Attached files

| file | filename |

|---|---|

| EX-32 - SECTION 1350 CERTIFICATIONS - PRICE T ROWE GROUP INC | trow-ex32_q22015.htm |

| EX-31.(I).1 - RULE 13A-14(A) CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - PRICE T ROWE GROUP INC | trow-ex31i1_q22015.htm |

| EX-15 - LETTER FROM KPMG LLP - PRICE T ROWE GROUP INC | trow-ex15_q22015x10q.htm |

| 10-Q - 10-Q - PRICE T ROWE GROUP INC | a10q-q22015.htm |

| EX-31.(I).2 - RULE 13A-14(A) CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - PRICE T ROWE GROUP INC | trow-ex31i2_q22015.htm |

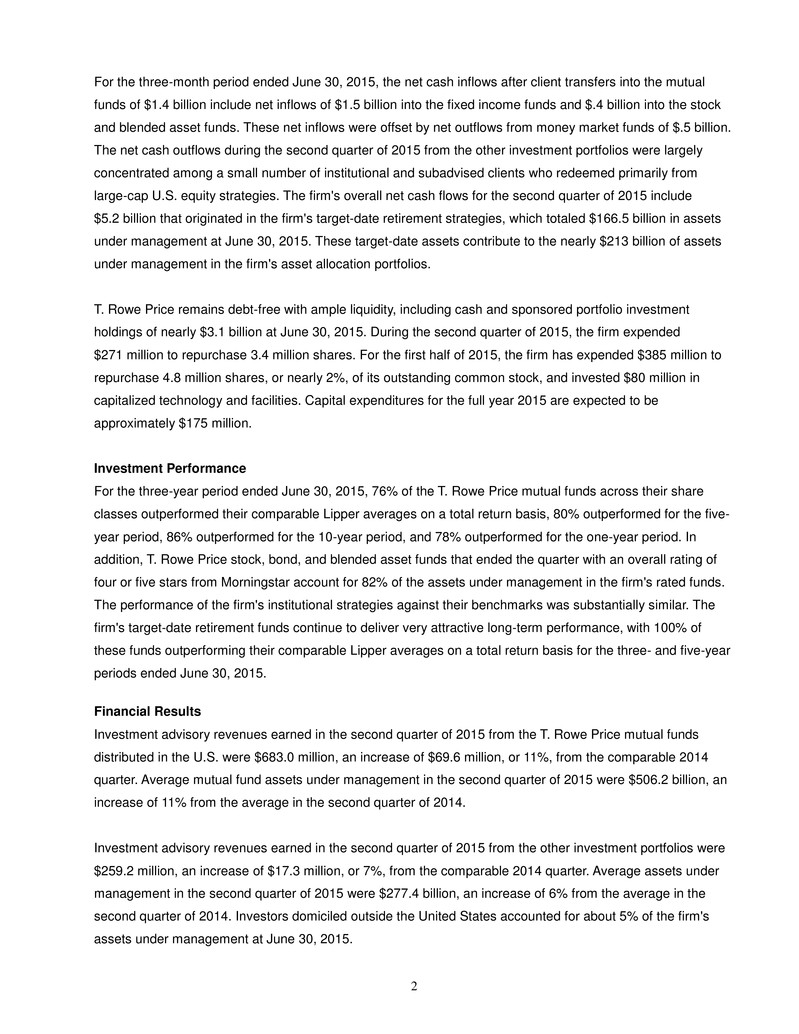

1 NEWS RELEASE T. ROWE PRICE GROUP REPORTS SECOND QUARTER 2015 RESULTS Assets Under Management Increase to $773.0 Billion BALTIMORE (July 23, 2015) - T. Rowe Price Group, Inc. (NASDAQ-GS: TROW) today reported its second quarter of 2015 results, including net revenues of $1.1 billion, net income of $333.2 million, and diluted earnings per common share of $1.24. On a comparable basis, net revenues were $984.3 million, net income was $305.8 million, and diluted earnings per common share was $1.13 in the second quarter of 2014. Financial Highlights Three months ended Percentage Change Six months ended Percentage Change (in millions, exception per-share data) 6/30/2014 6/30/2015 6/30/2014 6/30/2015 Investment advisory fees $ 855.3 $ 942.2 10% $ 1,681.7 $ 1,838.7 9 % Net revenues $ 984.3 $ 1,072.4 9% $ 1,938.9 $ 2,099.4 8 % Operating expenses $ 511.2 $ 564.6 10% $ 1,016.7 $ 1,113.8 10 % Net operating income $ 473.1 $ 507.8 7% $ 922.2 $ 985.6 7 % Net non-operating investment income $ 26.1 $ 33.0 26% $ 68.2 $ 59.8 (12)% Net income $ 305.8 $ 333.2 9% $ 610.1 $ 642.7 5 % Diluted earnings per share $ 1.13 $ 1.24 10% $ 2.25 $ 2.39 6 % Average assets under management (in billions) $ 717.2 $ 783.6 9% $ 709.2 $ 771.4 9 % Assets under management at June 30, 2015 were $773.0 billion, an increase of $.3 billion from March 31, 2015 and $26.2 billion from the end of 2014. Three months ended 6/30/2015 Six months ended 6/30/2015 (in billions) Sponsored U.S. mutual funds Other investment portfolios Total Sponsored U.S. mutual funds Other investment portfolios Total Assets under management at beginning of period $ 497.2 $ 275.5 $ 772.7 $ 477.6 $ 269.2 $ 746.8 Net cash flows before client transfers 2.5 (4.6) (2.1) 8.7 (8.9) (.2) Client transfers from mutual funds to other portfolios (1.1) 1.1 — (3.9) 3.9 — Net cash flows after client transfers 1.4 (3.5) (2.1) 4.8 (5.0) (.2) Net market appreciation and income 1.5 .9 2.4 17.7 8.7 26.4 Change during the period 2.9 (2.6) .3 22.5 3.7 26.2 Assets under management at June 30, 2015 $ 500.1 $ 272.9 $ 773.0 $ 500.1 $ 272.9 $ 773.0

2 For the three-month period ended June 30, 2015, the net cash inflows after client transfers into the mutual funds of $1.4 billion include net inflows of $1.5 billion into the fixed income funds and $.4 billion into the stock and blended asset funds. These net inflows were offset by net outflows from money market funds of $.5 billion. The net cash outflows during the second quarter of 2015 from the other investment portfolios were largely concentrated among a small number of institutional and subadvised clients who redeemed primarily from large-cap U.S. equity strategies. The firm's overall net cash flows for the second quarter of 2015 include $5.2 billion that originated in the firm's target-date retirement strategies, which totaled $166.5 billion in assets under management at June 30, 2015. These target-date assets contribute to the nearly $213 billion of assets under management in the firm's asset allocation portfolios. T. Rowe Price remains debt-free with ample liquidity, including cash and sponsored portfolio investment holdings of nearly $3.1 billion at June 30, 2015. During the second quarter of 2015, the firm expended $271 million to repurchase 3.4 million shares. For the first half of 2015, the firm has expended $385 million to repurchase 4.8 million shares, or nearly 2%, of its outstanding common stock, and invested $80 million in capitalized technology and facilities. Capital expenditures for the full year 2015 are expected to be approximately $175 million. Investment Performance For the three-year period ended June 30, 2015, 76% of the T. Rowe Price mutual funds across their share classes outperformed their comparable Lipper averages on a total return basis, 80% outperformed for the five- year period, 86% outperformed for the 10-year period, and 78% outperformed for the one-year period. In addition, T. Rowe Price stock, bond, and blended asset funds that ended the quarter with an overall rating of four or five stars from Morningstar account for 82% of the assets under management in the firm's rated funds. The performance of the firm's institutional strategies against their benchmarks was substantially similar. The firm's target-date retirement funds continue to deliver very attractive long-term performance, with 100% of these funds outperforming their comparable Lipper averages on a total return basis for the three- and five-year periods ended June 30, 2015. Financial Results Investment advisory revenues earned in the second quarter of 2015 from the T. Rowe Price mutual funds distributed in the U.S. were $683.0 million, an increase of $69.6 million, or 11%, from the comparable 2014 quarter. Average mutual fund assets under management in the second quarter of 2015 were $506.2 billion, an increase of 11% from the average in the second quarter of 2014. Investment advisory revenues earned in the second quarter of 2015 from the other investment portfolios were $259.2 million, an increase of $17.3 million, or 7%, from the comparable 2014 quarter. Average assets under management in the second quarter of 2015 were $277.4 billion, an increase of 6% from the average in the second quarter of 2014. Investors domiciled outside the United States accounted for about 5% of the firm's assets under management at June 30, 2015.

3 Money market advisory fees and other fund expenses voluntarily waived by the firm to maintain positive yields for investors in the second quarter of 2015 were $12.5 million, compared with $15.0 million in the 2014 quarter. The firm expects that it will continue to waive such fees for the remainder of the year. Operating expenses were $564.6 million in the second quarter of 2015, up $53.4 million from the comparable 2014 quarter. Compensation and related costs have increased $34.5 million from the second quarter of 2014, due primarily to higher salaries, benefits, and related employee costs from modest base salary increases at the beginning of the year and added headcount; an increase in the interim accrual for year-end bonus compensation; and higher stock-based compensation. The firm has increased its average staff size by 4.0% from the second quarter of 2014. At June 30, 2015, the firm employed 5,991 associates. Advertising and promotion costs were $14.2 million in the second quarter of 2015, compared with $14.6 million in the comparable 2014 period. The firm currently expects advertising and promotion costs for the full-year 2015 to increase about 5% from 2014 levels. Occupancy and facility costs, together with depreciation and amortization expense, were $72.1 million in the second quarter of 2015, up $8.1 million compared to the second quarter of 2014. The increase is primarily attributable to the added costs to update and enhance technology capabilities, including related maintenance programs. Other operating expenses in the second quarter of 2015 were up $8.0 million from the comparable 2014 quarter, as increased business demands and the firm's continued investment in its operating capabilities have increased costs. These higher costs in the second quarter of 2015 include costs related to the firm's defined contribution recordkeeping business, information and other third-party service costs, travel costs, and other general and administrative costs. Net non-operating investment income in the second quarter of 2015 increased $6.9 million from the 2014 quarter. The firm realized gains of $22.7 million from the sale of certain of its sponsored fund investments in the second quarter of 2015 compared with $11.7 million of realized gains in the 2014 quarter. The proceeds from the sale of the fund investments in 2015 were used to provide new or additional seed capital to other sponsored funds in support of the firm's global distribution efforts. The increase in realized gains in the 2015 quarter was offset in part by smaller net investment gains recognized on the firm's other investment portfolios and lower dividends earned on its sponsored investment portfolios. The firm's effective tax rate for the second quarter of 2015 is 38.4%, which reflects certain adjustments made in the quarter to the 2014 tax accruals. The firm currently estimates that its effective rate for the full-year 2015 will be about 38.7%.

4 Management Commentary James A. C. Kennedy, the company’s chief executive officer and president, commented: “U.S. economic growth picked up in the second quarter, as evidenced by increased consumer spending and exports, solid jobs improvement, and income growth. While oil prices ticked up from their first-quarter lows, they remain subdued and should continue to provide a tailwind for consumers and global economies. Corporate earnings also rose modestly. The Fed once again deferred its first rate hike since 2006, though improving economic data suggest the central bank could begin raising short-term interest rates later this year. We believe the pace of those rate hikes will be gradual. “The overseas economic picture was mixed. Europe’s growth outlook improved and deflation fears abated, but fallout from the Greek debt crisis and the political turmoil it has created on the Continent could hinder the broad recovery. Japanese growth likewise improved, although structural reforms have been slow to materialize. Weakening Chinese economic growth and the sharp downturn in Chinese asset prices since mid-June clearly bear close watching, as they could have broader economic and political ramifications. “Against this backdrop, major U.S. stock indexes reached new highs during the quarter, before retreating by the end of June. U.S. bond returns were mostly negative, but high yield issues had a modestly positive return. The broad MSCI indexes measuring equities in developed non-U.S. markets and emerging markets rose less than 1% in U.S. dollar terms. Global government bonds fell slightly, and bond returns in emerging markets varied as U.S. currency strength moderated and countries pursued divergent monetary policies. “Global market volatility has increased and is likely to remain higher for the near term. Given the significant appreciation of many asset classes over the last six years, we believe investors should continue to temper their performance expectations. U.S. equity valuations are mostly full and earnings growth could be harder to achieve as the economic expansion matures. With global bond yields at or near historically low levels, we expect modest fixed income returns going forward. “Our investment performance for our clients generally remains very strong, especially in our asset allocation portfolios. Our financial strength allows us to continue to invest in developing our talent, broadening our capabilities, and gaining efficiencies. We are confident that these investments will enable us to maintain competitive investment performance, further broaden our distribution reach, and meet changing client needs.” Other Matters The financial results presented in this release are unaudited. The firm expects that it will file its Form 10-Q Quarterly Report for the second quarter of 2015 with the U.S. Securities and Exchange Commission later today. The Form 10-Q will include additional information on the firm's unaudited financial results at June 30, 2015.

5 Certain statements in this earnings release may represent “forward-looking information,” including information relating to anticipated changes in revenues, net income and earnings per common share, anticipated changes in the amount and composition of assets under management, anticipated expense levels, estimated tax rates, and expectations regarding financial results, future transactions, investments, capital expenditures, dividends, stock repurchases, and other market conditions. For a discussion concerning risks and other factors that could affect future results, see the firm's 2014 Form 10-K. Founded in 1937, Baltimore-based T. Rowe Price (troweprice.com) is a global investment management organization that provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The organization also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. CONTACT T. ROWE PRICE, PUBLIC RELATIONS Brian Lewbart 410-345-2242 brian_lewbart@troweprice.com Bill Benintende 410-345-3482 bill_benintende@troweprice.com Kylie Muratore 410-345-2533 kylie_muratore@troweprice.com

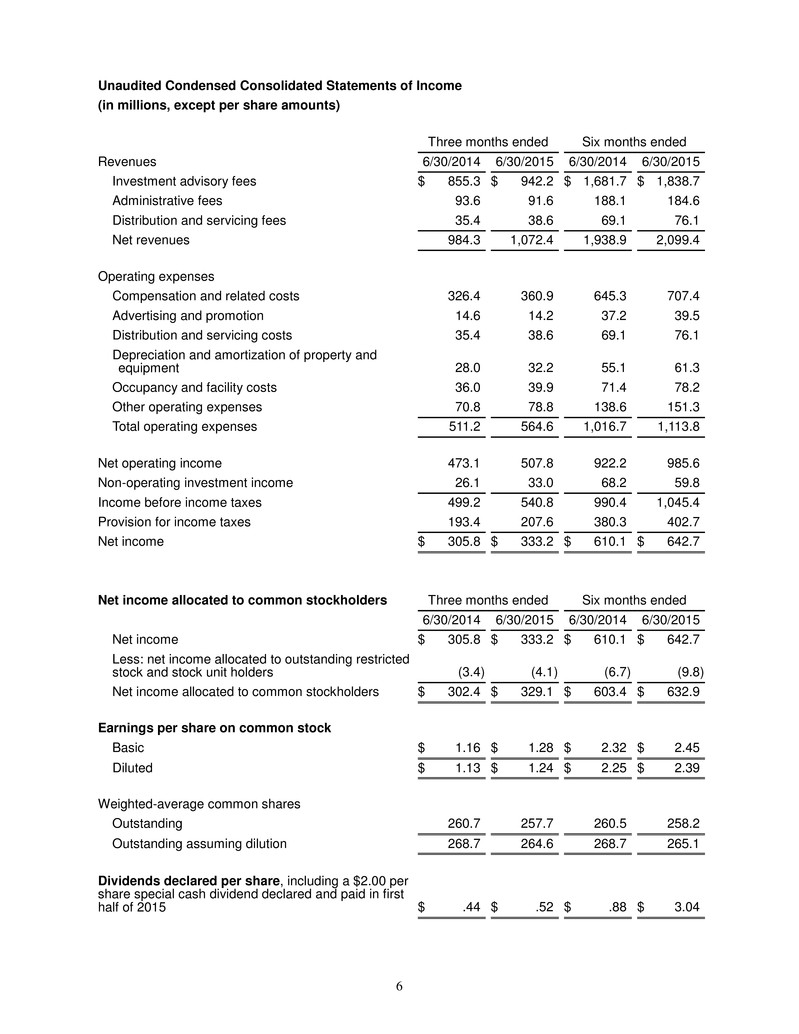

6 Unaudited Condensed Consolidated Statements of Income (in millions, except per share amounts) Three months ended Six months ended Revenues 6/30/2014 6/30/2015 6/30/2014 6/30/2015 Investment advisory fees $ 855.3 $ 942.2 $ 1,681.7 $ 1,838.7 Administrative fees 93.6 91.6 188.1 184.6 Distribution and servicing fees 35.4 38.6 69.1 76.1 Net revenues 984.3 1,072.4 1,938.9 2,099.4 Operating expenses Compensation and related costs 326.4 360.9 645.3 707.4 Advertising and promotion 14.6 14.2 37.2 39.5 Distribution and servicing costs 35.4 38.6 69.1 76.1 Depreciation and amortization of property and equipment 28.0 32.2 55.1 61.3 Occupancy and facility costs 36.0 39.9 71.4 78.2 Other operating expenses 70.8 78.8 138.6 151.3 Total operating expenses 511.2 564.6 1,016.7 1,113.8 Net operating income 473.1 507.8 922.2 985.6 Non-operating investment income 26.1 33.0 68.2 59.8 Income before income taxes 499.2 540.8 990.4 1,045.4 Provision for income taxes 193.4 207.6 380.3 402.7 Net income $ 305.8 $ 333.2 $ 610.1 $ 642.7 Net income allocated to common stockholders Three months ended Six months ended 6/30/2014 6/30/2015 6/30/2014 6/30/2015 Net income $ 305.8 $ 333.2 $ 610.1 $ 642.7 Less: net income allocated to outstanding restricted stock and stock unit holders (3.4) (4.1 ) (6.7) (9.8) Net income allocated to common stockholders $ 302.4 $ 329.1 $ 603.4 $ 632.9 Earnings per share on common stock Basic $ 1.16 $ 1.28 $ 2.32 $ 2.45 Diluted $ 1.13 $ 1.24 $ 2.25 $ 2.39 Weighted-average common shares Outstanding 260.7 257.7 260.5 258.2 Outstanding assuming dilution 268.7 264.6 268.7 265.1 Dividends declared per share, including a $2.00 per share special cash dividend declared and paid in first half of 2015 $ .44 $ .52 $ .88 $ 3.04

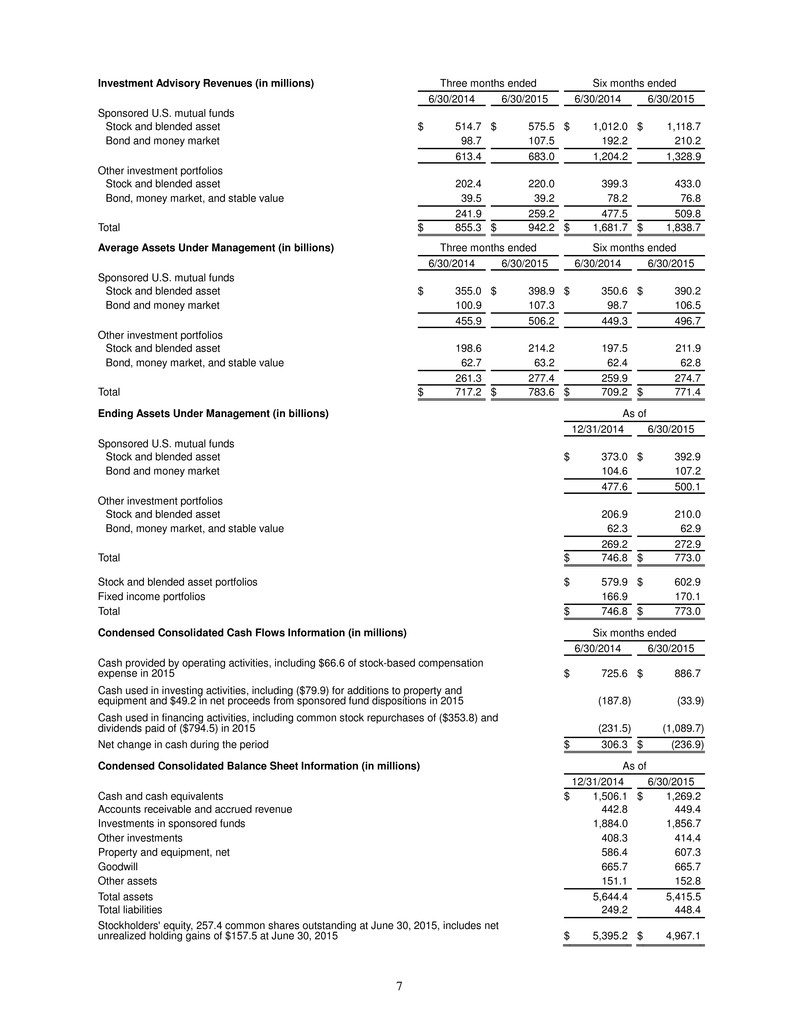

7 Investment Advisory Revenues (in millions) Three months ended Six months ended 6/30/2014 6/30/2015 6/30/2014 6/30/2015 Sponsored U.S. mutual funds Stock and blended asset $ 514.7 $ 575.5 $ 1,012.0 $ 1,118.7 Bond and money market 98.7 107.5 192.2 210.2 613.4 683.0 1,204.2 1,328.9 Other investment portfolios Stock and blended asset 202.4 220.0 399.3 433.0 Bond, money market, and stable value 39.5 39.2 78.2 76.8 241.9 259.2 477.5 509.8 Total $ 855.3 $ 942.2 $ 1,681.7 $ 1,838.7 Average Assets Under Management (in billions) Three months ended Six months ended 6/30/2014 6/30/2015 6/30/2014 6/30/2015 Sponsored U.S. mutual funds Stock and blended asset $ 355.0 $ 398.9 $ 350.6 $ 390.2 Bond and money market 100.9 107.3 98.7 106.5 455.9 506.2 449.3 496.7 Other investment portfolios Stock and blended asset 198.6 214.2 197.5 211.9 Bond, money market, and stable value 62.7 63.2 62.4 62.8 261.3 277.4 259.9 274.7 Total $ 717.2 $ 783.6 $ 709.2 $ 771.4 Ending Assets Under Management (in billions) As of 12/31/2014 6/30/2015 Sponsored U.S. mutual funds Stock and blended asset $ 373.0 $ 392.9 Bond and money market 104.6 107.2 477.6 500.1 Other investment portfolios Stock and blended asset 206.9 210.0 Bond, money market, and stable value 62.3 62.9 269.2 272.9 Total $ 746.8 $ 773.0 Stock and blended asset portfolios $ 579.9 $ 602.9 Fixed income portfolios 166.9 170.1 Total $ 746.8 $ 773.0 Condensed Consolidated Cash Flows Information (in millions) Six months ended 6/30/2014 6/30/2015 Cash provided by operating activities, including $66.6 of stock-based compensation expense in 2015 $ 725.6 $ 886.7 Cash used in investing activities, including ($79.9) for additions to property and equipment and $49.2 in net proceeds from sponsored fund dispositions in 2015 (187.8) (33.9) Cash used in financing activities, including common stock repurchases of ($353.8) and dividends paid of ($794.5) in 2015 (231.5) (1,089.7) Net change in cash during the period $ 306.3 $ (236.9) Condensed Consolidated Balance Sheet Information (in millions) As of 12/31/2014 6/30/2015 Cash and cash equivalents $ 1,506.1 $ 1,269.2 Accounts receivable and accrued revenue 442.8 449.4 Investments in sponsored funds 1,884.0 1,856.7 Other investments 408.3 414.4 Property and equipment, net 586.4 607.3 Goodwill 665.7 665.7 Other assets 151.1 152.8 Total assets 5,644.4 5,415.5 Total liabilities 249.2 448.4 Stockholders' equity, 257.4 common shares outstanding at June 30, 2015, includes net unrealized holding gains of $157.5 at June 30, 2015 $ 5,395.2 $ 4,967.1