Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Black Knight, Inc. | bkfs8-kitem70161215.htm |

| EX-99.1 - EXHIBIT 99.1 - Black Knight, Inc. | ex991.htm |

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Black Knight Financial Services, Inc Company Overview June 2015

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 2 Disclaimer To the extent any statements made in this presentation contain information that is not historical, these statements are forward-looking statements or forward-looking information, as applicable, within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (collectively “forward-looking statements”). These forward-looking statements relate to, among other things: Black Knight Financial Services, Inc., (“BKFS”), Black Knight Financial Services, LLC and Black Knight InfoServ, LLC’s (“BKIS”) (collectively, “Black Knight”) expectations regarding projected cash flows and growth. Forward-looking statements can generally be identified by the use of words such as “should,” “intend,” “may,” “expect,” “believe,” “anticipate,” “estimate,” “continue,” “plan,” “project,” “will,” “could,” “would,” “target,” “potential” and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Such forward- looking statements are not to be viewed as facts and involve significant risks, contingencies and uncertainties, many of which are beyond the control of Black Knight. No assurance can be given that any particular forward-looking statement will be realized. Certain material factors or assumptions are applied in making forward-looking statements, including, but not limited to, cash flows that are based on assumptions about future economic conditions and courses of action as well as factors and assumptions set out below. Actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from these expectations include, among other things, regional, national or global political, economic, business, competitive, market and regulatory conditions and other risks detailed in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and other sections of BKFS’s Form S-1, related amendments and other filings with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this communication and, except as expressly required by applicable law, Black Knight assumes no obligation to update or revise them to reflect new events or circumstances. No representation or warranty is made with respect to the information included herein. The information herein should be kept confidential and is intended only for the recipient hereof. There are non-GAAP financial measures used in this communication, including Adjusted Revenues, Adjusted EBITDA, Adjusted EBITDA Margin, Pro Forma Revenue, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin. Black Knight’s calculation of these measures may differ from the methodology used by other issuers and, accordingly, may not be comparable to other issuers. Adjusted Revenues, Adjusted EBITDA, Adjusted EBITDA Margin, Pro Forma Revenue, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin are not measures recognized under GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers and do not have a standardized meaning prescribed by GAAP. Management uses these measures to provide comparative information about performance. See slides titled ‘Non-GAAP Reconciliations – Annual’, ‘Non-GAAP Reconciliations – Quarterly’ and ‘Non-GAAP Reconciliations – Annual Pro Forma Revenue and Adjusted EBITDA’ for further information.

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 3 Company Overview

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 4 Our Mission To be the PREMIER BRAND for technology in the mortgage industry, known for PRODUCT EXCELLENCE; and to deliver INNOVATIVE, SEAMLESSLY INTEGRATED PRODUCTS with SUPERIOR CAPABILITIES, FUNCTIONALITY and SUPPORT that enable our clients to: Better manage and mitigate risk Realize greater efficiencies and drive improved financial performance

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 5 Black Knight Financial Services (BKFS) Overview 2014 Adjusted Revenue: $865M Servicing Technology $616 Origination Technology $93 Data & Analytics $156 71% 11% 18% Percent of all first mortgages processed using our servicing technology Mortgage servicers and 23 of top 25 mortgage originators Percent of U.S. population included in BKFS data ~57% TOP 25 99.99% Top provider of integrated technology, data and analytics to the U.S. mortgage industry

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 6 Unique and Compelling Business Model Hosted SaaS solutions Economies of scale benefits Long-term contracts Significant and predictable recurring revenue Volume-based pricing with minimums; annual COLA Embedded volume and pricing growth Mission critical technology solutions and products Deep, long-term relationships CHARACTERISTICS BENEFITS

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 7 Strong Track Record $206 $230 Q1 2014 Q1 2015 Transformation +11% Y/Y growth +690 bps Y/Y expansion 36% 43% Q1 2014 Q1 2015 Optimized management team Increased operational efficiency Streamlined operations Re-aligned sales organization Repositioned Black Knight for organic growth Product excellence Innovative new product offerings Enterprise sales approach Performance management structure Adjusted EBITDA margin (%) Adjusted Revenue ($mm) Black Knight Delivering

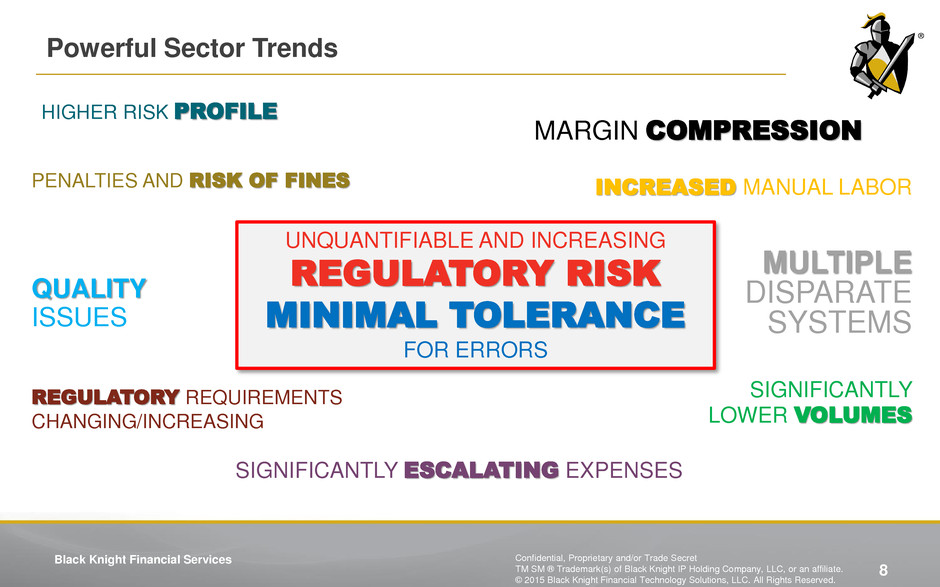

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 8 Powerful Sector Trends REGULATORY REQUIREMENTS CHANGING/INCREASING SIGNIFICANTLY LOWER VOLUMES PENALTIES AND RISK OF FINES MARGIN COMPRESSION UNQUANTIFIABLE AND INCREASING REGULATORY RISK MINIMAL TOLERANCE FOR ERRORS SIGNIFICANTLY ESCALATING EXPENSES MULTIPLE DISPARATE SYSTEMS QUALITY ISSUES INCREASED MANUAL LABOR HIGHER RISK PROFILE

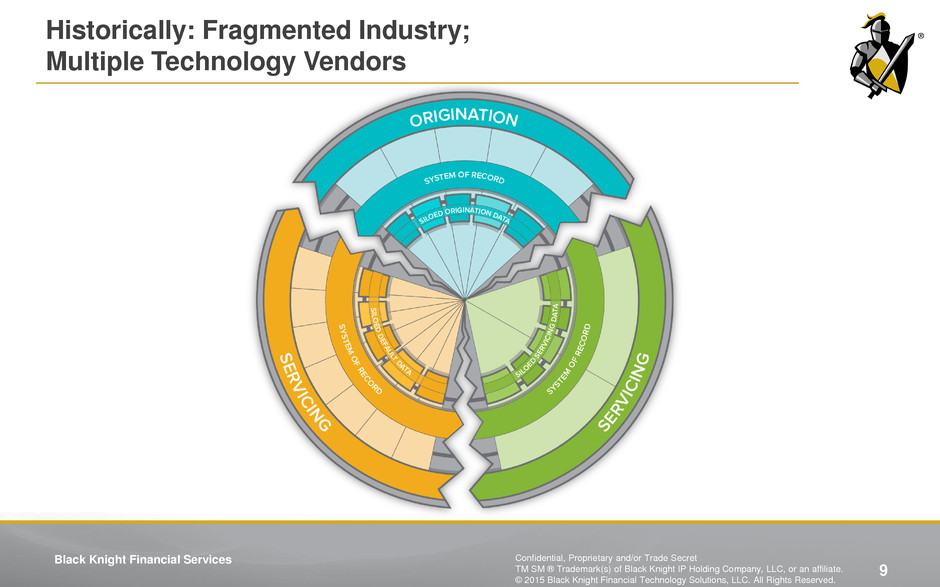

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 9 Historically: Fragmented Industry; Multiple Technology Vendors

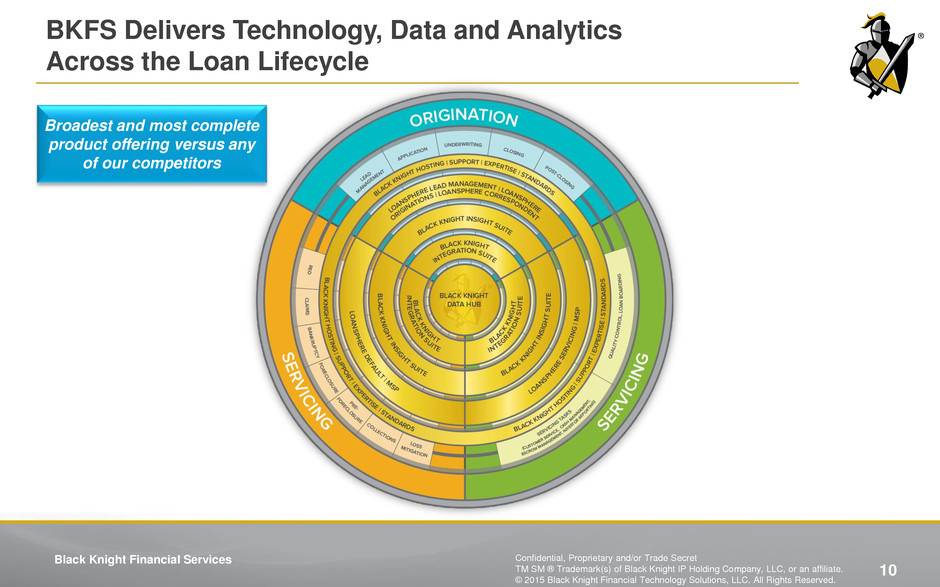

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 10 BKFS Delivers Technology, Data and Analytics Across the Loan Lifecycle Broadest and most complete product offering versus any of our competitors

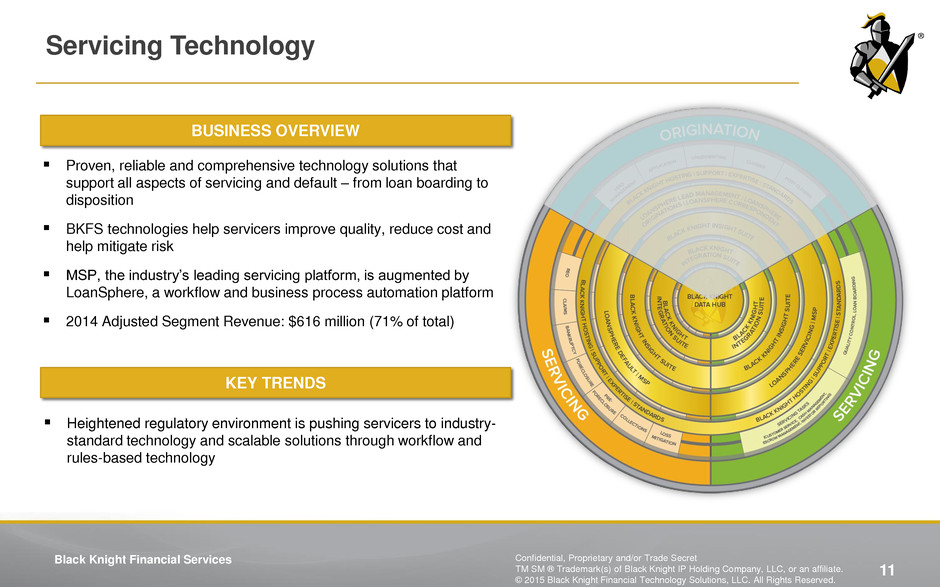

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 11 Servicing Technology BUSINESS OVERVIEW Proven, reliable and comprehensive technology solutions that support all aspects of servicing and default – from loan boarding to disposition BKFS technologies help servicers improve quality, reduce cost and help mitigate risk MSP, the industry’s leading servicing platform, is augmented by LoanSphere, a workflow and business process automation platform 2014 Adjusted Segment Revenue: $616 million (71% of total) KEY TRENDS Heightened regulatory environment is pushing servicers to industry- standard technology and scalable solutions through workflow and rules-based technology

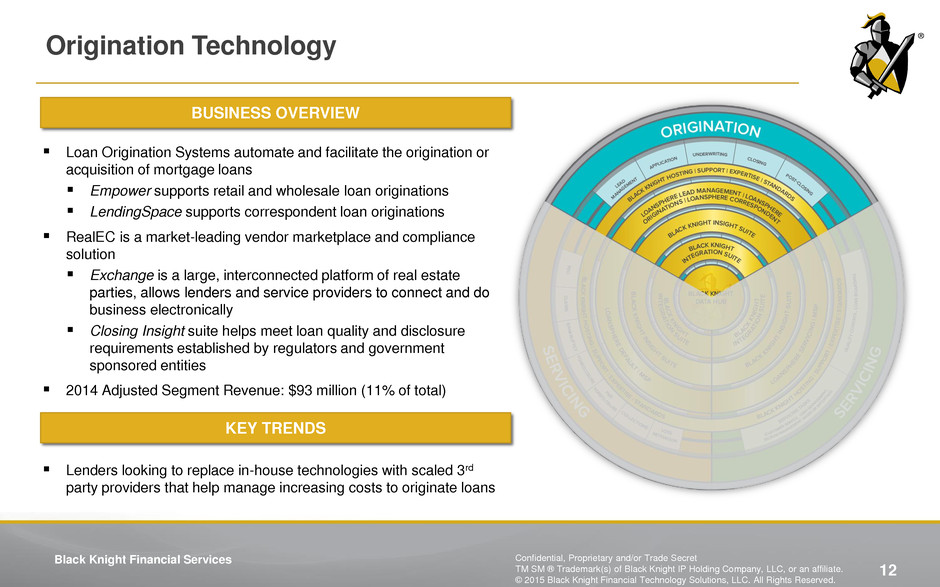

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 12 Origination Technology BUSINESS OVERVIEW Loan Origination Systems automate and facilitate the origination or acquisition of mortgage loans Empower supports retail and wholesale loan originations LendingSpace supports correspondent loan originations RealEC is a market-leading vendor marketplace and compliance solution Exchange is a large, interconnected platform of real estate parties, allows lenders and service providers to connect and do business electronically Closing Insight suite helps meet loan quality and disclosure requirements established by regulators and government sponsored entities 2014 Adjusted Segment Revenue: $93 million (11% of total) Lenders looking to replace in-house technologies with scaled 3rd party providers that help manage increasing costs to originate loans KEY TRENDS

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 13 Data & Analytics Data & Analytics (“D&A”) delivers solutions into multiple segments grouped into 3 primary categories: Mortgage (Origination, Default & Servicing) Secondary Market (Capital Market, Investors & Government) Real Estate Professionals (Associations, Brokers/Agents & Title) One of the largest public and proprietary data sets in the U.S., including 99.99% of the population and 96% of all mortgage transactions, enables unique D&A offerings delivered through our core platforms 2014 Adjusted Segment Revenue: $156 million (18% of total) BUSINESS OVERVIEW Increasing need for integrated data & analytics to enhance decision making and minimize risk in response to changing customer dynamics, regulatory demands and risk appetite KEY TRENDS

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 14 Rank1 Company BKFS Client 1 2 3 4 5 6 7 8 9 10 Broad and Deep Client Relationships with Top Mortgage Institutions Source: Insider Mortgage Finance 1 Rank by market share as of December 31, 2014 Rank1 Company BKFS Client 1 2 3 4 5 6 7 8 9 10 Average relationship with top servicer clients is over 25 years, with each client utilizing an average of 6 BKFS products TOP 10 ORIGINATORS TOP 10 SERVICERS

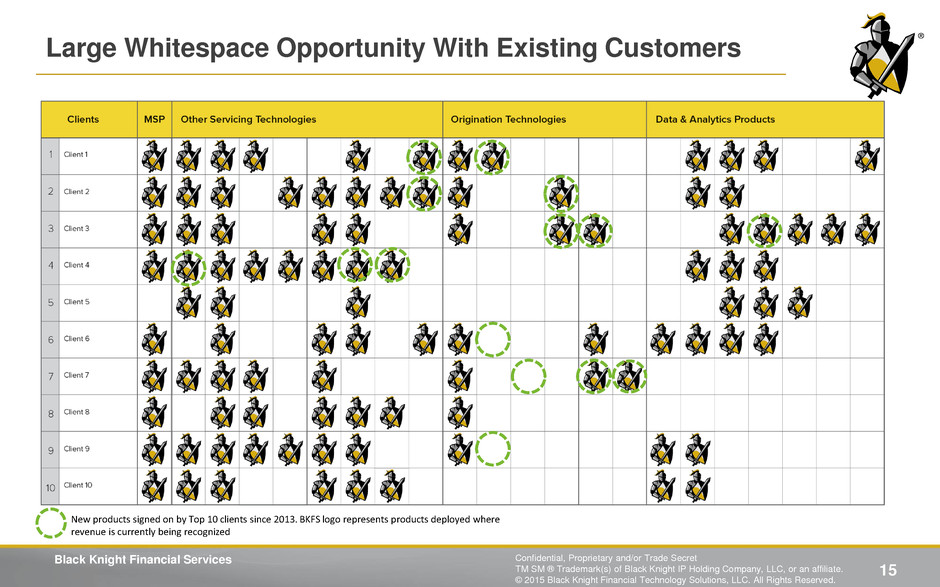

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 15 Large Whitespace Opportunity With Existing Customers New products signed on by Top 10 clients since 2013. BKFS logo represents products deployed where revenue is currently being recognized

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 16 Black Knight Growth Strategy Selectively Pursue Strategic Acquisitions Powerful Focus and Dedication to Staying Current with Regulatory Requirements Continue to Innovate and Introduce New Solutions Win New Clients in Existing Markets Further Penetration of Our Solutions with Existing Clients

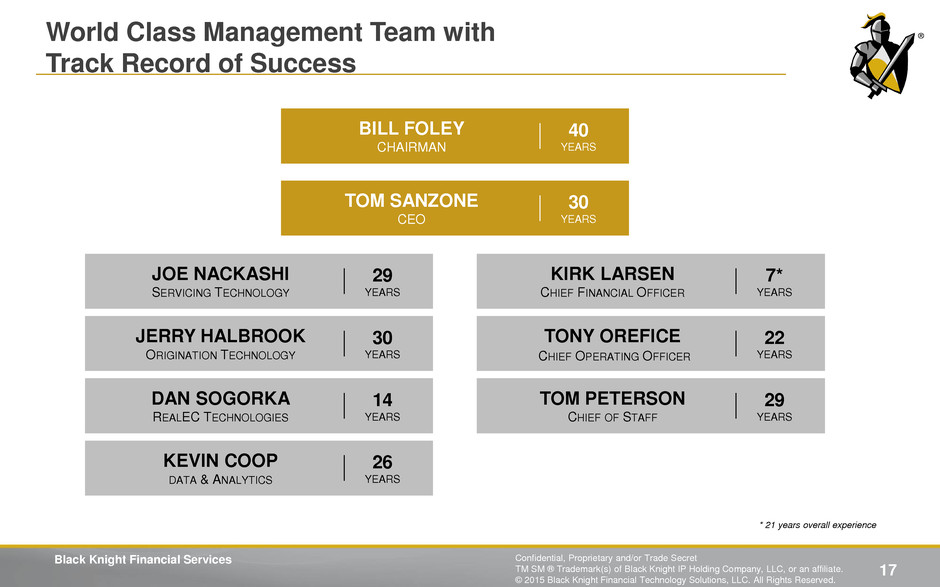

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 17 World Class Management Team with Track Record of Success * 21 years overall experience KIRK LARSEN CHIEF FINANCIAL OFFICER 7* YEARS JOE NACKASHI SERVICING TECHNOLOGY 29 YEARS TOM PETERSON CHIEF OF STAFF 29 YEARS DAN SOGORKA REALEC TECHNOLOGIES 14 YEARS KEVIN COOP DATA & ANALYTICS 26 YEARS JERRY HALBROOK ORIGINATION TECHNOLOGY 30 YEARS TONY OREFICE CHIEF OPERATING OFFICER 22 YEARS TOM SANZONE CEO 30 YEARS BILL FOLEY CHAIRMAN 40 YEARS

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 18 Financial Overview

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 19 Unique and Compelling Business Model Hosted SaaS solutions Economies of scale benefits High margins Long-term contracts Significant and predictable recurring revenue High revenue visibility Mission critical technology solutions and products Deep, long-term relationships Long term customers Volume-based pricing with minimums; annual COLA Embedded volume and pricing growth Strong organic growth CHARACTERISTICS BENEFITS FINANCIAL IMPLICATION

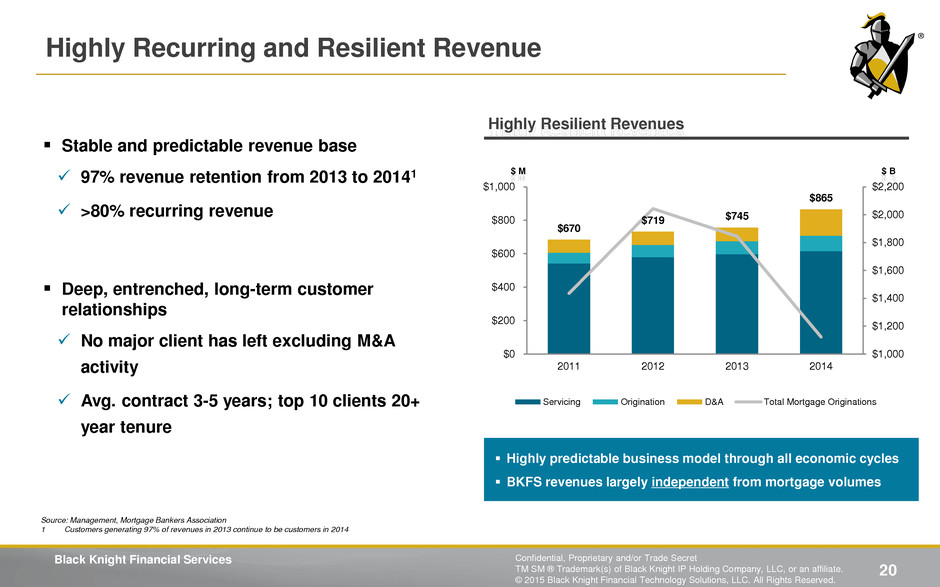

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 20 Highly Recurring and Resilient Revenue Highly Resilient Revenues $670 $719 $745 $865 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $0 $200 $400 $600 $800 $1,000 2011 2012 2013 2014 Servicing Origination D&A Total Mortgage Originations $ B $ M Highly predictable business model through all economic cycles BKFS revenues largely independent from mortgage volumes Stable and predictable revenue base 97% revenue retention from 2013 to 20141 >80% recurring revenue Deep, entrenched, long-term customer relationships No major client has left excluding M&A activity Avg. contract 3-5 years; top 10 clients 20+ year tenure Source: Management, Mortgage Bankers Association 1 Customers generating 97% of revenues in 2013 continue to be customers in 2014

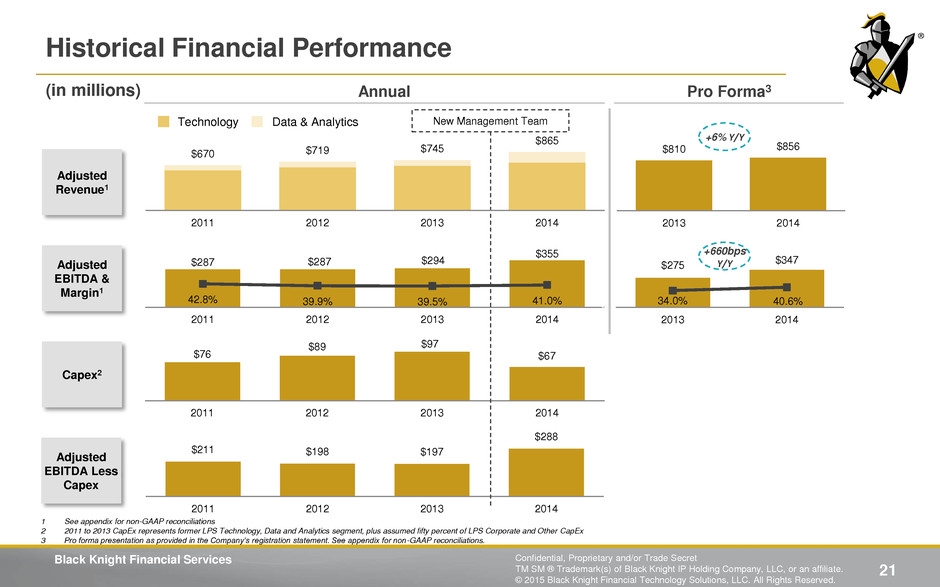

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 21 $287 $287 $294 $355 42.8% 39.9% 39.5% 41.0% 0% 20% 40% 60% 80% (40.0) 60.0 160.0 260.0 360.0 2011 2012 2013 2014 $275 $347 34.0% 40.6% $0 $100 $200 $300 2013 2014 Historical Financial Performance $76 $89 $97 $67 2011 2012 2013 2014 1 See appendix for non-GAAP reconciliations 2 2011 to 2013 CapEx represents former LPS Technology, Data and Analytics segment, plus assumed fifty percent of LPS Corporate and Other CapEx 3 Pro forma presentation as provided in the Company’s registration statement. See appendix for non-GAAP reconciliations. $211 $198 $197 $288 2011 2012 2013 2014 Adjusted EBITDA & Margin1 Adjusted Revenue1 Adjusted EBITDA Less Capex Capex2 (in millions) New Management Team $810 $856 2013 2014 Annual Pro Forma3 +6% Y/Y +660bps Y/Y $670 $719 $745 $865 2011 2012 2013 2014 Technology Data & Analytics

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 22 $74 $86 $95 $100 $98 35.9% 39.5% 43.6% 44.9% 42.8% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 $206 $218 $217 $223 $230 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Strong Momentum Adjusted Revenue1 Adjusted EBITDA & Margin1 (in millions) Last Five Quarters Financial Performance 1 See appendix for non-GAAP reconciliations Q1 Y/Y : +11% Q1 Y/Y: +33%

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 23 Capital Allocation Framework Continue to invest in the business Product development and implementation resources Critical infrastructure (i.e., hardware for hosting, information security) Repay debt Target leverage of approximately 3.5x Maintain ample liquidity Pursue targeted acquisitions Small size product-focused, tuck-in acquisitions Return cash to shareholders Evaluate upon achieving leverage target

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 24 Black Knight Financial Services Powerful sector trends creating significant growth opportunities Market leading provider of end-to- end solutions Broad and deep client relationships with top mortgage institutions Large whitespace opportunity with existing customers Differentiated data assets and analytics capabilities Highly recurring and resilient revenue Scalable and cost effective operating model World class management team with track record of success

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 25 Appendix

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 26 Non-GAAP Reconciliations – Annual Years Ended ($ in millions) 2011 2012 2013 2014 Reconciliation of Revenue (GAAP) to Adjusted Revenue (Non-GAAP) Revenue (as reported) $ 670.4 $ 718.9 $ 744.8 $ 852.1 Deferred Revenue Adjustment - - - 12.8 Adjusted Revenue $ 670.4 $ 718.9 $ 744.8 $ 864.9 Reconciliation of Operating Income (GAAP) to Adjusted EBITDA (Non-GAAP) Operating Income (Loss) (as reported) $ 152.7 $ 176.1 $ 184.2 $ 29.1 Depreciation & Amortization 68.4 75.8 83.6 188.8 EBITDA $ 221.1 $ 251.9 $ 267.8 $ 217.9 Deferred Revenue Adjustment - - - 12.8 Equity-Based Compensation 13.2 14.5 15.6 6.4 Legal & Regulatory Charges 10.4 14.4 2.5 - Exit Costs, Impairment and Other Charges 37.7 5.9 8.1 - Other Non-Recurring Items 4.2 - - (1.5) Transition and Integration Costs - - - 119.3 Adjusted EBITDA $ 286.6 $ 286.7 $ 294.0 $ 354.9 Adjusted EBITDA % Margin 42.8% 39.9% 39.5% 41.0%

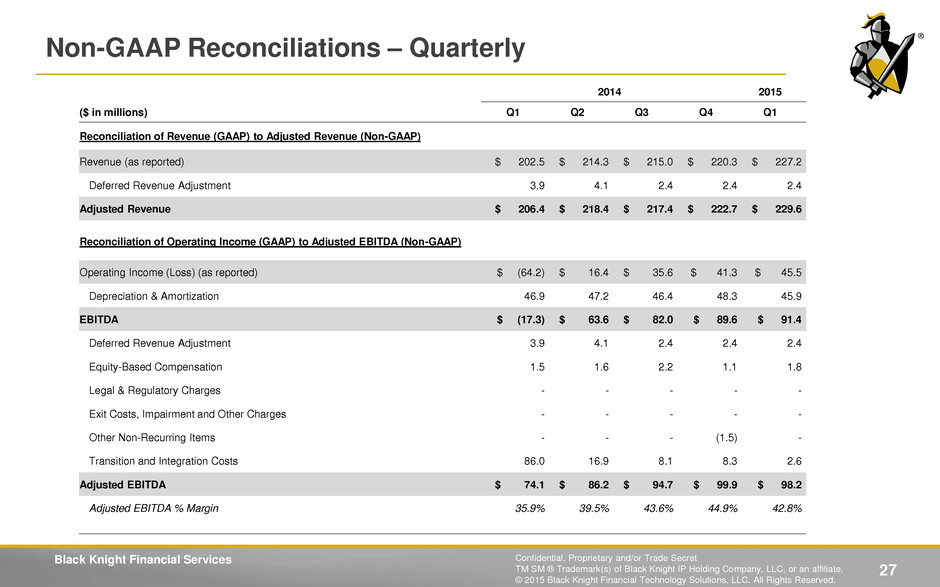

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 27 Non-GAAP Reconciliations – Quarterly 2014 2015 ($ in millions) Q1 Q2 Q3 Q4 Q1 Reconciliation of Revenue (GAAP) to Adjusted Revenue (Non-GAAP) Revenue (as reported) $ 202.5 $ 214.3 $ 215.0 $ 220.3 $ 227.2 Deferred Revenue Adjustment 3.9 4.1 2.4 2.4 2.4 Adjusted Revenue $ 206.4 $ 218.4 $ 217.4 $ 222.7 $ 229.6 Reconciliation of Operating Income (GAAP) to Adjusted EBITDA (Non-GAAP) Operating Income (Loss) (as reported) $ (64.2) $ 16.4 $ 35.6 $ 41.3 $ 45.5 Depreciation & Amortization 46.9 47.2 46.4 48.3 45.9 EBITDA $ (17.3) $ 63.6 $ 82.0 $ 89.6 $ 91.4 Deferred Revenue Adjustment 3.9 4.1 2.4 2.4 2.4 Equity-Based Compensation 1.5 1.6 2.2 1.1 1.8 Legal & Regulatory Charges - - - - - Exit Costs, Impairment and Other Charges - - - - - Other Non-Recurring Items - - - (1.5) - Transition and Integration Costs 86.0 16.9 8.1 8.3 2.6 Adjusted EBITDA $ 74.1 $ 86.2 $ 94.7 $ 99.9 $ 98.2 Adjusted EBITDA % Margin 35.9% 39.5% 43.6% 44.9% 42.8%

Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2015 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. 28 Non-GAAP Reconciliations – Annual Pro Forma Revenue and Adjusted EBITDA Years Ended ($ in millions) 2013 2014 Reconciliation of Revenue (GAAP) to Pro Forma Revenue (Non-GAAP) Revenue (as reported) $ 1,731.2 1,3 $ 852.1 Pro forma adjustments (920.9) 3.7 Pro Forma Revenue $ 810.3 $ 855.8 Reconciliation of Operating Income (GAAP) to Pro Forma Adjusted EBITDA (Non-GAAP) Operating Income (as reported) $ 204.9 2,3 $ 29.1 Pro forma adjustments (120.7) 133.4 Pro Forma Operating Income $ 84.2 $ 162.5 Equity-Based Compensation 2.6 3.2 Depreciation & Amortization 187.9 181.6 Exit costs, impairments and other charges 0.7 - PF Adjusted EBITDA $ 275.4 $ 347.3 PF Adjusted EBITDA % Margin 34.0% 40.6% 1 Represents LPS revenues on an as-reported basis for the year ended December 31, 2013, excluding the results of PCLender.com, Inc. (a business sold in 2014), and BKFS Operating LLC revenues on an as-reported basis for the period October 16, 2013 to December 31, 2013 2 Represents LPS operating income on an as-reported basis for the year ended December 31, 2013 excluding the results of PCLender.com, Inc. (a business sold in 2014), and BKFS Operating LLC operating income on an as-reported basis for the period October 16, 2013 to December 31, 2013 3 Comprises LPS Technology, Data and Analytics, Corporate and Other and Transaction Services segments