Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Under Armour, Inc. | d942540d8k.htm |

| EX-3.1 - EX-3.1 - Under Armour, Inc. | d942540dex31.htm |

| EX-99.1 - EX-99.1 - Under Armour, Inc. | d942540dex991.htm |

| EX-99.2 - EX-99.2 - Under Armour, Inc. | d942540dex992.htm |

Exhibit 99.3

Under Armour Internal Communication Documents

Internal Under Armour Email Communication to Employee Equity Award Recipients

Dear Under Armour Equity Award Holder,

As we posted on Our House, today Under Armour announced that our Board of Directors has approved a new class of non-voting common stock, the Class C stock. At some point following a stockholders meeting in late August, we expect shares of Class C stock to be distributed through a stock dividend to all of Under Armour’s stockholders – effectively a two-for-one stock split. This new Class C stock will help Under Armour maintain our current founder-led governance approach under Kevin Plank and let us continue to focus on our long-term goals.

Although this stock dividend is not expected to occur for a while, when it does occur your outstanding equity awards will become a combination of Class A and Class C awards. To learn more about the stock dividend, please see:

| (1) | A letter from Kevin Plank to stockholders regarding the creation of Class C, |

| (2) | A copy of the press release that Under Armour issued this afternoon regarding this matter, and |

| (3) | A set of FAQs regarding equity awards. |

We will keep you updated as we get closer to completing the stock dividend. In the meantime, if you have any questions, please contact Mehri Shadman in the Legal Department by phone at (410) 246-6881 or by email at mshadman@underarmour.com.

Thank you,

TOTAL REWARDS

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting

filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

CLASS C CAPITAL STOCK CHANGES

FAQs FOR UNDER ARMOUR EQUITY AWARD HOLDERS

Defined terms

Class A stock: Under Armour Class A common stock which has one vote for each share

Class B stock: Under Armour Class B common stock which has ten votes for each share

Class C stock: Under Armour Class C common stock which would not have any voting rights

General

| 1. | What is happening? |

Under Armour has created a new class of non-voting stock (Class C), in addition to the current voting Class A and Class B stock. This new Class C stock will be issued through a stock dividend for all outstanding Under Armour Class A and Class B shares. Each stockholder would receive a share of Class C stock for each share of Class A and Class B stock they hold as of a specified dividend record date. The record date will be announced once all required approvals have been obtained.

This is effectively a stock split — people who previously had one share would have two shares. We have completed two stock splits in the last three years, though never for a new class of stock. Class A shares would retain one stockholder vote per share. Class C shares would not have any voting rights. The Class A and Class C shares would be traded under different ticker symbols and their prices may vary over time. The new ticker symbol for the Class C shares has not been determined.

| 2. | How is this different from what we have today? |

Currently, Under Armour has two types of common stock: (1) Class A stock, which has one vote per share (this is the type of stock that is publicly traded and that eligible Under Armour teammates receive through their restricted stock units (“RSUs”) and stock options), and (2) Class B stock, which has 10 votes per share (which is held by Kevin Plank). If the dividend is declared, we’ll have three types of stock – Class A stock and Class B stock, which retain their voting rights, and a new Class C stock, which would have no voting rights. After the dividend is declared, all teammate equity award grants are expected to be made using Class C stock.

| 3. | You’re calling this a dividend? Does this mean we’re getting cash? |

No, the dividend will be issued in shares of Class C stock.

| 4. | When is this happening? |

No specific date has been set for the dividend, though we expect the dividend to occur sometime following a special meeting of our stockholders currently scheduled for August 26, 2015. We will update you when the date has been set.

| 5. | Why are we doing this? |

Please see the letter from Kevin Plank that can be found on our Investor Relations website (www.uabiz.com) for more information.

| 6. | To whom would this change apply? |

If the dividend is approved by our Board, these changes would apply to all stockholders who own Class A or Class B stock and all teammates, directors and other persons who have unvested RSUs (including both time based RSUs and performance based RSUs) and/or unexercised options as of a date to be set by the Board.

After the dividend is declared, all teammate equity award grants are expected to be made using Class C stock.

1

| 7. | What would happen to shares I own (i.e., RSUs that have vested or options I have exercised)? |

For each share of Class A stock that you own as of the record date for the stock dividend from the previous vesting of an RSU or exercise of an option, you would receive a Class C share. So, after the stock dividend, you would have one share of Class A stock and one share of Class C stock.

Restricted Stock Units (Time Based and Performance Based)

| 8. | What does this mean if I have unvested RSUs? |

For each unvested Class A RSU you have as of the record date for the stock dividend (both time based RSUs and performance based RSUs), you would receive an additional unvested RSU that covers one share of Class C stock. So after the stock dividend, you would have one unvested RSU that covers one share of Class A stock and one unvested RSU that covers one share of Class C stock.

| 9. | What about the vesting schedule for my RSUs? |

Your vesting schedule would remain the same. When an RSU covering a Class A share vests, the corresponding RSU covering a Class C share would also vest.

| 10. | Will there be any changes to the performance targets for my performance based RSUs? |

No, all outstanding performance based RSUs will continue to have their original performance vesting conditions.

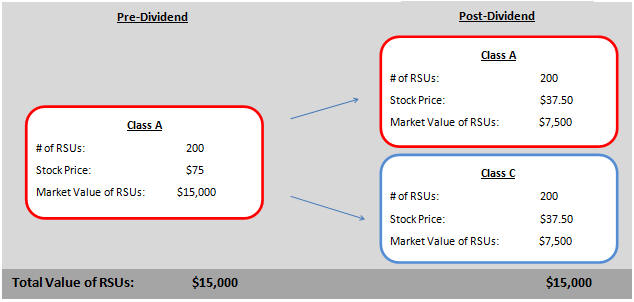

Example: RSUs Before and After the Stock Dividend

In this example, 200 pre-dividend Restricted Stock Units (RSUs) for 200 shares of Class A common stock would be adjusted as part of the dividend to yield an additional 200 RSUs for shares of Class C common stock. If the RSUs included performance criteria for vesting (which we commonly refer to as performance based RSUs), the same pre-dividend performance criteria would continue to apply.

| NOTE: | The pre-dividend and post-dividend stock prices and market values of RSUs shown above are illustrative only. The actual stock prices and RSU market values are determined by the trading prices on the New York Stock Exchange of Under Armour’s Class A shares and Class C shares (when the dividend is distributed). |

2

Stock Options

| 11. | What does this mean if I have unexercised options? |

For each unexercised option you have as of the record date for the stock dividend, you would receive an additional unexercised Class C stock option that covers one share of Class C stock. So after the stock dividend you would have one unexercised Class A option and one unexercised Class C option.

The original strike price of your Class A options (prior to the stock dividend) will be allocated between the strike price of our Class A and Class C options. This allocation will be based on the trading prices of the Class A and Class C shares following the dividend. We will provide more detail on the calculation of the adjusted strike price before the dividend date.

| 12. | What about the vesting schedule for my options? |

Your vesting schedule would remain the same. When a Class A option vests, the corresponding Class C option would also vest.

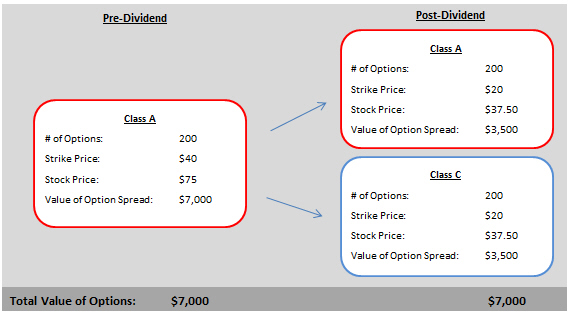

Example: Options Before and After Proposed Stock Dividend

In this example, 200 pre-dividend options to purchase 200 shares of Class A common stock with a strike price of $40 per share would be adjusted as part of the dividend to yield an additional 200 options to purchase shares of Class C common stock. If the options included performance criteria for vesting (which we commonly refer to as performance-based options), the same pre-dividend performance criteria would continue to apply.

| NOTE: | The pre-dividend and post-dividend stock prices, strike prices and value of the option spreads shown above are illustrative only. The actual stock prices and the value of the option spreads are determined by the trading prices on the New York Stock Exchange of Under Armour’s Class A shares and Class C shares (when the dividend is distributed). The actual post-dividend strike prices are expected to be based on an allocation of the original strike price of each Class A option (pre-dividend) between the new post-dividend strike prices for the post-dividend Class A option and the Class C option based on the trading prices of Under Armour’s Class A shares and Class C shares on the New York Stock Exchange following the dividend. |

3

Other Questions

| 13. | Will there be any changes to how I can trade these new Class C shares? |

No, as long as Under Armour is not in a blackout period and the trading window is open, you would be able to trade these new shares normally, consistent with our insider trading policy. Class A and Class C shares would each have their own ticker symbols and would be traded independently.

| 14. | How would this affect ongoing equity grants? |

After the dividend is declared, all teammate equity award grants are expected to be made using Class C stock.

| 15. | What would this look like in my Charles Schwab account? |

Once the dividend has been paid, when you log into your Charles Schwab account, you will see both your Class A and Class C shares in aggregate on your account home page.

| 16. | Do I need to do anything? |

Please log in to your Charles Schwab account and verify that you have accepted all of your existing grants. As long as you have done this, the administration of the stock dividend would happen automatically through your account.

| 17. | I haven’t accepted my grants yet. How will this impact me? |

Please accept your existing grants as soon as possible. Instructions on how to accept your grants are available from the Total Rewards Team (email totalrewards@underarmour.com).

| 18. | What if I moved my vested shares to another broker? How would the dividend work for me? |

The dividend would happen automatically, and your new Class C shares would be deposited into your brokerage account.

| 19. | How would this affect my voting rights on issues subject to a vote of stockholders? |

After the dividend is paid, you will continue to have the same number of votes — one for each Under Armour Class A share you own. You would not have any votes for any Under Armour Class C shares that you own.

| 20. | What can I share with my financial adviser? |

You can share these FAQs and our proxy statement that will be filed with the SEC and will be available on the SEC’s site.

| 21. | I live and work in the United States. How would this affect my taxes? |

For US taxpayers the stock dividend should not be taxable for federal income tax purposes, but you should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 22. | I live outside of the United States. Anything different for my country? |

We do not expect this stock dividend to be a taxable event in most countries, but are in the process of confirming this for each country. We will update you with more country-specific information as it becomes available. You should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 23. | I still have more questions. Where should I go? |

The Total Rewards team is available for questions relating to the administration of your RSUs, options and stock. You can email the Total Rewards Team at totalrewards@underarmour.com. You can also contact Mehri Shadman in the Legal Department by email at mshadman@underarmour.com with any questions regarding the Class C stock and dividend.

4

Note About Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of a new Class C common stock, its charter amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C common stock dividend.

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

5

Internal Under Armour Email Communication to ESPP Participants

Dear Under Armour ESPP Participant,

As we posted on Our House, today Under Armour announced that our Board of Directors has approved a new class of non-voting common stock, the Class C stock. At some point following a stockholders meeting in late August, we expect shares of Class C stock to be distributed through a stock dividend to all of Under Armour’s stockholders – effectively a two-for-one stock split. This new Class C stock will help Under Armour maintain our current founder-led governance approach under Kevin Plank and let us continue to focus on our long-term goals.

Although this stock dividend is not expected to occur for a while, when it does occur shares you have purchased through the ESPP will receive this dividend, and we expect to begin utilizing a new ESPP related to the Class C stock. To learn more about the stock dividend, please see:

| (1) | A letter from Kevin Plank to stockholders regarding the creation of Class C, |

| (2) | A copy of the press release that Under Armour issued this afternoon regarding this matter, and |

| (3) | A set of FAQs regarding the ESPP. |

We will keep you updated as we get closer to completing the stock dividend. In the meantime, if you have any questions, please contact Mehri Shadman in the Legal Department by phone at (410) 246-6881 or by email at mshadman@underarmour.com.

Thank you,

TOTAL REWARDS

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

CLASS C CAPITAL STOCK CHANGES

FAQs FOR UNDER ARMOUR ESPP PARTICIPANTS

Defined terms

Class A stock: Under Armour Class A common stock which has one vote for each share

Class B stock: Under Armour Class B common stock which has ten votes for each share

Class C stock: Under Armour Class C common stock which would not have any voting rights

| 1. | What is happening? |

Under Armour has created a new class of non-voting stock (Class C), in addition to the current voting Class A and Class B stock. This new Class C stock will be issued through a stock dividend for all outstanding Under Armour Class A and Class B shares. Each stockholder would receive a share of Class C stock for each share of Class A and Class B stock they hold as of a specified dividend record date. The record date will be announced once all required approvals have been obtained.

This is effectively a stock split — people who previously had one share would have two shares. We have completed two stock splits in the last three years, though never for a new class of stock. Class A shares would retain one stockholder vote per share. Class C shares would not have any voting rights. The Class A and Class C shares would be traded under different ticker symbols and their prices may vary over time. The new ticker symbol for the Class C shares has not been determined.

| 2. | How is this different from what we have today? |

Currently, Under Armour has two types of common stock: (1) Class A stock, which has one vote per share (this is the type of stock that is publicly traded and that eligible Under Armour teammates purchase through the Employee Stock Purchase Plan (the “ESPP”)), and (2) Class B stock, which has 10 votes per share (which is held by Kevin Plank). If the dividend is declared, we’ll have three types of stock – Class A stock and Class B stock, which retain their voting rights, and a new Class C stock, which would have no voting rights. After the dividend is declared, we expect that Class C stock will be available for purchase through a new ESPP rather than Class A stock.

| 3. | You’re calling this a dividend? Does this mean we’re getting cash? |

No, the dividend will be issued in shares of Class C stock.

| 4. | When is this happening? |

No specific date has been set for the dividend, though we expect the dividend to occur sometime following a special meeting of our stockholders currently scheduled for August 26, 2015. We will update you when the date has been set.

| 5. | Why are we doing this? |

Please see the letter from Kevin Plank that can be found on our Investor Relations website (www.uabiz.com) for more information.

| 6. | Will I still be able to purchase shares of stock through the ESPP? |

If the dividend is approved by our Board, we will have a new ESPP that allows purchases of shares of our Class C stock rather than the Class A stock. The terms of this new ESPP will be identical to the existing ESPP that you are participating in, other than the fact that you will now purchase shares of Class C stock. We do not expect to continue to allow teammates to purchase shares of Class A stock through the existing ESPP after the dividend occurs.

| 7. | What will happen to the shares I have already purchased and continue to hold through the existing ESPP? |

For each share of Class A stock you have already purchased through the existing ESPP before the record date for the dividend, you would receive a Class C share. So, after the stock dividend, you would have one share of Class A stock and one share of Class C stock.

1

| 8. | Will there be any changes to how I can trade these new Class C shares? |

No, as long as Under Armour is not in a blackout period and the trading window is open, you would be able to trade these new shares normally, consistent with our insider trading policy. Class A and Class C shares would each have their own ticker symbols and would be traded independently.

| 9. | What if I moved my shares to another broker? How would the dividend work for me? |

The dividend would happen automatically, and your new Class C shares would be deposited into your brokerage account.

| 10. | How would this affect my voting rights on issues subject to a vote of stockholders? |

After the dividend is paid, you will continue to have the same number of votes — one for each Under Armour Class A share you own. You would not have any votes for any Under Armour Class C shares that you own.

| 11. | What can I share with my financial adviser? |

You can share these FAQs and our proxy statement that will be filed with the SEC and will be available on the SEC’s site.

| 12. | I live and work in the United States. How would this affect my taxes? |

For US taxpayers the stock dividend should not be taxable for federal income tax purposes, but you should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 13. | I live outside of the United States. Anything different for my country? |

We do not expect this stock dividend to be a taxable event in most countries, but are in the process of confirming this for each country. We will update you with more country-specific information as it becomes available. You should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 14. | I still have more questions. Where should I go? |

The Total Rewards team is available for questions relating to the ESPP. You can email the Total Rewards Team at totalrewards@underarmour.com. You can also contact Mehri Shadman in the Legal Department by email at mshadman@underarmour.com with any questions regarding the Class C stock and dividend.

Note About Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of a new Class C common stock, its charter amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C common stock dividend.

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

2

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

3