Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PFO Global, Inc. | v414860_8k.htm |

| EX-10.1 - EXHIBIT 10.1 - PFO Global, Inc. | v414860_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - PFO Global, Inc. | v414860_ex2-1.htm |

| EX-10.2 - EXHIBIT 10.2 - PFO Global, Inc. | v414860_ex10-2.htm |

| EX-10.4 - EXHIBIT 10.4 - PFO Global, Inc. | v414860_ex10-4.htm |

| EX-10.7 - EXHIBIT 10.7 - PFO Global, Inc. | v414860_ex10-7.htm |

| EX-10.6 - EXHIBIT 10.6 - PFO Global, Inc. | v414860_ex10-6.htm |

| EX-10.8 - EXHIBIT 10.8 - PFO Global, Inc. | v414860_ex10-8.htm |

| EX-10.5 - EXHIBIT 10.5 - PFO Global, Inc. | v414860_ex10-5.htm |

| EX-10.3 - EXHIBIT 10.3 - PFO Global, Inc. | v414860_ex10-3.htm |

Exhibit 99.1

Corporate Presentation

2 This presentation is for informational purposes only and is not intended for any other use . This presentation is not an offering memorandum or prospectus and should not be treated as offering material of any sort . The information contained in this presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities . This presentation is intended to be of general interest only, and does not constitute or set forth professional opinions or advice . The information in this document is speculative and may or may not be accurate . Actual information and results may differ materially from those stated in this document . The Company makes no representations or warranties which respect to the accuracy of the whole or any part of this the Company presentation and disclaims all such representations and warranties . Some of the data and industry information used in the preparation of this presentation (and on which the presentation is based) was published by third - party sources, and has not been independently verified, validated, or audited . Neither the Company nor its principals, employees, or agents shall be liable to any user of this document or to any other person or entity for the truthfulness or accuracy of information contained in this presentation or for any errors or omissions in its content, regardless of the cause of such inaccuracy, error, or omission . Furthermore, the Company, its principals, employees, or agents accept no liability and disclaim all responsibility for the consequences of any user of this document or anyone else acting, or refraining to act, in reliance on the information contained in this document or for any decision based on it, or for any actual, consequential, special, incidental, or punitive damages to any person or entity for any matter relating to this document even if advised of the possibility of such damages . This presentation contains forward - looking statements within the meaning of the federal securities laws . Forward - looking statements express the Company’s expectations or predictions of future events or results . They are not guarantees and are subject to many risks and uncertainties . There are a number of factors beyond the Company’s control that could cause actual events or results to be significantly different from those described in the forward - looking statements . Any or all of the forward - looking statements in this document or in any other statements the Company makes may turn out to be wrong and should not be regarded as a representation by the Company or any other person that its objectives, future results, levels of activity, performance or plans will be achieved . Except as required by applicable law, the Company does not intend to publicly update or revise any forward - looking statements, whether as a result of new information, future developments or otherwise . Safe Harbor Statement

3 Revolutionizing the Optical I ndustry by providing Highest quality eyewear lens production at most competitive, high margin price points Logistical efficiency maximization via proprietary disruptive technology W orldwide market reach

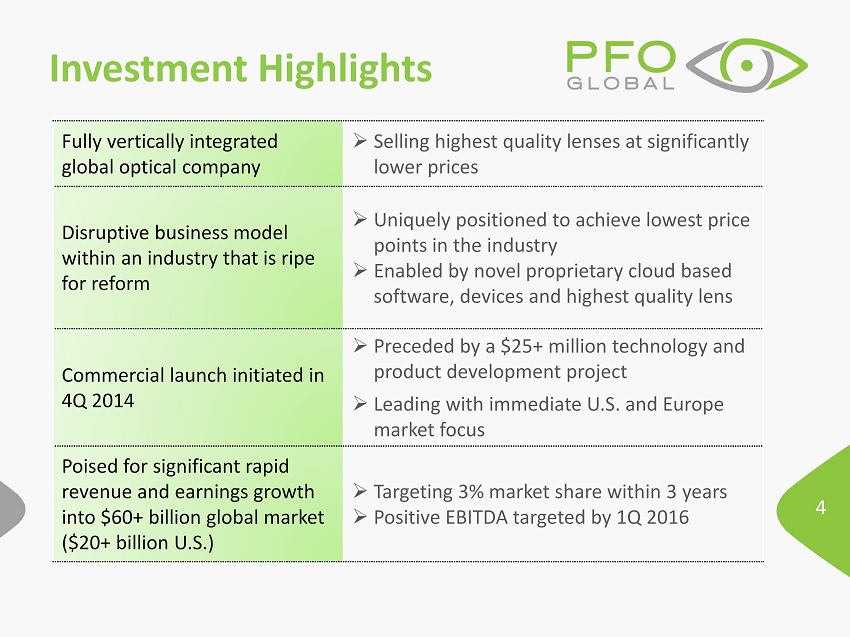

4 Investment Highlights Fully vertically integrated global optical company » Selling highest quality lenses at significantly lower prices Disruptive business model within an industry that is ripe for reform » Uniquely positioned to achieve lowest price points in the industry » Enabled by novel proprietary cloud based software, devices and highest quality lens Commercial launch initiated in 4Q 2014 » Preceded by a $25+ million technology and product development project » Leading with immediate U.S. and Europe market focus Poised for significant rapid revenue and earnings growth into $60+ billion global market ($20+ billion U.S.) » Targeting 3% market share within 3 years » Positive EBITDA targeted by 1Q 2016

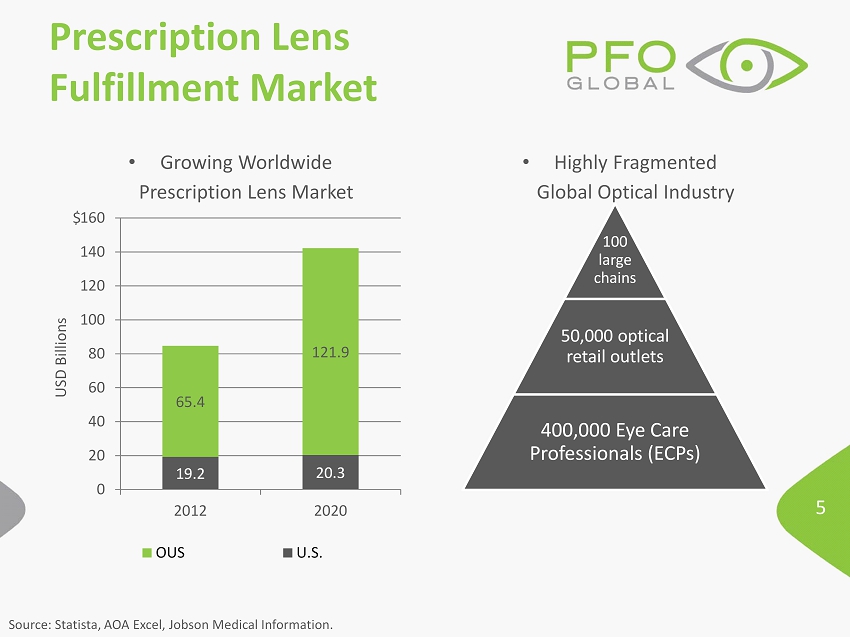

5 • Growing Worldwide Prescription Lens Market 19.2 20.3 65.4 121.9 0 20 40 60 80 100 120 140 160 2012 2020 USD Billions OUS U.S. • Highly Fragmented Global Optical Industry Prescription Lens Fulfillment Market Source: Statista , AOA Excel, Jobson Medical Information. 100 large chains 50,000 optical retail outlets 400,000 Eye Care Professionals (ECPs) $

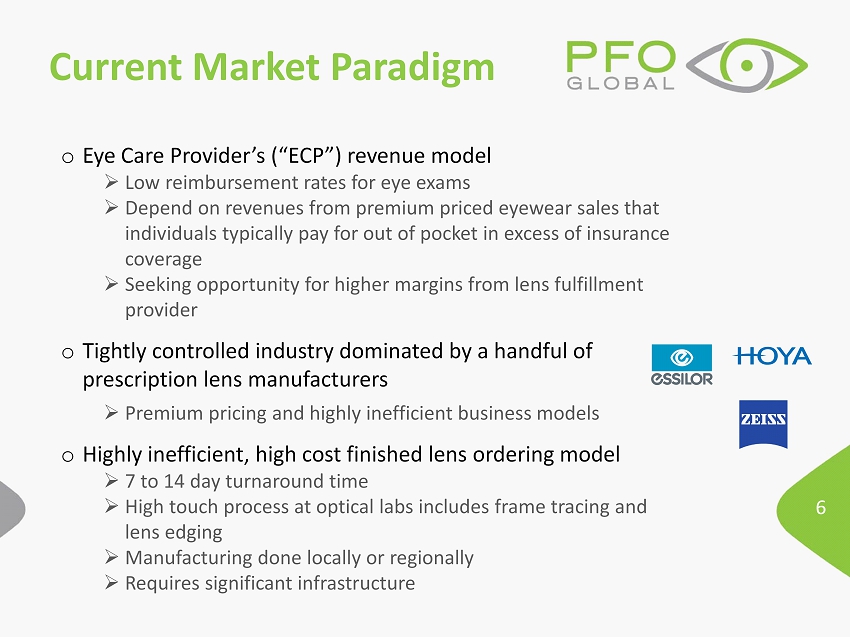

6 Current Market Paradigm o Eye Care Provider’s (“ECP”) revenue model » Low reimbursement rates for eye exams » Depend on revenues from premium priced eyewear sales that individuals typically pay for out of pocket in excess of insurance coverage » Seeking opportunity for higher margins from lens fulfillment provider o Tightly controlled industry dominated by a handful of prescription lens manufacturers » Premium pricing and highly inefficient business models o Highly inefficient, high cost finished lens ordering model » 7 to 14 day turnaround time » High touch process at optical labs includes frame tracing and lens edging » Manufacturing done locally or regionally » Requires significant infrastructure

7 PFO’s Proprietary Technological Innovations

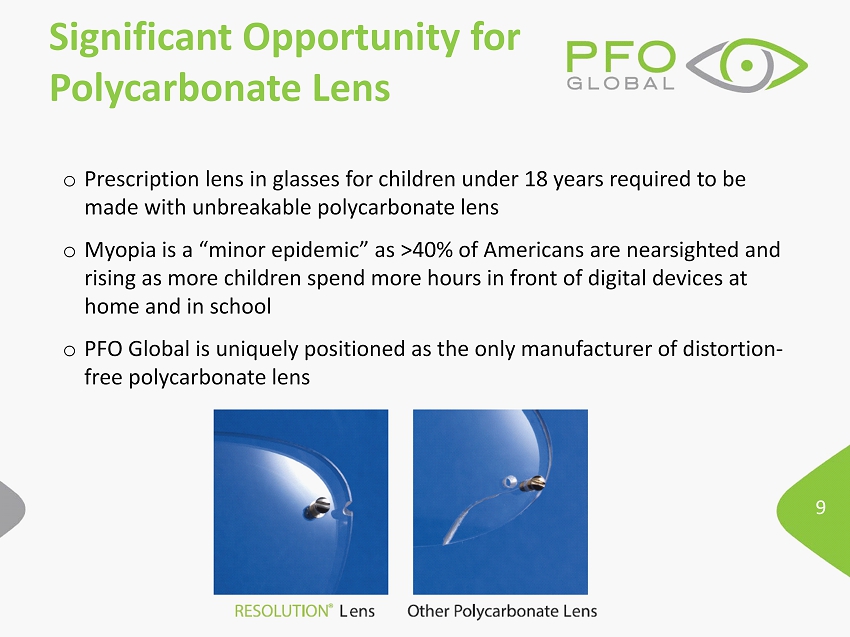

8 o Resolution ® Stress - free or stress - less polycarbonate lenses » Thinner, lighter and optically accurate » Highest impact lens available on the market (“unbreakable”) » Hold their power and acuity to the lens edge » More suitable for rimless drilling Resolution® Lens (Free of Birefringence) Other Polycarbonate Lens (High Birefringence)

9 Significant Opportunity for Polycarbonate Lens o Prescription lens in glasses for children under 18 years required to be made with unbreakable polycarbonate lens o Myopia is a “minor epidemic” as >40% of Americans are nearsighted and rising as more children spend more hours in front of digital devices at home and in school o PFO Global is uniquely positioned as the only manufacturer of distortion - free polycarbonate lens

10 Comprehensive Lens & Coating Offering o Digitally manufactured lens designs based on the individual patient fitting parameters, that are superior to competitive manufactured brands

11 o Highly accurate, 3D frame tracing system » Frame placed in scanner » Produces ultra high resolution 3D image » Data sent directly to edging machine at PFO’s lab » Recurring revenue model o Potential to transform the optical industry » Placed in ECP’s office and enable scanning of the frame within minutes » Directly connect to lab system via cloud » Reduces initiation of lens production to minutes instead of days » Perfect set of lenses delivered to ECP for mounting within 2 – 3 days » Significant logistical cost savings passed along to ECP

12 Enabling Software Solutions o Most advanced electronic ordering system in industry: Acuity Global System » Cloud based system connects ECP’s with PFO’s lab system » Integrated to insurers’ databases to assess real time benefit eligibility » Enables patient billing between remaining benefit and cost of finished eyewear o Lens calculation software: PFO SmartCalc » Proprietary software » Avoids $5 to $15 third party license fee » Solid performance at PFO labs » Potential out - licensing model

13 Centralized Lens Production o Exclusive contracts in place with two state - of - the - art production labs » Located in Hong Kong and Dubai » High degree of automation and lower cost vs. U.S. labs » Superior quality and vetted by U.S. FDA o U.S. based lab system » Five labs in network spanning Florida, California and Dallas » Available for remakes and corrections

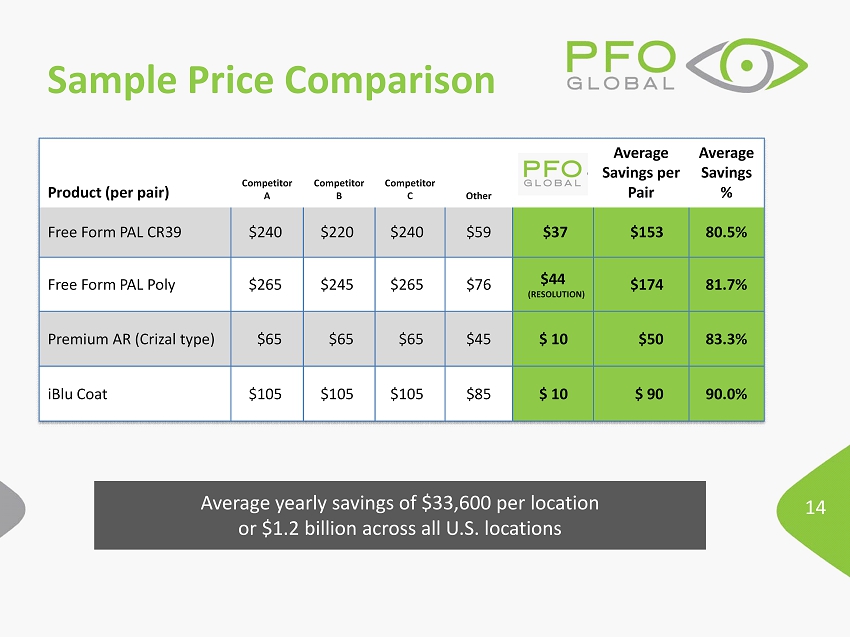

14 Product (per pair) Competitor A Competitor B Competitor C Other Average Savings per Pair Average Savings % Free Form PAL CR39 $ 240 $220 $ 240 $59 $ 37 $153 80.5% Free Form PAL Poly $ 265 $ 245 $ 265 $ 76 $ 44 (RESOLUTION) $174 81.7% Premium AR ( Crizal type) $ 65 $65 $65 $ 45 $ 10 $50 83.3% iBlu Coat $105 $105 $105 $85 $ 10 $ 90 90.0% Sample Price Comparison Average yearly savings of $33,600 per location or $1.2 billion across all U.S. locations

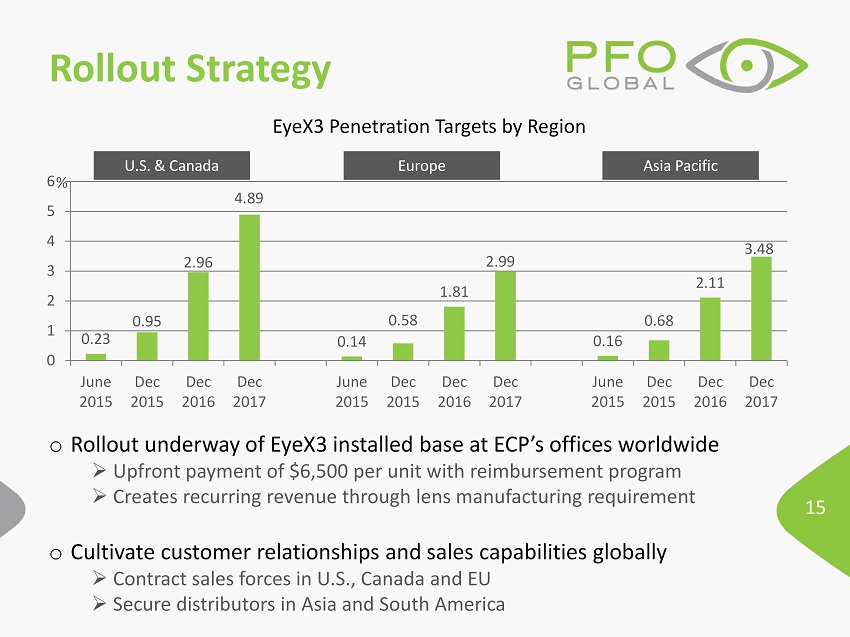

15 Rollout Strategy o Rollout underway of EyeX3 installed base at ECP’s offices worldwide » Upfront payment of $6,500 per unit with reimbursement program » Creates recurring revenue through lens manufacturing requirement o Cultivate customer relationships and sales capabilities globally » Contract sales forces in U.S., Canada and EU » Secure distributors in Asia and South America 0.23 0.95 2.96 4.89 0.14 0.58 1.81 2.99 0.16 0.68 2.11 3.48 0 1 2 3 4 5 6 June 2015 Dec 2015 Dec 2016 Dec 2017 June 2015 Dec 2015 Dec 2016 Dec 2017 June 2015 Dec 2015 Dec 2016 Dec 2017 % U.S. & Canada Europe Asia Pacific EyeX3 Penetration Targets by Region

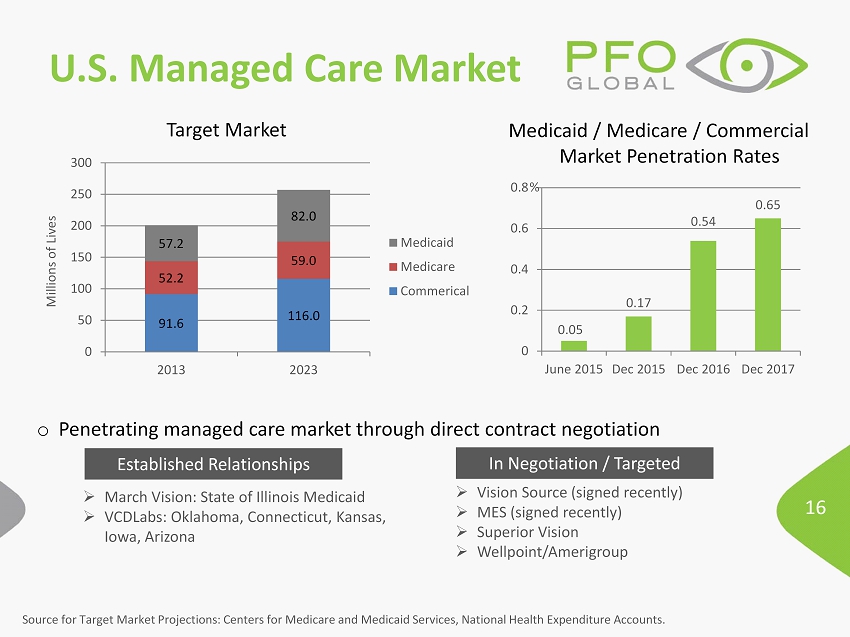

16 U.S. Managed Care Market 0.05 0.17 0.54 0.65 0 0.2 0.4 0.6 0.8 June 2015 Dec 2015 Dec 2016 Dec 2017 Target Market % 91.6 116.0 52.2 59.0 57.2 82.0 0 50 100 150 200 250 300 2013 2023 Millions of Lives Medicaid Medicare Commerical Medicaid / Medicare / Commercial Market Penetration Rates » March Vision: State of Illinois Medicaid » VCDLabs : Oklahoma, Connecticut, Kansas, Iowa, Arizona o Penetrating managed care market through direct contract negotiation » Vision Source (signed recently) » MES (signed recently) » Superior Vision » Wellpoint /Amerigroup Source for Target Market Projections: Centers for Medicare and Medicaid Services, National Health Expenditure Accounts. Established Relationships In Negotiation / Targeted

17 » Sole contracted supplier » 5,000 ECP panel members that are supplied through VCD » 3,000+ ECP member offices » PFO Global offers most competitive price points of any partners » $3 million annual sales in Zeiss , $2.6 million sales in VSP » Agreement finalizing with PFO as primary provider to members » #1 Optical Retailer in EU » Administrator of managed care programs » Market directly to ECP members so they will ask for PFO Global products » Commercial vision plans available through Blue Cross of California » Custom web portal development for fulfillment through PFO Global Representative Customers

18 » Proprietary safety dispensing kiosk » Advanced progressive design software » Primary fulfillment partner for frames and prescription glazing » Manufacturer and distributor of Resolution Distortion Free Polycarbonate lens » Primary distributing partner for Brazil » Over 30 direct and vertically integrated deployment accounts » Second largest lens manufacturer in India after Essilor » Secured five year distribution agreement for Resolution in India and Middle East » Primary lens distributor in the U.S. to independent laboratories » Distribution contracts negotiated for 2015 - 2016 Strategic Partnerships

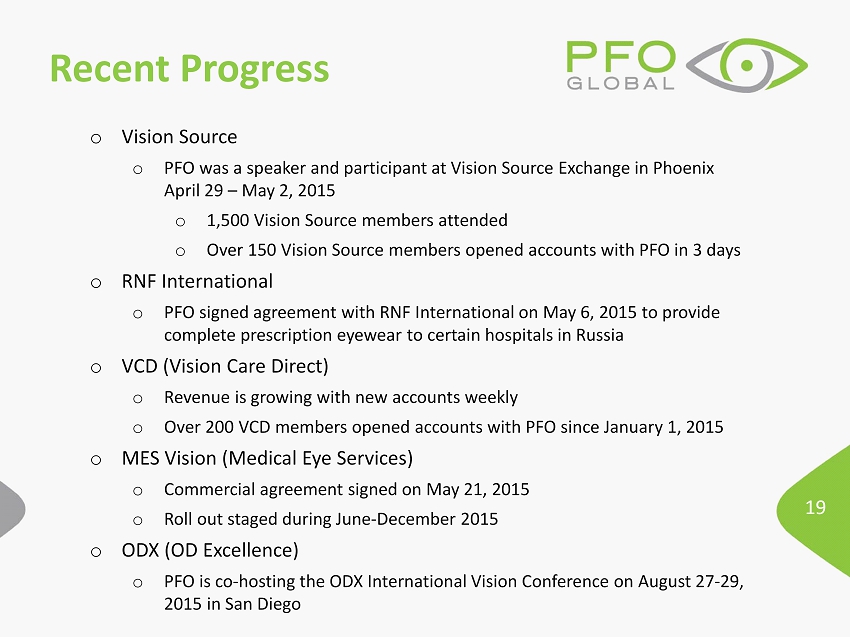

19 Recent Progress o Vision Source o PFO was a speaker and participant at Vision Source Exchange in Phoenix April 29 – May 2, 2015 o 1,500 Vision Source members attended o Over 150 Vision Source members opened accounts with PFO in 3 days o RNF International o PFO signed agreement with RNF International on May 6, 2015 to provide complete prescription eyewear to certain hospitals in Russia o VCD (Vision Care Direct) o Revenue is growing with new accounts weekly o Over 200 VCD members opened accounts with PFO since January 1, 2015 o MES Vision (Medical Eye Services) o Commercial agreement signed on May 21, 2015 o Roll out staged during June - December 2015 o ODX (OD Excellence) o PFO is co - hosting the ODX International Vision Conference on August 27 - 29, 2015 in San Diego

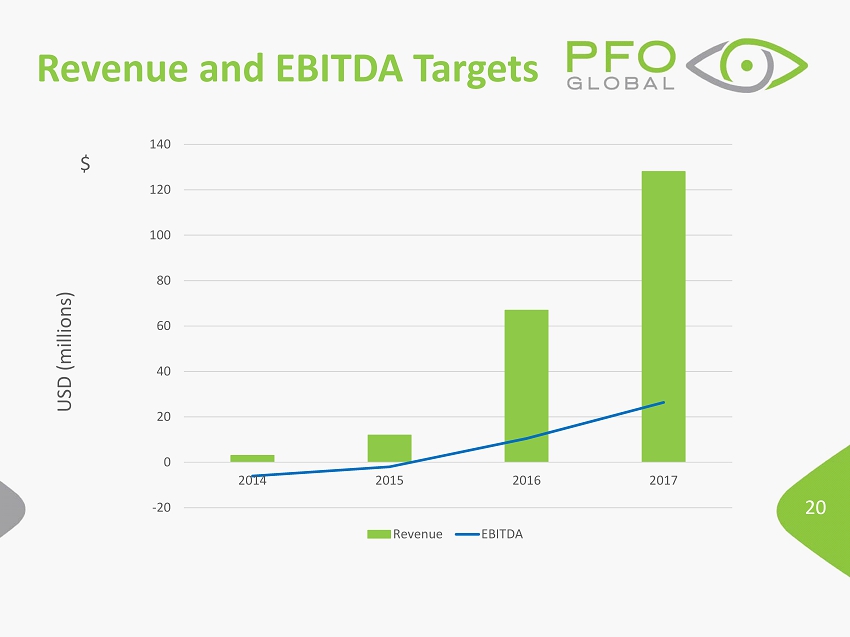

20 Revenue and EBITDA Targets USD (millions) $ -20 0 20 40 60 80 100 120 140 2014 2015 2016 2017 Revenue EBITDA

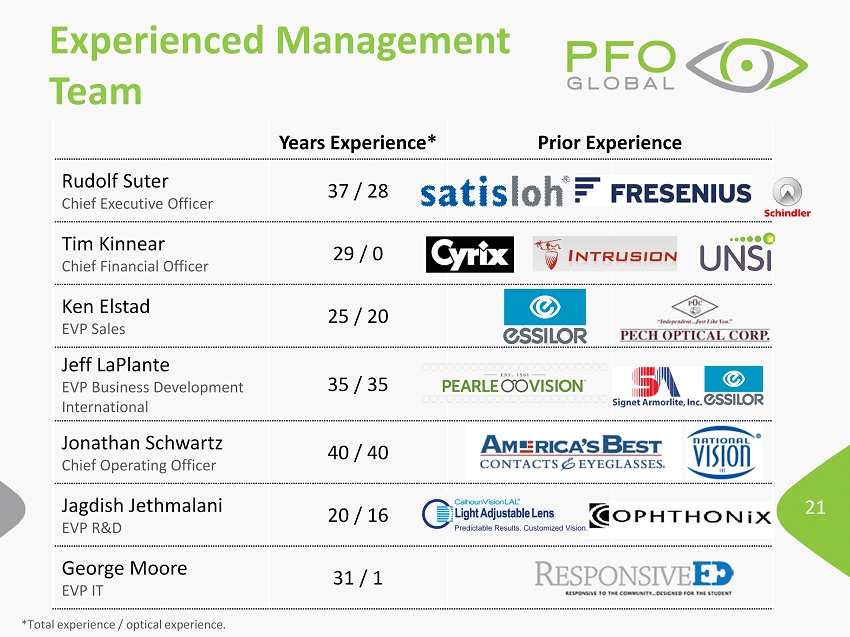

21 Experienced Management Team Years Experience* Prior Experience Rudolf Suter Chief Executive Officer 37 / 28 Tim Kinnear Chief Financial Officer 29 / 0 Ken Elstad EVP Sales 25 / 20 Jeff LaPlante EVP Business Development International 35 / 35 Jonathan Schwartz Chief Operating Officer 40 / 40 Jagdish Jethmalani EVP R&D 20 / 16 George Moore EVP IT 31 / 1 *Total experience / optical experience.

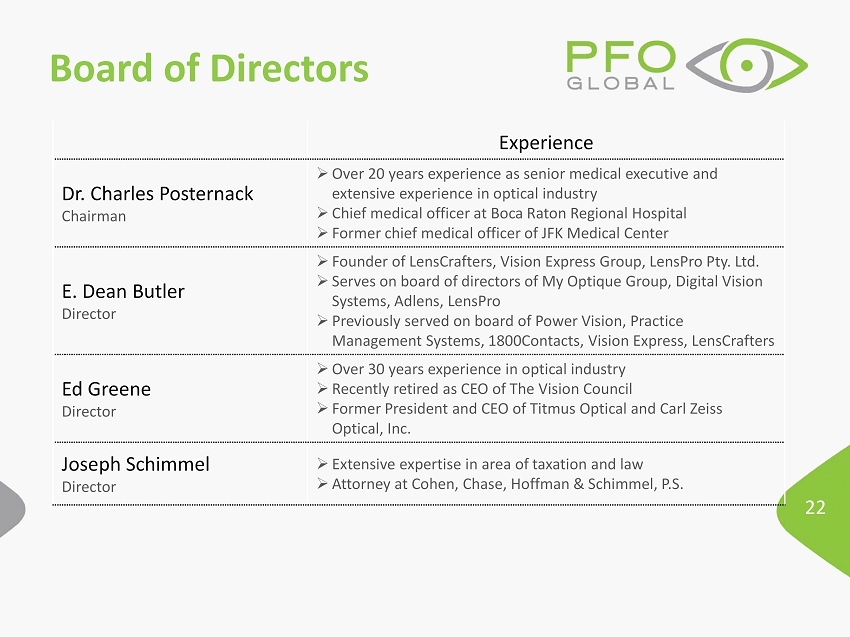

22 Board of Directors Experience Dr. Charles Posternack Chairman » Over 20 years experience as senior medical executive and extensive experience in optical industry » C hief medical officer at Boca Raton Regional Hospital » Former chief medical officer of JFK Medical Center E. Dean Butler Director » Founder of LensCrafters , Vision Express Group, LensPro Pty. Ltd. » Serves on board of directors of My Optique Group, Digital Vision Systems, Adlens , LensPro » Previously served on board of Power Vision, Practice Management Systems, 1800Contacts, Vision Express, LensCrafters Ed Greene Director » Over 30 years experience in optical industry » Recently retired as CEO of The Vision Council » Former President and CEO of Titmus Optical and Carl Zeiss Optical, Inc. Joseph Schimmel Director » Extensive expertise in area of taxation and law » Attorney at Cohen, Chase, Hoffman & Schimmel , P.S.

23 Investment Highlights o Highest quality eyewear lens production at most competitive, high margin price points • Enabled by novel proprietary cloud based software, devices and highest quality lens o Worldwide market reach o Commercial launch initiated in 4Q 2014 • >13,000 independent ECP’s in US now under purchasing group agreements • In EU, >3,000 independent ECP’s associated with 12 purchasing groups, along with >1,000 Grand Vision ECP’s o Targeting positive EBITDA in or before 1Q 2016

Thank You!