Attached files

| file | filename |

|---|---|

| EX-10.26 - EX-10.26 - W2007 Grace Acquisition I Inc | d933018dex1026.htm |

| EX-32.2 - EX-32.2 - W2007 Grace Acquisition I Inc | d933018dex322.htm |

| EX-21.1 - EX-21.1 - W2007 Grace Acquisition I Inc | d933018dex211.htm |

| EX-32.1 - EX-32.1 - W2007 Grace Acquisition I Inc | d933018dex321.htm |

| EX-31.1 - EX-31.1 - W2007 Grace Acquisition I Inc | d933018dex311.htm |

| EX-31.2 - EX-31.2 - W2007 Grace Acquisition I Inc | d933018dex312.htm |

| EX-10.25 - EX-10.25 - W2007 Grace Acquisition I Inc | d933018dex1025.htm |

| EX-10.24 - EX-10.24 - W2007 Grace Acquisition I Inc | d933018dex1024.htm |

| EX-10.27 - EX-10.27 - W2007 Grace Acquisition I Inc | d933018dex1027.htm |

| EX-10.23 - EX-10.23 - W2007 Grace Acquisition I Inc | d933018dex1023.htm |

| EX-10.28 - EX-10.28 - W2007 Grace Acquisition I Inc | d933018dex1028.htm |

| EX-10.29 - EX-10.29 - W2007 Grace Acquisition I Inc | d933018dex1029.htm |

| EXCEL - IDEA: XBRL DOCUMENT - W2007 Grace Acquisition I Inc | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-12073

W2007 GRACE ACQUISITION I, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Tennessee | 26-1187149 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 6011 Connection Drive Irving, TX |

75039 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 972-368-2200

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-Accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act.) Yes ¨ No x

As of June 30, 2014, the aggregate market value of the outstanding common stock held by non-affiliates of the registrant, was $0.

As of June 12, 2015, there were 100 shares of the registrant’s common stock outstanding.

-2-

EXPLANATORY NOTE

Throughout this Form 10-K, the words “Company,” “we,” “our” and “us” refer to W2007 Grace Acquisition I, Inc., a Tennessee corporation, and its consolidated subsidiaries, unless otherwise stated or the context requires otherwise. On February 27, 2015, consolidated subsidiaries of the Company sold all 20 of their hotels and subsidiaries of W2007 Equity Inns Senior Mezz, LLC (Senior Mezz), an entity in which the Company has a 3% equity interest, sold 96 of their 106 hotels to subsidiaries of American Realty Capital Hospitality Trust, Inc. (ARCH). Any references to our hotels or our business or operations for periods from and after February 27, 2015 refer to the 10 hotels that are currently held by Senior Mezz (the Remaining Hotels).

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

Throughout this Form 10-K and documents incorporated herein by reference, we make forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. Such statements are generally accompanied by words such as “may,” “believe,” “estimate,” “project,” “plan,” “intend,” “will,” “anticipate,” “expect” and words of similar import that convey uncertainty as to future events or outcomes. These forward-looking statements include information about possible or assumed future results of our business, financial condition and liquidity, results of operations, plans, and objectives. Statements regarding the following subjects are forward-looking by their nature:

| • | our business and investment strategy; |

| • | our projected operating results; |

| • | completion of any pending transactions; |

| • | our ability to obtain future financing arrangements; |

| • | our understanding of our competition; |

| • | market trends; and |

| • | projected capital expenditures. |

Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans and other objectives may vary materially from those expressed in our forward-looking statements. Additionally, the following factors could cause actual results to vary from our forward-looking statements:

| • | factors discussed in this Form 10-K, including those set forth under the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and “Properties;” |

| • | general volatility of the capital markets; |

| • | changes in our business or investment strategy; |

| • | availability, terms and deployment of capital; |

| • | availability of qualified personnel; |

| • | changes in our industry and the market in which we operate, interest rates or the general economy; and |

| • | the degree and nature of our competition. |

You should not place undue reliance on such forward-looking statements. We undertake no obligation and do not intend to publicly update or revise any forward-looking statements to reflect future events or developments, whether as a result of new information, future events or otherwise.

-3-

| ITEM 1. | BUSINESS |

OUR COMPANY

W2007 Grace Acquisition I, Inc., a Tennessee corporation (the Company), was incorporated on June 20, 2007. All of the common stock of the Company is owned by W2007 Grace I, LLC, a Tennessee limited liability company (Grace I). Grace I is owned by W2007 Finance Sub, LLC, a Delaware limited liability company, and Whitehall Parallel Global Real Estate Limited Partnership 2007, a Delaware limited partnership (collectively, Whitehall). The general partner of Whitehall Parallel Global Real Estate Limited Partnership 2007 and the partnerships owning W2007 Finance Sub, LLC is a wholly-owned subsidiary of The Goldman Sachs Group, Inc. (GS Group) and, therefore, is an affiliate of GS Group. GS Group in turn also controls Goldman, Sachs & Co. (GS) and Goldman Sachs Mortgage Company (GSMC). Consequently, GS and GSMC are also affiliates of Whitehall.

Grace I, the Company, Equity Inns, Inc. (Equity Inns), Grace II, L.P. (Grace II) and Equity Inns Partnership, L.P. (Equity LP) entered into an agreement and plan of merger pursuant to which Equity Inns merged with and into the Company and Grace II merged with and into Equity LP (such transactions collectively, the Merger). The Merger was completed on October 25, 2007. Prior to the Merger, the Company had no operations other than its activities in anticipation of the Merger.

Prior to the Merger, Equity Inns was a public hotel company and had elected to be taxed as a real estate investment trust (REIT) for federal income tax purposes. Equity Inns, through its wholly owned subsidiary, Equity Inns Trust (Equity Trust), was the sole general partner of Equity LP. Prior to the Merger, Equity Inns, Equity Trust and Equity LP (and its wholly owned subsidiaries) collectively owned 137 limited-service hotels located throughout the United States.

Subsequent to the Merger, Grace II changed its name to W2007 Equity Inns Partnership, L.P. (W2007 Equity LP). Since the Merger, Grace I has owned all of the shares of common stock of the Company and the Company has owned a 1% general partnership interest in W2007 Equity LP (with Grace I, our parent, owning a 1% general partnership interest and a 98% limited partnership interest). The Company also owns 100% of W2007 Equity Inns Trust, a Maryland trust (the Trust).

A group of 106 hotels (the OP Hotels) were owned by a series of wholly owned subsidiaries of W2007 Equity LP that were created in connection with financing for the Merger. GSMC acquired an option to purchase (the Purchase Option) a 97% equity interest in one of the Company’s wholly owned subsidiaries that indirectly owns all of the OP Hotels, which Purchase Option has since been acquired by an affiliate of Whitehall. A group of 20 hotels (the Trust Hotels) are owned by various limited partnerships with various corporations as their sole general partners, which corporations were wholly-owned by the Trust. These general partners each own a 1% ownership interest in the respective limited partnerships and W2007 Equity LP owns the remaining 99% ownership interest in the respective limited partnerships.

Following the Merger, the Company and Grace I entered into a Keepwell Agreement, effective as of the date of the Merger (the Keepwell Agreement), pursuant to which Grace I agreed to make such cash payments to the Company as are necessary to enable the Company to satisfy its obligations to the holders of the Company’s 8.75% Series B cumulative preferred stock (the Series B preferred stock) and 9.00% Series C cumulative preferred stock (the Series C preferred stock, and collectively with the Series B preferred stock, the preferred stock) in accordance with the Company’s charter when the Company determines, or is legally compelled, to satisfy such obligations. To date, no payments have been made and none are due under the Keepwell Agreement. The Keepwell Agreement may be terminated by Grace I at any time upon 30 days’ prior written notice. There are no third-party beneficiaries of the Keepwell Agreement.

On March 31, 2008, the Company, pursuant to Section 856(g)(2) of the Internal Revenue Code of 1986, as amended (the Code), revoked its election under Section 856(c)(1) of the Code to be a REIT for the taxable year ending on December 31, 2008. Consequently, subsequent to December 31, 2007, the Company is subject to income taxes at statutory corporate rates.

On April 11, 2014, the subsidiaries of W2007 Equity LP that owned the OP Hotels repaid the Mortgage Loan and the First Mezzanine Loan (each as defined in “Item 13. Certain Relationships and Related Transactions and Director Independence –Transactions with related persons – GE Mortgage loan agreement and Purchase Option”) in full with the proceeds of a $865 million non-recourse mortgage loan (the New Mortgage Loan) and a $111 million non-recourse mezzanine loan (the New Mezzanine Loan), each obtained from German American Capital Corporation (GACC) and secured, directly or indirectly, by the OP Hotels.

-4-

The New Mortgage Loan was componentized, while the New Mezzanine Loan was made pursuant to two separate, pari passu notes. Each of the loans is interest-only for the duration of its term, with a balloon payment of principal due upon maturity. The initial scheduled maturity date of each loan was May 1, 2016, with three one-year extension options available upon the satisfaction of certain conditions, the most restrictive of which is a debt yield test. The second and third extension options, but not the first, required the payment of an extension fee of 0.25% of the outstanding principal amount of the loans.

Under the loan agreements, the borrowers were required to fund and maintain certain reserves with the lender, including reserves for required repairs, taxes, insurance, the completion of franchise agreement capital improvements, the replacement of FF&E and rent payable under ground leases. In addition, under the loan agreements, if the borrowers did not maintain a certain aggregate debt yield, their net operating cash flows would be “trapped.” The loan agreements also specified certain limited uses for the “trapped” cash flows. Similar cash traps were required in an event of default under either of the loan agreements.

In June of 2014, GACC exercised its right under the loan agreements for the new loans to modify their relative principal balances and interest rates, for purposes of marketing and selling the loans. As a result of these modifications, the New Mortgage Loan had a weighted average interest rate of the one-month LIBOR rate, plus 3.1113%, while the New Mezzanine Loan had an interest rate of the one-month LIBOR rate, plus 4.7705%. The weighted average spread over LIBOR for the New Mortgage Loan was based on the principal balances under the New Mortgage Loan as of December 31, 2014. The principal balance and spread over LIBOR for each component of the New Mortgage Loan and each note of the New Mezzanine Loan is set forth below (as of December 31, 2014).

| Component/Note |

Principal Balance | Spread (Over LIBOR) | ||||||

| New Mortgage Loan |

||||||||

| Component A |

$ | 271,878,000 | 0.93270 | % | ||||

| Component B |

$ | 101,421,000 | 1.28270 | % | ||||

| Component C |

$ | 66,000,000 | 1.68270 | % | ||||

| Component D |

$ | 120,769,000 | 4.22678 | % | ||||

| Component E |

$ | 167,658,000 | 5.32678 | % | ||||

| Component F |

$ | 137,274,000 | 5.77678 | % | ||||

| New Mezzanine Loan |

||||||||

| Note A-1 |

$ | 66,600,000 | 4.7705 | % | ||||

| Note A-2 |

$ | 44,400,000 | 4.7705 | % | ||||

At the closing of the refinancing, GSMC acquired a 40% participation interest in each component of the New Mortgage Loan and a 100% participation interest in Note A-2 of the New Mezzanine Loan. In connection with the origination of the New Mortgage Loan and the New Mezzanine Loan, the borrowers thereunder were required to and did pay certain underwriting fees totaling $9.76 million to GACC, 40% of which GACC paid to GSMC in connection with GSMC’s acquisition of the participation interests in the loans.

On June 18, 2014, GACC securitized each of the New Mortgage Loan and the New Mezzanine Loan, and they are now held, respectively, by EQTY 2014-INNS Mortgage Trust and EQTY 2014-MZ Mezzanine Trust. GSMC no longer holds any interest in the loans.

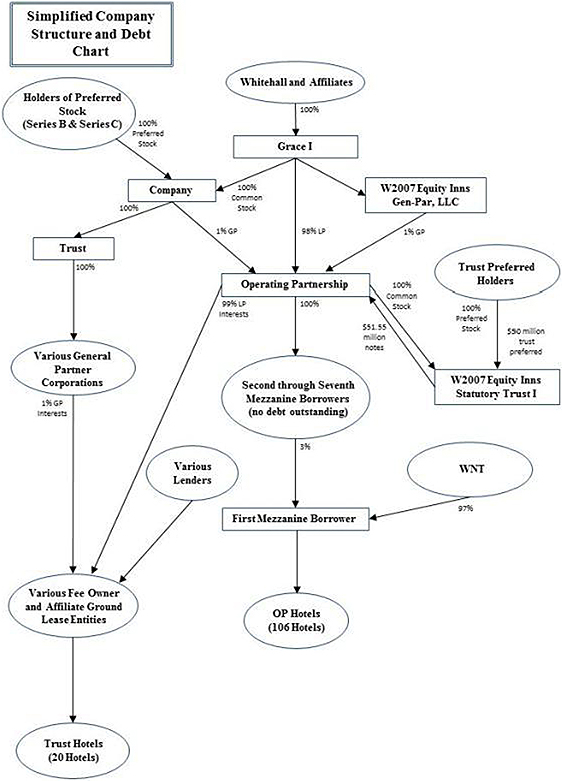

Concurrently with the refinancing of the Mortgage Loan and the First Mezzanine Loan, the Purchase Option was exercised by WNT Holdings, LLC (WNT), an affiliate of Whitehall. As a result, WNT holds a 97% equity interest in W2007 Equity Inns Senior Mezz, LLC (Senior Mezz) who in turn owns a 100% indirect interest in the borrower under the New Mezzanine Loan and the borrowers under the New Mortgage Loan (the owner of the OP Hotels). The remaining 3% equity interest in Senior Mezz is owned indirectly by W2007 Equity LP.

-5-

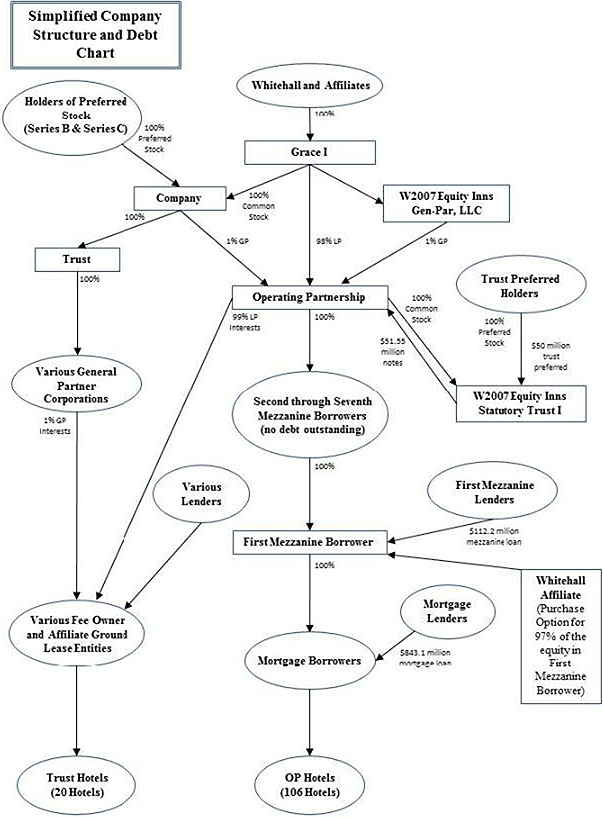

The diagram below reflects our organizational structure as of December 31, 2013 and prior to the exercise of the Purchase Option and refinancing of the Company’s debt on April 11, 2014. Subsidiary entities have been consolidated to simplify the diagram.

-6-

The diagram below reflects our organizational structure as of December 31, 2014 in light of the exercise of the Purchase Option and the refinancing of the Company’s debt. Subsidiary entities have been consolidated to simplify the diagram.

-7-

Sale of Assets

On May 23, 2014, the Company’s subsidiaries owning the 20 Trust Hotels and WNT’s subsidiaries owning the 106 OP Hotels (the Sellers) entered into a real estate sale agreement (the Original Purchase Agreement), which was amended and restated on November 11, 2014 (the Agreement), with subsidiaries of ARCH as purchasers (the Purchasers), pursuant to which the Purchasers agreed to purchase the 116 hotels listed below (the Portfolio) instead of all 126 hotels. The portion of the purchase price allocated to the properties is also listed below.

| Hotel Property |

Location |

Pool | Allocated Purchase Price |

|||||

| Courtyard |

Asheville, NC | Pool I | $ | 17,374,707 | ||||

| Courtyard |

Athens, GA | Pool I | $ | 12,520,081 | ||||

| Courtyard |

Bowling Green, KY | Pool I | $ | 13,903,166 | ||||

| Courtyard |

Carlsbad, CA | Pool II | $ | 22,686,825 | ||||

| Courtyard |

Dallas, TX | Pool I | $ | 26,447,729 | ||||

| Courtyard |

Dalton, GA | Pool II | $ | 10,241,716 | ||||

| Courtyard |

Elmhurst, IL | Pool I | $ | 10,890,288 | ||||

| Courtyard |

Gainesville, FL | Pool I | $ | 17,007,759 | ||||

| Courtyard |

Houston, TX | Pool II | $ | 32,083,929 | ||||

| Courtyard |

Jacksonville, FL | Pool I | $ | 6,606,165 | ||||

| Courtyard |

Knoxville, TN | Pool I | $ | 12,580,307 | ||||

| Courtyard |

Lexington, KY | Pool I | $ | 18,494,208 | ||||

| Courtyard |

Louisville, KY | Pool I | $ | 39,005,197 | ||||

| Courtyard |

Mobile, AL | Pool I | $ | 5,698,889 | ||||

| Courtyard |

Orlando, FL | Pool I | $ | 16,204,908 | ||||

| Courtyard |

Sarasota, FL | Pool I | $ | 11,537,396 | ||||

| Courtyard |

Tallahassee, FL | Pool I | $ | 13,209,349 | ||||

| Embassy Suites |

Orlando, FL | Pool I | $ | 23,802,848 | ||||

| Fairfield Inn & Suites |

Atlanta, GA | Pool I | $ | 8,604,369 | ||||

| Fairfield Inn & Suites |

Dallas, TX | Pool I | $ | 8,539,822 | ||||

| Hampton Inn |

Addison, TX | Pool I | $ | 10,753,205 | ||||

| Hampton Inn |

Albany, NY | Pool I | $ | 22,881,688 | ||||

| Hampton Inn |

Alcoa, TN | Pool II | $ | 7,960,928 | ||||

| Hampton Inn |

Austin, TX | Pool II | $ | 14,790,545 | ||||

| Hampton Inn |

Beckley, WV | Pool I | $ | 19,447,700 | ||||

| Hampton Inn |

Birmingham, AL | Pool I | $ | 9,284,784 | ||||

| Hampton Inn |

Boca Raton, FL | Pool I | $ | 13,994,573 | ||||

| Hampton Inn |

Charleston, SC | Pool I | $ | 8,205,785 | ||||

| Hampton Inn |

Chattanooga, TN | Pool I | $ | 8,350,000 | ||||

| Hampton Inn |

College Station, TX | Pool II | $ | 17,930,338 | ||||

| Hampton Inn |

Colorado Springs, CO | Pool I | $ | 7,308,506 | ||||

| Hampton Inn |

Columbus, GA | Pool I | $ | 5,900,000 | ||||

| Hampton Inn |

Deerfield Beach, FL | Pool I | $ | 12,809,617 | ||||

| Hampton Inn |

Dublin, OH | Pool I | $ | 12,621,596 | ||||

| Hampton Inn |

East Lansing, MI | Pool II | $ | 14,252,046 | ||||

| Hampton Inn |

Fayetteville, NC | Pool I | $ | 8,679,438 | ||||

| Hampton Inn |

Gastonia, NC | Pool I | $ | 11,841,758 | ||||

| Hampton Inn |

Glen Burnie, MD | Pool I | $ | 8,592,309 | ||||

| Hampton Inn |

Grand Rapids, MI | Pool I | $ | 14,884,362 | ||||

| Hampton Inn |

Gurnee, IL | Pool I | $ | 12,929,426 | ||||

| Hampton Inn |

Indianapolis, IN | Pool II | $ | 10,499,736 | ||||

| Hampton Inn |

Kansas City, MO | Pool I | $ | 9,271,676 | ||||

| Hampton Inn |

Madison Heights, MI | Pool I | $ | 15,711,626 | ||||

| Hampton Inn |

Maryland Heights, MO | Pool I | $ | 9,904,041 | ||||

| Hampton Inn |

Memphis, TN | Pool I | $ | 15,347,648 | ||||

-8-

| Hotel Property |

Location |

Pool | Allocated Purchase Price |

|||||

| Hampton Inn |

Milford, CT | Pool II | $ | 7,400,000 | ||||

| Hampton Inn |

Morgantown, WV | Pool I | $ | 17,681,700 | ||||

| Hampton Inn |

Naperville, IL | Pool II | $ | 10,587,539 | ||||

| Hampton Inn |

Norfolk, VA | Pool I | $ | 5,850,000 | ||||

| Hampton Inn |

Northville , MI | Pool I | $ | 9,776,761 | ||||

| Hampton Inn |

Orlando, FL | Pool II | $ | 13,886,925 | ||||

| Hampton Inn |

Overland Park, KS | Pool I | $ | 10,842,223 | ||||

| Hampton Inn |

Palm Beach Gardens, FL | Pool I | $ | 20,956,063 | ||||

| Hampton Inn |

Peabody, MA | Pool I | $ | 13,059,655 | ||||

| Hampton Inn |

Pickwick Dam, TN | Pool I | $ | 2,500,000 | ||||

| Hampton Inn |

Scranton, PA | Pool I | $ | 13,865,600 | ||||

| Hampton Inn |

State College, PA | Pool I | $ | 13,850,032 | ||||

| Hampton Inn |

Urbana, IL | Pool II | $ | 24,279,177 | ||||

| Hampton Inn |

West Columbia, SC | Pool I | $ | 6,000,000 | ||||

| Hampton Inn |

West Palm Beach, FL | Pool I | $ | 15,115,059 | ||||

| Hampton Inn |

Westlake, OH | Pool I | $ | 18,594,664 | ||||

| Hampton Inn & Suites |

Boynton Beach, FL | Pool I | $ | 32,415,587 | ||||

| Hampton Inn & Suites |

Franklin, TN | Pool I | $ | 21,016,491 | ||||

| Hilton Garden Inn |

Louisville, KY | Pool II | $ | 19,185,347 | ||||

| Hilton Garden Inn |

Rio Rancho, NM | Pool II | $ | 11,983,810 | ||||

| Hilton Garden Inn |

Round Rock, TX | Pool I | $ | 16,424,572 | ||||

| Holiday Inn |

Mt. Pleasant, SC | Pool I | $ | 7,900,000 | ||||

| Holiday Inn Express |

Miami, FL | Pool I | $ | 8,511,530 | ||||

| Homewood Suites |

Augusta, GA | Pool II | $ | 10,563,510 | ||||

| Homewood Suites |

Chicago, IL | Pool I | $ | 73,288,289 | ||||

| Homewood Suites |

Germantown, TN | Pool I | $ | 10,745,199 | ||||

| Homewood Suites |

Orlando, FL | Pool II | $ | 31,582,545 | ||||

| Homewood Suites |

Peabody, MA | Pool I | $ | 10,714,650 | ||||

| Homewood Suites |

Phoenix , AZ | Pool I | $ | 24,809,678 | ||||

| Homewood Suites |

San Antonio, TX | Pool I | $ | 17,635,891 | ||||

| Homewood Suites |

Seattle, WA | Pool II | $ | 55,983,779 | ||||

| Homewood Suites |

Windsor Locks, CT | Pool I | $ | 12,325,687 | ||||

| Hyatt Place |

Albuquerque, NM | Pool I | $ | 21,994,086 | ||||

| Hyatt Place |

Baton Rouge, LA | Pool I | $ | 13,075,389 | ||||

| Hyatt Place |

Birmingham, AL | Pool I | $ | 10,225,494 | ||||

| Hyatt Place |

Bloomington, MN | Pool I | $ | 14,667,789 | ||||

| Hyatt Place |

Blue Ash, OH | Pool I | $ | 10,337,545 | ||||

| Hyatt Place |

Columbus, OH | Pool I | $ | 13,352,636 | ||||

| Hyatt Place |

Franklin, TN | Pool I | $ | 19,879,751 | ||||

| Hyatt Place |

Glen Allen, VA | Pool I | $ | 9,128,843 | ||||

| Hyatt Place |

Indianapolis, IN | Pool I | $ | 16,261,993 | ||||

| Hyatt Place |

Las Vegas, NV | Pool I | $ | 19,906,596 | ||||

| Hyatt Place |

Linthicum Heights, MD | Pool I | $ | 12,476,068 | ||||

| Hyatt Place |

Memphis, TN | Pool I | $ | 15,767,331 | ||||

| Hyatt Place |

Miami, FL | Pool I | $ | 19,884,261 | ||||

| Hyatt Place |

Overland Park, KS | Pool I | $ | 9,949,330 | ||||

| Hyatt Place |

Tampa, FL | Pool I | $ | 20,915,567 | ||||

| Residence Inn |

Boise, ID | Pool I | $ | 12,668,682 | ||||

| Residence Inn |

Chattanooga, TN | Pool I | $ | 13,499,683 | ||||

| Residence Inn |

El Segundo, CA | Pool I | $ | 40,111,403 | ||||

| Residence Inn |

Ft Myers, FL | Pool I | $ | 11,932,019 | ||||

| Residence Inn |

Jacksonville, FL | Pool II | $ | 6,365,091 | ||||

-9-

| Hotel Property |

Location |

Pool | Allocated Purchase Price |

|||||

| Residence Inn |

Knoxville, TN | Pool I | $ | 14,263,366 | ||||

| Residence Inn |

Lexington, KY | Pool I | $ | 17,595,014 | ||||

| Residence Inn |

Macon, GA | Pool I | $ | 4,907,309 | ||||

| Residence Inn |

Mobile, AL | Pool I | $ | 9,523,623 | ||||

| Residence Inn |

Portland, OR | Pool I | $ | 50,878,043 | ||||

| Residence Inn |

San Diego, CA | Pool I | $ | 28,120,735 | ||||

| Residence Inn |

Sarasota, FL | Pool I | $ | 13,964,493 | ||||

| Residence Inn |

Savannah, GA | Pool I | $ | 11,231,254 | ||||

| Residence Inn |

Tallahassee, FL | Pool I | $ | 12,114,907 | ||||

| Residence Inn |

Tampa, FL | Pool I | $ | 10,709,571 | ||||

| Residence Inn |

Tampa, FL | Pool I | $ | 17,062,551 | ||||

| SpringHill Suites |

Asheville, NC | Pool II | $ | 14,796,371 | ||||

| SpringHill Suites |

Grand Rapids, MI | Pool I | $ | 11,413,845 | ||||

| SpringHill Suites |

Houston, TX | Pool I | $ | 13,200,866 | ||||

| SpringHill Suites |

Lexington, KY | Pool I | $ | 18,243,803 | ||||

| SpringHill Suites |

Round Rock, TX | Pool I | $ | 10,133,394 | ||||

| SpringHill Suites |

San Antonio, TX | Pool I | $ | 5,661,802 | ||||

| SpringHill Suites |

San Diego, CA | Pool I | $ | 21,190,695 | ||||

| TownePlace Suites |

Savannah, GA | Pool II | $ | 9,777,538 | ||||

The Company closed the sale of the Portfolio on February 27, 2015. The aggregate purchase price for the Portfolio was approximately $1.808 billion, subject to certain adjustments and proration. The purchase price consisted of approximately $1.361 billion in cash and approximately $447 million in preferred equity interests (the Preferred Equity) to be issued by two subsidiaries of ARCH (Pool I Owner and Pool II Owner) that are now the indirect owners of the Portfolio. Pool I Owner indirectly owns the 96 OP Hotels that are part of the Portfolio (the Pool I Hotels) and Pool II Owner indirectly owns the 20 Trust Hotels (the Pool II Hotels).

A portion of the purchase price has been allocated to each of the individual hotels in the Portfolio (as indicated in the chart above). The consideration received at closing, net of transaction costs, proration and other purchase price adjustments, generally was allocated amongst the Sellers in accordance with the allocated purchase prices of the portions of the Portfolio owned by them unless such costs are clearly associated with a particular pool (for example, the defeasance costs associated with the 20 Trust Hotels’ mortgages).

At closing, the Preferred Equity in the Pool I Owner was issued to the Sellers of the Pool I Hotels and the Preferred Equity in the Pool II Owner was issued to the Sellers of the Pool II Hotels. In each case, for the 18-month period after the closing, the Preferred Equity will accrue an annual preferred return of 7.50%. Thereafter, the annual preferred return will increase to 8.00%. The preferred return is payable in cash on a current basis each month. The Preferred Equity has a full liquidation preference to any other equity in the issuer.

The Preferred Equity is fully redeemable by the Pool I Owner or the Pool II Owner, as applicable, at any time at par plus any accrued and unpaid preferred return. In addition, there are certain mandatory redemption events, including a requirement that 50% of the Preferred Equity be redeemed by the third anniversary of the closing and 100% of the Preferred Equity be redeemed by the fourth anniversary of the closing.

The Sellers have the right to replace the managing member and assume full control of Pool I Owner or the Pool II Owner, respectively (including over any decision to refinance or sell Pool I Owner or the Pool II Owner, as applicable, or any properties) upon the occurrence, subject to certain cure and grace periods, of any “Changeover Event” (as described below). Changeover Events consist of the following types of events: failure to make payments when due; failure to contribute protective capital when required; breaches of representations, warranties and covenants; events of default under debt documents, lease agreements and franchise agreements; and insolvency events.

Following a Changeover Event, in addition to a Seller’s mandatory redemption rights, each Seller has the right to exercise a buy/sell option pursuant to which an ARCH affiliate must propose a price to the respective Seller for Pool I Owner or Pool II Owner, as applicable, for which the ARCH affiliate would either (i) buy all of the applicable Seller’s interests in the respective holding company for the amount that such Seller would receive in distribution if such holding company were sold

-10-

for such price, or (ii) sell to the applicable Seller all of the ARCH affiliate’s interest in such holding company for the amount that the ARCH affiliate would receive in distribution if such holding company were sold for such price. The applicable Seller would then have the right to elect to either sell its interests to the ARCH affiliate or to buy the ARCH affiliate’s interest at the applicable price.

The Purchasers assumed the New Mortgage Loan and the New Mezzanine Loan at closing.

The Sellers were required to repay $72.1 million of the debt secured by the Remaining Hotels and obtained the release of the Remaining Hotels from the lien securing the debt. Following that repayment, the cash portion of the purchase price for the Pool I Hotels was reduced by the remaining outstanding principal amount of the assumed debt (approximately $903.9 million in the aggregate).

Whitehall and one of its affiliates provided customary non-recourse carve-out guarantees and environmental indemnities in respect of the assumed debt (which they previously did). ARCH and certain of its affiliates guarantee the reimbursement of the Whitehall guarantors for any liabilities incurred under these guarantees and indemnities. In the event that the Whitehall guarantors have not been released from these guarantees and indemnities within the 18-month period following the closing, they will be entitled to receive an annual fee of $8 million.

The Pool II Hotels were delivered to the Purchasers free of any mortgages. Accordingly, at the closing, the Sellers defeased, or in the case of one mortgage prepaid, the debt that previously encumbered the Pool II Hotels. The Purchasers obtained new financing secured by those hotels to fund a portion of the purchase price.

W2007 Equity LP redeemed its junior subordinated debt in full at closing on February 27, 2015.

W2007 Equity LP, WNT and Whitehall Street Global Real Estate Limited Partnership 2007, an affiliate of GS Group, GS and GSMC, engaged GS and Deutsche Bank Securities Inc. (DB) to provide advisory services in connection with a potential sale or other transaction relating to the 126 hotels. As a result of that engagement, upon consummation of the sale of the Portfolio in accordance with the Agreement, GS and DB were paid, in the aggregate, an advisory fee of 1.10% of the aggregate consideration paid to the Sellers. GS and DB split the advisory fee 60% and 40% respectively.

As of December 31, 2014 and 2013, we owned interests in 126 hotels located in 35 states comprising 14,934 rooms. As described above, the 20 Trust Hotels and 96 of the OP Hotels were sold on February 27, 2015.

OUR HOTELS

On February 27, 2015, the 20 Trust Hotels and 96 of the 106 OP Hotels were sold to affiliates of ARCH. The Remaining Hotels held by Senior Mezz were under contract to be sold for a combined purchase price of $100 million. The contract for the sale of the Remaining Hotels was terminated by the purchasers on May 6, 2015. On June 8, 2015, the Company entered into a reinstatement and amendment to the terminated contract, which among other things, reinstated the contract for nine of the Remaining Hotels, amended the purchase price to $85 million and scheduled closing for July 23, 2015. There can be no assurance as to whether or when the transaction will close, as to the actual proceeds that will be realized if it does close or as to what the assets might ultimately sell for in an alternate transaction if the pending transaction does not close. Even if the transaction does close, there can be no assurance as to when a distribution from such sale proceeds will be received by the Company. While the Company intends to sell the one Remaining Hotel not currently under contract to be sold, there can be no assurance as to whether or when that hotel will be sold, the form of consideration which may be received in respect of that hotel or whether the consideration which may be received in respect of that hotel will be greater or less than the purchase price allocated to that hotel in the terminated sale agreement. Even if a transaction for the one Remaining Hotel not currently under contract to be sold does occur, there can be no assurance as to when a distribution from such sale proceeds will be received by the Company.

Through our subsidiaries, we primarily owned premium-branded, limited-service hotels in the upscale and upper midscale segments of the lodging industry, as these segments are currently defined by Smith Travel Research (STR), a leading source of lodging industry data. Limited-service hotels typically generate most of their revenue from room rentals, have limited food and beverage outlets and meeting space and require fewer employees than traditional full-service hotels. We believe that premium-branded, limited-service hotels have the potential to generate attractive returns relative to other types of hotels due to their ability to achieve revenue per available room (RevPAR) levels at or close to those generated by traditional full-service hotels, while achieving higher profit margins due to their more efficient operating model and less volatile cash flows. See “Item 7. Management’s Discussion & Analysis” for additional information regarding RevPAR.

The diversity of our portfolio was such that, as of December 31, 2014 and 2013, no individual hotel exceeded 10% of the total rooms in the portfolio. Our brand and segment diversity of the Trust Hotels that were included in continuing operations as of December 31, 2014 and 2013 is illustrated by the following table:

-11-

Brand and Segment (as defined by STR) Diversity

| Number of Hotels | Number of Rooms | |||||||

| Upscale hotels: |

||||||||

| Homewood Suites (1) |

3 | 478 | ||||||

| Courtyard (2) |

3 | 414 | ||||||

| Hilton Garden Inn (1) |

2 | 241 | ||||||

| SpringHill Suites (2) |

1 | 88 | ||||||

| Residence Inn (2) |

1 | 78 | ||||||

|

|

|

|

|

|||||

| 10 | 1,299 | |||||||

| Upper midscale hotels: |

||||||||

| Hampton Inn (1) |

9 | 1,163 | ||||||

| TownePlace Suites (2) |

1 | 95 | ||||||

|

|

|

|

|

|||||

| 10 | 1,258 | |||||||

|

|

|

|

|

|||||

| Total |

20 | 2,557 | ||||||

|

|

|

|

|

|||||

Franchise affiliation

| (1) | Hilton Hotels Corporation |

| (2) | Marriott International, Inc. |

The diversity of the OP Hotels was such that, as of December 31, 2014 and 2013 no individual hotel exceeded 2% of the total rooms in the portfolio. The brand and segment diversity of the OP Hotels that are included in continuing operations as of December 31, 2014 and 2013 is illustrated by the following table:

Brand and Segment (as defined by STR) Diversity

| Number of Hotels | Number of Rooms | |||||||

| Upper upscale hotels: |

||||||||

| Embassy Suites (1) |

1 | 246 | ||||||

| Upscale hotels: |

||||||||

| Residence Inn (2) |

24 | 2,465 | ||||||

| Hyatt Place (3) |

15 | 1,954 | ||||||

| Courtyard (2) |

14 | 1,434 | ||||||

| Homewood Suites (1) |

7 | 900 | ||||||

| SpringHill Suites (2) |

6 | 659 | ||||||

| Hilton Garden Inn (1) |

1 | 122 | ||||||

|

|

|

|

|

|||||

| 67 | 7,534 | |||||||

| Upper midscale hotels: |

||||||||

| Hampton Inn (1) |

34 | 4,114 | ||||||

| Fairfield Inn (2) |

2 | 259 | ||||||

| Holiday Inn (4) |

1 | 158 | ||||||

| Holiday Inn Express (4) |

1 | 66 | ||||||

|

|

|

|

|

|||||

| 38 | 4,597 | |||||||

|

|

|

|

|

|||||

| Total |

106 | 12,377 | ||||||

|

|

|

|

|

|||||

Franchise affiliation

| (1) | Hilton Hotels Corporation |

| (2) | Marriott International, Inc. |

| (3) | Hyatt Corporation |

| (4) | Intercontinental Hotels Group |

-12-

Our hotel portfolio included upper upscale, upscale and upper midscale hotels. This array of product offerings coupled with a property mix that is spread between suburban and urban locations helped to insulate us from various economic climates, including a depressed business travel climate.

We believe the geographic diversity of our hotel portfolio helped to limit our exposure to any one market. The following table illustrates the geographic presence of the Trust Hotels that are included in continuing operations by the number of rooms as of December 31, 2014 and 2013:

Geographical Diversity

| Region (as defined by STR): |

||||

| East North Central |

18.5 | % | ||

| East South Central |

9.0 | % | ||

| Mountain |

5.0 | % | ||

| New England |

5.8 | % | ||

| Pacific |

12.0 | % | ||

| South Atlantic |

32.9 | % | ||

| West South Central |

16.8 | % |

The following table illustrates the geographical presence of the OP Hotels that are included in continuing operations by the number of rooms as of December 31, 2014 and 2013:

Geographical Diversity

| Region (as defined by STR): |

||||

| East North Central |

13.3 | % | ||

| East South Central |

15.9 | % | ||

| Middle Atlantic |

6.7 | % | ||

| Mountain |

7.3 | % | ||

| New England |

3.5 | % | ||

| Pacific |

4.4 | % | ||

| South Atlantic |

31.7 | % | ||

| West North Central |

6.7 | % | ||

| West South Central |

10.5 | % |

We believe that multiple brands at the upscale and upper midscale levels helped to insulate our asset portfolio against the volatility of individual brand results relative to industry RevPAR performance. The following table summarizes key performance indicators, by brand, of the Trust Hotels that are included in continuing operations for the periods below:

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | |||||||||||||||||||||||||||||||

| Brand |

Number of Hotels |

Number of Rooms |

% Occupancy |

Average Daily Rate (ADR) |

RevPAR | % Occupancy |

Average Daily Rate (ADR) |

RevPAR | ||||||||||||||||||||||||

| Hampton Inn |

9 | 1,163 | 74.4 | % | $ | 100.91 | $ | 75.10 | 71.1 | % | $ | 97.81 | $ | 69.54 | ||||||||||||||||||

| Residence Inn |

1 | 78 | 81.7 | % | $ | 94.61 | $ | 77.26 | 78.5 | % | $ | 87.42 | $ | 68.58 | ||||||||||||||||||

| Courtyard |

3 | 414 | 67.4 | % | $ | 120.64 | $ | 81.26 | 65.7 | % | $ | 117.86 | $ | 77.41 | ||||||||||||||||||

| Homewood Suites |

3 | 478 | 78.6 | % | $ | 133.87 | $ | 105.23 | 81.1 | % | $ | 121.53 | $ | 98.62 | ||||||||||||||||||

| SpringHill Suites |

1 | 88 | 74.5 | % | $ | 120.06 | $ | 89.42 | 75.0 | % | $ | 112.58 | $ | 84.42 | ||||||||||||||||||

| Hilton Garden Inn |

2 | 241 | 70.8 | % | $ | 102.58 | $ | 72.60 | 67.6 | % | $ | 98.71 | $ | 66.71 | ||||||||||||||||||

| TownePlace Suites |

1 | 95 | 83.2 | % | $ | 79.16 | $ | 65.87 | 72.0 | % | $ | 76.11 | $ | 54.81 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 20 | 2,557 | 74.3 | % | $ | 110.05 | $ | 81.72 | 72.2 | % | $ | 105.23 | $ | 75.94 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

-13-

The following table summarizes key performance indicators, by brand, of the OP Hotels that are included in continuing operations for the periods below:

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | |||||||||||||||||||||||||||||||

| Brand |

Number of Hotels |

Number of Rooms |

% Occupancy |

Average Daily Rate (ADR) |

RevPAR | % Occupancy |

Average Daily Rate (ADR) |

RevPAR | ||||||||||||||||||||||||

| Hampton Inn |

34 | 4,114 | 71.3 | % | $ | 104.20 | $ | 74.34 | 69.8 | % | $ | 99.42 | $ | 69.41 | ||||||||||||||||||

| Residence Inn |

24 | 2,465 | 77.7 | % | $ | 115.63 | $ | 89.86 | 76.5 | % | $ | 111.60 | $ | 85.43 | ||||||||||||||||||

| Hyatt Place |

15 | 1,954 | 75.2 | % | $ | 101.19 | $ | 76.12 | 72.6 | % | $ | 96.60 | $ | 70.15 | ||||||||||||||||||

| Courtyard |

14 | 1,434 | 72.6 | % | $ | 112.99 | $ | 82.04 | 70.8 | % | $ | 107.85 | $ | 76.35 | ||||||||||||||||||

| Homewood Suites |

7 | 900 | 79.7 | % | $ | 133.80 | $ | 106.59 | 77.8 | % | $ | 128.65 | $ | 100.15 | ||||||||||||||||||

| SpringHill Suites |

6 | 659 | 74.5 | % | $ | 106.65 | $ | 79.49 | 71.7 | % | $ | 100.95 | $ | 72.41 | ||||||||||||||||||

| Hilton Garden Inn |

1 | 122 | 72.0 | % | $ | 102.86 | $ | 74.02 | 70.1 | % | $ | 100.10 | $ | 70.19 | ||||||||||||||||||

| Fairfield Inn & Suites |

2 | 259 | 67.8 | % | $ | 87.44 | $ | 59.30 | 59.1 | % | $ | 86.09 | $ | 50.92 | ||||||||||||||||||

| Embassy Suites |

1 | 246 | 75.4 | % | $ | 118.84 | $ | 89.61 | 79.6 | % | $ | 110.19 | $ | 87.68 | ||||||||||||||||||

| Holiday Inn |

1 | 158 | 53.8 | % | $ | 109.38 | $ | 58.80 | 59.3 | % | $ | 99.26 | $ | 58.84 | ||||||||||||||||||

| Holiday Inn Express |

1 | 66 | 83.4 | % | $ | 123.33 | $ | 102.92 | 80.5 | % | $ | 118.20 | $ | 95.16 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 106 | 12,377 | 74.0 | % | $ | 109.68 | $ | 81.17 | 72.3 | % | $ | 104.99 | $ | 75.90 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

STRATEGY

On February 27, 2015, the 20 Trust Hotels and 96 of the 106 OP Hotels were sold to affiliates of ARCH.

The Remaining Hotels held by Senior Mezz were under contract to be sold for a combined purchase price of $100 million. The contract for the sale of the Remaining Hotels was terminated by the purchasers on May 6, 2015. On June 8, 2015, the Company entered into a reinstatement and amendment to the terminated contract, which among other things, reinstated the contract for nine of the Remaining Hotels, amended the purchase price to $85 million and scheduled closing for July 23, 2015. There can be no assurance as to whether or when the transaction will close, as to the actual proceeds that will be realized if it does close or as to what the assets might ultimately sell for in an alternate transaction if the pending transaction does not close. Even if the transaction does close, there can be no assurance as to when a distribution from such sale proceeds will be received by the Company. While the Company intends to sell the one Remaining Hotel not currently under contract to be sold, there can be no assurance as to whether or when that hotel will be sold, the form of consideration which may be received in respect of that hotel or whether the consideration which may be received in respect of that hotel will be greater or less than the purchase price allocated to that hotel in the terminated sale agreement. Even if a transaction for the one Remaining Hotel not currently under contract to be sold does occur, there can be no assurance as to when a distribution from such sale proceeds will be received by the Company.

We do not have any current plans to acquire any additional hotels, although if a Changeover Event occurs, we and Senior Mezz may take control over the Portfolio. In addition, our ability to generate returns on the Remaining Hotels may be limited to the extent of the proceeds in the proposed sale.

SEGMENT REPORTING

The Company has considered each of its hotels to be an operating segment, none of which meets the threshold for a reportable segment as prescribed by accounting principles generally accepted in the United States (GAAP). The Company allocates resources and assesses operating performance based on each individual hotel. Additionally, the Company aggregates these individually immaterial operating segments into one reporting segment using the criteria established by the authoritative accounting guidance, including the similarities of its product offering, types of customers and method of providing service. Additional segment information may be found in the footnotes to our consolidated financial statements located in “Item 8. Financial Statements and Supplementary Data.”

EMPLOYEES

The Company has no employees. During 2014 and 2013, all persons involved in the day-to-day operation of the Company’s hotels were employed by third party management companies engaged pursuant to hotel management agreements. In addition, all persons supporting the Company through asset management and various other activities were employed by a related party engaged pursuant to an asset management agreement.

-14-

COMPETITION

The hotel industry is highly competitive with various participants competing on the basis of price, level of service and geographic location. Each of our hotels is located in a developed area that includes other hotel properties. Many of our management agreements have not had restrictions on the ability of the companies that manage our hotels to convert, franchise or develop other hotel properties in our markets. As a result, our hotels in a given market may compete with other hotels that our managers may own, invest in, manage or franchise. The number of competitive hotel properties in a particular area could have a material adverse effect on the occupancy, average daily rate (ADR) and RevPAR of our hotels. We believe that brand recognition, location, the quality of the hotel, consistency of services provided, supply of rooms in the market and price are and have been the principal competitive factors affecting our hotels.

FRANCHISE AGREEMENTS

A part of our asset management program is the licensing of our hotels under nationally franchised brands. We believe that the public’s perception of quality associated with a franchisor is an important feature in the operation of a hotel. We also believe that franchised properties generally have higher levels of RevPAR than unfranchised properties due to access to national reservation systems and national advertising and marketing programs provided by franchisors. Our franchise agreements generally have initial terms ranging from five to 21 years and expire between 2015 and 2028.

We typically have had commitments to franchisors to make certain capital improvements to our hotels (prior to April 11, 2014, this included all 126 hotels; after April 11, 2014, this included only the 20 Trust Hotels), which will be funded primarily through our operating cash flows. We made capital improvements of approximately $12 million and $24 million to our hotels in 2014 and 2013, respectively.

INFLATION

Operators of hotels, in general, possess the ability to adjust room rates daily to reflect the effects of inflation. However, competitive pressures may limit the ability of the companies that manage and operate our hotels to raise room rates.

SEASONALITY

Our operations historically have been seasonal in nature, generally reflecting higher RevPAR during the second and third quarters. This seasonality can be expected to cause fluctuations in our quarterly operating results.

ENVIRONMENTAL MATTERS

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous or toxic substances on, under or in such property. These laws may impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. In addition, certain environmental laws and common law principles could be used to impose liability for release of asbestos-containing materials, and third parties may seek recovery from owners or operators of real properties for personal injury associated with exposure to released asbestos-containing materials. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require corrective or other expenditures. In connection with our current or prior ownership or operation of hotels, we may be potentially liable for various environmental costs or liabilities. Although we are currently not aware of any material environmental claims pending or threatened against us, we can offer no assurance that a material environmental claim will not be asserted against us in the future.

In connection with the Merger, Phase I environmental site assessments were obtained for our hotels. These assessments included historical reviews of the hotels, reviews of certain public records, preliminary investigations of the sites and surrounding properties, screenings for hazardous and toxic substances and underground storage tanks, and the preparation and issuance of a written report. These assessments did not include invasive procedures to detect contaminants from former operations of our hotels or those migrating from neighbors or caused by third parties. These assessments have not revealed any environmental liability that we believe would have a material adverse effect on our business, assets, results of operations or liquidity, nor are we aware of any such liability or material environmental issues.

| ITEM 1A. | RISK FACTORS |

The risks described below could materially and adversely affect our business, financial condition, cash flow and ability to make distributions to our shareholders. The following risk factors are not necessarily exhaustive, particularly as to possible future events, and new risk factors may arise from time to time. Many things can happen that can cause our actual financial and operating results to be different than those described or anticipated by us in our Securities and Exchange Commission

-15-

(SEC) filings. As noted above, references to “our hotel properties” and similar references herein for periods from and after February 27, 2015 refer to the Remaining Hotels, which are owned by Senior Mezz in which we own a 3% equity interest. See “Item 1. Business” for additional information.

Risks related to our business

As a result of the sale of the Portfolio, we are at risk of not collecting the preferred return and the initial capital contribution of the Preferred Equity either through the interest held by us or our 3% equity interest in Senior Mezz.

At the closing of the sale of the Portfolio, the Preferred Equity in the Pool I Owner was issued to the Sellers of the Pool I Hotels and the Preferred Equity in the Pool II Owner was issued to the Sellers of the Pool II Hotels. The Preferred Equity is our most significant asset as of March 31, 2015 through both the Preferred Equity owned directly by us and the Preferred Equity owned indirectly through our 3% equity interest in Senior Mezz. In each case, for the 18-month period after the closing, the Preferred Equity will accrue an annual preferred return of 7.50%. Thereafter, the annual preferred return will increase to 8.00%. The preferred return is payable in cash on a current basis each month. The Preferred Equity has a full liquidation preference prior to any other equity in the issuer.

The Preferred Equity is fully redeemable at any time at par plus any accrued and unpaid preferred return. In addition, there are certain mandatory redemption events, including a requirement that 50% of the Preferred Equity be redeemed by the third anniversary of the closing and 100% of the Preferred Equity be redeemed by the fourth anniversary of the closing.

The ability of the Pool I Owner and the Pool II Owner to make the payments described above will depend upon the performance of the Portfolio. Generally, the risks to our business relating to hotels apply to the Portfolio and also to the ability of the Pool I Owner and the Pool II Owner to make payments to the Sellers in respect of the Preferred Equity. There can be no assurance as to whether or when the Sellers will receive payment of its initial capital contribution in respect of the Preferred Equity.

In addition, in the event that a Changeover Event occurs, we and Senior Mezz may assume control of the Portfolio, which would be subject to the risks inherent in owning a portfolio of hotel assets.

Our business depends upon demand for hotel rooms. Any setback in the economic recovery will adversely affect our future financial condition and cash flow.

Our hotel properties experienced declining operating performance across various U.S. markets during the recent economic recession. Our business prospects depend upon continued revenue and net income growth from anticipated improvement in demand for hotel rooms as the economic recovery continues, both in respect of the Preferred Equity and in the Remaining Hotels. We, however, cannot provide any assurances that demand for hotel rooms will increase from current levels, or the time or extent of any such demand growth. If demand does not continue to increase as the economy recovers, or if there is a setback in the economic recovery resulting in weakening demand, our operating results could be adversely affected. As a result, any delay in the continued economic recovery or a new economic downturn will adversely affect our future cash flow.

Our returns depend on management of our hotels by third parties, and ineffective or poor management could result in losses to our shareholders.

Although we and WNT own the Remaining Hotels, third party operators operating under management agreements control the daily operations of these hotels. Under the terms of the management agreements, our and WNT’s ability to participate in operating decisions regarding the Remaining Hotels is limited. We and WNT depend on these third party management companies to adequately operate the hotels as provided in the management agreements. Neither we nor WNT have the authority to require any hotel to be operated in a particular manner or to govern any particular aspect of the daily operations of any hotel (for instance, setting room rates). Thus, even if we or WNT believe the hotels are being operated inefficiently or in a manner that does not result in satisfactory occupancy rates, RevPAR and ADR, we may not be able to cause the management company to change its method of operation of our hotels. We and WNT can only seek redress if a management company violates the terms of the applicable management agreement, and then only to the extent of the remedies provided for under the terms of the management agreement. Additionally, in the event that any of the management companies that manage our hotels need to be replaced, we and WNT may experience significant disruptions at the hotels and in the operations generally.

-16-

The terms of our franchise agreements and the risk of loss of a franchise could adversely affect our business.

The Remaining Hotels operate under franchise agreements, and we are subject to the risks that are found in concentrating our hotel investments in several franchise brands. These risks include reductions in business following negative publicity related to one of our brands.

The maintenance of the franchise licenses for the hotels is subject to the franchisors’ operating standards and other terms and conditions. The franchisors periodically inspect the hotels to ensure that the owners and the companies that manage our hotels follow their standards. Failure by us, WNT or one of the companies which manage our hotels to maintain these standards or other terms and conditions could result in a franchise license being canceled. If a franchise license terminates due to a failure to make required improvements or to otherwise comply with its terms, there may be liability to the franchisor for a termination payment, which varies by franchisor and by hotel. As a condition of the continued holding of a franchise license, a franchisor could also possibly require capital expenditures to be made, even if we or WNT do not believe the capital improvements are necessary or desirable or will result in an acceptable return on our investment. Accordingly, there is a risk of losing a franchise license if franchisor required capital expenditures are not made.

If a franchisor terminates the franchise license, we and WNT may try either to obtain a suitable replacement franchise or to operate the hotel without a franchise license. The loss of a franchise license could materially and adversely affect the operations or the underlying value of the hotel because of the loss of associated name recognition, marketing support and centralized reservation systems provided by the franchisor and could materially and adversely affect our revenues.

We may not be able to sell our hotels on favorable terms or at all

On February 27, 2015, we and the other Sellers sold the Portfolio, resulting in Senior Mezz continuing to own the Remaining Hotels. On March 25, 2015, subsidiaries of Senior Mezz entered into an agreement to sell the Remaining Hotels for $100 million. The contract for the sale of the Remaining Hotels was terminated by the purchasers on May 6, 2015. On June 8, 2015, the Company entered into a reinstatement and amendment to the terminated contract, which among other things, reinstated the contract for nine of the Remaining Hotels, amended the purchase price to $85 million and scheduled closing for July 23, 2015. There can be no assurance as to whether or when the transaction will close, as to the actual proceeds that will be realized if it does close, or as to what the assets might ultimately sell for in an alternate transaction if the pending transaction does not close. Even if the transaction does close, there can be no assurance as to when a distribution from such sale proceeds will be received by the Company. While the Company intends to sell the one Remaining Hotel not currently under contract to be sold, there can be no assurance as to whether or when that hotel will be sold, the form of consideration which may be received in respect of that hotel or whether the consideration which may be received in respect of that hotel will be greater or less than the purchase price allocated to that hotel in the terminated sale agreement. Even if a transaction for the one Remaining Hotel not currently under contract to be sold does occur, there can be no assurance as to when a distribution from such sale proceeds will be received by the Company.

We cannot assure you that the market value of the Remaining Hotels will not decrease in the future. If the sale of the Remaining Hotels does not occur and/or a Changeover Event occurs and we and Senior Mezz assume control over the Portfolio, we may not be able to sell the hotels on favorable terms, and such hotels may be sold at a loss. We face competition for buyers of our hotel properties. Other sellers of hotels may have the financial resources to dispose of their hotels on unfavorable terms that we would be unable to accept.

Risks related to the real estate and lodging industries

Investing in hotel assets involves unique risks.

We have invested in hotels, which are subject to all the risks common to the hotel industry. These risks could adversely affect hotel occupancy and rates that can be charged for hotel rooms, and generally include:

| • | competition from other hotel properties in our markets; |

| • | over-building of hotels in our markets, which results in increased supply and could adversely affect occupancy and revenues at our hotels; |

| • | dependence on business and commercial travelers and tourism; |

| • | increases in operating costs due to inflation, increased energy costs and other factors that may not be offset by increased room rates; |

| • | changes in interest rates and in the availability, cost and terms of debt financing; |

| • | increases in assessed property taxes from changes in valuation or real estate tax rates; |

| • | increases in the cost of property insurance; |

-17-

| • | changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and ordinances; |

| • | unforeseen events beyond our control, such as terrorist attacks, travel related health concerns which could reduce travel, including pandemics and epidemics such as H1N1 influenza (swine flu), avian bird flu and SARS, imposition of taxes or surcharges by regulatory authorities, travel-related accidents, travel infrastructure interruptions and unusual weather patterns, including natural disasters such as hurricanes, tsunamis and earthquakes; |

| • | adverse effects of national, regional, and local economic and market conditions and increases in energy costs or labor costs and other expenses affecting travel, which may affect travel patterns and reduce the number of business and commercial travelers and tourists; |

| • | adverse effects of a downturn in the lodging industry; and |

| • | risks generally associated with the ownership of hotel properties and real estate, as we discuss in more detail below. |

These factors could adversely affect hotel revenues and expenses in properties in which we hold interests, which in turn could adversely affect our financial condition, net income and cash flows.

Failure of the hotel industry to continue to improve or remain stable may adversely affect our financial condition, net income and cash flows.

Our business is focused on the hotel industry, and we cannot assure you that hotel industry fundamentals will continue to improve or remain stable. Economic slowdown and world events outside our control, such as terrorism, have adversely affected the hotel industry in the recent past and if these events reoccur, may adversely affect the industry in the future. In the event conditions in the hotel industry do not continue to improve or remain stable, our financial condition, net income and cash flows will be adversely affected.

Illiquidity of real estate investments could significantly impede our ability to respond to adverse changes in the performance of our properties and harm our financial condition.

While the Company expects to sell the Remaining Hotels, there can be no assurance that a sale of the Remaining Hotels will occur. We cannot predict whether we will be able to sell any property for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a property.

Because real estate investments are relatively illiquid, our ability to promptly sell one or more properties in our portfolio in response to changing economic, financial and investment conditions is limited. The real estate market is affected by many factors that are beyond our control, including:

| • | adverse changes in national and local economic and market conditions; |

| • | changes in interest rates and in the availability, cost and terms of debt financing; |

| • | changes in costs of compliance with governmental laws and regulations, fiscal policies, zoning and other ordinances; |

| • | the ongoing need for capital improvements, particularly in older structures; |

| • | changes in operating expenses; and |

| • | civil unrest, acts of war and natural disasters, including earthquakes and floods, which may result in uninsured and underinsured losses. |

We may be required to expend funds to correct defects or to make improvements before a property can be sold. We cannot assure you that we will have funds available to correct those defects or to make those improvements. These factors and any others that would impede our ability to respond to adverse changes in the performance of our properties could have a material adverse effect on our financial condition, net income and cash flow.

-18-

Significant capital expenditures may be required to maintain our hotels.

Our hotels have an ongoing need for renovations and other capital improvements, including replacements of furniture, fixtures and equipment. Franchisors of the hotels may also require periodic capital improvements as a condition of maintaining franchise licenses. Generally, owners of hotels are responsible for the cost of these capital improvements, which gives rise to the following risks:

| • | cost overruns and delays; |

| • | renovations can be disruptive to operations and can displace revenue at the hotels, including revenue lost while rooms under renovation are out of service; |

| • | the cost of funding renovations and the possibility that financing for these renovations may not be available on attractive terms; and |

| • | the risk that the return on our investment in these capital improvements will not be what we expect. |

If we have insufficient cash flow to fund needed capital expenditures, then borrowing or liquidation of hotels or other assets may be required to fund future capital improvements.

Our hotels could be subject to environmental risks.

Our past and present hotel properties are subject to various federal, state and local environmental laws. Under these laws, courts and government agencies have the authority to require the owner of a contaminated property to clean up the property, even if the owner did not know of or was not responsible for the contamination. These laws also apply to persons who owned a property at the time it became contaminated. In addition to the costs of cleanup, environmental contamination can affect the value of a property and, therefore, an owner’s ability to borrow funds using the property as collateral or to sell the property. Under the environmental laws, courts and government agencies also have the authority to require that a person who sent waste to a waste disposal facility, like a landfill or an incinerator, to pay for the clean-up of that facility if it becomes contaminated and threatens human health or the environment. Various court decisions have established that third parties may recover damages for injury caused by property contamination, such as asbestos.

In addition, when excessive moisture accumulates in buildings or on building materials, mold growth may occur, particularly if the moisture problem remains undiscovered or is not addressed over a period of time. Some molds may produce airborne toxins or irritants. Concern about indoor exposure to mold has been increasing as exposure to mold may cause a variety of adverse health effects and symptoms, including allergic or other reactions. As a result, the presence of significant mold at any of our hotels could require us to undertake a costly remediation program to contain or remove the mold from the affected hotel. In addition, the presence of significant mold could expose us to liability from guests, employees and others if property damage or health concerns arise.

Our hotels may not comply with the Americans with Disabilities Act and other government regulations.

Under the Americans with Disabilities Act of 1990 (the ADA), all public accommodations must meet various federal requirements related to access and use by disabled persons. Compliance with the ADA’s requirements could require costly removal of access barriers, and non-compliance could result in the U.S. government imposing fines or in private litigants winning damages. If we and/or Senior Mezz are required to make substantial modifications to our hotels, whether to comply with the ADA or other changes in governmental rules and regulations, our financial condition, net income and cash flows could be adversely impacted.

The insurance maintained for our hotels may be inadequate.

Senior Mezz maintains comprehensive insurance on each of our hotels, including liability and property coverage, of the type and amount we believe are customarily obtained for or by hotel owners.

There are certain types of losses, generally of a catastrophic nature, such as earthquakes, floods, hurricanes and acts of terrorism, for which our insurance coverage may not be sufficient to cover the full current market value or replacement cost of our damaged or destroyed asset. Inflation, increases in insurance premiums, changes in building codes and ordinances, environmental considerations and other factors could also keep us from using insurance proceeds to fully replace or renovate a hotel after it has been damaged or destroyed. In those circumstances, the insurance proceeds that we receive could be inadequate to restore our economic position on the damaged or destroyed hotel.

-19-

We could be responsible for the costs discussed above if an environmental condition existed or was alleged to exist at one of our properties. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be substantial and could adversely affect our net income and cash flow. Even though we have not encountered a substantial environmental claim to date, we may have material environmental liabilities of which we are unaware. We can make no assurances that future laws or regulations will not impose material environmental liabilities or the current environmental condition of our hotels will not be affected by the condition of the properties in the vicinity of our hotels (such as the presence of leaking underground storage tanks) or by third parties unrelated to us.

The hotel business is seasonal, which affects our cash flow from quarter to quarter.

The hotel industry is seasonal in nature. This seasonality can cause quarterly fluctuations in our financial condition, net income and cash flow. Our quarterly operating results may be adversely affected by factors outside our control, including weather conditions and poor economic factors in certain markets in which our hotels operate. We can provide no assurances that our cash flows will be sufficient to offset any shortfalls that occur as a result of these fluctuations.

Many real estate costs are fixed, even if revenue from our hotels decreases.

Many costs, such as real estate taxes, insurance premiums and maintenance costs, generally are not reduced even when a hotel is not fully occupied, room rates decrease or other circumstances cause a reduction in revenues. In addition, newly renovated hotels may not produce the revenues we anticipate immediately, or at all, and the hotel’s operating cash flow may be insufficient to pay the operating expenses and debt service associated with these hotels. If our hotels are unable to offset real estate costs with sufficient revenues, we may be adversely affected.

The increasing use of Internet travel intermediaries by consumers may materially and adversely affect our profitability.

Although a majority of rooms sold on the Internet are sold through websites maintained by the hotel franchisors and managers, some of our hotel rooms will be booked through Internet travel intermediaries. Typically, these Internet travel intermediaries purchase rooms at a negotiated discount from participating hotels, which could result in lower room rates than the franchisor or manager otherwise could have obtained. As these Internet bookings increase, these intermediaries may be able to obtain higher commissions, reduced room rates or other significant contract concessions from us and any hotel management companies that we engage. Moreover, some of these Internet travel intermediaries are attempting to offer hotel rooms as a commodity, by increasing the importance of price and general indicators of quality, such as “three-star downtown hotel,” at the expense of brand identification or quality of product or service. If consumers develop brand loyalties to Internet reservations systems rather than to the brands under which our hotels are franchised, the value of our hotels could deteriorate and our business could be materially and adversely affected. Although most of the business for our hotels is expected to be derived from traditional channels, if the amount of sales made through Internet intermediaries increases significantly, room revenues may flatten or decrease and our profitability may be materially and adversely affected.

Risks related to our organization and structure

We are subject to the risk of possibly being required to register as an investment company.

On February 27, 2015, we completed the sale of the Portfolio to ARCH and in return acquired the Preferred Equity, which currently represents more than 40% of our total assets (exclusive of cash and certain cash equivalents). Although our board of directors believes that we are not engaged primarily in the business of investing, reinvesting, or trading in securities, and we do not hold ourselves out as being primarily engaged in those activities, we appear to fall within the scope of section 3(a)(1)(C) of the Investment Company Act of 1940, as amended (the Investment Company Act), because the value of our investment securities (as defined in the Investment Company Act) is more than 40% of our total assets (exclusive of cash and certain cash equivalents).

A company that falls within the scope of section 3(a)(1)(C) of the Investment Company Act can avoid being regulated as an investment company if it can rely on certain of the exclusions from being deemed to be an “investment company” under the Investment Company Act. One such exclusion that management believes applies is Rule 3a-2 under the Investment Company Act, which allows a 3(a)(1)(C) investment company (as a “transient investment company”) a grace period of one year from the date of classification (in our case, the date of the sale of the Portfolio), to avoid registration under the Investment Company Act so long as it does not intend to engage primarily in the business of investing, reinvesting, owning, holding or trading in securities.

-20-

Rule 3a-2 under the Investment Company Act provides that a company is deemed not to be an investment company during a period of time not to exceed one year provided that the company has a bona fide intent to be engaged primarily, as soon as is reasonably possible (in any event by the termination of such period of time), in a business other than that of an investment company.

Accordingly, the Board will explore transactions pursuant to which we may cease to be deemed to be an investment company, such as the merger contemplated by the stipulation described in “Item 3. Legal Proceedings”, or the disposition of our investment securities, including through liquidation, or the acquisition of sufficient assets that are not investment securities in order for us not to be deemed an investment company under the Investment Company Act. There can be no assurance that we will be able to complete such actions by the applicable deadline, or at all. If we were required to register as an “investment company” under the Investment Company Act, applicable restrictions could make it impractical for us to continue our business as currently conducted and could have a material adverse effect on us.

Our officers and directors face conflicts of interest related to the positions they hold with affiliated entities.

All of our executive officers and directors are employed by our asset manager. As a result, these individuals may owe duties to other entities, which duties may conflict with our interests. Their loyalties to these other entities could result in actions or inactions that are detrimental to our business. Conflicts with our business and interests are most likely to arise from involvement in activities related to management time and services between us and the other entities and transactions with the asset manager’s affiliates.

Risks related to the preferred stock

There is only a limited trading market for the Series B preferred stock and the Series C preferred stock.