Attached files

| file | filename |

|---|---|

| EX-99.2 - SUPPLEMENTAL INFORMATION - HEARTLAND FINANCIAL USA INC | supplementalinformationtopvb.pdf |

| 8-K - 8-K - HEARTLAND FINANCIAL USA INC | form8kpremiervalleybankacq.htm |

| EX-99.2 - EXHIBIT 99.2 - HEARTLAND FINANCIAL USA INC | ex992supplementalinformati.htm |

| EX-2.1 - EXHIBIT 2.1 - HEARTLAND FINANCIAL USA INC | ex21mergeragreementbetween.htm |

| EX-99.1 - EXHIBIT 99.1 - HEARTLAND FINANCIAL USA INC | ex991pressrelease-premierv.htm |

Acquisition of Premier Valley Bank Entry in California May 2015 Lynn B. Fuller Chairman, President and CEO Trading Symbol HTLF | www.htlf.com

2 Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this presentation that are not statements of historical fact are forward-looking statements. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “may”, “would”, “could”, “will”, “expect”, “anticipate”, “project”, “believe”, “intend”, “plan” and “estimate”, as well as similar expressions. These forward-looking statements include statements related to our projected growth, our anticipated acquisitions, including statements related to the expected timing, completion and other effects our anticipated acquisitions, our anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to the anticipated effects on results of operations and financial condition from expected developments or events, or business and growth strategies, including projections of future amortization and accretion, the impact of the expiration of loss share agreements, anticipated internal growth and plans to establish or acquire banks or the assets of failed banks. These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those anticipated in such statements. Potential risks and uncertainties include the following: > the inability to obtain the requisite regulatory and shareholder approvals for the anticipated acquisitions and meet other closing terms and conditions; > the reaction to the anticipated acquisitions of all the banks’ customers, employees and counter-parties or difficulties related to the transition of services; > general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a continued deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values; > the general decline in the real estate and lending markets, particularly in our market areas, may continue to negatively affect our financial results; > our ability to raise additional capital may be impaired if current levels of market disruption and volatility continue or worsen; > we may be unable to collect reimbursements on losses that we incur on our assets covered under loss share agreements with the FDIC as we anticipate; > costs or difficulties related to the integration of the banks we may acquire may be greater than expected; > restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; > legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; > competitive pressures among depository and other financial institutions may increase significantly; > changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; > other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; > our ability to attract and retain key personnel can be affected by the increased competition for experience employees in the banking industry; > adverse changes may occur in the bond and equity markets; > war or terrorist activities may cause further deterioration in the economy or cause instability in credit markets; > economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate; and > we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the SEC. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this report. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on form 10-K for the year ended December 31, 2014, for a description of some of the important factors that may affect actual outcomes.

3 Additional Information about the Merger and Where to Find it. In connection with the proposed merger transaction, Heartland Financial USA, Inc. will file a registration statement on From S-4 with the SEC to register Heartland Financial, USA, Inc. shares that will be issued to Premier Valley Bank shareholders in connection with the transaction. The registration statement will include a proxy statement of Premier Valley Bank and a prospectus of Heartland Financial USA, Inc. as well as other relevant documents concerning the proposed transaction. The registration statement and the proxy statement/prospectus to be filed with the SEC related to the proposed transaction will contain important information about Heartland Financial USA, Inc., Premier Valley Bank and the proposed transaction and related matters. WE URGE SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT AND PROXY/PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT AND PROXY/PROSPECTUS) BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Security holders may also obtain free copies of these documents and other documents filed with the SEC, at the SEC’s website at https://www.sec.gov. Security holders may also obtain free copies of the documents filed with the SEC by Heartland Financial USA, Inc. at its website at https://www.htlf.com (which website is not incorporated herein by reference) or by contacting Bryan R. McKeag by telephone at 563-589-1994. Security holders may also obtain free copies of the documents of Premier Valley Bank at its website at https://www.premiervalleybank.com (which website is not incorporated herein by reference) or by contacting Michael W. Martinez by telephone at 559-256-6408. Heartland Financial USA, Inc., Premier Valley Bank and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Premier Valley Bank in connection with the proposed merger. Information regarding these persons who may, under the rules of the SEC, be considered participants in the solicitation of shareholders in connection with the proposed merger will be provided in the proxy statement/prospectus described above when it is filed with SEC. Additional information regarding each of Heartland Financial USA, Inc. directors and executive officers, including shareholdings is included in Heartland Financial USA, Inc. definitive proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 6, 2015. You can obtain free copies of this document from Heartland Financial USA, Inc. using the contact information above.

4 Transaction Rationale Attractive Market Entry Financially Attractive Strategic Value • Entry into the heart of California’s Central Valley: a market similar to HTLF existing service territory • Acquisition of an institution with consistent performance in earnings and credit quality and strong and proven management • Opportunities to grow Premier Valley’s C& I lending and develop Wealth Management and Mortgage banking activities • Opportunities for further expansion and acquisitions within Central Valley. Existing management has long acquisition record • Estimated 5% EPS accretion in 2016 • IRR in excess of HTLF target of 15% • Accretive to tangible book value in approximately 4.75 years • Advances the re-balancing of HTLF between Midwest and West • Premier Valley shares commitment to HTLF’s core values, community banking model and community involvement • Ability to leverage HTLF’s mortgage and wealth management platforms across Premier Valley’s footprint • Enhanced opportunity for expanding commercial relationship by taking advantage of HTLF C&I lending expertise and Treasury Services. • Opportunity to consider over time extension of HTLF agricultural lending in the Central Valley • Diversifies existing Income stream

5 Profile of Premier Valley Bank: A Business Bank Serving the Heart of California’s Central Valley NowRetail Time Jumbo Time 1% Consumer 1% Financial Highlights Premier Valley Bank (a) ($ millions) Assets $ 647 Gross Loans $ 394 Deposits $ 561 Effiiciency Ratio (YTD) 52.84% TCE/TA 9.02% NPAs/Assets 1.40% Net Interest Margin 3.75% YTD ROAA 1.42% Company Overview (a) As of 03/31/2015 Source: SNL and Premier Valley Bank Established: 2001 Headquarters: Fresno, CA 5 locations in the Central Valley and the Central Coast Deposit Composition (a)Loan Composition (a) SFR 12% C&D 10% C&I 18% CRE 60% MMDAs & Savings 50% 36% Demand 7% 6%

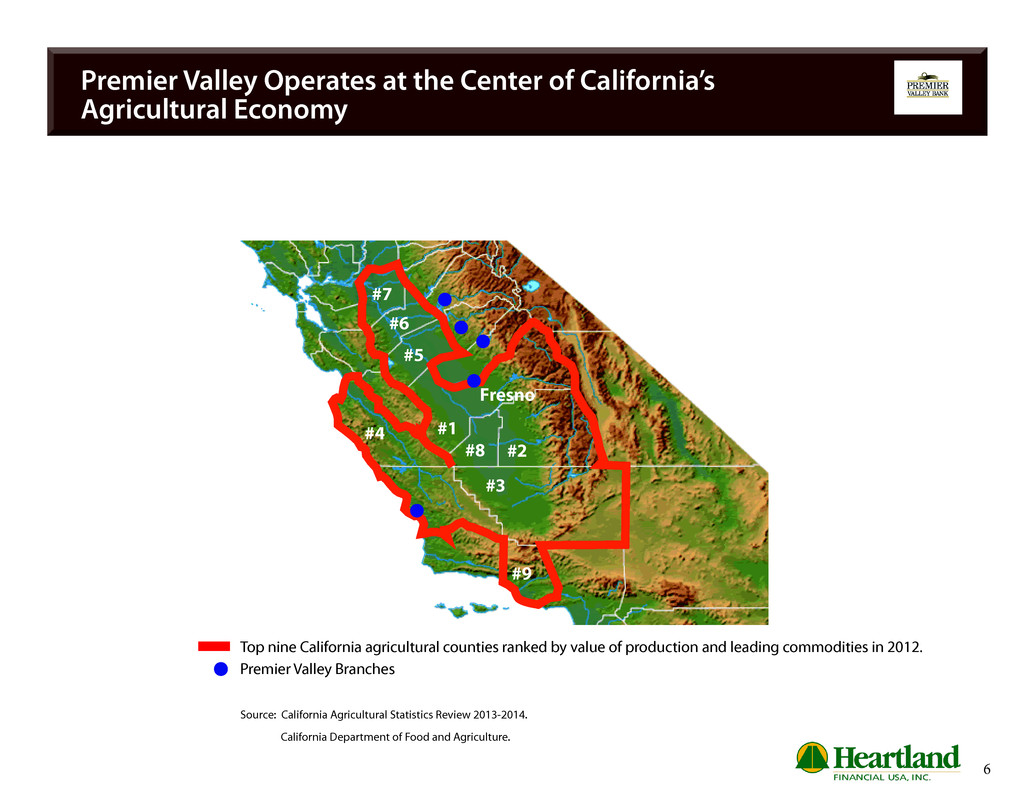

6 #1 #8 #9 #9 #2 #3 #4 #5 #6 #7 Fresno Premier Valley Operates at the Center of California’s Agricultural Economy Top nine California agricultural counties ranked by value of production and leading commodities in 2012. Premier Valley Branches Source: California Agricultural Statistics Review 2013-2014. California Department of Food and Agriculture.

7 An Expanding Franchise Heartland Financial USA, Inc. 9 INDEPENDENT BANK CHARTERS 90 OFFICES 66 COMMUNITIES As of December 31, 2014 Heartland Company Map

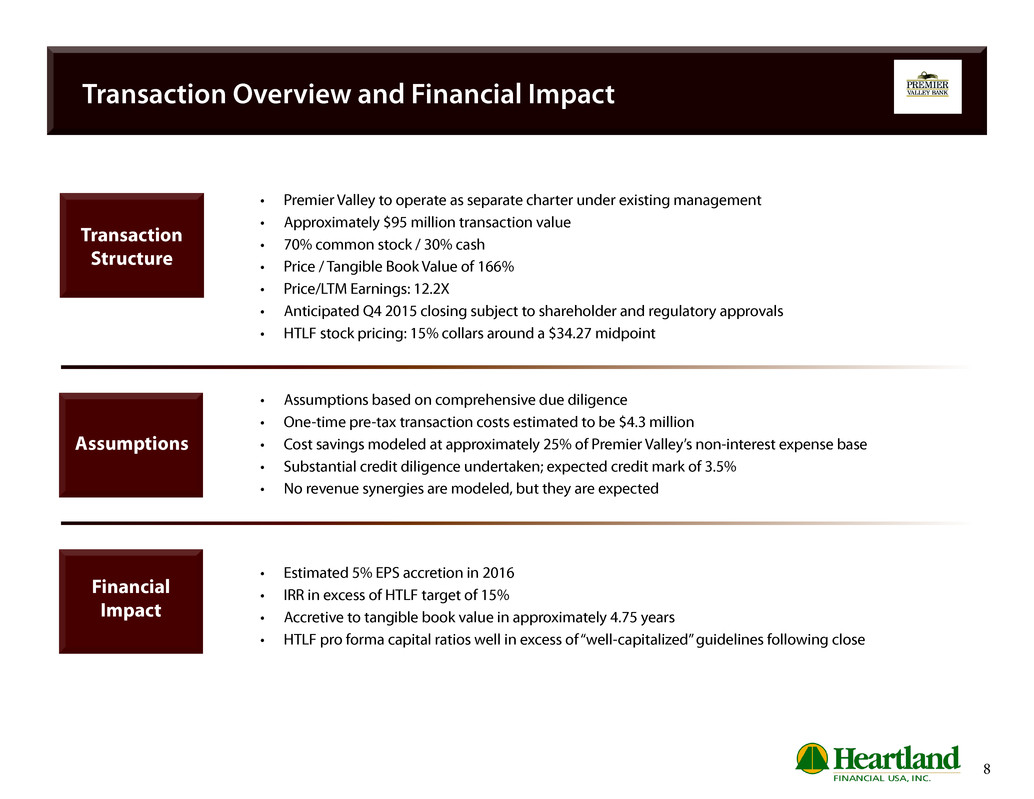

8 Transaction Overview and Financial Impact Transaction Structure Assumptions Financial Impact • Premier Valley to operate as separate charter under existing management • Approximately $95 million transaction value • 70% common stock / 30% cash • Price / Tangible Book Value of 166% • Price/LTM Earnings: 12.2X • Anticipated Q4 2015 closing subject to shareholder and regulatory approvals • HTLF stock pricing: 15% collars around a $34.27 midpoint • Assumptions based on comprehensive due diligence • One-time pre-tax transaction costs estimated to be $4.3 million • Cost savings modeled at approximately 25% of Premier Valley’s non-interest expense base • Substantial credit diligence undertaken; expected credit mark of 3.5% • No revenue synergies are modeled, but they are expected • Estimated 5% EPS accretion in 2016 • IRR in excess of HTLF target of 15% • Accretive to tangible book value in approximately 4.75 years • HTLF pro forma capital ratios well in excess of “well-capitalized” guidelines following close

9 Transaction Summary • Transaction expected to enhance earnings growth and overall shareholder value for both HTLF and Premier Valley shareholders • Strategic entrance into California and the Central Valley of the state with the right leadership and platform to support disciplined growth • Similar culture and complementary business lines • Pro forma institution expected to be well-capitalized and an acquirer of choice in the California Central Valley • Continues to increase liquidity in HTLF shares • Increases Premier Valley’s ability to serve larger customers, through enhanced Commercial lending, Treasury Services and Wealth Management products • Leverages the mortgage banking platform of HTLF

10 Contact Information