. In connection with the separation, we have also entered into various other agreements to effect the separation and provide a framework for our relationship with Viavi after the separation, including a tax matters agreement, an employee matters agreement, an intellectual

13

property matters agreement, an escrow agreement and a supply agreement. These agreements provide for the allocation between us and JDSU of assets, employees, liabilities and obligations (including our investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after our separation from JDSU and will govern certain relationships between Viavi and us after the separation. For additional information regarding the separation agreement and other transaction agreements, see “Risk Factors-Risks Related to the Separation” and “Certain Relationships and Related Person Transactions.”

Reasons for the Separation

The JDSU board of directors determined that the separation of JDSU’s CCOP business would be in the best interests of JDSU, its stockholders, and us for a number of reasons, including that it will:

| • | enable us to enhance our strategic focus on our leading position in the Telecom market, expand our position in the high-growth Datacom market, and grow our commercial lasers and 3-D sensing businesses; |

| • | enable JDSU to enhance its strategic focus on its transition to a more software-centric company aligned with the industry’s rapid shift to software defined networks, while leveraging and maintaining its leadership in network enablement; |

| • | create clearer investment profiles for both companies and increase opportunities for further industry consolidation; |

| • | enable a more efficient allocation of capital and resources for both companies and catalyze additional cost reductions within JDSU; and |

| • | enable both companies to benefit from increased operational flexibility, efficiency and support structures tailored to each company’s specific needs. |

The JDSU board of directors also considered a number of potentially negative factors in evaluating the separation, including the following:

| • | complexity of the transaction could distract management from executing on its business goals; |

| • | additional expense required to execute the spin-off and set up Lumentum as a publicly reporting company; and |

| • | potential for increased volatility in both our and Viavi’s stock prices as the individual businesses will be less diversified. |

The JDSU board of directors also considered the fact that JDSU’s existing net operating losses (“NOLs”) would make it likely that we could be established with a favorable cash effective tax rate for a number of years following the separation. After considering this and the other factors noted above, the JDSU board of directors concluded that the potential benefits of the separation outweighed the negative factors. Neither we nor JDSU can assure you that, following the separation, any of the benefits described above or otherwise will be realized to the extent anticipated or at all. For more information, see “The Separation and Distribution-Reasons for the Separation” and “Risk Factors.”

Corporate Information

We were incorporated in Delaware for the purpose of holding JDSU’s CCOP business in connection with the separation and distribution. Substantially all of our assets will be held by Lumentum Operations LLC. Until we complete the steps contemplated by our Transaction Structure, which will occur prior to the distribution, we will have no operations. The address of our principal executive offices is 400 N. McCarthy Blvd., Milpitas, CA 95035. Our telephone number is 408-546-5000.

14

“Emerging Growth Company” Status

Based on our revenues during our last fiscal year and other criteria, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”). For as long as we are deemed to be an “emerging growth company,” we may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”); |

| • | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board (“PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | reduced disclosure requirements related to executive compensation arrangements; and |

| • | an exemption from the requirements to hold a nonbinding advisory vote on executive compensation arrangements and to obtain stockholder approval of any golden parachutes not previously approved. |

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (“Securities Act”), for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected not to take advantage of this extended transition period.

We will cease to be an “emerging growth company” upon the earliest of:

| • | the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement filed under the Securities Act; |

| • | the last day of the fiscal year in which our total annual gross revenues exceed $1 billion; |

| • | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities; or |

| • | the date on which we become a “large accelerated filer,” as defined in Rule 12b-2 under the Securities and Exchange Act of 1934, as amended (“Exchange Act”), which would occur if the market value of our common stock held by non-affiliates exceeds $700 million as of the last day of our most recently completed second fiscal quarter. |

Reason for Furnishing This Information Statement

This information statement is being furnished solely to provide information to JDSU stockholders who will receive shares of our common stock in the distribution. It is not, and is not to be construed as, an inducement or encouragement to buy or sell any of our securities. We believe the information contained in this information statement is accurate as of the date set forth on its cover. Changes may occur after that date and neither JDSU nor we will update the information except in the normal course of our respective disclosure obligations and practices.

15

SUMMARY HISTORICAL COMBINED FINANCIAL DATA

The following table sets forth summary historical financial information for the CCOP business, which will be transferred to us prior to the distribution, for the periods indicated below. The summary balance sheet data as of June 28, 2014 and June 29, 2013 and the summary statements of operations data for the fiscal years ended June 28, 2014, June 29, 2013 and June 30, 2012 have been derived from the audited annual combined financial statements of the CCOP business, which are included elsewhere in this information statement. The summary balance sheet data as of March 28, 2015 and the summary statements of operations data for the nine months ended March 28, 2015 and March 29, 2014 have been derived from the unaudited interim condensed combined financial statements of the CCOP business, which are included elsewhere in this information statement. In management’s opinion, the unaudited interim condensed combined financial statements have been prepared on the same basis as the audited annual combined financial statements and include all adjustments, consisting only of ordinary recurring adjustments, necessary for a fair statement of the information for the periods presented.

Our historical combined financial statements include certain expenses allocated to us arising from shared services and infrastructure provided by JDSU to us, including costs of information technology, human resources, accounting, legal, real estate and facilities, corporate marketing, insurance, treasury and other corporate and infrastructure services. The amount and allocation basis of our historically allocated costs may not be comparable to the actual costs we will incur to secure these services when we are independent from JDSU, as we expect to experience changes in our personnel needs, tax structure, financing and business operations. Our historical combined financial statements also do not reflect the pro forma adjustments which are discussed elsewhere in this information statement under “Unaudited Pro Forma Combined Financial Statements.” Consequently, the financial information included here may not necessarily reflect our financial position and results of operations or what our financial position and results of operations would have been had we been an independent, publicly traded company during the periods presented or be indicative of our future performance as an independent company. The summary financial information should be read in conjunction with the discussion in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the unaudited pro forma combined financial statements and corresponding notes, the audited annual combined financial statements and corresponding notes and the unaudited interim condensed combined financial statements and corresponding notes included elsewhere in this information statement.

| Nine Months Ended | Years Ended | |||||||||||||||||||

| March 28, 2015 |

March 29, 2014 |

June 28, 2014 | June 29, 2013 | June 30, 2012 | ||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Combined Statements of Operations Data: |

||||||||||||||||||||

| Net revenue |

$ | 628.2 | $ | 616.9 | $ | 817.9 | $ | 769.9 | $ | 727.9 | ||||||||||

| (Loss) income before taxes |

(8.5 | ) | 16.8 | 9.8 | 3.7 | 4.0 | ||||||||||||||

| Net income |

13.5 | 17.4 | 10.7 | 6.5 | 2.6 | |||||||||||||||

| March 28, 2015 |

June 28, 2014 | June 29, 2013 | ||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Combined Balance Sheets Data: |

||||||||||||||||||||

| Working capital |

$ | 199.0 | $ | 149.1 | $ | 133.4 | ||||||||||||||

| Total assets |

495.7 | 492.1 | 410.7 | |||||||||||||||||

| Invested equity |

382.9 | 335.6 | 281.8 | |||||||||||||||||

16

RISK FACTORS

You should carefully consider the following risks and other information in this information statement in evaluating us and our common stock. Any of the following risks could materially and adversely affect our results of operations or financial condition. The risk factors generally have been separated into three groups: risks related to our business, risks related to the separation and risks related to our common stock.

Risks Related to Our Business

Our operating results may be adversely affected by unfavorable economic and market conditions.

Although the global economy has been showing signs of improvement, its uncertain state has contributed and continues to contribute to decreases in demand and spending in the technology industry at large, as well as to the specific markets in which we operate. The slow pace of global economic recovery and the resulting effects on global credit markets has created uncertainty in the timing and overall demand from our customers. This uncertainty may lead to greater revenue fluctuations, increased price competition for our products, and may increase the risk of excess and obsolete inventories and higher overhead costs as a percentage of revenue. Continued economic challenges in the global financial markets could further negatively impact our operations by affecting the solvency of our customers, the solvency of our key suppliers or the ability of our customers to obtain credit to finance purchases of our products. If economic conditions do not improve or if they deteriorate, our financial condition and results of operations would likely be materially and adversely impacted.

Changing technology and intense competition require us to continue to innovate.

The markets in which we operate are dynamic and complex, and our success depends upon our ability to deliver both our current product offerings and new products and technologies on time and at acceptable cost to our customers. The markets for our products are characterized by rapid technological change, frequent new product introductions, substantial capital investment, changes in customer requirements, continued price pressures and a constantly evolving industry. Our future performance will depend on the successful development, introduction and market acceptance of new and enhanced features and products that address these issues and provide solutions that meet our customers’ current and future needs.

The market for optical communications products in particular has matured over time and optical communications products have increasingly become subject to commoditization. Both legacy competitors as well as new entrants, predominantly Asia-based competitors, have intensified market competition in recent years leading to pricing pressure. To preserve our revenues and product margin structures, we will remain reliant on an integrated customer and market approach that anticipates end customer needs as Telecom and Datacom requirements evolve. We also must continue to develop more advanced, differentiated products that command a premium with customers, while conversely continuing to focus on streamlining product costs for legacy established products. However, our competitors may continue to enter markets or gain or retain market share through aggressive low pricing strategies that may impact the efficacy of our approach. Additionally, if significant competitors were to merge or consolidate, they may be able to offer a lower cost structure through economies of scale that we may be unable to match. Although historically we have emphasized a robust program of technical innovation and streamlining manufacturing operations, if we fail to continue to develop enhanced or new products, or over time are unable to adjust our cost structure to continue to competitively price more mature technologies, our revenue and profits and results of operations could be materially and adversely affected.

The manufacture of our products may be affected if our contract manufacturers and suppliers fail to meet our needs or if we are unable to manufacture certain products in our manufacturing facilities.

We rely on several independent contract manufacturers to supply us with certain products. For many products, a particular contract manufacturer may be the sole source of the finished good product. We depend on

17

these manufacturers to meet our production needs and to provide quality products to our customers. Despite rigorous testing for quality, both by us and our customers, we may receive defective products. We may incur significant costs to correct defective products which could include lost future sales, as well as potentially cause customer relations problems, litigation and damage to our reputation. Additionally, the ability of our contract manufacturers to fulfill their obligations may be affected by natural disasters or economic, political or other forces that are beyond our control. Any such failure could have a material impact on our ability to meet our customers’ expectations and may materially impact our operating results. In addition, some of our purchase commitments with contract manufacturers are not cancellable which may impact our earnings if customer forecasts driving these purchase commitments do not materialize and we are unable to sell the products to other customers. Furthermore, it would be costly and require a long period of time to move products from one contract manufacturer to another and could result in interruptions in supply, which would likely materially impact our financial condition and results of operations.

We manufacture some of the components that we provide to our contract manufacturers, along with our own finished goods, in our Bloomfield, Connecticut and San Jose, California manufacturing facilities. For some of the components and finished good products we are the sole manufacturer. Our manufacturing processes are highly complex and issues are often difficult to detect and correct. From time to time we have experienced problems achieving acceptable yields in our manufacturing facilities, resulting in delays in the availability of our products. In addition, if we experience problems with our manufacturing facilities, it would be costly and require a long period of time to move the manufacture of these components and finished good products to a contract manufacturer and could result in interruptions in supply, which would likely materially impact our financial condition and results of operations.

Changes in manufacturing processes are often required due to changes in product specifications, changing customer needs and the introduction of new products. These changes may reduce manufacturing yields at our contract manufacturers and at our own manufacturing facilities resulting in reduced margins on those products.

We depend on a limited number of suppliers for raw materials, packages and components.

We are dependent on a limited number of suppliers, who are often small and specialized, for raw materials, packages and standard components. Our business and results of operations have been, and could continue to be, adversely affected by this dependency. Specific concerns we periodically encounter with our suppliers include stoppages or delays of supply, insufficient resources to supply our requirements, substitution of more expensive or less reliable materials, receipt of defective parts or contaminated materials, increases in the price of supplies, and an inability to obtain reduced pricing from our suppliers in response to competitive pressures.

We rely on a limited number of customers for a significant portion of our sales; our business is subject to seasonality; and the majority of our customers do not have contractual purchase commitments.

We have consistently relied on a small number of customers for a significant portion of our sales and we expect that this customer concentration will continue in the future. For example, during the fiscal year ended June 28, 2014, our five largest customers accounted for over 45% of our revenue. Additionally, our business is exposed to risks associated with the seasonality of the business of certain of our customers, which may adversely affect our business and results of operations. In addition, the majority of our customers purchase products under purchase orders or under contracts that do not contain volume purchase commitments which could result in lost investment in R&D activities, our inability to maximize manufacturing capacity, or excess inventory if forecasted orders do not materialize.

The contemplated transaction structure may result in additional income tax liabilities which would negatively impact our operating results.

The CCOP business assets will be transferred to us in a transaction or transactions intended to be characterized as taxable, which will result in our receiving a fair market value or substantially stepped-up tax basis in the assets. We expect to reduce our cash taxes by depreciation and amortization deductions related to the

18

stepped-up tax basis in the assets. If the IRS or foreign tax authorities disagree with our characterization of the transactions pursuant to which the CCOP business assets will be transferred to us or disallow the depreciation and amortization deductions, and the position were sustained, our financial results would be materially and adversely affected.

We are subject to continued changes in tax laws; the possible fluctuation of our effective tax rate over time could materially and adversely affect our operating results.

We are subject to taxes in the United States and numerous international jurisdictions. We record tax expense based on current tax payments and our estimates of future tax payments, which may include reserves for estimates of probable settlements of international and domestic tax audits. At any one time, multiple tax years and jurisdictions are subject to audit by various taxing authorities. The results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues. As a result, there could be ongoing variability in our tax rates as taxable events occur and uncertain tax positions are re-evaluated or resolved.

Tax policy reform continues to be a topic of discussion in the United States and in the foreign jurisdictions in which we may conduct business. A significant change to the tax system in the United States or other foreign jurisdictions, including changes to the taxation of international income, could have a material adverse effect on our results of operations. Our effective tax rate in a given financial statement period may be materially impacted by changes in tax laws, changes in the mix and level of earnings by taxing jurisdiction, changes to existing accounting rules or regulations or by changes to our ownership or capital structures. Fluctuations in our tax obligations and effective tax rate could materially and adversely affect our results of business, financial condition and operating results.

We may change our international corporate structure in the near future in order to minimize our effective rate; however, if we are unable to adopt this structure or if it is challenged by U.S. or foreign tax authorities, we may be unable to realize such tax savings which could materially and adversely affect our operating results.

We are evaluating and prior to the spin-off may adopt an international corporate structure more closely aligned with our international operations. This potential corporate structure may reduce our overall effective tax rate through changes among our wholly-owned subsidiaries in how we use our intellectual property, and how we structure our international procurement and sales operations. The contemplated structure includes legal entities located in jurisdictions with income tax rates lower than the U.S. statutory tax rate. Such intercompany arrangements would be designed to result in income earned by such entities in accordance with arm’s-length principles and commensurate with functions performed, risks assumed and ownership of valuable corporate assets. We believe that income taxed in certain foreign jurisdictions at a lower rate relative to the U.S. statutory rate will have a beneficial impact on our worldwide effective tax rate over the medium to long term.

If we adopt this revised structure, we have agreed in principle to reimburse JDSU for any tax liability incurred by JDSU, following application of net operating losses by JDSU. Such a structure also will require us to incur additional expenses in the near term for which we may not realize related benefits, and in any event, we do not expect to materially realize such benefits for several years following the spin-off. If the intended structure is not accepted by the applicable taxing authorities, if changes in domestic and international tax laws negatively impact the proposed structure, including proposed legislation to reform U.S. taxation of international business activities, or if we do not operate our business consistent with the proposed structure and applicable tax provisions, we may fail to achieve the financial and operational efficiencies that we anticipate as a result of the proposed structure, and our business, financial condition and operating results may be materially and adversely affected.”

Our future operating results may be subject to volatility due to fluctuations in foreign currency.

We are exposed to foreign exchange risks with regard to our operating expenses which may affect our operating results. Although we price our products primarily in U.S. dollars, a portion of our operating expenses

19

are incurred in foreign currencies. If the value of the U.S. dollar depreciates relative to certain other foreign currencies, it would increase our costs as expressed in U.S. dollars. Conversely, if the U.S. dollar strengthens relative to other currencies, such strengthening could raise the relative cost of our products to non-U.S. customers, especially as compared to foreign competitors, and could reduce demand.

We intend to engage in currency hedging transactions to reduce our foreign exchange exposure. However, these transactions may not fully eliminate our risk and could have an adverse effect on our financial condition.

We face a number of risks related to our strategic transactions.

We completed the acquisition of Time-Bandwidth Products, Inc. (“Time-Bandwidth”) in January 2014 and we will continue to review opportunities to acquire other businesses or technologies. Such strategic transactions involve numerous risks, including the following:

| • | diversion of management’s attention from normal daily operations of the business; |

| • | unforeseen expenses, delays or conditions imposed upon the acquisition, including due to required regulatory approvals or consents; |

| • | unanticipated changes in the combined business due to potential divestitures or other requirements imposed by antitrust regulators; |

| • | the ability to retain and obtain required regulatory approvals, licenses and permits; |

| • | difficulties and costs in integrating the operations, technologies, products, IT and other systems, facilities and personnel of the purchased businesses; |

| • | potential difficulties in completing projects associated with in-process R&D; |

| • | an acquisition may not further our business strategy as we expected or we may overpay for, or otherwise not realize the expected return on, our investments; |

| • | insufficient net revenue to offset increased expenses associated with acquisitions; |

| • | potential loss of key employees of the acquired companies; and |

| • | difficulty forecasting revenues and margins. |

Our business and operations would be adversely impacted in the event of a failure of our information technology infrastructure.

We rely upon the capacity, reliability and security of our information technology infrastructure and our ability to expand and continually update this infrastructure in response to our changing needs. In some cases, we may rely upon third-party hosting and support services to meet these needs. Any failure to manage, expand and update our information technology infrastructure, any failure in the extension or operation of this infrastructure, or any failure by our hosting and support partners in the performance of their services could materially and adversely harm our business. Despite our implementation of security measures, our systems are vulnerable to damage from computer viruses, natural disasters, unauthorized access and other similar disruptions. Any system failure, accident or security breach could result in disruptions to our operations. To the extent that any disruption or security breach results in a loss or damage to our data or in inappropriate disclosure of confidential information, it could cause significant damage to our reputation, affect our relationships with our customers, and ultimately harm our business. In addition, we may be required to incur significant costs to protect against or mitigate damage caused by these disruptions or security breaches in the future.

If we have insufficient proprietary rights or if we fail to protect our rights, our business would be materially harmed.

We seek to protect our products and product roadmaps in part by developing and/or securing proprietary rights relating to those products, including patents, trade secrets, know-how and continuing technological

20

innovation. The steps we take to protect our intellectual property may not adequately prevent misappropriation or ensure that others will not develop competitive technologies or products. Other companies may be investigating or developing technologies that are similar to our own. It is possible that patents may not be issued from any of our pending applications or those we may file in the future and, if patents are issued, the claims allowed may not be sufficiently broad to deter or prohibit others from making, using or selling products that are similar to ours. We do not own patents in every country in which we sell or distribute our products, and thus others may be able to offer identical products in countries where we do not have intellectual property protections. In addition, the laws of some territories in which our products are or may be developed, manufactured or sold, including Europe, Asia-Pacific or Latin America, may not protect our products and intellectual property rights to the same extent as the laws of the United States. Any patents issued to us may be challenged, invalidated or circumvented. Additionally, we are currently a licensee for a number of third-party technologies including software and intellectual property rights from academic institutions, our competitors and others, and we are required to pay royalties to these licensors for the use thereof. In the future, if such licenses are unavailable or if we are unable to obtain such licenses on commercially reasonable terms, we may not be able to rely on such third-party technologies which could inhibit our development of new products, impede the sale of some of our current products, substantially increase the cost to provide these products to our customers, and could have a significant adverse impact on our operating results.

We also seek to protect our important trademarks by endeavoring to register them in certain countries. We do not own trademark registrations in every country in which we sell or distribute our products, and thus others may be able to use the same or confusingly similar marks in countries where we do not have trademark registrations. We are adopting Lumentum as a new house trademark and trade name for our company, and we have not yet established rights in this name and brand. We are also adopting the Lumentum logo as a new house trademark for our company, and we have not yet established rights in this brand. The new brands are not currently protected by registration in the United States or other jurisdictions. The efforts we take to register and protect trademarks, including the new brands, may not be sufficient or effective. Although we will seek to obtain trademark registrations for the new brands, it is possible we may not be able to protect our new brands through registration in one or more jurisdictions, for example, the applicable governmental authorities may not approve the registration. Furthermore, even if the applications are approved, third parties may seek to oppose or otherwise challenge registration. There is the possibility, despite efforts, that the scope of the protection obtained for our trademarks, including the new brands, will be insufficient or that a registration may be deemed invalid or unenforceable in one or more jurisdictions throughout the world.

Our products may be subject to claims that they infringe the intellectual property rights of others.