Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Aterra Energy Corporation, Inc. | aterra_ex2301.htm |

As filed with the Securities and Exchange Commission on June 11, 2015

333-204894

United States

Securities and Exchange Commission

Washington D.C. 20549

Amendment No. 1 to

Form S-1

Registration Statement under the Securities Act of 1933

Aterra Energy Corporation, Inc.

(Exact name of registrant as specified in its charter)

Wyoming

(State or other jurisdiction of incorporation or organization)

519999

(Primary Standard Industrial Classification Code Number)

47-3498503

(I.R.S. Employer Identification Number)

41 Riders Lane, Fairfield, CT 06824 (203) 343-3709

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

INCORP, 2360 Corporate Circle, Suite 400, Henderson, NV 89074-7722, (702) 866-2500

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

As soon as practicable after this Registration Statement becomes Effective

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. o

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount to be Registered |

Proposed Maximum Per Share (1) |

Proposed Maximum Offering Price |

Amount of Registration Fee | ||||

| Common Stock, par value $0.0001 per share | 12,311,250 | $.50 | $6,155,625 | $715.28 | ||||

|

| ||||||||

1) Based upon the average price paid for the common stock prior to registration pursuant to Rule 457 (c)

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Aterra Energy Corporation, Inc.

Cross Reference Sheet

LOCATION IN PROSPECTUS OF INFORMATION REQUIRED BY PART I

| Item Number | Caption | Location in Prospectus |

| 1. | Forepart of the Registration Statement and Outside Front Page of Prospectus | Outside Front Cover Page |

| 2. | Inside Front and Outside Back Cover Pages of Prospectus | Inside Front and Outside Cover; Back Cover Page |

| 3. | Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges | Prospectus Summary; the Company Proforma Financial Information |

| 4. | Use of Proceeds | Not Applicable |

| 5. | Determination of Offering Price | Outside Front Cover Page; Plan of Distribution |

| 6. | Dilution | Not Applicable |

| 7. | Selling Security Holders | Selling Shareholders |

| 8. | Plan of Distribution | Outside Front Cover Page;Plan of Distribution |

| 9. | Description of Securities to be registered | Description of Capital Stock |

| 10. | Interests of Named Experts and Counsel | Not applicable |

| 11. | Information with respect to the registrant | Outside front cover page; Prospectus Summary; The Company; Capitalization; Selected Consolidated Financial Data; |

| 12. | Incorporation of Certain Information by Reference | Incorporation of Certain Information by Reference |

| 13. | Disclosure of Commission | Not Applicable |

| Position on Indemnification for Securities Act Liabilities |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION DATED June __, 2015

Aterra Energy Corporation, Inc.

12,311,250 Shares of Common Stock

This Prospectus relates to 12,311,250 shares of Common Stock, $.0001 par value (the “Common Stock”) of Aterra Energy Corporation, Inc. (the “Company”) which may be offered from time to time by any and/or all of the selling Shareholders named herein (the “Selling Stockholders”). See “Selling Stockholders.” The Company will not receive any proceeds from the sales of shares offered hereby. The Company estimates that the expenses of this offering will be approximately $25,000, all of which will be paid by the Company.

The Company is not aware of any underwriting arrangements with respect to the offer and sale by the Selling Stockholders of the Common Stock. The Company has been advised by the Selling Stockholders that they or their successors may sell all or a portion of the shares offered hereby from time to time on the OTC:QB, in privately negotiated transaction, or otherwise, including sales through or directly to a broker or brokers. Sales will be at prices and terms then prevailing or at prices related to the then current market prices or at negotiated prices. In connection with any sales, any broker or dealer participating in such sales may be deemed to be underwriters within the meaning of the Securities Act of 1933. See “Plan of Distribution”.

The Common Stock will be traded on the OTC:QB. The recommended trading symbol is "ATRE". The market for the Common Stock must be considered limited and there can be no assurance that a meaningful trading market will develop. Furthermore, prices quoted may not represent the true value of the Common Stock.

THE SECURITIES OFFERED INVOLVE A HIGH DEGREE OF RISK. SEE "RISK FACTORS” AT PAGE 5.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is July 1, 2015

Table of Contents

| Page | |

| Available Information | 1 |

| Prospectus Summary | 2 |

| The Company | 2 |

| Summary Financial Information | 3 |

| Risk Factors | 4 |

| Consumer Preference and Industry Trends | 4 |

| Competition | 6 |

| Risk of Litigation | 7 |

| Development of Markets | 7 |

| Reliance on Key Distributors | 7 |

| Management of Growth | 7 |

| Reliance on Key Personnel | 8 |

| Dependence on Contractors for | 8 |

| Volatility of Stock Price | 8 |

| Regulation | 8 |

| Reduced Liquidity Attendant to Penny Stocks | 8 |

| Shares Eligible for Future Sale or Issuance | 9 |

| Ability to Pay Dividends | 9 |

| Formation of the Company | 9 |

| Market for Common Stock and Dividend Policy | 9 |

| Selling Stockholders | 10 |

| Plan of Distribution | 11 |

| Capitalization | 11 |

| Unaudited Pro Forma Condensed Consolidated Statements of Operations for the twelve month period ended December 31, 2015 | 12 |

| Selected Consolidated Financial and Operating Data | 13 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13 |

| Acquisition Agreements | 13 |

| Principles of Consolidation | 13 |

| Liquidity and Capital Resources | 14 |

| Business | 14 |

| Industry Outlook | 15 |

| Company Strategy | 15 |

| Proprietary Technology | 15 |

| Product Advantages | 16 |

| Markets | 16 |

| Marketing and Sales | 17 |

| Advertising and Promotion | 17 |

| Customer Service | 19 |

| Acquisitions | 19 |

| Government Regulation | 19 |

| Competition | 19 |

| Management | 19 |

| Manufacturing | 27 |

| Employees | 28 |

| Patents | 28 |

| Board of Directors | 29 |

| Executive Compensation | 29 |

| Principal Shareholders | 29 |

| Certain Transactions | 29 |

| Director Compensation | 29 |

| Employment Agreements | 30 |

| Indemnification of Directors and Executive Officers and limitation of liability | 30 |

| Description of Capital Stock | 30 |

| Index to Financial Statements | F-1 |

| i |

Available Information

The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance therewith, files reports, proxy statements and other information with the Securities and Exchange Commission (the S.E.C.”). Such reports, proxy statements and other information filed by the Company can be inspected and copied at the public reference facilities of the S.E.C at 450 Fifth Street N.W. (Room 1024), Judiciary Plaza, Washington, DC 20549; as well as at the regional offices of the S.E.C. located Northwestern Atrium Center, 500 West Madison Street (Suite 1400), Chicago, Illinois 50551, and Seven World Trade Center (13th Floor), New York, New York 10048, copies of such material can be obtained from the Public Reference Section of the S.E.C. at 450 Fifth Street N.W., Washington, DC 20549 at prescribed rates.

The Company has filed with the S.E.C. in Washington DC., a Registration Statement on Form S-1 with the Securities Act of 1933 (the “Act”). As amended, with respect to the Common Stock offered hereby (the “Registration Statement”). This Prospectus does not contain all of the information set forth in the Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the S.E.C. For Further information with respect to the Company and the securities offered hereby, information reference is made to the Registration Statement, including the exhibits and financial statements and schedules, if any, filed therewith or incorporated therein by reference. Statements contained in this Prospectus as to the contents of any contract or other document are not necessarily complete, and in each instance, reference is made to the copy of such contract or other document files as an exhibit to the Registration Statement or incorporated there by reference, each statement being qualified in its entirety by such reference. The Registration Statement, including the exhibits thereto, may be inspected without charge at the S.E.C.‘S principal office in Washington, DC, and copies of any and all parts thereof prescribed by the S.E.C.

| 1 |

Prospectus Summary

The following summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information with financial statements, including the notes thereto, appearing elsewhere in this prospectus,. Unless the context indicates otherwise in this prospectus (i) all References to ATRE or the “Company” refer to Aterra Energy Corporation, Inc., and (ii) all references to consolidated Financial Statements refer to the financial statements of ATRE.

The Company

Aterra Energy Corporation, Inc. (the “Company”) is engaged in alternate energy solutions through its investment in Solar JOOS, Inc via a Stock Swap of common shares dated March 20, 2015; whereby the Company exchanged 15% of its common shares outstanding with 15% of Solar JOOS common shares outstanding and its operating subsidiary New Hampshire Wood Pellets LLC (NHWP), which is in the business of sustainable production, sales and distribution of wood pellets for heating.

Solar JOOS

Privately held Solar JOOS uses its proprietary know-how and patented technology to produce best-in-class small-scale solar energy solutions for public, commercial, government and military end-users. Solar JOOS award-winning systems have been shown to generate at least twice the power and stored energy in all lighting conditions compared to its competitor’s similarly sized solar chargers.

Solar JOOS was awarded:

| · | Awarded top honors for Best of Innovation in the Eco-Design and Sustainable Technology product category by the International Consumer Electronics Association (CES) |

| · | Wired Magazine - 9/10, Editor’s Pick |

| · | Outdoor Life – Best portable solar charger, Editor’s Choice |

Solar JOOS has entered into the following Agreements:

| · | Exclusive sales agreement to provide the market-leader in battery-powered, time-lapse specialty cameras, Brinno Inc. (www.brinno.com), with Solar JOOS chargers. |

| · | Memorandum of Understanding with Spectrolab Inc., a wholly owned subsidiary of The Boeing Company, to investigate markets to pursue in partnership incorporating Spectrolab’s high efficiency Gallium-Arsenide solar cells into Solar JOOS small-scale solar chargers. |

Patents issued to Solar JOOS are:

| · | Patent #8,531,152 protects low-light circuitry, which gives all product lines competitive differentiation and power-production advantage; |

| · | Patent #8,629,646 protects Internet-based data uploads to capture energy credits and reward users for solar energy production |

New Hampshire Wood Pellets LLC

NHWP, a wholly owned subsidiary of the Company, was formed for the purpose of producing certifiable premium wood pellets that meets or exceeds industry standards; selling to the residential market via distributors, directly to the some of the largest distributors in the U.S. using the NHWP’s manufactured pellet under the distributor’s private label, and to large-scale commercial operations by creating alliances with wood pellet boiler/ furnace manufacturers.

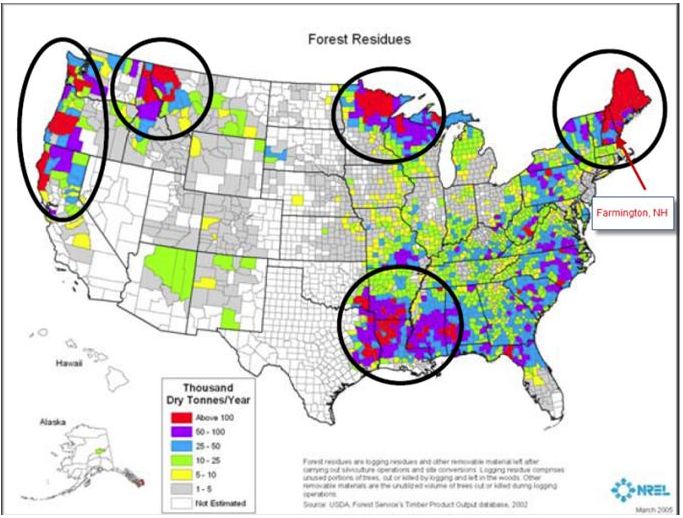

NHWP has located a site in and around the Center Barnstead area in New Hampshire. This facility will bring 26 to 30 permanent green manufacturing jobs to the local economy and 150 related permanent concomitant jobs generating broad local support. After the transaction closes, wood pellet production will begin within approximately eight months.

| 2 |

Summary Financial Information

The summary of financial data set forth below is derived from and should be read in conjunction with the financial statements, including the notes (if any) thereto, appearing elsewhere in this prospectus. See “The Company” and “Managements Discussion and Analysis of financial condition and Results of Operations”

For the Six Month Period ended June 30,

| 2015 | 2014 | 2013 | ||||||||||

| Statements of Income Data | ||||||||||||

| Revenues | $ | 0 | $ | 0 | $ | 0 | ||||||

| Income (loss) from Operations | 0 | 0 | 0 | |||||||||

| Net Income (Loss) | 0 | 0 | 0 | |||||||||

| Earnings (loss) per Share (a) | ||||||||||||

| Fo the six month period Ended June 30, | 2015 | 2014 | 2013 | |||||||||

| Balance Sheet Data | ||||||||||||

| Working Capital | $ | (1,796 | ) | $ | 0 | $ | 0 | |||||

| Total Assets | $ | 0 | $ | 0 | $ | 0 | ||||||

| Total Long Term Debt,including current Maturities | $ | 1,796 | $ | 0 | $ | 0 | ||||||

| Total Stockholders Equity | $ | (1,796 | ) | $ | 0 | $ | 0 | |||||

(a) Company was formed in March, 2015

| 3 |

Risk Factors

The purchase of shares of Common Stock involves a high degree of risk, in addition to other information contained in this Prospectus, before purchasing shares of Common Stock.

Limited operating history. The Company is thinly capitalized, was only recently organized, through a business combination with NHWP and investment in Solar JOOS and has been in business only three months, thus the Company has limited financial resources. Successful promotion and exploitation of this business opportunity will require substantially greater capital than is being sought in the current placement. There can be no assurance that the Company will achieve profitability in the near future nor that substantial additional capital will not be required in the near term, of which there can be no assurance that such funds will be available at the time that they are needed nor whether the Company will be able to continue operations in the event such funding proves unavailable in the immediate future.

Scarcity of competition for Business Opportunities. Because of its limited capital resources following completion of the placement, the Company will have limited ability to acquire further profitable or potentially profitable business opportunities. There are a large number of established and well financed entities, including venture capital firms engaged in merger and acquisition activities. Nearly all such entities have significantly greater financial resources, technical expertise and managerial capabilities than the Company and, consequently, the Company will be at a competitive disadvantage in identifying and attracting suitable candidates and successfully concluding a proposed acquisition. Management has been engaged in seeking suitable acquisition candidates and there are ongoing preliminary evaluations and discussions with a number of parties. There are no agreements in place at this time. Certain acquisitions are dependent on completion of this offering.

Need for Additional Financing for Growth.

In order to finance capital expenditures and related expenses for growth and product development, the Company will require substantial investment on a continuing basis until the Company becomes cash flow positive. The shares of Common Stock registered hereby have been issued or are issuable in connection with acquisitions and services relating to the growth and development of the Company. However, the Company will need to obtain additional financing in order to continue to penetrate its new and existing markets. If it does not obtain such financing, there is no assurance that the Company will be able to complete the development and expansion of the Company’s distribution channels for its products and for other programs described herein. To the extent that any future financing requirements are satisfied through their issuance of equity securities, investors may experience significant dilution in the tangibles book value per share of common stock, The amount and timing the Company’s future capital requirements will depend upon a number of factors, many of which are not within the Company’s control, including programming costs, capital costs, marketing expenses, staffing levels, and competitive conditions. There can be no assurance that the Company’s future capital requirements will be met or will not increase as a result of future acquisitions, if any, Failure to obtain any required additional financing could adversely affect the growth of the Company. See “Risk Factors” and Management’s Discussion and analysis of Financial Conditions and Results of Operation-liquidity and Capital Resources.

Consumer Preference and Industry Trends

Solar JOOS

The technology industry market in which the Solar JOOS operates, is characterized by frequent introduction of new products and services, and is subject to changing consumer preferences and industry trends, which may adversely affect Solar JOOS’ ability to plan for future design, development and marketing of its products and services. These are also characterized by rapidly changing technology and evolving industry standards, often resulting in product obsolesce or short product life cycles. The proliferation of new solar technologies, including personal communication services, cellular telephone products and services employing alternative technologies, may reduce demand for solar products generally as well as for solar products employing remote technology.

New Hampshire Wood Pellets

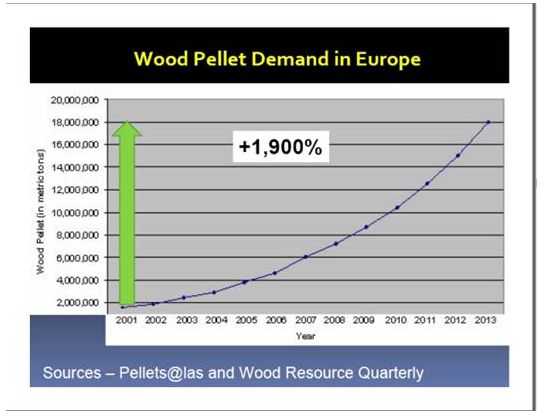

As the cost of imported foreign petroleum products and environmental concerns rise, the demand for home-grown, alternative and renewable fuel sources will continue to increase. Current demand for alternative fuel sources look toward biomass combustibles such as wood pellets. Wood pellets are considered a renewable resource and a carbon-neutral biofuel. The U.S. Energy Information Administration (EIA) has predicted that wood consumption (including wood pellets) in the residential market alone will rise by 700 trillion BTUs between now and 2030 Global wood pellet demand is projected to grow from an estimated 23 million tones in 2014 to 50 million in 2024

| 4 |

As a result of regulatory requirements, growing public awareness, the concept of “peak oil,” and the Kyoto protocol, the market for biomass in Europe is strong and growing. According to the European Biomass Association, the EU will increase its biomass consumption significantly by 2020. In fact, most large North American biomass pellet plants were recently built specifically to export to the European biomass market.

Bioenergy International Magazine’s January 2012 survey of worldwide WP manufacturing capacity identified 585 plants operating in 35 countries that have the capacity to produce ~33 million mtpy of wood pellets, with the USA and Canada having a combined capacity of 10.3 million mtpy. Biomass magazine shows that, currently, US has 122 plants operating with capacity of 10.0 million tons and Canada has 38 plants operating with capacity of 3.3 million tons.

North American WP Exports

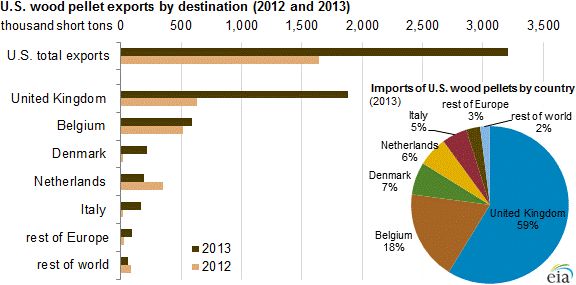

Source: U.S. Energy Information Administration, based on U.S. International Trade Commission data

Wood pellet exports from the United States nearly doubled last year, from 1.6 million short tons (approximately 22 trillion Btu) in 2012 to 3.2 million short tons in 2013. More than 98% of these exports were delivered to Europe, and 99% originated from ports in the southeastern and lower Mid-Atlantic regions of the country.

| 5 |

In 2013, the top five importing countries of U.S. wood pellets exports were all European: the United Kingdom, Belgium, Denmark, the Netherlands, and Italy. The United Kingdom accounted for the majority (59%) of U.S. wood pellet exports, and more than tripled its imports from the United States between 2012 and 2013.

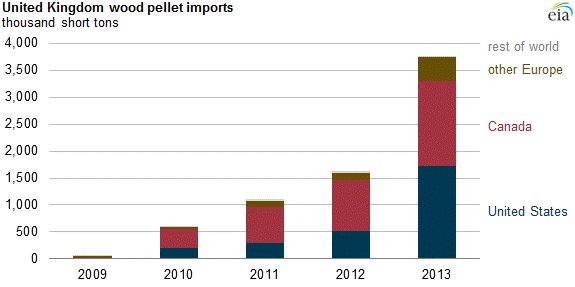

Source: U.S. Energy Information Administration, based on Eurostat data

The United Kingdom's wood pellet imports from all sources have grown from near zero in 2009 to more than 3.5 million short tons in 2013. Because of the United Kingdom's Renewables Obligation program, the operators of several large coal-fired power plants have either retrofitted existing units to cofire biomass wood pellets with coal or have converted to 100% biomass. The Drax power plant—rated at nearly 4,000 megawatts and the largest coal-fired power plant in the United Kingdom—is in the process of implementing plans to convert half of its six generating units to run solely on wood pellets. The first of these three units entered service in 2013, while the remaining two conversions are planned for completion in 2015. According to Eurostat, the United Kingdom is also a major importer of wood pellets from Canada and, to a lesser extent, from other European sources. Until 2013, Canada was the primary source of the United Kingdom's import supply.

The global market demand for wood pellets continues to trend upward and is competitively priced as compared to oil, natural gas (both fossil fuels) and electricity (predominately created by fossil fuels). The primary target market for the NHWP’s premium wood pellets initially is the residential sector with room for growth to sell to large-scale commercial and industrial users. Wood pellet demand globally is growing exponentially. There was a shortage of availability for wood pellets in North America in 2008. During 2009 and again in 2012, there were pockets of over-supply of wood pellets in the residential heating market in the U.S. where proper forecasting of potential sales and diversification into other business segments, such as high quality wood shavings and wood pellets for animal/horse bedding were lacking. These wood pellet mills have been built in areas of competition and without regard to having off-take agreements in place to purchase their end product. Due to the severe weather experienced this winter, there was a severe shortage of wood pellets in 2013/2014 winter. With the EIA forecasted long-term increase in demand for wood products combined with a limited number of competitors in the northeast, the NHWP is perfectly positioned to gain market share in the increasing use of wood pellets in large-scale commercial and industrial applications that is being supported by public incentives.

| 6 |

Competition

Solar JOOS

The markets for solar products and services throughout the world are being redefined as new products are brought to market and existing product life cycles are shortened. Solar JOOS’ success will be dependent on anticipating and responding to the constant changes and enduring that it can continue to compete on the basis of price, service and product offerings. The number of participants in the solar industry is extensive. Most are no-name companies building low-quality, commodity solar chargers which represent a risk only in that they can contaminate potential customers’ perception of the usefulness of solar chargers/solar batteries through the manufacture of products that perform poorly. Some competitive companies have achieved significant international national and regional consumer loyalty and have significantly greater financial, marketing, distribution, personnel and other resources than the Solar JOOS, thereby permitting such companies to implement extensive advertising and promotional campaigns.

New Hampshire Wood Pellets LLC

NHWP faces intense competition in the marketing and sales of its products. That said, it is extremely important to understand that it takes the better part of a year to develop the proper wood pellet formulas (recipes) to satisfactorily handle the demands of the different industries that it sells pellets to.

Risk of Litigation

Solar JOOS

Litigation in the solar industry has been used as a competitive tactic both by established companies seeking to protect their existing positions in the market and by emerging companies attempting to gain access to the market.

Like other retailers, distributors and manufacturers of products that are used by consumers, Solar JOOS will face an inherent risk of exposure to product liability claims in the event that the use of the products into which its products are incorporated results in injury. Management cannot predict whether or not product liability claims will be brought against Solar JOOS in the future or the effect of any resulting negative publicity on its business. Moreover, Solar JOOS may not have adequate resources in the event of a successful claim against it. Solar JOOS will evaluate the potential risks and obtain appropriate levels of insurance for product liability claims. At the present time, Solar JOOS is discussing with its insurance agent its potential risks and needed general liability insurance coverage to cover its potential product liability claims and has not obtained said product liability insurance at this time. The successful assertion of product liability claims against Solar JOOS could result in potentially significant monetary damages and if its insurance protection is inadequate to cover these claims, they could require Solar JOOS to make significant payments.

Development of markets

The Company’s success depends on its ability to develop both domestic and international markets for its products. There can be no assurances that the Company will continue to market its products successfully or that a larger market for its products will continue to develop.

Reliance on Key Distributors

New Hampshire Wood Pellets

In the near term, NHWP’S success in the wood pellet industry may depend on a number of large orders from a small group of distributors, which creates a risk that the loss of any one distributor may have a significant adverse impact on NHWP’s financial results.

| 7 |

Management of Growth

While a strategic and wisely executed marketing campaign is the key to expanding our customer base; providing new, cutting-edge, innovative ideas will ensure a solid operation built for long-term success.

Any need for outside services in which we cannot provide will all be initially outsourced in order to cut costs by not having facilities in excess of our needs. The Company will not attempt to establish relationships with providers of outsourcing services until the Company will be able to utilize such services.

Reliance on Key Personnel

The Company is highly dependent on Joseph J. Murphy and John F. Kehnle, the Company’s CEO and CAO respectively. The loss of such individuals could have a serious material adverse effect on the Company. The Company will have Key Person Insurance covering such individuals.

NHWP is highly dependent on Phil Bartels its general Manager. The loss of such individual could have a serious material adverse effect on the Company. The Company will have Key Person Insurance covering such individual.

NHWP’S experienced professional team will develop the NHWP project with proven construction, operations and management professionals dedicated to establishing a premier wood pellet facility with feedstock acquired through sustainable forest management practices. The management team was assembled for replication to align with market growth offering even greater potential returns.

Solar JOOS is highly dependent on Warren Sattler, its President. The loss of such individual could have a serious material adverse effect on the Company. The Company will have Key Person Insurance covering such individual.

Dependence on contractors for manufacturing

Solar JOOS

Solar JOOS uses outside manufacturers for it products and is substantially dependent on the ability of its manufacturers to provide adequate inventories of quality products on a timely basis and on favorable terms. Although Solar JOOS believes that the relationship with its manufacturers is satisfactory and that numerous alternative sources for it s products are currently available, the loss of the services of such manufacturers or substantial price increases imposed by such manufacturers would have a material adverse effect on the Solar JOOS.

Volatility of Stock Price

Factors such as announcements of the results of trials or the introduction of new Products by the Company or its competitors, market conditions in the solar and wood pellet and emerging growth sectors and rumors relating to the Company or its competitors may have a significant impact on the market price of the Common Stock. Furthermore, the stock market has experienced volatility that has particularly affected the market prices of equity securities of many emerging growth companies in the solar industry. This volatility has often been unrelated to the operating performance of such companies. These Market fluctuations could adversely affect the price of the common stock.

Regulation

Management believes the Company will not be subject to regulation under the Investment Company Act of 1940 insofar as: (i) the Company. will not be engaged in the business of investing or trading in securities, and (ii) the Company will not attempt to obtain a controlling interest in any asset acquisition or merger candidate.

Reduced Liquidity Attendant to Penny Stocks

S.E.C. rules impose additional sales practice requirements on broker-sealers who recommend certain low priced “penny stocks” to [persons other than established customers and institutional accredited investors. For transactions covered by these rules, the broker-dealer mist make a determination that based on the purchasers’ financial situation, investment experience and investment objectives, an investment in penny stocks is suitable for such purchaser and that such purchaser (or his independent advisor) is capable of evaluating the risks of transactions in penny stocks. The broker–dealer must also provide a prospective purchaser of penny stocks with certain disclosures materials and obtain the purchasers’ written consent to the transaction prior to the sale. Since the Common Stock currently is deemed to be “penny stock “, an investor may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of the securities offered hereby. An exemption form “penny stock” status will be available, however as to the common stock if and when the market price therefore exceeds $5.00 per share, the Company’s net tangible assets exceed $2,000,000 or the Company has average revenue of at least $1,000,000 over the preceding three years, see “Market for Common Stock and Dividend Policy”.

| 8 |

Shares Eligible for future sale or issuance

The Company has 53,000,000 shares of common stock outstanding at March 31, 2015 and 300 million shares of Common Stock available for issuance, of which 1,000,000 shares are reserved for issuance pursuant to the Company’s employee stock option plan.

2,561,250 shares will be available for public sale subject to (i) the limitations of Rule 144 promulgated under the Securities Act and (ii) the agreement of all directors, officers and Warrant holders and certain employees and other holders of 33,843,750 shares of Common Stock not to sell such shares for 360 days following the date of this Prospectus without the consent of the Company. In addition, existing stockholders of the Company holding approximately 9,905,000 shares of Common Stock, which shares are included in the 53,000,000 shares referenced above, have been granted certain “Piggy Back” registration rights with respect to such shares of Common Stock. Sales of substantial amounts of the common stock in the public market, or the availability of substantial amounts of the Common Stock for such sale, could adversely affect the prevailing market price of the Common Stock. Further, the authorized and unreserved shares of Common Stock available for issuance may be issued from time to time upon authorization of the Board of Directors, without further approval by the stockholders unless required by applicable law. The issuance of such shares of Common Stock by the Company could result in the dilution of the voting power of the shares. See “Description of Capital Stock” and “shares Eligible for Future Sale.”

Ability to pay Dividends

The Company has not paid dividends, and does not intend to pay any dividends in the foreseeable future, since earnings, if any, are expected to be retained for use in the development and expansion of the Company’s business.

Formation of the Company

Aterra Energy Corporation, Inc. (the “Company”) was originally incorporated on March 20, 2015.

Aterra Energy Corporation, Inc., a Wyoming corporation (the "Company"), provides alternative Energy solutions to various industries.

On March 20, 2015, the Company entered into an Agreement to acquire the Units of New Hampshire Wood Pellets, LLC (NHWP) in a stock for stock (“unit”) purchase with the Company exchanging 38,250,000 shares for all of NHWP’S shares (Units) outstanding.

On March 20, 2015 the Company signed a Stock Swap Agreement with Solar JOOS. The Company exchanged 6,750,000 shares for 841,878 shares of Solar JOOS common stock.

Market for Common Stock and Dividend Policy

The Company’s stock will be quoted on the OTC QB. The symbol that is recommended by the Company is "ATRE".

Under Rule 144, during the period commencing April 1, 2015 and ending April 1, 2016, an additional approximately 33,282,500 of such shares will become eligible for sale under Rule 144. The balance of such shares will become eligible for sale pursuant to Rule 144 upon the expiration of their respective one-year holding periods. In addition, most of the current holders of outstanding Common Stock, options and warrants have “piggy back” registration rights with respect to their securities should certain conditions be satisfied. Sales of outstanding Common Stock pursuant to Rule 144 or otherwise could materially affect the trading price of the Company’s Common Stock. See “Risk Factors – Shares Eligible for Future Sale”, S.E.C. rules impose additional sales practice requirements on broker-dealers who recommend certain low priced “penny stock” to persons other than established customers and institutional accredited investors, an additional customers and instructional accredited investors for transaction covered by these rules, the broker-dealer,must make a determination that based upon purchaser’s financial situation, the investment experience and investment objectives, an investment in penny stocks is suitable for such purchaser and that such purchaser (or independent adviser) is capable of evaluating the risks of transactions in penny stocks. The broker dealer must also provide a prospective Purchaser of penny stocks with certain disclosure materials and obtain the purchaser’s written consent to the transaction prior to the sale. The Common Stock currently is deemed to be “penny stock”. Since broker-dealers must create an extensive paper trail to sell penny stock, many investors are not qualified to purchase penny stocks and classifications as a penny stock often carries negative connotations, an investor may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of the securities offered hereby. An Exemption from “penny stock” status will be available, however, as to the common stock if and when the market price therefore exceeds $5.00 per share, the Company’s net tangible assets exceed $2,000,000 or the Company has an average revenue of at least $5,000,000 over the preceding three years.

| 9 |

To date, the Company has paid no cash dividends on its common Stock. The Company currently intends to retain all future earnings, if any, to fund the development and growth of its business, and it therefore does not anticipate paying any cash dividends in the foreseeable future.

Selling Stockholders

The following table shows for each of the selling stockholders (i) the number of shares of common stocks beneficially owned by each of them as of March 31, 2015, (ii) the number of shares of common stock covered by this Prospectus, and (iii) the number and the percentage of ownership of Common stock after the offering assuming all shares of Common Stock covered by this Prospectus are sold.

| Registering Stockholder | Number of shares beneficially owned | Number of shares covered by this Prospectus |

Number of shares owned after Offering |

Percent of class |

| Solar JOOS Inc. | 6,750,000 (a) | 6,750,000 | 0 | |

| Joseph Murphy II | 14,243,750 | 400,000 | 13,843,750 | |

| Grace Kiernan | 100,000 | 100,000 | 0 | |

| John Kehnle | 9,753,750 | 753,750 | 9,000,000 | |

| Don Crummet | 3,825,000 | 825,000 | 3,000,000 | |

| Tony Bruno | 5,737,500 | 737,500 | 5,000,000 | |

| Vince Miceli | 765,000 | 265,000 | 500,000 | |

| Cara Hohenhous | 3,000,000 | 1,000,000 | 2,000,000 | |

| Phil Bartels | 1,912,500 | 412,500 | 1,500,000 | |

| Jack Dudley | 956,250 | 456,250 | 500,000 | |

| Ron Green | 956,250 | 456,250 | 500,000 | |

| Ron Spidell | 20.000 | 20,000 | 0 | |

| Larry Shatsoff | 10,000 | 10,000 | 0 | |

| Hoffmann Trust | 20,000 | 20,000 | 0 | |

| Carrier Trust | 20,000 | 20,000 | 0 | |

| Andrew Rowe | 10,000 | 10,000 | 0 | |

| Steve T Shigemoto | 10,000 | 10,000 | 0 | |

| Stephania Fregosi | 5,000 | 5,000 | 0 | |

| Philip Lau | 20,000 | 20,000 | 0 | |

| Grant Lejonvarn | 30,000 | 30,000 | 0 | |

| Daniel & Kelli Labastie | 10,000 | 10,000 | 0 | |

| Totals | 48,155,000 | 12,311,250 | 35,843,750 |

(a) Shares to be received upon completion of Stock Swap Agreement

To the best of the Company’s knowledge none of the selling stockholders has had any material relationship with the Company or any of the Affiliates within the past three years except for their purchase of the common stock offered hereby and convertible preferred stock. The selling stockholders acquired the Common Stock in private placements as part of the acquisitions by the Company. The selling stockholders’ shares are being registered pursuant to the exercise of demand registration rights received in connection with the purchase of such shares.

| 10 |

Plan of Distribution

The shares may be sold by the selling stockholders, or by pledges, donees, transferees or other successors-in-interest. Such sales may be made on the OTC:QB, in privately negotiated transactions, or otherwise, at market prices or at negotiated prices. The shares, may be sold by one or more of the following methods: (a) a block trade in which the broker or dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal in order to consummate the transaction. (b) purchase by a broker or sealer as principal in order to consummate the resale by such broker or dealer for its account pursuant to this Prospectus, including resale to another broker or dealer; or (c) ordinary brokerage, transactions and transactions in which the broker solicits purchasers. In effecting sales, brokers or dealers engaged by the selling stockholders may arrange for other brokers or dealers to participate. Any such brokers or dealers may receive commissions or discounts from the Selling Stockholders in amounts to be negotiated immediately prior to the sales. Such brokers or dealers and any other participating brokers or dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended. Any gain realized by such a broker or dealer on the sale of such shares which it purchases as a principal may be deemed to be compensation to the broker or dealer in addition to any commissions paid to the broker by the Selling Stockholders.

The Company will not receive any portion of the proceeds of the shares sold by the selling stockholders. There is no assurance that any of the selling stockholders will sell any or all of the shares of Common Stock covered by this Prospectus.

The Selling Stockholders have advised the Company that during the time they are engaged in distribution of Common Stock covered by this Prospectus, they will comply with Rules 10b-5 and 1-b-6 under the Exchange Act, and pursuant thereto: (i) will not engage in any stabilization activity in connection with the Company’s securities; (ii) will furnish each broker through which Common Stock covered by this Prospectus may be offered the number of copies of this Prospectus which are required by each broker; and (iii) will not bid for or purchase any of the Company’ securities or attempt to induce any person to purchase any of the Company’s securities other than as permitted under the Exchange Act. Selling Stockholders who may be an “affiliated purchases” of the Company as defined in Rule 10b-6 have been further advised pursuant to Exchange Act Release 34-23611 (September 11.1986)., they must coordinate their sales under this Prospectus with each other and The Company for purposes of Rule 10b-6.

Capitalization

The following Table sets forth the Cash, Long Term Debt and total Capitalization of the Company as of June 30, 2015.

| (Audited) | ||||

| June 30, 2015 | ||||

| Actual | ||||

| Cash | $ | (1,796 | ) | |

| Long Term Debt | 0 | |||

| Convertible Preferred $5,000 Par Value | ||||

| 2,000 shares Authorized, 14.7 shares outstanding | 68,500 | |||

| Common Stock $.0001 Par Value 300 million shares authorized 53,000,000 outstanding | – | |||

| Additional Paid in Capital | 0 | |||

| Deficit | $ | (70,296 | ) | |

| Total Shareholders Equity | $ | (1,796 | ) | |

| 11 |

Audited Pro Forma Condensed Consolidated Statements of Operations for the six month period ended June 30, 2015

The following table summarizes the audited results of operations of the Company for the six month period ended December 31, 2015 assuming the acquisitions of New Hampshire Wood Pellets, LLC and Solar JOOS had occurred on January 1, 2015. The audited financial information presented is not necessarily indicative of the results of future operations.

| June 30, 2015 | ||||

| Net Sales | $ | 0 | ||

| Cost of Sales | ||||

| Gross Margin | ||||

| Selling, general and administrative expenses | 70,296 | |||

| Gain (Loss) from Operations | (70,296 | ) | ||

| Interest Income | 0 | |||

| Interest expense | 0 | |||

| Net Gain (Loss) | (70,296 | ) | ||

| Net Gain (Loss) per share | (0.00 | ) | ||

| Cash | $ | (1,796 | ) | |

| Accounts Receivable | 0 | |||

| Fixed Assets | 0 | |||

| Intangible Assets | 0 | |||

| Other Assets | 0 | |||

| Total Assets | $ | (1,796 | ) | |

| Accounts Payable and Accrued Expenses | 0 | |||

| Income Taxes | 0 | |||

| Due to Related Parties | 0 | |||

| Long Term Debt | 0 | |||

| Other Liabilities | 0 | |||

| Total Liabilities | $ | 0 | ||

| Total Shareholders' Equity | $ | (1,796 | ) | |

| 12 |

Selected Consolidated Financial and Operating Data

The Following selected financial data as of December 31, 2014, 2013, and 2012 are derived from the financial statements of NHWP which have been audited by Murphy Powers & Wilson CPA and are included elsewhere in this prospectus.

| Fiscal Year Ended December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Statements of Income | ||||||||||||

| Revenues | 0 | 0 | 0 | |||||||||

| Cost of sales | 0 | 0 | 0 | |||||||||

| Gross profit | 0 | 0 | 0 | |||||||||

| Operating Expenses | ||||||||||||

| Sales, General & Admin. | 0 | 0 | 0 | |||||||||

| Income (Loss) from Operations | 0 | 0 | 0 | |||||||||

| Net Income (Loss) from Operations | 0 | 0 | 0 | |||||||||

| Net Income (loss) | 0 | 0 | 0 | |||||||||

| Earnings (loss) per share | 0 | 0 | 0 | |||||||||

| December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Balance Sheet Data | 0 | 0 | 0 | |||||||||

| Working Capital | 0 | 0 | 0 | |||||||||

| Total Assets | 0 | 0 | 0 | |||||||||

| Total Long-Term debt, including current Maturities | 0 | 0 | 0 | |||||||||

| Total Shareholders' Equity | 0 | 0 | 0 | |||||||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis provides information that management believes is relevant to an assessment and understanding of Aterra Energy Corporation, Inc. and its subsidiaries (collectively, "the Company"), consolidated results of operations and financial condition for the three years ended December 31, 2014. The discussion should be read in conjunction with the Company’s consolidated financial statements and accompanying notes.

The Company, since its recent acquisitions, operates predominately in the solar and wood pellets industry providing a broad range of alternative energy services.

Acquisition Agreements

The investment in Solar JOOS, Inc. and the acquisition of New Hampshire Wood Pellets LLC will be accounted for as an investment in the former and under the purchase method of accounting regarding the latter under generally accepted accounting principles. The Company believes that through the combination of both will be better able to capitalize on the world wide growth in the alternative energy industry. In addition, the Company expects these companies will be able to derive significant advantages from the more efficient utilization of their combined assets, management and personnel.

Principles of Consolidation

The Consolidated financial statements include the accounts of the Company and its wholly owned subsidiary.

| 13 |

Liquidity and Capital Resources

On March 20, 2015 the Company acquired the assets of New Hampshire Wood Pellets LLC through the issue of 38,250,000 shares of Common Stock. Also, on March 20, 2015 the Company accomplished a Stock Swap with Solar JOOS, Inc. The acquisitions, particularly the investment in Solar JOOS, Inc. greatly improved the Company’s financial position.

However, cash used in operations was approximately $2.5 million in the years ended December 31, 2009, 2010 and December 31, 2011 respectively. The Company was able to overcome these shortfalls by converting the debt to Common Stock.

Business

The Company is engaged in alternate energy solutions through its investment in Solar JOOS, Inc. via a Stock Swap of common shares dated March 20, 2015; whereby the Company exchanged 15% of its common shares outstanding with 15% of Solar JOOS’ common shares outstanding and its operating subsidiary New Hampshire Wood Pellets LLC. which is in the business of sustainable production, sales and distribution of wood pellets for heating.

Solar JOOS

Privately held Solar JOOS uses its proprietary know-how and patented technology to produce best-in-class small-scale solar energy solutions for public, commercial, government and military end-users. Solar JOOS award-winning systems have been shown to generate at least twice the power and stored energy in all lighting conditions compared to its competitor’s similarly sized solar chargers.

Solar JOOS was awarded

| · | Awarded top honors for Best of Innovation in the Eco-Design and Sustainable Technology product category by the International Consumer Electronics Association (CES) |

| · | Wired Magazine - 9/10, Editor’s Pick |

| · | Outdoor Life – Best portable solar charger, Editor’s Choice |

Solar JOOS has entered into the following Agreements:

| · | Exclusive sales agreement to provide the market-leader in battery-powered, time-lapse specialty cameras, Brinno Inc. (www.brinno.com), with Solar JOOS chargers |

| · | Memorandum of Understanding with Spectrolab Inc., a wholly owned subsidiary of The Boeing Company, to investigate markets to pursue in partnership incorporating Spectrolab’s high efficiency Gallium-Arsenide solar cells into Solar JOOS small-scale solar chargers. |

Patents issued to Solar JOOS are:

| · | Patent #8,531,152 protects low-light circuitry, which gives all product lines competitive differentiation and power-production advantage; |

| · | Patent #8,629,646 protects Internet-based data uploads to capture energy credits and reward users for solar energy production |

New Hampshire Wood Pellets LLC

NHWP, a wholly owned subsidiary of the Company, was formed for the purpose of producing certifiable premium wood pellets that meets or exceeds industry standards; selling to the residential market via distributors, directly to the some of the largest distributors in the U.S. using their company’s manufactured pellet under the distributor’s private label, and to large-scale commercial operations by creating alliances with wood pellet boiler/ furnace manufacturers.

NHWP has located a site in and around the Center Barnstead area in New Hampshire. This facility will bring 26 to 30 permanent green manufacturing jobs to the local economy and 150 related permanent concomitant jobs generating broad local support. After the transaction closes, wood pellet production will begin within eight months.

| 14 |

Industry Outlook

Solar JOOS

Solar rechargeable battery market is highly competitive and extremely price sensitive, The Company believes that is can successfully compete in these markets due to several factors including a) it’s name recognition, b) its patents c) the present agreements that is already has and f) its substantial knowledge and understanding of the markets it is seeking to penetrate.

New Hampshire Wood Pellets

The demand for domestic wood pellets has far outstripped the supply as evidenced by the shortage of wood pellets over the last two consecutive years whereby the manufactures of wood pellets have run out of production. A major cost of this phenomenon is the ever increasing a) price of fossil fuels and b) knowledge by domestic consumers of the dramatic impact wood pellets has on their heating bills as witnessed in Europe

Company Strategy

Solar JOOS

Solar JOOS” principal objective is to achieve continued growth by providing a variety of products in the solar energy area and creating the infrastructure to deliver and support those products in a timely and cost effective manner.

Expansion of distribution channels – As the solar energy field is highly competitive, it is imperative that Solar JOOS continue its ongoing efforts to add distribution and sales channels for its products. Solar JOOS will aggressively seek distribution outlets in countries in which it currently has a presence and those which have been targeted for future growth. These distribution outlets will include chain stores, sporting goods stores, cell phone stores, resellers of survival equipment and on the internet such as through Amazon.com. In certain instances, businesses will be acquired which can immediately add distribution channels and profitability to the company.

Strategic partnerships will be developed with parties who occupy strategic positions and have substantial market share in the solar related industry in a specific territory and are capable of marketing, selling and distributing Solar JOOS products and services in significant numbers.

NHWP

Management recognizes that in order to succeed in the market several key factors must be realized with pellet quality being the predominant concern among pellet dealers and consumers. Pellet stove dealers will be reluctant to carry an inferior product therefore the manufacturing process is structured to produce a consistent high-quality pellet.

We have agreed to supply Pellets Now, a large wood pellet distributor with our wood pellets to be bagged under New Hampshire Premium Pellets™ which will allow us to sell a much higher percentage of wood pellets at inception. Pellets Now will pick up their production at the site. The same is true with the French Trading Group but they have not informed us if they have a private label name they wish to use.

Proprietary Technology

Solar JOOS

Solar JOOS has two patents and another one pending

NHWP

NHWP will employ various state-of-the-art technologies that will increase the efficiency of production. However, unlike Solar JOOS. There are no proprietary technologies created by NHWP. Rather NHWP will purchase all of the technology-related capital equipment from recognized vendors. The pellet product itself will exceed national standards, but it is not considered proprietary in itself.

| 15 |

Product Advantages

NHWP will provide customers with distinct advantages over existing pellets on the market. Consistent and reliable production of a high quality pellet has been identified as the single most influential factor affecting sales. The product, New Hampshire Premium Pellets™ will consistently meet national premium pellet standards for fines and ash because of the state-of-the-art production technology utilized and the constant quality assurance testing performed.

Markets

Solar JOOS

At present there are billions of cell phones. lap tops and tablets in existence all of which require power. Solar JOOS has been rated the #1 solar rechargeable battery in the world by Hammacher Schlemmer. That market alone is enormous. However in addition to that industry there is the remote camera industry in which Solar JOOS has a signed agreement with BRINNO but it doesn’t stop there; such as the electric billboard industry, airport security industry, the auto and aerospace industry to name a few.

New Hampshire Wood Pellets LLC

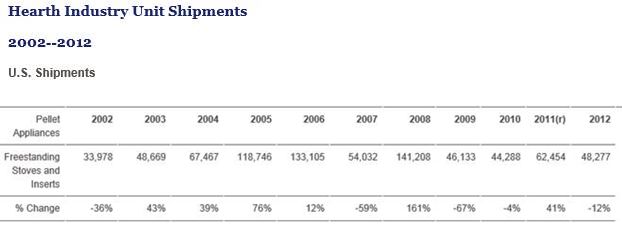

The number of pellet appliances shipped for the period 1998 thru 2012 was 935,157 units for U.S. shipments. The number of pellet appliances shipped in 2013 was 54,055 units, a change of 12%. This excludes pellet appliances made prior to 1998 and the commercial appetite for wood pellets, which is in the incipient stage. It is generally assumed that an average family in the U.S. will burn an average of 4 tons of wood pellets per year (page #5 of the USDA North America’s Wood Pellet Sector dated 9-2009). This average number is even higher in our targeted market because of the extended cold winters. Using the calculated U.S. shipments arrived at above; it can be assumed that the domestic demand for short tons of wood pellets will be approximately 4.0 million in 2014.

There are approximately 900,000 homes in the U.S. using wood pellets for heat, in freestanding stoves, fireplace inserts and even furnaces. Pellet fuel for heating can also be found in such large-scale environments as schools and prisons. North American pellets are produced in manufacturing facilities in Canada and the United States, and are available for purchase at fireplace dealers, nurseries, building supply stores, feed and garden supply stores and some discount merchandisers.

The pellet stove has significant differences from traditional wood stoves. A major difference, of course, is the feedstock. Pellet stoves require pellets and cannot burn traditional logs. The stove itself features convenient items not possible in conventional stoves. A hopper bin is integrated with the stove that may hold as much as 90 pounds of pellets, which are automatically fed by auger to the combustion box. Thermostatic controls allow for precise monitoring of temperature. The stove has an installed price of $2,000 to over $4,000 depending upon usage patterns and housing characteristics. A pellet stove may burn as much as two to five tons of pellets per year.

The European market is more advanced and matured than the domestic market as European governments have subsidized wood pellet stoves for several years. This has been addressed in the ARRA, with the availability of the 30% (up to $1,500) consumer tax credit for the purchase of a 75% efficient biomass-burning stove as measured using a lower heating value. NHWP expects this to have a major impact on the pellet industry as more consumers look to save money in these especially hard economic times and address the environmental concerns of fossil fuels by purchasing wood pellet stoves.

Pellet Industry Trends

Throughout North America, pellet mills receive, sort, grind, dry, compress and bag wood and other biomass waste products into a conveniently handled pelletized fuel.

| 16 |

Due to the attractiveness of pellet heat to the consumer market, pellet appliance manufacturers are committed to supporting the development and investing in research to further the sophistication of the appliances.

Pellet mills produce two grades of fuel – premium and standard. (New grades have been recently released by PFI, but as of today there is little demand for the new grades such as super premium.) The only difference between the two is ash content. Standard grade fuel is usually up to 3% ash content, while premium grade is less than 1%. This difference is a result of the pellet contents. Standard pellets are derived from materials that produce more residual ash, such as tree bark or agricultural residues. Premium pellets are usually produced from hardwood or softwood or a combination of both that contains no tree bark. Premium pellets make up 95 percent of current pellet production and can be burned in all appliances. Standard pellets should only be burned in appliances designed to burn the higher ash content pellets. NHWP will only sell a premium grade that will be described as New Hampshire Premium Pellets™.

Marketing and Sales

Solar JOOS

Solar JOOS will commence an aggressive marketing effort for all of the products and services described. In order to successfully penetrate the targeted areas, marketing activities currently being undertaken will be expanded and improved. Solar JOOS will be presented as a full service solar energy company

NHWP

To succeed, NHWP must establish a satisfied network of customers. The primary customers will be pellet distributors and dealers.

Product Strategy

Management recognizes that in order to succeed in its market segment, several key success factors must be realized. Pellet quality and consistency is the predominant concern among pellet appliance dealers and consumers. Pellet stove dealers will be reluctant to carry an inferior product. The stove dealers often have maintenance contracts with customers to ensure that their stoves are operating properly. The use of lower quality pellets will cause stoves to malfunction more often, which will increase the dealers cost of servicing the contracts. Therefore dealers have an incentive to only sell high quality pellets, because they can lower their servicing costs and maintain profitable margins.

Production quality control will begin well before initial distribution of the New Hampshire Premium Pellets™ to appliance dealers. The machinery startup period will be an important aspect of quality control and will result in the consumption of several hundred tons of feedstock. The purpose of the startup phase is to become familiar with the equipment and to minimize potential production problems over the long-term. NHWP’s manufacturing team will experiment with different feedstock, feedstock combinations, moisture content, production rate, and other variables to ensure the production of a consistent, high-quality product.

Control of sales growth will be important. It is anticipated that NHWP will be able to sell all of the pellets that it produces. The strategy is to limit sales in the initial year of production.

Advertising and Promotion

Historically, most pellet manufacturing firms have not needed to advertise their product because there has been more demand than supply. NHWP does not anticipate large scale advertising in the initial two years with the exception of trade magazines and being at trade shows in the Northeast. Local advertising will incur minimal cost during the first two years of operations.

Additionally, NHWP's sales representatives will drop off sample bags to the small retailers so that they can test the product themselves. From our numerous conversations with small retailers, they will not sell any wood pellet to their customer base without initially testing on their own stoves.

NHWP intends on making the New Hampshire Premium Wood Pellets™ brand the premier pellet product in the northeast by concentrating on quality and growing accordingly. The pellet manufacturing industry surveys indicate that there is considerable loyalty or allegiance that is fostered by word-of-mouth among consumers and through blogs on the Internet.

| 17 |

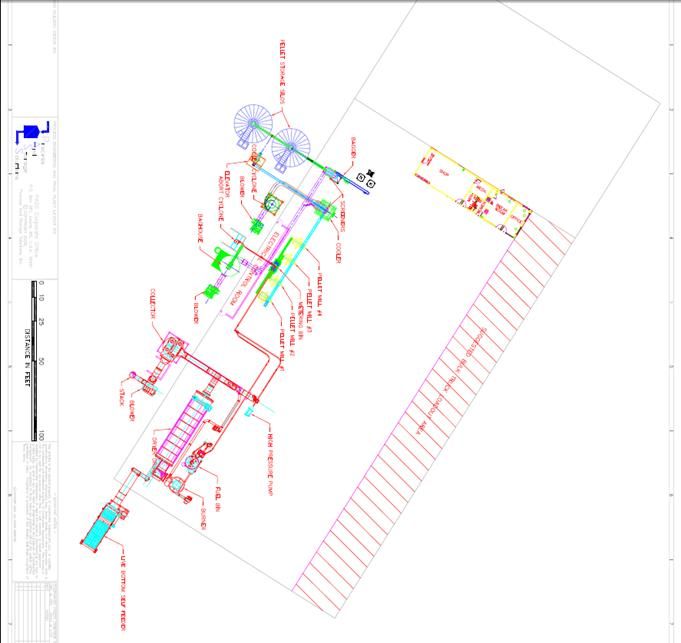

Plan of the Wood Pellet Mill

| 18 |

Customer Service

NHWP strives to provide superior customer service and believes that personal contact with potential and existing customers is a significant factor in customer acquisition and retention.

Acquisitions

The Company’s strategy is to supplement its growth though selective acquisitions. The Company believe that in some instances it is faster and less expensive to buy companies with customer bases rather than developing a customer base through internal marketing or sales effort. The Company believes that many smaller companies are willing to sell their customer bases because they have been unable to manage the growth of their enterprises or attract the capital necessary to finance receivables and develop a management and systems infrastructure.

Government regulation

Solar JOOS

In addition to federal regulation, sellers of solar services may be subject to regulation by the various state regulatory authorities. The scope of such regulation varies from state to state, with certain states requiring the filing and regulatory approvals of various certifications and state tariffs

Competition

In general, the solar industry is characterized by frequent introduction of new products, services and changing consumer preferences. The markets for solar products and services are constantly being redefined as new products are brought to market and exiting product life cycles are shortened. The Solar JOOS's success will be highly dependent on anticipating and responding to the constant changes taking place in the solar industry and ensuring that it can continue to compete on the basis of price, service and product offerings.

The number of participants in the solar industry id extensive and therefore no discussion of any one individual competitor is provided within the segment of solar providers.

Management - NHWP

Management Positions and Age

Name

|

Position | Age | |

| 1 | Joseph J. Murphy | Chairman and CEO | 76 |

| 2 | Gary Smith | Controller | 73 |

| 3 | Giulio Anthony Bruno | Vice President, Plant Operations | 77 |

| 4 | John Kehnle | Sr. Vice President, Administration | 65 |

| 5 | Wellington P. Bartels, III | General Manager | 70 |

| 6 | Construction Management LLC | Construction |

| 19 |

Officers’ Resumes

Joseph J Murphy. Mr. Murphy has served as our Chief Executive Officer and director since inception. He has more than 40 years of experience in investing in, starting up, building, operating and managing successful businesses. Mr. Murphy is the Chairman of the Board of Directors of Solar JOOS Inc, was an adjunct professor of Economics and Finance at Sacred Heart University, and has authored five books. He was formerly the Chairman and Chief Executive Officer of DCI Telecommunications Inc., an OTC company; Executive Vice President, Chief Financial Officer and member of the Board of Directors of Aquarion, Inc., a New York Stock Exchange company; Vice President and Chief Financial Officer of The Southern Connecticut Gas Company, a New York Stock Exchange company. In addition, he was a member of Price Waterhouse and served as an officer in the United States Marine Corps.

Mr. Murphy has served as a member of the Boys/Girls Club of Bridgeport, served on the economic advisory board for Fairfield University and Sudden Infant Death Syndrome (SIDS) for Fairfield County and is a member of the FBI/Marine Corps Assn. He was also a member of the National Association of Water Companies and The Patterson Club.

Mr. Murphy earned a Bachelor of Business Administration and Masters of Business Administration from Iona College. Mr. Murphy has spent the last several years working for the company.

Gary F Smith. Mr. Smith, a Certified Public Accountant has worked for one of Big Four public accounting firms, but the majority of his experience in the financial management of Non-Profit Higher Education. He was the secretary/treasurer and one of the founders of a for–profit corporation which sold computer animation systems based upon university applied research. As an adjunct professor of accounting he taught in the graduate and undergraduate programs at Adelphi University. He has served on the local school board as president and chairman of its finance committee. Mr. Smith earned a Bachelor of Science in accounting from Fordham University and a Masters of Business Administration from Adelphi University.

Giulio Anthony Bruno. Mr. Bruno joined NHWP and has served as its Vice President Plant Operations since March 2007. Mr. Bruno has more than 35 years experience in energy conservation and hazardous materials management, especially in the facilities and plant industry. He is presently a consultant with a security operations training facility in Fayetteville, North Carolina.

Mr. Bruno earned a Masters Degree (MS from Eastern Carolina University) in Industrial Technology where he graduated with honors. He also earned a Bachelor of Science degree in Industrial Technology from Southern Illinois University. Mr. Bruno has spent the last several years working for the NHWP. Mr. Bruno was manager of the central utility plant at Fort Bragg, and was responsible for 2.2 MW power facility, with fully automatic main switch gear controls. He is also am a certified energy auditor recognized by the Department of Energy in all states including possessions. Mr. Bruno managed all potable and waste water (water in and out).

Prior to this, Mr. Bruno was the Manager of the Central Utility Operations for SOTF and was responsible all Boilers, Chillers, (Refrigerant Certified) Potable Water, Waste Water, Compressed Air, Generators, Uninterruptible Power, Main Switchgear, All Power Mains and Subs, Spas, Swimming pools (Operator Certified), All Chemicals (including Handling, Storage, Transportation, and Disposal), Computer Controlled Air Handlers, Fuels, and Fuel Storage, and All night time Security and Lighting. He has worked for this company 14 years.

Prior to this position, Mr. Bruno was Equipment Control Manager for the Xerox Corporation in White Plains, NY Branch. The responsibilities included refurbishing of all models of Xerographic and Photo static equipment in multiple locations. This included all the parts inventory and ordering for the branch. Mr. Bruno has worked for Xerox for 14 years and was rated in first place the last three years in this position against 12 other Xerox branches in the North East Region.

John F. Kehnle. Mr. Kehnle serves as our Vice President – Administration and joined the NHWP in March, 2007. Mr. Kehnle has more than 30 years experience in banking including but not limited to operations, compliance, information technology and auditing. Mr. Kehnle was involved in the start-up of a foreign branch in NY. He was also the internal auditor and then the operations officer for the $25 billion foreign branch of Nordea Bank operating in the U.S. Prior to that he was audit supervisor for Irving Trust Company.

Mr. Kehnle was a founder and Vice President - COO of b4nAfterApplications LLC, a software company specializing in compliance, audit and corporate cash management systems between 2003 and 2006. Mr. Kehnle has spent the last two years working for the company. During this time he has become familiar with the wood pellets industry, researching industry standards including the new Quality Assurance/Quality Control program from the Pellet Fuels Institute.

Mr. Kehnle earned a Bachelor of Business Administration from Bernard M. Baruch College (CUNY) and a Master of Business Administration from St. John’s University.

| 20 |

Wellington P. Bartels III. Mr. Bartels has joined NHWP and will serve as General Manager of the wood pellet facility. Mr. Bartels worked in various capacities for Timco Inc. in Center Barnstead, NH for 25 years, 12 of those years as President & General Manager. Timco was a leading United States based manufacturer of eastern white pine servicing nationwide markets including chain markets. Position required acumen in full life cycle industry operations. Mr. Bartels has substantive knowledge of round wood, chipping and chip production, finished lumber and palletizing and shrink wrapping for shipment. Mr. Bartels successfully recruited, trained, retained, and directed a multidisciplinary assembly of high caliber industry professionals tasked with managing a workforce of 125 employees, eight of which were supervisor level employees, all of which reported to me directly. Under Mr. Bartels’ direction, Timco Inc. nearly doubled total sales within a seven year period.

Mr. Bartels earned a bachelor’s degree from the University of Phoenix in Business Management and an associate’s degree in Computer Science from the New Hampshire Technical Institute.

Mr. Bartels served as chairman of the grading rules committee for the Northeast Lumber Association (NELMA) for the term of three years, and on its board of directors for the term of nine years.

Construction Management LLC

Jack Dudley and Ron Green are managing partners of CM and are 20 year veterans of the US wood pellet industry, which includes owning and running a wood pellet mill as well as constructing numerous wood pellet mills. CM will be ongoing consultants to the NHWP after commission date of the wood pellet mill. Below is a list of wood pellet mills constructed:

| · | Future Fuels Corp. located in Batesville, AR |

In 2006, Future Fuels Corp. built an R&D wood pellet plant with the purpose of using residual materials generated as a by-product of one of their many experimental projects. This plant includes two pellet mills. The Münch-Edelstahl pellet mill ran at 3 tons per hour capacity during trials but due to the status of the residual-producing experimental project, this pellet plant is currently mothballed.

| · | Biowood, LLC located in Monticello, AR |

Biowood, LLC is one of several pellet manufacturing sites supplying the wood pellet division of Pennington Seed. Phase 1 was started up in December, 2006. This included two Münch-Edelstahl pellet mills. Currently, Biowood is producing 6 tons per hour of premium pellets. The plant was designed to eventually add a third pellet mill for phase 2. It took approximately 6 months after start-up to achieve the rated phase 1 capacity of 6 tph. They have been consistently running at that level since.

| · | Great Lakes Renewable Energy, Inc. located in Hayward, WI |

GLRE began the construction of phase 1 in May of 2008. Initial startup began in late November of 2008. Phase 1 includes 3 Münch-Edelstahl pellet mills, for a combined rated capacity of 9 tons per hour. Currently the plant production level is @ 65-70% of the rated design capacity of 9 TPH. Each pellet mill has run at 3 tons per hour when raw material was sequenced to their respective pre-bins, with 100% capacity expected within the next 30-45 days.

During phase 2, GLRE will add three more pellet mills and a second drying system. The cooler and pellet storage system as installed in phase 1 are both designed to handle the increased production of phase 2 for a combined output of 18 tons per hour. The bagging system will also be upgraded from the current manual system to a fully automated bagging system during phase 2.

| · | Piney Woods Pellets, LLC located in Wiggins, MS |

Like Great Lakes Renewable Energy and Bayou Wood Products, Piney Woods Pellets, LLC chose to build their plant in 2 phases. Phase 1 includes 3 Münch-Edelstahl pellet mills, each rated at 3 tons per hour. It also includes a Münch-Edelstahl pellet cooler, a fully automatic bagging system, and an EarthCare dryer system. Piney Wood Pellets began construction in late January, 2009 and made their first finished pellets in mid-May, 2009. At this early stage of start-up and training, they are running the pellet mills one at a time, with each pellet mill having been operated at its capacity of 3 TPH. Estimates are that the plant will be producing at the rated phase 1 capacity of 9 tons per hour by fall of 2009.

At phase 2, Piney Woods Pellets will add three more pellet mills and a second drying system. The cooler, bagging system, and pellet storage system from phase 1 are designed to handle the increased production of phase 2 for a combined output of 18 tons per hour.

| 21 |

Demand for Wood Pellets

Demand for wood pellets is growing worldwide. Demand for wood pellets in the US has been great in the 2013-2014 and 2014-2015 heating seasons with many manufacturers running out of product. During 2009 and 2012 there were pockets of oversupply in sections of the U.S. where proper forecasting of potential local sales by certain wood pellet mills had been lacking. During the end of 2007 and throughout 2008 when there was a general shortage of wood pellets in the U.S., the lack of proper forecasting for these wood pellet mills was not obvious. Only when equilibrium between supply and demand was reached in 2009 was their poor planning exacerbated and made clear.

NHWP will be one of two major producers located in New Hampshire. There is currently a shortage of quality-locally manufactured wood pellets in the Northeast, which became evident in our discussions with the small retail base that we would be selling a portion of production to.

The sales of wood pellet stoves and inserts represent only 5% of the total appliances sold in the U.S. in 2009; plenty of room for growth. Sales of pellet burning appliances hit a snag in 2009 mirroring the U.S. economy (see table below: source is the Hearth, Patio and Barbeque Association), which are a direct barometer of future demand for wood pellets. The primary reason for this decline in sales is that wood pellet stoves and inserts sell primarily to the middle class in the U.S. With economic conditions the way they are today, middle class Americans are refraining from buying high ticket items for the time being.

Natural gas is an alternative to wood pellets as it is relatively inexpensive. This fossil fuel took a black eye when the infrastructure in a small California town deteriorated to the point that a town was wiped out with an explosion. Subsequently it has been well documented that the natural gas infrastructure throughout the U.S. is aging, therefore having a negative impact on future sales.

As the USA moves to become Energy Independent and the number one oil exporter in the world, major oil fields in both the Middle East and Central America are in decline, thus continuing the upward pressure on global demand for wood pellets which tracks #2 oil.

| 22 |