Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PFO Global, Inc. | v415931_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - PFO Global, Inc. | v415931_ex99-2.htm |

Exhibit 99.1

PFO Global, Inc. Presentation July 22, 2015 1

LEGAL NOTICES AND DISCLAIMERS • This presentation is the property of PFO Global, Inc. and its subsidiaries (“PFO” or the “Company”) and is strictly confidential. It contains information intended only for the person to whom it is transmitted. With receipt of this information, recipient acknowledges and agrees that: ( i ) this document is not intended to be distributed, and if distributed inadvertently, will be returned to the Company as soon as possible; (ii) the recipient will not copy, fax, reproduce, divulge, or distribute this co nfi dential information, in whole or in part, without the express written consent of the Company; (iii) all of the information herein wil l b e treated as confidential material with no less care than that afforded to its own confidential material. • This presentation is for informational purposes only and is not intended for any other use. This presentation is not an offe rin g memorandum or prospectus and should not be treated as offering material of any sort. The information contained in this presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities. This presentation is i nte nded to be of general interest only, and does not constitute or set forth professional opinions or advice. The information in this document is speculative and may or may not be accurate. Actual information and results may differ materially from those stat ed in this document. • The Company makes no representations or warranties which respect to the accuracy of the whole or any part of this the Company presentation and disclaims all such representations and warranties. Some of the data and industry information used in the preparation of this presentation (and on which the presentation is based) was published by third - party sources, and has not been independently verified, validated, or audited. Neither the Company nor its principals, employees, or agents shall be li abl e to any user of this document or to any other person or entity for the truthfulness or accuracy of information contained in th is presentation or for any errors or omissions in its content, regardless of the cause of such inaccuracy, error, or omission. Furthermore, the Company, its principals, employees, or agents accept no liability and disclaim all responsibility for the consequences of any user of this document or anyone else acting, or refraining to act, in reliance on the information contain ed in this document or for any decision based on it, or for any actual, consequential, special, incidental, or punitive damages to any person or entity for any matter relating to this document even if advised of the possibility of such damages. • This presentation contains forward - looking statements within the meaning of the federal securities laws. Forward - looking statements express the Company’s expectations or predictions of future events or results. They are not guarantees and are subject to many risks and uncertainties. There are a number of factors beyond the Company’s control that could cause actual events or results to be significantly different from those described in the forward - looking statements. Any or all of the forwar d - looking statements in this document or in any other statements the Company makes may turn out to be wrong and should not be regarded as a representation by the Company or any other person that its objectives, future results, levels of activity, performance or plans will be achieved. Except as required by applicable law, the Company does not intend to publicly update o r revise any forward - looking statements, whether as a result of new information, future developments or otherwise. 2

CAUTIONARY NOTE REGARDING FINANCIAL INFORMATION • This presentation and the financial information contained herein (“Projections”) have not been audited or reviewed by our independent certified public accountants and accordingly they express no opinion or other form of assurance as to this financ ial information. • No representation or warranty of any kind is or can be made with respect to the accuracy or completeness of, and no representation or warranty should be inferred from, the Company’s Projections or the assumptions underlying them. No representation or warranty can be made as to the Company’s future operations or the amount of any future income or loss. Some assumptions on which the Projections are based may not materialize, and unanticipated events and circumstances will occur. Further, the Projections are not necessarily prepared nor are they presented in accordance with generally accepted accounting principles. Therefore, subsequent adjustments may be made that may cause the actual results achieved during the periods presented to vary from the Projections, and the variations may be significant and material. Prospective investors ar e cautioned not to rely on the Projections contained in the presentation and should not make an investment decision based on th e Projections. The Projections are not complete and do not necessarily provide a clear picture of the future financial health of the Company. • The Company does not intend to update or otherwise revise the Projections to reflect circumstances existing or adjustments made after the date hereof or to reflect the occurrence of unanticipated events even if some or all of the underlying assumpt ion s do not come to fruition. Any historical financial information contained herein may change significantly after the date hereo f. • THIS INFORMATION IS CONFIDENTIAL AND HAS BEEN PROVIDED TO THE RECIPIENT FOR INFORMATIONAL PURPOSES ONLY AND NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, IS MADE AS TO THE COMPLETENESS OR ACCURACY OF THE INFORMATION CONTAINED HEREIN . 3

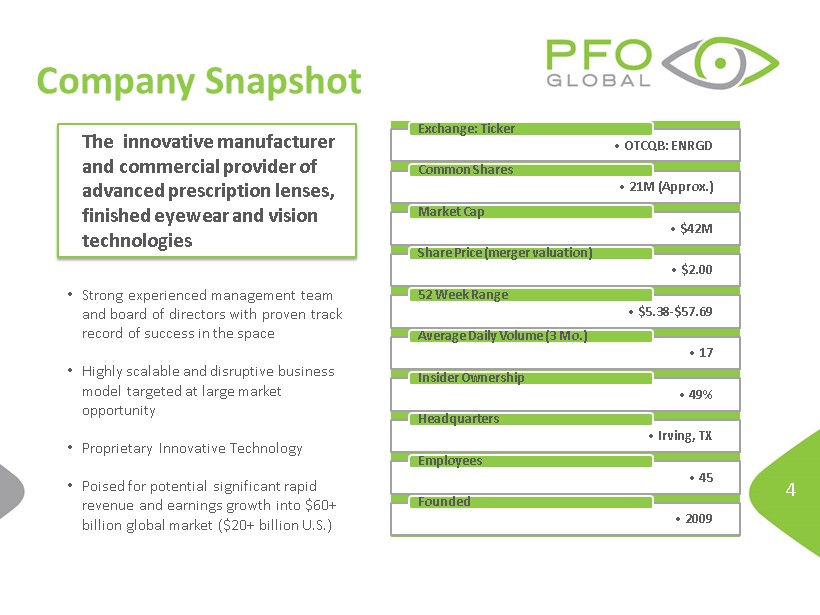

4 • OTCQB: ENRGD Exchange: Ticker • 21M (Approx.) Common Shares • $42M Market Cap • $2.00 Share Price (merger valuation) • $5.38 - $57.69 52 Week Range • 17 Average Daily Volume (3 Mo.) • 49% Insider Ownership • Irving, TX Headquarters • 45 Employees • 2009 Founded The innovative manufacturer and commercial provider of advanced prescription lenses, finished eyewear and vision technologies Company Snapshot • Strong experienced management team and board of directors with proven track record of success in the space • Highly scalable and disruptive business model targeted at large market opportunity • Proprietary Innovative Technology • Poised for potential significant rapid revenue and earnings growth into $60+ billion global market ($20+ billion U.S.)

Merger Update • Acquisition/Merger with OTC public ENRG completed – Name changed to PFO Global, Inc. – $2 share merger price with a market cap of $42 million – Trading symbol currently ENRGD ; request to change to PFOG submitted to FINRA • Response expected soon – New share issuances per the merger agreement have been mailed by the stock transfer agent • Extremely limited trading until new share certificates are received and trading restrictions expire • Hillair Capital $4 million investment completed – R equired debt restructuring completed: THANK YOU NOTEHOLDERS! 5

Changes to Noteholders • Notes – All notes continue per the terms of the executed amendments – There is a one time option to convert notes to common stock now (by July 30) at a conversion price of $1.60 – If you do not elect to convert now, the notes continue per the terms in the note agreements, as amended – To convert, complete the note “Form of Exercise Notice” provided in the amendment package (or request a replacement from DJS or PFO) • Warrants – Class A Warrants • New warrant documents are in preparation to reflect a $1.60 strike price and the number of common shares – Class B Warrants • Converted to common shares as part of the merger. Class B warrant holders will receive a new share certificate to replace the warrant – Class C Warrants • New warrant documents are in preparation to reflect a $2.20 strike price and the number of common shares 6

7 Recent Progress • Vision Care Direct (VCD) – Account is growing with new accounts weekly • Vision Source – PFO was a speaker and participant at Vision Source Exchange in Phoenix April 29 – May 2, 2015 – 1,500 Vision Source members attended – Over 150 Vision Source members opened accounts with PFO in 3 days • MES Vision (Medical Eye Services) – Commercial agreement signed on May 21, 2015 – Roll out staged during July - December 2015 • OD Excellence (ODX) – PFO is co - hosting the ODX International Vision Conference on August 27 - 29, 2015 in San Diego and expects to become a supplier to certain ODX members • RNF International – PFO signed agreement with RNF International on May 6, 2015 to provide complete prescription eyewear to certain hospitals in Russia – Ordering website converted into Russian language; samples of European frames ordered; program ramp up anticipated in 4Q 2015

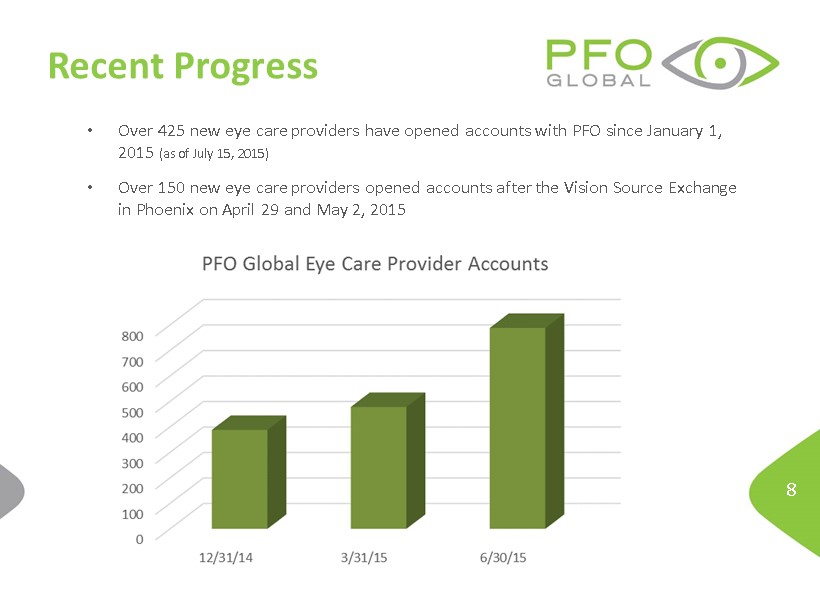

8 Recent Progress • Over 425 new eye care providers have opened accounts with PFO since January 1, 2015 (as of July 15, 2015) • Over 150 new eye care providers opened accounts after the Vision Source Exchange in Phoenix on April 29 and May 2, 2015

9 Near Term Objectives • Penetrate existing networks and managed care program accounts (March Vision Care, MES Vision, OD Excellence, Vision Care Direct and Vision Source) and begin RNF International production – Translate new accounts to increased revenue – Approximately $1.5 million monthly revenue at 40% gross profit margin required for break - even EBITDA • Our goal is to effectuate an up - list transaction, if and when PFO has achieved certain listing requirements