Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Prologis, Inc. | pld-8k_20150721.htm |

Second quarter 2015 Unaudited Earnings Release and Supplemental Information

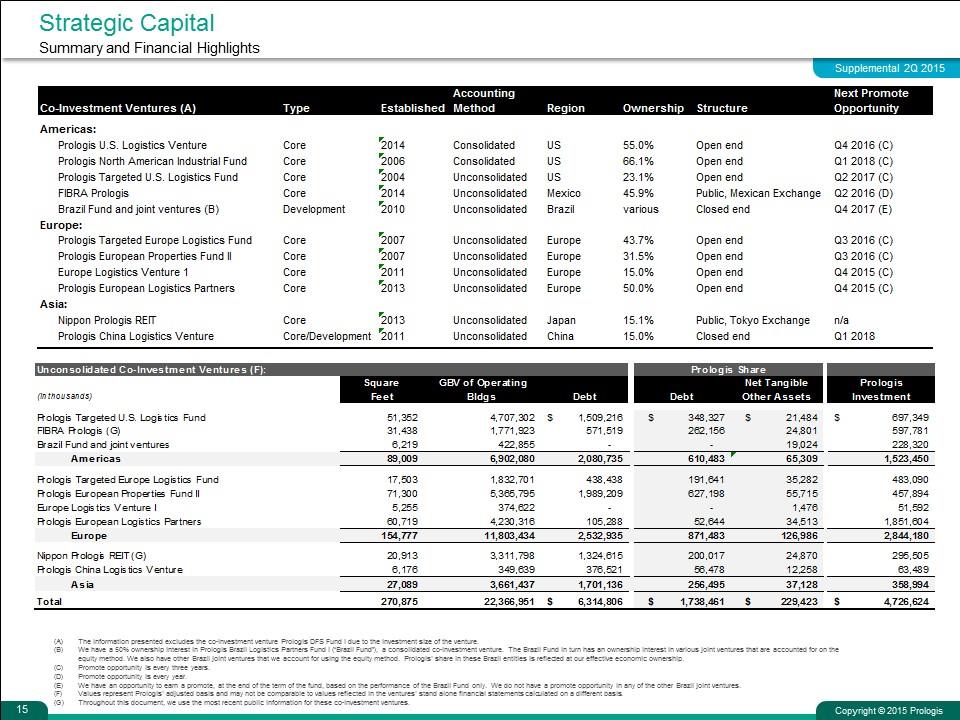

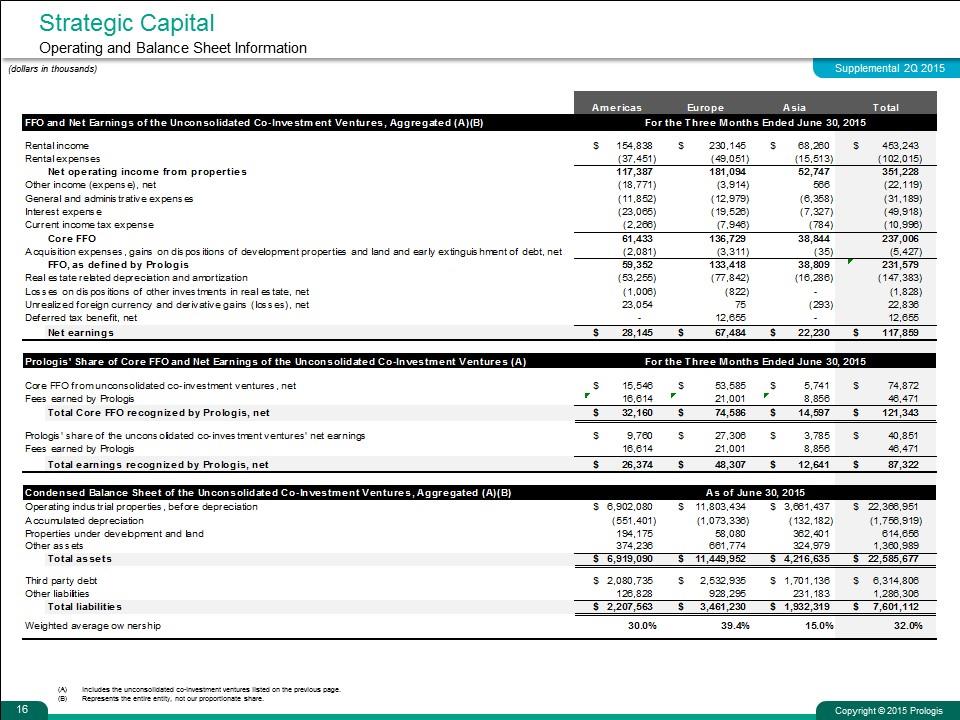

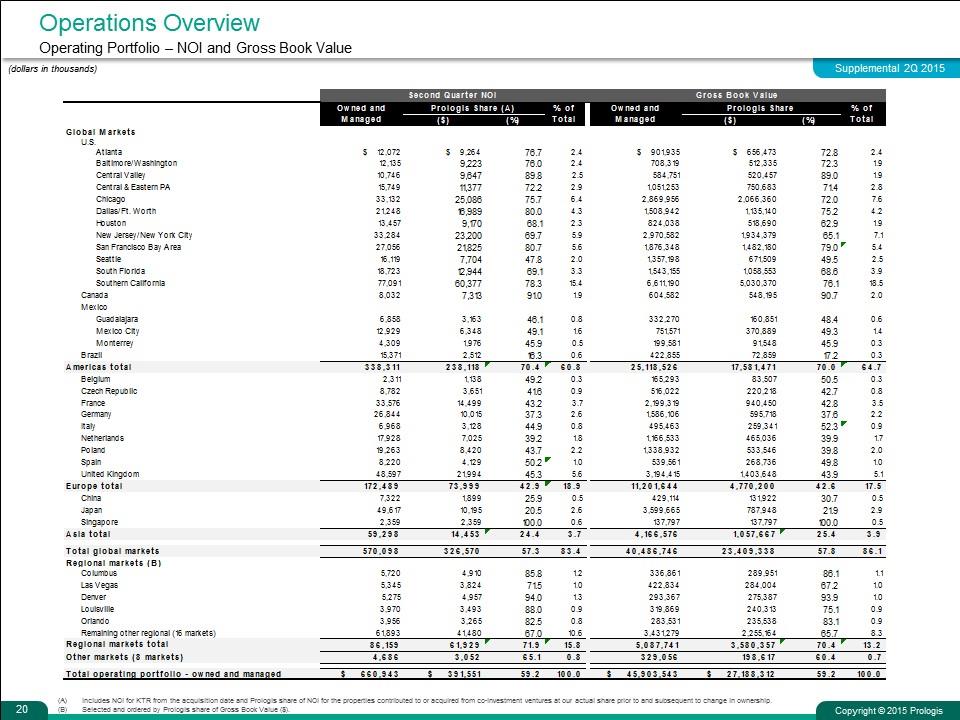

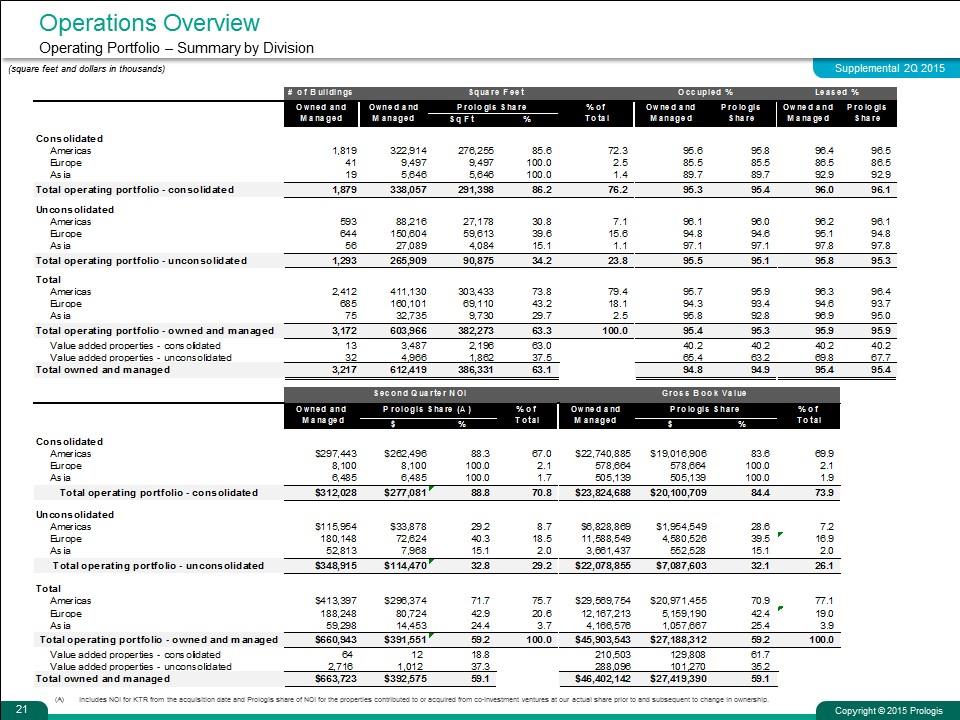

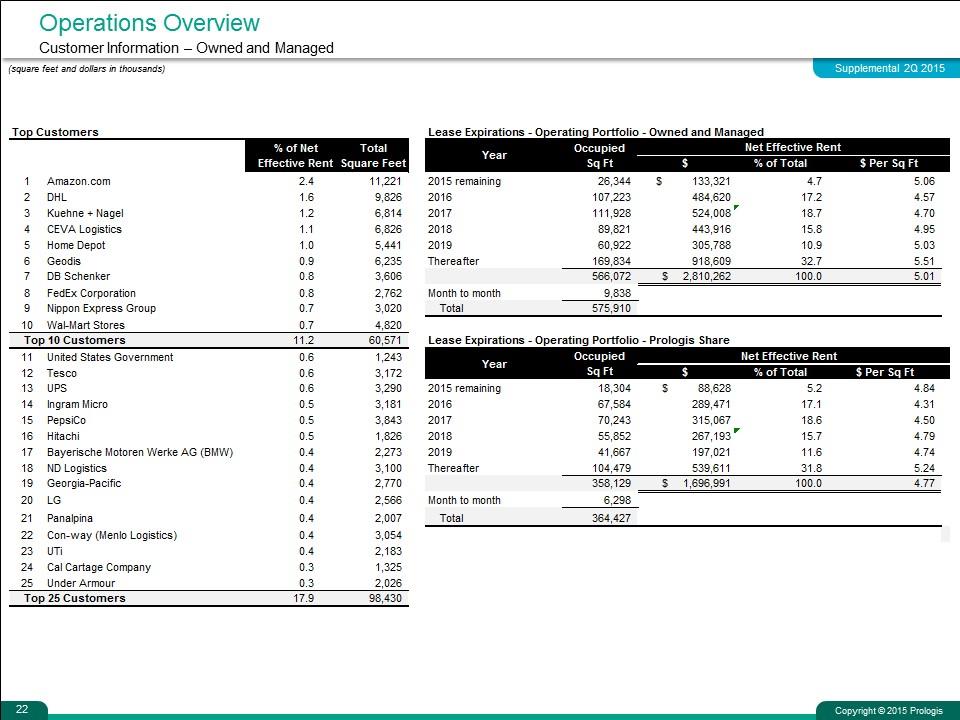

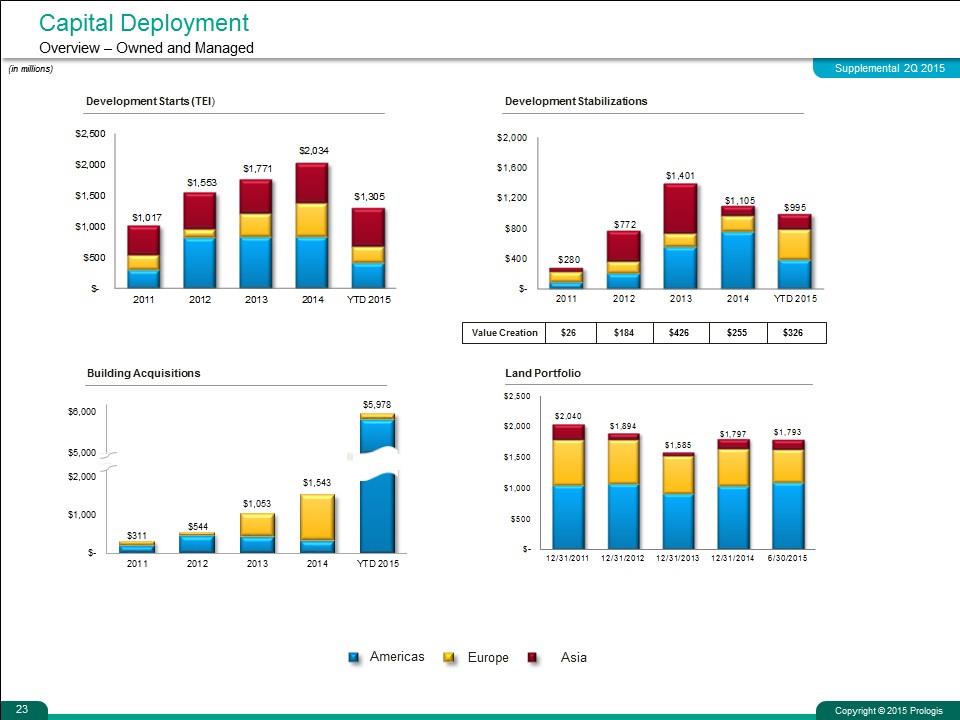

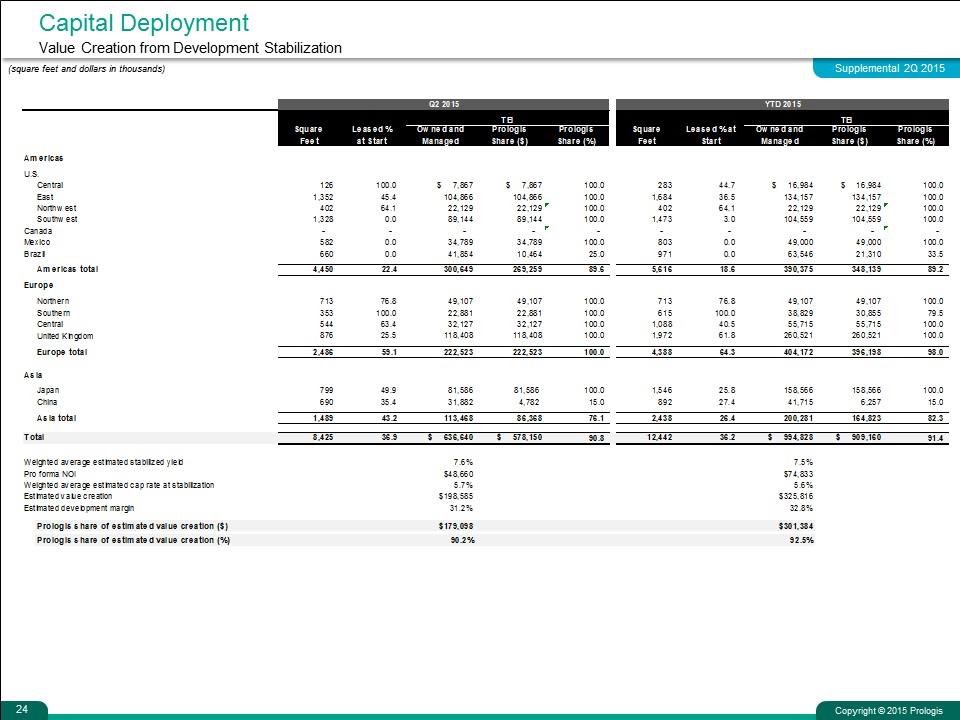

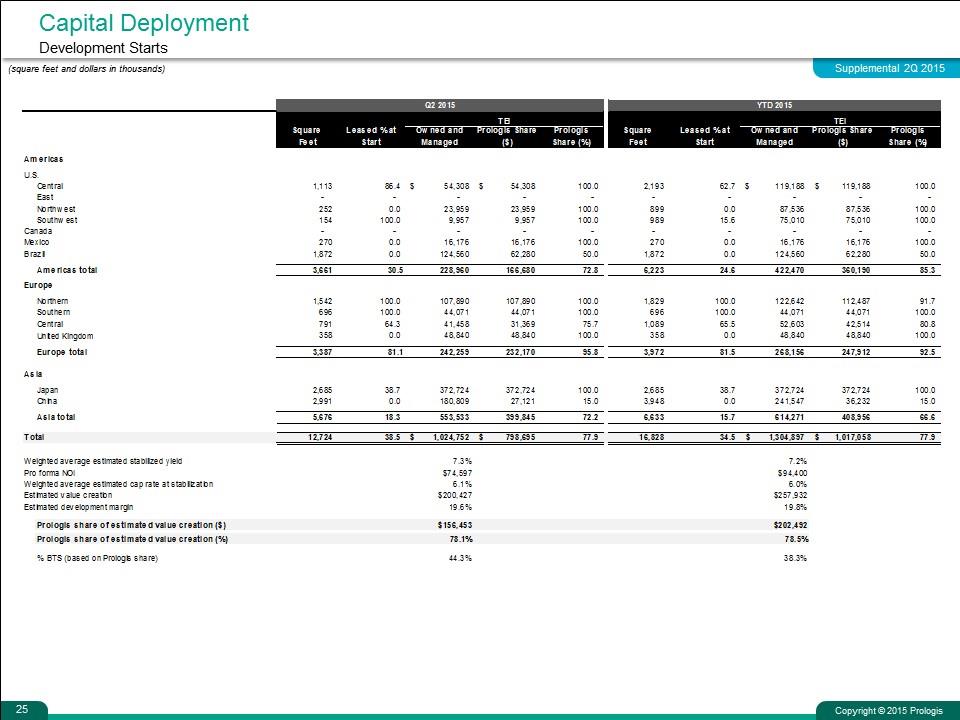

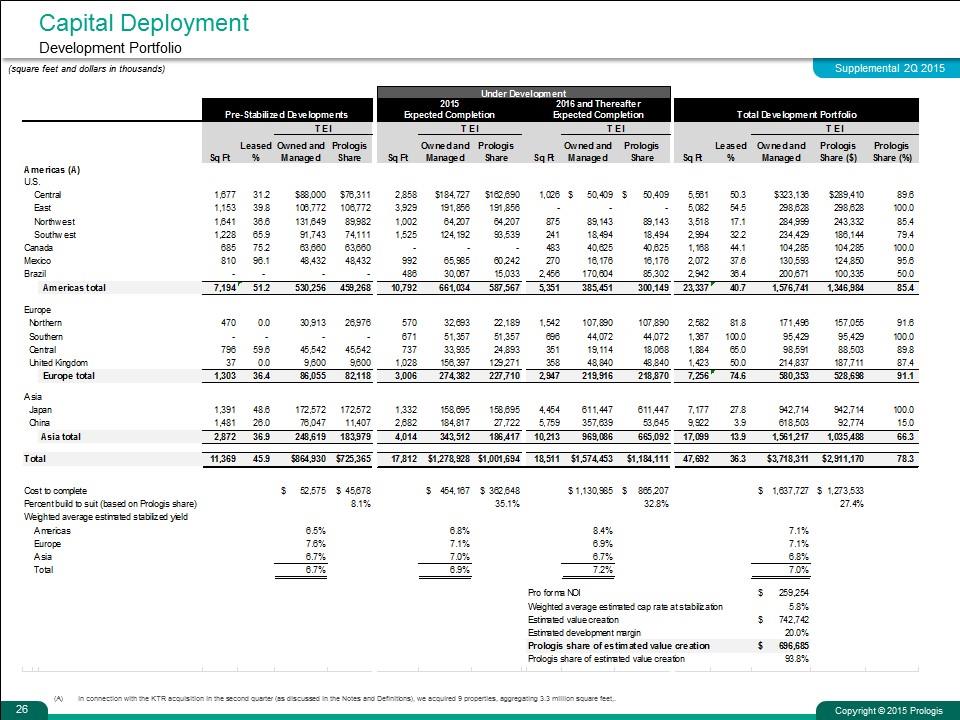

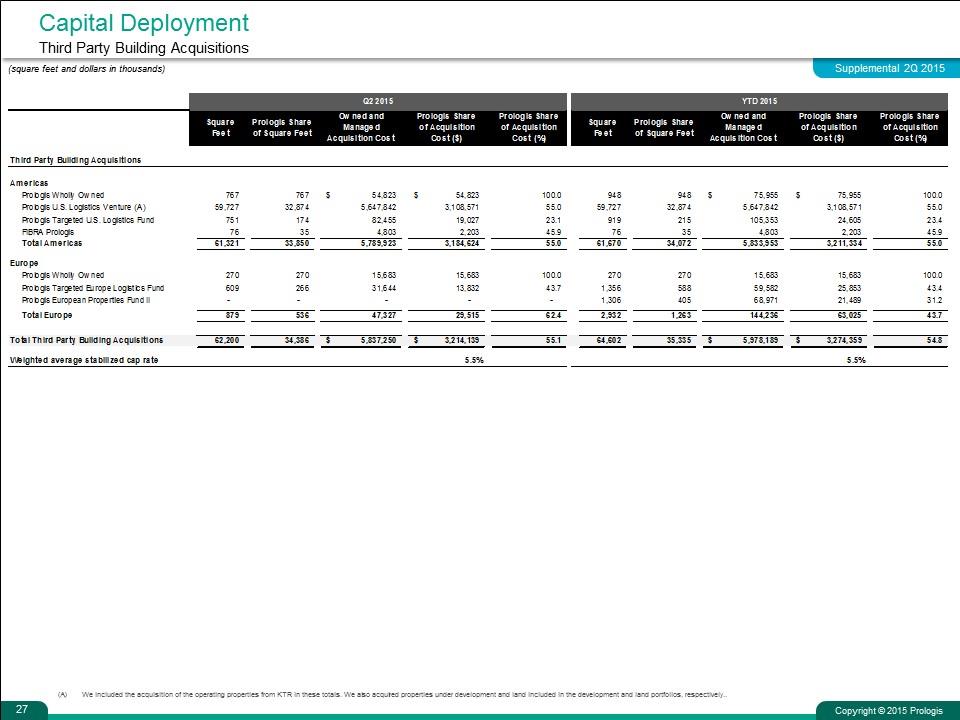

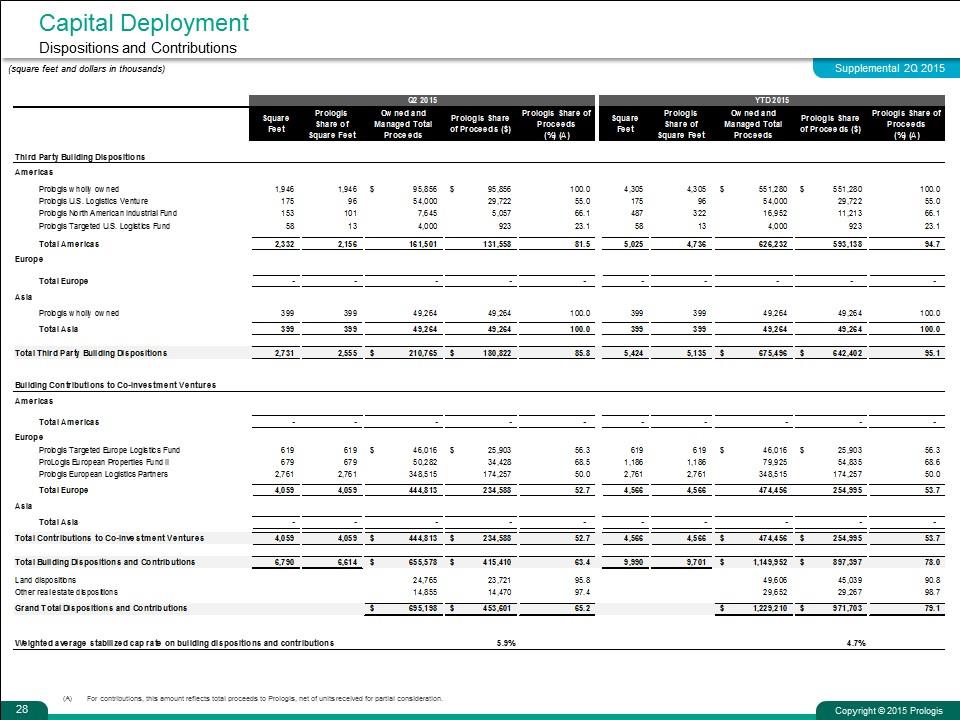

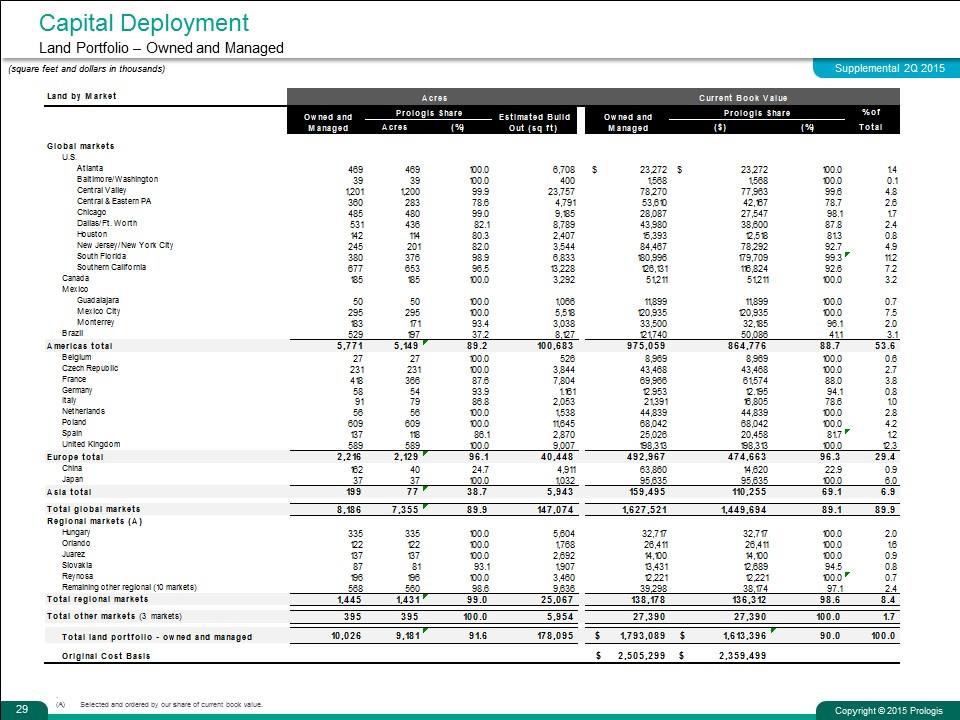

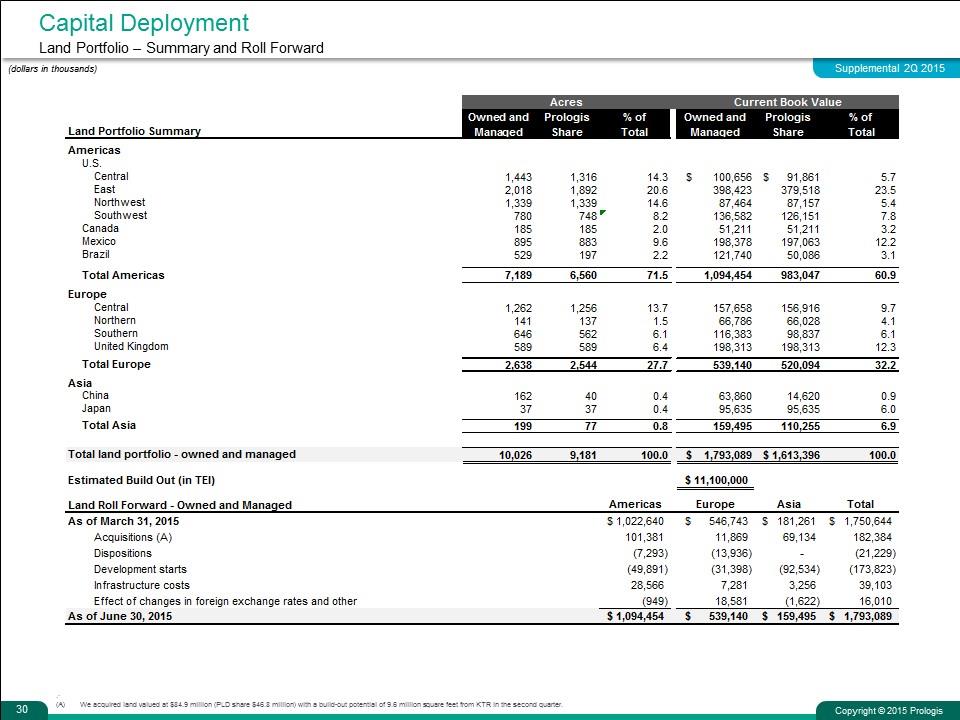

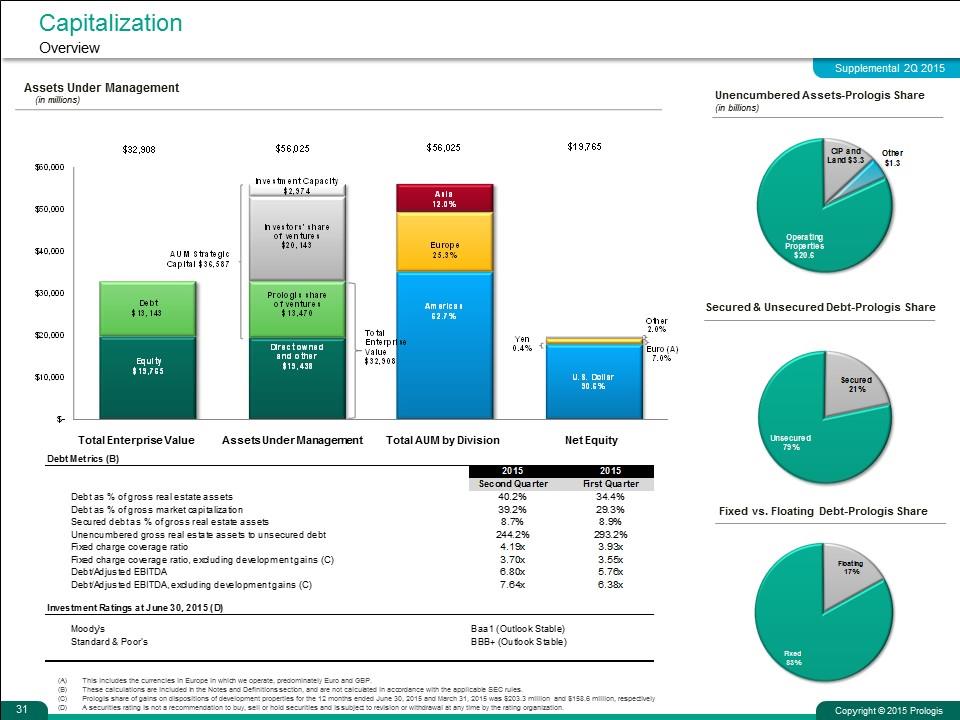

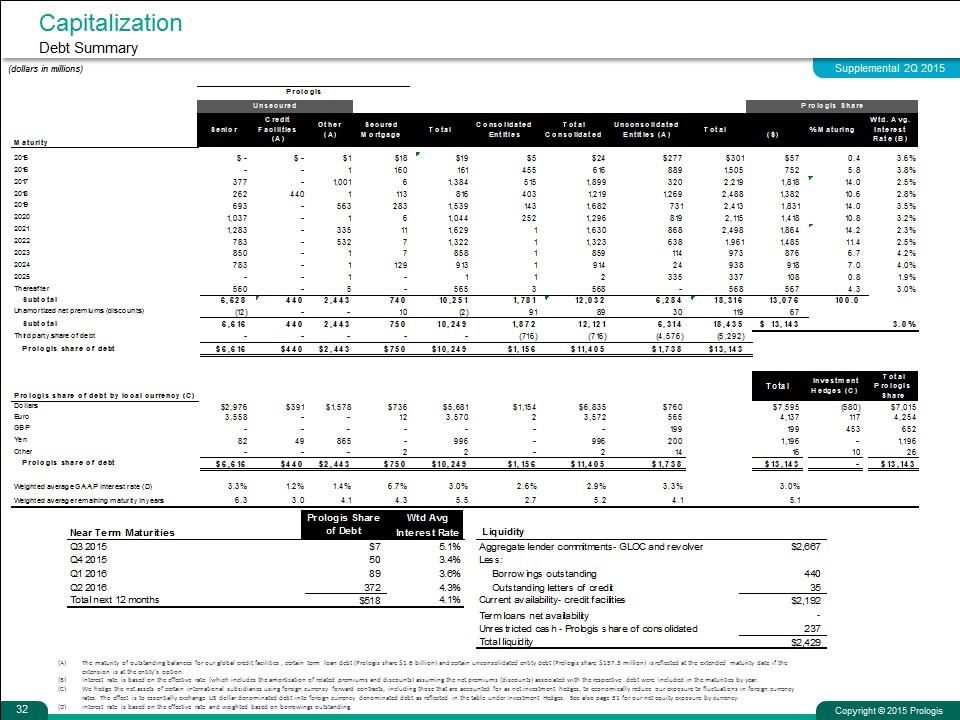

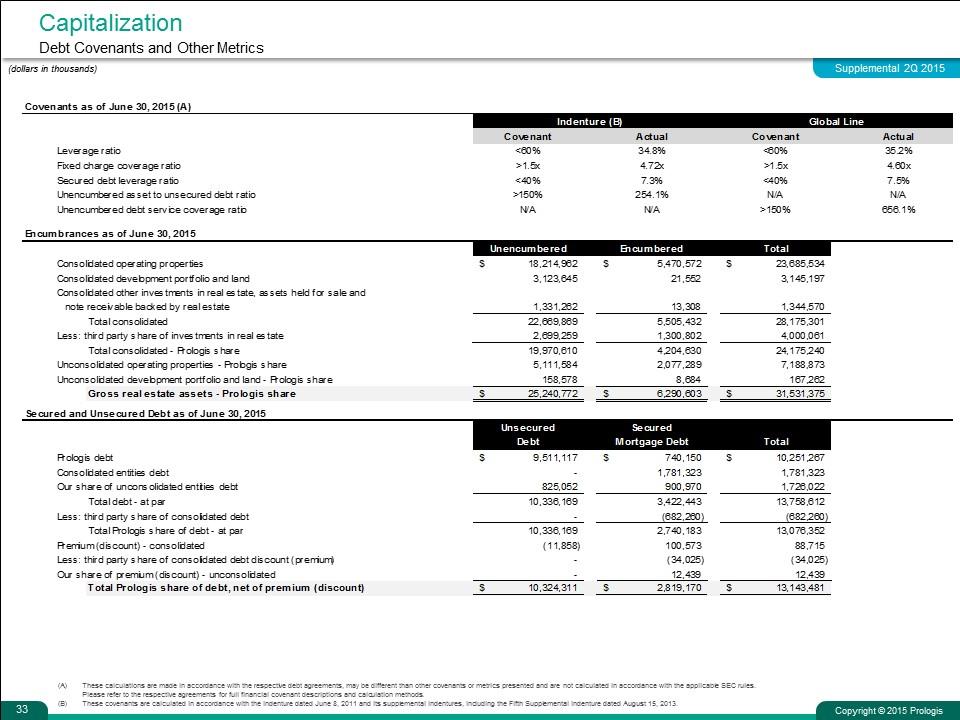

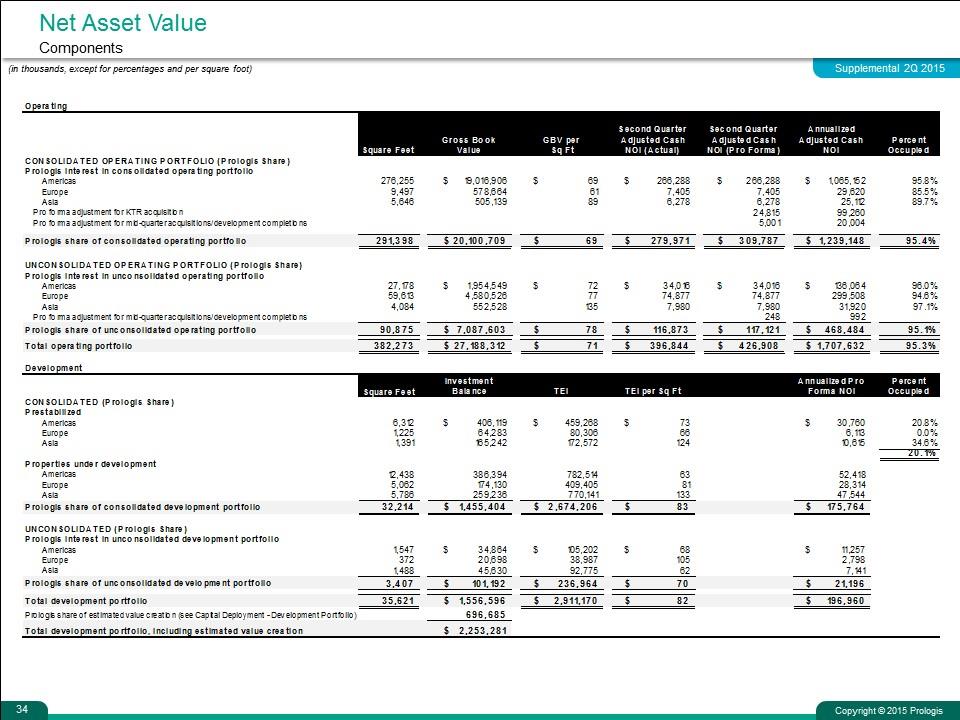

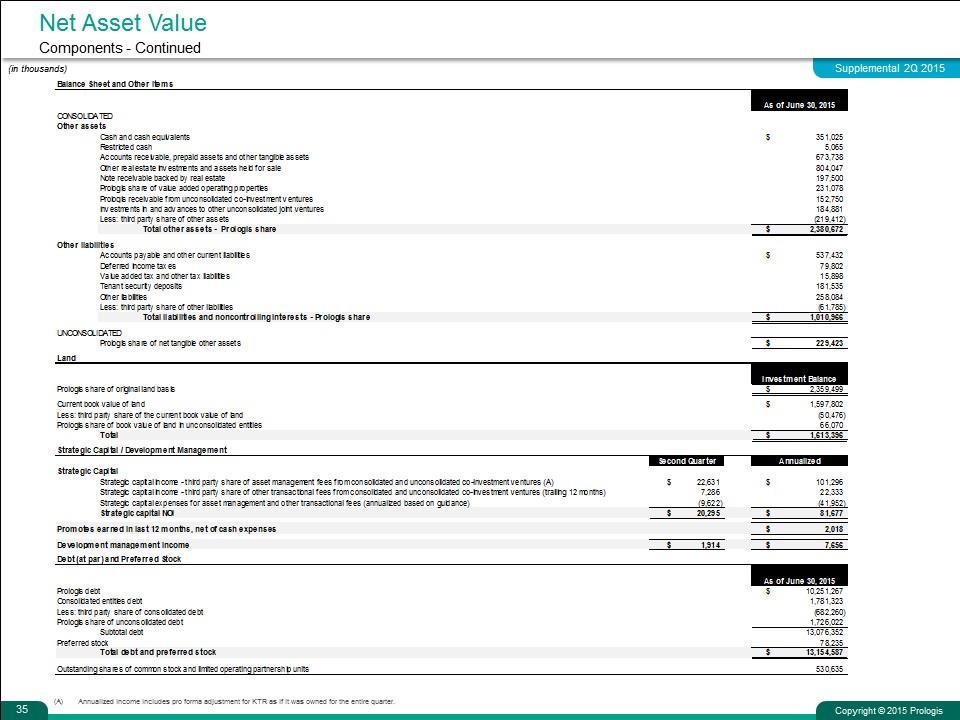

Table of Contents Prologis Park Ausgburg, Munich, Germany Cover: Dongguan Shipai Logistics Center, Dongguan, China Prologis Park Redlands, Inland Empire, California, U.S.A. Prologis Qingpu Zhonggu Distribution Center, Shanghai, China Overview Press Release1 Highlights Company Profile4 Company Performance5 Operating Performance7 Guidance8 Financial Information Consolidated Balance Sheets9 Pro-rata Balance Sheet Information10 Consolidated Statements of Operations11 Reconciliation of Net Earnings to FFO12 Pro-rata Operating Information and Reconciliation to FFO13 EBITDA Reconciliation14 Strategic Capital Summary and Financial Highlights15 Operating and Balance Sheet Information16 Operations Overview Operating Metrics17 Operating Portfolio 19 Customer Information22 Capital Deployment Overview 23 Value Creation from Development Stabilization 24 Development Starts25 Development Portfolio26 Third Party Building Acquisitions27 Dispositions and Contributions 28 Land Portfolio29 Capitalization Overview31 Debt Summary32 Debt Covenants and Other Metrics33 Net Asset Value Components34 Notes and Definitions (A)36 Terms used throughout document are defined in the Notes and Definitions

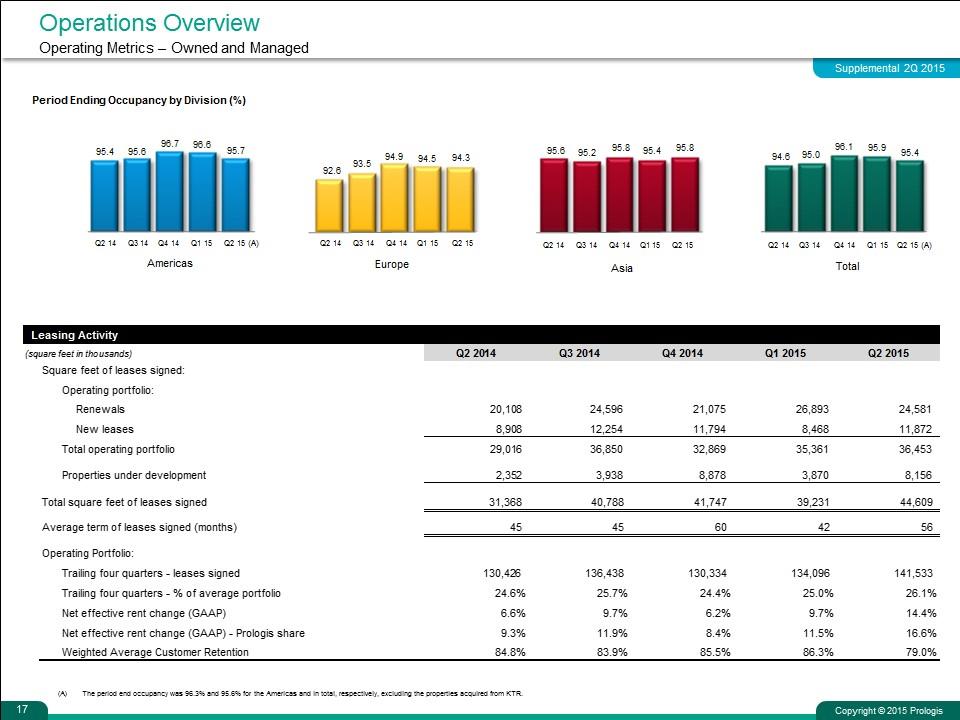

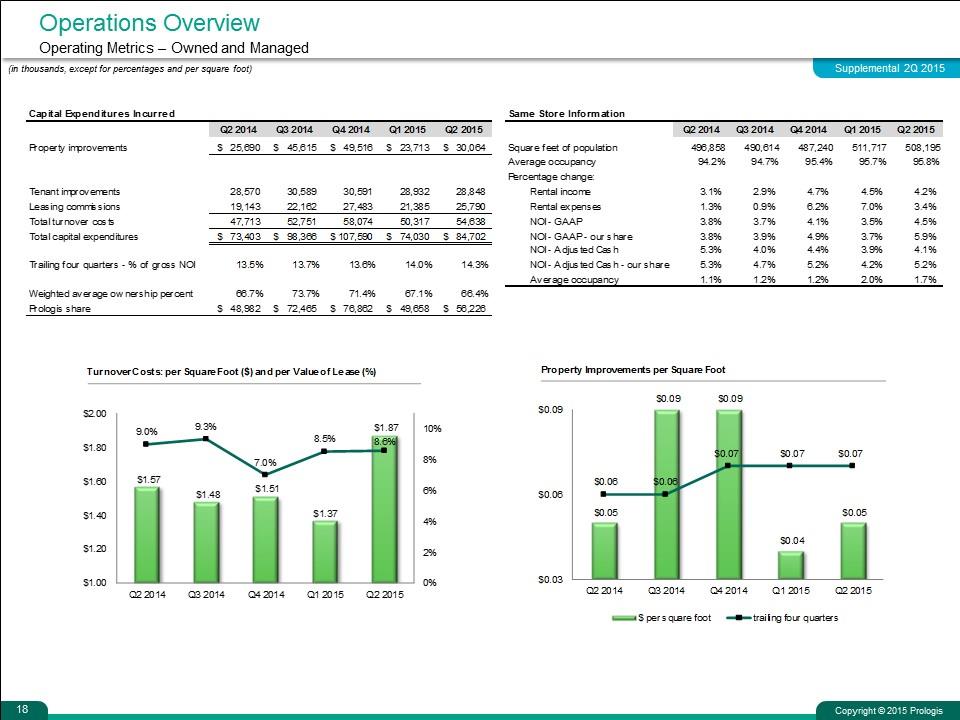

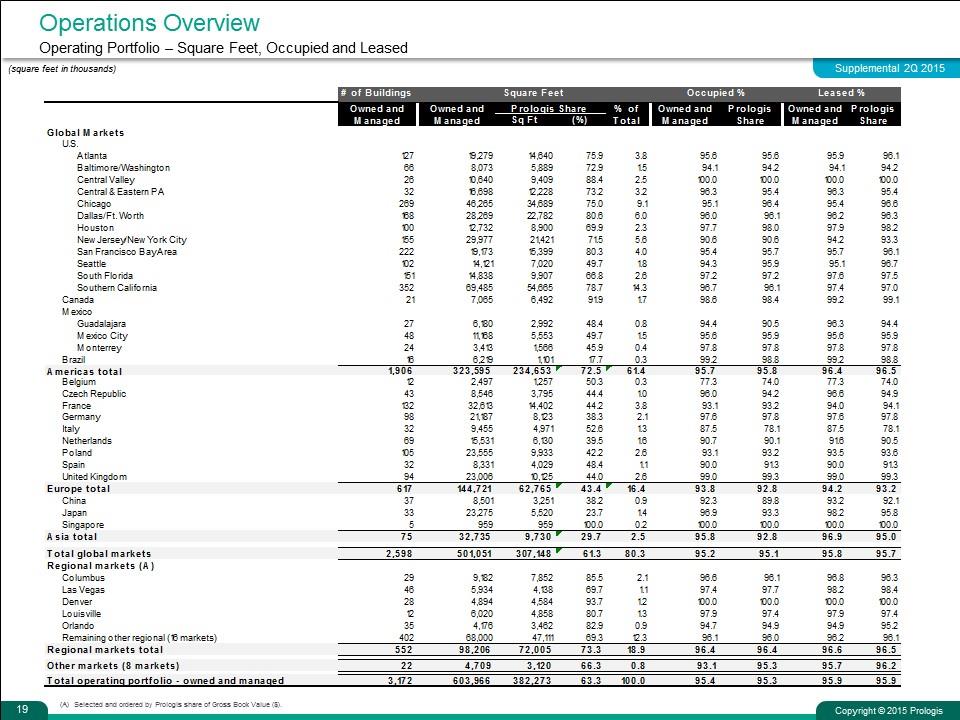

Prologis Reports Second Quarter 2015 Earnings Results and Announces 11 Percent Increase in Quarterly Common Stock Dividend 1– Rent Change on Rollovers Increased a Record 14.4 Percent –– Acquired $5.9 Billion of Real Estate Assets from KTR Capital Partners and its Affiliates –– Estimated Value Creation of $179.1 Million from Stabilizations, Reflecting a 31.0 Percent Margin –– Raised Midpoint of 2015 Core FFO Guidance, Representing Year-Over-Year Growth of 17 Percent –SAN FRANCISCO (July 21, 2015) – Prologis, Inc. (NYSE: PLD), the global leader in industrial real estate, today reported results for the second quarter of 2015 and announced that its Board of Directors has approved a quarterly dividend increase, raising the company’s annualized dividend level by 11 percent to $1.60 per share of common stock.Core funds from operations (Core FFO) per diluted share was $0.52 for the second quarter compared with $0.48 for the same period in 2014, an increase of 8 percent. “The team delivered ahead of plan and our results reflect strong underlying performance across all three lines of our business,” said Hamid R. Moghadam, chairman and CEO, Prologis. “We see significant earnings potential from harvesting the gap between our in-place and market rents, the profitable build-out of our land bank and the efficient scaling of our global platform.”OPERATING FUNDAMENTALS GAIN MOMENTUMPrologis ended the quarter with 95.4 percent occupancy in its operating portfolio, an increase of 80 basis points over the same period in 2014. Excluding the KTR assets, the company ended the quarter with 95.6 percent occupancy in its operating portfolio. Prologis leased a record 44.6 million square feet (4.1 million square meters) in its combined operating and development portfolios. Tenant retention was 79.0 percent. GAAP rental rates on signed leases during the quarter increased a record 14.4 percent from prior rents. The Americas region led the quarterly increase at 20.6 percent (U.S. at 21.9 percent), followed by Europe at 4.4 percent and Asia at 2.0 percent. Prologis’ share of same store NOI increased 5.9 percent on a GAAP basis and 5.2 percent on an adjusted cash basis.CAPITAL DEPLOYMENT ACTIVITY ACCELERATES New investments in buildings during the second quarter totaled $6.9 billion ($4.0 billion Prologis’ share).Development Stabilizations & Starts In the second quarter, on a Prologis share basis the company created $179.1 million of estimated value from its $578.2 million of development stabilizations at an estimated development margin of 31.0 percent. The company started $798.7 million of new developments on a Prologis share basis with an estimated weighted average yield upon stabilization of 7.3 percent and an estimated development margin of 19.6 percent. Build-to-suit activity remains robust, comprising 44 percent of starts volume in the quarter and including multi-market customers such as BMW and Kimberly-Clark. At quarter end, the book value of the company’s land bank was $1.8 billion, with an estimated build-out potential of $11.1 billion.AcquisitionsAs previously announced, Prologis completed the acquisition of the real estate assets and operating platform of KTR Capital Partners and its affiliates for $5.9 billion ($3.2 billion Prologis’ share) in the Prologis U.S. Logistics Venture. Also during the quarter, the company acquired $139.3 million of buildings on a Prologis share basis. The stabilized capitalization rate on total acquisitions in the quarter was 5.5 percent.Contributions & Dispositions The company completed $453.6 million of contributions and third-party dispositions on a Prologis share basis with a stabilized capitalization rate of 5.9 percent. CAPITAL MARKETS ACTIVITY BENEFITS FROM GLOBAL ACCESS During the quarter, Prologis completed $3.1 billion of financings at a weighted average interest rate of 1.6 percent and a weighted average term of 5 years.“We have access to foreign-denominated debt markets, which has allowed us to take advantage of attractive pricing to further strengthen our financial position and mitigate the impact of foreign currency movements,” said Tom Olinger, chief financial officer, Prologis. “As a result of our efforts, we currently have $2.4 billion in liquidity and we’ve addressed our unsecured debt maturities until 2017. We have the ability to

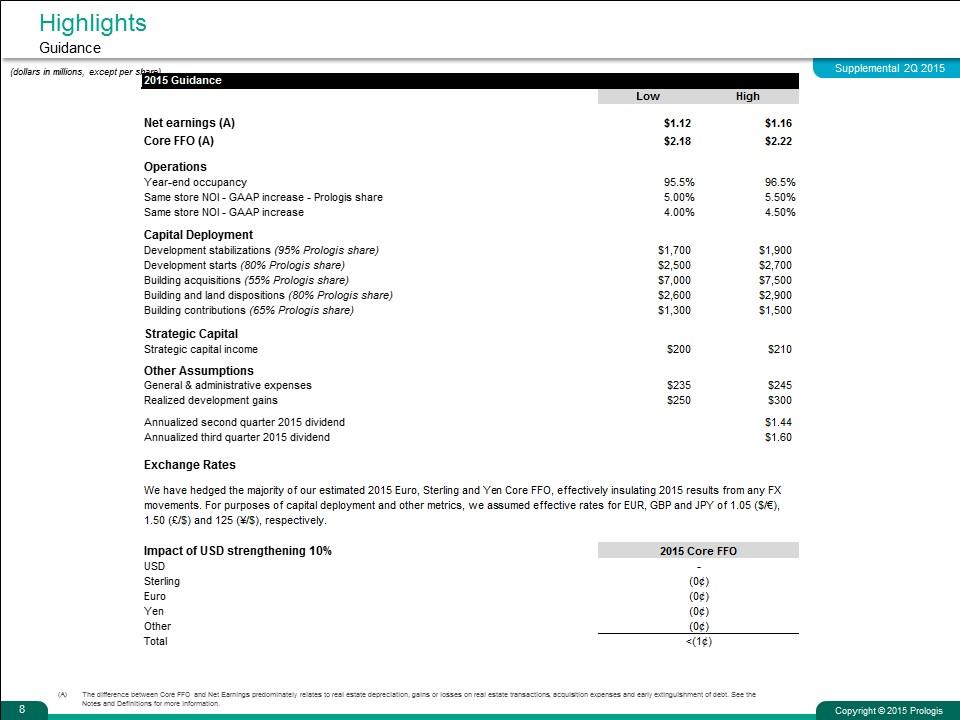

2complete the long-term funding of KTR and have the capital to support future growth through asset recycling.” NET EARNINGSNet earnings per diluted share was $0.27 for the second quarter compared with $0.13 for the same period in 2014.GROWS ANNUALIZED DIVIDEND BY 11 PERCENT AND INCREASES 2015 CORE FFO GUIDANCE MIDPOINTDividendThe Prologis Board of Directors declared a regular cash dividend for the quarter ending September 30, 2015, on the following securities:A dividend of $0.40 per share of the company’s common stock, representing an increase of 11 percent over the June 2015 quarterly common stock dividend, payable September 30, 2015, to common stockholders of record at the close of business on September 18, 2015; andA dividend of $1.0675 per share of the company’s 8.54 percent Series Q Cumulative Redeemable Preferred Stock, payable September 30, 2015, to Series Q stockholders of record at the close of business on September 18, 2015.“This increase in our common stock dividend is the second this year, and the combined impact results in a 21 percent increase over the 2014 dividend level on a run rate basis,” said Olinger. “The growth in our dividend was driven by the cash flow accretion from the KTR transaction and a stronger operations outlook.”GuidancePrologis increased the midpoint of its full-year 2015 Core FFO guidance and narrowed the range to $2.18 to $2.22 per diluted share from $2.16 to $2.22 per diluted share, representing expected year-over-year growth of 17 percent. The company expects to recognize net earnings, for GAAP purposes, of $1.12 to $1.16 per share. The Core FFO and earnings guidance described above excludes any potential future gains (losses) recognized from real estate transactions. In reconciling from net earnings to Core FFO, Prologis makes certain adjustments, including but not limited to real estate depreciation and amortization expense, gains (losses) recognized from real estate transactions and early extinguishment of debt, acquisition costs, impairment charges, deferred taxes and unrealized gains or losses on foreign currency or derivative activity. The difference between the company's Core FFO and net earnings guidance for 2015 relates predominantly to these items.WEBCAST & CONFERENCE CALL INFORMATIONPrologis will host a live webcast/conference call to discuss quarterly results, current market conditions and future outlook today, July 21, at 11 a.m. U.S. Eastern Time. Interested parties are encouraged to access the webcast by clicking on the Investor Events and Presentations section of the Prologis Investor Relations website (http://ir.prologis.com). Interested parties also can participate via conference call by dialing +1 877-256-7020 (toll-free from the U.S. and Canada) or +1 973-409-9692 (from all other countries) and entering conference code 48765490.A telephonic replay will be available July 21-Aug. 21 at +1 855-859-2056 (from the U.S. and Canada) or +1 404-537-3406 (from all other countries); please use conference code 48765490. The webcast replay will be posted when available in the "Events & Presentations" section of Investor Relations on the Prologis website. ABOUT PROLOGISPrologis, Inc. is the global leader in industrial real estate. As of June 30, 2015, Prologis owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 670 million square feet (62 million square meters) in 21 countries. The company leases modern distribution facilities to more than 5,200 customers, including third-party logistics providers, transportation companies, retailers and manufacturers.The statements in this document that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Prologis operates, management’s beliefs and assumptions made by management. Such statements involve uncertainties that could significantly impact Prologis’ financial results. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to rent and occupancy growth, development activity and changes in sales or contribution volume of properties, disposition activity, general conditions in the geographic areas where we operate, our debt and financial position, our ability to form new co-

3investment ventures and the availability of capital in existing or new co-investment ventures — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, international, regional and local economic climates, (ii) changes in financial markets, interest rates and foreign currency exchange rates, (iii) increased or unanticipated competition for our properties, (iv) risks associated with acquisitions, dispositions and development of properties, (v) maintenance of real estate investment trust (“REIT”) status and tax structuring, (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings, (vii) risks related to our investments in our co-investment ventures and funds, including our ability to establish new co-investment ventures and funds, (viii) risks of doing business internationally, including currency risks, (ix) environmental uncertainties, including risks of natural disasters, and (x) those additional factors discussed in reports filed with the Securities and Exchange Commission by Prologis under the heading “Risk Factors.” Prologis undertakes no duty to update any forward-looking statements appearing in this document.MEDIA CONTACTSTracy Ward, Tel: +1 415 733 9565, tward@prologis.com, San FranciscoNina Beizai, Tel: +1 415 733 9493, nbeizai@prologis.com, San Francisco

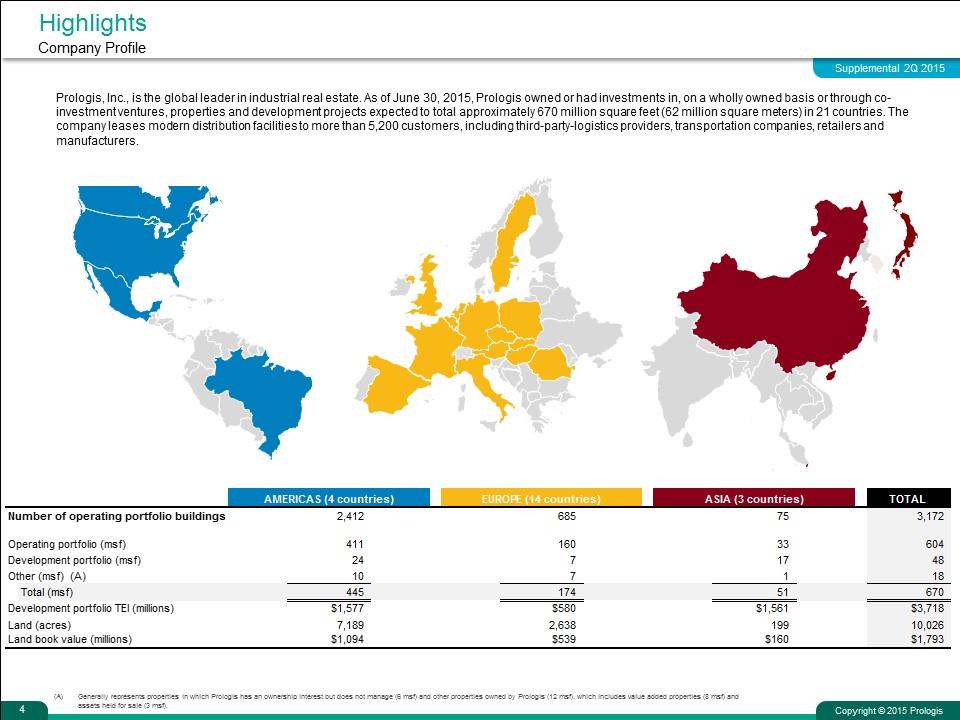

Prologis, Inc., is the global leader in industrial real estate. As of June 30, 2015, Prologis owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 670 million square feet (62 million square meters) in 21 countries. The company leases modern distribution facilities to more than 5,200 customers, including third-party-logistics providers, transportation companies, retailers and manufacturers. Highlights Company Profile Generally represents properties in which Prologis has an ownership interest but does not manage (6 msf) and other properties owned by Prologis (12 msf), which includes value added properties (8 msf) and assets held for sale (3 msf). 4 Country Count -- Taken from Operating Portfolio Americas Europe Asia USA Austria China Canada Belgium Japan Mexico Czech Republic Singapore Brazil France Germany Hungary Italy Netherlands Poland Romania Slovakia Spain Sweden UK AMERICAS (4 countries) EUROPE (14 countries) ASIA (3 countries) TOTAL Number of operating portfolio buildings 2,412 685 75 3,172 Operating portfolio (msf) 411 160 33 604 Development portfolio (msf) 24 7 17 48 Other (msf) (A) 10 7 1 18 Total (msf) 445 174 51 670 Development portfolio TEI (millions) $1,577 $580 $1,561 $3,718 Land (acres) 7,188.7129473969926 2,637.7197127860773 199 10,026.432660183069 Land book value (millions) $1,094 $539 $160 $1,793 Country Count -- Taken from Operating Portfolio Americas Europe Asia USA Austria China Canada Belgium Japan Mexico Czech Republic Singapore Brazil France Germany Hungary Italy Netherlands Poland Romania Slovakia Spain Sweden UK AMERICAS (4 countries) EUROPE (14 countries) ASIA (3 countries) TOTAL Number of operating portfolio buildings 2,412 685 75 3,172 Operating portfolio (msf) 411 160 33 604 Development portfolio (msf) 24 7 17 48 Other (msf) (A) 10 7 1 18 Total (msf) 445 174 51 670 Development portfolio TEI (millions) $1,577 $580 $1,561 $3,718 Land (acres) 7,188.7129473969926 2,637.7197127860773 199 10,026.432660183069 Land book value (millions) $1,094 $539 $160 $1,793

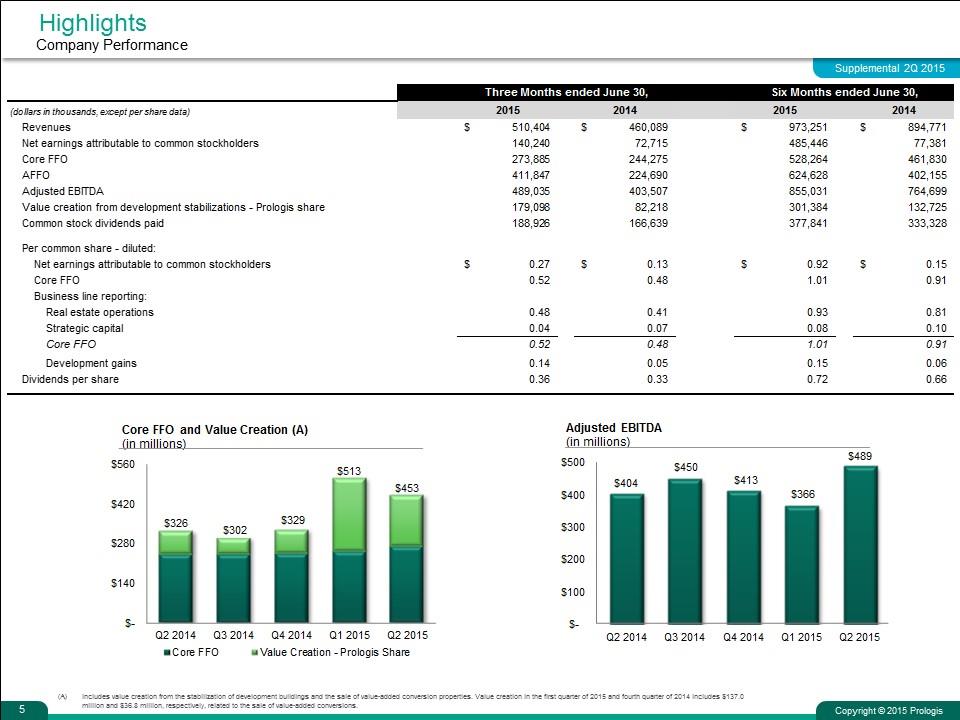

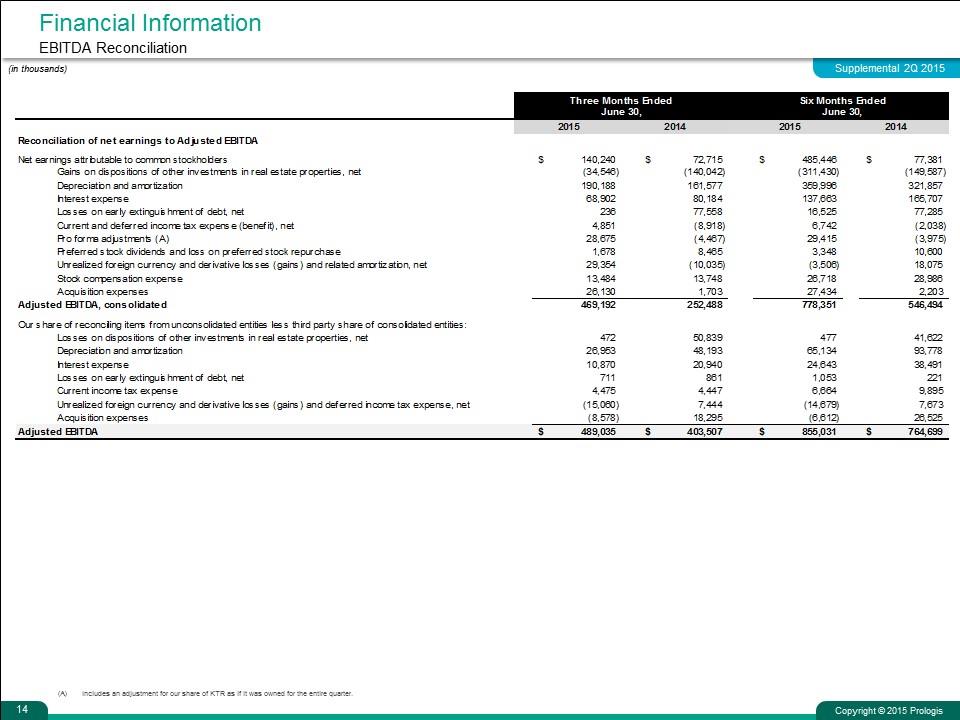

Highlights Company Performance Includes value creation from the stabilization of development buildings and the sale of value-added conversion properties. Value creation in the first quarter of 2015 and fourth quarter of 2014 includes $137.0 million and $36.8 million, respectively, related to the sale of value-added conversions. 5 PLD Three Months Ended Three Months Ended Core FFO Value Creation - Prologis Share $41,090 Q2 2012 $201.3 $41,182 Q3 2012 $232 $20 $252 $41,274 Q4 2012 $195.816 $13 $208.816 $41,364 Q1 2013 $188 $67 $255 $41,455 Q2 2013 $203 $15 $218 $41,547 Q3 2013 $206.89500000000001 $164 $370.89499999999998 $41,639 Q4 2013 $215.05500000000001 $125 $340.05500000000001 $41,729 Q1 2014 $217 $51 $268 $41,820 Q2 2014 $244 $82 $326 $41,912 Q3 2014 $244.89599999999999 $57 $301.89599999999996 $42,004 Q4 2014 $246.42130922999999 $83.138000000000005 $329.55930923 $42,094 Q1 2015 $254.37899999999999 $259 $513.37900000000002 $42,185 Q2 2015 $273.88499999999999 $179 $452.88499999999999 EBITDA $41,364 Q1 2013 $338 $41,455 Q2 2013 $336 $41,547 Q3 2013 $356 $41,639 Q4 2013 $367 $41,729 Q1 2014 $361 41820 Q2 2014 $404 41912 Q3 2014 $450 42004 Q4 2014 $413 42094 Q1 2015 $365.99599999999998 42185 Q2 2015 $489.03500000000003 Real Estate Operations $0.45 Strategic Captial $0.04 Development $0.02 Three Months ended June 30, Six Months ended June 30, (dollars in thousands, except per share data) 2015 2014 2015 2014 Revenues $,510,404 $,460,089 $,973,251 $,894,771 Net earnings attributable to common stockholders ,140,240 72,715 ,485,446 77,381 Core FFO ,273,885 ,244,275 ,528,264 ,461,830 AFFO ,411,847 ,224,690 ,624,628 ,402,155 Adjusted EBITDA ,489,035 ,403,507 ,855,031 ,764,699 Value creation from development stabilizations - Prologis share ,179,098 82,218 ,301,384 ,132,725 Common stock dividends paid ,188,926 ,166,639 ,377,841 ,333,328 Per common share - diluted: Net earnings attributable to common stockholders $0.27 $0.13 $0.92 $0.15 Core FFO 0.52 0.48 1.01 0.91 Business line reporting: Real estate operations 0.48 0.41 0.92999999999999994 0.81 Strategic capital 0.04 7.0000000000000007E-2 0.08 0.1 Core FFO 0.52 0.48 1.01 0.91 Development gains 0.14000000000000001 0.05 0.15 0.06 Dividends per share 0.36 0.33 0.72 0.66 q PLD Three Months Ended Three Months Ended Core FFO Value Creation - Prologis Share $41,090 Q2 2012 $201.3 $41,182 Q3 2012 $232 $20 $252 $41,274 Q4 2012 $195.816 $13 $208.816 $41,364 Q1 2013 $188 $67 $255 $41,455 Q2 2013 $203 $15 $218 $41,547 Q3 2013 $206.89500000000001 $164 $370.89499999999998 $41,639 Q4 2013 $215.05500000000001 $125 $340.05500000000001 $41,729 Q1 2014 $217 $51 $268 $41,820 Q2 2014 $244 $82 $326 $41,912 Q3 2014 $244.89599999999999 $57 $301.89599999999996 $42,004 Q4 2014 $246.42130922999999 $83.138000000000005 $329.55930923 $42,094 Q1 2015 $254.37899999999999 $259 $513.37900000000002 $42,185 Q2 2015 $273.88499999999999 $179 $452.88499999999999 EBITDA $41,364 Q1 2013 $338 $41,455 Q2 2013 $336 $41,547 Q3 2013 $356 $41,639 Q4 2013 $367 $41,729 Q1 2014 $361 41820 Q2 2014 $404 41912 Q3 2014 $450 42004 Q4 2014 $413 42094 Q1 2015 $365.99599999999998 42185 Q2 2015 $489.03500000000003 Real Estate Operations $0.45 Strategic Captial $0.04 Development $0.02 Three Months ended June 30, Six Months ended June 30, (dollars in thousands, except per share data) 2015 2014 2015 2014 Revenues $,510,404 $,460,089 $,973,251 $,894,771 Net earnings attributable to common stockholders ,140,240 72,715 ,485,446 77,381 Core FFO ,273,885 ,244,275 ,528,264 ,461,830 AFFO ,411,847 ,224,690 ,624,628 ,402,155 Adjusted EBITDA ,489,035 ,403,507 ,855,031 ,764,699 Value creation from development stabilizations - Prologis share ,179,098 82,218 ,301,384 ,132,725 Common stock dividends paid ,188,926 ,166,639 ,377,841 ,333,328 Per common share - diluted: Net earnings attributable to common stockholders $0.27 $0.13 $0.92 $0.15 Core FFO 0.52 0.48 1.01 0.91 Business line reporting: Real estate operations 0.48 0.41 0.92999999999999994 0.81 Strategic capital 0.04 7.0000000000000007E-2 0.08 0.1 Core FFO 0.52 0.48 1.01 0.91 Development gains 0.14000000000000001 0.05 0.15 0.06 Dividends per share 0.36 0.33 0.72 0.66 q

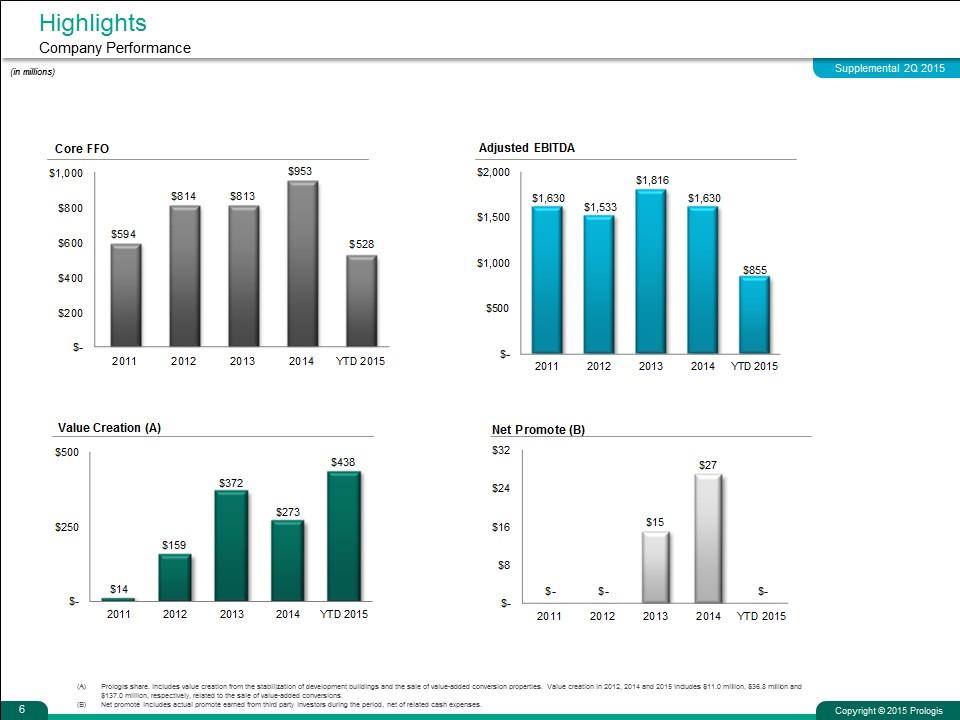

Highlights Company Performance Prologis share. Includes value creation from the stabilization of development buildings and the sale of value-added conversion properties. Value creation in 2012, 2014 and 2015 includes $11.0 million, $36.8 million and $137.0 million, respectively, related to the sale of value-added conversions. Net promote includes actual promote earned from third party investors during the period, net of related cash expenses. (in millions) 6

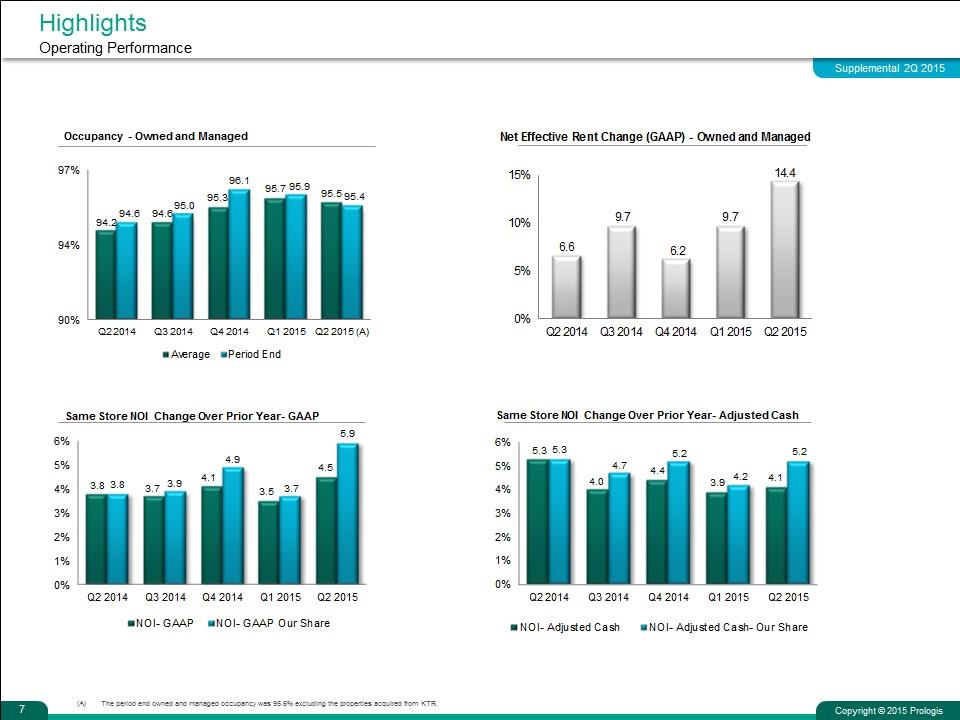

Highlights Operating Performance 7 The period end owned and managed occupancy was 95.6% excluding the properties acquired from KTR.

Highlights Guidance The difference between Core FFO and Net Earnings predominately relates to real estate depreciation, gains or losses on real estate transactions, acquisition expenses and early extinguishment of debt. See the Notes and Definitions for more information. (dollars in millions, except per share) 8 IGNORE THIS PART -- IT'S ONLY TO BUILD THE MOCK CHART ABOVE Q4 2013 Core FFO Annualized 1.7 0 SS NOI Growth 1.7 0.09 Development NOI 1.79 0.08 Contros / Dispos 1.78 0.09 Non Core 1.7 0 2014 Core FFO (Midpoint) 1.78 0 2015 Guidance Low High Net earnings (A) $1.1200000000000001 $1.1599999999999999 Core FFO (A) $2.1800000000000002 $2.2200000000000002 Operations Year-end occupancy 0.95499999999999996 0.96499999999999997 Same store NOI - GAAP increase - Prologis share 0.05 5.5E-2 Same store NOI - GAAP increase 0.04 4.4999999999999998E-2 Capital Deployment Development stabilizations (95% Prologis share) $1,700 $1,900 Development starts (80% Prologis share) $2,500 $2,700 Building acquisitions (55% Prologis share) $7,000 $7,500 Building and land dispositions (80% Prologis share) $2,600 $2,900 Building contributions (65% Prologis share) $1,300 $1,500 Strategic Capital Strategic capital income $200 $210 Other Assumptions General & administrative expenses $235 $245 Realized development gains $250 $300 Annualized second quarter 2015 dividend $1.44 Annualized third quarter 2015 dividend $1.6 Exchange Rates We have hedged the majority of our estimated 2015 Euro, Sterling and Yen Core FFO, effectively insulating 2015 results from any FX movements. For purposes of capital deployment and other metrics, we assumed effective rates for EUR, GBP and JPY of 1.05 ($/€), 1.50 (£/$) and 125 (¥/$), respectively. Impact of USD strengthening 10% 2015 Core FFO USD - Sterling (0¢) Euro (0¢) Yen (0¢) Other (0¢) Total <(1¢) IGNORE THIS PART -- IT'S ONLY TO BUILD THE MOCK CHART ABOVE Q4 2013 Core FFO Annualized 1.7 0 SS NOI Growth 1.7 0.09 Development NOI 1.79 0.08 Contros / Dispos 1.78 0.09 Non Core 1.7 0 2014 Core FFO (Midpoint) 1.78 0 2015 Guidance Low High Net earnings (A) $1.1200000000000001 $1.1599999999999999 Core FFO (A) $2.1800000000000002 $2.2200000000000002 Operations Year-end occupancy 0.95499999999999996 0.96499999999999997 Same store NOI - GAAP increase - Prologis share 0.05 5.5E-2 Same store NOI - GAAP increase 0.04 4.4999999999999998E-2 Capital Deployment Development stabilizations (95% Prologis share) $1,700 $1,900 Development starts (80% Prologis share) $2,500 $2,700 Building acquisitions (55% Prologis share) $7,000 $7,500 Building and land dispositions (80% Prologis share) $2,600 $2,900 Building contributions (65% Prologis share) $1,300 $1,500 Strategic Capital Strategic capital income $200 $210 Other Assumptions General & administrative expenses $235 $245 Realized development gains $250 $300 Annualized second quarter 2015 dividend $1.44 Annualized third quarter 2015 dividend $1.6 Exchange Rates We have hedged the majority of our estimated 2015 Euro, Sterling and Yen Core FFO, effectively insulating 2015 results from any FX movements. For purposes of capital deployment and other metrics, we assumed effective rates for EUR, GBP and JPY of 1.05 ($/€), 1.50 (£/$) and 125 (¥/$), respectively. Impact of USD strengthening 10% 2015 Core FFO USD - Sterling (0¢) Euro (0¢) Yen (0¢) Other (0¢) Total <(1¢)

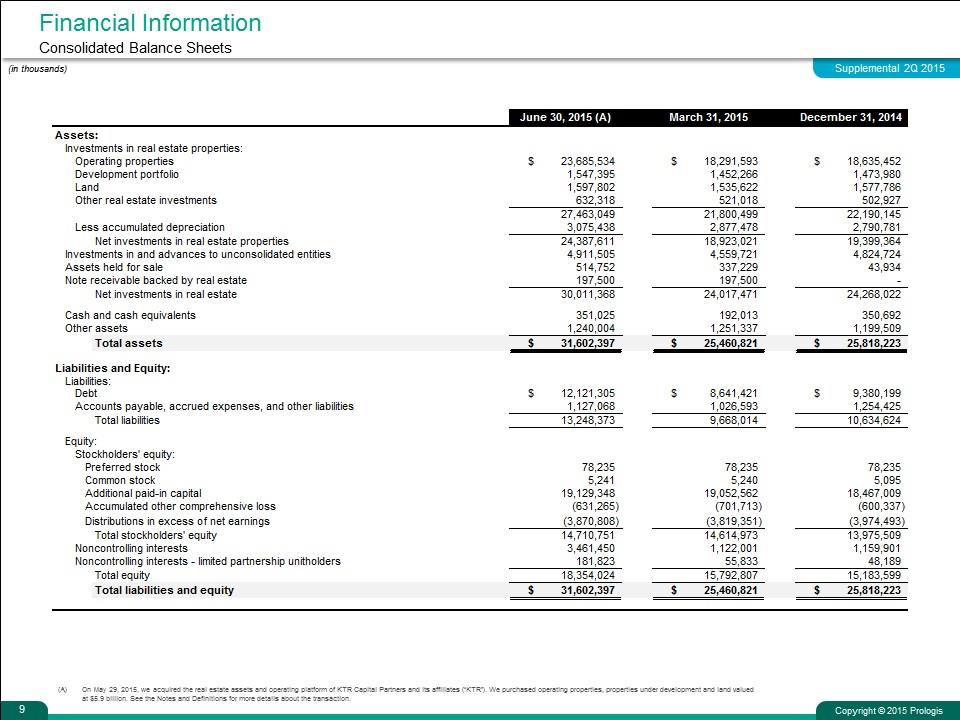

Financial Information Consolidated Balance Sheets (in thousands) 9 On May 29, 2015, we acquired the real estate assets and operating platform of KTR Capital Partners and its affiliates (“KTR”). We purchased operating properties, properties under development and land valued at $5.9 billion. See the Notes and Definitions for more details about the transaction. June 30, 2015 (A) $42,094 $42,004 Assets: Investments in real estate properties: Operating properties $23,685,534 $18,291,593 $18,635,452 Development portfolio 1,547,395 1,452,266 1,473,980 Land 1,597,802 1,535,622 1,577,786 Other real estate investments ,632,318 ,521,018 ,502,927 27,463,049 21,800,499 22,190,145 Less accumulated depreciation 3,075,438 2,877,478 2,790,781 Net investments in real estate properties 24,387,611 18,923,021 19,399,364 Investments in and advances to unconsolidated entities 4,911,505 4,559,721 4,824,724 Assets held for sale ,514,752 ,337,229 43,934 Note receivable backed by real estate ,197,500 ,197,500 0 Net investments in real estate 30,011,368 24,017,471 24,268,022 Cash and cash equivalents ,351,025 ,192,013 ,350,692 Accounts receivable 0 0 Other assets 1,240,004 1,251,337 1,199,509 Total assets $31,602,397 $25,460,821 $25,818,223 Liabilities and Equity: Liabilities: Debt $12,121,305 $8,641,421 $9,380,199 Accounts payable, accrued expenses, and other liabilities 1,127,068 1,026,593 1,254,425 Total liabilities 13,248,373 9,668,014 10,634,624 Equity: Stockholders' equity: Preferred stock 78,235 78,235 78,235 Common stock 5,241 5,240 5,095 Additional paid-in capital 19,129,348 19,052,562 18,467,009 Accumulated other comprehensive loss -,631,265 -,701,713 -,600,337 Distributions in excess of net earnings -3,870,808 -3,819,351 -3,974,493 Total stockholders' equity 14,710,751 14,614,973 13,975,509 Noncontrolling interests 3,461,450 1,122,001 1,159,901 Noncontrolling interests - limited partnership unitholders ,181,823 55,833 48,189 Total equity 18,354,024 15,792,807 15,183,599 Total liabilities and equity $31,602,397 $25,460,821 $25,818,223 June 30, 2015 (A) $42,094 $42,004 Assets: Investments in real estate properties: Operating properties $23,685,534 $18,291,593 $18,635,452 Development portfolio 1,547,395 1,452,266 1,473,980 Land 1,597,802 1,535,622 1,577,786 Other real estate investments ,632,318 ,521,018 ,502,927 27,463,049 21,800,499 22,190,145 Less accumulated depreciation 3,075,438 2,877,478 2,790,781 Net investments in real estate properties 24,387,611 18,923,021 19,399,364 Investments in and advances to unconsolidated entities 4,911,505 4,559,721 4,824,724 Assets held for sale ,514,752 ,337,229 43,934 Note receivable backed by real estate ,197,500 ,197,500 0 Net investments in real estate 30,011,368 24,017,471 24,268,022 Cash and cash equivalents ,351,025 ,192,013 ,350,692 Accounts receivable 0 0 Other assets 1,240,004 1,251,337 1,199,509 Total assets $31,602,397 $25,460,821 $25,818,223 Liabilities and Equity: Liabilities: Debt $12,121,305 $8,641,421 $9,380,199 Accounts payable, accrued expenses, and other liabilities 1,127,068 1,026,593 1,254,425 Total liabilities 13,248,373 9,668,014 10,634,624 Equity: Stockholders' equity: Preferred stock 78,235 78,235 78,235 Common stock 5,241 5,240 5,095 Additional paid-in capital 19,129,348 19,052,562 18,467,009 Accumulated other comprehensive loss -,631,265 -,701,713 -,600,337 Distributions in excess of net earnings -3,870,808 -3,819,351 -3,974,493 Total stockholders' equity 14,710,751 14,614,973 13,975,509 Noncontrolling interests 3,461,450 1,122,001 1,159,901 Noncontrolling interests - limited partnership unitholders ,181,823 55,833 48,189 Total equity 18,354,024 15,792,807 15,183,599 Total liabilities and equity $31,602,397 $25,460,821 $25,818,223

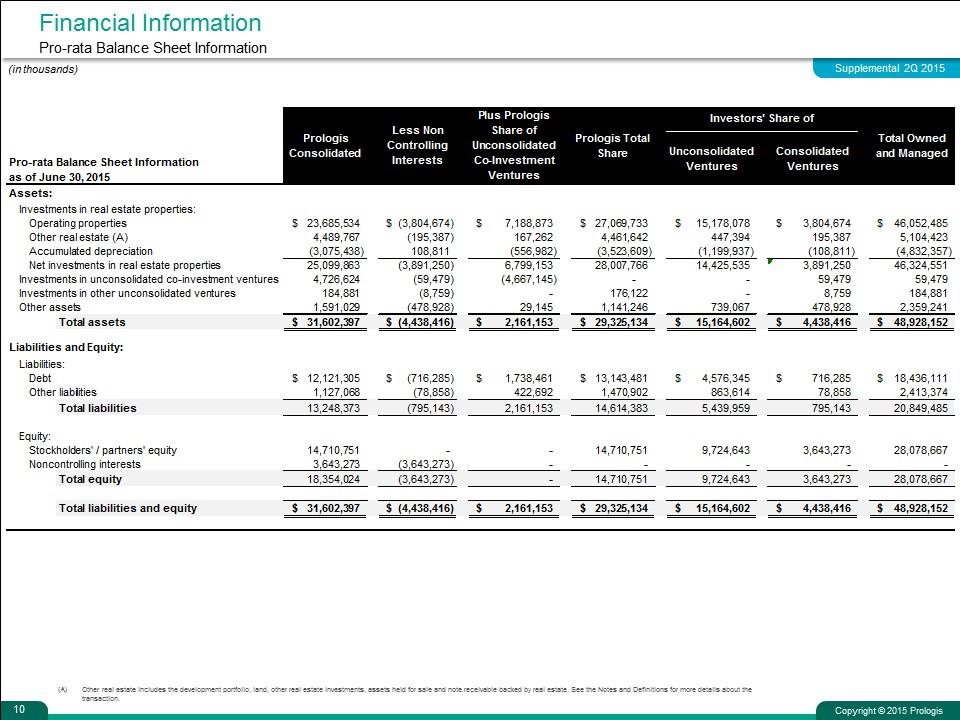

Financial Information Pro-rata Balance Sheet Information (in thousands) 10 Other real estate includes the development portfolio, land, other real estate investments, assets held for sale and note receivable backed by real estate. See the Notes and Definitions for more details about the transaction. Prologis Consolidated Less Non Controlling Interests Plus Prologis Share of UnconsolidatedCo-Investment Ventures Prologis Total Share Investors' Share of Total Owned and Managed Pro-rata Balance Sheet Information as of June 30, 2015 Unconsolidated Ventures Consolidated Ventures Assets: Investments in real estate properties: Operating properties $23,685,534 $-3,804,674 $7,188,873 $27,069,733 $15,178,078 $3,804,674 $46,052,485 Other real estate (A) 4,489,767 -,195,387 ,167,262 4,461,642 ,447,394 ,195,387 5,104,423 Accumulated depreciation -3,075,438 ,108,811 -,556,982 -3,523,609 -1,199,937 -,108,811 -4,832,357 Net investments in real estate properties 25,099,863 -3,891,250 6,799,153 28,007,766 14,425,535 3,891,250 46,324,551 Investments in and advances to unconsolidated investees Investments in unconsolidated co-investment ventures 4,726,624 ,-59,479 -4,667,145 0 0 59,479 59,479 Investments in other unconsolidated ventures ,184,881 -8,759 0 ,176,122 0 8,759 ,184,881 Other assets 1,591,029 -,478,928 29,145 1,141,246 ,739,067 ,478,928 2,359,241 Total assets $31,602,397 $-4,438,416 $2,161,153 $29,325,134 $15,164,602 $4,438,416 $48,928,152 Liabilities and Equity: Liabilities: Debt Debt $12,121,305 $-,716,285 $1,738,461 $13,143,481 $4,576,345 $,716,285 $18,436,111 Accounts payable, accrued expenses, and other liabilities Other liabilities 1,127,068 ,-78,858 ,422,692 1,470,902 ,863,614 78,858 2,413,374 Total liabilities 13,248,373 -,795,143 2,161,153 14,614,383 5,439,959 ,795,143 20,849,485 Equity: Stockholders' / partners' equity 14,710,751 0 0 14,710,751 9,724,643 3,643,273 28,078,667 Noncontrolling interests 3,643,273 -3,643,273 0 0 0 0 0 Total equity 18,354,024 -3,643,273 0 14,710,751 9,724,643 3,643,273 28,078,667 Total liabilities and equity $31,602,397 $-4,438,416 $2,161,153 $29,325,134 $15,164,602 $4,438,416 $48,928,152 Prologis Consolidated Less Non Controlling Interests Plus Prologis Share of UnconsolidatedCo-Investment Ventures Prologis Total Share Investors' Share of Total Owned and Managed Pro-rata Balance Sheet Information as of June 30, 2015 Unconsolidated Ventures Consolidated Ventures Assets: Investments in real estate properties: Operating properties $23,685,534 $-3,804,674 $7,188,873 $27,069,733 $15,178,078 $3,804,674 $46,052,485 Other real estate (A) 4,489,767 -,195,387 ,167,262 4,461,642 ,447,394 ,195,387 5,104,423 Accumulated depreciation -3,075,438 ,108,811 -,556,982 -3,523,609 -1,199,937 -,108,811 -4,832,357 Net investments in real estate properties 25,099,863 -3,891,250 6,799,153 28,007,766 14,425,535 3,891,250 46,324,551 Investments in and advances to unconsolidated investees Investments in unconsolidated co-investment ventures 4,726,624 ,-59,479 -4,667,145 0 0 59,479 59,479 Investments in other unconsolidated ventures ,184,881 -8,759 0 ,176,122 0 8,759 ,184,881 Other assets 1,591,029 -,478,928 29,145 1,141,246 ,739,067 ,478,928 2,359,241 Total assets $31,602,397 $-4,438,416 $2,161,153 $29,325,134 $15,164,602 $4,438,416 $48,928,152 Liabilities and Equity: Liabilities: Debt Debt $12,121,305 $-,716,285 $1,738,461 $13,143,481 $4,576,345 $,716,285 $18,436,111 Accounts payable, accrued expenses, and other liabilities Other liabilities 1,127,068 ,-78,858 ,422,692 1,470,902 ,863,614 78,858 2,413,374 Total liabilities 13,248,373 -,795,143 2,161,153 14,614,383 5,439,959 ,795,143 20,849,485 Equity: Stockholders' / partners' equity 14,710,751 0 0 14,710,751 9,724,643 3,643,273 28,078,667 Noncontrolling interests 3,643,273 -3,643,273 0 0 0 0 0 Total equity 18,354,024 -3,643,273 0 14,710,751 9,724,643 3,643,273 28,078,667 Total liabilities and equity $31,602,397 $-4,438,416 $2,161,153 $29,325,134 $15,164,602 $4,438,416 $48,928,152

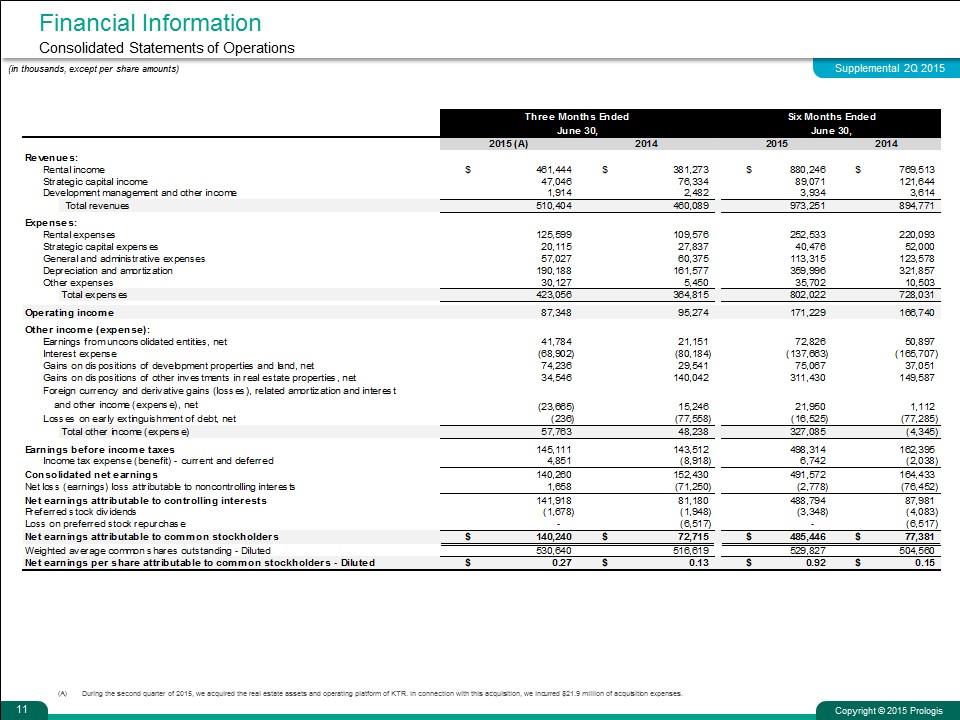

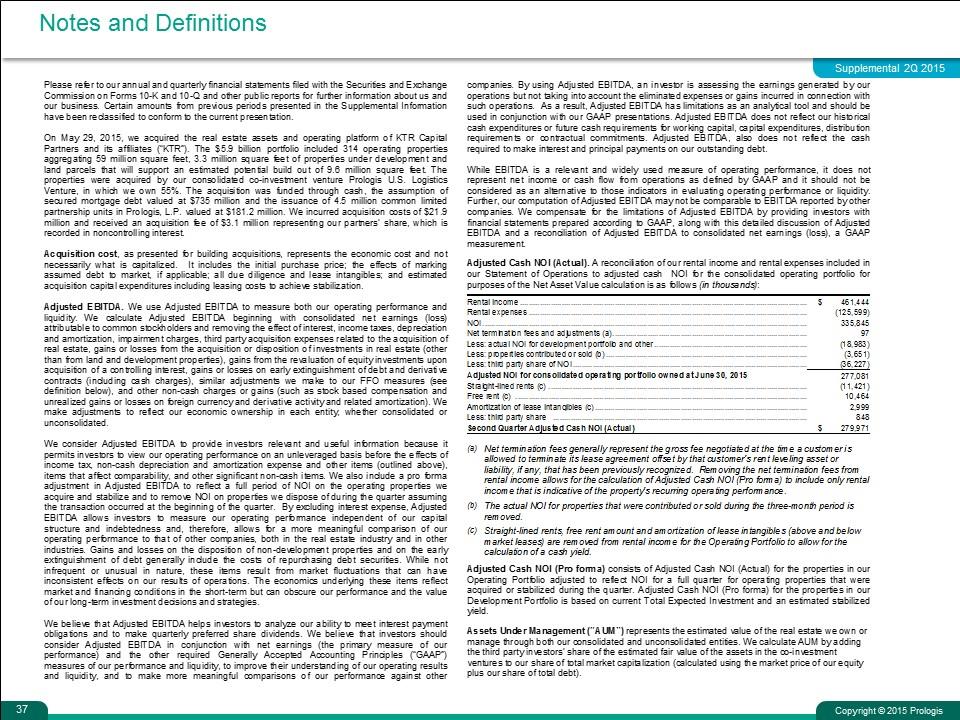

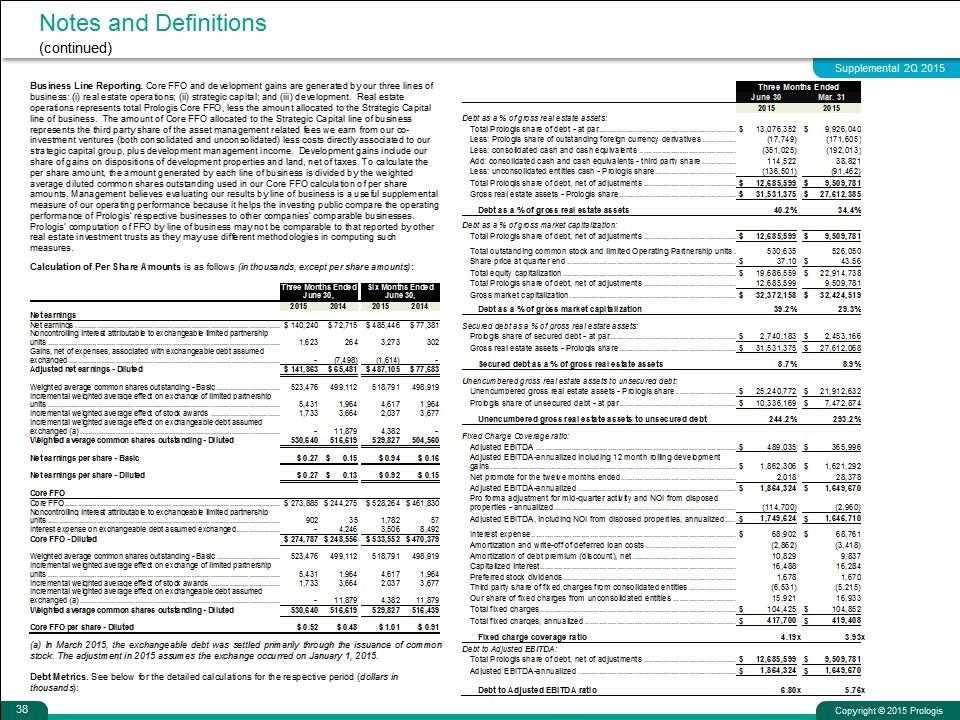

Financial Information Consolidated Statements of Operations (in thousands, except per share amounts) 11 During the second quarter of 2015, we acquired the real estate assets and operating platform of KTR. In connection with this acquisition, we incurred $21.9 million of acquisition expenses. Net Income Roll CQ PQ Q1 ,-46,616 ,-91,129 Q2 -151471 -23150 Q3 54906 -15052 Q4 140240 #REF! -2,941 #REF! CY PY YTD 72715 #REF! 75656 #REF! ##R I/Sroll #REF! Net income roll by quarter Three Months Ended Six Months Ended June 30, June 30, 2015 (A) 2014 2015 2014 Revenues: Rental income $,461,444 $,381,273 $,880,246 $,769,513 Strategic capital income 47,046 76,334 89,071 ,121,644 Development management and other income 1,914 2,482 3,934 3,614 Total revenues ,510,404 ,460,089 ,973,251 ,894,771 Expenses: Rental expenses ,125,599 ,109,576 ,252,533 ,220,093 Strategic capital expenses 20,115 27,837 40,476 52,000 General and administrative expenses 57,027 60,375 ,113,315 ,123,578 Depreciation and amortization ,190,188 ,161,577 ,359,996 ,321,857 Other expenses 30,127 5,450 35,702 10,503 Total expenses ,423,056 ,364,815 ,802,022 ,728,031 Operating income 87,348 95,274 ,171,229 ,166,740 Other income (expense): Earnings from unconsolidated entities, net 41,784 21,151 72,826 50,897 Interest expense ,-68,902 ,-80,184 -,137,663 -,165,707 Gains on dispositions of development properties and land, net 74,236 29,541 75,067 37,051 Gains on dispositions of other investments in real estate properties, net 34,546 ,140,042 ,311,430 ,149,587 Foreign currency and derivative gains (losses), related amortization and interest and other income (expense), net ,-23,665 15,246 21,950 1,112 Losses on early extinguishment of debt, net -,236 ,-77,558 ,-16,525 ,-77,285 Total other income (expense) 57,763 48,238 ,327,085 -4,345 Earnings before income taxes ,145,111 ,143,512 ,498,314 ,162,395 Income tax expense (benefit) - current and deferred 4,851 -8,918 6,742 -2,038 Earnings from continuing operations ,149,962 ,134,594 ,505,056 ,160,357 Discontinued operations: Income attributable to disposed properties and assets held for sale 0 0 0 0 Net gains on dispositions, including taxes 0 0 0 0 Total discontinued operations 0 0 0 0 Consolidated net earnings ,140,260 ,152,430 ,491,572 ,164,433 Net loss (earnings) loss attributable to noncontrolling interests 1,658 ,-71,250 -2,778 ,-76,452 Net earnings attributable to controlling interests ,141,918 81,180 ,488,794 87,981 Preferred stock dividends -1,678 -1,948 -3,348 -4,083 Loss on preferred stock repurchase 0 -6,517 0 -6,517 Net earnings attributable to common stockholders $,140,240 $72,715 $,485,446 $77,381 Weighted average common shares outstanding - Diluted ,530,640 ,516,619 ,529,827 ,504,560 Net earnings per share attributable to common stockholders - Diluted $0.27 $0.13 $0.92 $0.15 Net Income Roll CQ PQ Q1 ,-46,616 ,-91,129 Q2 -151471 -23150 Q3 54906 -15052 Q4 140240 #REF! -2,941 #REF! CY PY YTD 72715 #REF! 75656 #REF! ##R I/Sroll #REF! Net income roll by quarter Three Months Ended Six Months Ended June 30, June 30, 2015 (A) 2014 2015 2014 Revenues: Rental income $,461,444 $,381,273 $,880,246 $,769,513 Strategic capital income 47,046 76,334 89,071 ,121,644 Development management and other income 1,914 2,482 3,934 3,614 Total revenues ,510,404 ,460,089 ,973,251 ,894,771 Expenses: Rental expenses ,125,599 ,109,576 ,252,533 ,220,093 Strategic capital expenses 20,115 27,837 40,476 52,000 General and administrative expenses 57,027 60,375 ,113,315 ,123,578 Depreciation and amortization ,190,188 ,161,577 ,359,996 ,321,857 Other expenses 30,127 5,450 35,702 10,503 Total expenses ,423,056 ,364,815 ,802,022 ,728,031 Operating income 87,348 95,274 ,171,229 ,166,740 Other income (expense): Earnings from unconsolidated entities, net 41,784 21,151 72,826 50,897 Interest expense ,-68,902 ,-80,184 -,137,663 -,165,707 Gains on dispositions of development properties and land, net 74,236 29,541 75,067 37,051 Gains on dispositions of other investments in real estate properties, net 34,546 ,140,042 ,311,430 ,149,587 Foreign currency and derivative gains (losses), related amortization and interest and other income (expense), net ,-23,665 15,246 21,950 1,112 Losses on early extinguishment of debt, net -,236 ,-77,558 ,-16,525 ,-77,285 Total other income (expense) 57,763 48,238 ,327,085 -4,345 Earnings before income taxes ,145,111 ,143,512 ,498,314 ,162,395 Income tax expense (benefit) - current and deferred 4,851 -8,918 6,742 -2,038 Earnings from continuing operations ,149,962 ,134,594 ,505,056 ,160,357 Discontinued operations: Income attributable to disposed properties and assets held for sale 0 0 0 0 Net gains on dispositions, including taxes 0 0 0 0 Total discontinued operations 0 0 0 0 Consolidated net earnings ,140,260 ,152,430 ,491,572 ,164,433 Net loss (earnings) loss attributable to noncontrolling interests 1,658 ,-71,250 -2,778 ,-76,452 Net earnings attributable to controlling interests ,141,918 81,180 ,488,794 87,981 Preferred stock dividends -1,678 -1,948 -3,348 -4,083 Loss on preferred stock repurchase 0 -6,517 0 -6,517 Net earnings attributable to common stockholders $,140,240 $72,715 $,485,446 $77,381 Weighted average common shares outstanding - Diluted ,530,640 ,516,619 ,529,827 ,504,560 Net earnings per share attributable to common stockholders - Diluted $0.27 $0.13 $0.92 $0.15

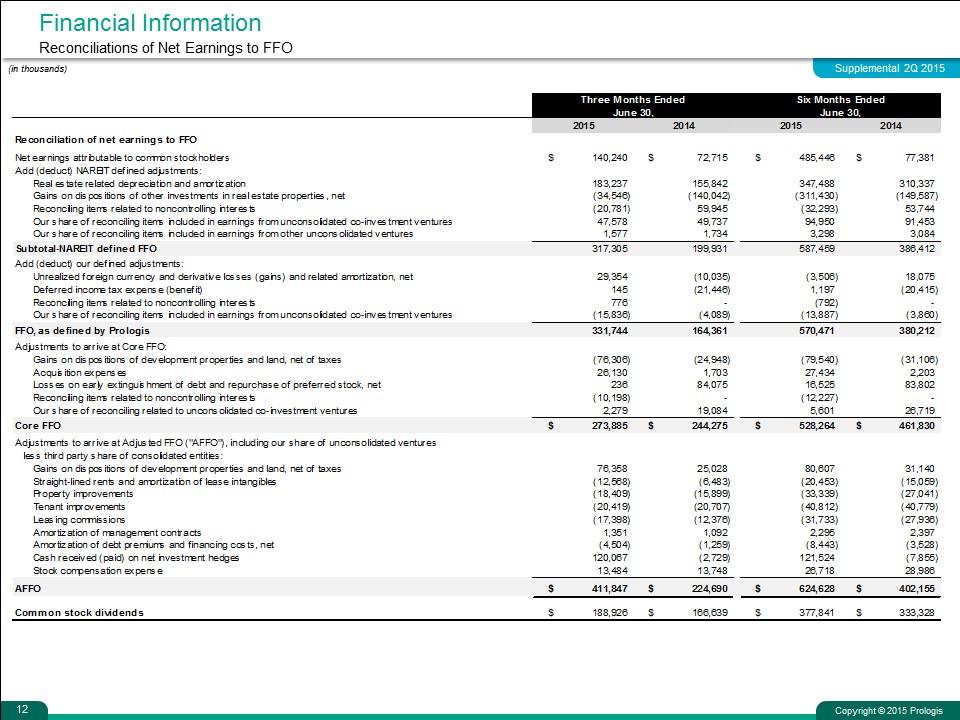

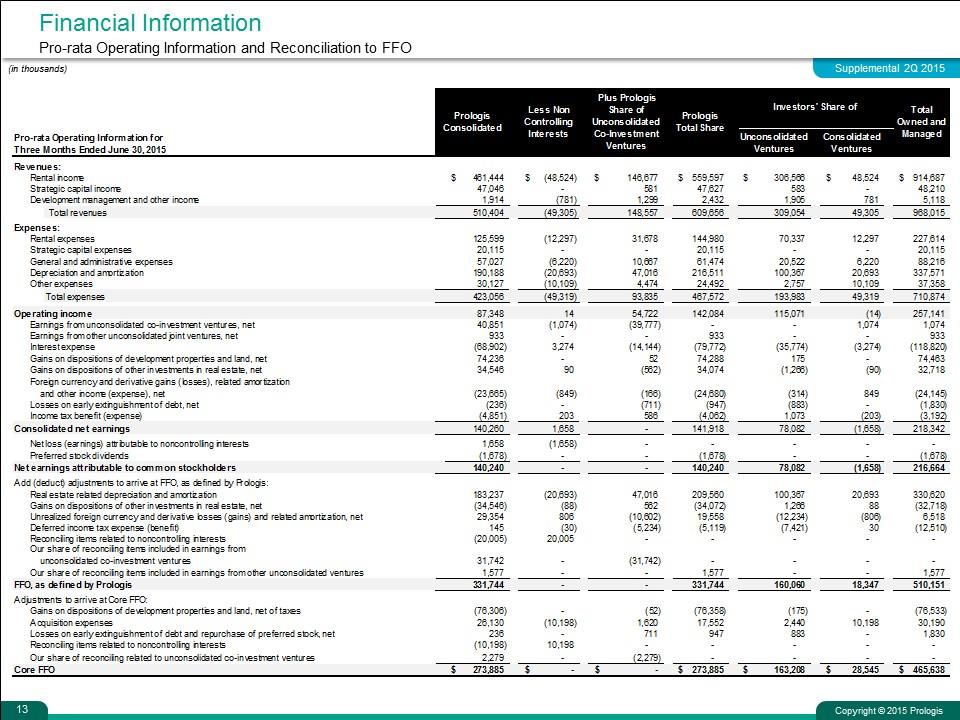

Financial Information Reconciliations of Net Earnings to FFO (in thousands) 12 Three Months Ended Six Months Ended June 30, June 30, 2015 2014 2015 2014 Reconciliation of net earnings to FFO Net earnings attributable to common stockholders $,140,240 $72,715 $,485,446 $77,381 Add (deduct) NAREIT defined adjustments: Real estate related depreciation and amortization ,183,237 ,155,842 ,347,488 ,310,337 Gains on dispositions of other investments in real estate properties, net ,-34,546 -,140,042 -,311,430 -,149,587 Reconciling items related to noncontrolling interests ,-20,781 59,945 ,-32,293 53,744 Our share of reconciling items included in earnings from unconsolidated co-investment ventures 47,578 49,737 94,950 91,453 Our share of reconciling items included in earnings from other unconsolidated ventures 1,577 1,734 3,298 3,084 Subtotal-NAREIT defined FFO ,317,305 ,199,931 ,587,459 ,386,412 Add (deduct) our defined adjustments: Unrealized foreign currency and derivative losses (gains) and related amortization, net 29,354 ,-10,035 -3,506 18,075 Deferred income tax expense (benefit) 145 ,-21,446 1,197 ,-20,415 Reconciling items related to noncontrolling interests 776 0 -,792 0 Our share of reconciling items included in earnings from unconsolidated co-investment ventures ,-15,836 -4,089 ,-13,887 -3,860 Our share of reconciling items included in earnings from other unconsolidated joint ventures #REF! #REF! #REF! #REF! FFO, as defined by Prologis ,331,744 ,164,361 ,570,471 ,380,212 Adjustments to arrive at Core FFO: Gains on dispositions of development properties and land, net of taxes ,-76,306 ,-24,948 ,-79,540 ,-31,106 Acquisition expenses 26,130 1,703 27,434 2,203 Losses on early extinguishment of debt and repurchase of preferred stock, net 236 84,075 16,525 83,802 Reconciling items related to noncontrolling interests ,-10,198 0 ,-12,227 0 Our share of reconciling related to unconsolidated co-investment ventures 2,279 19,084 5,601 26,719 Core FFO $,273,885 $,244,275 $,528,264 $,461,830 Adjustments to arrive at Adjusted FFO ("AFFO"), including our share of unconsolidated ventures less third party share of consolidated entities: Gains on dispositions of development properties and land, net of taxes 76,358 25,028 80,607 31,140 Straight-lined rents and amortization of lease intangibles ,-12,568 -6,483 ,-20,453 ,-15,059 Property improvements ,-18,409 ,-15,899 ,-33,339 ,-27,041 Tenant improvements ,-20,419 ,-20,707 ,-40,812 ,-40,779 Leasing commissions ,-17,398 ,-12,376 ,-31,733 ,-27,936 Amortization of management contracts 1,351 1,092 2,295 2,397 Amortization of debt premiums and financing costs, net -4,504 -1,259 -8,443 -3,528 Cash received (paid) on net investment hedges ,120,067 -2,729 ,121,524 -7,855 Stock compensation expense 13,484 13,748 26,718 28,986 AFFO $,411,847 $,224,690 $,624,628 $,402,155 Common stock dividends $,188,926 $,166,639 $,377,841 $,333,328 Three Months Ended Six Months Ended June 30, June 30, 2015 2014 2015 2014 Reconciliation of net earnings to FFO Net earnings attributable to common stockholders $,140,240 $72,715 $,485,446 $77,381 Add (deduct) NAREIT defined adjustments: Real estate related depreciation and amortization ,183,237 ,155,842 ,347,488 ,310,337 Gains on dispositions of other investments in real estate properties, net ,-34,546 -,140,042 -,311,430 -,149,587 Reconciling items related to noncontrolling interests ,-20,781 59,945 ,-32,293 53,744 Our share of reconciling items included in earnings from unconsolidated co-investment ventures 47,578 49,737 94,950 91,453 Our share of reconciling items included in earnings from other unconsolidated ventures 1,577 1,734 3,298 3,084 Subtotal-NAREIT defined FFO ,317,305 ,199,931 ,587,459 ,386,412 Add (deduct) our defined adjustments: Unrealized foreign currency and derivative losses (gains) and related amortization, net 29,354 ,-10,035 -3,506 18,075 Deferred income tax expense (benefit) 145 ,-21,446 1,197 ,-20,415 Reconciling items related to noncontrolling interests 776 0 -,792 0 Our share of reconciling items included in earnings from unconsolidated co-investment ventures ,-15,836 -4,089 ,-13,887 -3,860 Our share of reconciling items included in earnings from other unconsolidated joint ventures #REF! #REF! #REF! #REF! FFO, as defined by Prologis ,331,744 ,164,361 ,570,471 ,380,212 Adjustments to arrive at Core FFO: Gains on dispositions of development properties and land, net of taxes ,-76,306 ,-24,948 ,-79,540 ,-31,106 Acquisition expenses 26,130 1,703 27,434 2,203 Losses on early extinguishment of debt and repurchase of preferred stock, net 236 84,075 16,525 83,802 Reconciling items related to noncontrolling interests ,-10,198 0 ,-12,227 0 Our share of reconciling related to unconsolidated co-investment ventures 2,279 19,084 5,601 26,719 Core FFO $,273,885 $,244,275 $,528,264 $,461,830 Adjustments to arrive at Adjusted FFO ("AFFO"), including our share of unconsolidated ventures less third party share of consolidated entities: Gains on dispositions of development properties and land, net of taxes 76,358 25,028 80,607 31,140 Straight-lined rents and amortization of lease intangibles ,-12,568 -6,483 ,-20,453 ,-15,059 Property improvements ,-18,409 ,-15,899 ,-33,339 ,-27,041 Tenant improvements ,-20,419 ,-20,707 ,-40,812 ,-40,779 Leasing commissions ,-17,398 ,-12,376 ,-31,733 ,-27,936 Amortization of management contracts 1,351 1,092 2,295 2,397 Amortization of debt premiums and financing costs, net -4,504 -1,259 -8,443 -3,528 Cash received (paid) on net investment hedges ,120,067 -2,729 ,121,524 -7,855 Stock compensation expense 13,484 13,748 26,718 28,986 AFFO $,411,847 $,224,690 $,624,628 $,402,155 Common stock dividends $,188,926 $,166,639 $,377,841 $,333,328