Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP, INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Customers Bancorp, Inc. | ex99-2.htm |

Exhibit 99.1

Highly Focused, Low Risk, Above Average Growth

Bank Holding Company

Investor Presentation

July, 2015

NYSE: CUBI

2

Forward-Looking Statements

This presentation as well as other written or oral communications made from time to time by us, may contain certain forward-looking information

within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future

events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of

forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof

or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only

predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that

may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include:

within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future

events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of

forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof

or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only

predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that

may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include:

•changes in the external competitive market factors that might impact our results of operations;

•changes in laws and regulations, including without limitation changes in capital requirements under the federal prompt corrective action regulations;

•changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

•our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

•the timing of acquisition or investment transactions;

•constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these

opportunities;

opportunities;

•the failure of the Bank to complete any or all of the transactions described herein on the terms currently contemplated;

•local, regional and national economic conditions and events and the impact they may have on us and our customers;

•ability to attract deposits and other sources of liquidity;

•changes in the financial performance and/or condition of our borrowers;

•changes in the level of non-performing and classified assets and charge-offs;

•changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting

requirements;

requirements;

•inflation, interest rate, securities market and monetary fluctuations;

•the timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;

•changes in consumer spending, borrowing and saving habits;

•technological changes;

•the ability to increase market share and control expenses;

3

Forward-Looking Statements

• continued volatility in the credit and equity markets and its effect on the general economy;

• the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company

Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

• the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being

more difficult, time-consuming or costly than expected;

more difficult, time-consuming or costly than expected;

• material differences in the actual financial results of merger and acquisition activities compared with expectations, such as with respect to the full

realization of anticipated cost savings and revenue enhancements within the expected time frame;

realization of anticipated cost savings and revenue enhancements within the expected time frame;

• revenues following any merger being lower than expected;

• deposit attrition, operating costs, customer loss and business disruption following the merger, including, without limitation, difficulties in

maintaining relationships with employees being greater than expected.

maintaining relationships with employees being greater than expected.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we

believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower

than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents.

We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after

the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower

than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents.

We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after

the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

This presentation is for discussion purposes only, and shall not constitute any offer to sell or the solicitation of an offer to buy any security, nor is it

intended to give rise to any legal relationship between Customers Bancorp, Inc. (the "Company") and you or any other person, nor is it a

recommendation to buy any securities or enter into any transaction with the Company. This presentation also includes estimated guidance

regarding our fully diluted earnings per share for the year 2015, which we have previously disclosed and is subject to the assumptions and

qualifications included in that previous disclosure. The guidance consists solely of estimates prepared by management based on currently

available information and assumptions of future performance of the company and the general economy. Our independent registered public

accounting firm has not audited, reviewed or performed any procedures with respect to the guidance and, accordingly, does not express an

opinion or any other form of assurance with respect to this data. Our actual results may differ from the guidance, and any such differences could

be material. Accordingly, undue reliance should not be placed on this information. The factors discussed above should be considered and

evaluated with respect to our guidance.

intended to give rise to any legal relationship between Customers Bancorp, Inc. (the "Company") and you or any other person, nor is it a

recommendation to buy any securities or enter into any transaction with the Company. This presentation also includes estimated guidance

regarding our fully diluted earnings per share for the year 2015, which we have previously disclosed and is subject to the assumptions and

qualifications included in that previous disclosure. The guidance consists solely of estimates prepared by management based on currently

available information and assumptions of future performance of the company and the general economy. Our independent registered public

accounting firm has not audited, reviewed or performed any procedures with respect to the guidance and, accordingly, does not express an

opinion or any other form of assurance with respect to this data. Our actual results may differ from the guidance, and any such differences could

be material. Accordingly, undue reliance should not be placed on this information. The factors discussed above should be considered and

evaluated with respect to our guidance.

A $7.6 billion asset business

bank serving privately held

businesses

bank serving privately held

businesses

A consumer bank start up, set

up as a division of Customers

Bank, serving millennials,

middle income families and

underbanked throughout the

United States

up as a division of Customers

Bank, serving millennials,

middle income families and

underbanked throughout the

United States

5

Customers Bank Overview

$7.6 bn Business Bank with 21 sales offices with

target market from Boston to Philadelphia

target market from Boston to Philadelphia

Operating in key Mid-Atlantic and Northeast

markets

markets

§ Greater New York City area (Westchester County,

Manhattan and Melville)

Manhattan and Melville)

§ Philadelphia area (Bucks, Berks, Chester, Delaware

and Philadelphia Counties in southeastern

Pennsylvania and Greater Princeton area in New

Jersey)

and Philadelphia Counties in southeastern

Pennsylvania and Greater Princeton area in New

Jersey)

§ Greater Boston area (Boston, Providence and

Portsmouth, NH)

Portsmouth, NH)

“High-touch, supported with high-tech” value

proposition

proposition

§ Very experienced teams using “Single Point of

Contact” model

Contact” model

§ Provides exceptional customer service supported by

state-of-the-art technology support

state-of-the-art technology support

§ Risk based incentive compensation plans supported

by P&L statements created by teams

by P&L statements created by teams

Branches and Loan Production Offices

6

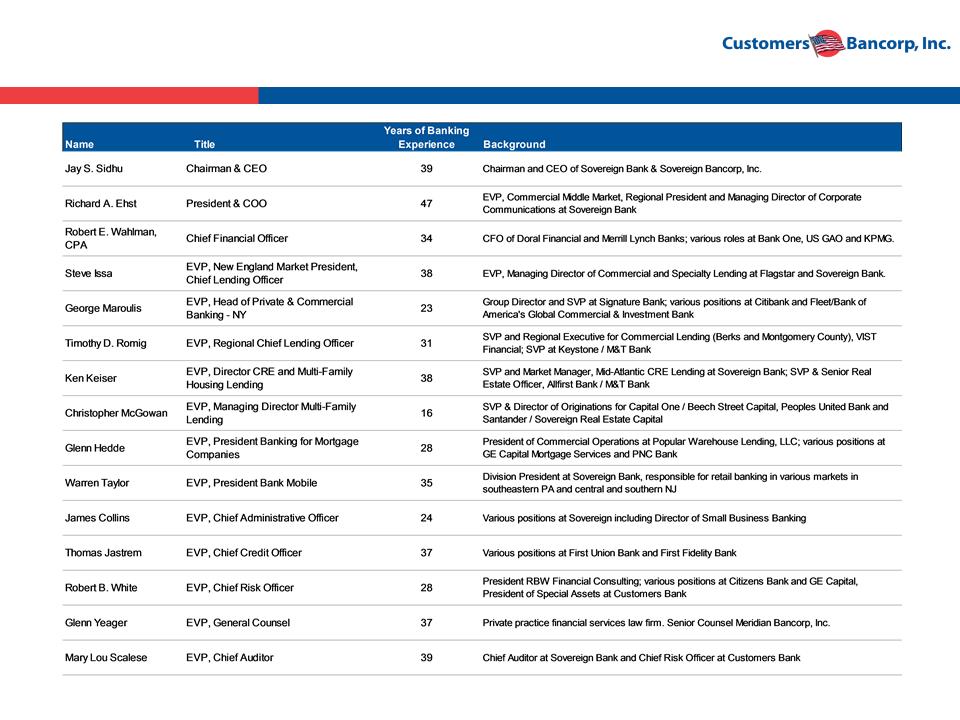

Our Competitive Advantage: A Highly Experienced Management Team

7

Investment Proposition

Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets

§ $7.6 billion asset bank with only 21 sales offices

§ Well capitalized at 11.1% total risk based capital (estimated), 7.4% tier 1 leverage, and 6.1% tangible equity to tangible assets

§ Target market from Boston to Philadelphia along Interstate 95

Strong Core Profitability, Growth & Efficient Operations

§ Q2 2015 core diluted earnings per share up 41% over Q2 2014 with a core ROA of .87% and a core ROE of 12.5%

§ Q2 2015 core net income of $14.9 million up 46% over Q2 2014

§ ROA goal of ~1% + and ROE of 12% + within 2-3 years, ROE goal already achieved

§ DDA and total deposits compounded annual growth of 83% and 68% respectively since 2009

§ Q2 2015 net interest margin was 2.73%

§ Operating efficiencies offset tighter margins and generate sustainable profitability

§ Q2 2015 efficiency ratio was 48.4%

Strong Credit Quality & Low Interest Rate Risk

§ 0.16% non-performing loans at June 30, 2015

§ Total core reserves to non-performing loans of 313.1%

§ Minimal risk of margin compression from modestly higher short term rates and flatter curve

Attractive Valuation

§ Current share price, as of June 30, 2015 $26.89 is 13.4x estimated 2015 core earnings

§ Price/tangible book only 1.5x estimated for year end 2015 core tangible book value

§ Peers, by size, trading at 14x LTM earnings and 1.7x price/tangible book; Peers with unique models trading at much higher

multiples

multiples

§ June 30, 2015 core tangible book value of $17.42, up 98% since July 2009 with a CAGR of 13%

• Non-GAAP core results including profitability measures, earnings, credit quality measures and valuation metrics exclude

the $6.0 million specific reserve for a potential fraudulent loan (see GAAP to non-GAAP core reconciliation on page 35).

the $6.0 million specific reserve for a potential fraudulent loan (see GAAP to non-GAAP core reconciliation on page 35).

8

Customers Bank

Executing On Our Unique High Performing

Banking Model

9

Disciplined Model for Increasing Shareholder Value

§ Strong organic revenue growth + scalable infrastructure =

sustainable double digit EPS = growth and increased shareholder

value

sustainable double digit EPS = growth and increased shareholder

value

§ A very robust risk management driven business strategy

§ Build tangible book value per share each quarter via earnings

§ Any book value dilution from any acquisitions must be overcome

within 1-2 years; otherwise stick with organic growth strategy

within 1-2 years; otherwise stick with organic growth strategy

§ Superior execution through proven management team

Disciplined Model for Superior Shareholder Value Creation

10

Execution Timeline

§ We invested in and

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

§ Identified existing

credit problems,

adequately reserved

and recapitalized the

bank

credit problems,

adequately reserved

and recapitalized the

bank

§ Actively worked out

very extensive loan

problems

very extensive loan

problems

§ Recruited experienced

management team

management team

§ Enhanced credit and risk

management

management

§ Developed infrastructure

for organic growth

for organic growth

§ Built out warehouse

lending platform and

doubled deposit and loan

portfolio

lending platform and

doubled deposit and loan

portfolio

§ Completed 3 small

acquisitions:

acquisitions:

– ISN Bank (FDIC-

assisted) ~ $70 mm

assisted) ~ $70 mm

– USA Bank (FDIC-

assisted) ~ $170 mm

assisted) ~ $170 mm

– Berkshire Bancorp

(Whole bank) ~ $85

mm

(Whole bank) ~ $85

mm

§ Recruited proven lending

teams

teams

§ Built out Commercial and

Multi-family lending

platforms

Multi-family lending

platforms

§ De Novo expansion;4-6

sales offices or teams

added each year

sales offices or teams

added each year

§ Continue to show strong

loan and deposit growth

loan and deposit growth

§ Built a “branch lite” high

growth Community Bank

and model for future

growth

growth Community Bank

and model for future

growth

§ Goals to ~12%+ ROE;

~1% ROA

~1% ROA

2009

Assets: $350M

Equity: $22M

2010-2011

Assets: $2.1B

Equity: $148M

2012-2013

Assets: $4.2B

Equity: $387M

Q2 2015

Assets: $7.6B

Core Equity: $527M

Core ROE: 12.5%

§ Single Point of Contact

Banking model executed -

commercial focus

Banking model executed -

commercial focus

§ Continued recruitment of

experienced teams

experienced teams

§ Introduce bankmobile -

banking of the future for

consumers

banking of the future for

consumers

§ Continue to show strong

loan and deposit growth

loan and deposit growth

§ ~12%+ ROE; ~1% ROA

expected within 36

months

expected within 36

months

§ ~$6.5+ billion asset bank

by end of 2014

by end of 2014

§ ~$9 billion asset bank by

end of 2017

end of 2017

Non-GAAP core results including profitability measures, earnings, equity, credit quality measures and valuation metrics exclude the $6.0 million

specific reserve for a potential fraudulent loan (see GAAP to non-GAAP core reconciliation on page 35)

specific reserve for a potential fraudulent loan (see GAAP to non-GAAP core reconciliation on page 35)

11

Banking Strategy - Customers Bank

Business Banking Focus - ~95% of revenues come from business segments

• Loan and deposit business through these segments:

• Banking Privately Held Businesses

• Banking High Net Worth Families

• Banking Privately Held Mortgage Companies

• Selected Commercial Real Estate

All Consumer

Products

Products

All Business

Products

Products

All Non-Credit

Products

Products

Client

Makes

One Call

Makes

One Call

Client

Private /

Personal

Bankers

Personal

Bankers

Concierge

Bankers

Bankers

Single Point of Contact

High Touch / High Tech

12

Results in: Organic Growth of Deposits with Controlled Costs

Total Deposit Growth ($mm)

Average DDA Growth ($mm)

Customers strategies of single point of contact and recruiting known teams in target markets produce

rapid deposit growth with low total cost

rapid deposit growth with low total cost

13

Lending Strategy

High Growth with Strong Credit Quality

§Continuous recruitment and retention of high quality teams

§Centralized credit committee approval for all loans

§Loans are stress tested for higher rates and a slower economy

§No losses on loans originated since new management team took over

§Creation of solid foundation for future earnings

Source: Company documents.

14

NPL

Source: SNL Financial, Company documents. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC insured banks.

Peer and Industry data as of March 31, 2015.

Peer and Industry data as of March 31, 2015.

Build an Outstanding Loan Quality Portfolio

Charge Offs

Customers non-performing loans at June 2015 excluding loans guaranteed by the FDIC were 0.12% of total loans.

Asset Quality Indicators Continue to Improve

15

C&I & Owner Occupied CRE Banking Strategy

Private & Commercial Banking

§Target companies with up to $100 million

annual revenues

annual revenues

§Very experienced teams

§Two new teams with 10 professionals added

year to date

year to date

§Single point of contact

§NE, NY, PA & NJ markets

Small Business

§Target companies with less than $5.0 million

annual revenue

annual revenue

§Principally SBA loans originated by small

business relationship managers or branch

network

business relationship managers or branch

network

§Current focus PA & NJ markets. Expanding

to National Markets

to National Markets

Banking Privately Held Business

C&I / Owner Occupied CRE Loan and Deposit

Growth ($mm)

Growth ($mm)

Source: Company documents.

16

Multi-Family Banking Strategy

Banking High Net Worth Families

Multi-Family Loan and Deposit Growth ($mm)

§ Focus on families that have income

producing real estate in their portfolios

producing real estate in their portfolios

§ Private banking approach

§ Focus Markets: New York & Philadelphia

MSAs

MSAs

§ Average Loan Size: $4.0 - $5.0 million

§ Remote banking for deposits and other

relationship based loans

relationship based loans

§ Portfolio grown organically from a start up

with very experienced teams hired in the

past 3 years

with very experienced teams hired in the

past 3 years

§ Strong credit quality niche

§ Interest rate risk managed actively

Source: Company documents.

17

Mortgage Warehouse Banking Strategy

§Private banking focused on mortgage

companies with $5 to $10 million equity

companies with $5 to $10 million equity

§Very strong credit quality relationship

business with good fee income and deposits

business with good fee income and deposits

§~75 strong warehouse clients

§All outstanding loans are variable rate and

classified as held for sale

classified as held for sale

§All deposits are non-interest bearing DDA’s

§Balances rebounding from 2013 low and

expected to stay at this level

expected to stay at this level

Banking Mortgage Companies

Mortgage Warehouse Banking Loan and Deposit

Growth ($mm)

Growth ($mm)

Source: Company documents.

18

Staff Expense Ratio

Build Efficient Operations

Source: SNL Financial, Company documents. Peer data consists of Northeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC insured banks.

Peer and Industry data as of March 31, 2015.

Peer and Industry data as of March 31, 2015.

Occupancy Expense Ratio

Total Costs as a % of Assets

Total Revenue per Employee ($000s)

Assets per Employee ($mm)

19

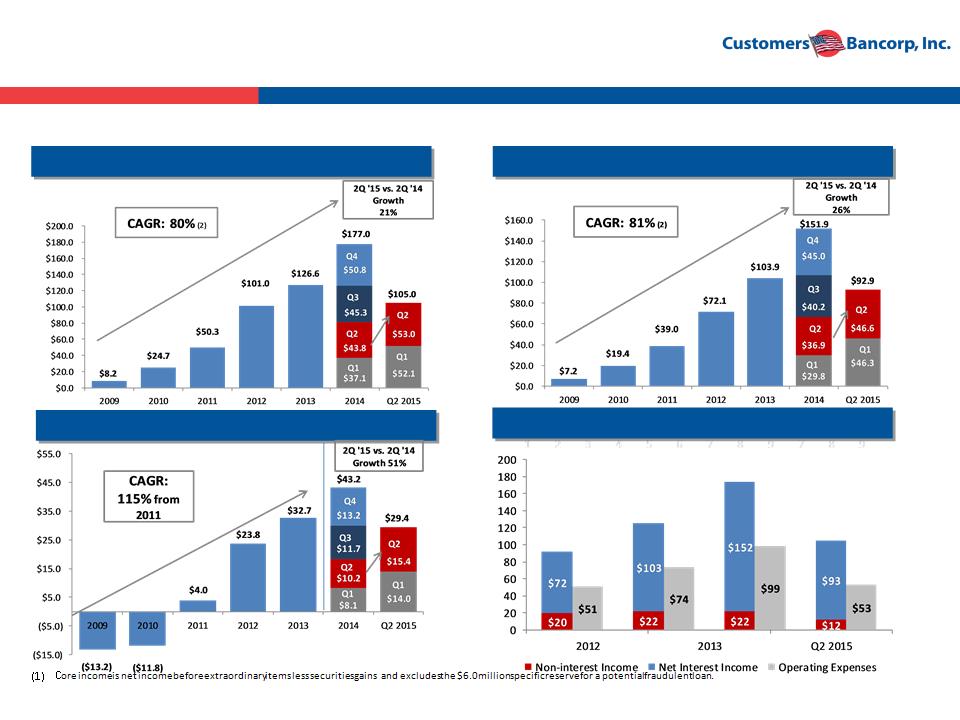

Deposit, Lending and Efficiency Strategies Results in

Disciplined & Profitable Growth

Disciplined & Profitable Growth

Core Revenue ($mm)

Core Net Income ($mm) (1)

(2) CAGR calculated from Dec-09 to June 2015 (annualized).

(3) Non-GAAP core results including profitability measures, earnings, credit quality measures and valuation metrics exclude the $6.0 million specific reserve for a potential fraudulent

loan (see GAAP to non-GAAP core reconciliation on page 35).

loan (see GAAP to non-GAAP core reconciliation on page 35).

Net Interest Income ($mm)

• Strategy execution has produced superior growth in revenues and core earnings

Income / Expense Growth ($mm)

20

Customers Bank

Risk Management

21

Elements of an Effective Risk Management Program

22

ERM Framework at Customers Bancorp, Inc.

Well Defined ERM Plan - ERM Integration into CAMELS +++++

23

Current Banking Environment and

How We are Positioned

How We are Positioned

24

What We See as The Role of CEO and Board …

Especially in this Environment

Especially in this Environment

1. Absolute clarity of your vision, strategy, goals and tactics;

there must be absolute alignment between board and

management

there must be absolute alignment between board and

management

2. Become a master of your internal environment

§ Our authentic internal assessment of strengths,

weaknesses and opportunities

weaknesses and opportunities

3. Be a master of your external environment

§ What is happening with customer trends, technology,

competition, economy, regulatory environment, etc. -

How does this impact us?

competition, economy, regulatory environment, etc. -

How does this impact us?

4. Highest level of integrity and fairness in all we do

5. Passion for continuous improvement

25

Banking Industry Trends……

How Do We Deal with These Issues

Impediments to Growth

External Forces

• Role of traditional bank branches

changing very rapidly

changing very rapidly

• Mobile banking fastest growing channel

• Banks of all sizes revisiting their

business strategies, revenue generation

models and cost structures

business strategies, revenue generation

models and cost structures

• Technology & customer needs, desires

and style changing rapidly

and style changing rapidly

• Traditional CRE lending very difficult to do

• Very little consumer loan growth;

headwinds for consumer credit quality

headwinds for consumer credit quality

• Growth exists only at niche players

• Mortgage banking revenues are

extremely volatile

extremely volatile

• Pressure to reduce or eliminate Overdraft

and other nuisance fees by CFPB

and other nuisance fees by CFPB

• Regulators have no appreciation or

incentive to see banks grow profitability

incentive to see banks grow profitability

Business Issues

Shareholder Expectations

• Start bank and sell at 2 to 3x book no

longer an option - what do shareholders of

small privately held banks do?

longer an option - what do shareholders of

small privately held banks do?

• Equity markets not available to small

banks

banks

• Banks need to earn 10% or more ROE if

they want to remain independent

they want to remain independent

• Consistent ROE of 12% or greater and

ROA of 1% or greater being rewarded well

by market

ROA of 1% or greater being rewarded well

by market

• Slow economic growth

• Low good quality consumer and business

loan demand

loan demand

• Pressure continues on margin. Days of

3.5%-4.0% margin are gone. Banks need

to reduce efficiency ratios

3.5%-4.0% margin are gone. Banks need

to reduce efficiency ratios

• Difficult to attract good talent

• Very difficult and inconsistent regulatory

environment

environment

• Shareholders want 10%+ ROE, consistent

quality growth and strong risk

management infrastructure

quality growth and strong risk

management infrastructure

Issues facing

Boards &

CEO’s

Boards &

CEO’s

What is our unique strategy

for revenue and profitable

growth

for revenue and profitable

growth

How do we attract and retain

best talent?

best talent?

How do we take advantage of

technology?

technology?

How do we deal with growing

compliance burden?

compliance burden?

How do we manage our risks

better than peers?

better than peers?

How do we lower our

efficiency ratios?

efficiency ratios?

26

§ Innovator / disruptor / not

branch dependent

branch dependent

§ Differentiated / Unique model

§ Technology savvy

Our Thesis on Current

U.S. Banking Environment

Credit Improving - Though Banks Face a Number of Operational Headwinds

§ Credit Improving

§ Quality Asset Generation Remains A Challenge

4 Banks are starved for interest-earning assets and exploring new asset classes, competing on price and looking into specialty finance business / lending

§ NIM Compression

4 Low rate environment for the foreseeable future will continue to compress NIM

4 Many institutions wither betting on rates or otherwise taking excessive interest rate risk

4 Industry NIM continues to decline

4 Down over 100 bps since 1995

4 Low interest rate environment, competitive pressures likely to prevent return to historical levels

§ Operational leverage

4 Expense management is top of mind as banks try to improve efficiency in light of revenue pressure and increased regulatory / compliance costs

4 Regulatory pressure expected to stay robust

§ New Strategies

4 Yesterdays strategies may not be appropriate tomorrow

Critical to Have a Winning Business Model

§ Heavy branch based delivery

system

system

§ Strong credit quality

§ Core deposits

§ Dependent on OD fees

§ Expense management

Traditional Banks

§ Diversified revenue sources

§ Cross sell strength

§ Capital efficiency

Fee Income Leaders

Relationship & Innovative

Banks

Banks

Source: SNL Financial.

1Includes data for top 50 U.S. banks by assets.

27

Our Approach to Developing a Winning Business

Model

1. Must focus on both “Relationship” or “High Touch” banking combined with

“Highly Efficient” or “High Tech”. Strategy should be unique as to not be copied

easily

“Highly Efficient” or “High Tech”. Strategy should be unique as to not be copied

easily

2. Attract and retain best high quality talent. Business Bankers / Relationship

Bankers with approximately 15 years+ experience who bring a book of business

with them

Bankers with approximately 15 years+ experience who bring a book of business

with them

3. Compensate leaders based upon risk and profitability with both cash and equity

4. Never deviate from following critical success factors

• Only focus on very strong credit quality niches

• Have very strong risk management culture

• Have significantly lower efficiency ratio than peers to deliver sustainable

strong profitability and growth with lower margin and lower risk profile

strong profitability and growth with lower margin and lower risk profile

• Always attract and retain top quality talent

• Culture of innovation and continuous improvement

28

29

Startling Facts about Banks

§ Banks each year charge $32 billion in overdraft fees - that’s

allowing or creating over 1 billion overdrafts each year….Why??

allowing or creating over 1 billion overdrafts each year….Why??

§ Payday lenders charge consumers another $7 billion in fees

§ That’s more than 3x what America spends on Breast Cancer and

Lung Cancer combined

Lung Cancer combined

§ This is about 50% of all America spends on Food Stamps

§ Some of banking industries most profitable consumer customers

hate banks

hate banks

§ Another estimated 25% consumers are unbanked or under banked

This should not be happening in America

We hope to start, in a small way, a new revolution

to profitably address this problem

to profitably address this problem

30

§ New no fee banking, 25 bps higher interest savings, line of credit, 55,000 ATM’s, Personal

Banker and more, all in the palm of your hand

Banker and more, all in the palm of your hand

§ Marketing Strategy

§ Target technology dependent younger consumers; including underserved /

underbanked and middle income Americans

underbanked and middle income Americans

§ Capitalize on retaining at least 25% of our ~ one million student customers over a 5

year period

year period

§ Reach middle income markets also through Affinity Banking Groups

§ Revenue generation from debit card interchange and margin from low cost core

deposits

deposits

§ Durbin Amendment a unique opportunity for Bank Mobile

§ Total investment not to exceed about $6.0 million by end of 2015

§ Expected to achieve profitability in 2-3 years and above average, franchise value, ROA and

ROE within 5 years

ROE within 5 years

Creating a Virtual Bank

for the Future for Consumers

for the Future for Consumers

31

Core Tangible BV per Share

Building Customers to Provide Superior Returns to

Investors

Investors

Recent Core Performance Results

Financial Performance Targets

Earnings per Share Guidance / Valuation Multiples

• Non-GAAP core results including profitability measures, earnings, credit quality measures and valuation metrics exclude

the $6.0 million specific reserve for a potential fraudulent loan (see GAAP to Non-GAAP reconciliation on page 35)

the $6.0 million specific reserve for a potential fraudulent loan (see GAAP to Non-GAAP reconciliation on page 35)

32

Summary

§ Strong high performing $7.6 billion bank with significant growth opportunities

§ Very experienced management team delivers strong results

§ Ranked #1 overall by Bank Director Magazine in the 2012 and 2013 Growth

Leader Rankings

Leader Rankings

§ “High touch, high tech” processes and technologies result in superior growth,

returns and efficiencies

returns and efficiencies

§ Shareholder value results from the combination of increasing tangible book, ROE

and strong and consistent earnings growth

and strong and consistent earnings growth

§ Attractive risk-reward: growing several times faster than industry average but

yet trading at a significant discount to peers

yet trading at a significant discount to peers

§ Building the first real mobile bank in the palm of your hand for consumers in the

U.S.

U.S.

33

Contacts

Company:

Robert Wahlman, CFO

Tel: 610-743-8074

rwahlman@customersbank.com

rwahlman@customersbank.com

www.customersbank.com

Jay Sidhu

Chairman & CEO

Tel: 610-301-6476

jsidhu@customersbank.com

jsidhu@customersbank.com

www.customersbank.com

Investor Relations:

Ted Haberfield

President, MZ North America

Tel: 760-755-2716

thaberfield@mzgroup.us

www.mzgroup.us

Appendix

35

Non GAAP Reconciliation

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

||||||||||||

|

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

|

||||||||||||

|

|

|

|

|

|

||||||||

|

Reconciliation of GAAP Net Income to Core Earnings

|

|

|

||||||||||

|

(amounts in thousands)

|

Three Months Ended June 30, 2015

|

Six Months Ended June 30, 2015

|

||||||||||

|

|

Net Income

|

Diluted EPS

|

Net Income

|

Diluted EPS

|

||||||||

|

|

|

|

|

|

||||||||

|

GAAP net income available to common shareholders

|

$

|

11,049

|

|

$

|

0.39

|

|

$

|

25,001

|

|

$

|

0.88

|

|

|

After-tax effect of the $6.0 million specific allowance

|

3,870

|

|

0.13

|

|

3,870

|

|

0.14

|

|

||||

|

Core Earnings

|

$

|

14,919

|

|

$

|

0.52

|

|

$

|

28,871

|

|

$

|

1.02

|

|

|

|

|

|

|

|

||||||||

|

Weighted average shares

|

|

28,681

|

|

|

28,522

|

|

||||||

|

|

|

|

|

|

||||||||

|

Reconciliation of GAAP to Non-GAAP Financial Metrics

|

|

||||||||

|

(amounts in thousands)

|

Three Months Ended June 30, 2015

|

||||||||

|

|

GAAP Amounts

|

Reconciling Item

|

Non-GAAP Amounts

|

||||||

|

Net Income

|

$

|

11,556

|

|

$

|

3,870

|

|

$

|

15,426

|

|

|

Average Total Assets

|

7,110,199

|

|

43

|

|

7,110,242

|

|

|||

|

Average Equity

|

496,557

|

|

43

|

|

496,660

|

|

|||

|

|

|

|

|

||||||

|

Return on Average Assets

|

0.65

|

%

|

0.22

|

%

|

0.87

|

%

|

|||

|

Return on Average Equity

|

9.33

|

%

|

3.13

|

%

|

12.46

|

%

|

|||

36

Income Statement

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

|||||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE MONTHS ENDED - UNAUDITED

|

|||||||||||

|

(Dollars in thousands, except per share data)

|

|

|

|

|

|

||||||

|

|

Q2

|

|

Q1

|

|

Q2

|

||||||

|

|

2015

|

|

2015

|

|

2014

|

||||||

|

Interest income:

|

|

|

|

|

|

||||||

|

Loans receivable, including fees

|

$

|

42,801

|

|

|

$

|

43,093

|

|

|

$

|

35,220

|

|

|

Loans held for sale

|

13,522

|

|

|

10,900

|

|

|

6,715

|

|

|||

|

Investment securities

|

2,253

|

|

|

2,363

|

|

|

2,543

|

|

|||

|

Other

|

1,107

|

|

|

2,362

|

|

|

614

|

|

|||

|

Total interest income

|

59,683

|

|

|

58,718

|

|

|

45,092

|

|

|||

|

|

|

|

|

|

|

||||||

|

Interest expense:

|

|

|

|

|

|

||||||

|

Deposits

|

8,145

|

|

|

7,526

|

|

|

5,727

|

|

|||

|

Other borrowings

|

1,496

|

|

|

1,488

|

|

|

1,184

|

|

|||

|

FHLB Advances

|

1,799

|

|

|

1,689

|

|

|

1,141

|

|

|||

|

Subordinated debt

|

1,685

|

|

|

1,685

|

|

|

110

|

|

|||

|

Total interest expense

|

13,125

|

|

|

12,388

|

|

|

8,162

|

|

|||

|

Net interest income

|

46,558

|

|

|

46,330

|

|

|

36,930

|

|

|||

|

Provision for loan losses

|

9,335

|

|

|

2,964

|

|

|

2,886

|

|

|||

|

Net interest income after provision for loan losses

|

37,223

|

|

|

43,366

|

|

|

34,044

|

|

|||

|

|

|

|

|

|

|

||||||

|

Non-interest income:

|

|

|

|

|

|

||||||

|

Mortgage warehouse transactional fees

|

2,799

|

|

|

2,273

|

|

|

2,215

|

|

|||

|

Mortgage loan and banking income

|

287

|

|

|

151

|

|

|

1,554

|

|

|||

|

Bank-owned life insurance income

|

1,169

|

|

|

1,061

|

|

|

836

|

|

|||

|

Gain on sale of loans

|

827

|

|

|

1,231

|

|

|

572

|

|

|||

|

Gain (loss) on sale of investment securities

|

(69

|

)

|

|

—

|

|

|

359

|

|

|||

|

Deposit fees

|

247

|

|

|

179

|

|

|

212

|

|

|||

|

Other

|

1,133

|

|

|

838

|

|

|

1,163

|

|

|||

|

Total non-interest income

|

6,393

|

|

|

5,733

|

|

|

6,911

|

|

|||

|

|

|

|

|

|

|

||||||

|

Non-interest expense:

|

|

|

|

|

|

||||||

|

Salaries and employee benefits

|

14,448

|

|

|

13,952

|

|

|

11,591

|

|

|||

|

FDIC assessments, taxes, and regulatory fees

|

995

|

|

|

3,278

|

|

|

3,078

|

|

|||

|

Occupancy

|

2,199

|

|

|

2,101

|

|

|

1,911

|

|

|||

|

Professional services

|

2,792

|

|

|

1,913

|

|

|

1,881

|

|

|||

|

Technology, communication and bank operations

|

2,838

|

|

|

2,531

|

|

|

2,305

|

|

|||

|

Other real estate owned expense (income)

|

(580

|

)

|

|

884

|

|

|

890

|

|

|||

|

Loan workout expense (income)

|

(13

|

)

|

|

269

|

|

|

477

|

|

|||

|

Advertising and promotion

|

429

|

|

|

347

|

|

|

428

|

|

|||

|

Other

|

2,552

|

|

|

2,190

|

|

|

2,644

|

|

|||

|

Total non-interest expense

|

25,660

|

|

|

27,465

|

|

|

25,205

|

|

|||

|

Income before tax expense

|

17,956

|

|

|

21,634

|

|

|

15,750

|

|

|||

|

Income tax expense

|

6,400

|

|

|

7,682

|

|

|

5,517

|

|

|||

|

Net income

|

11,556

|

|

|

13,952

|

|

|

10,233

|

|

|||

|

Preferred stock dividend

|

507

|

|

|

—

|

|

|

—

|

|

|||

|

Net income available to common shareholders

|

$

|

11,049

|

|

|

$

|

13,952

|

|

|

$

|

10,233

|

|

|

|

|

|

|

|

|

||||||

|

Basic earnings per share

|

$

|

0.41

|

|

|

$

|

0.52

|

|

|

$

|

0.38

|

|

|

Diluted earnings per share

|

0.39

|

|

|

0.49

|

|

|

0.37

|

|

|||

37

Income Statement

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

|||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE SIX MONTHS ENDED - UNAUDITED

|

|||||||

|

(Dollars in thousands, except per share data)

|

|||||||

|

|

June 30,

|

|

June 30,

|

||||

|

|

2015

|

|

2014

|

||||

|

Interest income:

|

|

|

|

||||

|

Loans receivable, including fees

|

$

|

85,894

|

|

|

$

|

63,576

|

|

|

Loans held for sale

|

24,422

|

|

|

11,798

|

|

||

|

Investment securities

|

4,616

|

|

|

5,583

|

|

||

|

Other

|

3,469

|

|

|

1,011

|

|

||

|

Total interest income

|

118,401

|

|

|

81,968

|

|

||

|

|

|

|

|

||||

|

Interest expense:

|

|

|

|

||||

|

Deposits

|

15,671

|

|

|

11,142

|

|

||

|

Other borrowings

|

2,984

|

|

|

2,340

|

|

||

|

FHLB Advances

|

3,488

|

|

|

1,637

|

|

||

|

Subordinated debt

|

3,370

|

|

|

126

|

|

||

|

Total interest expense

|

25,513

|

|

|

15,245

|

|

||

|

Net interest income

|

92,888

|

|

|

66,723

|

|

||

|

Provision for loan losses

|

12,299

|

|

|

7,253

|

|

||

|

Net interest income after provision for loan losses

|

80,589

|

|

|

59,470

|

|

||

|

|

|

|

|

||||

|

Non-interest income:

|

|

|

|

||||

|

Mortgage warehouse transactional fees

|

5,072

|

|

|

3,974

|

|

||

|

Mortgage loan and banking income

|

438

|

|

|

1,963

|

|

||

|

Bank-owned life insurance income

|

2,230

|

|

|

1,670

|

|

||

|

Gain on sale of loans

|

2,058

|

|

|

571

|

|

||

|

Gain (loss) on sale of investment securities

|

(69

|

)

|

|

3,191

|

|

||

|

Deposit fees

|

426

|

|

|

426

|

|

||

|

Other

|

1,971

|

|

|

2,425

|

|

||

|

Total non-interest income

|

12,126

|

|

|

14,220

|

|

||

|

|

|

|

|

||||

|

Non-interest expense:

|

|

|

|

||||

|

Salaries and employee benefits

|

28,400

|

|

|

20,942

|

|

||

|

FDIC assessments, taxes, and regulatory fees

|

4,273

|

|

|

5,209

|

|

||

|

Occupancy

|

4,300

|

|

|

3,942

|

|

||

|

Professional services

|

4,705

|

|

|

4,163

|

|

||

|

Technology, communication and bank operations

|

5,369

|

|

|

4,470

|

|

||

|

Other real estate owned expense

|

304

|

|

|

1,242

|

|

||

|

Loan workout

|

256

|

|

|

918

|

|

||

|

Advertising and promotion

|

776

|

|

|

843

|

|

||

|

Other

|

4,742

|

|

|

4,642

|

|

||

|

Total non-interest expense

|

53,125

|

|

|

46,371

|

|

||

|

Income before tax expense

|

39,590

|

|

|

27,319

|

|

||

|

Income tax expense

|

14,082

|

|

|

8,945

|

|

||

|

Net income

|

25,508

|

|

|

18,374

|

|

||

|

Preferred stock dividend

|

507

|

|

|

—

|

|

||

|

Net income available to common shareholders

|

$

|

25,001

|

|

|

$

|

18,374

|

|

|

|

|

|

|

||||

|

Basic earnings per share

|

$

|

0.93

|

|

|

$

|

0.69

|

|

|

Diluted earnings per share

|

0.88

|

|

|

0.66

|

|

||

38

Balance Sheet

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

|||||||||||

|

CONSOLIDATED BALANCE SHEET - UNAUDITED

|

|||||||||||

|

(Dollars in thousands, except per share data)

|

|

|

|||||||||

|

|

June 30,

|

|

December 31,

|

|

June 30,

|

||||||

|

|

2015

|

|

2014

|

|

2014

|

||||||

|

ASSETS

|

|

|

|

|

|

||||||

|

Cash and due from banks

|

$

|

44,064

|

|

|

$

|

62,746

|

|

|

$

|

48,521

|

|

|

Interest-earning deposits

|

347,525

|

|

|

308,277

|

|

|

217,013

|

|

|||

|

Cash and cash equivalents

|

391,589

|

|

|

371,023

|

|

|

265,534

|

|

|||

|

Investment securities available for sale, at fair value

|

373,953

|

|

|

416,685

|

|

|

425,061

|

|

|||

|

Loans held for sale

|

2,030,348

|

|

|

1,435,459

|

|

|

1,061,395

|

|

|||

|

Loans receivable

|

4,524,825

|

|

|

4,312,173

|

|

|

3,644,104

|

|

|||

|

Allowance for loan losses

|

(37,491

|

)

|

|

(30,932

|

)

|

|

(28,186

|

)

|

|||

|

Total loans receivable, net of allowance for loan losses

|

4,487,334

|

|

|

4,281,241

|

|

|

3,615,918

|

|

|||

|

FHLB, Federal Reserve Bank, and other restricted stock

|

78,148

|

|

|

82,002

|

|

|

75,558

|

|

|||

|

Accrued interest receivable

|

15,958

|

|

|

15,205

|

|

|

11,613

|

|

|||

|

FDIC loss sharing receivable

|

—

|

|

|

2,320

|

|

|

8,919

|

|

|||

|

Bank premises and equipment, net

|

11,453

|

|

|

10,810

|

|

|

11,075

|

|

|||

|

Bank-owned life insurance

|

155,940

|

|

|

138,676

|

|

|

106,668

|

|

|||

|

Other real estate owned

|

13,319

|

|

|

15,371

|

|

|

12,885

|

|

|||

|

Goodwill and other intangibles

|

3,658

|

|

|

3,664

|

|

|

3,670

|

|

|||

|

Other assets

|

55,943

|

|

|

52,914

|

|

|

37,432

|

|

|||

|

Total assets

|

$

|

7,617,643

|

|

|

$

|

6,825,370

|

|

|

$

|

5,635,728

|

|

|

|

|

|

|

|

|

||||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

||||||

|

Demand, non-interest bearing

|

$

|

584,380

|

|

|

$

|

546,436

|

|

|

$

|

555,936

|

|

|

Interest-bearing deposits

|

4,892,777

|

|

|

3,986,102

|

|

|

3,134,958

|

|

|||

|

Total deposits

|

5,477,157

|

|

|

4,532,538

|

|

|

3,690,894

|

|

|||

|

FHLB advances

|

1,388,000

|

|

|

1,618,000

|

|

|

1,301,500

|

|

|||

|

Other borrowings

|

88,250

|

|

|

88,250

|

|

|

88,250

|

|

|||

|

Subordinated debt

|

110,000

|

|

|

110,000

|

|

|

112,000

|

|

|||

|

Accrued interest payable and other liabilities

|

30,735

|

|

|

33,437

|

|

|

29,344

|

|

|||

|

Total liabilities

|

7,094,142

|

|

|

6,382,225

|

|

|

5,221,988

|

|

|||

|

|

|

|

|

|

|

||||||

|

Preferred Stock

|

55,569

|

|

|

—

|

|

|

—

|

|

|||

|

Common stock

|

27,402

|

|

|

27,278

|

|

|

27,262

|

|

|||

|

Additional paid in capital

|

359,455

|

|

|

355,822

|

|

|

353,371

|

|

|||

|

Retained earnings

|

93,422

|

|

|

68,421

|

|

|

43,581

|

|

|||

|

Accumulated other comprehensive loss

|

(4,114

|

)

|

|

(122

|

)

|

|

(2,220

|

)

|

|||

|

Treasury stock, at cost

|

(8,233

|

)

|

|

(8,254

|

)

|

|

(8,254

|

)

|

|||

|

Total shareholders' equity

|

523,501

|

|

|

443,145

|

|

|

413,740

|

|

|||

|

Total liabilities & shareholders' equity

|

$

|

7,617,643

|

|

|

$

|

6,825,370

|

|

|

$

|

5,635,728

|

|

39

Net Interest Margin

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

|||||||||

|

AVERAGE BALANCE SHEET / NET INTEREST MARGIN (UNAUDITED)

|

|||||||||

|

(Dollars in thousands, except per share data)

|

|

|

|||||||

|

|

Six Months Ended June 30,

|

||||||||

|

|

2015

|

|

2014

|

||||||

|

|

Average Balance

|

Average yield or

cost (%) |

|

Average Balance

|

Average yield or

cost (%) |

||||

|

Assets

|

|

|

|

|

|

||||

|

Interest earning deposits

|

$

|

286,945

|

|

0.25

|

|

$

|

199,069

|

|

0.25

|

|

Investment securities

|

395,401

|

|

2.33

|

|

482,290

|

|

2.32

|

||

|

Loans held for sale

|

1,530,938

|

|

3.22

|

|

672,308

|

|

3.54

|

||

|

Loans receivable

|

4,383,102

|

|

3.95

|

|

3,195,396

|

|

4.01

|

||

|

Other interest-earning assets

|

76,453

|

|

8.19

|

|

51,108

|

|

3.01

|

||

|

Total interest earning assets

|

6,672,839

|

|

3.58

|

|

4,600,171

|

|

3.59

|

||

|

Non-interest earning assets

|

272,937

|

|

|

|

211,368

|

|

|

||

|

Total assets

|

$

|

6,945,776

|

|

|

|

$

|

4,811,539

|

|

|

|

|

|

|

|

|

|

||||

|

Liabilities

|

|

|

|

|

|

||||

|

Total interest bearing deposits (1)

|

$

|

4,260,980

|

|

0.74

|

|

$

|

2,906,457

|

|

0.77

|

|

Borrowings

|

1,491,598

|

|

1.33

|

|

863,267

|

|

0.95

|

||

|

Total interest-bearing liabilities

|

5,752,578

|

|

0.89

|

|

3,769,724

|

|

0.81

|

||

|

Non-interest-bearing deposits (1)

|

689,047

|

|

|

|

625,847

|

|

|

||

|

Total deposits & borrowings

|

6,441,625

|

|

0.80

|

|

4,395,571

|

|

0.70

|

||

|

Other non-interest bearing liabilities

|

29,089

|

|

|

|

14,134

|

|

|

||

|

Total liabilities

|

6,470,714

|

|

|

|

4,409,705

|

|

|

||

|

Shareholders' equity

|

475,062

|

|

|

|

401,834

|

|

|

||

|

Total liabilities and shareholders' equity

|

$

|

6,945,776

|

|

|

|

$

|

4,811,539

|

|

|

|

|

|

|

|

|

|

||||

|

Net interest margin

|

|

2.81

|

|

|

2.92

|

||||

|

Net interest margin tax equivalent

|

|

2.81

|

|

|

2.93

|

||||

|

|

|

|

|

|

|

||||

|

(1) Total costs of deposits (including interest bearing and non-interest bearing) were 0.64% and 0.64% for the six months ended June 30, 2015 and 2014,

respectively. |

|||||||||

40

Net Interest Margin

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

|||||||||

|

AVERAGE BALANCE SHEET / NET INTEREST MARGIN (UNAUDITED)

|

|||||||||

|

(Dollars in thousands, except per share data)

|

|

|

|||||||

|

|

Three Months Ended June 30,

|

||||||||

|

|

2015

|

|

2014

|

||||||

|

|

Average Balance

|

Average yield or

cost (%) |

|

Average Balance

|

Average yield or

cost (%) |

||||

|

Assets

|

|

|

|

|

|

||||

|

Interest earning deposits

|

$

|

290,241

|

|

0.26

|

|

$

|

211,438

|

|

0.25

|

|

Investment securities

|

384,324

|

|

2.34

|

|

448,059

|

|

2.27

|

||

|

Loans held for sale

|

1,692,622

|

|

3.20

|

|

776,919

|

|

3.47

|

||

|

Loans receivable

|

4,404,304

|

|

3.90

|

|

3,544,859

|

|

3.98

|

||

|

Other interest-earning assets

|

77,822

|

|

4.75

|

|

64,063

|

|

3.01

|

||

|

Total interest earning assets

|

6,849,313

|

|

3.49

|

|

5,045,338

|

|

3.58

|

||

|

Non-interest earning assets

|

260,886

|

|

|

|

202,651

|

|

|

||

|

Total assets

|

$

|

7,110,199

|

|

|

|

$

|

5,247,989

|

|

|

|

|

|

|

|

|

|

||||

|

Liabilities

|

|

|

|

|

|

||||

|

Total interest bearing deposits (1)

|

$

|

4,399,164

|

|

0.74

|

|

$

|

3,065,597

|

|

0.75

|

|

Borrowings

|

1,511,481

|

|

1.32

|

|

1,171,766

|

|

0.83

|

||

|

Total interest bearing liabilities

|

5,910,645

|

|

0.89

|

|

4,237,363

|

|

0.77

|

||

|

Non-interest bearing deposits (1)

|

669,411

|

|

|

|

585,370

|

|

|

||

|

Total deposits & borrowings

|

6,580,056

|

|

0.80

|

|

4,822,733

|

|

0.68

|

||

|

Other non-interest bearing liabilities

|

33,586

|

|

|

|

16,622

|

|

|

||

|

Total liabilities

|

6,613,642

|

|

|

|

4,839,355

|

|

|

||

|

Shareholders' equity

|

496,557

|

|

|

|

408,634

|

|

|

||

|

Total liabilities and shareholders' equity

|

$

|

7,110,199

|

|

|

|

$

|

5,247,989

|

|

|

|

|

|

|

|

|

|

||||

|

Net interest margin

|

|

2.73

|

|

|

2.93

|

||||

|

Net interest margin tax equivalent

|

|

2.73

|

|

|

2.94

|

||||

|

|

|

|

|

|

|

||||

|

(1) Total costs of deposits (including interest bearing and non-interest bearing) were 0.65% and 0.63% for the three months ended June 30, 2015 and 2014,

respectively. |

|||||||||

41

Asset Quality

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

|

|

|

|

|

|||||||||||||||||||||

|

Asset Quality as of June 30, 2015 (Unaudited)

|

|

|

|

|

|||||||||||||||||||||

|

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

Total Loans

|

Non Accrual

/NPLs |

Other Real

Estate Owned |

Non Performing

Assets (NPAs) |

Allowance for

loan losses |

Cash

Reserve |

Total Credit

Reserves |

NPLs /

Total Loans |

Total

Reserves to Total NPLs |

||||||||||||||||

|

Loan Type

|

|||||||||||||||||||||||||

|

New Century Originated Loans

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Legacy

|

$

|

46,580

|

|

$

|

2,158

|

|

$

|

3,327

|

|

$

|

5,485

|

|

$

|

1,676

|

|

$

|

—

|

|

$

|

1,676

|

|

4.63

|

%

|

77.66

|

%

|

|

Troubled debt restructurings (TDRs)

|

2,052

|

|

881

|

|

—

|

|

881

|

|

5

|

|

—

|

|

5

|

|

42.93

|

%

|

0.57

|

%

|

|||||||

|

Total New Century Originated Loans

|

48,632

|

|

3,039

|

|

3,327

|

|

6,366

|

|

1,681

|

|

—

|

|

1,681

|

|

6.25

|

%

|

55.31

|

%

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Originated Loans

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Multi-Family

|

2,232,273

|

|

—

|

|

—

|

|

—

|

|

8,734

|

|

—

|

|

8,734

|

|

—

|

%

|

—

|

%

|

|||||||

|

Commercial & Industrial (1)

|

792,701

|

|

1,173

|

|

618

|

|

1,791

|

|

13,476

|

|

—

|

|

13,476

|

|

0.15

|

%

|

1,148.85

|

%

|

|||||||

|

Commercial Real Estate- Non-Owner Occupied

|

840,922

|

|

271

|

|

—

|

|

271

|

|

3,335

|

|

—

|

|

3,335

|

|

0.03

|

%

|

1,230.63

|

%

|

|||||||

|

Residential

|

105,332

|

|

9

|

|

—

|

|

9

|

|

1,722

|

|

—

|

|

1,722

|

|

0.01

|

%

|

—

|

%

|

|||||||

|

Construction

|

68,073

|

|

—

|

|

—

|

|

—

|

|

844

|

|

—

|

|

844

|

|

—

|

%

|

—

|

%

|

|||||||

|

Other Consumer

|

347

|

|

—

|

|

—

|

|

—

|

|

11

|

|

—

|

|

11

|

|

—

|

%

|

—

|

%

|

|||||||

|

TDRs

|

543

|

|

—

|

|

—

|

|

—

|

|

5

|

|

—

|

|

5

|

|

—

|

%

|

—

|

%

|

|||||||

|

Total Originated Loans

|

4,040,191

|

|

1,453

|

|

618

|

|

2,071

|

|

28,127

|

|

—

|

|

28,127

|

|

0.04

|

%

|

1,935.79

|

%

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Acquired Loans

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Covered

|

25,329

|

|

2,710

|

|

8,877

|

|

11,587

|

|

506

|

|

—

|

|

506

|

|

10.70

|

%

|

18.67

|

%

|

|||||||

|

Non-Covered

|

354,426

|

|

817

|

|

497

|

|

1,314

|

|

290

|

|

1,556

|

|

1,846

|

|

0.23

|

%

|

225.95

|

%

|

|||||||

|

TDRs Covered

|

526

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

%

|

—

|

%

|

|||||||

|

TDRs Non-Covered

|

6,926

|

|

2,537

|

|

—

|

|

2,537

|

|

—

|

|

—

|

|

—

|

|

36.63

|

%

|

—

|

%

|

|||||||

|

Total Acquired Loans

|

387,207

|

|

6,064

|

|

9,374

|

|

15,438

|

|

796

|

|

1,556

|

|

2,352

|

|

1.57

|

%

|

38.79

|

%

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Acquired Purchased Credit-impaired Loans

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Covered

|

5,834

|

|

—

|

|

—

|

|

—

|

|

1,114

|

|

—

|

|

1,114

|

|

—

|

%

|

—

|

%

|

|||||||

|

Non-Covered

|

42,031

|

|

—

|

|

—

|

|

—

|

|

5,773

|

|

—

|

|

5,773

|

|

—

|

%

|

—

|

%

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Total Acquired Purchased Credit-impaired Loans

|

47,865

|

|

—

|

|

—

|

|

—

|

|

6,887

|

|

—

|

|

6,887

|

|

—

|

%

|

—

|

%

|

|||||||

|

Deferred Origination Fees/Unamortized

Premium/Discounts, net |

930

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

%

|

—

|

%

|

|||||||

|

Total Loans Held for Investment

|

4,524,825

|

|

10,556

|

|

13,319

|

|

23,875

|

|

37,491

|

|

1,556

|

|

39,047

|

|

0.23

|

%

|

369.90

|

%

|

|||||||

|

Total Loans Held for Sale

|

2,030,348

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

%

|

—

|

%

|

|||||||

|

Total Portfolio

|

$

|

6,555,173

|

|

10,556

|

|

13,319

|

|

23,875

|

|

37,491

|

|

1,556

|

|

39,047

|

|

0.16

|

%

|

369.90

|

%

|

||||||