Attached files

| file | filename |

|---|---|

| 8-K - WEC FORM 8-K - WEC ENERGY GROUP, INC. | wec8-k06032015.htm |

June 2015

2 Cautionary Statement Regarding Forward-Looking Information This presentation contains certain forward-looking statements with respect to the financial condition, results of operations and business of Wisconsin Energy and Integrys and the combined businesses of Integrys and Wisconsin Energy and certain plans and objectives of Wisconsin Energy and Integrys with respect thereto, including the expected benefits of the proposed merger transaction. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements often use words such as “anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”, “goal”, “believe”, “hope”, “aim”, “continue”, “will”, “may”, “would”, “could” or “should” or other words of similar meaning or the negative thereof. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements. Such factors include, but are not limited to, the expected closing date of the proposed merger; the possibility that the expected value creation from the proposed merger will not be realized, or will not be realized within the expected time period; the risk that the businesses of Wisconsin Energy and Integrys will not be integrated successfully; disruption from the proposed merger making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred; changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters; the possibility that the proposed merger does not close, including, but not limited to, due to the failure to satisfy the closing conditions; and the risk that financing for the proposed merger may not be available on favorable terms. These forward-looking statements are based on numerous assumptions and assessments made by Wisconsin Energy and/or Integrys in light of their experience and perception of historical trends, current conditions, business strategies, operating environment, future developments and other factors that each party believes appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. The factors described in the context of such forward-looking statements in this presentation could cause actual results, performance or achievements, industry results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct and persons reading this presentation are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as of the date of this presentation. Neither Wisconsin Energy nor Integrys assumes any obligation to update the information contained in this presentation (whether as a result of new information, future events or otherwise), except as required by applicable law. A further list and description of risks and uncertainties at Wisconsin Energy can be found in Wisconsin Energy’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its reports filed on Form 10-Q and Form 8-K. A further list and description of risks and uncertainties at Integrys can be found in Integrys’ Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its reports filed on Form 10-Q and Form 8-K.

3 Additional Information And Where to Find It In connection with the proposed merger, Wisconsin Energy filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that includes a joint proxy statement/prospectus for the shareholders of Wisconsin Energy and Integrys. The registration statement was declared effective by the SEC on October 6, 2014. Each of Wisconsin Energy and Integrys mailed the joint proxy statement/prospectus to their respective shareholders and will file other documents regarding the proposed merger with the SEC. Wisconsin Energy and Integrys urge investors and shareholders to read the joint proxy statement/prospectus as well as other documents filed with the SEC when they become available, because they will contain important information. Investors and security holders will be able to receive the registration statement containing the joint proxy statement/prospectus and other documents free of charge at the SEC’s web site, http://www.sec.gov, from Wisconsin Energy at Wisconsin Energy Corporation Corporate Secretary, 231 W. Michigan St., P.O. Box 1331, Milwaukee, WI 53201, or from Integrys at 200 East Randolph Street, Chicago, IL 60601. Non-solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

4 Current Investment Thesis An “Earn and Return” Company with a Low Risk Profile Positive free cash flow Targeted EPS growth of 4%-6% Best in class dividend growth - targeting a dividend payout ratio of 65%-70% of earnings in 2017 In January, Board approved a quarterly dividend increase of 8.3% Proven management team that has delivered strong financial results and operational excellence Balanced regulatory climate

5 Future Investment Thesis An “Earn and Return” Company with a Low Risk Profile Remain positive free cash flow Targeted EPS growth of 5%-7% Accelerated dividend growth Implies dividend increase of 7-8% from current 2015 dividend at merger close* Targeting a dividend payout ratio of 65%-70% Same proven management team that has delivered strong financial results and operational excellence Balanced regulatory climate with additional regulatory diversity * From the perspective of a Wisconsin Energy shareholder

6 A Track Record of Performance Leading Reliability and Customer Satisfaction Named the most reliable utility in the Midwest for the fourth year in a row and seven of the past 10 years Ranked #1 in the Midwest for customer service and in the top quartile nationally for overall satisfaction * * Source: 2014 JD Power & Associates Electric Residential Customer Satisfaction Study/Large Utilities

7 A Track Record of Performance Dramatic Change in Environmental Performance From 2000 to 2015... Power plant capacity up 50% Emissions of nitrogen oxide sulfur dioxide down 80% mercury particulate matter

8 Wisconsin Energy is the only company in the S&P Electric Index S&P Utilities Index Philadelphia Utility Index Dow Jones Utilities Average that has grown earnings per share and dividends per share every year since 2003 A Track Record of Performance Consistent Earnings and Dividend Growth

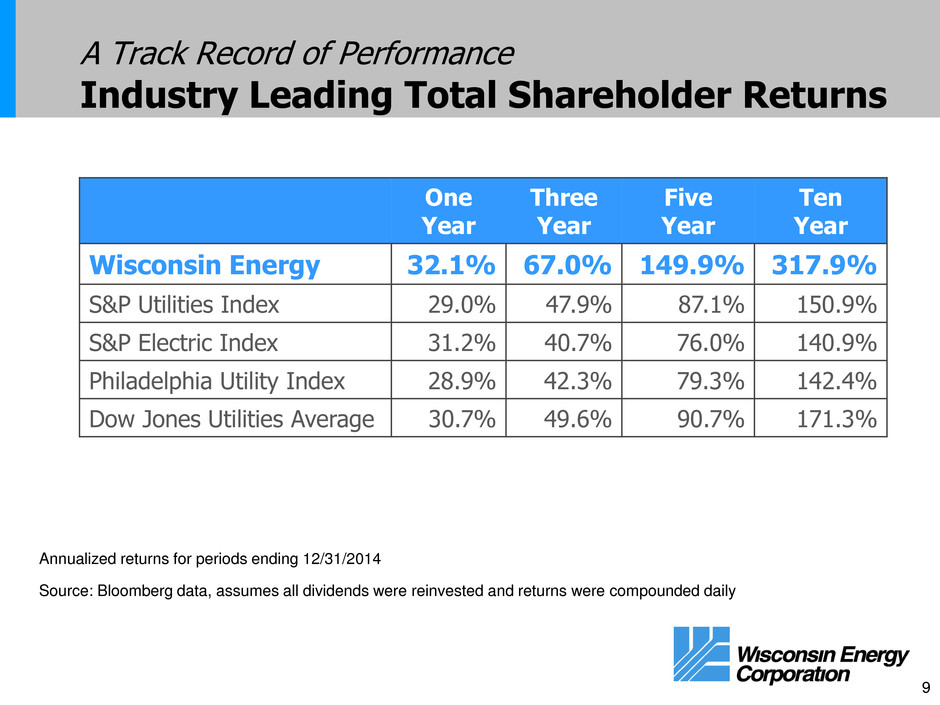

9 A Track Record of Performance Industry Leading Total Shareholder Returns One Year Three Year Five Year Ten Year Wisconsin Energy 32.1% 67.0% 149.9% 317.9% S&P Utilities Index 29.0% 47.9% 87.1% 150.9% S&P Electric Index 31.2% 40.7% 76.0% 140.9% Philadelphia Utility Index 28.9% 42.3% 79.3% 142.4% Dow Jones Utilities Average 30.7% 49.6% 90.7% 171.3% Annualized returns for periods ending 12/31/2014 Source: Bloomberg data, assumes all dividends were reinvested and returns were compounded daily

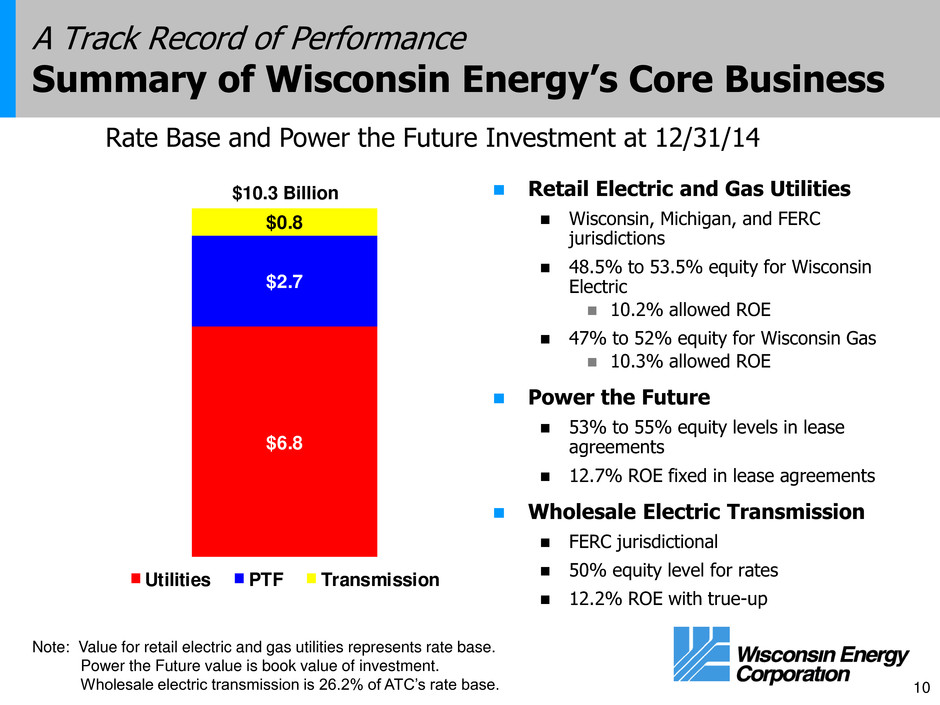

10 A Track Record of Performance Summary of Wisconsin Energy’s Core Business Retail Electric and Gas Utilities Wisconsin, Michigan, and FERC jurisdictions 48.5% to 53.5% equity for Wisconsin Electric 10.2% allowed ROE 47% to 52% equity for Wisconsin Gas 10.3% allowed ROE Power the Future 53% to 55% equity levels in lease agreements 12.7% ROE fixed in lease agreements Wholesale Electric Transmission FERC jurisdictional 50% equity level for rates 12.2% ROE with true-up $2.7 $5.7 Note: Value for retail electric and gas utilities represents rate base. Power the Future value is book value of investment. Wholesale electric transmission is 26.2% of ATC’s rate base. $10.3 Billion Rate Base and Power the Future Investment at 12/31/14 $6.8 $2.7 $0.8 Utilities PTF Transmission

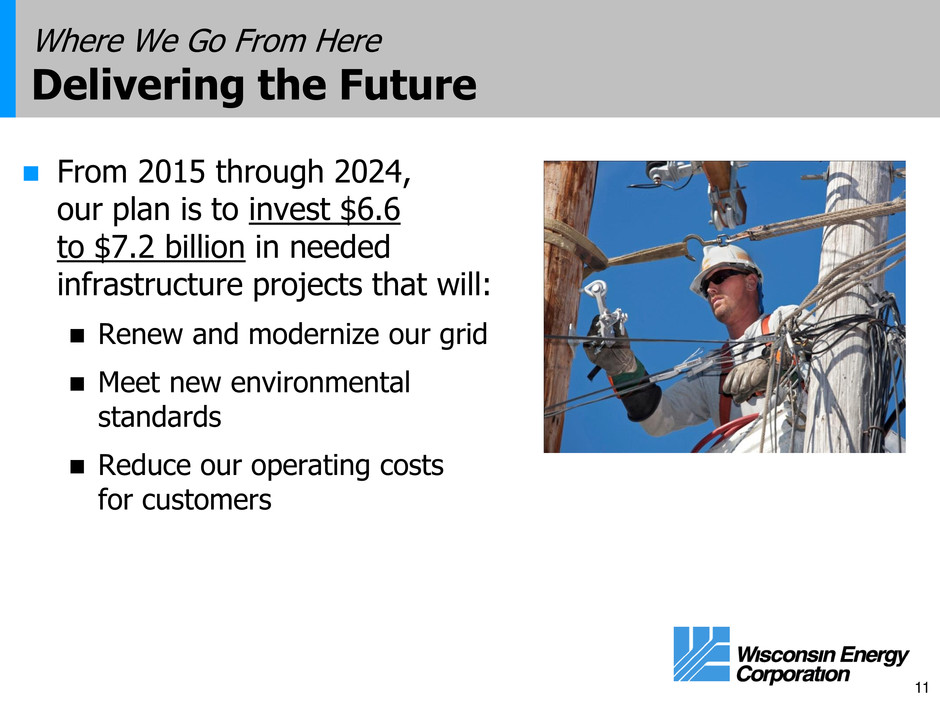

11 Where We Go From Here Delivering the Future From 2015 through 2024, our plan is to invest $6.6 to $7.2 billion in needed infrastructure projects that will: Renew and modernize our grid Meet new environmental standards Reduce our operating costs for customers

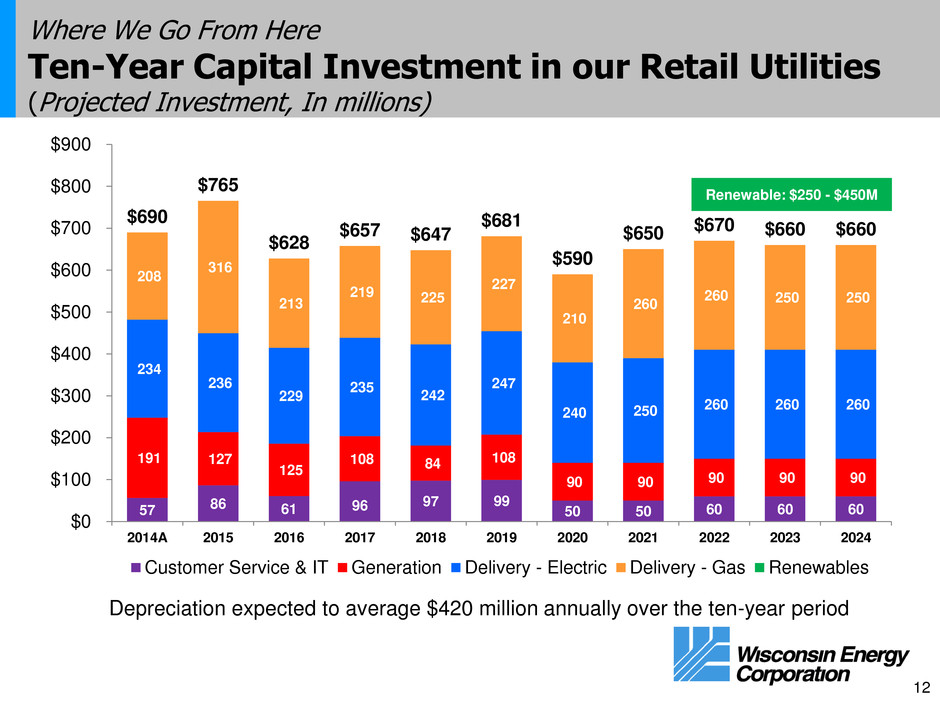

12 Where We Go From Here Ten-Year Capital Investment in our Retail Utilities (Projected Investment, In millions) 57 86 61 96 97 99 50 50 60 60 60 191 127 125 108 84 108 90 90 90 90 90 234 236 229 235 242 247 240 250 260 260 260 208 316 213 219 225 227 210 260 260 250 250 $690 $765 $628 $657 $647 $681 $590 $650 $670 $660 $660 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2014A 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Customer Service & IT Generation Delivery - Electric Delivery - Gas Renewables Renewable: $250 - $450M Depreciation expected to average $420 million annually over the ten-year period

13 Between 2015 and 2019, we plan to: Rebuild 2,500 miles of electric distribution lines that are more than 50 years old Upgrade our electric infrastructure by replacing: 27,000 power poles 22,000 transformers Hundreds of substation components Improve our gas distribution network by replacing: 1,100 miles of vintage plastic and steel gas mains 83,000 individual gas distribution lines 233,000 meter sets Where We Go From Here Delivering the Future – Overview

14 Western Wisconsin gas distribution expansion $175-$185 million investment Projected in-service date: Fourth quarter 2015 Where We Go From Here Major Construction Projects Projects at our new Oak Creek units Wisconsin Commission has approved: $21 million investment for plant modifications $58 million investment for storage, fuel handling Significant reduction in fuel cost for our customers Twin Falls: building a new powerhouse $60-$65 million projected investment Projected completion in 2016 Valley Power Plant: converting from coal to gas $65-$75 million investment Projected completion in late 2015

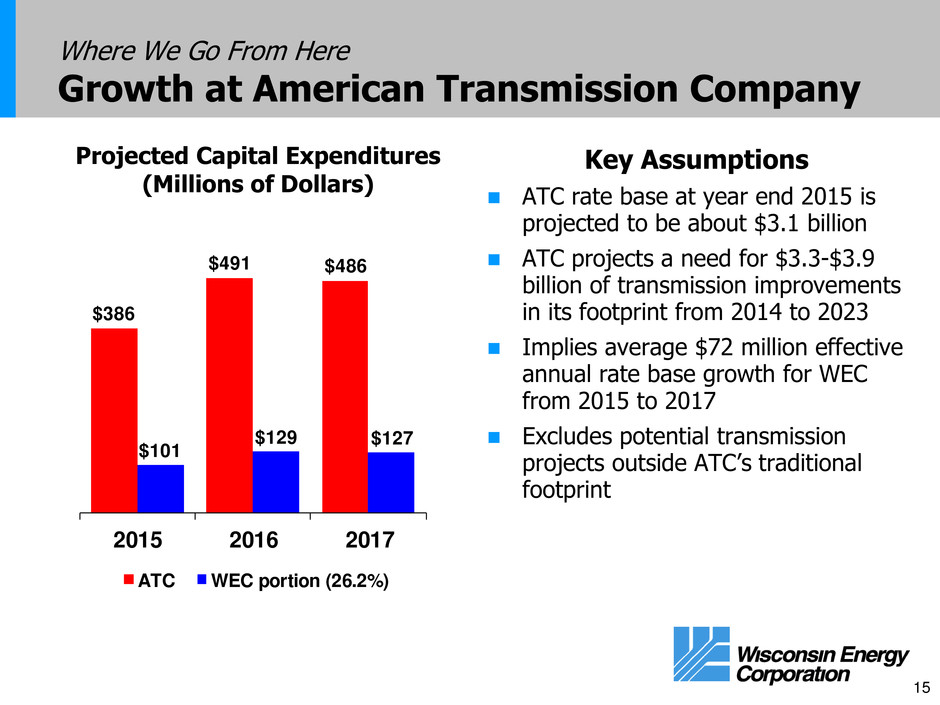

15 Where We Go From Here Growth at American Transmission Company $386 $491 $486 $101 $129 $127 2015 2016 2017 ATC WEC portion (26.2%) Key Assumptions ATC rate base at year end 2015 is projected to be about $3.1 billion ATC projects a need for $3.3-$3.9 billion of transmission improvements in its footprint from 2014 to 2023 Implies average $72 million effective annual rate base growth for WEC from 2015 to 2017 Excludes potential transmission projects outside ATC’s traditional footprint Projected Capital Expenditures (Millions of Dollars)

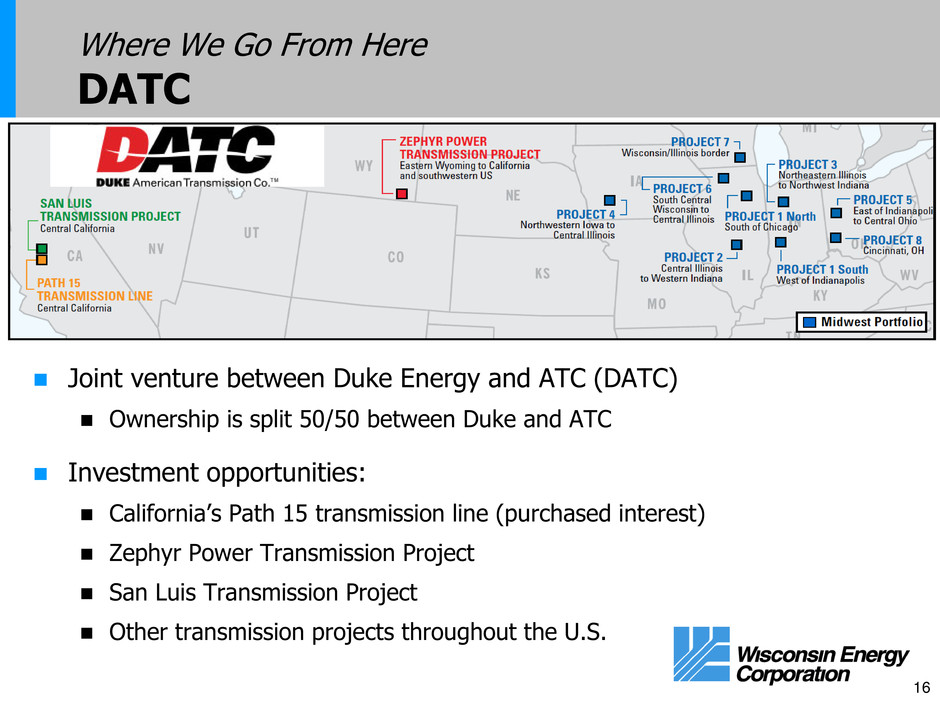

16 Where We Go From Here DATC Joint venture between Duke Energy and ATC (DATC) Ownership is split 50/50 between Duke and ATC Investment opportunities: California’s Path 15 transmission line (purchased interest) Zephyr Power Transmission Project San Luis Transmission Project Other transmission projects throughout the U.S.

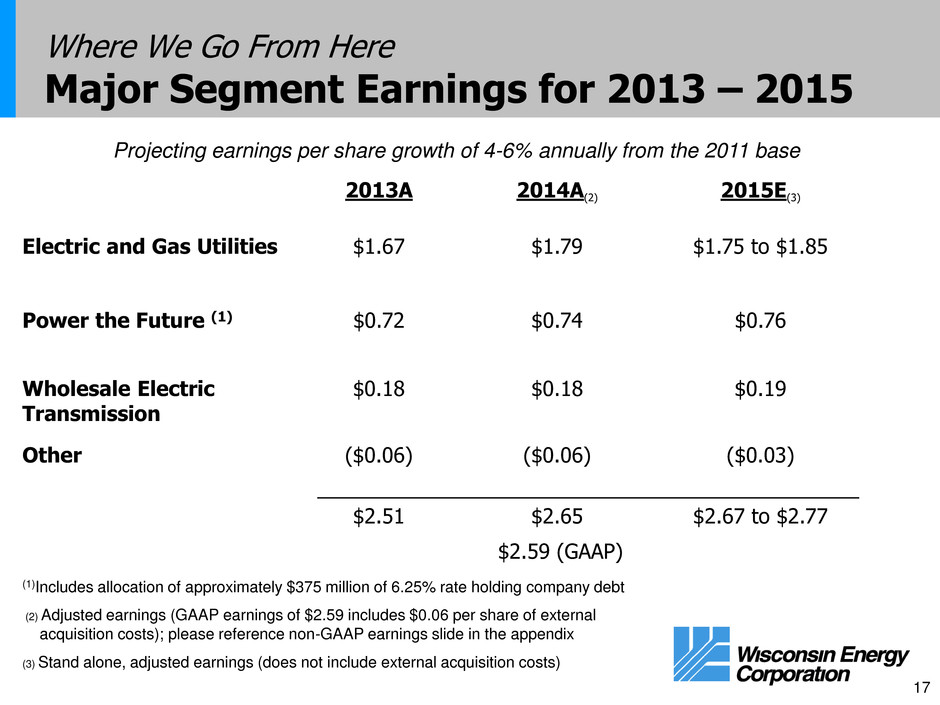

17 Where We Go From Here Major Segment Earnings for 2013 – 2015 2013A 2014A(2) 2015E(3) Electric and Gas Utilities $1.67 $1.79 $1.75 to $1.85 Power the Future (1) $0.72 $0.74 $0.76 Wholesale Electric Transmission $0.18 $0.18 $0.19 Other ($0.06) ($0.06) ($0.03) $2.51 $2.65 $2.59 (GAAP) $2.67 to $2.77 (1)Includes allocation of approximately $375 million of 6.25% rate holding company debt (2) Adjusted earnings (GAAP earnings of $2.59 includes $0.06 per share of external acquisition costs); please reference non-GAAP earnings slide in the appendix (3) Stand alone, adjusted earnings (does not include external acquisition costs) Projecting earnings per share growth of 4-6% annually from the 2011 base

Wisconsin Energy is planning to acquire Integrys for a total consideration of $71.47 per share based on June 20 closing price Transaction Overview 18

19 Strategic Rationale Transaction Overview Acquisition will create the leading electric and natural gas utility in the Midwest Combination will offer significant benefits to customers and shareholders of both companies Meets or exceeds WEC’s acquisition criteria Accretive to earnings per share starting in first full calendar year of combined operations Largely credit neutral Long-term growth prospects of combined entity equal to or greater than standalone company Combined company’s long term EPS growth rate expected to be 5-7%

20 Strategic Rationale Operational and Financial Fit Operational Strong geographic fit and complementary operations Majority ownership of ATC Regulatory diversification Financial Double the annual capital spending and increase regulated rate base by 70% EPS growth rate of 5-7%, more than 99% from regulated operations Charitable contributions and community involvement to be maintained at historic levels Continued strong balance sheet and cash flow Still expect to be cash flow positive on an annual basis

21 Strategic Rationale Pro Forma Company Overview Combined Service Territory Minnesota Wisconsin Illinois Michigan Wisconsin Energy Integrys Gas Integrys Combo Service Company Statistics $16.9 billion market cap 1.6 million electric customers 2.8 million gas customers 60% ownership of ATC 68,000 miles electric distribution 44,000 miles gas distribution $16.7 billion of rate base in 2015

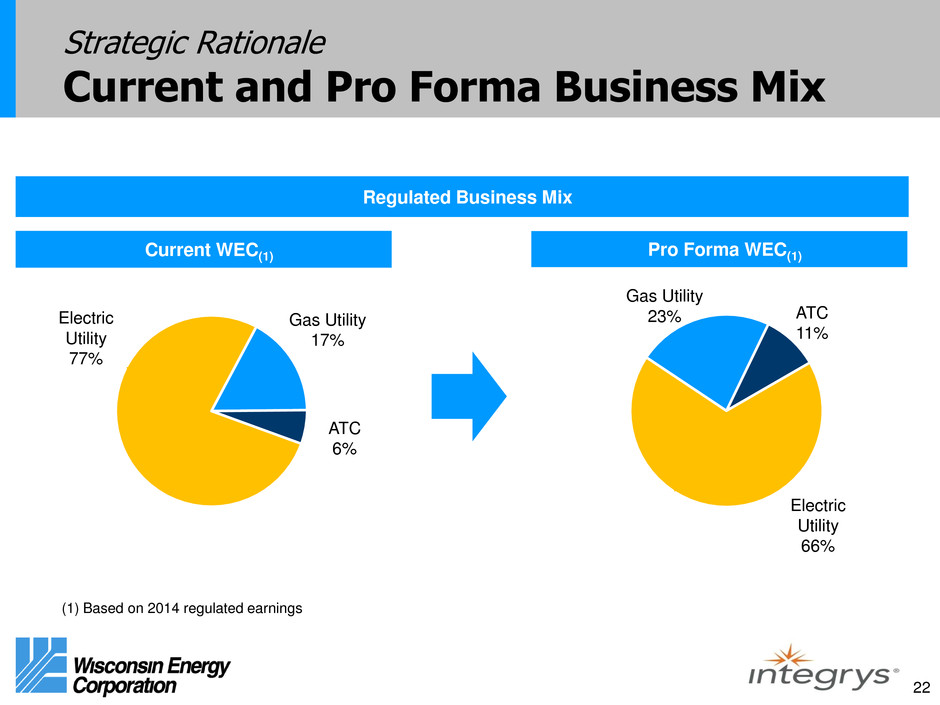

22 Strategic Rationale Current and Pro Forma Business Mix Current WEC(1) Pro Forma WEC(1) Electric Utility 77% Gas Utility 17% ATC 6% Electric Utility 66% Gas Utility 23% ATC 11% Regulated Business Mix (1) Based on 2014 regulated earnings

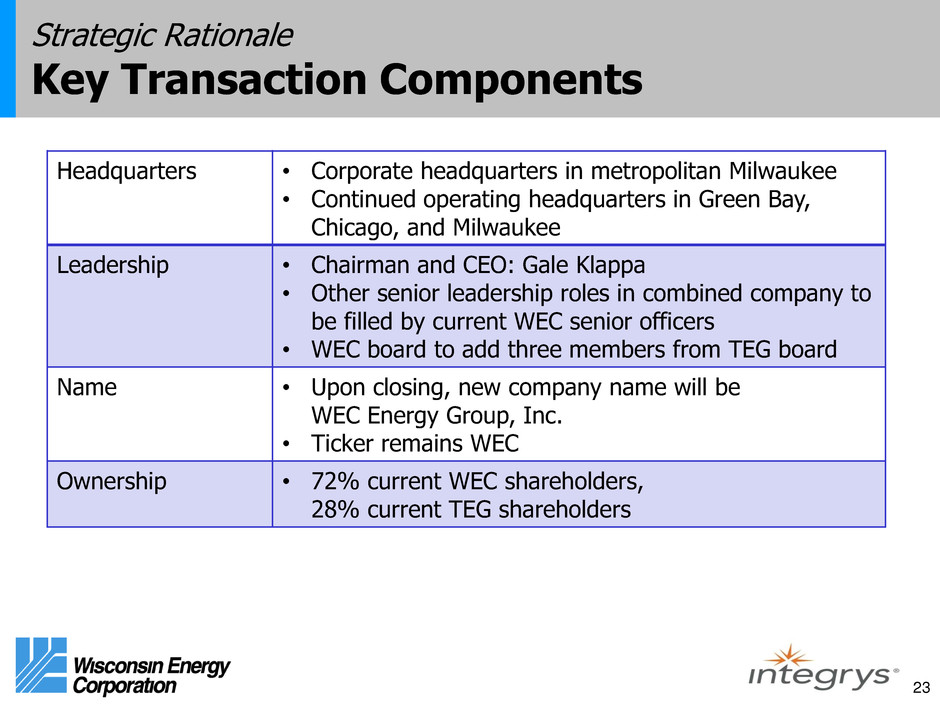

23 Strategic Rationale Key Transaction Components Headquarters • Corporate headquarters in metropolitan Milwaukee • Continued operating headquarters in Green Bay, Chicago, and Milwaukee Leadership • Chairman and CEO: Gale Klappa • Other senior leadership roles in combined company to be filled by current WEC senior officers • WEC board to add three members from TEG board Name • Upon closing, new company name will be WEC Energy Group, Inc. • Ticker remains WEC Ownership • 72% current WEC shareholders, 28% current TEG shareholders

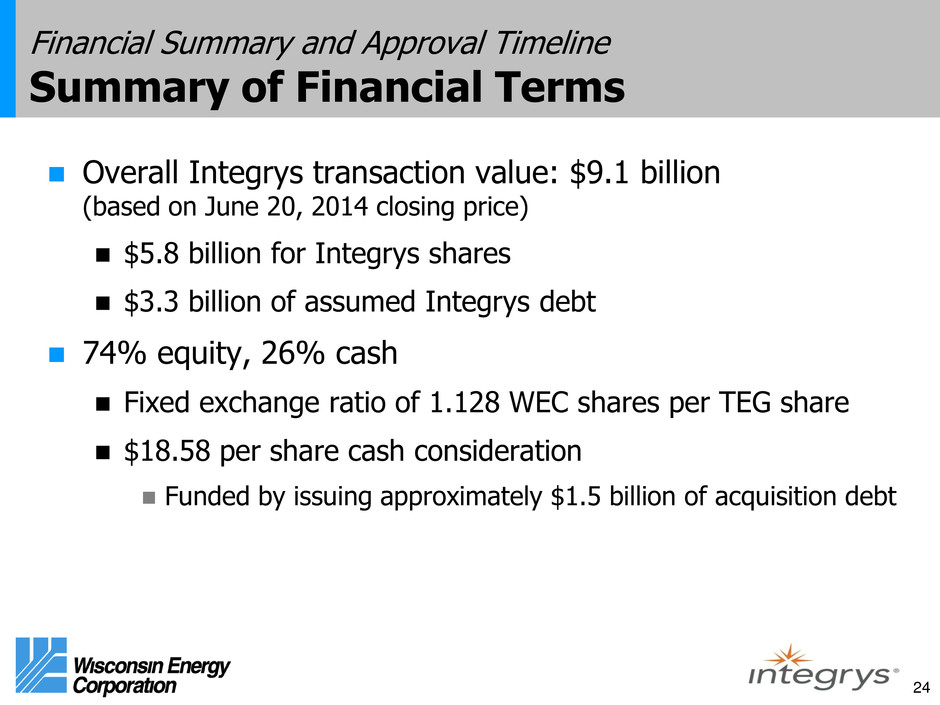

24 Financial Summary and Approval Timeline Summary of Financial Terms Overall Integrys transaction value: $9.1 billion (based on June 20, 2014 closing price) $5.8 billion for Integrys shares $3.3 billion of assumed Integrys debt 74% equity, 26% cash Fixed exchange ratio of 1.128 WEC shares per TEG share $18.58 per share cash consideration Funded by issuing approximately $1.5 billion of acquisition debt

25 Financial Summary and Approval Timeline Dividend Policy Integrys shareholders neutral initially Current dividend policy for WEC shareholders until closing WEC shareholders to receive dividend increase at time of close Expected to be accretive to both sets of shareholders in future years

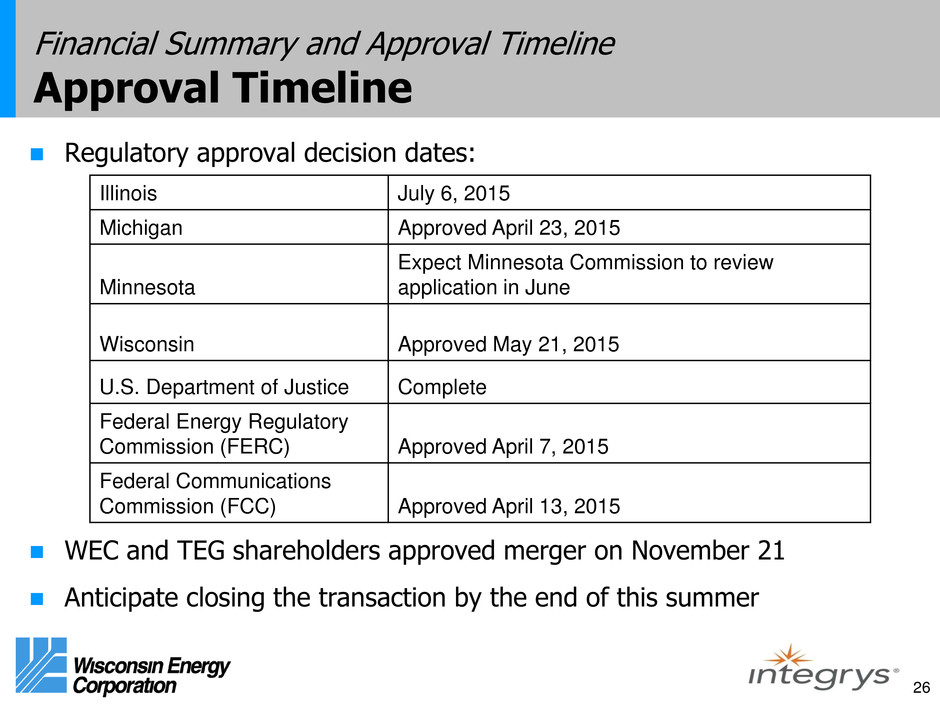

26 Financial Summary and Approval Timeline Approval Timeline Regulatory approval decision dates: WEC and TEG shareholders approved merger on November 21 Anticipate closing the transaction by the end of this summer Illinois July 6, 2015 Michigan Approved April 23, 2015 Minnesota Expect Minnesota Commission to review application in June Wisconsin Approved May 21, 2015 U.S. Department of Justice Complete Federal Energy Regulatory Commission (FERC) Approved April 7, 2015 Federal Communications Commission (FCC) Approved April 13, 2015

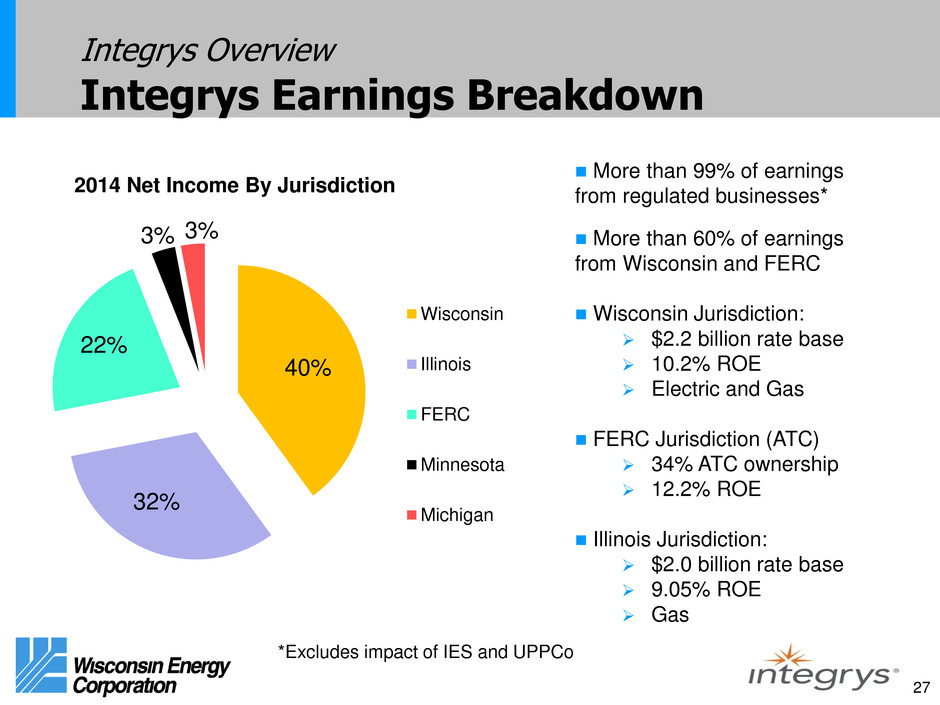

27 Integrys Overview Integrys Earnings Breakdown 40% 32% 22% 3% 3% 2014 Net Income By Jurisdiction Wisconsin Illinois FERC Minnesota Michigan More than 99% of earnings from regulated businesses* More than 60% of earnings from Wisconsin and FERC Wisconsin Jurisdiction: $2.2 billion rate base 10.2% ROE Electric and Gas FERC Jurisdiction (ATC) 34% ATC ownership 12.2% ROE Illinois Jurisdiction: $2.0 billion rate base 9.05% ROE Gas *Excludes impact of IES and UPPCo

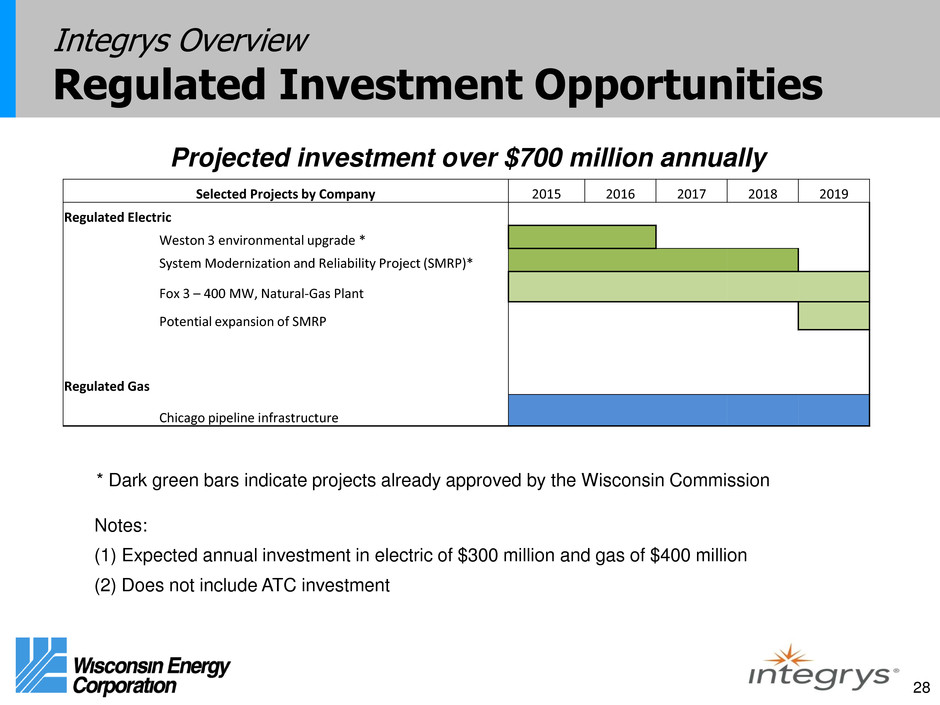

28 Integrys Overview Regulated Investment Opportunities Notes: (1) Expected annual investment in electric of $300 million and gas of $400 million (2) Does not include ATC investment Projected investment over $700 million annually Selected Projects by Company 2015 2016 2017 2018 2019 Regulated Electric Weston 3 environmental upgrade * System Modernization and Reliability Project (SMRP)* Fox 3 – 400 MW, Natural-Gas Plant Potential expansion of SMRP Regulated Gas Chicago pipeline infrastructure * Dark green bars indicate projects already approved by the Wisconsin Commission

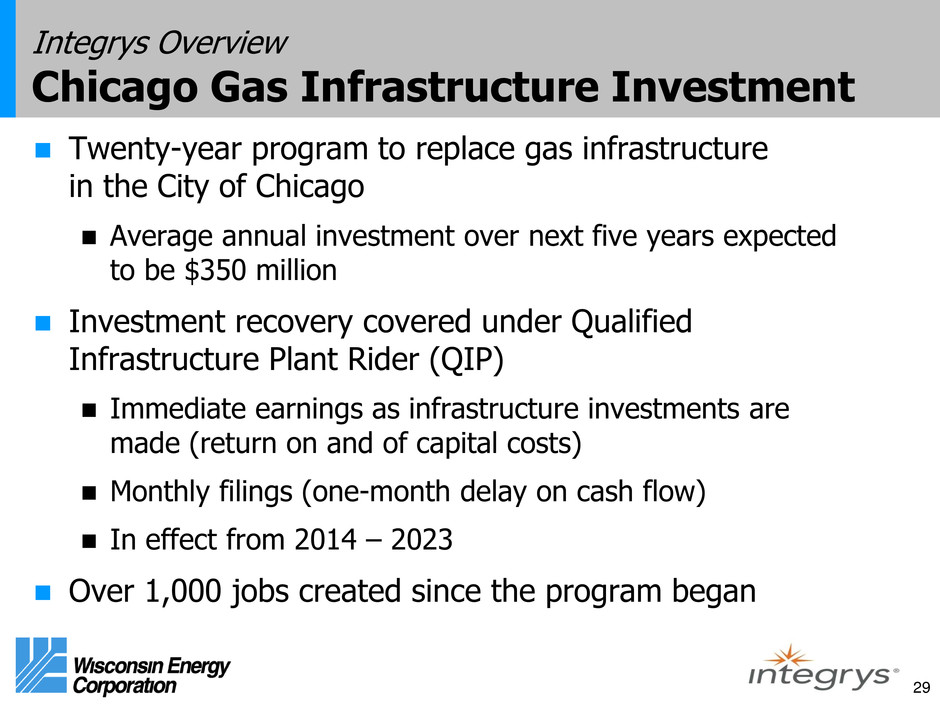

29 Integrys Overview Chicago Gas Infrastructure Investment Twenty-year program to replace gas infrastructure in the City of Chicago Average annual investment over next five years expected to be $350 million Investment recovery covered under Qualified Infrastructure Plant Rider (QIP) Immediate earnings as infrastructure investments are made (return on and of capital costs) Monthly filings (one-month delay on cash flow) In effect from 2014 – 2023 Over 1,000 jobs created since the program began

30 Integrys Overview Wisconsin Public Service Investment Weston 3 plant environmental upgrade Approved by Wisconsin Commission $345 million of total investment expected from 2013-2016 System Modernization and Reliability Project Approved by Wisconsin Commission $220 million of total investment expected from 2014-2018 Project activities: Convert over 1,000 miles of overhead distribution power lines to underground Add distribution automation equipment on 400 miles of lines

31 Key Takeaways of Transaction Combination creates the leading electric and natural gas utility in the Midwest and a top ten gas distribution company EPS growth of 5-7% coupled with strong dividend growth Larger ownership in ATC brings opportunity for additional transmission investment Positioned to deliver among the best risk-adjusted returns in the industry Positive free cash flow

Appendix June 2015

33 Targeting dividend payout ratio of 65 - 70 percent of earnings in 2017 A Track Record of Performance Industry Leading Dividend Growth $0.46 $0.50 $0.54 $0.68 $0.80 $1.04 $1.20 $1.45 $1.56 $1.69 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015E

34 A Track Record of Performance Power the Future Investments – Natural Gas Capacity 1,090 MW Investment $664 million ROE 12.7% Equity 53% In Service Dates Unit 1 – July 2005 Unit 2 – May 2008 Cost Per Unit of Capacity $609/kW Meeting the Region’s Energy Needs

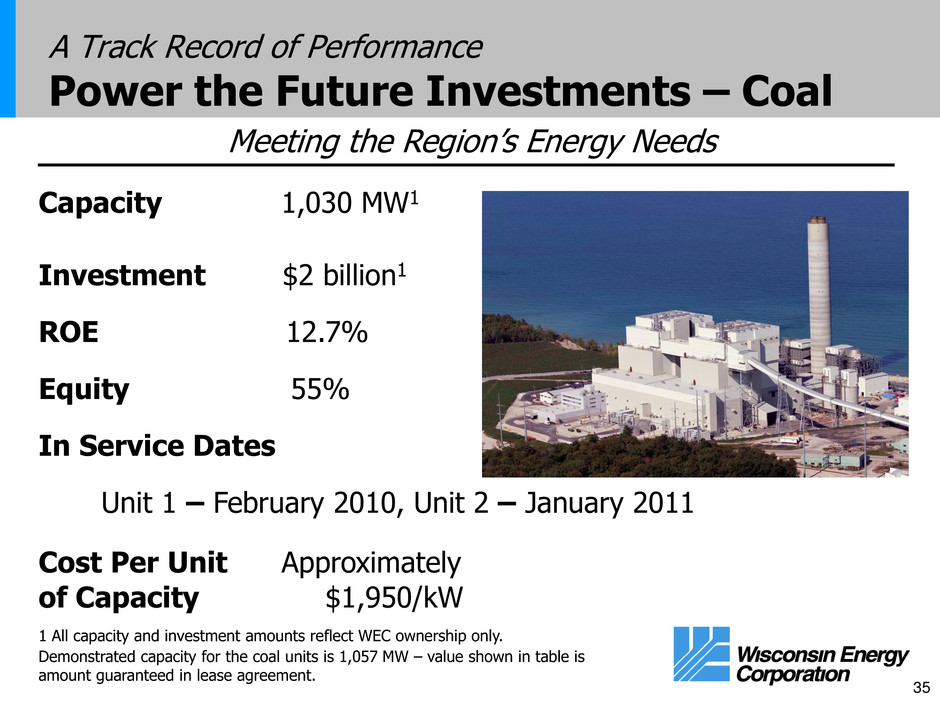

35 Capacity 1,030 MW1 Investment $2 billion1 ROE 12.7% Equity 55% In Service Dates Unit 1 – February 2010, Unit 2 – January 2011 Cost Per Unit Approximately of Capacity $1,950/kW 1 All capacity and investment amounts reflect WEC ownership only. Demonstrated capacity for the coal units is 1,057 MW – value shown in table is amount guaranteed in lease agreement. Meeting the Region’s Energy Needs A Track Record of Performance Power the Future Investments – Coal

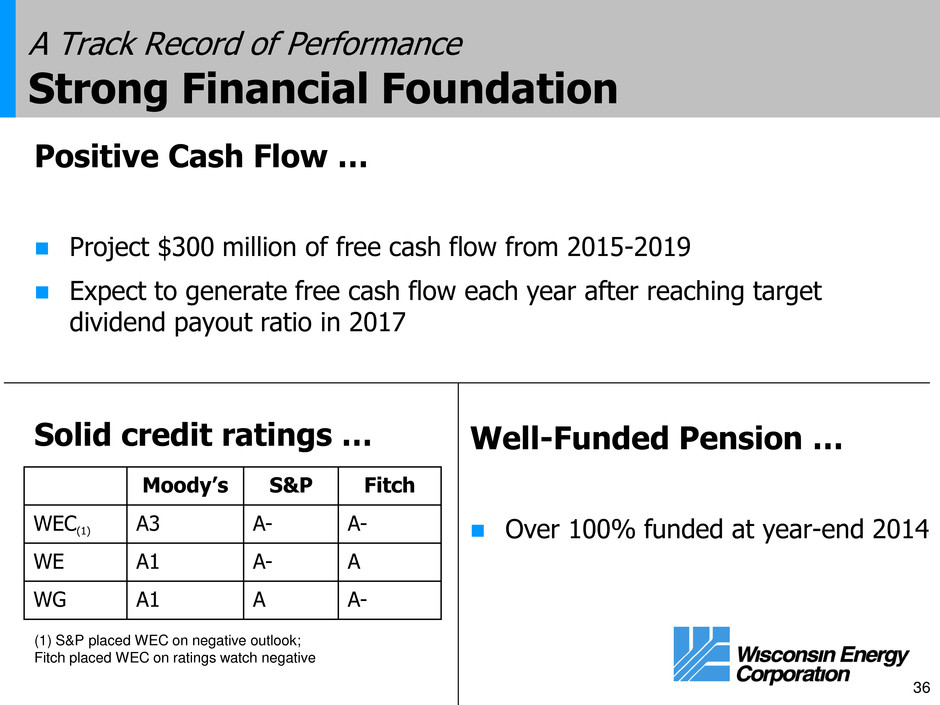

36 A Track Record of Performance Strong Financial Foundation Moody’s S&P Fitch WEC(1) A3 A- A- WE A1 A- A WG A1 A A- Well-Funded Pension … Over 100% funded at year-end 2014 Solid credit ratings … Positive Cash Flow … Project $300 million of free cash flow from 2015-2019 Expect to generate free cash flow each year after reaching target dividend payout ratio in 2017 (1) S&P placed WEC on negative outlook; Fitch placed WEC on ratings watch negative

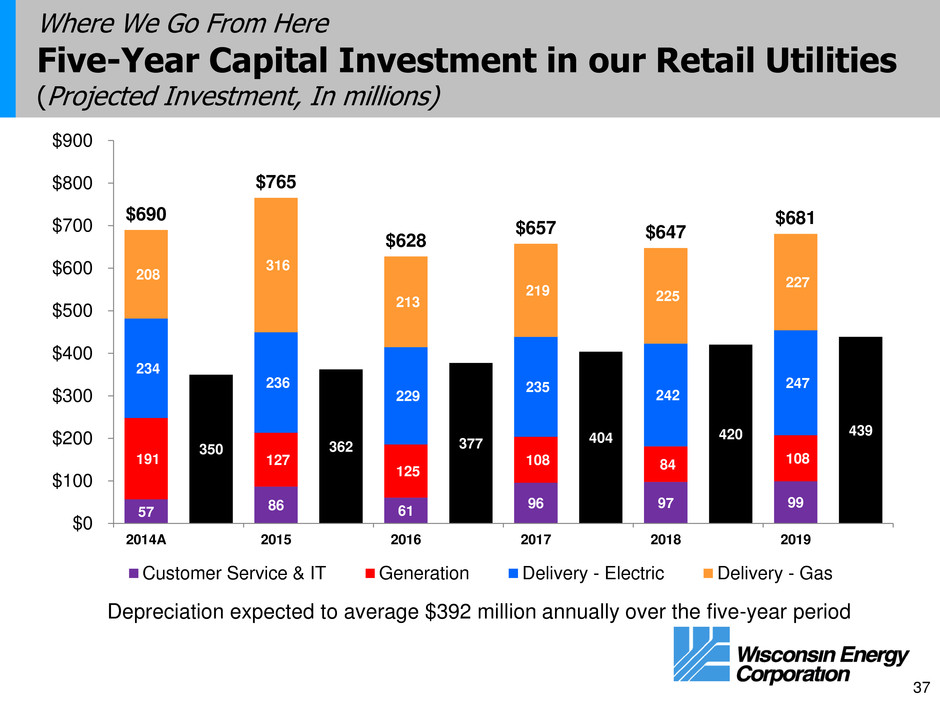

37 Where We Go From Here Five-Year Capital Investment in our Retail Utilities (Projected Investment, In millions) 57 86 61 96 97 99 191 127 125 108 84 108 234 236 229 235 242 247 208 316 213 219 225 227 $690 350 $765 362 $628 377 $657 404 $647 420 $681 439 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2014A 2015 2016 2017 2018 2019 Customer Service & IT Generation Delivery - Electric Delivery - Gas Depreciation expected to average $392 million annually over the five-year period

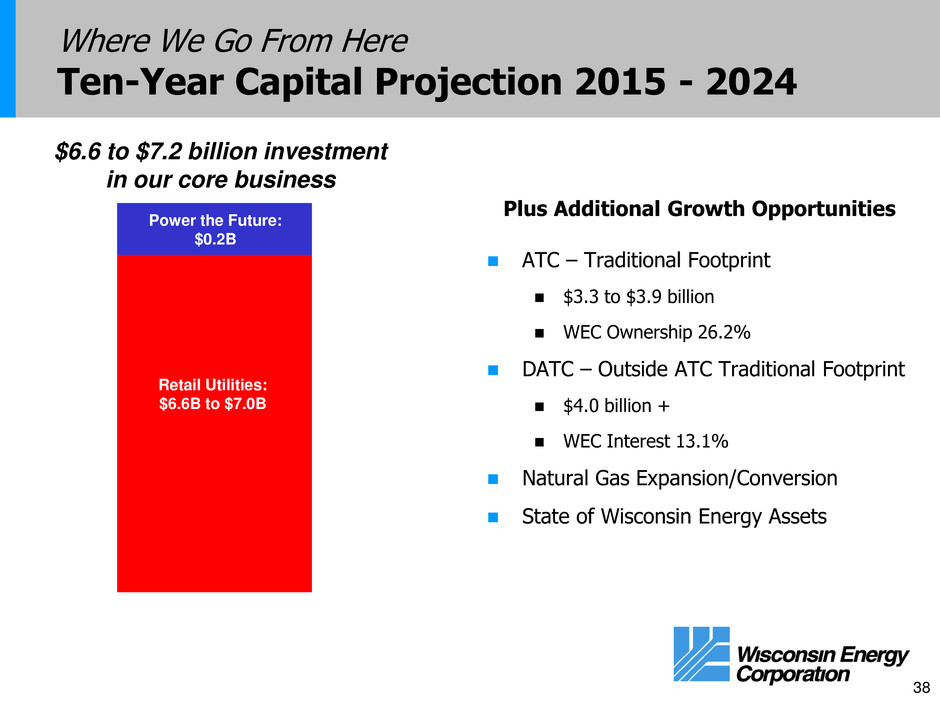

38 Where We Go From Here Ten-Year Capital Projection 2015 - 2024 Plus Additional Growth Opportunities ATC – Traditional Footprint $3.3 to $3.9 billion WEC Ownership 26.2% DATC – Outside ATC Traditional Footprint $4.0 billion + WEC Interest 13.1% Natural Gas Expansion/Conversion State of Wisconsin Energy Assets $2.7 $5.7 Retail Utilities: $6.6B to $7.0B Power the Future: $0.2B $6.6 to $7.2 billion investment in our core business

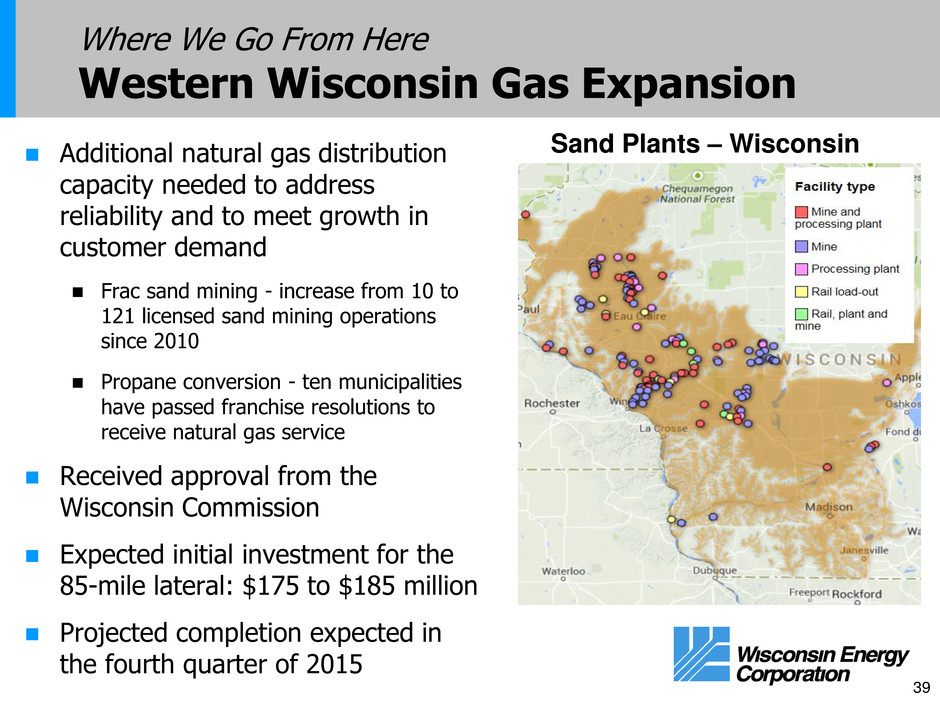

39 Where We Go From Here Western Wisconsin Gas Expansion Additional natural gas distribution capacity needed to address reliability and to meet growth in customer demand Frac sand mining - increase from 10 to 121 licensed sand mining operations since 2010 Propane conversion - ten municipalities have passed franchise resolutions to receive natural gas service Received approval from the Wisconsin Commission Expected initial investment for the 85-mile lateral: $175 to $185 million Projected completion expected in the fourth quarter of 2015 Sand Plants – Wisconsin

40 Where We Go From Here Renewable Energy Investments Biomass plant completed 50MW Investment of $269 million Commercial operation began in November of 2013 Renewable fleet in place Glacier Hills Wind Park (162 MW, in service since 2011) Blue Sky Green Field Wind Park (145 MW, in service since 2008) Montfort Wind Energy Center (30 MW, purchased in 2012) We expect to be in compliance with the Wisconsin renewable portfolio standard through 2023

41 Converting Valley from coal to natural gas Unit 1 conversion completed in November Targeting completion of project in late 2015 Follows construction of a $30 million gas pipeline upgrade (now in service) Where We Go From Here Valley Power Plant Projected conversion cost for Valley: $65 to $70 million

42 Building a new powerhouse at Twin Falls as existing powerhouse is in need of repair Construction began in the fall of 2013 with scheduled completion in 2016 Expected cost: $60 to $65 million Where We Go From Here Twin Falls Hydroelectric Powerhouse

43 Where We Go From Here Oak Creek Plant Projects In May Wisconsin Commission approved: $21 million of additional capital for plant modifications that will enable testing of up to 100% PRB coal Investment of $58 million for fuel handling and an expanded storage facility Objective is to have the flexibility to burn up to 100% PRB coal on a sustained basis Goal: enable our Oak Creek expansion units to burn both Powder River Basin (PRB) and bituminous coal

44 Where We Go From Here Amended Michigan Settlement Entered into an agreement in March with the Michigan Governor, Attorney General of Michigan, MPSC Staff and owners of the two iron ore mines in the Upper Peninsula (UP) of Michigan Wisconsin Electric retains ownership of Presque Isle Power Plant and its electric distribution assets in the UP Iron ore mines have entered into long-term contracts to purchase power If requested, would either invest in and/or purchase power from a new power plant (which would enable the retirement of the Presque Isle plant) WEC would potentially create a new Michigan only subsidiary for our current UP customers System Support Resource (SSR) payments no longer in effect

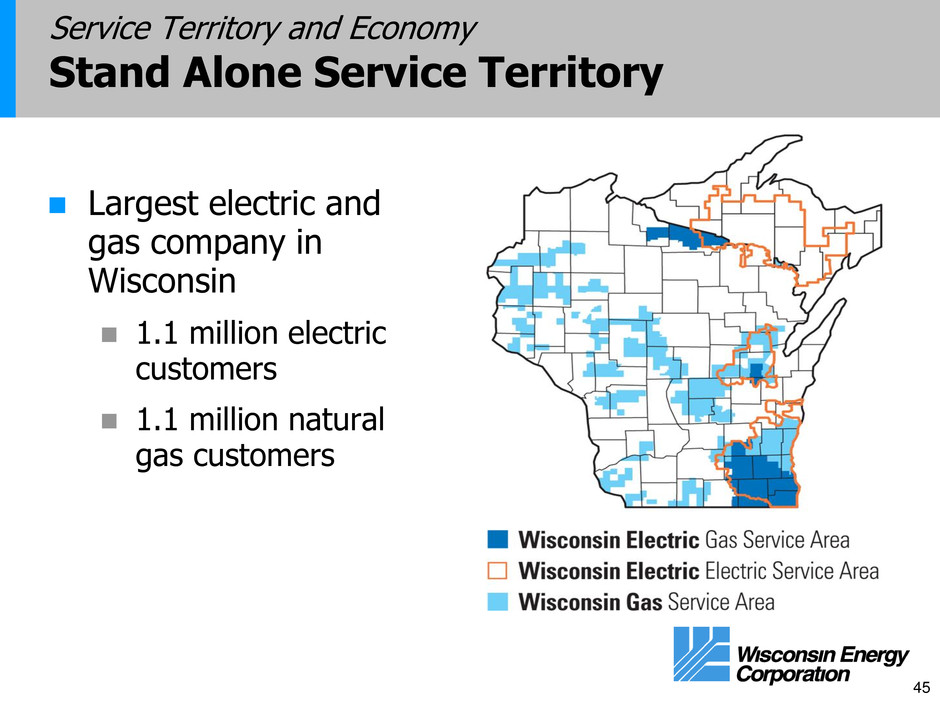

45 Largest electric and gas company in Wisconsin 1.1 million electric customers 1.1 million natural gas customers Service Territory and Economy Stand Alone Service Territory

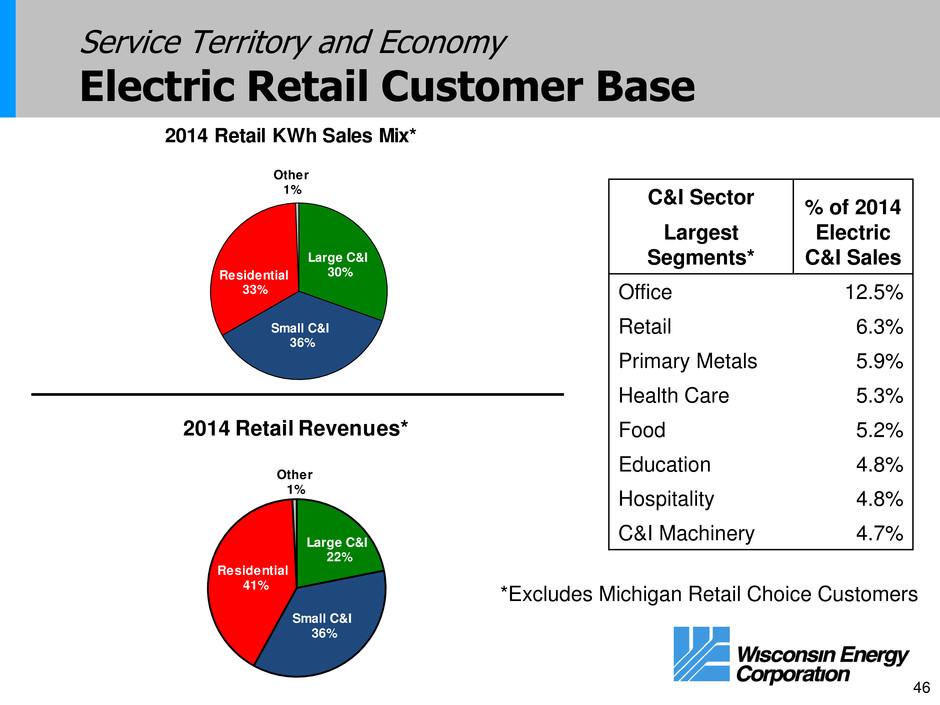

46 Service Territory and Economy Electric Retail Customer Base Large C&I 30% Small C&I 36% Residential 33% Other 1% 2014 Retail KWh Sales Mix* C&I Sector Largest Segments* % of 2014 Electric C&I Sales Office 12.5% Retail 6.3% Primary Metals 5.9% Health Care 5.3% Food 5.2% Education 4.8% Hospitality 4.8% C&I Machinery 4.7% Large C&I 22% Small C&I 36% Residential 41% Other 1% 2014 Retail Revenues* *Excludes Michigan Retail Choice Customers

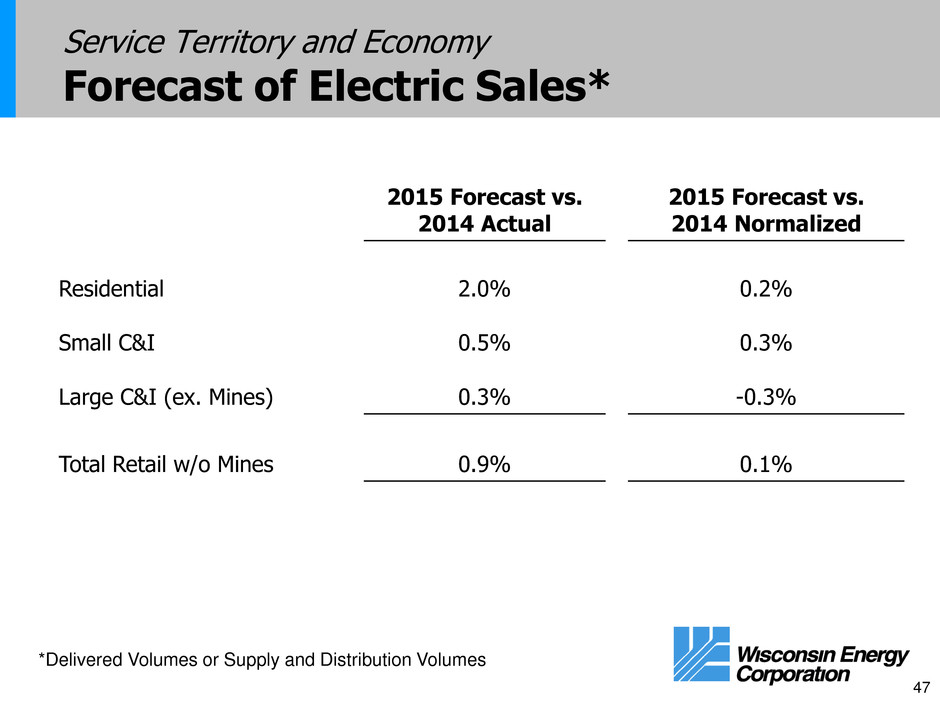

47 Service Territory and Economy Forecast of Electric Sales* 2015 Forecast vs. 2014 Actual 2015 Forecast vs. 2014 Normalized Residential 2.0% 0.2% Small C&I 0.5% 0.3% Large C&I (ex. Mines) 0.3% -0.3% Total Retail w/o Mines 0.9% 0.1% *Delivered Volumes or Supply and Distribution Volumes

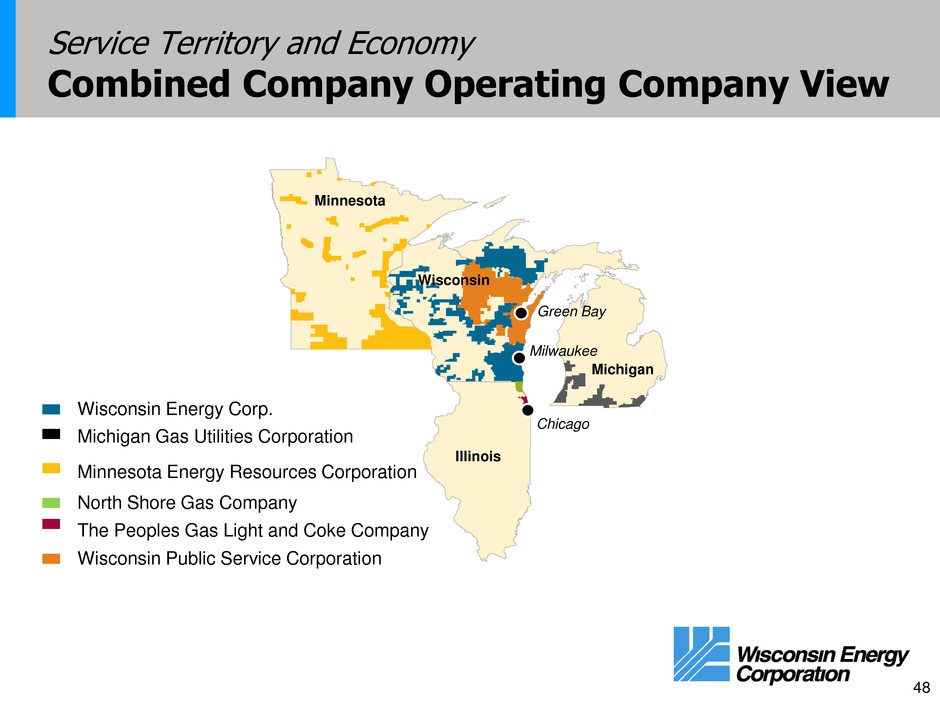

48 Chicago Green Bay Milwaukee Service Territory and Economy Combined Company Operating Company View Michigan Gas Utilities Corporation Wisconsin Energy Corp. Minnesota Energy Resources Corporation North Shore Gas Company The Peoples Gas Light and Coke Company Wisconsin Public Service Corporation Minnesota Michigan Illinois Wisconsin

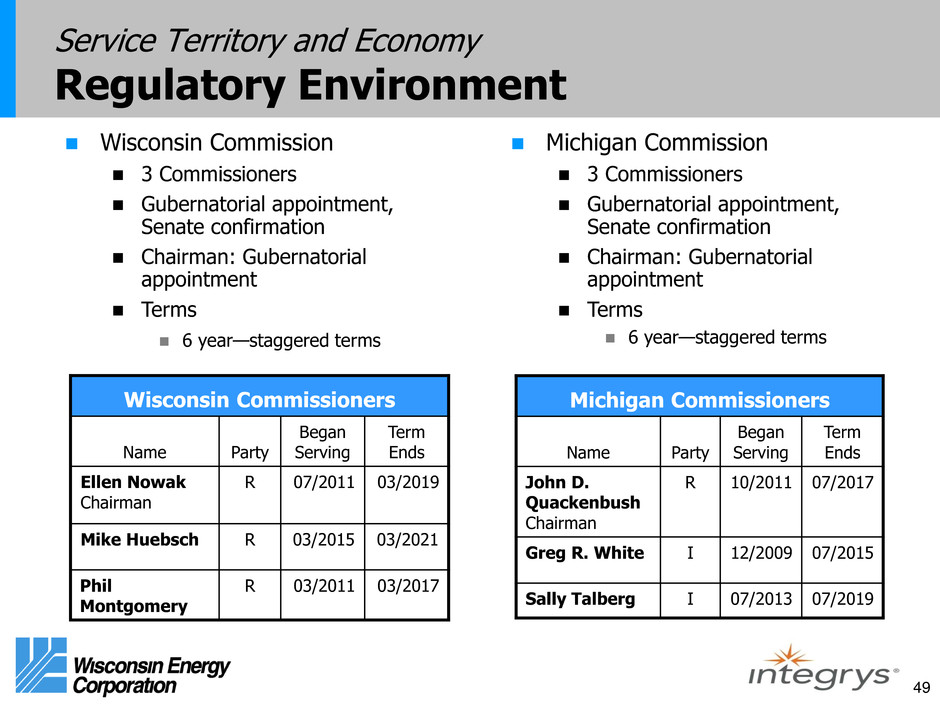

49 Wisconsin Commissioners Name Party Began Serving Term Ends Ellen Nowak Chairman R 07/2011 03/2019 Mike Huebsch R 03/2015 03/2021 Phil Montgomery R 03/2011 03/2017 Wisconsin Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commissioners Name Party Began Serving Term Ends John D. Quackenbush Chairman R 10/2011 07/2017 Greg R. White I 12/2009 07/2015 Sally Talberg I 07/2013 07/2019 Service Territory and Economy Regulatory Environment

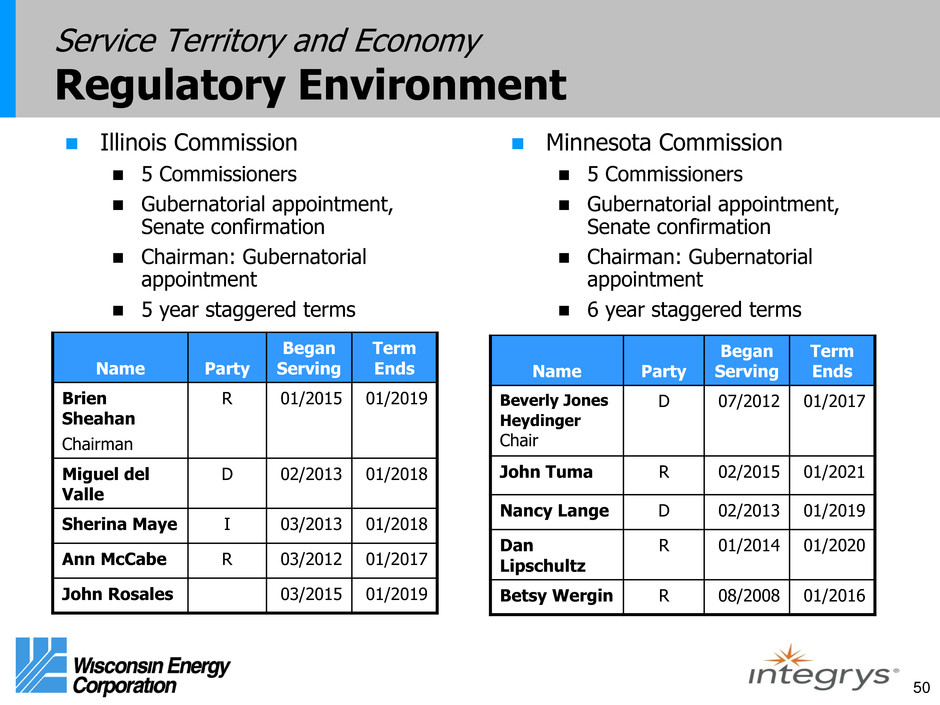

50 Service Territory and Economy Regulatory Environment Name Party Began Serving Term Ends Brien Sheahan Chairman R 01/2015 01/2019 Miguel del Valle D 02/2013 01/2018 Sherina Maye I 03/2013 01/2018 Ann McCabe R 03/2012 01/2017 John Rosales 03/2015 01/2019 Illinois Commission 5 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment 5 year staggered terms Minnesota Commission 5 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment 6 year staggered terms Name Party Began Serving Term Ends Beverly Jones Heydinger Chair D 07/2012 01/2017 John Tuma R 02/2015 01/2021 Nancy Lange D 02/2013 01/2019 Dan Lipschultz R 01/2014 01/2020 Betsy Wergin R 08/2008 01/2016

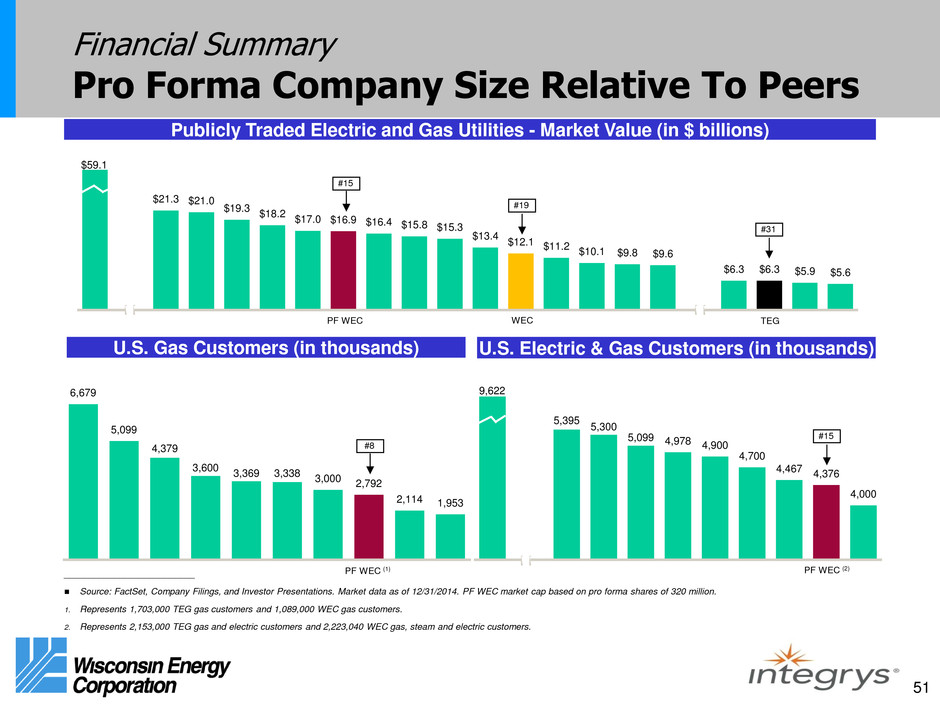

51 6,679 5,099 4,379 3,600 3,369 3,338 3,000 2,792 2,114 1,953 $21.3 $21.0 $19.3 $18.2 $17.0 $16.9 $16.4 $15.8 $15.3 $13.4 $12.1 $11.2 $10.1 $9.8 $9.6 $6.3 $6.3 $5.9 $5.6 Financial Summary Pro Forma Company Size Relative To Peers Publicly Traded Electric and Gas Utilities - Market Value (in $ billions) U.S. Gas Customers (in thousands) U.S. Electric & Gas Customers (in thousands) __________________________ Source: FactSet, Company Filings, and Investor Presentations. Market data as of 12/31/2014. PF WEC market cap based on pro forma shares of 320 million. 1. Represents 1,703,000 TEG gas customers and 1,089,000 WEC gas customers. 2. Represents 2,153,000 TEG gas and electric customers and 2,223,040 WEC gas, steam and electric customers. #19 #15 $59.1 #31 5,395 5,300 5,099 4,978 4,900 4,700 4,467 4,376 4,000 9,622 #15 #8 PF WEC (2) PF WEC (1) PF WEC WEC TEG

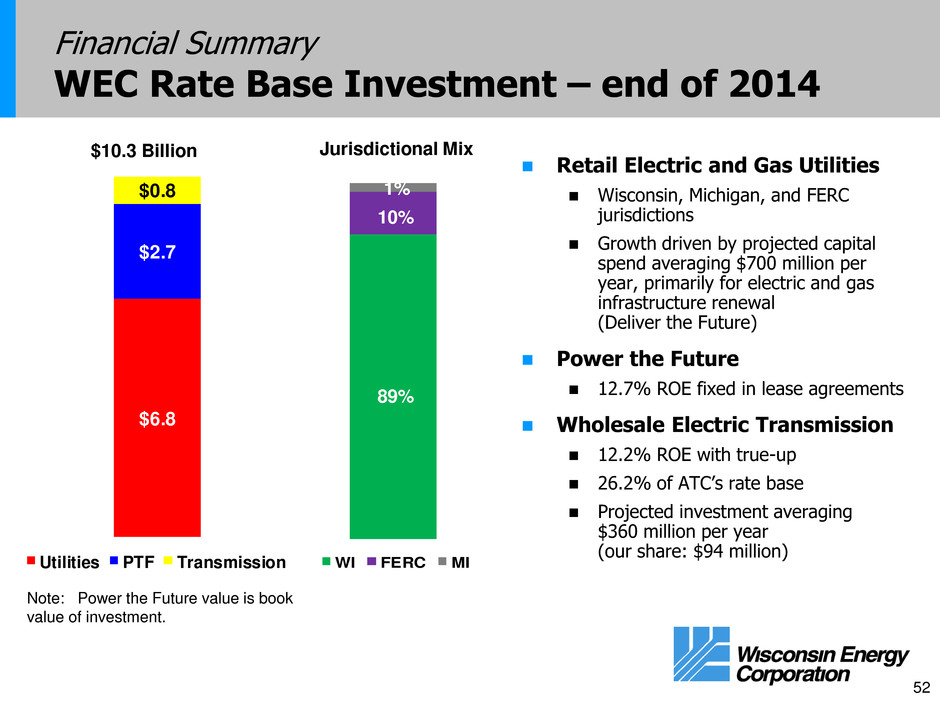

52 Retail Electric and Gas Utilities Wisconsin, Michigan, and FERC jurisdictions Growth driven by projected capital spend averaging $700 million per year, primarily for electric and gas infrastructure renewal (Deliver the Future) Power the Future 12.7% ROE fixed in lease agreements Wholesale Electric Transmission 12.2% ROE with true-up 26.2% of ATC’s rate base Projected investment averaging $360 million per year (our share: $94 million) Financial Summary WEC Rate Base Investment – end of 2014 WI FERC MI Note: Power the Future value is book value of investment. Jurisdictional Mix 89% 10% 1% $10.3 Billion $6.8 $2.7 $0.8 Utilities PTF Transmission

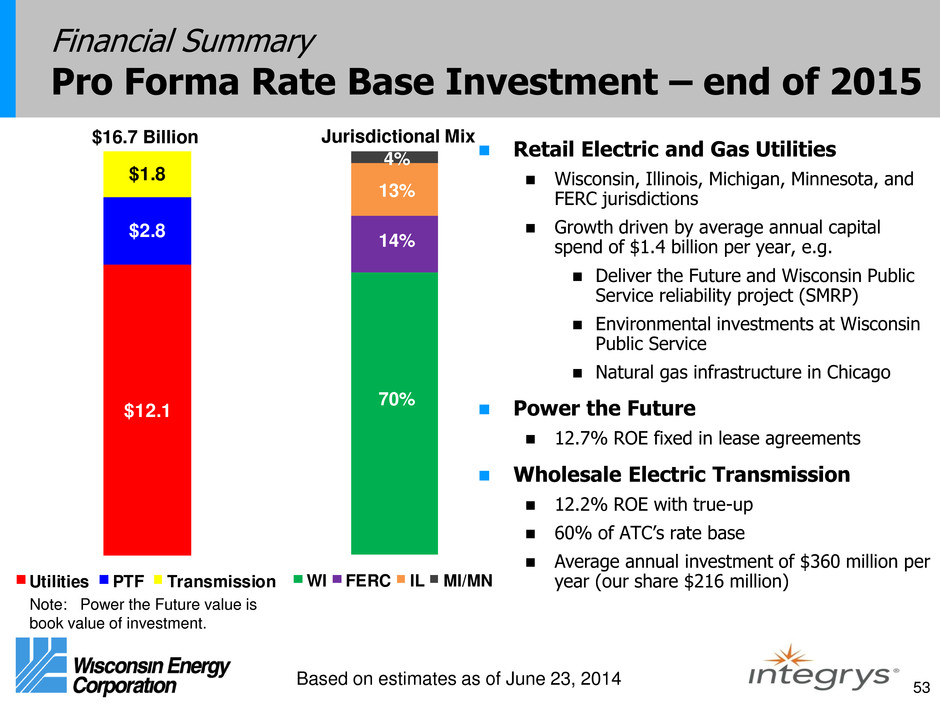

53 WI FERC IL MI/MN $12.1 $2.8 $1.8 Utilities PTF Transmission Financial Summary Pro Forma Rate Base Investment – end of 2015 Note: Power the Future value is book value of investment. $16.7 Billion Retail Electric and Gas Utilities Wisconsin, Illinois, Michigan, Minnesota, and FERC jurisdictions Growth driven by average annual capital spend of $1.4 billion per year, e.g. Deliver the Future and Wisconsin Public Service reliability project (SMRP) Environmental investments at Wisconsin Public Service Natural gas infrastructure in Chicago Power the Future 12.7% ROE fixed in lease agreements Wholesale Electric Transmission 12.2% ROE with true-up 60% of ATC’s rate base Average annual investment of $360 million per year (our share $216 million) Jurisdictional Mix 70% 14% 13% 4% Based on estimates as of June 23, 2014

54 Financial Summary Dividend Parity – Illustrative Example (based on current dividend rates per share) ___________________________ 1. For illustrative purposes, assumes Wisconsin Energy’s 10 trading day average closing price at the effective merger close date is equal to Wisconsin Energy’s closing stock price as of February 17, 2015. Per Share DIVIDEND EXCHANGE RATIO Wisconsin Energy 10 trading day average closing price at effective merger close date (1) $51.01 x Stock consideration exchange ratio 1.128x = Value of stock consideration $57.54 + Value of cash consideration $18.58 = Total transaction consideration $76.12 / Wisconsin Energy 10 trading day average closing price at effective merger close date (1) $51.01 = Dividend Exchange Ratio 1.492x ADJUSTED DIVIDEND Current Integrys dividend $2.72 ÷ Dividend Exchange Ratio 1.492x Implied Wisconsin Energy adjusted dividend $1.82 Current Wisconsin Energy dividend $1.69 Wisconsin Energy dividend uplift for parity $0.13 or 7.9%

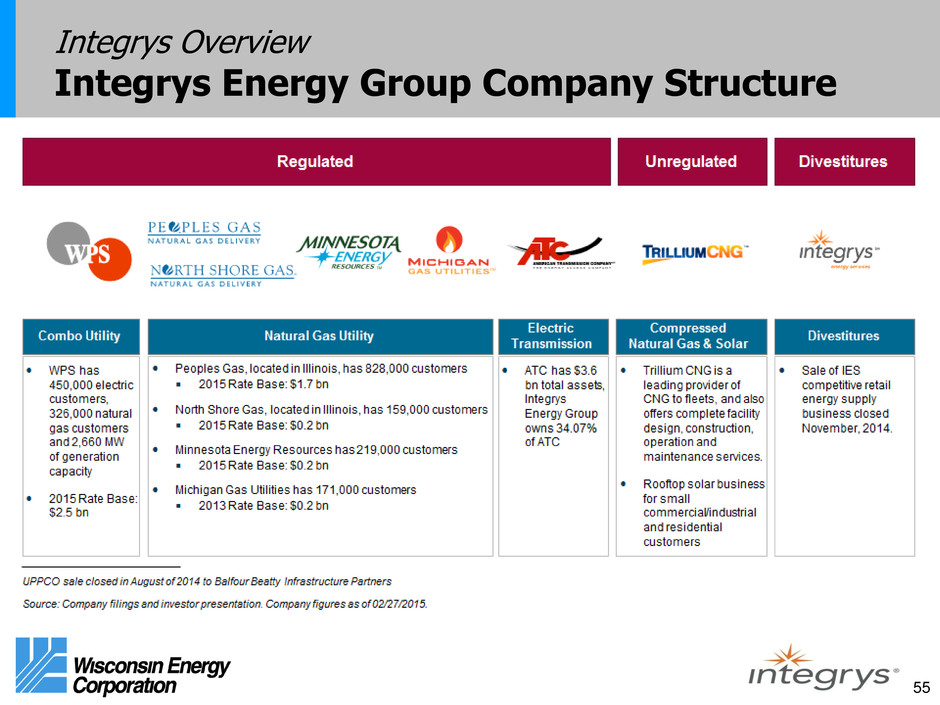

55 Integrys Overview Integrys Energy Group Company Structure

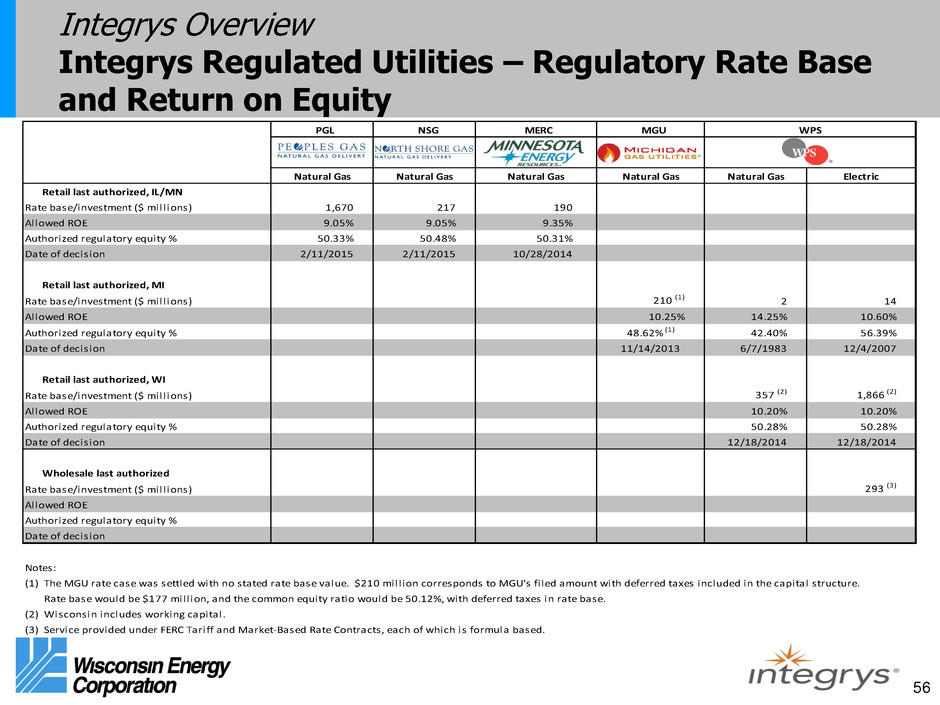

56 Integrys Overview Integrys Regulated Utilities – Regulatory Rate Base and Return on Equity Retail last authorized, IL/MN Rate base/investment ($ mill ions) 1,670 217 190 Allowed ROE 9.05% 9.05% 9.35% Authorized regulatory equity % 50.33% 50.48% 50.31% Date of decision 2/11/2015 2/11/2015 10/28/2014 Retail last authorized, MI Rate base/investment ($ mill ions) 210 (1) 2 14 Allowed ROE 10.25% 14.25% 10.60% Authorized regulatory equity % 42.40% 56.39% Date of decision 6/7/1983 12/4/2007 Retail last authorized, WI Rate base/investment ($ mill ions) 357 (2) 1,866 (2) Allowed ROE 10.20% 10.20% Authorized regulatory equity % 50.28% 50.28% Date of decision 12/18/2014 12/18/2014 Wholesale last authorized Rate base/investment ($ mill ions) 293 (3) Allowed ROE Authorized regulatory equity % Date of decision Notes: (1) The MGU rate case was settled with no stated rate base value. $210 mill ion corresponds to MGU's fi led amount with deferred taxes included in the capital structure. Rate base would be $177 mill ion, and the common equity ratio would be 50.12%, with deferred taxes in rate base. (2) Wisconsin includes working capital. (3) Service provided under FERC Tariff and Market-Based Rate Contracts, each of which is formula based. 48.62% (1) 11/14/2013 Natural Gas Natural Gas Natural Gas Natural Gas Natural Gas Electric PGL NSG MERC MGU WPS

57 Non-GAAP Earnings Measures Adjusted earnings (non-GAAP earnings), which generally exclude nonoperational items that are not associated with the company’s ongoing operations, are provided as a complement to, and should not be considered as an alternative to, reported earnings presented in accordance with GAAP. The excluded items are not indicative of the company’s operating performance. Therefore, we believe that the presentation of adjusted earnings is relevant and useful to investors to understand Wisconsin Energy’s operating performance. Management uses such measures internally to evaluate the company’s performance and manage its operations.