Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LOJACK CORP | a8-k8615.htm |

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - LOJACK CORP | q22015earningsrelease.htm |

1 © 2015 LoJack Corporation. All Rights Reserved. LoJack and the LoJack logo are trademarks or registered trademarks of the LoJack Corporation in the United States and other countries. LoJack Corporation Q2 2015 Results August 6, 2015

2 Forward-looking Statements Statements in this presentation that are not statements of historical fact are forward-looking statements. Such forward- looking statements, which include statements regarding the Company’s strategic plans and initiatives, markets, customer orders and shipments, and future financial performance, are based on a number of assumptions and involve a number of risks and uncertainties, and accordingly, actual results could differ materially. Factors that may cause such differences include, but are not limited to: (1) the continued and future acceptance of the Company's products and services, including the Company's Pre-Install Program and inventory management, fleet management and telematics solutions; (2) the Company's ability to obtain financing from lenders and to satisfy or obtain waivers for covenant requirements under its credit facility; (3) the outcome of ongoing litigation involving the Company; (4) the Company’s ability to enforce the terms of the settlement agreement with Tracker do Brasil LTDA and its impact on the Company's future relationships with Tracker and its affiliates; (5) the rate of growth in the industries of the Company's customers; (6) the presence of competitors with greater technical, marketing, and financial resources; (7) the Company's customers' ability to access the credit markets, including changes in interest rates; (8) the Company's ability to promptly and effectively respond to technological change to meet evolving customer needs; (9) the Company's ability to successfully expand its operations, including through the introduction of new products and services; (10) changes in general economic or geopolitical conditions; (11) conditions in the automotive retail market and the Company's relationships with dealers, licensees, partners, agents and local law enforcement; (12) delays or other changes in the timing of purchases by the Company's customers; (13) the Company's ability to achieve the expected benefits of its strategic alliances with TomTom and Trackunit; (14) financial and reputational risks related to product quality and liability issues; (15) the Company's ability to re-enter the Brazilian market in a timely manner and/or on favorable terms; and (16) trade tensions and governmental regulations and restrictions in Argentina and the Company's other international markets. For a further discussion of these and other significant factors to consider in connection with forward-looking statements concerning the Company, reference is made to the Company's Annual Report on Form 10-K for the year ended December 31, 2014 and the Company's other filings with the Securities and Exchange Commission. Such forward-looking statements speak only as of the date made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements.

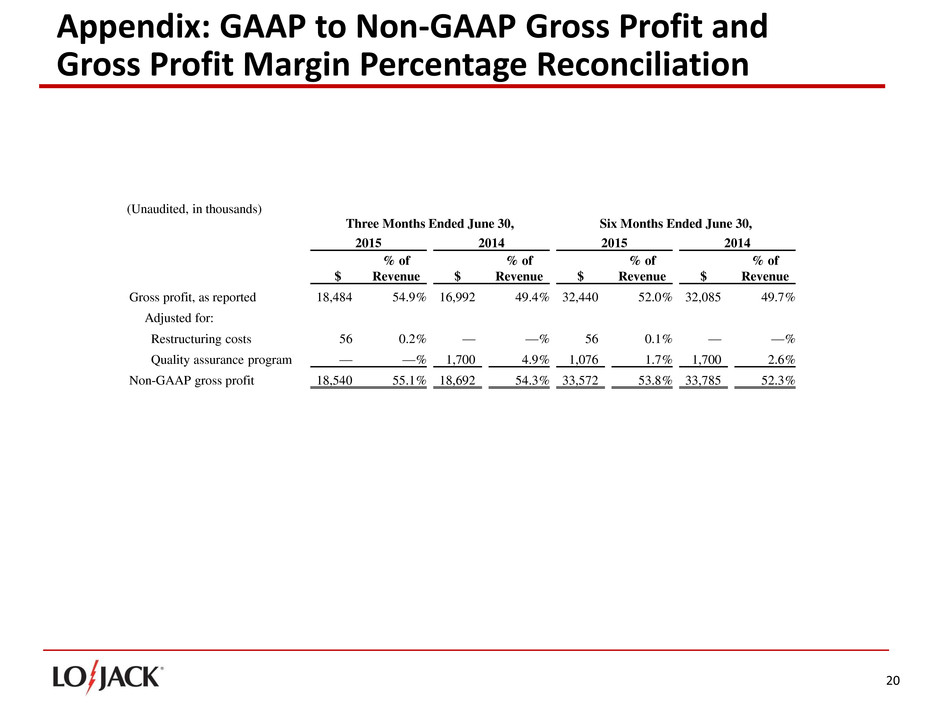

3 In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this presentation also contains certain non-GAAP financial measures including EBITDA, Adjusted EBITDA and non-GAAP gross profit (and the corresponding gross margin percentages). The Company believes that the inclusion of these non-GAAP financial measures in this presentation helps investors to gain a meaningful understanding of changes in the Company's core operating results, and can also help investors who wish to make comparisons between LoJack and other companies on both a GAAP and a non-GAAP basis. LoJack management uses these non-GAAP measures, in addition to GAAP financial measures, as the basis for measuring our core operating performance and comparing such performance to that of prior periods and to the performance of our competitors. These measures are also used by management to assist with their financial and operating decision making. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation may be different from, and therefore may not be comparable to, similar measures used by other companies. Reconciliations of the non- GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures are set forth in the accompanying appendix to this presentation. Use of Non-GAAP Financial Measures

4 Overview • Net Income of $1.2 million, or $0.06 per diluted share • Company reduces operating expenses $2.8 million from Q2 2014, representing a 14.1% reduction • Gross margin of 54.9% • Operating cash flow of $2.7 million; debt repayment of $3 million

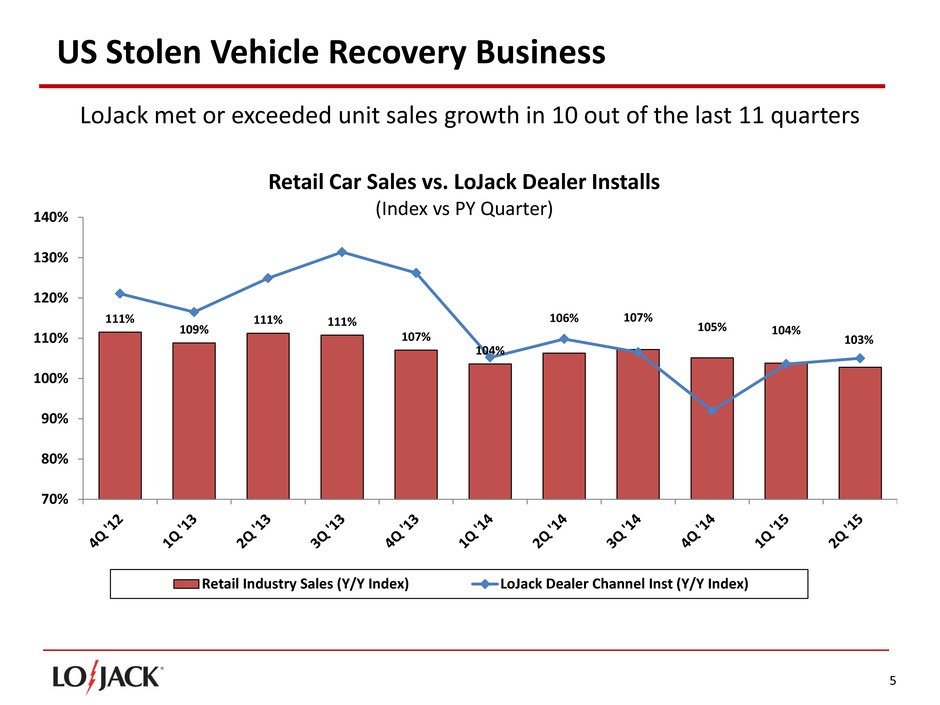

5 US Stolen Vehicle Recovery Business LoJack met or exceeded unit sales growth in 10 out of the last 11 quarters 111% 109% 111% 111% 107% 104% 106% 107% 105% 104% 103% 70% 80% 90% 100% 110% 120% 130% 140% Retail Car Sales vs. LoJack Dealer Installs (Index vs PY Quarter) Retail Industry Sales (Y/Y Index) LoJack Dealer Channel Inst (Y/Y Index)

6 Advancing the Pre-Install Strategy Pre-Install Program Sales Mix % Share of Dealer Channel Volume Strong Preinstall Acquisition in Q2 expected to set the stage for continued unit sales and revenue for the balance of 2015 31% 32% 34% 43% 44% 45% 46% 51% 52% 55% 54% 61% 62% 60% 0% 10% 20% 30% 40% 50% 60% 70% Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015

7 U.S. Sales Outlook Remains Positive Industry forecasts project annual total light vehicle growth of +3.5% in 2015, with retail sales projected to be up 2.7%. Source: Power Information Network – PIN, a business division of J.D. Power & Associates 0.00 5.00 10.00 15.00 20.00 25.00 2008 2009 2010 2011 2012 2013 2014 2015 F'cst 2016 F'cst Total U.S. Light Vehicle Sales Fleet & Retail (2008 to 2016 E) Retail Sales Fleet Sales +5.9% +3.5% 16.5M 17.1M -17.2% -18.6% +6.3% +12.4% +13.6% +9.5% +5.6% +2.7% 17.2M +1.4% 13.2M 10.4M 11.6M 12.8M 14.5M 15.6M -18.0% -21.1% +11.1% +10.2% +7.6% +13.4% +1.0%

8 International International revenue was off 1% vs. Year Ago Argentina • No shipments in the quarter • Expect shipments in the coming two quarters Brazil Update • Actively evaluating new licensee candidates, while laying the groundwork for market re-entry Italy • Stronger growth continues to deliver profitability; revenue growth of 28% vs. same period year ago • Surpassed 59,000 subscribers in Italy in Q2 2015

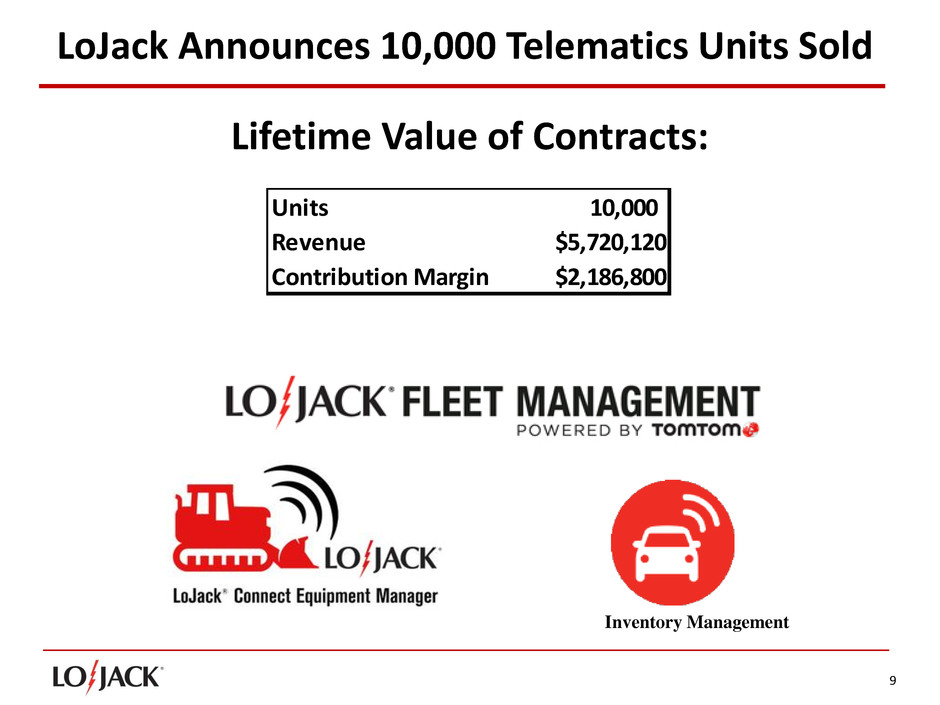

9 LoJack Announces 10,000 Telematics Units Sold Lifetime Value of Contracts: Units 10,000 Revenue $5,720,120 Contribution Margin $2,186,800 Inventory Management

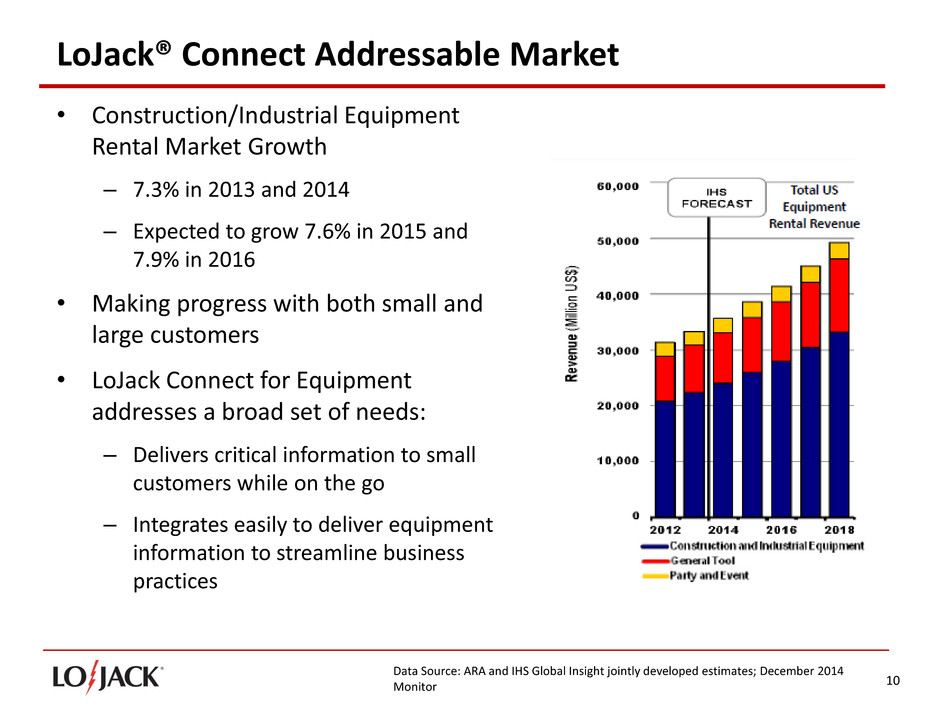

10 LoJack® Connect Addressable Market • Construction/Industrial Equipment Rental Market Growth – 7.3% in 2013 and 2014 – Expected to grow 7.6% in 2015 and 7.9% in 2016 • Making progress with both small and large customers • LoJack Connect for Equipment addresses a broad set of needs: – Delivers critical information to small customers while on the go – Integrates easily to deliver equipment information to streamline business practices Data Source: ARA and IHS Global Insight jointly developed estimates; December 2014 Monitor

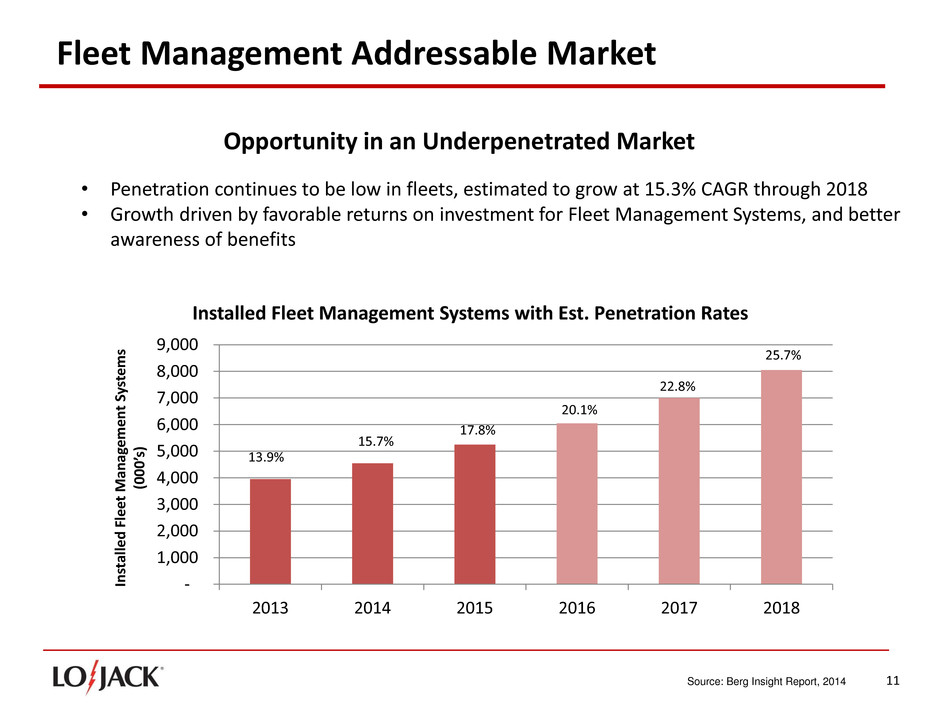

11 Fleet Management Addressable Market Opportunity in an Underpenetrated Market • Penetration continues to be low in fleets, estimated to grow at 15.3% CAGR through 2018 • Growth driven by favorable returns on investment for Fleet Management Systems, and better awareness of benefits Source: Berg Insight Report, 2014 - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2013 2014 2015 2016 2017 2018 In st al le d F le et M an ag em en t Sy st em s (000 ’s) Installed Fleet Management Systems with Est. Penetration Rates 13.9% 25.7% 22.8% 20.1% 17.8% 15.7%

12 LoJack® IM1 Dealer Inventory Management • Pilot Market going well with expanded capabilities, and a newly updated software back-end making it ready for rollout • Based on an internal study, about half of dealer personnel surveyed are interested in LoJack IM1. A vast majority indicate that the dealership had no inventory management system • We have just begun to market to selected Pre- Install customers who have expressed an interest in the technology • We will expand the offering to our existing preinstall customers, followed by a broader rollout as we move through the balance of the year

13 Financial Review

14 Q2 Revenues ($ in millions) (unaudited) Q2 2015 Q2 2014 % change Consolidated revenues $ 33.6 $ 34.4 (2%) U.S. revenues 23.0 23.0 0% International licensees 6.9 7.3 (5%) Canada 0.4 1.6 (73%) Italy 1.9 1.5 28% All other 1.3 1.0 29%

15 Q2 Consolidated Results Highlights *Please refer to Appendix for reconciliation of non-GAAP items ($ in thousands, except per share data) (unaudited) Q2 2015 Q2 2014 Revenue $ 33,642 $ 34,411 Y/Y change (2.2%) Gross profit 18,484 16,992 Y/Y change 8.8% Gross profit margin 54.9% 49.4% Non-GAAP gross profit* 18,540 18,692 Non-GAAP gross profit margin* 55.1% 54.3% Operating expenses 17,073 19,866 Y/Y change 14.1% EBITDA* 2,742 (1,760) Adjusted EBITDA* 1,607 1,199 Net income (loss) attributable to LoJack Corp. $ 1,188 $ (3,388) Net income (loss) per diluted share attributable to LoJack Corp. $ 0.06 $ (0.19)

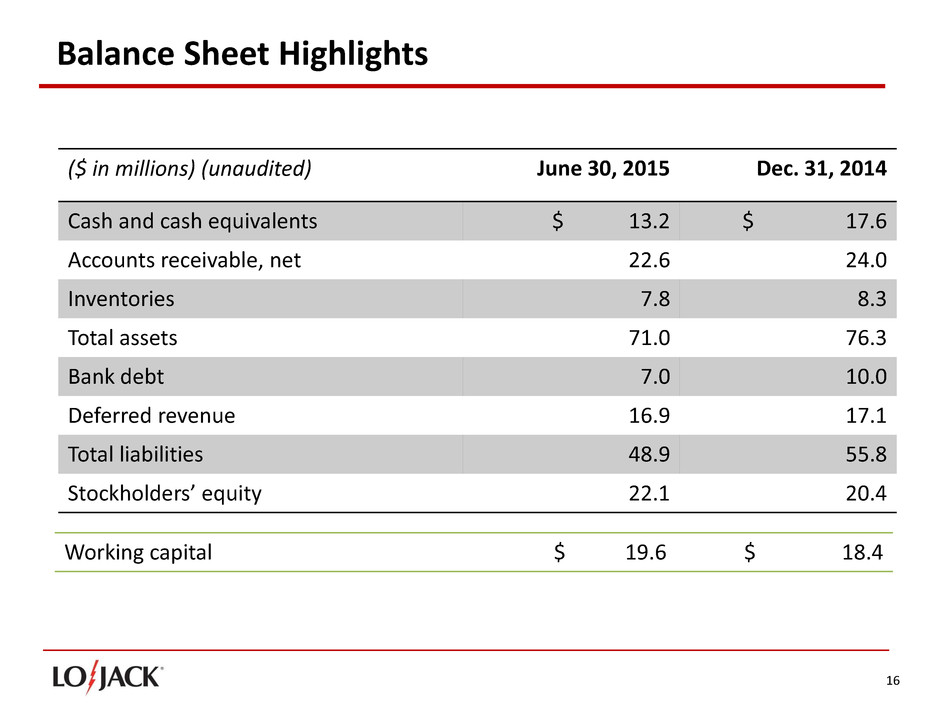

16 Balance Sheet Highlights ($ in millions) (unaudited) June 30, 2015 Dec. 31, 2014 Cash and cash equivalents $ 13.2 $ 17.6 Accounts receivable, net 22.6 24.0 Inventories 7.8 8.3 Total assets 71.0 76.3 Bank debt 7.0 10.0 Deferred revenue 16.9 17.1 Total liabilities 48.9 55.8 Stockholders’ equity 22.1 20.4 Working capital $ 19.6 $ 18.4

17 Quality Assurance Program Reserve (QAP) ($ in thousands) (unaudited) QAP Reserve Balance at December 31, 2014 $ 6,406 Additions $ 1,076 Payments/reductions $ (4,277) Foreign exchange impact $ (56) Balance at June 30, 2015 $ 3,149

18 Summary • Pre-install has driven unit growth and enabled us to stabilize U.S. SVR business in recent quarters • Reduced operating expenses as we position the Company for the future • Telematics represents expansion opportunity for the LoJack brand • Our long-term vision is to become the premier aftermarket provider of telematics-based products and services for the connected car

19 Appendix: GAAP to Non-GAAP Reconciliation Net income to EBITDA and Adjusted EBITDA (Unaudited, in thousands) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Net income (loss), as reported $ 1,209 $ (3,435 ) $ (417 ) $ (8,974 ) Adjusted for: Interest expense 248 480 380 587 Provision for income taxes 25 141 90 178 Depreciation and amortization 1,260 1,054 2,305 2,042 EBITDA 2,742 (1,760 ) 2,358 (6,167 ) Stock compensation expense 403 359 721 883 Licensee agreement modification (2,000 ) — (2,000 ) — Brazil legal settlement — — (2,000 ) — Quality assurance program — 1,700 1,076 1,700 Restructuring costs 462 900 462 900 Adjusted EBITDA $ 1,607 $ 1,199 $ 617 $ (2,684 )

20 Appendix: GAAP to Non-GAAP Gross Profit and Gross Profit Margin Percentage Reconciliation (Unaudited, in thousands) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 $ % of Revenue $ % of Revenue $ % of Revenue $ % of Revenue Gross profit, as reported 18,484 54.9 % 16,992 49.4 % 32,440 52.0 % 32,085 49.7 % Adjusted for: Restructuring costs 56 0.2 % — — % 56 0.1 % — — % Quality assurance program — — % 1,700 4.9 % 1,076 1.7 % 1,700 2.6 % Non-GAAP gross profit 18,540 55.1 % 18,692 54.3 % 33,572 53.8 % 33,785 52.3 %