Attached files

| file | filename |

|---|---|

| 8-K - GLPI 7.21.15 8-K - Gaming & Leisure Properties, Inc. | glpi721158-k.htm |

| EX-99.1 - GLPI 7.21.15 EXHIBIT 99.1 - Gaming & Leisure Properties, Inc. | glpi72115exhibit991.htm |

| EX-99.3 - GLPI 7.21.15 EXHIBIT 99.3 - Gaming & Leisure Properties, Inc. | glpi72115exhibit993.htm |

Gaming & Leisure Properties Inc. Acquisition of Pinnacle Entertainment’s Real Estate Assets Exhibit 99.2

Forward-looking statements in this document are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of Gaming and Leisure Properties, Inc. (“GLPI”) (NASDAQ: GLPI) and its subsidiaries (“GLPI”) and Pinnacle Entertainment, Inc. and its subsidiaries (“Pinnacle”) (NYSE: PNK) to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward- looking statements include information concerning GLPI’s and Pinnacle’s business strategy, plans, and goals and objectives. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could’ are generally forward-looking in nature and not historical facts. You should understand that the following important factors could affect future results and could cause actual results to differ materially from those expressed in such forward-looking statements: the ultimate outcome and results of integrating the assets to be acquired by GLPI in the proposed transaction with Pinnacle; the effects of a transaction between GLPI and Pinnacle on each party, including the post- transaction GLPI’s and Pinnacle’s financial condition, operating results, strategy and plans; and additional factors discussed in the sections entitled “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in GLPI’s and Pinnacle’s respective most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed with the Securities and Exchange Commission. Other unknown or unpredictable factors may also cause actual results to differ materially from those projected by the forward-looking statements. Most of these factors are difficult to anticipate and are generally beyond the control of GLPI and Pinnacle. Neither GLPI nor Pinnacle undertakes any obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required to do so by law. Forward Looking Statements 2 Gaming & Leisure Properties, Inc.

Additional Information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In connection with the proposed transaction, GLPI intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of GLPI and Pinnacle that also constitutes a prospectus of GLPI. GLPI and Pinnacle also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by GLPI and Pinnacle with the SEC at the SEC’s website at www.sec.gov. Certain Information Regarding Participants GLPI and Pinnacle and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Investors may obtain information regarding the names, affiliations and interests of GLPI’s directors and executive officers in GLPI’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 27, 2015, and its proxy statement for its 2015 Annual Meeting, which was filed with the SEC on April 30, 2015. Investors may obtain information regarding the names, affiliations and interests of Pinnacle’s directors and executive officers in Pinnacle’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on March 2, 2015, and its proxy statement for its 2015 Annual Meeting, which was filed with the SEC on April 10, 2015. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction if and when they become available. Investors should read the joint proxy statement/prospectus carefully and in its entirety when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents at the SEC’s website at www.sec.gov. Important Information for Investors and Security Holders 3 Gaming & Leisure Properties, Inc.

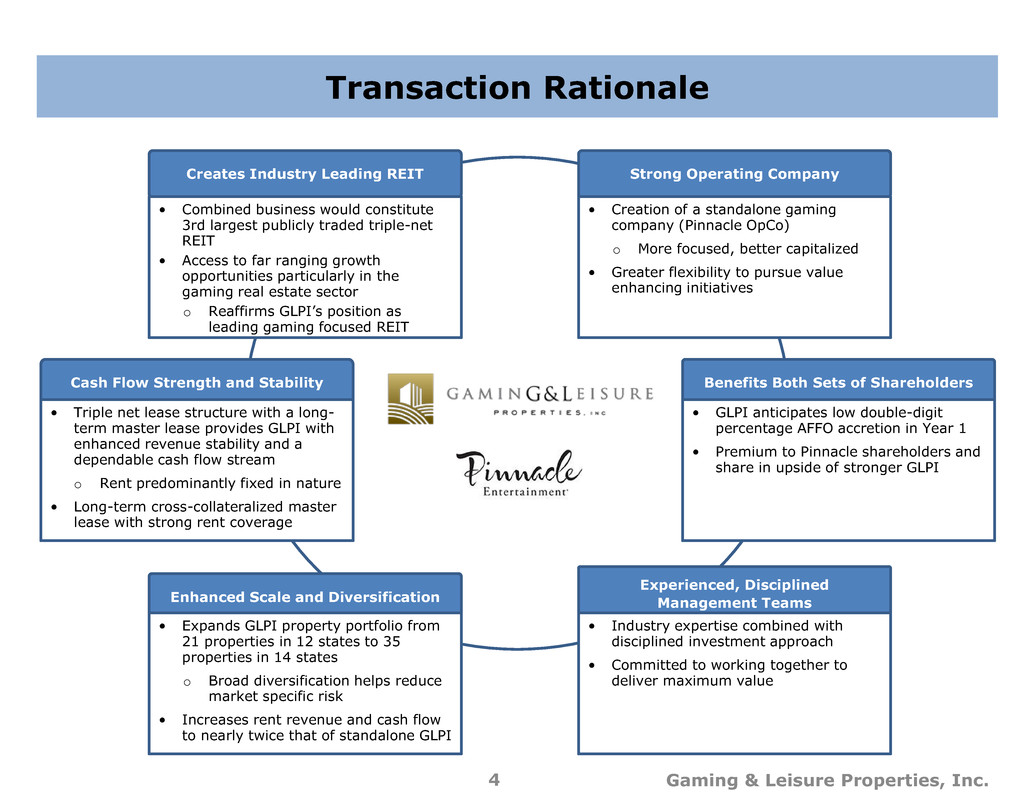

Transaction Rationale 4 Gaming & Leisure Properties, Inc. Benefits Both Sets of Shareholders • GLPI anticipates low double-digit percentage AFFO accretion in Year 1 • Premium to Pinnacle shareholders and share in upside of stronger GLPI Cash Flow Strength and Stability • Triple net lease structure with a long- term master lease provides GLPI with enhanced revenue stability and a dependable cash flow stream o Rent predominantly fixed in nature • Long-term cross-collateralized master lease with strong rent coverage Creates Industry Leading REIT • Combined business would constitute 3rd largest publicly traded triple-net REIT • Access to far ranging growth opportunities particularly in the gaming real estate sector o Reaffirms GLPI’s position as leading gaming focused REIT Enhanced Scale and Diversification • Expands GLPI property portfolio from 21 properties in 12 states to 35 properties in 14 states o Broad diversification helps reduce market specific risk • Increases rent revenue and cash flow to nearly twice that of standalone GLPI Experienced, Disciplined Management Teams • Industry expertise combined with disciplined investment approach • Committed to working together to deliver maximum value Strong Operating Company • Creation of a standalone gaming company (Pinnacle OpCo) o More focused, better capitalized • Greater flexibility to pursue value enhancing initiatives

Transaction Summary 5 Gaming & Leisure Properties, Inc.

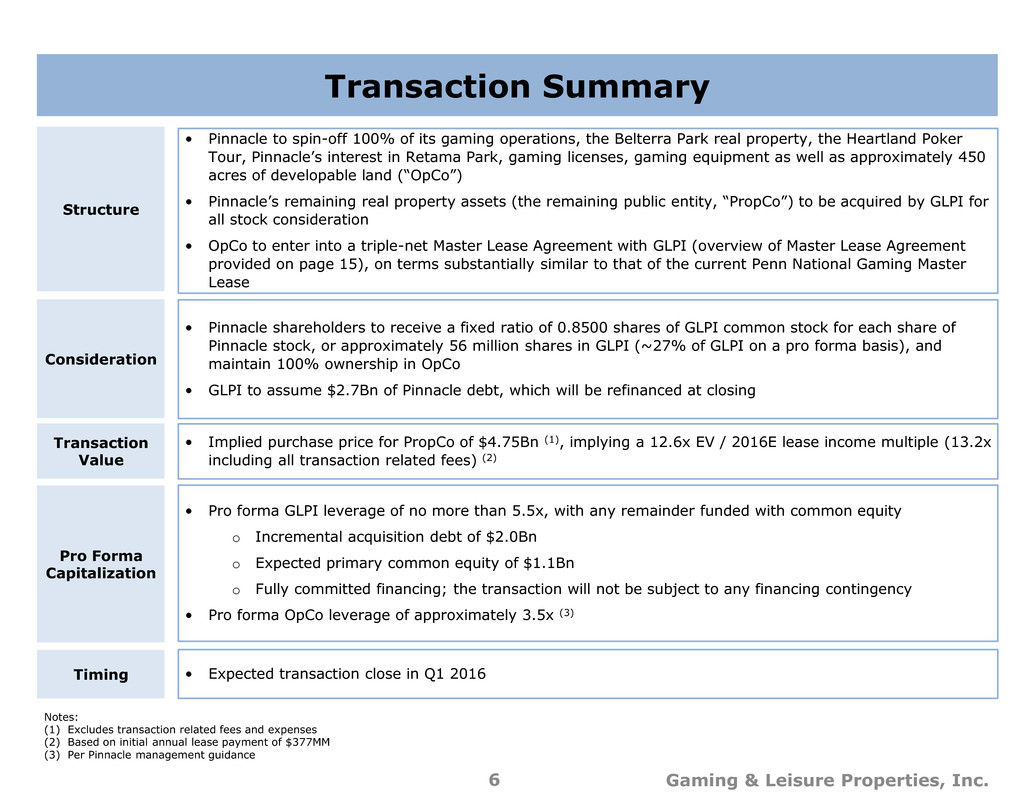

Transaction Summary 6 Structure • Pinnacle to spin-off 100% of its gaming operations, the Belterra Park real property, the Heartland Poker Tour, Pinnacle’s interest in Retama Park, gaming licenses, gaming equipment as well as approximately 450 acres of developable land (“OpCo”) • Pinnacle’s remaining real property assets (the remaining public entity, “PropCo”) to be acquired by GLPI for all stock consideration • OpCo to enter into a triple-net Master Lease Agreement with GLPI (overview of Master Lease Agreement provided on page 15), on terms substantially similar to that of the current Penn National Gaming Master Lease • Implied purchase price for PropCo of $4.75Bn (1), implying a 12.6x EV / 2016E lease income multiple (13.2x including all transaction related fees) (2) Transaction Value Gaming & Leisure Properties, Inc. • Pinnacle shareholders to receive a fixed ratio of 0.8500 shares of GLPI common stock for each share of Pinnacle stock, or approximately 56 million shares in GLPI (~27% of GLPI on a pro forma basis), and maintain 100% ownership in OpCo • GLPI to assume $2.7Bn of Pinnacle debt, which will be refinanced at closing Consideration • Expected transaction close in Q1 2016 Timing • Pro forma GLPI leverage of no more than 5.5x, with any remainder funded with common equity o Incremental acquisition debt of $2.0Bn o Expected primary common equity of $1.1Bn o Fully committed financing; the transaction will not be subject to any financing contingency • Pro forma OpCo leverage of approximately 3.5x (3) Pro Forma Capitalization Notes: (1) Excludes transaction related fees and expenses (2) Based on initial annual lease payment of $377MM (3) Per Pinnacle management guidance

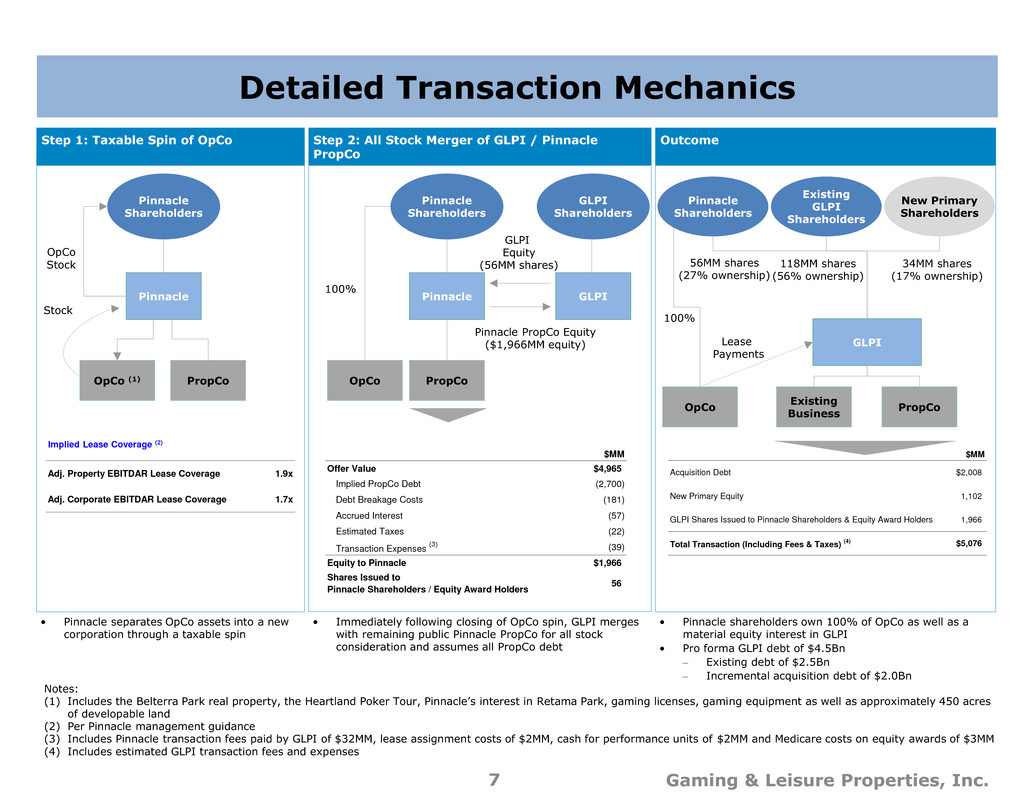

Detailed Transaction Mechanics 7 • Pinnacle shareholders own 100% of OpCo as well as a material equity interest in GLPI • Pro forma GLPI debt of $4.5Bn – Existing debt of $2.5Bn – Incremental acquisition debt of $2.0Bn • Pinnacle separates OpCo assets into a new corporation through a taxable spin Outcome PropCo Pinnacle Shareholders New Primary Shareholders GLPI Existing Business Lease Payments OpCo 56MM shares (27% ownership) 34MM shares (17% ownership) 100% Step 2: All Stock Merger of GLPI / Pinnacle PropCo PropCo Pinnacle Pinnacle Shareholders OpCo GLPI GLPI Shareholders GLPI Equity (56MM shares) Pinnacle PropCo Equity ($1,966MM equity) • Immediately following closing of OpCo spin, GLPI merges with remaining public Pinnacle PropCo for all stock consideration and assumes all PropCo debt 100% Step 1: Taxable Spin of OpCo OpCo (1) Pinnacle Shareholders PropCo Stock OpCo Stock Pinnacle Existing GLPI Shareholders 118MM shares (56% ownership) Gaming & Leisure Properties, Inc. Notes: (1) Includes the Belterra Park real property, the Heartland Poker Tour, Pinnacle’s interest in Retama Park, gaming licenses, gaming equipment as well as approximately 450 acres of developable land (2) Per Pinnacle management guidance (3) Includes Pinnacle transaction fees paid by GLPI of $32MM, lease assignment costs of $2MM, cash for performance units of $2MM and Medicare costs on equity awards of $3MM (4) Includes estimated GLPI transaction fees and expenses Adj. Property EBITDAR Lease Coverage 1.9x Adj. Corporate EBITDAR Lease Coverage 1.7x Implied Lease Coverage (2) $MM Offer Value $4,965 Implied PropCo Debt (2,700) Debt Breakage Costs (181) Accrued Interest (57) Estimated Taxes (22) Transaction Expenses (3) (39) Equity to Pinnacle $1,966 Shares Issued to Pinnacle Shareholders / Equity Award Holders 56 $MM Acquisition Debt $2,008 New Primary Equity 1,102 GLPI Shares Issued to Pinnacle Shareholders & Equity Award Holders 1,966 Total Transaction (Including Fees & Taxes) (4) $5,076

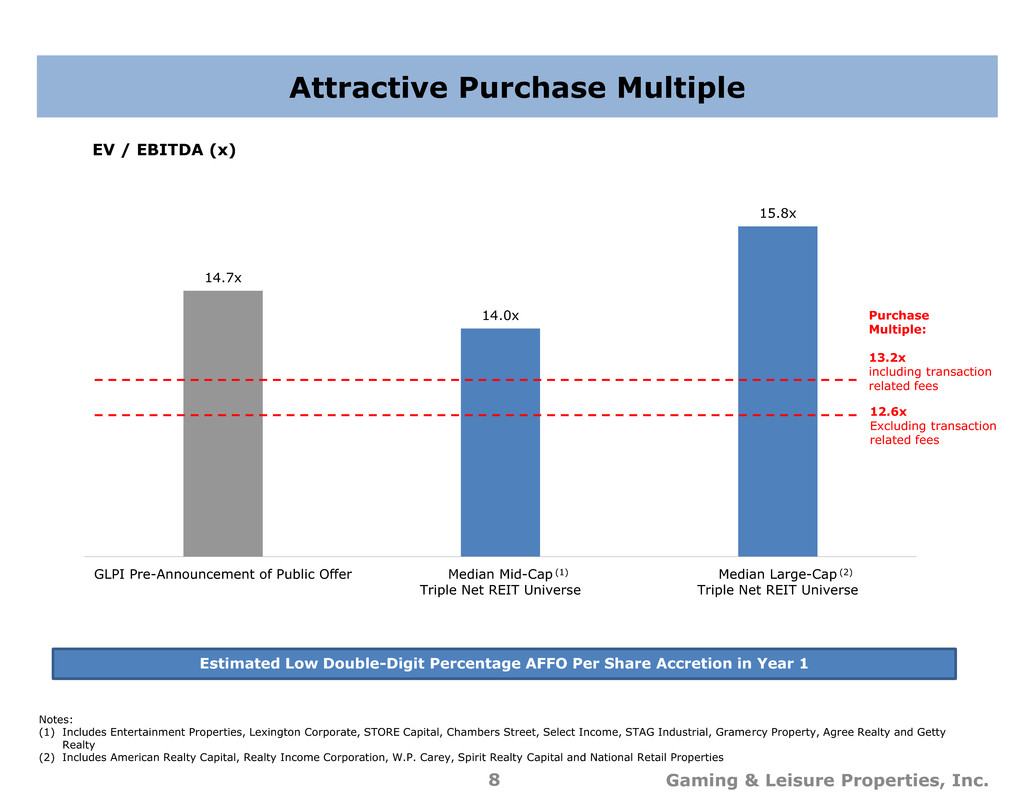

Attractive Purchase Multiple 8 Gaming & Leisure Properties, Inc. GLPI Dividend / Share: 14.7x 14.0x 15.8x GLPI Pre-Announcement of Public Offer Median Mid-Cap Triple Net REIT Universe Median Large-Cap Triple Net REIT Universe EV / EBITDA (x) Notes: (1) Includes Entertainment Properties, Lexington Corporate, STORE Capital, Chambers Street, Select Income, STAG Industrial, Gramercy Property, Agree Realty and Getty Realty (2) Includes American Realty Capital, Realty Income Corporation, W.P. Carey, Spirit Realty Capital and National Retail Properties (1) (2) Purchase Multiple: 13.2x including transaction related fees 12.6x Excluding transaction related fees Estimated Low Double-Digit Percentage AFFO Per Share Accretion in Year 1

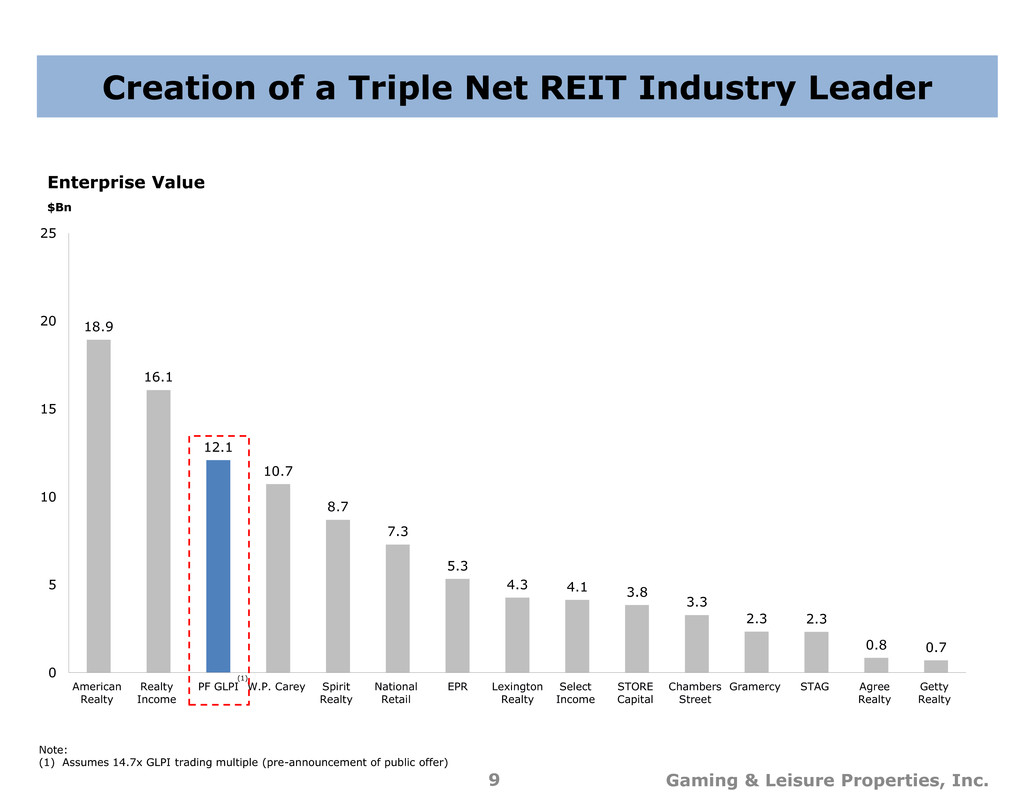

Creation of a Triple Net REIT Industry Leader 9 Gaming & Leisure Properties, Inc. Enterprise Value $Bn 18.9 16.1 12.1 10.7 8.7 7.3 5.3 4.3 4.1 3.8 3.3 2.3 2.3 0.8 0.7 0 5 10 15 20 25 American Realty Realty Income PF GLPI W.P. Carey Spirit Realty National Retail EPR Lexington Realty Select Income STORE Capital Chambers Street Gramercy STAG Agree Realty Getty Realty (1) Note: (1) Assumes 14.7x GLPI trading multiple (pre-announcement of public offer)

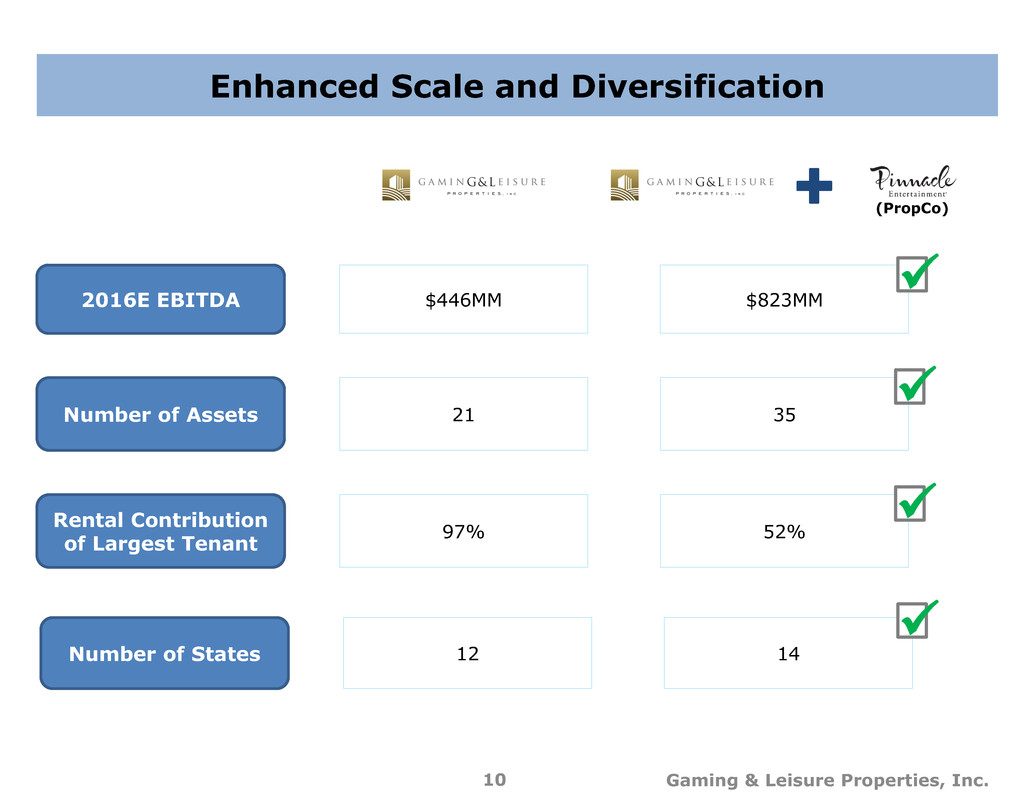

Enhanced Scale and Diversification 10 21 35 Number of Assets 12 14 Number of States $446MM $823MM 2016E EBITDA 97% 52% Rental Contribution of Largest Tenant Gaming & Leisure Properties, Inc. (PropCo)

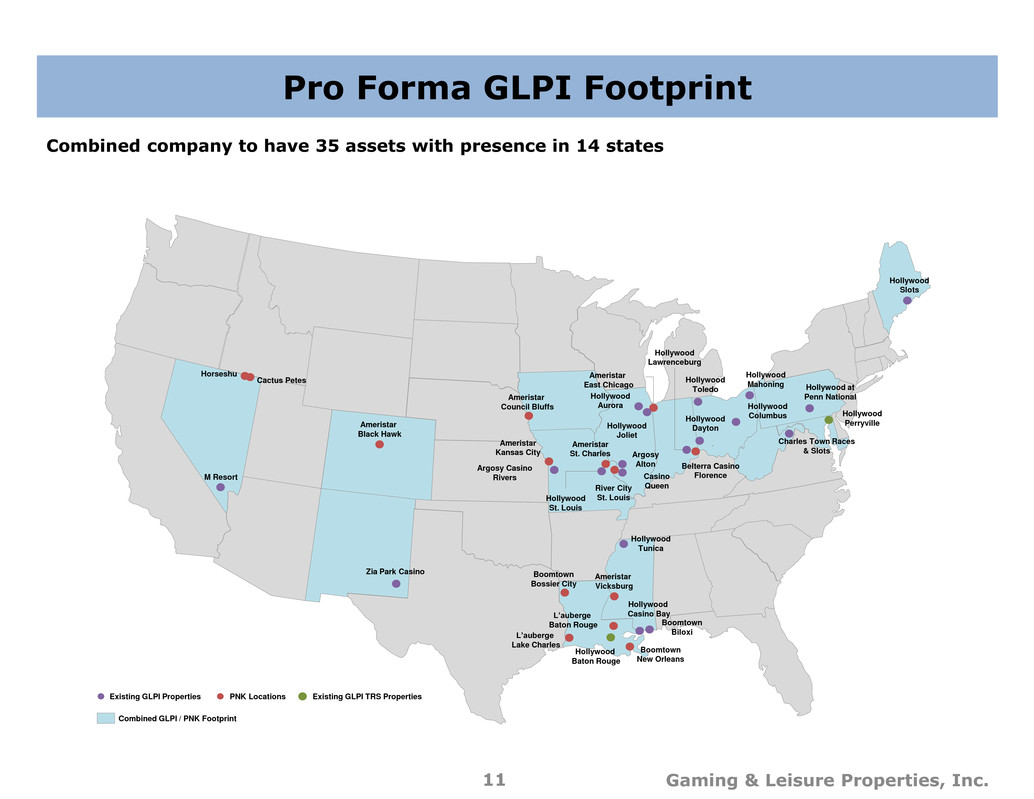

Pro Forma GLPI Footprint 11 Gaming & Leisure Properties, Inc. Combined GLPI / PNK Footprint PNK Locations Existing GLPI Properties Ameristar Council Bluffs Ameristar East Chicago Ameristar Kansas City River City St. Louis Belterra Casino Florence Ameristar St. Charles Ameristar Vicksburg Boomtown Bossier City Boomtown New Orleans L’auberge Baton Rouge L’auberge Lake Charles M Resort Zia Park Casino Hollywood Baton Rouge Hollywood Casino Bay Boomtown Biloxi Hollywood Tunica Argosy Casino Rivers Hollywood St. Louis Casino Queen Argosy Alton Hollywood Joliet Hollywood Aurora Hollywood Lawrenceburg Hollywood Slots Hollywood at Penn National Hollywood Dayton Hollywood Toledo Hollywood Columbus Hollywood Mahoning Charles Town Races & Slots Hollywood Perryville Cactus Petes Ameristar Black Hawk Combined company to have 35 assets with presence in 14 states Existing GLPI TRS Properties Horseshu

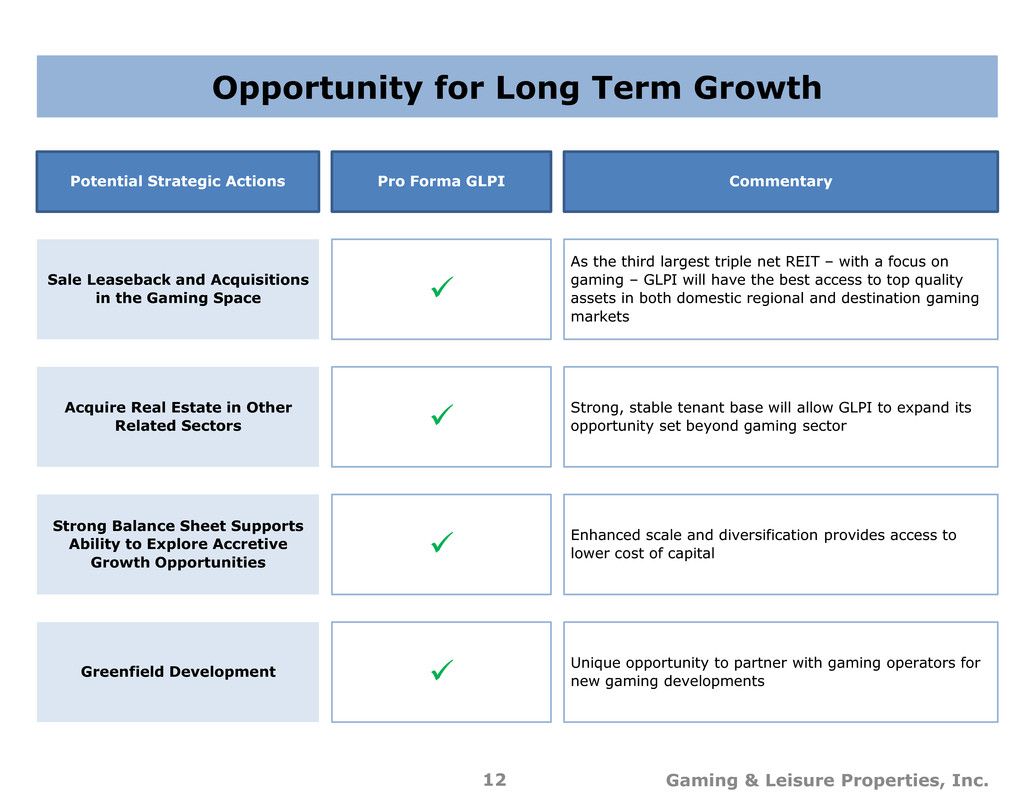

Opportunity for Long Term Growth 12 Gaming & Leisure Properties, Inc. Potential Strategic Actions Commentary Pro Forma GLPI As the third largest triple net REIT – with a focus on gaming – GLPI will have the best access to top quality assets in both domestic regional and destination gaming markets Sale Leaseback and Acquisitions in the Gaming Space Strong, stable tenant base will allow GLPI to expand its opportunity set beyond gaming sector Acquire Real Estate in Other Related Sectors Enhanced scale and diversification provides access to lower cost of capital Strong Balance Sheet Supports Ability to Explore Accretive Growth Opportunities Unique opportunity to partner with gaming operators for new gaming developments Greenfield Development

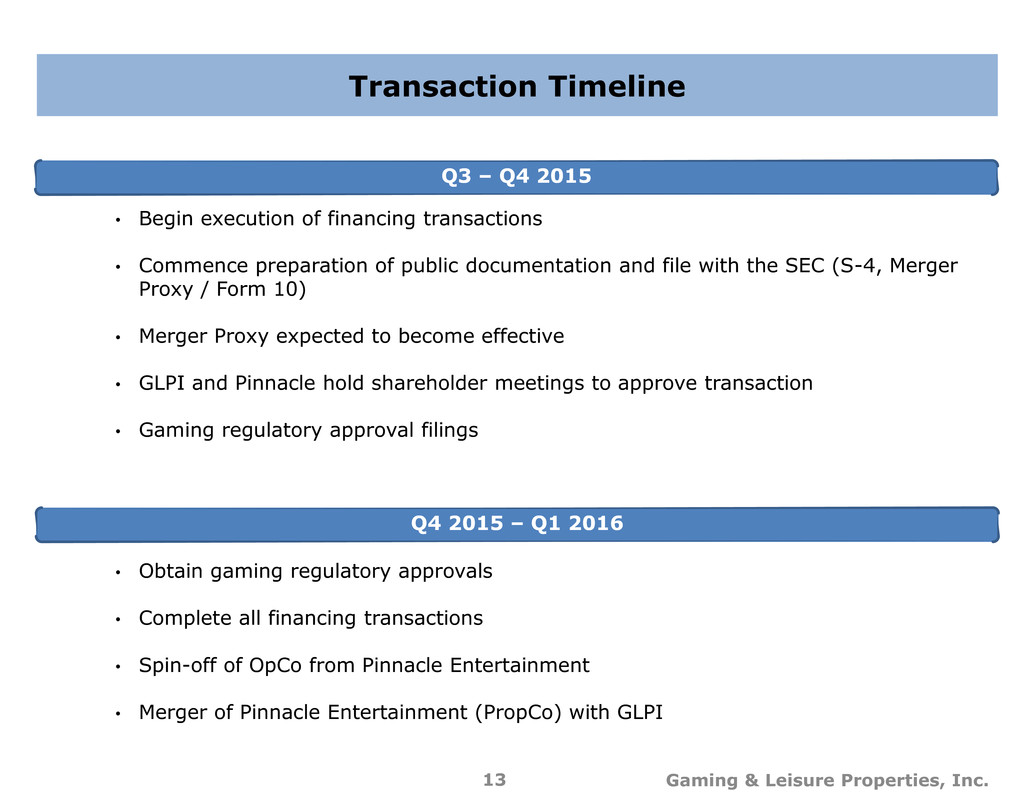

Transaction Timeline 13 Gaming & Leisure Properties, Inc. • Q2 2015 • Begin execution of financing transactions • Commence preparation of public documentation and file with the SEC (S-4, Merger Proxy / Form 10) • Merger Proxy expected to become effective • GLPI and Pinnacle hold shareholder meetings to approve transaction • Gaming regulatory approval filings • Obtain gaming regulatory approvals • Complete all financing transactions • Spin-off of OpCo from Pinnacle Entertainment • Merger of Pinnacle Entertainment (PropCo) with GLPI Q3 – Q4 2015 Q4 2015 – Q1 2016

Appendix: Supporting Information 14 Gaming & Leisure Properties, Inc.

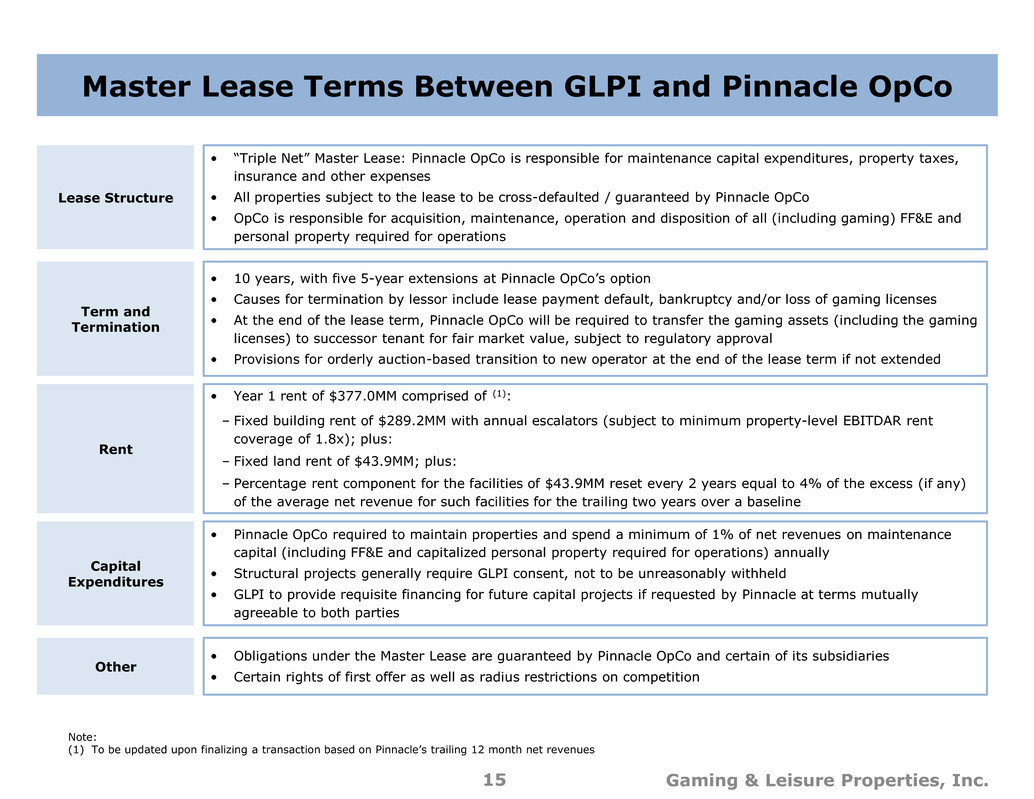

Master Lease Terms Between GLPI and Pinnacle OpCo 15 Gaming & Leisure Properties, Inc. Term and Termination • 10 years, with five 5-year extensions at Pinnacle OpCo’s option • Causes for termination by lessor include lease payment default, bankruptcy and/or loss of gaming licenses • At the end of the lease term, Pinnacle OpCo will be required to transfer the gaming assets (including the gaming licenses) to successor tenant for fair market value, subject to regulatory approval • Provisions for orderly auction-based transition to new operator at the end of the lease term if not extended • “Triple Net” Master Lease: Pinnacle OpCo is responsible for maintenance capital expenditures, property taxes, insurance and other expenses • All properties subject to the lease to be cross-defaulted / guaranteed by Pinnacle OpCo • OpCo is responsible for acquisition, maintenance, operation and disposition of all (including gaming) FF&E and personal property required for operations Lease Structure • Year 1 rent of $377.0MM comprised of (1): – Fixed building rent of $289.2MM with annual escalators (subject to minimum property-level EBITDAR rent coverage of 1.8x); plus: – Fixed land rent of $43.9MM; plus: – Percentage rent component for the facilities of $43.9MM reset every 2 years equal to 4% of the excess (if any) of the average net revenue for such facilities for the trailing two years over a baseline Rent • Pinnacle OpCo required to maintain properties and spend a minimum of 1% of net revenues on maintenance capital (including FF&E and capitalized personal property required for operations) annually • Structural projects generally require GLPI consent, not to be unreasonably withheld • GLPI to provide requisite financing for future capital projects if requested by Pinnacle at terms mutually agreeable to both parties Capital Expenditures • Obligations under the Master Lease are guaranteed by Pinnacle OpCo and certain of its subsidiaries • Certain rights of first offer as well as radius restrictions on competition Other Note: (1) To be updated upon finalizing a transaction based on Pinnacle’s trailing 12 month net revenues

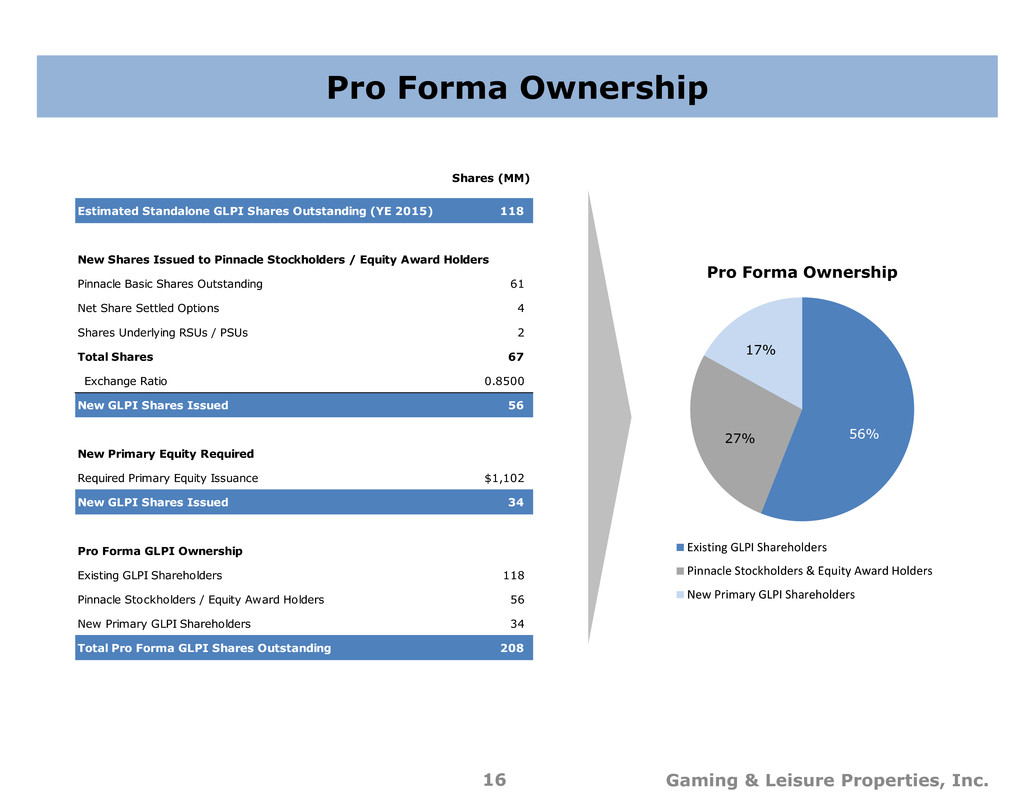

Pro Forma Ownership 16 Gaming & Leisure Properties, Inc. 56% 27% 17% Pro Forma Ownership Existing GLPI Shareholders Pinnacle Stockholders & Equity Award Holders New Primary GLPI Shareholders Shares (MM) Estimated Standalone GLPI Shares Outstanding (YE 2015) 118 New Shares Issued to Pinnacle Stockholders / Equity Award Holders Pinnacle Basic Shares Outstanding 61 Net Share Settled Options 4 Shares Underlying RSUs / PSUs 2 Total Shares 67 Exchange Ratio 0.8500 New GLPI Shares Issued 56 New Primary Equity Required Required Primary Equity Issuance $1,102 New GLPI Shares Issued 34 Pro Forma GLPI Ownership Existing GLPI Shareholders 118 Pinnacle Stockholders / Equity Award Holders 56 New Primary GLPI Shareholders 34 Total Pro Forma LPI Shares Outstanding 208

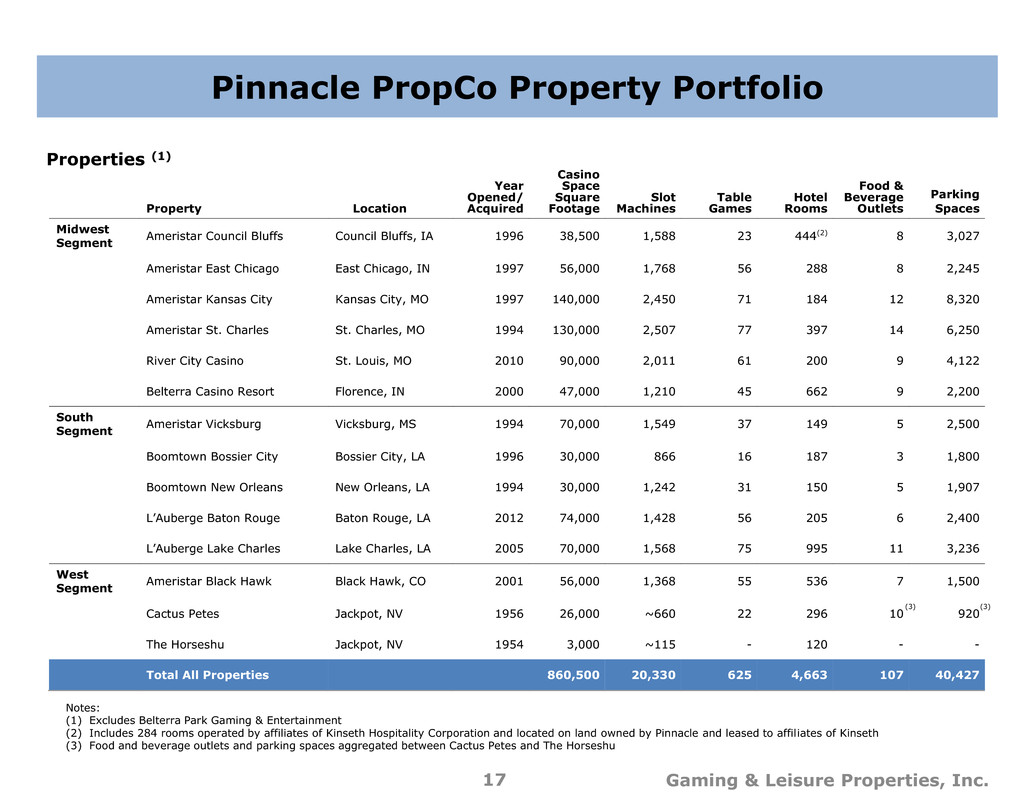

Pinnacle PropCo Property Portfolio 17 Gaming & Leisure Properties, Inc. Notes: (1) Excludes Belterra Park Gaming & Entertainment (2) Includes 284 rooms operated by affiliates of Kinseth Hospitality Corporation and located on land owned by Pinnacle and leased to affiliates of Kinseth (3) Food and beverage outlets and parking spaces aggregated between Cactus Petes and The Horseshu Property Location Year Opened/ Acquired Casino Space Square Footage Slot Machines Table Games Hotel Rooms Food & Beverage Outlets Parking Spaces Midwest Segment Ameristar Council Bluffs Council Bluffs, IA 1996 38,500 1,588 23 444(2) 8 3,027 Ameristar East Chicago East Chicago, IN 1997 56,000 1,768 56 288 8 2,245 Ameristar Kansas City Kansas City, MO 1997 140,000 2,450 71 184 12 8,320 Ameristar St. Charles St. Charles, MO 1994 130,000 2,507 77 397 14 6,250 River City Casino St. Louis, MO 2010 90,000 2,011 61 200 9 4,122 Belterra Casino Resort Florence, IN 2000 47,000 1,210 45 662 9 2,200 South Segment Ameristar Vicksburg Vicksburg, MS 1994 70,000 1,549 37 149 5 2,500 Boomtown Bossier City Bossier City, LA 1996 30,000 866 16 187 3 1,800 Boomtown New Orleans New Orleans, LA 1994 30,000 1,242 31 150 5 1,907 L’Auberge Baton Rouge Baton Rouge, LA 2012 74,000 1,428 56 205 6 2,400 L’Auberge Lake Charles Lake Charles, LA 2005 70,000 1,568 75 995 11 3,236 West Segment Ameristar Black Hawk Black Hawk, CO 2001 56,000 1,368 55 536 7 1,500 Cactus Petes Jackpot, NV 1956 26,000 ~660 22 296 10 920 The Horseshu Jackpot, NV 1954 3,000 ~115 - 120 - - Total All Properties 860,500 20,330 625 4,663 107 40,427 Properties (1) (3) (3)

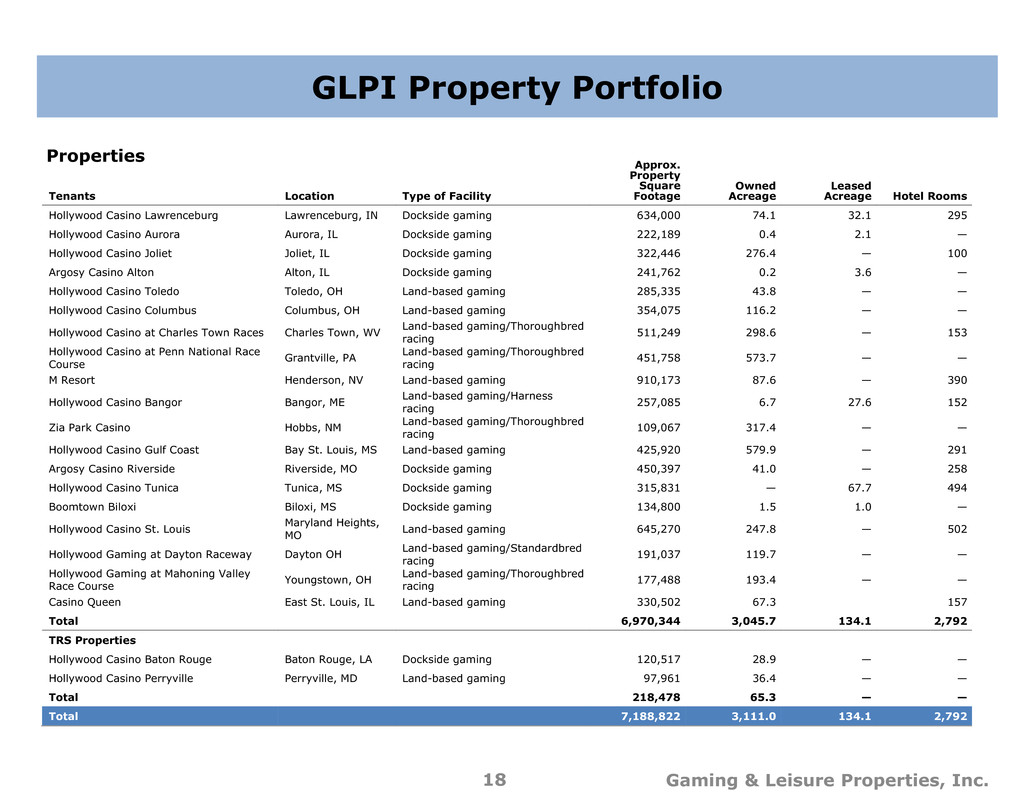

GLPI Property Portfolio 18 Gaming & Leisure Properties, Inc. Tenants Location Type of Facility Approx. Property Square Footage Owned Acreage Leased Acreage Hotel Rooms Hollywood Casino Lawrenceburg Lawrenceburg, IN Dockside gaming 634,000 74.1 32.1 295 Hollywood Casino Aurora Aurora, IL Dockside gaming 222,189 0.4 2.1 — Hollywood Casino Joliet Joliet, IL Dockside gaming 322,446 276.4 — 100 Argosy Casino Alton Alton, IL Dockside gaming 241,762 0.2 3.6 — Hollywood Casino Toledo Toledo, OH Land-based gaming 285,335 43.8 — — Hollywood Casino Columbus Columbus, OH Land-based gaming 354,075 116.2 — — Hollywood Casino at Charles Town Races Charles Town, WV Land-based gaming/Thoroughbred racing 511,249 298.6 — 153 Hollywood Casino at Penn National Race Course Grantville, PA Land-based gaming/Thoroughbred racing 451,758 573.7 — — M Resort Henderson, NV Land-based gaming 910,173 87.6 — 390 Hollywood Casino Bangor Bangor, ME Land-based gaming/Harness racing 257,085 6.7 27.6 152 Zia Park Casino Hobbs, NM Land-based gaming/Thoroughbred racing 109,067 317.4 — — Hollywood Casino Gulf Coast Bay St. Louis, MS Land-based gaming 425,920 579.9 — 291 Argosy Casino Riverside Riverside, MO Dockside gaming 450,397 41.0 — 258 Hollywood Casino Tunica Tunica, MS Dockside gaming 315,831 — 67.7 494 Boomtown Biloxi Biloxi, MS Dockside gaming 134,800 1.5 1.0 — Hollywood Casino St. Louis Maryland Heights, MO Land-based gaming 645,270 247.8 — 502 Hollywood Gaming at Dayton Raceway Dayton OH Land-based gaming/Standardbred racing 191,037 119.7 — — Hollywood Gaming at Mahoning Valley Race Course Youngstown, OH Land-based gaming/Thoroughbred racing 177,488 193.4 — — Casino Queen East St. Louis, IL Land-based gaming 330,502 67.3 157 Total 6,970,344 3,045.7 134.1 2,792 TRS Properties Hollywood Casino Baton Rouge Baton Rouge, LA Dockside gaming 120,517 28.9 — — Hollywood Casino Perryville Perryville, MD Land-based gaming 97,961 36.4 — — Total 218,478 65.3 — — Total 7,188,822 3,111.0 134.1 2,792 Properties

Appendix: Definitions and Reconciliation of Non- GAAP Measures to GAAP 19 Gaming & Leisure Properties, Inc.

Definitions and Reconciliation of Non-GAAP Measures to GAAP Adjusted EBITDA, or earnings before interest, taxes on income, stock-based compensation, management fees, depreciation, amortization, and gains and/or losses on dispositions of property is not a measure of performance or liquidity calculated in accordance with GAAP Adjusted EBITDA information is presented as a supplemental disclosure. Adjusted EBITDA should not be construed as an alternative to operating income, as an indicator of the Company's operating performance, as an alternative to cash flows from operating activities, as a measure of liquidity, or as any other measure of performance determined in accordance with GAAP. The Company has significant uses of cash flows, including capital expenditures, interest payments, dividend payments, taxes and debt principal repayments, which are not reflected in adjusted EBITDA. Adjusted EBITDA is presented as a supplemental disclosure as this measure is considered by many to be a better indicator of the Company’s operating results than net income (computed in accordance with GAAP). A reconciliation of the Company’s adjusted EBITDA to net income (computed in accordance with GAAP) is included in the Company’s news announcements and financial schedules available on the Company’s website. Adjusted EBITDAR is Adjusted EBITDA excluding rent Funds From Operations (“FFO”) is equal to net income, excluding gains or losses from dispositions of property, and real estate depreciation FFO is defined by NAREIT (the National Association of Real Estate Investment Trusts, the trade organization for REITs) as “the most commonly accepted and reported measure of REIT operating performance.” Adjusted Funds From Operations (“AFFO”) is defined as FFO excluding stock based compensation expense, the amortization of debt issuance costs and other depreciation reduced by maintenance capex. A reconciliation of FFO and AFFO to net income (computed in accordance with GAAP) is included in the news announcements and financial schedules available on the Company’s website. FFO and AFFO do not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income as defined by GAAP and are not indicative of cash available to fund all cash flow needs. Notwithstanding the foregoing, GLPI’s measures of adjusted EBITDA, FFO and AFFO may not be comparable to similarly titled measures used by other companies 20 Gaming & Leisure Properties, Inc.

Gaming & Leisure Properties Inc. Acquisition of Pinnacle Entertainment’s Real Estate Assets