Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Chubb Ltd | d111370d8k.htm |

| EX-99.1 - EX-99.1 - Chubb Ltd | d111370dex991.htm |

| Exhibit 99.2

|

ACE to Acquire Chubb:

Creating a Global P&C Industry Leader

July 1, 2015

|

|

Explanatory Notes

Cautionary Statement Regarding Forward-Looking Statements

All forward-looking statements made in this presentation, related to the acquisition of Chubb, potential post-acquisition performance or otherwise, reflect ACE’s current views with respect to future events, business transactions and business performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” “project” or other words of similar meaning. All forward-looking statements involve risks and uncertainties, which may cause actual results to differ, possibly materially, from those contained in the forward-looking statements.

Forward-looking statements include, but are not limited to, statements about the benefits of the proposed transaction involving ACE and Chubb, including future financial results; ACE’s and Chubb’s plans, objectives, expectations and intentions; the expected timing of completion of the transaction and other statements that are not historical facts. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, without limitation, the following: the inability to complete the transaction in a timely manner; the inability to complete the transaction due to the failure of Chubb’s shareholders to adopt the transaction agreement or the failure of ACE shareholders to approve, among other matters, the issuance of ACE common stock in connection with the acquisition; the failure to satisfy other conditions to completion of the transaction, including receipt of required regulatory approvals; the failure of the proposed transaction to close for any other reason; the possibility that any of the anticipated benefits of the proposed transaction will not be realized; the risk that integration of Chubb’s operations with those of ACE will be materially delayed or will be more costly or difficult than expected; the challenges of integrating and retaining key employees; the effect of the announcement of the transaction on ACE’s, Chubb’s or the combined company’s respective business relationships, operating results and business generally; the possibility that the anticipated synergies and cost savings of the transaction will not be realized, or will not be realized within the expected time period; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; general competitive, economic, political and market conditions and fluctuations; and actions taken or conditions imposed by the United States and foreign governments and regulatory authorities. In addition, you should carefully

consider the risks and uncertainties and other factors that may affect future results of the combined company described in the section entitled “Risk Factors” in the joint proxy statement/prospectus to be delivered to ACE’s and Chubb’s respective shareholders, and in ACE’s and Chubb’s respective filings with the Securities and Exchange Commission (“SEC”) that are available on the SEC’s website, located at www.sec.gov, including the sections entitled “Risk Factors” in ACE’s Annual Report on Form 10–K for the year ended December 31, 2014, which was filed with the SEC on February 27, 2015, and “Risk Factors” in Chubb’s Annual Report on Form 10–K for the year ended December 31, 2014, which was filed with the SEC on February 26, 2015. You should not place undue reliance on forward-looking statements, which speak only as of the date of this presentation. ACE undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| 2 |

|

|

|

Explanatory Notes

Additional Information and Where to Find It

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This presentation may be deemed to be solicitation material in respect of the proposed transaction between ACE and Chubb. In connection with the proposed transaction, ACE intends to file a registration statement on Form S-4, containing a joint proxy statement/prospectus with the SEC. The final joint proxy statement/prospectus will be delivered to the shareholders of ACE and Chubb. This presentation is not a substitute for the registration statement, definitive joint proxy statement/prospectus or any other documents that ACE or Chubb may file with the SEC or send to shareholders in connection with the proposed transaction. Shareholders are urged to read all relevant documents filed with the SEC, including the joint proxy statement/prospectus, because they will contain important information about the proposed transaction.

Shareholders will be able to obtain copies of the joint proxy statement/prospectus and other documents filed with the SEC (when available) free of charge at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by ACE will be made available free of charge on ACE’s website at www.acegroup.com. Copies of documents filed with the SEC by Chubb will be made available free of charge on Chubb’s website at www. Chubb.com.

Participants in Solicitation

ACE, Chubb and their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of ACE is set forth in the proxy

statement for ACE’s 2015 Annual General Meeting, which was filed with the SEC on April 8, 2015, and ACE’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 27, 2015. Information about the directors and executive officers of Chubb is set forth in the proxy statement for Chubb’s 2015 Annual Meeting of Shareholders, which was filed with the SEC on March 13, 2015, and Chubb’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 26, 2015. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. You may obtain free copies of these documents as described above.

| 3 |

|

|

|

Compelling Strategic Rationale

? Two Great Underwriting Companies Combined Will Create a Global P&C Industry Leader with Greater Earning Power and Substantial Future Value Creation Opportunity

? A Growth Company: Complementary, Superior Strengths in Product, Distribution and Customer Expertise with Increased Data and Insight Will Drive New Opportunities in Both Developed and Developing Markets

? Greater Growth and Earning Power Together than the Sum of the Two Companies Separately

? Exceptional Balance as a Result of Greater Product Diversification; Product Mix Has Reduced Exposure to the P&C Industry Cycle

? Shared Culture of Underwriting Discipline with Proven Long-Term Track Record of World-Class Underwriting Results

? Efficiencies Gained through the Combination and Greater Revenue Growth Medium-Term Will Drive Returns, Create Opportunities to Invest and Improve Competitive Profile

? Attractive Shareholder Returns: Immediately Accretive to EPS and Book Value; Double-Digit EPS Accretion, ROE Accretive and Double-Digit ROI by Year Three; ROI Exceeds Company’s Cost of Capital by Year Two; Tangible Book Value Per Share Returns to Current Level in Year Three

? Size and Strength of Balance Sheet Puts Company into Elite Group of Global Insurers

| 4 |

|

|

|

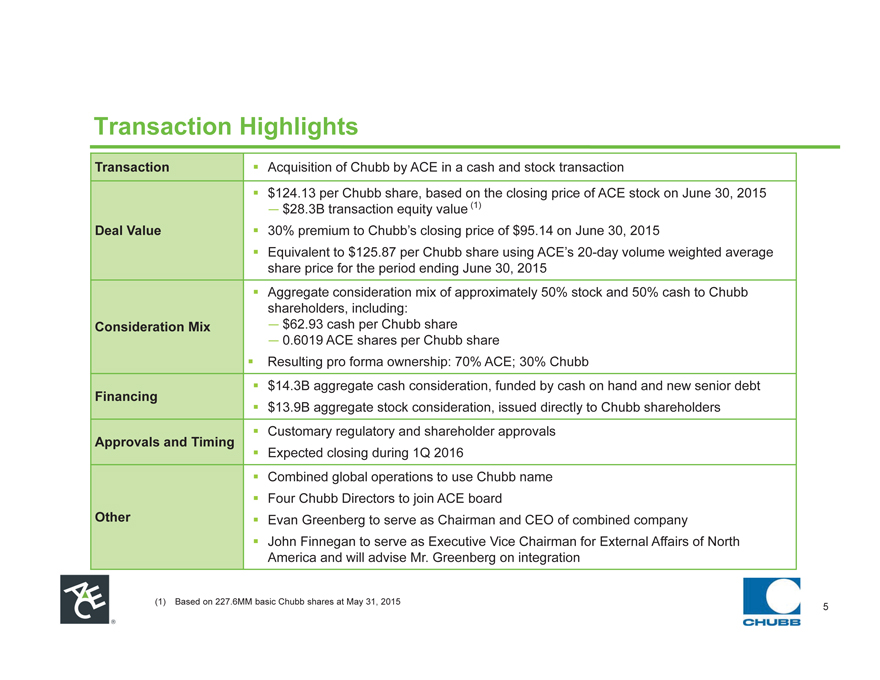

Transaction Highlights

Transaction Acquisition of Chubb by ACE in a cash and stock transaction

$124.13 per Chubb share, based on the closing price of ACE stock on June 30, 2015

— $28.3B transaction equity value (1)

Deal Value 30% premium to Chubb’s closing price of $95.14 on June 30, 2015

Equivalent to $125.87 per Chubb share using ACE’s 20-day volume weighted average

share price for the period ending June 30, 2015

Aggregate consideration mix of approximately 50% stock and 50% cash to Chubb

shareholders, including:

Consideration Mix — $62.93 cash per Chubb share

— 0.6019 ACE shares per Chubb share

Resulting pro forma ownership: 70% ACE; 30% Chubb

$14.3B aggregate cash consideration, funded by cash on hand and new senior debt

Financing

$13.9B aggregate stock consideration, issued directly to Chubb shareholders

Customary regulatory and shareholder approvals

Approvals and Timing

Expected closing during 1Q 2016

Combined global operations to use Chubb name

Four Chubb Directors to join ACE board

Other Evan Greenberg to serve as Chairman and CEO of combined company

John Finnegan to serve as Executive Vice Chairman for External Affairs of North

America and will advise Mr. Greenberg on integration

| (1) |

|

Based on 227.6MM basic Chubb shares at May 31, 2015 |

| 5 |

|

|

|

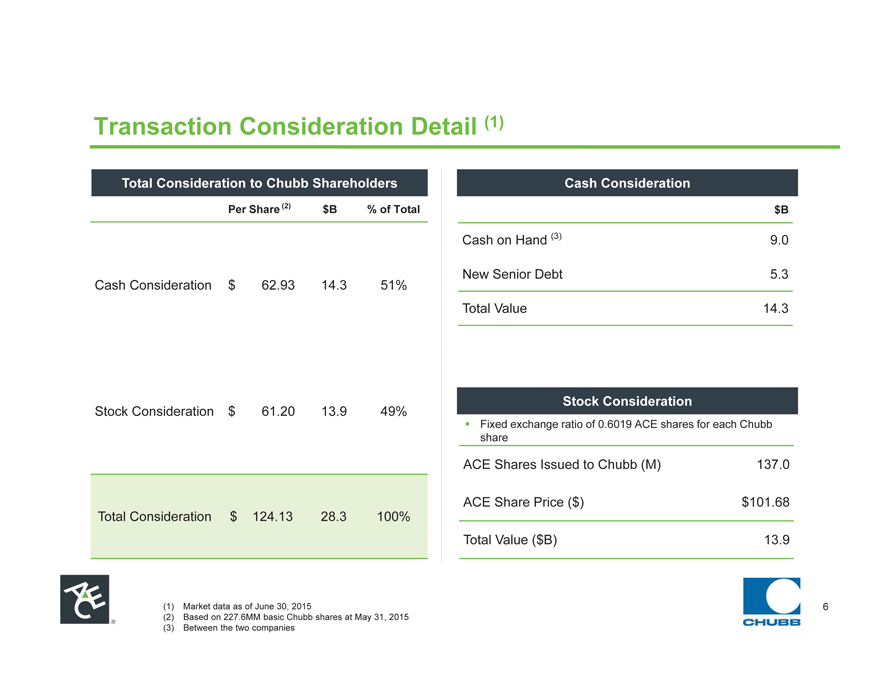

Transaction Consideration Detail (1)

Total Consideration to Chubb Shareholders

Per Share (2) $B % of Total

Cash Consideration $ 62.93 14.3 51%

Stock Consideration $ 61.20 13.9 49%

Total Consideration $ 124.13 28.3 100%

Cash Consideration

$B

Cash on Hand (3) 9.0

New Senior Debt 5.3

Total Value 14.3

Stock Consideration

? Fixed exchange ratio of 0.6019 ACE shares for each Chubb

share

ACE Shares Issued to Chubb (M) 137.0

ACE Share Price ($) $101.68

Total Value ($B) 13.9

| (1) |

|

Market data as of June 30, 2015 |

| (2) |

|

Based on 227.6MM basic Chubb shares at May 31, 2015 (3) Between the two companies |

| 6 |

|

|

|

Transaction Provides Significant Value to Chubb Shareholders

Provides significant value to shareholders today and as part of combined business

- Attractive premium

- Significant and immediate value

- Upside potential

- Number of strategic benefits (overview)

- Enhanced earning power and growth/value creation opportunities? Compelling transaction for Chubb

| 7 |

|

|

|

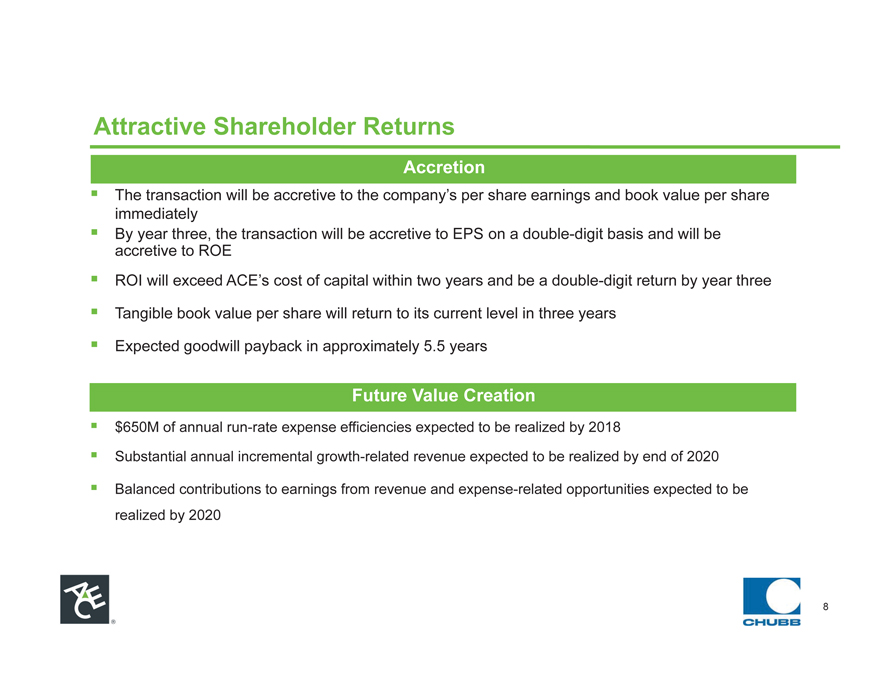

Attractive Shareholder Returns

Accretion

The transaction will be accretive to the company’s per share earnings and book value per share immediately ? By year three, the transaction will be accretive to EPS on a double-digit basis and will be accretive to ROE

ROI will exceed ACE’s cost of capital within two years and be a double-digit return by year three? Tangible book value per share will return to its current level in three years? Expected goodwill payback in approximately 5.5 years

Future Value Creation

$650M of annual run-rate expense efficiencies expected to be realized by 2018

Substantial annual incremental growth-related revenue expected to be realized by end of 2020? Balanced contributions to earnings from revenue and expense-related opportunities expected to be realized by 2020

| 8 |

|

|

|

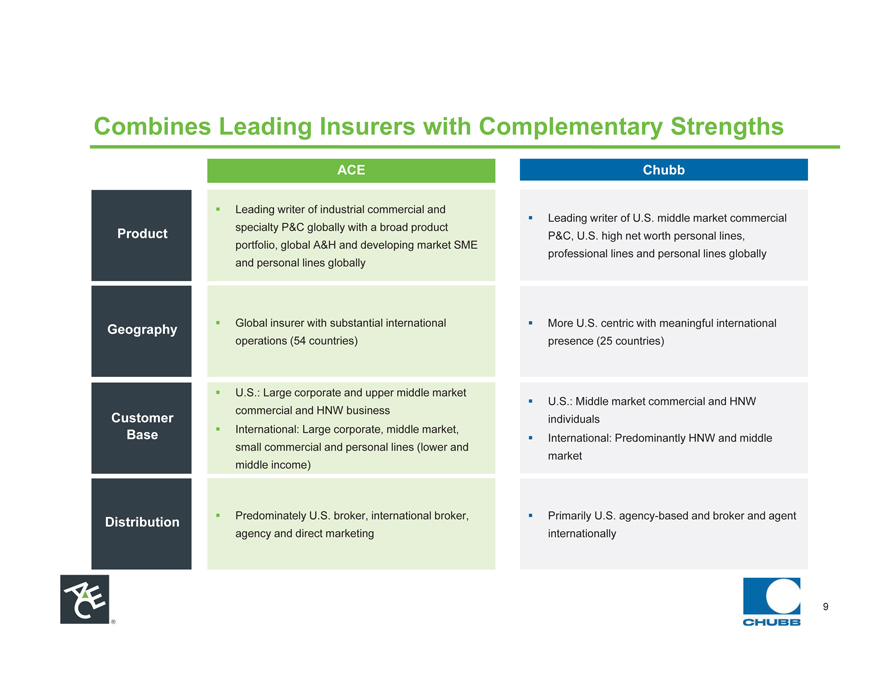

Combines Leading Insurers with Complementary Strengths

ACE

Leading writer of industrial commercial and

Product specialty P&C globally with a broad product

portfolio, global A&H and developing market SME

and personal lines globally

Geography Global insurer with substantial international

operations (54 countries)

U.S.: Large corporate and upper middle market

Customer commercial and HNW business

Base International: Large corporate, middle market,

small commercial and personal lines (lower and

middle income)

Distribution Predominately U.S. broker, international broker,

agency and direct marketing

Chubb

Leading writer of U.S. middle market commercial P&C, U.S. high net worth personal lines, professional lines and personal lines globally

More U.S. centric with meaningful international presence (25 countries)

U.S.: Middle market commercial and HNW individuals

International: Predominantly HNW and middle market

Primarily U.S. agency-based and broker and agent internationally

9

|

|

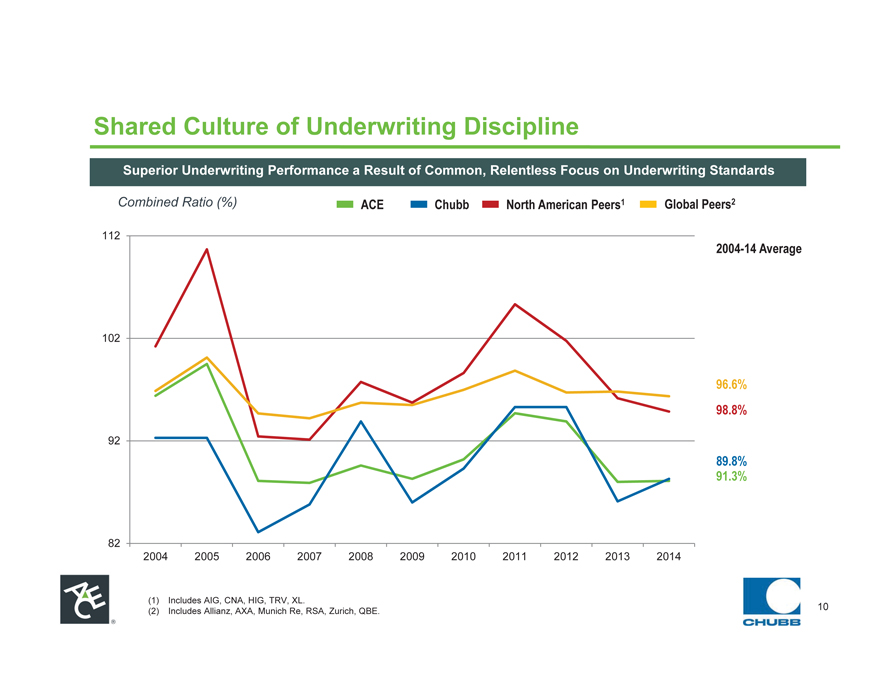

Shared Culture of Underwriting Discipline

Superior Underwriting Performance a Result of Common, Relentless Focus on Underwriting Standards

Combined Ratio (%) ACE Chubb North American Peers1 Global Peers2

2004-14 Average

96.6% 98.8%

89.8% 91.3%

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

| (1) |

|

Includes AIG, CNA, HIG, TRV, XL. |

| (2) |

|

Includes Allianz, AXA, Munich Re, RSA, Zurich, QBE. |

10

|

|

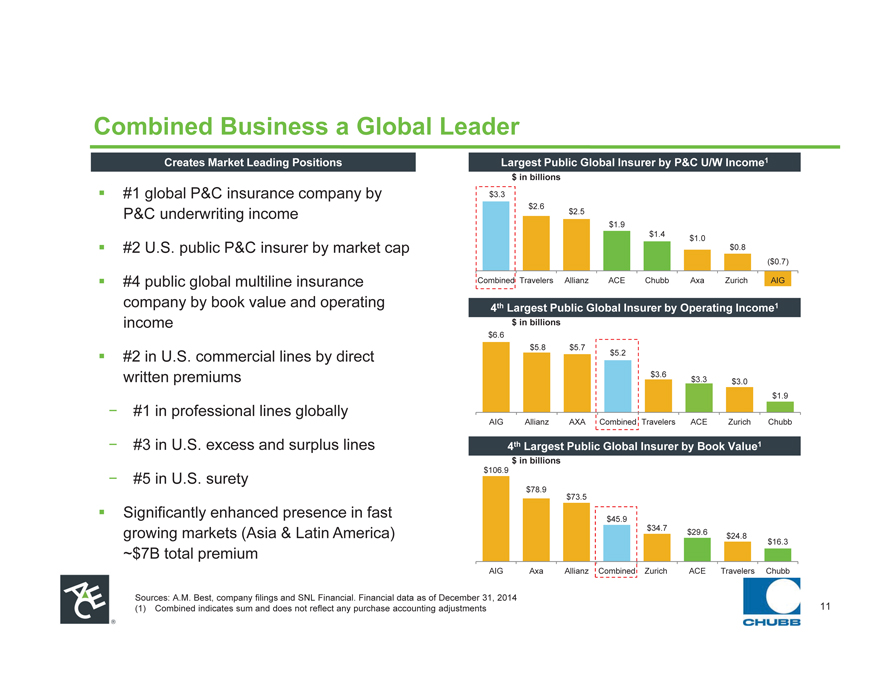

Combined Business a Global Leader

Creates Market Leading Positions

#1 global P&C insurance company by P&C underwriting income

#2 U.S. public P&C insurer by market cap

#4 public global multiline insurance company by book value and operating income

#2 in U.S. commercial lines by direct written premiums

- #1 in professional lines globally

- #3 in U.S. excess and surplus lines

- #5 in U.S. surety

Significantly enhanced presence in fast growing markets (Asia & Latin America)

~$7B total premium

Largest Public Global Insurer by P&C U/W Income1

$ in billions

$3.3

$2.6 $2.5

$1.9

$1.4 $1.0

$0.8

($0.7)

Combined Travelers Allianz ACE Chubb Axa Zurich AIG

4th Largest Public Global Insurer by Operating Income1

$ in billions

$6.6

$5.8 $5.7 $5.2

$3.6 $3.3 $3.0

$1.9

AIG Allianz AXA Combined Travelers ACE Zurich Chubb

4th Largest Public Global Insurer by Book Value1

$ in billions

$106.9

$78.9

$73.5

$45.9

$34.7

$29.6 $24.8

$16.3

AIG Axa Allianz Combined Zurich ACE Travelers Chubb

Sources: A.M. Best, company filings and SNL Financial. Financial data as of December 31, 2014 (1) Combined indicates sum and does not reflect any purchase accounting adjustments

11

|

|

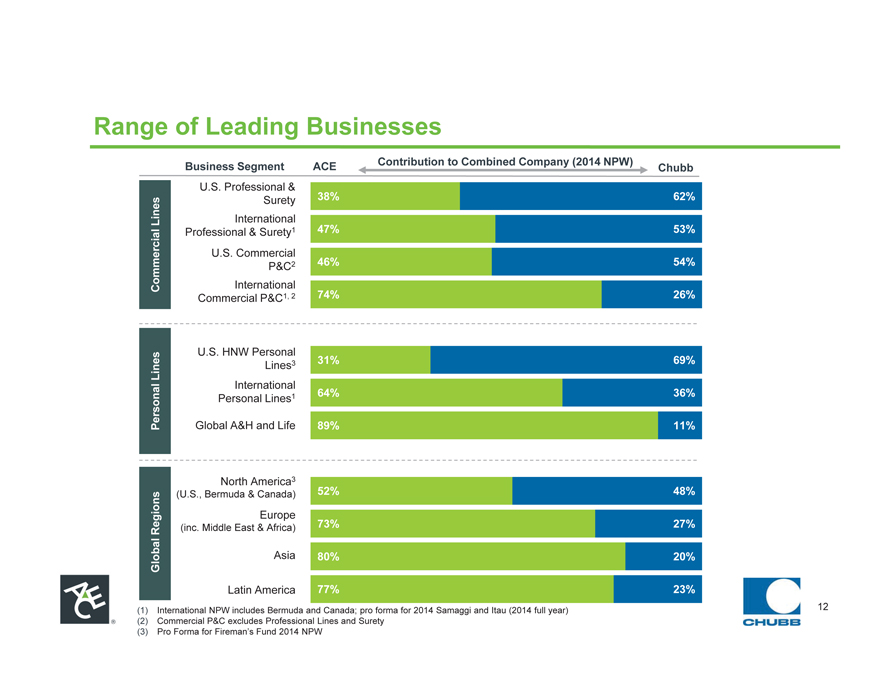

Range of Leading Businesses

Business Segment ACE Contribution to Combined Company (2014 NPW) Chubb

U.S. Professional &

Surety 38% 62%

Lines International

Professional & Surety1 47% 53%

U.S. Commercial

P&C2 46% 54%

Commercial International

Commercial P&C1, 2 74% 26%

U.S. HNW Personal

Lines Lines3 31% 69%

International

Personal Lines1 64% 36%

Personal Global A&H and Life 89% 11%

50%

North America3

(U.S., Bermuda & Canada) 52% 48%

Europe

Regions (inc. Middle East & Africa) 73% 27%

Global Asia 80% 20%

Latin America 77% 23%

(1) International NPW includes Bermuda and Canada; pro forma for 2014 Samaggi and Itau (2014 full year) (2) Commercial P&C excludes Professional Lines and Surety (3) Pro Forma for Fireman’s Fund 2014 NPW

12

|

|

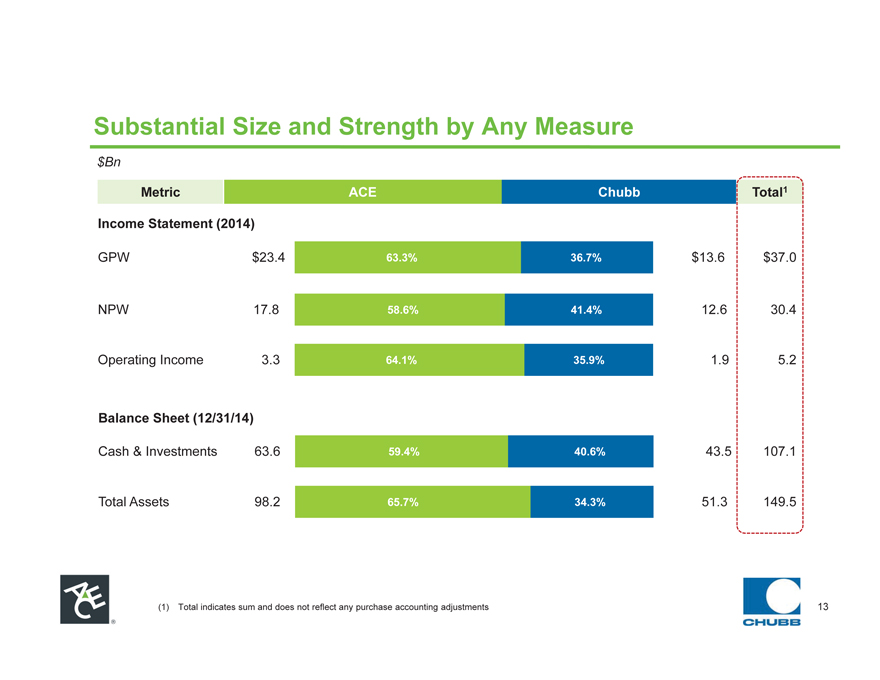

Substantial Size and Strength by Any Measure

$Bn

Metric ACE Chubb Total1

Income Statement (2014)

GPW $23.4 63.3% 36.7% $13.6 $37.0

NPW 17.8 58.6% 41.4% 12.6 30.4

Operating Income 3.3 64.1% 35.9% 1.9 5.2

Balance Sheet (12/31/14)

Cash & Investments 63.6 59.4% 40.6% 43.5 107.1

Total Assets 98.2 65.7% 34.3% 51.3 149.5

| (1) |

|

Total indicates sum and does not reflect any purchase accounting adjustments |

13

|

|

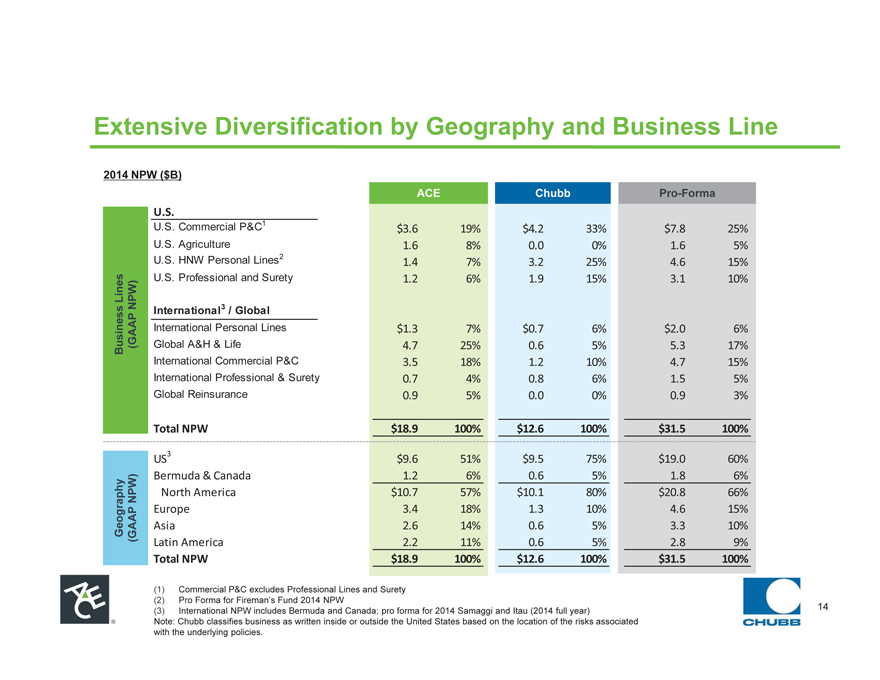

Extensive Diversification by Geography and Business Line

2014 NPW ($B)

ACE Chubb Pro-Forma

U.S.

U.S. Commercial P&C1 $3.6 19% $4.2 33% $7.8 25%

U.S. Agriculture 1.6 8% 0.0 0% 1.6 5%

U.S. HNW Personal Lines2 1.4 7% 3.2 25% 4.6 15%

U.S. Professional and Surety 1.2 6% 1.9 15% 3.1 10%

Lines NPW) International3 / Global

International Personal Lines $1.3 7% $0.7 6% $2.0 6%

Business (GAAP Global A&H & Life 4.7 25% 0.6 5% 5.3 17%

International Commercial P&C 3.5 18% 1.2 10% 4.7 15%

International Professional & Surety 0.7 4% 0.8 6% 1.5 5%

Global Reinsurance 0.9 5% 0.0 0% 0.9 3%

Total NPW $18.9 100% $12.6 100% $31.5 100%

US3 $9.6 51% $9.5 75% $19.0 60%

Bermuda & Canada 1.2 6% 0.6 5% 1.8 6%

NPW) North America $10.7 57% $10.1 80% $20.8 66%

Europe 3.4 18% 1.3 10% 4.6 15%

Geography (GAAP Asia 2.6 14% 0.6 5% 3.3 10%

Latin America 2.2 11% 0.6 5% 2.8 9%

Total NPW $18.9 100% $12.6 100% $31.5 100%

| (1) |

|

Commercial P&C excludes Professional Lines and Surety (2) Pro Forma for Fireman’s Fund 2014 NPW |

| (3) |

|

International NPW includes Bermuda and Canada; pro forma for 2014 Samaggi and Itau (2014 full year) |

Note: Chubb classifies business as written inside or outside the United States based on the location of the risks associated with the underlying policies.

14

|

|

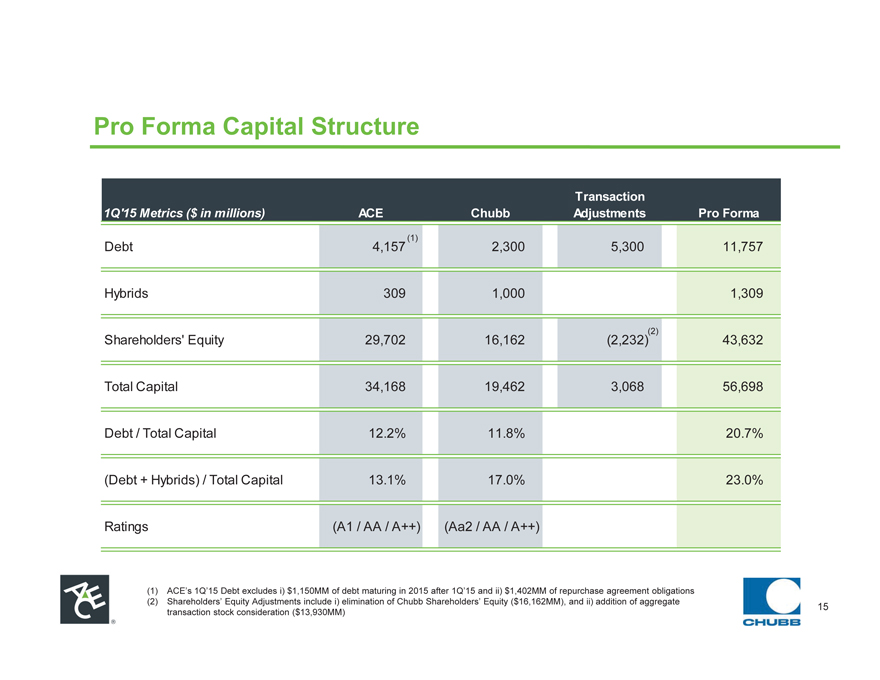

Pro Forma Capital Structure

Transaction

1Q’15 Metrics ($ in millions) ACE Chubb Adjustments Pro Forma

Debt 4,157 (1) 2,300 5,300 11,757

Hybrids 309 1,000 1,309

Shareholders’ Equity 29,702 16,162 (2,232)(2) 43,632

Total Capital 34,168 19,462 3,068 56,698

Debt / Total Capital 12.2% 11.8% 20.7%

(Debt + Hybrids) / Total Capital 13.1% 17.0% 23.0%

Ratings (A1 / AA / A++) (Aa2 / AA / A++)

(1) ACE’s 1Q’15 Debt excludes i) $1,150MM of debt maturing in 2015 after 1Q’15 and ii) $1,402MM of repurchase agreement obligations (2) Shareholders’ Equity Adjustments include i) elimination of Chubb Shareholders’ Equity ($16,162MM), and ii) addition of aggregate transaction stock consideration ($13,930MM)

15

|

|

Conclusion

Two Great Underwriting Companies Combined Will Create a Global P&C Industry Leader with Greater Earning Power and Substantial Future Value Creation Opportunity

A Growth Company: Complementary, Superior Strengths in Product, Distribution and Customer Expertise with Increased Data and Insight Will Drive New Opportunities in Both Developed and Developing Markets

Greater Growth and Earning Power Together than the Sum of the Two Companies Separately

Exceptional Balance as a Result of Greater Product Diversification; Product Mix Has Reduced Exposure to the P&C Industry Cycle

Shared Culture of Underwriting Discipline with Proven Long-Term Track Record of World-Class Underwriting Results

Efficiencies Gained through the Combination and Greater Revenue Growth Medium-Term Will Drive Returns, Create Opportunities to Invest and Improve Competitive Profile

Attractive Shareholder Returns: Immediately Accretive to EPS and Book Value; Double-Digit EPS Accretion, ROE Accretive and Double-Digit ROI by Year Three; ROI Exceeds Company’s Cost of Capital by Year Two; Tangible Book Value Per Share Returns to Current Level in Year Three

Size and Strength of Balance Sheet Puts Company into Elite Group of Global Insurers

16

|

|

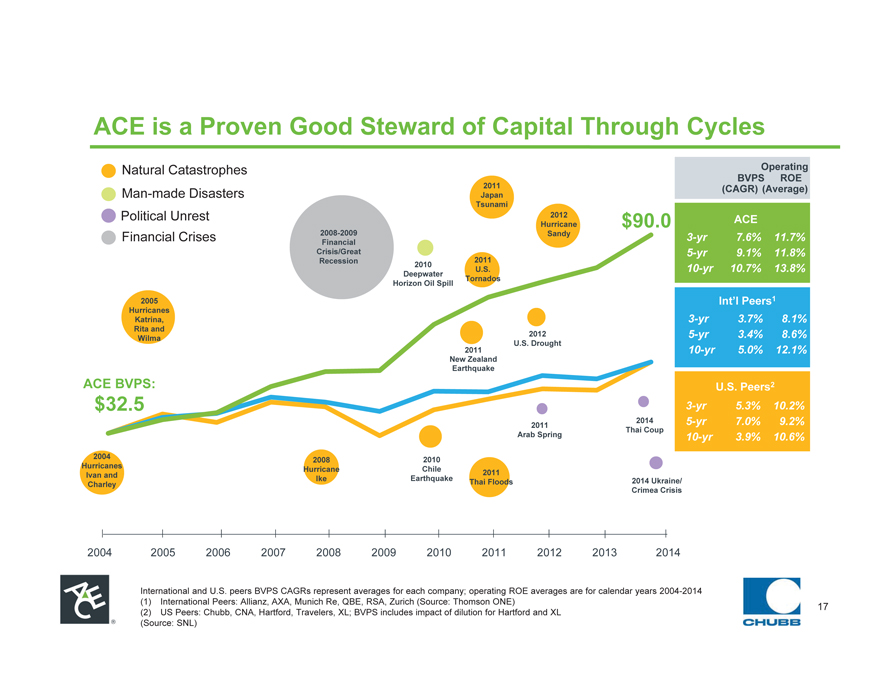

ACE is a Proven Good Steward of Capital Through Cycles

Natural Catastrophes Operating

BVPS ROE

Man-made Disasters Japan 2011 (CAGR) (Average)

Tsunami

Political Unrest 2012

Hurricane $90.0 ACE

Financial Crises 2008-2009 Sandy 3-yr 7.6% 11.7%

Financial

Crisis/Great 5-yr 9.1% 11.8%

Recession 2011

2010 U.S. 10-yr 10.7% 13.8%

Deepwater

Horizon Oil Spill Tornados

2005 Int’l Peers1

Hurricanes

Katrina, 3-yr 3.7% 8.1%

Rita and

Wilma 2012 5-yr 3.4% 8.6%

U.S. Drought

2011 10-yr 5.0% 12.1%

New Zealand

Earthquake

ACE BVPS: U.S. Peers2

$32.5 3-yr 5.3% 10.2%

2011 2014 5-yr 7.0% 9.2%

Thai Coup

Arab Spring 10-yr 3.9% 10.6%

2004 2008 2010

Hurricanes Hurricane Chile

Ivan and 2011

Ike Earthquake Thai Floods 2014 Ukraine/

Charley

Crimea Crisis

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

International and U.S. peers BVPS CAGRs represent averages for each company; operating ROE averages are for calendar years 2004-2014 (1) International Peers: Allianz, AXA, Munich Re, QBE, RSA, Zurich (Source: Thomson ONE) (2) US Peers: Chubb, CNA, Hartford, Travelers, XL; BVPS includes impact of dilution for Hartford and XL

(Source: SNL)

17