Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Voya Financial, Inc. | d937495d8k.htm |

| EX-99.1 - EX-99.1 - Voya Financial, Inc. | d937495dex991.htm |

Voya Financial

2015 Investor Day

June 2, 2015

Exhibit 99.2 |

Darin Arita

Senior Vice President, Investor Relations

Introduction |

This

presentation

and

the

remarks

made

orally

contain

forward-looking

statements.

Forward-looking

statements

include

statements

relating

to

future

developments

in

our

business

or

expectations

for

our

future

financial

performance

and

any

statement

not

involving

a

historical

fact.

Forward-looking

statements

use

words

such

as

“anticipate,”

“believe,”

“estimate,”

“expect,”

“intend,”

“plan,”

“projected”,

“target,”

and

other

words

and

terms

of

similar

meaning

in

connection

with

a

discussion

of

future

operating

or

financial

performance.

In

particular,

our

2018

Adjusted

ROE

and

Adjusted

ROC

targets,

and

all

other

statements

about

our

financial

targets

and

expectations,

are

forward-looking

statements.

Actual

results,

performance

or

events

may

differ

materially

from

those

projected

in

any

forward-looking

statement

due

to,

among

other

things,

(i)

general

economic

conditions,

particularly

economic

conditions

in

our

core

markets,

(ii)

performance

of

financial

markets,

including

emerging

markets,

(iii)

the

frequency

and

severity

of

insured

loss

events,

(iv)

mortality

and

morbidity

levels,

(v)

persistency

and

lapse

levels,

(vi)

interest

rates,

(vii)

currency

exchange

rates,

(viii)

general

competitive

factors,

(ix)

changes

in

laws

and

regulations,

including

those

relating

to

the

use

and

accreditation

of

captive

reinsurance

entities

and

those

made

pursuant

to

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act

or

the

U.S.

Department

of

Labor’s

proposed

rules

and

exemptions

pertaining

to

the

fiduciary

status

of

providers

of

investment

advice

and

(x)

changes

in

the

policies

of

governments

and/or

regulatory

authorities.

Factors

that

may

cause

actual

results

to

differ

from

those

in

any

forward-looking

statement

also

include

those

described

in

“Risk

Factors,”

“Management’s

Discussion

and

Analysis

of

Results

of

Operations

and

Financial

Condition—Trends

and

Uncertainties”

and

“Business—Closed

Blocks—Closed

Block

Variable

Annuity”

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2014

as

filed

with

the

Securities

and

Exchange

Commission

(“SEC”)

on

February

27,

2015,

and

our

Quarterly

Report

on

Form

10-Q

for

the

three

months

ended March 31, 2015, as filed with the SEC on May 8, 2015.

This

presentation

and

the

remarks

made

orally

contain

certain

non-GAAP

financial

measures.

Non-GAAP

measures

include

Operating

Earnings,

Adjusted

Operating

Earnings,

Ongoing

Business

Adjusted

Operating

Earnings,

Ongoing

Business

Adjusted

Operating

Return

on

Equity,

Adjusted

Operating

Return

on

Capital,

Ongoing

Business

Adjusted

Return

on

Capital,

Operating

Margin,

and

debt-to-capital

ratio.

Information

regarding

these

and

other

non-GAAP

financial

measures,

including

reconciliations

to

the

most

directly

comparable

GAAP

financial

measures,

is

provided

in

our

quarterly

earnings

press

releases

and

in

our

quarterly

investor

supplements,

all

of

which

are

available

at

the

Investor

Relations

section of Voya Financial’s website at investors.voya.com.

Forward-Looking and Other Cautionary Statements

3 |

Agenda

4

Topic

Presenter

Welcome

Darin Arita

State of the Company and Forward Vision

Rod Martin

ROE / ROC Walk and Incremental Investments

Alain Karaoglan

Capital Generation and Management

Ewout Steenbergen

Q&A with Martin, Karaoglan, and Steenbergen

Annuities / Retirement

Q&A with Nelson

Alain Karaoglan / Charles Nelson

Break

Investment Management

Q&A with Becker

Jeff Becker

Insurance Solutions

Q&A with Smith

Mike Smith

Closing Remarks

Rod Martin

General Q&A

All Speakers

Cocktail Reception |

Rod

Martin Chairman and Chief Executive Officer

State of the Company

and Forward Vision |

Financial Update Announced Today

6

13.5%

$750

million

14.5%

to

Revised 2018 Ongoing Business

Adjusted Operating ROE Target

Additional Share Repurchase

Authorization |

Investor Day Overall Key Takeaways

7

Team Delivered on the IPO Plan and Remains Focused on Execution

Strong and Experienced Leadership

Each Business has a Strong Value Proposition that Together can

Differentiate Voya’s Value Proposition |

CEO Key

Themes 8

Evolving to Deliver Greater Value for Customers and Shareholders

2

1

Management Team has Executed Since IPO |

ROE

target met two years ahead of schedule Significant Progress as a Public

Company 9

Capital generation and share repurchases

Rebrand

Independent Board

Public float increased

Credit ratings upgrade |

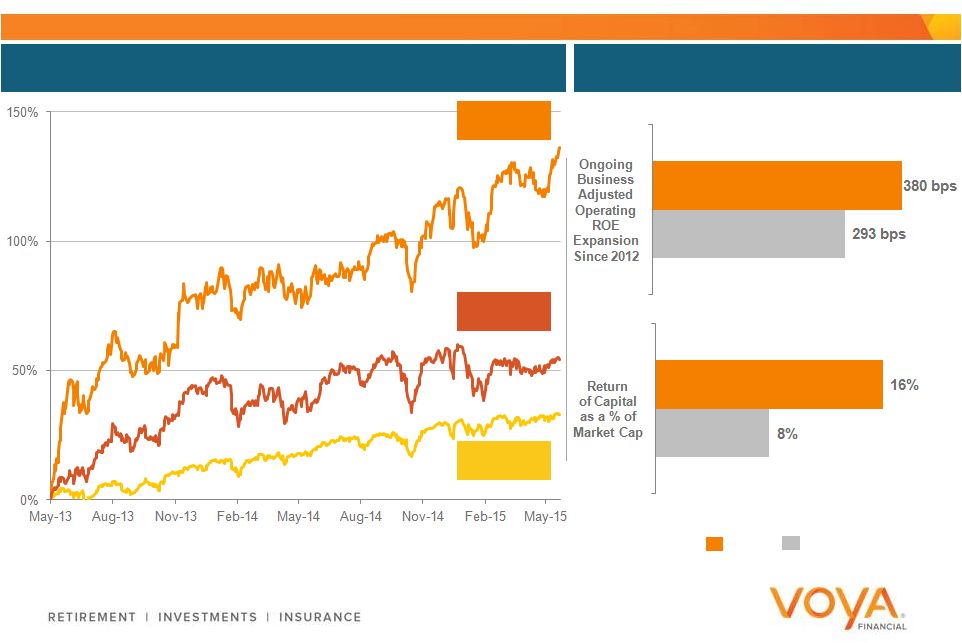

Significant Value Created for Shareholders

10

Voya Stock Performance Since IPO

Recent Financial Performance

Source: Bloomberg as of 5/26/2015

1.

Peers include AMP, LNC, MET, PFG, PRU

2.

Adjusts for items not expected to recur and excludes closed blocks

3.

Estimated

4.

Measured by cumulative share repurchase and dividends as a percentage of average

equity market value since 1/1/2014 VOYA

+135%

Peers

+52%¹

S&P 500

+32%

4

Peers

1

Voya

2

3 |

CEO

Key Themes 11

Evolving to Deliver Greater Value for Customers and Shareholders

2

1

Management Team has Executed since IPO |

Opportunity to Grow as Individual Retirement Needs and

Demands Continue to Increase

12 |

by 2018

Current

Evolving to Meet Increasing Individual Needs and Demands

13

Each business has its

own view of the

customer

Customer at the center

Complex IT

infrastructure

Simplified IT

infrastructure

Basic data analytics

capabilities

Advanced data

analytics capabilities

Product focus

Solutions focus |

14

Our metrics remain in place

Risk-adjusted returns

Distributable cash flow

Sales at or above target IRRs

Empower

Employees

Enhance Value

via Continuous

Improvement

Front-line

Problem

Solving

Remove

Silos

Improve

Customer

Experience

Top-line focus

Ongoing Cultural Transformation Enables Value Creation

Value Creation

Focus |

Customer Benefits: Next Generation Experiences and Solutions

15

Voya as a

Lifetime

Partner

Simple,

Actionable,

and

Tailored

Solutions

Effortless

Experience |

Shareholder Benefits: Multiple Drivers for Increased Value

16

Expanded

ROE

Accelerated

Earnings

Growth

Increased

Free Cash

Flow

Differentiated

Value

Proposition

$350

million

Incremental

Investment |

CEO

Key Themes 17

Evolving to Deliver Greater Value for Customers and Shareholders

2

1

Management Team has Executed since IPO |

Alain Karaoglan

Chief Operating Officer

Chief Executive Officer, Retirement and Investment Solutions

ROE / ROC Walk and

Incremental

Investments |

COO

Key Themes 19

Growth and Margin Initiatives are Key Return on Equity Drivers

2

1

Same Formula for Success

3

Incremental Investments will Increase Capabilities and Efficiency

|

Used

IPO Blueprint to Form New ROC / ROE Improvement Plan 20

1

2

3

Collaborate with key members and partners responsible for initial

ROC / ROE walk

Analyzed strengths and areas of improvement by business

Created ROC walk by business |

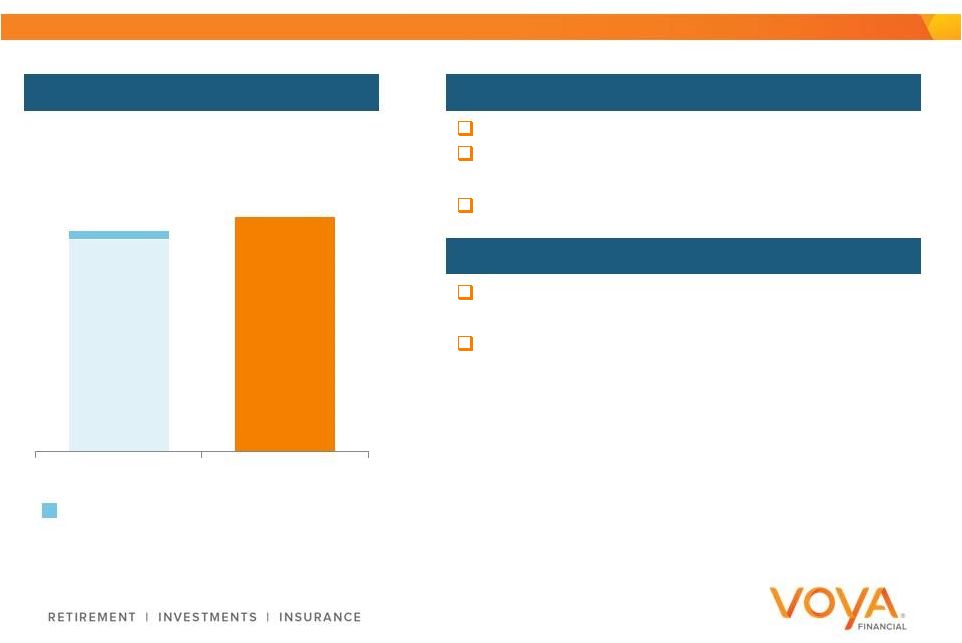

Continued Execution of Return on Equity Improvement

21

Each business and

function contributes to

the ROE progression

Each initiative targets

one of three categories:

Growth, Margin, Capital

More than 20 strategic

initiatives

monitored

and

actively tracked

2018 Ongoing

Business

Adjusted

Operating ROE

Target of

13.5 –

14.5% |

COO

Key Themes 22

Growth and Margin Initiatives are Key Return on Equity Drivers

2

1

Same Formula for Success

3

Incremental Investments will Increase Capabilities and Efficiency

|

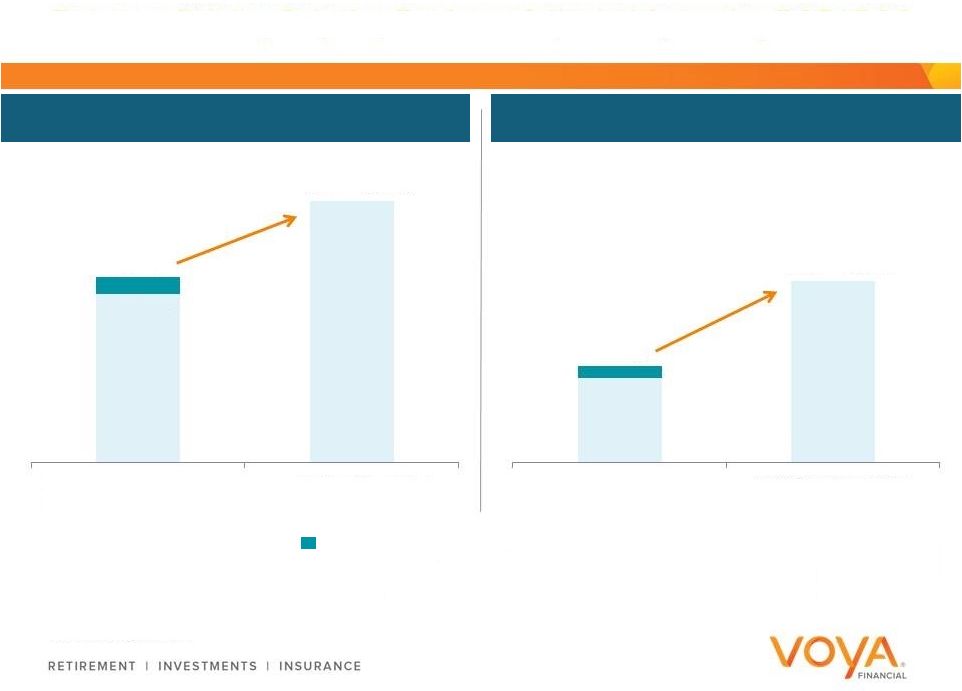

Focus

on Driving Ongoing Business Adjusted Operating ROE / ROC Ongoing

Business Adjusted

Operating ROE Goal

Ongoing

Business Adjusted

Operating ROC Goal

23

13.5 –

14.5%

11.5 –

12.5%

12.1%

9.9%

Items that we do not expect to recur at the same levels

1.

Ongoing Business includes Retirement, Annuities, Investment Management, Individual

Life, and Employee Benefits segments 2.

Ongoing

Business

adjusted

operating

earnings

is

calculated

using

the

operating

earnings

(loss)

before

income

taxes

for

the

Ongoing

Business,

excluding

DAC/VOBA

unlocking,

and

the

gain

on

a

reinsurance

recapture in 2014. Ongoing Business adjusted operating ROE is then calculated by

dividing the after-tax adjusted operating earnings (loss) (using a pro forma effective tax rate of 32% effective with 1Q’15 and 35%

for all prior periods and applying a pro forma allocation of interest expense) by

the average capital allocated to the Ongoing Business reflecting an allocation of pro forma debt. Assumes debt-to-capital ratio of 25%

for all periods presented, and reflects the actual weighted average pre-tax

interest rate for all periods 3.

We calculate Ongoing Business adjusted operating return on capital by dividing

Ongoing Business adjusted operating earnings before interest and after income taxes by average capital

allocated to the Ongoing Business

11.7%

9.6%

2014 Ongoing Business

Adjusted Operating ROE

2018 Target Ongoing

Business Adjusted

Operating ROE

2014 Ongoing Business

Adjusted Operating ROC

2018 Target Ongoing

Business Adjusted

Operating ROC

3

2

1

1 |

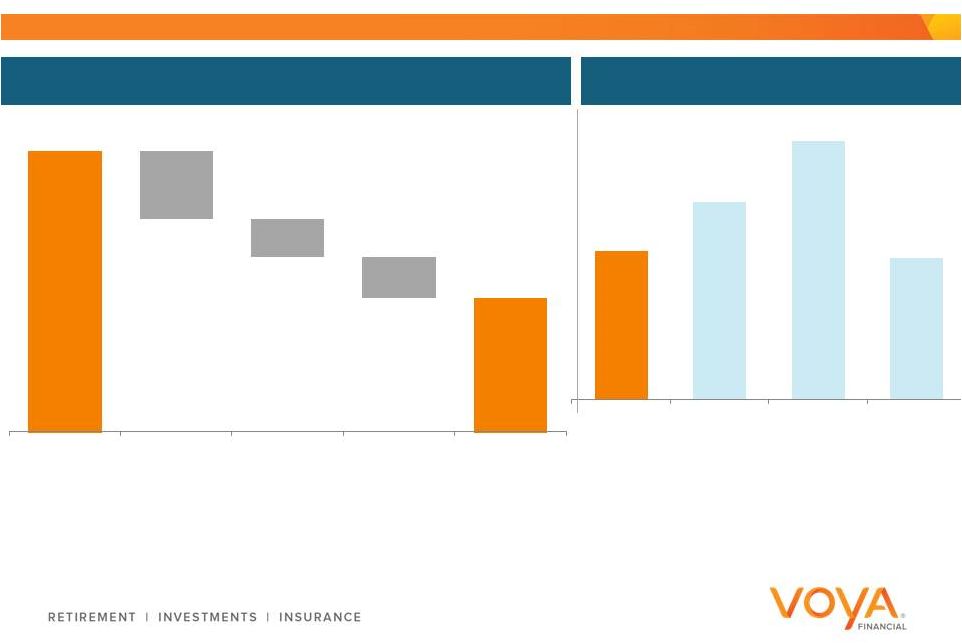

Growth

Margin

Capital

Initiatives

Category

Approx.

150 –

180bps

Approx.

40 –

60bps

Interest Rate Impact

1

Approx.

(70) –

(90)bps

Ongoing Operating

ROC Improvement

2

Total –

Ongoing Operating ROC Improvement by 2018

2

Approx.

150 –

250bps

1.

Consists of lower expected investment income due to lower portfolio yields compared

to 2014 levels in Retirement and Insurance Solutions, and expected lower net margin (investment income less credited interest)

compared to 2014 levels in Annuities

2.

Target improvement over the period of 2015 to 2018; management best estimate of

contributions from initiatives total 150-250 bps Expand Retirement

Distribution Reach

Grow Employee Benefits Mid-

market and Private Exchange

Continue to Grow Investment

Management

Leverage Cross-market

Relationships

Continue to Manage Crediting

Rates

Consolidate IT Platforms

Streamline Operations

Through Process Digitization

Migrate to Cloud Environment

In-force Management

Reinsurance Transactions

Clear Initiatives to Improve Ongoing Business Adjusted Operating

ROC

24

Approx.

50 –

80bps |

COO

Key Themes 25

Growth and Margin Initiatives are Key Return on Equity Drivers

2

1

Same Formula for Success

3

Incremental Investments will Increase Capabilities and Efficiency

|

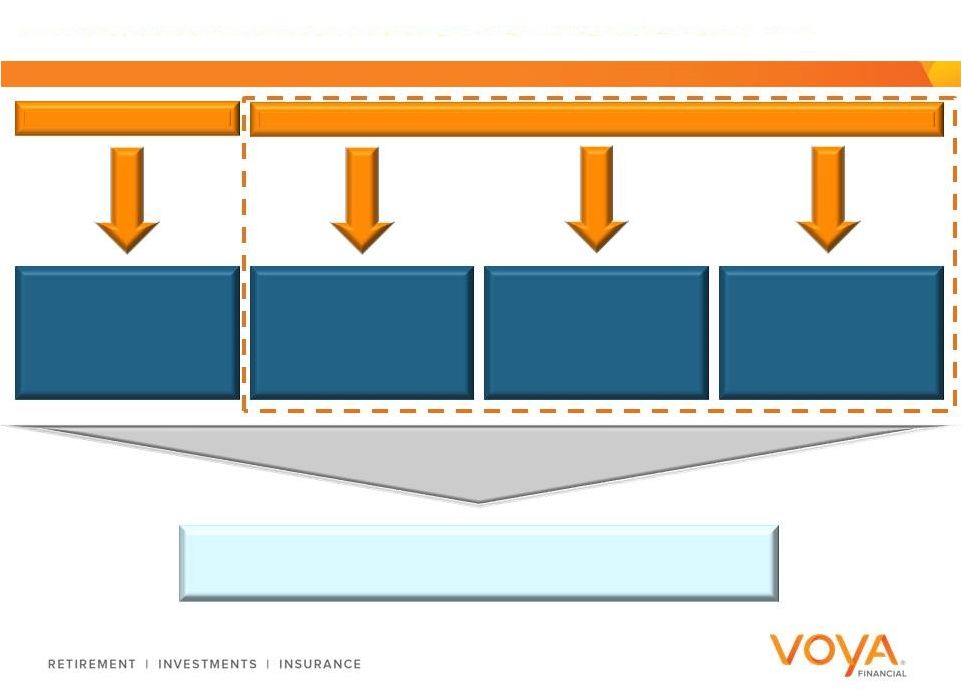

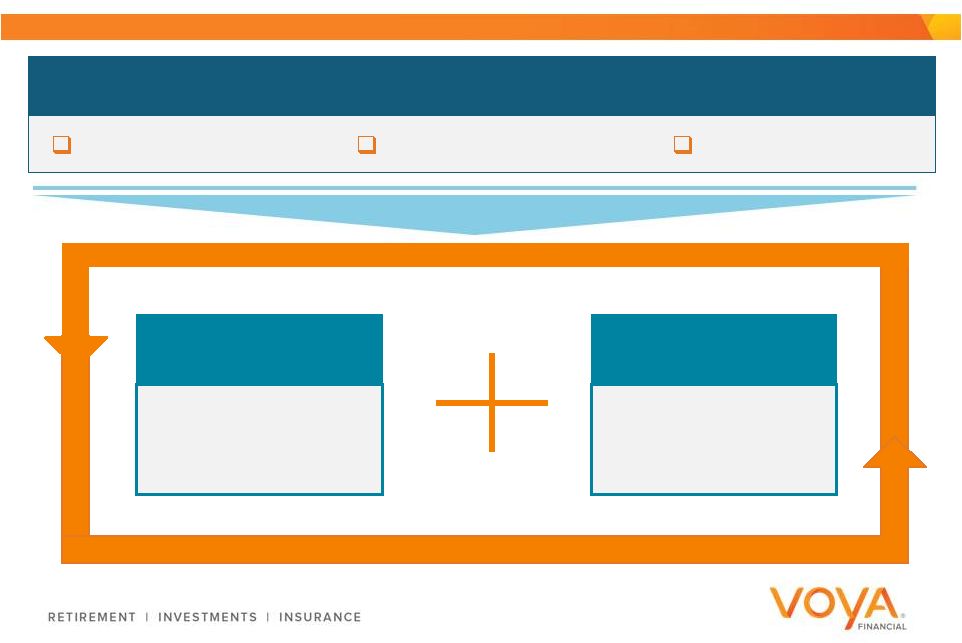

Incremental Investments to Increase Growth and Reduce Cost

Ongoing Business Adjusted Operating

ROE target of 13.5-14.5% by 2018

Ongoing Business

Initiatives

Digital &

Analytics

Cross-

enterprise

IT

Simplification

26

$350 million Incremental Investment

Ongoing Investment |

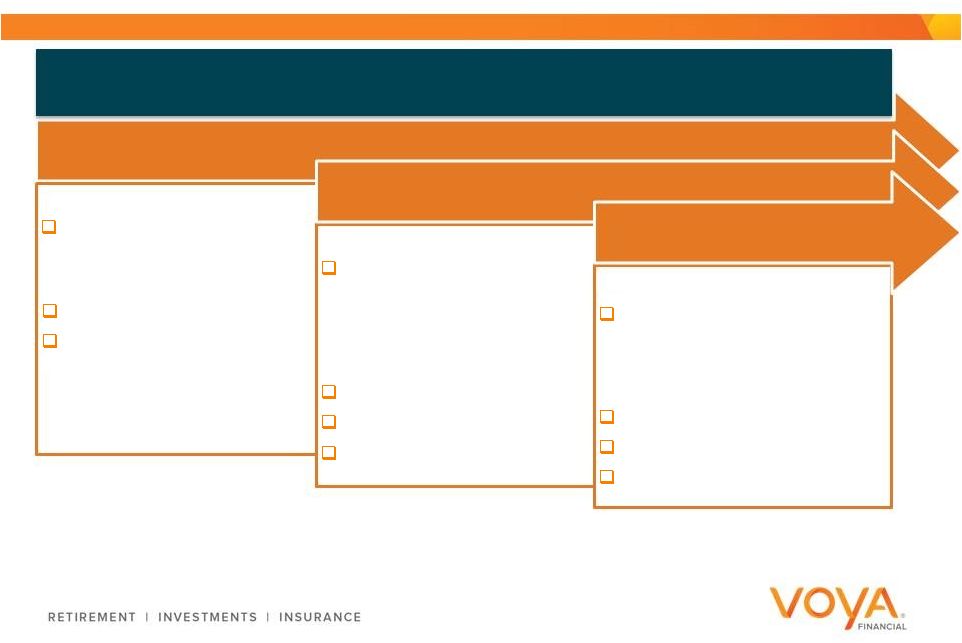

by 2018

Current

IT Simplification Will be a Key Enabler

27

Overlapping systems and

applications

Customer servicing

conducted across multiple

platforms

Older infrastructure expensive

to maintain

Streamlined systems and

fewer applications

Customer servicing

coordinated on a common

platform

Simplified infrastructure

reduces cost

Complex technology

infrastructure

Simplified IT platform |

Digital and Analytics Creating Efficiency and Growth

28

Partial digitization

Basic data insights

Product development and

strategy mostly reside within

business silos

End-to-end digitization

Data-driven culture centered

on customer

Integrate solutions with a

common view

Emerging Capabilities

Effortless Experience

by 2018

Current |

Cross-Enterprise Initiatives Will Leverage Our Capabilities and Create

Differentiated Solutions

29

Limited cross-enterprise

collaboration

Focus on products

Businesses have individual

view of customer

Enhanced institutional

coordination

Focus on solutions

Enterprise view of customer

by 2018

Current |

COO

Key Themes 30

Growth and Margin Initiatives are Key Return on Equity Drivers

2

1

Same Formula for Success

3

Incremental Investments will Increase Capabilities and Efficiency

|

Ewout Steenbergen

Chief Financial Officer

Capital Generation and

Management |

CFO

Key Themes 32

Diligent Stewards of Capital

2

1

Potential for Greater Free Cash Flow Generation

3

Quality of Earnings Offers Potential Upside |

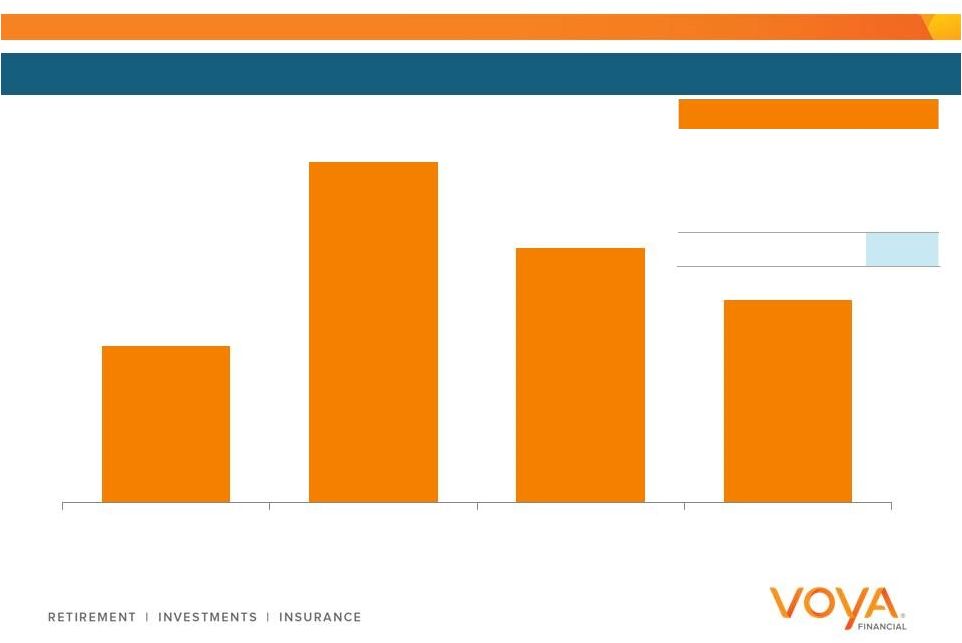

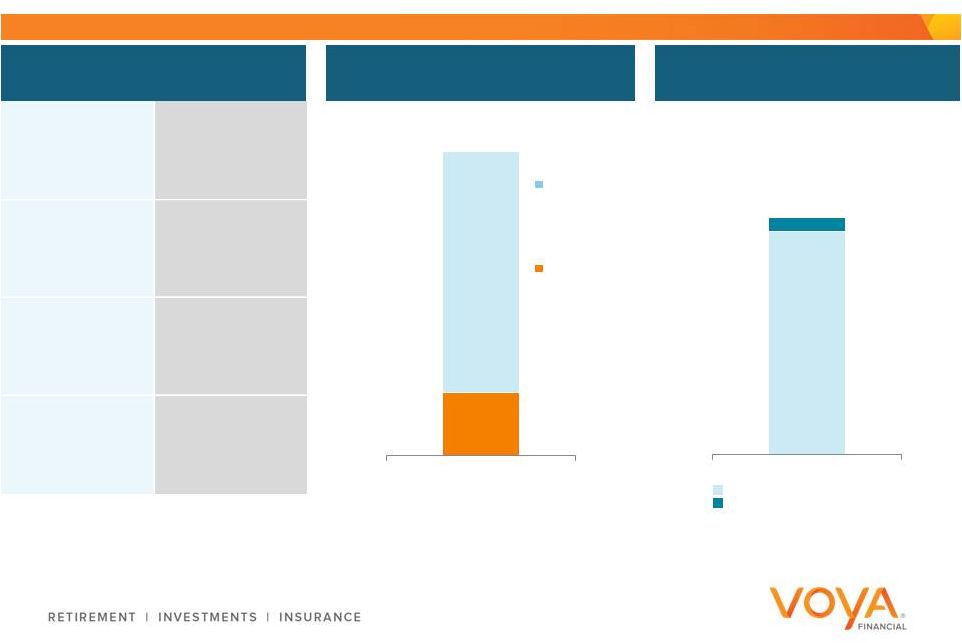

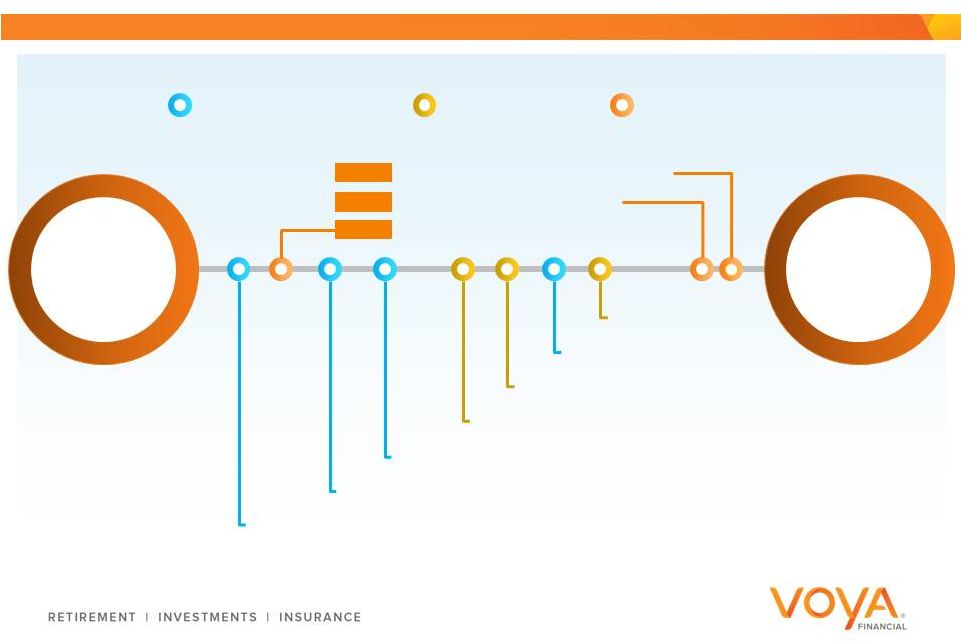

Majority of $350 Million

Investment Expected to Occur in the First Three Years

33

Investments

by

Year

($

millions)

1

Aggregate Breakdown

IT Simplification

$120

Digital & Analytics

160

Cross-enterprise

70

Total

$350

$50-70

$110-130

$80-100

$60-80

1.

Projected.

Includes

only

$350

million

incremental

investments

to

be

allocated

to

Corporate

segment

2015

2016

2017

2018 |

Key

Assumptions for ROC and ROE Improvement Plan 34

Plan Assumptions

Equity Market

Return

7.5%

equity

market

growth

Interest Rates

Forward curve for the 2015-2018 period as of December 31, 2014

Leverage

25% target debt-to-capital ratio

Capital

Slight capital increase

Tax

32% effective tax rate for Ongoing Business operating earnings

1.

Excludes dividends

1 |

Manageable Impact of Low Interest Rates on ROE and Capital

35

Impact of Flat 10-Year Treasury at

2%

Through

2018

1

2015 -

2018

Ongoing Business Adjusted

Operating Earnings Annual

Impact

(%)

(1) –

(5) %

RBC Ratio Cumulative Impact

(RBC percentage points)

(10) –

(60) points

1.

Treasury curve as of December 31, 2014. Financial impact before $350 million

incremental investment |

Retirement, Investment Management, and Employee Benefits

Generate Significant Free Cash Flow

36

Projected Free Cash Flow Conversion by Segment

1,3

Retirement

65-75%

Annuities

40-50%

Investment Management

90-100%

Individual Life

45-55%

Employee Benefits

70-80%

Ongoing

Business

2

75-85%

1.

Segment ratios based on projected segment distributable cash flow after-tax

divided by projected segment GAAP operating earnings after-tax; using 32% tax rate

2.

Ongoing Business ratio based on projected Ongoing Business distributable cash flow

after-tax divided by projected Consolidated GAAP operating earnings after-tax and after-

interest expense; using 32% tax rate

3.

Assumes no impairments factored into analysis. Does not include the effect of $350

million of incremental investments. |

Free

Cash Flow Ratio Can Increase Over Time 37

1.

Distributable cash flow after-tax divided by Consolidated GAAP operating

earnings after-tax and after-interest expense using a 32% tax rate

2.

Based on difference between actual tax payments and implied taxes on distributable

cash flow divided by Consolidated GAAP operating earnings after-tax and after-interest

expense using a 32% tax rate

Free Cash Flow Conversion Components

2015

2018

Total

Ongoing

Business

1

75-85%

75-85%

Corporate

and

Closed

Blocks

1

(20)-(30)%

(15)-(25)%

Tax

Asset

Utilization

Benefit

2

10-15%

20-30%

Total Free Cash Flow Conversion

60-70%

80-90%

Projected |

CFO

Key Themes 38

Diligent Stewards of Capital

2

1

Potential for Greater Free Cash Flow Generation

3

Quality of Earnings Offers Potential Upside |

Strong

Capital Position 39

1. Pro forma based on actual RBC ratio of 547% at March 31, 2015, adjusted to give effect to $819 million of ordinary dividends upstreamed to Voya

Financial, Inc. in May 2015 2.

Estimated combined RBC ratio primarily for our four principal U.S. insurance

subsidiaries 3.

Pro forma based on actual ratio as of March 31, 2015, adjusted to give effect to $72

million of share repurchases during 2Q’15. Based on U.S. GAAP capital (adjusted to exclude minority interest and AOCI), and ignores the 100% and 25% equity treatment afforded to subordinated debt by S&P and Moody’s, respectively

4. Holding company liquidity includes cash, cash equivalents, and short-term investments. Pro forma based on actual holding company liquidity as of March 31, 2015, adjusted to give effect to $819 million of ordinary dividends upstreamed to Voya Financial, Inc. in May 2015, $21 million of external interest payments in May 2015, $72 million of share repurchases

during 2Q’15, and repayment of net inter-company borrowings of $499

million to/from operating companies

5. Target of 24-month holding company liquidity of $450 million 6. Authorization expires June 30, 2016 Repurchase Authorization ($ million) Holding Co. Working Capital Above Target 4,5 Estimated Statutory Surplus in Excess of 425% RBC Level 1,2 $1,150 $239 5/26/15 5/26/15 Pro Forma Excess Capital ($ million) $911 $750 $58 Key Capital Metrics RBC ratio 1,2 489% Debt-to-Capital ratio 3 22.0% Holding Company liquidity 1,4 $689 million Off-balance sheet capacity $500 million of nominal contingent capital $808 Remaining capacity on prior authorization New share repurchase authorization 6 |

Deploy

Excess Capital Prudently 40

Share

repurchases

Dividends

Bolt-on M&A |

CFO

Key Themes 41

Diligent Stewards of Capital

2

1

Potential for Greater Free Cash Flow Generation

3

Quality of Earnings Offers Potential Upside |

Implied

Ongoing Business Price-to-Earnings Ratio is Below Peers With Minimal

Variable Annuities Earnings and Similar Business Mix 42

Implied Ongoing Stock Price

Ongoing P/E Peer Comparison

1. As of 5/26/2015 2. Based on sell-side analyst consensus estimates 3. Based on holding company liquidity in excess of $450 million target, estimated statutory surplus in excess of 425% RBC, $21 million of external

interest payment in May 2015, and most recent broker estimate of value of

common stock warrants held by ING Group 4.

Blended price-to-forward earnings of peers with less than 15% of pre-tax

operating earnings from variable annuities with living benefit guarantees, including AMP and PFG 5. Blended price-to-forward earnings of peers including AMG, AB, BLK, EV, FII, BEN, IVZ, JNS, LM, TROW, and WDR

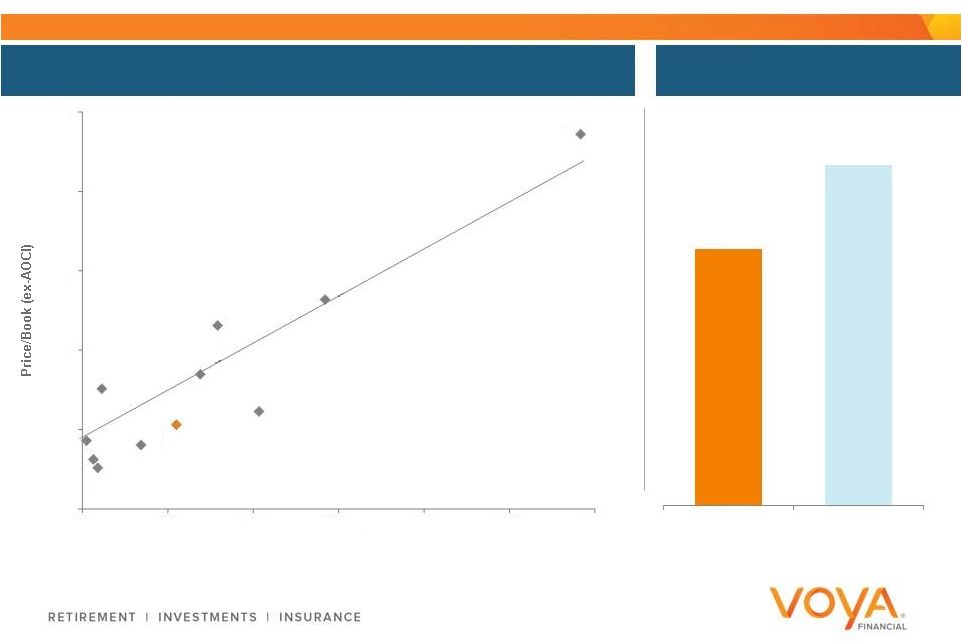

6. Blended price-to-forward earnings of peers including LNC, MET and PRU 1 2 2 3 4 5 6 $45.77 $6.24 $3.49 $3.74 $32.30 Current Voya Stock Price Excess Implied Ongoing Business 9.5 x 12.6 x 16.5 x 9.0 x Voya Retirement and Investment Management Companies Investment Management VA Companies Insurance and Companies DTA CBVA Capital |

1.

Current stock price adjusted for DTA, CBVA, excess capital (which has been reduced

by the full after-tax amount of $350 million of incremental investments), and residual debt. Assumes 25% debt-to-capitalization

ratio; residual debt based on allocated interest expense and peer forward multiple.

ROE based on consensus analyst estimates. 2.

Price-to-book value = adjusted operating equity value divided by equity

allocated to Ongoing Business 3.

Based on regression

.

43

2015E Return on Equity (ex-AOCI)

Current Price-to-Book Value Over ROE

Implied Ongoing Price-to-Book Value is Below Regression

Implied Ongoing Price-to-

Book Value

3

2

1.47 x

1.23 x

AMP

LNC

MET

PFG

PRU

UNM

SFG

RGA

TMK

PRI

VOYA Implied

Ongoing

Business

1

0.7

1.2

1.7

2.2

2.7

3.2

10%

12%

14%

16%

18%

20%

22%

Implied Ongoing

P/B Multiple

P/B Multiple Based

on 2015E ROE |

CFO

Key Themes 44

Diligent Stewards of Capital

2

1

Potential for Greater Free Cash Flow Generation

3

Quality of Earnings Offers Potential Upside |

Alain Karaoglan

Chief Operating Officer

Chief Executive Officer, Retirement and Investment Solutions

Annuities |

Annuities Key Themes

46

Enhanced Product Solutions to Drive Return on Capital

2

1

Dependable Solutions Partner for a Diverse Distribution Network

3

Positioned to Meet the Income Needs of Customers |

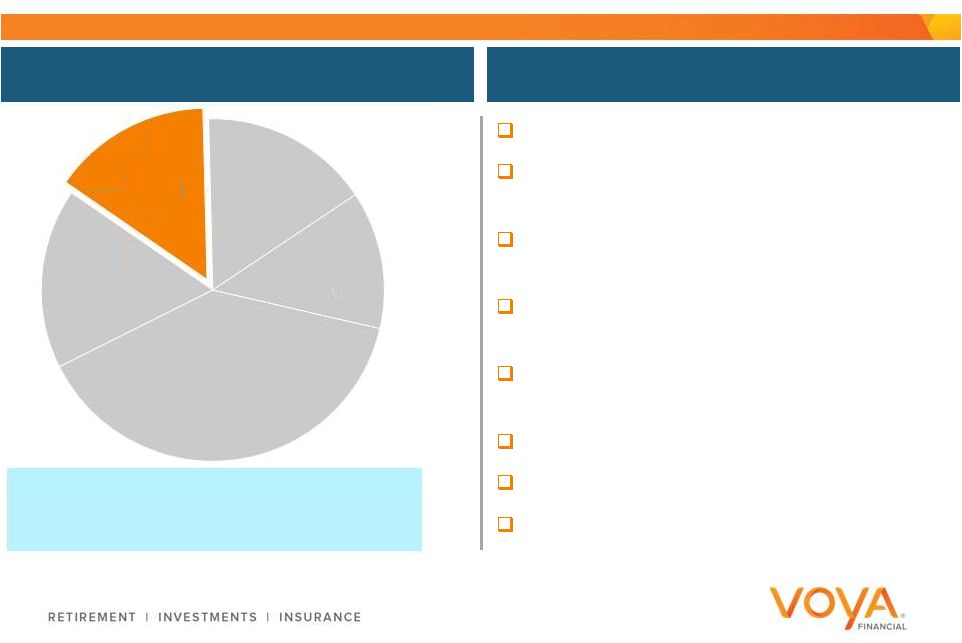

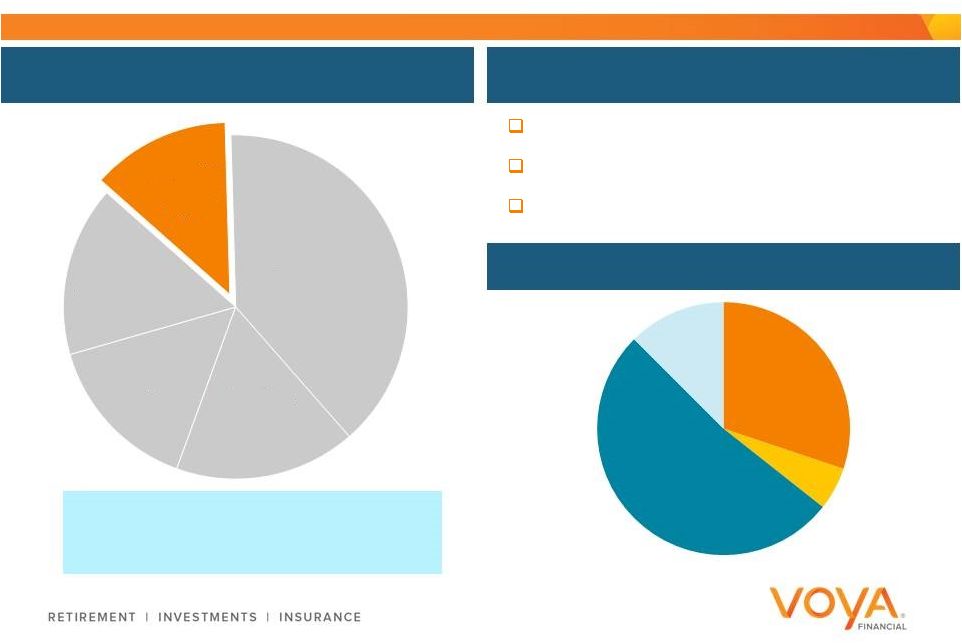

Diverse Distribution

Leveraging Expansive Product Portfolio 1Q’15 TTM Adjusted Operating Earnings

Pre-Tax Contribution

160,000 potential producers

$27 billion AUM

400,000 policies

Comprehensive solution set

–

Fixed Indexed Annuities (FIA)

–

Investment-Only Variable

Annuities

–

Single Premium Immediate

Annuities (SPIA)

–

Mutual Fund Custodial Accounts

Business Highlights

47

$243

million

in

TTM

Annuities

adjusted operating earnings

1.

Trailing twelve months

2.

Annuities AUM as of 3/31/15. Includes Mutual Fund Custodial

3.

Annuities policy count as of 12/31/14

Employee

Benefits

Retirement

Annuities

17%

Investment

Management

Individual

Life

1

2

3 |

Focused on the Fastest Growing Areas

Voya’s Growth Focus

Historical Industry Sales Growth By Product (CAGR 2008 –

2014)

Source: LIMRA -

US Individual Annuity Industry Sales Report from 2008-2014

48

10.5%

7.5%

4.4%

-13.0%

-4.3%

FIA

SPIA/DIA

Investment

-Only VA

FA

VA (w GLB) |

Comprehensive

Solution Set

High Touch,

Accommodative Service

Value-Added

Support Tools

Diverse Distribution Channels

Hybrid / External

Wholesale Model

Reputable Brand

and Staying

Power

Value Delivered

49

High Touch Service and Support with Comprehensive Solutions

|

Independent Agents

Independent Broker/Dealers

Strategic Alliances

Voya Financial Advisors

Banks

2012

Attracting and Growing a Diverse Distribution Network

National Marketing Organizations

Independent Agents

Independent Broker/Dealers

Voya Financial Advisors

Banks

Today

Direct

National Marketing Organizations

50

Distribute wider range of

registered and non-registered

solutions through:

Distribute primarily non-registered

solutions through: |

Annuities Key Themes

51

Enhanced Product Solutions to Drive Return on Capital

2

1

Dependable Solutions Partner for a Diverse Distribution Network

3

Positioned to Meet the Income Needs of Customers |

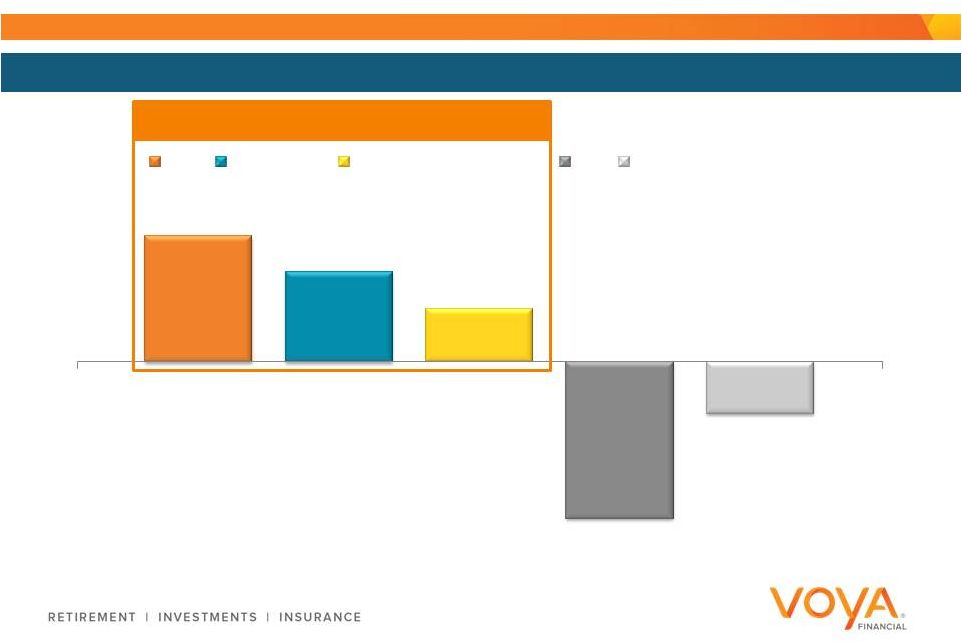

9.0%

8.6%

Growth is the Biggest Driver Of Return on Capital

Continued product development / expansion

Continued growth of less capital-intensive

mutual fund custodial product

Expand distribution to underserved markets

Continued management of credited rates /

investment spread

Continued run-off of Annual Reset /

Multi-Year Guarantee Annuity block

Adjusted Operating ROC

Growth

Margin

9.5–10.5%

Items we do not expect to recur at the same levels

52

FY'14

2018 Target |

Launched 1Q’15

Enhancing Product Solutions is Key to Return on Capital Expansion

Developing Solutions to Meet Evolving Customer Needs

Launched 1Q’15

Expected Launch 3Q’15

53

PotentialPLUS

WealthBuilder Plus

Accumulation

Some downside protection

Indexed withdrawal benefit

rider provides enhanced

guaranteed income

potential

Accumulation

Income

Protection

Non-Qualified complement to

our Mutual Fund Custodial

product

Accumulation

Tax-deferral

Liquidity

Preferred Advantage

Provides increased

accumulation potential

Structured Annuity

Needs Addressed:

Fixed Indexed Annuity

Needs Addressed:

Investment-Only VA

Needs Addressed: |

Annuities Key Themes

54

Enhanced Product Solutions to Drive Return on Capital

2

1

Dependable Solutions Partner for a Diverse Distribution Network

3

Positioned to Meet the Income Needs of Customers |

Annuities Helps Customers Invest and Protect

55

Denotes value delivered to

customer by Annuities

Plan

Invest

Protect |

Annuities Works Across All of Voya to Deliver Income Solutions

Common Business Areas

Individual

Retail Intermediary

Retirement

Individual Life

Employee

Benefits

Investment

Management

56

Joint Solutions

with Annuities

Markets in Common

with Annuities

Intersecting Distribution

with Annuities

Retirement

Individual Life

Investment

Management

Employee

Benefits

Retirement

Individual Life

Investment

Management

Employee

Benefits |

Opportunity to Develop Joint Income Solutions

Single Premium

Immediate Annuity

Voya Annuities

Target Payment Fund

Voya Investment

Management

Joint Retirement Income Solution

57

Flexibility to choose desired allocations

Guaranteed lifetime income

Additional growth generated by fund performance

Liquidity

Beneficiaries access to residual funds

Packaged solution integrated with

myOrangeMoney provides:

|

Annuities Key Themes

58

Enhanced Product Solutions to Drive Return on Capital

2

1

Dependable Solutions Partner for a Diverse Distribution Network

3

Positioned to Meet the Income Needs of Customers |

Charlie Nelson

Chief Executive Officer, Retirement

Retirement |

Retirement Key Themes

60

Growth Initiatives to Drive Return on Capital Expansion

2

1

Making it Simpler to be Ready for Retirement

3

Leveraging the Broader Enterprise for Customer Solutions

|

61

1Q’15 TTM Adjusted Operating Earnings

Pre-Tax Contribution

Business Highlights

$314 billion AUM and AUA

1

Over 46,000 sponsors

Nearly 5 million participants

Multiple segments and markets

–

Corporate, Tax Exempt, IRA

–

Small, Mid, Large, Mega

Markets

–

Full service, Recordkeeping,

Retail Wealth Management

Large Retirement Provider With a Broad Customer Portfolio

1.

As of March 31, 2015

$550

million

in

TTM

Retirement

adjusted pre-tax operating earnings

Individual

Life

Employee

Benefits

Retirement

39%

Annuities

Investment

Management |

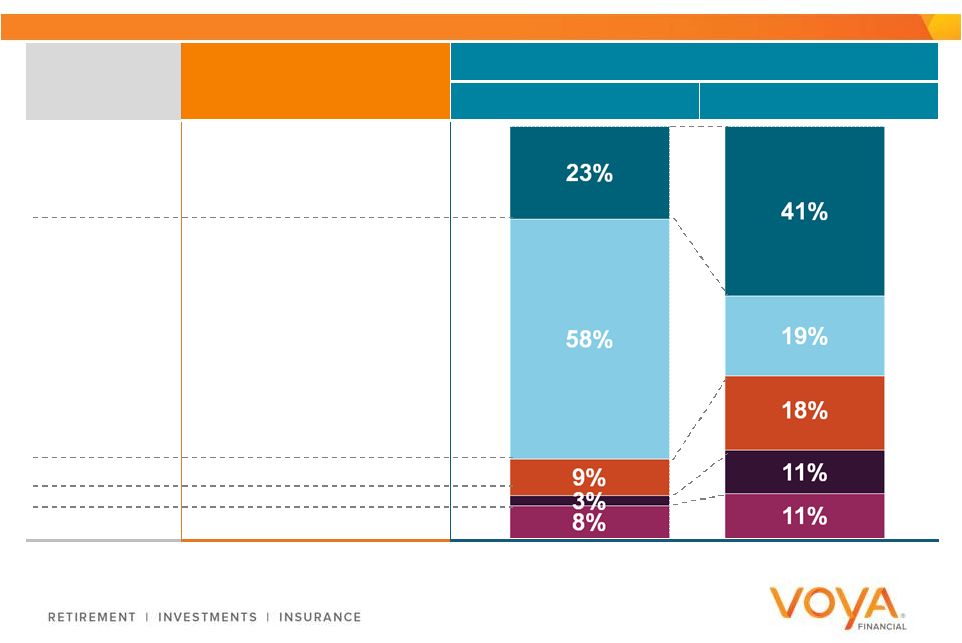

62

Potential for Growth Across All Defined Contribution Markets

Markets

Voya

Financial

®

Share

Of Industry DC Assets

Industry

Defined

Contribution

1

Assets

Profit Pool

Small/Mid

Corporate

2

Government

Healthcare

Education

Large/Mega

Corporate

4%

5%

6%

8%

10%

1.

Sterling Resources Custom Analysis, May 2015 (Based on 2013 Data)

2.

Plans with $100 million or less in AUM/AUA

3.

Plans with $100 million or more in AUM/AUA

3 |

63

Making It Simpler to be Ready for Retirement

Ease of Access: Digital, Phone, Affiliated and Non-

Affiliated Advisors

Expansive Footprint Across 50 States

Complementary Advisor Business Model

Small to Mega Multi-Segment Capabilities and Expertise

|

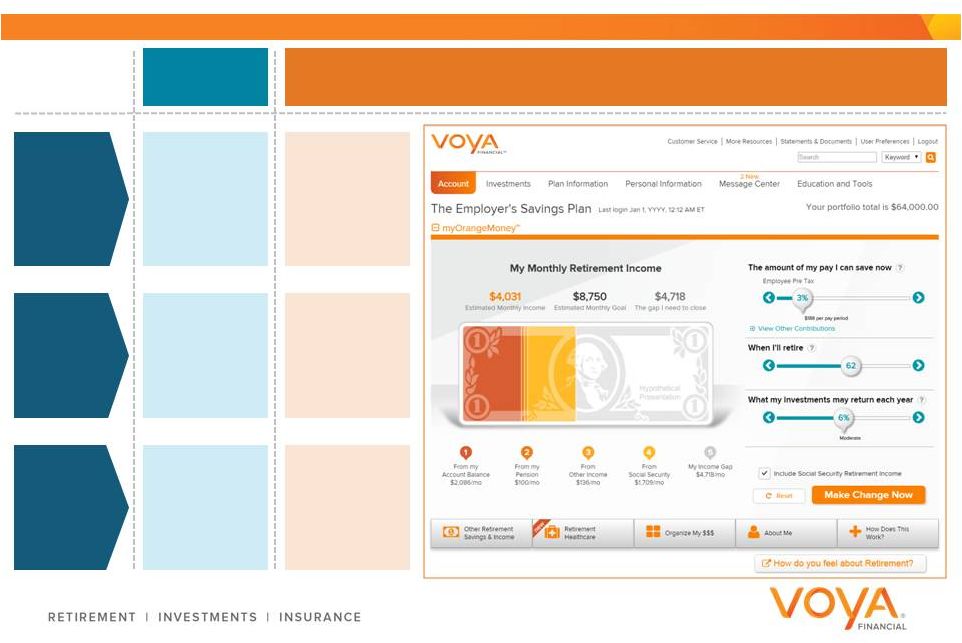

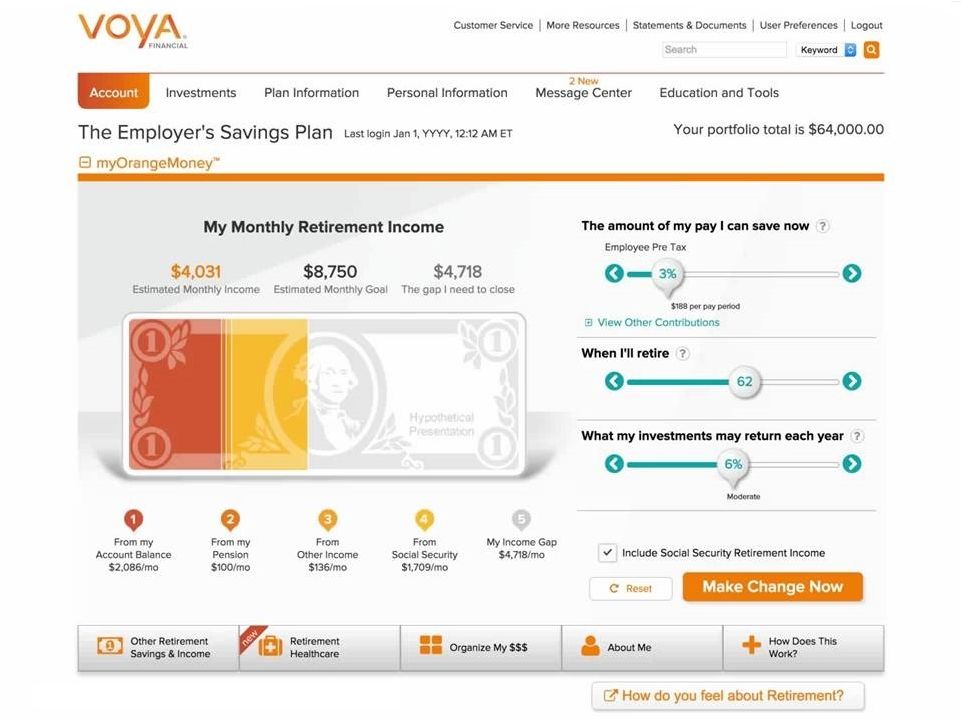

myOrangeMoney

TM

Industry

Method

Context

Account

Balance

Retirement

Income

Content

Seamlessly

Integrated

Action

Delayed /

No Action

Instant

64

Ease of Access is Revolutionized by Voya Retirement Income

Digital Solutions

Manually

Entered |

|

Retirement Key Themes

66

Growth Initiatives to Drive Return on Capital Expansion

2

1

Making it Simpler to be Ready for Retirement

3

Leveraging the Broader Enterprise for Customer Solutions

|

Enhancing distribution and market reach

Leveraging cross-market relationships

Advancing retirement focused solutions

Target client engagements that align with our

value proposition

Technology investments

Continuous management of in-force block

Growth

Margin

Items we do not expect to recur at the same levels

Adjusted Operating ROC

67

Retirement

Target

of

11

-

12%

Return

on

Capital

by

2018

9.2%

8.9%

11–12%

FY'14

2018 Target |

Drive Asset Growth: New Plan Sales, Retention, Account Optimization

68

Enhancing Distribution Reach is Key to Return on Capital Expansion

Distribution channels

Internal sales and servicing staff

Affiliated / non-affiliated advisors

Strengthening data analytics

Optimizing customer engagement

and action

Expanding product suite

Advancing Productivity

Furthering Breadth and Depth |

Retirement Key Themes

69

Growth Initiatives to Drive Return on Capital Expansion

2

1

Making it Simpler to be Ready for Retirement

3

Leveraging the Broader Enterprise for Customer Solutions

|

Retirement Helps Customers Plan, Invest, and Protect

70

Denotes value delivered to customer by

Retirement

Plan

Invest

Protect |

Multiple Opportunities to Leverage the Broader Enterprise For

Cross-Market Solutions

71

Joint Solutions

with Retirement

Markets in Common

with Retirement

Intersecting Distribution

with Retirement

Common Business Areas

Individual

Institutional

Retail Intermediary

Institutional

Annuities

Investment

Management

Individual Life

Employee

Benefits

Annuities

Investment

Management

Individual Life

Employee

Benefits

Annuities

Investment

Management

Individual Life

Employee

Benefits

Annuities

Investment

Management

Individual Life

Employee

Benefits

Annuities

Investment

Management

Individual Life

Employee

Benefits |

72

Aging Demographic

Regulatory Changes

“DB-ing”

DC Plans

Demand

drivers

create

opportunity

for

lifetime

retirement

income

solutions

Delivered With Advice & Guidance

Workplace and

Personal Savings

Voya Retirement

Retirement Income

Voya Annuities

Increasing Opportunity to Deliver Retirement Income |

Retirement Key Themes

73

Growth Initiatives to Drive Return on Capital Expansion

2

1

Making it Simpler to be Ready for Retirement

3

Leveraging the Broader Enterprise for Customer Solutions

|

Jeff Becker

Chief Executive Officer, Investment Management

Investment

Management |

Investment Management Key Themes

75

Asset Growth is the Primary Driver Behind Increasing Margins

and Earnings

2

1

Reliable Investing is Investment Management’s Core Proposition

3

Product Solutions Address Customer Needs Across Life Stages

|

Full Service,

Multi-Asset Investment Manager 1Q’15 TTM Adjusted Operating Earnings

Pre-Tax Contribution

$209 billion AUM

1

Over 900 employees and 200 investment

professionals

Top 20 manager of U.S. institutional tax

exempt

assets

2

Top 20 manager of U.S. institutional tax

exempt

Defined

Contribution

assets

2

#26 manager of open-end mutual funds and

variable

portfolios

3

Equities, fixed income, alternatives

Multi-asset solutions

Retail, institutional, and retirement

Business Highlights

1.

As of March 31, 2015

2.

Pensions & Investments Magazine, Money Manager Directory (based on 401(k), 403(b), 457 and DB

assets as of December 31, 2014) 3.

SimFund MF, SimFund VP, excludes ETFs and Money Market Funds as identified by SimFund (March 31,

2015) 76

$207

million

in

TTM

Investment

Management

adjusted

operating

earnings

Retirement

Annuities

Individual

Life

Employee

Benefits

Investment

Management

15% |

Data Source: McKinsey & Company

YE2013 AUM = $29.8 trillion

Defined Contribution

Retail

Institutional (excl. Defined

Contribution)

18%

52%

30%

US Industry Assets by Market Segment

Key Growth Segments

Defined Contribution Investment Only

is the fastest growing component of the

Defined Contribution market

2

1

3

toward individual responsibility and Baby

Boomer retirements

Investment Management Well Positioned In Key Growth Segments

77

Insurance Outsourcing

a strong growth

component of Institutional

Retail Segment

growth driven by trend |

Investment Management Well Positioned In Key Asset Classes

YE2013 AUM = $29.8 trillion

Money Market

Active Equity

Passive

9%

36%

13%

US Industry Assets by Strategy

Key Asset Classes

Specialized active Fixed Income and

Equity

in strong demand

2

Multi-Asset Solutions

driving DC growth,

capturing vast majority of flows

1

4

Passive, Smart Beta, & ETF strategies,

increasing flows and market share

Balanced / Multi-Asset

10%

Alternatives

13%

Active Fixed Income

19%

3

Alternative and Private Assets

moving to “Main Street”

78

Data Source: McKinsey & Company |

Stewardship and Service Guide Investment Management

79 |

Reliable Investing is Foundational to Investment Management

Team-oriented approach based in

deep research

Risk-aware portfolio construction

Consistent, disciplined, and

repeatable investment processes

Core Tenets

Reliable

investment

performance

More consistency

Strong upside /

downside capture

How We View Success

Unconstrained investment thinking

Long-term perspective

80 |

Reliable

Investing

Delivered

Through

Five

Scaled

Platforms

Multi-Asset

Strategies &

Solutions

Private Equity

Fixed

Income

Public

Equity

Senior

Loans

Assets

$119

billion

2

Assets

$20 billion

Assets

$30 billion

3

Assets

$50 billion

Assets

$7 billion

(Pomona Capital)

Average

CIO

experience

4

30 years

81

1.

Voya IM assets of $209 billion as reported in Voya Financial, Inc. SEC filings,

include approximately $8 billion in Real Estate and $5 billion in other assets including those sub-advised

through the Voya family of funds and the Multi-Asset Strategies and Solutions

product offerings 2.

Total Fixed Income assets include proprietary insurance general account assets

totaling $79 billion as reported in Voya Financial, Inc. SEC filings 3.

The Multi-Asset team AUM are included in other categories shown on the page,

and / or are managed by external entities 4.

Total years in industry

Data as of March 31, 2015

1 |

Strong

Investment Track Records Over Time %

of

IM

1

assets

outperforming

either

benchmark

or

peer

median

5-year

returns

100%

92%

64%

99%

Fixed Income

Senior Loan

Public Equity

Multi-Asset

82%

As of 1Q’15

Total Firm

82

1.

Excludes Pomona Private Equity. Metrics presented measure each investment product based on (i) rank

above the median of its peer category within Morningstar (mutual funds) or eVestment

(institutional composites) for unconstrained and fully-active investment products; or (ii) outperformance against its benchmark index for

“index-like”, rules-based, risk-constrained, or client-specific investment

products |

Strong

Outperformance with Less Risk Over Time 91%

of Voya IM-managed Mutual Fund and Variable

Portfolio assets had investment returns

that beat

their

ten-year

Morningstar

category

average

1

81%

of Voya IM-managed Mutual Fund and Variable

Portfolio assets have had less risk

than

their

ten-year

Morningstar

category

average

1

83

1.

All data sourced from Morningstar as of March 31, 2015, including monthly total return and standard

deviation data for both Morningstar category averages and Voya IM Mutual Funds and Variable

Portfolios. Investment Return metric defined as the asset-weighted % of IM-managed Mutual Fund and Variable Portfolio assets with

higher total returns than the applicable Morningstar category average. Risk metric defined as the

asset-weighted % of IM-managed Mutual Fund and Variable Portfolio assets with lower

standard deviations than the applicable Morningstar category average |

Investment Management Key Themes

84

Asset Growth is the Primary Driver Behind Increasing Margins

and Earnings

2

1

Reliable Investing is Investment Management’s Core Proposition

3

Product Solutions Address Customer Needs Across Life Stages

|

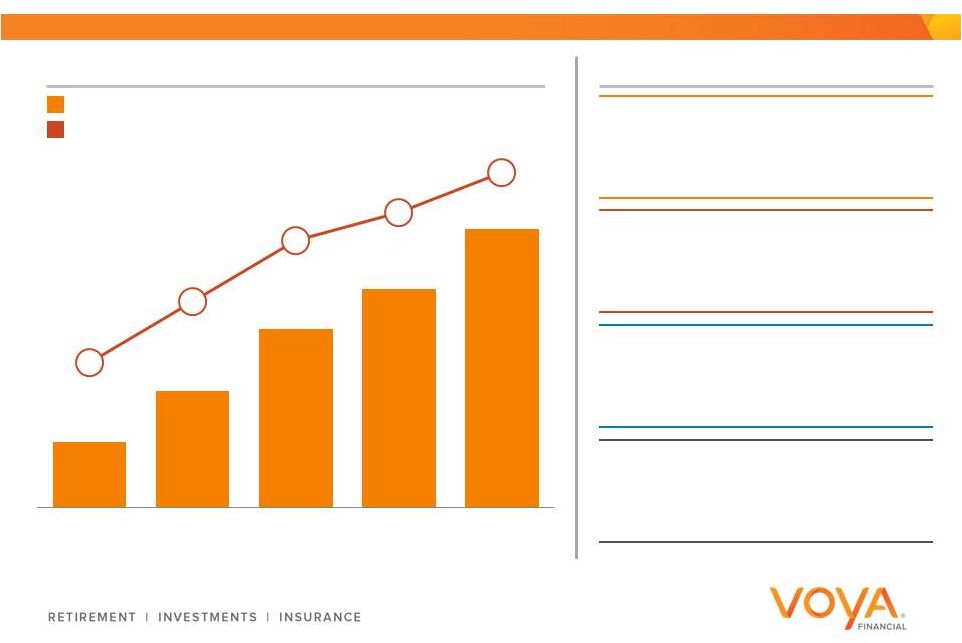

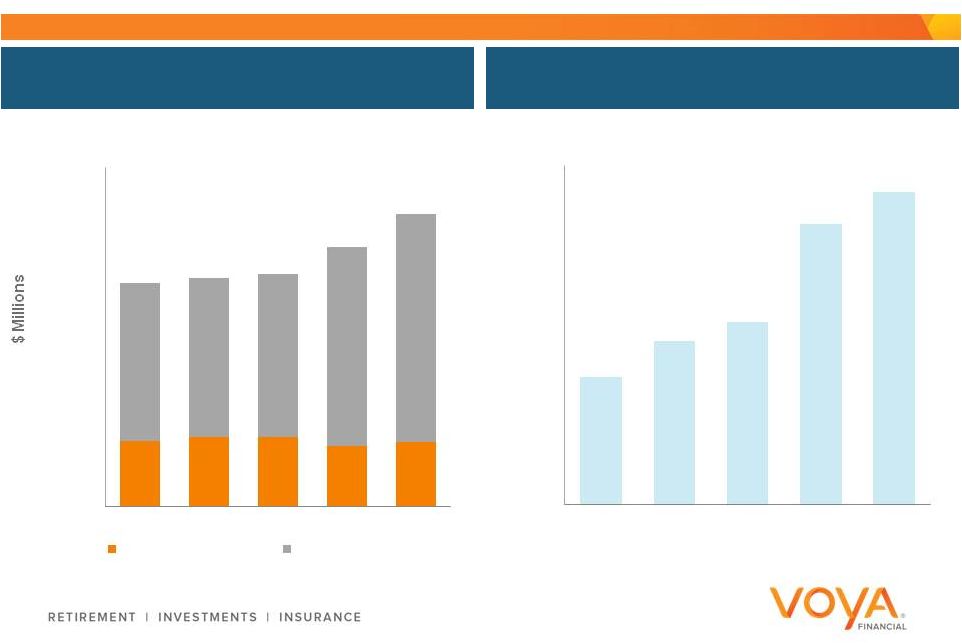

Franchise at Scale Poised for Future Earnings Growth

Earnings & Margin Expansion

Operating Earnings Before Income Tax ($, million)

Operating Margin, including capital

Key Drivers, 2011-2014

Commercial

AUM Growth

Average Annual

Expense Growth

Cumulative Net

Flows

Average Annual

Revenue Growth

$47+

billion

2%

$27+

billion

10%

1

1

85

1.

Excludes gain from Lehman Recovery

$50

$88

$135

$165

$210

2010

2011

2012

2013

2014

11.0%

17.8%

24.6%

27.7%

32.1% |

Key

Initiatives to Achieve 2018 Financial Targets Key Initiatives

Operating Margin

33.0-35.0%

Client

Segments

•

Defined Contribution Investment Only /

Sub-advisory / 529

•

Intermediary retirement strategy

•

Insurance outsourcing

Specialized

Product &

Capability

Extensions

•

Unconstrained fixed income

•

Private credit

•

Concentrated equity

•

Global equity

•

Alternatives and structures

Ongoing

Infrastructure

Reinvestment

•

Sales force productivity enhancements

•

Technology & operations

•

Customer service capabilities

Enterprise

Retirement

•

Qualified Default Investment

Alternative (QDIA) options

•

Target date / Target risk strategies

•

Income solutions

86

32.1%

2014

2018

Results from investment capital |

Investment Management Key Themes

87

Asset Growth is the Primary Driver Behind Increasing Margins

and Earnings

2

1

Reliable Investing is Investment Management’s Core Proposition

3

Product Solutions Address Customer Needs Across Life Stages

|

Investment Management Helps Customers Plan, Invest, and Protect

Denotes value delivered to

customer by Investment

Management

88

Plan

Invest

Protect |

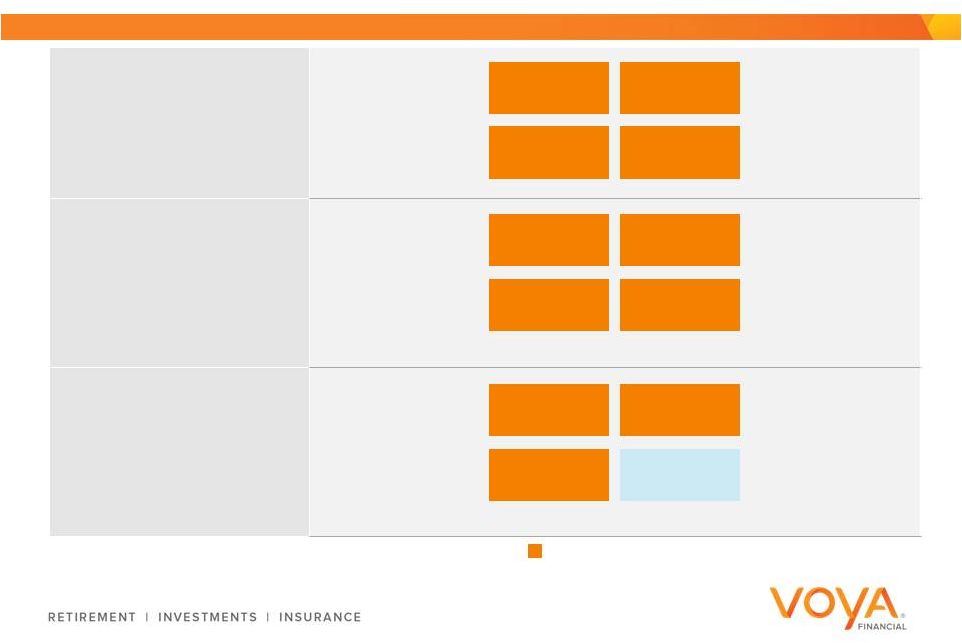

Investment Management is a Key Part of Enterprise Solutions

Common Business Areas

89

Retirement

Individual Life

Employee

Benefits

Annuities

Individual

Retirement

Individual Life

Employee

Benefits

Annuities

Institutional

Retirement

Individual Life

Employee

Benefits

Annuities

Retail Intermediary

Retirement

Individual Life

Employee

Benefits

Annuities

Institutional

Retirement

Individual Life

Employee

Benefits

Annuities

Joint Solutions

with Investment Management

Markets in Common

with Investment Management

Intersecting Distribution

with Investment Management |

Institutional Money Management

Capital Market Structures & Transactions (CLO)

General Account Management

Advisor-led Individual Savings

Investment Management Addresses a Range of Client Needs

90

Institutional

Client Partner

Solutions

B2B

Individual

Customer

Solutions

B2B2C

Advisor-led Individual Retirement

Voya Enterprise Solutions

Insurance Outsourcing

NEW

NEW

NEW

DCIO / Sub-Advisory

529 College Savings

Custom Target Date

Being Added 2014+

Added 2009-2013

IM Foundation Pre-2009

Phased Extensions of Reliable Investing |

Investment Management Key Themes

91

Asset Growth is the Primary Driver Behind Increasing Margins

and Earnings

2

1

Reliable Investing is Investment Management’s Core Proposition

3

Product Solutions Address Customer Needs Across Life Stages

|

Mike Smith

Chief Executive Officer, Insurance Solutions

Insurance Solutions |

Employee Benefits Key Themes

93

Growing Earnings at an Attractive Return on Capital

2

1

Proven Success in Mid-to-Large Employer Market

3

A More Comprehensive Employee Financial Wellness Solution

|

1Q’15 TTM Adjusted Operating Earnings

Pre-Tax Contribution

Business

Highlights

1

94

In-force Product Mix

$177

million

in

TTM

Employee

Benefits

adjusted

operating

earnings

1.

Data as of March 31, 2015

1.6 billion of premium & fees in-force

1,600 active employers served

5.5 million individuals covered

Investment

Management

Individual Life

Employee

Benefits

13%

Retirement

Annuities

Life

30%

Disability

6%

Stop Loss

52%

Voluntary

12%

A Substantial and Balanced Book of Business |

Markets Provide Combination of Growth Environments and

Mature, Stable Products

95

Group Life Industry Trend

Stop Loss Industry Trend

Group Disability

Voluntary Industry Trend

1

1.

Source: For Stop Loss, Citi Research. LIMRA US Group Life & Disability Sales

& In-force Reports; Eastbridge Consulting Voluntary $10

$3

$0

$20

$30

$40

2011

2012

2013

2014

$0

$6

$9

$12

2011

2012

2013

2014

$0

$10

$20

$30

$40

2011

2012

2013

2014

$0

$10

$20

$30

$40

2011

2012

2013

2014 |

Experienced distribution team sells all solutions

Regional sales and service model

Long-term approach to customer relationships

Stop Loss provides differentiation

Building Long-Term Relationships with Experience and Trust

96

Highlights |

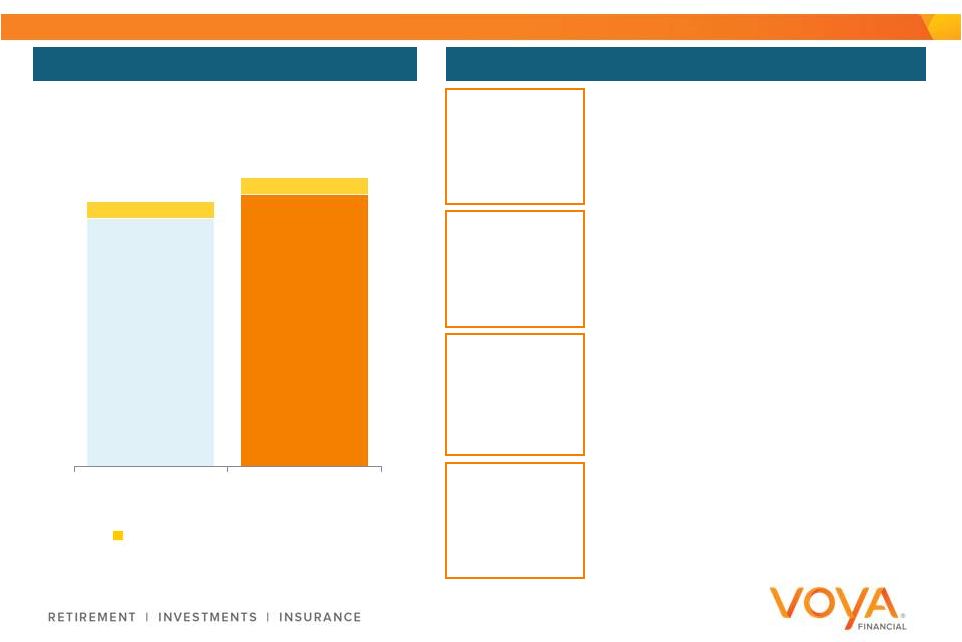

97

In-force Premium by Segment

Adjusted Operating Return on Capital

Proven Ability to Grow Profitably in the Mid and Large Employer

Markets

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2011

2012

2013

2014

1Q'15

<1,000 Employees

+1,000 Employees

0%

5%

10%

15%

20%

25%

30%

35%

2011

2012

2013

2014

1Q’15

TTM |

Employee Benefits Key Themes

98

Growing Earnings at an Attractive Return on Capital

2

1

Proven Success in Mid-to-Large Employer Market

3

A More Comprehensive Employee Financial Wellness Solution

|

28.9%

Mid-Market expansion

Private exchange market growth

Leveraging Stop Loss market position

Growth

23–25%

Adjusted Operating ROC

99

Growing at an Attractive Return on Capital

FY'14

2018 Target |

MID-MARKET EXPANSION

PRIVATE EXCHANGE GROWTH

Adjusted sales incentives

Aligned model (national and local)

Profitable Growth via Mid-Market Expansion and Private Exchange

Potential

Partnered with 8 private exchanges

Leverage Stop Loss leadership

Packaged solutions

Enhanced customer experience

Selective approach -

Holistic offering

100 |

Employee Benefits Key Themes

101

Growing Earnings at an Attractive Return on Capital

2

1

Proven Success in Mid-to-Large Employer Market

3

A More Comprehensive Employee Financial Wellness Solution

|

102

Denotes value delivered to

customer by Employee

Benefits

Plan

Invest

Protect

Employee Benefits Helps Employers and Employees Plan and

Protect |

103

Many Common Areas Across Organization

Joint Solutions

with Employee Benefits

Markets in Common

with Employee Benefits

Intersecting Distribution

with Employee Benefits

Retirement

Annuities

Individual Life

Investment

Management

Retirement

Annuities

Individual Life

Investment

Management

Institutional

Common Business Areas

Retirement

Annuities

Individual Life

Investment

Management

Institutional |

104

Working with Retirement is a Significant Near-Term Opportunity

Employee Benefits

Retirement

< 5%

Note: This reflects institutions that have 200 or more covered lives or plan

participants >1,200 institutions

4.2 million covered

lives

$1.1 billion in-force

premium

>1,600 institutions

2.5 million plan

participants

>$180 billion of

assets |

Employee Benefits Key Themes

105

Growing Earnings at an Attractive Return on Capital

2

1

Proven Success in Mid-to-Large Employer Market

3

A More Comprehensive Employee Financial Wellness Solution

|

Individual Life Key Themes

106

In-force Management Drives Improved Returns

2

1

Focused Distribution with a Commitment to Customer Financial

Wellness

3

Range of Solutions Addresses Customer Needs Across All Life

Stages |

A

Scale Platform with Focus 1Q’15 TTM Adjusted Operating Earnings

Pre-Tax Contribution

$473 billion insurance in-force

1.1 million policies

$98 million of sales, 57% indexed

universal life

2

Approximately 100 aligned distributors

Business

Highlights

107

$233

million

in

TTM

Individual

Life

adjusted operating earnings

1.

Data as of March 31, 2015

2.

Last 12 months

Annuities

Investment

Management

Individual

Life

16%

Employee

Benefits

Retirement

1

|

Industry 1 ($ billions) Voya Financial ($ millions) 2014 Sales Annualized Premium Other UL IUL 108 Capturing Indexed Universal Life Growth $27.6 $49.8 $13.2 $9.9 2013 2014 $1.6 $2.0 $2.3 $1.9 2013 2014 1. LIMRA U.S. Retail Individual Life Insurance Sales Fourth Quarter 2013; LIMRA U.S. Retail Individual Life Insurance Sales Fourth Quarter 2014

|

Customer focused

products

Customer education

Aligned Distributors focus on

customers retirement readiness

Sales tools

109

Enable Aligned Distributors to Do More for Customers |

Voya Life Journey

“This is truly one of the most impressive attempts by a major life insurance

carrier to reach out to assist their sales force in a really meaningful

manner.” -Aligned Distribution Partner

110

New Technology Enables Customer Financial Wellness Solutions

|

Individual Life Key Themes

111

In-force Management Drives Improved Returns

2

1

Focused Distribution with a Commitment to Customer Financial

Wellness

3

Range of Solutions Addresses Customer Needs Across All Life

Stages |

Improve in-force profit metrics

Manage non-guaranteed elements

Reduce redundant reserve financing

cost

Digitize operational processes

Exploring opportunities to further reduce

capital usage

Margin

Capital

7.5–8.5%

Adjusted Operating ROC

112

In-force Management is the Biggest Driver of ROC Improvement

FY'14

2018 Target

5.3% |

Individual Life Key Themes

113

In-force Management Drives Improved Returns

2

1

Focused Distribution with a Commitment to Customer Financial

Wellness

3

Range of Solutions Addresses Customer Needs Across All Life

Stages |

Individual Life Helps Customers Plan, Invest, and Protect

114

Denotes value delivered to

customer by Individual Life

Plan

Invest

Protect |

Individual Life Can Play a Key Role Across the Organization

115

Common Business Areas

Markets in Common

with

Individual Life

Joint

Solutions

with Individual Life

Intersecting Distribution

with

Individual Life

Individual

Retail Intermediary

Retirement

Employee

Benefits

Investment

Management

Annuities

Retirement

Employee

Benefits

Investment

Management

Annuities

Retirement

Investment

Management

Annuities

Employee

Benefits |

116

Voya Life Journey App Can Leverage the Enterprise Capabilities

Addressing Retirement Income and

Protection Needs |

Individual Life Key Themes

117

In-force Management Drives Improved Returns

2

1

Focused Distribution with a Commitment to Customer Financial

Wellness

3

Range of Solutions Addresses Customer Needs Across All Life

Stages |

Rod Martin

Chairman and Chief Executive Officer

Closing Remarks |

Investor Day Overall Key Takeaways

119

Team Delivered on the IPO Plan and Remains Focused on Execution

Strong and Experienced Leadership

Each Business has a Strong Value Proposition that Together can

Differentiate Voya’s Value Proposition |