Attached files

| file | filename |

|---|---|

| 8-K - SWISS HELVETIA FUND, INC. | p15-0242_8k.htm |

Portfolio and Performance Review

The Swiss Helvetia Fund, Inc.

The Swiss Helvetia Fund, Inc.

Date: June 25, 2015

|

Stefan Frischknecht, CFA

|

Fund Manager

|

Agenda

Source: Schroders

n Case for Swiss equities

n Performance

n Portfolio positioning

n Outlook

n Conclusion

n Q & A

n Appendix

1

Switzerland leading in global competitiveness

Top position maintained for several consecutive years

2

Source: World Economic Forum, Global Competitiveness Report 2014-15; report includes rankings for 144 economies.

Swiss stocks also leading in global competitiveness

Very high percentage of Swiss index members are global leaders

Source: Schroders

3

|

Name

|

Global rank

within market |

Market

|

|

Nestle

|

1

|

Food

|

|

Novartis

|

2

|

Drugs

|

|

Roche

|

1

|

Diagnostics

|

|

UBS

|

1

|

Wealth management

|

|

ABB

|

2

|

Power transmission / distribution

|

|

Richemont

|

1

|

Jewelry

|

|

Syngenta

|

1

|

Crop protection

|

|

Swiss Re

|

2

|

Reinsurance

|

|

LafargeHolcim

|

1

|

Cement

|

|

Givaudan

|

1

|

Flavours / fragrance

|

|

Adecco

|

1

|

Staffing

|

|

Swatch

|

1

|

Watches

|

|

SGS

|

1

|

Inspection / testing

|

|

Transocean

|

1

|

Ocean drilling rigs

|

70% of blue chip stocks on the Swiss Market

Index (“SMI”) are ranked first or second within

their markets on a global basis

Index (“SMI”) are ranked first or second within

their markets on a global basis

Approx. 40% of Swiss mid caps, too

Global leadership in profit margins

4

Source: Schroders, Bloomberg, December 31, 2014

Thanks in large part to top market positions, Swiss profit margins are high

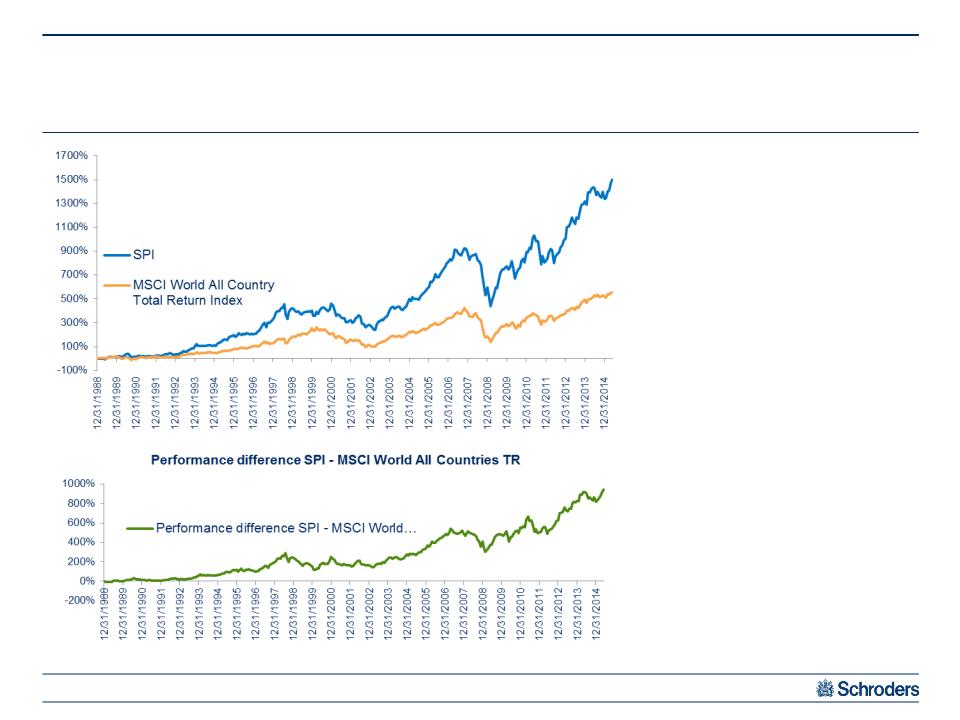

Swiss equities have an outstanding track record

5

Source: Bloomberg, performance in USD, May 31, 2015

Performance difference: 3.7%

p.a.

p.a.

Swiss Equities: 11.1 % p.a. in

USD

USD

MSCI World All Country

Total Return Index: 7.4% p.a.

in USD

Total Return Index: 7.4% p.a.

in USD

Swiss stocks significantly outperformed global stocks over past approx. 25 years

Other factors that help explain outperformance

6

n Low taxes

n Low interest rates

n Low debt / GDP ratio

n Stable political system

n Highly skilled labour force

n Leadership in innovation (highest density of patents per capita)*

Source: Schroders,

* Innovation Union Scoreboard 2011 (EU)

* Innovation Union Scoreboard 2011 (EU)

Apart from global leadership, Swiss domiciled companies benefit from:

Performance

For Q1 2015 and ytd 2015

Net Asset Value

Performance

8

NAV and price performance in USD

|

Performance in USD %

|

H2 2014

|

YTD 2015

|

Since July 1,

2014 |

|

NAV (US GAAP) as per quarterly filings

|

-7.78

|

10.95

|

2.32

|

|

SWZ NAV as published*

|

-7.43

|

10.61

|

2.39

|

|

Swiss Performance Index, SPI

|

-6.06

|

11.16

|

4.43

|

|

Difference NAV as per quarterly filings

|

-1.72

|

-0.21

|

-2.11

|

Source: Schroders, Citi for fund performance and Bloomberg for Index performance; year-to-date performance as at May 31, 2015

|

Performance in USD %

|

H2 2014

|

YTD 2015

|

Since July 1,

2014 |

|

Share price SWZ

|

-8.91

|

10.32

|

0.49

|

|

Swiss Performance Index, SPI

|

-6.06

|

11.16

|

4.43

|

|

Difference

|

-2.85

|

-0.84

|

-3.94

|

Share price

* published e.g., on Bloomberg

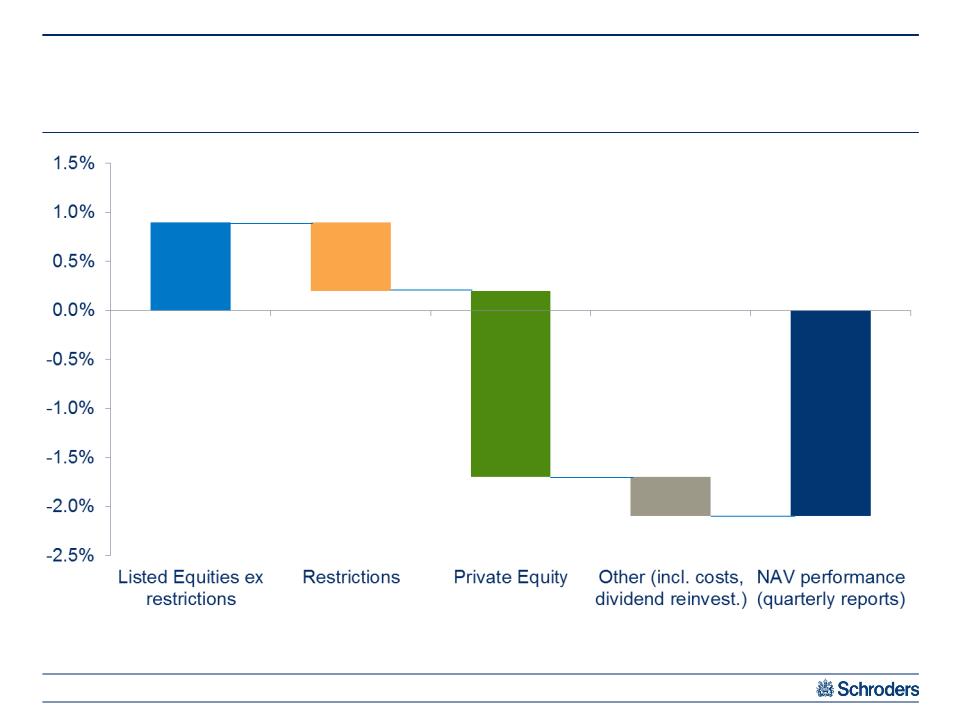

Approximate performance components:

Since take-over (July 1, 2014 - May 31, 2015)

9

Source: Schroders, Citi for Fund performance and Bloomberg for Index performance

0.9%

-0.7%

-1.9%

-0.4%

-2.1%

Portfolio

positioning

positioning

Portfolio positioning

ICB classification

11

Source: Schroders, Citi, Bloomberg, May 31, 2015

Top Ten holdings absolute

Portfolio positioning

As per 31 May 2015

12

Source: Schroders, May 31, 2015

|

Name

|

Absolute weight

|

|

Novartis

|

14.60%

|

|

Roche

|

11.94%

|

|

Nestlé

|

11.61%

|

|

Lindt & Sprüngli

|

4.61%

|

|

Syngenta

|

3.64%

|

|

Burckhardt Compression

|

3.09%

|

|

UBS

|

2.87%

|

|

Richemont, Cie. Fin

|

2.62%

|

|

Swatch (Registered)

|

2.55%

|

|

Credit Suisse

|

2.55%

|

|

Total

|

60.08%

|

Top relative weights

|

Name

|

Relative weight

|

|

Lindt & Sprüngli

|

+3.8%

|

|

Burckhardt Compression

|

+2.8%

|

|

Tecan

|

+2.2%

|

|

Swatch (Registered)

|

+2.1%

|

|

Logitech

|

+2.1%

|

|

Zurich Insurance

|

-3.4%

|

|

Roche

|

-3.5%

|

|

ABB

|

-3.6%

|

|

Novartis

|

-5.1%

|

|

Nestlé

|

-6.9%

|

Portfolio characteristics

Portfolio positioning

Moderate value tilt, high balance sheet quality, clear small & mid cap bias

13

Source: Bloomberg consensus estimates, Schroders, May 31, 2015

|

|

Swiss Performance Index

|

Swiss Helvetia Fund

|

|

P/E 2015e

|

19.3x

|

18.3x

|

|

P/E 2016e

|

17.6x

|

16.6x

|

|

P/B

|

4.4x

|

4.3x

|

|

Net debt / equity

|

34.3%

|

14.6%

|

|

Goodwill / equity

|

35.2%

|

29.6%

|

|

Small & Mid Cap wgt

|

15.5%

|

40.1%

|

Risk measures 31.05.2015

Portfolio positioning

Key statistical measures

14

Source: Schroders, Charles River, Prism, May 31, 2015

|

|

Swiss Helvetia Fund

|

|

Tracking error

|

2.7%

|

|

Beta

|

0.90

|

|

Relative VaR (95%)

|

1.3%

|

|

Volatility

|

9.9%

|

|

Active share

|

44.0%

|

Portfolio turnover

|

|

Swiss Helvetia Fund

|

|

Turnover in % of AuM

Q1 2015 |

12%

|

|

Turnover in % of AuM

YTD 2015 |

19%

|

Turnover calculation method: (Buys + Sells) / (average AuM)

Outlook

Investment Outlook

No change

n Stock market valuations have become more expensive

n But equity markets likely to benefit further from attractive / increasing dividends

n We believe that Swiss equities will be among the best performing equity markets long - term

- thanks to its global leaders

- which has over past 10 years led to superior earnings growth (which is likely to persist)

- in spite of strong Swiss franc (CHF overvalued; earnings impact limited to 2015 financial year)

- thanks to its global leaders

- which has over past 10 years led to superior earnings growth (which is likely to persist)

- in spite of strong Swiss franc (CHF overvalued; earnings impact limited to 2015 financial year)

n Simultaneously, investors need to be aware of shorter - term risks / volatility

(due to geopolitics, central banks, economic data, contagion from other asset classes, etc.)

(due to geopolitics, central banks, economic data, contagion from other asset classes, etc.)

16

Source: Schroders. Views expressed are those of the Fund’s portfolio management team

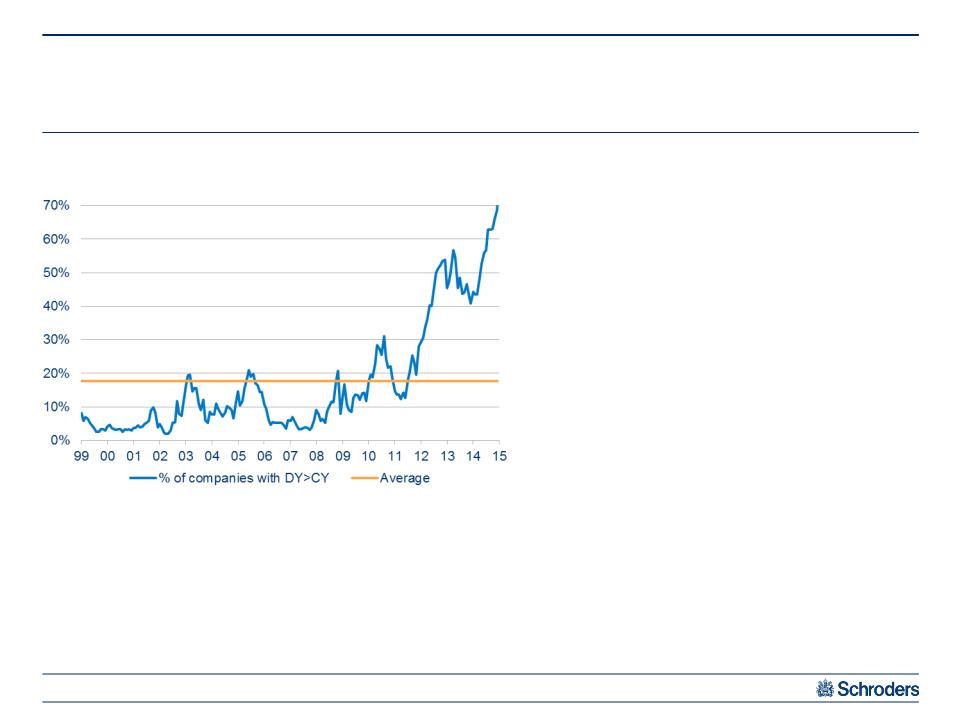

Investment Outlook

Global comparison of dividend yield versus government bond yield

17

Investment Outlook

18

Source: LHS: Goldman Sachs Global Investment Research, January 2015

% of issuers where dividend yield exceeds corporate bond yield (iBoxx bond index)

n Our view is that equity valuations are not cheap in absolute terms

n However, they should continue to move higher in “search of yield”

Investment Outlook

Global comparison of earnings expecations

19

Source: Bloomberg, May 31, 2015, all earnings converted into US dollars

Real GDP growth (q/q)1

Real GDP since the crisis2

Index 2007 q4 = 100

Index 2007 q4 = 100

Investment Outlook

20

Blue dotted line is average path of real GDP after a non-financial crisis.

Based on IMF Study.

Based on IMF Study.

“Normal”

recovery

recovery

Investment Outlook

Historic development of USDCHF exchange rate

21

Source: Schroders, Bloomberg, May 31, 2015

The decision on January 15,

2015 by the Swiss National

Bank (SNB) to remove the

floor vs the Euro looks like

“business as usual” from

long-term perspective

2015 by the Swiss National

Bank (SNB) to remove the

floor vs the Euro looks like

“business as usual” from

long-term perspective

Conclusion

Conclusion

n Performance: significant negative impact from inherited private equity investments

n Listed stock selection positive, except in first 3 months since take-over

n Positive environment for stock markets as an asset class

n Swiss stock market not cheap (compared to other countries and on absolute basis)

n However, global leadership, superior earnings growth and low bond yields speak for Swiss equities

23

Source: Schroders. Views expressed are those of the Fund’s portfolio management team

Appendix

Swiss Equities

Swiss companies regional sales exposure

25

Source: HSBC, July 3, 2014; *UBS February 10, 2015, Data based on averages

Europe

ex domestic

ex domestic

MEA

Unclassified

APAC

Americas

Domestic

Europe

ex domestic

ex domestic

MEA

Unclassified

APAC

Americas

Domestic

Europe

ex domestic

ex domestic

MEA

Unclassified

APAC

Americas

Domestic

Europe

Unclassified

APAC

Americas

ex US

ex US

Domestic

CV

Stefan Frischknecht, CFA - Head Swiss Equities

nFund manager Swiss Equities

nMember of the Executive Board

nJoined Schroders in 1998

nInvestment experience since 1994

nMaster of Science, University of Bern

nCFA Charterholder

Source: Schroders

26

Important Information

27

This presentation is intended to be for information purposes only and it is not intended as promotional material in any respect. The

material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to

provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is

believed to be reliable but Schroder Investment Management North America Inc. does not warrant its completeness or accuracy.

material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to

provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is

believed to be reliable but Schroder Investment Management North America Inc. does not warrant its completeness or accuracy.

The returns presented represent past performance and are not necessarily representative of future returns, which may vary. The

value of investments can fall as well as rise as a result of market or currency movements.

value of investments can fall as well as rise as a result of market or currency movements.

All investments, domestic and foreign, involve risks, including the risk of possible loss of principal. The market value of a fund’s

portfolio may decline as a result of a number of factors, including adverse economic and market conditions, prospects of stocks in the

portfolio, changing interest rates, and real or perceived adverse competitive industry conditions. Investing overseas involves special

risks including among others risks related to political or economic instability, foreign currency (such as exchange, valuation, and

fluctuation) risk, market entry or exit restrictions, illiquidity, and taxation.

portfolio may decline as a result of a number of factors, including adverse economic and market conditions, prospects of stocks in the

portfolio, changing interest rates, and real or perceived adverse competitive industry conditions. Investing overseas involves special

risks including among others risks related to political or economic instability, foreign currency (such as exchange, valuation, and

fluctuation) risk, market entry or exit restrictions, illiquidity, and taxation.

The views and forecasts contained herein are those of the Schroders Swiss Equities team and are subject to change. The

information and opinions contained in this document have been obtained from sources we consider to be reliable. No responsibility

can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the

document when taking individual investment and/or strategic decisions.

information and opinions contained in this document have been obtained from sources we consider to be reliable. No responsibility

can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the

document when taking individual investment and/or strategic decisions.

Schroder Investment Management North America Inc.

875 Third Avenue, New York, NY 10022-6225

(212) 641-3800

www.schroders.com\us