Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - BEACON ROOFING SUPPLY INC | v417022_8k.htm |

| EX-99.1 - PRESS RELEASE - BEACON ROOFING SUPPLY INC | v417022_ex99-1.htm |

Exhibit 99.2

2015 Third Quarter Earnings Call August 6, 2015 www.BeaconRoofingSupply.com 0% 20% 40% 60% 80% 100% FY 2015 FY 2014 14.0% 14.5% 36.2% 37.6% 49.8% 47.9% Residential Roofing Non-Residential Roofing Complementary $- $100 $200 $300 $400 $500 $600 $700 FY 2015 FY 2014 $695.9 $663.4 $162.8 $150.8 Sales Gross Profit / Margin 1 Quarterly Results Existing Market Product Mix Northeast 12.1% Mid-Atlantic 0.9% Southeast 10.4% Southwest (8.4%) Midwest 7.3% West 15.2% Canada 6.9% Total 4.9% Organic Sales Growth (Decline) $ in millions Existing Market results above exclude branches acquired during the four quarters prior to the start of the third quarter of Fiscal 2015. 22.7% Existing Market Sales, Gross Profit & Gross Margin 23.4% Note: Some totals above may not foot due to rounding.

2015 Third Quarter Earnings Call August 6, 2015 www.BeaconRoofingSupply.com $- $20 $40 $60 $80 $100 $120 FY 2015 FY 2014 $114.7 $105.0 2 $ in millions 16.5% of Sales 15.8% of Sales Existing Market Operating Expenses Quarterly Results Note: Some totals above may not foot due to rounding. Existing Market results above exclude branches acquired during the four quarters prior to the start of the third quarter of Fiscal 2015. New Greenfield branch investments 4.3$ Payroll and employee benefit costs 3.5 Non-cash stock compensation expense 2.5 Amortization (0.8) Other 0.2 Total 9.7$ Operating Expense Incr. (Decr.)

2015 Third Quarter Earnings Call August 6, 2015 www.BeaconRoofingSupply.com $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 FY 2015 FY 2014 $1,674.0 $1,600.4 $388.5 $364.5 Sales Gross Profit / Margin 0% 20% 40% 60% 80% 100% FY 2015 FY 2014 15.1% 15.0% 36.3% 37.8% 48.6% 47.2% Residential Roofing Non-Residential Roofing Complementary 3 Year - to - Date Results Northeast 9.3% Mid-Atlantic 3.1% Southeast (0.4%) Southwest (9.2%) Midwest 13.6% West 12.9% Canada 7.2% Total 4.6% Organic Sales Growth (Decline) $ in millions Existing Market results above exclude branches acquired during the four quarters prior to the start of Fiscal 2015. Existing Market Sales, Gross Profit & Gross Margin Existing Market Product Mix Note: Some totals above may not foot due to rounding. 22.8% 23.2%

2015 Third Quarter Earnings Call August 6, 2015 www.BeaconRoofingSupply.com $- $50 $100 $150 $200 $250 $300 $350 FY 2015 FY 2014 $328.5 $308.8 4 $ in millions 19.6% of Sales 19.3% of Sales Existing Market Operating Expenses Year - to - Date Results Note: Some totals above may not foot due to rounding. Existing Market results above exclude branches acquired during the four quarters prior to the start of Fiscal 2015. New Greenfield branch investments 15.8$ Payroll and employee benefit costs 4.6 Non-cash stock compensation 1.1 Amortization (1.9) Other 0.1 Total 19.7$ Operating Expense Incr. (Decr.)

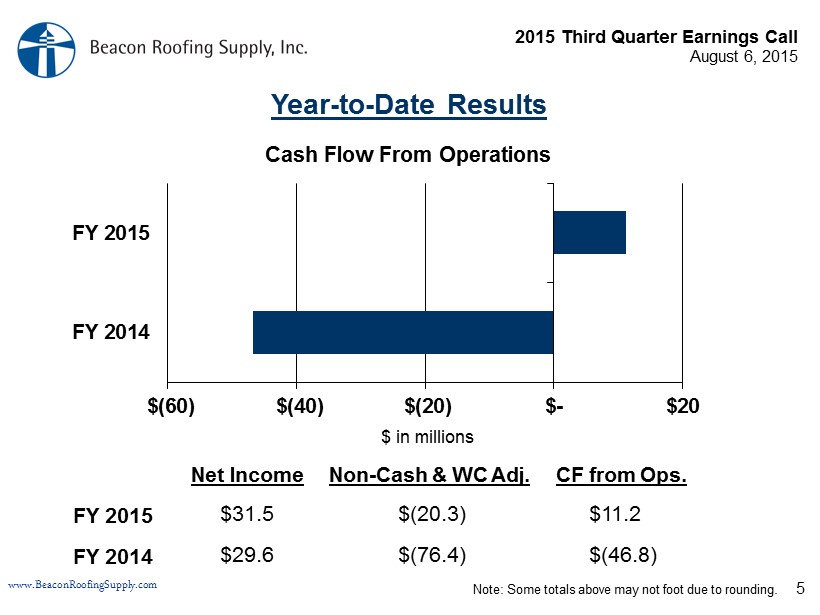

2015 Third Quarter Earnings Call August 6, 2015 www.BeaconRoofingSupply.com $(60) $(40) $(20) $- $20 FY 2014 FY 2015 5 $11.2 $ ( 46.8) $ in millions Cash Flow From Operations Year - to - Date Results Note: Some totals above may not foot due to rounding. CF from Ops. $(20.3) $(76.4) Non - Cash & WC Adj. $31.5 $29.6 Net Income FY 2015 FY 2014