Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Poage Bankshares, Inc. | v415992_8-k.htm |

Exhibit 99.1

Welcome Shareholders

. Your Bank of Choice Nasdaq: PBSK

Poage Bankshares, Inc. Forward - Looking Statements Disclosures Statements contained in this presentation that are not historical facts constitute forward - looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements are subject to significant risks and uncertainties. Poage Bankshares intends such forward - looking statements to be covered by the safe harbor provisions contained in such Act. Poage Bankshares ' ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of Poage Bankshares include, but are not limited to, changes in market interest rates, general economic conditions, changes in federal and state regulation, actions by competitors, loan delinquency rates, our ability to control costs and expenses, and other factors disclosed in Poage Bankshares ‘ periodic reports filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance should not be placed on such statements. Poage Bankshares assumes no obligation to update any forward - looking statement except as may be required by applicable law or regulation.

CORPORATE OVERVIEW Poage Bankshares, Inc.

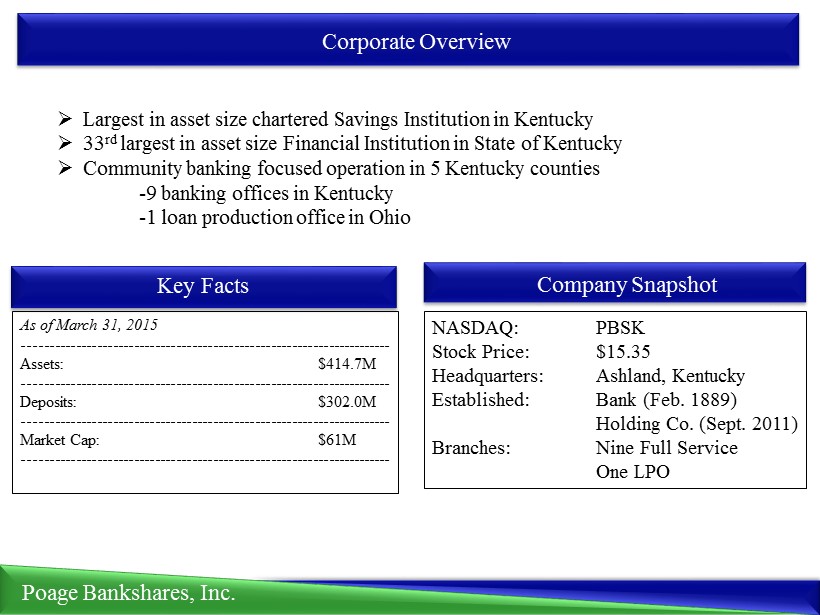

Poage Bankshares, Inc. Corporate Overview » Largest in asset size chartered Savings Institution in Kentucky » 33 rd largest in asset size Financial Institution in State of Kentucky » Community banking focused operation in 5 Kentucky counties - 9 banking offices in Kentucky - 1 loan production office in Ohio Key Facts As of March 31, 2015 ---------------------------------------------------------------------- Assets: $414.7M ---------------------------------------------------------------------- Deposits: $302.0M ---------------------------------------------------------------------- Market Cap: $61M ---------------------------------------------------------------------- Company Snapshot NASDAQ: PBSK Stock Price: $15.35 Headquarters: Ashland, Kentucky Established: Bank (Feb. 1889) Holding Co. (Sept. 2011) Branches: Nine Full Service One LPO

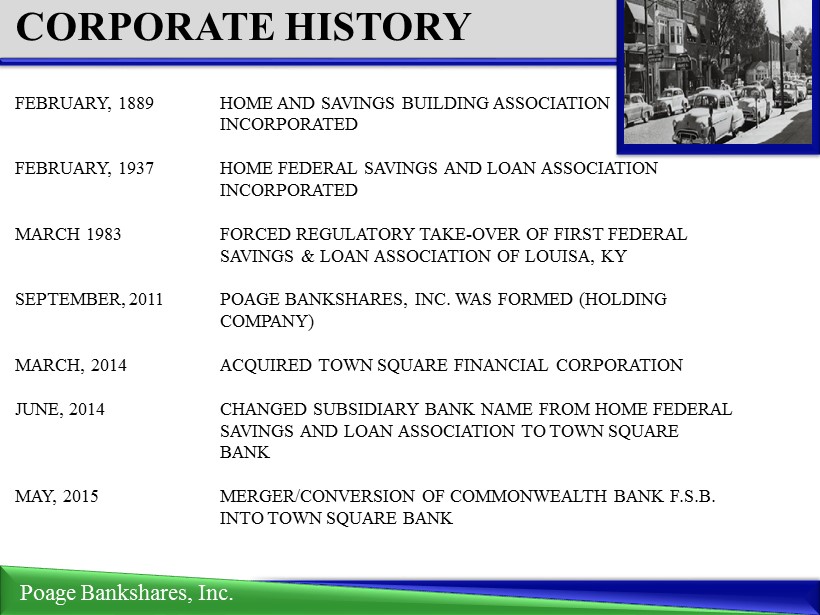

FEBRUARY, 1889 HOME AND SAVINGS BUILDING ASSOCIATION INCORPORATED FEBRUARY, 1937 HOME FEDERAL SAVINGS AND LOAN ASSOCIATION INCORPORATED MARCH 1983 FORCED REGULATORY TAKE - OVER OF FIRST FEDERAL SAVINGS & LOAN ASSOCIATION OF LOUISA , KY SEPTEMBER, 2011 POAGE BANKSHARES, INC. WAS FORMED (HOLDING COMPANY) MARCH, 2014 ACQUIRED TOWN SQUARE FINANCIAL CORPORATION JUNE , 2014 CHANGED SUBSIDIARY BANK NAME FROM HOME FEDERAL SAVINGS AND LOAN ASSOCIATION TO TOWN SQUARE BANK MAY, 2015 MERGER/CONVERSION OF COMMONWEALTH BANK F.S.B. INTO TOWN SQUARE BANK Poage Bankshares , Inc. CORPORATE HISTORY

* Based on ------- closing price of $ --- Poage Bankshares, Inc. STOCK MARKET STATISTICS » 3.97 million shares outstanding » Listed on NASDAQ Global Market in September, 2011 » Market capitalization of $61 million* » Institutions hold 35.73% of shares (1) » Average daily trading volume (90 day) is 1,959 shares *As of March 31, 2015 (1) PBSK ESOP Plan excluded

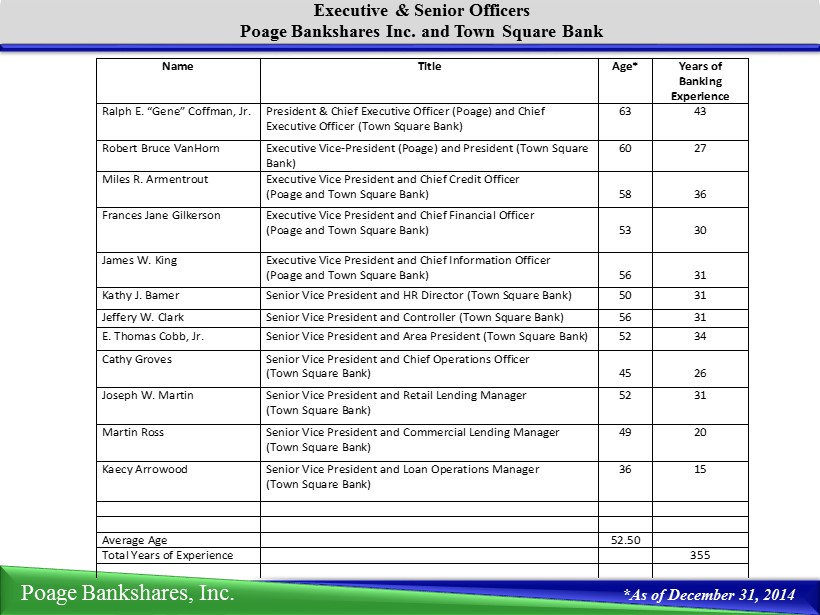

Poage Bankshares, Inc. Name Title Age* Years of Banking Experience Ralph E. “Gene” Coffman, Jr. President & Chief Executive Officer (Poage) and Chief Executive Officer (Town Square Bank) 63 43 Robert Bruce VanHorn Executive Vice-President (Poage) and President (Town Square Bank) 60 27 Miles R. Armentrout Executive Vice President and Chief Credit Officer (Poage and Town Square Bank) 58 36 Frances Jane Gilkerson Executive Vice President and Chief Financial Officer (Poage and Town Square Bank) 53 30 James W. King Executive Vice President and Chief Information Officer (Poage and Town Square Bank) 56 31 Kathy J. Bamer Senior Vice President and HR Director (Town Square Bank) 50 31 Jeffery W. Clark Senior Vice President and Controller (Town Square Bank) 56 31 E. Thomas Cobb, Jr. Senior Vice President and Area President (Town Square Bank) 52 34 Cathy Groves Senior Vice President and Chief Operations Officer (Town Square Bank) 45 26 Joseph W. Martin Senior Vice President and Retail Lending Manager (Town Square Bank) 52 31 Martin Ross Senior Vice President and Commercial Lending Manager (Town Square Bank) 49 20 Kaecy Arrowood Senior Vice President and Loan Operations Manager (Town Square Bank) 36 15 Average Age 52.50 Total Years of Experience 355 Executive & Senior Officers Poage Bankshares Inc. and Town Square Bank *As of December 31, 2014

» Completed integration of Town Square Bank » Introduced new subsidiary bank name – Town Square Bank » Rebranded bank and emphasized “Community Focus ” and goal to customers “Bank of Choice” » September 2014, entered into acquisition agreement with Commonwealth Bank F.S.B., completed acquisition on May 31, 2015 » Ranked in top five for Deposit Market S hare in 4 of 5 counties with a branch presence (Source: FDIC) » Ended 2014 with record Assets, Deposits, Net Loans Outstanding, and Stockholders Equity Poage Bankshares, Inc. 2014 Highlights

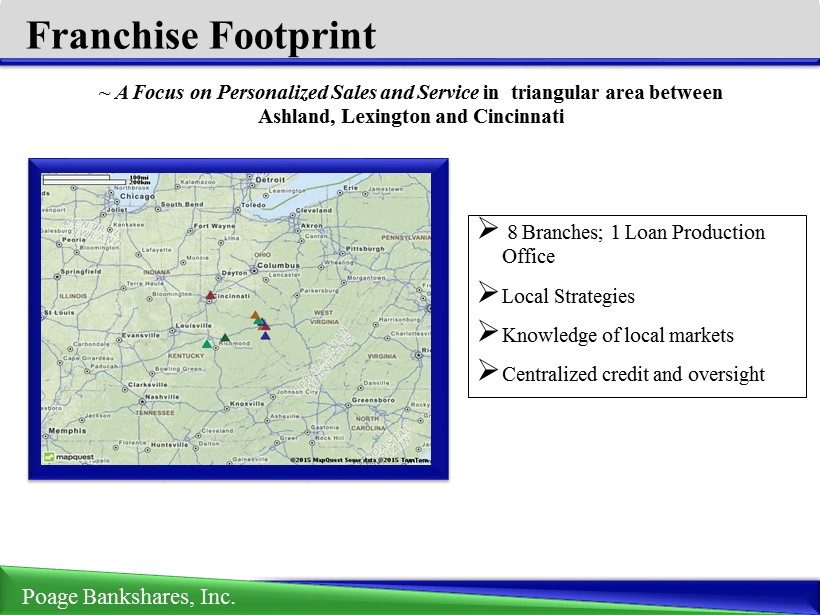

» 8 Branches; 1 Loan Production Office » Local Strategies » Knowledge of local markets » Centralized credit and oversigh t ~ A Focus on Personalized Sales and Service in triangular area between Ashland, Lexington and Cincinnati Franchise Footprint Poage Bankshares , Inc.

» 7 banking offices » Low - growth, but mature stable market » Very competitive; over - banked » PBSK holds strong deposit and loan base » Number 1 Market Share at 21.84% as of June 30, 2014 (Source: FDIC) Poage Bankshares, Inc. Markets Ashland Region Boyd, Lawrence & Greenup

Markets Lexington Region Lexington & Mt. Sterling 2 Banking offices, including mortgage lending department Loan to Deposit Ratio 132.1% as of March 31, 2015 Strong potential loan growth market Number 6 Market Share at 9.28% as of June 30, 2014. (Source FDIC) Montgomery County Number 5 Market Share at 3.03% as of June 30, 2014. (Source: FDIC) Poage Bankshares, Inc.

» 1 loan production office » Small presence in large metropolitan market » Largest commercial loan growth area for 2014; projected same for 2015. Markets Poage Bankshares, Inc. Cincinnati Region

Poage Bankshares , Inc. Financials

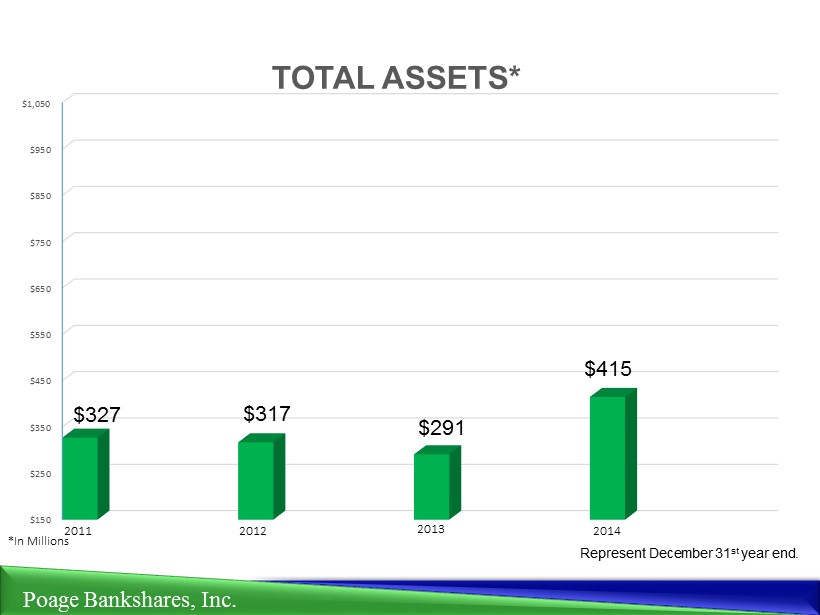

$150 $250 $350 $450 $550 $650 $750 $850 $950 $1,050 TOTAL ASSETS* $291 $415 Poage Bankshares , Inc. $327 $317 Represent December 31 st year end. *In Millions 2011 2012 2013 2014

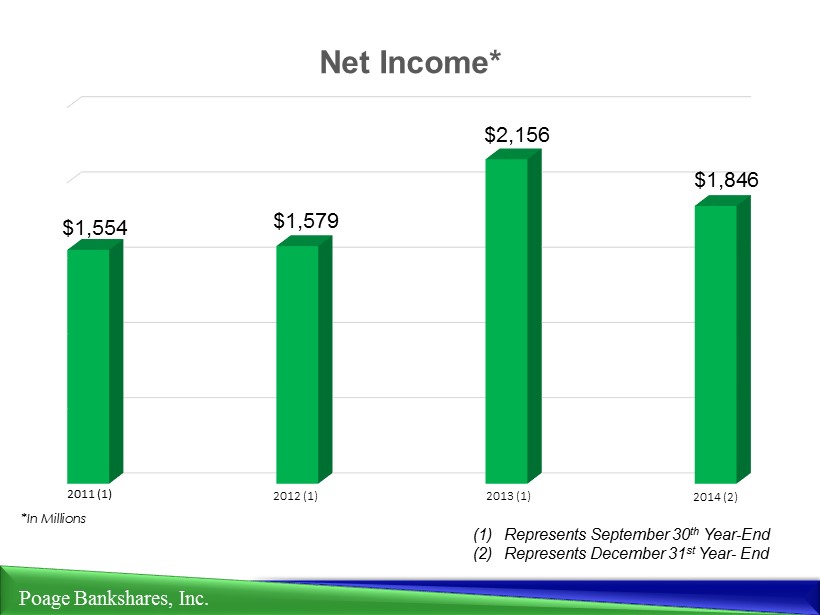

Poage Bankshares , Inc. Net Income* 2011 (1) $1,846 2012 (1) 2013 (1) 2014 (2) (1) Represents September 30 th Year - End (2) Represents December 31 st Year - End $1,554 $1,579 $2,156 *In Millions

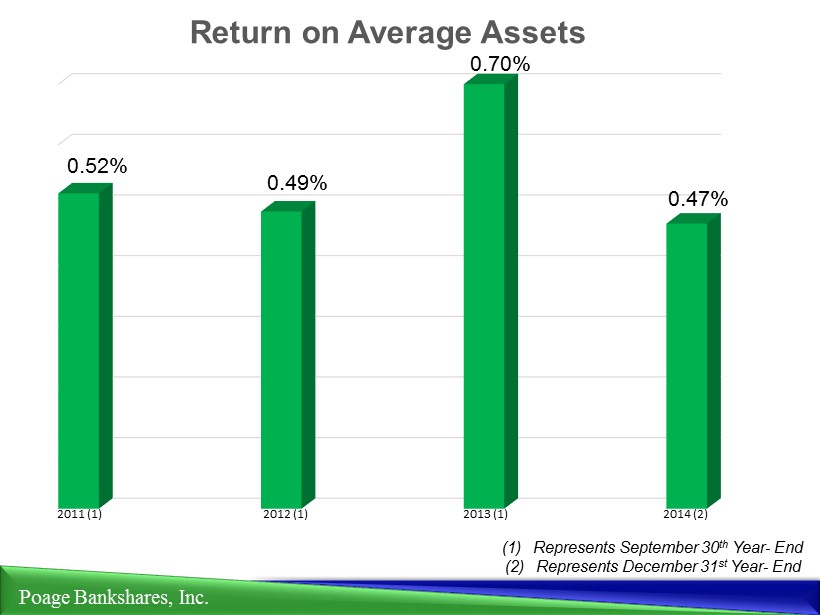

Poage Bankshares , Inc. Return on Average Assets 2011 (1) 2012 (1) 2013 (1) 2014 (2) 0.49% 0.70% 0.47% 0.52% (1) Represents September 30 th Year - End (2) Represents December 31 st Year - End

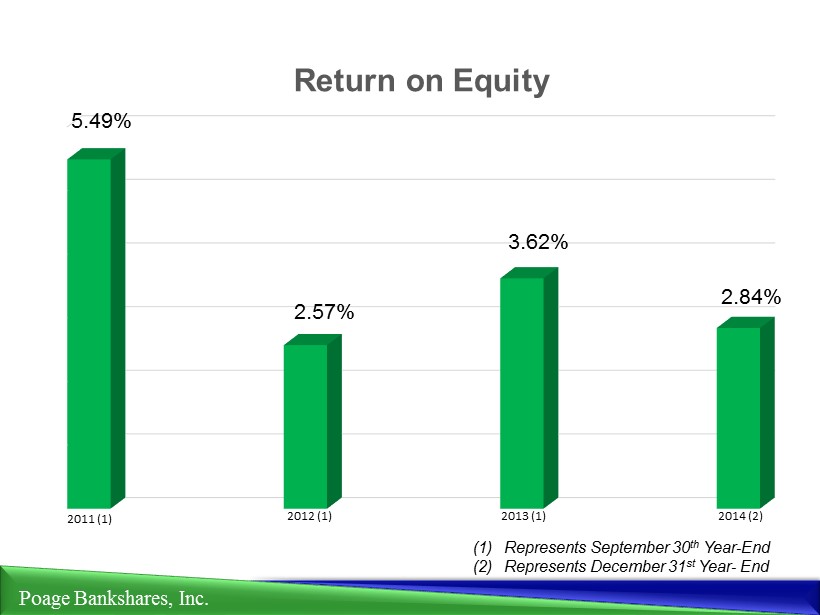

Poage Bankshares , Inc. Return on Equity 2011 (1) 2012 (1) 2013 (1) 2014 (2) 2.57% 3.62% 2.84% 5.49% (1) Represents September 30 th Year - End (2) Represents December 31 st Year - End

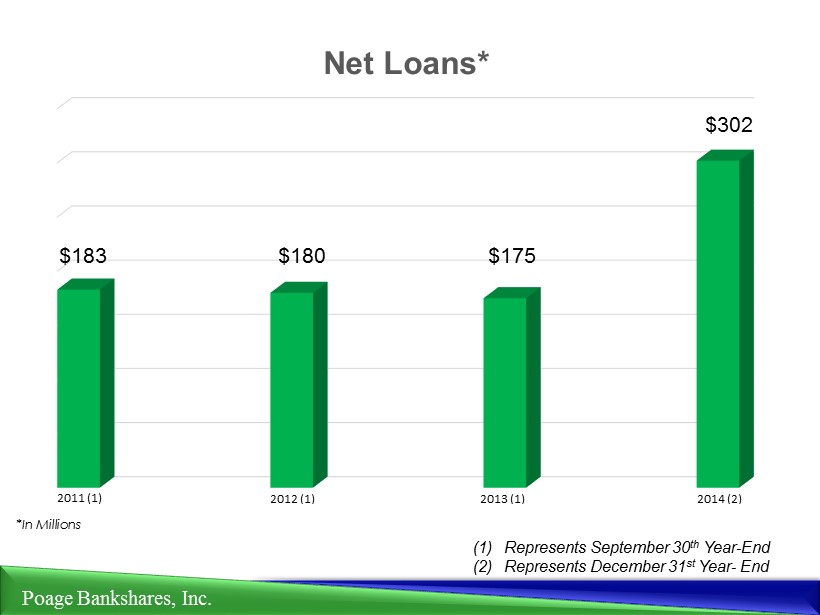

Poage Bankshares , Inc. Net Loans* 2011 (1) 2012 (1) 2013 (1) 2014 (2) (1) Represents September 30 th Year - End (2) Represents December 31 st Year - End $183 $180 $175 $302 *In Millions

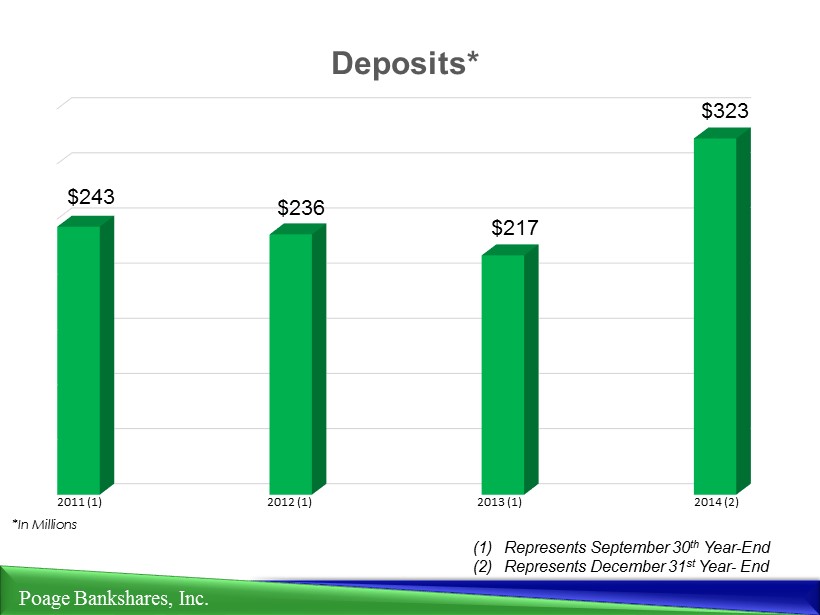

Poage Bankshares , Inc. Deposits* 2011 (1) 2012 (1) 2013 (1) 2014 (2) $243 $236 $217 $323 (1) Represents September 30 th Year - End (2) Represents December 31 st Year - End *In Millions

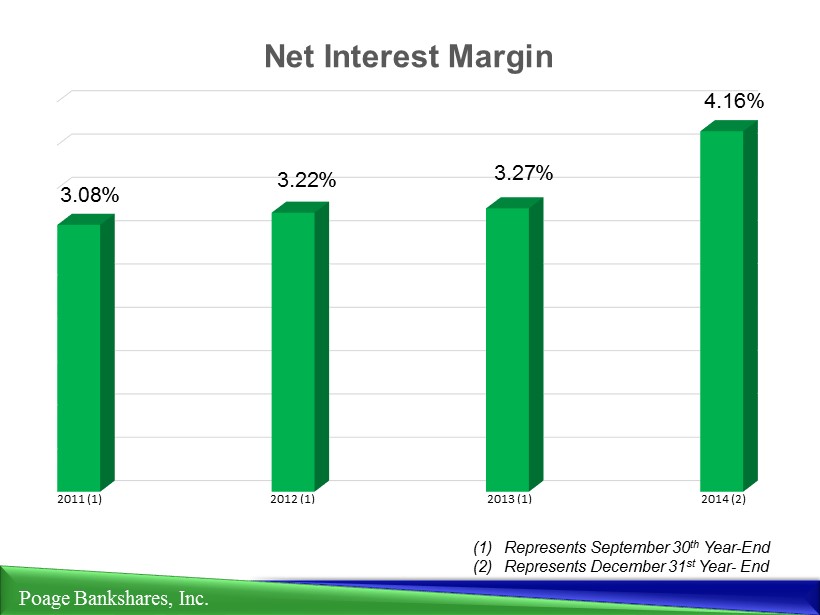

Poage Bankshares , Inc. Net Interest Margin 2011 (1) 2012 (1) 2013 (1) 2014 (2) 3.27% 4.16% (1) Represents September 30 th Year - End (2) Represents December 31 st Year - End 3.08% 3.22%

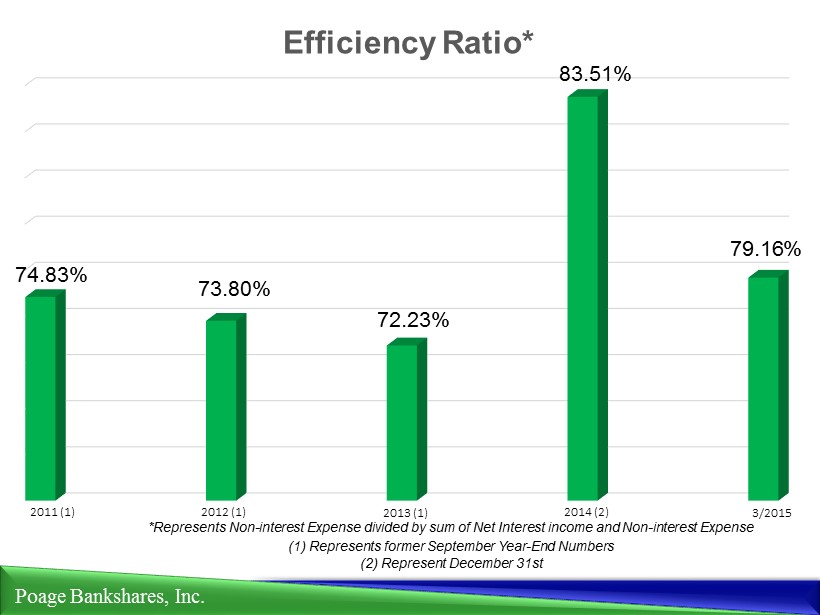

Poage Bankshares, Inc. Efficiency Ratio* 74.83% 73.80% 72.23% 83.51% 79.16% 2011 (1) 2012 (1) 2013 (1) 2014 (2) 3/2015 *Represents Non - interest Expense divided by sum of Net Interest income and Non - interest Expense (1) Represents former September Year - End Numbers (2) Represent December 31st

Financial Highlights Poage Bankshares, Inc. » Earned over $2.9 million net income in last 12 months; best four quarter record in history » Core EPS for past 12 months has increased over 171% compared to last 12 months ended 3/31/14 » Cost of deposits continues to decline – 56bp for past 12 months versus 70 bp for 12 months ended 3/31/14 » Strong core deposit base with approximately 75% in non - jumbo deposits » 13.3% of deposits are non - interest bearing; compared to 2.9% at end of 2013 » Efficiency ratio continues to improve at 74.1% compared to 84.6% for LTM period ending 3/31/14 (Although compared to Peer levels, still too high) » LTM Net Interest Income/Average Assets was 62 bp compared to 46 bp for the LTM period ending 3/31/14 » Asset Quality remains excellent with Non - Performing Assets representing only 1.35% of Total Assets and Texas Ratio of 8.38% » Loans to Deposit ratio of 93% indicates our ability to leverage the balance sheet

Poage Bankshares , Inc. Shareholder Focus

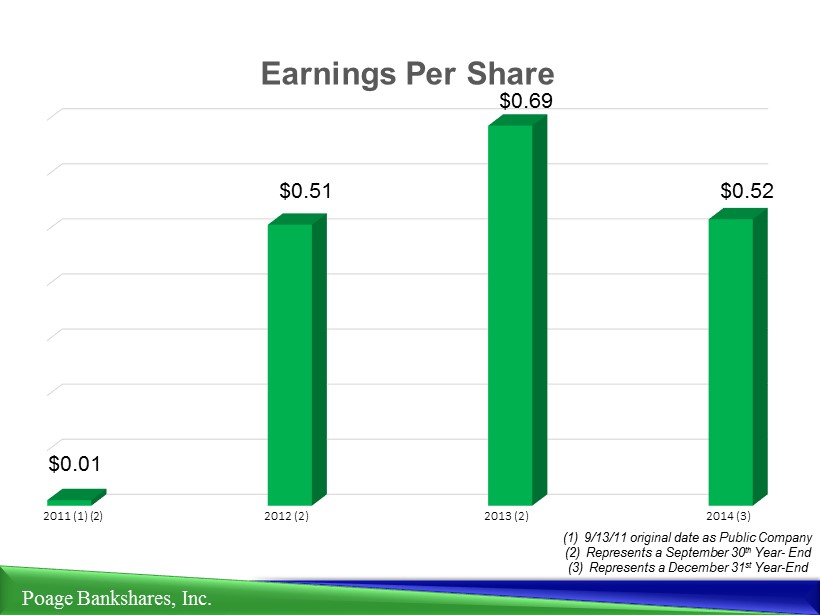

Poage Bankshares, Inc. Earnings Per Share 2011 (1) (2) 2012 (2) 2013 (2) 2014 (3) $0.01 $0.51 $0.69 $0.52 (1) 9/13/11 original date as Public Company (2) Represents a September 30 th Year - End (3) Represents a December 31 st Year - End

PBSK’S STOCK PRICE HAS INCREASED 55% SINCE ITS INITIAL PUBLIC OF FERING (IPO) IN 2011 (62% TOTAL RETURN) TANGIBLE BOOK VALUE PER SHARE HAS INCREASED $0.97 OVER THE PAST TWELVE MONTHS ENDED MARCH 31, 2015* STEADILY INCREASED DIVIDENDS – RECENTLY ANNOUNCED ANOTHER QUARTE RLY INCREASE ($0.06 PER SHARE) CONTINUE TO REPURCHASE SHARES OF STOCK DUE TO MANAGEMENTS BELIEF STOCK IS TRADING AT AN ATTRACTIVE VALUATION - REPURCHASED 81,823 SHARES IN FIRST QUARTER OF 2015 AT AVERAGE PRICE OF $14.96 PER SHARE; REPRESENTS PREMIUM OF APPROXIMATELY 50% FROM THE IPO * TANGIBLE BOOK VALUE PER SHARE IS A FINANCIAL MEASURE NOT CALCULA TED IN ACCORDANCE WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN THE UNITED STATES (“GAAP”). F OR PURPOSES OF CALCULATING TANGIBLE BOOK VALUE PER SHARE, POAGE BANKSHARES DEDUCTS FROM IT SHAREHOLDERS’ EQUITY GOODWILL AND OTHER INTANGI BLE ASSETS IN ORDER TO CALCULATE TANGIBLE BOOK VALUE. BOOK VALUE PER SHARE, WHICH IS THE MOST COMPARABLE FINANCIAL MEASURE CALCULATED IN ACCORDANCE WITH GAAP, INCREASED $1.04 FROM MARCH 31, 2014 TO MARCH 31, 2015. POAGE BANKSHARES BELIEVES THAT TANGIBLE BOOK VALUE PER SHARE IS USEFUL INFORMATI ON TO INVESTORS BECAUSE IT IS COMMONLY USED BY INVESTORS AS A MEASURE OF FRANCHISE VALUE. Poage Bankshares , Inc. Creation and Return of Shareholder Value

Thank you for your investment in Your Bank of Choice www.townsquarebank.com NASDAQ: PBSK