Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPARK NETWORKS INC | lov-8k_20150618.htm |

Analyst & Investor Day June 18, 2015 Exhibit 99.1

Except for statements of historical fact, the information presented herein may constitute forward looking statements within the meaning of and subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "expect," "estimate," "anticipate," "intend," “goal,“ “strategy,” "believe," and similar expressions and variations thereof. Such forward-looking statements include statements regarding the intent, belief, current expectations or projections about future events of Spark Networks, Inc. Readers are cautioned that these forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Spark Networks, Inc. to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include without limitation, general economic and business conditions, the loss of market share, changes in the competitive landscape, failure to keep up with technological advances and other factors over which Spark Networks, Inc. has little or no control. Spark Networks, Inc. undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date hereof. Use of Non-GAAP Measures: The Company reports Adjusted EBITDA and Free Cash Flow as supplemental measures to generally accepted accounting principles ("GAAP"). These non-GAAP measures are some of the primary metrics by which we evaluate the performance of our businesses, budget, forecast and compensate management. We believe these measures provide management and investors with a consistent view, period to period, of the core earnings generated from on-going operations. Adjusted EBITDA excludes the impact of: (i) non-cash items such as stock-based compensation, asset impairments, non-cash currency translation adjustments related to an inter-company loan and (ii) one-time items that have not occurred in the past two years and are not expected to recur in the next two years. Free Cash Flow reflects operating cash flow less capital expenditures and capitalized wages. Adjusted EBITDA and Free Cash Flow should not be construed as substitutes for net income (loss) (as determined in accordance with GAAP) for the purpose of analyzing our operating performance or financial position, as Adjusted EBITDA and Free Cash Flow are not defined by GAAP. Safe Harbor

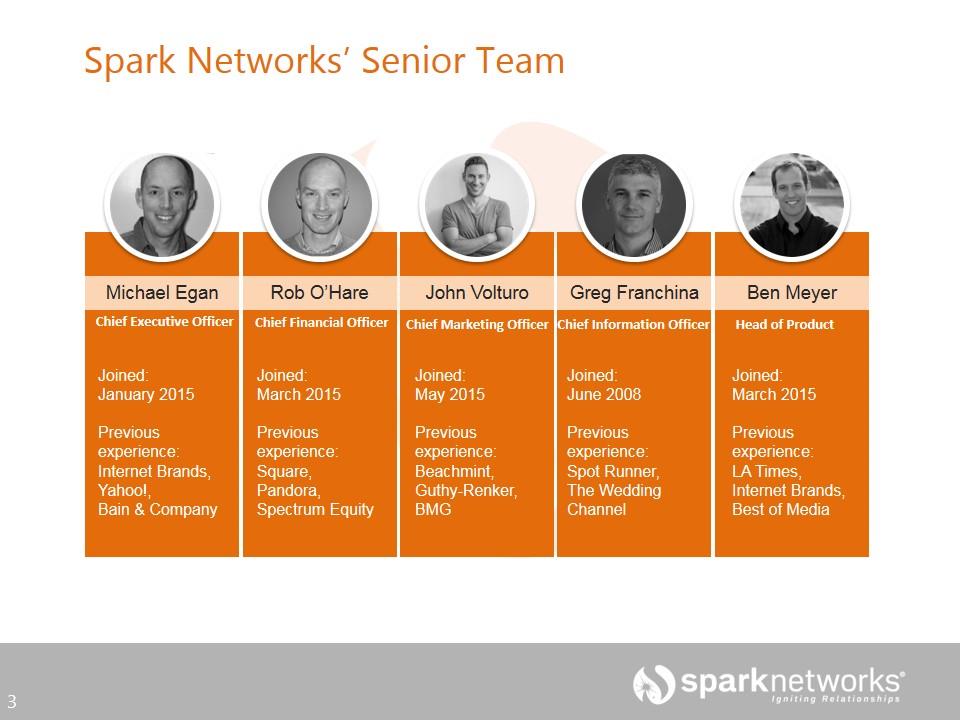

Spark Networks’ Senior Team Chief Executive Officer Joined: January 2015 Previous experience: Internet Brands, Yahoo!, Bain & Company Michael Egan Rob O’Hare John Volturo Greg Franchina Ben Meyer Joined: March 2015 Previous experience: Square, Pandora, Spectrum Equity Chief Marketing Officer Joined: May 2015 Previous experience: Beachmint, Guthy-Renker, BMG Head of Product Joined: March 2015 Previous experience: LA Times, Internet Brands, Best of Media Chief Information Officer Joined: June 2008 Previous experience: Spot Runner, The Wedding Channel Chief Financial Officer

Introduction Michael Egan Chief Executive Officer Product Overview Ben Meyer Head of Product Marketing Overview John Volturo Chief Marketing Officer Financial Overview Rob O’Hare Chief Financial Officer Q&A Agenda

Michael Egan Chief Executive Officer Introduction

Spark Networks is poised to become a growth company again and we are focused on doing so profitably. We currently operate two strong brands (JDate and ChristianMingle) that occupy differentiated and defensible positions in a high-growth industry. The Company, the brands, and our underlying technology all require work before we begin to grow. We now have the team and a very clear set of priorities that will enable us to come out of the year healthy and ready to accelerate the business. Key Takeaways

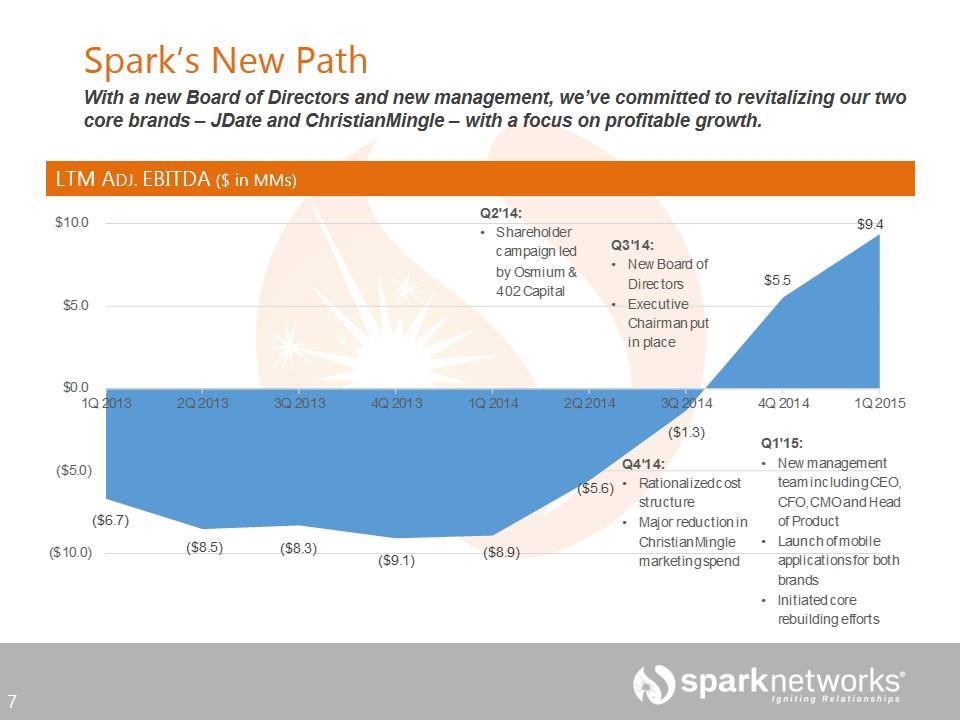

With a new Board of Directors and new management, we’ve committed to revitalizing our two core brands – JDate and ChristianMingle – with a focus on profitable growth. Spark’s New Path LTM ADJ. EBITDA ($ in MMs)

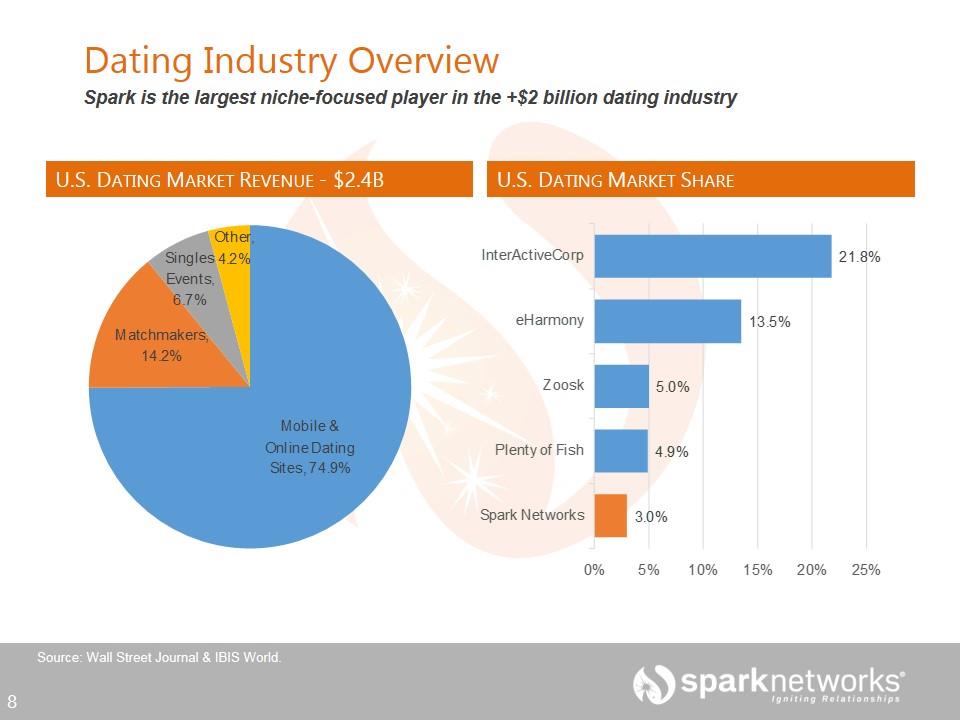

U.S. DATING MARKET REVENUE - $2.4B Spark is the largest niche-focused player in the +$2 billion dating industry Dating Industry Overview Source: Wall Street Journal & IBIS World. U.S. DATING MARKET SHARE

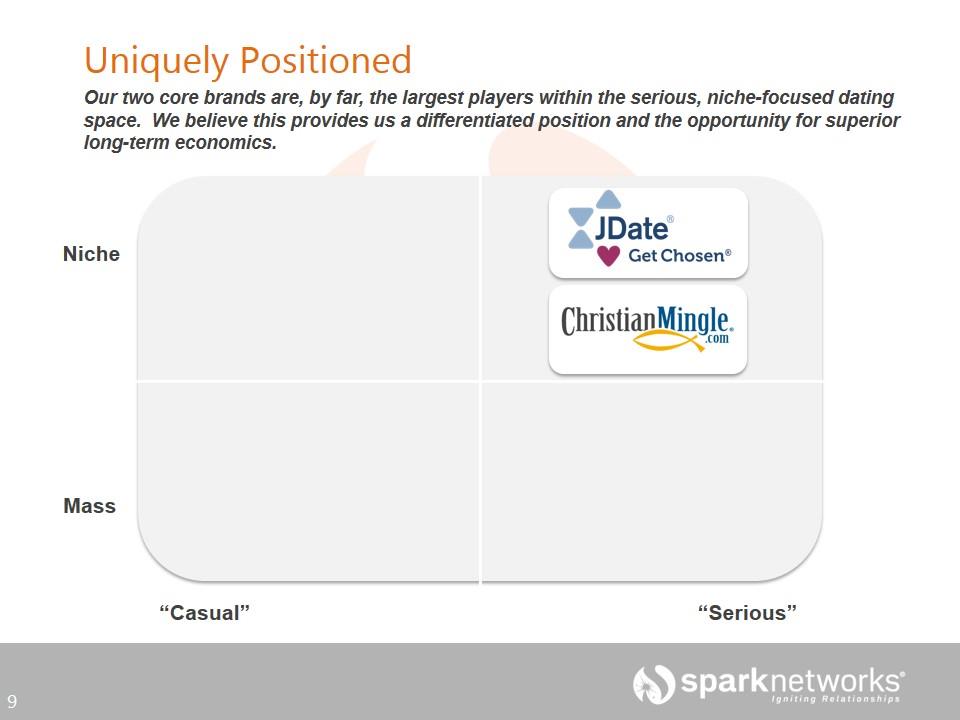

Our two core brands are, by far, the largest players within the serious, niche-focused dating space. We believe this provides us a differentiated position and the opportunity for superior long-term economics. Uniquely Positioned “Casual” “Serious” Mass Niche

Continuously serving the Jewish community for 18 years. Responsible for more Jewish marriages than all other dating sites combined. Ubiquitous awareness within its market. Continues to demonstrate strong network dynamics and resulting economics. A Cultural Icon

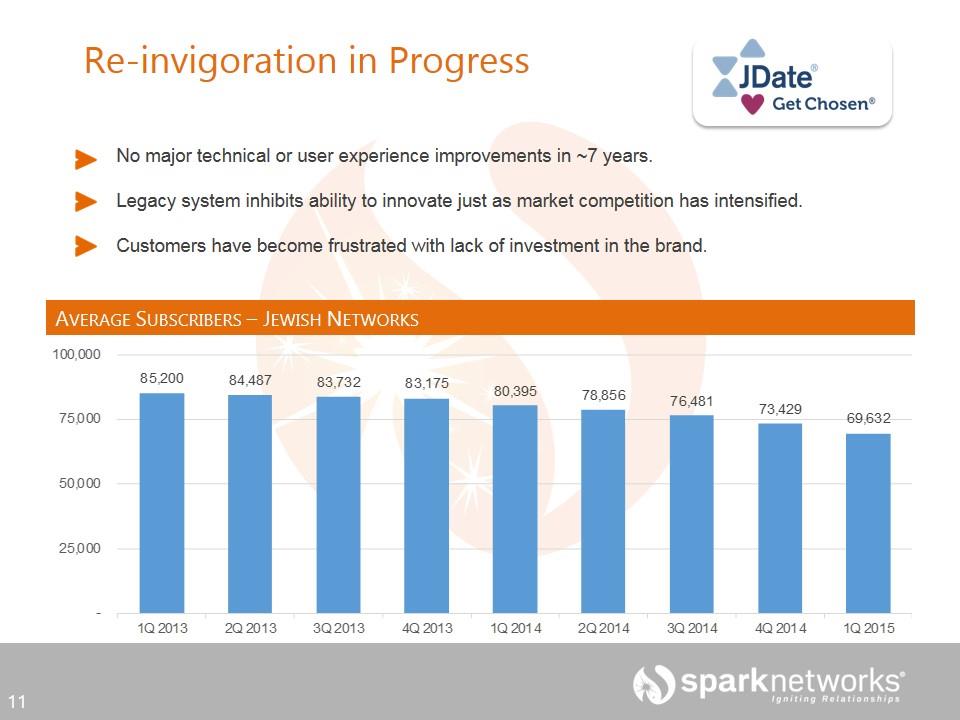

No major technical or user experience improvements in ~7 years. Legacy system inhibits ability to innovate just as market competition has intensified. Customers have become frustrated with lack of investment in the brand. Re-invigoration in Progress AVERAGE SUBSCRIBERS – JEWISH NETWORKS

+80% brand awareness - 3rd behind eHarmony and Match. Very large market - over 70 million Christian singles in the US. Uniquely positioned within the serious relationship space. Un-tapped Value

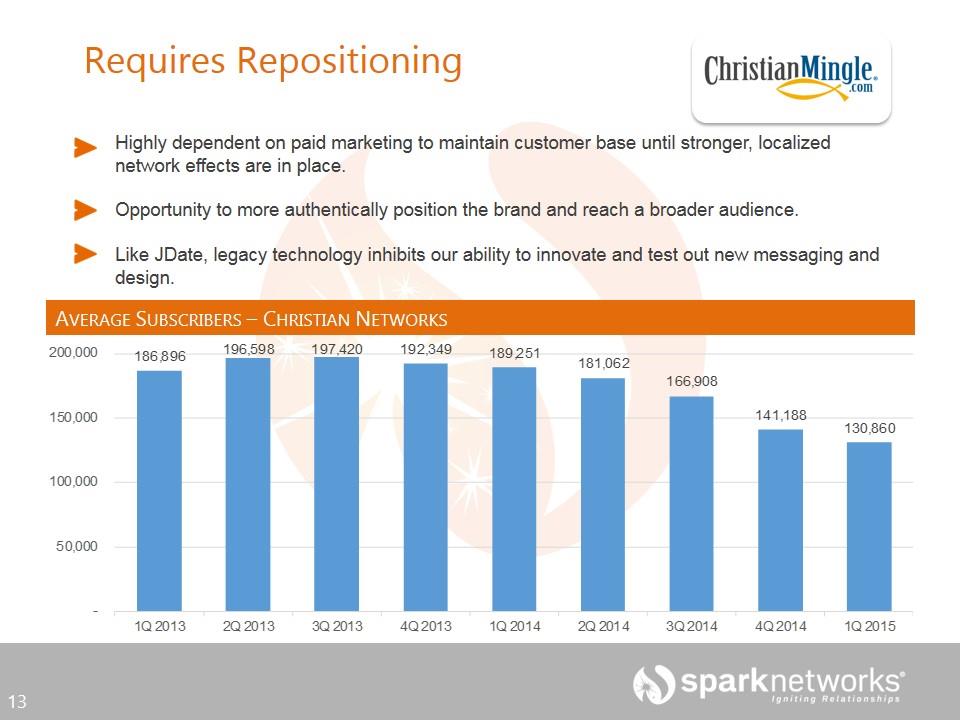

Highly dependent on paid marketing to maintain customer base until stronger, localized network effects are in place. Opportunity to more authentically position the brand and reach a broader audience. Like JDate, legacy technology inhibits our ability to innovate and test out new messaging and design. Requires Repositioning AVERAGE SUBSCRIBERS – CHRISTIAN NETWORKS

Our Core Priorities Team Product Marketing Services We identified a set of very specific priorities for 2015 to drive fundamental change in the performance of the business.

Our Core Priorities Team Product Marketing Services Build an experienced team that brings the skills needed to transform the business. COMPLETE We identified a set of very specific priorities for 2015 to drive fundamental change in the performance of the business.

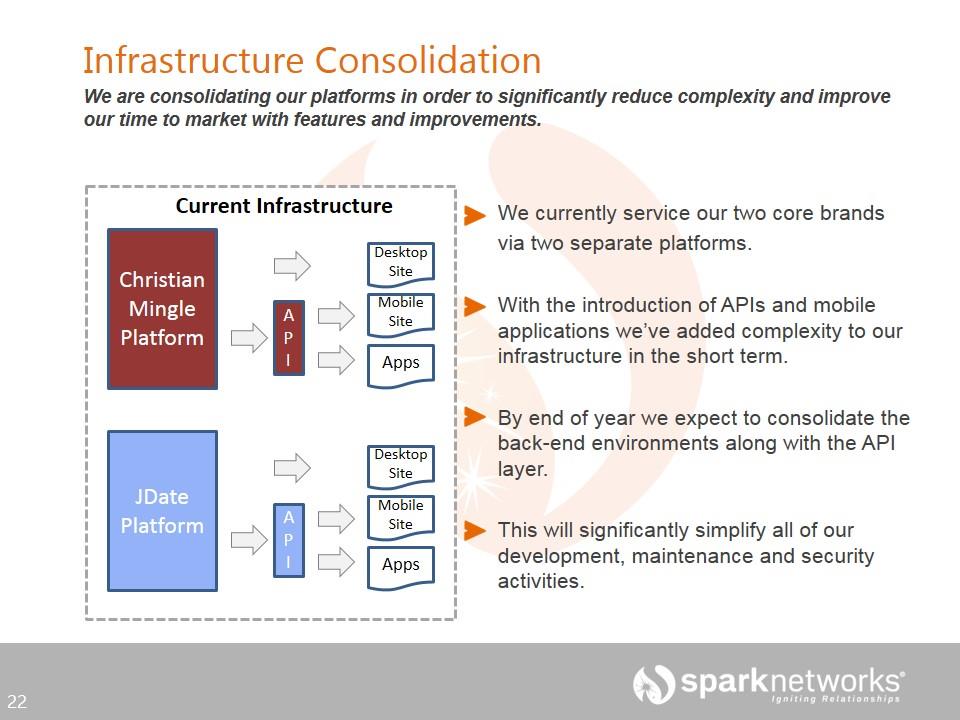

Our Core Priorities Team Product Consolidate our platforms and re-architect our user experience to become more nimble and innovative. Q4 TARGET Marketing Services We identified a set of very specific priorities for 2015 to drive fundamental change in the performance of the business.

Our Core Priorities Team Reposition our brands and grow via profitable acquisition and retention programs. INITIATED Marketing Product Team Services We identified a set of very specific priorities for 2015 to drive fundamental change in the performance of the business.

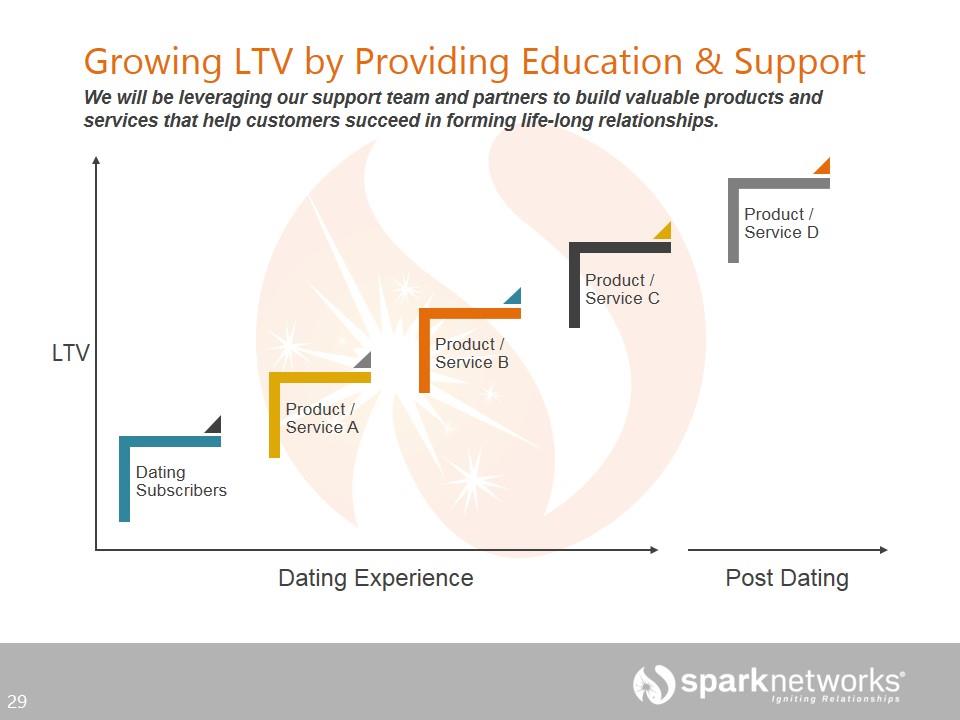

Our Core Priorities Services Drive customer success and grow ARPU and retention through improved service. INITIATED Product Team Marketing We identified a set of very specific priorities for 2015 to drive fundamental change in the performance of the business.

Ben Meyer Head of Product Product Overview

We are completely focused on reinvigorating our products by strengthening our underlying platforms and developing nimble, modern user experiences. Our Product Priorities Expand Mobile Continue to expand and improve our mobile presence and capabilities for both of our core brands. Consolidate Platforms Consolidate our multiple platforms onto a single, common infrastructure to enable quicker product introduction and iteration. Redesign Front-ends Improve Core Features & Monetization Redesign and re-architect CM and JD websites to improve user experience and enable easier optimization and development. Continuously improve our core search, matching, fraud management, analytics and communications capabilities.

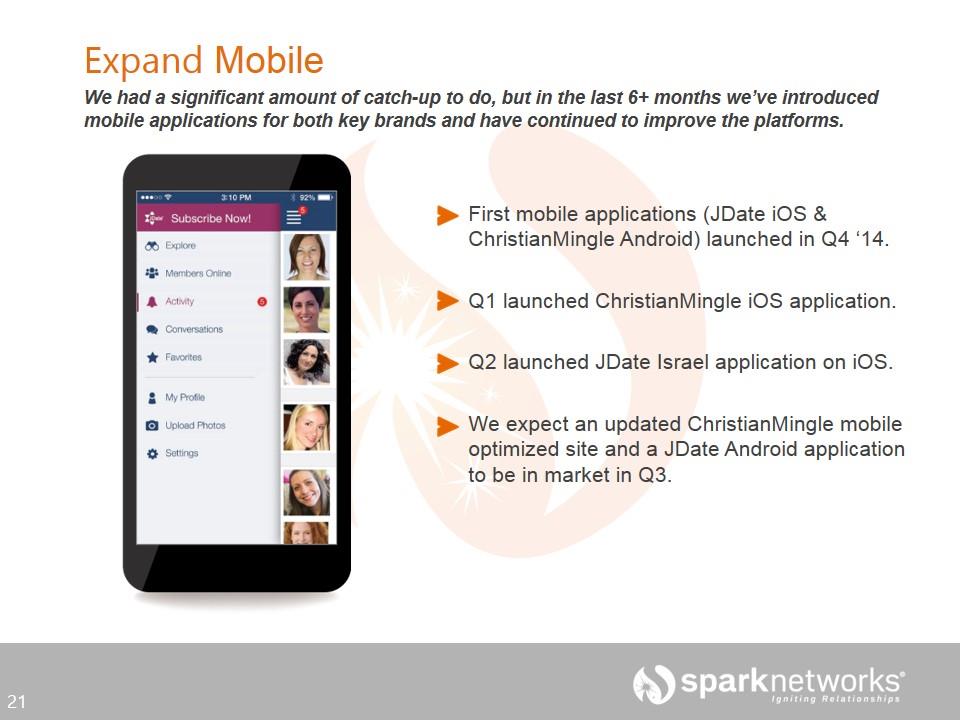

We had a significant amount of catch-up to do, but in the last 6+ months we’ve introduced mobile applications for both key brands and have continued to improve the platforms. Expand Mobile First mobile applications (JDate iOS & ChristianMingle Android) launched in Q4 ‘14. Q1 launched ChristianMingle iOS application. Q2 launched JDate Israel application on iOS. We expect an updated ChristianMingle mobile optimized site and a JDate Android application to be in market in Q3.

We are consolidating our platforms in order to significantly reduce complexity and improve our time to market with features and improvements. Infrastructure Consolidation Christian Mingle Platform API Apps Mobile Site Desktop Site JDate Platform API Apps Mobile Site Desktop Site Current Infrastructure We currently service our two core brands via two separate platforms. With the introduction of APIs and mobile applications we’ve added complexity to our infrastructure in the short term. By end of year we expect to consolidate the back-end environments along with the API layer. This will significantly simplify all of our development, maintenance and security activities.

We believe a major impetus for growth will be the introduction of new, modern user experiences for both of our core brands. Redesign our Front-end Web Experiences Both core brands have websites that are built on legacy technology and have not been updated in years (last JDate design update was 2009). We are redesigning and re-architecting both website experiences along 3 clear principles: Nimble, API-driven technology Simple, modern, user-focused design Strong search engine optimization fundamentals Both brands will launch in Q4. WEBSITES

John Volturo Chief Marketing Officer Marketing Overview

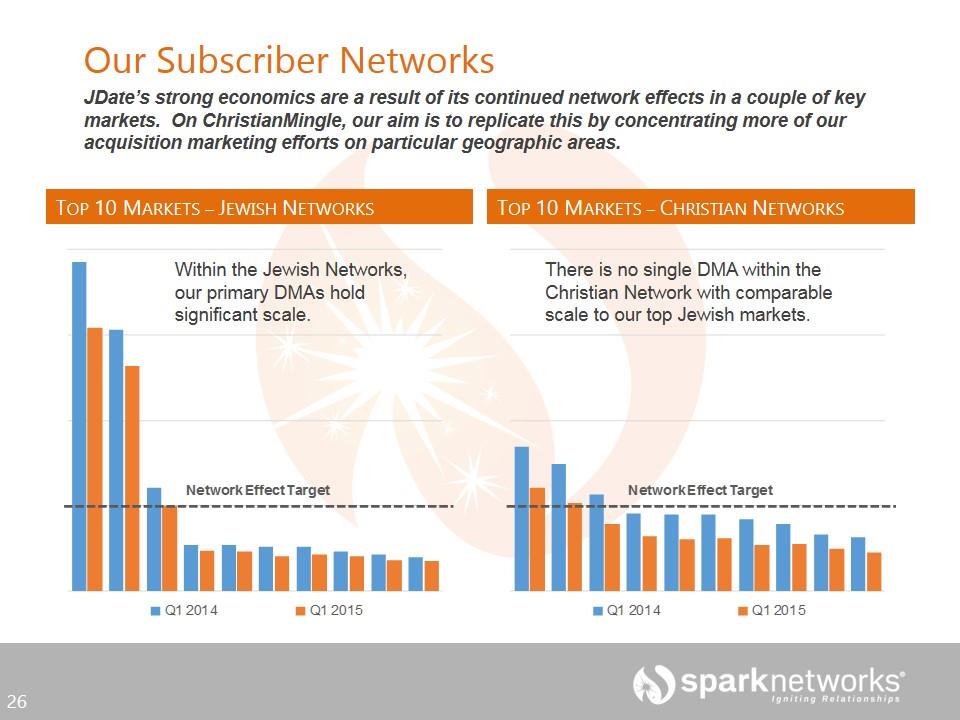

We are re-architecting how we market our brands and communicate with prospects and customers. We are building engagement and focusing on profitable subscriber growth. Our Marketing Priorities Build Networks Focus acquisition programs on building local networks in key markets in order to drive significant improvement in economics. Reposition ChristianMingle Expand the addressable market for ChristianMingle by repositioning along faith & values. Improve Customer Success Implement world-class lifecycle marketing programs aimed at improving conversions, retention and customer success. Expand Lifetime Value (LTV) Through our customer service organization, provide additional products and services to increase each customers’ value.

Within the Jewish Networks, our primary DMAs hold significant scale. There is no single DMA within the Christian Network with comparable scale to our top Jewish markets. JDate’s strong economics are a result of its continued network effects in a couple of key markets. On ChristianMingle, our aim is to replicate this by concentrating more of our acquisition marketing efforts on particular geographic areas. Our Subscriber Networks TOP 10 MARKETS – JEWISH NETWORKS TOP 10 MARKETS – CHRISTIAN NETWORKS

U.S. Christian Singles 18-65 years old ~70 Million Religion Most Central Religion Less Central Current CM Customers Potential CM Customers Repositioning ChristianMingle to Expand Addressable Market Research suggests our current messaging has resonated with only a minority of the single Christian population. With more ‘authentic’ and modern messaging we will be able to broaden our potential market. In Q4 2015, we will re-launch ChristianMingle with a new look, inclusive messaging and unified voice across all channels. Source: Pew Research Center (May 2015), US Census & Company estimates

We are moving from a one-size fits all lifecycle marketing program to one that will rely on relevancy to drive performance. Building Best-In-Class Lifecycle Marketing Previous Near Future Set of email messages sent to all registrants and subscribers regardless of demographic or event triggers Set of customized marketing messages sent to the right consumer at the right time on the right device, amplifying our ability to drive desired behaviors and generate incremental transactions

We will be leveraging our support team and partners to build valuable products and services that help customers succeed in forming life-long relationships. Growing LTV by Providing Education & Support Dating Subscribers Product / Service A Product / Service B Product / Service C Product / Service D Dating Experience Post Dating LTV

Rob O’Hare Chief Financial Officer Financial Overview

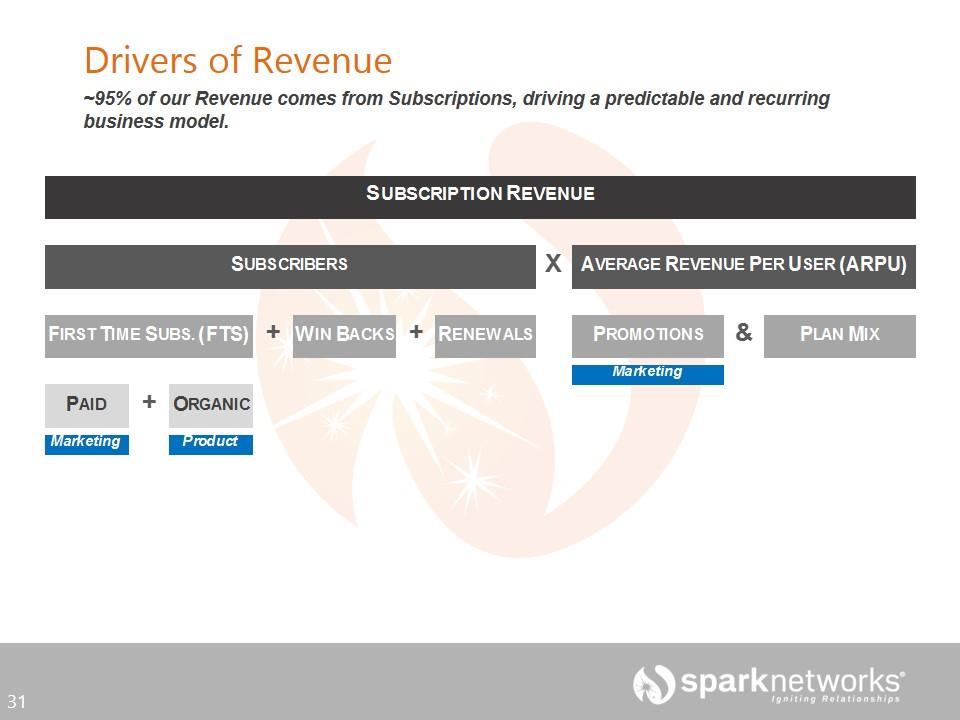

Drivers of Revenue ~95% of our Revenue comes from Subscriptions, driving a predictable and recurring business model.

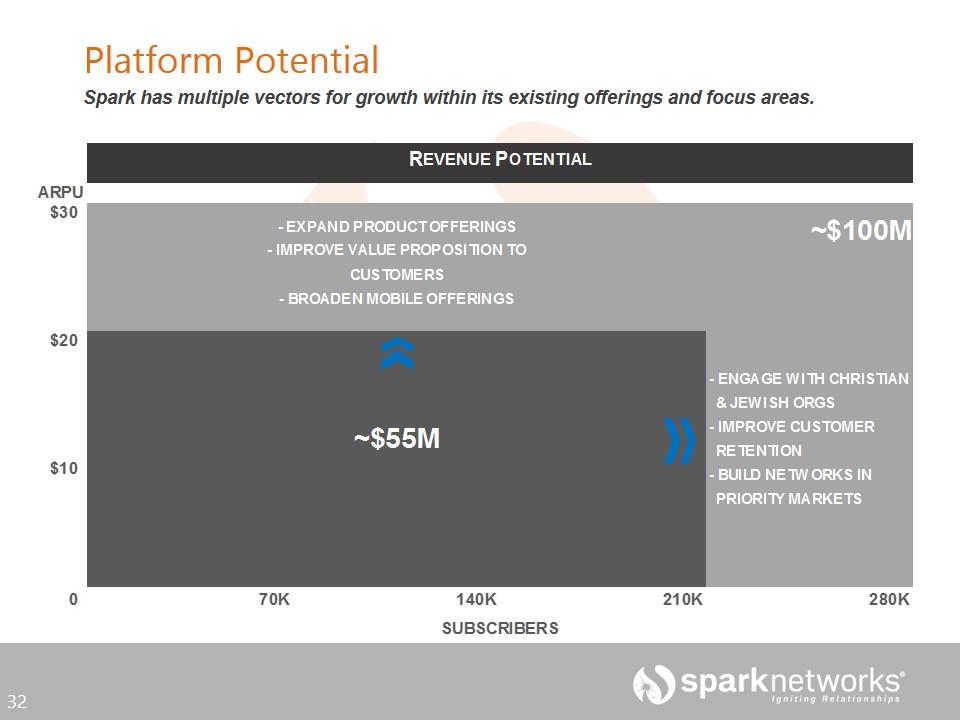

Spark has multiple vectors for growth within its existing offerings and focus areas. Platform Potential

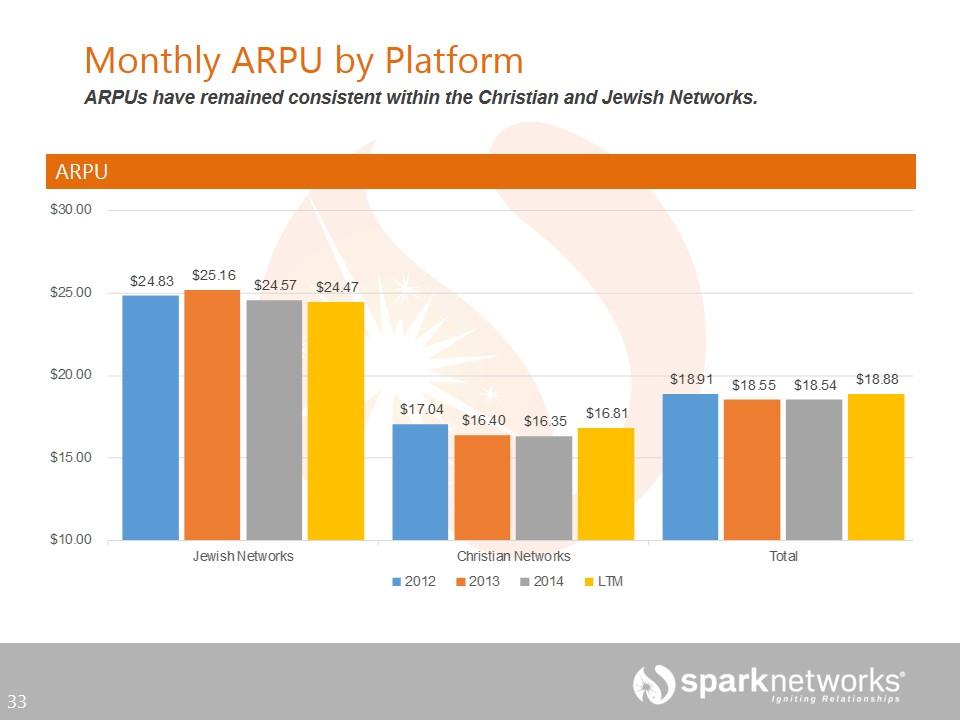

ARPUs have remained consistent within the Christian and Jewish Networks. Monthly ARPU by Platform ARPU

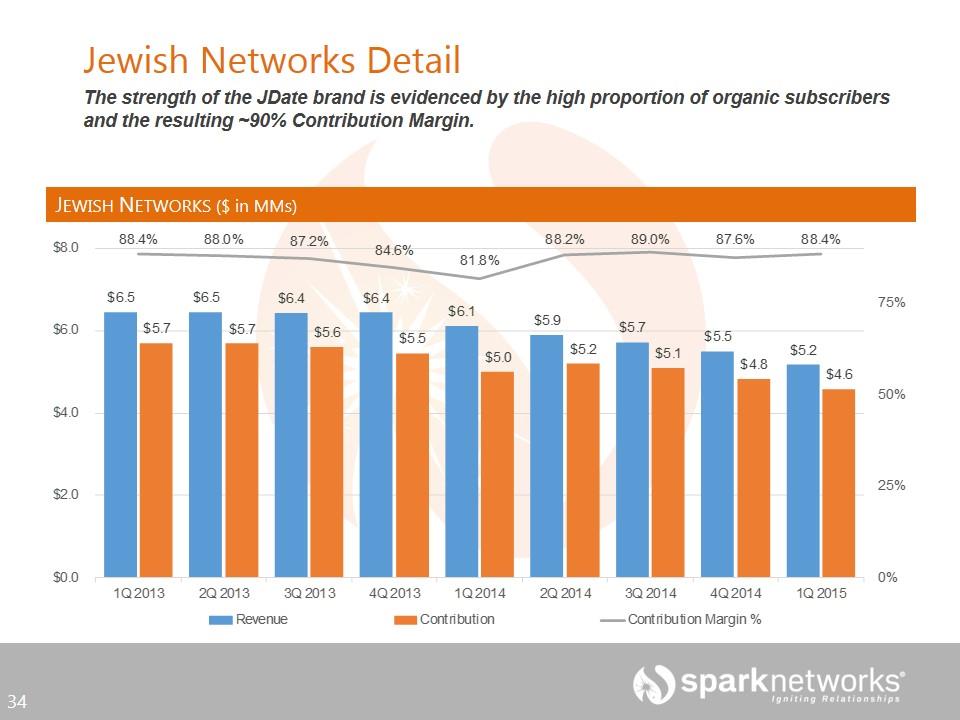

The strength of the JDate brand is evidenced by the high proportion of organic subscribers and the resulting ~90% Contribution Margin. Jewish Networks Detail JEWISH NETWORKS ($ in MMs)

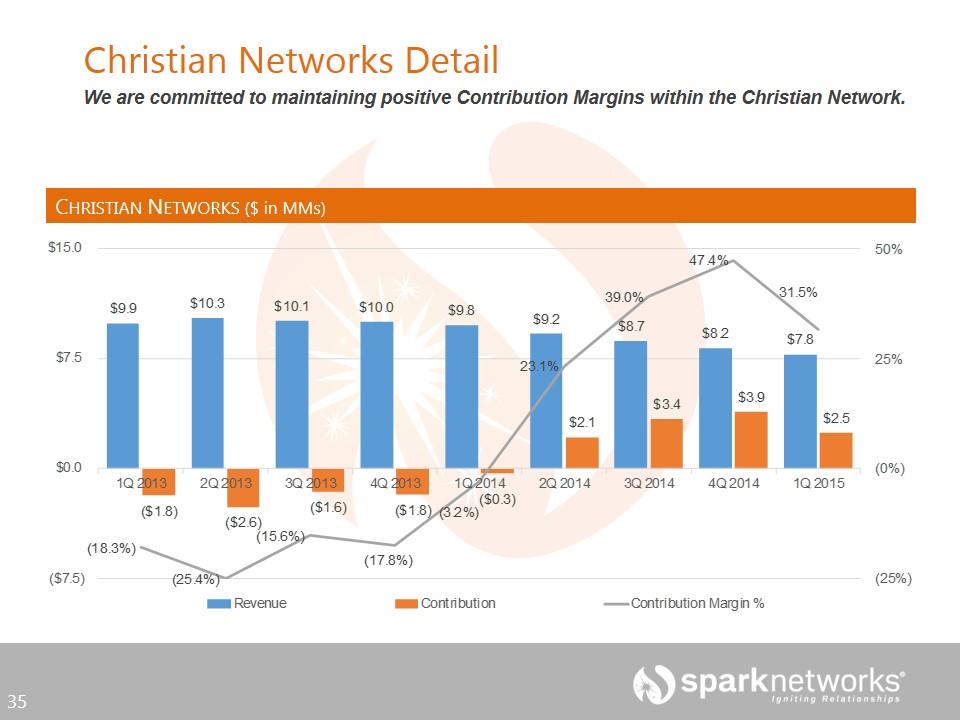

We are committed to maintaining positive Contribution Margins within the Christian Network. Christian Networks Detail CHRISTIAN NETWORKS ($ in MMs)

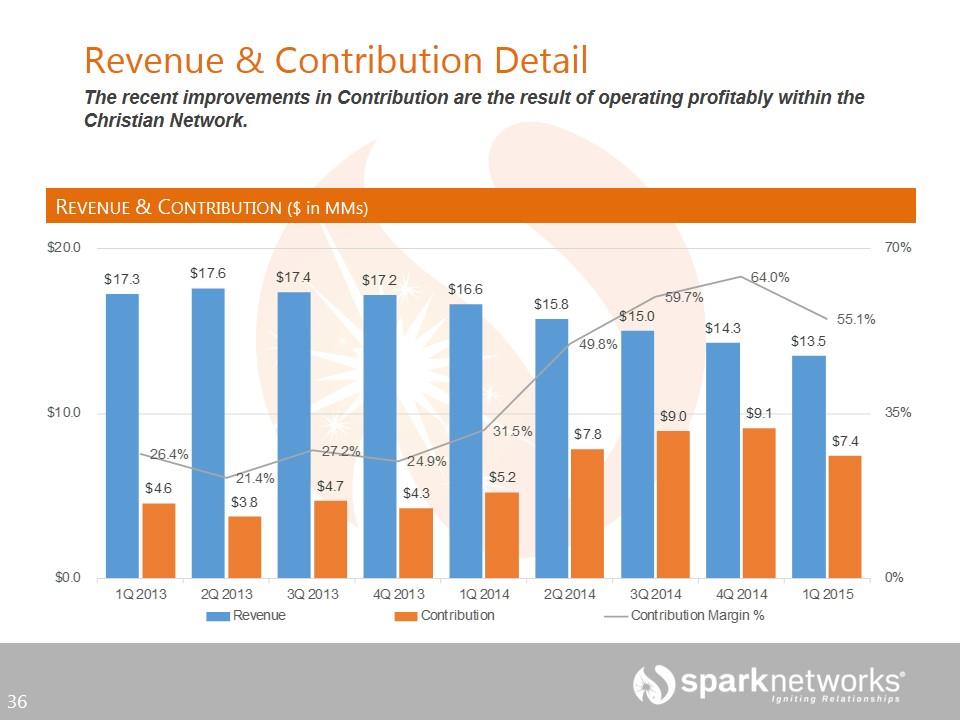

The recent improvements in Contribution are the result of operating profitably within the Christian Network. Revenue & Contribution Detail REVENUE & CONTRIBUTION ($ in MMs)

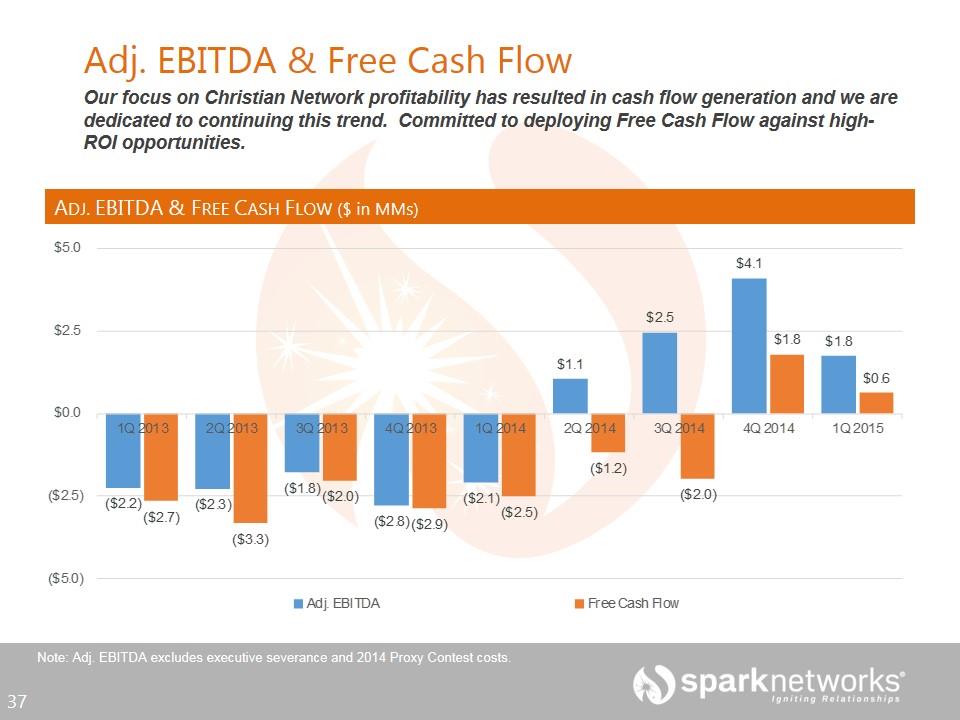

Our focus on Christian Network profitability has resulted in cash flow generation and we are dedicated to continuing this trend. Committed to deploying Free Cash Flow against high-ROI opportunities. Adj. EBITDA & Free Cash Flow Note: Adj. EBITDA excludes executive severance and 2014 Proxy Contest costs. ADJ. EBITDA & FREE CASH FLOW ($ in MMs)

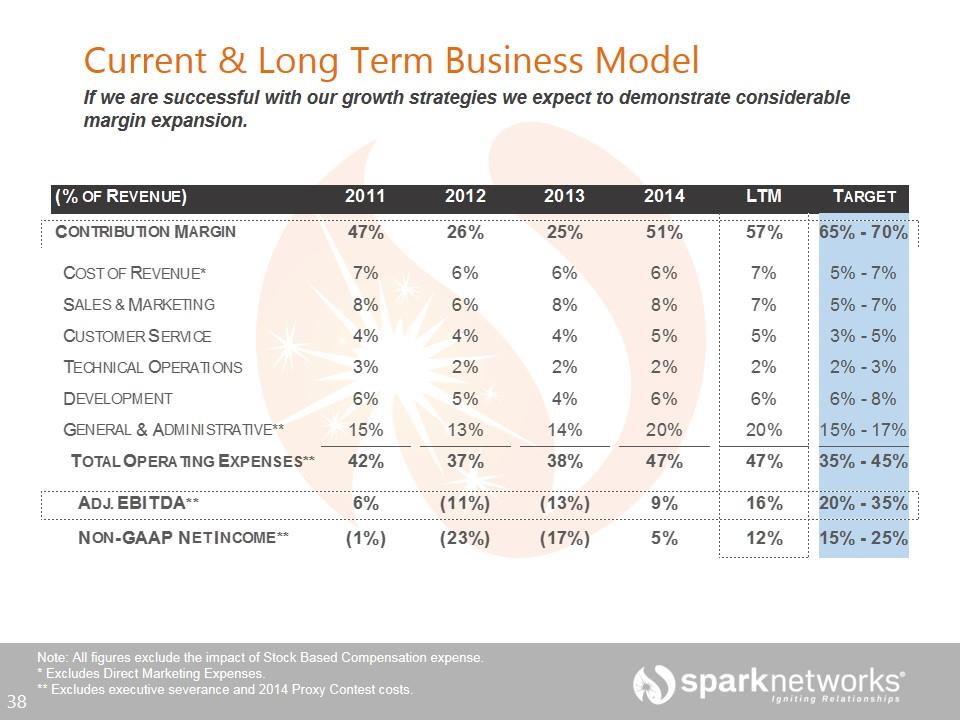

If we are successful with our growth strategies we expect to demonstrate considerable margin expansion. Current & Long Term Business Model Note: All figures exclude the impact of Stock Based Compensation expense. * Excludes Direct Marketing Expenses. ** Excludes executive severance and 2014 Proxy Contest costs.

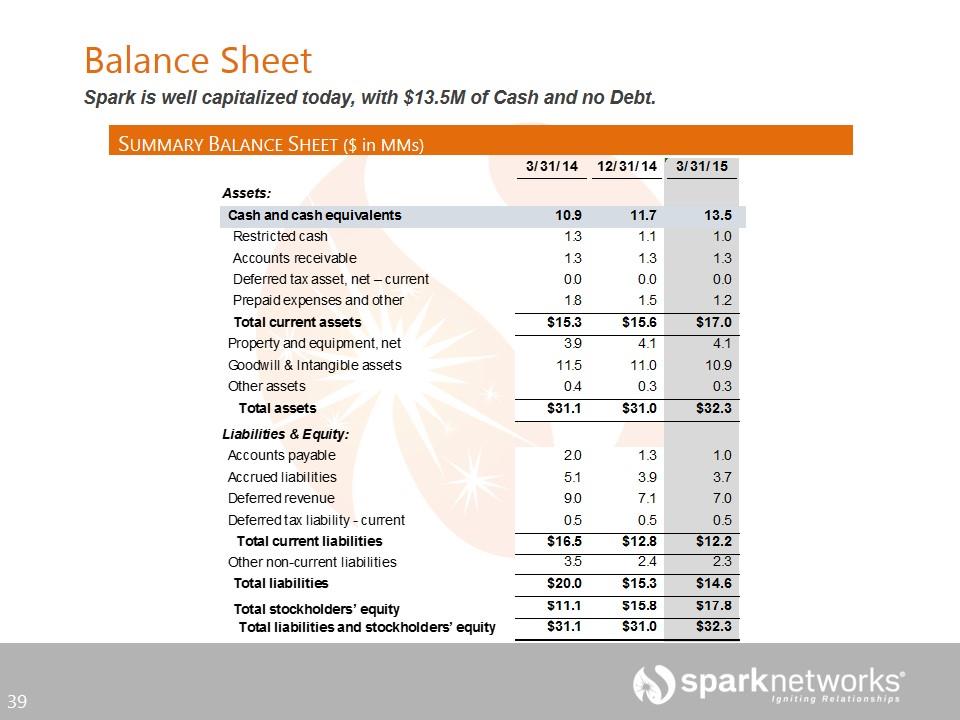

Spark is well capitalized today, with $13.5M of Cash and no Debt. Balance Sheet SUMMARY BALANCE SHEET ($ in MMs)