Attached files

| file | filename |

|---|---|

| EX-10.1 - EX-10.1 - WILLIS TOWERS WATSON PLC | d948067dex101.htm |

| 8-K - FORM 8-K - WILLIS TOWERS WATSON PLC | d948067d8k.htm |

| EX-99.1 - EX-99.1 - WILLIS TOWERS WATSON PLC | d948067dex991.htm |

| EX-99.4 - EX-99.4 - WILLIS TOWERS WATSON PLC | d948067dex994.htm |

| EX-99.3 - EX-99.3 - WILLIS TOWERS WATSON PLC | d948067dex993.htm |

| EX-99.5 - EX-99.5 - WILLIS TOWERS WATSON PLC | d948067dex995.htm |

| EX-10.2 - EX-10.2 - WILLIS TOWERS WATSON PLC | d948067dex102.htm |

| EX-10.4 - EX-10.4 - WILLIS TOWERS WATSON PLC | d948067dex104.htm |

| EX-10.3 - EX-10.3 - WILLIS TOWERS WATSON PLC | d948067dex103.htm |

| EX-2.1 - EX-2.1 - WILLIS TOWERS WATSON PLC | d948067dex21.htm |

1 Creating a Leading Global Advisory, Broking and Solutions Firm June 30, 2015 Exhibit 99.2 |

2 Responsibility Statement The directors of Willis accept responsibility for the information contained in this document other than that relating to Towers Watson,

the Towers Watson Group and the directors of Towers Watson and

members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Willis (who have taken all reasonable care to ensure that such is

the case) the information contained in this document for which

they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

The directors of Towers Watson accept responsibility for the information

contained in this document relating to Towers Watson, the Towers

Watson Group and the directors of Towers Watson and members of their immediate

families, related trusts and persons connected with them.

To the best of the knowledge and belief of the directors of Towers Watson (who have taken all reasonable care to ensure that such is the case) the information contained in this document for which they accept responsibility is in accordance with the facts and does not omit

anything likely to affect the import of such information. |

3 Important Information About the Transaction and Where to Find It WILLIS TOWERS WATSON 200 Liberty Street, 7th Floor New York, NY 10281-1003 901 N. Glebe Road Arlington, VA 22203 Attention: Investor Relations Attention: Investor Relations 212-915-8084 703-258-8000 investor.relations@willis.com investor.relations@towerswatson.com This document shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of

1933, as amended. Willis

plans to file with the SEC a Registration Statement on Form S-4 in connection with the transaction. Willis and Towers Watson plan to file with the SEC and mail to their respective shareholders a Joint Proxy Statement/Prospectus in connection with the transaction. The

Registration Statement and the Joint Proxy Statement/Prospectus

will contain important information about Willis, Towers Watson, the transaction and related matters. Investors and security holders are urged to read the Registration Statement, the

Joint Proxy Statement/Prospectus and other related documents carefully when they are available. Investors and security holders will be able to obtain free copies of the Registration Statement, the Joint Proxy Statement/Prospectus and

other related documents filed with the SEC by Willis and Towers

Watson through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department of Willis or Towers Watson at the following:

|

4 Participants in the Solicitation Willis and Towers Watson, and their respective directors and executive officers, may be deemed to be participants in the solicitation of

proxies in respect of the transactions contemplated by the merger

agreement. Information regarding the directors and executive officers of Willis, and their direct or indirect interests in the transaction, by security holdings or otherwise, is contained in Willis’s Form 10-K for

the year ended December 31, 2014 and its proxy statement filed on

April 17, 2015, which are filed with the SEC. Information regarding Towers Watson’s directors and executive officers, and their direct or indirect interests in the transaction, by security holdings or otherwise, is

contained in Towers Watson’s Form 10-K for the year

ended June 30, 2014 and its proxy statement filed on October 3, 2014, which are filed with the SEC. A more complete description will be available in the Registration Statement and the Joint Proxy

Statement/Prospectus. |

5 Forward Looking Statements This document contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not

historical facts, including statements regarding expectations,

hopes, intentions or strategies regarding the future are forward-looking statements. Forward- looking statements are based on Willis or Towers Watson management’s beliefs, as well as assumptions made by, and information

currently available to, them. Because such statements are based

on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Willis and Towers Watson undertake no obligation to update any

forward-looking statements, whether as a result of new

information, future events or otherwise. The risks and uncertainties which forward-looking statements are subject to include, but are not limited to: the ability to consummate the proposed transaction; the ability to obtain requisite

regulatory and shareholder approvals and the satisfaction of

other conditions to the consummation of the proposed transaction on the proposed terms and schedule; the ability of Willis and Towers Watson to successfully integrate their respective operations and employees and realize

synergies and cost savings at the times, and to the extent,

anticipated; the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers and competitors; changes in general economic, business and

political conditions, including changes in the financial markets;

significant competition that Willis and Towers Watson face; compliance with extensive government regulation; the combined company’s ability to make acquisitions and its ability to integrate or manage such

acquired businesses; and other risks detailed in the

“Statement Regarding Forward-Looking Information,” “Risk Factors” and other sections of Willis’s and Towers Watson’s Form 10-K and other filings with the Securities and Exchange Commission. |

6 Today’s Presenters DOMINIC CASSERLEY Chief Executive Officer JOHN HALEY Chairman and Chief Executive Officer |

7 A Highly Complementary, Strategic Combination POWERFUL CLIENT PROPOSITION Integrated global platform with highly complementary offerings Comprehensive advice, analytics, specialty capabilities and solutions covering benefits; exchange solutions;

brokerage and advisory; risk and capital management; and talent and rewards

ACCELERATES REVENUE GROWTH AND STRATEGIC PRIORITIES

Leverage mutual distribution strength to enhance market penetration

Enhanced global footprint

Platform for further innovation

SIGNIFICANT COST SYNERGY OPPORTUNITIES

Highly achievable, identified cost savings and efficiencies

CULTURES ALIGNED AROUND SHARED VALUES

Creates leading global advisory, broking and solutions firm

|

8 Significant Shareholder Value Creation GB, WESTERN EUROPE & REST OF WORLD Expand Towers Watson’s reach by 80+ countries Internationalize Towers Watson’s Global Health and Group Benefits solution and exchange platform over time Enhance both Towers Watson’s and Willis’ ability to serve multinational Human Capital & Benefits clients Deliver more comprehensive local market solutions for multinationals NORTH AMERICA Increase Willis’ penetration in $10+ billion U.S. large P&C corporate market Accelerate growth of OneExchange via middle- market distribution $100 - $125 million of cost synergies expected to be fully realized within three years post close Increased efficiencies from scale Incremental to current cost saving and operational efficiency initiatives Maintain Irish domicile and achieve effective tax rate in mid-20 percent range DELIVERING TANGIBLE REVENUE GROWTH OPPORTUNITIES CAPITALIZING ON IDENTIFIED COST SYNERGIES Accelerate revenue, cash flow, EBITDA and earnings growth |

9 Transaction Overview Transaction Structure Merger of equals Approximately $18 billion transaction value Pro forma ownership: 50.1% Willis shareholders and 49.9% Towers Watson shareholders, on a

fully diluted basis

Combined company will be named Willis Towers Watson

Shareholder Consideration Towers Watson shareholders to receive 2.6490 Willis shares for each Towers Watson share Towers Watson shareholders to receive one-time $4.87 per share cash dividend pre-closing

Subject to Willis shareholder approval, Willis will implement at the time of

the merger a 2.6490 for one reverse stock split, so that one

Willis share will be converted into 0.3775 shares of the

combined company (1) If the reverse split is approved, Towers Watson shareholders to receive 1 share of the combined

company for each Towers Watson share

Governance James McCann to be Chairman John Haley to be CEO Dominic Casserley to be President and Deputy CEO Roger Millay to be CFO 12 person Board; 6 Willis directors and 6 Towers Watson directors Domicile/ Locations Maintain Irish domicile and significant presence in major markets globally

Closing Conditions Closing expected by December 31, 2015 Subject to customary closing conditions, including Willis and Towers Watson shareholder approvals and regulatory approvals (1) Merger is not conditioned on approval of the reverse stock split. |

10 Merger Consideration SHAREHOLDERS SHAREHOLDERS $4.87 cash dividend per share plus 1 share of Willis Towers Watson for each Towers Watson Share (1) Subject to Willis shareholder approval. If not approved each Towers Watson share will receive a cash dividend of $4.87 per

share and 2.6490 shares of Willis Towers Watson for each Towers

Watson share. Willis shareholders will continue to own their existing

number of shares. The merger is not conditioned on approval of the reverse stock split. 0.3775 shares of Willis Towers Watson for each Willis Share 2.6490 : 1 Reverse Stock Split (1) Receive $4.87 cash dividend per share Exchange each Towers Watson share for 2.6490 Willis Shares Willis 2.6490 : 1 Reverse Stock Split (1) |

11 CFO Roger Millay Towers Watson HEAD OF HR Anne Bodnar Towers Watson GENERAL COUNSEL Matt Furman Willis HEAD OF OPS & TECH David Shalders Willis Organizational Structure of the Combined Company WESTERN EUROPE Paul Morris Towers Watson GREAT BRITAIN Nicolas Aubert Willis REST OF WORLD Adam Garrard Willis NORTH AMERICA CO HEAD Carl Hess Towers Watson NORTH AMERICA CO HEAD Todd Jones Willis HUMAN CAPITAL AND BENEFITS Julie Gebauer Towers Watson EXCHANGE SOLUTIONS Jim Foreman Towers Watson CORPORATE RISK & BROKING Tim Wright Willis INVESTMENT, RISK & REINSURANCE Dominic Casserley Willis CEO | John Haley

PRESIDENT AND DEPUTY CEO | Dominic

Casserley

BUSINESS LINES

REGIONS CORPORATE |

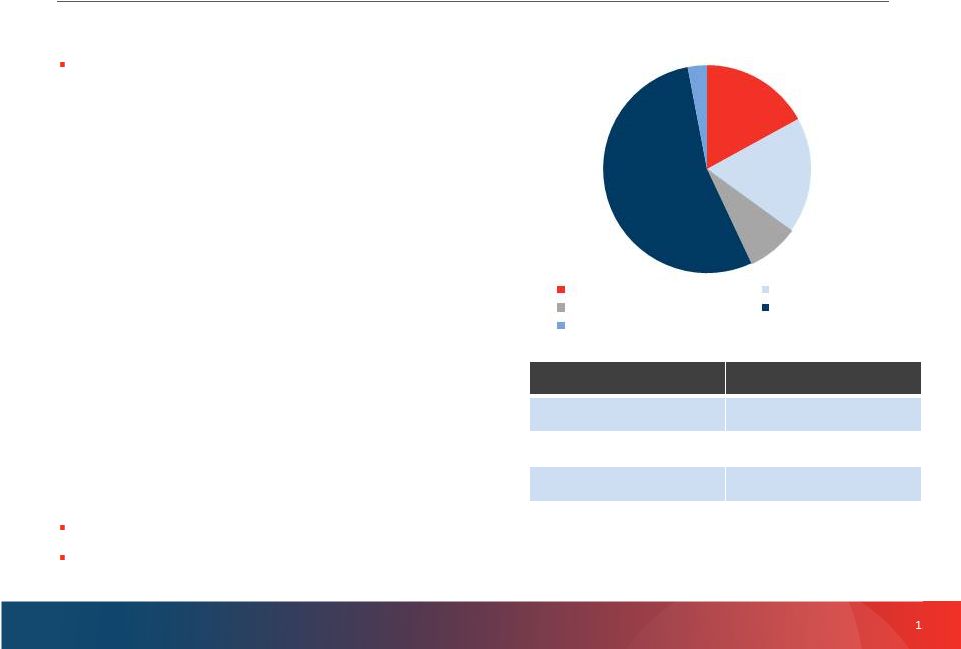

12 Towers Watson Overview BUSINESS DESCRIPTION A leading provider of advisory services and solutions across four business segments: » Benefits – Retirement – Health and Group Benefits – Technology and Administration Solutions – International » Risk and Financial Services – Risk Consulting and Software – Investment » Exchange Solutions – OneExchange for active and retired employees – Health and Welfare Administration – Consumer Directed Accounts » Talent and Rewards – Rewards, Talent and Communications – Data, Surveys and Technology – Executive Compensation ~16,000 associates in 37 countries 150 year history Note: Fiscal Year 2014 ended June 30, 2014. (1) Market cap as of June 29, 2015. (2) See Towers Watson non-GAAP measures for definition. KEY FINANCIALS FY 2014 Market Cap $9.7 billion (1) Revenue $3.5 billion Adj. EBITDA (2) $670 million Free Cash Flow $391 million FY 2014 REVENUE BY SEGMENT 17% 18% 8% 54% 3% Talent & Rewards Risk & Financial Services Exchange Solutions Benefits Other |

13 (1) Includes Gras Savoye. (2) Fiscal Year 2014 ended December 31, 2014. (3) Market cap as of June 29, 2015. (4) See Willis non-GAAP measures for definition. Willis Overview 27% 35% 20% 18% FY 2014 REVENUE BY SEGMENT International North America Capital, Wholesale and Reinsurance Great Britain BUSINESS DESCRIPTION Willis is a leading global risk advisory, re/insurance broking, and human capital and benefits firm organized in four business segments: » Willis North America – Focused on delivering P&C and human capital and benefits services across the United States and Canada » Willis Capital, Wholesale and Reinsurance – Willis Re – Willis Capital Markets & Advisory – Wholesale businesses (e.g., Miller) – Willis Portfolio and Underwriting Services » Willis GB – Comprises Willis’ Great Britain-based Specialty and Retail businesses – Focused on delivering full range of Willis expertise across Great Britain and specialty capabilities around the world » Willis International – Focused on delivering P&C and human capital and benefits services across Asia, CEEMA, Latin America and Western Europe Pending acquisition of Gras Savoye ~22,500 associates (1) in more than 120 countries 187 year history KEY FINANCIALS FY 2014 (2) Market Cap $8.4 billion (3) Revenue $3.8 billion Underlying EBITDA (4) $829 million Free Cash Flow $364 million |

Willis Towers Watson: A Comprehensive Offering

Powerful Global Growth Platform BROAD APPEAL TO CLIENTS WORLDWIDE 14 |

15 Willis Towers Watson: Increased Scale, Diversity & Financial Strength $8.2BN Revenue Human Capital & Benefits Exchange Solutions Corporate Risk & Broking Investment, Risk & Reinsurance $1.7BN (1) Towers Watson Adjusted EBITDA & Willis Underlying EBITDA ~39,000 Associates 120+ Countries Strong Balance Sheet North America Western Europe Great Britain Rest of World 43% 5% 35% 17% APPROXIMATE COMBINED BUSINESS MIX 48% 19% 20% 13% APPROXIMATE COMBINED GEOGRAPHIC MIX Financials based on calendar year 2014 results, pro forma for the merger, completion of Willis’

acquisitions of Miller and Gras Savoye (pending), and full year run rate

contributions for Willis’ acquisitions of IFG, Max

Matthiessen and Charles Monat. (1) See Willis and Towers

Watson non-GAAP measures for definitions. |

16 Tangible Revenue Growth Opportunities Accelerates growth and strategic priorities GB, WESTERN EUROPE & REST OF WORLD Expand Towers Watson’s reach by 80+ countries Internationalize Towers Watson’s Global Health and Group Benefits solutions

and exchange platform over time

Enhance both Towers Watson’s and Willis’ ability to serve

multinational Human Capital & Benefits clients

Deliver more comprehensive local market solutions for multinationals NORTH AMERICA Rely upon Towers Watson relationships to increase Willis’ penetration in $10+

billion U.S. large P&C corporate market with Willis product

suite Accelerate growth of OneExchange via Willis

middle-market distribution |

17 Significant OneExchange Growth Opportunity Middle-market client segment represents an attractive growth opportunity Towers Watson provides best-in-class OneExchange platform Willis provides enhanced access to middle- market client base Continued focus on channel partner distribution Accelerating growth of OneExchange |

18 Capitalizing on Identified Cost Synergies Cost savings expected to be fully realized within three years post close

Corporate costs

Economies of scale

Incremental to current cost saving and operational improvement

initiative Non-recurring costs to achieve synergies of

approximately 1.25 times savings EXPECTED

RUN RATE COST SYNERGIES OF $100 - $125 MILLION TAX EFFICIENCIES Expected effective tax rate: mid-20 percent range Proven track record of identifying and capturing synergies |

Roadmap for Successful Integration

Realize full

benefits of

combination Joint integration team Well-defined integration process Strongest combination of talent and practices Commitment to communicate with and engage talent Unwavering focus on client service and current growth and operational improvement opportunities 19 |

20 A Highly Complementary, Strategic Combination POWERFUL CLIENT PROPOSITION Integrated global platform with highly complementary offerings Comprehensive advice, analytics, specialty capabilities and solutions covering benefits; exchange solutions;

brokerage and advisory; risk and capital management; and talent and rewards

ACCELERATES REVENUE GROWTH AND STRATEGIC PRIORITIES

Leverage mutual distribution strength to enhance market penetration

Enhanced global footprint

Platform for further innovation

SIGNIFICANT COST SYNERGY OPPORTUNITIES

Highly achievable, identified cost savings and efficiencies

CULTURES ALIGNED AROUND SHARED VALUES

Significant Shareholder Value Creation

Creates leading global advisory, broking and solutions firm

|

21 Towers Watson Non-GAAP Measures Adjusted EBITDA – Net income (attributable to common stockholders) adjusted for discontinued operations, net of tax, provision for income taxes, interest, net, depreciation and amortization, transaction and integration expenses, and other non-operating income excluding income from variable interest

entity. Free

Cash Flow – Cash Flows from Operating Activities less cash used to purchase Fixed Assets and Software for Internal Use. These non-U.S. GAAP measures are not defined in the same manner by all companies and may not be comparable to other similarly titled measures

of other companies. Non-U.S. GAAP measures should be considered in

addition to, and not as a substitute for, the information contained within our financial statements. |

22 Underlying EBITDA – Net income (attributable to Willis Group Holdings) adjusted for net income attributable to

non-controlling interests, interest in earnings of associates, net of tax, income tax charges, interest expense, restructuring charges, depreciation, amortization and other

non-operating income. Free Cash Flow – Net Cash provided by Operating Activities less additions to Fixed Assets. Willis Non-GAAP Measures

Underlying EBITDA Free Cash Flow These non-U.S. GAAP measures are not defined in the same manner by all companies and may not be comparable to other similarly titled

measures of other companies. Non-U.S. GAAP measures should be

considered in addition to, and not as a substitute for, the information contained within our financial statements. |