Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Rand Logistics, Inc. | Financial_Report.xls |

| EX-23 - EXHIBIT 23 - Rand Logistics, Inc. | rlog-20150331x10kex23.htm |

| EX-21 - EXHIBIT 21 - Rand Logistics, Inc. | rlog-20150331x10kex21.htm |

| EX-32.1 - EXHIBIT 32.1 - Rand Logistics, Inc. | rlog-20150331x10kex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Rand Logistics, Inc. | rlog-20150331x10kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Rand Logistics, Inc. | rlog-20150331x10kex311.htm |

| EX-32.2 - EXHIBIT 32.2 - Rand Logistics, Inc. | rlog-20150331x10kex322.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

X ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended March 31, 2015

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-33345

RAND LOGISTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware | No. 20-1195343 |

(State or other jurisdiction of | (I.R.S. Employer |

Incorporation or organization) | Identification No.) |

500 Fifth Avenue, 50th Floor | |

New York, NY | 10110 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code:

(212) 863-9427

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, $.0001 par value per share | The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to the filing requirements for at least the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | Accelerated filer X |

Non-accelerated filer | Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of voting stock held by non-affiliates of the registrant as of September 30, 2014 was $82,645,132.20.

18,035,427 shares of Common Stock were outstanding at June 10, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the end of the registrant's fiscal year covered by this Annual Report on Form 10-K, with respect to the Annual Meeting of Stockholders, are incorporated by reference into Part III of this Annual Report on Form 10-K.

RAND LOGISTICS, INC.

TABLE OF CONTENTS

Business | |||

Risk Factors | |||

Unresolved Staff Comments | |||

Properties | |||

Legal Proceedings | |||

Mine Safety Disclosures | |||

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

Selected Financial Data | |||

Management's Discussion and Analysis of Financial Condition and Results of Operations | |||

Quantitative and Qualitative Disclosures About Market Risk | |||

Financial Statements and Supplementary Data | |||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||

Controls and Procedures | |||

Other Information | |||

Directors, Executive Officers and Corporate Governance | |||

Executive Compensation | |||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

Certain Relationships and Related Transactions, and Director Independence | |||

Principal Accountant Fees and Services | |||

Exhibits and Financial Statement Schedules | |||

PART I

In this Annual Report on Form 10-K, unless the context otherwise requires, references to Rand Logistics, Inc. (“Rand”), “we,” “our,” “us” and the “Company” include Rand and its wholly-owned direct and indirect subsidiaries, and references to Lower Lakes' business or the business of Lower Lakes mean the combined businesses of Lower Lakes Towing Ltd. (“Lower Lakes Towing”), Lower Lakes Transportation Company (“Lower Lakes Transportation”), Grand River Navigation Company, Inc. (“Grand River”), Black Creek Shipping Company, Inc. (“Black Creek”), Black Creek Shipping Holding Company, Inc. (“Black Creek Holdings”), Lower Lakes Ship Repair Company Ltd. ("Lower Lakes Ship Repair") and Lower Lakes Towing (17) Ltd. ("Lower Lakes (17)").

Cautionary Note Regarding Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements, including those relating to our capital needs, business strategy, expectations and intentions. Forward-looking statements involve matters that are not historical facts. Because these statements involve anticipated events or conditions, forward-looking statements often include words such as “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “target,” “will,” “would,” or similar expressions. Forward-looking statements include, but are not limited to, statements regarding:

•our future operating or financial results;

•descriptions of anticipated plans, goals or objectives of our management for operations and services;

• | anticipated financial position and liquidity, growth opportunities and growth rates, acquisition and divestiture opportunities, business prospects, regulatory and competitive outlook, investment and expenditure plans, investment results, strategic alternatives, business strategies, and other similar statements of expectations or objectives; |

•our capital resources and the adequacy thereof, including our ability to obtain financing in the future;

• | our expectations of vessels’ useful lives and the estimated obligations, and the timing thereof, relating to vessel repair or maintenance work; |

•our expected capital spending or operating expenses, including drydocking and insurance costs;

•our ability to remain in compliance with applicable regulations and our debt covenants;

•changes in laws, regulations or tax rates, or the outcome of pending legislative or regulatory initiatives; and

•assumptions regarding any of the foregoing.

Do not unduly rely on forward-looking statements. They represent our expectations about the future and are not guarantees. Forward-looking statements are only as of the date of the filing of this report, and, except as required by law, might not be updated to reflect changes as they occur after the forward-looking statements are made. We urge you to review our periodic filings with the Securities and Exchange Commission (the “SEC”) for any updates to our forward-looking statements.

We undertake no obligation, other than as may be required by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. We do not assume responsibility for the accuracy and completeness of forward-looking statements. Although we believe that the expectations reflected in these forward-looking statements are reasonable, any or all of the forward-looking statements contained in this report and in any other of our public statements may prove to be incorrect. This may occur as a result of inaccurate assumptions as a consequence of known or unknown risks and uncertainties. We caution that our list of risk factors may not be exhaustive (refer to Item 1A. Risk Factors in this report). We operate in a continually changing business environment, and new risk factors emerge from time to time. We cannot predict these new risk factors, nor can we assess the impact, if any, of the new risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those expressed or implied by any forward-looking statement. In light of these risks, uncertainties, and assumptions, the events anticipated by our forward-looking statements discussed in this report might not occur.

4

ITEM 1. BUSINESS

Background

Rand was incorporated in the State of Delaware in 2004 as a blank check company. In 2006, we acquired all of the outstanding shares of capital stock of Lower Lakes Towing and its affiliate, Grand River. Subsequent to our acquisition of Lower Lakes Towing and Grand River, we have added ten vessels to our fleet through acquisition transactions and we retired three smaller vessels.

On December 27, 2012, Lower Lakes Ship Repair, a wholly-owned subsidiary of Lower Lakes Towing, was incorporated under the laws of Canada. Lower Lakes Ship Repair provides ship repair services exclusively to the Company. On March 11, 2014, Lower Lakes (17), a wholly-owned subsidiary of Lower Lakes Towing whose primary asset is the new forebody vessel under construction at a shipyard, was incorporated under the laws of Canada.

Vessel Acquisitions

On July 21, 2011, Lower Lakes Towing acquired a Canadian-flagged bulk carrier for CDN $2.7 million.

On October 14, 2011, Lower Lakes Towing purchased a bulk carrier from United Ocean Service, LLC (“USUOS”) for a purchase price of approximately $5.3 million.

On December 1, 2011, Grand River purchased a tug from USUOS for a purchase price of approximately $7.8 million. Also on December 1, 2011, Grand River acted as USUOS's third-party designee to purchase a self-unloading barge from U.S. Bank National Association, as Trustee of the GTC Connecticut Statutory Trust, for a purchase price of approximately $12.0 million. Subsequent to these acquisitions, the Company undertook modifications to the tug/barge vessel to meet Great Lakes standards. This tug/barge vessel was put into service on October 23, 2012.

On March 11, 2014, Lower Lakes (17) acquired the LALANDIA SWAN from Uni-Tankers M/T "Lalandia Swan" for a purchase price of $7.0 million. The Lalandia Swan was a Danish flagged chemical tanker that is being converted with a new forebody into a Canadian flagged river class self-unloader vessel. We currently plan to introduce this vessel into service during the second half of the 2015 sailing season.

Business Overview

Introduction

Our shipping business is operated in Canada by Lower Lakes Towing and in the United States by Lower Lakes Transportation. Lower Lakes Towing was organized in March 1994 under the laws of Canada to provide marine transportation services to dry bulk goods suppliers and purchasers operating in ports on the Great Lakes and has grown from its origin as a small tug and barge operator to a full service shipping company with a fleet of fifteen cargo-carrying vessels. We have grown to become one of the largest bulk shipping companies operating on the Great Lakes and the leading service provider in the River Class market segment, as defined below. We transport construction aggregates, coal, iron ore, salt, grain and other dry bulk commodities for customers in the construction, electric utility, integrated steel and food industries.

We believe that Lower Lakes is the only company providing significant domestic port-to-port services to both Canada and the United States in the Great Lakes region. Lower Lakes maintains this operating flexibility by operating both U.S. and Canadian flagged vessels in compliance with the Shipping Act, 1916, and the Merchant Marine Act, 1920, commonly referred to as the Jones Act in the U.S. and the Coasting Trade Act in Canada.

5

Fleet

Lower Lakes' fleet consists of five self-unloading bulk carriers and four conventional bulk carriers in Canada and six self-unloading bulk carriers in the U.S., including three articulated tug and barge units. Lower Lakes Towing owns the nine Canadian vessels. Lower Lakes Transportation time charters the six U.S. vessels, including the three tug and barge units, from Grand River. With the exception of two of the articulated tug and barge units (which Grand River bareboat charters from Black Creek), Grand River owns the vessels that it time charters to Lower Lakes Transportation.

Lower Lakes operates over one-half of all River Class vessels and boom-forward equipped vessels servicing the Great Lakes. River Class vessels represent the smaller end of Great Lakes vessels, with maximum dimensions of approximately 650 feet in length and 72 feet in beam and carrying capacities of 15,000 to 20,000 tons, and are ideal for customers seeking to move significant quantities of dry bulk product to or from ports that restrict non-River Class vessels due to size and capacity constraints. Boom forward self-unloading vessels - those with their booms located in front of the cargo holds - offer greater accessibility for delivery of cargo to locations where only forward access is possible. Five of the vessels used in Lower Lakes' operations are boom forward self-unloaders and six vessels are boom aft self-unloaders.

As of March 31, 2015, our fleet consisted of the following vessels:

Self-Unloading Bulk Carriers | ||||

Vessel Name | Dimensions | Horsepower | Year Built/Rebuilt | Cargo capacity at mid-summer draft in gross tons |

Canadian-flagged: | ||||

Cuyahoga | 620x60x35 | 3,084 | 1943/1974/2000 | 15,675 |

Michipicoten | 698x70x37 | 8,160 | 1952/1980/2011 | 22,300 |

Mississagi | 620x60x35 | 4,500 | 1943/1967/1985 | 15,800 |

Robert S. Pierson | 630x68x37 | 5,598 | 1974 | 19,650 |

Saginaw | 640x72x36 | 8,160 | 1953/2008 | 20,200 |

U.S.-flagged: | ||||

Calumet | 630x68x37 | 5,598 | 1973 | 19,650 |

Manitowoc | 630x68x37 | 5,598 | 1973 | 19,650 |

Manistee | 620x60x35 | 2,950 | 1943/1964/1976 | 14,900 |

Straight Deck Bulk carriers (all Canadian-flagged) | ||||

Vessel Name | Dimensions | Horsepower | Year Built/Rebuilt | Cargo capacity at mid-summer draft in gross tons |

Kaministiqua | 730x75x48 | 11,679 | 1983 | 33,824 |

Manitoba | 608x62x36 | 5,328 | 1967 | 19,093 |

Ojibway | 642x67x35 | 4,100 | 1952/2005 | 20,668 |

Tecumseh | 640x78x45 | 12,000 | 1972 | 29,984 |

Self-Unloading Articulated Tug and Barge Units (all U.S.-flagged) | ||||

Vessel Name | Dimensions | Horsepower | Year Built/Rebuilt | Cargo capacity at mid-summer draft in gross tons |

Barge Ashtabula | 700x78x51 | 1982 | 28,959 | |

Tug Defiance | 7,200 | 1982 | ||

Barge James L. Kuber | 815x70x36 | 1953/1983/2007 | 25,500 | |

Tug Victory | 7,994 | 1981 | ||

Barge Lewis J Kuber | 728x70x37 | 1952/1980/2006 | 22,300 | |

Tug Olive L. Moore | 6,600 | 1928 | ||

Customers

Lower Lakes services approximately 50 customers in a diverse array of end markets by shipping dry bulk commodities such as grain, coal, iron ore, construction aggregates and salt. Lower Lakes' top ten customers accounted for approximately 64%, 64% and 60% of its revenue during the fiscal years ended March 31, 2015, 2014 and 2013, respectively. The timing of the end of the Company's fiscal year in relation to the sailing season allows most of a sailing season's receivables to be collected prior to the end of the Company's fiscal year. Lower Lakes is the sole-source shipping provider to several of its customers. With few exceptions, Lower Lakes' customers are under long-term contracts with Lower Lakes, which contracts typically average three to five years in duration and provide for minimum and maximum annual tonnage requirements, annual price escalation features and fuel surcharge adjustments. Certain of our customer contracts also provide for water level adjustments, demurrage and discharge provisions. Lower Lakes has one customer that represents more than 10% of our revenues.

Industry and Competition

Lower Lakes faces competition from other marine and land-based transporters of dry bulk commodities in and around the Great Lakes area. In the River Class market segment, Lower Lakes generally faces two primary competitors: Algoma Central Corporation and American Steamship Company. Algoma Central Corporation is a Canadian company that owns 17 self-unloading vessels, two of which are River Class boom-forward vessels, and operates eight gearless bulk carriers. American Steamship Company operates in the U.S. and maintains a fleet of 17 vessels, three of which are River Class vessels. We believe that industry participants compete on the basis of customer relationships, price and service, and that the ability to meet a customer's schedule and offer shipping flexibility is a key competitive factor. Moreover, we believe that customers are generally willing to continue to use the same carrier assuming such carrier provides satisfactory service with competitive pricing.

Employees

As of March 31, 2015, Lower Lakes had approximately 515 full-time employees, 81 of whom were shoreside and management and 434 of whom were shipboard employees. Approximately 40% of Lower Lakes' shipboard employees (all U.S. based Grand River crews) are unionized with the International Organization of Masters, Mates and Pilots, AFL-CIO. Lower Lakes has never experienced a work stoppage on its crewed vessels as a result of labor issues, and we believe that our employee relations are good.

Our executive officers are Edward Levy, who serves as our President and Chief Executive Officer; Mark S. Hiltwein, who serves as our Chief Financial Officer and Laurence S. Levy, who serves as our Executive Vice Chairman. Carol Zelinski is the Secretary of Rand. Mr. Hiltwein was appointed to succeed Joseph W. McHugh, Jr., who previously announced his intention to retire as Chief Financial Officer subsequent to the hiring of his successor.

Seasonality

Lower Lakes operates in a seasonal waterway system, primarily due to the cold weather patterns on the Great Lakes from December through March which cause lock closures, waterway ice, and customer facility closings, which typically shut down Great Lakes shipping for a period of up to approximately 90 days commencing from late December until late March or early April, depending on weather conditions. Lower Lakes also experiences a seasonal pattern for its capital spending cycle, typically off-season from the shipping revenues, to permit annual maintenance and investment in its vessels. This pattern causes seasonal fluctuations in Lower Lakes' liquidity and capital resources. Such winter work, capital expenditures and drydocking costs are incurred during a period when customer collections have largely ended in February from the prior season, and fit-out and vessel operating costs will be incurred at the beginning of the season as much as 30 to 60 days prior to the receipt of significant customer collections for services provided at the beginning of the shipping season.

Government Regulations

General. The Company’s marine transportation operations are subject to United States Coast Guard (USCG) and Environmental Protection Agency (EPA) legislative oversight, and to other federal, state and Canadian legislation and certain international conventions.

The Canadian Coasting Act limits the carriage of goods between Canadian ports to vessels of Canadian registry. The U.S. Merchant Marine Act, 1920, the so-called “Jones Act”, limits the carriage of goods between U.S. ports to vessels of U.S. registry that have additional Jones Act “coastwise endorsements”. These coastwise endorsements require USCG determinations that the vessel has been “built in the U.S.” and is “owned by U.S. citizens”.

Sections 2(a) and 2(c) of the Shipping Act, 1916 (now codified as 46 U.S.C. 50501 (a), (b) and (d)), and the Coast Guard regulations at 46 CFR Ch. I, “Subpart C - Citizenship Requirements for Vessel Documentation”, govern the USCG “owned by U.S. citizens” determinations (“Citizenship Standards”). The Company’s Certificate of Incorporation and By-Laws are consistent with these Citizenship Standards, and the Company implements the policies that the Coast Guard recommends for compliance with these Citizenship Standards by “publicly traded corporations”.

Compliance with United States and Canadian domestic trade requirements are important to the operations of the Company. The loss of Jones Act status could have a material negative effect on the Company. The Company monitors the citizenship of its employees and stockholders.

Environmental

The Company's operations are subject to various environmental protection legislation enacted by the United States and Canadian governments, Great Lakes and St Lawrence River states and provinces and companion regulations.

Water Pollution Regulations. The Federal Water Pollution Control Act of 1972, as amended by the Clean Water Act of 1977, the Comprehensive Environment Response, Compensation and Liability Act of 1981 ("CERCLA") and the Oil Pollution Act of 1990 ("OPA") impose strict prohibitions against the discharge of oil and its derivatives and of other discharges that are incidental to the normal operation of our vessels. These acts impose civil and criminal penalties for any prohibited discharges and impose substantial strict liability for cleanup of these discharges and any associated damages. Certain states also have water pollution laws that prohibit discharges into waters that traverse the state or adjoin the state, and impose civil and criminal penalties and liabilities similar in nature to those imposed under federal laws. The EPA discharge rules are enforced under Vessel General Permit (VGP) regulations.

Ballast Water Discharges. U.S. Coast Guard involvement with ballast water discharges on the Great Lakes dates to the 1980s arrival of the non-indigenous zebra mussel. The U.S. Coast Guard's “Standards for Living Organisms in Ships Ballast Water Discharged in U.S. Waters” became effective on June 21, 2012. However, vessels destined for the Great Lakes were required to continue with established ballast water exchange (BWE) procedures. Further, studies of the circumstances of the Great Lakes' low salinity, cold water and substantial communities, when combined with short voyage times, substantial ballast flow rates and uncoated ballast tanks have confirmed that these conditions present a set of challenges for ballast water treatment on the Great Lakes and St. Lawrence river. It does not appear that any of the ballast water management (BWM) discharge systems now adopted in the Coast Guard regulations will provide effective treatment for the Great Lakes. The Coast Guard and Transport Canada now require that 100 percent of vessels entering the Great Lakes comply with established BWE procedures. These BWE procedures are expected to continue in effect. And, at this time it is not clear when an agreement will be reached on the effectiveness of a BWM system or systems for operations that are strictly limited to the Great Lakes and St. Lawrence River ecosystems.

Clean Air Regulations. The Company's Great Lakes and St. Lawrence River services are subject to North American Emissions Control Area ("ECA") rules. These rules have limited the sulfur content of marine fuels to 1.0% since August 1, 2012. Such limit decreased to 0.1% of marine fuels effective January 1, 2015, subject to availability.

Under a reciprocal agreement between the U.S. and Canada, a "Fleet Averaging" framework for Canadian flag vessels, including those of the Company, was put in place to coincide with the imposition of the U.S. ECA. Fleet Averaging allows Canadian flag ship owners to achieve a reduction in emissions across their fleets in a phased-in manner through the period ending 2020. The Company anticipates achieving its required marine emissions through a variety of improvement programs such as the use of exhaust gas scrubbers, switching to low sulfur content fuels (including, potentially, liquefied natural gas) and through other means.

Financial Information About Geographic Areas

Our shipping business is operated in Canada by Lower Lakes Towing and in the United States by Lower Lakes Transportation. Lower Lakes provides domestic port-to-port services to both Canada and the United States in the Great Lakes region and operates both U.S. and Canadian flagged vessels.

Information about our geographic operations is as follows:

Year ended March 31, 2015 | Year ended March 31, 2014 | Year ended March 31, 2013 | ||||||||||

Revenue by country: | ||||||||||||

Canada | $ | 87,261 | $ | 91,109 | $ | 92,813 | ||||||

United States | 65,699 | 64,695 | 63,825 | |||||||||

$ | 152,960 | $ | 155,804 | $ | 156,638 | |||||||

Revenues from external customers are allocated based on the country of the legal entity of the Company in which the revenues were recognized.

March 31, 2015 | March 31, 2014 | ||||||

Property and equipment by country: | |||||||

Canada | $ | 92,436 | $ | 99,050 | |||

United States | 113,840 | 116,437 | |||||

$ | 206,276 | $ | 215,487 | ||||

Intangible assets by country: | |||||||

Canada | $ | 7,457 | $ | 9,666 | |||

United States | 5,748 | 6,567 | |||||

$ | 13,205 | $ | 16,233 | ||||

Goodwill by country: | |||||||

Canada | $ | 8,284 | $ | 8,284 | |||

United States | 1,909 | 1,909 | |||||

$ | 10,193 | $ | 10,193 | ||||

Availability of Information

Our Internet website is http://www.randlogisticsinc.com. Through our website, we make available, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as well as proxy statements, and, from time to time, other documents as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or SEC. These SEC reports can be accessed through the investor relations section of our website. The information found on our website is not part of this or any other report we file with or furnish to the SEC.

You may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding Rand and other issuers that file electronically with the SEC. The SEC's Internet website is http://www.sec.gov.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following material risks and uncertainties before you decide to buy our common stock. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations. If any of the following risks and uncertainties actually occur, our business, results of operations and financial condition would likely suffer. In these circumstances, the market price of our common stock could decline and you may lose all or part of your investment.

RISKS ASSOCIATED WITH OUR BUSINESS

The current state of the global financial markets and current economic conditions may adversely impact our ability to obtain additional financing on acceptable terms and otherwise negatively impact our business.

Global financial markets and economic conditions have been, and continue to be, volatile. In recent years, operating businesses in the global economy have faced tightening credit, weakening demand for goods and services, deteriorating international liquidity conditions, and declining markets. There has been a general decline in the willingness of banks and other financial institutions to extend credit, particularly in the shipping industry. As a result, additional financing may not be available if needed and to the extent required, on acceptable terms or at all. If additional financing is not available when needed, or is available only on unfavorable terms, we may be unable to expand or meet our obligations as they come due or we may be unable to enhance our existing business, complete additional vessel acquisitions or otherwise take advantage of business opportunities as they arise. As the shipping industry is highly dependent on the availability of credit to finance and expand operations, it has been negatively affected by this decline.

These conditions could have an adverse effect on our industry and our business and future operating results. Our customers may curtail their capital and operating expenditure programs, which could result in a decrease in demand for our vessels and a reduction in rates and/or utilization. In addition, certain of our customers could experience an inability to pay suppliers, including us, in the event they are unable to access the capital markets to fund their business operations. Likewise, our suppliers may be unable to sustain their current level of operations, fulfill their commitments and/or fund future operations and obligations, each of which could adversely affect our operations.

Capital expenditures and other costs necessary to operate and maintain Lower Lakes' vessels tend to increase with the age of the vessel and may also increase due to changes in governmental regulations, safety or other equipment standards.

As of March 31, 2015, the average age of the vessels operated by Lower Lakes was approximately 54 years. The expense of maintaining, repairing and upgrading Lower Lakes' vessels typically increases with age, and after a period of time the cost necessary to satisfy required marine certification standards may not be economically justifiable. For example, if the U.S. Coast Guard, Transport Canada, the American Bureau of Shipping or Lloyd's Register of Shipping (independent classification societies that inspect the hull and machinery of commercial ships to assess compliance with minimum criteria as set by U.S., Canadian and international regulations) enact new standards, Lower Lakes may be required to incur significant costs for alterations to its fleet or the addition of new equipment. In order to satisfy any such requirement, Lower Lakes may be required to take its vessels out of service for extended periods of time, with corresponding losses of revenues. There can be no assurance that Lower Lakes will be able to maintain its fleet by extending the economic life of existing vessels, or that our financial resources will be sufficient to enable us to make expenditures necessary for these purposes.

Unless we set aside reserves or are able to borrow funds for vessel replacement, we will be unable to replace the vessels in our fleet at the end of their useful lives.

Unless we maintain reserves or are able to borrow or raise funds for vessel replacement, we will be unable to replace the vessels in our fleet upon the expiration of their remaining useful lives. In addition, the supply of replacement vessels is very limited and the costs associated with acquiring a newly constructed vessel are prohibitively high. In the event that Lower Lakes were to lose the use of any of its vessels, our financial performance would be adversely affected.

11

Our practice of purchasing and operating previously owned vessels may result in increased operating costs, which could adversely affect our earnings.

We have grown our business through the acquisition of previously owned vessels. While we typically inspect previously owned vessels before purchase, this does not provide us with the same knowledge about their condition that we would have had if these vessels had been built for and operated exclusively by us. Accordingly, we may not discover defects or other problems with such vessels before purchase. Any such hidden defects or problems, when detected, may be expensive to repair, and if not detected, may result in accidents or other incidents for which we may become liable to third parties. Also, when purchasing previously owned vessels, we generally do not receive the benefit of any builder warranties.

The climate in the Great Lakes region limits Lower Lakes' vessel operations to approximately nine months per year.

Lower Lakes' operating business is seasonal, meaning that it experiences higher levels of activity in some periods of the year than in others. Ordinarily, Lower Lakes is able to operate its vessels on the Great Lakes for approximately nine months per year beginning in late March or April and continuing through December or mid-January. However, weather conditions and customer demand cause increases or decreases in the number of days Lower Lakes actually operates.

We depend upon a few significant customers for a large part of our revenues and cash flow, and the loss of one or more of these customers could adversely affect our financial performance.

We expect to derive a significant part of our revenue and cash flow from a relatively small number of repeat customers. For the year ended March 31, 2015, our top two customers accounted for 25.7% of our revenues and Lower Lakes' top ten customers accounted for approximately 68%, 64% and 60% of its revenue during the fiscal years ended March 31, 2015, 2014, and 2013, respectively. If we lose a significant customer, we could suffer a loss of revenues that could have a material adverse effect on our business, results of operations and financial condition.

The shipping industry has inherent operational risks that may not be adequately covered by Lower Lakes' insurance.

Lower Lakes maintains insurance on its fleet for risks commonly insured against by vessel owners and operators, including hull and machinery insurance, war risks insurance and protection and indemnity insurance (which includes environmental damage and pollution insurance). Lower Lakes does not, however, insure the loss of a vessel's income when it is being repaired due to an insured hull and machinery claim. We can give no assurance that Lower Lakes will be adequately insured against all risks or that its insurers will pay a particular claim. Even if its insurance coverage is adequate to cover its losses, Lower Lakes may not be able to timely obtain a replacement vessel in the event of a loss. Furthermore, in the future, Lower Lakes may not be able to obtain adequate insurance coverage at reasonable rates for Lower Lakes' fleet. Lower Lakes may also be subject to calls, or premiums, in amounts based not only on its own claims record but also the claims record of all other members of the protection and indemnity associations through which Lower Lakes may receive indemnity insurance coverage. Lower Lakes' insurance policies will also contain deductibles, limitations and exclusions which, although we believe are standard in the shipping industry, may nevertheless increase its costs.

Lower Lakes is subject to certain risks with respect to its counterparties on contracts and failure of such counterparties to meet their obligations could cause us to suffer losses on such contracts, decreasing our revenues and earnings.

Lower Lakes enters into contracts of affreightment (COAs) pursuant to which Lower Lakes agrees to carry cargoes, typically for industrial customers, who transport dry bulk cargoes. Lower Lakes also enters into spot market voyage contracts, where Lower Lakes is paid a rate per ton to carry a specified cargo from one location to another. All of these contracts, as well as the various other contracts that are material to the operation of our business, subject Lower Lakes to counterparty risk. As a result, we are subject to counterparty risks at various levels, including with charterers, cargo interests, or terminal customers. If the counterparties fail to meet their obligations, Lower Lakes could suffer losses on such contracts which would decrease our revenues and earnings.

12

Lower Lakes may not be able to generate sufficient cash flows to meet its debt service obligations.

Lower Lakes' ability to make payments on its indebtedness will depend on its ability to generate cash from its future operations. Lower Lakes' business may not generate sufficient cash flow from operations or from other sources sufficient to enable it to repay its indebtedness and to fund its liquidity needs, including capital expenditures and winter work expenses. Lower Lakes may need to refinance or restructure all or a portion of its indebtedness on or before maturity. Lower Lakes may not be able to refinance any of its indebtedness on commercially reasonable terms, or at all. If Lower Lakes cannot service or refinance its indebtedness, it may have to take actions such as selling assets, seeking additional equity or reducing or delaying capital expenditures, any of which could have a material adverse effect on our operations. Additionally, Lower Lakes may not be able to effect such actions, if necessary, on commercially reasonable terms, or at all.

A significant portion of our indebtedness is subject to floating interest rates, which may expose us to higher interest payments.

All of our indebtedness is subject to floating interest rates, which makes us more vulnerable in the event of adverse economic conditions, increases in prevailing interest rates, or a downturn in our business. As of March 31, 2015, approximately $173.7 million aggregate principal, or all of our indebtedness, which represents the outstanding principal under our credit facilities, was subject to floating interest rates. We currently have interest rate cap contracts which cover approximately 62% of first lien loan as of March 31, 2015. These contracts will terminate on December 1, 2015.

A default under Lower Lakes' indebtedness may have a material adverse effect on our financial condition.

In the event of a default under Lower Lakes’ indebtedness, the holders of the indebtedness under Lower Lakes’ credit facilities generally would be able to declare all of the indebtedness under such facilities, together with accrued interest, to be due and payable. In addition, borrowings under Lower Lakes’ senior credit facility are secured by a first priority lien on substantially all of the assets of Lower Lakes Towing, Lower Lakes Transportation, Grand River, Black Creek and the other guarantors and, in the event of a default under that facility, the lenders thereunder generally would be entitled to seize the collateral, including assets which are necessary to operate our business. Borrowings under Lower Lakes’ second-lien credit facility are secured by a second priority lien on all of the assets of Lower Lakes Towing, Lower Lakes Transportation, Grand River, Black Creek and the other guarantors. Subject to the terms of the intercreditor agreement between the lenders under our senior credit facility and the lenders under our second-lien credit facility, in the event of a default under our second-lien credit facility, the lenders thereunder generally would be entitled to seize the collateral, including assets which are necessary to operate our business. In addition, default under one debt instrument within Lower Lakes’ credit facilities could in turn permit lenders under other debt instruments to declare borrowings outstanding under those other instruments to be due and payable pursuant to cross default and cross acceleration clauses. Moreover, upon the occurrence of an event of default under Lower Lakes' credit facilities, the commitment of the lenders to make any further loans to us could be terminated. Accordingly, the occurrence of a default under any debt instrument, unless cured or waived, may have a material adverse effect on our results of operations.

Servicing debt could limit funds available for other purposes, such as the payment of dividends.

Lower Lakes will use cash to pay the principal and interest on its debt, and to fund capital expenditures, drydock costs and winter work expenses. Such payments limit funds that would otherwise be available for other purposes, including distributions of cash to our stockholders.

13

Lower Lakes' credit facilities contain restrictive covenants that will limit its liquidity and corporate activities.

The terms of our credit facilities require us to meet certain financial covenants that are customary with these types of credit facilities and also contain affirmative covenants and events of default, including payment defaults, covenant defaults and cross defaults. If an event of default occurs, the agent would be entitled to take various actions, including the acceleration of amounts due under the outstanding credit facilities.

The credit facilities also contain certain negative covenants, including those that restrict our ability, and that of our subsidiaries and the other guarantors, to engage in certain transactions and may impair our ability to respond to changing business and economic conditions, including, among other things, limitations on our ability to:

o | incur additional indebtedness; |

o | create additional liens on its assets; |

o | sell or acquire assets or businesses; |

o | change the nature of their businesses; |

o | make investments; |

o | engage in mergers or acquisitions or transactions with related parties; or |

o | pay dividends. |

Therefore, Lower Lakes will need to seek permission from its lenders in order to engage in some corporate actions. Lower Lakes' lenders' interests may be different from those of Lower Lakes and no assurance can be given that Lower Lakes will be able to obtain its lenders' permission when needed. This may prevent Lower Lakes from taking actions that are in its best interest.

Because Lower Lakes generates approximately 60% of its revenues and expenses in Canadian dollars, exchange rate fluctuations could cause us to suffer reduced U.S. dollar earnings.

Lower Lakes generates a significant portion of its revenues and incurs a significant portion of its expenses in Canadian dollars. This could lead to fluctuations in our net income due to changes in the value of the U.S. Dollar relative to the Canadian Dollar.

Lower Lakes depends upon unionized labor for its U.S. operations. Any work stoppages or labor disturbances could disrupt its business.

All of Grand River's shipboard employees are unionized with the International Organization of Masters, Mates and Pilots, AFL-CIO. Any work stoppages or other labor disturbances could have a material adverse effect on our business, results of operations and financial condition.

A labor union has attempted to unionize Lower Lakes' Canadian employees.

The Seafarers International Union of Canada, or SIU, attempted without success to organize Lower Lakes' unlicensed Canadian employees several years ago. The SIU regularly disseminates union information to determine the level of interest among our employees. Although we believe that support for this union is low, if SIU is ever successful in organizing a union among Lower Lakes' Canadian employees, it could result in an increased cost structure and/or reduced productivity for Lower Lakes, which could have a material adverse effect on our results of operations.

Lower Lakes' employees are covered by U.S. Federal laws that may subject it to job-related claims in addition to those provided by state laws.

All of Grand River's shipboard employees are covered by the Jones Act and general maritime law. These laws typically operate to make liability limits established by state workers' compensation laws inapplicable to these employees and to permit these employees and their representatives to pursue actions against employers for job-related injuries in Federal courts. Because Lower Lakes is not generally protected by the limits imposed by state workers' compensation statutes, Lower Lakes has greater exposure for claims made by these employees as compared to employers whose employees are not covered by these provisions.

14

Our capital stock is subject to restriction on foreign ownership and possible required divestiture by non-U.S. citizen stockholders.

Under U.S. maritime laws, in order for us to maintain our eligibility to own and operate vessels in the U.S. domestic trade, 75% of our outstanding capital stock and voting power is required to be held by U.S. citizens. Although our amended and restated certificate of incorporation contains provisions limiting non-citizenship ownership of our capital stock, we could lose our ability to conduct operations in the U.S. domestic trade if such provisions prove unsuccessful in maintaining the required level of citizen ownership. Such loss would have a material adverse effect on our results of operations. If our board of directors determines that persons who are not citizens of the U.S. own more than 23% of our outstanding capital stock or more than 23% of our voting power, we may redeem such stock or, if redemption is not permitted by applicable law or if our board of directors, in its discretion, elects not to make such redemption, we may require the non-citizens who most recently acquired shares to divest such excess shares to persons who are U.S. citizens in such manner as our board of directors directs. The required redemption would be at a price equal to the average closing price during the preceding 30 trading days, which price could be materially different from the current price of the common stock or the price at which the non-citizen acquired the common stock. If a non-citizen purchases the common stock, there can be no assurance that he or she will not be required to divest the shares and such divestiture could result in a material loss. Such restrictions and redemption rights may make Rand's equity securities less attractive to potential investors, which may result in Rand's publicly traded common stock having a lower market price than it might have in the absence of such restrictions and redemption rights.

Our business is dependent upon key personnel whose loss may adversely impact our business.

We depend on the expertise, experience and continued services of Lower Lakes' senior management employees, especially Scott Bravener, its President. Mr. Bravener has acquired specialized knowledge and skills with respect to Lower Lakes and its operations and most decisions concerning the business of Lower Lakes are made or significantly influenced by him. The loss of Mr. Bravener or other senior management employees, or an inability to attract or retain other key individuals, could materially adversely affect our business. We seek to compensate and incentivize executives, as well as other employees, through competitive salaries and bonus plans, but there can be no assurance that these programs will allow us to retain key employees or hire new key employees. As a result, if Mr. Bravener or other senior management employees were to leave Lower Lakes, we could face substantial difficulty in hiring a qualified successor or successors and could experience a loss in productivity while any such successor obtains the necessary training and experience.

We may be unable to attract and retain qualified, skilled employees or crew necessary to operate our business.

Our continued success depends in significant part on the continued services of the officers and seamen who operate our vessels. In crewing our vessels, we require technically skilled employees with specialized training who can perform physically demanding work. Competition to attract and retain qualified crew members is intense. If we are not able to increase our rates to compensate for any crew cost increases, it could have a material adverse effect on our business, results of operations and financial condition. Any inability we experience in the future to hire, train and retain a sufficient number of qualified employees could impair our ability to manage, maintain and grow our business, which could have a material adverse effect on our business, results of operations and financial condition.

We may be subject to litigation, arbitration and other proceedings that could have an adverse effect on our business.

We may be, from time to time, involved in various litigation matters arising in the ordinary course of business, or otherwise. These matters may include, among other things, contract disputes, personal injury claims, environmental matters, governmental claims for taxes or duties, securities, or maritime matters. The potential costs to resolve any claim or other litigation matter, or a combination of these, may have a material adverse effect on us because of potential negative outcomes, the costs associated with asserting our claims or defending such lawsuits, and the diversion of management's attention to these matters.

15

The conversion of our series A convertible preferred stock will result in significant and immediate dilution of our existing stockholders and the book value of their common stock.

The shares of series A convertible preferred stock issued in connection with the acquisition of Lower Lakes are convertible into 2,419,355 shares of our common stock, subject to certain adjustments, which, on an “as converted” basis, represents approximately 12% of our aggregate outstanding common stock. The conversion price of our series A convertible preferred stock is subject to weighted average anti-dilution provisions whereby, if Rand issues shares in the future for consideration below the existing conversion price of $6.20, then the conversion price of the series A convertible preferred stock would automatically be decreased, allowing the holders of the series A convertible preferred stock to receive additional shares of common stock upon conversion. Upon any conversion of the series A convertible preferred stock, the equity interests of our existing common stockholders, as a percentage of the total number of the outstanding shares of our common stock, and the net book value of the shares of our common stock will be significantly diluted.

We may issue shares of our common stock and preferred stock to raise additional capital, including to complete a future acquisition, which would reduce the equity interest of our stockholders.

Our amended and restated certificate of incorporation authorizes the issuance of up to 50,000,000 shares of common stock, par value $.0001 per share, and 1,000,000 shares of preferred stock, par value $.0001 per share. We currently have 31,484,788 authorized but unissued shares of our common stock available for issuance (after appropriate reservation for the issuance of shares upon full exercise of our outstanding employee stock options) and 700,000 shares of preferred stock available for issuance. Although we currently have no other commitments to issue any additional shares of our common or preferred stock, we may in the future determine to issue additional shares of our common or preferred stock to raise additional capital for a variety of purposes, including to complete a future acquisition. The issuance of additional shares of our common stock or preferred stock may significantly reduce the equity interest of stockholders and may adversely affect prevailing market prices for our common stock.

Future acquisitions of vessels or businesses by Rand or Lower Lakes would subject Rand and Lower Lakes to additional business, operating and industry risks, the impact of which cannot presently be evaluated, and could adversely impact Rand's or Lower Lakes' capital structure.

Rand intends to pursue acquisition opportunities in an effort to diversify its investments and/or grow its business. While neither Rand nor Lower Lakes is presently committed to any acquisition, Rand may be actively pursuing one or more potential acquisition opportunities.

Future acquisitions may be of individual or groups of vessels or of businesses operating in the shipping or other industries. Rand is not limited to any particular industry or type of business that it may acquire. Accordingly, there is no current basis for you to evaluate the possible merits or risks of the particular business or assets that Rand may acquire, or of the industry in which any such business may operate. To the extent Rand acquires an operating business, we may be affected by numerous risks inherent in the acquired business's operations.

In addition, the financing of any acquisition completed by Rand could adversely impact Rand's capital structure as any such financing could include the issuance of additional equity securities and/or the borrowing of additional funds. The issuance of additional equity securities may significantly dilute the equity interest of existing stockholders and/or adversely affect prevailing market prices for Rand's common stock. Increasing Rand's indebtedness could increase the risk of a default that would entitle the holder to declare all of such indebtedness due and payable and/or to seize any collateral securing the indebtedness. In addition, default under one debt instrument could in turn permit lenders under other debt instruments to declare borrowings outstanding under those other instruments to be due and payable pursuant to cross default clauses. Accordingly, the financing of future acquisitions could adversely impact our capital structure and your equity interest in Rand.

Except as required by law or the rules of any securities exchange on which our securities might be listed at the time we seek to consummate an acquisition, you will not be asked to vote on any proposed acquisition.

16

Security breaches and other disruptions could compromise our information, expose us to liability and harm our reputation and business.

In the ordinary course of our business we collect and store sensitive data, including intellectual property, personal information, our proprietary business information and that of our customers, suppliers and business partners, and personally identifiable information of our customers and employees in our data centers and on our networks. The secure maintenance and transmission of this information is critical to our operations and business strategy. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential information. Computer hackers may attempt to penetrate our computer systems and, if successful, misappropriate personal or confidential business information. In addition, an associate, contractor, or other third-party with whom we do business may attempt to circumvent our security measures in order to obtain such information, and may purposefully or inadvertently cause a breach involving such information. Any such compromise of our data security and access, public disclosure, or loss of personal or confidential business information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, and regulatory penalties, disrupt our operations, damage our reputation and customers’ willingness to transact business with us, and subject us to additional costs and liabilities which could adversely affect our business.

RISKS ASSOCIATED WITH THE SHIPPING INDUSTRY

The cyclical nature of the Great Lakes dry bulk shipping industry may lead to decreases in shipping rates, which may reduce Lower Lakes' revenue and earnings.

The shipping business, including the dry cargo market, has been cyclical in varying degrees, experiencing fluctuations in charter rates, profitability and, consequently, vessel values. Rand anticipates that the future demand for Lower Lakes' dry bulk carriers and dry bulk charter rates will be dependent upon continued demand for commodities, economic growth in the United States and Canada, seasonal and regional changes in demand, and changes to the capacity of the Great Lakes fleet which cannot be predicted. Adverse economic, political, social or other developments could decrease demand and growth in the shipping industry and thereby reduce revenue and earnings. Fluctuations, and the demand for vessels, in general, have been influenced by, among other factors:

o | global and regional economic conditions; |

o | developments in international and Great Lakes trade; |

o | changes in seaborne and other transportation patterns, such as port congestion and canal closures; |

o | weather, water levels and crop yields; |

o | political developments; and |

o | embargoes and strikes. |

The market values of Lower Lakes' vessels may decrease, which could cause Lower Lakes to breach covenants in its credit facilities, which could reduce earnings and revenues as a result of potential foreclosures.

Vessel values are influenced by several factors, including:

o | changes in environmental and other regulations that may limit the useful life of vessels; |

o | changes in Great Lakes dry bulk commodity supply and demand; |

o | types and sizes of vessels; |

o | development of and increase in use of other modes of transportation; |

o | costs of new buildings; |

o | technological advances; |

o | governmental or other regulations; and |

o | prevailing level of contract of affreightment rates and charter rates. |

17

If the market values of Lower Lakes' owned vessels decrease, Lower Lakes may breach some of the covenants contained in its credit facilities. If Lower Lakes breaches such covenants and is unable to remedy the relevant breach, Lower Lakes' lenders could accelerate their debt and foreclose on the collateral, including Lower Lakes' vessels. Any loss of vessels would significantly decrease the ability of Rand to generate revenue and income. In addition, if the book value of a vessel is impaired due to unfavorable market conditions, or a vessel is sold at a price below its book value, Rand would incur a loss that would reduce earnings.

A failure to pass inspection by classification societies and regulators could result in one or more vessels being unemployable unless and until they pass inspection, resulting in a loss of revenues from such vessels for that period and a corresponding decrease in earnings, which may be material.

The hull and machinery of every commercial vessel must be classed by a classification society authorized by its country of registry, as well as being subject to survey and inspection by shipping regulatory bodies such as Transport Canada. The classification society certifies that a vessel is safe and seaworthy in accordance with the applicable rules and regulations of the country of registry of the vessel and the United Nations Safety of Life at Sea Convention. Lower Lakes' owned fleet is currently enrolled with either the American Bureau of Shipping or Lloyd's Register of Shipping.

A vessel must undergo Annual Surveys, Intermediate Surveys, and Special Surveys by its classification society, as well as periodic inspections by shipping regulators. In lieu of a special survey, a vessel’s machinery may be on a continuous survey cycle, under which the machinery would be surveyed periodically over a five-year period. Lower Lakes' vessels are on Special Survey cycles for hull inspection and continuous survey cycles for machinery inspection. Every vessel is also required to be drydocked every five years for inspection of the underwater parts of such vessel during the special survey.

Due to the age of several of the vessels, the repairs and remediations required in connection with such classification society surveys and other inspections may be extensive and require significant expenditures. Additionally, until such time as certain repairs and remediations required in connection with such surveys and inspections are completed (or if any vessel fails such a survey or inspection), the vessel may be unable to trade between ports and, therefore, would be unemployable. Any such loss of the use of a vessel could have an adverse impact on Rand's revenues, results of operations and liquidity, and any such impact may be material.

Lower Lakes' business would be adversely affected if Lower Lakes failed to comply with U.S. maritime laws or the Coasting Trade Act (Canada) provisions on coastwise trade, or if those provisions were modified or repealed.

Rand is subject to the Jones Act, other U.S. laws and the Coasting Trade Act (Canada) that restrict domestic maritime transportation to vessels operating under the flag of the subject state. In the case of the United States, vessels must be at least 75% owned and operated by U.S. citizens and manned by U.S. crews and, in addition, the vessels must have been built in the United States. Compliance with the foregoing legislation increases the operating costs of the vessels. With respect to its U.S. flagged vessels, Rand is responsible for monitoring the ownership of its capital stock to ensure compliance with U.S. maritime laws. If Rand does not comply with these restrictions, Rand will be prohibited from operating its vessels in U.S. coastwise trade, and under certain circumstances Rand will be deemed to have undertaken an unapproved foreign transfer, resulting in severe penalties, including permanent loss of U.S. coastwise trading rights for its vessels, and fines or forfeiture of the vessels.

Over the past decade, interest groups have lobbied Congress to modify or repeal U.S. maritime laws so as to facilitate foreign flag competition. Foreign vessels generally have lower construction costs and generally operate at significantly lower costs than vessels in the U.S. markets, which would likely result in reduced charter rates. Rand believes that continued efforts will be made to modify or repeal these laws. If these efforts are successful, it could result in significantly increased competition and have a material adverse effect on our business, results of operations and financial condition.

Lower Lakes is subject to environmental laws that could require significant expenditures both to maintain compliance with such laws and to pay for any uninsured environmental liabilities resulting from a spill or other environmental disaster.

Our shipping business and vessel operations are materially affected by environmental and other government regulations in the form of international conventions, United States and Canadian treaties, national, state, provincial, and local laws, and regulations in force in the jurisdictions in which vessels operate. Because such conventions, treaties, laws and regulations are often revised, we cannot predict the ultimate cost of compliance or its impact on the resale price or useful life of our vessels. Additional conventions, treaties, laws and regulations may be adopted which could limit our ability to do business or increase the cost of doing business, which may materially adversely affect our operations, as well as the shipping industry generally. Lower

18

Lakes is required by various governmental and quasi-governmental agencies to obtain certain permits, licenses, and certificates with respect to its operations and any increased cost in connection with obtaining such permits, licenses and certificates, or the imposition on Lower Lakes of the obligation to obtain additional permits, licenses and certificates, could adversely affect our results of operations. Lower Lakes currently maintains pollution liability coverage insurance. However, if the damages from a catastrophic incident exceed this insurance coverage, it could have a significant adverse impact on Rand's cash flow, profitability and financial position.

The operation of Lower Lakes' vessels is dependent on the price and availability of fuel. Continued periods of historically volatile fuel costs may materially adversely affect Rand's operating results.

Rand's operating results may be significantly impacted by changes in the availability or price of fuel for Lower Lakes' vessels. Fuel prices have varied significantly since 2004. Although fuel price surcharge/rebate clauses are included in substantially all of Lower Lakes' contracts of affreightment, which enable Lower Lakes to pass the majority of its increased and decreased fuel costs on to its customers, these measures may not be sufficient to enable Lower Lakes to fully recoup increased fuel costs or assure the continued availability of its fuel supplies. Although we are currently able to obtain adequate supplies of fuel, it is impossible to predict the price of fuel. Political disruptions or wars involving oil-producing countries (including, but not limited to, recent political unrest in the Middle East), changes in government policy, changes in fuel production capacity, environmental concerns and other unpredictable events may result in fuel supply shortages and fuel price increases in the future. There can be no assurance that Lower Lakes will be able to fully recover its increased fuel costs by passing these costs on to its customers. In the event that Lower Lakes is unable to do so, Rand's operating results will be adversely affected.

Governments could requisition Lower Lakes' vessels during a period of war or emergency, resulting in loss of revenues and earnings from such requisitioned vessels.

The United States or Canada could requisition title or seize Lower Lakes' vessels during a war or national emergency. Requisition of title occurs when a government takes a vessel and becomes the owner. A government could also requisition Lower Lakes vessels for hire, which would result in the government's taking control of a vessel and effectively becoming the charterer at a dictated charter rate. Requisition of one or more of Lower Lakes' vessels would have a substantial negative effect on Rand, as Rand would potentially lose all or substantially all revenues and earnings from the requisitioned vessels and/or permanently lose the vessels. Such losses might be partially offset if the requisitioning government compensated Rand for the requisition.

The operation of Great Lakes-going vessels entails the possibility of marine disasters including damage or destruction of the vessel due to accident, the loss of a vessel due to piracy or terrorism, damage or destruction of cargo and similar events that may cause a loss of revenue from affected vessels and damage Lower Lakes' business reputation, which may in turn lead to loss of business.

The operation of Great Lakes-going vessels entails certain inherent risks that may adversely affect Lower Lakes' business and reputation, including:

◦ | damage or destruction of a vessel due to marine disaster such as a collision; |

◦ | the loss of a vessel due to piracy and terrorism; |

◦ | cargo and property losses or damage as a result of the foregoing or less drastic causes such as human error, mechanical failure, low water levels and bad weather; |

◦ | environmental accidents as a result of the foregoing; and |

◦ | business interruptions and delivery delays caused by mechanical failure, human error, war, terrorism, political action in various countries, labor strikes or adverse weather conditions. |

Any of these circumstances or events could substantially increase Lower Lakes' costs, as for example, the costs of replacing a vessel or cleaning up a spill, or lower its revenues by taking vessels out of operation permanently or for periods of time. The involvement of Lower Lakes' vessels in a disaster or delays in delivery or damages or loss of cargo may harm its reputation as a safe and reliable vessel operator and cause it to lose business.

19

If Lower Lakes' vessels suffer damage, they may need to be repaired at Lower Lakes' cost at a drydocking facility. The costs of drydock repairs are unpredictable and can be substantial. Lower Lakes may have to pay repair costs that insurance does not cover. The loss of earnings while these vessels are being repaired and repositioned, a risk that Lower Lakes does not maintain insurance to cover, as well as the actual cost of these repairs, could decrease its revenues and earnings substantially, particularly if a number of vessels are damaged or repaired at the same time.

We face periodic drydocking costs for our vessels, which can be substantial.

Vessels must be drydocked periodically for regulatory compliance and for maintenance and repair. Our drydocking requirements are subject to associated risks, including delay and cost overruns, lack of necessary equipment, unforeseen engineering problems, employee strikes or other work stoppages, unanticipated cost increases, inability to obtain necessary certifications and approvals and shortages of materials or skilled labor. A significant delay in drydockings could have an adverse effect on our customer contract commitments. The cost of repairs and renewals required at each drydock are difficult to predict with certainty and can be substantial. Our insurance does not cover these costs.

Maritime claimants could arrest Lower Lakes' vessels, which could interrupt its cash flow.

Crew members, suppliers of goods and services to a vessel, shippers of cargo, and other parties may be entitled to a maritime lien against a vessel for unsatisfied debts, claims or damages against such vessel. In many jurisdictions, a maritime lien holder may enforce its lien by arresting a vessel through foreclosure proceedings. The arrest or attachment of one or more of Lower Lakes' vessels could interrupt its cash flow and require it to pay large sums of funds to have the arrest lifted.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We maintain our executive offices at 500 Fifth Avenue, 50th Floor, New York, New York 10110 pursuant to an agreement with Hyde Park Real Estate LLC, an affiliate of Laurence S. Levy, our Executive Vice Chairman. We also currently lease the following properties:

o | Lower Lakes Towing leases approximately 12,000 square feet of warehouse space at 107 Greenock Street, Port Dover, Ontario under a lease that expires on August 31, 2022. |

o | Lower Lakes Towing leases approximately 24,800 square feet of warehouse space at 109 Greenock Street, Port Dover, Ontario under a lease that expires on August 31, 2022. |

o | Lower Lakes Towing leases approximately 5,000 square feet of office space at 517 Main Street, Port Dover, Ontario under a lease that expires in October, 2018. |

o | Grand River leases approximately 1,300 square feet of space at 32861 Pin Oak Parkway, Suite B, Avon Lake, Ohio under a lease that expires on March 31, 2016. |

o | Grand River leases approximately 1,194 square feet at 3301 Veterans Drive, Suite 210, Traverse City, Michigan under a lease that expires October 31, 2015. |

o | Rand Finance Corp. (“Rand Finance”), a wholly-owned subsidiary of the Company, leases approximately 400 square feet at 9 Acton Road, Chelmsford, Massachusetts under a lease that expires June 30, 2015. |

We believe that we have adequate space for our anticipated needs and that suitable additional space will be available at commercially reasonable prices as needed.

20

Item 3. | Legal Proceedings. |

The nature of our business exposes us to the potential for legal proceedings related to labor and employment, personal injury, property damage, and environmental matters. Although the ultimate outcome of any legal matter cannot be predicted with certainty, based on present information, including our assessment of the merits of each particular claim, as well as our current reserves and insurance coverage, we do not expect that any known legal proceeding will in the foreseeable future have a material adverse impact on our financial condition or the results of our operations.

Item 4. | Mine Safety Disclosures. |

Not applicable.

21

PART II. OTHER INFORMATION

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is currently traded on the NASDAQ Capital Market under the symbol RLOG. The following table sets forth the high and low sales prices for each full quarterly period within the two most recent fiscal years.

Common Stock | ||

Quarter Ended | High | Low |

June 30, 2013 | $6.10 | $4.80 |

September 30, 2013 | $5.58 | $4.66 |

December 31, 2013 | $6.20 | $4.69 |

March 31, 2014 | $7.49 | $5.58 |

June 30, 2014 | $7.07 | $5.72 |

September 30, 2014 | $6.50 | $5.53 |

December 31, 2014 | $5.68 | $3.72 |

March 31, 2015 | $3.94 | $3.02 |

Holders

As of June 10, 2015, there were 19 holders of record of our common stock.

Dividends

We have not paid any dividends on our common stock to date. The payment of dividends in the future will be contingent upon our revenues, earnings, capital requirements and general financial condition. The payment of dividends is within the discretion of our board of directors. In addition, no dividends may be declared or paid on our common stock unless all accrued dividends on our preferred stock have been paid. The existing covenants under our debt instruments also place limits on our ability to issue dividends.

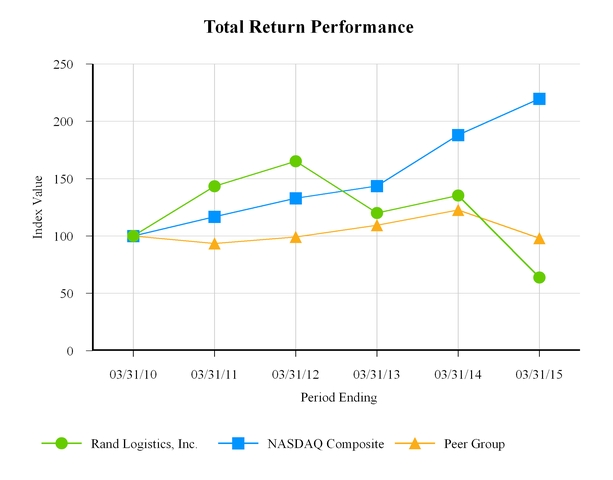

Stock Performance Graph

The graph below compares the cumulative 5-Year total shareholder return on our common stock with the cumulative total returns of the NASDAQ Composite Index and a customized peer group of three companies that includes: Algoma Central Corp., Horizon Lines Inc. and International Shipholding Corp. Measurement points are the last trading day of each respective fiscal year. The graph assumes the investment of $100 on March 31, 2010 in our common stock, in the NASDAQ Composite Index, and in the peer group.

22

23

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected consolidated financial data of the Company as of and for the years ended March 31, 2015, 2014, 2013, 2012 and 2011. The information in the following table should be read together with the Company's consolidated financial statements and accompanying notes as of March 31, 2015 and 2014, and for the years ended March 31, 2015, 2014 and 2013 included under Item 15 of this report, and “Management's Discussion and Analysis of Financial Condition and Results of Operations” included under Item 7 of this report. These historical results are not necessarily indicative of the results to be expected in the future.

Selected Financial Data (USD millions except share and vessel data) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

Revenue | |||||||||||||||

Freight and related revenue | $ | 129.1 | $ | 128.1 | $ | 117.8 | $ | 107.6 | $ | 90.4 | |||||

Fuel and other surcharges | $ | 22.1 | $ | 26.5 | $ | 37.4 | $ | 38.9 | $ | 20.5 | |||||

Outside voyage charter revenue | $ | 1.8 | $ | 1.2 | $ | 1.4 | $ | 1.3 | $ | 7.1 | |||||

$ | 153.0 | $ | 155.8 | $ | 156.6 | $ | 147.8 | $ | 118.0 | ||||||

Operating income | $ | 7.3 | $ | 10.9 | $ | 8.1 | $ | 15.2 | $ | 6.8 | |||||

Net (loss) income applicable to common shareholders | $ | (10.6 | ) | $ | (7.9 | ) | $ | (7.0 | ) | $ | 5.3 | $ | (2.2 | ) | |

Net (loss) income per share -basic | $ | (0.59 | ) | $ | (0.44 | ) | $ | (0.39 | ) | $ | 0.33 | $ | (0.16 | ) | |

Net (loss) income per share - diluted | $ | (0.59 | ) | $ | (0.44 | ) | $ | (0.39 | ) | $ | 0.33 | $ | (0.16 | ) | |

Weighted average shares - basic | 17,847,939 | 17,912,647 | 17,740,372 | 16,336,930 | 13,632,961 | ||||||||||

Weighted average shares - diluted | 17,847,939 | 17,912,647 | 17,740,372 | 16,336,930 | 13,632,961 | ||||||||||

Other Operating Data | |||||||||||||||

Depreciation | $ | 18.3 | $ | 17.0 | $ | 15.4 | $ | 11.6 | $ | 7.7 | |||||

Amortization of drydock costs | $ | 3.3 | $ | 3.3 | $ | 3.5 | $ | 3.0 | $ | 2.8 | |||||

Amortization of intangibles | $ | 1.2 | $ | 1.3 | $ | 1.3 | $ | 1.3 | $ | 1.2 | |||||

Property and equipment, net | $ | 206.3 | $ | 215.5 | $ | 219.1 | $ | 200.9 | $ | 166.7 | |||||

Total assets | $ | 250.3 | $ | 265.0 | $ | 270.8 | $ | 257.8 | $ | 215.5 | |||||

Long-term debt, including current portion | $ | 101.2 | $ | 104.9 | $ | 143.4 | $ | 133.6 | $ | 112.2 | |||||

Subordinated debt | $ | 72.5 | $ | 72.5 | $ | — | $ | — | $ | — | |||||

Total equity | $ | 46.2 | $ | 60.7 | $ | 72.4 | $ | 79.3 | $ | 58.3 | |||||

Number of vessels operated as of year end date | 15 | 15 | 16 | 14 | 12 | ||||||||||

24

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

All dollar amounts are presented in millions except share, per share, per day and vessel amounts. The following management's discussion and analysis (“MD&A”) is written to help the reader understand our company. The MD&A is provided as a supplement to, and should be read in conjunction with, the Consolidated Financial Statements and the accompanying financial statement notes of the Company appearing elsewhere in this Annual Report on Form 10-K as of March 31, 2015 and 2014 and for the fiscal years ended March 31, 2015, 2014 and 2013.

Overview

Business

Rand was incorporated in the State of Delaware in 2004 as a blank check company. In 2006, we acquired all of the outstanding shares of capital stock of Lower Lakes Towing and its affiliate, Grand River. Subsequent to our acquisition of Lower Lakes Towing and Grand River, we have added ten vessels to our fleet through acquisition transactions and we retired three smaller vessels.