Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - GT Advanced Technologies Inc. | gtat8ka-6x1x2015.htm |

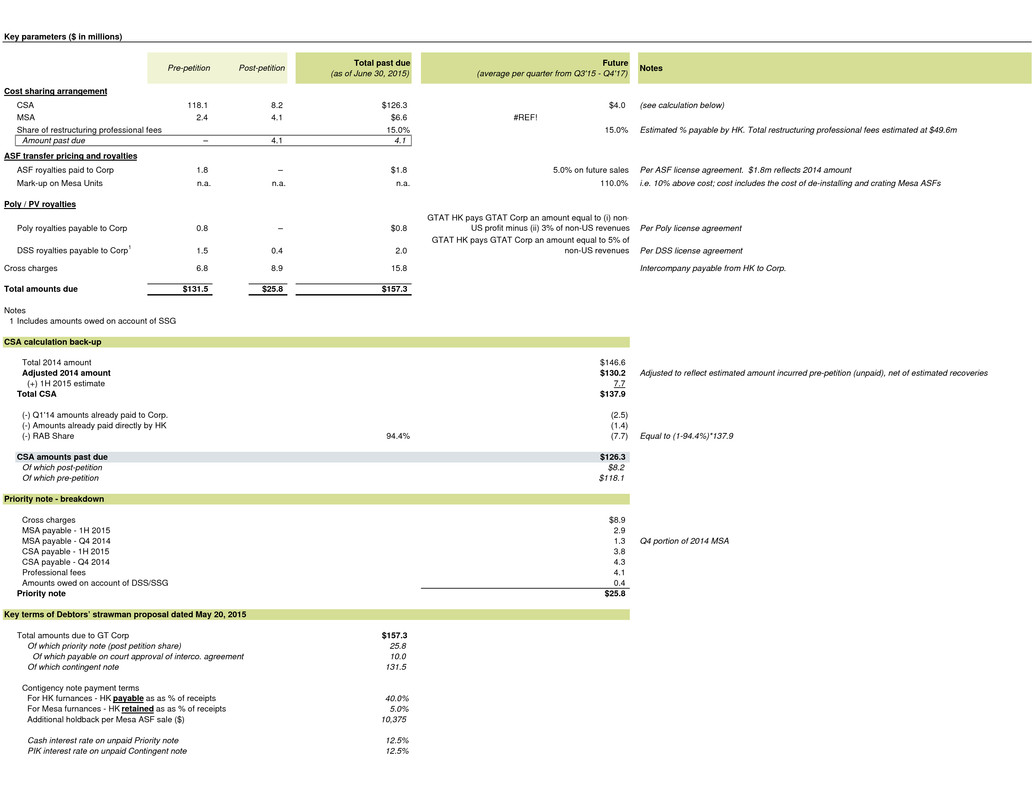

Key parameters ($ in millions) Pre-petition Post-petition Total past due (as of June 30, 2015) Future (average per quarter from Q3'15 - Q4'17) Notes Cost sharing arrangement CSA 118.1 8.2 $126.3 $4.0 (see calculation below) MSA 2.4 4.1 $6.6 #REF! Share of restructuring professional fees 15.0% 15.0% Estimated % payable by HK. Total restructuring professional fees estimated at $49.6m Amount past due – 4.1 4.1 ASF transfer pricing and royalties ASF royalties paid to Corp 1.8 – $1.8 5.0% on future sales Per ASF license agreement. $1.8m reflects 2014 amount Mark-up on Mesa Units n.a. n.a. n.a. 110.0% i.e. 10% above cost; cost includes the cost of de-installing and crating Mesa ASFs Poly / PV royalties Poly royalties payable to Corp 0.8 – $0.8 GTAT HK pays GTAT Corp an amount equal to (i) non- US profit minus (ii) 3% of non-US revenues Per Poly license agreement DSS royalties payable to Corp 1 1.5 0.4 2.0 GTAT HK pays GTAT Corp an amount equal to 5% of non-US revenues Per DSS license agreement Cross charges 6.8 8.9 15.8 Intercompany payable from HK to Corp. Total amounts due $131.5 $25.8 $157.3 Notes 1 Includes amounts owed on account of SSG CSA calculation back-up Total 2014 amount $146.6 Adjusted 2014 amount $130.2 Adjusted to reflect estimated amount incurred pre-petition (unpaid), net of estimated recoveries (+) 1H 2015 estimate 7.7 Total CSA $137.9 (-) Q1'14 amounts already paid to Corp. (2.5) (-) Amounts already paid directly by HK (1.4) (-) RAB Share 94.4% (7.7) Equal to (1-94.4%)*137.9 CSA amounts past due $126.3 Of which post-petition $8.2 Of which pre-petition $118.1 Priority note - breakdown Cross charges $8.9 MSA payable - 1H 2015 2.9 MSA payable - Q4 2014 1.3 Q4 portion of 2014 MSA CSA payable - 1H 2015 3.8 CSA payable - Q4 2014 4.3 Professional fees 4.1 Amounts owed on account of DSS/SSG 0.4 Priority note $25.8 Key terms of Debtors’ strawman proposal dated May 20, 2015 Total amounts due to GT Corp $157.3 Of which priority note (post petition share) 25.8 Of which payable on court approval of interco. agreement 10.0 Of which contingent note 131.5 Contigency note payment terms For HK furnances - HK payable as as % of receipts 40.0% For Mesa furnances - HK retained as as % of receipts 5.0% Additional holdback per Mesa ASF sale ($) 10,375 Cash interest rate on unpaid Priority note 12.5% PIK interest rate on unpaid Contingent note 12.5%

Requested disclosure ($ in millions) Cash balances as of May 1, 2015 ($ in millions) GTAT Corporation ("GTAT Corp.") $30.4 GT Advanced Technologies Limited ("GT HK") 23.4 Of which $20.0 was in US accounts Other 4.0 Consolidated $57.8 Projected cash flows assuming: 1. Excluding cash flows relating to ASF sales 2. No intercompany resolution Q2'15 ⁴ Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 GT HK cash flow (excluding potential cost savings) ⁵ (8.4) (3.7) (7.4) (4.9) 16.5 32.5 (43.4) 30.9 (33.7) (5.0) (5.0) 3. Assuming no intercompany resolution and no ASF sales, projected payments from GT HK to GTAT Corp. assumed to relate solely to royalties on DSS and Poly sales, as follows Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 – – (2.3) – – – (38.4) – (19.2) – – 4. Total GTAT consolidated restructuring professional fees $22.4 HK pro forma cash sweep GT HK cash as of March 31, 2015 $24.1 (+) Gross projected receipts from court-approved ASF sale 45.5 (+) GT HK Q2-Q4 2015 cash flow assuming no interco resolution (19.5) (-) Maximum unrestricted cash held outside control accounts per DIP commitment (5.3) Subtotal $44.8 Estimated CSA amount incurred pre-petition and not paid in cash $27.3 Estimated unsecured + admin claims balances as of May 2015 ¹ ($ in millions) GTAT Corp. GT HK Admin 503(b)(9) claims $15 - $20 $5 - $10 Cure costs TBD TBD Professional fees TBD TBD Unsecured Intercompany claims by GTAT Corp. (pre-settlement) – 150 Other unsecured ² ³ 100 - 315 55 - 230 Total admin + unsecured $115 - $335 $210 - $390 . Notes 1. Highly preliminary estimates. Subject to substantial revision based on ongoing due diligence 2. High end of GTAT Corp. range includes potential rejection damages and guarantee claims, while the low end excludes these items 3. High end of GT HK range includes potential rejection damages, whereas the low end excludes such items. Both the high end and the low end include the TXT claims in the approximate amount of $17.5m 4. $8.4m in Q2 '15 excludes past due amounts 5. Includes payments from GT HK to GTAT Corp. related to royalties on DSS and Poly sales

Additional disclosure request In the cleansing materials that were published on March 2nd, there was a reference to polysilicon equipment purchased by GT valued at approximately $50 million which is currently classified as long term inventory on GT’s balance sheet (Item 6). That equipment was purchased by GT HK and is classified as long term inventory on GT HK’s balance sheet.

Technology Owner Licensee Licensee Rights Economics GT Crystal ASFs GTAT Corp GT HK GT HK has exclusive right to sell ASFs outside US GTAT Corp has exclusive right to sell ASFs in US and exclusive right to sell sapphire materials in all regions GT HK pays GTAT Corp: -5% royalty on non-US revenues -RAB share of CSA Zephyr GTAT Corp None N/A N/A SiC GTAT IP Holding LLC (indirect sub of GT HK) None N/A N/A GT Solar DSS GTAT Corp GT HK GT HK has exclusive right to sell outside of US GTAT HK pays GTAT Corp an amount equal to 5% of non-US revenues Poly GTAT Corp GT HK GT HK has exclusive right to sell outside of US GTAT HK pays GTAT Corp an amount equal to (i) non-US profit minus (ii) 3% of non-US revenues Merlin GTAT Corp None N/A N/A HiCz GTAT IP Holding LLC (indirect sub of GT HK) None N/A N/A GT Industrial SSG GT Sapphire Sytstems Group (indirect sub of GTAT Corp) None N/A N/A ASMG GTAT Corp (ASMG is a division of GTAT Corp) None, since ASMG sells sapphire materials (GTAT Corp has the right to sell sapphire materials in all regions) N/A N/A Hyperion GTAT Corp None N/A N/A